Fermenters Market by Application (Food, Beverage, and Healthcare & Cosmetics), Microorganism (Bacteria and Fungi), Process (Batch, Fed-batch, and Continuous), Mode of Operation (Semi-automatic and Automatic), and Region - Global Forecast to 2023

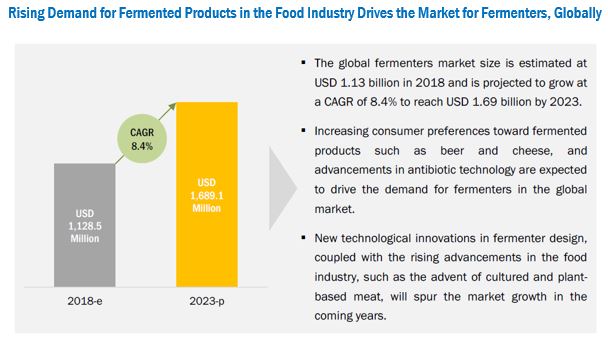

[134 Pages Report] The fermenters market was valued at USD 1.04 billion in 2017 and is projected to grow at a CAGR of 8.4% from 2018, to reach USD 1.69 billion by 2023. The basic objective of the report is to define, segment, and project the global fermenters market size of the market on the basis of application, mode of operation, microorganism, process, material, and region. It also helps to understand the structure of this market by identifying its various segments. The other objectives include analyzing the opportunities in the market for the stakeholders, providing the competitive landscape of the market trends, and projecting the size of the market and its submarkets, in terms of value.

For More details on this research, Request Free Sample Report

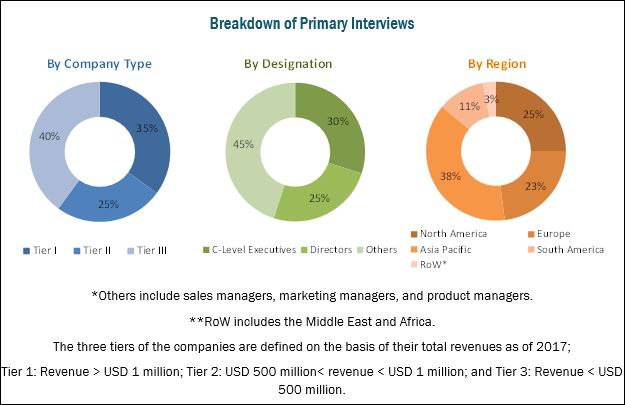

This research study involved the extensive use of secondary sources (which included directories and databases) such as Hoovers, Forbes, Bloomberg Businessweek, and Factiva to identify and collect information useful for this technical, market-oriented, and commercial study of the fermenters market. The primary sources that have been involved include industry experts from core and related industries and preferred suppliers, dealers, manufacturers, alliances, standards & certification organizations from companies, and organizations related to all segments of this industry’s value chain. In-depth interviews have been conducted with various primary respondents, such as key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information as well as to assess future prospects. The following figure depicts the market research methodology applied in drafting this report on the market.

To know about the assumptions considered for the study, download the pdf brochure

Key participants in the fermenters market are the fermenting equipment manufacturers, suppliers, and regulatory bodies. The key players that are profiled in the report includes Eppendorf (Germany), Sartorius (Germany), Thermo Fisher Scientific (US), Pierre Guerin (France), CerCell ApS (Denmark), Electrolab Biotech (UK), Applikon Biotechnology (Netherlands), GEA Group (Germany), General Electric (US), Bioengineering AG (Switzerland), Zeta Holding (Austria), and bbi-biotech (Germany).

This report is targeted at the existing players in the industry, which include the following:

- Fermenting equipment manufacturers

- Regulatory bodies

- Intermediary suppliers

- Trade associations and industry bodies

- Government and research organizations

“The study answers several questions for the stakeholders; primarily, which market segments to focus on in the next two to five years, for prioritizing efforts and investments.”

Drivers

Increased consumption of fermented beverages in developed economies

The rapid growing fermented beverage industry is expected to significantly drive the demand for fermenter systems and solutions during the forecast period, owing to the growing popularity of a variety of beers and wines in the emerging economies worldwide. According to the Brewer’s Association, in 2017, the craft beer sales continued to grow at a rate of about 5% by volume, which reached 12.7% of the US beer market, in terms of volume. According to the US Alcohol and Tobacco Tax and Trade Bureau (TTB) and US Commerce Department, 2018, the US beer industry, in 2017, exported about 207.4 million barrels of beer. According to the TTB and US Commerce, 2018, the US domestically produced about 83% of beer, and 17% of beer was imported from more than 100 different countries globally. According to TTB preliminary reports, the US recorded about 5,648 brewery production facilities in the region in 2017. According to the Brewers of Europe Organization, in 2016, Europe’s five countries recorded the highest growth in beer production, namely, Germany, the UK, Poland, Spain, and the Netherlands. Thus, the growing popularity of beer among consumers is expected to lead to the exponential growth in demand for fermented beverages, thereby increasing the demand for fermenters used for the fermentation of alcoholic beverages.

The global beer production volume reached 189 million kiloliters in 2015, of which Asia Pacific held a share of 33.8% of the global beer market in 2015. In 2015, China continued to be the largest beer producing country in the Asia Pacific region, followed by India and Vietnam.

Growing awareness about food preservation

Nowadays, fermentation is one of the most preferred methods of food preservation owing to the health benefits offered by this process. Fermented beverages such as mead, kvass, water kefir, dairy kefir, and kombucha are fermented and preserved by the fermentation process. During the fermentation, microorganisms produce lactic acid and acetic acid that are also known as bio-preservatives, which help in retaining the nutrients while also preventing food spoilage.

Restraints

Increasing cost of fermenters

Majorly, large-scale or commercial microbial or biopharmaceutical fermenters are always associated with high risks of contamination that occur during the fermentation process in large-scale production facilities. To avoid bacterial, fungal, and viral infections during microbial fermentations, fermenter producing manufacturers are incorporating sterilize-in-place and clean-in-place systems in fermenters, which result in high cost as the systems comprise highly polished stainless-steel material, thus ultimately resulting in the high cost of the fermenters.

Scope of the Report

The market has been segmented as follows:

On the basis of Application,

- Food

- Beverages

- Healthcare & cosmetics

On the basis of Mode of Operation,

- Semi-automatic

- Automatic

On the basis of Microorganism,

- Bacteria

- Fungi

On the basis of Process,

- Batch

- Fed-batch

- Continuous

On the basis of Region,

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW): This includes the Middle East and Africa

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Segment Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Rest of Asia Pacific market for fermenters, by country

- Further breakdown of the Rest of European market for fermenters, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

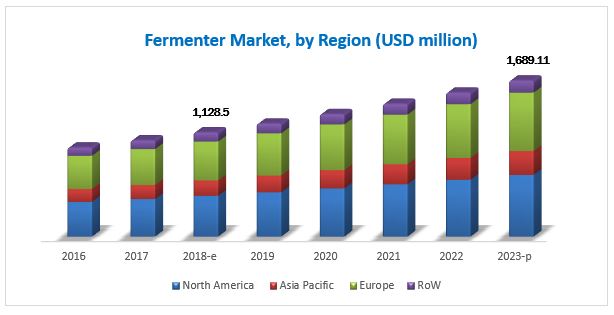

The fermenters market is estimated at USD 1.13 billion in 2018 and is projected to reach USD 1.69 billion by 2023, growing at a CAGR of 8.4% during the forecast period. The rise in application of fermentation technology in food, beverage, and pharmaceutical industries, along with the growing consumer perception regarding fermentation in terms of health claims, is the major factors spurring the demand for fermenters across the globe.

Based on process, the fed-batch fermenters dominated the market in terms of value. The application of these fermenters in extensive production of microbial cultures for various applications and production of mammalian cell culture systems are the main factors for the dominance of fed-batch systems in the market.

The beverage segment, by application, accounted for the largest share of the global market in 2017. With the increasing consumption of fermented beverages in the US and European countries, the production facilities of beer and wine have been increasing across the globe, which in turn reflects an increasing demand for fermenters. Beverage and food applications are projected to grow at a higher rate in the global market for fermenters, owing to the increasing adoption of fermentation technologies by key players for development of novel products.

Fermenters made using stainless steel, accounted for the largest share of the global market in 2017, by material. Owing to the advantages of reusability, increased durability, and ease in sanitization, stainless steel fermenters are increasingly preferred by end-use industries. Moreover, the adoption of stainless steel fermenters for large-scale production of metabolites in developed regions such as North America and Europe, contribute to the high demand for these fermenters in the market.

Asia Pacific is projected to be the fastest-growing market for fermenters during the forecast period. Emerging economies such as India have favorable market potential for fermented food products, which has led to food manufacturers in these countries adopting strategies such as expansions to cater to the demand and using fermenters to increase the production capacity of fermented products. Also, Asia Pacific is expanding as a leading region in the production of a variety of probiotic-based foods, beverages, and dietary supplements, along with innovations in the dessert, confectionery, and fermented food sectors. The growing population and per capita income in China, India, and Japan are expected to drive the demand for fermented foods & beverages, which, in turn, drive the demand for fermenters.

For More details on this research, Request Free Sample Report

One of the major restraining factors for the growth of the market is the high cost associated with large-scale fermenters. The high contamination risks associated with large-scale commercial, microbial, or biopharmaceutical fermenters are avoided by incorporating sterilize-in-place and clean-in-place systems in fermenters, which result in high cost. Also, manufacturers are preferring conical shaped fermenters for high-quality beverages, which are available at a higher price.

Players such as Eppendorf AG (Germany), Sartorius (Germany), Pierre Guerin SAS (France), and Applikon Biotechnology BV (Netherlands) have been actively strategizing their growth plans to expand in the fermenters market. These companies have a strong presence in Europe and North America, and also have manufacturing facilities across these regions and a strong distribution network.

Opportunities

Opportunities for fermented foods in emerging economies

With the reduced cost of production and preferred health benefits from fermented products, emerging economies such as China, India, and Thailand are majorly focusing on high utilization of fermentation technologies. According to the New Nutrition Business report on fermentation, many consumers in these economies are shifting their focus toward the consumption of fermented foods & beverages such as kombucha, kefir, teas, pickles, kimchi, and tempeh. For instance, Rhythm Health is producing a non-dairy kefir shot beverage, which is 100% natural with no added sugar and preservatives.

Technological innovations in fermenters

Fermentation extends the shelf life and improves the texture & product quality of food products such as yogurt, breads, and sauerkraut, beverages such as kefir, beer, and wines, and healthcare products. Fermenter equipment manufacturers have started investing in R&D, which has led to several effective fermentation technologies being introduced in the market in recent years. For instance, in 2016, Eppendorf AG launched a stirred tank and rigid wall bioreactor/fermenter for microbial fermentation. The product has favorable scalability and helps in reducing damage during installations.

Challenges

Complications associating with the cultivation of mammalian cell culture for the healthcare industry

The fermentation process is widely used in the healthcare industry to produce a variety of products such as antibiotics, ethanol, anti-viral drugs, mammalian cells, monoclonal antibodies, and therapeutic recombinant DNA and proteins. There is an increased demand for the cultivation of mammalian cells to produce biologics for therapeutic and diagnostics in the healthcare industry. Although there is an increased demand for mammalian cell culture in fermenters for the healthcare industry, there are a few drawbacks related to mammalian cell fermenters. For instance, the cells might end up not producing the desired products efficiently. Apart from this, the cultivation of mammalian cells requires a complex media, which further adds to the cost of mammalian cell culture fermenters. Thus, complications associated with mammalian cell culture are expected to limit the growth prospects for fermenter manufacturers in the healthcare industry.

Expansions, 2015–2017

|

Date |

Company |

Description |

|

October 2017 |

Eppendorf |

Eppendorf expanded the training center at its facility in Chennai, India. The facility consisted of a laboratory, which was equipped with research products such as sample handling, cell handling, and liquid handling. This enhanced the company’s position in India, along with demonstrating its product and service capabilities to its customers based in India. |

|

September 2017 |

Sartorius |

Sartorius expanded its biopharmaceutical and laboratory equipment production facility by investing around USD 45.5 million in Germany. |

Acquisitions, 2015–2017

|

Date |

Company |

Description |

|

April 2017 |

Sartorius |

Sartorius, through its subsidiary Sartorius Stedim Biotech, acquired MKS Instruments AB (Umetrics) (Sweden), a leading company in data analytics software and biopharmaceutical manufacturing process. Sartorius acquired Umetrics for USD 72.5 million from MKS Instruments Group. |

|

March 2017 |

Sartorius |

Sartorius acquired Essen BioScience (US), a leading company in bioprocess data analytics software. Through this acquisition, the Sartorius lab products & services division expanded its portfolio in bioanalytics. |

New Product Launches, 2015–2018

|

Date |

Company |

Description |

|

March 2018 |

Sartorius |

Sartorius Stedim Biotech launched ambr 250 high throughput fermenter/bioreactor for single-use perfusion system, which consisted of parallel bioreactor system. It was specifically designed for cell culture perfusion process to produce therapeutic antibodies. |

|

May 2017 |

Eppendorf |

Eppendorf launched the BioFlo 120, a fermenter system (bioprocess control station) for microbial fermentation and mammalian cell culture applications. It consisted of a wide range of glass and BioBLU single-use vessel options (250 mL to 40 L). |

Agreements, Partnerships and Collaborations, 2015–2018

|

Date |

Company |

Description |

|

April 2018 |

Sartorius |

Sartorius Stedim Biotech and Pennsylvania State University (US) entered into a collaborative partnership, in which Sartorius would invest in the fermentation facility and a central laboratory to enhance the fermentation facility in Penn State’s Center of Excellence in Industrial Biotechnology (CoEIB) in the US. |

|

February 2017 |

GEA Group |

GEA Group agreed to provide two media preparation production lines and identical fermentation to Hanmi Pharmaceutical, a drug manufacturer in Korea. It also included production lines for insulin, which consisted of centrifugal separators, homogenizers, fermenters, and flow components, along with fully equipped GEA VESTA aseptic valves for the producing human immunoglobulin type G media. |

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.4 Periodization Considered

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Key Industry Insights

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 31)

4.1 Attractive Growth Opportunities in the Fermenters Market

4.2 North America: Market for Fermenters, By Application & Country

4.3 Market for Fermenters, By Microorganism, 2018 vs 2023

4.4 Market for Fermenters, By Mode of Operation

4.5 Market for Fermenters, By Material, 2018 vs 2023

4.6 Market for Fermenters, By Process, 2018 vs 2023

4.7 Market for Fermenters, By Region

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increased Consumption of Fermented Beverages in Developed Economies

5.2.1.2 Growing Awareness About Food Preservation

5.2.1.3 Higher Demand for Antibiotics

5.2.1.4 Growing Consumer Perception of Fermentation for Health Claims

5.2.2 Restraints

5.2.2.1 Increasing Cost of Fermenters

5.2.3 Opportunities

5.2.3.1 Opportunities for Fermented Foods in Emerging Economies

5.2.3.2 Technological Innovations in Fermenters

5.2.4 Challenges

5.2.4.1 Complications Associating With the Cultivation of Mammalian Cell Culture for the Healthcare Industry

6 Market for Fermenters, By Application (Page No. - 43)

6.1 Introduction

6.2 Food

6.3 Beverage

6.3.1 Alcoholic Beverages

6.3.2 Non-Alcoholic Beverages

6.4 Healthcare Products & Cosmetics

7 Market for Fermenters, By Process (Page No. - 49)

7.1 Introduction

7.2 Batch

7.3 Fed-Batch

7.4 Continuous

8 Market for Fermenters, By Mode of Operation (Page No. - 54)

8.1 Introduction

8.2 Automatic

8.3 Semi-Automatic

9 Market for Fermenters, By Material (Page No. - 58)

9.1 Introduction

9.2 Stainless-Steel

9.3 Glass

10 Market for Fermenters, By Microorganism (Page No. - 62)

10.1 Introduction

10.2 Bacteria

10.3 Fungi

11 Market for Fermenters, By Region (Page No. - 67)

11.1 Introduction

11.2 North America

11.2.1 US

11.2.2 Canada

11.2.3 Mexico

11.3 Europe

11.3.1 UK

11.3.2 Germany

11.3.3 France

11.3.4 Italy

11.3.5 Rest of Europe

11.4 Asia Pacific

11.4.1 China

11.4.2 India

11.4.3 Japan

11.4.4 Australia & New Zealand

11.4.5 Rest of Asia Pacific

11.5 South America

11.5.1 Brazil

11.5.2 Argentina

11.5.3 Rest of South America

11.6 Rest of the World (RoW)

11.6.1 Middle East

11.6.2 Africa

12 Competitive Landscape (Page No. - 95)

12.1 Overview

12.2 Market Share

12.2.1 Key Market Strategies

12.3 Competitive Scenario

12.3.1 Expansions

12.3.2 Acquisitions

12.3.3 New Product Launches

12.3.4 Agreements, Partnerships, and Collaborations

13 Company Profiles (Page No. - 103)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

13.1 Eppendorf AG

13.2 Sartorius

13.3 Thermo Fisher Scientific

13.4 GEA Group

13.5 General Electric

13.6 Pierre Guérin SAS

13.7 Cercell APS

13.8 ElectRoLAb Biotech Ltd.

13.9 Applikon Biotechnology Bv

13.10 Bioengineering AG

13.11 Zeta Holding GmbH

13.12 BBI-Biotech GmbH

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 127)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.3 Available Customizations

14.4 Related Reports

14.5 Author Details

List of Tables (80 Tables)

Table 1 Currency Conversion

Table 2 Fermenters Market Size, By Application, 2016–2023 (USD Million)

Table 3 Food Fermenters Market Size, By Region, 2016–2023 (USD Million)

Table 4 Beverage Fermenters Market Size, By Region, 2016–2023 (USD Million)

Table 5 Alcoholic Beverage Fermenters Market Size, By Region, 2016–2023 (USD Million)

Table 6 Non-Alcoholic Beverage Fermenters Market Size, By Region, 2016–2023 (USD Million)

Table 7 Healthcare Products & Cosmetic Fermenters Market Size, By Region, 2016–2023 (USD Million)

Table 8 Fermenters Market Size, By Process, 2016–2023 (USD Million)

Table 9 Batch Fermenters Market Size, By Region, 2016–2023 (USD Million)

Table 10 Fed-Batch Fermenters Market Size, By Region, 2016–2023 (USD Million)

Table 11 Continuous Market for Fermenters Size, By Region, 2016–2023 (USD Million)

Table 12 Market for Fermenters Size, By Mode of Operation, 2016–2023 (USD Million)

Table 13 Automatic Market for Fermenters Size, By Region, 2016–2023 (USD Million)

Table 14 Semi-Automatic Fermenters Market Size, By Region, 2016–2023 (USD Million)

Table 15 Market for Fermenters Size, By Material, 2016–2023 (USD Million)

Table 16 Stainless-Steel Fermenters Market Size, By Region, 2016–2023 (USD Million)

Table 17 Glass Fermenters Market Size, By Region, 2016–2023 (USD Million)

Table 18 Market for Fermenters Size, By Microorganism, 2016–2023 (USD Million)

Table 19 Bacteria Used for the Fermentation of Various Food & Beverage Products

Table 20 Bacterial Market for Fermenters Size, By Region, 2016–2023 (USD Million)

Table 21 Fungi Used for the Fermentation of Various Food & Beverage Products

Table 22 Fungal Market for Fermenters Size, By Region, 2016–2023 (USD Million)

Table 23 Market for Fermenters Size, By Region, 2016–2023 (USD Million)

Table 24 North America: Market for Fermenters Size, By Country, 2016–2023 (USD Million)

Table 25 North America: Market for Fermenters Size, By Application, 2016–2023 (USD Million)

Table 26 North America: Market for Fermenters Size, By Beverage Sub-Application, 2016–2023 (USD Million)

Table 27 North America: Market for Fermenters Size, By Process, 2016–2023 (USD Million)

Table 28 North America: Market for Fermenters Size, By Mode of Operation, 2016–2023 (USD Million)

Table 29 North America: Market for Fermenters Size, By Material, 2016–2023 (USD Million)

Table 30 North America: Market for Fermenters Size, By Microorganism, 2016–2023 (USD Million)

Table 31 US: Market for Fermenters Size, By Material, 2016–2023 (USD Million)

Table 32 Canada: Market for Fermenters Size, By Material, 2016–2023 (USD Million)

Table 33 Mexico: Market for Fermenters Size, By Material, 2016–2023 (USD Million)

Table 34 Europe: Market for Fermenters Size, By Country, 2016–2023 (USD Million)

Table 35 Europe: Market for Fermenters Size, By Application, 2016–2023 (USD Million)

Table 36 Europe: Market for Fermenters Size, By Beverage Sub-Application, 2016–2023 (USD Million)

Table 37 Europe: Market for Fermenters Size, By Process, 2016–2023 (USD Million)

Table 38 Europe: Market for Fermenters Size, By Mode of Operation, 2016–2023 (USD Million)

Table 39 Europe: Market for Fermenters Size, By Material, 2016–2023 (USD Million)

Table 40 Europe: Market for Fermenters Size, By Microorganism, 2016–2023 (USD Million)

Table 41 UK: Fermenters Market Size, By Material, 2016–2023 (USD Million)

Table 42 Germany: Market for Fermenters Size, By Material, 2016–2023 (USD Million)

Table 43 France: Market for Fermenters Size, By Material, 2016–2023 (USD Million)

Table 44 Italy: Market for Fermenters Size, By Material, 2016–2023 (USD Million)

Table 45 Rest of Europe: Market for Fermenters Size, By Material, 2016–2023 (USD Million)

Table 46 Asia Pacific: Market for Fermenters Size, By Country, 2016–2023 (USD Million)

Table 47 Asia Pacific: Market for Fermenters Size, By Application, 2016–2023 (USD Million)

Table 48 Asia Pacific: Market for Fermenters Size, By Beverage Sub-Application, 2016–2023 (USD Million)

Table 49 Asia Pacific: Market for Fermenters Size, By Process, 2016–2023 (USD Million)

Table 50 Asia Pacific: Market for Fermenters Size, By Mode of Operation, 2016–2023 (USD Million)

Table 51 Asia Pacific: Market for Fermenters Size, By Material, 2016–2023 (USD Million)

Table 52 Asia Pacific: Market for Fermenters Size, By Microorganism, 2016–2023 (USD Million)

Table 53 China: Market for Fermenters Size, By Material, 2016–2023 (USD Million)

Table 54 India: Market for Fermenters Size, By Material, 2016–2023 (USD Million)

Table 55 Japan: Market for Fermenters Size, By Material, 2016–2023 (USD Million)

Table 56 Australia & New Zealand: Market for Fermenters Size, By Material, 2016–2023 (USD Million)

Table 57 Rest of Asia Pacific: Market for Fermenters Size, By Material, 2016–2023 (USD Million)

Table 58 South America: Market for Fermenters Size, By Country, 2016–2023 (USD Million)

Table 59 South America: Market for Fermenters Size, By Application, 2016–2023 (USD Million)

Table 60 South America: Market for Fermenters Size, By Beverage Sub-Application, 2016–2023 (USD Million)

Table 61 South America: Market for Fermenters Size, By Process, 2016–2023 (USD Million)

Table 62 South America: Market for Fermenters Size, By Mode of Operation, 2016–2023 (USD Million)

Table 63 South America: Market for Fermenters Size, By Material, 2016–2023 (USD Million)

Table 64 South America: Market for Fermenters Size, By Microorganism, 2016–2023 (USD Million)

Table 65 Brazil: Market for Fermenters Size, By Material, 2016–2023 (USD Million)

Table 66 Argentina: Market for Fermenters Size, By Material, 2016–2023 (USD Million)

Table 67 Rest of South America: Market for Fermenters Size, By Material, 2016–2023 (USD Million)

Table 68 RoW: Market for Fermenters Size, By Region, 2016–2023 (USD Million)

Table 69 RoW: Market for Fermenters Size, By Application, 2016–2023 (USD Million)

Table 70 RoW: Market for Fermenters Size, By Beverage Sub-Application, 2016–2023 (USD Million)

Table 71 RoW: Market for Fermenters Size, By Process, 2016–2023 (USD Million)

Table 72 RoW: Market for Fermenters Size, By Mode of Operation, 2016–2023 (USD Million)

Table 73 RoW: Market for Fermenters Size, By Material, 2016–2023 (USD Million)

Table 74 RoW: Market for Fermenters Size, By Microorganism, 2016–2023 (USD Million)

Table 75 Middle East & Africa: Market for Fermenters Size, By Material, 2016–2023 (USD Million)

Table 76 Africa: Fermenters Market Size, By Material, 2016–2023 (USD Million)

Table 77 Expansions, 2015–2017

Table 78 Acquisitions, 2015–2017

Table 79 New Product Launches, 2015–2018

Table 80 Agreements, Partnerships and Collaborations, 2015–2018

List of Figures (42 Figures)

Figure 1 Fermenters Market Segmentation

Figure 2 Market for Fermenters, Regional Scope

Figure 3 Market for Fermenters: Research Design

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Market Size Estimation: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation

Figure 8 Fermenters Market Size, By Industry, 2018 (USD Million)

Figure 9 Bacteria Segment to Dominate the Market, By Microorganism, By 2023

Figure 10 Fermenters Market: Regional Snapshot

Figure 11 Rising Demand for Fermented Products in the Food Industry Drives the Market for Fermenters, Globally

Figure 12 Beverage Was the Dominant Application Industry in the North American Fermenters Market

Figure 13 Bacteria Segment to Dominate the Market During the Forecast Period

Figure 14 Automatic Segment Dominated the Market Across All Regions in 2017

Figure 15 Stainless-Steel Segment to Dominate the Market Between 2018 and 2023

Figure 16 Fed-Batch Segment to Dominate the Market Between 2018 and 2023

Figure 17 India is Expected to Register the Highest Cage in the Global Fermenters Market Between 2018 and 2023

Figure 18 Fermenters Market Dynamics

Figure 19 Beer Market Share (Volume), By Region, 2015

Figure 20 World Wine Consumption, 2016

Figure 21 Consumer Perception in Numbers for Fermentation Health Claims

Figure 22 Market for Fermenters Size, By Application, 2018 vs 2023 (USD Million)

Figure 23 Market for Fermenters Size, By Process, 2018 vs 2023 (USD Million)

Figure 24 Market for Fermenters Size, By Mode of Operation, 2018 vs 2023 (USD Million)

Figure 25 Market for Fermenters Size, By Material, 2018 vs 2023 (USD Million)

Figure 26 Market for Fermenters Size, By Microorganism, 2018 vs 2023 (USD Million)

Figure 27 Market for Fermenters Size, By Region, 2018 vs 2023 (USD Million)

Figure 28 North America: Fermenters Market Snapshot

Figure 29 Asia Pacific Fermenters Market Snapshot

Figure 30 Key Developments of the Leading Players in the Market for 2015-2018

Figure 31 Competitive Scenario, By Key Players, 2017

Figure 32 Market for Fermenters Developments, By Growth Strategy, 2015–2018

Figure 33 Eppendorf: Company Snapshot

Figure 34 Eppendorf AG: SWOT Analysis

Figure 35 Sartorius: Company Snapshot

Figure 36 Sartorius: SWOT Analysis

Figure 37 Thermo Fisher Scientific: Company Snapshot

Figure 38 Thermo Fisher Scientific: SWOT Analysis

Figure 39 GEA Group: Company Snapshot

Figure 40 GEA Group: SWOT Analysis

Figure 41 General Electric: Company Snapshot

Figure 42 General Electric: SWOT Analysis

Growth opportunities and latent adjacency in Fermenters Market