Cold Pain Therapy Market by Product (OTC (Gels, Creams, Patches, Wraps, Pads), Prescription (Motorized, Non-motorized)), Application (Musculoskeletal, Post-Op, Sports Injuries), Distribution Channel (Hospital, Retail, E-Pharmacy) & Region - Global Forecast to 2027

Updated on : March 13, 2023

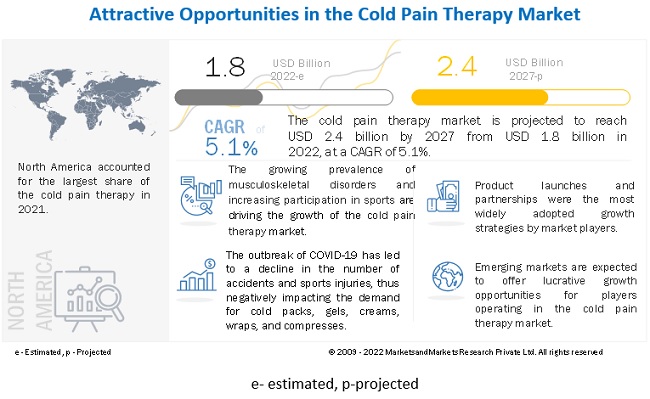

The global cold pain therapy market in terms of revenue was estimated to be worth $1.8 billion in 2022 and is poised to reach $2.4 billion by 2027, growing at a CAGR of 5.1% from 2022 to 2027. A total of 25 companies have been profiled. The current edition of the report covers pricing analysis, case study analysis, value chain analysis, supply chain analysis, ecosystem analysis, market mapping, trade analysis, regulatory landscape analysis, technology analysis, trends and disruptions impacting the business of customers, key conferences and events in 2022–2023, key stakeholders in the buying process, and Porter’s five forces analysis in the market overview chapter. This edition also covers the product and geographical footprint of the key players in the competitive landscape chapter. Market growth is driven by the rising geriatric population, coupled with the increasing prevalence of musculoskeletal disorders and the easy availability of products for cold pain therapy.

To know about the assumptions considered for the study, Request for Free Sample Report

Cold Pain Therapy Market Dynamics

Driver: Increasing number of hip and knee surgeries

There has been evidence that aging-related changes in the musculoskeletal system increase the propensity to osteoarthritis (OA), and the severity of the disease is closely related to other OA risk factors such as joint injury, obesity, genetics, and anatomical factors that affect joint mechanics. OA is not an inevitable consequence of growing older, although older age is the greatest risk factor for OA. The market demand for surgical treatment, including joint replacement surgery (hip and knee replacement), is expected to increase significantly, owing to the rapidly increasing aging population worldwide.

Opportunity: Increasing adoption of analgesic patches

Analgesic patches feature a transdermal drug delivery system, which is a non-invasive mode of medication delivery through the skin. Patches deliver an analgesic drug at a fixed rate across the dermis while being placed on the skin. The use of analgesic patches through transdermal drug delivery systems offers various advantages over oral medications.

Restraint: Growing use of low-priced analgesic pills for immediate pain relief

The most widely used OTC analgesic drugs are paracetamol or acetaminophen, ibuprofen, and aspirin. These drugs are widely available at lower costs. This, coupled with the lack of awareness of the adverse effects of painkillers, is a key factor contributing to the high adoption of analgesic pills for immediate pain relief. Additionally, the lack of awareness about new therapies for pain management, the availability of low-priced generic versions of drugs, and increasing health concerns are contributing to the high usage of analgesic pills, which causes a high adoption of OTC drugs by customers in emerging nations.

Challenge: Alternative pain management therapies

The alternative treatment options available for acute and chronic pain management in patients are non-drug or device therapy approaches, such as physical therapy or exercise, meditation, relaxation techniques, yoga, cognitive-behavioral therapy (CBT), acupuncture, biofeedback, chiropractic manipulation, the application of heat, ultrasound, compression therapy, and massages.

These alternative therapies are easily available, have fewer side effects, and are less expensive. Thus, the adoption of these therapies is usually high among patients for the management of acute and chronic pain. According to Acupuncture and Massage College, Inc. (2018), acupuncture is one of the most commonly used techniques worldwide to treat lower back pain, arthritis, neck pain, and muscle pain. Acupuncture also helps reduce the need for drugs and improves the quality of life of patients suffering from chronic pain if used in combination with other therapies.

The cold pain therapy market is moderately consolidated. The top players—Sanofi (France), Rohto Pharmaceutical (Japan), Hisamitsu Pharmaceutical Co., Inc. (Japan), Johnson & Johnson (US), and Cardinal Health, Inc. (US)—in the market accounted for a combined majority market share in 2021. There is a high degree of competition among the market players. Only major companies can afford high capital investments as well as the high cost of R&D and manufacturing. This will prevent new entrants from entering this market.

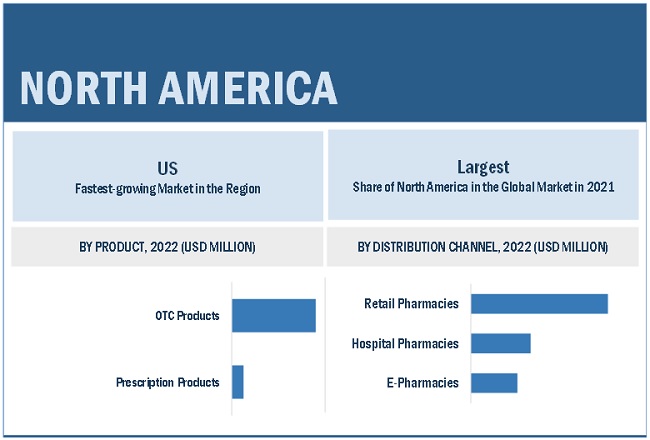

In 2021, the OTC products segment accounted for the largest share of the cold pain therapy market, by product type.

The market is segmented into OTC products and prescription products. In 2021, OTC products accounted for the largest share of the market, mainly due to their easy accessibility in retail and online pharmacies.

In 2021, the musculoskeletal disorders segment accounted for the largest share in the cold pain therapy market by application.

The market has been segmented into musculoskeletal disorders, sports medicine, post-operative therapy, and post-trauma therapy. In 2021, the musculoskeletal disorders segment accounted for the largest share of the market. Factors such as the immediate pain relief provided by cold pain therapy products are driving the growth of the market.

In 2021, the retail pharmacies segment accounted for the largest share of the cold pain therapy market by distribution channel.

The market has been segmented into hospital pharmacies, retail pharmacies, and e-pharmacies. In 2021, the retail pharmacies segment accounted for the largest share of the market. The easy availability of all the essential cold pain therapy products in retail pharmacies is driving the growth of this segment.

North America is the largest region in the world for the market for cold pain therapy.

The market is segmented into five major regions: North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa. In 2021, North America accounted for the largest share of the market. The North American market growth can be attributed to the growing sports participation.

To know about the assumptions considered for the study, download the pdf brochure

The major players operating in the cold pain therapy market are Beiersdorf AG (Germany), DJO Global, Inc. (US), Hisamitsu Pharmaceutical Co., Inc. (Japan), Össur (Iceland), Johnson & Johnson (US), Pfizer (US), Sanofi (France), Rohto Pharmaceutical (Japan), 3M (US), Cardinal Health Inc. (US), Bird & Cronin (US), Compass Health Brands (US), Breg, Inc. (US), Medline Industries (US), Performance Health (US), Romsons Group of Industries (India), Unexo Life Sciences (India), Polar Products (US), Rapid Aid (Canada), Mueller Sports Medicine (US), Pic Solution (US), Bruder Healthcare Company (US), Brownmed Inc. (US), Medichill (Australia), and ThermoTek, Inc. (US).

Cold Pain Therapy Market Report Scope

|

Report Metric |

Details |

|

Market Revenue in 2022 |

$.8 billion |

|

Estimated Value by 2027 |

$2.4 billion |

|

Growth Rate |

Poised to grow at a CAGR of 5.1% |

|

Segments covered |

Product, application, distribution channel, and region |

|

Geographies covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

This report categorizes the cold pain therapy market to forecast revenue and analyze trends in each of the following submarkets

By Product

-

OTC Products

-

Pharmaceuticals

- Gels, Ointments, and Creams

- Sprays & Foams

- Patches

- Roll-Ons

-

Medical Devices

- Cold Packs

- Cooling Towels, Compresses, Wraps, and Pads

-

Pharmaceuticals

-

Prescription Products

- Motorized Devices

- Non-Motorized Devices

By Application

- Musculoskeletal Disorders

- Post-operative Therapy

- Sports Injuries

- Post-trauma Therapy

By Distribution Channel

- Retail Pharmacies

- Hospital Pharmacies

- E- Pharmacies

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

Recent Developments

- In June 2021, Hisamitsu Pharmaceutical CO., Inc. (Japan) launched Air Salonpas Z, an analgesic and anti-inflammatory spray for muscle pain, bruises, and sprains, among other conditions.

- In November 2020, Beiersdorf AG (Germany) invested USD 72.9 million (EUR 60 million) in Hamburg to develop technological centers for strengthening its R&D unit.

- In September 2019, Rohto Pharmaceutical (Japan) announced the launch of an advanced technology research laboratory at the Hong Kong Science Park in New Territory, Hong Kong.

Frequently Asked Questions (FAQ):

What is the projected market value of the global cold pain therapy market?

The global market of cold pain therapy is projected to reach USD 2.4 billion.

What is the estimated growth rate (CAGR) of the global cold pain therapy market for the next five years?

The global cold pain therapy market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.1% from 2022 to 2027.

What are the major revenue pockets in the cold pain therapy market currently?

The global market is segmented into five major regions: North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. In 2021, North America accounted for the largest share of the cold pain therapy market. The North American cold pain therapy market growth can be attributed to the growing sports participation.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 34)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS OF THE STUDY

1.3 MARKETS COVERED

1.3.1 COLD PAIN THERAPY MARKET

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 39)

2.1 RESEARCH DATA

2.2 RESEARCH APPROACH

FIGURE 1 MARKET: RESEARCH DESIGN METHODOLOGY

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Primary sources

2.2.2.2 Key data from primary sources

2.2.2.3 Key industry insights

2.2.2.4 Breakdown of primary interviews

FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS (GLOBAL MARKET)

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

2.3.1.1 Approach 1: Company revenue estimation approach

FIGURE 4 BOTTOM-UP APPROACH: COMPANY REVENUE ESTIMATION APPROACH

2.3.1.2 Approach 2: Presentations of companies and primary interviews

2.3.1.3 Growth forecast

2.3.1.4 CAGR projections

FIGURE 5 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

2.3.2 TOP-DOWN APPROACH

FIGURE 6 MARKET: TOP-DOWN APPROACH

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION METHODOLOGY

2.5 MARKET SHARE

2.6 ASSUMPTIONS FOR THE STUDY

2.7 LIMITATIONS

2.8 RISK ASSESSMENT

2.8.1 RISK ASSESSMENT: MARKET

2.9 GROWTH RATE ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 51)

FIGURE 8 MARKET, BY PRODUCT, 2022 VS. 2027 (USD MILLION)

FIGURE 9 MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 10 MARKET, BY DISTRIBUTION CHANNEL, 2022 VS. 2027 (USD MILLION)

FIGURE 11 MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 54)

4.1 COLD PAIN THERAPY MARKET OVERVIEW

FIGURE 12 GROWING PREVALENCE OF MUSCULOSKELETAL CONDITIONS AND INCREASING PARTICIPATION IN SPORTS TO DRIVE MARKET GROWTH

4.2 MARKET SHARE, BY PRODUCT, 2022 VS. 2027

FIGURE 13 OTC PRODUCTS SEGMENT WILL CONTINUE TO DOMINATE THE MARKET IN 2027

4.3 MARKET SHARE, BY APPLICATION, 2022 VS. 2027

FIGURE 14 MUSCULOSKELETAL DISORDERS SEGMENT TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

4.4 MARKET SHARE, BY DISTRIBUTION CHANNEL, 2022 VS. 2027

FIGURE 15 RETAIL PHARMACIES SEGMENT TO CONTINUE TO DOMINATE THE MARKET IN 2027

4.5 MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 16 ASIA PACIFIC TO REGISTER THE HIGHEST GROWTH RATE IN THE MARKET DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 57)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing incidence of sports injuries and rising emphasis on exercise and gym activities

5.2.1.2 Growing number of hip and knee surgeries across the globe

5.2.1.3 Rising geriatric population and subsequent growth in the prevalence of bone diseases and trauma injuries

5.2.1.4 Growing need for safer pain management modalities as opposed to oral drug therapy

5.2.1.5 Clinical evidence in favor of menthol-based topical analgesics

5.2.2 RESTRAINTS

5.2.2.1 Wide use of low-priced analgesic pills for immediate pain relief

5.2.2.2 Lack of substantial clinical evidence and reimbursement in favor of cold pain therapy

5.2.2.3 Health hazards and discomfort associated with cold pain therapy products

5.2.3 OPPORTUNITIES

5.2.3.1 Growing adoption of analgesic patches

5.2.3.2 Growing use of cold pain therapy among middle-aged women

5.2.3.3 Increasing regulatory barriers for oral pain medications

5.2.4 CHALLENGES

5.2.4.1 Availability of alternative non-drug/device pain management therapies

5.2.5 IMPACT OF COVID-19 ON THE MARKET

5.3 PRICING ANALYSIS

TABLE 1 AVERAGE SELLING PRICE OF COLD PAIN THERAPY PRODUCTS (2022)

5.4 PATENT ANALYSIS

FIGURE 18 PATENT ANALYSIS FOR MOTORIZED COLD PAIN THERAPY DEVICES

TABLE 2 LIST OF KEY PATENTS

5.5 VALUE CHAIN ANALYSIS

FIGURE 19 VALUE CHAIN ANALYSIS OF THE MARKET: MAJOR VALUE IS ADDED DURING THE MANUFACTURING AND ASSEMBLY PHASES

5.6 SUPPLY CHAIN ANALYSIS

FIGURE 20 MARKET: SUPPLY CHAIN ANALYSIS

5.7 ECOSYSTEM/MARKET MAP

FIGURE 21 MARKET: ECOSYSTEM/MARKET MAP

TABLE 3 MARKET: ROLE IN ECOSYSTEM

5.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.8.1 THREAT OF NEW ENTRANTS

5.8.2 THREAT OF SUBSTITUTES

5.8.3 BARGAINING POWER OF BUYERS

5.8.4 BARGAINING POWER OF SUPPLIERS

5.8.5 DEGREE OF COMPETITION

5.9 REGULATORY LANDSCAPE

TABLE 5 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 6 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 7 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.9.1 NORTH AMERICA

5.9.1.1 US

5.9.1.2 Canada

5.9.2 EUROPE

5.9.3 ASIA PACIFIC

5.9.3.1 Japan

5.9.3.2 India

5.9.4 LATIN AMERICA

5.9.4.1 Brazil

5.9.4.2 Mexico

5.9.5 MIDDLE EAST

5.9.6 AFRICA

5.10 TRADE ANALYSIS

5.10.1 TRADE ANALYSIS FOR COLD PAIN THERAPY PRODUCTS

TABLE 10 IMPORT DATA FOR ARTICLES AND EQUIPMENT FOR SPORTS AND OUTDOOR GAMES, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 11 EXPORT DATA FOR ARTICLES AND EQUIPMENT FOR SPORTS AND OUTDOOR GAMES, BY COUNTRY, 2017–2021 (USD MILLION)

5.11 TECHNOLOGY ANALYSIS

5.12 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 12 MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.13.1 REVENUE SOURCES ARE SHIFTING TOWARD SAFER PAIN MANAGEMENT DUE TO THE COVID-19 PANDEMIC

FIGURE 22 REVENUE SHIFT IN THE MARKET

5.14 KEY STAKEHOLDERS & BUYING CRITERIA

5.14.1 KEY STAKEHOLDERS IN THE BUYING PROCESS

FIGURE 23 INFLUENCE OF STAKEHOLDERS IN THE BUYING PROCESS OF COLD PAIN THERAPY PRODUCTS

TABLE 13 INFLUENCE OF STAKEHOLDERS IN THE BUYING PROCESS OF COLD PAIN THERAPY PRODUCTS

5.14.2 BUYING CRITERIA

FIGURE 24 KEY BUYING CRITERIA FOR COLD PAIN THERAPY PRODUCTS

TABLE 14 KEY BUYING CRITERIA FOR COLD PAIN THERAPY PRODUCTS

5.15 CASE STUDIES

5.15.1 CASE STUDY 1

6 COLD PAIN THERAPY MARKET, BY PRODUCT (Page No. - 85)

6.1 INTRODUCTION

TABLE 15 MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

6.2 OTC PRODUCTS

TABLE 16 COLD PAIN THERAPY OTC PRODUCTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 17 COLD PAIN THERAPY OTC PRODUCTS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 18 COLD PAIN THERAPY OTC PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

TABLE 19 COLD PAIN THERAPY OTC PRODUCTS MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.1 OTC PHARMACEUTICALS

TABLE 20 COLD PAIN THERAPY OTC PHARMACEUTICALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 21 COLD PAIN THERAPY OTC PHARMACEUTICALS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 22 COLD PAIN THERAPY OTC PHARMACEUTICALS MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

TABLE 23 COLD PAIN THERAPY OTC PHARMACEUTICALS MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.1.1 Gels, ointments, and creams

6.2.1.1.1 Gels, ointments, and creams offer effective orthopedic pain management

TABLE 24 KEY GELS, OINTMENTS, AND CREAMS AVAILABLE IN THE MARKET

TABLE 25 MARKET FOR GELS, OINTMENTS, AND CREAMS, BY REGION, 2020–2027 (USD MILLION)

TABLE 26 MARKET FOR GELS, OINTMENTS, AND CREAMS, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 27 MARKET FOR GELS, OINTMENTS, AND CREAMS, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

6.2.1.2 Sprays and foams

6.2.1.2.1 Procedural benefits offered by sprays and foams to increase their adoption among sportspersons

TABLE 28 KEY SPRAYS AND FOAMS AVAILABLE IN THE MARKET

TABLE 29 MARKET FOR SPRAYS AND FOAMS, BY REGION, 2020–2027 (USD MILLION)

TABLE 30 MARKET FOR SPRAYS AND FOAMS, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 31 MARKET FOR SPRAYS AND FOAMS, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

6.2.1.3 Patches

6.2.1.3.1 Ability to deliver consistent dosage of drugs over topical creams resulting in the greater consumption of cold pain patches

TABLE 32 KEY PATCHES AVAILABLE IN THE MARKET

TABLE 33 MARKET FOR PATCHES, BY REGION, 2020–2027 (USD MILLION)

TABLE 34 MARKET FOR PATCHES, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 35 MARKET FOR PATCHES, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

6.2.1.4 Roll-ons

6.2.1.4.1 Inconsistent drug delivery and the need for repetitive use on skin are expected to hamper the adoption of roll-ons

TABLE 36 MARKET FOR ROLL-ONS, BY REGION, 2020–2027 (USD MILLION)

TABLE 37 MARKET FOR ROLL-ONS, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 38 MARKET FOR ROLL-ONS, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

6.2.2 OTC MEDICAL DEVICES

TABLE 39 COLD PAIN THERAPY OTC MEDICAL DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 40 COLD PAIN THERAPY OTC MEDICAL DEVICES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 41 COLD PAIN THERAPY OTC MEDICAL DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

TABLE 42 COLD PAIN THERAPY OTC MEDICAL DEVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.2.1 Cold packs

6.2.2.1.1 Cold packs are among the widely used cold pain therapy medical devices

TABLE 43 KEY COLD PACKS AVAILABLE IN THE MARKET

TABLE 44 MARKET FOR COLD PACKS, BY REGION, 2020–2027 (USD MILLION)

TABLE 45 MARKET FOR COLD PACKS, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 46 MARKET FOR COLD PACKS, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

6.2.2.2 Cooling towels, compresses, wraps, and pads

6.2.2.2.1 Growing availability of wraps and cooling pads to aid the growth of this market segment

TABLE 47 KEY COOLING TOWELS, COMPRESSES, WRAPS, AND PADS AVAILABLE IN THE MARKET

TABLE 48 MARKET FOR COOLING TOWELS, COMPRESSES, WRAPS, AND PADS, BY REGION, 2020–2027 (USD MILLION)

TABLE 49 MARKET FOR COOLING TOWELS, COMPRESSES, WRAPS, AND PADS, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 50 MARKET FOR COOLING TOWELS, COMPRESSES, WRAPS, AND PADS, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

6.3 PRESCRIPTION PRODUCTS

TABLE 51 KEY PRESCRIPTION PRODUCTS AVAILABLE IN THE MARKET

TABLE 52 COLD PAIN THERAPY PRESCRIPTION PRODUCTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 53 COLD PAIN THERAPY PRESCRIPTION PRODUCTS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 54 COLD PAIN THERAPY PRESCRIPTION PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

TABLE 55 COLD PAIN THERAPY PRESCRIPTION PRODUCTS MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.1 MOTORIZED DEVICES

6.3.1.1 Preference for motorized devices is increasing among patients

TABLE 56 MARKET FOR MOTORIZED DEVICES, BY REGION, 2020–2027 (USD MILLION)

TABLE 57 MARKET FOR MOTORIZED DEVICES, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 58 MARKET FOR MOTORIZED DEVICES, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

6.3.2 NON-MOTORIZED DEVICES

6.3.2.1 Non-motorized devices cost lower as compared to motorized devices

TABLE 59 MARKET FOR NON-MOTORIZED DEVICES, BY REGION, 2020–2027 (USD MILLION)

TABLE 60 MARKET FOR NON-MOTORIZED DEVICES, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 61 MARKET FOR NON-MOTORIZED DEVICES, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

7 COLD PAIN THERAPY MARKET, BY APPLICATION (Page No. - 112)

7.1 INTRODUCTION

TABLE 62 MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

7.2 MUSCULOSKELETAL DISORDERS

7.2.1 INCREASING PREVALENCE OF MUSCULOSKELETAL DISORDERS TO DRIVE THE GROWTH OF THIS MARKET SEGMENT

TABLE 63 MARKET FOR MUSCULOSKELETAL DISORDERS, BY REGION, 2020–2027 (USD MILLION)

7.3 POST-OPERATIVE THERAPY

7.3.1 INCREASING NUMBER OF ORTHOPEDIC SURGICAL PROCEDURES TO DRIVE SEGMENT GROWTH

TABLE 64 MARKET FOR POST-OPERATIVE THERAPY, BY REGION, 2020–2027 (USD MILLION)

7.4 POST-TRAUMA THERAPY

7.4.1 INCREASING INCIDENCE OF TRAUMA INJURIES TO PROPEL SEGMENT GROWTH

TABLE 65 MARKET FOR POST-TRAUMA THERAPY, BY REGION, 2020–2027 (USD MILLION)

7.5 SPORTS INJURIES

7.5.1 INCREASING NUMBER OF SPORTS INJURIES TO DRIVE SEGMENT GROWTH

TABLE 66 MARKET FOR SPORTS INJURIES, BY REGION, 2020–2027 (USD MILLION)

8 COLD PAIN THERAPY MARKET, BY DISTRIBUTION CHANNEL (Page No. - 118)

8.1 INTRODUCTION

TABLE 67 MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

8.2 RETAIL PHARMACIES

8.2.1 RETAIL PHARMACIES FORM THE LARGEST DISTRIBUTION CHANNEL FOR COLD PAIN THERAPY PRODUCTS

TABLE 68 MARKET FOR RETAIL PHARMACIES, BY REGION, 2020–2027 (USD MILLION)

8.3 HOSPITAL PHARMACIES

8.3.1 IMPROVING HEALTHCARE INFRASTRUCTURE TO DRIVE SEGMENT GROWTH

TABLE 69 MARKET FOR HOSPITAL PHARMACIES, BY REGION, 2020–2027 (USD MILLION)

8.4 E-PHARMACIES

8.4.1 E-PHARMACIES SEGMENT TO WITNESS THE HIGHEST GROWTH DURING THE FORECAST PERIOD

TABLE 70 MARKET FOR E-PHARMACIES, BY REGION, 2020–2027 (USD MILLION)

9 COLD PAIN THERAPY MARKET, BY REGION (Page No. - 123)

9.1 INTRODUCTION

TABLE 71 MARKET, BY REGION, 2020–2027 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 25 NORTH AMERICA: COLD PAIN THERAPY MARKET SNAPSHOT

TABLE 72 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 73 NORTH AMERICA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 75 NORTH AMERICA: MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

9.2.1 US

9.2.1.1 Strong presence of key companies has driven market growth in the US

TABLE 76 US: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 77 US: MARKET FOR OTC PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 78 US: MARKET FOR OTC PHARMACEUTICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 79 US: MARKET FOR OTC MEDICAL DEVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 80 US: MARKET FOR PRESCRIPTION PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 81 US: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 82 US: MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Market growth is driven by the rising number of hip and knee replacement surgeries

TABLE 83 CANADA: COLD PAIN THERAPY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 84 CANADA: MARKET FOR OTC PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 85 CANADA: MARKET FOR OTC PHARMACEUTICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 86 CANADA: MARKET FOR OTC MEDICAL DEVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 87 CANADA: MARKET FOR PRESCRIPTION PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 88 CANADA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 89 CANADA: MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

9.3 EUROPE

TABLE 90 EUROPE: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 91 EUROPE: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 92 EUROPE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 93 EUROPE: MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Increasing healthcare expenditure to drive market growth in Germany

TABLE 94 GERMANY: COLD PAIN THERAPY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 95 GERMANY: MARKET FOR OTC PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 96 GERMANY: MARKET FOR OTC PHARMACEUTICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 97 GERMANY: MARKET FOR OTC MEDICAL DEVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 98 GERMANY: MARKET FOR PRESCRIPTION PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 99 GERMANY: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 100 GERMANY: MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

9.3.2 UK

9.3.2.1 Market growth in the UK is mainly driven by the increasing prevalence of musculoskeletal conditions

TABLE 101 UK: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 102 UK: MARKET FOR OTC PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 103 UK: MARKET FOR OTC PHARMACEUTICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 104 UK: MARKET FOR OTC MEDICAL DEVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 105 UK: MARKET FOR PRESCRIPTION PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 106 UK: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 107 UK: MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

9.3.3 FRANCE

9.3.3.1 Increasing target patient population to drive market growth in France

TABLE 108 FRANCE: COLD PAIN THERAPY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 109 FRANCE: MARKET FOR OTC PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 110 FRANCE: MARKET FOR OTC PHARMACEUTICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 111 FRANCE: MARKET FOR OTC MEDICAL DEVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 112 FRANCE: MARKET FOR PRESCRIPTION PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 113 FRANCE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 114 FRANCE: MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

9.3.4 ITALY

9.3.4.1 Growing public awareness about the preventive care of musculoskeletal disorders to drive market growth

TABLE 115 ITALY: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 116 ITALY: MARKET FOR OTC PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 117 ITALY: MARKET FOR OTC PHARMACEUTICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 118 ITALY: MARKET FOR OTC MEDICAL DEVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 119 ITALY: MARKET FOR PRESCRIPTION PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 120 ITALY: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 121 ITALY: MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

9.3.5 SPAIN

9.3.5.1 Increasing prevalence of target diseases to drive market growth

TABLE 122 SPAIN: COLD PAIN THERAPY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 123 SPAIN: MARKET FOR OTC PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 124 SPAIN: MARKET FOR OTC PHARMACEUTICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 125 SPAIN: MARKET FOR OTC MEDICAL DEVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 126 SPAIN: MARKET FOR PRESCRIPTION PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 127 SPAIN: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 128 SPAIN: MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

9.3.6 REST OF EUROPE

TABLE 129 NUMBER OF SURGERIES CONDUCTED IN ROE COUNTRIES

TABLE 130 ROE: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 131 ROE: MARKET FOR OTC PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 132 ROE: MARKET FOR OTC PHARMACEUTICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 133 ROE: FOR OTC MEDICAL DEVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 134 ROE: MARKET FOR PRESCRIPTION PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 135 ROE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 136 ROE: MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

9.4 ASIA PACIFIC

FIGURE 26 APAC: COLD PAIN THERAPY MARKET SNAPSHOT

TABLE 137 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 138 ASIA PACIFIC: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 139 ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 140 ASIA PACIFIC: MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

9.4.1 JAPAN

9.4.1.1 Increasing geriatric population to drive market growth in Japan

TABLE 141 JAPAN: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 142 JAPAN: MARKET FOR OTC PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 143 JAPAN: MARKET FOR OTC PHARMACEUTICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 144 JAPAN: MARKET FOR OTC MEDICAL DEVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 145 JAPAN: MARKET FOR PRESCRIPTION PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 146 JAPAN: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 147 JAPAN: MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

9.4.2 CHINA

9.4.2.1 Expansion in the target patient population to drive market growth

TABLE 148 CHINA: COLD PAIN THERAPY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 149 CHINA: MARKET FOR OTC PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 150 CHINA: MARKET FOR OTC PHARMACEUTICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 151 CHINA: MARKET FOR OTC MEDICAL DEVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 152 CHINA: MARKET FOR PRESCRIPTION PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 153 CHINA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 154 CHINA: MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

9.4.3 INDIA

9.4.3.1 Growing number of arthritis cases to drive market growth

TABLE 155 INDIA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 156 INDIA: MARKET FOR OTC PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 157 INDIA: MARKET FOR OTC PHARMACEUTICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 158 INDIA: MARKET FOR OTC MEDICAL DEVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 159 INDIA: MARKET FOR PRESCRIPTION PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 160 INDIA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 161 INDIA: MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

9.4.4 AUSTRALIA

9.4.4.1 Rising prevalence of target diseases to drive market growth

TABLE 162 AUSTRALIA: COLD PAIN THERAPY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 163 AUSTRALIA: MARKET FOR OTC PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 164 AUSTRALIA: MARKET FOR OTC PHARMACEUTICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 165 AUSTRALIA: MARKET FOR OTC MEDICAL DEVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 166 AUSTRALIA: MARKET FOR PRESCRIPTION PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 167 AUSTRALIA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 168 AUSTRALIA: MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

9.4.5 SOUTH KOREA

9.4.5.1 Supportive government initiatives are expected to positively impact market growth

TABLE 169 SOUTH KOREA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 170 SOUTH KOREA: MARKET FOR OTC PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 171 SOUTH KOREA: MARKET FOR OTC PHARMACEUTICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 172 SOUTH KOREA: MARKET FOR OTC MEDICAL DEVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 173 SOUTH KOREA: MARKET FOR PRESCRIPTION PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 174 SOUTH KOREA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 175 SOUTH KOREA: MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

9.4.6 REST OF ASIA PACIFIC

TABLE 176 ROAPAC: COLD PAIN THERAPY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 177 ROAPAC: MARKET FOR OTC PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 178 ROAPAC: MARKET FOR OTC PHARMACEUTICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 179 ROAPAC: MARKET FOR OTC MEDICAL DEVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 180 ROAPAC: MARKET FOR PRESCRIPTION PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 181 ROAPAC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 182 ROAPAC: MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

9.5 LATIN AMERICA

TABLE 183 LATIN AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 184 LATIN AMERICA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 185 LATIN AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 186 LATIN AMERICA: MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

9.5.1 BRAZIL

9.5.1.1 Growing obese population will drive market growth in Brazil

TABLE 187 BRAZIL: COLD PAIN THERAPY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 188 BRAZIL: MARKET FOR OTC PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 189 BRAZIL: MARKET FOR OTC PHARMACEUTICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 190 BRAZIL: MARKET FOR OTC MEDICAL DEVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 191 BRAZIL: MARKET FOR PRESCRIPTION PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 192 BRAZIL: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 193 BRAZIL: MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

9.5.2 MEXICO

9.5.2.1 Favorable investment scenario for medical device manufacturers to drive market growth

TABLE 194 MEXICO: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 195 MEXICO: MARKET FOR OTC PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 196 MEXICO: MARKET FOR OTC PHARMACEUTICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 197 MEXICO: MARKET FOR OTC MEDICAL DEVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 198 MEXICO: MARKET FOR PRESCRIPTION PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 199 MEXICO: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 200 MEXICO: MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

9.5.3 REST OF LATIN AMERICA

TABLE 201 ROLATAM: COLD PAIN THERAPY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 202 ROLATAM: MARKET FOR OTC PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 203 ROLATAM: MARKET FOR OTC PHARMACEUTICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 204 ROLATAM: MARKET FOR OTC MEDICAL DEVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 205 ROLATAM: MARKET FOR PRESCRIPTION PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 206 ROLATAM: THERAPY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 207 ROLATAM: MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

9.6 MIDDLE EAST & AFRICA

TABLE 208 MIDDLE EAST & AFRICA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 209 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 210 MIDDLE EAST & AFRICA: MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 187)

10.1 OVERVIEW

10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

10.2.1 OVERVIEW OF STRATEGIES DEPLOYED BY PLAYERS IN THE COLD PAIN THERAPY MARKET

TABLE 211 OVERVIEW OF STRATEGIES DEPLOYED BY KEY COLD PAIN THERAPY PRODUCT MANUFACTURING COMPANIES

10.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 27 REVENUE SHARE ANALYSIS OF TOP PLAYERS IN THE MARKET

10.4 MARKET SHARE ANALYSIS

10.4.1 GLOBAL MARKET

FIGURE 28 MARKET SHARE, BY KEY PLAYER (2021)

TABLE 212 MARKET: DEGREE OF COMPETITION

10.4.2 EUROPE: MARKET SHARE OF PLAYERS

FIGURE 29 EUROPE: MARKET SHARE OF TOP 3 PLAYERS (2021)

10.4.3 EUROPE: LIST OF KEY PLAYERS (2021)

10.5 COMPANY EVALUATION MATRIX

10.5.1 LIST OF EVALUATED VENDORS

10.5.2 STARS

10.5.3 EMERGING LEADERS

10.5.4 PERVASIVE PLAYERS

10.5.5 PARTICIPANTS

FIGURE 30 MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

10.6 COMPETITIVE LEADERSHIP MAPPING FOR START-UPS/SMES (2021)

10.6.1 PROGRESSIVE COMPANIES

10.6.2 STARTING BLOCKS

10.6.3 RESPONSIVE COMPANIES

10.6.4 DYNAMIC COMPANIES

FIGURE 31 MARKET: COMPETITIVE LEADERSHIP MAPPING FOR START-UPS/SMES, 2021

10.7 COMPETITIVE BENCHMARKING

10.7.1 PRODUCT AND REGIONAL FOOTPRINT ANALYSIS

FIGURE 32 PRODUCT AND REGIONAL FOOTPRINT ANALYSIS OF TOP PLAYERS IN THE MARKET

TABLE 213 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

TABLE 214 PRODUCT FOOTPRINT OF KEY PLAYERS

TABLE 215 REGIONAL FOOTPRINT OF KEY PLAYERS

TABLE 216 MARKET: DETAILED LIST OF KEY START-UPS/SMES

10.8 COMPETITIVE SCENARIO

10.8.1 PRODUCT LAUNCHES

TABLE 217 KEY PRODUCT LAUNCHES & REGULATORY APPROVALS

10.8.2 DEALS

TABLE 218 KEY DEALS

11 COMPANY PROFILES (Page No. - 199)

11.1 KEY PLAYERS

(Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)*

11.1.1 BEIERSDORF AG

TABLE 219 BEIERSDORF AG: BUSINESS OVERVIEW

FIGURE 33 BEIERSDORF AG: COMPANY SNAPSHOT (2021)

11.1.2 DJO GLOBAL, INC.

TABLE 220 DJO GLOBAL, INC.: BUSINESS OVERVIEW

FIGURE 34 DJO GLOBAL, INC.: COMPANY SNAPSHOT (2020)

11.1.3 HISAMITSU PHARMACEUTICAL CO., INC.

TABLE 221 HISAMITSU PHARMACEUTICAL CO., INC.: BUSINESS OVERVIEW

FIGURE 35 HISAMITSU PHARMACEUTICAL CO., INC.: COMPANY SNAPSHOT (2021)

11.1.4 ÖSSUR

TABLE 222 ÖSSUR: BUSINESS OVERVIEW

FIGURE 36 ÖSSUR: COMPANY SNAPSHOT (2021)

11.1.5 JOHNSON & JOHNSON

TABLE 223 JOHNSON & JOHNSON: BUSINESS OVERVIEW

FIGURE 37 JOHNSON & JOHNSON: COMPANY SNAPSHOT (2021)

11.1.6 PFIZER

TABLE 224 PFIZER: BUSINESS OVERVIEW

FIGURE 38 PFIZER: COMPANY SNAPSHOT (2021)

11.1.7 SANOFI

TABLE 225 SANOFI: BUSINESS OVERVIEW

FIGURE 39 SANOFI: COMPANY SNAPSHOT (2021)

11.1.8 ROHTO PHARMACEUTICAL

TABLE 226 ROHTO PHARMACEUTICAL: BUSINESS OVERVIEW

FIGURE 40 ROHTO PHARMACEUTICAL: COMPANY SNAPSHOT (2021)

11.1.9 3M

TABLE 227 3M: BUSINESS OVERVIEW

FIGURE 41 3M: COMPANY SNAPSHOT (2021)

11.1.10 CARDINAL HEALTH, INC.

TABLE 228 CARDINAL HEALTH, INC.: BUSINESS OVERVIEW

FIGURE 42 CARDINAL HEALTH, INC.: COMPANY SNAPSHOT (2021)

*Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

11.2 OTHER PLAYERS

11.2.1 BREG, INC.

TABLE 229 BREG, INC.: COMPANY OVERVIEW

11.2.2 MEDLINE INDUSTRIES, INC.

TABLE 230 MEDLINE INDUSTRIES, INC.: COMPANY OVERVIEW

11.2.3 PERFORMANCE HEALTH

TABLE 231 PERFORMANCE HEALTH: COMPANY OVERVIEW

11.2.4 ROMSONS GROUP OF INDUSTRIES

TABLE 232 ROMSONS GROUP OF INDUSTRIES: COMPANY OVERVIEW

11.2.5 UNEXO LIFE SCIENCES PVT. LTD.

TABLE 233 UNEXO LIFE SCIENCES PVT. LTD.: COMPANY OVERVIEW

11.2.6 BIRD & CRONIN LLC

TABLE 234 BIRD & CRONIN LLC: COMPANY OVERVIEW

11.2.7 POLAR PRODUCTS INC.

TABLE 235 POLAR PRODUCTS INC.: COMPANY OVERVIEW

11.2.8 RAPID AID CORP.

TABLE 236 RAPID AID CORP.: COMPANY OVERVIEW

11.2.9 MUELLER SPORTS MEDICINE, INC.

TABLE 237 MUELLER SPORTS MEDICINE, INC.: COMPANY OVERVIEW

11.2.10 PIC SOLUTION

TABLE 238 PIC SOLUTION: COMPANY OVERVIEW

11.2.11 BRUDER HEALTHCARE COMPANY

TABLE 239 BRUDER HEALTHCARE COMPANY: COMPANY OVERVIEW

11.2.12 BROWNMED INC.

TABLE 240 BROWNMED INC.: COMPANY OVERVIEW

11.2.13 MEDICHILL

TABLE 241 MEDICHILL: COMPANY OVERVIEW

11.2.14 COMPASS HEALTH BRANDS

TABLE 242 COMPASS HEALTH BRANDS: COMPANY OVERVIEW

11.2.15 THERMOTEK, INC.

TABLE 243 THERMOTEK, INC.: COMPANY OVERVIEW

12 APPENDIX (Page No. - 243)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

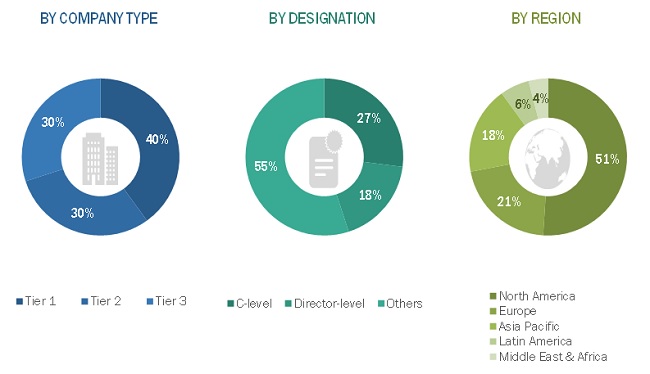

This study involved four major activities in estimating the current size of the cold pain therapy market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate segments and subsegments' market size.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources were mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects.

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

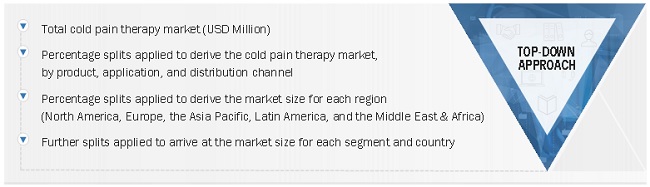

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the cold pain therapy market's total size. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research

- The revenues generated by leading players operating in the cold pain therapy market have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size applying the process mentioned above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, segment, and forecast the global cold pain therapy market by product, application, distribution channel, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall cold pain therapy market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments with respect to five regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze company developments such as product launches, agreements, partnerships, and acquisitions in the cold pain therapy market

- To benchmark players within the market using the proprietary "Competitive Leadership Mapping" framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Country Information

- Cold pain therapy market size and growth rate estimates for countries in the Rest of Europe, the Rest of Asia Pacific, Latin America, and Middle East & Africa

Company profiles

- Additional five company profiles of players operating in the cold pain therapy market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cold Pain Therapy Market