Bookbinding Adhesives Market by Technology (Emulsion based, Hot melt), Chemistry (PVA, VAE, EVA, PUR), and Applications (Hardcover and Softcover Books, Magazines and Catalogs, Print on Demand), and Region - Global Forecast to 2027

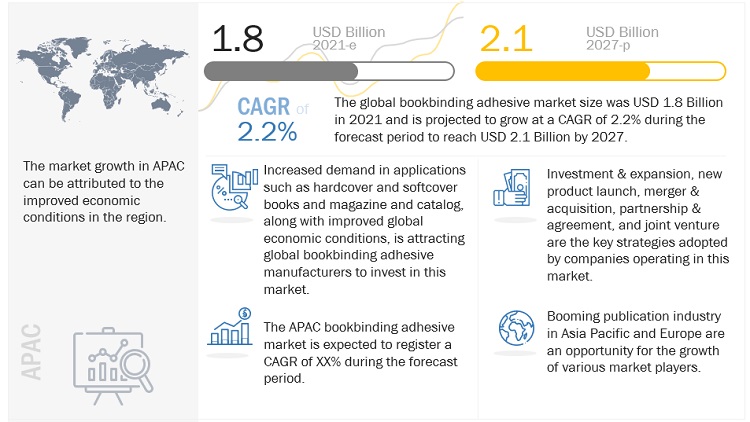

[187 Pages Report] The global bookbinding adhesive market size was USD 1.8 Billion in 2021 and is projected to grow at a CAGR of 2.2% during the forecast period to reach USD 2.1 Billion by 2027. Bookbinding adhesives market is projected to exhibit high growth in the future due to the increasing demand from various applications.

Note: e-estimated p-projected.

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Bookbinding adhesives Market Dynamics

Driver: Increase in demand for physical books

The pandemic had an odd influence on the book publishing industry. Closed bookstores and classrooms initially reduced the market sales, particularly of academic publications. After the pandemic, in most of the countries, educational institutions opened. This benefited the global bookbinding adhesive market.

Restraint: Availability of online resources for educational purpose

Advances in technology over the last few years, combined with the urgent need for remote learning during the COVID-19 pandemic, clearly impacted the way educational institute operates. Learning during COVID-19 will probably continue to change, how education is viewed in the long run. Easy, cheap, and fast availability of internet significantly impacted the physical book market.

Opportunity: Technological advancement

The Innovative hot-melt adhesives show outstanding results in terms of heat/cold resistance, and thermal stability. This innovative hot-melt adhesive has reduced the cost of bookbinding with better finish. Magazines & catalogs applications require smooth finish at competitive cost. This innovative hot -melt is solution for many such applications.

Challenge: Volatility in raw material prices

Parameters such as price and availability of raw materials are the key factors that determine the cost structure of products. Raw materials used in the adhesive industry include plastic resins, synthetic rubber, inorganic chemicals, and refined petroleum products. Most of these raw materials are petroleum-based derivatives and are vulnerable to fluctuations in commodity prices.

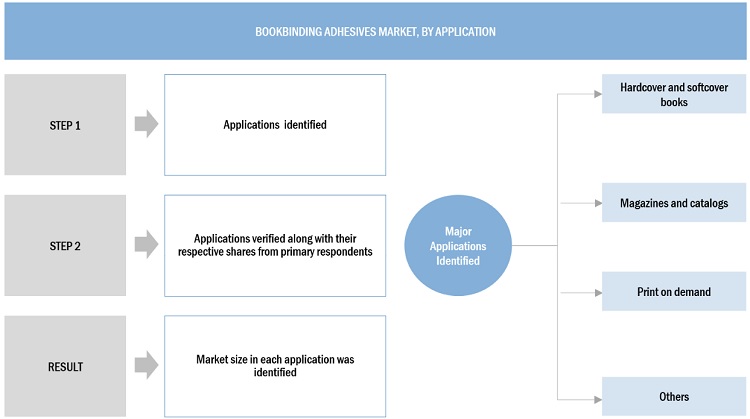

Hardcover & softcover books of the application is projected to register the second-highest CAGR during the forecast period.

Hardcover & softcover books demand is growing in the emerging nations such as China, India. Development in educational institutions and high gross enrolment ratio in higher education is driving the bookbinding adhesive market for hardcover & softcover books application. Higher education books requires good quality of binding and this will fuel and fuel their market growth throughout the forecast period.

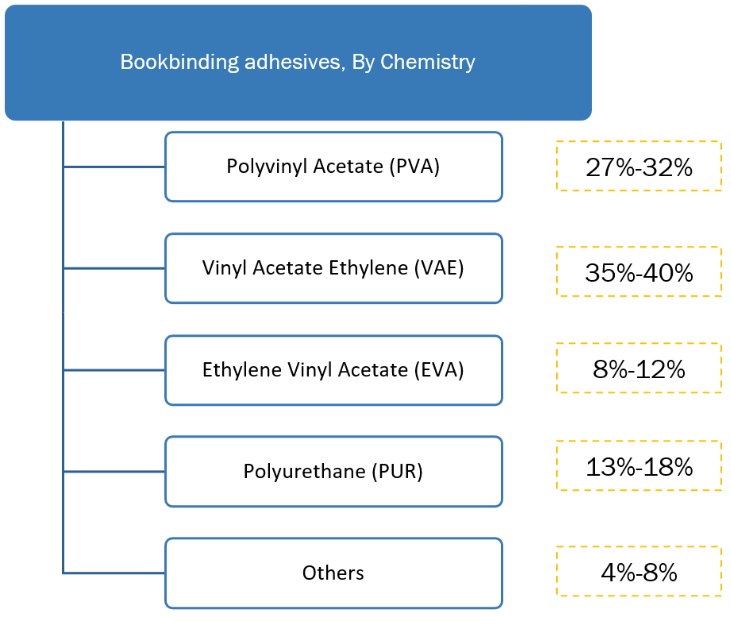

The Polyurethane (PUR) segment of the chemistry is projected to register the highest CAGR during the forecast period.

The polyurethane has excellent cohesive strength and flexibility. Polyurethane adhesives are available in variety of viscosity. They have good resilience at low temperatures but often lose strength after long-term exposure to temperatures above 150°C. the application of polyurethane includes hardcover & softcover books, magazines & catalogs, and print on demand. These applications are the factors to drive the market in the forecast period.

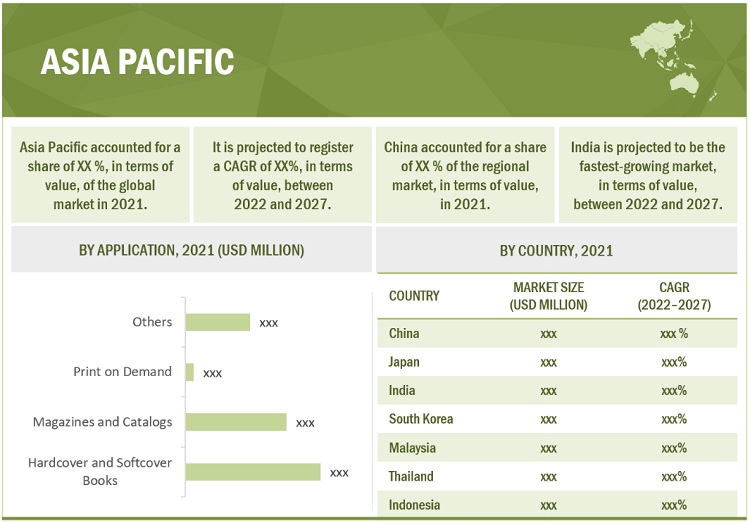

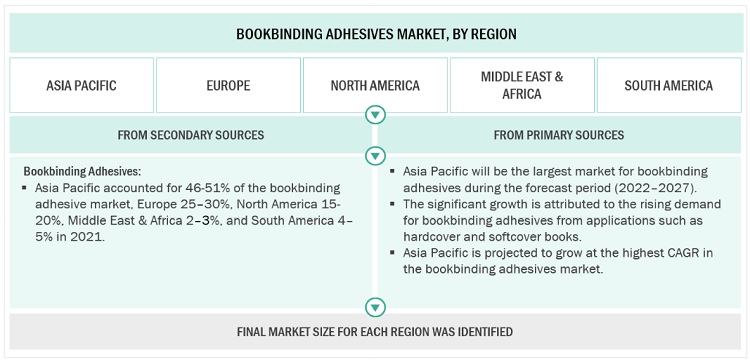

China is expected to account for the largest share of in bookbinding adhesive market during the forecast period, in terms of value.

In this report, the Asia pacific region is segmented into China, South Korea, Japan, India, Indonesia, Thailand, Malaysia, and Rest of Asia Pacific. The continuous rise in the manufacturing of products for consumption and also for exports is driving the demand for bookbinding adhesives in the region. China is an industry hub, with increasing demand for quality products, rising population, and growing end-use industries. The rapid growth of the economy, increasing innovation, and industry consolidations are expected to contribute to the high growth of the bookbinding adhesive market in the region.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Henkel AG (Germany), H.B. Fuller Company (US) are some of the players operating in the global adhesive market.

Recent Developments

- In June 2022, Henkel is expanding its production capabilities in Mexico by opening a new state-of-the-art plant for hot melt adhesives in Guadalupe, Nuevo Leon. The new facility has been designed for primarily manufacturing pressure-sensitive and non-pressure sensitive hot melts under the leading Technomelt brand.

- In February 2022, Arkema acquired a wide range of key technologies and well-known brands of Ashland Performance Adhesives. Ashland is a major player in pressure-sensitive adhesives, particularly decorative, protection, and signage films for the automotive and building industries. It also holds a leading position in structural adhesives and offers an extensive range of HMA for flexible packaging.

Scope of the Report:

|

Report Metrics |

Details |

| Years considered for the study | 2020–2027 |

| Base year | 2021 |

| Forecast period | 2022–2027 |

| Unit considered | Value (USD Million/USD Billion) and Volume (Kiloton) |

| Segments | Technology, Chemistry, Application, and Region |

| Regions | Asia Pacific, Europe, North America, Middle East & Africa, and South America |

| Companies | Henkel AG(Germany), H.B. Fuller Company (US) |

This research report categorizes the bookbinding adhesives market based on technology, chemistry, application, and region.

Bookbinding Adhesives Market, Based on technology Type

- Emulsion based

- Hot melt

Bookbinding Adhesives Market, Based on chemistry Type

- Polyvinyl Acetate (PVA)

- Vinyl Acetate Ethylene (VAE)

- Ethylene Vinyl Acetate (EVA)

- Polyurethane (PUR)

- Others

Bookbinding Adhesives Market, Based on Application

- Hardcover and Softcover Books

- Magazines and Catalogs

- Print on Demand

- Others

Bookbinding Adhesives Market, Based on Region

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

- Others

Frequently Asked Questions (FAQ):

What is the mid-to-long term impact of the developments undertaken in the industry?

Continuous developments in the market, including new product launches, mergers & acquisitions, investments & expansions, and partnership and agreement are expected to help the market grow. New product launches/developments, mergers & acquisitions, and investments & expansions are some of the key strategies adopted by the players to achieve growth in the bookbinding adhesive market.

What are the upcoming technologies used in the bookbinding adhesive market?

During the manufacture of bookbinding adhesive, technologies that do not release VOC fumes or minimal release of VOC fumes are preferred.

Which segment has the potential to register the highest market share?

Hardcover & softcover books segment to register the highest market share of bookbinding adhesive market.

What is the current competitive landscape in the bookbinding adhesive market in terms of new technologies, production, and sales?

The competitive landscape of the bookbinding adhesive market includes the important growth strategies adopted by the key players between 2016 and 2022. Henkel AG (Germany), H.B. Fuller Company (US), Arkema (France) are the leading players in the bookbinding adhesive market.

What will be the growth prospects of the bookbinding adhesive market?

The drivers of market growth are identified as the Increasing adoption for bookbinding adhesive in various applications. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

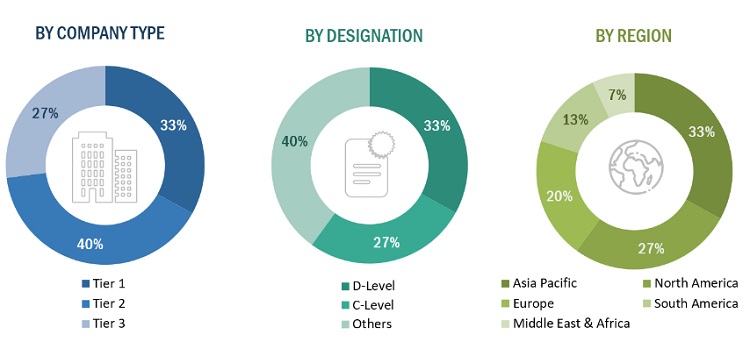

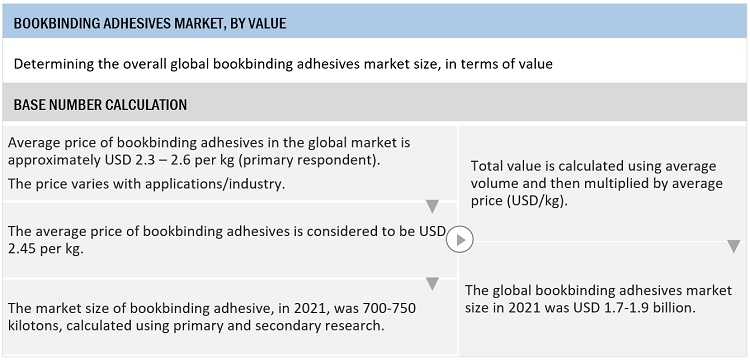

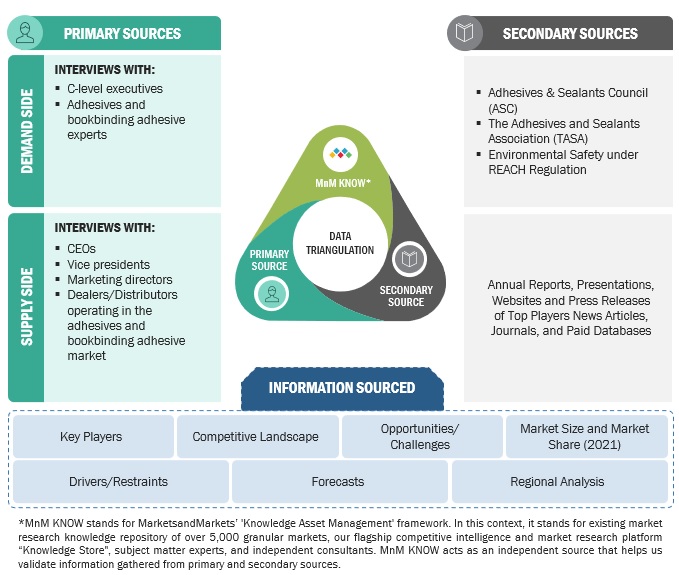

The study involved four major activities in estimating the current market size of bookbinding adhesives. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and subsegments of the overall market.

Secondary Research

Secondary sources include annual reports of companies, press releases, investor presentations, white papers, articles by recognized authors, and databases, such as D&B, Bloomberg, Chemical Weekly, and Factiva; and publications and databases from associations, including the National Institute for Occupational Safety and Health (NIOSH), United States Environmental Protection Agency (USEPA), The Adhesive and Sealant Council, and The Pressure Sensitive Tape Council.

Primary Research

In the primary research process, experts from the supply and demand sides have been interviewed to obtain qualitative and quantitative information and validate the data for this report. Primary sources from the supply side include industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the bookbinding adhesives market. Extensive primary research has been conducted to gather information and validate the market numbers arrived at. Primary research has also been conducted to identify market segmentation and industry trends.

Notes: Companies are classified based on their revenue–Tier 1 = >USD 7 billion, Tier 2 = USD 500 million to USD 7 billion, and Tier 3 =

Others include sales, marketing, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

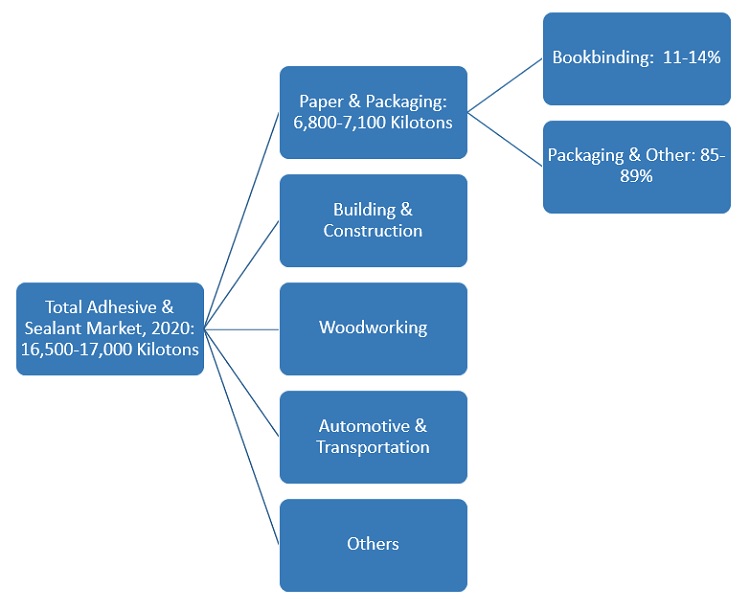

Top-Down Approach

The top-down approach used to estimate the market size included the following steps:

- The market size was assessed from the supply side. First, from the secondary sources, the overall adhesive and sealant market size was noted, and then, consumption across various end-use industries was ascertained. This helped quantify the overall bookbinding adhesive market in the global adhesive and sealant market. The penetration of the market in different regions was determined through secondary research and interactions with industry experts.

- Ascertaining the share of various bookbinding adhesive technologies in the overall bookbinding adhesive market led to quantifying the market size in terms of volume (kiloton).

Market Size Estimation: Top-Down Approach

Source: Annual Reports, Investor Presentations, Primary Interviews, Environmental Protection Agency, National Institute for Occupational Safety and Health (NIOSH), United States Environmental Protection Agency (USEPA), The Adhesive and Sealant Council, and The Pressure Sensitive Tape Council, and MarketsandMarkets Analysis

Market Size Estimation: Bookbinding Adhesives Market

Source: Annual Reports, Investor Presentations, Primary Interviews, Environmental Protection Agency, National Institute for Occupational Safety and Health (NIOSH), United States Environmental Protection Agency (USEPA), The Adhesive and Sealant Council, and The Pressure Sensitive Tape Council, and MarketsandMarkets Analysis

Bookbinding Adhesives Market By Region

Source: Annual Reports, Investor Presentations, Primary Interviews, Environmental Protection Agency, National Institute for Occupational Safety and Health (NIOSH), United States Environmental Protection Agency (USEPA), The Adhesive and Sealant Council, and The Pressure Sensitive Tape Council, and MarketsandMarkets Analysis

Bookbinding Adhesives Market By Chemistry

Source: Annual Reports, Investor Presentations, Primary Interviews, Environmental Protection Agency, National Institute for Occupational Safety and Health (NIOSH), United States Environmental Protection Agency (USEPA), The Adhesive and Sealant Council, and The Pressure Sensitive Tape Council, and MarketsandMarkets Analysis

Bottom-Up Approach

The bottom-up approach has been used to arrive at the overall size of the bookbinding adhesives market from the revenues of the key market players in 2021. With the data triangulation procedure and validation of data through primary interviews, the exact values of the overall parent market size and individual market sizes have been determined and confirmed in this study. The bottom-up approach has been implemented to validate the sizes of the market segments in terms of value.

Market Size Estimation: Bottom-Up Approach By Applications

Source: Annual Reports, Investor Presentations, Primary Interviews, Environmental Protection Agency, National Institute for Occupational Safety and Health (NIOSH), United States Environmental Protection Agency (USEPA), The Adhesive and Sealant Council, and The Pressure Sensitive Tape Council, and MarketsandMarkets Analysis

Market Forecast Approach

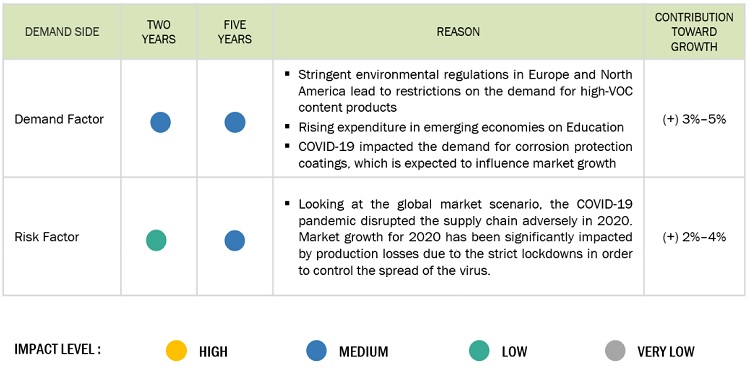

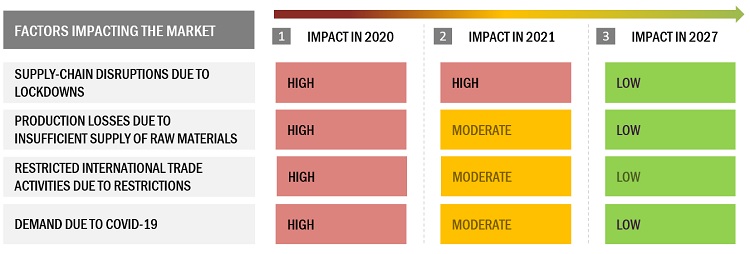

Demand-Side Forecast Projection

Source: MarketsandMarkets Analysis

Factor Analysis

Source: MarketsandMarkets Analysis

Data Triangulation

After arriving at the overall market size, the market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from the demand and supply sides. In addition, the market has been validated using both the top-down and bottom-up approaches.

Bookbinding Adhesives Market: Data Triangulation

Report Objectives

- To define, describe, and forecast the global bookbinding adhesives market in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To analyze and forecast the market by technology, chemistry, application, and region.

- To forecast the market size with respect to five main regions: Asia Pacific, Europe, North America, Middle East & Africa, and South America.

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments in the market, such as investments & expansions, and mergers & acquisitions

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Available Customizations:

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis:

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- A further breakdown of the bookbinding adhesives market, by country

Company Information:

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Bookbinding Adhesives Market