Low VOC Adhesives Market by Technology (Water-based, Hot-melt, Reactive), Chemistry (Acrylic Polymer Emulsion, PVA Emulsion, VAE Emulsion, EVA Emulsion, SBC, Polyurethane, epoxy), End-Use Industry, and Region (2022 - 2026)

Updated on : April 11, 2024

Low VOC Adhesives Market

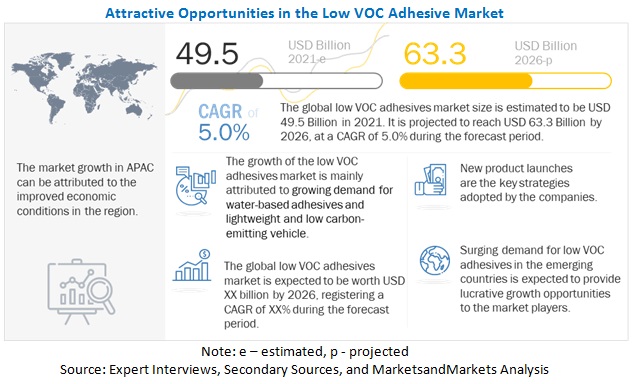

The global low VOC adhesives market was valued at USD 49.5 billion in 2021 and is projected to reach USD 63.3 billion by 2026, growing at 5.0% cagr from 2021 to 2026. The key factor driving the growth of the market includes the growing demand for water based adhesives due to their flexibility, durability, and economic feasibility. The building and construction sector, by end use industry in APAC region is expecting a boom in the forecasted period and will lead to an increase in the demand for Low VOC adhesive.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Low VOC adhesive Market

According to recent updates by the IMF (International Monetary Fund), there will be a recession as bad as the global economic crisis of 2008 or worse in 2020. The IMF has warned of a total output loss of USD 9 trillion of the world economy between 2020 and 2021. The extent of the economic damage still depends on how the virus spreads in Europe, the US, and other major economies.

- According to economists, the Chinese economy is likely to be hit further by reduced global demand for its products due to the effect of the outbreak on economies around the world. As the pandemic escalates, the growth rate will fall sharply against the backdrop of volatile markets and growing credit stress.

- Initial data from China suggests that its economy has been hit far harder than projected, although a tentative stabilization has begun. In Europe and the US, increasing restrictions on travel & transportation and prolonged lockdown will lead to a demand collapse that is expected to recover a little in the second quarter before significant recovery begins later in the year.

- Central banks have swung into action and are undertaking some combinations of sharply reduced policy rates, resumed assets purchase, and liquidity injections. Fiscal authorities have generally lagged but begun to loosen their purse strings. It is expected that larger and more targeted spending to the most affected groups is forthcoming.

- Restrictions on movement in Europe and the US are putting a severe dent on economic activity. India and Southeast Asian countries are also facing major disruption in their economies.

Low VOC Adhesives Market Dynamics

Drivers: Increasing demand from construction and woodworking industries

The growth of the construction and woodworking industries play a key role in driving the low VOC adhesives market. The increase in the use of these adhesives in these industries is backed by their potential advantages, such as high-temperature resistance, high water resistance, ease of use, and stability. These adhesives possess the ability to meet the specific requirements of these two industries and fulfill the need for water resistance, high bond strength, and fast curing under increasing humidity in new constructions.

Restraints: Volatility in raw material prices

The price and availability of raw materials are the key factors considered by adhesive manufacturers for determining the cost structure of their products. The raw materials used for adhesive manufacturing include plastic resins, synthetic rubber, inorganic chemicals, industrial inorganic chemicals, and refined petroleum products. Most of these raw materials are petroleum-based derivatives and are vulnerable to fluctuations in crude oil prices. Recently, oil prices have been highly volatile, fluctuating by over 8.0%. The increasing global demand for oil and the unrest in the Middle East have been primarily responsible for these fluctuations.

Opportunities: Growing demand for green and sustainable adhesives

The use of green adhesives or those with low VOC is increasing due to growing demand for eco-friendly or green products. The U.S. Environmental Protection Agency (EPA), Europe’s Regulation on Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH), and other regional regulatory authorities have forced manufacturers to produce eco-friendly adhesives with low VOC levels. The shift towards a more sustainable product portfolio will provide the market with a concrete growth opportunity.

The awareness of environment-friendly or green buildings has increased in the global building & construction industry, which is promising for the development of green and more sustainable adhesive solutions. These green adhesive solutions are made from renewable, recycled, remanufactured, or biodegradable materials. The growing building & construction industry will help the adhesive industry to capitalize on the resulting opportunities arising during the forecast period.

Challenges: Stringent regulatory policies

Many stringent government regulations are being set on the usage of adhesives to curb the adverse effects of their VOC content on the environment and human health. Although reactive hot melt adhesives have low VOC content, the manufacturers need to comply with the regulations to sell their products in the market. Rising consumer awareness of the impact of VOC-containing adhesives has increased the number of government regulations related to adhesives. The environmental regulations and standards that are governing the VOC limits in adhesives include National Ambient Air Quality Standards, 310 CMR 7.18(30), and Air Pollution Control Regulation. The companies offering adhesive products with VOC content need to adhere to these regulations to sustain their business within a country/state where the regulations are being formulated or implemented. Compliance with these regulations is necessary as the smallest defect in manufacturing a product may cause harmful effects on the environment. Compliance with such standards and regulations needs more effort, time, costs, and resources. Reactive hot melt adhesive manufacturers need to deal with such stringent standards and, at the same time, provide cost-effective products, which pose a challenge for the growth of the market.

Paper & Packaging segment accounted for the largest share of the Low VOC adhesive market in 2020.

Paper & Packaging is the largest end-use industry segment of the Low VOC adhesive market. The paper & packaging end-use industry uses low VOC adhesives in various types of applications such as case & carton, corrugated packaging, and flexible packaging. Case & carton are boxes made of paperboard that are used for packaging of goods. They are used for storage of agricultural & poultry products, biscuits, chocolates, pharmaceutical products, and industrial purposes. The adhesive technology to be used for case & carton packaging applications is chosen based on the production line. The hot-melt and water-based adhesives technologies are mainly preferred for case & carton applications.

To know about the assumptions considered for the study, download the pdf brochure

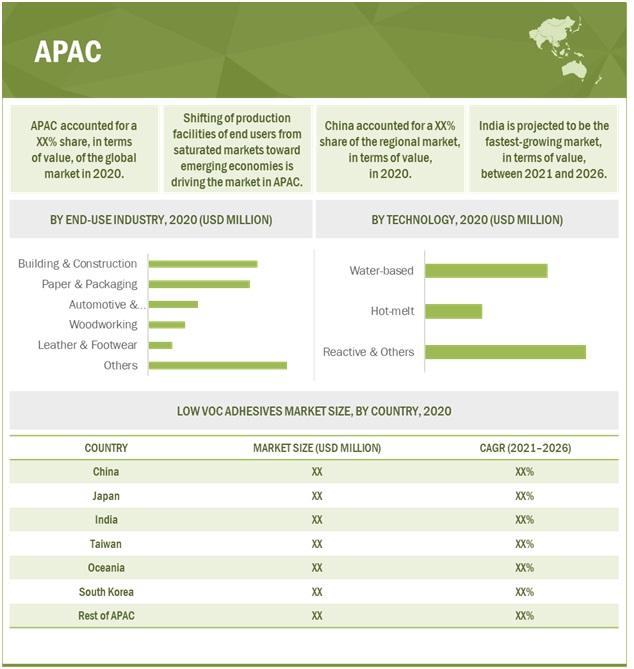

APAC is the fastest-growing Low VOC adhesive market.

APAC is projected to be the fastest-growing market during the forecast period. The region comprises countries with different levels of economic development. The growth in the region is mainly attributed to the use of Low VOC adhesive in various end-use industries such as Building & Construction and Paper & Packaging.

Low VOC Adhesives Market Players

Henkel (Germany), 3M (USA), Sika AG (Switzerland), H.B. Fuller (USA) and Bostik (France) are the major players in the Low VOC adhesive market.

Bostik (France) is expanding its global business in the four business segments—advanced materials, coating solutions, adhesives, and intermediates. The group reported annual sales of USD 9.8 billion in 2019. Arkema acquired Bostik SA (the world’s no. 3 industrial adhesives manufacturer) in February 2015 to strengthen its position in the specialty chemicals market. Its adhesives are mainly used in the construction industry (both interior and exterior use). Three years after joining Arkema’s high-performance materials segment, Bostik, the smart adhesives specialist, is leveraging investment, innovation, and customer approach to expand its technological leadership in industrial, personal care, construction, and consumer products markets. The company operates in approximately 55 countries and 144 production sites.

Low VOC Adhesives Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 49.5 billion |

|

Revenue Forecast in 2026 |

USD 63.3 billion |

|

CAGR |

5.0% |

|

Years Considered for the study |

2017-2026 |

|

Base year |

2020 |

|

Forecast period |

2021–2026 |

|

Units considered |

Value (USD) and Volume (Kiloton) |

|

Segments |

By Technology |

|

Regions covered |

APAC, Europe, North America, Middle East & Africa, South America |

|

Companies profiled |

Henkel (Germany), 3M (USA), Sika AG (Switzerland), H.B. Fuller (USA) and Bostik (France). A total of 25 players have been covered. |

This research report categorizes the Low VOC adhesives market based on Technology, Chemistry, End-use Industry, and Region.

Low VOC Adhesives Market by Technology:

- Water based

- Hot-melt

- Reactive and others

Low VOC Adhesives Market by Chemistry:

- PVA Emulsion

- PAE Emulsion

- VAE Emulsion

- EVA Emulsion

- Polyurethane

- Epoxy

- Others

Low VOC Adhesives Market by End-use Industry:

- Paper & Packaging

- Building & Construction

- Woodworking

- Transportation

- Consumers

- Others

Low VOC Adhesives Market by Region:

- APAC

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In September 2020, Arkema announced the inauguration of the new adhesives plant in Japan which will enable Bostik to serve the Japanese customers in the continuously growing markets of hygiene, packaging, labelling, transportation, and electronics. This expansion of Bostik’s is in the line with its growth and geographical expansion strategy.

- In March 2021, DriTac is a well-recognized name in the US floor covering industry, with a strong reputation in the wood floor bonding segment. DriTac brings long-established customer and distributor relationships across the country that are highly complementary to Sika’s existing network. This deal will help to accelerate Sika’s expansion in the interior finishing market in the US. The acquired business has generated a revenue of USD 22.26 million in 2020.

Frequently Asked Questions (FAQ):

How big is the Low VOC adhesive market?

The global Low VOC adhesive market is projected to grow USD 63.3 billion by 2026 from USD 49.5 billion in 2021, at a CAGR of 5.0%.

Which region is set to lead the Low VOC adhesive market?

Asia Pacific region is projected to lead the Low VOC adhesive market in the forecast period.

What are the factors influencing the growth of Low VOC adhesive?

The global Low VOC adhesive market is driven by the paper and packaging industries and automobile and transportation organizations.

What are the major end-use industries for Low VOC adhesive?

The major end-use industries of Low VOC adhesive are paper and packaging, building & construction, woodworking, transportation, consumers, and others.

Who are the major manufacturers?

Henkel (Germany), 3M (USA), H.B. Fuller (USA), Sika AG (Switzerland) and Bostik (France) are some of the leading players operating in the global Low VOC adhesive market.

Why Low VOC adhesive are gaining market share?

The growth of this market is attributed to the growing demand in APAC and the increasing usage of Low VOC adhesive in the paper and packaging industry and construction and transportation industry. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 18)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 MARKET INCLUSIONS

1.2.2 MARKET EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 23)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary interviews

2.1.2.3 Primary data sources

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.3 MARKET FORECAST APPROACH

2.4 DATA TRIANGULATION

2.5 FACTOR ANALYSIS

2.6 ASSUMPTIONS

2.7 LIMITATIONS & ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 34)

4 PREMIUM INSIGHTS (Page No. - 38)

4.1 ATTRACTIVE OPPORTUNITIES IN LOW VOC ADHESIVES MARKET

4.2 LOW VOC ADHESIVES MARKET, BY CHEMISTRY

4.3 LOW VOC ADHESIVES MARKET, BY TECHNOLOGY

4.4 LOW VOC ADHESIVES MARKET, BY END-USE INDUSTRY

4.5 APAC: LOW VOC ADHESIVES MARKET, BY CHEMISTRY AND END-USE INDUSTRY

4.6 LOW VOC ADHESIVES MARKET, DEVELOPED VS. DEVELOPING COUNTRIES

4.7 LOW VOC ADHESIVES MARKET, BY COUNTRY

5 MARKET OVERVIEW (Page No. - 42)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Growing demand for water-based adhesives due to their flexibility, durability, and economic feasibility

5.2.1.2 Growing demand for lightweight and low carbon-emitting vehicles

5.2.1.3 Increasing demand from construction and woodworking industries

5.2.2 RESTRAINTS

5.2.2.1 Volatility in raw material prices

5.2.3 OPPORTUNITIES

5.2.3.1 Technological advancements

5.2.3.2 Growing demand for green and sustainable adhesives

5.2.3.3 Increasing trend of hybrid and electric vehicles

5.2.3.1 Innovations in water-based adhesives

5.2.4 CHALLENGES

5.2.4.1 Stringent regulatory policies

5.3 PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 MACROECONOMIC INDICATORS

5.4.1 INTRODUCTION

5.4.2 TRENDS AND FORECASTS OF GDP

5.4.3 TRENDS AND FORECASTS FOR GLOBAL AUTOMOTIVE INDUSTRY

5.4.4 TRENDS AND FORECAST FOR GLOBAL CONSTRUCTION INDUSTRY

5.4.5 TRENDS AND FORECAST FOR GLOBAL PACKAGING INDUSTRY

5.4.6 TRENDS IN AEROSPACE INDUSTRY

5.4.7 TRENDS IN FOOTWEAR INDUSTRY

5.4.8 TRENDS IN ELECTRONICS INDUSTRY

5.5 COVID-19 IMPACT

5.6 COVID-19 ECONOMIC ASSESSMENT

5.6.1 COVID-19 ECONOMIC IMPACT: SCENARIO ASSESSMENT

5.7 IMPACT OF COVID-19 ON END-USE INDUSTRIES

5.7.1 IMPACT ON CONSTRUCTION INDUSTRY

5.7.2 IMPACT ON AUTOMOTIVE INDUSTRY

5.8 IMPACT OF COVID-19 ON REGIONS

5.8.1 IMPACT OF COVID-19 ON APAC

5.8.2 IMPACT OF COVID-19 ON NORTH AMERICA

5.8.3 IMPACT OF COVID-19 ON EUROPE

5.8.4 IMPACT OF COVID-19 ON MIDDLE EAST & AFRICA

5.8.5 IMPACT OF COVID-19 ON SOUTH AMERICA

5.9 VALUE CHAIN ANALYSIS

5.10 AVERAGE SELLING PRICE ANALYSIS

5.11 ECOSYSTEM/MARKET MAP

5.12 REVENUE SHIFT AND NEW REVENUE POCKETS FOR LOW VOC ADHESIVES MANUFACTURERS

5.13 EXPORT-IMPORT TRADE STATISTICS FOR ADHESIVES

5.14 PATENTS ANALYSIS

5.14.1 METHODOLOGY

5.14.2 PUBLICATION TRENDS

5.14.3 PATENTS ANALYSIS BY JURISDICTION

5.14.4 TOP APPLICANTS

5.15 REGULATIONS

5.15.1 EMISSION STANDARDS FOR ADHESIVES

5.16 CASE STUDY ANALYSIS

5.17 TECHNOLOGY ANALYSIS

6 LOW VOC ADHESIVES MARKET, BY TECHNOLOGY (Page No. - 79)

6.1 INTRODUCTION

6.2 WATER-BASED ADHESIVES

6.2.1 MOST WIDELY USED TECHNOLOGY AMONG LOW VOC ADHESIVES

6.3 HOT-MELT ADHESIVES

6.3.1 REDUCTION OF VOC EMISSIONS IS A MAJOR ADVANTAGES OF HOT-MELT ADHESIVES

6.4 REACTIVE & OTHER ADHESIVES

6.4.1 AUTOMOTIVE INDUSTRY TO DRIVE REACTIVE AND OTHER ADHESIVES SEGMENT

7 LOW VOC ADHESIVES MARKET, BY CHEMISTRY (Page No. - 87)

7.1 INTRODUCTION

7.2 ACRYLIC POLYMER EMULSION

7.2.1.1 Acrylic polymer emulsion widely preferred in water-based adhesive formulation

7.3 PVA (POLYVINYL ACETATE EMULSION)

7.3.1 TRANSPORTATION INDUSTRY TO BOOST DEMAND FOR PVA ADHESIVES

7.4 VINYL ACETATE ETHYLENE (VAE) EMULSION

7.4.1 VAE IS AN IMPORTANT SYNTHETIC POLYMER USED IN PAPER & PACKAGING AND WOODWORKING APPLICATIONS

7.5 ETHYLENE-VINYL ACETATE (EVA)

7.5.1 EVA OFFERS GREATER FLEXIBILITY OR ABILITY TO WITHSTAND ADVERSE TEMPERATURE CHANGES

7.6 POLYURETHANE

7.6.1 POLYURETHANE PROVIDES STRONG AND DURABLE LOAD-BEARING JOINTS AND HAS HIGH COHESIVE STRENGTH

7.7 STYRENIC BLOCK COPOLYMER (SBC)

7.7.1 STYRENIC BLOCK COPOLYMER SEGMENT EXPECTED TO REGISTER MODERATE GROWTH DURING THE FORECAST PERIOD

7.8 EPOXY

7.8.1 EPOXY PROVIDES HIGH COHESIVE STRENGTH, CHEMICAL RESISTANCE, AND EXCELLENT ADHESION TO VARIETY OF SUBSTRATES

7.9 OTHERS

8 LOW VOC ADHESIVES MARKET, BY END-USE INDUSTRY (Page No. - 104)

8.1 INTRODUCTION

8.2 PAPER & PACKAGING

8.2.1 ADHESIVES MARKET IN PAPER & PACKAGING DRIVEN BY ENVIRONMENTAL NORMS AND GOVERNMENT REGULATIONS

8.3 BUILDING & CONSTRUCTION

8.3.1 GOVERNMENT REGULATIONS AND INITIATIVES FOR SUSTAINABLE DEVELOPMENT OF HIGH-QUALITY BUILDINGS DRIVING GROWTH

8.4 WOODWORKING

8.4.1 GROWTH IN FURNITURE INDUSTRY WILL INCREASE DEMAND FOR WOODWORKING ADHESIVES

8.5 AUTOMOTIVE & TRANSPORTATION

8.5.1 NEED FOR REDUCING WEIGHT OF VEHICLES TO BOOST THE DEMAND FOR LOW VOC ADHESIVES

8.6 LEATHER & FOOTWEAR

8.6.1 HIGH PRODUCTION OF FOOTWEAR IN ASIA TO BOOST THE DEMAND FOR ADHESIVES

8.7 OTHERS

9 LOW VOC ADHESIVES MARKET, BY REGION (Page No. - 118)

9.1 INTRODUCTION

9.2 APAC

9.2.1 CHINA

9.2.1.1 China is largest low VOC adhesives market

9.2.2 JAPAN

9.2.2.1 Infrastructural redevelopment expected to boost the demand

9.2.3 INDIA

9.2.3.1 Expansion of packaging industry will drive the market

9.2.4 SOUTH KOREA

9.2.4.1 Construction industry to drive the demand for low VOC adhesives

9.2.5 OCEANIA

9.2.5.1 Booming construction sector expected to drive the market

9.2.6 TAIWAN

9.2.6.1 Growth in construction industry likely to fuel the market growth

9.2.7 REST OF APAC

9.3 NORTH AMERICA

9.3.1 US

9.3.1.1 Automotive, packaging, and electronics industries expected to fuel the demand for low VOC adhesives

9.3.2 CANADA

9.3.2.1 New trends in packaging industry expected to boost the market

9.3.3 MEXICO

9.3.3.1 Growth of construction industry expected to be drive the market

9.4 EUROPE

9.4.1 GERMANY

9.4.1.1 Packaging and automotive industries to play an important role in the country’s market

9.4.2 FRANCE

9.4.2.1 Construction and automotive industries to boost the demand for low VOC adhesives

9.4.3 ITALY

9.4.3.1 Numerous motor manufacturing companies shifting production facilities to Italy creating growth opportunities

9.4.4 UK

9.4.4.1 Growing use of adhesives in paper & packaging, woodworking, and other consumer applications driving the market

9.4.5 TURKEY

9.4.5.1 Investment in various industries to boost the demand

9.4.6 RUSSIA

9.4.6.1 Packaging industry will boost the demand

9.4.7 REST OF EUROPE

9.5 MIDDLE EAST & AFRICA

9.5.1 SAUDI ARABIA

9.5.1.1 With an increase in tourism, the construction industry is expected to increase the demand for low VOC adhesives

9.5.2 UAE

9.5.2.1 Logistics market will improve the demand of Low VOC adhesives

9.5.3 REST OF MIDDLE EAST & AFRICA

9.6 SOUTH AMERICA

9.6.1 BRAZIL

9.6.1.1 New investments in construction industry to boost the market of Low VOC adhesives

9.6.2 ARGENTINA

9.6.2.1 Government investments in infrastructure will enhance sales of low VOC adhesives market

9.6.3 REST OF SOUTH AMERICA

10 COMPETITIVE LANDSCAPE (Page No. - 168)

10.1 OVERVIEW

10.1.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY LOW VOC ADHESIVE PLAYERS

10.2 COMPANY EVALUATION QUADRANT MATRIX: DEFINITION AND METHODOLOGY, 2020

10.2.1 STAR

10.2.2 EMERGING LEADERS

10.2.3 PERVASIVE

10.2.4 EMERGING COMPANIES

10.3 STRENGTH OF PRODUCT PORTFOLIO

10.4 BUSINESS STRATEGY EXCELLENCE

10.5 COMPETITIVE SCENARIO

10.5.1 MARKET EVALUATION MATRIX

10.6 SME MATRIX, 2020

10.6.1 RESPONSIVE COMPANIES

10.6.2 PROGRESSIVE COMPANIES

10.6.3 STARTING BLOCKS

10.6.4 DYNAMIC COMPANIES

10.7 LOW VOC ADHESIVES MARKET SHARE ANALYSIS

10.8 REVENUE ANALYSIS

10.8.1 HENKEL AG

10.8.2 3M

10.8.3 H.B. FULLER

10.8.4 SIKA AG

10.8.5 ARKEMA (BOSTIK)

10.9 MARKET RANKING ANALYSIS

10.9.1 COMPETITIVE SCENARIO AND TRENDS

11 COMPANY PROFILES (Page No. - 188)

11.1 MAJOR PLAYERS

11.1.1 HENKEL

11.1.1.1 Business overview

11.1.1.2 Products offered

11.1.1.3 Recent developments

11.1.1.4 MnM view

11.1.1.4.1 Right to win

11.1.1.4.2 Strategic choices made

11.1.1.4.3 Weaknesses and competitive threats

11.1.2 3M

11.1.2.1 Business overview

11.1.2.2 Products offered

11.1.2.3 Recent developments

11.1.2.4 MnM view

11.1.2.4.1 Right to win

11.1.2.4.2 Strategic choices made

11.1.2.4.3 Weaknesses and competitive threats

11.1.3 H.B. FULLER

11.1.3.1 Business overview

11.1.3.2 Products offered

11.1.3.3 Recent developments

11.1.3.4 MnM view

11.1.3.4.1 Right to win

11.1.3.4.2 Strategic choices made

11.1.3.4.3 Weaknesses and competitive threats

11.1.4 SIKA

11.1.4.1 Business overview

11.1.4.2 Products offered

11.1.4.3 Recent developments

11.1.4.4 MnM view

11.1.4.4.1 Right to win

11.1.4.4.2 Strategic choices made

11.1.4.4.3 Weaknesses and competitive threats

11.1.5 ARKEMA (BOSTIK)

11.1.5.1 Business overview

11.1.5.2 Products offered

11.1.5.3 Recent developments

11.1.5.4 MnM View

11.1.5.4.1 Right to win

11.1.5.4.2 Strategic choices made

11.1.5.4.3 Weaknesses and competitive threats

11.1.6 DOW

11.1.6.1 Business overview

11.1.6.2 Products offered

11.1.6.3 MnM View

11.1.6.3.1 Right to win

11.1.6.3.2 Strategic choices made

11.1.6.3.3 Weaknesses and competitive threats

11.1.7 HUNTSMAN INTERNATIONAL LLC

11.1.7.1 Business overview

11.1.7.2 Products offered

11.1.7.3 Recent developments

11.1.8 ILLINOIS TOOL WORKS

11.1.8.1 Business overview

11.1.8.2 Products offered

11.1.9 ASHLAND GLOBAL HOLDINGS

11.1.9.1 Business overview

11.1.9.2 Products offered

11.1.10 MAPEI

11.1.10.1 Business overview

11.1.10.2 Products offered

11.2 OTHER COMPANIES

11.2.1 RPM INTERNATIONAL INC.

11.2.1.1 Products offered

SOURCE: COMPANY WEBSITE

11.2.2 AKZONOBEL

11.2.2.1 Products offered

11.2.3 PPG INDUSTRIES

11.2.3.1 Products offered

11.2.4 PARKER HANNIFIN

11.2.4.1 Products offered

11.2.5 WACKER CHEMIE

11.2.5.1 Products offered

11.2.6 SOUDAL GROUP

11.2.6.1 Products offered

11.2.7 SOURCE: COMPANY WEBSITEPIDILITE INDUSTRIES

11.2.7.1 Products offered

11.2.7.2 Recent developments

11.2.8 MERIDIAN ADHESIVES

11.2.8.1 Products offered

11.2.9 PERMABOND LLC.

11.2.9.1 Products offered

11.2.10 FRANKLIN INTERNATIONAL

11.2.10.1 Products offered

11.2.11 JOWAT

11.2.11.1 Products offered

11.2.12 DELO INDUSTRIAL ADHESIVES

11.2.12.1 Products offered

11.2.13 DYMAX

11.2.13.1 Products offered

11.2.14 THE REYNOLDS COMPANY

11.2.14.1 Products offered

11.2.15 UNISEAL

11.2.15.1 Products offered

11.2.16 MASTER BOND

11.2.16.1 Products offered

12 APPENDIX (Page No. - 241)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

12.3 INTRODUCING RT: REAL-TIME MARKET INTELLIGENCE

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHORS DETAILS

LIST OF TABLES (220 Tables)

TABLE 1 LOW VOC ADHESIVES MARKET SNAPSHOT, 2021 VS. 2026

TABLE 2 LOW VOC ADHESIVES MARKET: PORTERS FIVE FORCES ANALYSIS

TABLE 3 GDP TRENDS AND FORECASTS, USD BILLION (2015–2022)

TABLE 4 AUTOMOTIVE INDUSTRY PRODUCTION (2019–2020)

TABLE 5 GROWTH INDICATORS FOR AEROSPACE INDUSTRY, 2015–2033

TABLE 6 GROWTH INDICATORS FOR AEROSPACE INDUSTRY, BY REGION, 2015–2033

TABLE 7 LOW VOC ADHESIVES MARKET: ECOSYSTEM

TABLE 8 COUNTRY-WISE EXPORT DATA FOR ADHESIVES, 2017–2019

TABLE 9 COUNTRY-WISE IMPORT DATA FOR ADHESIVES, 2017–2019

TABLE 10 RECENT PATENTS BY COMPANIES

TABLE 1 VOC CONTENT LIMITS: ADHESIVES

TABLE 2 VOC CONTENT LIMITS: ADHESIVE PRIMERS

TABLE 3 VOC CONTENT LIMITS: ADHESIVES APPLIED TO THE LISTED SUBSTRATE

TABLE 4 LOW VOC ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 5 LOW VOC ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 6 LOW VOC ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2017–2020 (KILOTON)

TABLE 7 LOW VOC ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2021–2026 (KILOTON)

TABLE 8 WATER-BASED: LOW VOC ADHESIVES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 9 WATER-BASED: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 10 WATER-BASED: LOW VOC ADHESIVES MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 11 WATER-BASED: MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

TABLE 12 HOT-MELT: LOW VOC ADHESIVES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 13 HOT-MELT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 14 HOT-MELT: MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 15 HOT-MELT: MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

TABLE 16 REACTIVE & OTHERS: LOW VOC ADHESIVES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 17 REACTIVE & OTHERS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 18 REACTIVE & OTHERS: MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 19 REACTIVE & OTHERS: MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

TABLE 20 LOW VOC ADHESIVES MARKET SIZE, BY CHEMISTRY, 2017–2020 (USD MILLION)

TABLE 21 MARKET SIZE, BY CHEMISTRY, 2021–2026 (USD MILLION)

TABLE 22 MARKET SIZE, BY CHEMISTRY, 2017–2020 (KILOTON)

TABLE 23 MARKET SIZE, BY CHEMISTRY, 2021–2026 (KILOTON)

TABLE 24 ACRYLIC POLYMER EMULSION: APPLICATION

TABLE 25 ACRYLIC POLYMER EMULSION: LOW VOC ADHESIVES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 26 ACRYLIC POLYMER EMULSION: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 27 ACRYLIC POLYMER EMULSION: MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 28 ACRYLIC POLYMER EMULSION: MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

TABLE 29 PVA: LOW VOC ADHESIVES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 30 PVA: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 31 PVA: MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 32 PVA: MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

TABLE 33 VAE: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 34 VAE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 35 VAE: MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 36 VAE: MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

TABLE 37 EVA: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 38 EVA: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 39 EVA: MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 40 EVA:MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

TABLE 41 POLYURETHANE: LOW VOC ADHESIVES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 42 POLYURETHANE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 43 POLYURETHANE:MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 44 POLYURETHANE: MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

TABLE 45 SBC: LOW VOC ADHESIVES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 46 SBC: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 47 SBC: MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 48 SBC: MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

TABLE 49 EPOXY: LOW VOC ADHESIVES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 50 EPOXY: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 51 EPOXY: MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 52 EPOXY: MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

TABLE 53 OTHERS: LOW VOC ADHESIVES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 54 OTHERS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 55 OTHERS: MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 56 OTHERS: MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

TABLE 57 LOW VOC ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 58 MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 59 LOW VOC ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 60 MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

TABLE 61 PAPER & PACKAGING: LOW VOC ADHESIVES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 62 PAPER & PACKAGING: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 63 PAPER & PACKAGING: MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 64 PAPER & PACKAGING: MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

TABLE 65 BUILDING & CONSTRUCTION: LOW VOC ADHESIVES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 66 BUILDING & CONSTRUCTION: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 67 BUILDING & CONSTRUCTION: MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 68 BUILDING & CONSTRUCTION: MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

TABLE 69 WOODWORKING: LOW VOC ADHESIVES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 70 WOODWORKING: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 71 WOODWORKING: MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 72 WOODWORKING: MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

TABLE 73 AUTOMOTIVE & TRANSPORTATION: LOW VOC ADHESIVES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 74 AUTOMOTIVE & TRANSPORTATION: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 75 AUTOMOTIVE & TRANSPORTATION: MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 76 AUTOMOTIVE & TRANSPORTATION:MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

TABLE 77 LEATHER & FOOTWEAR: LOW VOC ADHESIVES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 78 LEATHER & FOOTWEAR: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 79 LEATHER & FOOTWEAR: MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 80 LEATHER & FOOTWEAR: MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

TABLE 81 OTHERS: LOW VOC ADHESIVES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 82 OTHERS:MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 83 OTHERS: MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 84 OTHERS: MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

TABLE 85 LOW VOC ADHESIVES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 86 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 87 MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 88 LOW VOC ADHESIVES MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

TABLE 89 APAC: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 90 APAC: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 91 APAC: MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 92 APAC: MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

TABLE 93 APAC: MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 94 APAC: MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 95 APAC: MARKET SIZE, BY TECHNOLOGY, 2017–2020 (KILOTON)

TABLE 96 APAC: MARKET SIZE, BY TECHNOLOGY, 2021–2026 (KILOTON)

TABLE 97 APAC: MARKET SIZE, BY CHEMISTRY, 2017–2020 (USD MILLION)

TABLE 98 APAC: LOW VOC ADHESIVES MARKET SIZE, BY CHEMISTRY, 2021–2026 (USD MILLION)

TABLE 99 APAC: MARKET SIZE, BY CHEMISTRY, 2017–2020 (KILOTON)

TABLE 100 APAC: MARKET SIZE, BY CHEMISTRY, 2021–2026 (KILOTON)

TABLE 101 APAC: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 102 APAC: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 103 APAC: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 104 APAC: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

TABLE 105 NORTH AMERICA: LOW VOC ADHESIVES MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 106 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 107 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 108 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

TABLE 109 NORTH AMERICA: MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 110 NORTH AMERICA: MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 111 NORTH AMERICA: MARKET SIZE, BY TECHNOLOGY, 2017–2020 (KILOTON)

TABLE 112 NORTH AMERICA: MARKET SIZE, BY TECHNOLOGY, 2021–2026 (KILOTON)

TABLE 113 NORTH AMERICA: MARKET SIZE, BY CHEMISTRY, 2017–2020 (USD MILLION)

TABLE 114 NORTH AMERICA: MARKET SIZE, BY CHEMISTRY, 2021–2026 (USD MILLION)

TABLE 115 NORTH AMERICA: MARKET SIZE, BY CHEMISTRY, 2017–2020 (KILOTON)

TABLE 116 NORTH AMERICA: MARKET SIZE, BY CHEMISTRY, 2021–2026 (KILOTON)

TABLE 117 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 118 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 119 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 120 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

TABLE 121 EUROPE: LOW VOC ADHESIVES MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 122 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 123 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 124 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

TABLE 125 EUROPE: MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 126 EUROPE: MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 127 EUROPE: MARKET SIZE, BY TECHNOLOGY, 2017–2020 (KILOTON)

TABLE 128 EUROPE: MARKET SIZE, BY TECHNOLOGY, 2021–2026 (KILOTON)

TABLE 129 EUROPE: MARKET SIZE, BY CHEMISTRY, 2017–2020 (USD MILLION)

TABLE 130 EUROPE: MARKET SIZE, BY CHEMISTRY, 2021–2026 (USD MILLION)

TABLE 131 EUROPE: MARKET SIZE, BY CHEMISTRY, 2017–2020 (KILOTON)

TABLE 132 EUROPE: MARKET SIZE, BY CHEMISTRY, 2021–2026 (KILOTON)

TABLE 133 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 134 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 135 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 136 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

TABLE 137 MIDDLE EAST & AFRICA: LOW VOC ADHESIVES MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 138 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 139 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 140 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

TABLE 141 MIDDLE EAST & AFRICA: MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 142 MIDDLE EAST & AFRICA: MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 143 MIDDLE EAST & AFRICA: MARKET SIZE, BY TECHNOLOGY, 2017–2020 (KILOTON)

TABLE 144 MIDDLE EAST & AFRICA: MARKET SIZE, BY TECHNOLOGY, 2021–2026 (KILOTON)

TABLE 145 MIDDLE EAST & AFRICA: MARKET SIZE, BY CHEMISTRY, 2017–2020 (USD MILLION)

TABLE 146 MIDDLE EAST & AFRICA: MARKET SIZE, BY CHEMISTRY, 2021–2026 (USD MILLION)

TABLE 147 MIDDLE EAST & AFRICA: MARKET SIZE, BY CHEMISTRY, 2017–2020 (KILOTON)

TABLE 148 MIDDLE EAST & AFRICA: MARKET SIZE, BY CHEMISTRY, 2021–2026 (KILOTON)

TABLE 149 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 150 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 151 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 152 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

TABLE 153 SOUTH AMERICA: LOW VOC ADHESIVES MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 154 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 155 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 156 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

TABLE 157 SOUTH AMERICA: MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 158 SOUTH AMERICA: MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 159 SOUTH AMERICA: MARKET SIZE, BY TECHNOLOGY, 2017–2020 (KILOTON)

TABLE 160 SOUTH AMERICA: MARKET SIZE, BY TECHNOLOGY, 2021–2026 (KILOTON)

TABLE 161 SOUTH AMERICA: MARKET SIZE, BY CHEMISTRY, 2017–2020 (USD MILLION)

TABLE 162 SOUTH AMERICA: MARKET SIZE, BY CHEMISTRY, 2021–2026 (USD MILLION)

TABLE 163 SOUTH AMERICA: MARKET SIZE, BY CHEMISTRY, 2017–2020 (KILOTON)

TABLE 164 SOUTH AMERICA: SIZE, BY CHEMISTRY, 2021–2026 (KILOTON)

TABLE 165 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 166 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 167 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 168 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

TABLE 169 PRODUCT FOOTPRINT OF COMPANIES

TABLE 170 INDUSTRY FOOTPRINT OF COMPANIES

TABLE 171 REGION FOOTPRINT OF COMPANIES

TABLE 172 STRATEGIC DEVELOPMENTS, BY COMPANY

TABLE 173 MOST FOLLOWED STRATEGIES

TABLE 174 GROWTH STRATEGIES ADOPTED BY KEY COMPANIES

TABLE 175 LOW VOC ADHESIVES MARKET: PRODUCT LAUNCHES, 2016–2021

TABLE 176 LOW VOC ADHESIVES MARKET: DEALS, 2016–2021

TABLE 177 LOW VOC ADHESIVES MARKET: OTHERS, 2016–2021

TABLE 178 HENKEL: COMPANY OVERVIEW

TABLE 179 HENKEL: PRODUCT LAUNCHES

TABLE 180 HENKEL: DEALS

TABLE 181 3M: COMPANY OVERVIEW

TABLE 182 3M: PRODUCT LAUNCHES

TABLE 183 3M: OTHERS

TABLE 184 H.B. FULLER: COMPANY OVERVIEW

TABLE 185 H.B. FULLER: PRODUCT LAUNCHES

TABLE 186 H.B. FULLER: DEALS

TABLE 187 SIKA: COMPANY OVERVIEW

TABLE 188 SIKA: PRODUCT LAUNCHES

TABLE 189 SIKA: DEALS

TABLE 190 SIKA: OTHERS

TABLE 191 ARKEM (BOSTIK SA): COMPANY OVERVIEW

TABLE 192 ARKEMA (BOSTIK): PRODUCT LAUNCHES

TABLE 193 ARKEMA (BOSTIK): DEALS

TABLE 194 ARKEMA (BOSTIK): OTHERS

TABLE 195 DOW: COMPANY OVERVIEW

TABLE 196 HUNTSMAN INTERNATIONAL LLC: COMPANY OVERVIEW

TABLE 197 HUNTSMAN INTERNATIONAL LLC: PRODUCT LAUNCHES

TABLE 198 HUNTSMAN INTERNATIONAL LLC: DEALS

TABLE 199 HUNTSMAN INTERNATIONAL LLC: OTHERS

TABLE 200 ILLINOIS TOOL WORKS: COMPANY OVERVIEW

TABLE 201 ASHLAND GLOBAL HOLDINGS: COMPANY OVERVIEW

TABLE 202 ASHLAND GLOBAL HOLDINGS: PRODUCT LAUNCHES

TABLE 203 MAPEI: COMPANY OVERVIEW

TABLE 204 RPM INTERNATIONAL INC.: BUSINESS OVERVIEW

TABLE 205 AKZONOBEL: BUSINESS OVERVIEW

TABLE 206 PPG INDUSTRIES: BUSINESS OVERVIEW

TABLE 207 PARKER HANNIFIN: BUSINESS OVERVIEW

TABLE 208 WACKER CHEMIE: BUSINESS OVERVIEW

TABLE 209 SOUDAL GROUP: BUSINESS OVERVIEW

TABLE 210 PIDILITE INDUSTRIES: BUSINESS OVERVIEW

TABLE 211 PIDILITE INDUSTRIES: DEALS

TABLE 212 MERIDIAN ADHESIVES: BUSINESS OVERVIEW

TABLE 213 PERMABOND LLC.: BUSINESS OVERVIEW

TABLE 214 FRANKLIN INTERNATIONAL: BUSINESS OVERVIEW

TABLE 215 JOWAT: BUSINESS OVERVIEW

TABLE 216 DELO INDUSTRIAL ADHESIVES: BUSINESS OVERVIEW

TABLE 217 DYMAX: BUSINESS OVERVIEW

TABLE 218 THE REYNOLDS COMPANY: BUSINESS OVERVIEW

TABLE 219 UNISEAL: BUSINESS OVERVIEW

TABLE 220 MASTER BOND: BUSINESS OVERVIEW

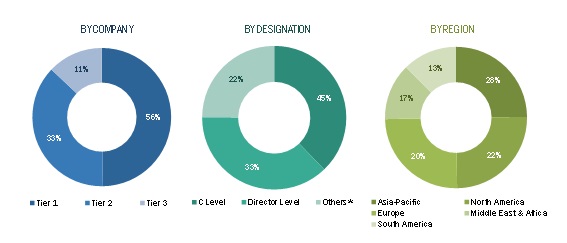

The study involves four major activities in estimating the current market size of Low VOC adhesives. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and sub-segments of the overall market.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, have been referred to for identifying and collecting information for this study. These secondary sources also included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; gold standard & silver standard websites; regulatory bodies; trade directories; and databases.

Primary Research

The Low VOC adhesives market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations. The demand side of this market is characterized by the development in end-use industries, such as Paper & Packaging, Building & construction, Woodworking, Transportation, Consumers and others. The supply side is characterized by advancements in technology. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the Low VOC adhesives market. These methods were also used extensively to estimate the sizes of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Low VOC adhesives Market Size: Top-down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the global low Volatile Organic Compound (VOC) adhesives market, in terms of value and volume

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To define, describe, and forecast the market based on chemistry, technology, end-use industry, and region

- To forecast the market size with respect to five main regions, namely North America, Europe, APAC, South America, and the Middle East & Africa

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contribution to the overall market

- To analyze the opportunities in the market for stakeholders and draw a competitive landscape for the market leaders

- To analyze competitive developments in the market, such as mergers, acquisitions, new product launches, investments, and expansions

- To strategically profile the key players and comprehensively analyze their core competencies2

Note: 1. Micromarkets are defined as the sub-segments of the Low VOC adhesives market included in the report.

Note 2: Core competencies of the companies are captured in terms of their key developments and key strategies adopted to sustain their position in the market.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Low VOC adhesives market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Low VOC Adhesives Market