Compressor Oil Market by Base oil (Synthetic, Mineral, Semi-Synthetic, and Bio-based), Compressor Type (Dynamic, Positive Displacement), Application (Gas, Air), End-Use Industry (General Manufacturing, Construction, Oil & Gas) - Global Forecast to 2023

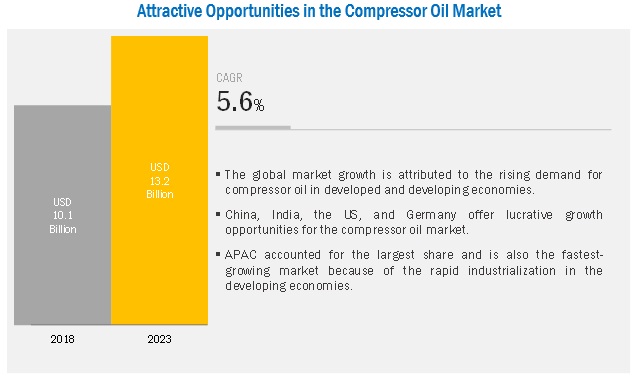

[157 Pages Report] The compressor oil market size is estimated to be USD 10.1 billion in 2018 and is projected reach USD 13.2 billion by 2023, at a CAGR of 5.6% between 2018 and 2023. Compressor oils are mixtures of base oils and additives. The additives help enhance, add, or suppress unwanted properties of the base oil. They are usually produced in a liquid or semi-solid state. Compressor oils are utilized to reduce friction between moving surfaces of the compressor. In addition, compressor oils help reduce wear and tear of machinery and prevent overheating and corrosion, which increases the efficiency of the machine. The growing end-use industries such as oil & gas, general manufacturing, and chemical & petrochemical drive the demand for compressor oil. On the other hand, technological advancement and oil rejuvenation are restraining the market growth.

Synthetic oil is expected to be the largest segment of the overall compressor oil market during the forecast period.

On the basis of base oil, the compressor oil market has been segmented into synthetic oil, mineral oil, semi-synthetic oil, and bio-based oil. The synthetic oil segment is expected to lead the compressor oil market between 2018 and 2023, in terms of value. The higher demand for synthetic oil is mainly attributed to its high performance in extreme conditions, high drain interval, better viscosity index, higher shear stability, and chemical resistance.

The dynamic compressor segment accounts for the largest share of the overall compressor oil market.

On the basis of compressor type, the compressor oil market has been segmented into dynamic compressor and positive displacement compressor. Dynamic compressors deliver a large volume of air by accelerating it to high velocity with the help of rotating blades and confines the air flow to decelerate under expansion to increase pressure. Unlike positive displacement compressor, the output for dynamic compressor fluctuates with the speed of rotating blades as there is nothing that physically forces the air out of the compressor.

Chemical & petrochemical is projected to be the fastest-growing end-use industry of compressor oil market during the forecast period.

On the basis of end-use industry, the compressor oil market has been segmented into general manufacturing, construction, oil & gas, mining, chemical & petrochemical, power generation, and others. The chemical & petrochemical is estimated to be the fastest-growing end-use industry of compressor oil, in terms of volume, during the forecast period. The demand for compressor oil in the industry is expected to increase as a result of increasing chemical manufacturing capacities across the globe.

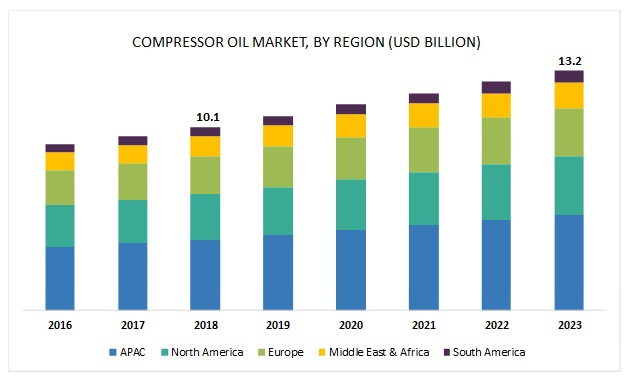

APAC is expected to account for the largest share of the compressor oil market during the forecast period.

APAC is projected to be the largest compressor oil market during the forecast period due to the high growth of the manufacturing and construction industries in the emerging countries such as China, India, Japan, and South Korea. The domestic and foreign investments in the construction industry have been consistently growing over the past decade in this region. Moreover, the rising investment for infrastructure development in the developing countries of APAC is fueling the compressor oil market in the region.

Market Dynamics

Massive industrial growth in APAC and the Middle East & Africa

The massive industrial growth in APAC has been fueling the compressor oil market in the past few years, and this is expected to continue during the next five years. Domestic and foreign investments in key sectors such as energy, manufacturing, construction, and mining have been consistently growing over the past decade. China, the home to almost 20% of the global population, has surpassed the US in the consumption of compressor oil. The GDP growth of China increased by 6.9% in 2017, which will lead to the growth of the industrial sector and the sale of compressor oil in the country.

Over the past decade, India has been witnessing moderate GDP growth. The country has attracted several investments in key industrial sectors such as construction, cement, steel, and energy. The economic outlook for India has been very optimistic. The Government of India is currently working on encouraging the manufacturing sector in the country by liberalizing policies and providing additional incentives such as land at cheap rates and faster clearances from all the concerned departments. As a result, the manufacturing industry in the country is rapidly growing. This is expected to drive the sales of compressor oil in the manufacturing industry the country during the forecast period.

Growing demand for high quality compressor oil

Modern compressors are expected to operate in the most severe conditions, carrying greater loads and offering higher performance. Owing to the extended durability & shelf life and improved performance of the machinery & equipment, consumers demand high-quality lubricants that can sustain under extreme temperature and pressure. This has led several manufacturers to produce single compressor oil that offers anti-foaming, anti-oxidant, waterproofing, and rust preventive properties. In Europe and North America, the demand for high-quality compressor oil is very high due to strong consumer awareness and increased purchasing power. Moreover, the extended drain interval of high-quality compressor oils in various equipment enables cost saving, and hence the demand for high-quality compressor oil is increasing not only in the developed regions but also in developing regions.

Technological Advancements

There are several industries such as pharmaceutical, healthcare, food & beverages, textile, and electronics where manufacturers cannot afford the risk of contamination. High quality and extremely clean air are required in such industries. A single drop of oil can cause product spoilage. The pharmaceutical industry requires clean and oil-free compressed air for drug manufacturing, culture vessels, aeration tanks, and packaging. Manufacturers prefer to use the oil-free compressor for that particular operation. Oil-free compressors operate with less compressor oil and are lightweight and economical as compared to the conventional one. With the use of oil-free compressors, the risk of contamination is eliminated. Moreover, the oil-free compressor does not require extra space for oil storage and are more economical than lubricated one as it involves less complex design and function. Hence, the increasing popularity of oil-free compressor is restraining the growth of the compressor oil market.

Development of zinc-free (ashless) compressor oil

Zinc is one of the key additives used as an anti-wear agent in compressor oils; however, it is harmful to the environment as it is toxic and non-biodegradable. The Environmental Protection Agency (EPA) in Australia, New Zealand, the UK, and the US enforces regulations to ensure that industries pre-treat used lubricants before releasing it into the environment, which is an expensive process. The development of zinc-free compressor oil in the various industries will help reduce the cost involved in pre-treatment of wastes.

Scope of the Report

|

Report Metric |

Details |

|

Years considered for the study |

2016-2023 |

|

Base yea |

2017 |

|

Forecast period |

20182023 |

|

Unit Considered |

Value (USD Million), Volume (Kiloton) |

|

Segments |

Base Oil, Compressor Type, Application, End-use Industry, and Region |

|

Regions |

APAC, North America, Europe, Middle East & Africa, and South America |

|

Companies |

Royal Dutch Shell PLC (The Netherlands), ExxonMobil Corporation (US), British Petroleum Plc ((UK), Chevron Corporation (US), Total SA (France), Sinopec Limited (China), and Lukoil (Russia) |

This report categorizes the global compressor oil market based on base oil, compressor type, application, end-use industry, and region.

On the basis of base oil, the compressor oil market has been segmented as follows:

- Mineral Oil

- Synthetic Oil

- PAO

- PAG

- Esters

- Semi-synthetic Oil

- Bio-based Oil

On the basis of compressor type, the compressor oil market has been segmented as follows:

- Dynamic Compressor

- Centrifugal Compressor

- Axial Compressor

- Positive Displacement Compressor

- Rotary Screw Compressor

- Reciprocating Compressor

On the basis of application, the compressor oil market has been segmented as follows:

- Gas Compressor

- Air Compressor

On the basis of end-use Industry, the compressor oil market has been segmented as follows:

- General Manufacturing

- Transportation Equipment

- Metal Production

- Commercial Machinery

- Food & Beverage

- Rubber & Plastics

- Construction

- Oil & Gas

- Chemical & Petrochemical

- Mining

- Power Generation

- Others (Cement production, Textile, Paper, and Wood & lumber)

On the basis of region, the compressor oil market has been segmented as follows:

- APAC

- North America

- Europe

- Middle East & Arica

- South America

Key Market Players

The key players in this market are Royal Dutch Shell PLC (The Netherlands), ExxonMobil Corporation (US), British Petroleum Plc ((UK), Chevron Corporation (US), Total SA (France), Sinopec Limited (China), Lukoil (Russia), Indian Oil Corporation Ltd. (India), Fuchs Group (Germany), and Idemitsu Kosan Co. Ltd. (Japan). These players have adopted various growth strategies to expand their presence and increase their shares in the compressor oil market. For instance, Fuchs Group acquired Ultrachem Inc. a US-based lubricants manufacturer known for producing synthetic lubricants for compressor for over 40 years.

Recent Developments

- In August 2016, Fuchs Group acquired Ultrachem Inc., a US-based lubricants manufacturer. Ultrachem Inc. is a well-known producer of synthetic lubricants for compressor for more than 40 years.

Key Questions addressed by the report

- What are the major developments impacting the market?

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming applications of compressor oil?

- What are the emerging end-use industries of compressor oil?

- What will be the major factors impacting the market growth during the forecast period?

Frequently Asked Questions (FAQ):

What are the factors Influencing the growth of compressor oil market?

What are the base oils used to produce compressor oil?

Who are the major manufacturers?

What is the biggest Restraint for Compressor Oil?

What is the high growth industries for Compressor Oil?

How is the compressor oil market aligned?

What are the key countries in the compressor oil market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Regions Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 33)

4.1 Significant Opportunities in the Compressor Oil Market

4.2 Compressor Oil Market, By Region

4.3 APAC Compressor Oil Market, By End-Use Industry and Country

4.4 Compressor Oil Market, By Base Oil

4.5 Compressor Oil Market Attractiveness

4.6 Compressor Oil Market, By End-Use Industry and Region

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Massive Industrial Growth in APAC and the Middle East & Africa

5.2.1.2 Growing Demand for High-Quality Compressor Oil

5.2.1.3 Rise in Automation in Various Industries

5.2.2 Restraints

5.2.2.1 Technological Advancements

5.2.2.2 Oil Rejuvenation

5.2.3 Opportunities

5.2.3.1 Development of Zinc-Free (Ashless) Compressor Oils

5.3 Porters Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Threat of Substitutes

5.3.3 Bargaining Power of Suppliers

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

5.4 Industry Outlook

5.4.1 Construction Industry

6 Compressor Oil Market, By Compressor Type (Page No. - 43)

6.1 Introduction

6.2 Dynamic Compressor

6.2.1 Dynamic Compressor is Expected to Be the Larger Compressor Type

6.2.2 Centrifugal Compressor

6.2.3 Axial Compressor

6.3 Positive Displacement Compressor

6.3.1 High Efficiency of Positive Displacement Compressors Expected to Drive the Market

6.2.2 Rotary Screw Compressor

6.2.3 Reciprocating Compressor

7 Compressor Oil Market, By Application (Page No. - 47)

7.1 Introduction

7.2 Gas Compressor

7.2.1 Demand From Oil & Gas Industry to Drive the PAG oil market in Gas Compressor Application

7.3 Air Compressor

7.3.1 Demand in Several Industries to Boost the Air Compressor Segment

8 Compressor Oil Market, By Base Oil (Page No. - 50)

8.1 Introduction

8.2 Synthetic Oil

8.2.1 Synthetic Oil Accounted for the Largest Share Owing to Its Various Advantages

8.3 Mineral Oil

8.3.1 Low Price and Easy Availability of Mineral Oil is Expected to Drive the Market

8.4 Semi-Synthetic Oil

8.4.1 High Performance at Low Cost of Semi-Synthetic Compressor Oil is Driving the Market

8.5 Bio-Based Oil

8.5.1 Demand for Bio-Based Compressor Oils High as They are Biodegradable

9 Compressor Oil Market, By End-Use Industry (Page No. - 59)

9.1 Introduction

9.2 General Manufacturing

9.2.1 Rising Vehicle Demand is Driving the Compressor Oil Market

9.2.2 Transportation Equipment

9.2.3 Metal Production

9.2.4 Commercial Machinery

9.2.5 Food & Beverage

9.2.6 Rubber & Plastic

9.3 Construction

9.3.1 Increasing Construction Activities in China to Drive the Compressor Oil Market

9.4 Oil & Gas

9.4.1 Increased Natural Gas Production in Brazil Expected to Drive the Market

9.5 Mining

9.5.1 Increased Mineral Production in APAC is Driving the Market

9.6 Chemical & Petrochemical

9.6.1 High Demand for Chemicals From APAC is Expected to Drive the Market

9.7 Power Generation

9.7.1 Rising Electricity Demand Across the Globe is Driving the Market

9.8 Others

10 Compressor Oil Market, By Region (Page No. - 73)

10.1 Introduction

10.2 APAC

10.2.1 China

10.2.1.1 Countrys Economic Growth is A Major Driver for the Market

10.2.2 Japan

10.2.2.1 Increased Vehicle Production is Driving the Market in Japan

10.2.3 India

10.2.3.1 Rising Industrialization in India to Drive the Market

10.2.4 Australia

10.2.4.1 Growing Natural Gas Production is Driving the Market in the Country

10.2.5 South Korea

10.2.5.1 Automotive and Marine Industries are Propelling the Market in South Korea

10.3 North America

10.3.1 US

10.3.1.1 Growth in the Manufacturing Sector is Likely to Affect the Market in the US Positively

10.3.2 Canada

10.3.2.1 Growth in Power Generation Industry is Expected to Drive the Market in Canada

10.3.3 Mexico

10.3.3.1 Rising Industrialization is Likely to Propel the Market Growth

10.4 Europe

10.4.1 Russia

10.4.1.1 Well-Established Oil & Gas Industry is Expected to Augment the Demand for Compressor Oil in Russia

10.4.2 Germany

10.4.2.1 Rising Government Expenditure on Manufacturing Sector is an Opportunity for the Market

10.4.3 UK

10.4.3.1 Construction Industry is One of the Major Drivers of the Market in UK

10.4.4 France

10.4.4.1 Increasing Demand for Vehicles is Augmenting the Demand for Compressor Oil in General Manufacturing Industry

10.4.5 Italy

10.4.5.1 Growth in Automotive and Metal Production Industries are Driving the Market in Italy

10.5 Middle East & Africa

10.5.1 Saudi Arabia

10.5.1.1 Saudi Arabia is the Largest Market in the Middle East & Africa

10.5.2 Egypt

10.5.2.1 Growth in the Construction Industry is Expected to Generate A Positive Impact on the Market in Egypt

10.5.3 UAE

10.5.3.1 Increasing Infrastructural Spending is Driving the Market in the UAE

10.5.4 Iran

10.5.4.1 Growing Demand for Housing is Expected to Drive the Market in the Construction End-Use Segment

10.6 South America

10.6.1 Brazil

10.6.1.1 Brazil is the Largest Market in South America

10.6.2 Venezuela

10.6.2.1 Oil & Gas Industry is Propelling the Market in Venezuela

10.6.3 Argentina

10.6.3.1 Rising Investment in the Oil & Gas Industry is Likely to Drive the Market

11 Competitive Landscape (Page No. - 116)

11.1 Introduction

11.2 Competitive Leadership Mapping (Overall Market)

11.2.1 Visionary Leaders

11.2.2 Dynamic Differentiators

11.2.3 Innovators

11.3 Strength of Product Portfolio

11.4 Business Strategy Excellence

11.5 Competitive Leadership Mapping (SMSE)

11.5.1 Progressive Companies

11.5.2 Responsive Companies

11.5.3 Dynamic Companies

11.5.4 Starting Blocks

11.6 Strength of Product Portfolio

11.7 Business Strategy Excellence

11.8 Market Share Analysis

11.8.1 Royal Dutch Shell PLC

11.8.2 Exxonmobil Corporation

11.8.3 BP PLC

11.9 Competitive Scenario

11.9.1 New Product Launch

11.9.2 Acquisition

12 Company Profiles (Page No. - 124)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

12.1 Royal Dutch Shell PLC

12.2 Exxonmobil Corporation

12.3 British Petroleum (BP) PLC

12.4 Chevron Corporation

12.5 Total SA

12.6 Sinopec Limited

12.7 Lukoil

12.8 Indian Oil Corporation Ltd.

12.9 Fuchs Group

12.10 Idemitsu Kosan Co. Ltd.

12.11 Petroliam Nasional Berhad (Petronas)

12.12 Other Key Market Players

12.12.1 The DOW Chemical Company

12.12.2 Croda International PLC.

12.12.3 Sasol Limited

12.12.4 Phillips 66

12.12.5 Bel-Ray Company LLC.

12.12.6 Morris Lubricants

12.12.7 Penrite Oil

12.12.8 Valvoline Inc.

12.12.9 Liqui Moly GmbH

12.12.10 Bharat Petroleum

12.12.11 Rock Valley Oil and Chemical Co.

12.12.12 Peak Lubricants Pty Ltd.

12.12.13 Amalie Oil Co.

12.12.14 ENI SPA

12.12.15 Addinol

12.12.16 Lubrication Technologies Inc.

12.12.17 Engen Petroleum

12.12.18 Petro-Canada Lubricants Inc.

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 151)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets Subscription Portal

13.3 Available Customizations

13.4 Related Reports

13.5 Author Details

List of Tables (128 Tables)

Table 1 Annual GDP and Industrial Production Growth Rate of Key Countries in APAC and Middle East & Africa

Table 2 Contribution of Construction Industry to GDP of APAC, By Key Country, 2016 (USD Billion)

Table 3 Contribution of Construction Industry to GDP of North America, By Key Country, 2016 (USD Billion)

Table 4 Contribution of Construction Industry to GDP of Europe, By Key Country, 2016 (USD Billion)

Table 5 Contribution of Construction Industry to GDP of South America, By Key Country, 2016 (USD Billion)

Table 6 Contribution of Construction Industry to GDP of Middle East & Africa, By Key Country, 2016 (USD Billion)

Table 7 Compressor Oil Market Size, By Compressor Type, 20162023 (Kiloton)

Table 8 Compressor Oil Market Size, By Compressor Type, 20162023 (USD Million)

Table 9 Compressor Oil Market Size, By Application, 20162023 (Kiloton)

Table 10 Compressor Oil Market Size, By Application, 20162023 (USD Million)

Table 11 Compressor Oil Market Size, By Base Oil, 20162023 (Kiloton)

Table 12 Compressor Oil Market Size, By Base Oil, 20162023 (USD Million)

Table 13 Synthetic Compressor Oil Market Size, By Region, 20162023 (Kiloton)

Table 14 Synthetic Compressor Oil Market Size, By Region, 20162023 (USD Million)

Table 15 PAO Compressor Oil Market Size, By Region, 20162023 (USD Million)

Table 16 PAO Compressor Oil Market Size, By Region, 20162023 (Kiloton)

Table 17 PAG Compressor Oil Market Size, By Region, 20162023 (USD Million)

Table 18 PAG Compressor Oil Market Size, By Region, 20162023 (Kiloton)

Table 19 Esters Compressor Oil Market Size, By Region, 20162023 (USD Million)

Table 20 Esters Compressor Oil Market Size, By Region, 20162023 (Kiloton)

Table 21 Mineral Compressor Oil Market Size, By Region, 20162023 (Kiloton)

Table 22 Mineral Compressor Oil Market Size, By Region, 20162023 (USD Million)

Table 23 Semi-Synthetic Compressor Oil Market Size, By Region, 20162023 (Kiloton)

Table 24 Semi-Synthetic Compressor Oil Market Size, By Region, 20162023 (USD Million)

Table 25 Bio-Based Compressor Oil Market Size, By Region, 20162023 (Kiloton)

Table 26 Bio-Based Compressor Oil Market Size, By Region, 20162023 (USD Million)

Table 27 Compressor Oil Market Size, By End-Use Industry, 20162023 (Kiloton)

Table 28 Compressor Oil Market Size, By End-Use Industry, 20162023 (USD Million)

Table 29 Compressor Oil Market Size in General Manufacturing, By Region, 20162023 (Kiloton)

Table 30 Compressor Oil Market Size for General Manufacturing, By Region, 20162023 (USD Million)

Table 31 Compressor Oil Market Size for Transpprtation Equipment, By Region, 20162023 (USD Million)

Table 32 Compressor Oil Market Size for Transportation Equipment, By Region, 20162023 (Kiloton)

Table 33 Compressor Oil Market Size for Metal Production, By Region, 20162023 (USD Million)

Table 34 Compressor Oil Market Size for Metal Production, By Region, 20162023 (Kiloton)

Table 35 Compressor Oil Market Size for Commercial Machinery, By Region, 20162023 (USD Million)

Table 36 Compressor Oil Market Size for Commercial Machinery, By Region, 20162023 (Kiloton)

Table 37 Compressor Oil Market Size for Food & Beverage, By Region, 20162023 (USD Million)

Table 38 Compressor Oil Market Size for Food & Beverage, By Region, 20162023 (Kiloton)

Table 39 Compressor Oil Market Size for Rubber & Plastics, By Region, 20162023 (USD Million)

Table 40 Compressor Oil Market Size for Rubber & Plastics, By Region, 20162023 (Kiloton)

Table 41 Compressor Oil Market Size for Transpprtation Equipment, By Region, 20162023 (USD Million)

Table 42 Compressor Oil Market Size for Transportation Equipment, By Region, 20162023 (Kiloton)

Table 43 Compressor Oil Market Size in Construction Industry, By Region, 20162023 (Kiloton)

Table 44 Compressor Oil Market Size in Construction Industry, By Region, 20162023 (USD Million)

Table 45 Compressor Oil Market Size in Oil & Gas Industry, By Region, 20162023 (Kiloton)

Table 46 Compressor Oil Market Size in Oil & Gas Industry, By Region, 20162023 (USD Million)

Table 47 Compressor Oil Market Size in Mining Industry, By Region, 20162023 (Kiloton)

Table 48 Compressor Oil Market Size in Mining Industry, By Region, 20162023 (USD Million)

Table 49 Compressor Oil Market Size in Chemical & Petrochemical Industry, By Region, 20162023 (Kiloton)

Table 50 Compressor Oil Market Size in Chemical & Petrochemical Industry, By Region, 20162023 (USD Million)

Table 51 Compressor Oil Market Size in Power Generation Industry, By Region, 20162023 (Kiloton)

Table 52 Compressor Oil Market Size in Power Generation Industry, By Region, 20162023 (USD Million)

Table 53 Compressor Oil Market Size in Other End-Use Industries, By Region, 20162023 (Kiloton)

Table 54 Compressor Oil Market Size in Other End-Use Industries, By Region, 20162023 (USD Million)

Table 55 Compressor Oil Market Size, By Region, 20162023 (Kiloton)

Table 56 Compressor Oil Market Size, By Region, 20162023 (USD Million)

Table 57 APAC: Compressor Oil Market Size, By Country, 20162023 (Kiloton)

Table 58 APAC: Compressor Oil Market Size, By Country, 20162023 (USD Million)

Table 59 APAC: Compressor Oil Market Size, By Base Oil, 20162023 (Kiloton)

Table 60 APAC: Compressor Oil Market Size, By Base Oil, 20162023 (USD Million)

Table 61 APAC: Compressor Oil Market Size, By End-Use Industry, 20162023 (Kiloton)

Table 62 APAC: Compressor Oil Market Size, By End-Use Industry, 20162023 (USD Million)

Table 63 China: Compressor Oil Market Size, By End-Use Industry, 20162023 (Kiloton)

Table 64 China: Compressor Oil Market Size, By End-Use Industry, 20162023 (USD Million)

Table 65 Japan: Compressor Oil Market Size, By End-Use Industry, 20162023 (Kiloton)

Table 66 Japan: Compressor Oil Market Size, By End-Use Industry, 20162023 (USD Million)

Table 67 India: Compressor Oil Market Size, By End-Use Industry, 20162023 (Kiloton)

Table 68 India: Compressor Oil Market Size, By End-Use Industry, 20162023 (USD Million)

Table 69 Australia: Compressor Oil Market Size, By End-Use Industry, 20162023 (Kiloton)

Table 70 Australia: Compressor Oil Market Size, By End-Use Industry, 20162023 (USD Million)

Table 71 South Korea: Compressor Oil Market Size, By End-Use Industry, 20162023 (Kiloton)

Table 72 South Korea: Compressor Oil Market Size, By End-Use Industry, 20162023 (USD Million)

Table 73 North America: Compressor Oil Market Size, By Country, 20162023 (Kiloton)

Table 74 North America: Compressor Oil Market Size, By Country, 20162023 (USD Million)

Table 75 North America: Compressor Oil Market Size, By Base Oil, 20162023 (Kiloton)

Table 76 North America: Compressor Oil Market Size, By Base Oil, 20162023 (USD Million)

Table 77 North America: Compressor Oil Market Size, By End-Use Industry, 20162023 (Kiloton)

Table 78 North America: Compressor Oil Market Size, By End-Use Industry, 20162023 (USD Million)

Table 79 US: Compressor Oil Market Size, By End-Use Industry, 20162023 (Kiloton)

Table 80 US: Compressor Oil Market Size, By End-Use Industry, 20162023 (USD Million)

Table 81 Canada: Compressor Oil Market Size, By End-Use Industry, 20162023 (Kiloton)

Table 82 Canada: Compressor Oil Market Size, By End-Use Industry, 20162023 (USD Million)

Table 83 Mexico: Compressor Oil Market Size, By End-Use Industry, 20162023 (Kiloton)

Table 84 Mexico: Compressor Oil Market Size, By End-Use Industry, 20162023 (USD Million)

Table 85 Europe: Compressor Oil Market Size, By Country, 20162023 (Kiloton)

Table 86 Europe: Compressor Oil Market Size, By Country, 20162023 (USD Million)

Table 87 Europe: Compressor Oil Market Size, By Base Oil, 20162023 (Kiloton)

Table 88 Europe: Compressor Oil Market Size, By Base Oil, 20162023 (USD Million)

Table 89 Europe: Compressor Oil Market Size, By End-Use Industry, 20162023 (Kiloton)

Table 90 Europe: Compressor Oil Market Size, By End-Use Industry, 20162023 (USD Million)

Table 91 Russia: Compressor Oil Market Size, By End-Use Industry, 20162023 (Kiloton)

Table 92 Russia: Compressor Oil Market Size, By End-Use Industry, 20162023 (USD Million)

Table 93 Germany: Compressor Oil Market Size, By End-Use Industry, 20162023 (Kiloton)

Table 94 Germany: Compressor Oil Market Size, By End-Use Industry, 20162023 (USD Million)

Table 95 UK: Compressor Oil Market Size, By End-Use Industry, 20162023 (Kiloton)

Table 96 UK: Compressor Oil Market Size, By End-Use Industry, 20162023 (USD Million)

Table 97 France: Compressor Oil Market Size, By End-Use Industry, 20162023 (Kiloton)

Table 98 France: Compressor Oil Market Size, By End-Use Industry, 20162023 (USD Million)

Table 99 Italy: Compressor Oil Market Size, By End-Use Industry, 20162023 (Kiloton)

Table 100 Italy: Compressor Oil Market Size, By End-Use Industry, 20162023 (USD Million)

Table 101 Middle East & Africa: Compressor Oil Market Size, By Country, 20162023 (Kiloton)

Table 102 Middle East & Africa: Compressor Oil Market Size, By Country, 20162023 (USD Million)

Table 103 Middle East & Africa: Compressor Oil Market Size, By Base Oil, 20162023 (Kiloton)

Table 104 Middle East & Africa: Compressor Oil Market Size, By Base Oil, 20162023 (USD Million)

Table 105 Middle East & Africa: Compressor Oil Market Size, By End-Use Industry, 20162023 (Kiloton)

Table 106 Middle East & Africa: Compressor Oil Market Size, By End-Use Industry, 20162023 (USD Million)

Table 107 Saudi Arabia: Compressor Oil Market Size, By End-Use Industry, 20162023 (Kiloton)

Table 108 Saudi Arabia: Compressor Oil Market Size, By End-Use Industry, 20162023 (USD Million)

Table 109 Egypt: Compressor Oil Market Size, By End-Use Industry, 20162023 (Kiloton)

Table 110 Egypt: Compressor Oil Market Size, By End-Use Industry, 20162023 (USD Million)

Table 111 UAE: Compressor Oil Market Size, By End-Use Industry, 20162023 (Kiloton)

Table 112 UAE: Compressor Oil Market Size, By End-Use Industry, 20162023 (USD Million)

Table 113 Iran: Compressor Oil Market Size, By End-Use Industry, 20162023 (Kiloton)

Table 114 Iran: Compressor Oil Market Size, By End-Use Industry, 20162023 (USD Million)

Table 115 South America: Compressor Oil Market Size, By Country, 20162023 (Kiloton)

Table 116 South America: Compressor Oil Market Size, By Country, 20162023 (USD Million)

Table 117 South America: Compressor Oil Market Size, By Base Oil, 20162023 (Kiloton)

Table 118 South America: Compressor Oil Market Size, By Base Oil, 20162023 (USD Million)

Table 119 South America: Compressor Oil Market Size, By End-Use Industry, 20162023 (Kiloton)

Table 120 South America: Compressor Oil Market Size, By End-Use Industry, 20162023 (USD Million)

Table 121 Brazil: Compressor Oil Market Size, By End-Use Industry, 20162023 (Kiloton)

Table 122 Brazil: Compressor Oil Market Size, By End-Use Industry, 20162023 (USD Million)

Table 123 Venezuela: Compressor Oil Market Size, By End-Use Industry, 20162023 (Kiloton)

Table 124 Venezuela: Compressor Oil Market Size, By End-Use Industry, 20162023 (USD Million)

Table 125 Argentina: Compressor Oil Market Size, By End-Use Industry, 20162023 (Kiloton)

Table 126 Argentina: Compressor Oil Market Size, By End-Use Industry, 20162023 (USD Million)

Table 127 New Product Launch, 20142018

Table 128 Acquisition, 20142018

List of Figures (59 Figures)

Figure 1 Compressor Oil Market Segmentation

Figure 2 PAG Oil Market : Research Design

Figure 3 Compressor Oil Market: Data Triangulation

Figure 4 General Manufacturing to Be the Largest End-Use Industry of Compressor Oil

Figure 5 Semi-Synthetic Oil to Be the Fastest-Growing Base Oil Segment

Figure 6 Gas Compressor to Be the Larger Application of Compressor Oil

Figure 7 Dynamic Compressor Was the Larger Compressor Type in 2017

Figure 8 APAC Accounted for Largest Share of the Compressor Oil Market in 2017

Figure 9 Rapid Industrialization in APAC Will Significantly Influence the Market Growth

Figure 10 APAC to Be the Largest PAG Oil Market During the Forecast Period

Figure 11 China Accounted for the Largest Share of the APAC Compressor Oil Market in 2017

Figure 12 Synthetic Compressor Oil to Account for the Largest Market Share

Figure 13 India to Drive the APAC PAG Oil Market During the Forecast Period

Figure 14 General Manufacturing Was the Largest End-Use Industry of Compressor Oil in 2017

Figure 15 Overview of Factors Governing the Compressor Oil Market

Figure 16 Compressor Oil Market: Porters Five Forces Analysis

Figure 17 Dynamic Compressor to Be the Larger Compressor Type

Figure 18 Gas Compressor to Be the Larger Application of Compressor Oil

Figure 19 Synthetic Oil to Be the Largest Base Oil Segment in the Market

Figure 20 APAC to Be the Largest Synthetic PAG Oil Market

Figure 21 APAC to Be the Largest Mineral PAG Oil Market During the Forecast Period

Figure 22 APAC to Be the Largest Semi-Synthetic PAG Oil Market

Figure 23 Europe to Be the Largest Bio-Based PAG Oil Market During the Forecast Period

Figure 24 General Manufacturing to Be the Largest End-Use Industry of Compressor Oil During the Forecast Period

Figure 25 APAC to Be the Largest PAG Oil Market in the General Manufacturing Industry

Figure 26 APAC to Be the Largest PAG Oil Market in the Construction Industry

Figure 27 Middle East & Africa to Be the Largest Market in the Oil & Gas Industry

Figure 28 APAC to Be the Largest PAG Oil Market in the Mining Industry

Figure 29 APAC to Be the Largest PAG Oil Market in the Chemical & Petrochemical Industry

Figure 30 APAC to Be the Largest PAG Oil Market in the Power Generation Industry

Figure 31 APAC to Be the Largest PAG Oil Market in Other End-Use Industries

Figure 32 APAC to Be the Fastest-Growing Market

Figure 33 APAC: Market Snapshot

Figure 34 North America: PAG Oil Market Snapshot

Figure 35 Europe: Compressor Oil Market Snapshot

Figure 36 Compressor Oil Competitive Leadership Mapping, 2017

Figure 37 Strength of Product Portfolio, 2017

Figure 38 Business Strategy Excellence, 2017

Figure 39 Small and Medium-Sized Enterprises (SMSE) Mapping, 2017

Figure 40 Strength of Product Portfolio, 2017

Figure 41 Business Strategy Excellence, 2017

Figure 42 New Product Launch and Acquisition Were the Major Strategies Adopted Between 2014 and 2018

Figure 43 Global Compressor Oil Market Share, By Company, 2017

Figure 44 Royal Dutch Shell PLC: Company Snapshot

Figure 45 Royal Dutch Shell PLC: SWOT Analysis

Figure 46 Exxonmobil Corporation: Company Snapshot

Figure 47 Exxonmobil Corporation: SWOT Analysis

Figure 48 BP PLC: Company Snapshot

Figure 49 BP PLC: SWOT Analysis

Figure 50 Chevron Corporation: Company Snapshot

Figure 51 Chevron Corporation: SWOT Analysis

Figure 52 Total SA: Company Snapshot

Figure 53 Total SA: SWOT Analysis

Figure 54 Sinopec Limited: Company Snapshot

Figure 55 Lukoil: Company Snapshot

Figure 56 Indian Oil Corporation Ltd.: Company Snapshot

Figure 57 Fuchs Group: Company Snapshot

Figure 58 Idemitsu Kosan Co. Ltd.: Company Snapshot

Figure 59 Petronas: Company Snapshot

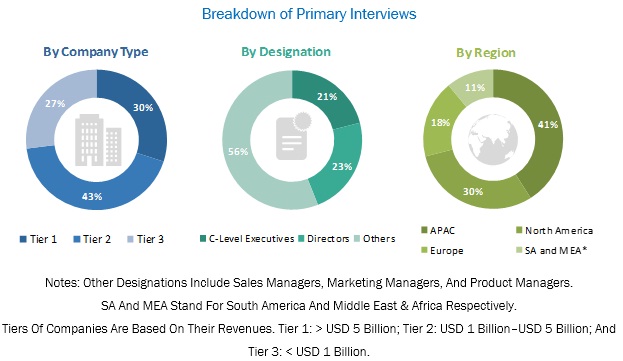

The study involves four major activities in estimating the market size for compressor oil. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the each segment.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. Findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Primary Research

The compressor oil market comprises several stakeholders such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the oil & gas, chemical & petrochemical, construction, mining, and power generation. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the compressor oil market. These methods were also used extensively to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

The key players in the industry have been identified through extensive secondary research.

- The industrys supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments, the data triangulation procedure was employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides.

Report Objectives

- To analyze and forecast the compressor oil market size, in terms of value and volume

- To provide detailed information regarding the major factors (drivers, restraints, and opportunities) influencing the growth of the market

- To segment the compressor oil market on the basis of base oil, compressor type, application, and end-use industry

- To forecast the market size of different segments based on regions, namely, Asia Pacific (APAC), Europe, North America, the Middle East & Africa, and South America along with their key countries

- To analyze the micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze the opportunities for stakeholders by identifying the high-growth segments of the market

- To track and analyze competitive developments such as expansion, agreement, and new product launch in the compressor oil market

- To strategically profile the key players and comprehensively analyze their growth strategies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the companys specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional end-use industry

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Growth opportunities and latent adjacency in Compressor Oil Market

Compresor Market

clarification on numbers given in the report of a particular company

Industrial synthetic lubricants for air and gas compressors producers in Mexico.