Commercial Greenhouse Market Size, Share, Industry Growth, Trends Report by Type (Glass Greenhouse, Plastic Greenhouse), Crop Type (Fruits, Vegetables, Flowers & Ornamentals, Nursery Crops), Equipment (Hardware, Software & Services) and Region - Global Forecast to 2028

Commercial Greenhouse Market Size

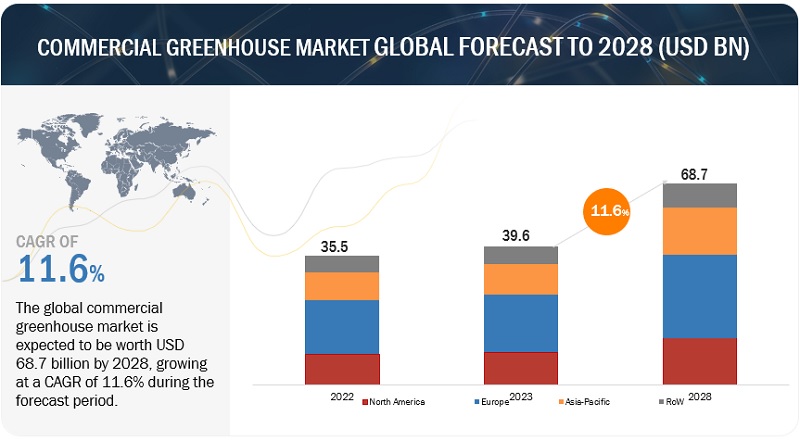

Global commercial greenhouse market size was accounted for USD 39.6 Billion in 2023 and is expected to hit around USD 68.7 Billion by 2028, growing at a CAGR of 11.6% during the forecast period 2023-2028. Several important factors augment the demand for commercial greenhouse solutions and services on a global scale. Commercial greenhouses provide the opportunity to lengthen growing seasons, lessen the effects of unfavorable weather, and ensure reliable crop harvests. Additionally, as consumer's awareness of the provenance and quality of their food grows, the transparency and traceability provided by greenhouse-grown products find a significant market resonance.

To know about the assumptions considered for the study, Request for Free Sample Report

Commercial Greenhouse Market Trends & Dynamics

Driver: Need for higher yields using limited space and water.

As the population expansion continues, available arable land becomes insufficient, making efficient land utilization a critical concern. Commercial greenhouses address this challenge by maximizing space utilization through vertical farming, hydroponic, and aeroponic systems, allowing for multiple layers of cultivation within a compact area. This spatial efficiency enables growers to achieve substantially higher crop yields compared to traditional open-field methods. Moreover, water scarcity is a compelling issue across many regions, necessitating the adoption of water-efficient cultivation techniques. Commercial greenhouses excel in this aspect by enabling precise control over irrigation, preventing water wastage through targeted delivery directly to plant roots. Additionally, advanced irrigation systems like drip and recirculation systems within greenhouses optimize water use and reduce evaporation losses. Thus, these factors are anticipated to drive the market of commercial greenhouses in the upcoming years.

Restraint: Deployment of expensive systems in commercial greenhouses

Commercial greenhouses are highly expensive owing to the use of several high-cost systems, such as HVAC systems, control systems, LED grow lights and sensors. Each LED grow light unit contains an array of LEDs specially designed for greenhouse applications, which increases their overall costs. These units contain different types of LED lights with variations in terms of wattage and wavelengths to provide the required light spectrum for the optimal growth of specific plant species.

It can be too expensive to make the initial investment needed to build up advanced infrastructure and equipment within greenhouses. Potential investors may be discouraged from entering the market by high expenses, especially smaller-scale farmers or those in emerging regions. This can restrict market commercial greenhouse market growth and accessibility. Additionally, ongoing operational expenses associated with maintaining and running these advanced systems can be substantial. Energy-intensive climate control, lighting, and automation systems contribute to elevated utility bills. Thus, these factors could act as a restraint for market growth.

Opportunity: Rise in demand for floriculture and ornamental horticulture applications.

The increasing demand for floriculture and ornamental horticulture presents a significant opportunity for the commercial greenhouse market. As urbanization and disposable incomes rise across the globe, there is a growing interest in enhancing living and working spaces with aesthetically pleasing plants and flowers. Commercial greenhouses provide an ideal environment for cultivating a wide variety of flowers, plants, and ornamental foliage with precision and control.

To know about the assumptions considered for the study, download the pdf brochure

Commercial greenhouses' capacity to provide ideal growing conditions independent of the climate outside is expected to benefit commercial greenhouse market growth. This makes it possible to grow flowers and decorative plants all year long, satisfying demand for these items during off-seasons or in areas with unfavorable weather. Additionally, greenhouses shield sensitive plants from harsh weather, pests, and illnesses, producing goods of superior quality and greater aesthetic appeal.

Challenge: Risk of equipment failure and delays in the learning curve of growers

The high risk of equipment failure and the resultant possibility of limited production is hindering the adoption of greenhouse farming. For instance, failure of a part of the system, such as a water pump, may lead to the death of the plants within a matter of hours. Without soil, there is no water or nutrient storage for plants to feed on. Much like any typical grow room, in case of a power outage, the backup must be ready. This might result in additional costs, consequently affecting the cost of production and profit margins.

The delay in the learning curve of users also acts as a challenging factor in the growth of this market. For a large portion of the population that is accustomed to traditional ways and farming techniques, it becomes difficult to adopt modern and newer techniques, such as hydroponics. They are required to spend considerable time to understand the systems. Delays in getting familiar with the systems can hamper production. Delayed learning curves among growers thus pose a potential challenge to market growth.

Commercial Greenhouse Market Ecosystem

Leading companies in this market include well-established, financially stable solution providers of commercial greenhouse products and service providers. These companies have been operating in the market for several years and possess a diversified service portfolio, state-of-the-art laboratory & technologies, and strong global sales and marketing networks. Prominent companies in this market include Berry Global Group, Inc (US), Signify Holding (Netherlands), Heliospectra AB (Sweden), PLASTIKA KRITIS S.A. (Greece), EVERLIGHT ELECTRONICS CO., LTD (Taiwan), Prospiant (US), RICHEL GROUP (France), Argus Control Systems Limited (Canada), Certhon (Netherlands), LOGIQS.B.V. (Netherlands), Lumigrow, Inc (Canada), Agra Tech, Inc (US), Hort Americas (US), Top Greenhouses (Israel), and Stuppy Greenhouse (US).

Commercial Greenhouse Market Segment Analysis

Within the greenhouse type segment, plastic greenhouse is projected to have the highest market growth rate during the forecast period.

Alternatives to conventional glass structures that are more affordable include plastic greenhouses. Plastic greenhouses often have cheaper construction costs and material costs, making them more affordable for a wider range of producers, including small and medium-sized businesses. This accessibility promotes broader market adoption and expansion.

Furthermore, greenhouses made of plastic have great insulating capabilities. They can hold onto heat more effectively than glass buildings, which results in energy savings while controlling temperature. This thermal efficiency helps maintain favorable growing conditions and lowers the running costs for heating and cooling. Thus, such factors contribute to the growth of the market, and the plastic greenhouse category is the fastest-growing segment in the type segment. It is expected to propel the market growth further.

Within the equipment segment, hardware is predicted to have the largest market value during the forecast period.

The hardware segment is predicted to have the largest market value in the commercial greenhouse segment due to its fundamental role in establishing and maintaining greenhouse structures. Typically, the hardware components are made to survive environmental obstacles, including wind, snow, rain, and freezing temperatures. High-quality hardware components also protect the greenhouse structure's durability and dependability, decreasing the need for frequent repairs or replacements and helping greenhouse operators save money overall. Moreover, the expansion of commercial greenhouse farming into regions with varying climates and agricultural practices creates a demand for adaptable and reliable hardware solutions.

Within the crop-type segment, vegetables are anticipated to have the leading market share during the forecast period.

Greenhouse environments enable precise control over factors such as temperature, humidity, light, and nutrients. This level of control enhances crop growth, leading to higher yields and superior-quality produce. Consumers are increasingly seeking nutritious and visually appealing vegetables, which are more reliably achieved within greenhouse farming techniques. Since vegetables are utilized across the majority of dishes and are considered a staple food across the world, thus there is a never decreasing demand for vegetables, which is expected to drive the market of commercial greenhouses in the upcoming years.

Commercial Greenhouse Industry Regional Analysis

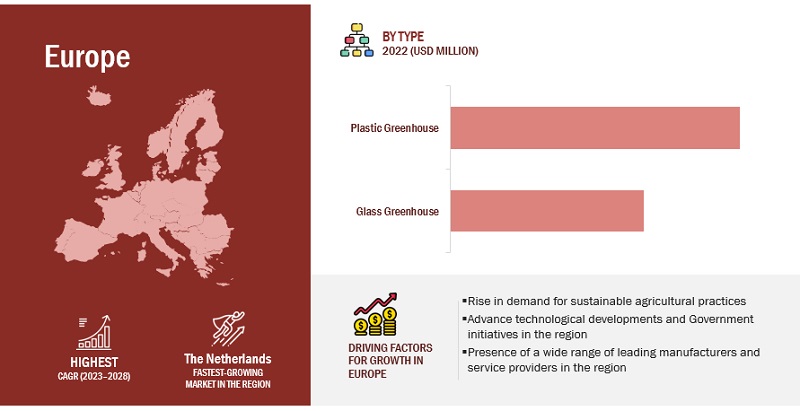

Europe is expected to have the largest market share during the commercial greenhouse market forecast period.

Due to urbanization and other land-use pressures, certain European countries have a limited amount of arable land accessible. Commercial greenhouses, therefore, offer an effective approach to maximize food production in a constrained location, making them a workable answer to the problem of food security. European institutions, universities, and research organizations are at the forefront of agricultural research and innovation. This has led to the development of advanced greenhouse technologies, cultivation practices, and crop varieties that enhance productivity and sustainability. Moreover, the developed commercial greenhouse sector in Europe enables surplus output that may be exported to other regions, which helps the area dominate the market.

Top Commercial Greenhouse Companies

The key players in this market include Berry Global Group, Inc (US), Signify Holding (Netherlands), Heliospectra AB (Sweden), PLASTIKA KRITIS S.A. (Greece), EVERLIGHT ELECTRONICS CO., LTD (Taiwan), Prospiant (US), RICHEL GROUP (France), Argus Control Systems Limited (Canada), Certhon (Netherlands), LOGIQS.B.V. (Netherlands), Lumigrow, Inc (Canada), Agra Tech, Inc (US), Hort Americas (US), Top Greenhouses (Israel), Stuppy Greenhouse (US). These companies have been focusing on expanding their market presence, enhancing their solutions, and partnering with many channel partners and technology companies to cater to consumers across the globe. The deep roots of these players in the market and their robust offerings are among the major factors that have helped them achieve major sales and revenues in the global commercial greenhouse market.

Scope of the Commercial Greenhouse Market Report

|

Report Metric |

Details |

|

Market size value in 2023 |

USD 39.6 billion |

|

Market size prediction in 2028 |

USD 68.7 billion |

|

Growth rate |

CAGR of 11.6% from 2023–2028 |

|

Forecast units |

Value (USD) |

|

Segments Covered |

Type, Equipment, Crop Type, And Region. |

|

Regions covered |

North America, Europe, Asia Pacific, South America, and Rest of the World (RoW) |

|

Companies covered |

Berry Global (US), Signify Holdings (Netherlands), Heliospectra AB (Sweden), Plastika Kritis S.A. (Greece) Richel Group (France), Argus Control Systems Limited (Canada), Certhon (Netherlands), Logiqs B.V. (Netherlands), Agra Tech, Inc (US), and Hort Americas LLC (US). |

Global Commercial Greenhouse Market Report Segmentation

This research report categorizes the global greenhouse market report based on type, equipment, crop type, and region.

|

Aspect |

Details |

|

Based on Type |

|

|

Based on the Equipment |

|

|

Based on the Crop Type |

|

|

Based on the Region |

|

Commercial Greenhouse Market: Recent Developments

- In August 2023, Certhon (Netherlands) acquired DENSO (Japan), which helped Certhon to accelerate the global expansion of its agricultural production business by leveraging Certhon's advanced horticultural technologies to develop innovative farm models, address food challenges, and enhance the agricultural value chain.

- In May 2022, Signify Holding (India) acquired the rights of Fluence (US). This acquisition allowed Signify Holding to expand its product offering in indoor farming lighting solutions that help Signify’s position n in the attractive North American horticulture lighting market.

- In May 2021, Heliospectra AB (Sweden) partnered with Harahara Inc. (Japan). The partnership enabled Heliospectra AB to sell it to bring light automation to the Japanese market, thereby expanding its geographical presence. The partnership is expected to augment Heliospectra AB's long-term growth strategy in new geographies across the Japanese market.

- In December 2020, Prospiant (US) acquired Sunfig Corporation (US), which helps Prospiant by providing software solutions to the market Sunfig Corporation is a provider of software solutions that optimize solar energy investments through upstream design, performance, and financial modeling.

Frequently Asked Questions (FAQ):

What is commercial greenhouse?

A commercial greenhouse is a controlled environment designed for the cultivation of crops on a larger, commercial scale. These structures are specifically built to optimize growing conditions, providing controlled temperature, humidity, light, and other environmental factors to enhance crop production.

Which players are involved in manufacturing of commercial greenhouse? What are their major strategies to strengthen their market presence?

The key players in this market include Berry Global Group, Inc (US), Signify Holding (Netherlands), Heliospectra AB (Sweden), PLASTIKA KRITIS S.A. (Greece), EVERLIGHT ELECTRONICS CO., LTD (Taiwan), Prospiant (US), RICHEL GROUP (France), Argus Control Systems Limited (Canada), Certhon (Netherlands), LOGIQS.B.V. (Netherlands), Lumigrow, Inc (Canada), Agra Tech, Inc (US), Hort Americas (US), Top Greenhouses (Israel), Stuppy Greenhouse (US). Companies are focusing on expanding their production facilities by entering collaborations and partnerships as well as by launching new products to expand their businesses and increase their consumer base across various geographical areas. New product launches due to extensive research & development (R&D) initiatives, geographical expansion to tap the potential of emerging economies, and strategic acquisitions to gain a foothold over the large extent of the supply chain are the key strategies adopted by companies in the commercial greenhouse market.

What crops are most likely to be grown in commercial production greenhouses?

Common crops grown in commercial greenhouses include tomatoes, cucumbers, peppers, lettuce, herbs, strawberries, flowers, berries, microgreens, and specialty crops like saffron and medicinal herbs.

What are the drivers and opportunities for the commercial greenhouse market?

Government initiatives to promote smart agricultural practices, the need for higher yields using limited space & water, and increasing demand for food and climate change challenges are some of the major drivers of the commercial greenhouse market. The upcoming opportunities include a rising preference for vegetables and fruits in developing countries.

Which region is expected to hold the highest market share?

The market in Europe will dominate the market share in 2023, showcasing strong demand for commercial greenhouse farming in the region. Over the predicted period, it is anticipated that the regional market will continue to be the largest. This can be linked to the initiatives by the European governments to provide support and subsidies for sustainable agriculture practices, including greenhouse cultivation. These incentives encourage growers to invest in commercial greenhouse technology, further driving market growth.

What are the key technology trends prevailing in the commercial greenhouse market?

The agriculture industry is experiencing technological innovations as companies engaged in the commercial greenhouse market are offering faster and more accurate technologies such as solid-state lighting (SSL) technology. The use of SSL technology in horticulture helps save energy and enhance plant growth. SSL devices are unique light sources offering various emission spectrums and advantages. Higher SSL efficiency decreases radiated heat. Reduced heat allows for lighting to be placed closer to the plant, increasing crop density and lowering water consumption. White SSL provides a continuous spectrum from IR to UV, replicating the sun and allowing indoor growth in secure, controlled environments. Monochromatic SSL's narrow wavelengths and instant dimming or on/off features allow for excellent spectral control. Light can be matched to the plant's unique spectra requirement, and the light spectrum can be adjusted to enhance the growth stage.

What is the total CAGR expected to be recorded for the commercial greenhouse market during 2023-2028?

The CAGR is expected to record a CAGR of 11.6% from 2023-2028.

What type of market failure is climate change greenhouse gases?

Climate change and greenhouse gases represent an environmental externality, specifically a negative externality. It's a market failure where the true costs of emissions are not fully reflected in market prices, leading to overconsumption of goods and services that contribute to climate change.

Who is the target market for a greenhouse?

The target market for a greenhouse includes farmers, gardeners, and agricultural businesses. Greenhouses are designed to create a controlled environment for plant growth, providing optimal conditions for various crops. This can be beneficial for both commercial agriculture and individual gardeners who want to extend the growing season, protect plants from adverse weather, or cultivate specific crops that require precise environmental conditions. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MACROECONOMIC INDICATORSRISE IN GLOBAL POPULATION AND FOOD REQUIREMENTSDECLINE IN PER CAPITA ARABLE LAND

-

5.3 MARKET DYNAMICSDRIVERS- Growing demand for food and climate change challenges- Need for higher yields using limited space and water- Government initiatives to promote smart agricultural practicesRESTRAINTS- Deployment of expensive systems in commercial greenhouses- Limited variety of crops suited to greenhouse farmingOPPORTUNITIES- Increase in demand for floriculture and ornamental horticulture applications- Rising preference for vegetables and fruits in developing countries- R&D initiatives to improve greenhouse farming methods- Growing worldwide environmental concernsCHALLENGES- Lack of temperature control systems to maintain optimum crop production conditions in warm regions- Risk of equipment failure and delays in learning curve of growers

- 6.1 INTRODUCTION

-

6.2 VALUE CHAIN ANALYSISRESEARCH AND PRODUCT DEVELOPMENTSOURCINGPRODUCTIONMARKETING, SALES, LOGISTICS, AND RETAIL

- 6.3 SUPPLY CHAIN ANALYSIS

-

6.4 TECHNOLOGY ANALYSISSOLID-STATE LIGHTING TECHNOLOGYADVANCEMENTS IN TECHNOLOGY- Mobile applications and data tracking for assessment of real-time informationM2M SOLUTIONS- Increasing use of M2M solutions in greenhouse farming by key market playersAGRICULTURAL DRONES/UNMANNED AERIAL VEHICLES (UAVS)

-

6.5 PATENT ANALYSISLIST OF MAJOR PATENTS PERTAINING TO COMMERCIAL GREENHOUSES, 2018–2023

-

6.6 MARKET ECOSYSTEMDEMAND SIDESUPPLY SIDE

- 6.7 TRADE ANALYSIS

- 6.8 KEY CONFERENCES & EVENTS

-

6.9 TRENDS/DISRUPTIONS IMPACTING BUYERS

-

6.10 AVERAGE SELLING PRICEINTRODUCTION

-

6.11 CASE STUDY ANALYSISLUMIGROW PILOT CUSTOMERS USED GROW LIGHT SENSORS TO MANAGE LIGHTCERTHON BUILT HIGH-TECH GREENHOUSE IN JAPAN THAT WAS RESISTANT TO EARTHQUAKES

-

6.12 PORTER’S FIVE FORCES ANALYSIS: COMMERCIAL GREENHOUSE MARKETTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

6.13 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.14 REGULATORY FRAMEWORKNORTH AMERICA- USEUROPEAN UNION- European Committee for Standardization (CEN)ASIA PACIFIC- India- ChinaSOUTH AMERICA- Brazil- ChileMIDDLE EAST- Egypt- UAE

- 6.15 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1 INTRODUCTION

-

7.2 GLASS GREENHOUSELIMITED DEPENDENCY ON SUPPLEMENTAL LIGHTING LIKELY TO DRIVE DEMANDHORTICULTURE GLASS- Increasing grower preference for low-priced glass providing natural light to greenhouses to drive demandOTHER GREENHOUSE GLASS- Increased application scope in greenhouse sector to propel market

-

7.3 PLASTIC GREENHOUSELOW COST AND MOISTURE-RETAINING PROPERTIES EXPECTED TO DRIVE MARKETPOLYETHYLENE- Low cost of polyethylene sheets to drive demand in emerging marketsPOLYCARBONATE- Durability and low maintenance requirements of polycarbonate to drive demandPOLYMETHYL METHACRYLATE (PMMA)- PMMA to witness growing demand due to long life and environment-friendly properties

- 8.1 INTRODUCTION

-

8.2 HARDWAREDIVERSE CLIMATE CONDITIONS AND RISING ADOPTION OF MODERN FARMING TECHNIQUES TO DRIVE DEMANDCLIMATE CONTROL SYSTEMS- Increased farmer interest in monitoring yield quality and quantity to drive demand for climate control systemsLIGHTING SYSTEMS- Increased demand for LED lights for energy reduction and better operational efficiency to drive demandCOMMUNICATION SYSTEMS- Rising adoption of advanced technologies, such as IoT and AI, in greenhouse farms to drive demand for communication systemsSENSORS- Sensors to drive adoption of more precise agricultural strategiesSYSTEM CONTROLS- Increasing scope for monitoring greenhouse operations to create growth opportunitiesIRRIGATION SYSTEMS- Need for efficient use of water expected to propel marketOTHER HARDWARE- Focus on shortening supply chain through farm-to-fork concept to drive market

-

8.3 SOFTWARE & SERVICESINCREASING SCOPE FOR AUTOMATION AND SMART FARMING TO CREATE GROWTH OPPORTUNITIES FOR MARKET

- 9.1 INTRODUCTION

-

9.2 VEGETABLESPOSSIBILITY OF YEAR-ROUND VEGETABLE PRODUCTION IN GREENHOUSES TO DRIVE MARKETROOTS & TUBERS- Rising application of roots & tubers likely to drive commercial greenhouse marketBRASSICAS- Growing demand for indoor vertical farms to increase yield of leafy greens to boost marketOTHER VEGETABLES- Rising demand for hydroponically produced vegetables to spur overall commercial greenhouses market

-

9.3 FRUITSDEMAND FOR ORGANIC FRUITS TO DRIVE MARKET GROWTHCITRUS FRUITS- Adoption of high-end technologies to produce better yields to meet demandBERRIES- Rising production of strawberries and blueberries in greenhouses to drive marketOTHER FRUIT TYPES- Optimum lighting conditions and climate control systems in greenhouses to facilitate rapid crop cultivation

-

9.4 FLOWERS & ORNAMENTALSGROWING CONSUMPTION OF FLOWERS & ORNAMENTALS FOR AROMATHERAPY AND DECORATION PURPOSES TO DRIVE MARKET

-

9.5 NURSERY CROPSGREENHOUSES TO PROVIDE EXTRA CARE TO NURSERY CROPS AGAINST ENVIRONMENTAL FACTORS

- 9.6 OTHER CROP TYPES

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACT ANALYSISUS- Dynamic market to bolster demand for commercial greenhousesCANADA- High awareness of greenhouse farming techniques to fuel growth prospectsMEXICO- Rising demand for greenhouse production among farmers and consumers to drive market

-

10.3 EUROPEEUROPE: RECESSION IMPACT ANALYSISSPAIN- Increasing investments in state-of-the-art greenhouses to increase vegetable exports to drive marketTURKEY- Growing demand for hydroponically cultivated products likely to drive overall market in TurkeyAUSTRIA- Cold temperatures in Austria to drive demand for commercial greenhousesITALY- Growing demand for out-of-season products in Italy to boost need for commercial greenhousesNETHERLANDS- Increasing inclination toward efficient farming to enhance market growth in NetherlandsREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACT ANALYSISCHINA- Growing government initiatives and private investments in China to drive marketSOUTH KOREA- Entry of multiple key players and government initiatives to promote installation of smart greenhouses in South KoreaJAPAN- Collaborative efforts to promote greenhouse farming to boost demand in JapanAUSTRALIA- Rising awareness leading to demand to upgrade current greenhouse technologies in AustraliaINDIA- Increasing investments from key players to propel market growth in IndiaREST OF ASIA PACIFIC

-

10.5 SOUTH AMERICASOUTH AMERICA: RECESSION IMPACT ANALYSISBRAZIL- Increased emphasis on agricultural output to drive market in BrazilARGENTINA- Government initiatives in Argentina to boost market for commercial greenhousesREST OF SOUTH AMERICA

-

10.6 REST OF THE WORLD (ROW)ROW: RECESSION IMPACTMIDDLE EAST- Increasing demand for fresh vegetables in Middle East to drive demand for commercial greenhousesAFRICA- Low- or mid-tech level affordable greenhouses to create growth opportunities in Africa

- 11.1 OVERVIEW

- 11.2 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

- 11.3 MARKET SHARE ANALYSIS, 2022

- 11.4 KEY PLAYERS’ ANNUAL REVENUE VS. GROWTH

- 11.5 KEY PLAYERS’ EBITDA

- 11.6 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.7 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

-

11.8 COMPANY EVALUATION MATRIX (KEY PLAYERS)STARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

- 11.9 COMPANY FOOTPRINT

-

11.10 STARTUP/SME EVALUATION QUADRANTPROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIESCOMPETITIVE BENCHMARKINGCOMPETITIVE SCENARIODEALSOTHERS

-

12.1 KEY PLAYERSBERRY GLOBAL GROUP, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSIGNIFY HOLDING- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHELIOSPECTRA AB- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPLASTIKA KRITIS S.A.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewEVERLIGHT ELECTRONICS CO., LTD- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGIBRALTAR INDUSTRIES- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewRICHEL GROUP- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewARGUS CONTROL SYSTEMS LIMITED- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCERTHON- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLOGIQS B.V.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLUMIGROW, INC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAGRA TECH, INC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHORT AMERICAS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTOP GREENHOUSES- Business overview- Products/Solutions/Services offered- MnM viewSTUPPY GREENHOUSE- Business overview- Products/Solutions/Services offered- Recent developments- MnM view

-

12.2 OTHER PLAYERS/STARTUPSTHE GLASSHOUSE COMPANY PTY LTD- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDECLOET GREENHOUSE MANUFACTURING LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewEUROPROGRESS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLUITEN GREENHOUSES- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSOTRAFA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNOBUTEC B.VAMMERLAAN CONSTRUCTIONLUDY.COMSAVEER BIOTECHHARFORD

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

-

13.3 SMART AGRICULTURE MARKETMARKET DEFINITIONMARKET OVERVIEWSMART AGRICULTURE MARKET, BY OFFERING

-

13.4 SMART GREENHOUSE MARKETMARKET DEFINITIONMARKET OVERVIEWSMART GREENHOUSE MARKET, BY TYPE

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2019–2022

- TABLE 2 COMMERCIAL GREENHOUSE MARKET SNAPSHOT, 2023 VS. 2028

- TABLE 3 OVERVIEW OF PATENTS GRANTED FOR COMMERCIAL GREENHOUSES

- TABLE 4 COMMERCIAL GREENHOUSE MARKET ECOSYSTEM

- TABLE 5 IMPORT VALUE OF POLYCARBONATES FOR KEY COUNTRIES, 2022 (USD THOUSAND)

- TABLE 6 EXPORT VALUE OF POLYCARBONATES FOR KEY COUNTRIES, 2022 (USD THOUSAND)

- TABLE 7 IMPORT VALUE OF POLYETHYLENE FOR KEY COUNTRIES, 2022 (USD THOUSAND)

- TABLE 8 EXPORT VALUE OF POLYETHYLENE FOR KEY COUNTRIES, 2021 (USD THOUSAND)

- TABLE 9 IMPORT VALUE OF POLYMETHYL METHACRYLATE FOR KEY COUNTRIES, 2022 (USD THOUSAND)

- TABLE 10 EXPORT VALUE OF POLYMETHYL METHACRYLATE FOR KEY COUNTRIES, 2022 (USD THOUSAND)

- TABLE 11 COMMERCIAL GREENHOUSE MARKET: CONFERENCES & EVENTS, 2023–2024

- TABLE 12 AVERAGE SELLING PRICE OF KEY PLAYERS FOR COMMERCIAL GREENHOUSE TYPES (USD)

- TABLE 13 GLASS GREENHOUSE: AVERAGE SELLING PRICE, BY REGION, 2018–2022 (USD/SQ. FT.)

- TABLE 14 PLASTIC GREENHOUSE: AVERAGE SELLING PRICE, BY REGION, 2018–2022 (USD/SQ. FT.)

- TABLE 15 PORTER’S FIVE FORCES ANALYSIS

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 EQUIPMENT

- TABLE 17 KEY BUYING CRITERIA FOR TOP TWO COMMERCIAL GREENHOUSE TYPES

- TABLE 18 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 24 COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 25 COMMERCIAL GLASS GREENHOUSE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 26 COMMERCIAL GLASS GREENHOUSE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 COMMERCIAL GLASS GREENHOUSE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 28 COMMERCIAL GLASS GREENHOUSE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 29 HORTICULTURE GLASS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 30 HORTICULTURE GLASS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 OTHER GREENHOUSE GLASS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 32 OTHER GREENHOUSE GLASS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 33 COMMERCIAL PLASTIC GREENHOUSE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 34 COMMERCIAL PLASTIC GREENHOUSE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 COMMERCIAL PLASTIC GREENHOUSE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 36 COMMERCIAL PLASTIC GREENHOUSE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 37 POLYETHYLENE PLASTIC GREENHOUSE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 38 POLYETHYLENE PLASTIC GREENHOUSE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 POLYCARBONATE PLASTIC GREENHOUSE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 40 POLYCARBONATE PLASTIC GREENHOUSE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 POLYMETHYL METHACRYLATE PLASTIC GREENHOUSE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 42 POLYMETHYL METHACRYLATE PLASTIC GREENHOUSE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 COMMERCIAL GREENHOUSE MARKET, BY EQUIPMENT, 2018–2022 (USD MILLION)

- TABLE 44 COMMERCIAL GREENHOUSE MARKET, BY EQUIPMENT, 2023–2028 (USD MILLION)

- TABLE 45 COMMERCIAL GREENHOUSE HARDWARE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 46 COMMERCIAL GREENHOUSE HARDWARE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 COMMERCIAL GREENHOUSE HARDWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 48 COMMERCIAL GREENHOUSE HARDWARE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 49 COMMERCIAL GREENHOUSE SOFTWARE & SERVICES MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 50 COMMERCIAL GREENHOUSE SOFTWARE & SERVICES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 COMMERCIAL GREENHOUSE MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 52 COMMERCIAL GREENHOUSE MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 53 COMMERCIAL GREENHOUSE MARKET FOR VEGETABLES, BY REGION, 2018–2022 (USD MILLION)

- TABLE 54 COMMERCIAL GREENHOUSE MARKET FOR VEGETABLES, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 COMMERCIAL GREENHOUSE MARKET FOR VEGETABLES, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 56 COMMERCIAL GREENHOUSE MARKET FOR VEGETABLES, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 57 COMMERCIAL GREENHOUSE MARKET FOR FRUITS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 58 COMMERCIAL GREENHOUSE MARKET FOR FRUITS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 COMMERCIAL GREENHOUSE MARKET FOR FRUITS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 60 COMMERCIAL GREENHOUSE MARKET FOR FRUITS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 61 COMMERCIAL GREENHOUSE MARKET FOR FLOWERS & ORNAMENTALS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 62 COMMERCIAL GREENHOUSE MARKET FOR FLOWERS & ORNAMENTAL, BY REGION, 2023–2028 (USD MILLION)

- TABLE 63 COMMERCIAL GREENHOUSE MARKET FOR NURSERY CROPS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 64 COMMERCIAL GREENHOUSE MARKET FOR NURSERY CROPS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 65 COMMERCIAL GREENHOUSE MARKET FOR OTHER CROP TYPES, BY REGION, 2018–2022 (USD MILLION)

- TABLE 66 COMMERCIAL GREENHOUSE MARKET FOR OTHER CROP TYPES, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 COMMERCIAL GREENHOUSE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 68 COMMERCIAL GREENHOUSE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 69 NORTH AMERICA: COMMERCIAL GREENHOUSE MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 70 NORTH AMERICA: COMMERCIAL GREENHOUSE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 71 NORTH AMERICA: COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 72 NORTH AMERICA: COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 73 NORTH AMERICA: COMMERCIAL GREENHOUSE MARKET, BY GLASS GREENHOUSE, 2018–2022 (USD MILLION)

- TABLE 74 NORTH AMERICA: COMMERCIAL GREENHOUSE MARKET, BY GLASS GREENHOUSE, 2023–2028 (USD MILLION)

- TABLE 75 NORTH AMERICA: COMMERCIAL GREENHOUSE MARKET, BY PLASTIC GREENHOUSE, 2018–2022 (USD MILLION)

- TABLE 76 NORTH AMERICA: COMMERCIAL GREENHOUSE MARKET, BY PLASTIC GREENHOUSE, 2023–2028 (USD MILLION)

- TABLE 77 NORTH AMERICA: COMMERCIAL GREENHOUSE MARKET, BY EQUIPMENT, 2018–2022 (USD MILLION)

- TABLE 78 NORTH AMERICA: COMMERCIAL GREENHOUSE MARKET, BY EQUIPMENT, 2023–2028 (USD MILLION)

- TABLE 79 NORTH AMERICA: COMMERCIAL GREENHOUSE MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 80 NORTH AMERICA: COMMERCIAL GREENHOUSE MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 81 US: COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 82 US: COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 83 US: COMMERCIAL GREENHOUSE MARKET, BY GLASS GREENHOUSE, 2018–2022 (USD MILLION)

- TABLE 84 US: COMMERCIAL GREENHOUSE MARKET, BY GLASS GREENHOUSE, 2023–2028 (USD MILLION)

- TABLE 85 US: COMMERCIAL GREENHOUSE MARKET, BY PLASTIC GREENHOUSE, 2018–2022 (USD MILLION)

- TABLE 86 US: COMMERCIAL GREENHOUSE MARKET, BY PLASTIC GREENHOUSE, 2023–2028 (USD MILLION)

- TABLE 87 CANADA: COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 88 CANADA: COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 89 CANADA: COMMERCIAL GREENHOUSE MARKET, BY GLASS GREENHOUSE, 2018–2022 (USD MILLION)

- TABLE 90 CANADA: COMMERCIAL GREENHOUSE MARKET, BY GLASS GREENHOUSE, 2023–2028 (USD MILLION)

- TABLE 91 CANADA: COMMERCIAL GREENHOUSE MARKET, BY PLASTIC GREENHOUSE, 2018–2022 (USD MILLION)

- TABLE 92 CANADA: COMMERCIAL GREENHOUSE MARKET, BY PLASTIC GREENHOUSE, 2023–2028 (USD MILLION)

- TABLE 93 MEXICO: COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 94 MEXICO: COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 95 MEXICO: COMMERCIAL GREENHOUSE MARKET, BY GLASS GREENHOUSE, 2018–2022 (USD MILLION)

- TABLE 96 MEXICO: COMMERCIAL GREENHOUSE MARKET, BY GLASS GREENHOUSE, 2023–2028 (USD MILLION)

- TABLE 97 MEXICO: COMMERCIAL GREENHOUSE MARKET, BY PLASTIC GREENHOUSE, 2018–2022 (USD MILLION)

- TABLE 98 MEXICO: COMMERCIAL GREENHOUSE MARKET, BY PLASTIC GREENHOUSE, 2023–2028 (USD MILLION)

- TABLE 99 EUROPE: COMMERCIAL GREENHOUSE MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 100 EUROPE: COMMERCIAL GREENHOUSE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 101 EUROPE: COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 102 EUROPE: COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 103 EUROPE: COMMERCIAL GREENHOUSE MARKET, BY GLASS GREENHOUSE, 2018–2022 (USD MILLION)

- TABLE 104 EUROPE: COMMERCIAL GREENHOUSE MARKET, BY GLASS GREENHOUSE, 2023–2028 (USD MILLION)

- TABLE 105 EUROPE: COMMERCIAL GREENHOUSE MARKET, BY PLASTIC GREENHOUSE, 2018–2022 (USD MILLION)

- TABLE 106 EUROPE: COMMERCIAL GREENHOUSE MARKET, BY PLASTIC GREENHOUSE, 2023–2028 (USD MILLION)

- TABLE 107 EUROPE: COMMERCIAL GREENHOUSE MARKET, BY EQUIPMENT, 2018–2022 (USD MILLION)

- TABLE 108 EUROPE: COMMERCIAL GREENHOUSE MARKET, BY EQUIPMENT, 2023–2028 (USD MILLION)

- TABLE 109 EUROPE: COMMERCIAL GREENHOUSE MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 110 EUROPE: COMMERCIAL GREENHOUSE MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 111 SPAIN: COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 112 SPAIN: COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 113 SPAIN: COMMERCIAL GREENHOUSE MARKET, BY GLASS GREENHOUSE, 2018–2022 (USD MILLION)

- TABLE 114 SPAIN: COMMERCIAL GREENHOUSE MARKET, BY GLASS GREENHOUSE, 2023–2028 (USD MILLION)

- TABLE 115 SPAIN: COMMERCIAL GREENHOUSE MARKET, BY PLASTIC GREENHOUSE, 2018–2022 (USD MILLION)

- TABLE 116 SPAIN: COMMERCIAL GREENHOUSE MARKET, BY PLASTIC GREENHOUSE, 2023–2028 (USD MILLION)

- TABLE 117 TURKEY: COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 118 TURKEY: COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 119 TURKEY: COMMERCIAL GREENHOUSE MARKET, BY GLASS GREENHOUSE, 2018–2022 (USD MILLION)

- TABLE 120 TURKEY: COMMERCIAL GREENHOUSE MARKET, BY GLASS GREENHOUSE, 2023–2028 (USD MILLION)

- TABLE 121 TURKEY: COMMERCIAL GREENHOUSE MARKET, BY PLASTIC GREENHOUSE, 2018–2022 (USD MILLION)

- TABLE 122 TURKEY: COMMERCIAL GREENHOUSE MARKET, BY PLASTIC GREENHOUSE, 2023–2028 (USD MILLION)

- TABLE 123 AUSTRIA: COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 124 AUSTRIA: COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 125 AUSTRIA: COMMERCIAL GREENHOUSE MARKET, BY GLASS GREENHOUSE, 2018–2022 (USD MILLION)

- TABLE 126 AUSTRIA: COMMERCIAL GREENHOUSE MARKET, BY GLASS GREENHOUSE, 2023–2028 (USD MILLION)

- TABLE 127 AUSTRIA: COMMERCIAL GREENHOUSE MARKET, BY PLASTIC GREENHOUSE, 2018–2022 (USD MILLION)

- TABLE 128 AUSTRIA: COMMERCIAL GREENHOUSE MARKET, BY PLASTIC GREENHOUSE, 2023–2028 (USD MILLION)

- TABLE 129 ITALY: COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 130 ITALY: COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 131 ITALY: COMMERCIAL GREENHOUSE MARKET, BY GLASS GREENHOUSE, 2018–2022 (USD MILLION)

- TABLE 132 ITALY: COMMERCIAL GREENHOUSE MARKET, BY GLASS GREENHOUSE, 2023–2028 (USD MILLION)

- TABLE 133 ITALY: COMMERCIAL GREENHOUSE MARKET, BY PLASTIC GREENHOUSE, 2018–2022 (USD MILLION)

- TABLE 134 ITALY: COMMERCIAL GREENHOUSE MARKET, BY PLASTIC GREENHOUSE, 2023–2028 (USD MILLION)

- TABLE 135 NETHERLANDS: COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 136 NETHERLANDS: COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 137 NETHERLANDS: COMMERCIAL GREENHOUSE MARKET, BY GLASS GREENHOUSE, 2018–2022 (USD MILLION)

- TABLE 138 NETHERLANDS: COMMERCIAL GREENHOUSE MARKET, BY GLASS GREENHOUSE, 2023–2028 (USD MILLION)

- TABLE 139 NETHERLANDS: COMMERCIAL GREENHOUSE MARKET, BY PLASTIC GREENHOUSE, 2018–2022 (USD MILLION)

- TABLE 140 NETHERLANDS: COMMERCIAL GREENHOUSE MARKET, BY PLASTIC GREENHOUSE, 2023–2028 (USD MILLION)

- TABLE 141 REST OF EUROPE: COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 142 REST OF EUROPE: COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 143 REST OF EUROPE: COMMERCIAL GREENHOUSE MARKET, BY GLASS GREENHOUSE, 2018–2022 (USD MILLION)

- TABLE 144 REST OF EUROPE: COMMERCIAL GREENHOUSE MARKET, BY GLASS GREENHOUSE, 2023–2028 (USD MILLION)

- TABLE 145 REST OF EUROPE: COMMERCIAL GREENHOUSE MARKET, BY PLASTIC GREENHOUSE, 2018–2022 (USD MILLION)

- TABLE 146 REST OF EUROPE: COMMERCIAL GREENHOUSE MARKET, BY PLASTIC GREENHOUSE, 2023–2028 (USD MILLION)

- TABLE 147 ASIA PACIFIC: COMMERCIAL GREENHOUSE MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 148 ASIA PACIFIC: COMMERCIAL GREENHOUSE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 149 ASIA PACIFIC: COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 150 ASIA PACIFIC: COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 151 ASIA PACIFIC: COMMERCIAL GREENHOUSE MARKET, BY GLASS GREENHOUSE, 2018–2022 (USD MILLION)

- TABLE 152 ASIA PACIFIC: COMMERCIAL GREENHOUSE MARKET, BY GLASS GREENHOUSE, 2023–2028 (USD MILLION)

- TABLE 153 ASIA PACIFIC: COMMERCIAL GREENHOUSE MARKET, BY PLASTIC GREENHOUSE, 2018–2022 (USD MILLION)

- TABLE 154 ASIA PACIFIC: COMMERCIAL GREENHOUSE MARKET, BY PLASTIC GREENHOUSE, 2023–2028 (USD MILLION)

- TABLE 155 ASIA PACIFIC: COMMERCIAL GREENHOUSE MARKET, BY EQUIPMENT, 2018–2022 (USD MILLION)

- TABLE 156 ASIA PACIFIC: COMMERCIAL GREENHOUSE MARKET, BY EQUIPMENT, 2023–2028 (USD MILLION)

- TABLE 157 ASIA PACIFIC: COMMERCIAL GREENHOUSE MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 158 ASIA PACIFIC: COMMERCIAL GREENHOUSE MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 159 CHINA: COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 160 CHINA: COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 161 CHINA: COMMERCIAL GREENHOUSE MARKET, BY GLASS GREENHOUSE, 2018–2022 (USD MILLION)

- TABLE 162 CHINA: COMMERCIAL GREENHOUSE MARKET, BY GLASS GREENHOUSE, 2023–2028 (USD MILLION)

- TABLE 163 CHINA: COMMERCIAL GREENHOUSE MARKET, BY PLASTIC GREENHOUSE, 2018–2022 (USD MILLION)

- TABLE 164 CHINA: COMMERCIAL GREENHOUSE MARKET, BY PLASTIC GREENHOUSE, 2023–2028 (USD MILLION)

- TABLE 165 SOUTH KOREA: COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 166 SOUTH KOREA: COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 167 SOUTH KOREA: COMMERCIAL GREENHOUSE MARKET, BY GLASS GREENHOUSE, 2018–2022 (USD MILLION)

- TABLE 168 SOUTH KOREA: COMMERCIAL GREENHOUSE MARKET, BY GLASS GREENHOUSE, 2023–2028 (USD MILLION)

- TABLE 169 SOUTH KOREA: COMMERCIAL GREENHOUSE MARKET, BY PLASTIC GREENHOUSE, 2018–2022 (USD MILLION)

- TABLE 170 SOUTH KOREA: COMMERCIAL GREENHOUSE MARKET, BY PLASTIC GREENHOUSE, 2023–2028 (USD MILLION)

- TABLE 171 JAPAN: COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 172 JAPAN: COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 173 JAPAN: COMMERCIAL GREENHOUSE MARKET, BY GLASS GREENHOUSE, 2018–2022 (USD MILLION)

- TABLE 174 JAPAN: COMMERCIAL GREENHOUSE MARKET, BY GLASS GREENHOUSE, 2023–2028 (USD MILLION)

- TABLE 175 JAPAN: COMMERCIAL GREENHOUSE MARKET, BY PLASTIC GREENHOUSE, 2018–2022 (USD MILLION)

- TABLE 176 JAPAN: COMMERCIAL GREENHOUSE MARKET, BY PLASTIC GREENHOUSE, 2023–2028 (USD MILLION)

- TABLE 177 AUSTRALIA: COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 178 AUSTRALIA: COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 179 AUSTRALIA: COMMERCIAL GREENHOUSE MARKET, BY GLASS GREENHOUSE, 2018–2022 (USD MILLION)

- TABLE 180 AUSTRALIA: COMMERCIAL GREENHOUSE MARKET, BY GLASS GREENHOUSE, 2023–2028 (USD MILLION)

- TABLE 181 AUSTRALIA: COMMERCIAL GREENHOUSE MARKET, BY PLASTIC GREENHOUSE, 2018–2022 (USD MILLION)

- TABLE 182 AUSTRALIA: COMMERCIAL GREENHOUSE MARKET, BY PLASTIC GREENHOUSE, 2023–2028 (USD MILLION)

- TABLE 183 INDIA: COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 184 INDIA: COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 185 INDIA: COMMERCIAL GREENHOUSE MARKET, BY GLASS GREENHOUSE, 2018–2022 (USD MILLION)

- TABLE 186 INDIA: COMMERCIAL GREENHOUSE MARKET, BY GLASS GREENHOUSE, 2023–2028 (USD MILLION)

- TABLE 187 INDIA: COMMERCIAL GREENHOUSE MARKET, BY PLASTIC GREENHOUSE, 2018–2022 (USD MILLION)

- TABLE 188 INDIA: COMMERCIAL GREENHOUSE MARKET, BY PLASTIC GREENHOUSE, 2023–2028 (USD MILLION)

- TABLE 189 REST OF ASIA PACIFIC: COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 190 REST OF ASIA PACIFIC: COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 191 REST OF ASIA PACIFIC: COMMERCIAL GREENHOUSE MARKET, BY GLASS GREENHOUSE, 2018–2022 (USD MILLION)

- TABLE 192 REST OF ASIA PACIFIC: COMMERCIAL GREENHOUSE MARKET, BY GLASS GREENHOUSE, 2023–2028 (USD MILLION)

- TABLE 193 REST OF ASIA PACIFIC: COMMERCIAL GREENHOUSE MARKET, BY PLASTIC GREENHOUSE, 2018–2022 (USD MILLION)

- TABLE 194 REST OF ASIA PACIFIC: COMMERCIAL GREENHOUSE MARKET, BY PLASTIC GREENHOUSE, 2023–2028 (USD MILLION)

- TABLE 195 SOUTH AMERICA: COMMERCIAL GREENHOUSE MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 196 SOUTH AMERICA: COMMERCIAL GREENHOUSE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 197 SOUTH AMERICA: COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 198 SOUTH AMERICA: COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 199 SOUTH AMERICA: COMMERCIAL GREENHOUSE MARKET, BY GLASS GREENHOUSE, 2018–2022 (USD MILLION)

- TABLE 200 SOUTH AMERICA: COMMERCIAL GREENHOUSE MARKET, BY GLASS GREENHOUSE, 2023–2028 (USD MILLION)

- TABLE 201 SOUTH AMERICA: COMMERCIAL GREENHOUSE MARKET, BY PLASTIC GREENHOUSE, 2018–2022 (USD MILLION)

- TABLE 202 SOUTH AMERICA: COMMERCIAL GREENHOUSE MARKET, BY PLASTIC GREENHOUSE, 2023–2028 (USD MILLION)

- TABLE 203 SOUTH AMERICA: COMMERCIAL GREENHOUSE MARKET, BY EQUIPMENT, 2018–2022 (USD MILLION)

- TABLE 204 SOUTH AMERICA: COMMERCIAL GREENHOUSE MARKET, BY EQUIPMENT, 2023–2028 (USD MILLION)

- TABLE 205 SOUTH AMERICA: COMMERCIAL GREENHOUSE MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 206 SOUTH AMERICA: COMMERCIAL GREENHOUSE MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 207 BRAZIL: COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 208 BRAZIL: COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 209 BRAZIL: COMMERCIAL GREENHOUSE MARKET, BY GLASS GREENHOUSE, 2018–2022 (USD MILLION)

- TABLE 210 BRAZIL: COMMERCIAL GREENHOUSE MARKET, BY GLASS GREENHOUSE, 2023–2028 (USD MILLION)

- TABLE 211 BRAZIL: COMMERCIAL GREENHOUSE MARKET, BY PLASTIC GREENHOUSE, 2018–2022 (USD MILLION)

- TABLE 212 BRAZIL: COMMERCIAL GREENHOUSE MARKET, BY PLASTIC GREENHOUSE, 2023–2028 (USD MILLION)

- TABLE 213 ARGENTINA: COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 214 ARGENTINA: COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 215 ARGENTINA: COMMERCIAL GREENHOUSE MARKET, BY GLASS GREENHOUSE, 2018–2022 (USD MILLION)

- TABLE 216 ARGENTINA: COMMERCIAL GREENHOUSE MARKET, BY GLASS GREENHOUSE, 2023–2028 (USD MILLION)

- TABLE 217 ARGENTINA: COMMERCIAL GREENHOUSE MARKET, BY PLASTIC GREENHOUSE, 2018–2022 (USD MILLION)

- TABLE 218 ARGENTINA: COMMERCIAL GREENHOUSE MARKET, BY PLASTIC GREENHOUSE, 2023–2028 (USD MILLION)

- TABLE 219 REST OF SOUTH AMERICA: COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 220 REST OF SOUTH AMERICA: COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 221 REST OF SOUTH AMERICA: COMMERCIAL GREENHOUSE MARKET, BY GLASS GREENHOUSE, 2018–2022 (USD MILLION)

- TABLE 222 REST OF SOUTH AMERICA: COMMERCIAL GREENHOUSE MARKET, BY GLASS GREENHOUSE, 2023–2028 (USD MILLION)

- TABLE 223 REST OF SOUTH AMERICA: COMMERCIAL GREENHOUSE MARKET, BY PLASTIC GREENHOUSE, 2018–2022 (USD MILLION)

- TABLE 224 REST OF SOUTH AMERICA: COMMERCIAL GREENHOUSE MARKET, BY PLASTIC GREENHOUSE, 2023–2028 (USD MILLION)

- TABLE 225 ROW: COMMERCIAL GREENHOUSE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 226 ROW: COMMERCIAL GREENHOUSE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 227 ROW: COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 228 ROW: COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 229 ROW: COMMERCIAL GREENHOUSE MARKET, BY GLASS GREENHOUSE, 2018–2022 (USD MILLION)

- TABLE 230 ROW: COMMERCIAL GREENHOUSE MARKET, BY GLASS GREENHOUSE, 2023–2028 (USD MILLION)

- TABLE 231 ROW: COMMERCIAL GREENHOUSE MARKET, BY PLASTIC GREENHOUSE, 2018–2022 (USD MILLION)

- TABLE 232 ROW: COMMERCIAL GREENHOUSE MARKET, BY PLASTIC GREENHOUSE, 2023–2028 (USD MILLION)

- TABLE 233 ROW: COMMERCIAL GREENHOUSE MARKET, BY EQUIPMENT, 2018–2022 (USD MILLION)

- TABLE 234 ROW: COMMERCIAL GREENHOUSE MARKET, BY EQUIPMENT, 2023–2028 (USD MILLION)

- TABLE 235 ROW: COMMERCIAL GREENHOUSE MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 236 ROW: COMMERCIAL GREENHOUSE MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 237 MIDDLE EAST: COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 238 MIDDLE EAST: COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 239 MIDDLE EAST: COMMERCIAL GREENHOUSE MARKET, BY GLASS GREENHOUSE, 2018–2022 (USD MILLION)

- TABLE 240 MIDDLE EAST: COMMERCIAL GREENHOUSE MARKET, BY GLASS GREENHOUSE, 2023–2028 (USD MILLION)

- TABLE 241 MIDDLE EAST: COMMERCIAL GREENHOUSE MARKET, BY PLASTIC GREENHOUSE, 2018–2022 (USD MILLION)

- TABLE 242 MIDDLE EAST: COMMERCIAL GREENHOUSE MARKET, BY PLASTIC GREENHOUSE, 2023–2028 (USD MILLION)

- TABLE 243 AFRICA: COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 244 AFRICA: COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 245 AFRICA: COMMERCIAL GREENHOUSE MARKET, BY GLASS GREENHOUSE, 2018–2022 (USD MILLION)

- TABLE 246 AFRICA: COMMERCIAL GREENHOUSE MARKET, BY GLASS GREENHOUSE, 2023–2028 (USD MILLION)

- TABLE 247 AFRICA: COMMERCIAL GREENHOUSE MARKET, BY PLASTIC GREENHOUSE, 2018–2022 (USD MILLION)

- TABLE 248 AFRICA: COMMERCIAL GREENHOUSE MARKET, BY PLASTIC GREENHOUSE, 2023–2028 (USD MILLION)

- TABLE 249 COMMERCIAL GREENHOUSE MARKET: DEGREE OF COMPETITION

- TABLE 250 COMPANY FOOTPRINT, BY EQUIPMENT

- TABLE 251 COMPANY FOOTPRINT, BY TYPE

- TABLE 252 COMPANY FOOTPRINT, BY REGION

- TABLE 253 COMMERCIAL GREENHOUSE MARKET: OVERALL COMPANY FOOTPRINT OF KEY PLAYERS

- TABLE 254 DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 255 COMPETITIVE BENCHMARKING (OTHER PLAYERS), 2022

- TABLE 256 COMMERCIAL GREENHOUSE MARKET: PRODUCT LAUNCHES, 2019–2022

- TABLE 257 COMMERCIAL GREENHOUSE MARKET: DEALS, 2019–2023

- TABLE 258 COMMERCIAL GREENHOUSE MARKET: OTHERS, 2019–2020

- TABLE 259 BERRY GLOBAL GROUP, INC.: BUSINESS OVERVIEW

- TABLE 260 BERRY GLOBAL GROUP, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 261 BERRY GLOBAL GROUP, INC.: DEALS

- TABLE 262 SIGNIFY HOLDING: BUSINESS OVERVIEW

- TABLE 263 SIGNIFY HOLDING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 264 SIGNIFY HOLDING: DEALS

- TABLE 265 HELIOSPECTRA AB: BUSINESS OVERVIEW

- TABLE 266 HELIOSPECTRA AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 267 HELIOSPECTRA AB: PRODUCT LAUNCHES

- TABLE 268 HELIOSPECTRA AB: DEALS

- TABLE 269 PLASTIKA KRITIS S.A.: BUSINESS OVERVIEW

- TABLE 270 PLASTIKA KRITIS S.A: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 271 EVERLIGHT ELECTRONICS CO., LTD: BUSINESS OVERVIEW

- TABLE 272 EVERLIGHT ELECTRONICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 273 GIBRALTAR INDUSTRIES: BUSINESS OVERVIEW

- TABLE 274 GIBRALTAR INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 275 GIBRALTAR INDUSTRIES: DEALS

- TABLE 276 RICHEL GROUP: BUSINESS OVERVIEW

- TABLE 277 RICHEL GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 278 RICHEL GROUP: DEALS

- TABLE 279 ARGUS CONTROL SYSTEMS LIMITED: BUSINESS OVERVIEW

- TABLE 280 ARGUS CONTROL SYSTEMS LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 281 ARGUS CONTROL SYSTEMS LIMITED: PRODUCT LAUNCHES

- TABLE 282 ARGUS CONTROL SYSTEMS LIMITED: DEALS

- TABLE 283 CERTHON: BUSINESS OVERVIEW

- TABLE 284 CERTHON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 285 CERTHON: DEALS

- TABLE 286 CERTHON: OTHERS

- TABLE 287 LOGIQS B.V.: BUSINESS OVERVIEW

- TABLE 288 LOGIQS B.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 289 LOGIQS B.V.: DEALS

- TABLE 290 LUMIGROW, INC: BUSINESS OVERVIEW

- TABLE 291 LUMIGROW, INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 292 LUMIGROW, INC: PRODUCT LAUNCHES

- TABLE 293 LUMIGROW, INC: DEALS

- TABLE 294 AGRA TECH, INC: BUSINESS OVERVIEW

- TABLE 295 AGRA TECH, INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 296 HORT AMERICAS: BUSINESS OVERVIEW

- TABLE 297 HORT AMERICAS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 298 TOP GREENHOUSES: BUSINESS OVERVIEW

- TABLE 299 TOP GREENHOUSES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 300 STUPPY GREENHOUSE: BUSINESS OVERVIEW

- TABLE 301 STUPPY GREENHOUSE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 302 THE GLASSHOUSE COMPANY PTY LTD: BUSINESS OVERVIEW

- TABLE 303 THE GLASSHOUSE COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 304 DECLOET GREENHOUSE MANUFACTURING LTD.: BUSINESS OVERVIEW

- TABLE 305 DECLOET GREENHOUSE MANUFACTURING LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 306 EUROPROGRESS: BUSINESS OVERVIEW

- TABLE 307 EUROPROGRESS: PRODUCTS/SOLUTIONS/SERVICES

- TABLE 308 LUITEN GREENHOUSES: BUSINESS OVERVIEW

- TABLE 309 LUITEN GREENHOUSES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 310 SOTRAFA: BUSINESS OVERVIEW

- TABLE 311 SOTRAFA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 312 ADJACENT MARKETS TO COMMERCIAL GREENHOUSE MARKET

- TABLE 313 SMART AGRICULTURE MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 314 SMART AGRICULTURE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 315 SMART GREENHOUSE MARKET, BY TYPE, 2017–2025 (USD MILLION)

- FIGURE 1 COMMERCIAL GREENHOUSE MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 COMMERCIAL GREENHOUSE MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 4 COMMERCIAL GREENHOUSE MARKET SIZE ESTIMATION (DEMAND SIDE)

- FIGURE 5 COMMERCIAL GREENHOUSE MARKET SIZE ESTIMATION, BY TYPE (SUPPLY SIDE)

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 INDICATORS OF RECESSION

- FIGURE 8 WORLD INFLATION RATE: 2011–2021

- FIGURE 9 GLOBAL GDP: 2011–2021 (USD TRILLION)

- FIGURE 10 RECESSION INDICATORS AND THEIR IMPACT ON COMMERCIAL GREENHOUSE MARKET

- FIGURE 11 COMMERCIAL GREENHOUSE MARKET: EARLIER FORECAST VS. RECESSION FORECAST

- FIGURE 12 COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 COMMERCIAL GREENHOUSE MARKET, BY CROP TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 COMMERCIAL GREENHOUSE MARKET SHARE, BY EQUIPMENT, 2023 VS. 2028

- FIGURE 15 COMMERCIAL GREENHOUSE MARKET: REGIONAL SNAPSHOT

- FIGURE 16 DEMAND FOR YEAR-ROUND CROP PRODUCTION TO DRIVE COMMERCIAL GREENHOUSE MARKET

- FIGURE 17 VEGETABLES SEGMENT TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 18 PLASTIC GREENHOUSE SEGMENT TO HOLD LARGER MARKET DURING FORECAST PERIOD

- FIGURE 19 HARDWARE SEGMENT TO ACCOUNT FOR LARGER MARKET DURING FORECAST PERIOD

- FIGURE 20 PLASTIC GREENHOUSE SEGMENT DOMINATED EUROPEAN MARKET IN 2022

- FIGURE 21 US, CANADA, NETHERLANDS, AND CHINA TO SHOW SIGNIFICANT GROWTH DURING FORECAST PERIOD

- FIGURE 22 GLOBAL POPULATION GROWTH TREND, 2011–2022 (BILLION)

- FIGURE 23 TOTAL AVAILABLE ARABLE LAND, 1970–2020 (HECTARES/PERSON)

- FIGURE 24 COMMERCIAL GREENHOUSE MARKET: MARKET DYNAMICS

- FIGURE 25 WORLD’S LARGEST FOOD-EXPORTING COUNTRIES, 2020 (USD BILLION)

- FIGURE 26 GLOBAL WATER REUSE AFTER TERTIARY TREATMENT - MARKET SHARE, BY APPLICATION, 2020

- FIGURE 27 GLOBAL AGRI-FOOD EXPORT, 2019–2021 (USD BILLION)

- FIGURE 29 SUPPLY CHAIN ANALYSIS

- FIGURE 30 NUMBER OF PATENTS APPROVED FOR COMMERCIAL GREENHOUSE IN GLOBAL MARKET, 2012–2022

- FIGURE 31 JURISDICTIONS WITH HIGHEST PATENT APPROVALS FOR COMMERCIAL GREENHOUSES, 2016–2022

- FIGURE 32 ECOSYSTEM MAP

- FIGURE 33 TRENDS/DISRUPTIONS IMPACTING BUYERS IN COMMERCIAL GREENHOUSE MARKET

- FIGURE 34 AVERAGE SELLING PRICE TREND, BY TYPE, 2022 (USD/SETUP)

- FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE EQUIPMENT

- FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP TWO GREENHOUSE TYPES

- FIGURE 37 PLASTIC GREENHOUSE SEGMENT TO DOMINATE COMMERCIAL GREENHOUSE MARKET DURING FORECAST PERIOD

- FIGURE 38 HARDWARE SEGMENT TO DOMINATE COMMERCIAL GREENHOUSE MARKET DURING FORECAST PERIOD

- FIGURE 39 VEGETABLES SEGMENT TO DOMINATE COMMERCIAL GREENHOUSE MARKET DURING FORECAST PERIOD

- FIGURE 40 COMMERCIAL GREENHOUSE MARKET, BY REGION, 2023 VS. 2028 (USD MILLION)

- FIGURE 41 NORTH AMERICA: COMMERCIAL GREENHOUSE MARKET SNAPSHOT

- FIGURE 42 INFLATION IN NORTH AMERICA: COUNTRY-LEVEL DATA, 2017–2021

- FIGURE 43 NORTH AMERICA: RECESSION IMPACT ANALYSIS, 2022

- FIGURE 44 EUROPE: COMMERCIAL GREENHOUSE MARKET SNAPSHOT

- FIGURE 45 INFLATION IN EUROPE: COUNTRY-LEVEL DATA, 2017–2021

- FIGURE 46 EUROPEAN COMMERCIAL GREENHOUSE MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 47 INFLATION IN ASIA PACIFIC: COUNTRY-LEVEL DATA, 2017–2021

- FIGURE 48 ASIA PACIFIC: RECESSION IMPACT ANALYSIS, 2022

- FIGURE 49 INFLATION IN SOUTH AMERICA: COUNTRY-LEVEL DATA, 2017–2021

- FIGURE 50 SOUTH AMERICA: RECESSION IMPACT ANALYSIS, 2022

- FIGURE 51 INFLATION IN ROW, 2017–2021

- FIGURE 52 ROW: RECESSION IMPACT ANALYSIS, 2022

- FIGURE 53 SEGMENTAL REVENUE ANALYSIS OF KEY MARKET PLAYERS, 2020–2022 (USD BILLION)

- FIGURE 54 ANNUAL REVENUE, 2022 (USD BILLION) VS. REVENUE GROWTH, 2020–2022 (%)

- FIGURE 55 EBITDA, 2022 (USD BILLION)

- FIGURE 56 COMMERCIAL GREENHOUSE MARKET: GLOBAL SNAPSHOT OF KEY PARTICIPANTS, 2022

- FIGURE 57 COMMERCIAL GREENHOUSE MARKET: COMPANY EVALUATION MATRIX, 2022 (KEY PLAYERS)

- FIGURE 58 COMMERCIAL GREENHOUSE MARKET: COMPANY EVALUATION MATRIX, 2022 (STARTUPS/SMES)

- FIGURE 59 BERRY GLOBAL GROUP, INC.: COMPANY SNAPSHOT

- FIGURE 60 SIGNIFY HOLDING: COMPANY SNAPSHOT

- FIGURE 61 HELIOSPECTRA AB: COMPANY SNAPSHOT

- FIGURE 62 PLASTIKA KRITIS S.A.: COMPANY SNAPSHOT

- FIGURE 63 EVERLIGHT ELECTRONICS: COMPANY SNAPSHOT

- FIGURE 64 GIBRALTAR INDUSTRIES: COMPANY SNAPSHOT

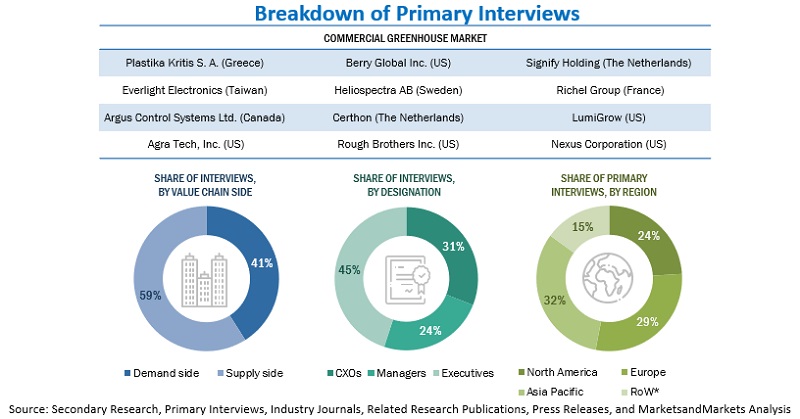

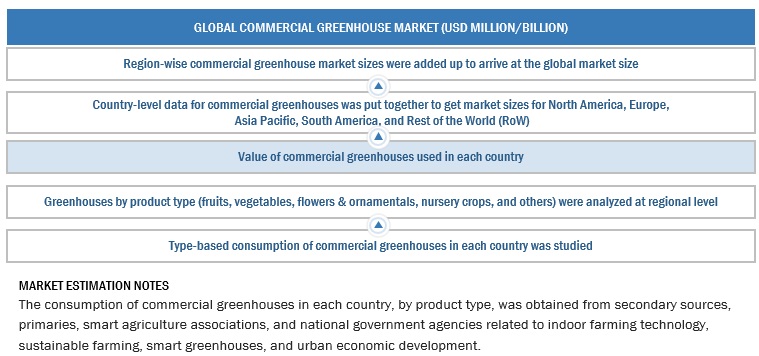

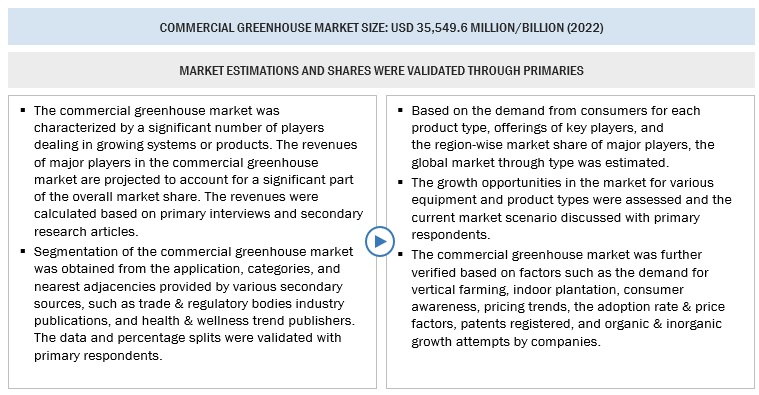

Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, sources such as annual reports, press releases, investor presentations of companies, white papers, certified publications, articles from regulatory bodies, trade directories by recognized authors, and databases were used to identify and collect information for this study.

Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to the commercial greenhouse industry trends to the bottom-most level, geographic markets, and key developments from both market and technology-oriented perspectives.

Primary Research

The global commercial greenhouse market comprises several stakeholders, including raw material suppliers, system manufacturers, grow media and nutrient formulators, suppliers, crop growers, end-product manufacturers, and regulatory organizations in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary interviewees from the supply side include research institutions involved in R&D to introduce technology, distributors, wholesalers, climate control system manufacturers, grow media and nutrient manufacturers, raw material suppliers, key opinion leaders, and technology providers. Primary sources from the demand side include key opinion research institutions, hydroponic growers, government agencies, horticulturists, floriculturists, and sustainable and indoor farming associations who provided inputs through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Commercial Greenhouse Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the commercial greenhouse market size. These approaches were extensively used to determine the size of the subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the commercial greenhouse industry and the overall markets were identified through extensive secondary research.

- The revenues of the major commercial greenhouse players were determined through primary and secondary research; these were used as the basis for market sizing and estimation.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macroeconomic and microeconomic factors affecting the commercial greenhouse market growth were considered while estimating the market size.

- All parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

- All macroeconomic and microeconomic factors affecting the commercial greenhouse market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Global Commercial Greenhouse Market Size: Bottom-Up Approach

In the bottom-up approach, the overall size of the commercial greenhouse market was calculated by identifying various entities influencing the value chain of the market. The revenue was arrived at by analyzing the major companies, system integrators, and service providers operating in the market. The estimation of the size of the smart greenhouse market for each region and country was based on the demand for commercial greenhouses. Developments and other critical parameters, such as ongoing and upcoming commercial greenhouse projects, were also tracked and identified for forecasting the market size.

To know about the assumptions considered for the study, Request for Free Sample Report

Global commercial greenhouse market size: Top-Down Approach

In the top-down approach, the overall market size has been used to estimate the size of individual markets (mentioned in the market segmentation) through the percentage splits from secondary and primary research.

For the calculation of specific market segments, the most appropriate parent market size has been used to implement the top-down approach. The bottom-up approach has also been implemented for the data extracted from the secondary research to validate the market size for each segment. With the data triangulation procedure and the validation of data through primaries, the overall parent market size and each individual market size have been determined and confirmed in this study.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. Where applicable, the data triangulation and market breakdown procedures were employed to estimate the overall market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Commercial Greenhouse Market Definition

A greenhouse is a structure with a transparent roof and walls, often made of glass or plastic. Various types of plants are grown in greenhouses, where their growth conditions can be monitored and controlled. Greenhouses vary in size from small greenhouses to commercial buildings.

According to the International Journal of Environmental Research and Public Health, a commercial greenhouse is used for the mass production of plants or produce (such as vegetables) that will be sold to retailers, who will sell them to the public. They are often high-tech structures controlled by a computer and may house complex equipment to control heating, cooling, lighting, relative humidity, and vapor-pressure deficit.

Key Stakeholders

- Manufacturers of commercial greenhouse and indoor farming equipment

- Original design manufacturing (ODM) and original equipment manufacturing (OEM) technology solution providers

- Sensor providers

- Software solution providers

- Individual and large growers

- Horticulturists and floriculturists

- Research institutes and organizations

- Government bodies, regulatory authorities, venture capitalists, and private equity firms

Commercial Greenhouse Market Report Objectives

Market Intelligence

- Determining and projecting the size of the market based on mode of application and region over a five-year period ranging from 2023 to 2028.

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across the key regions

- Analyzing the demand-side factors based on the following:

- Impact of macro- and microeconomic factors on the market

- Shifts in demand patterns across different subsegments and regions.

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders.

- To strategically profile the key players and comprehensively analyze their core competencies.

- To analyze competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & development (R&D) in the commercial greenhouse market

Competitive Intelligence

- Identifying and profiling the key market players in the market

-

Providing a comparative analysis of the market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key region.

- Analyzing the value chain and regulatory frameworks across regions and their impact on prominent market players

- Providing insights into the key investments and product innovations, and technology in the commercial greenhouse market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

- Further breakdown of the Rest of Europe's commercial greenhouse market into Poland, Greece, and Denmark.

- Further breakdown of the Rest of Asia Pacific commercial greenhouse industry into New Zealand, Indonesia, Vietnam, South Korea, and Singapore.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Commercial Greenhouse Market

I want commercial greenhouse market statistics for Europe region.