Catalyst Carriers Market by Product Type (Ceramics, Activated Carbon, Zeolites), Shape/Composition (Sphere, Porous, Ring, Extrudate, Honeycomb), End-use Industry (Oil & Gas, Chemical Manufacturing, Automotive), and Region - Global Forecast to 2023

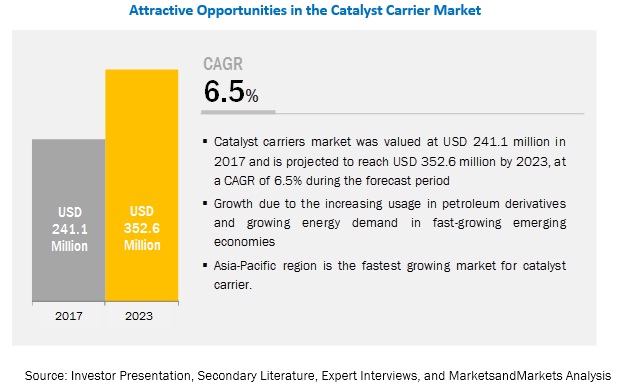

[127 Pages Report] The global catalyst carriers market was valued at USD 241.1 million in 2017 and is projected to reach USD 352.6 million by 2023, at a CAGR of 6.5% during the forecast period. In this study, 2017 has been considered as the base year and 2023 as the forecast year to estimate the Catalyst carriers market size. The market is witnessing growth due to the increasing usage in petroleum derivatives and growing energy demand in fast-growing emerging economies. Stringent environmental regulation pertaining to petroleum treatment and demand for efficient catalysts across all industrial verticals is also increasing the consumption of catalyst carriers.

Increasing use of catalyst carriers in the petroleum derivatives, stringent regulations associated with petroleum treatment, and the demand for effective catalysis are driving the growth of the catalyst carriers market.

The global catalyst carriers market is estimated to be USD 257.1 million in 2018 and is projected to reach USD 352.6 million by 2023, at a CAGR of 6.5% between 2018 and 2023.

Growing consumption of petroleum derivatives to meet the increasing energy demand is the major driving factor to drive the growth of catalyst carriers. This growth of this market is further driven by stringent regulations associated with petroleum treatment. Demand for effective catalysis across industrial verticals is another major factor that is expected to drive catalyst carriers market. Incorporation of advanced technologies in chemical synthesis diminishing the use of catalysts, this in turn restraining the catalyst carriers market.

Based on product type, ceramic catalyst carriers are expected to be the fastest-growing segment of the catalyst carriers market.

Ceramic catalyst carriers are estimated to be the fastest-growing type segment of the catalyst carriers market during the forecast period. The growth of the segment is mainly attributed to its growing consumption in petroleum refining in catalytic cracking hydroprocessing and catalytic reforming as a support material with the catalyst. They are also used in chemical synthesis of various hydrocarbons and the Haber’s process.

Based on shape, sphere shaped catalyst carriers are expected to be the fastest-growing segment of the catalyst carriers market.

Sphere shaped catalyst carriers is expected to be the fastest-growing application segment of the catalyst carriers market during the forecast period. The growth of the segment is mainly attributed to its superior properties such higher stiffness, lower thermal expansion, lighter weight, increased corrosion resistance, and higher electrical resistance than its counterparts.

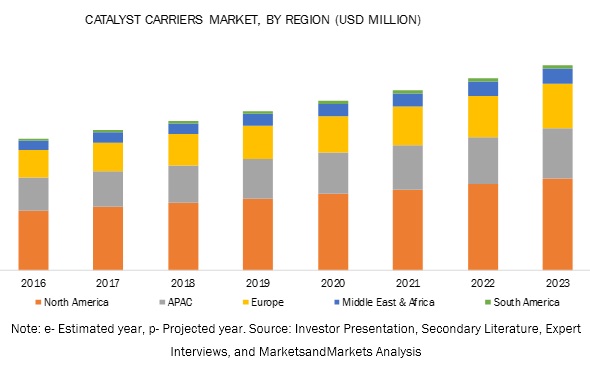

Asia Pacific is the fastest-growing market for catalyst carriers.

The Asia Pacific region is expected to be the fastest-growing market for Catalyst carriers during the forecast period. Massive economic development has led to the growth of the manufacturing sector in the region, which has led the growth of chemical, oil & gas, and automotive industry. Low production cost, easy access to skilled work force at low cost, and government initiatives such as FCI is further expected to high investment in terms of capacity expansions in these industries in the region. Such factors are expected to drive the growth of catalyst carriers market in the region.

This study has been validated through primaries conducted with various industry experts globally. These primary sources have been divided into 3 categories, namely, company, designation, and region.

Market Dynamics

Drivers:

Growing consumption of petroleum derivatives to satisfy the increasing energy demands

Energy consumption accounts for more than 10% of the world expenditures. In this the industrial demand for energy accounts for around half of the increase in energy consumption; according to BP Energy Outlook 2018. In reference to The International Energy Outlook 2017, by the U.S. Energy Information Administration (EIA), in 2017, total world energy consumption is expected to rise from 575 quadrillion British thermal units (Btu) in 2015 to 736 quadrillion Btu in 2040, with an overall increase of 28%. Although the consumption of non-fossil fuels is expected to be higher than fossil fuels, however the fossil fuels including the liquid still will contribute to 77% of the energy consumption in 2040.

The rapidly increasing demand for gasoline and diesel has increased the requirement of raw materials for their production. However, the limited supply of raw materials increases the overall cost of production. This factor has attracted manufacturers toward refinery catalysts, as they help extract relatively more diesel and gasoline from the same amount of crude oil. Thus, the refinery catalysts market is improved by the fact that the efficient use of catalysts can help the manufacturer’s better address the increasing energy demand. Thus, due to aforementioned factor the demand for refinery catalyst is expected to increase, proportionally increasing the demand for catalyst carrier which are used to give support and provide large surface area to refinery catalysts. Moreover, apart from the use of gasoline and diesel more than 200 by-products including fuels such as kerosene, jet fuel, ethane, LPG, fuel oils, and derivatives such as alkenes (or olefins used to manufacture plastic), lubricants, wax, sulfur, tar, isopropyl alcohol, butyl, and polypropylene are used in various industries. The extraction of these derivatives from petroleum involves the use of catalyst and its carrier which are used to increase the efficiency of recovered products.

Stringent regulations associate with petroleum treatment

The International Energy Agency (IEA) has estimated that fuel consumption and emissions of CO2 from the world’s cars will roughly double between 2000 and 2050. CO2 emissions from fossil fuel combustion will increase by 45% from 2006 to 2030, with 97% of this increase occurring in non-OECD (Organization for Economic Co-operation and Development) countries. One-fifth of this increase is the result of global transport-related GHG emissions–98% of which will occur in non-OECD countries. In order to support global reductions in CO2 emissions from the transport sector, technical innovation will have to go hand-in-hand with supporting policies. New environmental regulations to reduce air pollution by decreasing the sulfur content for gasoline and ultra-low sulfur content in diesel (ULSD) have necessitated the process of petroleum treatment, which in-turn is dependent on the kind of catalyst and support material used in the refining. Catalysis is a major factor in petroleum refining as the process carried out after crude unit are catalytic. For instance, gasoline with low aromatic content (benzene/naphthalenes) is produced after alkylation of light olefins with isobutane in the presence of hydrogen and metallic catalysts. Thus, for efficient conversion to obtain high product yield the use of catalyst with a carrier is imperative. This is expected to drive the demand for catalyst carrier.

Demand for efficient catalysis across all industrial verticals

Catalyst are inevitable part of chemical industry. They are used across wide range of industries such as petrochemicals and chemical synthesis to provide efficient reaction output. Due to the growing need for cleaner fuels and heavy and sour crudes, the demand for cracking and hydroprocessing catalysts along with its support is increasing. Global catalyst carrier’s consumption in both petroleum refining and chemical synthesis has increased due to the growing demand for clean fuels and petroleum-based derivatives, thus, driving the demand for catalysts carriers. Catalyst are used in combination with catalyst carriers to enhance its performance because catalyst carriers and support materials provide high-geometric surface area, uniform packing, and even flow distribution

Restraints

Incorporation of advanced technologies in chemical synthesis diminishing the use of catalyst

Catalyst carriers are basically made from metal and non-metal oxides such as alumina, rare-earth metal oxides, zirconia, silica and various other metals. The use of rare earth elements as catalysts carriers improves the hydrothermal stability in the extraction process. However, the cost involved in using these elements increases the overall cost of manufacturing due to their low availability. Catalyst carriers and the support materials used with catalyst are an important source of product yield efficiency improvement potential. Around 90% of chemical processes uses catalysts for efficient production, resulting in the usage of catalysts in higher volume. Thus, to offset the usage of catalyst in high volume and ensure its enhanced performance the use catalyst carriers is important. However, the fabrication of catalyst carriers is both time and capital intensive. Mostly they are customized and tailored for a specific catalyst and chemical reaction. Thus, it is a research-driven market with innovations being implemented periodically. In order to reduce the costs and time of overall process, companies are actively seeking for high performance technology based alternatives, so as to minimize the usage of catalysts carriers. This is expected to restrain the growth of the global catalyst carrier market.

Opportunities

Research & Development intensive market

The companies in the market are engaged in R&D operations to develop innovative catalyst carriers which can render support to the catalyst to increase its mechanism of action. R&D activities can lead to the development of substitutes that exhibit similar properties of rare earth elements which are one of the constituents of catalyst carriers and are responsible for increasing the overall cost of catalyst carriers. These substitutes can significantly reduce manufacturing costs of catalyst carriers and can emerge as cost-effective alternatives. Continuous R& D activities are imperative for the growth of catalyst carrier’s market, as these substances are largely synthesized according to needs of the customers. They are generally customized and tailored pertaining to the chemical reactions. Therefore, R&D activities play a pivotal role in improving the quality of catalyst carrier. They are expected to have a huge market impact, as the quality of catalyst carrier is a key determinant of feedstock output. For instance, one of the leading players in catalyst carrier market Saint-Gobain NorPro, recently introduced Accu spheres, a type of spherical catalyst carriers in the dimension 0.3mm to 3.5mm which are used effectively in slurry or moving-bed reactors, where coking and constant catalyst regeneration is required. Thus, major players are adopting strategies of new product developments as a result of rigorous R&D operations.

Challenge

Fluctuating raw material prices

Catalyst carriers are predominantly synthesized from various metal and non-metal oxides. The cost of raw materials required for manufacturing of catalyst carriers has been fluctuating over the period of time. This has severely impacted the market of catalyst carriers. Moreover, some of them are synthesized from rare earth elements which increase the overall cost of manufacturing catalyst carriers due to their low availability. The cost of raw materials is expected to further fluctuate in the nearby future, thus having a significant impact on the catalyst carrier market. Furthermore, the prices of metals that go in the production of catalyst carriers has fluctuated in the recent years. This is expected to have major impact on the catalyst carrier manufacturers, as they would be forced to pass on the cost to the catalyst carrier consumers.

Scope of the Report

|

Report Metric |

Details |

|

Years considered for the study |

2016-2023 |

|

Base year considered |

2017 |

|

Forecast period |

2017-2023 |

|

Units considered |

Value (USD Million) and Volume (Kiloton) |

|

Segments covered |

Type, Application, Material Type, Surface Area, End-Use Industry and Region |

|

Regions covered |

APAC, Europe, North America, Middle East & Africa, and South America |

|

Companies profiled |

CeramTec GmbH (Germany), Saint-Gobain (France), W. R. Grace & Co. (US), CoorsTek Inc. (US), Cabot Corporation (US), Almatis GmbH (Germany), Sasol Ltd. (South Africa), Evonik Industries (Germany), NORITAKE CO., LIMITED (Japan), and Magma Ceramics & Catalysts (UK), among others. |

This research report categorizes the global Catalyst carriers market based on type, application, end-use industry, and region, and forecasts revenue growth and provides an analysis of trends in each of the submarkets.

Based on Product Type

- Ceramics

- Activated Carbon

- Zeolites

- Others

Based on Material Type

- Alumina

- Titania

- Zirconia

- Silicone Carbide

- Silica

- Others

Based on Surface Area

- Low

- Intermediate

- High

Based on Shape/Composition

- Spheres

- Porous

- Rings

- Extrudate

- Pellets

- Powder

- Honeycomb

- Others

Based on End-use Industry

- Oil & Gas

- Chemical Manufacturing

- Automotive

- Petrochemicals

- Pharmaceuticals

- Agrochemicals

- Others

Based on Region

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Key Market Players

The report also provides company profiles and competitive strategies adopted by major market players, such as CeramTec GmbH (Germany), Saint-Gobain (France), W. R. Grace & Co. (US), CoorsTek Inc. (US), Cabot Corporation (US), Almatis GmbH (Germany), Sasol Ltd. (South Africa), Evonik Industries (Germany), NORITAKE CO., LIMITED (Japan), and Magma Ceramics & Catalysts (UK), among others.Recent Developments

- In JULY 2017, Saint Gobain Norpro (U.S.) introduced Accu sphere catalyst carriers. This new spherical catalyst carrier is estimated to satisfy growing demand from petrochemical, chemical & refining industry for small diameter supports which provide high-geometric surface area, uniform packing, and even flow distribution.

- In June 2016, Cabot Corporation (US)opened new technology center in Shanghai (China) for R&D activities of activated carbon

- In April 2018, W. R. Grace & Co (US) & Albemarle Corporation (US) acquired the polyolefin catalysts business of Albemarle Corporation which is primarily involved in the development and manufacturing custom-made single-site catalysts as well as metallocenes and activators used in the production of plastic resins. It also includes a comprehensive series of highly optimized Ziegler-Natta catalysts for polyethylene production. The acquisition also includes production plants in Baton Rouge, LA and Yeosu, South Korea; R&D and pilot plant capabilities; and an extensive portfolio of intellectual property. This acquisition is expected to significantly enhance the position of Grace in the fastest growing polyethylene segment and fills out its polyolefin catalysts portfolio.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in Catalyst Carriers Market