Commercial Lighting Market by Offering (Hardware, Software, and Services), Installation Type (New and Retrofit), End-use Application (Indoor and Outdoor), Communication Technology, and Region - Global Forecast

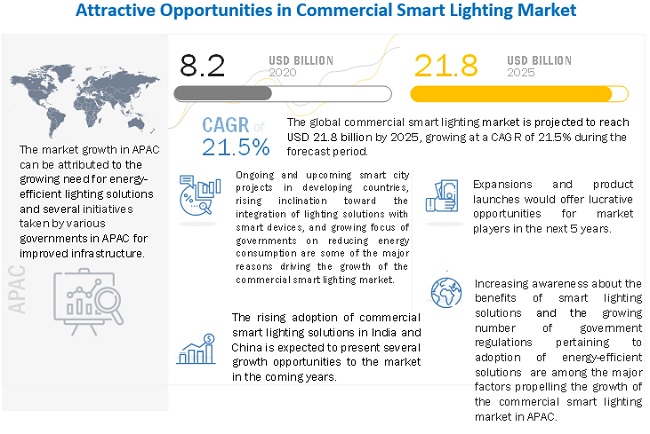

The commercial lighting market is projected to reach USD 21.8 billion by 2025 from USD 8.2 billion in 2020; it is expected to grow at a CAGR of 21.5% during the forecast period.

The most significant factors driving the growth of this market are the ongoing and upcoming smart city projects in the developing countries, growing focus of governments worldwide on energy consumption, increasing acceptance of standard protocols for lighting control systems, escalating demand for LED lights and luminaires for use in outdoor applications, and surging use of integrated lighting control systems. Rapid transition from traditional lighting to connected lighting solutions and increased adoption of PoE-based and solar lighting system are major opportunities for the commercial lighting market.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on Commercial lighting Market:

The outbreak of COVID-19 has significantly impacted the lighting industry owing to the lockdown across many countries and disruptions in the supply chain. Thus, most of the lighting OEMs and integrators are witnessing a shortage of electronic components such as chips and LED drivers. This has created an imbalance, resulting in a demand-supply gap and an increase in the prices of lighting products. For instance, Signify has announced a temporary price hike on all LED and lamp electronics as the costs in its logistics chain is on the rise due to the pandemic. Disruption in the supply chain would create an imbalance in the demand-supply equation and create pressure across entities in the smart lighting ecosystem.

Market Dynamics:

Driver: Ongoing and upcoming smart city projects in developing countries

Presently, there are several ongoing smart city projects across the world that offer opportunities to technology companies, technology service providers, utility providers, and consulting companies. The efficient use of electricity is one of the primary goals of smart city infrastructures. Smart cities are considered as the driving factor for sustainable economic growth in a country. Energy efficiency, the sustainability of resources, and advancements in digital technologies have led to the rise of the smart cities concept. The smart lighting application is expected to play a significant role in achieving sustainability and energy savings.

Restraint: High initial costs

The initial cost of smart lightings, as well as the cost of integration and installation services, is high. Smart lightings comprise hardware components such as dimmers, switches, sensors, control systems, and software. Hence, the installation cost of smart lighting is higher than that of conventional lightings. This is primarily due to the requirement for highly expensive software, control systems, and LED light sources for smart lighting solutions. This hampers the adoption of smart lighting control systems.

Opportunity: Rapid transition from traditional lighting to connected lighting solutions

In recent years, there has been a rapid shift from conventional lighting systems to connected lighting systems due to various advantages offered by connected lighting solutions, such as increased energy efficiency, improved ambiance at the workplace, and cost savings in the long run. Connected lighting devices are well known for their energy efficiency. These devices consume less power and have a long life, thereby reducing maintenance and replacement costs. Most of the connected lighting solutions consist of wireless sensors and switches that provide flexibility in lighting control operations, whereas conventional lighting solutions do not have these features. The introduction of wireless lighting controls has boosted the market for retrofit lighting systems, which, in turn, has increased the demand for lighting control systems. Wireless lighting control solutions have not only reduced the use of wires but also helped avoid reconstruction of existing buildings.

Challenge: Interoperability issues between different network components

At present, the biggest concern in the lighting control ecosystem is the availability of solutions with multiple interoperable technologies. End-users need to choose a suitable lighting control solution from a wider range of available solutions but, the lack of uniform standards makes it challenging to integrate the available solutions. The incompatibility of various components and the lack of interoperability create problems for end-users. Traditional lighting control systems usually consist of hardware and software manufactured by the same manufacturer, whereas different manufacturers develop controls in connected lighting solutions. This creates interoperability issues, causing problems for communication between various network components of a lighting system. Hence, there is a need to establish standard protocols to develop compatible products. Several organizations such as the Connected Lighting Alliance (TCLA) and the ZigBee Alliance are trying to standardize the protocols used in connected lighting technology so that luminaires could be used to collect and share data for analytics purposes.

Based on end-use application, the indoor segment held the largest share of the commercial lighting market in 2019.

The market for indoor smart lighting is expected to hold the larger share, owing to the high demand in commercial space. In these applications, smart lighting is an essential element in creating a modern workspace that attracts customers with changing preferences. It continues helping owners to create a flexible working environment, reduce expenses, improve work efficiencies, and create quality lighting that enhances the occupant experience. Hence, the adoption of smart lighting in commercial spaces is gaining more traction and has a high opportunity in the near future due to smart city initiatives by governments across the world.

The wired communication technology segment projected to account for a larger size of the commercial lighting market during the forecast period.

The wired segment is estimated to continue to hold a larger share of the commercial lighting market during the forecast period. Wired technology offers reliable performance and greater control. However, the cost of wiring and installation is high, especially in a commercial setting. This high cost, therefore, acts as a restraining factor for the adoption of wired technology-based smart lighting solutions.

To know about the assumptions considered for the study, download the pdf brochure

Asia Pacific (APAC) is projected to be the fastest-growing market for commercial lighting market. This growth can be attributed to the rapid infrastructure development activities being undertaken in APAC, mainly in China, where smart lighting solutions pave the way for the modernization of infrastructure. Projects related to infrastructure modernization and development, such as smart cities, across the region would also drive the demand for smart street lights, thereby propelling the growth of the market for commercial smart lighting in this region. The increasing number of smart city and smart infrastructure projects undertaken by the governments will create several new opportunities for energy-efficient lighting and advanced lighting systems in the next few years.

Key Market Players

Signify (Philips Lighting) (Netherlands); Legrand S.A. (France); Acuity Brands, Inc. (US); GE Current, a Daintree Company (US); OSRAM Licht AG (Germany); Leviton Manufacturing Company, Inc. (US); Lutron Electronics (US); Hubbell Incorporated (US); LEDVANCE GmbH (Germany); Schneider Electric SE (France); Ideal Industries, Inc. (Cree Lighting) (US); and Zumtobel Group (Austria) are a few major players in the commercial lighting market.

Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2016–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD) Billion/Million |

|

Segments covered |

Offering, Communication Technology, Installation Type, End-use Application, and Region |

|

Regions covered |

North America, Europe, APAC, and RoW |

|

Companies covered |

Signify (Philips Lighting) (Netherlands); Legrand S.A. (France); Acuity Brands, Inc. (US); GE Current, a Daintree Company (US); OSRAM Licht AG (Germany); Leviton Manufacturing Company, Inc. (US); Lutron Electronics (US); Hubbell Incorporated (US); LEDVANCE GmbH (Germany); Schneider Electric SE (France); Ideal Industries, Inc. (Cree Lighting) (US); and Zumtobel Group (Austria) are a few major players in the commercial lighting market. |

Commercial lighting Market Segmentation:

In this report, the commercial lighting market has been segmented into the following categories:

Commercial Lighting Market By Offering:

- Hardware

- Software

- Services

Commercial Lighting Market By Installation Type:

- New Installations

- Retrofit Installation

Commercial Lighting Market By Communication Technology

- Wired

- Wireless

Commercial Lighting Market By End-use Application:

- Indoor

- Outdoor

Commercial Lighting Market By Region

- North America

- Europe

- APAC

- RoW

Recent Developments

- In July 2020, Leviton announced a new online and robust product support center on its website for customers to access at any time. The new support platform encourages self-help for most popular Leviton products, such as how to install videos, compatibility tools to pair the right light bulb with the right dimmer, a competitive comparison tool and where to purchase Leviton products. The center also provides customers FAQs on various popular products, an online chat feature, and a toll-free hotline to call for questions related to Leviton’s diverse product offerings.

- In July 2020, GE Current partnered with Pointr (UK) to enable location-based services in large buildings such as retail premises, warehouses, workplaces, and distribution centers. Current smart lighting combined with Pointr’s location-based services deliver high-value applications to retailers, warehouses, and industrial premises, providing the ability to understand the precise location of employees and visitors using any Android or iOS devices such as smartphones or Honeywell devices.

- In June 2020, OSRAM launched BackLED AREA G1 900 and BackLED AREA G1 900 TW. These are rigid 24V constant-voltage LED boards which allow easy and time-saving installation and achieve outstanding lighting uniformity results, especially in large and shallow light boxes and luminous stretch ceilings with low depths between 90 and 40 mm.

- In March 2020, Signify upgraded its portfolio of compact Philips Xitanium Sensor Ready Xtreme LED drivers for outdoor applications with the recently granted D4i certification. This certification program is designed to deliver standardization in the market, drive wider adoption of IoT connectivity in lighting, and aid smart city or building projects.

- In February 2020, Legrand acquired Focal Point, a Chicago-based privately-held manufacturer of architectural lighting products. This acquisition is Legrand’s fifth addition to its Lighting Sector and marks the company’s elevation to a full solutions provider in the architectural lighting space.

Frequently Asked Questions (FAQ):

Which are the major companies in the commercial smart lighting market? What are their major strategies to strengthen their market presence?

The major companies in the Commercial smart lighting market are – Signify (Philips Lighting) (Netherlands); Legrand S.A. (France); Acuity Brands, Inc. (US); GE Current, a Daintree Company (US); OSRAM Licht AG (Germany); Leviton Manufacturing Company, Inc. (US); Lutron Electronics (US);. The major strategies adopted by these players are product launches, expansions, agreements and acquisitions.

Which is the potential market for commercial smart lighting in terms of region?

APAC is the fastest-growing market for commercial smart lighting. This growth can be attributed to the rapid infrastructure development activities being undertaken in APAC, mainly in China, where smart lighting solutions pave the way for the modernization of infrastructure. Projects related to infrastructure modernization and development, such as smart cities, across the region would also drive the demand for smart street lights, thereby propelling the growth of the market for commercial smart lighting in this region.

Which end-use application are expected to drive the growth of the market in the next 5 years?

The market for outdoor segment is expected to grow at the higher CAGR for commercial smart lighting segment. There is increasing adoption of smart lighting for public places such as wide parking areas, parks, and airports etc. which is expected drive the market for outdoor. Public lighting is a principal factor in ensuring safety in public areas. However, the costs to be covered by the local municipality are high. Smart lighting at parking areas is the most adopted solution across airports, shopping centers, and city garages. The ability to connect, analyze, and automate data gathered from devices, powered by, and described as IoT, is what makes smart lighting at parking possible.

What are the opportunities for new market entrants?

Cureently, there is increasing adoption of PoE lighting. Power over Ethernet (PoE) provides power and network connectivity to devices through a single network cable. PoE solutions make the installation and expansion of a network simpler and cheaper in buildings where it is too expensive or inconvenient to install new power lines. PoE-enabled solutions reduce log jams for organizations since they do not require a considerable budget to expand their capabilities. Commercial buildings such as office buildings, warehouses, and retail buildings opt for PoE-enabled solutions, owing to their benefits such as savings in installation costs, low overall design & construction costs, and reduced labor efforts by minimizing the amount of Ethernet cables required. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 COMMERCIAL LIGHTING MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 2 COMMERCIAL LIGHTING MARKET: PROCESS FLOW OF MARKET SIZE ESTIMATION

FIGURE 3 COMMERCIAL SMART LIGHTING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primaries

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.2 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE)—REVENUE GENERATED BY COMPANIES FROM SOLUTIONS/PRODUCTS/ SERVICES OFFERED IN COMMERCIAL SMART LIGHTING MARKET

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2—DEMAND-SIDE ANALYSIS

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach used to arrive at market size using bottom-up analysis

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach used to arrive at market size using top-down analysis

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

TABLE 1 ASSUMPTIONS OF RESEARCH STUDY

3 EXECUTIVE SUMMARY (Page No. - 45)

3.1 COMMERCIAL LIGHTING MARKET: REALISTIC SCENARIO (POST-COVID-19)

FIGURE 10 COMMERCIAL SMART LIGHTING MARKET: OPTIMISTIC, REALISTIC, AND PESSIMISTIC SCENARIO ANALYSES (2017–2025)

3.2 COMMERCIAL SMART LIGHTING MARKET: OPTIMISTIC SCENARIO (POST-COVID-19)

3.3 COMMERCIAL SMART LIGHTING MARKET: PESSIMISTIC SCENARIO (POST-COVID-19)

FIGURE 11 SERVICES SEGMENT OF COMMERCIAL SMART LIGHTING MARKET TO WITNESS HIGHEST CAGR FROM 2020 TO 2025

FIGURE 12 NEW INSTALLATIONS TO HOLD LARGER SIZE OF COMMERCIAL SMART LIGHTING MARKET FROM 2020 TO 2025

FIGURE 13 WIRELESS COMMUNICATION TECHNOLOGY TO REGISTER HIGHER CAGR IN COMMERCIAL SMART LIGHTING MARKET DURING 2020–2025

FIGURE 14 OUTDOOR APPLICATIONS TO RECORD HIGHER CAGR IN COMMERCIAL SMART LIGHTING MARKET DURING FORECAST PERIOD

FIGURE 15 EUROPE HELD LARGEST SHARE OF COMMERCIAL SMART LIGHTING MARKET IN 2019

4 PREMIUM INSIGHTS (Page No. - 51)

4.1 ATTRACTIVE OPPORTUNITIES FOR GROWTH OF COMMERCIAL LIGHTING MARKET

FIGURE 16 INCREASING INVESTMENTS IN SMART CITY AND INFRASTRUCTURE DEVELOPMENT PROJECTS DRIVING MARKET GROWTH

4.2 COMMERCIAL SMART LIGHTING MARKET, BY END-USE APPLICATION

FIGURE 17 INDOOR APPLICATIONS TO DOMINATE COMMERCIAL SMART LIGHTING MARKET THROUGHOUT FORECAST PERIOD

4.3 COMMERCIAL SMART LIGHTING MARKET, BY HARDWARE OFFERING

FIGURE 18 LIGHTING CONTROLS TO EXHIBIT HIGHER CAGR THAN LIGHTS & LUMINAIRES IN SMART LIGHTING MARKET DURING FORECAST PERIOD

4.4 COMMERCIAL SMART LIGHTING MARKET IN APAC, BY INDOOR END-USE APPLICATION AND COUNTRY

FIGURE 19 CHINA TO LEAD SMART LIGHTING MARKET DURING FORECAST PERIOD

4.5 COMMERCIAL SMART LIGHTING MARKET, BY GEOGRAPHY

FIGURE 20 COMMERCIAL SMART LIGHTING MARKET IN APAC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 54)

5.1 INTRODUCTION

FIGURE 21 MARKET DYNAMICS: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.1.1 DRIVERS

5.1.1.1 Ongoing and upcoming smart city projects in developing countries

FIGURE 22 SMART CITIES INDEX, 2019

5.1.1.2 Growing focus of governments worldwide on energy conservation

5.1.1.3 Increasing acceptance of standard protocols for lighting control systems

5.1.1.4 Escalating demand for LED lights and luminaires for use in outdoor applications

5.1.1.5 Surging use of integrated lighting control systems

FIGURE 23 EVOLUTION OF LIGHTING CONTROL SYSTEMS

FIGURE 24 COMMERCIAL SMART LIGHTING MARKET DRIVERS AND THEIR IMPACT

5.1.2 RESTRAINTS

5.1.2.1 High installation costs

5.1.2.2 Major supply chain disruptions due to COVID-19 outbreak

FIGURE 25 COMMERCIAL SMART LIGHTING MARKET RESTRAINTS AND THEIR IMPACT

5.1.3 OPPORTUNITIES

5.1.3.1 Rapid transition from traditional lighting to connected lighting solutions

5.1.3.2 Increased adoption of PoE-based and solar lighting solutions

FIGURE 26 COMMERCIAL SMART LIGHTING MARKET OPPORTUNITIES AND THEIR IMPACT

5.1.4 CHALLENGES

5.1.4.1 Interoperability issues between different network components

5.1.4.2 Security and reliability issues related to IoT-based lighting systems

FIGURE 27 COMMERCIAL SMART LIGHTING MARKET CHALLENGES AND THEIR IMPACT

6 INDUSTRY TRENDS (Page No. - 62)

6.1 INTRODUCTION

6.2 VALUE CHAIN ANALYSIS

FIGURE 28 COMMERCIAL LIGHTING MARKET: VALUE CHAIN ANALYSIS

6.2.1 RESEARCH AND PRODUCT DEVELOPMENT EXECUTIVES

6.2.2 RAW MATERIAL/INPUT SUPPLIERS

6.2.3 ORIGINAL EQUIPMENT MANUFACTURERS

6.2.4 SYSTEM INTEGRATORS, TECHNOLOGY PROVIDERS, AND SERVICE PROVIDERS

6.2.5 DISTRIBUTORS AND SALES REPRESENTATIVES

6.2.6 APPLICATIONS

6.3 COMMERCIAL SMART LIGHTING: ECOSYSTEM

FIGURE 29 ECOSYSTEM VIEW

6.4 KEY INDUSTRY TRENDS

FIGURE 30 LEADING TRENDS IN COMMERCIAL SMART LIGHTING MARKET

6.5 PRICING ANALYSIS

TABLE 2 PRICE COMPARISON: SMART LED BULB

TABLE 3 PRICE COMPARISON: SOLAR STREET LED LIGHT LUMINAIRE

6.6 SHIPMENTS OF COMPONENTS

FIGURE 31 COMMERCIAL SMART LIGHTING MARKET FOR LIGHTING CONTROLS, BY COMPONENT (MILLION UNITS)

6.7 TECHNOLOGY ANALYSIS

TABLE 4 WIRED PROTOCOLS

TABLE 5 WIRELESS PROTOCOL

6.8 TARIFF REGULATIONS REGARDING COMMERCIAL SMART LIGHTING

TABLE 6 TARIFF REGULATIONS

7 CASE STUDY ANALYSIS (Page No. - 71)

7.1 INTRODUCTION

7.2 CITY OF CHICAGO

TABLE 7 AMERESCO INC. (US) PROVIDED SMART STREETLIGHTS TO MODERNIZE AND CONNECT LARGEST CITY-LED WIRELESS SMART STREET LIGHTING PROJECT IN THE US

7.3 HOTEL XCARET

TABLE 8 HOTEL XCARET INSTALLED CUSTOMIZED IN-ROOM LIGHTING CONTROLS FROM LUTRON ELECTRONICS CO., INC (US)

7.4 CITY OF MONTREAL

TABLE 9 MONTREAL CITY CONVERTED LED STREET LIGHTING WITH HELP OF DIMONOFF INC. (US) SOLUTION

7.5 CITY OF LONDON

TABLE 10 IN ASSOCIATION WITH ITRON (US) AND WI-SUN ALLIANCE (US), LONDON REPLACED ALL OLD UNITS OF STREETLIGHTS

7.6 DORTMUND STREET LIGHTING

TABLE 11 TVILIGHT (NETHERLAND) HELPS TURN DORTMUND’S 25,000 STREETLIGHTS INTO SMART CITY PLATFORM

7.7 PINK CITY JAIPUR

TABLE 12 TVILIGHT (NETHERLANDS) RUNS LARGEST SENSOR-BASED SMART LIGHTING PROJECT IN INDIA

7.8 DUBAI MALL

TABLE 13 DUBAI MALL CAME UP WITH NEW LOOK BY INSTALLING OSRAM LICHT AG (GERMANY) LEDS

7.9 GRAND LAPA MACAU

TABLE 14 LUTRON (US) HELPS GRAND LAPA MACAU WITH SMART LIGHTING SOLUTION

8 COMMERCIAL LIGHTING MARKET, BY OFFERING (Page No. - 79)

8.1 INTRODUCTION

FIGURE 32 COMMERCIAL LIGHTING MARKET, BY OFFERING

FIGURE 33 HARDWARE OFFERINGS TO HOLD LARGEST SIZE OF COMMERCIAL SMART LIGHTING MARKET FROM 2020 TO 2025

TABLE 15 COMMERCIAL SMART LIGHTING MARKET, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 16 COMMERCIAL SMART LIGHTING MARKET, BY OFFERING, 2020–2025 (USD MILLION)

8.2 HARDWARE

FIGURE 34 COMMERCIAL SMART LIGHTING MARKET, BY HARDWARE

TABLE 17 COMMERCIAL SMART LIGHTING MARKET FOR HARDWARE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 18 COMMERCIAL SMART LIGHTING MARKET FOR HARDWARE, BY TYPE, 2020–2025 (USD MILLION)

8.2.1 LIGHTS & LUMINAIRES

8.2.1.1 Lights & luminaires segment holds larger share of commercial smart lighting market

8.2.1.1.1 Smart bulbs

8.2.1.1.2 Fixtures

8.2.2 LIGHTING CONTROLS

8.2.2.1 Lighting control to grow at a faster rate during the forecast period

TABLE 19 COMMERCIAL SMART LIGHTING MARKET FOR LIGHTING CONTROLS, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 20 COMMERCIAL SMART LIGHTING MARKET FOR LIGHTING CONTROLS, BY COMPONENT, 2020–2025 (USD MILLION)

8.2.2.1.1 LED drivers & ballasts

8.2.2.1.2 Sensors

8.2.2.1.3 Switches

8.2.2.1.4 Dimmers

8.2.2.1.5 Relay units

8.2.2.1.6 Gateways

8.3 SOFTWARE

FIGURE 35 COMMERCIAL LIGHTING MARKET, BY SOFTWARE

8.3.1 LOCAL/WEB-BASED SOFTWARE

8.3.1.1 High demand for advanced lighting control systems is driving adoption of smart lighting control system software

8.3.2 CLOUD-BASED SOFTWARE

8.3.2.1 Cloud-based software plays pivotal role in data analytics to improve lighting efficiency

8.4 SERVICES

FIGURE 36 COMMERCIAL LIGHTING MARKET, BY SERVICE

8.4.1 PRE-INSTALLATION SERVICES

8.4.1.1 Increasing demand for pre-installation services in commercial and office spaces

8.4.2 POST-INSTALLATION SERVICES

8.4.2.1 Growing demand for maintenance and analytics to maintain efficiency of commercial smart lighting solutions

8.5 IMPACT OF COVID-19 ON OFFERING OF COMMERCIAL SMART LIGHTING

9 COMMERCIAL LIGHTING MARKET, BY INSTALLATION TYPE (Page No. - 91)

9.1 INTRODUCTION

FIGURE 37 COMMERCIAL LIGHTING MARKET, BY INSTALLATION TYPE

FIGURE 38 NEW INSTALLATIONS TO CAPTURE LARGEST SIZE OF COMMERCIAL SMART LIGHTING MARKET IN 2025

TABLE 21 COMMERCIAL SMART LIGHTING MARKET, BY INSTALLATION TYPE, 2016–2019 (USD MILLION)

TABLE 22 COMMERCIAL SMART LIGHTING MARKET, BY INSTALLATION TYPE, 2020–2025 (USD MILLION)

9.2 NEW INSTALLATIONS

9.2.1 COMMERCIAL SMART LIGHTING MARKET TO WITNESS INCREASED DEMAND FOR NEW INSTALLATIONS DURING FORECAST PERIOD

9.3 RETROFIT INSTALLATIONS

9.3.1 MARKET FOR RETROFIT INSTALLATIONS TO GROW AT HIGHER GROWTH RATE DURING FORECAST PERIOD

9.4 IMPACT OF COVID-19 ON INSTALLATION TYPES OF COMMERCIAL SMART LIGHTING SOLUTIONS

10 COMMERCIAL LIGHTING MARKET, BY COMMUNICATION TECHNOLOGY (Page No. - 95)

10.1 INTRODUCTION

FIGURE 39 COMMERCIAL LIGHTING MARKET, BY COMMUNICATION TECHNOLOGY

FIGURE 40 WIRELESS TECHNOLOGIES TO EXHIBIT HIGHER CAGR IN COMMERCIAL SMART LIGHTING MARKET DURING FORECAST PERIOD

TABLE 23 COMMERCIAL SMART LIGHTING MARKET, BY COMMUNICATION TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 24 COMMERCIAL SMART LIGHTING MARKET, BY COMMUNICATION TECHNOLOGY, 2020–2025 (USD MILLION)

10.2 WIRED TECHNOLOGY

TABLE 25 COMMERCIAL SMART LIGHTING MARKET FOR WIRED COMMUNICATION TECHNOLOGY, BY TYPE, 2016–2019 (USD MILLION)

TABLE 26 COMMERCIAL SMART LIGHTING MARKET FOR WIRED COMMUNICATION TECHNOLOGY, BY TYPE, 2020–2025 (USD MILLION)

10.2.1 DALI

10.2.1.1 Dali communication technology captured largest share of commercial smart lighting market in 2019

10.2.2 POWER OVER ETHERNET (POE)

10.2.2.1 PoE to witness at highest CAGR for commercial smart lighting market during forecast period

FIGURE 41 TIMELINE OF POE-RELATED IEEE STANDARDS

TABLE 27 OVERVIEW OF POE PROTOCOLS

10.2.3 POWER-LINE COMMUNICATION (PLC)

10.2.3.1 PLC is widely adopted for outdoor streetlights and industrial lighting applications

10.2.4 OTHERS

10.3 WIRELESS

TABLE 28 WIRELESS COMMERCIAL LIGHTING PROTOCOLS

TABLE 29 COMMERCIAL SMART LIGHTING MARKET FOR WIRELESS COMMUNICATION TECHNOLOGY, BY TYPE, 2016–2019 (USD MILLION)

TABLE 30 COMMERCIAL SMART LIGHTING MARKET FOR WIRELESS COMMUNICATION TECHNOLOGY, BY TYPE, 2020–2025 (USD MILLION)

10.3.1 ZIGBEE

10.3.1.1 Open global standard to address unique needs of low-cost, low-power, wireless IoT networks

10.3.2 WI-FI

10.3.2.1 Wi-Fi wireless communication technology to exhibit highest CAGR in commercial smart lighting market during forecast period

10.3.3 BLUETOOTH LOW ENERGY (BLE)

10.3.3.1 Widely used networking technology that eliminates use of cables

10.3.4 ENOCEAN

10.3.4.1 Remove need to install wires between switches and controlled devices

10.3.5 OTHERS

11 COMMERCIAL LIGHTING MARKET, BY END-USE APPLICATION (Page No. - 105)

11.1 INTRODUCTION

FIGURE 42 COMMERCIAL LIGHTING MARKET, BY END-USE APPLICATION

FIGURE 43 OUTDOOR APPLICATIONS TO RECORD HIGHER CAGR IN COMMERCIAL SMART LIGHTING MARKET DURING FORECAST PERIOD

TABLE 31 COMMERCIAL SMART LIGHTING MARKET, BY END-USE APPLICATION, 2016–2019 (USD MILLION)

TABLE 32 COMMERCIAL SMART LIGHTING MARKET, BY END-USE APPLICATION, 2020–2025 (USD MILLION)

11.2 INDOOR

TABLE 33 COMMERCIAL SMART LIGHTING MARKET FOR INDOOR APPLICATIONS, BY TYPE, 2016–2019 (USD MILLION)

TABLE 34 COMMERCIAL SMART LIGHTING MARKET FOR INDOOR APPLICATIONS, BY TYPE, 2020–2025 (USD MILLION)

11.2.1 COMMERCIAL

11.2.1.1 Increasing adoption of smart lighting in commercial applications to drive growth of market for indoor applications

TABLE 35 COMMERCIAL SMART LIGHTING MARKET FOR COMMERCIAL APPLICATIONS, BY TYPE, 2016–2019 (USD MILLION)

TABLE 36 COMMERCIAL SMART LIGHTING MARKET FOR COMMERCIAL APPLICATIONS, BY TYPE, 2020–2025 (USD MILLION)

11.2.1.1.1 Healthcare

11.2.1.1.1.1 Use of smart lighting to enhance staff’s ability to provide high-quality care and promote overall well-being of patients

11.2.1.1.2 Office spaces

11.2.1.1.2.1 Implementation of smart lighting to ensure comfort and productivity of working staff

11.2.1.1.3 Retail stores & malls

11.2.1.1.3.1 Retail stores & malls segment to exhibit highest CAGR during forecast period

11.2.1.1.4 Hospitality

11.2.1.1.4.1 Deployment of smart lighting to attract guests and make customers feel comfortable

11.2.1.1.5 Education institutes

11.2.1.1.5.1 Adoption of smart lighting in educational institutes to offer environment conducive to learning

11.2.1.1.6 Stadiums

11.2.1.1.6.1 Employment of smart lighting making stadiums more energy-efficient

11.2.2 INDUSTRIAL

11.2.2.1 Use of appropriate lighting to ensure safety of industrial plants

11.2.3 OTHERS

11.3 OUTDOOR

TABLE 37 COMMERCIAL LIGHTING MARKET, BY OUTDOOR APPLICATION, BY TYPE, 2016–2019 (USD MILLION)

TABLE 38 COMMERCIAL SMART LIGHTING MARKET, BY OUTDOOR APPLICATION, BY TYPE, 2020–2025 (USD MILLION)

11.3.1 HIGHWAYS AND ROADWAYS LIGHTING

11.3.1.1 Highways and roadways lighting segment accounted largest share of commercial smart lighting market in 2019

11.3.2 ARCHITECTURAL LIGHTING

11.3.2.1 Opportunity for architectural lighting business in coming years to propel market growth

11.3.3 LIGHTING FOR PUBLIC PLACES

11.3.3.1 Government support and subsidies to fuel demand for energy-efficient smart lighting solutions

11.4 IMPACT OF COVID-19 ON END-USE APPLICATIONS OF COMMERCIAL SMART LIGHTING SOLUTIONS

12 COMMERCIAL LIGHTING MARKET, BY REGION (Page No. - 116)

12.1 INTRODUCTION

FIGURE 44 COMMERCIAL LIGHTING MARKET, BY REGION

TABLE 39 COMMERCIAL LIGHTING MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 40 COMMERCIAL SMART LIGHTING MARKET, BY REGION, 2020–2025 (USD MILLION)

12.2 NORTH AMERICA

FIGURE 45 SNAPSHOT: COMMERCIAL SMART LIGHTING MARKET IN NORTH AMERICA

TABLE 41 COMMERCIAL SMART LIGHTING MARKET IN NORTH AMERICA, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 42 COMMERCIAL SMART LIGHTING MARKET IN NORTH AMERICA, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 43 COMMERCIAL SMART LIGHTING MARKET IN NORTH AMERICA FOR HARDWARE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 44 COMMERCIAL SMART LIGHTING MARKET IN NORTH AMERICA FOR HARDWARE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 45 COMMERCIAL SMART LIGHTING MARKET IN NORTH AMERICA FOR LIGHTING CONTROL, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 46 COMMERCIAL SMART LIGHTING MARKET IN NORTH AMERICA FOR LIGHTING CONTROLS, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 47 COMMERCIAL SMART LIGHTING MARKET IN NORTH AMERICA, BY END-USE APPLICATION, 2016–2019 (USD MILLION)

TABLE 48 COMMERCIAL SMART LIGHTING MARKET IN NORTH AMERICA, BY END-USE APPLICATION, 2020–2025 (USD MILLION)

TABLE 49 COMMERCIAL SMART LIGHTING MARKET IN NORTH AMERICA FOR INDOOR APPLICATION, BY TYPE, 2016–2019 (USD MILLION)

TABLE 50 COMMERCIAL SMART LIGHTING MARKET IN NORTH AMERICA FOR INDOOR APPLICATION, BY TYPE, 2020–2025 (USD MILLION)

TABLE 51 COMMERCIAL SMART LIGHTING MARKET IN NORTH AMERICA FOR OUTDOOR APPLICATION, BY TYPE, 2016–2019 (USD MILLION)

TABLE 52 COMMERCIAL SMART LIGHTING MARKET IN NORTH AMERICA FOR OUTDOOR APPLICATION, BY TYPE, 2020–2025 (USD MILLION)

TABLE 53 COMMERCIAL SMART LIGHTING MARKET IN NORTH AMERICA FOR COMMERCIAL APPLICATION, 2016–2019 (USD MILLION)

TABLE 54 COMMERCIAL SMART LIGHTING MARKET IN NORTH AMERICA FOR COMMERCIAL APPLICATION, BY TYPE, 2020–2025 (USD MILLION)

TABLE 55 COMMERCIAL SMART LIGHTING MARKET IN NORTH AMERICA, BY INSTALLATION TYPE, 2016–2019 (USD MILLION)

TABLE 56 COMMERCIAL SMART LIGHTING MARKET IN NORTH AMERICA, BY INSTALLATION TYPE, 2020–2025 (USD MILLION)

TABLE 57 COMMERCIAL SMART LIGHTING MARKET IN NORTH AMERICA, BY COMMUNICATION TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 58 COMMERCIAL SMART LIGHTING MARKET IN NORTH AMERICA, BY COMMUNICATION TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 59 COMMERCIAL SMART LIGHTING MARKET IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 60 COMMERCIAL SMART LIGHTING MARKET IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

12.2.1 US

12.2.1.1 US to hold major share of commercial smart lighting market in North America during forecast period

12.2.2 CANADA

12.2.2.1 Fastest-growing market for commercial smart lighting in North America

12.2.3 MEXICO

12.2.3.1 Government initiatives to implement energy-efficient lighting systems

12.2.4 IMPACT OF COVID-19 ON NORTH AMERICAN MARKET

12.3 EUROPE

FIGURE 46 SNAPSHOT: COMMERCIAL SMART LIGHTING MARKET IN EUROPE

TABLE 61 COMMERCIAL SMART LIGHTING MARKET IN EUROPE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 62 COMMERCIAL SMART LIGHTING MARKET IN EUROPE, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 63 COMMERCIAL SMART LIGHTING MARKET IN EUROPE FOR HARDWARE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 64 COMMERCIAL SMART LIGHTING MARKET IN EUROPE FOR HARDWARE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 65 COMMERCIAL SMART LIGHTING MARKET IN EUROPE FOR LIGHTING CONTROLS, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 66 COMMERCIAL SMART LIGHTING MARKET IN EUROPE FOR LIGHTING CONTROLS, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 67 COMMERCIAL SMART LIGHTING MARKET IN EUROPE, BY END-USE APPLICATION, 2016–2019 (USD MILLION)

TABLE 68 COMMERCIAL SMART LIGHTING MARKET IN EUROPE, BY END-USE APPLICATION, 2020–2025 (USD MILLION)

TABLE 69 COMMERCIAL SMART LIGHTING MARKET IN EUROPE FOR INDOOR APPLICATION, BY TYPE, 2016–2019 (USD MILLION)

TABLE 70 COMMERCIAL SMART LIGHTING MARKET IN EUROPE FOR INDOOR APPLICATION, BY TYPE, 2020–2025 (USD MILLION)

TABLE 71 COMMERCIAL SMART LIGHTING MARKET IN EUROPE FOR COMMERCIAL APPLICATION, BY TYPE, 2016–2019 (USD MILLION)

TABLE 72 COMMERCIAL SMART LIGHTING MARKET IN EUROPE FOR COMMERCIAL APPLICATION, BY TYPE, 2020–2025 (USD MILLION)

TABLE 73 COMMERCIAL SMART LIGHTING MARKET IN EUROPE FOR OUTDOOR APPLICATION, BY TYPE, 2016–2019 (USD MILLION)

TABLE 74 COMMERCIAL SMART LIGHTING MARKET IN EUROPE FOR OUTDOOR APPLICATION, BY TYPE, 2020–2025 (USD MILLION)

TABLE 75 COMMERCIAL SMART LIGHTING MARKET IN EUROPE, BY COMMUNICATION TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 76 COMMERCIAL SMART LIGHTING MARKET IN EUROPE, BY COMMUNICATION TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 77 COMMERCIAL SMART LIGHTING MARKET IN EUROPE, BY INSTALLATION TYPE, 2016–2019 (USD MILLION)

TABLE 78 COMMERCIAL SMART LIGHTING MARKET IN EUROPE, BY INSTALLATION TYPE, 2020–2025 (USD MILLION)

TABLE 79 COMMERCIAL SMART LIGHTING MARKET IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 80 COMMERCIAL SMART LIGHTING MARKET IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

12.3.1 UK

12.3.1.1 Rising demand for energy-saving lighting solutions to drive commercial smart lighting market in UK

12.3.2 GERMANY

12.3.2.1 Growing emphasis of government on phasing out conventional lighting technologies fueling market growth in Germany

12.3.3 FRANCE

12.3.3.1 Increasing awareness regarding benefits of smart lighting creating opportunities for market players

12.3.4 ITALY

12.3.4.1 Rising focus of government organizations on minimizing energy consumption to foster smart lighting market in Italy

12.3.5 REST OF EUROPE

12.3.6 IMPACT OF COVID-19 ON EUROPEAN MARKET

12.4 APAC

FIGURE 47 SNAPSHOT: COMMERCIAL LIGHTING MARKET IN APAC

TABLE 81 COMMERCIAL SMART LIGHTING MARKET IN APAC, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 82 COMMERCIAL SMART LIGHTING MARKET IN APAC, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 83 COMMERCIAL SMART LIGHTING MARKET IN APAC FOR HARDWARE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 84 COMMERCIAL SMART LIGHTING MARKET IN APAC FOR HARDWARE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 85 COMMERCIAL SMART LIGHTING MARKET IN APAC FOR LIGHTING CONTROLS, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 86 COMMERCIAL SMART LIGHTING MARKET IN APAC FOR LIGHTING CONTROLS, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 87 COMMERCIAL SMART LIGHTING MARKET IN APAC, BY END-USE APPLICATION, 2016–2019 (USD MILLION)

TABLE 88 COMMERCIAL SMART LIGHTING MARKET IN APAC, BY END-USE APPLICATION, 2020–2025 (USD MILLION)

TABLE 89 COMMERCIAL SMART LIGHTING MARKET IN APAC, BY INDOOR APPLICATION, 2016–2019 (USD MILLION)

TABLE 90 COMMERCIAL SMART LIGHTING MARKET IN APAC, BY INDOOR APPLICATION, 2020–2025 (USD MILLION)

TABLE 91 COMMERCIAL SMART LIGHTING MARKET IN APAC, BY COMMERCIAL APPLICATION, 2016–2019 (USD MILLION)

TABLE 92 COMMERCIAL SMART LIGHTING MARKET IN APAC, BY COMMERCIAL APPLICATION, 2020–2025 (USD MILLION)

TABLE 93 COMMERCIAL SMART LIGHTING MARKET IN APAC, BY OUTDOOR APPLICATION, 2016–2019 (USD MILLION)

TABLE 94 COMMERCIAL SMART LIGHTING MARKET IN APAC, BY OUTDOOR APPLICATION, 2020–2025 (USD MILLION)

TABLE 95 COMMERCIAL SMART LIGHTING MARKET IN APAC, BY INSTALLATION TYPE, 2016–2019 (USD MILLION)

TABLE 96 COMMERCIAL SMART LIGHTING MARKET IN APAC, BY INSTALLATION TYPE, 2020–2025 (USD MILLION)

TABLE 97 COMMERCIAL SMART LIGHTING MARKET IN APAC, BY COMMUNICATION TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 98 COMMERCIAL SMART LIGHTING MARKET IN APAC, BY COMMUNICATION TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 99 COMMERCIAL SMART LIGHTING MARKET IN APAC, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 100 COMMERCIAL SMART LIGHTING MARKET IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

12.4.1 CHINA

12.4.1.1 Increasing government expenditure on public infrastructure to drive commercial smart lighting market growth in China

12.4.2 JAPAN

12.4.2.1 Growing use of commercial smart lighting systems for indoor lighting applications to boost market growth in Japan

12.4.3 INDIA

12.4.3.1 Ongoing government support for deployment of energy-efficient lighting solutions to drive market growth in India

12.4.4 AUSTRALASIA

12.4.4.1 Growing number of smart infrastructure projects to spur commercial smart lighting market growth

12.4.5 REST OF APAC

12.4.6 IMPACT OF COVID-19 ON APAC MARKET

12.5 REST OF THE WORLD

TABLE 101 COMMERCIAL LIGHTING MARKET IN ROW, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 102 COMMERCIAL SMART LIGHTING MARKET IN ROW, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 103 COMMERCIAL SMART LIGHTING MARKET IN ROW FOR HARDWARE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 104 COMMERCIAL SMART LIGHTING MARKET IN ROW FOR HARDWARE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 105 COMMERCIAL SMART LIGHTING MARKET IN ROW FOR LIGHTING CONTROLS, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 106 COMMERCIAL SMART LIGHTING MARKET IN ROW FOR LIGHTING CONTROLS, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 107 COMMERCIAL SMART LIGHTING MARKET IN ROW, BY END-USE APPLICATION, 2016–2019 (USD MILLION)

TABLE 108 COMMERCIAL SMART LIGHTING MARKET IN ROW, BY END-USE APPLICATION, 2020–2025 (USD MILLION)

TABLE 109 COMMERCIAL SMART LIGHTING MARKET IN ROW, BY INDOOR APPLICATION, 2016–2019 (USD MILLION)

TABLE 110 COMMERCIAL SMART LIGHTING MARKET IN ROW, BY INDOOR APPLICATION, 2020–2025 (USD MILLION)

TABLE 111 COMMERCIAL SMART LIGHTING MARKET IN ROW, BY COMMERCIAL APPLICATION, 2016–2019 (USD MILLION)

TABLE 112 COMMERCIAL SMART LIGHTING MARKET IN ROW, BY COMMERCIAL APPLICATION, 2020–2025 (USD MILLION)

TABLE 113 COMMERCIAL SMART LIGHTING MARKET IN ROW, BY OUTDOOR APPLICATION, 2016–2019 (USD MILLION)

TABLE 114 COMMERCIAL SMART LIGHTING MARKET IN ROW, BY OUTDOOR APPLICATION, 2020–2025 (USD MILLION)

TABLE 115 COMMERCIAL SMART LIGHTING MARKET IN ROW, BY INSTALLATION TYPE, 2016–2019 (USD MILLION)

TABLE 116 COMMERCIAL SMART LIGHTING MARKET IN ROW, BY INSTALLATION TYPE, 2020–2025 (USD MILLION)

TABLE 117 SMART LIGHTING MARKET IN ROW, BY COMMUNICATION TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 118 SMART LIGHTING MARKET IN ROW, BY COMMUNICATION TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 119 SMART LIGHTING MARKET IN ROW, BY REGION, 2016–2019 (USD MILLION)

TABLE 120 SMART LIGHTING MARKET IN ROW, BY REGION, 2020–2025 (USD MILLION)

12.5.1 MIDDLE EAST AND AFRICA

12.5.1.1 Rapid urbanization to drive commercial smart lighting market in Middle East and Africa

12.5.2 SOUTH AMERICA

12.5.2.1 High adoption of commercial smart lighting hardware devices to drive market in South America

12.5.3 IMPACT OF COVID-19 ON MARKET IN ROW

13 COMPETITIVE LANDSCAPE (Page No. - 155)

13.1 OVERVIEW

FIGURE 48 KEY DEVELOPMENTS BY LEADING PLAYERS IN MARKET FROM 2016 TO 2020

13.2 MARKET RANKING ANALYSIS, 2019

FIGURE 49 MARKET RANKING OF TOP 3 PLAYERS IN COMMERCIAL LIGHTING MARKET, 2019

13.3 MARKET SHARE ANALYSIS,2019

TABLE 121 COMMERCIAL LIGHTING MARKET SHARE ANALYSIS, 2019

13.4 HISTORICAL REVENUE ANALYSIS, 2015–2019 (USD BILLION)

TABLE 122 5-YEAR HISTORICAL REVENUE ANALYSIS FOR LIGHTING COMPANIES (USD BILLION)

13.5 COMPETITIVE SITUATIONS AND TRENDS

FIGURE 50 BATTLE FOR MARKET SHARE: PRODUCT LAUNCHES AND DEVELOPMENTS WERE KEY STRATEGIES ADOPTED BETWEEN 2016 AND 2020

13.5.1 PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 123 PRODUCT LAUNCHES AND DEVELOPMENTS, 2016–2020

13.5.2 AGREEMENTS, PARTNERSHIPS, COLLABORATIONS, AND CONTRACTS

TABLE 124 AGREEMENTS, PARTNERSHIPS, COLLABORATIONS, AND CONTRACTS, 2016–2020

13.5.3 ACQUISITIONS

TABLE 125 ACQUISITIONS, 2017–2020

13.5.4 PRODUCT EXPANSIONS & UPGRADES

TABLE 126 PRODUCT EXPANSIONS & UPGRADES, 2018–2020

13.5.5 DEMONSTRATIONS, DIVESTITURES, & FUNDING

TABLE 127 DEMONSTRATIONS, DIVESTITURES, & FUNDING, 2018–2020

13.6 COMPANY EVALUATION MATRIX

13.6.1 STAR

13.6.2 EMERGING

13.6.3 PERVASIVE

13.6.4 PARTICIPANT

FIGURE 51 COMMERCIAL SMART LIGHTING MARKET (GLOBAL), COMPANY EVALUATION MATRIX, 2020

13.7 STARTUP/SME EVALUATION MATRIX, 2020

13.7.1 PROGRESSIVE COMPANIES

13.7.2 RESPONSIVE COMPANIES

13.7.3 DYNAMIC COMPANIES

13.7.4 STARTING BLOCKS

FIGURE 52 COMMERCIAL SMART LIGHTING MARKET (GLOBAL), STARTUP/SME EVALUATION MATRIX, 2020

14 COMPANY PROFILES (Page No. - 173)

14.1 INTRODUCTION

14.2 KEY PLAYERS

(Business overview, Products offered, Recent developments, SWOT analysis, MNM view)*

14.2.1 SIGNIFY HOLDING (PHILIPS LIGHTING N.V.)

FIGURE 53 SIGNIFY: COMPANY SNAPSHOT

14.2.2 LEGRAND S.A.

FIGURE 54 LEGRAND: COMPANY SNAPSHOT

14.2.3 ACUITY BRANDS, INC.

FIGURE 55 ACUITY BRANDS: COMPANY SNAPSHOT

14.2.4 GE CURRENT, A DAINTREE COMPANY

14.2.5 OSRAM LICHT AG

FIGURE 56 OSRAM LICHT AG: COMPANY SNAPSHOT

14.2.6 IDEAL INDUSTRIES, INC. (CREE LIGHTING)

14.2.7 LEVITON MANUFACTURING COMPANY, INC.

14.2.8 LUTRON ELECTRONICS CO., INC.

14.2.9 LEDVANCE GMBH

14.2.10 ZUMTOBEL GROUP AG

FIGURE 57 ZUMTOBEL GROUP AG: COMPANY SNAPSHOT

14.2.11 HUBBELL INCORPORATED

FIGURE 58 HUBBELL INCORPORATED: COMPANY SNAPSHOT

14.2.12 SCHNEIDER ELECTRIC SE

FIGURE 59 SCHNEIDER ELECTRIC SE: COMPANY SNAPSHOT

*Business overview, Products offered, Recent developments, SWOT analysis, MNM view might not be captured in case of unlisted companies.

14.3 RIGHT TO WIN

14.4 OTHER IMPORTANT PLAYERS

14.4.1 HONEYWELL INTERNATIONAL INC.

14.4.2 DIALIGHT PLC

14.4.3 ABB

14.4.4 RAB LIGHTING INC.

14.4.5 SYNAPSE WIRELESS, INC. (MCWANE, INC.)

14.4.6 PANASONIC GROUP

14.4.7 LG ELECTRONICS INC.

14.4.8 ENLIGHTED INC. (A SIEMENS COMPANY)

14.4.9 HELVAR

14.4.10 WIPRO ENTERPRISES (P) LIMITED

14.4.11 SYSKA LED

15 APPENDIX (Page No. - 229)

15.1 INSIGHTS FROM INDUSTRY EXPERTS

15.2 DISCUSSION GUIDE

15.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.4 AVAILABLE CUSTOMIZATIONS

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

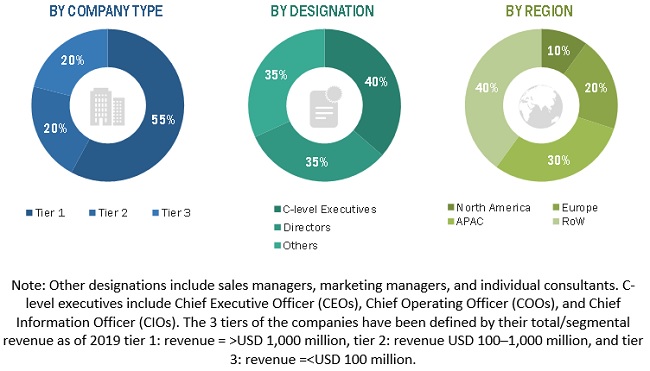

The study involved 4 major activities for estimating the current size of the commercial smart lighting market. Exhaustive secondary research has been carried out to collect information on the market, peer markets, and the parent market. The next step has been to validate these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures have been used to estimate the size of segments and subsegments of the market.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. Secondary sources include annual reports, press releases, and investor presentations of companies; white papers, journals, certified publications, articles from recognized authors; websites; directories; and databases. Secondary research has mainly been used to obtain key information about the industry’s supply chain, market’s value chain, major players, market classification, and segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both market- and technology oriented perspectives. Secondary data has been collected and analyzed to arrive at the overall market size, which has further been validated through primary research

Primary Research

Primary research has also been conducted to identify market segmentation and key players, analyze the competitive landscape, key factors affecting the market’s dynamics (drivers, restraints, opportunities, and challenges), and strategies of key players. During market engineering, both top-down and bottom-up approaches have been extensively used, along with several data triangulation methods, to estimate and forecast the market, including the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analyses have been performed during market engineering to list key information/insights throughout the report.

Primary interviews have been conducted with experts from both the demand and supply sides across 4 regions: North America, Europe, APAC, and RoW. Approximately 25% of the primary interviews have been conducted with the demand side, while 75% have been conducted with the supply side. This primary data has been collected mainly through telephonic interviews, which consist of 80% of total primary interviews. However, questionnaires and emails have also been used to collect the data.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been implemented to estimate and validate the total size of the commercial smart lighting market. These methods have been also used extensively to estimate the size of the markets based on various segments. The research methodology used to estimate the market size included the following steps:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for each market segment and subsegment. The data has been triangulated by studying various factors and trends from demand and supply sides across different end users.

Study Objectives

- To define, describe, forecast, and analyze the size of the commercial smart lighting market, based on offering (hardware, software, and services), communication technology (wired and wireless), end-use application (indoor and outdoor), installation type (new and retrofit), and geography

-

To forecast the market for various segments with regard to four main regions, namely,

North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW) - To provide detailed information regarding major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze micromarkets1 with respect to their individual growth trends, prospects, and contributions to the overall market

- To analyze the key industry trends related to components, communication technologies, and end-use applications that shape and influence the market

- To analyze opportunities in the market for various stakeholders by identifying high-growth segments of the market

- To profile the key players and comprehensively analyze their market position in terms of their market ranking and core competencies2

- To provide a detailed competitive landscape of the market, along with a share analysis of key players

- To analyze competitive growth strategies such as partnerships, contracts, agreements and collaborations, acquisitions, and new product launches and developments, adopted by key players in the commercial smart lighting market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for this report:

Regional Analysis

- Country-wise breakdown of the commercial smart lighting market for North America, Europe, APAC, and RoW

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Commercial Lighting Market