Coiled Tubing Market by Fleet (Operator, Region), Service (Well Intervention Service (Well Completions & Mechanical Operations, Well Cleaning & Pumping Operations) Drilling Service, Others), Application (Onshore, Offshore), Region - Global Forecast to 2035

The global coiled tubing market was valued at USD 3.84 billion in 2024 and is estimated to reach USD 5.76 billion by 2035, at a CAGR of 3.9% between 2025 and 2035.

The coiled tubing market is driven by rising demand for efficient well intervention, drilling, and maintenance operations in the oil and gas sector. Its advantages in enhancing production, reducing downtime, and lowering operational costs make it a preferred alternative to conventional workover methods. The adoption of digital oilfield technologies under Industry 4.0/5.0 is improving real-time monitoring and operational efficiency. Recent trends include advanced high-strength tubing materials, integration of downhole tools, and hybrid coiled tubing units. North America, particularly the U.S. and Canada, leads market growth due to expanding shale gas exploration and EOR investments.

Coiled tubing is a continuous length of steel pipe wound onto a spool, used primarily for well intervention, drilling, and completion operations in the oil and gas industry. It enables efficient downhole operations without removing the tubing from the well, reducing downtime and operational costs. The system operates with various tools and equipment such as injectors, reel units, and control systems that manage pressure, flow, and movement. Coiled tubing is commonly used for applications like well cleaning, acidizing, fracturing, and milling, offering flexibility, speed, and cost-effectiveness compared to conventional workover methods.

Market by Service

Well Intervention

The coiled tubing market for well intervention is driven by the need to maintain and enhance production from existing oil and gas wells. Coiled tubing enables efficient operations such as well cleanouts, acid stimulation, scale removal, and fishing, without the need to pull the entire tubing string, reducing downtime and operational costs. Its flexibility and ability to operate under live well conditions make it ideal for interventions in mature and unconventional fields. Growing focus on optimizing production, combined with advanced coiled tubing units equipped with real-time monitoring and downhole measurement tools, is further boosting market adoption.

Drilling

In drilling applications, coiled tubing is increasingly used for slimhole drilling, underbalanced drilling, and extended-reach operations. Its continuous, jointless design allows for faster deployment and safer operations, particularly in challenging onshore and offshore environments. Coiled tubing drilling reduces the risk of stuck pipe, minimizes non-productive time, and supports precise well trajectory control. Innovations such as high-strength tubing, hybrid units, and integrated sensors are enhancing performance and reliability, driving growth in drilling services. North America remains a key market due to extensive shale and unconventional drilling activities.

Market by Application

Onshore

In onshore operations, coiled tubing is widely used for well intervention, stimulation, and drilling in conventional and unconventional reservoirs. Its ability to perform tasks like well cleanouts, acidizing, fracturing, and fishing without pulling the tubing string reduces downtime and operational costs. The technology is particularly beneficial for shale gas and tight oil fields, where frequent interventions are required. Advanced coiled tubing units with real-time monitoring and automation enhance operational efficiency and safety. The growing focus on mature field optimization and cost-effective production methods is driving adoption in onshore markets globally.

Offshore

Coiled tubing plays a critical role in offshore oil and gas operations, offering efficient solutions for deepwater and ultra-deepwater well intervention and drilling. Its continuous, flexible design allows for complex downhole operations, including underbalanced drilling, stimulation, and maintenance, in challenging subsea environments. Offshore coiled tubing units often integrate advanced monitoring, hybrid injector systems, and high-strength materials to withstand extreme pressures and harsh conditions. The increasing focus on maximizing production from existing offshore fields, combined with investments in subsea technology, is fueling demand in the offshore coiled tubing segment.

Market by Fleet:

The coiled tubing market is segmented by fleet across major regions including North America, Europe, Asia Pacific, South & Central America, the Middle East, and Africa. North America dominates the market due to extensive shale gas and unconventional oilfield activities, with key operators such as NexTier Oilfield Solutions, STEP Energy Services, Key Energy Services, Pioneer Energy Services, Basic Energy Services, and Calfrac Well Services leading deployment. Europe and Asia Pacific are witnessing steady growth driven by offshore and onshore well intervention projects. In regions like South & Central America, the Middle East, and Africa, increasing upstream investments and enhanced oil recovery (EOR) projects are expanding the utilization of coiled tubing fleets.

Market by Geography:

Geographically, the coiled tubing market is experiencing widespread adoption across North America, Europe, Asia Pacific, the Middle East, South America and Africa. North America is the largest regional market, supported by extensive shale gas exploration, unconventional oilfield development, and frequent well intervention operations. The region’s mature fields and high focus on production optimization make coiled tubing a preferred solution for cost-efficient, rapid, and reliable downhole operations. Asia Pacific and Europe are witnessing steady growth due to increasing upstream investments, offshore and onshore drilling activities, and the adoption of advanced coiled tubing technologies such as high-strength tubing and hybrid units. South & Central America, the Middle East, and Africa are experiencing rising demand driven by enhanced oil recovery (EOR) projects, exploration of new reserves, and the need to improve production efficiency in both mature and emerging fields. Overall, regional growth is fueled by technological advancements, automation, and operational efficiency initiatives in the global oil and gas sector.

Market Dynamics

Driver: Growing Demand for Well Intervention Operations

According to Halliburton, mature fields account for about 70% of global oil and gas production, with average recovery factors of 70% for gas and 35% for oil. As newly discovered fields rapidly deplete, operators are increasingly focusing on maximizing production from mature reserves through secondary and tertiary recovery techniques. These fields still hold vast untapped potential—about 80% of mature reserves are in the Middle East and North Africa, 43% in Asia Pacific, and 24% in Latin America. Major oil and gas companies are prioritizing well intervention operations to improve recovery and extend field life instead of drilling new wells, which is highly cost-intensive. This shift has significantly boosted the demand for coiled tubing operations, as they offer a cost-effective and efficient method for re-perforation, stimulation, and clean-out activities. Thus, the growing focus on enhancing mature field productivity is a key driver for the global coiled tubing market.

Restraint: Oil Price Volatility and Reduced Upstream Investment Restraining the market

As of late 2024, oil prices are projected to average around USD 81 per barrel, down from USD 83 per barrel in 2023, reflecting continued volatility driven by geopolitical tensions and economic uncertainties. The Russia–Ukraine conflict previously pushed WTI and Brent crude prices up by over 50%, prompting OPEC+ to implement additional production cuts of 1.2 million b/d through 2023. Such price fluctuations create instability in capital investment decisions, leading operators to delay or scale back drilling and well intervention activities. During periods of lower oil prices, upstream companies tend to reduce spending on secondary and tertiary recovery operations, including coiled tubing services, to preserve cash flow. This cyclical nature of oil prices directly affects the utilization rate of coiled tubing units, particularly in high-cost regions. Therefore, persistent oil price volatility and reduced upstream investment act as key restraints on the growth of the global coiled tubing market.

Opportunity: Technological Advancements and Intelligent Coiled Tubing

Well integrity challenges, increasing drilling complexity, and the expansion of multilateral and long-lateral wells have created significant opportunities for the coiled tubing market. The adoption of intelligent coiled tubing technologies—integrating artificial intelligence, IoT, and real-time downhole monitoring—enables operators to prevent buckling, stuck tubing, and debris accumulation, while improving steerability during complex interventions. Oilfield service providers are increasingly offering advanced solutions, such as Baker Hughes’ TeleCoil and Schlumberger’s ACTive services, which combine fiber-optic telemetry, dynamic interpretation software, and smart Bottomhole Assemblies to provide real-time data on temperature, pressure, and wellbore conditions. These innovations allow faster, safer, and more efficient well interventions, reducing operational time and costs. As upstream activities expand into harsher geographies with higher pressures, temperatures, and well complexities, the demand for intelligent, adaptive coiled tubing services is expected to grow. This paradigm shift toward digitalized, data-driven interventions presents a lucrative growth opportunity for the global coiled tubing market.

Challenge: Energy Transition and Shift Toward Renewables

Major oil companies are increasingly reallocating budgets from traditional exploration and production (E&P) activities toward renewable energy projects as part of their decarbonization strategies. As the global energy mix transitions, the share of fossil fuels in primary energy is projected to decline from around 80% in 2019 to between 55% and 20% by 2050, while renewables are expected to rise from 10% to between 35% and 65% over the same period. This transition is driven by improved cost competitiveness of renewable technologies and stronger policy support for low-carbon energy systems. As investment flows toward renewables, oil and gas companies are scaling back upstream activities, particularly drilling, re-completion, and well intervention operations. Consequently, the reduced focus on conventional and mature field development poses a major challenge for the coiled tubing market, limiting growth opportunities in traditional oilfield service segments.

Future Outlook

The coiled tubing market is expected to expand steadily from 2025 to 2035, fueled by the need for faster, safer, and more cost-effective well interventions and drilling operations. Adoption of advanced coiled tubing systems with integrated sensors, hybrid units, and automated controls will improve precision and reduce downtime. North America is anticipated to remain the largest market due to extensive shale and unconventional oilfield activities, while Asia Pacific, Europe, and the Middle East will grow steadily with investments in offshore projects and enhanced oil recovery initiatives. Operational challenges like equipment wear are mitigated by high-strength materials and digital monitoring technologies.

Key Market Players

Key Coiled Tubing companies include Halliburton (US), Baker Hughes (US), Weatherford International (US), SLB (US), Step Energy Services (Canada), among others.

Key Questions addressed in this report:

- Market Size and Growth: What is the current size of the coiled tubing market, and how is it expected to grow from 2025 to 2035 across regions and service types?

- Regional Dynamics: Which regions are leading the adoption of coiled tubing services, and what factors are driving growth in North America, Asia Pacific, Europe, the Middle East, and Africa?

- Service and Application Segmentation: How is the market segmented by service (well intervention, drilling) and application (onshore vs offshore), and which segments offer the highest growth opportunities?

- Key Players and Competitive Landscape: Who are the leading companies in the coiled tubing market, what are their offerings, and how are they positioned globally?

- Trends and Future Outlook: What technological advancements, operational strategies, and industry trends are shaping the future of the coiled tubing market, and what challenges need to be addressed?

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 36)

1.1 OBJECTIVES OF THE STUDY

1.2 DEFINITION

1.2.1 COILED TUBING MARKET, BY SERVICE: INCLUSIONS VS. EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATION

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 40)

2.1 RESEARCH DATA

FIGURE 1 COILED TUBING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

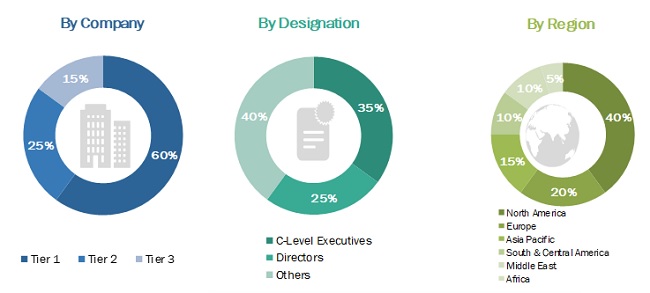

2.1.2.2 Breakdown of primaries

TABLE 1 COILED TUBING MARKET: PLAYERS/COMPANIES CONNECTED

2.2 SCOPE

2.3 KEY INFLUENCING FACTORS/DRIVERS

2.3.1 WELL COUNT

FIGURE 2 NEWLY DRILLED WELLS, 2018

2.3.2 COILED TUBING UNIT COUNT

FIGURE 3 CRUDE OIL PRICE AND OPERATIONAL WELL COUNT VS. COILED TUBING UNIT COUNT (2014–2018)

2.3.3 PRODUCTION TRENDS

FIGURE 4 OPERATIONAL WELL COUNT VS. CRUDE OIL PRODUCTION (2013–2019)

2.3.4 CRUDE OIL PRICES

FIGURE 5 CRUDE OIL PRICE TREND

2.3.5 IMPACT OF COVID-19

2.4 MARKET SIZE ESTIMATION

2.4.1 IDEAL DEMAND-SIDE ANALYSIS

TABLE 2 COILED TUBING MARKET: IDEAL DEMAND-SIDE APPROACH

2.4.1.1 Assumptions

2.4.1.2 Calculation

FIGURE 6 COILED TUBING MARKET: IDEAL DEMAND-SIDE CALCULATION

2.4.2 SUPPLY-SIDE ANALYSIS

2.4.2.1 Assumptions

2.4.2.2 Calculation

FIGURE 7 RESEARCH METHODOLOGY: ILLUSTRATION OF COILED TUBING COMPANY REVENUE ESTIMATION (2019)

FIGURE 8 RANKING OF KEY PLAYERS & INDUSTRY CONCENTRATION, 2019

2.4.3 FORECAST

2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION METHODOLOGY

2.6 PRIMARY INSIGHTS

FIGURE 10 KEY SERVICE PROVIDERS’ POINT OF VIEW

3 EXECUTIVE SUMMARY (Page No. - 53)

3.1 PRE- AND POST-COVID-19 SCENARIO ANALYSIS

FIGURE 11 PRE- AND POST-COVID-19 SCENARIO ANALYSIS

TABLE 3 COILED TUBING MARKET SNAPSHOT

FIGURE 12 NORTH AMERICA DOMINATED THE MARKET IN 2019

FIGURE 13 NORTH AMERICA DOMINATED THE MARKET, BY FLEET, 2016–2019

FIGURE 14 WELL INTERVENTION SEGMENT IS EXPECTED TO LEAD THE MARKET, BY SERVICE, 2020–2025

FIGURE 15 ONSHORE SEGMENT IS EXPECTED TO DOMINATE THE MARKET, BY APPLICATION, DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 58)

4.1 ATTRACTIVE OPPORTUNITIES IN THE MARKET

FIGURE 16 MATURING OILFIELDS TO DRIVE THE DEMAND FOR WELL INTERVENTION ACTIVITIES AND BOOST THE MARKET GROWTH, 2020–2025

4.2 COILED TUBING MARKET, BY SERVICE

FIGURE 17 WELL INTERVENTION SEGMENT IS EXPECTED TO DOMINATE THE MARKET, BY SERVICE, 2020—2025

4.3 COILED TUBING MARKET, BY APPLICATION

FIGURE 18 ONSHORE SEGMENT DOMINATED THE MARKET, BY APPLICATION IN 2019

4.4 COILED TUBING MARKET, BY REGION

FIGURE 19 COILED TUBING MARKET IN THE MIDDLE EAST IS EXPECTED TO REGISTER HIGHEST CAGR FROM 2020 TO 2025

4.5 NORTH AMERICAN MARKET, BY APPLICATION & COUNTRY

FIGURE 20 ONSHORE SEGMENT AND THE US DOMINATED THE NORTH AMERICAN MARKET IN 2019

5 MARKET OVERVIEW (Page No. - 61)

5.1 INTRODUCTION

5.2 COVID-19 HEALTH ASSESSMENT

FIGURE 21 COVID-19 GLOBAL PROPAGATION

FIGURE 22 COVID-19 PROPAGATION IN SELECT COUNTRIES

5.3 ROAD TO RECOVERY

FIGURE 23 RECOVERY ROAD FOR 2020

5.4 COVID-19 ECONOMIC ASSESSMENT

FIGURE 24 REVISED GDP FORECAST FOR SELECT G20 COUNTRIES IN 2020

5.5 MARKET DYNAMICS

FIGURE 25 COILED TUBING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.5.1 DRIVERS

5.5.1.1 Growing demand for well intervention operations is driving the market

FIGURE 26 WELL INTERVENTION SERVICES VS. COILED TUBING/WIRELINE DEPLOYMENT FOR PERFORMING THE OPERATIONS

FIGURE 27 GLOBAL OIL & GAS UPSTREAM CAPITAL SPENDING (2014–2019)

5.5.1.2 Redevelopment of mature oilfields demands coiled tubing units for production enhancement

FIGURE 28 PEAK LOSS OF OIL FROM MATURE CONVENTIONAL OILFIELDS (2010–2017)

5.5.1.3 Advancements in shale oil extraction require more coiled tubing operations

TABLE 4 TOP COUNTRIES WITH SIGNIFICANT TECHNICALLY RECOVERABLE SHALE RESOURCES

5.5.1.4 Rising primary energy consumption from Asia Pacific will boost the market in the region

FIGURE 29 WORLD OIL DEMAND GROWTH (2018–2024)

5.5.2 RESTRAINTS

5.5.2.1 Risks associated with coiled tubing operations and regulations associated with operational safety are restraining the market growth

5.5.2.2 Wireline operations, which are a cheaper substitute of coiled tubing operations, hinder the growth of the market

5.5.3 OPPORTUNITIES

5.5.3.1 Increasing exploration & production activities from new discoveries offer lucrative opportunities for the market

FIGURE 30 TRENDS OF EXPLORATIONS & PRODUCTION CAPEX WITH RESPECT TO CRUDE OIL PRICES (2010–2018)

5.5.3.2 Evolution of intelligent coiled tubing technologies

5.5.4 CHALLENGES

5.5.4.1 Challenging coiled tubing operations in offshore well interventions & drilling pose challenges for the market

5.5.4.2 Impact of COVID-19 on oil and gas production activities

5.6 ADJACENT AND INTERCONNECTED MARKETS

TABLE 5 ADJACENT AND INTERCONNECTED MARKETS (USD BILLION)

6 COILED TUBING MARKET, BY SERVICE (Page No. - 74)

6.1 INTRODUCTION

FIGURE 31 WELL INTERVENTION SEGMENT IS EXPECTED TO DOMINATE THE MARKET, BY SERVICE, 2020–2025

TABLE 6 COILED TUBING MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 7 PRE-COVID-19: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 8 POST-COVID-19: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

6.2 WELL INTERVENTION

FIGURE 32 WELL COMPLETIONS & MECHANICAL OPERATIONS SUB-SEGMENT DOMINATED WELL INTERVENTION MARKET IN 2019

TABLE 9 WELL INTERVENTION: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 10 POST-COVID-19: WELL INTERVENTION: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 11 WELL INTERVENTION: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 12 POST-COVID-19: WELL INTERVENTION: MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

6.2.1 WELL COMPLETIONS & MECHANICAL OPERATIONS

6.2.1.1 Increasing concerns for improving well accessibility and enhancing production are expected to drive the well completions & mechanical operations market

TABLE 13 WELL COMPLETIONS & MECHANICAL OPERATIONS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 14 POST-COVID-19: WELL COMPLETIONS & MECHANICAL OPERATIONS: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.2.2 WELL CLEANING & PUMPING OPERATIONS

6.2.2.1 Optimization of mature oil & gas reservoirs drives the demand for well cleaning & pumping operations

TABLE 15 WELL CLEANING & PUMPING OPERATIONS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 16 POST-COVID-19: WELL CLEANING & PUMPING OPERATIONS: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.3 DRILLING

6.3.1 MULTILATERAL WELL DRILLING IS DRIVING THE COILED TUBING DRILLING MARKET

TABLE 17 DRILLING: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 18 POST-COVID-19: DRILLING: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.4 OTHERS

TABLE 19 OTHERS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 20 POST-COVID-19: OTHERS: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

7 COILED TUBING MARKET, BY APPLICATION (Page No. - 85)

7.1 INTRODUCTION

FIGURE 33 ONSHORE SEGMENT IS EXPECTED TO LEAD MARKET, BY APPLICATION, FROM 2020 TO 2025

TABLE 21 COILED TUBING MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 22 PRE-COVID-19: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 23 POST-COVID-19: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

7.2 ONSHORE

7.2.1 ONSHORE SHALE DEVELOPMENT IN NORTH AMERICA AND HIGHER NUMBER OF MATURE ONSHORE OILFIELDS IN THE MIDDLE EAST ARE LIKELY TO PROVIDE OPPORTUNITIES FOR COILED TUBING SERVICE PROVIDERS

TABLE 24 ONSHORE: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 25 POST-COVID-19: ONSHORE: MARKET SIZE, BY REGION, BY REGION, 2020–2025 (USD MILLION)

7.3 OFFSHORE

7.3.1 GREATER LOGISTICAL AND OPERATIONAL CHALLENGES ARE AFFECTING THE GROWTH OF COILED TUBING OPERATIONS IN OFFSHORE REGIONS

TABLE 26 OFFSHORE: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 27 POST-COVID-19: OFFSHORE: MARKET SIZE, BY REGION, BY REGION, 2020–2025 (USD MILLION)

8 COILED TUBING MARKET, BY FLEET (Page No. - 91)

8.1 INTRODUCTION

FIGURE 34 COILED TUBING FLEET, BY REGION, MARKET SHARE (VOLUME) 2019

TABLE 28 COILED TUBING MARKET, BY FLEET, 2016–2019 (UNITS)

8.2 BY REGION

8.2.1 NORTH AMERICA

8.2.1.1 Demand for coiled tubing operations from shale development in North America is the major reason for the higher number of active fleets in the region

8.2.2 EUROPE

8.2.2.1 Europe witnessed the highest utilization rate for coiled tubing fleets as offshore operations are high in the region

8.2.3 ASIA PACIFIC

8.2.3.1 Asia Pacific is expected to increase the highest number of fleet in the next 5 years as production activities in the region are rising

8.2.4 SOUTH & CENTRAL AMERICA

8.2.4.1 High demand for well intervention services from Brazil and Mexico were the major demand generators for coiled tubing units in South & Central America

8.2.5 MIDDLE EAST

8.2.5.1 Redevelopment of the mature fields in the Middle East creates an enormous demand for coiled tubing services in the region

8.2.6 AFRICA

8.2.6.1 Africa is still in the nascent phase for the market; thus, the fleet count is lower in the region

TABLE 29 FLEET: MARKET, BY REGION, 2016–2019 (UNITS)

TABLE 30 UTILIZATION RATE: MARKET, BY REGION, 2016–2019 (%)

TABLE 31 ACTIVE FLEET: MARKET, BY REGION, 2016–2019 (UNITS)

8.3 BY OPERATOR

8.3.1 INTRODUCTION

TABLE 32 FLEET: MARKET, BY OPERATOR, 2016–2019 (UNITS)

TABLE 33 UTILIZATION RATE: MARKET, BY OPERATOR, 2016–2019 (%)

TABLE 34 ACTIVE FLEET: MARKET, BY OPERATOR, 2016–2019 (UNITS)

8.3.2 NEXTIER OILFIELD SOLUTIONS

TABLE 35 NEXTIER OILFIELD SOLUTIONS: MARKET, BY FLEET, 2016–2019 (UNITS)

8.3.3 STEP ENERGY SERVICES

TABLE 36 STEP ENERGY SERVICES: MARKET, BY FLEET, 2016–2019 (UNITS)

8.3.4 KEY ENERGY SERVICES

TABLE 37 KEY ENERGY SERVICES: MARKET, BY FLEET, 2016–2019 (UNITS)

8.3.5 PIONEER ENERGY SERVICES

TABLE 38 PIONEER ENERGY SERVICES: MARKET, BY FLEET, 2016–2019 (UNITS)

8.3.6 BASIC ENERGY SERVICES

TABLE 39 BASIC ENERGY SERVICES: ARKET, BY FLEET, 2016–2019 (UNITS)

8.3.7 CALFRAC WELL SERVICES

TABLE 40 CALFRAC WELL SERVICES: MARKET, BY FLEET, 2016–2019 (UNITS)

9 COILED TUBING MARKET, BY REGION (Page No. - 100)

9.1 INTRODUCTION

FIGURE 35 SAUDI ARABIA MARKET IS EXPECTED TO REGISTER HIGHEST CAGR FROM 2020 TO 2025

FIGURE 36 NORTH AMERICA IS EXPECTED TO DOMINATE MARKET, BY REGION, 2020–2025

TABLE 41 COILED TUBING MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 42 PRE-COVID-19: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 43 POST-COVID-19: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 37 REGIONAL SNAPSHOT: NORTH AMERICAN MARKET, 2019

9.2.1 BY SERVICE

TABLE 44 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 45 POST-COVID-19: NORTH AMERICA: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 46 WELL INTERVENTION: NORTH AMERICA MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 47 POST-COVID-19: WELL INTERVENTION: NORTH AMERICA MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

9.2.2 BY APPLICATION

TABLE 48 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 49 POST-COVID-19: NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.2.3 BY FLEET

TABLE 50 NORTH AMERICA: MARKET, BY FLEET, 2016–2019 (UNITS)

9.2.4 BY COUNTRY

TABLE 51 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 52 POST-COVID-19: NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

FIGURE 38 US DOMINATED THE NORTH AMERICAN MARKET IN 2019

9.2.5 US

9.2.5.1 Rising demand for well intervention operations for shale development and redevelopment of mature oil basins is driving the US market

TABLE 53 US: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 54 POST-COVID-19: US: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 55 US: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 56 POST-COVID-19: US: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.2.6 CANADA

9.2.6.1 Rising focus on the increasing production from the oil sands is likely to drive the market in Canada

TABLE 57 CANADA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 58 POST-COVID-19: CANADA: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 59 CANADA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 60 POST-COVID-19: CANADA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.3 EUROPE

FIGURE 39 REGIONAL SNAPSHOT: EUROPEAN MARKET, 2019

9.3.1 BY SERVICE

TABLE 61 EUROPE: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 62 POST-COVID-19: EUROPE: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 63 WELL INTERVENTION: EUROPE MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 64 POST-COVID-19: WELL INTERVENTION: EUROPE MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

9.3.2 BY APPLICATION

TABLE 65 EUROPE: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 66 POST-COVID-19: EUROPE: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.3.3 BY FLEET

TABLE 67 EUROPE: MARKET, BY FLEET, 2016–2019 (UNITS)

9.3.4 BY COUNTRY

TABLE 68 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 69 POST-COVID-19: EUROPE: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

9.3.4.1 Russia

9.3.4.1.1 Rising exploration & production activities in the East Siberia and Caspian region are likely to drive the Russian market

TABLE 70 RUSSIA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 71 POST-COVID-19: RUSSIA: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 72 RUSSIA: COILED TUBING MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 73 POST-COVID-19: RUSSIA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.3.4.2 UK

9.3.4.2.1 Rising demand for well intervention operations in the UK is likely to drive the market

TABLE 74 UK: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 75 POST-COVID-19: UK: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 76 UK: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 77 POST-COVID-19: UK: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.3.4.3 Norway

9.3.4.3.1 High maturity rates of oil & gas fields in Norwegian Continental Shelf (NCS) are boosting the demand for coiled tubing operations in Norway

TABLE 78 NORWAY: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 79 POST-COVID-19: NORWAY: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 80 NORWAY: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 81 POST-COVID-19: NORWAY: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.3.4.4 Rest of Europe

TABLE 82 REST OF EUROPE: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 83 POST-COVID-19: REST OF EUROPE: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 84 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 85 POST-COVID-19: REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.4 SOUTH & CENTRAL AMERICA

9.4.1 BY SERVICE

TABLE 86 SOUTH & CENTRAL AMERICA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 87 POST-COVID-19: SOUTH & CENTRAL AMERICA: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 88 WELL INTERVENTION: SOUTH & CENTRAL AMERICA MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 89 POST-COVID-19: WELL INTERVENTION: SOUTH & CENTRAL AMERICA MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

9.4.2 BY APPLICATION

TABLE 90 SOUTH & CENTRAL AMERICA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 91 POST-COVID-19: SOUTH & CENTRAL AMERICA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.4.3 BY FLEET

TABLE 92 SOUTH & CENTRAL AMERICA: MARKET, BY FLEET, 2016–2019 (UNITS)

9.4.4 BY COUNTRY

TABLE 93 SOUTH & CENTRAL AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 94 POST-COVID-19: SOUTH & CENTRAL AMERICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

9.4.4.1 Mexico

9.4.4.1.1 Investments for expediting oil & gas production from existing reserves are driving the Mexican market

TABLE 95 MEXICO: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 96 POST-COVID-19: MEXICO: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 97 MEXICO: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 98 POST-COVID-19: MEXICO: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.4.4.2 Brazil

9.4.4.2.1 Recent developments in offshore Brazilian oil & gas fields are driving the market

TABLE 99 BRAZIL: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 100 POST-COVID-19: BRAZIL: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 101 BRAZIL: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 102 POST-COVID-19: BRAZIL: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.4.4.3 Venezuela

9.4.4.3.1 Reviving oil & gas activities in Venezuela is likely to bring opportunities for the market

TABLE 103 VENEZUELA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 104 POST-COVID-19: VENEZUELA: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 105 VENEZUELA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 106 POST-COVID-19: VENEZUELA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.4.4.4 Argentina

9.4.4.4.1 Development of shale reserves is expected to drive the well intervention market, thereby driving the market in Argentina

TABLE 107 ARGENTINA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 108 POST-COVID-19: ARGENTINA: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 109 ARGENTINA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 110 POST-COVID-19: ARGENTINA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.4.4.5 Rest of South & Central America

TABLE 111 REST OF SOUTH & CENTRAL AMERICA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 112 POST-COVID-19: REST OF SOUTH & CENTRAL AMERICA: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 113 REST OF SOUTH & CENTRAL AMERICA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 114 POST-COVID-19: REST OF SOUTH & CENTRAL AMERICA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.5 ASIA PACIFIC

9.5.1 BY SERVICE

TABLE 115 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 116 POST-COVID-19: ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 117 WELL INTERVENTION: ASIA PACIFIC MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 118 POST-COVID-19: WELL INTERVENTION: ASIA PACIFIC MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

9.5.2 BY APPLICATION

TABLE 119 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 120 POST-COVID-19: ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.5.3 BY FLEET

TABLE 121 ASIA PACIFIC: MARKET, BY FLEET, 2016–2019 (UNITS)

9.5.4 BY COUNTRY

TABLE 122 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 123 POST-COVID-19: ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

9.5.4.1 China

9.5.4.1.1 Deepwater drilling activities and shale exploration & production are likely to drive the Chinese market

TABLE 124 CHINA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 125 POST-COVID-19: CHINA: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 126 CHINA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 127 POST-COVID-19: CHINA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.5.4.2 India

9.5.4.2.1 Revamping of mature oilfields is expected to drive the market in India during the forecast period

TABLE 128 INDIA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 129 POST-COVID-19: INDIA: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 130 INDIA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 131 POST-COVID-19: INDIA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.5.4.3 Australia

9.5.4.3.1 Development of the untapped shale reserves in Australia is driving the Australian market

TABLE 132 AUSTRALIA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 133 POST-COVID-19: AUSTRALIA :MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 134 AUSTRALIA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 135 POST-COVID-19: AUSTRALIA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.5.4.4 Indonesia

9.5.4.4.1 Rising demand for well intervention operations to revive the production is boosting the demand for coiled tubing operations in Indonesia

TABLE 136 INDONESIA: COILED TUBING MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 137 POST-COVID-19: INDONESIA: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 138 INDONESIA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 139 POST-COVID-19: INDONESIA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.5.4.5 Malaysia

9.5.4.5.1 Concerns for optimization of oil & gas production are likely to drive the Malaysian coiled tubing market

TABLE 140 MALAYSIA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 141 POST-COVID-19: MALAYSIA: COILED TUBING MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 142 MALAYSIA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 143 POST-COVID-19: MALAYSIA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.5.4.6 Rest of Asia Pacific

TABLE 144 REST OF ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 145 POST-COVID-19: REST OF ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 146 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 147 POST-COVID-19: REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.6 MIDDLE EAST

9.6.1 BY SERVICE

TABLE 148 MIDDLE EAST: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 149 POST-COVID-19: MIDDLE EAST: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 150 WELL INTERVENTION: MIDDLE EAST MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 151 POST-COVID-19: WELL INTERVENTION: MIDDLE EAST MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

9.6.2 BY APPLICATION

TABLE 152 MIDDLE EAST: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 153 POST-COVID-19: MIDDLE EAST: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.6.3 BY FLEET

TABLE 154 MIDDLE EAST: COILED TUBING MARKET, BY FLEET, 2016–2019 (UNITS)

9.6.4 BY COUNTRY

TABLE 155 MIDDLE EAST: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 156 POST-COVID-19: MIDDLE EAST: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

9.6.4.1 Saudi Arabia

9.6.4.1.1 Boosted oil production from onshore fields and the surge in offshore oil & gas exploration are expected to drive the coiled tubing market

TABLE 157 SAUDI ARABIA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 158 POST-COVID-19: SAUDI ARABIA: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 159 SAUDI ARABIA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 160 POST-COVID-19: SAUDI ARABIA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.6.4.2 UAE

9.6.4.2.1 Demand for well intervention services is likely to grow with fast depleting oil production from oilfields

TABLE 161 UAE: COILED TUBING MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 162 POST-COVID-19: UAE: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 163 UAE: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 164 POST-COVID-19: UAE: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.6.4.3 Kuwait

9.6.4.3.1 The government’s focus to increase oil production is expected to create opportunities for coiled tubing operations

TABLE 165 KUWAIT: COILED TUBING MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 166 POST-COVID-19: KUWAIT: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 167 KUWAIT: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 168 POST-COVID-19: KUWAIT: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.6.4.4 Oman

9.6.4.4.1 Recent oil & gas exploration & production activities in onshore Oman are likely to create demand for the coiled tubing market in the country

TABLE 169 OMAN: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 170 POST-COVID-19: OMAN: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 171 OMAN: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 172 POST-COVID-19: OMAN: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.6.4.5 Rest of Middle East

TABLE 173 REST OF MIDDLE EAST: COILED TUBING MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 174 POST-COVID-19: REST OF MIDDLE EAST: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 175 REST OF MIDDLE EAST: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 176 POST-COVID-19: REST OF MIDDLE EAST: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.7 AFRICA

9.7.1 BY SERVICE

TABLE 177 AFRICA: COILED TUBING MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 178 POST-COVID-19: AFRICA: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 179 WELL INTERVENTION: AFRICA MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 180 POST-COVID-19: WELL INTERVENTION: AFRICA MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

9.7.2 BY APPLICATION

TABLE 181 AFRICA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 182 POST-COVID-2019: AFRICA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.7.3 BY FLEET

TABLE 183 AFRICA: MARKET, BY FLEET, 2016–2019 (UNITS)

9.7.4 BY COUNTRY

TABLE 184 AFRICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 185 POST-COVID-19: AFRICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

9.7.4.1 Algeria

9.7.4.1.1 Upcoming drilling projects in Algeria and rising capital expenditure in upstream operations are likely to boost the coiled tubing market in the country

TABLE 186 ALGERIA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 187 POST-COVID-19: ALGERIA: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 188 ALGERIA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 189 POST-COVID-19: ALGERIA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.7.4.2 Egypt

9.7.4.2.1 New discoveries in Egypt pave demand opportunities for coiled tubing operations

TABLE 190 EGYPT: COILED TUBING MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 191 POST-COVID-19: EGYPT: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 192 EGYPT: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 193 POST-COVID-19: EGYPT: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.7.4.3 Nigeria

9.7.4.3.1 Rising exploration activities and developments in mature oil & gas fields are expected to support the coiled tubing market in Nigeria during the forecast period

TABLE 194 NIGERIA: COILED TUBING MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 195 POST-COVID-19: NIGERIA: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 196 NIGERIA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 197 POST-COVID-19: NIGERIA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.7.4.4 Angola

9.7.4.4.1 Demand for well intervention operations from offshore locations is driving the coiled tubing market in Angola

TABLE 198 ANGOLA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 199 POST-COVID-19: ANGOLA: COILED TUBING MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 200 ANGOLA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 201 POST-COVID-19: ANGOLA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.7.4.5 Rest of Africa

TABLE 202 REST OF AFRICA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 203 POST-COVID-19: REST OF AFRICA: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 204 REST OF AFRICA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 205 POST-COVID-19: REST OF AFRICA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 177)

10.1 OVERVIEW

FIGURE 40 KEY DEVELOPMENTS IN THE COILED TUBING MARKET, 2016–2020

10.2 RANKING OF PLAYERS AND INDUSTRY CONCENTRATION, 2019

FIGURE 41 RANKING OF KEY PLAYERS & INDUSTRY CONCENTRATION, 2019

10.3 COMPETITIVE SCENARIO

TABLE 206 DEVELOPMENTS OF KEY PLAYERS IN THE MARKET, JANUARY 2016–JUNE 2020

10.3.1 MERGERS & ACQUISITIONS

10.3.2 CONTRACTS & AGREEMENTS

10.3.3 NEW PRODUCT LAUNCH

10.3.4 ALLIANCES/COLLABORATIONS/JOINT VENTURES/PARTNERSHIPS

10.4 COMPETITIVE LEADERSHIP MAPPING

10.4.1 VISIONARY LEADERS

10.4.2 INNOVATORS

10.4.3 DYNAMIC

10.4.4 EMERGING

FIGURE 42 COILED TUBING MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

11 COMPANY PROFILE (Page No. - 184)

(Business overview, Product & Service offerings, Recent developments, SWOT analysis & MnM View)*

11.1 HALLIBURTON

FIGURE 43 HALLIBURTON: COMPANY SNAPSHOT

11.2 SCHLUMBERGER

FIGURE 44 SCHLUMBERGER: COMPANY SNAPSHOT

11.3 BAKER HUGHES COMPANY

FIGURE 45 BAKER HUGHES COMPANY: COMPANY SNAPSHOT

11.4 WEATHERFORD

FIGURE 46 WEATHERFORD: COMPANY SNAPSHOT

11.5 NEXTIER OILFIELD SOLUTIONS

FIGURE 47 NEXTIER OILFIELD SOLUTIONS: COMPANY SNAPSHOT

11.6 RPC, INC.

FIGURE 48 RPC, INC.: COMPANY SNAPSHOT

11.7 STEP ENERGY SERVICES

FIGURE 49 STEP ENERGY SERVICES: COMPANY SNAPSHOT

11.8 SUPERIOR ENERGY SERVICES

FIGURE 50 SUPERIOR ENERGY SERVICES: COMPANY SNAPSHOT

11.9 TRICAN

FIGURE 51 TRICAN: COMPANY SNAPSHOT

11.10 ALTUS INTERVENTION

11.11 NATIONAL ENERGY SERVICES REUNITED (NESR)

FIGURE 52 NATIONAL ENERGY SERVICES REUNITED (NESR): COMPANY SNAPSHOT

11.12 OILSERV

11.13 BASIC ENERGY SERVICES

FIGURE 53 BASIC ENERGY SERVICES: COMPANY SNAPSHOT

11.14 OCEANEERING INTERNATIONAL

FIGURE 54 OCEANEERING INTERNATIONAL: COMPANY SNAPSHOT

11.15 CALFRAC WELL SERVICES

FIGURE 55 CALFRAC WELL SERVICES: COMPANY SNAPSHOT

11.16 KEY ENERGY SERVICES

FIGURE 56 KEY ENERGY SERVICES: COMPANY SNAPSHOT

11.17 NINE ENERGY SERVICES

FIGURE 57 NINE ENERGY SERVICES: COMPANY SNAPSHOT

11.18 PIONEER ENERGY SERVICES

FIGURE 58 PIONEER ENERGY SERVICES: COMPANY SNAPSHOT

11.19 LEGEND ENERGY SERVICES

*Details on Business overview, Products offered, Recent developments, SWOT analysis & MnM View might not be captured in case of unlisted companies.

12 ADJACENT & RELATED MARKETS (Page No. - 234)

12.1 INTRODUCTION

12.2 LIMITATIONS

12.3 OIL & GAS INTERCONNECTED MARKETS

12.4 WELL INTERVENTION MARKET

12.4.1 MARKET DEFINITION

12.4.2 LIMITATION

12.4.3 MARKET OVERVIEW

FIGURE 59 WELL INTERVENTION MARKET, 2018—2025 (USD MILLION)

12.4.4 WELL INTERVENTION MARKET, BY APPLICATION

12.4.4.1 Onshore

TABLE 207 ONSHORE: WELL INTERVENTION MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 208 POST-COVID-19: ONSHORE: WELL INTERVENTION MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

12.4.4.2 Offshore

TABLE 209 OFFSHORE: WELL INTERVENTION MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 210 POST-COVID-19: OFFSHORE: WELL INTERVENTION MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

12.4.5 WELL INTERVENTION MARKET, BY REGION

12.4.5.1 North America

TABLE 211 NORTH AMERICA: WELL INTERVENTION MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 212 POST-COVID-19: NORTH AMERICA: WELL INTERVENTION MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

12.4.5.2 Europe

TABLE 213 EUROPE: WELL INTERVENTION MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 214 POST-COVID-19: EUROPE: WELL INTERVENTION MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

12.4.5.3 South & Central America

TABLE 215 SOUTH & CENTRAL AMERICA: WELL INTERVENTION MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 216 POST-COVID -19: SOUTH & CENTRAL AMERICA: WELL INTERVENTION MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

12.4.5.4 Asia Pacific

TABLE 217 ASIA PACIFIC: WELL INTERVENTION MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 218 POST-COVID-19: ASIA PACIFIC: WELL INTERVENTION MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

12.4.5.5 Middle East

TABLE 219 MIDDLE EAST: WELL INTERVENTION MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 220 POST-COVID-19: MIDDLE EAST: WELL INTERVENTION MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

12.4.5.6 Africa

TABLE 221 AFRICA: WELL INTERVENTION MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 222 POST-COVID-19: AFRICA: WELL INTERVENTION MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

12.5 ARTIFICIAL LIFT MARKET

12.5.1 MARKET DEFINITION

12.5.2 ARTIFICIAL LIFT MARKET, BY MECHANISM: INCLUSIONS VS. EXCLUSIONS

12.5.3 LIMITATIONS

12.5.4 MARKET OVERVIEW

FIGURE 60 ARTIFICIAL LIFT MARKET, 2018—2025 (USD MILLION)

12.5.5 ARTIFICIAL LIFT MARKET, BY APPLICATION

12.5.5.1 Onshore

TABLE 223 ONSHORE: ARTIFICIAL LIFT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

12.5.5.2 Offshore

TABLE 224 OFFSHORE: ARTIFICIAL LIFT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

12.5.6 ARTIFICIAL LIFT MARKET, BY REGION

12.5.6.1 North America

TABLE 225 NORTH AMERICA: ARTIFICIAL LIFT MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

12.5.6.2 Europe

TABLE 226 EUROPE: ARTIFICIAL LIFT MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

12.5.6.3 Asia Pacific

TABLE 227 ASIA PACIFIC: ARTIFICIAL LIFT MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

12.5.6.4 South & Central America

TABLE 228 SOUTH & CENTRAL AMERICA: ARTIFICIAL LIFT MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

12.5.6.5 Middle East & Africa

TABLE 229 MIDDLE EAST & AFRICA: ARTIFICIAL LIFT MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

12.6 DIGITAL OILFIELD MARKET

12.6.1 MARKET DEFINITION

12.6.2 LIMITATIONS

12.6.3 MARKET OVERVIEW

FIGURE 61 DIGITAL OILFIELD MARKET, 2018—2025 (USD BILLION)

12.6.4 DIGITAL OILFIELD MARKET, BY APPLICATION

12.6.4.1 Onshore

TABLE 230 ONSHORE: DIGITAL OILFIELD MARKET SIZE, BY REGION, 2016–2019 (USD BILLION)

TABLE 231 POST-COVID-19: ONSHORE: DIGITAL OILFIELD MARKET SIZE, BY REGION, 2020–2025 (USD BILLION)

12.6.4.2 Offshore

TABLE 232 OFFSHORE: DIGITAL OILFIELD MARKET SIZE, BY REGION, 2016–2019 (USD BILLION)

TABLE 233 POST-COVID-19: OFFSHORE: DIGITAL OILFIELD MARKET SIZE, BY REGION, 2020–2025 (USD BILLION)

12.6.5 DIGITAL OILFIELD MARKET, BY REGION

12.6.5.1 Europe

TABLE 234 EUROPE: DIGITAL OILFIELD MARKET SIZE, BY APPLICATION, 2016–2019 (USD BILLION)

TABLE 235 POST-COVID-19: EUROPE: DIGITAL OILFIELD MARKET SIZE, BY APPLICATION, 2020–2025 (USD BILLION)

12.6.5.2 Asia Pacific

TABLE 236 ASIA PACIFIC: DIGITAL OILFIELD MARKET SIZE, BY APPLICATION, 2016–2019 (USD BILLION)

TABLE 237 POST-COVID-19: ASIA PACIFIC: DIGITAL OILFIELD MARKET SIZE, BY APPLICATION, 2020–2025 (USD BILLION)

12.6.5.3 Middle East

TABLE 238 MIDDLE EAST: DIGITAL OILFIELD MARKET SIZE, BY APPLICATION, 2016–2019 (USD BILLION)

TABLE 239 POST-COVID-19: MIDDLE EAST : DIGITAL OILFIELD MARKET SIZE, BY APPLICATION, 2020–2025 (USD BILLION)

12.6.5.4 North America

TABLE 240 NORTH AMERICA: DIGITAL OILFIELD MARKET SIZE, BY APPLICATION, 2016–2019 (USD BILLION)

TABLE 241 POST-COVID-19: NORTH AMERICA : DIGITAL OILFIELD MARKET SIZE, BY APPLICATION, 2020–2025 (USD BILLION)

12.6.5.5 Africa

TABLE 242 AFRICA: DIGITAL OILFIELD MARKET SIZE, BY APPLICATION, 2016–2019 (USD BILLION)

TABLE 243 POST-COVID-19: AFRICA : DIGITAL OILFIELD MARKET SIZE, BY APPLICATION, 2020–2025 (USD BILLION)

12.6.5.6 South America

TABLE 244 SOUTH AMERICA: DIGITAL OILFIELD MARKET SIZE, BY APPLICATION, 2016–2019 (USD BILLION)

TABLE 245 POST-COVID-19: SOUTH AMERICA: DIGITAL OILFIELD MARKET SIZE, BY APPLICATION, 2020–2025 (USD BILLION)

13 APPENDIX (Page No. - 257)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

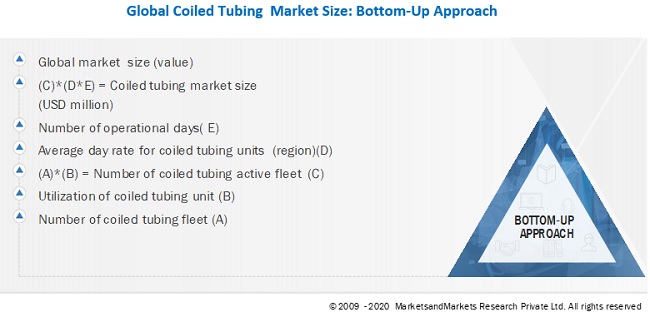

This study involved four major activities in estimating the current size of the global coiled tubing market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakdown and data triangulation were done to estimate the market size of the segments and sub-segments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the global coiled tubing market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The coiled tubing market comprises several stakeholders, such as end-product manufacturers and end-users in the supply chain. The demand-side of this market is characterized by its end-users, such as drilling service providers, upstream operators, and others. The supply-side is characterized by intervention service providers, tool providers, integrators, and others. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global coiled tubing market and its dependent submarkets. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the oil & gas upstream sector.

Report Objectives

- To define, describe, segment, and forecast the coiled tubing market on the basis of service, application, fleet, and region

- To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the market with respect to individual growth trends, future expansions, and contribution of each segment to the market

- The impact of the COVID-19 pandemic on the market has been analyzed for the estimation of the market size.

- To analyze market opportunities for stakeholders and details of the competitive landscape for market leaders

- To forecast the growth of the coiled tubing market with respect to the main regions (North America, Europe, Asia Pacific, Middle East, South & Central America, and Africa)

- To profile and rank key players and comprehensively analyze their market share

- To analyze competitive developments such as contracts & agreements, expansions & investments, new product launches, mergers & acquisitions, joint ventures, and partnerships & collaborations in the coiled tubing market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Regional Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Coiled Tubing Market

Can you please share the key players and comprehensively analyze their respective market shares and core competencies of Coiled Tubing Market to the forecast period.. Need to know more.