Directional Drilling Services Market by Application (Onshore, and Offshore), Type (Conventional, and Rotary Steerable System), Service (LWD, MWD & Survey, RSS, Motors), and Region - Global Forecast to 2021

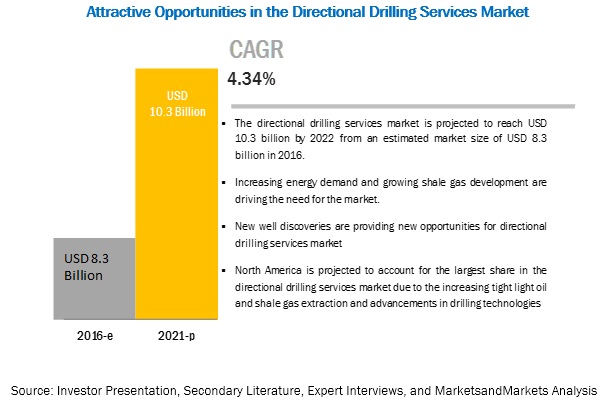

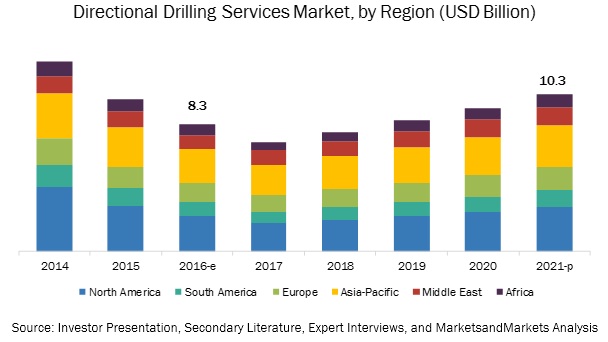

[164 Pages Report] MarketsandMarkets forecasts the global directional drilling services market to grow from USD 8.3 billion in 2016 to USD 10.3 billion by 2021, at a Compound Annual Growth Rate (CAGR) of 4.34% during the forecast period. The major factors driving the Directional Drilling Services market include increasing demand for energy, ongoing shale gas developments, and new oilfield discoveries. The objective of the report is to define, describe, and forecast the global market by application, service, type and region

By Application, Onshore segment is expected to dominate the Directional Drilling Services market during the forecast period

The report segments the Directional Drilling Services, by application, into onshore and offshore applications. The onshore application is expected to hold the largest market share by 2021. The market is driven by the high number of maturing onshore wells across global regions. North America is the key market for onshore applications because of increasing shale gas production in the US and due to well intervention activities in its shale basin regions.

By Type, the rotary steerable system segment is expected to grow at the highest CAGR during the forecast period

The rotary steerable system segment is expected to grow at the highest rate during the forecast period. The market growth in this segment can be attributed to the need for remote steering which provides improved trajectory control resulting in reduced drilling time and smoother well bores.

By Service Type, Measurement-While-Drilling (MWD) & Survey segment is expected to grow at the highest CAGR during the forecast period

The Measurement-While-Drilling (MWD) and Survey segment is expected to grow at the highest rate during the forecast period in directional drilling services market by service type. The market growth in this segment can be attributed to the ability to continuously monitor wellbore and the real time directional survey of downhole conditions.

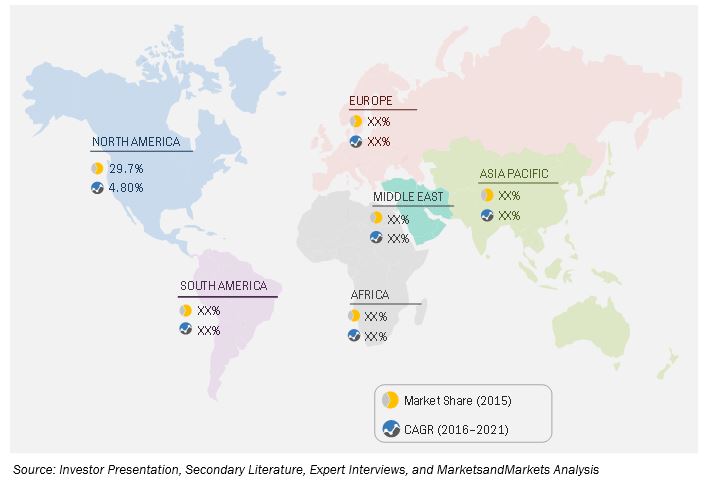

North America to account for the largest market size during the forecast period.

The market in North America is estimated to be the largest for Directional Drilling Services market from 2016 to 2021. Tight oil and shale gas are emerging as an important new source of energy supply in the US and Canada. Technological advancements in drilling such as long-reach horizontal well bores and completion techniques such as multi-stage hydraulic fracturing are increasing the implementation of this service in the North America region.

Market Dynamics

Driver: Increase in energy demand

With the United Nations predicting world population growth from 6.7 billion in 2011 to 8.7 billion by 2035, demand for energy must increase considerably over that period. Both population growth and increasing standards of living for many people in developing countries will cause strong growth in energy demand. Over 70% of the increased energy demand is from developing countries, led by China and India. United Nations Organizations (UNO) projections indicate an ongoing trend of urbanization, from 52% in 2011 to 62% in 2035 and reaching 70% worldwide by 2050. Also, by 2040 the global urban population will be almost double the rural population. To meet production requirements, it becomes important to maintain the well at its optimum production and extract the maximum amount of oil & gas resources.

Restraint: Increasing focus on renewable energy

Largest consumers of oil & gas, China and the U.S. along with other countries, are increasing their investments in renewable energy every year to reduce their carbon footprints and dependence on fossil fuels. Global investment in renewable energy increased by 5% from 2014, and reached an all-time high of USD 285.9 billion in 2015. China alone contributed to more than 30% of this investment, followed by the U.S. These are likely to go up in the coming years, directly impacting the growth of thermal and nuclear power plants and restraining the power plant boiler growth.

According to the MENA Solar Energy Report 2014, up to 37,000 MW of new solar, wind, and hydroelectric projects are planned to be commissioned till 2020 worldwide. Solar energy projects will specifically source about 12,000 MW15,000 MW by 2020. Power generation from renewable energy sources is expected to scale up 40% from 2012 to 2018. According to the BP Energy Outlook, renewable energy sources are expected to overtake natural gas generation by 2016. Meanwhile, the total installed capacity of solar energy was 138 GW in 2013, and 65 GW of capacity is expected to be installed in the next 5 years. Hence, increasing focus on renewable energy sources would decrease dependency on oil & gas, which is likely to affect the oilfield services industry including directional drilling services market.

Opportunity: New oilfield discoveries

New oilfields and reserves has been discovered across the globe in almost every region in 2016. Few of the major discoveries included deepwater offshore field discovery in Senegal, Alpine high in West Texas, U.S., northern Kerio Valley in Kenya, Alaska in U.S., and Golan Heights in Israel, among others. Due to low oil prices, oil field operators have cut back on exploration cost which has led to least number of new oil reserves and field discoveries in 2016 since 1947. However, by 2018, it is expected that oil prices will bounce back to USD 70 per barrel. This will encourage oil field operators and independent exploration companies to start investing in exploration activities to improve their reserve replacement ratio

Challenge: Stringent regulatory policies

The government regulations regarding oil & gas field developments are highly strict. For instance, on May 22, 2013, the European Union (EU) Parliament approved a new law on the safety of oil & gas operations. According to the law, before commencing any drilling operations in EU waters, oil & gas companies have to submit a special report on possible hazards. They also need to provide internal emergency response plans with full details of the available equipment and resources, along with what actions it will take in the consequence of an accident. The new directive also recommends all the EU member states to prepare external emergency response plans that cover all offshore drilling installations within their territory. In Poland, some leading players, such as ExxonMobil, Talisman, Marathon, and even state run Lotos have withdrawn from the shale gas exploration in May 2011 citing difficult geology and complex regulatory framework. Meanwhile in France, shale gas exploration is banned under the French Law no. 2011-835 dated July 13, 2011. These restrictions will hamper the growth of directional drilling services in these regions as shale explorations as well as offshore developments require directional drilling technologies to drill cost effective wells.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

20142021 |

|

Base year considered |

2015 |

|

Forecast period |

20162021 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

By Application (Onshore and Offshore), By Service (Rotary Steerable System (RSS), Logging-While-Drilling(LWD),Measurement-While-Drilling (MWD) & Survey), Motors (MUD Motors), By Type (Conventional, Rotary Steerable System) |

|

Geographies covered |

Asia Pacific, Europe, North America, South America, Middle East, and Africa |

|

|

Baker Hughes Incorporated (US), Halliburton Company (US), Schlumberger Limited (US), Weatherford International, PLC (Switzerland), National Oilwell Varco, Inc. (US), Nabors Industries, Ltd. (Bermuda), Cathedral Energy Services Ltd. (Canada), Jindal Drilling & Industries Limited (India), Gyrodata Incorporated (US), Scientific Drilling International (US), Leam Drilling Systems, LLC.(US) |

The research report categorizes the market to forecast the revenues and analyze the trends in each of the following sub-segments:

Directional Drilling Services Market, By Application

- Onshore Applications

- Offshore Applications

Directional Drilling Services Market, By Service

- Rotary Steerable System (RSS)

- Logging-While-Drilling(LWD)

- Measurement-While-Drilling (MWD) & Survey

- Motors (MUD Motors)

- Others

Directional Drilling Services Market, By Type

- Conventional

- Rotary Steerable System

Directional Drilling Services Market, By Region

- Asia Pacific

- North America

- Europe

- Middle East

- Africa

- South America

Key Market Players

Baker Hughes Incorporated (US), Halliburton Company (US), Schlumberger Limited (US), Weatherford International, PLC (Switzerland), National Oilwell Varco, Inc. (US), Nabors Industries, Ltd. (Bermuda), Cathedral Energy Services Ltd. (Canada), Jindal Drilling & Industries Limited (India), Gyrodata Incorporated (US), Scientific Drilling International (US), Leam Drilling Systems, LLC.(US)

Schlumberger Limited (U.S.) is the global market leader in the field of drilling. The company has focused on new product launch as one of its key growth strategies. Recently in 2016, Smith Bits a Schlumberger subsidiary, released a new bit named AxeBlade ridged diamond element bit. This bit consists of rigid diamond elements along the bits face and thus provides a better rate of penetration (ROP) for various formations and steering in directional applications. In 2015, the company Schlumberger released a new measurement while drilling service named as TeleScope ICE ultrahigh-temperature measurements-while-drilling service. This service allows the operator to operate the tool at high reservoir temperature conditions.

Recent Developments

- In November 2016, GE oil & gas will open a new facility in Egypt, in collaboration with General Authority for Investment and Free Zones (GAFI) (Egypt). This facility will disassembly, assembly, repair, and provide maintenance & testing for GE Oil & Gas products. This facility will be operational by mid-2017.

- In October 2016, National Oilwell Varco, is developing its closed loop automation system. This system uses intelligent controls to develop its technology. This system is a combination of drilling systems, software application of eVolve Optimization Service, NOV Operating System (NOVOS) and control systems. This system will enhance the operators drilling operations.

- In September 2016, Halliburton Company released new drilling motors GeoForceฎ Endure and StrataForce Endure motors, these motors reduce non-productive time associated with chunking, and enhances the motors reliability in harsh environments.

- In August 2016, GE oil & gas has entered into an agreement with Oil and Natural Gas Corporation Limited (ONGC) (India), to support its drilling operations in the shallow & medium offshore regions in the west and east cost of India, for the next three years. The company will also supply 55 subsea wellheads to ONCG.

Critical questions the report answers:

- Where will all these developments take the industry in the long term?

- What are the upcoming trends for the Directional Drilling Services market?

- Which segment provides the most opportunity for growth?

- Who are the leading manufacturers operating in this market?

- What are the opportunities for new market entrants?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of The Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Countries Covered

1.3.3 Years Considered for The Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 28)

3.1 Introduction

3.2 Historical Backdrop and Evolution

3.3 Current Scenario

3.4 Future Outlook

3.5 Conclusion

4 Premium Insights (Page No. - 34)

4.1 Directional Drilling Services Market, By Type

4.2 Directional Drilling Services Market, By Service

4.3 Directional Drilling Services Market, By Application

4.4 Directional Drilling Services Market: Application vs. Type

4.5 North America: The Largest Market During The Forecast Period

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Application

5.2.2 By Type

5.2.3 By Service

5.2.4 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increase in Energy Demand

5.3.1.2 Shale Gas Development

5.3.1.3 Advancement in Drilling Technologies

5.3.2 Restraints

5.3.2.1 Declining Oil Spending Due to Low Crude Oil Price

5.3.2.2 Increasing Focus on Renewable Energy

5.3.3 Opportunities

5.3.3.1 New Oilfield Discoveries

5.3.3.2 Lifting of Iranian Oil Export Sanctions

5.3.4 Challenges

5.3.4.1 Stringent Regulatory Policies

5.4 Technical Overview

6 Directional Drilling Services Market, By Application (Page No. - 48)

6.1 Introduction

6.1.1 Drilling Services Market Size, By Application, 20142021 (USD Million)

6.2 Onshore Applications

6.2.1 Onshore Application:Drilling Services Market Size, By Region, 20142021 (USD Million)

6.3 Offshore Applications

6.3.1 Offshore Application:Drilling Services Market Size, By Application, 20142021 (USD Million)

7 Directional Drilling Services Market, By Type (Page No. - 52)

7.1 Introduction

7.1.1 Drilling Services Market Size, By Type, 20142021 (USD Million)

7.2 Conventional

7.2.1 Coventional:Drilling Services Market Size, By Region, 20142021 (USD Million)

7.3 Rotary Steerable System

7.3.1 Rotary Steerable System: Coventional:Drilling Services Market Size, By Region, 20142021 (USD Million)

8 Directional Drilling Services Market, By Service (Page No. - 56)

8.1 Introduction

8.1.1 Drilling Services Market Size, By Service, 20142021 (USD Million)

8.2 Rotary Steerable System (RSS)

8.2.1 RSS: Coventional:Drilling Services Market Size, By Region, 20142021 (USD Million)

8.3 Logging-While-Drilling(LWD)

8.3.1 LWD: Coventional:Drilling Services Market Size, By Region, 20142021 (USD Million)

8.4 Measurement-While-Drilling (Mwd) & Survey

8.4.1 Mwd: Coventional:Drilling Services Market Size, By Region, 20142021 (USD Million)

8.5 Motors (MUD Motors)

8.5.1 Motors: Coventional:Drilling Services Market Size, By Region, 20142021 (USD Million)

8.6 Others

8.6.1 Others: Coventional:Drilling Services Market Size, By Region, 20142021 (USD Million)

9 Directional Drilling Services Market, By Region (Page No. - 63)

9.1 Introduction

9.1.1 Coventional:Drilling Services Market Size, By Region, 20142021 (USD Million)

9.2 North America

9.2.1 North America: Coventional:Drilling Services Market Size, By Type, 20142021 (USD Million)

9.2.2 North America: Coventional:Drilling Services Market Size, By Application, 20142021 (USD Million)

9.2.3 North America: Coventional:Drilling Services Market Size, By Service, 20142021 (USD Million)

9.2.4 North America: Coventional:Drilling Services Market Size, Bycountry, 20142021 (USD Million)

9.2.5 By Type

9.2.6 By Application

9.2.7 By Service

9.2.8 By Country

9.2.8.1 U.S.

9.2.8.2 Canada

9.2.8.3 Mexico

9.3 Asia-Pacific

9.3.1 By Type

9.3.2 By Application

9.3.3 By Service

9.3.4 By Country

9.3.4.1 China

9.3.4.2 Thailand

9.3.4.3 India

9.3.4.4 Indonesia

9.3.4.5 Australia

9.3.4.6 Malaysia

9.3.4.7 Central Asia

9.3.4.8 Rest of AsiaPacific

9.4 Europe

9.4.1 By Type

9.4.2 By Application

9.4.3 By Service

9.4.4 By Country

9.4.4.1 Russia

9.4.4.2 Norway

9.4.4.3 U.K.

9.4.4.4 The Netherlands

9.4.4.5 Rest of Europe

9.5 South America

9.5.1 By Type

9.5.2 By Application

9.5.3 By Service

9.5.4 By Country

9.5.4.1 Brazil

9.5.4.2 Argentina

9.5.4.3 Venezuela

9.5.4.4 Colombia

9.5.4.5 Ecuador

9.5.4.6 Rest of South America

9.6 Africa

9.6.1 By Type

9.6.2 By Application

9.6.3 By Service

9.6.4 By Country

9.6.4.1 Angola

9.6.4.2 Egypt

9.6.4.3 Nigeria

9.6.4.4 Algeria

9.6.4.5 Rest of Africa

9.7 Middle East

9.7.1 By Type

9.7.2 By Application

9.7.3 By Service

9.7.4 By Country

9.7.4.1 Saudi Arabia

9.7.4.2 UAE

9.7.4.3 Iran

9.7.4.4 Qatar

9.7.4.5 Rest of The Middle East

10 Competitive Landscape (Page No. - 107)

10.1 Overview

10.2 Market Share Analysis, By Revenue, 2015

10.3 Competitive Situation and Trends

10.3.1 Key New Product/Service Developments

10.3.2 Key Expansions

10.3.3 Key Contracts and Agreements

10.3.4 Key Mergers & Acquisitions

10.3.5 Key Partnerships, Collaborations, Alliances, and Joint Ventures

10.3.6 Other Developments

11 Company Profiles (Page No. - 122)

11.1 Introduction

11.2 Baker Hughes Incorporated

11.2.1 Business Overview

11.2.2 Products Offered

11.2.3 Developments

11.2.4 SWOT Analysis

11.2.5 MnM View

11.3 Halliburton Company

11.3.1 Business Overview

11.3.2 Products Offered

11.3.3 Developments

11.3.4 SWOT Analysis

11.3.5 MnM View

11.4 Schlumberger Limited

11.4.1 Business Overview

11.4.2 Products Offered

11.4.3 Developments

11.4.4 SWOT Analysis

11.4.5 MnM View

11.5 Weatherford International PLC.

11.5.1 Business Overview

11.5.2 Products Offered

11.5.3 Developments

11.5.4 SWOT Analysis

11.5.5 MnM View

11.6 National Oilwell Varco, Inc.

11.6.1 Business Overview

11.6.2 Products Offered

11.6.3 Developments

11.6.4 SWOT Analysis

11.6.5 MnM View

11.7 GE Oil & Gas

11.7.1 Business Overview

11.7.2 Products Offered

11.7.3 Developments

11.8 Nabors Industries Ltd.

11.8.1 Business Overview

11.8.2 Products Offered

11.8.3 Developments

11.9 Cathedral Energy Services Ltd.

11.9.1 Business Overview

11.9.2 Products Offered

11.9.3 Developments

11.1 Jindal Drilling & Industries Limited

11.10.1 Business Overview

11.10.2 Products Offered

11.10.3 Developments

11.11 Gyrodata Incorporated

11.11.1 Business Overview

11.11.2 Products Offered

11.11.3 Developments

11.12 Scientific Drilling International

11.12.1 Business Overview

11.12.2 Products Offered

11.12.3 Developments

11.13 Leam Drilling Systems, LLC.

11.13.1 Business Overview

11.13.2 Products Offered

12 Appendix (Page No. - 155)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: MarketsandMarkets Subscription Portal

12.4 Introducing RT: A Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (75 Tables)

Table 1 Investment in Renewable Energy, By Sector, 2015

Table 2 Directional Drilling Services Market Size, By Application, 20142021 (USD Million) 49

Table 3 Onshore Application: Market Size, By Region, 20142021 (USD Million) 49

Table 4 Offshore: Market Size, By Region, 20142021 (USD Million) 50

Table 5 Market Size, By Type, 20142021 (USD Million) 52

Table 6 Conventional : Market Size, By Region, 20142021 (USD Million)

Table 7 Rotary Steerable System: Market Size, By Region, 20142021 (USD Million) 54

Table 8 Directional Drilling Services Market Size, By Service, 20142021 (USD Million) 56

Table 9 Rotary Steerable System: Market Size, By Region, 20142021 (USD Million) 57

Table 10 Logging-While-Drilling: Market Size, By Region, 20142021 (USD Million) 58

Table 11 Measurement While-Drilling (Mwd) & Survey: Market Size, By Region, 20142021 (USD Million)

Table 12 Motors: Market Size, By Region, 20142021 (USD Million) 60

Table 13 Other: Market Size, By Region, 20142021 (USD Million) 61

Table 14 Market Size, By Region, 20142021 (USD Million) 64

Table 15 North America: Directional Drilling Services Market Size, By Type, 20142021 (USD Million)

Table 16 North America: Market Size, By Application, 20142021 (USD Million) 67

Table 17 North America: Market Size, By Service, 20142021 (USD Million)

Table 18 North America: Market Size, By Country, 20142021 (USD Million)

Table 19 U.S.: Market, By Service, 20142021 (USD Million) 69

Table 20 Canada: Market Size, By Service, 2014-2021 (USD Million) 70

Table 21 Mexico: Market Size, By Service, 20142021 (USD Million) 71

Table 22 Asia-Pacific: Directional Drilling Services Market Size, By Type, 20142021 (USD Million) 73

Table 23 Asia Pacific : Market Size, By Application, 20142021 (USD Million) 73

Table 24 Asia Pacific : Market Size, By Service, 20142021 (USD Million)

Table 25 Asia-Pacific: Market Size, By Country, 20142021 (USD Million)

Table 26 China: Market Size, By Service, 20142021 (USD Million) 75

Table 27 Thailand: Market Size, By Service, 20142021 (USD Million) 76

Table 28 India: Market Size, By Service, 20142021 (USD Million) 77

Table 29 Indonesia: Market Size, By Service, 20142021 (USD Million) 77

Table 30 Australia: Market Size, By Service, 20142021 (USD Million) 78

Table 31 Malaysia: Market Size, By Service, 20142021 (USD Million) 79

Table 32 Central Asia: Market Size, By Service, 20142021 (USD Million)

Table 33 Rest of Asia-Pacific: Market Size, By Service, 20142021 (USD Million) 80

Table 34 Europe: Directional Drilling Services Market Size, By Type, 20142021 (USD Million) 81

Table 35 Europe: Market Size, By Application, 20142021 (USD Million)

Table 36 Europe: Market Size, By Service, 20142021 (USD Million) 82

Table 37 Europe: Market Size, By Country, 20142021 (USD Million) 82

Table 38 Russia: Market Size, By Service, 20142021 (USD Million) 83

Table 39 Norway: Market Size, By Service, 20142021 (USD Million) 84

Table 40 U.K.: Market Size, By Service, 20142021 (USD Million) 85

Table 41 The Netherlands: Market Size, By Service, 20142021 (USD Million)

Table 42 Rest of Europe: Market Size, By Service, 20142021 (USD Million)

Table 43 South America: Directional Drilling Services Market Size, By Type, 20142021 (USD Million)

Table 44 South America: Market Size, By Application, 20142021 (USD Million) 87

Table 45 South America: Market Size, By Service, 20142021 (USD Million)

Table 46 South America: Market Size, By Country, 20142021 (USD Million)

Table 47 Brazil: Market Size, By Service, 20142021 (USD Million) 89

Table 48 Argentina: Market Size, By Service, 20142021 (USD Million) 90

Table 49 Venezuela: Market Size, By Service, 20142021 (USD Million) 90

Table 50 Colombia: Market Size, By Service, 20142021 (USD Million) 91

Table 51 Ecuador: Market Size, By Service, 20142021 (USD Million) 92

Table 52 Rest of South America: Market Size, By Service, 20142021 (USD Million) 93

Table 53 Africa: Directional Drilling Services Market Size, By Type, 20142021 (USD Million) 93

Table 54 Africa: Market Size, By Application, 20142021 (USD Million) 94

Table 55 Africa: Market Size, By Service, 20142021 (USD Million) 94

Table 56 Africa: Market Size, By Country, 20142021 (USD Million) 95

Table 57 Angola: Market Size, By Service, 20142021 (USD Million) 96

Table 58 Egypt: Market Size, By Service, 20142021 (USD Million) 97

Table 59 Nigeria: Market Size, By Service, 20142021 (USD Million) 98

Table 60 Algeria: Market Size, By Service, 20142021 (USD Million) 98

Table 61 Rest of Africa: Market Size, By Service, 20142021 (USD Million)

Table 62 Middle East: Directional Drilling Services Market Size, By Type, 20142021 (USD Million) 100

Table 63 Middle East: Market Size, By Application, 20142021 (USD Million)

Table 64 Middle East: Market Size, By Service, 20142021 (USD Million)

Table 65 Middle East: Market Size, By Country, 20142021 (USD Million)

Table 66 Saudi Arabia: Market Size, By Service, 20142021 (USD Million)

Table 67 UAE: Market Size, By Service, 20142021 (USD Million) 103

Table 68 Qatar: Market Size, By Service, 20142021 (USD Million) 104

Table 69 Rest of The Middle East: Market Size, By Service, 20142021 (USD Million) 105

Table 70 Key New Product/Service Launches, 2013-2016

Table 71 Key Expansions, 2013-2016

Table 72 Key Contracts Awarded, 2013-2016

Table 73 Key Mergers & Acquisitions, 2013-2016

Table 74 Key Partnerships, Collaborations, Alliance, and Joint Ventures, 2013-2016 114

Table 75 Other Developments, 2013-2016

List of Figures (45 Figures)

Figure 1 Directional Drilling Services Market: Research Design

Figure 2 Breakdown of Primary Interviews: By Company Type, Designation, and Region 22

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Directional Drilling Services Market: Data Triangulation

Figure 6 Assumptions of The Research Study

Figure 7 North America Accounted for The Largest Market Share of The Market in 2015 (By Value)

Figure 8 North America is Expected to Lead The Directional Drilling Services Market By 2021

Figure 9 Onshore Segment is Expected to Lead The Market, 20162021

Figure 10 Rotary Steerable System Segment is Expected to Lead Directional Drilling Services Market, 20162021

Figure 11 Conventional Segment is Projected to Dominate Market During The Forecast Period

Figure 12 Top Market Developments (20132016)

Figure 13 Attractive Opportunities in The Directional Drilling Services Market

Figure 14 Market Share, By Type, 20162021

Figure 15 RSS Segment is Expected to Lead The Directional Drilling Services Market, 20162021

Figure 16 Onshore Segment is Expected to Be The Largest in The Directional Drilling Services Market During The Forecast Period

Figure 17 Onshore Directional Drilling Segment is Estimated to Hold The Largest Market Share in 2016

Figure 18 Directional Drilling Market Share (Value), By Region, 2015

Figure 19 Directional Drilling Services Market Segmentation

Figure 20 Increasing Demand for Energy Along With Shale Gas Revolution is Expected to Drive The Directional Drilling Services Market

Figure 21 Decline in Crude Oil Prices has Continued From 2014 to 2016

Figure 22 Oil & Gas Rig Count has Seen A Decreasing Trend Worldwide in 2016

Figure 23 Iran Oil Production, 20072017

Figure 24 Onshore Application Segment is Expected to Lead The Directional Drilling Services Market By 2021

Figure 25 Conventional Segment Expected to Lead Directional Drilling Services Market From 2016 to 2021

Figure 26 Rotary Steerable System Service Segment to Dominate The Market During The Forecast Period

Figure 27 Directional Drilling Services Market Size, By Region, 20142021

Figure 28 Market Size, By Region, 2015

Figure 29 Middle East: The Fastest Growing Directional Drilling Services Market, 20162021

Figure 30 North America: Overview of The Directional Drilling Market

Figure 31 Asia-Pacific: Overview of The Directional Drilling Market

Figure 32 Companies Adopted New Product Launches as The Key Growth Strategy

Figure 33 Market Share Analysis, By Revenue, 2015

Figure 34 Market Evaluation Framework, 20132016

Figure 35 Battle for Market Share (20132016):New Product Development Was The Key Strategy

Figure 36 Regional Revenue Mix of The Top Five Players

Figure 37 Baker Hughes Incorporated: Company Snapshot

Figure 38 Halliburton Company: Company Snapshot

Figure 39 Schlumberger Limited: Company Snapshot

Figure 40 Weatherford International PLC.: Company Snapshot

Figure 41 National Oilwell Varco, Inc.: Company Snapshot

Figure 42 GE Oil & Gas: Company Snapshot

Figure 43 Nabors Industries Ltd.: Company Snapshot

Figure 44 Cathedral Energy Services Ltd.: Company Snapshot

Figure 45 Jindal Drilling & Industries Limited: Company Snapshot

Growth opportunities and latent adjacency in Directional Drilling Services Market