Drone (UAV) Payload Market Size, Share & Trends - 2030

Drone (UAV) Payload Market by Payload Type (Camera, CBRN Sensor, Signal Intelligence, Radar, LiDAR, Gimbal, Others), Payload Weight (<25 Kg, 25-50 Kg, 51-100 Kg, 101-300 Kg, >300 Kg), Application, Platform, End Use, Point of Sale, Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The drone (UAV) payload market is estimated to be USD 4.15 billion in 2025 and projected to reach USD 6.69 billion by 2030, at a CAGR of 10.0% during the forecast period. The drone (UAV) payload market is driven by rising defense ISR modernization, growing adoption of drones in infrastructure and agriculture, miniaturization of sensors, AI-enabled data analytics, and expanding commercial applications across logistics, mapping, and environmental monitoring, supported by government investments and relaxed UAV operational regulations worldwide.

KEY TAKEAWAYS

-

By Payload TypeThe global drone (UAV) payload market comprises camera, CBRN sensor, signal intelligence payload, radar, LiDAR, gimbal, and others. The signal intelligence payload segment dominated the market in 2024, driven by rising defense investments in electronic warfare, battlefield intelligence, and real-time communication interception systems.

-

By Payload WeightThe global drone (UAV) payload market comprises < 25 Kg, 25–50 Kg, 51–100 Kg, 101–300 Kg, and > 300 Kg. The < 25 Kg segment dominated the drone (UAV) payload market in 2024, owing to increasing adoption of lightweight multi-rotor drones for commercial applications such as inspection, mapping, and aerial imaging.

-

By ApplicationThe global drone (UAV) payload market comprises combat & support, inspection & monitoring, surveying & mapping, spraying & feeding, cargo & delivery, photography/filming, and others. The combat & support segment dominated the drone (UAV) payload market in 2024, supported by defense modernization programs and the growing use of ISR-equipped drones for tactical missions and battlefield surveillance.

-

By PlatformThe global drone (UAV) payload market comprises fixed-wing, rotary wing, and hybrid. The fixed-wing segment dominated the drone (UAV) payload market in 2024, due to longer endurance, higher payload-carrying capacity, and suitability for long-range defense and mapping operations.

-

By End UseThe global drone (UAV) payload market comprises civil & commercial, defense, and government. The defense segment dominated the drone (UAV) payload market in 2024, owing to growing military procurement of ISR drones, radar, and SIGINT payloads for tactical situational awareness.

-

By Point of SaleThe global drone (UAV) payload market comprises OEM and aftermarket. The OEM segment dominated the drone (UAV) payload market in 2024, driven by the rising integration of advanced payloads during initial drone manufacturing and increased defense procurement contracts.

-

By RegionThe global drone (UAV) payload market comprises North America, Europe, Asia Pacific, Middle East, Rest of the World. The North America region dominated the drone (UAV) payload market in 2024, fueled by strong defense budgets, extensive UAV fleet modernization, and the presence of leading payload manufacturers in the United States.

-

Competitive LandscapeMajor players in the global drone payload market have adopted both organic and inorganic growth strategies, including partnerships, product launches, and defense contracts. For instance, Trillium Engineering expanded its electro-optical and infrared (EO/IR) payload portfolio with new lightweight gimbal systems, while Safran Electronics & Defense strengthened its presence through strategic collaborations in advanced sensor payloads. Similarly, Leonardo and RTX enhanced their ISR and radar payload capabilities through defense modernization programs. Such initiatives are aimed at improving payload performance, enhancing integration with UAV platforms, expanding global reach, and meeting the rising demand from both civil and defense end users.

The drone (UAV) payload market is estimated to be USD 4.15 billion in 2025 and is projected to reach USD 6.69 billion by 2030, at a CAGR of 10.0% during the forecast period.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The drone (UAV) payload market is projected to register a CAGR of 10.0% during the forecast period. The market is undergoing significant transformations, driven by trends and disruptions that are reshaping customer businesses. Additionally, increasing demand for air transportation is expected to fuel the market, leading to new revenue opportunities.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising deployment of ISR payloads for defense modernization

-

Growing utilization of cargo and delivery payloads

Level

-

Regulatory barriers slowing payload integration

-

High development costs restricting market accessibility

Level

-

Expansion of drone payloads in precision agriculture

-

Rising adoption of medical and humanitarian delivery payloads

Level

-

Integration complexity across platforms

-

Environmental and operational constraints

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Rising deployment of ISR payloads for defense modernization

Increasing global defense budgets and modernization programs are driving large-scale adoption of ISR payloads to enhance situational awareness, target acquisition, and real-time battlefield intelligence across tactical and strategic missions.

Regulatory barriers slowing payload integration

Strict national and regional airspace regulations, certification delays, and interoperability challenges limit UAV payload deployment, slowing cross-border operations and commercial scaling despite rapid technological advances and increasing industry standardization efforts.

Expansion of drone payloads in precision agriculture

Growing demand for yield optimization and crop health monitoring fuels integration of multispectral and LiDAR payloads in agricultural drones, enabling high-resolution imaging, data analytics, and cost-effective farm management solutions.

Integration complexity across platforms

Payload miniaturization, data bandwidth limitations, and power management constraints complicate seamless integration across different UAV platforms, requiring advanced modular architectures and adaptive interfaces for efficient multi-mission compatibility and performance optimization.

drone-payload-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Developed multi-domain payloads, including EO/IR, radar, and SIGINT systems integrated into UAVs for intelligence, surveillance, and reconnaissance (ISR) missions | Provided advanced targeting, situational awareness, and precision data capabilities for both tactical and strategic drones | Enhances real-time data acquisition and target tracking accuracy, supports defense modernization programs, and ensures superior operational range and reliability under complex mission environments |

|

Provided electro-optical and infrared (EO/IR) imaging payloads used in UAVs for border surveillance, environmental monitoring, and tactical reconnaissance | Its thermal sensors are integrated into small- to medium-class drones for persistent aerial observation. | Offers superior image resolution and night-vision capabilities, reduces operator workload with AI-assisted analytics, and delivers scalable imaging systems adaptable to multiple UAV platforms |

|

Designed advanced multi-sensor gimbal systems (WESCAM MX-Series) providing real-time ISR imagery and video stabilization used in tactical, maritime, and homeland security drone applications for target detection and intelligence gathering | Provides high-definition, stabilized imaging across varied altitudes, improves mission accuracy and surveillance range, and supports modular payload configurations compatible with multiple UAV systems |

|

Supplied synthetic aperture radar (SAR), electronic warfare (EW), and EO/IR payloads integrated into UAVs like Falco EVO and Sky-Y | Supported European and Middle Eastern ISR, border security, and maritime surveillance operations | Delivers long-range sensing with all-weather performance, enables early threat detection and mapping precision, and supports autonomous mission execution through integrated AI-driven processing |

|

Developed SIGINT, EO/IR, and optronic payloads for UAV-based intelligence and reconnaissance mission used across defense and homeland security sectors for signal interception, threat tracking, and tactical awareness | Strengthens UAV mission adaptability, ensures secure data transmission and superior situational awareness, and reduces latency through high-speed digital processing and modular sensor design. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The drone (UAV) payload market ecosystem integrates manufacturers, solution & service providers, and end users to deliver advanced imaging, sensing, and communication capabilities. Solution & service providers play a key role in aligning payloads with varied defense, commercial, and industrial applications, while regulatory bodies ensure compliance and airspace safety. Research institutions and technology partners drive continuous innovation, particularly in miniaturization and AI-enabled payloads. This collaborative structure enables efficient deployment, scalability, and lifecycle support, positioning drone payloads as critical enablers of data-driven operations.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Drone (UAV) Payload Market, By Payload Type

The signal intelligence payload segment dominated the drone (UAV) payload Market in 2024, mainly driven by the increasing demand for real-time battlefield intelligence, electronic surveillance, and threat detection capabilities, particularly across defense forces modernizing their ISR and EW systems to enhance tactical communication and situational awareness.

Drone (UAV) Payload Market, By Payload Weight

The < 25 Kg segment dominated the drone (UAV) payload market in 2024, mainly driven by widespread adoption of lightweight drones for commercial uses, such as inspection, mapping, and photography, supported by relaxed regulations, affordability, and advancements in compact, high-performance payload integration technologies.

Drone (UAV) Payload Market, By Application

The combat & support segment dominated the drone (UAV) payload market in 2024, primarily driven by the rising defense investments in UAV-based reconnaissance, targeting, and tactical support missions, as military forces increasingly rely on advanced payload-equipped drones for real-time battlefield surveillance and precision strike operations.

Drone (UAV) Payload Market, By Platform

The fixed-wing segment dominated the drone (UAV) payload market in 2024. Fixed-wing UAVs lead due to their extended range, higher endurance, and superior payload capacity, which makes them ideal for long-duration missions in defense, border surveillance, and large-scale mapping and environmental monitoring applications.

Drone (UAV) Payload Market, By End Use

The defense segment is likely to dominate the drone (UAV) payload market in 2024. The defense segment dominates owing to substantial government spending on UAV modernization programs, increased procurement of ISR and electronic intelligence payloads, and their strategic role in national security, border control, and military intelligence operations.

Drone (UAV) Payload Market, By Point of Sale

The OEM segment is likely to register a significant CAGR during the forecast period, primarily driven by the rising demand for integrated payload systems during drone manufacturing, supported by continuous technological upgrades, defense contract inflows, and strong collaborations between UAV manufacturers and payload technology providers.

REGION

Asia Pacific to be the fastest-growing region in global drone (UAV) payload market during forecast period

Asia Pacific is projected to be the fastest-growing drone (UAV) payload market during the forecast period. This projected growth is fueled by strong government investments in border surveillance and disaster management UAVs. Other factors include expanding commercial drone ecosystem, rapid miniaturization of sensors, and cost-effective manufacturing enhance payload accessibility.

drone-payload-market: COMPANY EVALUATION MATRIX

In the global drone (UAV) payload market matrix, RTX (Star) leads with the strongest market share and a broad product portfolio, driven by its advanced ISR, EO/IR, and radar payload systems deployed across military and government UAV programs. Teledyne FLIR (Emerging Leader) follows closely, leveraging its superior thermal imaging and multi-sensor payload technologies that dominate surveillance and industrial drone applications. L3Harris Technologies maintains a solid position through its robust SIGINT and communication payloads tailored for defense and intelligence missions. Leonardo S.p.A. demonstrates strength in radar and electro-optical payload integration, expanding its footprint through European defense collaborations. Meanwhile, Thales Group continues to grow through innovation in miniaturized multispectral and secure communication payloads, showing strong potential to advance toward the leaders’ quadrant as demand for intelligent and interoperable payload systems accelerates globally.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- BAE Systems (UK)

- Elbit Systems Ltd. (Israel)

- Lockheed Martin Corporation (US)

- Northrop Grumman (US)

- AeroVironment, Inc. (US)

- Thales Alenia Space (France/Italy)

- Israel Aerospace Industries (Israel)

- DJI (China)

- Parrot Drones SAS (France)

- Teledyne FLIR LLC (US)

- General Atomics (US)

- L3Harris Technologies, Inc. (US)

- Leonardo S.p.A (Italy)

- Saab AB (Sweden)

- RTX (US)

- Kratos (US)

- Hensoldt AG (Germany)

- Honeywell International Inc. (US)

- QinetiQ (United Kingdom)

- 3DR, Inc. (US)

- Autel Robotics (China)

- Draganfly Innovations Inc. (Canada)

- IMSAR LLC. (US)

- Trillium (US)

- Insitu (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 3.97 Billion |

| Revenue Forecast in 2030 | USD 6.69 Billion |

| Growth Rate | CAGR of 10.0% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, Middle East, Rest of the World |

WHAT IS IN IT FOR YOU: drone-payload-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Manufacturer | Additional segment breakdown for countries | Additional country-level market sizing tables for segments/sub-segments covered at regional/global level to gain an understanding on market potential by each country |

| Emerging Leader | Additional company profiles | Competitive information on targeted players to gain granular insights on direct competition |

| Regional Market Leader | Additional country market estimates | Additional country-level deep dive for a more targeted understanding on the total addressable market |

RECENT DEVELOPMENTS

- August 2025 : Echodyne provided MESA radar as a sensor payload for unmanned aerial systems under an OTA contract awarded by DHS S&T (USA) for counter-UAS efforts.

- February 2025 : Trillium Engineering won a Phase One production contract from Raytheon to supply HD25-LV EO/IR gimbal payloads for a loitering munition program.

- June 2025 : Safran Electronics & Defense partnered with Pen Aviation (Malaysia), which became the launch customer for Safran’s new Euroflir airborne EO systems for UAVs, marking the first export success.

- July 2025 : Auterion secured a USD 50 million Pentagon contract from the US Department of Defense to deliver 33,000 AI drone guidance kits, including camera, compute, and radio payloads, to enhance Ukraine’s UAV capability.

- September 2025 : Echodyne was selected by the Australian Defence Force to supply radar systems as part of Project LAND 156 counter-UAS initiative, including deployment on interceptor drones.

Table of Contents

Methodology

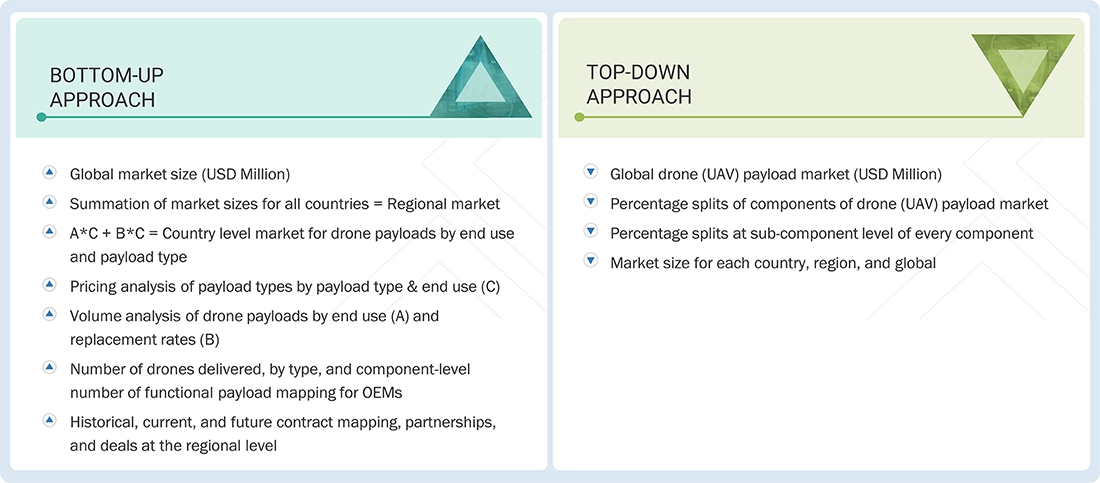

The research study involved four major activities in estimating the automotive semiconductor market size. Exhaustive secondary research has been done to collect key information about the market and peer markets. The next step has been to validate these findings and assumptions and size them with the help of primary research with industry experts across the value chain. Both top-down and bottom-up approaches have been used to estimate the market size. After this, the market breakdown and data triangulation were adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information required for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, and articles from recognized authors. Secondary research has been mainly done to obtain key information about the market’s value chain, the pool of key market players, market segmentation according to industry trends, regional outlook, and developments from market and technology perspectives.

The automotive semiconductor market report estimates the global market size using the top-down and bottom-up approaches and several other dependent submarkets. Major players in the market were identified using extensive secondary research, and their presence in the market was determined using secondary and primary research. All the percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

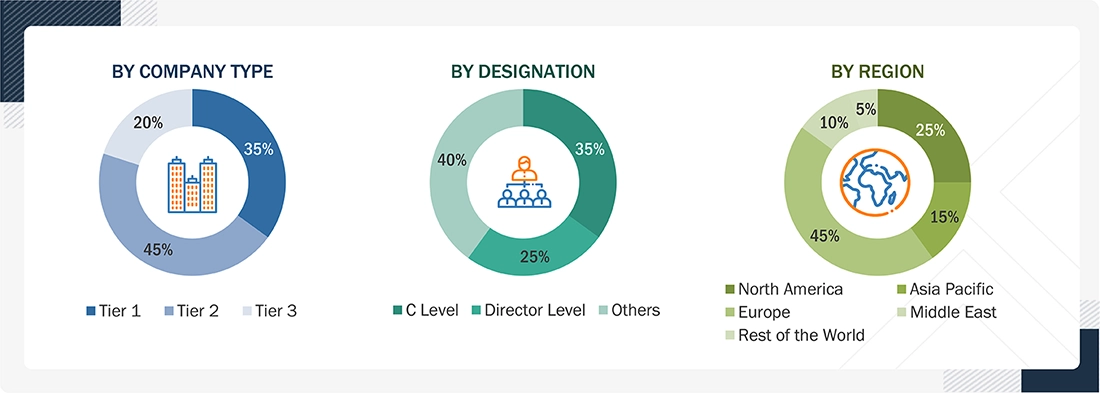

Primary Research

After understanding the automotive semiconductor market scenario through secondary research, extensive primary research has been conducted. Several primary interviews have been conducted with key opinion leaders from demand- and supply-side vendors across four major regions—North America, Europe, Asia Pacific, and RoW. Approximately 25% of the primary interviews have been conducted with the demand-side vendors and 75% with the supply-side vendors. Primary data was collected mainly through telephonic interviews, which comprised 80% of the total primary interviews; questionnaires and emails were also used to collect the data.

After successful interaction with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings of our primary research. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, the top-down and bottom-up approaches and data triangulation methods have been used to estimate and validate the size of the automotive semiconductor market and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Identifying vehicle production volumes across all vehicle types (passenger cars, light commercial vehicles, and heavy commercial vehicles) by region and country, including data from major automotive manufacturing hubs

- Analyzing semiconductor content per vehicle across different vehicle types, with consideration for varying content levels based on feature sets and electrification levels

- Studying semiconductor adoption trends across vehicle types and propulsion systems, including the shift from ICE to electric vehicles, ADAS penetration rates, connectivity requirements, and safety mandates across different regions and vehicle segments

- Tracking recent automotive semiconductor market developments, including supply chain disruptions, OEM production adjustments, semiconductor shortages and recovery patterns, new vehicle platform launches with advanced semiconductor content, and regional manufacturing capacity expansions

- Conducting multiple discussions with key opinion leaders across automotive OEMs, Tier 1 suppliers, semiconductor manufacturers, and industry analysts to understand real-time adoption dynamics, semiconductor content evolution, regional production shifts, and the impact of electrification and autonomous driving on semiconductor demand

- Validating market estimates through in-depth consultations with industry experts, ranging from semiconductor design engineers at leading chipmakers to procurement heads at major automotive OEMs and technical advisors at Tier 1 system suppliers, and finally aligning insights with domain experts at MarketsandMarkets to ensure robustness and precision in market projections

Drone (UAV) Payload Market: Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size by the market size estimation process explained in the earlier section, the overall automotive semiconductor market has been divided into several segments and subsegments. The data triangulation and market breakdown procedures have been used to complete the overall market engineering process and arrive at the exact statistics for all segments, wherever applicable. The data was triangulated by studying various factors and trends from the perspectives of demand and supply. Along with data triangulation and market breakdown, the market has been validated by top-down and bottom-up approaches.

Market Definition

Automotive semiconductors are specialized electronic components, including ICs, sensors, power devices, microcontrollers, and memory chips, that enable and optimize key vehicle functions across powertrain, safety, infotainment, connectivity, and driver-assistance systems. Manufactured from silicon, gallium arsenide, or wide bandgap materials such as SiC and GaN, they are increasingly critical in hybrid and electric vehicles, advanced driver-assistance systems (ADAS), and autonomous driving platforms. Vehicle electrification, regulatory safety and emissions regulations, rising adoption of software-defined vehicles, and growing demand for in-vehicle connectivity and infotainment drive market growth. As automotive technology evolves, semiconductors form the foundation for efficiency, intelligence, and sustainability in next-generation mobility.

Key Stakeholders

- Raw Material Suppliers

- Drone Payload Component Suppliers

- Drone Payload Manufacturers

- System Integrators

- Maintenance, Repair, and Overhaul (MRO) Companies

- UAV Platform OEMs

- Investors and Financial Community Professionals

- Research Organizations

Report Objectives

- To define, describe, and forecast the drone (UAV) payload market based on payload type, payload weight, application, platform, end use, point of sale, and region

- To forecast the size of different segments of the market with respect to North America, Europe, Asia Pacific, Middle East, and the Rest of the World

- To identify and analyze the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To identify industry trends, market trends, and technology trends currently prevailing in the market

- To analyze micro markets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze the degree of competition in the market by analyzing recent developments adopted by leading market players

- To provide a detailed competitive landscape of the market, along with a ranking analysis of key players, and an analysis of startup companies in the market

- To strategically profile the key market players and comprehensively analyze their core competencies

- To provide a detailed competitive landscape of the drone (UAV) payload market, along with a market share analysis and revenue analysis of key players

Customization Options

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the drone (UAV) payload market

- Profiling of other market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the drone (UAV) payload market

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Drone (UAV) Payload Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Drone (UAV) Payload Market