Power Over Ethernet Lighting Market Size, Share, Statistics and Industry Growth Analysis Report by Offering (Hardware, Software and Services), Wattage (Up to 25 Watts, Above 25 Watts), Application (Commercial, Industrial), and Geography (2021-2026)

Updated on : Oct 23, 2023

The global power over ethernet lighting size is projected to reach USD 922 million by 2026 from USD 243 million in 2021, growing at a CAGR of 30.6% from 2021 to 2026.

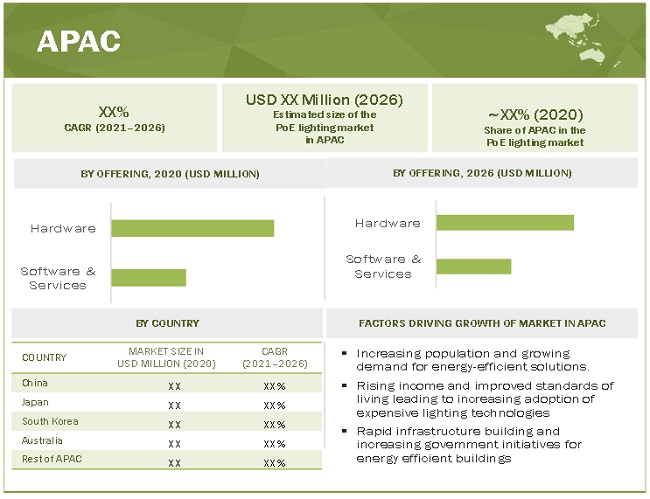

North America has the largest market share for PoE lighting. Whereas, APAC has the highest growth rate and is expected to grow at the highest CAGR during the forecast period owing to the rapidly changing face of technology and customer needs in high-potential markets such as China, Japan, South Korea, and Australia. Due to advancements in technology and the emergence of new business models as well as new constructions in the developing cities of the region, the PoE lighting market is exhibiting an upbeat outlook. The booming commercial and industrial sectors would further fuel the adoption of PoE lightings in APAC. Furthermore, growth in end-use sectors and mounting investments from government bodies are also favoring the growth of the PoE lighting industry in the region. China is projected to witness the highest demand for PoE lighting in the region.

To know about the assumptions considered for the study, Request for Free Sample Report

PoE Lighting Market Dynamics:

Driver: Increased adoption in commercial and industrial sectors due to low overheads and maintenance costs

PoE provides power and network connectivity to devices through a single network cable the technology enables end-users to deliver power and data through cables from power sourcing equipment (PSE), such as switches, directly to the network port of connected powered devices (PD), such as LED luminaires. PoE solutions make installation and expansion of a network simpler and cost-effective, especially in buildings where it is too expensive or inconvenient to install new power lines.

Industrial sectors and commercial buildings such as office buildings, warehouses, and retail buildings are increasingly opting for PoE-enabled solutions, which bring benefits such as savings in installation and maintenance costs, low overall design and construction costs, and reduced labor efforts due to the limited amount of Ethernet cables required. PoE is largely considered in commercial applications because of the presence of data networking switches that support thousands of endpoints. The use of PoE lighting in commercial buildings enables the implementation of concepts such as smart buildings that drive efficiency and productivity. According to the University of Michigan, in the US, the commercial building floor space is expected to reach 126.1 billion sq. ft. by 2050, a 39% increase over 2017 levels. The growing commercial floor space holds significant potential for PoE lighting vendors.

PoE-enabled lighting solutions are easy, safe and cost-effective to install. The ability to reuse the existing IT networking infrastructure is one of the biggest reasons driving the use of such solutions in commercial spaces. . For instance, in 2018, CompuCom saved USD 275,000 on electrical labor and wiring by powering its global 151,000 sq. ft headquarters in Charlotte, NC, US with PoE lighting. PoE enables IT personnel and even end-users to install additional LED light sources at almost any location. PoE lighting offers a more cost-efficient option for automated lighting and helps to manage the power supply for devices through a centralized switch. The growing use of PoE lighting in the commercial and industrial sectors is expected to boost the PoE lighting market growth.

Restraint: Hight initial costs of PoE equipment and accessories

The initial capital investment required for setting up a PoE network is high. This is mainly due to the high cost of Ethernet switches that use PSE (Power Sourcing Equipment) over traditional counterparts; and the cost of maintenance power sourcing equipment. Additional equipment, such as switches, injectors, splitters, ethernet cables, and PoE jacks, are also required. The cost of procuring these components also adds to the total initial costs. This is one of the major barriers to the growth of the PoE lighting market. While, in the long run, the PoE network can be more cost-effective, the uncertainty about the return on investment also proves to be a retraining factor.

Opportunity: Growing smart office and smart retail trends

Organizations are embracing digital disruptions to stay relevant and profitable and attract talent. Owners and operators of commercial facilities are becoming increasingly interested in PoE lighting for energy management and enhanced performance. PoE enables the installers to power, control, and manage the lighting system throughout a facility. Enterprises are also increasingly inclining toward converging separate systems into a single, secure network infrastructure to enhance flexibility, efficiency, and performance; this increases the opportunities for the PoE lighting market. The growing trends of remote workplaces and smart retail are resulting in the deployment of PoE to power networked devices. The increasing adoption of smart and automated systems by commercial enterprises is thus expected to boost the PoE lighting market share.

Challenge: Disruption in PoE lighting supply chain due to Covid-19

The COVID-19 pandemic has had a heavy impact across industries and businesses. Since the outbreak began in China in 2020, major disruptions have created ripple effects in economies around the world. The impact of COVID-19 on the PoE lighting market will have a long-lasting effect. Like much of the manufacturing sector, PoE lighting manufacturers also depend on China for a significant percentage of the components used. The lockdowns imposed across the world disrupted the production of LED and other components, resulting in a profound impact on the PoE lighting industry supply chain. Without the necessary components, production came to a complete stop in many places. However, the situation improved in the second half of 2020, as supplier companies started operating with limited capacity.

In applications, the commercial segment projected to hold the largest share of the PoE Lighting Market during the forecast period

The commercial segment accounted for the largest share of the PoE lighting market growth in 2020. Growing affordability and higher efficiencies are driving the use of PoE lighting in commercial buildings. The commercial segment includes offices, retail shops and malls, healthcare facilities, educational institutions, stadiums (arenas) and hospitality facilities. Reducing energy consumption has become a major objective for building owners, governments, utilities, and many other stakeholders. Replacing existing lights with more energy-efficient lighting sources (e.g., LED) is one of the ways to reduce this massive pool of energy use, but it is a small-scale solution. North America held the largest share of the PoE lighting market for commercial application in 2020. The presence of major PoE lighting solution providers coupled with escalated demand for PoE lighting solutions in commercial offices is fueling the growth of the said market in the region.

The above 25 Watt segment, in the market by wattage, of the PoE Lighting Market, projected to hold a larger share during the forecast period

The market for above 25 watts accounted for a larger share in 2020. Improved PoE standards coupled with the growing demand for high input-powered devices for lighting are driving the said market. OEMs are coming up with integrated solutions in luminaires, which require more input power. Thus, there is a growing requirement for Power Source Equipment (PSE) with high output to power the Power Devices (PDs). This is further expected to propel the market for high-wattage PoE lighting systems. PoE lighting of above 25 watts offers many advantages, such as greater brightness and illumination, and support for more direct/indirect loads. The digital revolution is generating a wave of emerging PoE systems and IoT applications for lighting, plug loads, office workstations, device charging, and other applications.

To know about the assumptions considered for the study, download the pdf brochure

The PoE Lighting Market in APAC projected to have highest CARG during the forecast period (2021-2026)

The PoE lighting market in APAC comprises China, Japan, Australia, South Korea and the Rest of APAC, which primarily includes India, Indonesia, Singapore, Taiwan, Malaysia, Thailand, Vietnam, Bangladeshand the Philippines. It is expected to be the fastest-growing market for PoE lighting during the forecast period. The PoE lighting market has enormous growth potential in this region, as connected lighting systems are rapidly being adopted in various applications, especially in smart offices/workspaces.

Lighting manufacturers based in China are giving fierce competition to companies based in North America and Europe. Chinese cities are offering a perfect mix of cost-effective land, good infrastructure, and abundant workforce to attract investments in industrial development. China is expected to lead the PoE lighting market in APAC owing to the availability of cost-effective land for setting up manufacturing plants as well as for new constructions of commercial spaces, presence of multiple lighting manufacturers, and continuing growth in commercial and industrial buildings as well as smart offices. The country has expertise in manufacturing lighting equipment and adopts technologies at a faster rate than other nations in the region. Rapid economic growth in China, India, Japan, and South Korea is expected to propel the APAC PoE lighting market in the coming years.

Key Players of PoE Lighting Market

Major vendors in the Power Over Ethernet Lighting Companies include Signify Holding (Philips Lighting) (Netherlands), Hubbell Inc. (US), Cisco Systems (US), H.E. Williams (US), Molex (Koch Industries) (US), Ubiquiti Networks Inc. (US), Siemon (US), Silvertel (UK), NETGEAR (US), Ideal Industries (Cree) (US), Herbert Waldmann GmbH & Co. Kg (Waldmann Lighting) (Germany), Prolojik (UK), Innovative Lighting (GENISYS) (US), Deco Lighting (US), Wipro Lighting (India), Axis Lighting (Canada), Igor Inc. (US), ALLNet GmbH (Germany) and NuLEDs (US).

PoE Lighting Market Report Scope

The report covers the demand and supply side segmentation of the PoE lighting market. The supply-side market segmentation includes offering, wattage, whereas the demand-side market segmentation includes application and region. The following figure represents an overview of the micro-markets covered in the report.

The following are the years considered:

PoE lighting Market Segmentation:

In this report, the PoE lighting market has been segmented into the following categories:

By Offering:

-

Hardware

- LED Luminaires

- Lighting Controls

- Software& Services

By Wattage:

- Up to 25 Watt

- Above 25 Watt

By Application:

- Commercial

- Industrial

- Others (Residential, Outdoor, Airport, Government Buildings, Railway Stations, etc.)

By Region:

- North America

- Europe

- APAC

- RoW

Recent Developments

- In March 2021, Hubbell Control Solutions announced the launch of a new and improved NX Distributed Intelligence Lighting Control Panel (NXP2 Series) that centralizes connection points in an enclosure, providing an installer-friendly solution that reduces time and costs to deploy code-compliant lighting control.

- In March 2021, Hubbell Lighting announced its partnership with LightAZ, a luminaire manufacturing company with headquarters in Illinois, US.

- In August 2020, Signify announced the expansion of its smart lighting system that works with the WiZ connected ecosystem in the US. The WiZ portfolio now includes smart bulbs in a wider variety of shapes and sizes, an integrated downlight, light strips and accessories that put the user in complete control of the lighting.

- In October 2019, Signify announced the acquisition of Cooper Lighting, a leading provider of professional lighting, lighting controls, and connected lighting.

- In September 2019, H.E. Williams announced its new series – Continuous. The extensive suite of continuous lighting solutions is designed to provide uninterrupted, low-glare illumination while enhancing the architecture of any space.

- In May 2019, H.E. Williams Company acquired Platformatics, Inc., a provider of network-based systems for the smart building Internet of Things (IoT) industry.

Frequently Asked Questions (FAQ):

Which are the major companies in the PoE lighting market? What are their major strategies to strengthen their market presence?

The major companies in the PoE lighting market are –Signify Holding (Philips Lighting), Hubbell Inc., Cisco Systems, Molex (Koch Industries) and H.E. Williams. The major strategies adopted by these players are product launches, expansions, agreements and acquisitions.

Which is the potential market for PoE lighting in terms of region?

Asia Pacific (APAC) is the largest market for PoE lighting. APAC, being one of the fastest-growing markets for technology and lighting solutions, provides attractive opportunities for players offering PoE lighting; as a result, many companies are expanding their footprint in this region. China, South Korea, and Japan are among the key digital hubs in APAC that occupy the maximum share of the market of the region. The booming commercial and industrial spaces would further fuel the adoption of PoE lightings in APAC. Furthermore, growth in end-use sectors and mounting investments from government bodies are also favoring the growth of the PoE lighting market in the region.

Which application segment are expected to drive the growth of the market in the next 5 years?

Commercial segment among all others is expected to grow at highest CAGR in coming years. PoE lightings offers multiple benefits and latest technology features such as temperature and humidity check, occupancy check, video surveillance, etc. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.2.1 GENERAL INCLUSIONS & EXCLUSIONS

1.2.2 INCLUSIONS AND EXCLUSIONS AT OFFERING LEVEL

1.2.3 INCLUSIONS AND EXCLUSIONS AT POWERED DEVICES LEVEL

1.2.4 INCLUSIONS AND EXCLUSIONS AT APPLICATION LEVEL

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 POE LIGHTING MARKET SEGMENTATION

1.3.2 GEOGRAPHIC ANALYSIS

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 2 POE LIGHTING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key participants in primary processes across value chain of PoE lighting market

2.1.2.3 Breakdown of primary interviews

2.1.2.4 Key industry insights

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.2 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE GENERATED BY KEY MARKET PLAYERS IN MARKET

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE): ILLUSTRATION OF REVENUE ESTIMATION OF KEY PLAYERS IN MARKET

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 (DEMAND SIDE) —BOTTOM-UP ESTIMATION OF MARKET, BY APPLICATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for capturing market size by bottom-up analysis

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market size by top-down analysis

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET SHARE ESTIMATION

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.5 RISK ASSESSMENT

TABLE 1 RISK FACTOR ANALYSIS

2.6 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.6.1 ASSUMPTIONS

2.6.2 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 42)

FIGURE 9 COMPARISON OF SCENARIO-BASED IMPACT OF COVID-19 ON POE LIGHTING MARKET

TABLE 2 COMPARISON TABLE FOR SCENARIO-BASED IMPACT OF COVID-19 ON MARKET, 2017–2026 (USD MILLION)

3.1 SCENARIO ANALYSIS

3.1.1 REALISTIC SCENARIO (POST-COVID-19)

3.1.2 PESSIMISTIC SCENARIO (POST-COVID-19)

3.1.3 OPTIMISTIC SCENARIO (POST-COVID-19)

FIGURE 10 SOFTWARE & SERVICES SEGMENT TO REGISTER HIGHER CAGR FROM 2021 TO 2026

FIGURE 11 LIGHTING CONTROLS SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

FIGURE 12 COMMERCIAL SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 13 MARKET IN APAC TO EXHIBIT HIGHEST CAGR FROM 2021 TO 2026

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN POE LIGHTING MARKET

FIGURE 14 GROWING ADOPTION OF POE LIGHTING IN COMMERCIAL SEGMENT TO SUPPORT MARKET GROWTH

4.2 MARKET, BY APPLICATION

FIGURE 15 COMMERCIAL SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2026

4.3 MARKET IN APAC, BY OFFERING AND COUNTRY

FIGURE 16 HARDWARE SEGMENT AND CHINA TO ACCOUNT FOR LARGEST SHARES OF MARKET IN APAC IN 2026

4.4 MARKET, BY COUNTRY

FIGURE 17 MARKET IN CHINA TO REGISTER HIGHEST CAGR FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 51)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 POE LIGHTING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increased adoption in commercial and industrial sectors due to low overheads and maintenance costs

5.2.1.2 Improved PoE standards for high power, speed and efficiency

TABLE 3 COMPARISON OF POE, POE+, UPOE, AND POE++

5.2.1.3 Introduction of new features such as data analytics and API event generation

5.2.1.4 Rising demand for IoT-enabled lighting fixtures and smart lighting solutions

FIGURE 19 IOT CONNECTIONS, BY COUNTRY/REGION, IN BILLION

5.2.1.5 Decreasing costs and superior benefits of LED lighting solutions

FIGURE 20 MARKET DRIVERS: IMPACT ANALYSIS

5.2.2 RESTRAINTS

5.2.2.1 High initial costs of PoE equipment and accessories

TABLE 4 INDICATIVE PRICES OF POE LIGHTING EQUIPMENT

FIGURE 21 POE LIGHTING MARKET RESTRAINTS: IMPACT ANALYSIS

5.2.3 OPPORTUNITIES

5.2.3.1 Growing smart office and smart retail trends

5.2.3.2 Geographical opportunities in APAC and RoW regions

5.2.3.3 Development of human-centric lighting solutions

5.2.3.4 Rapid transition from traditional lighting to connected lighting solutions

FIGURE 22 MARKET OPPORTUNITIES: IMPACT ANALYSIS

5.2.4 CHALLENGES

5.2.4.1 Limited transmission distance and power delivery rate

5.2.4.2 Disruption in PoE lighting supply chain due to COVID-19

FIGURE 23 MARKET CHALLENGES: IMPACT ANALYSIS

5.3 VALUE CHAIN ANALYSIS

FIGURE 24 VALUE CHAIN ANALYSIS: POE LIGHTING MARKET

5.4 REVENUE SHIFT AND NEW REVENUE POCKETS FOR MARKET PLAYERS

FIGURE 25 REVENUE SHIFT IN MARKET

5.5 MARKET MAP/MARKET ECOSYSTEM

TABLE 5 MARKET: ECOSYSTEM

FIGURE 26 KEY PLAYERS IN MARKET

5.6 KEY TECHNOLOGY TRENDS

TABLE 6 MARKET: LEADING TRENDS AMONG KEY MARKET PLAYERS

5.7 TECHNOLOGY ANALYSIS

5.7.1 POE LIGHTING AND WIRELESS LIGHTING TECHNOLOGY

TABLE 7 COMPARISON OF POE LIGHTING AND WIRELESS LIGHTING TECHNOLOGY

5.7.2 COLOR TEMPERATURE ANALYSIS

TABLE 8 COMPARISON OF 3000K AND 4000K TEMPERATURES

5.8 PRICE TREND ANALYSIS

TABLE 9 INDICATIVE PRICES OF POE LUMINAIRES, SWITCHES AND PANELS

5.9 AVERAGE SELLING PRICE TREND

FIGURE 27 AVERAGE SELLING PRICE (ASP) TREND FOR POE SWITCHES

FIGURE 28 AVERAGE SELLING PRICE (ASP) TREND FOR POE LUMINAIRES

5.10 CASE STUDY ANALYSIS

5.10.1 POE LIGHTING IN HOTELS

TABLE 10 UNIFI IMPROVES STREAMING AND LIGHTING SOLUTION AT STAYPINEAPPLE HOTELS

5.10.2 POE LIGHTING IN OFFICE

TABLE 11 SMARTER OFFICE WITH INTERACT OFFICE SOFTWARE

5.10.3 POE LIGHTING FOR INTERNATIONAL BUSINESS CENTER

TABLE 12 MOLEX HELPS INTEGRATE OIL COMPANY HEADQUARTERS IN MOSCOW

5.10.4 POE LIGHTING FOR LEARNING ENVIRONMENT

TABLE 13 SMART AND PERSONALIZED LEARNING ENVIRONMENT WITH PHILIPS CONNECTED LIGHTING

5.11 PATENT ANALYSIS

5.11.1 DOCUMENT TYPE

TABLE 14 PATENTS FILED

FIGURE 29 PATENTS FILED FROM 2011 TO 2020

5.11.2 PUBLICATION TREND

FIGURE 30 NO. OF PATENTS FILED EACH YEAR FROM 2011 TO 2020

5.11.3 JURISDICTION ANALYSIS

FIGURE 31 JURISDICTION ANALYSIS

5.11.4 TOP PATENT OWNERS

FIGURE 32 TOP 10 COMPANIES IN TERMS OF PATENT APPLICATIONS FROM 2011 TO 2020

TABLE 15 TOP 20 PATENT OWNERS IN LAST 10 YEARS

5.12 TRADE ANALYSIS

FIGURE 33 COUNTRY-WISE EXPORT DATA FOR PRODUCTS CLASSIFIED UNDER HS CODE: 9405, 2016–2020

TABLE 16 EXPORT SCENARIO FOR HS CODE: 9405-COMPLIANT PRODUCTS, BY COUNTRY, 2016–2020 (USD THOUSAND)

FIGURE 34 COUNTRY-WISE IMPORT DATA FOR PRODUCTS CLASSIFIED UNDER HS CODE: 9405, 2016–2020

TABLE 17 IMPORT SCENARIO FOR HS CODE: 9405-COMPLIANT PRODUCTS, BY COUNTRY, 2016–2020 (USD THOUSAND)

5.13 PORTER’S FIVE FORCES ANALYSIS

FIGURE 35 PORTER’S FIVE FORCES ANALYSIS

TABLE 18 PORTER’S FIVE FORCES ANALYSIS WITH THEIR WEIGHTAGE IMPACT

5.13.1 THREAT OF NEW ENTRANTS

FIGURE 36 THREAT OF NEW ENTRANTS

5.13.2 THREAT OF SUBSTITUTES

FIGURE 37 THREAT OF SUBSTITUTES

5.13.3 BARGAINING POWER OF SUPPLIERS

FIGURE 38 BARGAINING POWER OF SUPPLIERS

5.13.4 BARGAINING POWER OF BUYERS

FIGURE 39 BARGAINING POWER OF BUYERS

5.13.5 DEGREE OF COMPETITIVE RIVALRY

FIGURE 40 COMPETITIVE RIVALRY

5.14 REGULATORY LANDSCAPE

TABLE 19 REGULATIONS: LIGHTING ECOSYSTEM

6 POE LIGHTING MARKET, BY WATTAGE (Page No. - 81)

6.1 INTRODUCTION

FIGURE 41 REGISTERED LUMINAIRES IN LED LIGHTING FACTS DATABASE

TABLE 20 DATASET SOURCES AND COUNT OF LED LUMINAIRES

FIGURE 42 MARKET, BY WATTAGE

FIGURE 43 POWERED DEVICES OF ABOVE 25 WATTS TO HOLD LARGER SIZE OF MARKET DURING FORECAST PERIOD

TABLE 21 MARKET, BY WATTAGE, 2017–2020 (USD MILLION)

TABLE 22 MARKET, BY WATTAGE, 2021–2026 (USD MILLION)

TABLE 23 MARKET, BY WATTAGE, 2017–2020 (THOUSAND UNITS)

TABLE 24 MARKET, BY WATTAGE, 2021–2026 (THOUSAND UNITS)

6.2 UP TO 25 WATTS

6.2.1 APAC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 25 MARKET FOR WATTAGE OF UP TO 25 WATTS, BY REGION, 2017–2020 (USD MILLION)

TABLE 26 MARKET FOR WATTAGE OF UP TO 25 WATTS, BY REGION, 2021–2026 (USD MILLION)

6.3 ABOVE 25 WATTS

6.3.1 EXPECTED TO HOLD HIGHER MARKET SHARE DURING FORECAST PERIOD

TABLE 27 MARKET FOR WATTAGE OF ABOVE 25 WATTS, BY REGION, 2017–2020 (USD MILLION)

TABLE 28 MARKET FOR WATTAGE OF ABOVE 25 WATTS, BY REGION, 2021–2026 (USD MILLION)

7 POE LIGHTING MARKET, BY OFFERING (Page No. - 88)

7.1 INTRODUCTION

FIGURE 44 MARKET SEGMENTATION, BY OFFERING

FIGURE 45 SOFTWARE AND SERVICES SEGMENT TO ACCOUNT FOR A HIGHER CAGR DURING FORECAST PERIOD

TABLE 29 MARKET, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 30 MARKET, BY OFFERING, 2021–2026 (USD MILLION)

7.2 HARDWARE

FIGURE 46 TIMELINE OF POE-RELATED IEEE STANDARDS

TABLE 31 MARKET FOR HARDWARE, BY REGION, 2017–2020 (USD MILLION)

TABLE 32 MARKET FOR HARDWARE, BY REGION, 2021–2026 (USD MILLION)

FIGURE 47 LED LUMINAIRES SEGMENT TO ACCOUNT FOR A HIGHER MARKET SHARE DURING FORECAST PERIOD

TABLE 33 MARKET, BY HARDWARE, 2017–2020 (USD MILLION)

TABLE 34 MARKET, BY HARDWARE, 2021–2026 (USD MILLION)

7.2.1 LIGHTING CONTROLS/POWER SOURCING EQUIPMENT (PSE)

7.2.1.1 Expected to record higher growth rate during forecast period

TABLE 35 MARKET FOR LIGHTING CONTROLS/PSE, BY REGION, 2017–2020 (USD MILLION)

TABLE 36 MARKET FOR LIGHTING CONTROLS/PSE, BY REGION, 2021–2026 (USD MILLION)

7.2.2 LED LUMINAIRES/POWERED DEVICES (PD)

7.2.2.1 Expected to account for larger market share during forecast period

TABLE 37 MARKET FOR LED LUMINAIRES/PD, BY REGION, 2017–2020 (USD MILLION)

TABLE 38 MARKET FOR LED LUMINAIRES/PD, BY REGION, 2021–2026 (USD MILLION)

7.2.3 OTHER COMPONENTS

7.3 SOFTWARE & SERVICES

7.3.1 EXPECTED TO RECORD HIGHER CAGR DURING FORECAST PERIOD

TABLE 39 MARKET FOR SOFTWARE & SERVICES, BY REGION, 2017–2020 (USD MILLION)

TABLE 40 MARKET FOR SOFTWARE & SERVICES, BY REGION, 2021–2026 (USD MILLION)

8 POE LIGHTING MARKET, BY APPLICATION (Page No. - 97)

8.1 INTRODUCTION

FIGURE 48 MARKET SEGMENTATION, BY APPLICATION

FIGURE 49 COMMERCIAL APPLICATION TO HOLD LARGEST MARKET SHARE IN 2026

TABLE 41 MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 42 MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

8.2 COMMERCIAL

8.2.1 GROWING ADOPTION OF POE LIGHTING IN OFFICES, RETAIL AND HEALTHCARE FACILITIES

TABLE 43 MARKET FOR COMMERCIAL, BY REGION, 2017–2020 (USD MILLION)

TABLE 44 MARKET FOR COMMERCIAL, BY REGION, 2021–2026 (USD MILLION)

8.3 INDUSTRIAL

8.3.1 NORTH AMERICA TO ACCOUNT FOR HIGHEST DEMAND DURING FORECAST PERIOD

TABLE 45 MARKET FOR INDUSTRIAL, BY REGION, 2017–2020 (USD MILLION)

TABLE 46 MARKET FOR INDUSTRIAL, BY REGION, 2021–2026 (USD MILLION)

8.4 OTHERS

TABLE 47 MARKET FOR OTHERS, BY REGION, 2017–2020 (USD MILLION)

TABLE 48 MARKET FOR OTHERS, BY REGION, 2021–2026 (USD MILLION)

9 POE LIGHTING MARKET, BY GEOGRAPHY (Page No. - 104)

9.1 INTRODUCTION

FIGURE 50 MARKET SEGMENT BY GEOGRAPHY

FIGURE 51 MARKET SHARE BY REGION

FIGURE 52 MARKET IN APAC TO RECORD HIGHEST CAGR FROM 2021 TO 2026

TABLE 49 MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 50 MARKET, BY REGION, 2021–2026 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 53 SNAPSHOT: MARKET IN NORTH AMERICA

TABLE 51 MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 52 MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 53 MARKET IN NORTH AMERICA, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 54 MARKET IN NORTH AMERICA, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 55 MARKET IN NORTH AMERICA, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 56 MARKET IN NORTH AMERICA, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 57 MARKET IN NORTH AMERICA, BY HARDWARE, 2017–2020 (USD MILLION)

TABLE 58 MARKET IN NORTH AMERICA, BY HARDWARE, 2021–2026 (USD MILLION)

TABLE 59 MARKET IN NORTH AMERICA, BY WATTAGE, 2017–2020 (USD MILLION)

TABLE 60 MARKET IN NORTH AMERICA, BY WATTAGE, 2021–2026 (USD MILLION)

TABLE 61 MARKET IN US, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 62 MARKET IN US, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 63 MARKET IN CANADA, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 64 MARKET IN CANADA, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 65 MARKET IN MEXICO, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 66 MARKET IN MEXICO, BY OFFERING, 2021–2026 (USD MILLION)

9.2.1 US

9.2.1.1 Growing demand for PoE lighting solutions in commercial spaces to drive market

9.2.2 CANADA

9.2.2.1 Rising consumer awareness regarding energy-efficient lighting systems to propel market

9.2.3 MEXICO

9.2.3.1 Emerging technologies to boost demand for PoE lighting

9.3 EUROPE

FIGURE 54 SNAPSHOT: POE LIGHTING MARKET IN EUROPE

TABLE 67 MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 68 MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 69 MARKET IN EUROPE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 70 MARKET IN EUROPE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 71 MARKET IN EUROPE, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 72 MARKET IN EUROPE, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 73 MARKET IN EUROPE, BY HARDWARE, 2017–2020 (USD MILLION)

TABLE 74 MARKET IN EUROPE, BY HARDWARE, 2021–2026 (USD MILLION)

TABLE 75 MARKET IN EUROPE, BY WATTAGE, 2017–2020 (USD MILLION)

TABLE 76 MARKET IN EUROPE, BY WATTAGE, 2021–2026 (USD MILLION)

TABLE 77 MARKET IN UK, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 78 MARKET IN UK, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 79 MARKET IN GERMANY, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 80 MARKET IN GERMANY, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 81 MARKET IN FRANCE, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 82 MARKET IN FRANCE, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 83 MARKET IN REST OF EUROPE, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 84 MARKET IN REST OF EUROPE, BY OFFERING, 2021–2026 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Technological advancements by PoE vendors to fuel market

9.3.2 UK

9.3.2.1 Improvements in current PoE standards to propel market

9.3.3 FRANCE

9.3.3.1 Rising penetration of LED lighting to boost market growth

9.3.4 REST OF EUROPE

9.4 APAC

FIGURE 55 SNAPSHOT: POE LIGHTING MARKET IN APAC

TABLE 85 MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 86 MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 87 MARKET IN APAC, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 88 MARKET IN APAC, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 89 MARKET IN APAC, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 90 MARKET IN APAC, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 91 MARKET IN APAC, BY HARDWARE, 2017–2020 (USD MILLION)

TABLE 92 MARKET IN APAC, BY HARDWARE, 2021–2026 (USD MILLION)

TABLE 93 MARKET IN APAC, BY WATTAGE, 2017–2020 (USD MILLION)

TABLE 94 MARKET IN APAC, BY WATTAGE, 2021–2026 (USD MILLION)

TABLE 95 MARKET IN CHINA, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 96 MARKET IN CHINA, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 97 MARKET IN JAPAN, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 98 MARKET IN JAPAN, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 99 MARKET IN SOUTH KOREA, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 100 MARKET IN SOUTH KOREA, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 101 MARKET IN AUSTRALIA, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 102 MARKET IN AUSTRALIA, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 103 MARKET IN REST OF APAC, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 104 MARKET IN REST OF APAC, BY OFFERING, 2021–2026 (USD MILLION)

9.4.1 CHINA

9.4.1.1 Expected to dominate APAC market during forecast period

9.4.2 JAPAN

9.4.2.1 Increasing adoption of PoE lighting in commercial spaces to drive market

9.4.3 SOUTH KOREA

9.4.3.1 PoE lighting market in nascent stage

9.4.4 AUSTRALIA

9.4.4.1 Increasing government initiatives for energy efficient spaces boost market

9.4.5 REST OF APAC

9.5 ROW

FIGURE 56 SNAPSHOT: POE LIGHTING MARKET IN ROW

TABLE 105 MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 106 MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

TABLE 107 MARKET IN ROW, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 108 MARKET IN ROW, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 109 MARKET IN ROW, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 110 MARKET IN ROW, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 111 MARKET IN ROW, BY HARDWARE, 2017–2020 (USD MILLION)

TABLE 112 MARKET IN ROW, BY HARDWARE, 2021–2026 (USD MILLION)

TABLE 113 MARKET IN ROW, BY WATTAGE, 2017–2020 (USD MILLION)

TABLE 114 MARKET IN ROW, BY WATTAGE, 2021–2026 (USD MILLION)

TABLE 115 MARKET IN MIDDLE EAST, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 116 MARKET IN MIDDLE EAST, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 117 MARKET IN SOUTH AMERICA, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 118 MARKET IN SOUTH AMERICA, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 119 MARKET IN AFRICA, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 120 MARKET IN AFRICA, BY OFFERING, 2021–2026 (USD MILLION)

9.5.1 MIDDLE EAST

9.5.1.1 Expected to dominate ROW market

9.5.2 AFRICA

9.5.2.1 Rapid urbanization to boost nascent market

9.5.3 SOUTH AMERICA

9.5.3.1 Developing economies such as Brazil and Argentina are expected to drive the market in the region

10 COMPETITIVE LANDSCAPE (Page No. - 135)

10.1 OVERVIEW

FIGURE 57 KEY DEVELOPMENTS UNDERTAKEN BY LEADING PLAYERS IN POE LIGHTING MARKET FROM 2018 TO 2021

10.2 MARKET SHARE AND RANKING ANALYSIS

FIGURE 58 MARKET: MARKET SHARE ANALYSIS

TABLE 121 MARKET: DEGREE OF COMPETITION

TABLE 122 MARKET: MARKET RANKING ANALYSIS

TABLE 123 MARKET: MARKET RANKING ANALYSIS (POE LUMINAIRE PROVIDERS)

TABLE 124 MARKET: MARKET RANKING ANALYSIS (POE CONTROLLER PROVIDERS)

10.3 5-YEAR COMPANY REVENUE ANALYSIS

FIGURE 59 REVENUE ANALYSIS FOR KEY COMPANIES IN PAST 5 YEARS

10.4 COMPANY EVALUATION QUADRANT, 2020

FIGURE 60 MARKET (GLOBAL) COMPANY EVALUATION MATRIX, 2020

10.4.1 STAR

10.4.2 PERVASIVE

10.4.3 EMERGING LEADER

10.4.4 PARTICIPANT

10.5 COMPETITIVE BENCHMARKING

TABLE 125 COMPANY APPLICATION FOOTPRINT (25 COMPANIES)

TABLE 126 COMPANY REGION FOOTPRINT (25 COMPANIES)

10.6 STARTUP/SME EVALUATION MATRIX, 2020

FIGURE 61 POE LIGHTING (GLOBAL) STARTUP/SME EVALUATION MATRIX, 2020

10.6.1 PROGRESSIVE COMPANIES

10.6.2 RESPONSIVE COMPANIES

10.6.3 DYNAMIC COMPANIES

10.6.4 STARTING BLOCKS

10.7 COMPETITIVE SCENARIO AND TRENDS

10.7.1 PRODUCT LAUNCHES

TABLE 127 POE LIGHTING: NEW PRODUCT LAUNCHES, BY COMPANY, JANUARY 2019- FEBRUARY 2021

10.7.2 DEALS

TABLE 128 POE LIGHTING: DEALS, BY COMPANY, JANUARY 2019-FEBRUARY 2021

11 COMPANY PROFILES (Page No. - 151)

(Business Overview, Products/solutions/services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

11.1 INTRODUCTION

11.2 KEY PLAYERS

11.2.1 SIGNIFY HOLDING (PHILIPS LIGHTING N.V.)

FIGURE 62 SIGNIFY N.V.: COMPANY SNAPSHOT

TABLE 129 SIGNIFY N.V: BUSINESS OVERVIEW

11.2.2 INNOVATIVE LIGHTING (GENISYS)

TABLE 130 INNOVATIVE LIGHTING: BUSINESS OVERVIEW

11.2.3 HUBBELL INCORPORATED

FIGURE 63 HUBBELL INCORPORATED: COMPANY SNAPSHOT

TABLE 131 HUBBELL INCORPORATED: BUSINESS OVERVIEW

11.2.4 DECO LIGHTING

TABLE 132 DECO LIGHTING: BUSINESS OVERVIEW

11.2.5 IDEAL INDUSTRIES (CREE)

TABLE 133 IDEAL INDUSTRIES (CREE): BUSINESS OVERVIEW

11.2.6 HERBERT WALDMANN GMBH & CO. KG (WALDMANN LIGHTING)

TABLE 134 HERBERT WALDMANN GMBH & CO. KG (WALDMANN LIGHTING): BUSINESS OVERVIEW

11.2.7 H.E. WILLIAMS COMPANY

TABLE 135 H.E. WILLIAMS COMPANY: BUSINESS OVERVIEW

11.2.8 ALLNET GMBH

TABLE 136 ALLNET GMBH: BUSINESS OVERVIEW

11.2.9 UBIQUITI NETWORKS, INC.

FIGURE 64 UBIQUITI NETWORKS, INC.: COMPANY SNAPSHOT

TABLE 137 UBIQUITI NETWORKS, INC.: BUSINESS OVERVIEW

11.2.10 NORTH AMERICAN MANUFACTURING ENTERPRISES (NAME) ENERGY GROUP (MHT LIGHTING)

TABLE 138 NORTH AMERICAN MANUFACTURING ENTERPRISES (NAME) ENERGY GROUP (MHT LIGHTING): BUSINESS OVERVIEW

11.3 OTHER KEY PLAYERS

11.3.1 WIPRO LIGHTING (WIPRO ENTERPRISES)

11.3.2 CISCO SYSTEMS

11.3.3 IGOR INC

11.3.4 NULEDS

11.3.5 MOLEX (KOCH INDUSTRIES)

11.3.6 LEVITON

11.3.7 MICROSEMI CORPORATION (MICROCHIP TECHNOLOGY INC.)

11.3.8 NETGEAR

11.3.9 MICROSENS (EUROMICRON AG)

11.3.10 SIEMON

11.3.11 LED INDUSTRIES (POE LIGHTING USA)

11.3.12 SILVERTEL

11.3.13 PROLOJIK LIMITED

11.3.14 AXIS LIGHTING

11.3.15 C&C TECHNOLOGY GROUP

11.3.16 JUNIPER NETWORKS

11.3.17 RUCKUS NETWORKS

11.3.18 DELL TECHNOLOGIES

*Details on Business Overview, Products/solutions/services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 193)

12.1 INSIGHTS OF INDUSTRY EXPERTS

12.2 QUESTIONNAIRE FOR POE LIGHTING MARKET

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 AUTHOR DETAILS

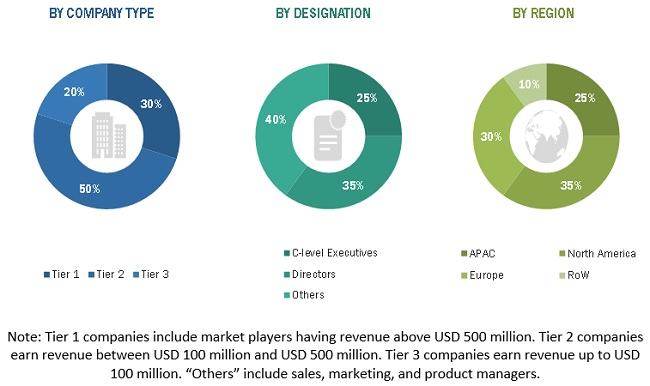

This study involves the usage of extensive secondary sources, directories, and databases such as Hoovers, Bloomberg BusinessWeek, Factiva, and OneSource to identify and collect information useful for this technical, market-oriented, and commercial study of the PoE lighting market. Primary sources include several industry experts from the core and related industries, along with preferred suppliers, manufacturers, distributors, service providers, and technology developers. In-depth interviews have been conducted with key industry participants, subject matter experts (SMEs), C-level executives of key companies operating in the PoE lighting market, and industry consultants, among other experts, to obtain and verify qualitative and quantitative information, as well as to assess prospects. The following illustrative figure shows the market research methodology applied in making this report on the PoE lighting market.

Secondary Research

In the secondary research process, various secondary sources have been utilized for identifying and collecting information for this study. Secondary sources referred to for this research study include annual reports, investor presentations, and financial statements; trade, business, and professional associations; white papers, PoE lighting-related journals, certified publications, and articles from recognized authors; and directories and databases. The global size of the PoE lighting market has been obtained from the secondary data made available through paid and unpaid sources. It has also been gathered by analysing the product portfolios of the leading companies and rating them based on the quality of their offerings.

Secondary research has been used to gather key information about the industry’s supply chain, the market’s monetary chain, the total number of key players, and market segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both the market- and technology-oriented perspectives. Secondary research has also been conducted to identify and analyse the industry trends in the market and key developments that have been undertaken from both the market- and technology perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides have been interviewed to obtain the qualitative and quantitative information related to the market across 4 main regions—APAC, North America, Europe, and RoW (the Middle East, Africa, and South America). Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology directors, and some other related key executives from major companies and organizations that are operating in the PoE lighting market or related markets.

After the completion of market engineering, primary research has been conducted to gather information and verify and validate critical numbers that were obtained from other sources. Primary research has also been conducted to identify various market segments; industry trends; key players; competitive landscape; and key market dynamics, such as drivers, restraints, opportunities, and challenges, along with key strategies adopted by market players. Approximately 70% and 30% of the primary interviews have been conducted with the supply and demand side, respectively. This primary data has been collected through questionnaires, mails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used extensively in the market engineering process. Several data triangulation methods have also been used to perform the market forecasting and market estimation for the overall market segments and sub-segments in the report. Multiple qualitative and quantitative analyses have been performed on the market engineering process to gain key insights throughout the report.

Secondary research has been used to identify the key players of the PoE lighting market. The revenues of those key players have been determined through both primary and secondary research. The revenues have been identified geographically as well as market segment-wise, using financial statements and analyzing annual reports of the key market players. Interviews with CEOs, VPs, directors, and marketing executives were also conducted to gain insights on the key players and the PoE lighting market. All the market shares have been estimated using secondary and primary research. This data has been consolidated, supplemented with detailed inputs and analysis from MarketsandMarkets, and presented in this report.

Data Triangulation

After arriving at the overall market size from the market size estimation process that is explained above, the total market is then split into several segments and sub-segments. Data triangulation procedure has been employed to complete the market engineering process and arrives at the exact statistics for all segments and sub-segments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Study Objectives

- To define, estimate, and forecast the Power over Ethernet (PoE) lighting market, in terms of value, segmented on the basis of offering, wattage, application, and geography

- To estimate and forecast the market size, in terms of value, for various segments across four regions—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To analyze the emerging applications/use cases and standards in the PoE lighting market

- To analyze the manufacturers of PoE lighting products, their strategies, and new production plans to analyze the PoE ecosystem/supply chain, which consists of suppliers of materials and components, and product manufacturers

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape of the market

- To analyze competitive developments in the PoE lighting market, such as collaborations, contracts, partnerships, acquisitions, and product launches and developments

- To strategically profile key players and comprehensively analyze their market ranking and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for this report:

Regional Analysis

- Country-wise breakdown of the PoE lighting market for North America, Europe, APAC, and RoW

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Power Over Ethernet Lighting Market