Ceramic & Porcelain Tableware Market by Material (Bone China, Porcelain, Stoneware), Technology (Slip casting, Pressure casting, Isostatic casting), Product, Application, Distribution Channel and Region - Global Forecast to 2028

Updated on : June 17, 2024

Ceramic and Porcelain Tableware Market

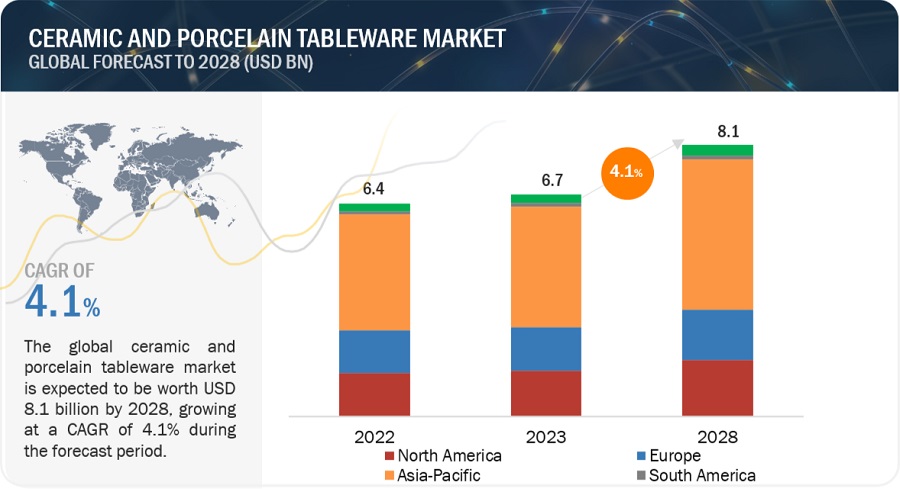

The Ceramic Tableware Market and Porcelain Tableware Market was valued at USD 6.7 billion in 2023 and is projected to reach USD 8.1 billion by 2028, growing at 4.1% cagr from 2023 to 2028. The ceramic and porcelain tableware market is thriving due to several key drivers. Increasing demand for visually appealing and durable tableware, driven by rising disposable income, plays a significant role in its growth. The expansion of the hospitality and food service industries, along with changing consumer preferences towards eco-friendly products and innovative designs, further contributes to the market's success. Additionally, the accessibility provided by online retail platforms and the enduring quality of ceramic and porcelain products adds to their popularity, ensuring a strong and dynamic market outlook for the future.

Attractive Opportunities in the Ceramic and Porcelain Tableware Market

To know about the assumptions considered for the study, Request for Free Sample Report

Ceramic And Porcelain Market Dynamics

Driver: The growth of the hospitality industry propelled the demand for the ceramic and porcelain tableware market.

One of the primary drivers is the increasing global travel and tourism. As travel becomes more accessible and affordable, there is a growing number of people exploring new destinations for leisure, business, and other purposes. This surge in traveler demand has created a significant market for hospitality services, including accommodations, dining, entertainment, and related amenities.

Another driver is the changing consumer preferences and expectations. Modern travelers are seeking unique and personalized experiences during their stays. They prioritize high-quality services, comfortable and well-appointed accommodations, diverse dining options, and engaging recreational activities. The hospitality industry has responded by offering innovative and tailored experiences to meet these evolving demands, including boutique hotels, themed resorts, culinary experiences, and wellness facilities.

The hospitality industry's growth and the popularity of dining out have significantly impacted the market. Restaurants, hotels, and cafes require ceramic and porcelain tableware to create visually appealing dining environments, elevating the overall experience for their customers. This has led to increased demand for tableware products.

Restraint: High production costs in the ceramic and porcelain tableware market

The ceramic and porcelain tableware market faces restraints primarily due to the high production cost associated with these materials. The production process for ceramic and porcelain tableware involves several intricate steps, including shaping, glazing, and firing at high temperatures. These processes require skilled labor, specialized equipment, and energy-intensive kilns, which contribute to the overall production cost.

The cost of raw materials is a significant contributing factor to the high production expenses in the ceramic and porcelain tableware market. The primary materials used, such as high-quality clay and kaolin, can be expensive, especially when sourced from regions renowned for their exceptional quality. Additionally, factors like material sourcing, transportation costs, and fluctuations in material prices further impact the overall production cost.

Opportunities: Leveraging the resurgence of artisanal and handcrafted ceramic and porcelain tableware.

The market has seen a revival in consumer interest for artisanal and handcrafted tableware. This trend is fueled by a growing demand for unique and authentic pieces. Ceramic and porcelain tableware are particularly suited to artisanal craftsmanship, providing an opportunity for manufacturers to create exclusive designs and limited-edition collections. By highlighting the handcrafted nature of their products, manufacturers can attract consumers seeking distinctive and artistic tableware options, making each piece a work of art in itself. This emphasis on artisanal craftsmanship adds value to the products and creates a sense of authenticity and individuality for consumers.

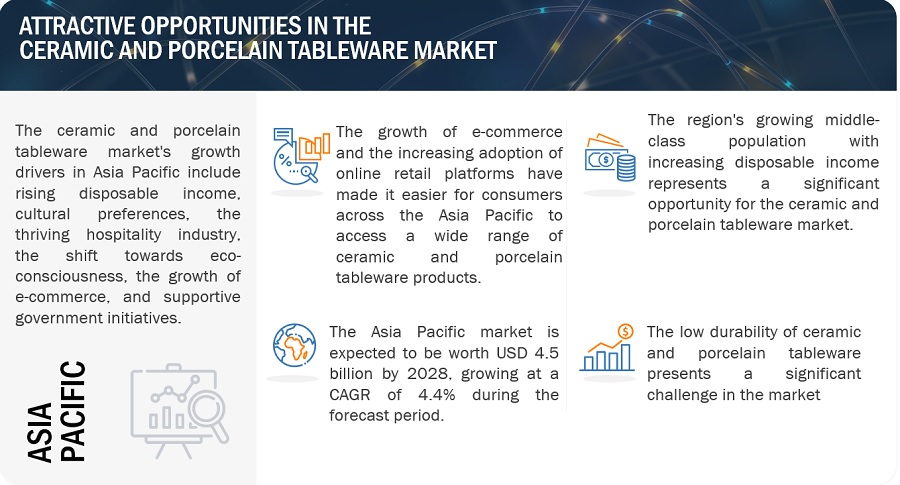

Challenges: Low durability in ceramic and porcelain tableware.

The low durability of ceramic and porcelain tableware presents a significant challenge in the market. While these materials are valued for their aesthetic appeal and elegance, they can be more prone to breakage and damage compared to alternative options. This low durability can impact consumer perception and deter them from investing in ceramic and porcelain tableware. One contributing factor to the low durability is the inherent fragility of these materials. Ceramic and porcelain tableware are crafted from delicate clay that undergoes shaping, glazing, and firing at high temperatures. This delicate nature makes them vulnerable to chipping, cracking, or shattering when subjected to accidental drops or mishandling. Consequently, consumers may have concerns about the longevity and reliability of these tableware items.

Ceramic And Porcelain Market Ecosystem

By Material, porcelain accounted for the highest CAGR during the forecast period.

Porcelain tableware is manufactured using a combination of kaolin clay, feldspar, quartz, and silica. The kaolin clay provides plasticity and contributes to the whiteness and translucency of the final product. Feldspar acts as a fluxing agent, aiding in the fusion of components and enhancing vitrification. Quartz adds strength and durability to the porcelain, making it suitable for everyday use. Silica further enhances vitrification and improves thermal shock resistance. The precise combination of these raw materials ensures that porcelain tableware exhibits durability, smoothness, and an elegant appearance. The production process for bone china and porcelain is similar, with the key distinction being the inclusion of bone ash in bone china. Bone ash enhances the strength of the tableware, making it more pliable, less prone to brittleness, and less susceptible to breakage.

By Product, Beverage ware accounted for the highest CAGR during the forecast period.

The ceramic and porcelain beverage ware market is driven by increasing coffee and tea consumption, the rise of café culture, the preference for sustainable and premium products, the resurgence of traditional and artisanal items, health and safety considerations, licensing and promotions, customization opportunities, and the convenience of online retail. As these drivers continue to shape consumer preferences, the market is expected to witness steady growth and innovation.

By Application, households accounted for the highest CAGR during the forecast period.

The household market for ceramic and porcelain tableware is driven by aesthetics and elegance, durability, health and safety considerations, cultural significance, sustainability preferences, special occasions, replacement and upgrading needs, the convenience of online retail, and the availability and affordability of these products. Manufacturers who can align their offerings with these market drivers are likely to see continued growth and success in the household segment.

Asia Pacific is projected to account for the highest CAGR in the cladding systems market during the forecast period.

The Asia Pacific ceramic and porcelain tableware market presents promising growth opportunities due to factors such as the rising middle-class population with increased disposable income, evolving consumer preferences towards eco-friendly products and innovative designs, the surge in e-commerce adoption, and the thriving hospitality industry. Additionally, the market can benefit from the potential for export, catering to modern urban lifestyles, and exploring product diversification and collaborations with notable figures. Embracing these opportunities can position manufacturers for success in this competitive market.

To know about the assumptions considered for the study, download the pdf brochure

Ceramic And Porcelain Market Players

The ceramic and porcelain tableware market comprises key players such as Villeroy & Boch AG (Germany), Fiskars Group (Finland), Noritake Co., Ltd. (Japan), RAK Ceramics PJSC (United Arab Emirates), Lifetime Brands Inc. (US), Lenox Corporation (US), Rosenthal GmbH (Germany), Churchill China (UK) Limited (England), Richard Ginori Srl (Italy), Tognana Porcellane SpA (Italy) and others. Expansions, acquisitions, joint ventures, and new product developments are some of the major strategies adopted by these key players to enhance their positions in the ceramic and porcelain tableware market. The major focus was given to new product development due to the changing requirements of product consumers across the world.

Ceramic And Porcelain Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2023 |

USD 6.7 billion |

|

Revenue Forecast in 2028 |

USD 8.1 billion |

|

CAGR |

4.1% |

|

Years Considered |

2021–2028 |

|

Base year |

2022 |

|

Forecast period |

2023–2028 |

|

Unit considered |

Value (USD Million/Billion), Volume (Kilo Tons) |

|

Segments |

Material, Technology, Product, Application, Distribution Channel, and Region |

|

Regions |

North America, Asia Pacific, Europe, South America, and Middle East & Africa |

|

Companies |

The major players are Villeroy & Boch AG (Germany), Fiskars Group (Finland), Noritake Co., Ltd. (Japan), RAK Ceramics PJSC (United Arab Emirates), Lifetime Brands Inc. (US), Lenox Corporation (US), Rosenthal GmbH (Germany), Churchill China (UK) Limited (England), Richard Ginori Srl (Italy), Tognana Porcellane SpA (Italy), and Porzellanmanufaktur KAHLA/ Thüringen GmbH (Germany). |

This research report categorizes the global ceramic and porcelain tableware market based on Material, Technology, Product, Application, distribution channel, and Region.

Ceramic and Porcelain Market on the basis of Material:

- Bone China

- Porcelain

- Stoneware

- Others (terracotta, fine china, and paper clay)

Ceramic and Porcelain Market on the basis of Technology:

- Slip Casting

- Pressure Casting

- Isostatic Casting

- Others (plaster casting, jiggering, and RAM pressing)

Ceramic and Porcelain Market on the basis of the Product:

- Dinnerware

- Beverage Ware

- Cookware

- Others (flatware and decorative tableware)

Ceramic and Porcelain Market on the basis of Application:

- Commercial

- Household

Ceramic and Porcelain Market on the basis of the Distribution Channel:

- Supermarkets & Hypermarkets

- Wholesalers & Retailers

- Online

Ceramic and Porcelain Market on the basis of Region:

- North America

- Asia Pacific

- Europe

- South America

- Middle East & Africa

The market has been further analyzed for the key countries in each of these regions.

Recent Developments

- In June 2021, Lenox Corporation, America's Leading Tabletop, Giftware, and Home Entertaining Company, Announced the Acquisition of Oneida Consumer LLC.

- In July 2022, Lenox Corporation, America's leading tabletop, giftware, and home entertaining company, announced the acquisition of Cambridge Silversmiths, Ltd., Inc.In

- In January 2022, Villeroy & Boch introduced their signature product line, Avarua, inspired by the captivating beauty of the Cook Islands. This exclusive collection of fine porcelain crockery embodies the spirit of adventure and offers an exotic dining experience at home.

Frequently Asked Questions (FAQ):

What are the major drivers driving the growth of the ceramic and porcelain tableware market?

Ceramic and porcelain tableware is expected to witness significant growth in the future due to the rise in Hospitality Industry.

What are the major challenges in the ceramic and porcelain tableware market?

The major challenge in the ceramic and porcelain tableware market is low durability.

What are the restraining factors in the ceramic and porcelain tableware market?

The major restraining factor faced by the ceramic and porcelain tableware market is high production costs.

What is the key opportunity in the ceramic and porcelain tableware market?

The ceramic and porcelain tableware market offers numerous opportunities for growth and success. By focusing on innovative designs, sustainability, premiumization, digital marketing, collaborations, export, diversification, niche markets, and technological advancements, manufacturers can position themselves for success in this dynamic and competitive industry.

What are the end-use industries where ceramic and porcelain tableware are used?

The key end-use industries of ceramic and porcelain tableware include households, hospitality, food service, and the tourism industry. The growing middle-class population, evolving consumer preferences, and the rise of tourism and dining-out experiences are driving the demand for these materials in various sectors. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing demand for tableware from hospitality sector- High import and export rates of ceramic tableware- Rising influence of social media and prevalence of food bloggersRESTRAINTS- High production cost and complex procedureOPPORTUNITIES- Resurgence of artisanal and handcrafted ceramic and porcelain tableware- Expansion of online retail channelsCHALLENGES- Low durability of ceramic and porcelain tableware

-

6.1 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESINTENSITY OF COMPETITIVE RIVALRY

- 6.2 SUPPLY CHAIN ANALYSIS

-

6.3 ECOSYSTEM MAPPING

-

6.4 MACROECONOMIC INDICATORSINTRODUCTIONGDP TRENDS AND FORECAST

- 6.5 TECHNOLOGY ANALYSIS

-

6.6 CASE STUDY ANALYSISDIGITAL TRANSFORMATION IN CERAMIC AND PORCELAIN TABLEWARE MANUFACTURING

- 6.7 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

6.8 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.9 KEY CONFERENCES AND EVENTS, 2023–2024

- 6.10 TRADE ANALYSIS

-

6.11 PATENT ANALYSISMETHODOLOGYDOCUMENT TYPESPUBLICATION TRENDSINSIGHTSJURISDICTION ANALYSISTOP APPLICANTS

- 6.12 REGULATORY LANDSCAPE

- 6.13 REGULATORY BODIES

-

6.14 RAW MATERIAL ANALYSISCLAYKAOLINFELDSPAROTHER RAW MATERIALS

- 6.15 RAW MATERIAL SUSTAINABILITY

- 6.16 RAW MATERIAL PRICES

-

6.17 MARKET ANALYSISCOLORS AND SHAPESMARKET STRATEGIESIMPACT OF E-COMMERCE AND ONLINE SALES

-

6.18 RECESSION IMPACT ANALYSISREALISTIC SCENARIOPESSIMISTIC SCENARIOOPTIMISTIC SCENARIO

-

6.19 PRICING ANALYSISAVERAGE SELLING PRICE, BY REGION

- 7.1 INTRODUCTION

-

7.2 BONE CHINATRANSLUCENT AND RESISTANT TO BREAKAGE

-

7.3 PORCELAINDURABLE AND PLIABLE

-

7.4 STONEWARERESISTANT TO CHIPPING AND CRACKING

- 7.5 OTHER MATERIALS

- 8.1 INTRODUCTION

-

8.2 SLIP CASTINGIDEAL FOR INTRICATE AND COMPLEX DESIGNS

-

8.3 PRESSURE CASTINGINCREASES STRENGTH AND DURABILITY

-

8.4 ISOSTATIC CASTINGOFFERS VERSATILE AND INTRICATE DESIGNS

- 8.5 OTHER TECHNOLOGIES

- 9.1 INTRODUCTION

-

9.2 DINNERWAREPLATES- Exquisite designs with intricate patterns to drive marketBOWL- Elegant glazes and heat resistance to fuel marketTRAYS- Attractive shapes and prints to boost marketOTHER DINNERWARE

-

9.3 BEVERAGEWARERISING TREND OF AESTHETIC CAFES TO FUEL DEMAND FOR PORCELAIN CUPS

-

9.4 COOKWARENON-TOXIC COATINGS TO FUEL DEMAND FOR CERAMIC COOKWARE

- 9.5 OTHER PRODUCTS

- 10.1 INTRODUCTION

- 10.2 HOUSEHOLD

- 10.3 COMMERCIAL

- 11.1 INTRODUCTION

- 11.2 SUPERMARKETS & HYPERMARKETS

- 11.3 WHOLESALERS & RETAILERS

- 11.4 ONLINE DISTRIBUTION CHANNELS

- 12.1 INTRODUCTION

-

12.2 ASIA PACIFICRECESSION IMPACT ON ASIA PACIFICCHINA- Significant global export to drive marketJAPAN- Timeless craftsmanship and contemporary products to fuel marketSOUTH KOREA- Global demand for terracotta bowls and stone pots to drive marketINDIA- Initiatives to promote handicraft sector to fuel marketAUSTRALIA & NEW ZEALAND- Flourishing culinary culture to fuel marketREST OF ASIA PACIFIC

-

12.3 NORTH AMERICARECESSION IMPACT ON NORTH AMERICAUS- Increase in global trade to drive marketCANADA- Growing interest in home decor and aesthetics to propel marketMEXICO- Growth of hospitality industry to fuel market

-

12.4 EUROPERECESSION IMPACT ON EUROPEGERMANY- Economic growth and strong food culture to drive marketITALY- Preference for high-quality and aesthetically pleasing cups and saucers to drive marketUK- Increasing use of artistic tableware to drive marketFRANCE- Increased interest in home entertainment to fuel demand for ceramic tablewareSWITZERLAND- Increased household spending and consumer demand to drive marketSWEDEN- Increasing use of home decor to drive marketREST OF EUROPE

-

12.5 MIDDLE EAST & AFRICARECESSION IMPACT ON MIDDLE EAST & AFRICA

-

12.6 SAUDI ARABIAHOSPITALITY AND FINE DINING TO INCREASE DEMAND FOR CERAMIC AND PORCELAIN TABLEWARE

-

12.7 UAEECONOMIC GROWTH AND RISING DISPOSABLE INCOME TO DRIVE MARKET

-

12.8 SOUTH AFRICAGROWTH OF TOURISM INDUSTRY TO DRIVE MARKETREST OF MIDDLE EAST & AFRICA

-

12.9 SOUTH AMERICARECESSION IMPACT ON SOUTH AMERICABRAZIL- Growth of foodservice industry to drive marketARGENTINA- Competitive prices and innovative designs to drive marketREST OF SOUTH AMERICA

- 13.1 INTRODUCTION

- 13.2 MARKET SHARE ANALYSIS

- 13.3 REVENUE ANALYSIS OF KEY MARKET PLAYERS

-

13.4 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERS

- 13.5 COMPETITIVE BENCHMARKING

- 13.6 STRENGTH OF PRODUCT PORTFOLIO

-

13.7 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

13.8 COMPETITIVE SCENARIOPRODUCT LAUNCHESOTHERSMERGERS & ACQUISITIONS

-

14.1 KEY PLAYERSROSENTHAL GMBH- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewVILLEROY & BOCH AG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFISKARS GROUP- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewRAK CERAMICS PJSC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewKAHLA/THÜRINGEN GMBH- Business overview- Products/Solutions/Services offered- MnM viewTOGNANA PORCELLANE- Business overview- Products/Solutions/Services offered- MnM viewLIFETIME BRANDS, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNORITAKE CO., LTD.- Business overview- Products/Solutions/Services offered- MnM viewRICHARD GINORI S.R.L.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCHURCHILL CHINA (UK) LTD.- Business overview- Products/Solutions/Services offered- MnM viewLENOX CORPORATION- Business overview- Products/Solutions/Services offered- MnM view

-

14.2 OTHER PLAYERSCUISINARTMEYER CORPORATIONSTEELITE INTERNATIONAL LTD.SHARP DAWSON (SHANGHAI) INDUSTRIAL CO., LTD.EMILE HENRYJARS CERAMISTESWMF GMBHBERNARDAUDBECASASTAATLICHE PORZELLAN-MANUFAKTUR MEISSEN GMBHDEGRENNECERAMICHE PICCADILLYJAIPUR CERAMICS PRIVATE LIMITEDWATERFORD WEDGWOODLIBBEY

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 WORLDWIDE GDP GROWTH PROJECTION

- TABLE 2 KEY BUYING CRITERIA FOR CERAMIC AND PORCELAIN TABLEWARE

- TABLE 3 CERAMIC AND PORCELAIN TABLEWARE MARKET: CONFERENCES AND EVENTS, 2023–2024

- TABLE 4 HS CODE - 6912 IMPORT DATA OF CERAMIC AND PORCELAIN TABLEWARE MARKET

- TABLE 5 HS CODE - 6912 EXPORT DATA OF CERAMIC AND PORCELAIN TABLEWARE MARKET

- TABLE 6 HS CODE - 6911 IMPORT DATA OF CERAMIC AND PORCELAIN TABLEWARE MARKET

- TABLE 7 HS CODE - 6911 EXPORT DATA OF CERAMIC AND PORCELAIN TABLEWARE MARKET

- TABLE 8 CERAMIC AND PORCELAIN TABLEWARE MARKET: REGISTERED PATENTS

- TABLE 9 AVERAGE PRICE OF RAW MATERIALS IN US, 2022

- TABLE 10 REALISTIC SCENARIO: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY REGION, 2021–2028 (KILOTON)

- TABLE 11 REALISTIC SCENARIO: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 12 PESSIMISTIC SCENARIO: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY REGION, 2021–2028 (KILOTON)

- TABLE 13 PESSIMISTIC SCENARIO: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 14 OPTIMISTIC SCENARIO: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY REGION, 2021–2028 (KILOTON)

- TABLE 15 OPTIMISTIC SCENARIO: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 16 AVERAGE SELLING PRICE, BY REGION (USD/TON)

- TABLE 17 CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 18 CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (KIL0TON)

- TABLE 19 CERAMIC AND PORCELAIN TABLEWARE MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 20 CERAMIC AND PORCELAIN TABLEWARE MARKET, BY TECHNOLOGY, 2021–2028 (KILOTON)

- TABLE 21 CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (KILOTON)

- TABLE 22 CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 23 CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 24 CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 25 CERAMIC AND PORCELAIN TABLEWARE MARKET, BY DISTRIBUTION CHANNEL, 2021–2028 (USD MILLION)

- TABLE 26 CERAMIC AND PORCELAIN TABLEWARE MARKET, BY DISTRIBUTION CHANNEL, 2021–2028 (KILOTON)

- TABLE 27 CERAMIC AND PORCELAIN TABLEWARE MARKET, BY REGION, 2021–2028 (KILOTON)

- TABLE 28 CERAMIC AND PORCELAIN TABLEWARE MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 29 ASIA PACIFIC: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY COUNTRY, 2021–2028 (KILOTON)

- TABLE 30 ASIA PACIFIC: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 31 ASIA PACIFIC: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 32 ASIA PACIFIC: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 33 ASIA PACIFIC: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (KILOTON)

- TABLE 34 ASIA PACIFIC: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 35 ASIA PACIFIC: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 36 ASIA PACIFIC: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 37 ASIA PACIFIC: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY DISTRIBUTION CHANNEL, 2021–2028 (USD MILLION)

- TABLE 38 ASIA PACIFIC: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY DISTRIBUTION CHANNEL, 2021–2028 (KILOTON)

- TABLE 39 CHINA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 40 CHINA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 41 CHINA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (KILOTON)

- TABLE 42 CHINA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 43 CHINA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 44 CHINA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 45 JAPAN: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 46 JAPAN: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 47 JAPAN: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (KILOTON)

- TABLE 48 JAPAN: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 49 JAPAN: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 50 JAPAN: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 51 SOUTH KOREA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 52 SOUTH KOREA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 53 SOUTH KOREA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (KILOTON)

- TABLE 54 SOUTH KOREA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 55 SOUTH KOREA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 56 SOUTH KOREA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 57 INDIA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 58 INDIA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 59 INDIA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (KILOTON)

- TABLE 60 INDIA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 61 INDIA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 62 INDIA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 63 AUSTRALIA & NEW ZEALAND: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 64 AUSTRALIA & NEW ZEALAND: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 65 AUSTRALIA & NEW ZEALAND: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (KILOTON)

- TABLE 66 AUSTRALIA & NEW ZEALAND: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 67 AUSTRALIA & NEW ZEALAND: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 68 AUSTRALIA & NEW ZEALAND: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 69 REST OF ASIA PACIFIC: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 70 REST OF ASIA PACIFIC: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 71 REST OF ASIA PACIFIC: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (KILOTON)

- TABLE 72 REST OF ASIA PACIFIC: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 73 REST OF ASIA PACIFIC: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 74 REST OF ASIA PACIFIC: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 75 NORTH AMERICA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY COUNTRY, 2021–2028 (KILOTON)

- TABLE 76 NORTH AMERICA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 77 NORTH AMERICA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 79 NORTH AMERICA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (KILOTON)

- TABLE 80 NORTH AMERICA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 81 NORTH AMERICA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 82 NORTH AMERICA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 83 NORTH AMERICA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY DISTRIBUTION CHANNEL, 2021–2028 (USD MILLION)

- TABLE 84 NORTH AMERICA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY DISTRIBUTION CHANNEL, 2021–2028 (KILOTON)

- TABLE 85 US: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 86 US: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 87 US: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (KILOTON)

- TABLE 88 US: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 89 US: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 90 US: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 91 CANADA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 92 CANADA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 93 CANADA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (KILOTON)

- TABLE 94 CANADA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 95 CANADA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 96 CANADA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 97 MEXICO: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 98 MEXICO: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 99 MEXICO: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (KILOTON)

- TABLE 100 MEXICO: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 101 MEXICO: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 102 MEXICO: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 103 EUROPE: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY COUNTRY, 2021–2028 (KILOTON)

- TABLE 104 EUROPE: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 105 EUROPE: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 106 EUROPE: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 107 EUROPE: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (KILOTON)

- TABLE 108 EUROPE: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 109 EUROPE: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 110 EUROPE: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 111 EUROPE: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY DISTRIBUTION CHANNEL, 2021–2028 (USD MILLION)

- TABLE 112 EUROPE: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY DISTRIBUTION CHANNEL, 2021–2028 (KILOTON)

- TABLE 113 GERMANY: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 114 GERMANY: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 115 GERMANY: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (KILOTON)

- TABLE 116 GERMANY: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 117 GERMANY: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 118 GERMANY: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 119 ITALY: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 120 ITALY: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 121 ITALY: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (KILOTON)

- TABLE 122 ITALY: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 123 ITALY: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 124 ITALY: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 125 UK: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 126 UK: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 127 UK: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (KILOTON)

- TABLE 128 UK: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 129 UK: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 130 UK: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 131 FRANCE: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 132 FRANCE: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 133 FRANCE: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (KILOTON)

- TABLE 134 FRANCE: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 135 FRANCE: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 136 FRANCE: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 137 SWITZERLAND: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 138 SWITZERLAND: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 139 SWITZERLAND: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (KILOTON)

- TABLE 140 SWITZERLAND: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 141 SWITZERLAND: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 142 SWITZERLAND: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 143 SWEDEN: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 144 SWEDEN: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 145 SWEDEN: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (KILOTON)

- TABLE 146 SWEDEN: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 147 SWEDEN: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 148 SWEDEN: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 149 REST OF EUROPE: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 150 REST OF EUROPE: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 151 REST OF EUROPE: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (KILOTON)

- TABLE 152 REST OF EUROPE: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 153 REST OF EUROPE: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 154 REST OF EUROPE: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY COUNTRY, 2021–2028 (KILOTON)

- TABLE 156 MIDDLE EAST & AFRICA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 159 MIDDLE EAST & AFRICA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (KILOTON)

- TABLE 160 MIDDLE EAST & AFRICA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 162 MIDDLE EAST & AFRICA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 163 MIDDLE EAST & AFRICA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY DISTRIBUTION CHANNEL, 2021–2028 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY DISTRIBUTION CHANNEL, 2021–2028 (KILOTON)

- TABLE 165 SAUDI ARABIA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 166 SAUDI ARABIA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 167 SAUDI ARABIA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (KILOTON)

- TABLE 168 SAUDI ARABIA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 169 SAUDI ARABIA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 170 SAUDI ARABIA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 171 UAE: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 172 UAE: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 173 UAE: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (KILOTON)

- TABLE 174 UAE: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 175 UAE: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 176 UAE: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 177 SOUTH AFRICA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 178 SOUTH AFRICA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 179 SOUTH AFRICA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (KILOTON)

- TABLE 180 SOUTH AFRICA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 181 SOUTH AFRICA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 182 SOUTH AFRICA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 183 REST OF MIDDLE EAST & AFRICA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 184 REST OF MIDDLE EAST & AFRICA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 185 REST OF MIDDLE EAST & AFRICA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (KILOTON)

- TABLE 186 REST OF MIDDLE EAST & AFRICA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 187 REST OF MIDDLE EAST & AFRICA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 188 REST OF MIDDLE EAST & AFRICA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 189 SOUTH AMERICA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY COUNTRY, 2021–2028 (KILOTON)

- TABLE 190 SOUTH AMERICA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 191 SOUTH AMERICA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 192 SOUTH AMERICA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 193 SOUTH AMERICA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (KILOTON)

- TABLE 194 SOUTH AMERICA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 195 SOUTH AMERICA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 196 SOUTH AMERICA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 197 SOUTH AMERICA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY DISTRIBUTION CHANNEL, 2021–2028 (USD MILLION)

- TABLE 198 SOUTH AMERICA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY DISTRIBUTION CHANNEL, 2021–2028 (KILOTON)

- TABLE 199 BRAZIL: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 200 BRAZIL: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 201 BRAZIL: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (KILOTON)

- TABLE 202 BRAZIL: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 203 BRAZIL: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 204 BRAZIL: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 205 ARGENTINA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 206 ARGENTINA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 207 ARGENTINA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (KILOTON)

- TABLE 208 ARGENTINA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 209 ARGENTINA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 210 ARGENTINA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 211 REST OF SOUTH AMERICA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 212 REST OF SOUTH AMERICA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 213 REST OF SOUTH AMERICA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (KILOTON)

- TABLE 214 REST OF SOUTH AMERICA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 215 REST OF SOUTH AMERICA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 216 REST OF SOUTH AMERICA: CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 217 CERAMIC AND PORCELAIN TABLEWARE MARKET: DEGREE OF COMPETITION

- TABLE 218 MANUFACTURERS IN CERAMIC AND PORCELAIN TABLEWARE MARKET

- TABLE 219 CERAMIC AND PORCELAIN TABLEWARE MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 220 CERAMIC AND PORCELAIN TABLEWARE MARKET: STRENGTH OF PRODUCT PORTFOLIO OF KEY PLAYERS

- TABLE 221 CERAMIC AND PORCELAIN TABLEWARE MARKET: PRODUCT LAUNCHES, 2019–2023

- TABLE 222 CERAMIC AND PORCELAIN TABLEWARE MARKET: OTHERS, 2019–2023

- TABLE 223 CERAMIC AND PORCELAIN TABLEWARE MARKET: MERGERS & ACQUISITIONS, 2019–2023

- TABLE 224 ROSENTHAL GMBH: COMPANY OVERVIEW

- TABLE 225 ROSENTHAL GMBH: PRODUCT LAUNCHES

- TABLE 226 VILLEROY & BOCH AG: COMPANY OVERVIEW

- TABLE 227 VILLEROY & BOCH AG: PRODUCT LAUNCHES

- TABLE 228 VILLEROY & BOCH AG: OTHERS

- TABLE 229 FISKARS GROUP: COMPANY OVERVIEW

- TABLE 230 FISKARS GROUP: DEALS

- TABLE 231 FISKARS GROUP: OTHERS

- TABLE 232 RAK CERAMICS PJSC: COMPANY OVERVIEW

- TABLE 233 RAK CERAMICS PJSC: OTHERS

- TABLE 234 KAHLA/THÜRINGEN GMBH: COMPANY OVERVIEW

- TABLE 235 TOGNANA PORCELLANE: COMPANY OVERVIEW

- TABLE 236 LIFETIME BRANDS, INC.: COMPANY OVERVIEW

- TABLE 237 LIFETIME BRANDS, INC.: DEALS

- TABLE 238 NORITAKE CO., LTD.: COMPANY OVERVIEW

- TABLE 239 RICHARD GINORI S.R.L.: COMPANY OVERVIEW

- TABLE 240 RICHARD GINORI S.R.L.: OTHERS

- TABLE 241 CHURCHILL CHINA (UK) LTD.: COMPANY OVERVIEW

- TABLE 242 LENOX CORPORATION: COMPANY OVERVIEW

- TABLE 243 LENOX CORPORATION: DEALS

- FIGURE 1 CERAMIC AND PORCELAIN TABLEWARE MARKET: RESEARCH DESIGN

- FIGURE 2 STAKEHOLDERS INVOLVED AND BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: SUPPLY SIDE

- FIGURE 6 CERAMIC AND PORCELAIN TABLEWARE MARKET: DATA TRIANGULATION

- FIGURE 7 PORCELAIN TO ACCOUNT FOR LARGEST MARKET SHARE IN 2028

- FIGURE 8 SLIP CASTING TO ACCOUNT FOR LARGEST MARKET SHARE IN 2028

- FIGURE 9 BEVERAGEWARE TO RECORD HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 10 COMMERCIAL APPLICATION TO ACCOUNT FOR LARGEST MARKET SHARE IN 2028

- FIGURE 11 SUPERMARKETS & HYPERMARKETS TO ACCOUNT FOR LARGEST MARKET SHARE IN 2028

- FIGURE 12 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 GROWTH OF HOSPITALITY INDUSTRY TO DRIVE MARKET

- FIGURE 14 COMMERCIAL APPLICATION AND CHINA ACCOUNTED FOR LARGEST SHARE IN 2022

- FIGURE 15 INDIA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 CERAMIC AND PORCELAIN TABLEWARE MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 18 CERAMIC AND PORCELAIN TABLEWARE: SUPPLY CHAIN ANALYSIS

- FIGURE 19 CERAMIC AND PORCELAIN TABLEWARE FUTURE REVENUE MIX

- FIGURE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 21 KEY BUYING CRITERIA FOR CERAMIC AND PORCELAIN TABLEWARE

- FIGURE 22 CERAMIC AND PORCELAIN TABLEWARE MARKET: REGISTERED PATENTS

- FIGURE 23 CERAMIC AND PORCELAIN TABLEWARE MARKET: PATENT PUBLICATION TRENDS, 2015–2022

- FIGURE 24 CERAMIC AND PORCELAIN TABLEWARE MARKET: JURISDICTION ANALYSIS

- FIGURE 25 CERAMIC AND PORCELAIN TABLEWARE MARKET: TOP PATENT APPLICANTS

- FIGURE 26 PORCELAIN SEGMENT TO CAPTURE LARGEST MARKET SHARE BETWEEN 2023 AND 2028

- FIGURE 27 SLIP CASTING TECHNOLOGY TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 28 DINNERWARE TO ACCOUNT FOR LARGEST MARKET SHARE IN 2028

- FIGURE 29 COMMERCIAL APPLICATION TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 30 SUPERMARKETS & HYPERMARKETS TO ACCOUNT FOR LARGEST SHARE IN 2028

- FIGURE 31 INDIA TO RECORD HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 32 ASIA PACIFIC: CERAMIC AND PORCELAIN TABLEWARE MARKET SNAPSHOT

- FIGURE 33 NORTH AMERICA: CERAMIC AND PORCELAIN TABLEWARE MARKET SNAPSHOT

- FIGURE 34 KEY GROWTH STRATEGIES ADOPTED BY MARKET PLAYERS BETWEEN 2019 AND 2023

- FIGURE 35 SHARE OF KEY PLAYERS IN CERAMIC AND PORCELAIN TABLEWARE MARKET, 2022

- FIGURE 36 KEY PLAYERS DOMINATED MARKET IN LAST FIVE YEARS

- FIGURE 37 COMPANY EVALUATION MATRIX: CERAMIC AND PORCELAIN TABLEWARE MARKET, 2022

- FIGURE 38 STARTUP/SME MATRIX: CERAMIC AND PORCELAIN TABLEWARE MARKET, 2022

- FIGURE 39 VILLEROY & BOCH AG: COMPANY SNAPSHOT

- FIGURE 40 FISKARS GROUP: COMPANY SNAPSHOT

- FIGURE 41 RAK CERAMICS PJSC: COMPANY SNAPSHOT

- FIGURE 42 LIFETIME BRANDS, INC.: COMPANY SNAPSHOT

- FIGURE 43 NORITAKE CO., LTD.: COMPANY SNAPSHOT

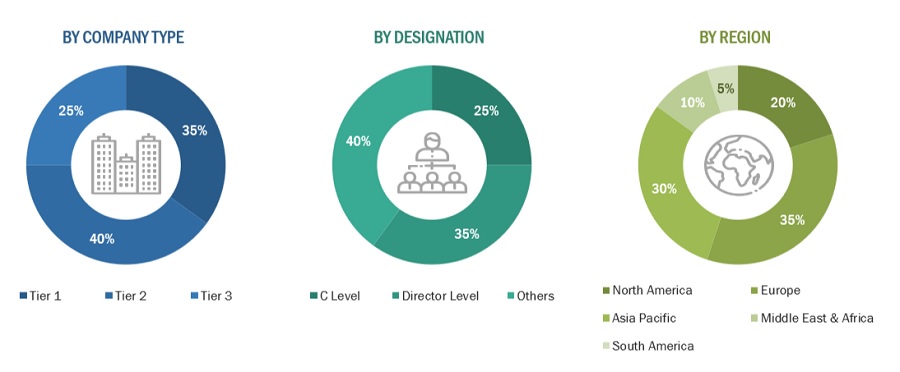

Extensive secondary sources, directories, and databases such as Hoovers, Bloomberg BusinessWeek, Factiva, and OneSource have been used to identify and collect information for this technical, market-oriented, and commercial study of the ceramic and porcelain tableware market. In-depth interviews were conducted with various primary respondents, which included key industry participants, subject matter experts (SMEs), C-level executives of key industry players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and to assess prospects.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers; publications from recognized websites; and databases. Secondary research has mainly been used to obtain key information about the supply chain of the industry, the total pool of key players, market classification & segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

The market size of ceramic and porcelain tableware has been estimated based on secondary data available through paid and unpaid sources and by analyzing the product portfolios of key companies. This data has been further validated through various primary sources.

Primary Research

The ceramic and porcelain tableware market comprises various stakeholders in the supply chain and includes suppliers, manufacturers, and end-users. Various primary sources from the supply and demand sides of the ceramic and porcelain tableware market have been interviewed to obtain qualitative and quantitative information. Primary participants from the supply side include key opinion leaders, executives, vice presidents, and CEOs of companies in the market. Primary sources from the demand side include experts from end-use industries, associations, and institutions involved in the market, and key opinion leaders.

Following is the breakdown of primary respondents

Notes: *Others include sales, marketing, and product managers.

Tier 1: >USD 5 Billion; Tier 2: USD 1 Billion– USD 5 Billion; and Tier 3: <USD 1 Billion.

To know about the assumptions considered for the study, download the pdf brochure

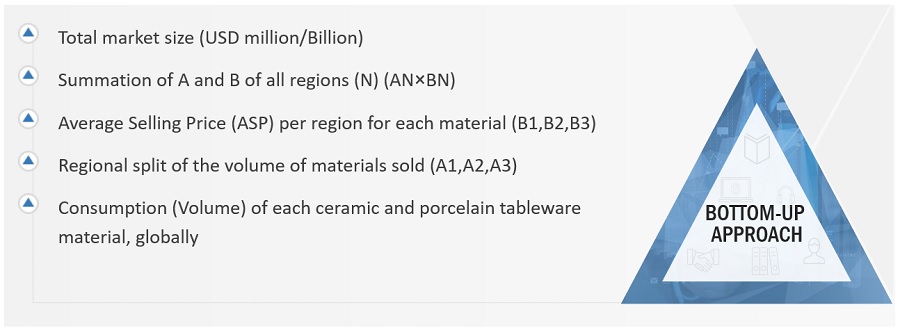

Market Size Estimation

The supply-side and demand-side approaches have been extensively used, along with several data triangulation methods, for market size estimation and forecast of the overall market segments listed in this report. Extensive qualitative and quantitative data were analyzed to list key information/insights throughout the report. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares split and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of annual reports, reviews, ceramic and porcelain tableware associations, and newsletters of key industry players, along with extensive interviews with key officials, such as directors and marketing executives.

Bottom-up approach

To know about the assumptions considered for the study, Request for Free Sample Report

The bottom-up procedure was employed to arrive at the overall market size of the ceramic and porcelain tableware market from the revenues of key players and their respective market shares in the global market. The bottom-up approach has also been used for the data extracted from secondary research to validate the market sizes of segments and subsegments in terms of value.

Top-down approach

In the top-down approach, the overall market size has been used to estimate the size of other individual markets (Application and Region) through percentage splits obtained from secondary and primary research.

For the calculation of the size of a specific market segment, the size of the most appropriate immediate parent market was used to implement the top-down approach. The bottom-up procedure was also implemented for the data extracted from secondary research to validate the market segment revenues obtained. With the data triangulation procedure and validation of data through primaries, the exact values of the overall parent market size have been determined and confirmed in this study. The data triangulation procedure implemented for this study has been explained in the next section.

Data Triangulation

After arriving at the overall market size, the total market was split into several segments and subsegments. To complete the overall market estimation process and arrive at the exact statistics for all the segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. Data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

The ceramic and porcelain tableware market is a segment of the global tableware market that comprises products made from ceramic and porcelain materials. Ceramic tableware is made from clay and other minerals that are fired at high temperatures, while porcelain tableware is made from a type of ceramic that is fired at even higher temperatures. Both ceramic and porcelain tableware are durable and resistant to staining, making them ideal for use in the home. Ceramics and porcelain are widely used materials to produce plates, bowls, cups, saucers, serving dishes, and other tableware items. These materials are known for their durability, heat resistance, and aesthetic appeal.

Key stakeholders

- Raw material suppliers and producers

- Ceramic and porcelain tableware manufacturers

- Ceramic and porcelain tableware distributors/suppliers

- Regulatory bodies

- Local governments

Report Objectives

- To define, describe, and forecast the ceramic and porcelain tableware market in terms of value and volume.

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the market.

- To forecast the market based on Material, Technology, Product, Application, distribution channel, and regions.

- To forecast the size of the market based on regions: North America, Asia Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- To estimate and forecast the market at the country level in each Region.

- To analyze market opportunities for stakeholders and provide details of the competitive landscape of market leaders.

- To analyze the recent market developments and competitive strategies, such as expansions, new product launches, agreements, and acquisitions.

- To strategically identify and profile key market players and analyze their core competencies1 in the market.

- To track and analyze competitive developments such as expansions & investments, mergers & acquisitions, new Technology & Product launches, and agreements & contracts in the ceramic and porcelain tableware market.

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Product Analysis:

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of the Rest of the APAC, Ceramic And Porcelain Tableware Market

- Further breakdown of the Rest of Europe, Ceramic And Porcelain Tableware Market

- Further breakdown of the Rest of South America, Ceramic And Porcelain Tableware Market

- Further breakdown of the Rest of Middle East & Africa, Ceramic And Porcelain Tableware Market

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Ceramic & Porcelain Tableware Market