Photonics Market

Photonics Market by Product Type (LED), Wavelength (Infrared, Visible), Material (Silicon, Glass), Application (Information & Communication Technology), End-use Industry (Industrial, Media & Telecommunication), & Region - Global Forecast to 2030

Updated on : December 11, 2025

PHOTONICS MARKET

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The photonics market was valued at USD 1,094 billion in 2025 and is projected to reach USD 1481.8 billion by 2030, growing at 6.3% cagr from 2025 to 2030. The market is growing steadily, driven by its ongoing usage in numerous vital sectors, primarily construction, media & telecommunication, medical, and industrial. The dramatic shift to smart manufacturing and Industry 4.0 is increasing the demand for photonics in automation, machine vision and sensing.

KEY TAKEAWAYS

-

BY PRODUCT TYPEPhotonics technologies include light sources, lasers, sensors, imaging devices, optical communication systems, components, and photonic integrated circuits (PICs). Lasers dominate in industrial processing, medical, and defence, while optical communication systems are central to 5G and data center growth. Sensors and imaging devices are widely used in automotive safety, healthcare, and security. PICs are the fastest-growing, enabling miniaturization and cost-efficient data transmission.

-

BY MATERIALPhotonics components are manufactured using diverse materials such as silicon, indium phosphide, gallium arsenide, gallium nitride, lithium niobate, and glass. Silicon photonics dominates in data centers and telecommunication due to scalability and cost-efficiency, while compound semiconductors like InP and GaAs are favored in high-speed and high-frequency applications. Lithium niobate is increasingly used in modulators for 5G and quantum technologies, and specialty glasses play a key role in lenses, sensors, and laser systems.

-

BY WAVELENGTHPhotonics systems operate across ultraviolet (UV), visible, and infrared (IR) spectrums. UV photonics is gaining traction in semiconductor lithography, disinfection, and medical imaging. Visible light technologies are widely deployed in displays, lighting, and consumer electronics. Infrared holds the largest share, driven by its critical role in optical communication, thermal imaging, spectroscopy, and defense applications. Market trends show rapid growth in the IR and UV segments due to rising demand for high-precision sensing and connectivity.

-

BY END-USE INDUSTRYEnd-use sectors include telecommunication, medical, construction, defense, and industrial. Telecommunication dominates through fiber optics and broadband expansion. The medical sector is rapidly growing with photonics-based imaging and surgical systems. Defense continues to adopt lasers, IR imaging, and optical sensors, while construction benefits from smart glass and energy-efficient solutions. Industrial use remains vital in manufacturing, inspection, and automation.

-

COMPETITIVE LANDSCAPEThe photonics market is shaped by technological innovation, capacity expansion, and partnerships among global leaders. Key players include Thorlabs Inc. (US), IPG Photonics Corporation (US), Lumentum Holdings Inc. (US), ams-OSRAM AG (Austria), Hamamatsu Photonics K.K. (Japan), Corning Incorporated (US), Coherent Corp. (US), OFS Fitel LLC (US), ON Semiconductor Corporation (US), and Signify Holding (Netherlands). These companies are advancing in areas such as optical communication, lasers, sensors, imaging, and integrated photonics. Strategic focus remains on enhancing efficiency, miniaturization, and energy performance to address demand from the telecommunications, medical, defense, and industrial automation sectors.

The photonics market is growing rapidly due to rising demand for high-speed communication, advanced imaging, and energy-efficient solutions. Key drivers include 5G and data center expansion in telecom, increasing use of lasers and sensors in healthcare, LiDAR and smart lighting in construction, and adoption in defense, industrial, and consumer electronics. Government support for renewable energy and digital infrastructure further accelerates growth, making photonics central to innovation across industries.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Changes in customer trends or disruptions impact consumers’ businesses. These shifts impact the revenue of end users. Consequently, the revenue impact on end users is expected to affect the revenue of photonics suppliers, which, in turn, impacts the revenue of photonics manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

PHOTONICS MARKET DYNAMICS

Level

-

Advancement in photonic integrated circuits enabling miniaturization and cost-effective high-performance solutions

-

Rising demand for high-speed optical communication

Level

-

High-optical losses in silicon nitride and SOI (Silicon on insulator) waveguide fabrication

-

Lack of unified design standards for photonics devices

Level

-

Commercialization and innovation in quantum technologies leveraging photonics for next generation secure communication and sensing

-

Integration of photonics with artificial intelligence and Internet of Things (IoT)

Level

-

Signal Distortion from Non-Linear Effects in High-Power Photonic Systems

-

Complexity in integration of photonic sensors into industrial IoT systems

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: : Advancement in photonic integrated circuits enabling miniaturization and cost-effective high-performance solutions

Developments in photonic integrated circuits (PICs) are a critical driver of the photonics market, fostering miniaturization and cost-effective, high-performing solutions across telecommunications, data centers, healthcare, and sensing applications. PICs combine multiple photonic components - lasers, modulators, waveguides, and detectors - on a single chip, using silicon as the base material and fabricating shared processes in existing supply chains and manufacturing methods with CMOS compatible silicon. They have thus been demonstrated to reduce footprint, power consumption, and costs, compared to discrete optical systems across these applications. Miniaturization enabled by PICs allow high-speed data transmission to be integrated into compact transceivers.

Restraint: High-Optical losses in silicon nitride and SOI (Silicon on insulator) waveguide fabrication

High optical losses in silicon nitride (SiN) and silicon-on-insulator (SOI) waveguide fabricating is a considerable limitation on the photonics industry and a limitation in the area of photonic integrated circuits (PICs), which are critical for telecommunications, data centers, and sensing applications. Optical waveguides are used to guide light within PICs, and the light signal transmitted through a waveguide is attenuated by scattering and absorption that takes place in the SiN and SOI platforms, which are generally attributed to material non-idealities such as defects, surface roughness, etc. Silicon nitride is useful as an optical waveguide material due to wide transparency range and CMOS compatibility. While SiN allows for processing with suitable materials, the propagation losses are often not acceptable because the light is typically propagating through a waveguide which has rough sidewalls, and various imperfections which occur during the fabrication processes ultimately impart excess scattering losses.

Opportunity: : Commercialization and innovation in quantum technologies leveraging photonics for next generation secure communication and sensing

The commercialization as well as innovation in photonic-based quantum technologies offers a paradigm-changing event in the photonics market and the supporting technologies by enabling next-generation secure communication and advanced sensing applications. Photonics technologies utilize the properties of photons to manipulate quantum states to enable quantum computing, cryptography, and sensing manipulation. Quantum communication, including quantum key distribution (QKD), requires photonic systems, such as single-photon sources and single-photon detectors, to create unhackable data transmission capabilities while meeting the growing requirements of cybersecurity in telecommunications applications.

Challenge: Signal Distortion from Non-Linear Effects in High-Power Photonic Systems disruptions.

Signal distortion originating from any non-linear effects particular to high power photonic systems is a significant market hurdle in the field of photonics which limits high performance. Non-linear effects that typically occur with electromagnetic fields associated with high-intensity light-beams interacting with materials in optical fibers, waveguides or lasers include self-phase modulation, four-wave mixing, and stimulated Brillouin scattering, all leading to inevitable unwanted phase, frequency, or amplitude deviations from the optical signal.

Photonics Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Development of optical fibers and cables for high-speed telecommunication networks | Enables faster internet connectivity, low signal loss, and supports growing demand from 5G and data centers |

|

High-performance laser components for industrial cutting, welding, and medical surgery | Provides precision manufacturing, reduces defects, and improves efficiency in healthcare and automotive sectors |

|

Advanced photonic components for displays and consumer electronics | Provides brighter displays, higher resolution, and energy-efficient performance for smartphones and TVs |

|

Development of optoelectronic devices, light sources, and sensors for applications in medical imaging, spectroscopy, life sciences, and semiconductor inspection | Provides ultra-high sensitivity, precision detection, and reliable performance in critical industries such as healthcare and semiconductors, enabling advanced diagnostics, research, and high-quality manufacturing |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

PHOTONICS MARKET ECOSYSTEM

The photonics market ecosystem consists of raw material suppliers (IQE PLC, Coherent Corp), part manufacturers (ams-OSRAM AG, Hamamatsu Photonics K.K), and end users (Samsung). Raw materials like silicon, glass, indium phosphide and others are processed into lightweight, high-performance materials for use in photonics components. End users drive demand for fuel efficiency and sustainability, while manufacturers deliver precision-engineered parts. Collaboration across the value chain is key to innovation and market growth.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

PHOTONICS MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Photonics Market, By Product Type

The light source segment accounts for the largest share of the product type segment in the photonics market because of their superior versatility, efficiency, and multi-industry transformative effect. The superior qualities of LEDs allow them to dominate photonics due to additional qualitative aspects that favor and support their widespread adoption and market dominance. For starters, LEDs are energy efficient and durable, which renders substantial operational, maintenance and power savings. Factors like energy efficiency, durability and lower maintenance costs make them very appealing as operationally and financially advantageous solutions for a large-scale utilization in business segments like general purpose lighting, automotive, consumer electronics and displays where operational efficiency and longevity are of paramount importance.

Photonics Market, By Material

Silicon is the largest materials segment of the photonics market because its properties and compatibility with technology make it ideal for large-scale, performing, and cost-effective photonic integration. This large share is due to its compatibility with existing semiconductor technologies, especially CMOS processes, which gives rise to the complete co-integration of photonics and electronics on the same chip.

Photonics Market, By Wavelength

The infrared modality has the largest market share across the wavelength segments of the photonics market due to its unique capability to fulfil different aspects of industrial or technological needs. The infrared spectrum adjacent to visible light consists of near-, mid-, and long-wave infrared (NIR, MWIR, LWIR). Its market leadership is due to its ability and depth of applications to cover telecommunications, imaging, security, healthcare, and industrial automation. Infrared photonics has enabled non-contact sensing, thermal imaging, spectroscopy and high-speed optical communication systems. In telecommunications, infrared photonics is responsible for data transmission through fiber-optic networks since it has low attenuation and superior transmission properties at infrared wavelengths.

Photonics Market, By Application

The information & communication technology (ICT) segment accounts for the largest share in the application segment of the photonics market. This is a direct result of photonics’ capabilities to facilitate the increasingly high speed and high capacity for data transport and processing in modern communications networks. The growth of digital data traffic driven by cloud computing, streaming services, Internet of Things (IoT) and 5G networks is dependent on photonic technologies (optical fiber, lasers and photonic integrated circuits) to transport data quickly, efficiently and with low loss or delay. Photonics provides unprecedented bandwidth capacity, speed, and energy efficiency as compared to traditional methods of electronic communications, making them essential for growing and building telecommunications infrastructure and data centers.

Photonics Market, By End-Use Industry

Media & telecommunication is the largest end-use industry in the photonics market because of its critical reliance on optical technologies for data transmission and connectivity. With the surge in internet traffic, 5G deployment, cloud computing, and data center expansions, demand for optical fibers, photonic integrated circuits, and laser components has increased significantly. Photonics enables faster, more reliable, and energy-efficient communication over long distances compared to traditional electronic systems. The industry also benefits from the continuous shift toward streaming, video conferencing, and IoT, which requires high bandwidth and low-latency networks.

REGION

Asia Pacific to be largest and fastest-growing region in global photonics market during forecast period

The largest regional market in the photonics industry is Asia Pacific, which has an extensive manufacturing ecosystem, rapid technology development, and strong government support of high-tech industry. China, Japan, South Korea, and Taiwan are global centers for electronics and optoelectronics manufacturing with heavy reliance on photonic components like laser diodes, LEDs, optical fibers, and image sensors. China leads the world in the production of optical communication equipment and LED related products, driven by its large telecom and consumer electronics industries. Japan and South Korea are also strong in advanced photonics applications, including automotive safety systems, semiconductor inspection, and high-resolution imaging for health care and factory automation. and development and manufacturing capacity for high-speed communication networks, smart manufacturing, and clean energy.

Photonics Market: COMPANY EVALUATION MATRIX

In the photonics market matrix, Corning Incorporated (Star) leads with a strong market share and extensive product footprint. Corning Incorporated is a global leader in materials science with a history dating back to 1851 in the world's center of glass innovation in Corning, New York. It is well known for glass, ceramics, and optical physics; its Optical Communications segment enables the continued advance of the photonics market. The segment plays a critical role in bringing next-generation optical fibers, fiber optic cables, and network connectivity solutions to customers. Corning companies have been central to high-speed, high-capacity data transmission systems since its invention of the world's first low-loss optical fiber in 1970, supporting advancements in telecommunications, 5G infrastructure, data centers, and AI-enabled applications.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

PHOTONICS MARKET PLAYERS

PHOTONICS MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 997.5 Billion |

| Market Forecast in 2030 (value) | USD 1,481.8 Billion |

| Growth Rate | CAGR of 6.3% from 2025-2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | • Material: Silicon, Glass, Indium Phosphide, Gallium Arsenide, Gallium Nitride, Lithium Niobate and Above • Wavelength: Ultraviolet, Visible, Infrared • Application: Display, Information & Communication Technology, Photovoltaics, Medical Technology & Life Science, Measurement & Automated Vision, Lighting and above • End-use industry: Construction, Media & Telecommunication, Medical, Security & Defense, Industrial, and above |

| Regions Covered | Asia Pacific, North America, Europe, Middle East & Africa, South America |

WHAT IS IN IT FOR YOU: Photonics Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Country-Level Breakdown | Instead of merely regional coverage, the report can provide country-specific market data (e.g., US, Germany, China, Japan, South Korea, India). This includes demand drivers, production hubs, R&D clusters, import/export trends, and regulatory policies. | Helps companies identify high-growth national markets (like China for telecom, Germany for automotive photonics) and plan market entry or expansion strategies with precision |

| Application-Specific Deep Dive | Customized focus on key applications such as displays, information & communication technology (ICT), medical imaging & diagnostics, LiDAR in automotive, and photovoltaics; includes adoption rates, OEM integration, and forward-looking demand scenarios | Enables clients to target niche opportunities, refine product portfolios, and prioritize R&D investment across high-demand photonics applications |

| Product Type Customization | Comparative analysis of light sources, lasers, detectors & sensors, optical communication systems, and photonic integrated circuits (PICs); covers performance metrics, pricing trends, and adoption across industries | Allows manufacturers and buyers to align product offerings with industry-specific needs, optimize cost-performance tradeoffs, and capture opportunities in emerging technologies like integrated photonics and quantum applications |

| Competitive Benchmarking | Extended profiling of global leaders (e.g., IPG Photonics, Lumentum, Hamamatsu Photonics, Corning, ams-OSRAM) alongside regional players; includes SWOT, product portfolios, technology focus, mergers & acquisitions, and market positioning | Provides a clear competitive landscape, helping clients identify potential partnerships, acquisition targets, or risks from disruptive competitors |

RECENT DEVELOPMENTS

- March 2023 : Corning Incorporated launched MiniXtend Optical Cable with Flow Ribbon Technology at OFC 2023, designed for data centers and carrier networks. It reduces installation costs and carbon emissions, targeting high-density, sustainable network deployments in North America and Europe.

- March 2023 : Corning Incorporated partnered with Infinera to showcase industry-leading 400G data transmission using TXF optical fiber, targeting high-capacity submarine and long-haul networks worldwide.

- November 2021 : OFS Fitel, LLC introduced AllWave Flex ZWP Fiber for FTTH and 5G networks, targeting high-density, bend-insensitive applications in North America and Europe.

- July 2024 : NICHIA CORPORATION launched NVSW219C-V2 LED with improved color uniformity for outdoor lighting, targeting global industrial markets.

- February 2021 : ON Semiconductor Corporation acquired Cypress Semiconductor’s CMOS Image Sensor Business Unit for USD 31.4 million, strengthening ON Semiconductor’s imaging portfolio for automotive and industrial applications in North America.

Table of Contents

Methodology

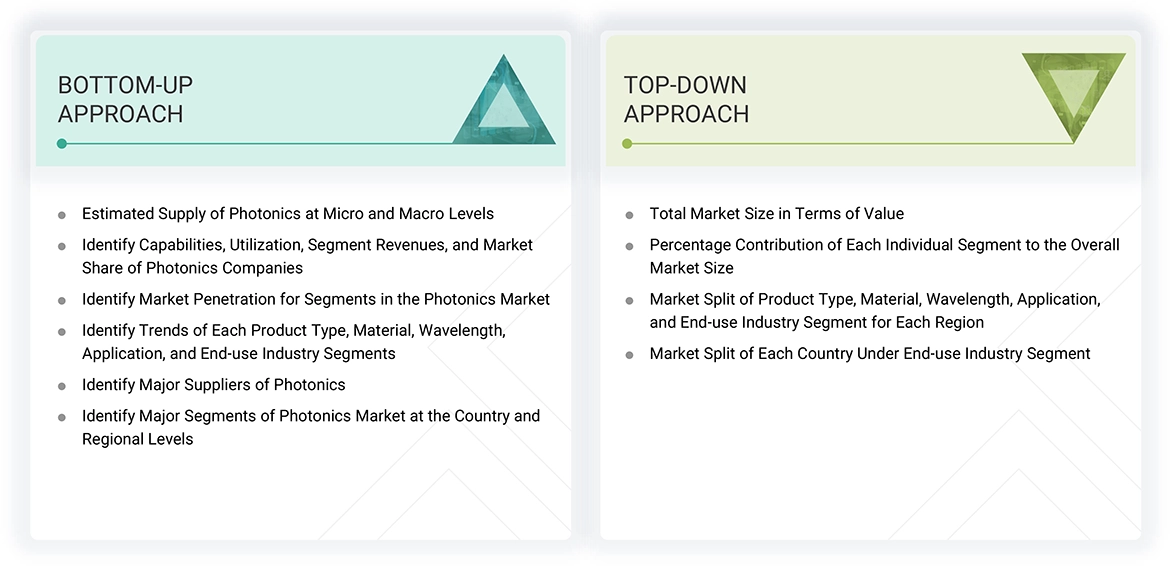

The study involved four major activities in estimating the market size of the photonics market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, certified publications, articles from recognized authors, gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The photonics market comprises several stakeholders in the value chain, which include raw material suppliers, manufacturers, and end users. Various primary sources from the supply and demand sides of the photonics market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the photonics market industry.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to chemistry, application, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of the photonics market and future outlook of their business, which will affect the overall market.

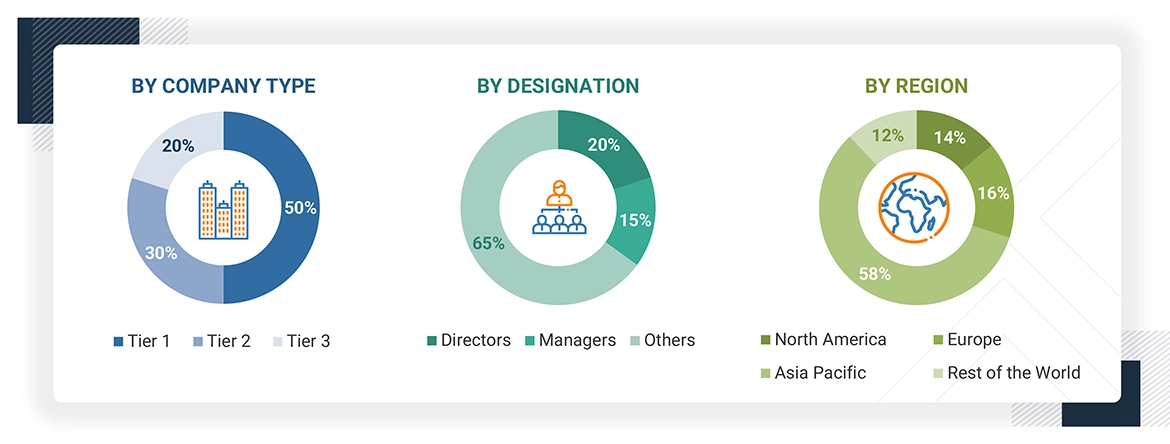

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2024 available in the public domain, product portfolios, and geographical presence.

Other designations include sales representatives, production heads, and technicians.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach was used to estimate and validate the size of various submarkets for the photonics market. The research methodology used to estimate the market size included the following steps:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns based on product type, material, wavelength, application, and end-use industry, and region were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added with detailed inputs and analysis and presented in this report.

Data Triangulation

After arriving at the total market size from the estimation process above, the overall market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

Photonics is the science and technology of generating, controlling, and detecting photons (particles of light) within the electromagnetic spectrum (from ultraviolet to visible to infrared wavelengths). The photonics market includes all types of components, systems, and technologies that use light (photons) for functional applications across a number of industries, including telecommunications, healthcare, manufacturing, defense, and consumer electronics. The raw components of photonics include light sources, such as light-emitting diodes (LEDs) and lasers, optical fibers, lenses, modulators, sensors and detectors, and imaging systems, each working in precise and interconnected patterns to manipulate light or photons. Photonics technologies typically arise out of advanced material science or semiconductor fabrication. Photonic chips, optical components, or laser diodes are produced from materials such as silicon, glass, gallium arsenide, and lithium niobate. “Fabricating” these in cleanroom facilities, allows the manufacturing of precision components and devices using methods similar to those used in microelectronics (e.g., lithography, deposition, doping and etching). Optical fibers, for example, are produced by drawing purified silica glass into extremely thin strands that transmit light over fantastic distances with minimal loses, enabling global internet and communications.

Stakeholders

- Photonics Manufacturers

- Photonics Traders, Distributors, and Suppliers

- Raw Type Suppliers

- Government and Private Research Organizations

- Associations and Industrial Bodies

- R&D Institutions

- Environmental Support Agencies

Report Objectives

- To define, describe, and forecast the size of the photonics market in terms of value and volume

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on product type, material, wavelength, application, end-use industry, and region

- To forecast the size of the market with respect to major regions, namely, North America, Europe, the Middle East & Africa, and South America, along with their key countries

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders

- To track and analyze recent development such as partnerships, agreements, joint ventures, collaborations, awards, and expansions in the market

- To strategically profile the key market players and comprehensively analyze their core competencies

Key Questions Addressed by the Report

Which factors influence the growth of the photonics market?

The photonics market is poised to grow due to increasing high-speed data transmission, sophisticated medical imaging, and precision manufacturing. Significant factors driving growth include the expansion of fiber-optic and 5G networks, increased use of lasers and sensors in manufacturing and industrial automation, and adoption of energy-efficient LED lighting and solar technology. Additionally, newer expansion areas like quantum computing, LiDAR, and AR/VR are also demonstrating robust market growth.

Which country is expected to have the largest share in the photonics market?

China is projected to have the largest market share in the photonics market due to its well-established manufacturing base, large investment in optical communication infrastructure, and rapid growth in sectors like semiconductors, consumer electronics, and renewable energy. The country has committed to becoming a global leader in advanced technologies, which has contributed to the demand for photonic components such as sensors, lasers, and optical fibers.

Who are the major manufacturers?

Major manufacturers include Thorlabs, Inc. (US), IPG Photonics Corporation (US), Lumentum Operations LLC (US), ams-OSRAM AG (Austria), Hamamatsu Photonics K.K. (Japan), Corning Incorporated (US), Coherent Corp (US), OFS Fitel, LLC (US), ON SEMICONDUCTOR CORPORATION (US), and Signify Holding (Netherlands).

What are the opportunities in the photonics market?

The photonics industry has expansive opportunities resulting from its central role in fast-growing and developing technologies across industries. The fast growth of 5G networks and data centers creates opportunities for optical communication systems (fiber optics and silicon photonics) to support high-speed and low-latency data transmission to enable cloud computing and the Internet of Things (IoT). Silicon photonics allows the combination of photonic devices and electronic devices and provides opportunities for small-form, low-power solutions for data centers and autonomous vehicle sensors, such as LiDAR, improving navigation and safety.

Which application has the largest share in the photonics market?

Information & communication technology accounts for the largest market share.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Photonics Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Photonics Market

Yunze

Aug, 2019

Laser equipment and manufacturing information in the Photonics market.

Edward

May, 2022

Can we get the information on Photonics Market, 2022 - 2027, Industry Share, Size, Growth ? .

Daniel

Jul, 2019

Deeper photonic market data regarding revenue and CAGR by regions (WW; EU, Asia, Query not Clear, SA and middle east) and by application (Analysis and measurement technology, Optical components, SPACE. Medical Technology / Life Science, microscopy, production technology, optometry, lighting, Information and communication technology).