Bone Growth Stimulator Market by Product (Device (External Bone Growth Stimulators), Platelet-Rich Plasma), Application (Spinal Fusion Surgeries, Oral & Maxillofacial Surgeries), End User (Hospital, Ambulatory Surgical Centers) & Region - Global Forecast to 2027

Updated on : May 16, 2023

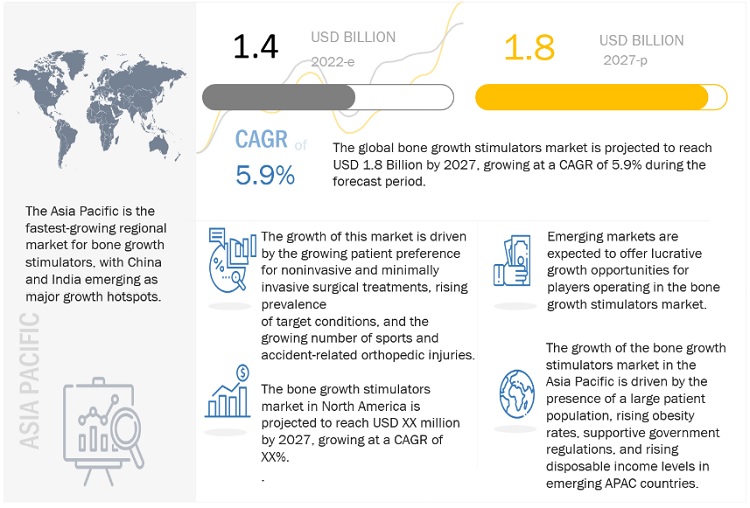

The global bone growth stimulator market in terms of revenue was estimated to be worth $1.4 billion in 2022 and is poised to reach $1.8 billion by 2027, growing at a CAGR of 5.9% from 2022 to 2027. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The growing demand for bone growth stimulators in spinal fusion surgeries, delayed union and nonunion bone fracture applications, and the increasing demand for bone growth stimulator devices are the major driving factors of this market.

Growth Opportunities in Bone Growth Stimulators Market

e-estimated, p-projected

To know about the assumptions considered for the study, Request for Free Sample Report

Bone Growth Stimulator Market Dynamics

Driver: Growing patient preference for non-invasive and minimally invasive surgical treatments

The rising incidence of age-related disorders (such as rheumatoid arthritis, osteoarthritis, osteoporosis, and fractures) and sports injuries drives the demand for non-invasive and minimally invasive surgical treatments worldwide.

Minimally invasive therapeutic procedures are increasingly being preferred owing to their benefits, such as painless treatment, reduced postoperative hospital stay, reduced surgical trauma, limited tissue scarring, reduced surgical risks, improved patient care, shorter postoperative recovery periods, and greater affordability. These procedures are used for a broad range of spinal disorders, such as spondylosis/spondylolisthesis, stenosis, pseudarthrosis, fractures, trauma, and bone healing.

Restraint: Limited medical reimbursement for bone stimulation products

The healthcare system is facing a number of challenges as a result of rising healthcare costs and an ageing population (combined with an increase in the prevalence of age-related disorders). Medical reimbursement is among the major factors that affect the adoption and demand of specific diagnostic or therapeutic products among patients and healthcare providers at the country level. Many private insurance providers do not include insurance or reimbursement for bone growth stimulation surgeries. For instance, most healthcare insurance providers worldwide (except in the US) do not cover the cost of plasma therapy owing to a lack of sufficient clinical data related to its therapeutic efficacy. This factor may act as a restraint in the market for bone growth stimulators.

Opportunity: Increasing use of PRP in other applications

Platelet-rich plasma (PRP) is increasingly being used in various therapeutic areas as the first-line therapy for various orthopedic conditions, such as musculoskeletal injuries, arthritis, and chronic tendinitis. This can primarily be attributed to the effective tissue growth capabilities and the advantages offered by PRP (such as no or fewer immunogenic reactions or disease transfer as it is prepared from autologous blood). PRP-based therapy is noninvasive, clinically safer, and helps in faster patient recovery as compared to conventional surgical therapies. For instance, PRP therapy is widely preferred during hair transplantation and plastic surgeries. PRP is also effective in the treatment of cardiac muscle injuries and nerve injuries, and its use is increasing in periodontal surgeries and wound healing. The clinical applications of PRP are expected to increase across major healthcare markets in the coming years, mainly due to the minimal clinical risks associated with its use. This, in turn, is expected to offer significant growth opportunities to players offering PRP products in the market.

Challenge: Side effects associated with BMP-based orthopedic treatment

Although BMPs are increasingly being used in spinal fusion and bone healing, they are associated with certain side effects. Tissue swelling, male infertility, and implant dislodgement are the major side effects associated with BMPs during spinal fusion surgery. During bone healing, BMPs are reported to cause antigenic reactions and stimulation of oncogenes. Medtronic reported several clinical complications associated with its BMP product during its use in spinal fusion surgeries for bone healing. Patients treated with high doses of rhBMP are at a higher risk of cancer as compared to patients treated with other alternatives. rhBMP-based spinal surgeries are associated with 10%–50% higher risks of adverse effects as compared to conventional spinal surgeries. Adverse reactions and clinical risks associated with BMP-based therapies during orthopedic treatment are expected to restrict their demand, thereby hindering market growth.

Bone Growth Stimulator Market Ecosystem

The spinal fusion surgeries segment accounted for the largest share of the bone growth stimulator market, by product.

By product type, the market is segmented into bone growth stimulation devices, bone morphogenetic proteins (BMPs), and platelet-rich plasma (PRP). The bone growth stimulation devices segment accounted for the largest share of the global market. The growing prevalence of nonunion fractures and increasing preference for non-surgical treatment procedures will boost market growth.

Spinal fusion surgeries dominated bone growth stimulator market.

On the basis of application, the market is broadly segmented into spinal fusion surgeries, delayed union and nonunion bone fractures, oral and maxillofacial surgeries, and other applications. The spinal fusion surgeries segment accounted for the largest share of the global market. The market's growth can be attributed to the growing demand for spinal fusion surgeries.

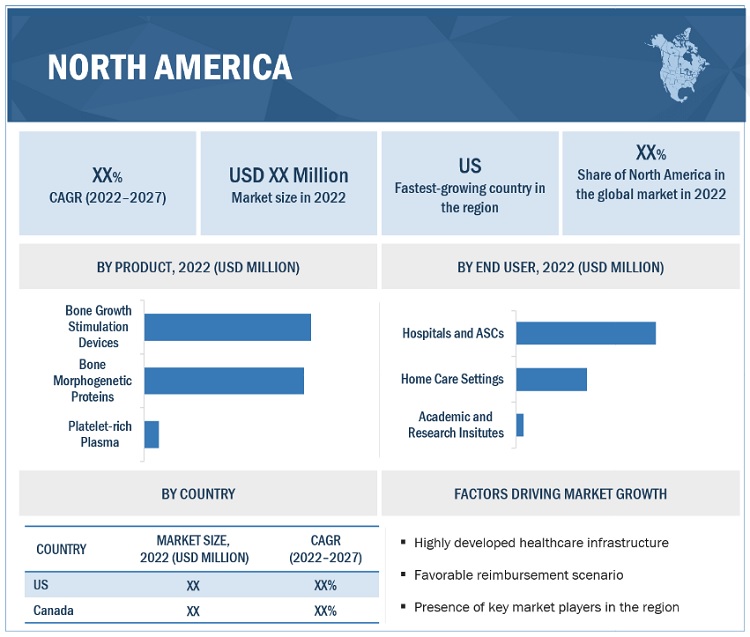

North America accounted for the largest share of the bone growth stimulator market.

The market is segmented into four major regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa. North America accounted for the largest share of the market. Factors such as the growing demand for minimally invasive orthopedic therapies are contributing to the large share of this regional segment.

To know about the assumptions considered for the study, download the pdf brochure

The bone growth stimulator market is dominated by players such as Orthofix Medical Inc. (US), Enovis Corporation (Formerly Colfax (US), ZimVie (US), Bioventus LLC (US) and Medtronic plc (Ireland).

Bone Growth Stimulator Market Report Scope

|

Report Metric |

Details |

|

Market Revenue in 2022 |

$1.4 billion |

|

Projected Revenue by 2027 |

$1.8 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 5.9% |

|

Market Driver |

Growing patient preference for non-invasive and minimally invasive surgical treatments |

|

Market Opportunity |

Increasing use of PRP in other applications |

This research report categorizes the bone growth stimulator market to forecast revenue and analyze trends in each of the following submarkets:

By Material Type

-

Bone Growth Stimulation Devices

-

External Bone Growth Stimulators

- Ultrasonic Bone Growth Stimulators

- Implanted Bone Growth Stimulators

-

External Bone Growth Stimulators

- Bone Morphogenetic Proteins

- Platelet-Rich Plasma

By Application

- Spinal Fusion Surgeries

- Delayed Union & Nonunion Bone Fractures

- Oral & Maxillofacial Surgeries

- Other Applications

By End User

- Hospitals and Ambulatory Surgical Centers

- Home Care Settings

- Academic and Research Institutes

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- RoE

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- RoAPAC

-

Latin America

- Brazil

- Mexico

- RoLA

- Middle East & Africa

Recent Developments

- In 2022, Orthofix Medical Inc. (US) received FDA premarket approval for the AccelStim Bone Growth Stimulation Device.

- In 2021, The company announced the competition of its spinoff of ZimVie. The spinoff marks a major milestone in the active portfolio management of Zimmer Biomet.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the bone growth stimulator market?

The bone growth stimulator market boasts a total revenue value of $1.8 billion by 2027.

What is the estimated growth rate (CAGR) of the bone growth stimulator market?

The global bone growth stimulator market has an estimated compound annual growth rate (CAGR) of 5.9% and a revenue size in the region of $1.4 billion in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 LIMITATIONS

1.6 MARKET STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

FIGURE 2 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

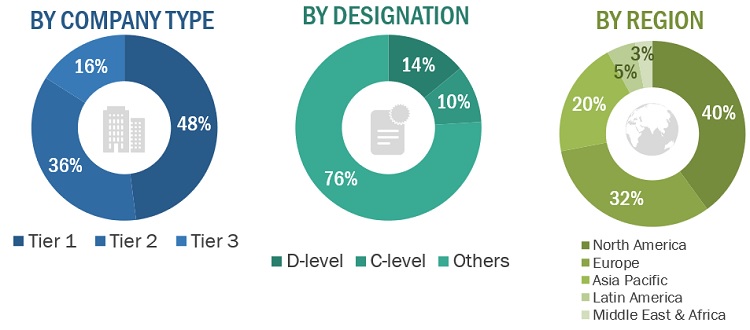

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY AND DEMAND-SIDE PARTICIPANTS

FIGURE 4 BREAKDOWN OF SUPPLY-SIDE PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.2.1 GROWTH FORECAST

FIGURE 6 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

FIGURE 7 TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

FIGURE 9 ASSUMPTIONS FOR STUDY

TABLE 1 INDICATORS AND ASSUMPTIONS

2.5 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 45)

FIGURE 10 BONE GROWTH STIMULATOR MARKET, BY PRODUCT, 2022 VS. 2027 (USD MILLION)

FIGURE 11 BONE GROWTH STIMULATORS MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 12 MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

FIGURE 13 GEOGRAPHICAL SNAPSHOT OF MARKET

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 BONE GROWTH STIMULATOR MARKET OVERVIEW

FIGURE 14 RISING PREVALENCE OF ORTHOPEDIC DISORDERS TO DRIVE MARKET

4.2 NORTH AMERICA: MARKET, BY PRODUCT AND COUNTRY (2022)

FIGURE 15 BONE GROWTH STIMULATION DEVICES TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

4.3 GEOGRAPHIC SNAPSHOT OF MARKET

FIGURE 16 CHINA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 51)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 BONE GROWTH STIMULATORS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 MARKET DRIVERS

5.2.1.1 Growing patient preference for noninvasive and minimally invasive surgical treatments

5.2.1.2 Increasing target patient population

5.2.1.3 Rising number of sports and accident-related orthopedic injuries

FIGURE 18 US: INJURIES CAUSED BY VARIOUS SPORTS ACTIVITIES (2021)

5.2.1.4 Rising geriatric population

TABLE 2 GERIATRIC POPULATION, BY REGION, 2022 VS. 2030 VS. 2050

5.2.2 MARKET RESTRAINTS

5.2.2.1 Limited medical reimbursement for bone stimulation products

5.2.2.2 High treatment costs associated with BMP and PRP products

5.2.2.3 Limited clinical evidence to support therapeutic efficacy of bone growth stimulators

5.2.3 MARKET OPPORTUNITIES

5.2.3.1 Emerging markets

5.2.3.2 Increasing use of PRP in other applications

5.2.3.3 Rising number of hospitals and surgical centers

TABLE 3 NUMBER OF ASCS AND OPERATING ROOMS, 2015–2020

5.2.4 MARKET CHALLENGES

5.2.4.1 Lack of access to diagnostics

5.2.4.2 Side effects associated with BMP-based orthopedic treatment

TABLE 4 CLINICAL SIDE EFFECTS ASSOCIATED WITH BMP-2

TABLE 5 PRECLINICAL SIDE EFFECTS WITH BMP-2 (IN VITRO AND IN VIVO)

5.3 PRICING ANALYSIS

TABLE 6 PRICE RANGE FOR BONE GROWTH STIMULATORS

5.4 VALUE CHAIN ANALYSIS

FIGURE 19 VALUE CHAIN ANALYSIS: MAXIMUM VALUE ADDED DURING MANUFACTURING PHASE

5.5 SUPPLY CHAIN ANALYSIS

5.5.1 PROMINENT COMPANIES

5.5.2 SMALL & MEDIUM-SIZED ENTERPRISES

5.5.3 END USERS

FIGURE 20 BONE GROWTH STIMULATORS: SUPPLY CHAIN ANALYSIS

5.6 PORTER’S FIVE FORCES ANALYSIS

5.6.1 OVERVIEW

TABLE 7 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.6.2 THREAT OF NEW ENTRANTS

5.6.3 THREAT OF SUBSTITUTES

5.6.4 BARGAINING POWER OF SUPPLIERS

5.6.5 BARGAINING POWER OF BUYERS

5.6.6 DEGREE OF COMPETITION

5.7 ECOSYSTEM ANALYSIS

TABLE 8 BONE GROWTH STIMULATORS: ROLE IN ECOSYSTEM

FIGURE 21 KEY PLAYERS IN BONE GROWTH STIMULATORS ECOSYSTEM

5.8 REGULATORY ANALYSIS

5.8.1 NORTH AMERICA

5.8.1.1 US

TABLE 9 US FDA: MEDICAL DEVICE CLASSIFICATION

TABLE 10 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

5.8.1.2 Canada

TABLE 11 CANADA: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

5.8.2 EUROPE

5.8.3 ASIA PACIFIC

5.8.3.1 Japan

TABLE 12 JAPAN: MEDICAL DEVICE CLASSIFICATION UNDER PMDA

5.8.3.2 China

TABLE 13 CHINA: CLASSIFICATION OF MEDICAL DEVICES

5.8.3.3 India

5.9 PATENT ANALYSIS

5.9.1 PATENT TRENDS FOR BONE GROWTH STIMULATORS

FIGURE 22 PATENT ANALYSIS (JANUARY 2013–SEPTEMBER 2022)

5.9.2 JURISDICTION AND TOP APPLICANT ANALYSIS

FIGURE 23 TOP APPLICANTS AND OWNERS (COMPANIES/INSTITUTES) FOR BONE GROWTH STIMULATOR PATENTS, JANUARY 2013–SEPTEMBER 2022

5.10 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.10.1 REVENUE SHIFT AND REVENUE POCKETS FOR BONE GROWTH STIMULATOR MANUFACTURERS

FIGURE 24 REVENUE SHIFT FOR BONE GROWTH STIMULATORS

5.11 KEY CONFERENCES AND EVENTS IN 2022–2023

TABLE 14 MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.12 TECHNOLOGY ANALYSIS

5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF BONE GROWTH STIMULATORS

TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF BONE GROWTH STIMULATORS (%)

5.13.2 BUYING CRITERIA

FIGURE 26 KEY BUYING CRITERIA FOR END USERS OF BONE GROWTH STIMULATORS

TABLE 16 KEY BUYING CRITERIA FOR END USERS OF BONE GROWTH STIMULATORS

5.14 TRADE ANALYSIS

5.14.1 TRADE ANALYSIS FOR BONE GROWTH STIMULATORS

TABLE 17 IMPORT DATA FOR BONE GROWTH STIMULATORS, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 18 EXPORT DATA FOR BONE GROWTH STIMULATORS, BY COUNTRY, 2017–2021 (USD MILLION)

6 BONE GROWTH STIMULATOR MARKET, BY PRODUCT (Page No. - 78)

6.1 INTRODUCTION

TABLE 19 MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

6.2 BONE GROWTH STIMULATION DEVICES

TABLE 20 BONE GROWTH STIMULATION DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 21 BONE GROWTH STIMULATION DEVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.1 EXTERNAL BONE GROWTH STIMULATORS

TABLE 22 MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 23 MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.1.1 Pulsed electromagnetic field devices

6.2.1.1.1 Pulsed electromagnetic field devices to witness highest growth in market

TABLE 24 PULSED ELECTROMAGNETIC FIELD DEVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.1.2 Combined magnetic field devices

6.2.1.2.1 Combined magnetic field devices portable, battery-powered, and noninvasive

TABLE 25 COMBINED MAGNETIC FIELD DEVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.1.3 Capacitive coupling devices

6.2.1.3.1 Need for frequent battery replacement or recharge—disadvantage associated with CC devices

TABLE 26 CAPACITIVE COUPLING DEVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.2 ULTRASONIC BONE GROWTH STIMULATORS

6.2.2.1 Used in treatment of nonunion bone fractures and failed arthrodesis

TABLE 27 HCPCS CODE

TABLE 28 MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.3 IMPLANTED BONE GROWTH STIMULATORS

6.2.3.1 Implanted bone growth stimulators provide constant stimulation of bone directly at fracture site

TABLE 29 MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3 BONE MORPHOGENETIC PROTEINS

6.3.1 SAFE AND EFFECTIVE ALTERNATIVES TO BONE GRAFTS

TABLE 30 BONE MORPHOGENETIC PROTEINS MARKET, BY REGION, 2020–2027 (USD MILLION)

6.4 PLATELET-RICH PLASMA

6.4.1 ADVANTAGES OF PRP OVER OTHER PRODUCTS USED IN BONE STIMULATION TO DRIVE MARKET

TABLE 31 PLATELET-RICH PLASMA MARKET, BY REGION, 2020–2027 (USD MILLION)

7 BONE GROWTH STIMULATOR MARKET, BY APPLICATION (Page No. - 89)

7.1 INTRODUCTION

TABLE 32 BONE GROWTH STIMULATORS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

7.2 SPINAL FUSION SURGERIES

7.2.1 SPINAL FUSION SURGERIES TO DOMINATE MARKET

TABLE 33 MARKET FOR SPINAL FUSION SURGERIES, BY REGION, 2020–2027 (USD MILLION)

7.3 DELAYED UNION AND NONUNION BONE FRACTURES

7.3.1 INCREASING NUMBER OF DELAYED UNION AND NONUNION BONE FRACTURES TO INCREASE DEMAND FOR BONE GROWTH STIMULATORS

TABLE 34 STIMULATORS MARKET FOR DELAYED UNION AND NONUNION BONE FRACTURES, BY REGION, 2020–2027 (USD MILLION)

7.4 ORAL AND MAXILLOFACIAL SURGERIES

7.4.1 BMPS USED IN ORAL AND MAXILLOFACIAL SURGERIES TO FORM BASE FOR DENTAL IMPLANTS

TABLE 35 MARKET FOR ORAL AND MAXILLOFACIAL SURGERIES, BY REGION, 2020–2027 (USD MILLION)

7.5 OTHER APPLICATIONS

TABLE 36 BONE GROWTH STIMULATORS MARKET FOR OTHER APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

8 BONE GROWTH STIMULATOR MARKET, BY END USER (Page No. - 94)

8.1 INTRODUCTION

TABLE 37 MARKET, BY END USER, 2020–2027 (USD MILLION)

8.2 HOSPITALS AND AMBULATORY SURGERY CENTERS

8.2.1 LARGEST AND FASTEST-GROWING END USERS OF BONE GROWTH STIMULATORS

TABLE 38 MARKET FOR HOSPITALS AND ASCS, BY REGION, 2020–2027 (USD MILLION)

8.3 HOME CARE SETTINGS

8.3.1 AVAILABILITY OF REIMBURSEMENT AND INSURANCE COVERAGE TO SUPPORT MARKET GROWTH

TABLE 39 MARKET FOR HOME CARE SETTINGS, BY REGION, 2020–2027 (USD MILLION)

8.4 ACADEMIC AND RESEARCH INSTITUTES

8.4.1 GROWING RESEARCH ON BONE GROWTH STIMULATION PRODUCTS TO DRIVE MARKET

TABLE 40 MARKET FOR ACADEMIC AND RESEARCH INSTITUTES, BY REGION, 2020–2027 (USD MILLION)

9 BONE GROWTH STIMULATOR MARKET, BY REGION (Page No. - 99)

9.1 INTRODUCTION

TABLE 41 BONE GROWTH STIMULATORS MARKET, BY REGION, 2020–2027 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 27 NORTH AMERICA: BONE GROWTH STIMULATOR MARKET SNAPSHOT

TABLE 42 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 43 NORTH AMERICA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 44 NORTH AMERICA: BONE GROWTH STIMULATION DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 45 NORTH AMERICA: EXTERNAL BONE-GROWTH STIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 46 NORTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 47 NORTH AMERICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.2.1 US

9.2.1.1 High burden of sports-related injuries to drive market

TABLE 48 US: BONE GROWTH STIMULATORS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 49 US: BONE GROWTH STIMULATION DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 50 US: EXTERNAL BONE-GROWTH STIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 51 US: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 52 US: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Market growth driven by rising incidence of bone-related diseases

TABLE 53 CANADA: BONE GROWTH STIMULATOR MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 54 CANADA: BONE GROWTH STIMULATION DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 55 CANADA: EXTERNAL BONE-GROWTH STIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 56 CANADA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 57 CANADA: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3 EUROPE

TABLE 58 EUROPE: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 59 EUROPE: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 60 EUROPE: BONE GROWTH STIMULATION DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 61 EUROPE: EXTERNAL BONE GROWTH STIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 62 EUROPE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 63 EUROPE: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Largest market for bone growth stimulators in Europe

FIGURE 28 GERMANY: POPULATION AGED 65 AND ABOVE, 2015–2021 (MILLION)

TABLE 64 GERMANY: BONE GROWTH STIMULATOR MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 65 GERMANY: BONE GROWTH STIMULATION DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 66 GERMANY: EXTERNAL BONE-GROWTH STIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 67 GERMANY: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 68 GERMANY: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.2 UK

9.3.2.1 Increasing funding by public and private organizations to drive market

TABLE 69 UK: BONE GROWTH STIMULATORS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 70 UK: BONE GROWTH STIMULATION DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 71 UK: EXTERNAL BONE-GROWTH STIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 72 UK: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 73 UK: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.3 FRANCE

9.3.3.1 Rising prevalence of diabetes to support market growth

TABLE 74 FRANCE: BONE GROWTH STIMULATOR MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 75 FRANCE: BONE GROWTH STIMULATION DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 76 FRANCE: EXTERNAL BONE GROWTH STIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 77 FRANCE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 78 FRANCE: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.4 ITALY

9.3.4.1 Increasing market availability of high-end bone growth stimulators to drive market

TABLE 79 ITALY: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 80 ITALY: BONE GROWTH STIMULATION DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 81 ITALY: EXTERNAL BONE-GROWTH STIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 82 ITALY: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 83 ITALY: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.5 SPAIN

9.3.5.1 Growing geriatric population and subsequent increase in prevalence of target conditions to drive market

TABLE 84 SPAIN: BONE GROWTH STIMULATOR MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 85 SPAIN: BONE GROWTH STIMULATION DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 86 SPAIN: EXTERNAL BONE-GROWTH STIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 87 SPAIN: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 88 SPAIN: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.6 REST OF EUROPE

TABLE 89 REST OF EUROPE: BONE GROWTH STIMULATORS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 90 REST OF EUROPE: BONE GROWTH STIMULATION DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 91 REST OF EUROPE: EXTERNAL BONE-GROWTH STIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 92 REST OF EUROPE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 93 REST OF EUROPE: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4 ASIA PACIFIC

FIGURE 29 ASIA PACIFIC: BONE GROWTH STIMULATOR MARKET SNAPSHOT

TABLE 94 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 95 ASIA PACIFIC: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 96 ASIA PACIFIC: BONE GROWTH STIMULATION DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 97 ASIA PACIFIC: EXTERNAL BONE-GROWTH STIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 98 ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 99 ASIA PACIFIC: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4.1 JAPAN

9.4.1.1 Japan dominates Asia Pacific bone growth stimulators market

TABLE 100 JAPAN: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 101 JAPAN: BONE GROWTH STIMULATION DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 102 JAPAN: EXTERNAL BONE-GROWTH STIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 103 JAPAN: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 104 JAPAN: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4.2 CHINA

9.4.2.1 Expansion in target patient population and modernization of healthcare facilities to drive market

TABLE 105 CHINA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 106 CHINA: BONE GROWTH STIMULATION DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 107 CHINA: EXTERNAL BONE-GROWTH STIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 108 CHINA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 109 CHINA: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4.3 INDIA

9.4.3.1 Growing number of orthopedic surgeries to support market growth

TABLE 110 INDIA: BONE GROWTH STIMULATOR MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 111 INDIA: BONE GROWTH STIMULATION DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 112 INDIA: EXTERNAL BONE GROWTH STIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 113 INDIA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 114 INDIA: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4.4 AUSTRALIA

9.4.4.1 Availability of grants for development of advanced treatments to support market growth

TABLE 115 AUSTRALIA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 116 AUSTRALIA: BONE GROWTH STIMULATION DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 117 AUSTRALIA: EXTERNAL BONE-GROWTH STIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 118 AUSTRALIA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 119 AUSTRALIA: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4.5 SOUTH KOREA

9.4.5.1 Supportive government initiatives positively impact market growth

TABLE 120 SOUTH KOREA: BONE GROWTH STIMULATOR MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 121 SOUTH KOREA: BONE GROWTH STIMULATION DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 122 SOUTH KOREA: EXTERNAL BONE GROWTH STIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 123 SOUTH KOREA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 124 SOUTH KOREA: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4.6 REST OF ASIA PACIFIC

TABLE 125 GERIATRIC POPULATION, BY COUNTRY, 2015–2021

TABLE 126 REST OF ASIA PACIFIC: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 127 REST OF ASIA PACIFIC: BONE GROWTH STIMULATION DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 128 REST OF ASIA PACIFIC: EXTERNAL BONE-GROWTH STIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 129 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 130 REST OF ASIA PACIFIC: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.5 LATIN AMERICA

TABLE 131 LATIN AMERICA: BONE GROWTH STIMULATOR MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 132 LATIN AMERICA: BONE GROWTH STIMULATORS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 133 LATIN AMERICA: BONE GROWTH STIMULATION DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 134 LATIN AMERICA: EXTERNAL BONE-GROWTH STIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 135 LATIN AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 136 LATIN AMERICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.5.1 BRAZIL

9.5.1.1 Modernization of healthcare facilities to drive market

TABLE 137 BRAZIL: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 138 BRAZIL: BONE GROWTH STIMULATION DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 139 BRAZIL: EXTERNAL BONE-GROWTH STIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 140 BRAZIL: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 141 BRAZIL: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.5.2 MEXICO

9.5.2.1 Favorable investment scenario for medical device manufacturers to drive market

TABLE 142 MEXICO: BONE GROWTH STIMULATOR MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 143 MEXICO: BONE GROWTH STIMULATION DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 144 MEXICO: EXTERNAL BONE-GROWTH STIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 145 MEXICO: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 146 MEXICO: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.5.3 REST OF LATIN AMERICA

TABLE 147 REST OF LATIN AMERICA: BONE GROWTH STIMULATORS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 148 REST OF LATIN AMERICA: BONE GROWTH STIMULATION DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 149 REST OF LATIN AMERICA: EXTERNAL BONE-GROWTH STIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 150 REST OF LATIN AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 151 REST OF LATIN AMERICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.6 MIDDLE EAST AND AFRICA

9.6.1 AWARENESS INITIATIVES TO DRIVE ADOPTION OF BONE GROWTH STIMULATORS

TABLE 152 MIDDLE EAST AND AFRICA: BONE GROWTH STIMULATOR MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 153 MIDDLE EAST AND AFRICA: BONE GROWTH STIMULATION DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 154 MIDDLE EAST AND AFRICA: EXTERNAL BONE GROWTH STIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 155 MIDDLE EAST AND AFRICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 156 MIDDLE EAST AND AFRICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 165)

10.1 OVERVIEW

10.2 STRATEGIES ADOPTED BY KEY PLAYERS/RIGHT TO WIN

TABLE 157 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN BONE GROWTH STIMULATOR MARKET

10.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 30 REVENUE SHARE ANALYSIS OF TOP PLAYERS IN BONE GROWTH STIMULATORS MARKET

10.4 MARKET SHARE ANALYSIS

TABLE 158 BONE GROWTH STIMULATORS MARKET: DEGREE OF COMPETITION

10.5 COMPETITIVE LEADERSHIP MAPPING

10.5.1 STARS

10.5.2 EMERGING LEADERS

10.5.3 PARTICIPANTS

10.5.4 PERVASIVE PLAYERS

FIGURE 31 BONE GROWTH STIMULATORS MARKET: COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2021

10.6 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES

10.6.1 PROGRESSIVE COMPANIES

10.6.2 STARTING BLOCKS

10.6.3 RESPONSIVE COMPANIES

10.6.4 DYNAMIC COMPANIES

FIGURE 32 BONE GROWTH STIMULATORS MARKET: COMPETITIVE LEADERSHIP MAPPING FOR STARTUPS/SMES, 2021

10.7 FOOTPRINT ANALYSIS OF TOP PLAYERS IN BONE GROWTH STIMULATORS MARKET

10.7.1 PRODUCT AND REGIONAL FOOTPRINT ANALYSIS OF TOP PLAYERS IN BONE GROWTH STIMULATOR MARKET

TABLE 159 PRODUCT FOOTPRINT OF COMPANIES

TABLE 160 REGIONAL FOOTPRINT OF COMPANIES

10.8 COMPETITIVE SCENARIO

10.8.1 PRODUCT LAUNCHES

TABLE 161 KEY PRODUCT LAUNCHES, JANUARY 2019–AUGUST 2022

10.8.2 DEALS

TABLE 162 KEY DEALS, JANUARY 2019–AUGUST 2022

10.8.3 OTHER DEVELOPMENTS

TABLE 163 OTHER KEY DEVELOPMENTS, JANUARY 2019–AUGUST 2022

11 COMPANY PROFILES (Page No. - 176)

11.1 KEY PLAYERS

(Business overview, Products offered, Recent developments, MnM view, Right to win, Strategic choices made, and Weaknesses and competitive threats)*

11.1.1 ORTHOFIX MEDICAL INC.

TABLE 164 ORTHOFIX MEDICAL INC.: BUSINESS OVERVIEW

FIGURE 33 ORTHOFIX, MEDICAL INC.: COMPANY SNAPSHOT (2021)

11.1.2 DEPUY SYNTHES

TABLE 165 DEPUY SYNTHES: BUSINESS OVERVIEW

FIGURE 34 DEPUY SYNTHES: COMPANY SNAPSHOT (2021)

11.1.3 STRYKER

TABLE 166 STRYKER: BUSINESS OVERVIEW

FIGURE 35 STRYKER: COMPANY SNAPSHOT (2021)

11.1.4 BIOVENTUS LLC

TABLE 167 BIOVENTUS LLC: BUSINESS OVERVIEW

FIGURE 36 BIOVENTUS LLC: COMPANY SNAPSHOT (2021)

11.1.5 MEDTRONIC PLC

TABLE 168 MEDTRONIC PLC: BUSINESS OVERVIEW

FIGURE 37 MEDTRONIC PLC: COMPANY SNAPSHOT (2021)

11.1.6 ENOVIS CORPORATION (FORMERLY COLFAX)

TABLE 169 ENOVIS CORPORATION (FORMERLY COLFAX): BUSINESS OVERVIEW

FIGURE 38 ENOVIS CORPORATION: COMPANY SNAPSHOT (2021)

11.1.7 ZIMVIE INC. (SUBSIDIARY OF ZIMMER BIOMET)

TABLE 170 ZIMVIE INC.: BUSINESS OVERVIEW

FIGURE 39 ZIMVIE INC.: COMPANY SNAPSHOT (2021)

11.1.8 ARTHREX, INC.

TABLE 171 ARTHREX, INC.: BUSINESS OVERVIEW

11.1.9 TERUMO CORPORATION

TABLE 172 TERUMO CORPORATION: BUSINESS OVERVIEW

FIGURE 40 TERUMO CORPORATION: COMPANY SNAPSHOT (2021)

11.1.10 OSSATEC BENELUX LTD.

TABLE 173 OSSATEC BENELUX LTD.: BUSINESS OVERVIEW

11.1.11 ISTO BIOLOGICS

TABLE 174 ISTO BIOLOGICS: BUSINESS OVERVIEW

11.1.12 EMBER THERAPEUTICS, INC.

TABLE 175 EMBER THERAPEUTICS, INC.: BUSINESS OVERVIEW

11.1.13 REGEN LAB SA

TABLE 176 REGEN LAB SA: BUSINESS OVERVIEW

11.1.14 ALTIS BIOLOGICS (PTY) LTD.

TABLE 177 ALTIS BIOLOGICS (PTY) LTD.: BUSINESS OVERVIEW

11.1.15 ITO CO., LTD.

TABLE 178 ITO CO., LTD.: BUSINESS OVERVIEW

11.2 OTHER COMPANIES

11.2.1 ELIZUR CORPORATION

11.2.2 BTT HEALTH GMBH

11.2.3 STIMULATE HEALTH

11.2.4 VQ ORTHOCARE

11.2.5 KINEX MEDICAL COMPANY, LLC

*Details on Business overview, Products offered, Recent developments, MnM view, Right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 210)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 CUSTOMIZATION OPTIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, fundamental market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B), white papers, annual reports, companies house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the bone growth stimulators market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

Extensive primary research was conducted after acquiring knowledge about the bone growth stimulators market scenario through secondary research. A significant number of primary interviews were conducted with stakeholders from both the demand side (such hospitals, ambulatory surgery centers (ASCs), home care settings, and academic & research institutes) and supply side (such as product manufacturers, wholesalers, channel partners, and distributors). Approximately 32% of the primary interviews were conducted with stakeholders from the demand side while those from the supply side accounted for the remaining 48%. Primary data for this report was collected through questionnaires, emails, and telephonic interviews.

A breakdown of the primary respondents is provided below:

*Others includes sales managers, marketing managers, business development managers, product managers, distributors, and suppliers

Note: Tiers are defined based on a company’s total revenue. As of 2021: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

All major product manufacturers offering various bone growth stimulators were identified at the global/regional level. Revenue mapping was done for the major players (who contribute at least 35-40% of the overall market share at the global level) and was extrapolated to arrive at the global market value of each type segment. The market value of bone growth stimulators was also split into various segments and subsegments at the region and country level based on:

- Product mapping of various manufacturers for each type of bone growth stimulators at the regional and country-level

- Relative adoption pattern of each bone growth stimulators among key application segments at the regional and/or country-level

- Detailed primary research to gather qualitative and quantitative information related to segments and subsegments at the regional and/or country-level

- Detailed secondary research to gauge the prevailing market trends at the regional and/or country-level

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the bone growth stimulators industry.

Report Objectives

- To define, describe, and forecast the bone growth stimulators market based on the product, type, application, and region

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micro markets with respect to their growth trends, prospects, and contributions to the total market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the revenue of market segments with respect to five regions, namely, North America (US and Canada), Europe (Germany, France, the UK, Italy, Spain, and the Rest of Europe), Asia Pacific (China, Japan, India, Australia, South Korea, and the Rest of Asia Pacific), Latin America (Brazil, Mexico, and RoLA), and the Middle East & Africa

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as collaborations, partnerships, acquisitions, expansions, and product launches in the bone growth stimulators market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the present global bone growth stimulators market report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)/

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Bone Growth Stimulator Market

Can you share the detailed information on technological advancements in the Bone Growth Stimulator Market?

In what way COVID19 is Impacting the global growth of the Bone Growth Stimulator Market?

Can you enlighten us about the key players operating in the global Bone Growth Stimulator Market?