UAV Drones Market by Type (Fixed Wing, VTOL, STUAS, MALE, HALE), Payload (Up to 150 and 600 kg), Component (Camera, Sensor), Application (Media & Entertainment, Precision Agriculture), and Geography - Global Forecast to 2023

[171 Pages Report] The unmanned aerial vehicle (UAV) drones market is expected to grow from USD 13.81 Billion in 2016 to USD 48.88 Billion by 2023, at a CAGR of 18.32% during the forecast period. The objectives of the report include the forecast of the UAV drones market size in terms of value and volume for military and commercial drones. Further, it includes the detailed information regarding the drivers of the UAV drones market such as increase in venture funding, rise in demand for drone-generated data in commercial applications, and rapid technological advancements. It also includes detailed information about restraints, opportunities, and challenges for the UAV drones market. The study of the value chain of the UAV drones market is also one of the objectives of the report that includes information about suppliers and integrators in the value chain of the UAV drones market.

Years considered for this report:

- 2016 – Base Year

- 2017 – Estimated Year

- 2023 – Projected Year

- Forecast Period: 2017–2023

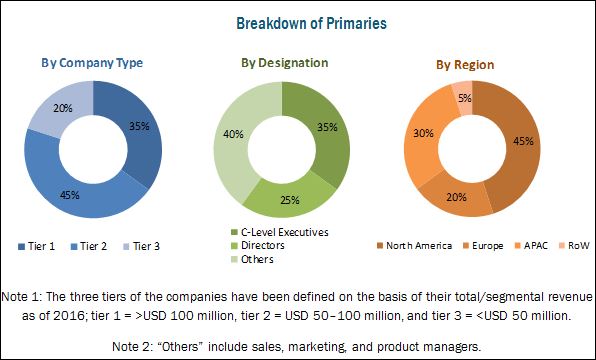

Major players of the UAV drones ecosystem were identified across regions, and their offerings, distribution channels; regional presence is understood through in-depth discussions. Also, average revenue generated by these companies, segmented by regions, is used to arrive at the overall AI in drones market size. This overall market size is used in the top-down procedure to estimate the sizes of other individual markets through percentage splits from secondary sources directories, databases such as Hoovers, Bloomberg Businessweek, Factiva, OneSource, and primary research. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interview of key insights from industry experts such as CEOs, VPs, directors, and marketing executives.

To know about the assumptions considered for the study, download the pdf brochure

The UAV drones market ecosystem includes UAV drones manufacturers such as Northrop Grumman (US), DJI (China), General Atomics Aeronautical Systems (US), Parrot (France), Thales (France), 3DR (US), Boeing (US), PrecisionHawk (US), Lockheed Martin (US), AeroVironment (US), Elbit Systems (Israel), Israel Aerospace Industries (Israel), YUNEEC (China), Leonardo (Italy), BAE Systems (UK), Saab (Sweden), ALCORE Technologies (France), ING Robotic Aviation (Canada), AiDrones (Germany), Nimbus (Italy), Aeroscout (Switzerland), VTOL Technologies (UK), Xiaomi (China), and Delta Drone (France). It also includes the payload suppliers such as Honeywell (US) and ADLINK Technology (Taiwan).

Key Target Audience:

- Original equipment manufacturers (OEMs)

- OEM technology solution providers

- Research institutes

- Market research and consulting firms

- Forums, alliances, and associations

- Technology investors

- Governments and financial institutions

- Analysts and strategic business planners

- End users of UAV drones

Study answers several questions for the stakeholders, primarily which market segments to focus in the next two to five years (depends on the range of forecast period) for prioritizing the efforts and investments.

Report Scope:

In this report, the UAV drones market has been segmented into the following categories in addition to the industry trends which have also been detailed below:

-

By Type:

-

Commercial Drones

- Fixed-Wing Drones

-

VTOL Drones

- Rotary Blade Drones

- Nano Drones

- Hybrid Drones

-

Military Drones

- Small Tactical Unmanned Aircraft Systems (STUAS)

- Medium-Altitude Long-Endurance (MALE) UAVs

- High-Altitude Long-Endurance (HALE) UAVs

- Unmanned Combat Air Systems (UCAS)

-

Commercial Drones

-

By Payload:

- Commercial Drones (Up to 25 kg)

-

Military Drones

- Up to 150 kg

- Up to 600 kg

- More than 600 kg

-

By Component:

- Camera

- Battery

- Propulsion System

- Controller

- Sensor

- Navigation System

- Others (Range Extender, Frame)

-

By Application:

-

Commercial Drones

- Law Enforcement

- Precision Agriculture

- Media and Entertainment

- Retail

- Inspection and Monitoring

- Surveying and Mapping

- Personal

- Education

-

Military Drones

- Spying

- Search and Rescue Operations

- Border Security

- Combat Operations

-

Commercial Drones

-

By Geography:

-

North America

- US

- Canada

- Mexico

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

-

APAC

- China

- Japan

- India

- Rest of APAC

-

RoW

- South America

- Middle East and Africa

- Competitive Landscape

- Company Profiles: Detailed analysis of the major companies present in the UAV drones market.

-

North America

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix gives a detailed comparison of product portfolio of each company.

Company Information

- Detailed analysis and profiling of additional market players (up to five).

Get more insight on other verticals of Semiconductor and Electronics Market Research Reports & Consulting

The unmanned aerial vehicle (UAV) drones market is expected to grow from USD 17.82 Billion in 2017 to USD 48.88 Billion by 2023, at a CAGR of 18.32% between 2017 and 2023. The drivers for this market are rapid technological advancements in drones and increase in demand for drone-generated data in commercial applications are the key factors for the growth of the market. Further, the increase in venture funding propels the growth of the UAV drones market.

The military drones are expected to hold the largest market share in 2017. Military drones are being used successfully by defense agencies across the world to guard their borders, enforce law, and for combat missions. Commercial drones are expected to hold the largest market share by 2023 and grow at the highest CAGR during the forecast period. This growth is attributed to the rising demand for drones and drone-generated data in commercial applications. Also, in some countries, the rules for operating drones in the airspace have been relaxed, thereby boosting the adoption rate of commercial drones.

Among all the components, camera is expected to hold the largest share of the market during the forecast period. Camera systems are used in UAVs continuous video monitoring, investigation, remote surveillance, border security, and protection of critical infrastructure, thermographic inspection of inaccessible buildings, and firefighting and law enforcement applications. The high rate of adoption of cameras for military and commercial applications is a key factor driving the growth of the UAV drones market for cameras. However, the market for sensors is expected to grow at the highest CAGR between 2017 and 2023.

The market for military drones with payload carrying capacity of up to 150 kg is expected to hold the largest share during the forecast period as they have simple operational and maintenance procedures with high tactical capabilities. They are versatile and can carry out a variety of missions such as search and rescue, illegal traffic monitoring, support to ground forces, and intelligence missions. The market for drones with payload carrying capacity of up to 600 kg is expected to grow at the highest CAGR during the forecast period.

Among all the major applications of the commercial drones, the market for media and entertainment is expected to hold the largest share in 2017. Drones offer numerous advantages over other methods of capturing images; some of the benefits offered by drones include lower costs and improved quality of films and photos. This is the main driver for the growth of UAV drones market for media and entertainment. The market for precision agriculture is expected to grow at the highest CAGR during the forecast period.

Of all the major applications of military drones, the market for border security is expected to hold the largest share in 2017. Drones help in capturing images and videos (e.g., footage of smugglers and undocumented immigrants crossing borders) using various payloads such as camera systems and sensors. Predator drones can silently patrol borders looking for infiltrants, illegal immigrants, human traffickers, and drug peddlers in desolated areas. The increasing demand for long-endurance and highly stable UAV systems from armies worldwide to secure their borders is a key factor driving the growth of the military drones market for border security applications. The market for spying applications is expected to grow at the highest CAGR during the forecast period.

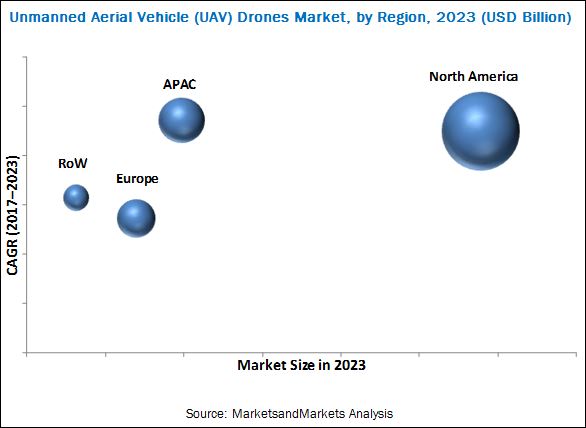

In terms of different geographic regions, North America is expected to hold the largest market share in 2017. UAVs have been extensively used by the US in strikes against terrorist outfits in Syria, Libya, and Iraq. In Canada, UAVs have been used in diverse environments and high-risk roles such as atmospheric research including weather and atmospheric gas sampling and oceanographic research. The market in APAC is expected to grow at the highest CAGR between 2017 and 2023.

Drones are being widely used for the collection of data. In this process, at times confidential or sensitive information about a private property or a private behavior gets accumulated. Thus, security and safety concerns as well as social issues, such as privacy and nuisance concerns, are the key factors restraining the growth of the UAV drones market. Also, the cost of commercial drones today is far lower than what it was in the initial stages but their characteristics and capabilities have grown manifold. Moreover, the increase in the number of drones can rise security concerns. Hence, security and safety concerns are among the key factors that limit the growth of the UAV drones market.

Northrop Grumman Corp. has been consistently upgrading its product in accordance with the technological advances. For instance, in August 2017, the company demonstrated its advanced mission management and control system at Advanced Naval Technology Exercise (ANTX). This system enables collaborative operations of several unmanned undersea vehicles (UUVs), unmanned surface vehicles (USVs), and unmanned aerial vehicles (UAVs) for collecting, analyzing, and synthesizing data from numerous sensors. The gathered information further helps in developing real-time targeting solutions that enable an UUV to engage an adversary’s seabed infrastructure. The company adopts expansion as its key business strategy to remain competitive in the UAV drones market. For instance, in April 2017, the company opened a new facility in North Dakota, US. Research and development; pilot, operator, and maintainer training; operations and mission analysis; and aircraft maintenance are the key activities carried out at this new facility. The company also plans to increase its clientele, especially among private companies rather than existing government agencies that currently account for most of its revenue generation.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Definition

1.3 Study Scope

1.3.1 Market Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.1.2.3 Key Industry Insights

2.1.3 Secondary and Primary Research

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions and Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Attractive Market Opportunities in the UAV Drones Market

4.2 UAV Drones Market in North America, By Type and Country

4.3 UAV Drones Market, By Component

4.4 Military Drones Market vs Commercial Drones Market, By Application

4.5 UAV Drones Market, By Country

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Evolution

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increase in Venture Funding

5.3.1.2 Increase in Demand for Drone-Generated Data in Commercial Applications

5.3.1.3 Rapid Technological Advancements

5.3.2 Restraints

5.3.2.1 Security and Safety Concerns

5.3.2.2 Social Issues Such as Privacy and Nuisance Concerns

5.3.3 Opportunities

5.3.3.1 Increase in the Number of Exemptions for the Use of UAV Drones in Commercial Applications By Faa

5.3.3.2 High Adoption of Drones By the Developing Economies for Military Applications

5.3.4 Challenges

5.3.4.1 Air Traffic Management

5.3.4.2 Scarcity of Trained Pilots

5.4 Value Chain Analysis

6 UAV Drones Market, By Drones Type (Page No. - 41)

6.1 Introduction

6.2 Military Drones

6.2.1 Small Tactical Unmanned Aircraft Systems (STUAS)

6.2.2 Medium-Altitude Long-Endurance (MALE) UAVs

6.2.3 High-Altitude Long-Endurance (HALE) UAVs

6.2.4 Unmanned Combat Air System (UCAS)

6.3 Commercial Drones

6.3.1 Fixed-Wing Drones

6.3.2 VTOL Drones

6.3.2.1 Rotary Blade Drones

6.3.2.2 Nano Drones

6.3.2.3 Hybrid Drones

7 UAV Drones Market, By Payload (Page No. - 58)

7.1 Introduction

7.2 Up to 25 Kg (Commercial Drones)

7.3 Up to 150 Kg

7.4 Up to 600 Kg

7.5 More Than 600 Kg

8 UAV Drones Market, By Component (Page No. - 62)

8.1 Introduction

8.2 Sensor

8.2.1 Motion Sensor

8.2.2 Light Sensor

8.2.3 Proximity Sensor

8.2.4 Temperature Sensor

8.2.5 Position Sensor

8.2.6 Other Sensors

8.3 Controller System

8.3.1 Common Data Link (CDL)

8.3.2 Tactical Common Data Link (TCDL)

8.4 Camera

8.4.1 Multispectral Camera

8.4.2 Thermal Camera

8.4.3 Lidar Camera

8.4.4 High-Resolution Camera

8.5 Navigation System

8.5.1 Global Positioning System (GPS)

8.5.2 Geographic Information System (GIS)

8.6 Propulsion System

8.7 Battery

8.8 Others

9 UAV Drones Market, By Application (Page No. - 71)

9.1 Introduction

9.2 Military Drone Applications

9.2.1 Spying

9.2.2 Search and Rescue Operations

9.2.3 Border Security

9.2.4 Combat Operations

9.3 Commercial Drone Applications

9.3.1 Inspection and Monitoring

9.3.1.1 Oil & Gas

9.3.1.2 Power Plants

9.3.1.3 Public Infrastructure

9.3.2 Law Enforcement

9.3.3 Precision Agriculture

9.3.4 Media and Entertainment

9.3.5 Retail

9.3.6 Surveying and Mapping

9.3.7 Personal

9.3.8 Education

10 Geographic Analysis (Page No. - 84)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 UK

10.3.2 Germany

10.3.3 France

10.3.4 Italy

10.3.5 Spain

10.3.6 Rest of Europe

10.4 APAC

10.4.1 China

10.4.2 Japan

10.4.3 India

10.4.4 Rest of APAC

10.5 RoW

10.5.1 South America

10.5.2 Middle East

11 Competitive Landscape (Page No. - 111)

11.1 Introduction

11.2 UAV Drones Market Ranking Analysis, 2016

11.3 Competitive Situations and Trends

11.4 Developments

11.4.1 Product Launches

11.4.2 Partnerships and Collaborations

11.4.3 Contracts and Agreements

11.4.4 Expansions

11.4.5 Acquisitions

12 Company Profiles (Page No. - 117)

(Business Overview, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments, MnM View, Key Relationships)*

12.1 Key Players

12.1.1 Northrop Grumman

12.1.2 DJI

12.1.3 General Atomics Aeronautical Systems (GA-ASI)

12.1.4 Parrot

12.1.5 Aerovironment

12.1.6 Thales

12.1.7 Lockheed Martin

12.1.8 3DR

12.1.9 Boeing

12.1.10 Precisionhawk

12.1.11 Textron

*Details on Business Overview, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments, MnM View, Key Relationships Might Not Be Captured in Case of Unlisted Companies.

12.2 Key Innovators

12.2.1 Elbit Systems

12.2.2 Israel Aerospace Industries (Iai)

12.2.3 Bae Systems

12.2.4 Leonardo

12.2.5 Yuneec

12.3 Other Key Players

12.3.1 Saab

12.3.2 Alcore Technologies

12.3.3 Ing Robotic Aviation

12.3.4 Aidrones

12.3.5 Nimbus SRL

12.3.6 Xiaomi

12.3.7 VTOL Technologies

12.3.8 Delta Drone

12.3.9 Aeroscout

13 Appendix (Page No. - 162)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (68 Tables)

Table 1 UAV Drones Market, By Drone Type, 2014–2023 (USD Billion)

Table 2 UAV Drones Market, By Drone Type, 2014–2023 (Thousand Units)

Table 3 Military Drones Market, By Region, 2014–2023 (USD Billion)

Table 4 Military Drones Market in North America, By Country, 2014–2023 (USD Million)

Table 5 Military Drones Market in Europe, By Country, 2014–2023 (USD Million)

Table 6 Military Drones Market in APAC, By Country, 2014–2023 (USD Million)

Table 7 Military Drones Market in RoW, By Region, 2014–2023 (USD Million)

Table 8 Commercial Drones Market, By Type, 2014–2023 (USD Million)

Table 9 Commercial Drones Market, By Type, 2014–2023 (Thousand Units)

Table 10 Fixed-Wing Drones Market, By Application, 2014–2023 (USD Million)

Table 11 Fixed-Wing Drones Market, By Region, 2014–2023 (USD Million)

Table 12 Fixed-Wing Drones Market in North America, By Country, 2014–2023 (USD Million)

Table 13 Fixed-Wing Drones Market in Europe, By Country, 2014–2023 (USD Million)

Table 14 Fixed-Wing Drones Market in APAC, By Country, 2014–2023 (USD Million)

Table 15 Fixed-Wing Drones Market in RoW, By Region, 2014–2023 (USD Million)

Table 16 VTOL Drones Market, By Type, 2014–2023 (USD Million)

Table 17 VTOL Drones Market, By Type, 2014–2023 (Thousand Units)

Table 18 VTOL Drones Market, By Region, 2014–2023 (USD Million)

Table 19 VTOL Drones Market in North America, By Country, 2014–2023 (USD Million)

Table 20 VTOL Drones Market in Europe, By Country, 2014–2023 (USD Million)

Table 21 VTOL Drones Market in APAC, By Country, 2014–2023 (USD Million)

Table 22 VTOL Drones Market in RoW, By Region, 2014–2023 (USD Million)

Table 23 Rotary Blade Drones Market, By Application, 2014–2023 (USD Million)

Table 24 Nano Drones Market, By Application, 2014–2023 (USD Thousand)

Table 25 Hybrid Drones Market, By Application, 2014–2023 (USD Million)

Table 26 Military Drones Market, By Payload, 2014–2023 (USD Billion)

Table 27 UAV Drones Market, By Component, 2014–2023 (USD Billion)

Table 28 Military Drones Market, By Application, 2014–2023 (USD Billion)

Table 29 Commercial Drones Market, By Application, 2014–2023 (USD Million)

Table 30 Commercial Drones Market for Inspection and Monitoring, By Type, 2014–2023 (USD Million)

Table 31 Commercial Drones Market for Law Enforcement, By Type, 2014–2023 (USD Million)

Table 32 Commercial Drones Market for Precision Agriculture, By Type, 2014–2023 (USD Million)

Table 33 Commercial UAV Drones Market for Media and Entertainment, By Type, 2014–2023 (USD Million)

Table 34 Commercial Drones Market for Retail, By Type, 2014–2023 (USD Million)

Table 35 Commercial Drones Market for Surveying and Mapping, By Type, 2014–2023 (USD Million)

Table 36 Commercial Drones Market for Personal Applications, By Type, 2014-2023 (USD Thousand)

Table 37 Commercial Drones Market for Education Application, By Type, 2014–2023 (USD Million)

Table 38 UAV Drones Market, By Region, 2014–2023 (USD Billion)

Table 39 UAV Drones Market in North America, By Country, 2014–2023 (USD Million)

Table 40 UAV Drones Market in North America, By Type, 2014–2023 (USD Billion)

Table 41 UAV Drones Market in the Us, By Type, 2014–2023 (USD Million)

Table 42 UAV Drones Market in Canada, By Type, 2014–2023 (USD Million)

Table 43 UAV Drones Market in Mexico, By Type, 2014–2023 (USD Million)

Table 44 UAV Drones Market in Europe, By Country, 2014–2023 (USD Million)

Table 45 UAV Drones Market in Europe, By Type, 2014–2023 (USD Million)

Table 46 UAV Drones Market in the Uk, By Type, 2014–2023 (USD Million)

Table 47 UAV Drones Market in Germany, By Type, 2014–2023 (USD Million)

Table 48 UAV Drones Market in France, By Type, 2014–2023 (USD Million)

Table 49 UAV Drones Market in Italy, By Type, 2014–2023 (USD Million)

Table 50 UAV Drones Market in Spain, By Type, 2014–2023 (USD Million)

Table 51 UAV Drones Market in Rest of Europe, By Type, 2014–2023 (USD Million)

Table 52 UAV Drones Market in APAC, By Country, 2014–2023 (USD Million)

Table 53 UAV Drones Market in APAC, By Type, 2014–2023 (USD Million)

Table 54 UAV Drones Market in China, By Type, 2014–2023 (USD Million)

Table 55 UAV Drones Market in Japan, By Type, 2014–2023 (USD Million)

Table 56 UAV Drones Market in India, By Type, 2014–2023 (USD Million)

Table 57 UAV Drones Market in Rest of APAC, By Type, 2014–2023 (USD Million)

Table 58 UAV Drones Market in RoW, By Region, 2014–2023 (USD Million)

Table 59 UAV Drones Market in RoW, By Type, 2014–2023 (USD Million)

Table 60 UAV Drones Market in South America, By Type, 2014–2023 (USD Million)

Table 61 UAV Drones Market in the Middle East and Africa, By Type, 2014–2023 (USD Million)

Table 62 Military Drones Market Ranking, 2016

Table 63 Commercial Drones Market Ranking, 2016

Table 64 Product Launches, 2014–2017

Table 65 Partnerships and Collaborations, 2014–2017

Table 66 Contracts and Agreements, 2014–2017

Table 67 Expansions, 2014–2017

Table 68 Acquisitions, 2014–2017

List of Figures (43 Figures)

Figure 1 UAV Drones: Markets Segmentation

Figure 2 UAV Drones Market: Research Design

Figure 3 UAV Drones Market: Bottom-Up Approach

Figure 4 UAV Drones Market: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Market for Commercial Drones Expected to Grow at the Highest CAGR During the Forecast Period

Figure 7 Payloads Up to 150 Kg Expected to Hold the Largest Share of the Military Drones Market During the Forecast Period

Figure 8 UAV Drones Market for Sensors Expected to Grow at the Highest CAGR During the Forecast Period

Figure 9 Commercial Drones Market for Precision Agriculture Application Expected to Grow at the Highest CAGR During the Forecast Period

Figure 10 North America Expected to Hold the Largest Share of the UAV Drones Market During the Forecast Period

Figure 11 Growing Demand for Drone-Generated Data in Commercial Applications to Drive the UAV Drones Market During the Forecast Period

Figure 12 VTOL Drones Expected to Hold the Largest Share of the UAV Drones Market in North America During the Forecast Period

Figure 13 Camera Expected to Hold the Largest Share of the UAV Drones Market in 2017

Figure 14 Border Security Application Expected to Hold the Largest Share of the UAV Drones Market for Military Drones in 2017

Figure 15 US Expected to Hold the Largest Share of the UAV Drones Market in 2017

Figure 16 Drivers, Restraints, Opportunities, Challenges

Figure 17 UAV Drones Value Chain Analysis: Research & Development and Manufacturing Phases Contribute Maximum Value

Figure 18 Commercial Drones Market Expected to Grow at the Highest CAGR During the Forecast Period

Figure 19 Commercial Drones Market for VTOL Drones Expected to Grow at A Higher CAGR During the Forecast Period

Figure 20 Market for Hybrid Drones Expected to Grow at the Highest CAGR During the Forecast Period

Figure 21 UAV Drones Market for Precision Agriculture Application Expected to Grow at the Highest CAGR During the Forecast Period

Figure 22 Market for Military Drones With Payload Carrying Capacity of Up to 600 Kg Expected to Grow at the Highest CAGR During the Forecast Period

Figure 23 Cameras to Hold Largest Share of the UAV Drones Market in 2017

Figure 24 Frequency Ranges for Commercial UAV Operations

Figure 25 Tactical Common Data Link (TCDL) Frequencies for Military UAV Operations

Figure 26 Border Security Applications to Hold the Largest Size of the Military Drones Market in 2017

Figure 27 Commercial Drones Market for Precision Agriculture Applications to Grow at the Highest CAGR During the Forecast Period

Figure 28 Rotary Blade Drones to Hold the Largest Size of the Commercial Drones Market for Inspection and Monitoring in 2017

Figure 29 Rotary Blade Drones to Hold the Largest Size of the Commercial Drones Market for Precision Agriculture in 2017

Figure 30 UAV Drones Market in APAC Expected to Grow at the Highest CAGR During the Forecast Period

Figure 31 North America Expected to Hold the Largest Size of the UAV Drones Market in 2017

Figure 32 Market Snapshot: North America

Figure 33 Market Snapshot: Europe

Figure 34 Market Snapshot: APAC

Figure 35 Players in the UAV Drones Market Adopted Product Launches as Their Key Strategy for Business Expansion Between January 2015 and September 2017

Figure 36 Players in the UAV Drones Market Adopted Product Launches, Partnerships and Collaborations as Key Business Strategies Between January 2014 and September 2017

Figure 37 Northrop Grumman: Company Snapshot

Figure 38 Parrot: Company Snapshot

Figure 39 Aerovironment: Company Snapshot

Figure 40 Thales: Company Snapshot

Figure 41 Lockheed Martin: Company Snapshot

Figure 42 Boeing: Company Snapshot

Figure 43 Textron: Company Snapshot

Growth opportunities and latent adjacency in UAV Drones Market

I am interested in the size and growth rate of the commercial drone market, specifically in the entertainment space.

I am a consultant and one of my clients need information on drones industry specifically in Africa. What kind of data can you provide for the requirement?

I am writing my thesis around the drone industry. Specifically commercial applications. "An internet business model for the drone industry" is the title of the thesis. Can you help me with the regional market data for my thesis?

We are a drone startup active in Japan, and wish to expand our business worldwide. The agenda to receive the research data for drones market is to get substantial market inputs to present to the investors for the next round of investments. Can you help us with the brochure and few more region wise insights?

We are interested in forecast for > 55 lb. commercial UAVs in terms of platform sales for next 5 years; Further, we would like to know potential ADS-B market for UAVs for same period.

We are a couple of architecture students and are writing an article about African infrastructure and the role of the drone in this area. We would kindly ask you, if possible, to share few insights related to it.

We are a drone camera start-up company and would like to know if there is any possibility of a price reduction for this report - it is not within the range of our project budget

Within military space, do the report breakdown the military drones in volumes in different weight classes preferably 0-10kg, 10-25kg and up? Note - it is the size of the platform and not the payload.

We are interested in understanding customer preference for selecting an UAS systems and the dynamic challenges faced by end users targeting applications such as, Law Enforcement, Search & Rescue, First Responders, Disaster Recovery, Homeland Security, News agencies, & Commercial operations such as agriculture, pipeline monitoring, etc.

Does the report include market of UAV with embedded systems for industrial applications such as surveying, industrial inspection and agriculture?

Particularly interested in market size and attractive applications for drones in various European countries.

Our institution is currently initiating a collaboration with a private air force in the scope of UAV drones with fixed wing for maritime monitoring campaigns. Thus, this study if found interesting could have a great applicability for us.

I would like to know categories of drones that have you covered (STUAV, MALE etc.). Are you covering specific VTOL companies, if so which are those?

Our USP is software that geotags videography and photography captured from cameras mounted to UAV drones. We would specifically like to have a look at commercial surveying applications of drones in utilities industry.

I need the % share of commercial and military application of drones and market size by industry (Mining, Government, Agriculture etc.). I would also like to get some insights on market size of service based offerings like end to end integration, software, and SDKs.

Here are the topics I am interested to hear about - • Market share for commercial drones, • What are the emerging infrastructure wireless standards enabling the UAV market?, • FAA (and other organization) requirements regarding UAV control beyond line of sight, and • UAV market Influence on the semiconductor ecosystem

Hi, I am interested in drone usage forecasts for specific countries broken down by application (e.g.. forecast of drone usage in precision agriculture, energy & power, etc.) for each country rather than just total per country, specifically for UK. Can you confirm if the report contains this, or if you have any customization options?

Interested in the complexities of the value chain network in this industry as well as operational performance measures for various companies operating at different stages of the value chain.

I was interested in the actual worth of the Drones Market- $19.3 billion and where those profits would go? How much would go to the manufacturers and distributors, and how much would go to sub-system manufacturers?

I am an Ex armed forces Chopper Pilot, post VRS Worked as Chief Manager in a private firm. I am interested in knowing technology trends and drone market specifically for power sector in Europe.

We are trying to enter into yet to commercialize Taxi drones market space, can you help us with the market value of the taxi drone industry?

I am a professor in one of the renowned Universities. Currently, I have taken up a class and am teaching satellite navigation and positioning and integrated systems in geomatics and for lecturing purposes I am interested in statistics on UAV. Can you help me with the same?

1) Could you give me more detail about 'Request for Free 10% Customization of Report'? 2) Is it possible to request for customization before I purchase the report?

Currently we are on the way to start our business in drone wireless charger industry. So, we need to get your analysis which covers all possible industry and technology trends

We need US specific sales information for mid/long duration, high altitude, fixed wing drones below the FAA 55 pound threshold. Is this covered in the report? If not, how can you help us with this?

Hi, I am writing an investment thesis on a major drone maker focused on the media and entertainment sector and I would be really interested in the corresponding section of your report.

For my research in the field of Applied Sciences, I need information regarding the commercial UAV drones and their adoption for various applications specifically in Europe.

I represent a student startup company from Norway that is currently developing a new type of VTOL drone. We are now building a prototype and have some financial problems. This is the reason I request this report for free.

As we are a service company, we would be interested to know the market size and forecast for yearly drone flights in the US and not the drone market size. Is this information covered in the report?

Does the report provide data for commercial drones market in the US and Europe broken down into various applications; specifically Agriculture, Mining, Power & Utilities, Construction?