Construction Lubricants Market by Base Oil (Mineral Oil, Synthetic Oil), Type (Hydraulic Fluid, Engine Oil, Gear Oil, ATF, Grease, Compressor Oil), Equipment (Earthmoving, Material Handling, Heavy Construction), and Region - Global Forecast to 2027

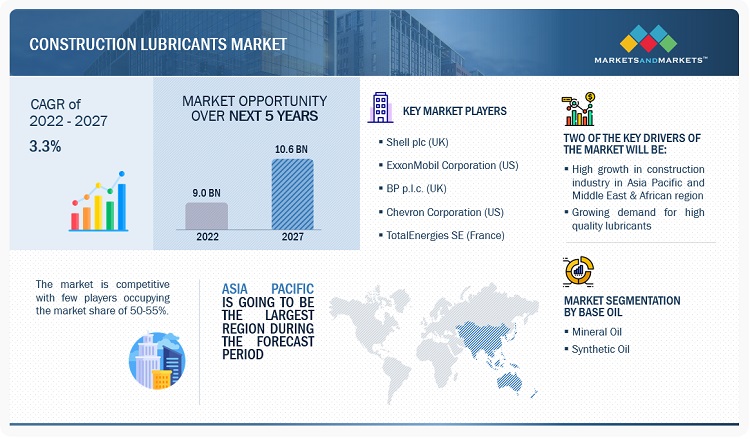

The construction lubricants market is projected to grow from USD 9.0 billion in 2022 to USD 10.6 billion by 2027 at a CAGR of 3.3%. Over the world, the construction lubricants market is expanding significantly, and during the forecast period, a similar trend is anticipated. The extensive use of construction lubricants and growing demand for high-quality lubricants has raised the demand for construction lubricants worldwide. Rapid industrialization in the Asia Pacific and the Middle East & Africa regions post-COVID-19, coupled with the rise in process automation in the construction industry and the gradual increase in construction equipment, are key factors expected to drive the global construction lubricants industry during the forecast period. Furthermore, leveraging the E-commerce industry to increase customer reach and development of zinc-free (ashless) lubricants is an opportunity for market growth. However, rising raw material prices and maintaining product quality, and stringent environmental norms by the government are the major challenges in the construction lubricants market.

Attractive Opportunities in Construction Lubricants Market

To know about the assumptions considered for the study, Request for Free Sample Report

Construction Lubricants Market Dynamics

Driver: Rise in automation in the construction industry

Automation is the use of construction equipment and technology to automate production processes or systems to boost efficiency by reducing manual labor. As automation increases, mechanical parts of the construction equipment are constantly under motion and load, which asks for a high lubrication requirement for the equipment to work efficiently and properly without any failures. The construction industry uses numerous heavy-load equipment that requires regular lubrication. The increasing cost of workforce and safety requirements is also driving the demand for process automation. Hence, most companies are automating their operations which is driving the construction lubricants market.

Restraints: Technological Advancements

Portable and compact machinery has been introduced in the construction industry, which is gaining popularity. Due to reduced gearbox & hydraulic equipment size and extended drain intervals, lubricant consumption in the construction industry has decreased. Construction industries are using new ideas and technologies like proactive lubricant life extension, optimizing the relube interval, reducing package waste (avoiding the bulk purchase of lubricants to reduce the wastage of unused lubricants), and reducing leakage to minimize the use of lubricants. Such technological advancements in the construction industry are expected to hamper the demand for construction lubricants.

Opportunities: Leveraging the E-commerce industry to increase customer reach

E-commerce is an internet platform where manufacturers and sellers can directly sell their construction lubricants without involving any shop, dealer, or distributor. This platform helps the manufacturers of construction lubricants to cut down the value chain and improve their margins. Several construction lubricants manufacturing companies also started to leverage this revolutionary virtual marketplace to gain a customer base using digital market techniques and online campaigns.

Challenges: Rising raw material prices

The construction lubricants market is significantly influenced by the variation in the crude oil market. In 2021 and 2022, the overall market enjoyed profits as prices of WTI and Brent crude oil covered and went to a high of 84.65 and 123.70 WTI crude oil and for the Brent crude oil 85.76 and 133.18 USD per barrel. As a result, such volatile crude oil prices affected the margins of construction lubricant manufacturing companies in the past three years. The majority of the lubricant products are mineral oil-based, which is sourced from crude oil. Therefore, the prices of lubricant products depend on crude oil prices. The price change has a huge impact on the lubricants market.

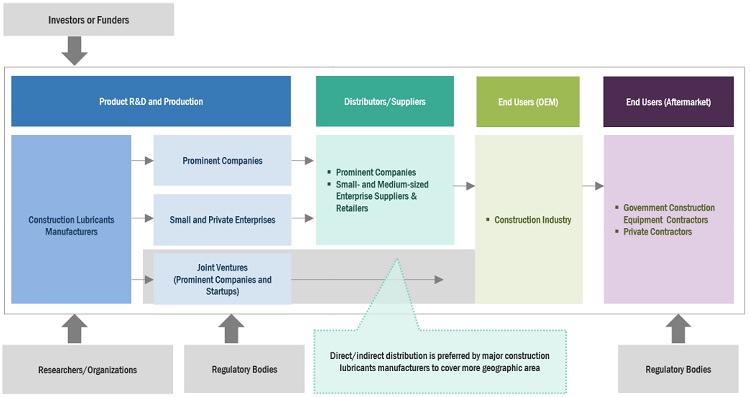

Construction Lubricants Market Ecosystem

Prominent companies in construction lubricants market include financially stable and well-established manufacturers of construction lubricants. These key players have been operating in the market for several years and possess state-of-the-art technologies, a diversified product portfolio, and strong worldwide marketing and sales networks. Prominent companies in this market include Shell Plc (UK), ExxonMobil Corporation (US), BP p.l.c. (UK), Chevron Corporation (US), and TotalEnergies SE (France).

Based on base oil, the mineral oil segment is estimated to account for the largest market share of the construction lubricants market

Based on base oil, the mineral oil segment is estimated to account for the largest market share. This is attributed to its lower price and widespread availability compared to synthetic oil. However, synthetic oil is anticipated to grow at the highest CAGR during the forecast period because of its superior qualities.

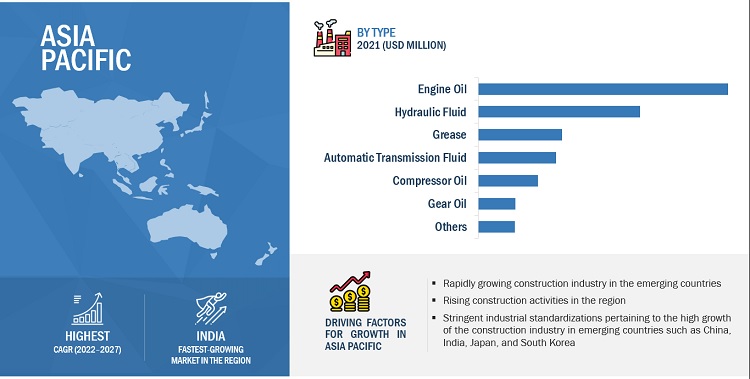

Based on type, the engine oil segment is anticipated to dominate the market

Engine oil segment dominated the global construction lubricants market. This high growth is mainly driven by the frequent replacement of engine oil in various construction equipment and off-road vehicles. Engine oil is mainly used in crankcases and lubrication in various heavy-load equipment in the construction industry. This drives the consumption of engine oil in the construction industry.

The Asia Pacific market is projected to contribute the largest share of the construction lubricant market

Asia Pacific is projected to hold the largest share of the global construction lubricants market throughout the forecast period, in terms of value and volume. According to projections, the region will be a prime location for the construction lubricants business attributed to rise in construction activities, expanding industrial investment, growing population, and the development of its infrastructure in the developing markets of China, Japan, and India.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The key market players profiled in the Report include Shell plc (UK), Exxon Mobil Corporation (US), BP p.l.c. (UK), Chevron Corporation (US), TotalEnergies SE (France), Sinopec Corp. (China), FUCHS Petrolub SE (Germany), LUKOIL (Russia), Indian Oil Corporation Limited (India), Petronas (Malaysia), among others.

Please visit 360Quadrants to see the vendor listing of Top Lubricants companies

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017-2027 |

|

Base Year Considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Million), Volume (Kiloton) |

|

Segments Covered |

Base oil, Type, Equipment, and Region |

|

Geographies covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies covered |

Shell plc (UK), ExxonMobil Corporation (US), BP p.l.c. (UK), Chevron Corporation (US), TotalEnergies SE (France), Sinopec Corp. (China), FUCHS Petrolub SE (Germany), India Oil Corporation Limited (India), LUKOIL (Russia), Petronas (Malaysia), and others |

The study categorizes the construction lubricants market based on Base Oil, Type, Equipment, and Region.

By Base Oil

- Mineral Oil

- Synthetic Oil

- PAO

- PAG

- Esters

- Group III (Hydrocracking)

By Type

- Hydraulic Fluid

- Engine Oil

- Gear Oil

- Automatic Transmission Fluid

- Grease

- Compressor Oil

- Others

By Equipment

-

Earthmoving Equipment

- Excavators

- Loaders

- Crawler Dozers

- Motor Graders

- Others

- Material Handling Equipment

- Heavy Construction Vehicles

-

Others

- Compactors and Road Rollers

- Pavers/Asphalt Finishers

- Other Equipment and Machinery

By Region

- Asia Pacific

- North America

- Europe

- Middle East & Arica

- South America

Recent Development

- In December 2021, TotalEnergies Marketing & Services Australia, a subsidiary of TotalEnergies SE, announced a new partnership with Mitsubishi Motors Australia Limited to launch the latest Mitsubishi Genuine Oil Program. The partnership is based on common goals and provides integrated solutions with a focus on innovation, advanced technology, sustainability, and customer experience.

- In October 2021, TotalEnergies Specialties USA, a subsidiary of TotalEnergies SE, partnered with Hyperfuels to market the full range of TotalEnergies' automotive lubricants nationwide.

- In June 2021, BP p.l.c. has set up a digital hub in Pune, India. This expansion helped them to grow their digital expertise and meet the changing demands by providing sustainable solutions.

- In March 2020, Shell plc announced its investment to double the capacity of the Indonesian lubricants oil blending plant to meet the growing domestic demand. After completion, the plant will be capable of producing up to 300 million liters of finished lubricants annually.

Frequently Asked Questions (FAQ):

What are the drivers and opportunities for the construction lubricants market?

Factors such as high growth in the construction industry in the Asia Pacific and Middle East & African region, growing demand for high-quality lubricants, and rise in automation in the construction industry drive the market growth. Moreover, the development of zinc-free (ashless) lubricants and leveraging the E-commerce industry to increase customer reach creates an opportunity for the construction lubricants market.

Who are the major players in the construction lubricants market?

The key market players are Shell plc (UK), ExxonMobil Corporation (US), BP p.l.c. (UK), Chevron Corporation (US), and TotalEnergies SE (France).

What is the emerging type of construction lubricants?

The engine oil segment is the emerging type of construction lubricant during the forecast period.

What are the major factors restraining market growth during the forecast period?

Technological advancements are the major restraint for the construction lubricants market growth.

What will be the impact of Climate Control Change and other initiatives on the growth of the global industry?

Due to rising environmental concerns, the construction lubricants industry is closely monitored by environmental regulatory bodies. This has resulted in its slow growth, specifically in developed regions. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- High growth of construction industry in Asia Pacific and Middle East & Africa- Growing demand for high-quality lubricants- Rise in automation in construction industryRESTRAINTS- Technological advancementsOPPORTUNITIES- Development of zinc-free (ashless) lubricants- Leveraging e-commerce industry to increase customer reachCHALLENGES- Rising raw material prices- Maintaining product quality and stringent government environmental norms

-

5.3 PORTER’S FIVE FORCES ANALYSISBARGAINING POWER OF SUPPLIERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSINTENSITY OF COMPETITION RIVALRY

-

5.4 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.5 CONSTRUCTION LUBRICANTS MARKET: REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIOSNON-COVID-19 SCENARIOOPTIMISTIC SCENARIOPESSIMISTIC SCENARIOREALISTIC SCENARIO

-

5.6 PRICING ANALYSISAVERAGE SELLING PRICE OF KEY PLAYERS, BY TYPEAVERAGE SELLING PRICE, BY REGION

-

5.7 MACROECONOMIC INDICATORSGDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

-

6.1 SUPPLY CHAIN ANALYSISRAW MATERIAL SUPPLIERMANUFACTURERDISTRIBUTION TO END USERS

-

6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSESREVENUE SHIFT & REVENUE POCKETS FOR CONSTRUCTION LUBRICANTS MARKET

-

6.3 CONNECTED MARKETS: ECOSYSTEM

-

6.4 TECHNOLOGY ANALYSISADVANCED ADDITIVE TECHNOLOGYIOT-ENABLED TECHNOLOGY

-

6.5 CASE STUDIESSHELL PLC HELPED SUREWAY CONSTRUCTION TO SAVE USD 140,298 BY UPGRADING AND CONSOLIDATING ITS TRANSMISSION OIL PORTFOLIO

-

6.6 TRADE DATA STATISTICSIMPORT SCENARIO OF CONSTRUCTION LUBRICANTSEXPORT SCENARIO OF CONSTRUCTION LUBRICANTS

-

6.7 GLOBAL REGULATORY FRAMEWORK AND ITS IMPACT ON CONSTRUCTION LUBRICANTS MARKETREGULATIONS RELATED TO CONSTRUCTION LUBRICANTS

- 6.8 KEY CONFERENCES & EVENTS IN 2023

-

6.9 PATENT ANALYSISAPPROACHDOCUMENT TYPEJURISDICTION ANALYSISTOP APPLICANTS

- 7.1 INTRODUCTION

-

7.2 MINERAL OILLOW COST AND EASY AVAILABILITY OF MINERAL OIL TO DRIVE MARKET

-

7.3 SYNTHETIC OILHIGH PERFORMANCE UNDER EXTREME CONDITIONS TO DRIVE SEGMENTPOLYALPHAOLEFIN (PAO)POLYALKYLENE GLYCOL (PAG)ESTERSGROUP III (HYDROCRACKING)

- 8.1 INTRODUCTION

-

8.2 HYDRAULIC FLUIDHUGE DEMAND FROM ASIA PACIFIC REGION TO DRIVE MARKET

-

8.3 ENGINE OILGROWING DEMAND FOR OFF-ROAD VEHICLES TO BOOST MARKET

-

8.4 GEAR OILEXTENSIVE USE OF MINERAL-BASED GEAR OIL IN CONSTRUCTION INDUSTRY TO DRIVE MARKET

-

8.5 AUTOMATIC TRANSMISSION FLUIDASIA PACIFIC TO LEAD SEGMENT

-

8.6 GREASEENHANCED WATER RESISTANCE AND DURABILITY OF MACHINES TO DRIVE MARKET

-

8.7 COMPRESSOR OILHIGH DEMAND FOR SYNTHETIC COMPRESSOR OIL TO SUPPORT MARKET GROWTH

- 8.8 OTHERS

- 9.1 INTRODUCTION

-

9.2 EARTHMOVING EQUIPMENTEXCAVATORS- Crawler excavators- Mini excavators- Wheeled excavatorsLOADERS- Crawler loaders- Wheeled loaders- Skid-steer loaders- Backhoe loadersCRAWLER DOZERSMOTOR GRADERSOTHERS

- 9.3 MATERIAL HANDLING EQUIPMENT

- 9.4 HEAVY CONSTRUCTION VEHICLES

-

9.5 OTHERSCOMPACTORS AND ROAD ROLLERSPAVERS/ASPHALT FINISHERSOTHER EQUIPMENT AND MACHINERY

- 10.1 INTRODUCTION

-

10.2 ASIA PACIFICIMPACT OF RECESSIONASIA PACIFIC CONSTRUCTION LUBRICANTS MARKET, BY BASE OILASIA PACIFIC CONSTRUCTION LUBRICANTS MARKET, BY TYPEASIA PACIFIC CONSTRUCTION LUBRICANTS MARKET, BY COUNTRY- China- Japan- India- Australia- South Korea

-

10.3 NORTH AMERICAIMPACT OF RECESSIONNORTH AMERICA: CONSTRUCTION LUBRICANTS MARKET, BY BASE OILNORTH AMERICA: CONSTRUCTION LUBRICANTS MARKET, BY TYPENORTH AMERICA: CONSTRUCTION LUBRICANTS MARKET, BY COUNTRY- US- Canada- Mexico

-

10.4 EUROPEIMPACT OF RECESSIONEUROPE CONSTRUCTION LUBRICANTS MARKET, BY BASE OILEUROPE CONSTRUCTION LUBRICANTS MARKET, BY TYPEEUROPE CONSTRUCTION LUBRICANTS MARKET, BY COUNTRY- Germany- UK- France- Spain- Italy

-

10.5 MIDDLE EAST & AFRICAIMPACT OF RECESSIONMIDDLE EAST & AFRICA CONSTRUCTION LUBRICANTS MARKET, BY BASE OILMIDDLE EAST & AFRICA CONSTRUCTION LUBRICANTS MARKET, BY TYPEMIDDLE EAST & AFRICA CONSTRUCTION LUBRICANTS MARKET, BY COUNTRY- Turkey- Saudi Arabia- UAE

-

10.6 SOUTH AMERICAIMPACT OF RECESSIONSOUTH AMERICA CONSTRUCTION LUBRICANTS MARKET, BY BASE OILSOUTH AMERICA CONSTRUCTION LUBRICANTS MARKET, BY TYPESOUTH AMERICA CONSTRUCTION LUBRICANTS MARKET, BY COUNTRY- Brazil- Argentina

- 11.1 INTRODUCTION

-

11.2 STRATEGIES ADOPTED BY KEY PLAYERSOVERVIEW OF STRATEGIES ADOPTED BY KEY CONSTRUCTION LUBRICANT MANUFACTURERS

-

11.3 MARKET SHARE ANALYSISRANKING OF KEY MARKET PLAYERS, 2021DEGREE OF COMPETITION OF KEY PLAYERS

- 11.4 COMPANY PRODUCT FOOTPRINT ANALYSIS

-

11.5 COMPANY EVALUATION QUADRANT (TIER 1)STARSEMERGING LEADERSPARTICIPANTSPERVASIVE PLAYERS

- 11.6 COMPETITIVE BENCHMARKING

-

11.7 STARTUP/SME EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKSDYNAMIC COMPANIES

-

11.8 COMPETITIVE SITUATIONS AND TRENDSPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

12.1 MAJOR PLAYERSSHELL PLC- Business overview- Products offered- Recent developments- MnM ViewCHEVRON CORPORATION- Business overview- Products offered- Recent developments- MnM ViewBP P.L.C.- Business overview- Products offered- Recent developments- MnM ViewTOTALENERGIES SE- Business overview- Products offered- Recent developments- MnM ViewEXXON MOBIL CORPORATION- Business overview- Products offered- Recent developments- MnM ViewFUCHS PETROLUB SE- Business overview- Products offered- Recent developmentsSINOPEC CORP.- Business overview- Products offered- Recent developmentsLUKOIL- Business overview- Products offered- Recent developmentsINDIAN OIL CORPORATION LIMITED- Business overview- Products offered- Recent developmentsPETRONAS- Business overview- Products offered- Recent developments

-

12.2 OTHER KEY MARKET PLAYERSBEL-RAY COMPANY, LLC.MORRIS LUBRICANTSPENRITE OIL COMPANYLIQUI MOLY GMBHENI S.P.A.ADDINOL LUBE OIL GMBHDYADE LUBRICANTSKLUBER LUBRICATIONLUBRIPLATE LUBRICANTS COMPANYSASOL LIMITEDPETRO-CANADA LUBRICANTS INC.PHILLIPS 66US LUBRICANTSPERTAMINAENEOS HOLDINGS, INC.

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

-

13.3 HYDRAULIC FLUIDS MARKETMARKET DEFINITIONMARKET OVERVIEW- Asia Pacific- Europe- North America- Middle East & Africa- South America

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 CONSTRUCTION LUBRICANTS MARKET: RISK ASSESSMENT

- TABLE 2 ONGOING AND UPCOMING CONSTRUCTION PROJECTS

- TABLE 3 CRUDE OIL PRICE TRENDS (2019–2022)

- TABLE 4 CONSTRUCTION LUBRICANTS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR CONSTRUCTION INDUSTRY (%)

- TABLE 6 KEY BUYING CRITERIA FOR CONSTRUCTION INDUSTRY

- TABLE 7 CONSTRUCTION LUBRICANTS MARKET FORECAST SCENARIO, 2019–2027 (USD MILLION)

- TABLE 8 AVERAGE SELLING PRICES OF KEY PLAYERS FOR TOP THREE TYPES (USD/KG)

- TABLE 9 AVERAGE SELLING PRICES OF CONSTRUCTION LUBRICANTS, BY REGION, 2020–2027 (USD/KG)

- TABLE 10 GDP TRENDS AND FORECAST, BY MAJOR ECONOMIES, 2020–2027 (USD BILLION)

- TABLE 11 VALUE ADDED BY CONSTRUCTION INDUSTRY FOR KEY COUNTRIES, 2016–2020 (USD BILLION)

- TABLE 12 CONSTRUCTION LUBRICANTS MARKET: ECOSYSTEM

- TABLE 13 IMPORTS OF CONSTRUCTION LUBRICANTS, BY REGION, 2013–2021 (USD MILLION)

- TABLE 14 EXPORTS OF CONSTRUCTION LUBRICANTS, BY REGION, 2013–2021 (MILLION)

- TABLE 15 CONSTRUCTION LUBRICANTS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 16 PATENT APPLICATIONS ACCOUNTED FOR 57% OF TOTAL COUNT

- TABLE 17 PATENTS BY BASF SE

- TABLE 18 PATENTS BY DOW GLOBAL TECHNOLOGIES LLC

- TABLE 19 TOP 10 PATENT OWNERS IN US, 2011–2021

- TABLE 20 CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL, 2017–2020 (KILOTON)

- TABLE 21 CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL, 2021–2027 (KILOTON)

- TABLE 22 CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL, 2017–2020 (USD MILLION)

- TABLE 23 CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL, 2021–2027 (USD MILLION)

- TABLE 24 MINERAL OIL: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2017–2020 (KILOTON)

- TABLE 25 MINERAL OIL: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2021–2027 (KILOTON)

- TABLE 26 MINERAL OIL: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 27 MINERAL OIL: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 28 SYNTHETIC OIL: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2017–2020 (KILOTON)

- TABLE 29 SYNTHETIC OIL: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2021–2027 (KILOTON)

- TABLE 30 SYNTHETIC OIL: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 31 SYNTHETIC OIL: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 32 CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017–2020 (KILOTON)

- TABLE 33 CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021–2027 (KILOTON)

- TABLE 34 CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 35 CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 36 HYDRAULIC FLUID: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2017–2020 (KILOTON)

- TABLE 37 HYDRAULIC FLUID: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2021–2027 (KILOTON)

- TABLE 38 HYDRAULIC FLUID: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 39 HYDRAULIC FLUID: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 40 ENGINE OIL: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2017–2020 (KILOTON)

- TABLE 41 ENGINE OIL: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2021–2027 (KILOTON)

- TABLE 42 ENGINE OIL: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 43 ENGINE OIL: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 44 GEAR OIL: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2017–2020 (KILOTON)

- TABLE 45 GEAR OIL: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2021–2027 (KILOTON)

- TABLE 46 GEAR OIL: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 47 GEAR OIL: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 48 AUTOMATIC TRANSMISSION FLUID: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2017–2020 (KILOTON)

- TABLE 49 AUTOMATIC TRANSMISSION FLUID: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2021–2027 (KILOTON)

- TABLE 50 AUTOMATIC TRANSMISSION FLUID: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 51 AUTOMATIC TRANSMISSION FLUID: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 52 GREASE: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2017–2020 (KILOTON)

- TABLE 53 GREASE: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2021–2027 (KILOTON)

- TABLE 54 GREASE: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 55 GREASE: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 56 COMPRESSOR OIL: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2017–2020 (KILOTON)

- TABLE 57 COMPRESSOR OIL: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2021–2027 (KILOTON)

- TABLE 58 COMPRESSOR OIL: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 59 COMPRESSOR OIL: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 60 OTHERS: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2017–2020 (KILOTON)

- TABLE 61 OTHERS: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2021–2027 (KILOTON)

- TABLE 62 OTHERS: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 63 OTHERS: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 64 CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2017–2020 (KILOTON)

- TABLE 65 CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2021–2027 (KILOTON)

- TABLE 66 CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 67 CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 68 ASIA PACIFIC: CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL, 2017–2020 (KILOTON)

- TABLE 69 ASIA PACIFIC: CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL, 2021–2027 (KILOTON)

- TABLE 70 ASIA PACIFIC: CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL, 2017–2020 (USD MILLION)

- TABLE 71 ASIA PACIFIC: CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL, 2021–2027 (USD MILLION)

- TABLE 72 ASIA PACIFIC: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017–2020 (KILOTON)

- TABLE 73 ASIA PACIFIC: CONSTRUCTION LUBRICANTS MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

- TABLE 74 ASIA PACIFIC: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 75 ASIA PACIFIC: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 76 ASIA PACIFIC: CONSTRUCTION LUBRICANTS MARKET, BY COUNTRY, 2017–2020 (KILOTON)

- TABLE 77 ASIA PACIFIC: CONSTRUCTION LUBRICANTS MARKET, BY COUNTRY, 2021–2027 (KILOTON)

- TABLE 78 ASIA PACIFIC: CONSTRUCTION LUBRICANTS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 79 ASIA PACIFIC: CONSTRUCTION LUBRICANTS MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 80 CHINA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017–2020 (KILOTON)

- TABLE 81 CHINA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021–2027 (KILOTON)

- TABLE 82 CHINA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 83 CHINA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 84 JAPAN: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017–2020 (KILOTON)

- TABLE 85 JAPAN: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021–2027 (KILOTON)

- TABLE 86 JAPAN: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 87 JAPAN: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 88 INDIA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017–2020 (KILOTON)

- TABLE 89 INDIA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021–2027 (KILOTON)

- TABLE 90 INDIA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 91 INDIA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 92 AUSTRALIA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017–2020 (KILOTON)

- TABLE 93 AUSTRALIA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021–2027 (KILOTON)

- TABLE 94 AUSTRALIA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 95 AUSTRALIA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 96 SOUTH KOREA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017–2020 (KILOTON)

- TABLE 97 SOUTH KOREA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021–2027 (KILOTON)

- TABLE 98 SOUTH KOREA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 99 SOUTH KOREA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 100 NORTH AMERICA: CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL, 2017–2020 (KILOTON)

- TABLE 101 NORTH AMERICA: CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL, 2021–2027 (KILOTON)

- TABLE 102 NORTH AMERICA: CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL, 2017–2020 (USD MILLION)

- TABLE 103 NORTH AMERICA: CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL, 2021–2027 (USD MILLION)

- TABLE 104 NORTH AMERICA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017–2020 (KILOTON)

- TABLE 105 NORTH AMERICA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021–2027 (KILOTON)

- TABLE 106 NORTH AMERICA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 107 NORTH AMERICA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 108 NORTH AMERICA: CONSTRUCTION LUBRICANTS MARKET, BY COUNTRY, 2017–2020 (KILOTON)

- TABLE 109 NORTH AMERICA: CONSTRUCTION LUBRICANTS MARKET, BY COUNTRY, 2021–2027 (KILOTON)

- TABLE 110 NORTH AMERICA: CONSTRUCTION LUBRICANTS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 111 NORTH AMERICA: CONSTRUCTION LUBRICANTS MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 112 US: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017–2020 (KILOTON)

- TABLE 113 US: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021–2027 (KILOTON)

- TABLE 114 US: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 115 US: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 116 CANADA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017–2020 (KILOTON)

- TABLE 117 CANADA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021–2027 (KILOTON)

- TABLE 118 CANADA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 119 CANADA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 120 MEXICO: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017–2020 (KILOTON)

- TABLE 121 MEXICO: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021–2027 (KILOTON)

- TABLE 122 MEXICO: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 123 MEXICO: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 124 EUROPE: CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL, 2017–2020 (KILOTON)

- TABLE 125 EUROPE: CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL, 2021–2027 (KILOTON)

- TABLE 126 EUROPE: CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL, 2017–2020 (USD MILLION)

- TABLE 127 EUROPE: CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL, 2021–2027 (USD MILLION)

- TABLE 128 EUROPE: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017–2020 (KILOTON)

- TABLE 129 EUROPE: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021–2027 (KILOTON)

- TABLE 130 EUROPE: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 131 EUROPE: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 132 EUROPE: CONSTRUCTION LUBRICANTS MARKET, BY COUNTRY, 2017–2020 (KILOTON)

- TABLE 133 EUROPE: CONSTRUCTION LUBRICANTS MARKET SIZE, BY COUNTRY, 2021–2027 (KILOTON)

- TABLE 134 EUROPE: CONSTRUCTION LUBRICANTS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 135 EUROPE: CONSTRUCTION LUBRICANTS MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 136 GERMANY: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017–2020 (KILOTON)

- TABLE 137 GERMANY: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021–2027 (KILOTON)

- TABLE 138 GERMANY: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 139 GERMANY: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 140 UK: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017–2020 (KILOTON)

- TABLE 141 UK: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021–2027 (KILOTON)

- TABLE 142 UK: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 143 UK: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 144 FRANCE: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017–2020 (KILOTON)

- TABLE 145 FRANCE: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021–2027 (KILOTON)

- TABLE 146 FRANCE: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 147 FRANCE: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 148 SPAIN: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017–2020 (KILOTON)

- TABLE 149 SPAIN: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021–2027 (KILOTON)

- TABLE 150 SPAIN: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 151 SPAIN: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 152 ITALY: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017–2020 (KILOTON)

- TABLE 153 ITALY: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021–2027 (KILOTON)

- TABLE 154 ITALY: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 155 ITALY: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 156 MIDDLE EAST & AFRICA: CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL, 2017–2020 (KILOTON)

- TABLE 157 MIDDLE EAST & AFRICA: CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL, 2021–2027 (KILOTON)

- TABLE 158 MIDDLE EAST & AFRICA: CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL, 2017–2020 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: CONSTRUCTION LUBRICANTS MARKET SIZE, BY BASE OIL, 2021–2027 (USD MILLION)

- TABLE 160 MIDDLE EAST & AFRICA: CONSTRUCTION LUBRICANTS MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

- TABLE 161 MIDDLE EAST & AFRICA: CONSTRUCTION LUBRICANTS MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

- TABLE 162 MIDDLE EAST & AFRICA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 163 MIDDLE EAST & AFRICA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: CONSTRUCTION LUBRICANTS MARKET, BY COUNTRY, 2017–2020 (KILOTON)

- TABLE 165 MIDDLE EAST & AFRICA: CONSTRUCTION LUBRICANTS MARKET, BY COUNTRY, 2021–2027 (KILOTON)

- TABLE 166 MIDDLE EAST & AFRICA: CONSTRUCTION LUBRICANTS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: CONSTRUCTION LUBRICANTS MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 168 TURKEY: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017–2020 (KILOTON)

- TABLE 169 TURKEY: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021–2027 (KILOTON)

- TABLE 170 TURKEY: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 171 TURKEY: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 172 SAUDI ARABIA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017–2020 (KILOTON)

- TABLE 173 SAUDI ARABIA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021–2027 (KILOTON)

- TABLE 174 SAUDI ARABIA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 175 SAUDI ARABIA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 176 UAE: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017–2020 (KILOTON)

- TABLE 177 UAE CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021–2027 (KILOTON)

- TABLE 178 UAE: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 179 UAE: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 180 SOUTH AMERICA: CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL, 2017–2020 (KILOTON)

- TABLE 181 SOUTH AMERICA: CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL, 2021–2027 (KILOTON)

- TABLE 182 SOUTH AMERICA: CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL, 2017–2020 (USD MILLION)

- TABLE 183 SOUTH AMERICA: CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL, 2021–2027 (USD MILLION)

- TABLE 184 SOUTH AMERICA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017–2020 (KILOTON)

- TABLE 185 SOUTH AMERICA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021–2027 (KILOTON)

- TABLE 186 SOUTH AMERICA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 187 SOUTH AMERICA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 188 SOUTH AMERICA: CONSTRUCTION LUBRICANTS MARKET, BY COUNTRY, 2017–2020 (KILOTON)

- TABLE 189 SOUTH AMERICA: CONSTRUCTION LUBRICANTS MARKET SIZE, BY COUNTRY, 2021–2027 (KILOTON)

- TABLE 190 SOUTH AMERICA: CONSTRUCTION LUBRICANTS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 191 SOUTH AMERICA: CONSTRUCTION LUBRICANTS MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 192 BRAZIL: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017–2020 (KILOTON)

- TABLE 193 BRAZIL: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021–2027 (KILOTON)

- TABLE 194 BRAZIL: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 195 BRAZIL: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 196 ARGENTINA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017–2020 (KILOTON)

- TABLE 197 ARGENTINA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021–2027 (KILOTON)

- TABLE 198 ARGENTINA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 199 ARGENTINA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 200 CONSTRUCTION LUBRICANTS MARKET: DEGREE OF COMPETITION

- TABLE 201 CONSTRUCTION LUBRICANTS MARKET: TYPE FOOTPRINT

- TABLE 202 CONSTRUCTION LUBRICANTS MARKET: EQUIPMENT TYPE FOOTPRINT

- TABLE 203 CONSTRUCTION LUBRICANTS MARKET: COMPANY REGION FOOTPRINT

- TABLE 204 CONSTRUCTION LUBRICANTS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 205 CONSTRUCTION LUBRICANTS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 206 CONSTRUCTION LUBRICANTS MARKET: PRODUCT LAUNCHES (2019–2022)

- TABLE 207 CONSTRUCTION LUBRICANTS MARKET: DEALS (2019–2022)

- TABLE 208 CONSTRUCTION LUBRICANTS MARKET: OTHER DEVELOPMENTS (2019–2022)

- TABLE 209 SHELL PLC: COMPANY OVERVIEW

- TABLE 210 CHEVRON CORPORATION: COMPANY OVERVIEW

- TABLE 211 BP P.L.C.: COMPANY OVERVIEW

- TABLE 212 TOTALENERGIES SE: COMPANY OVERVIEW

- TABLE 213 EXXON MOBIL CORPORATION: COMPANY OVERVIEW

- TABLE 214 FUCHS PETROLUB SE: COMPANY OVERVIEW

- TABLE 215 SINOPEC CORP.: COMPANY OVERVIEW

- TABLE 216 LUKOIL: COMPANY OVERVIEW

- TABLE 217 INDIAN OIL CORPORATION LIMITED: COMPANY OVERVIEW

- TABLE 218 PETRONAS: COMPANY OVERVIEW

- TABLE 219 BEL RAY COMPANY, LLC.: COMPANY OVERVIEW

- TABLE 220 MORRIS LUBRICANTS: COMPANY OVERVIEW

- TABLE 221 PENRITE OIL COMPANY: COMPANY OVERVIEW

- TABLE 222 LIQUI MOLY GMBH: COMPANY OVERVIEW

- TABLE 223 ENI S.P.A.: COMPANY OVERVIEW

- TABLE 224 ADDINOL LUBE OIL GMBH: COMPANY OVERVIEW

- TABLE 225 DYADE LUBRICANTS: COMPANY OVERVIEW

- TABLE 226 KLUBER LUBRICATION: COMPANY OVERVIEW

- TABLE 227 LUBRIPLATE LUBRICANTS COMPANY: COMPANY OVERVIEW

- TABLE 228 SASOL LIMITED: COMPANY OVERVIEW

- TABLE 229 PETRO-CANADA LUBRICANTS INC.: COMPANY OVERVIEW

- TABLE 230 PHILLIPS 66: COMPANY OVERVIEW

- TABLE 231 US LUBRICANTS: COMPANY OVERVIEW

- TABLE 232 PERTAMINA: COMPANY OVERVIEW

- TABLE 233 ENEOS HOLDINGS, INC.: COMPANY OVERVIEW

- TABLE 234 HYDRAULIC FLUIDS MARKET, BY REGION, 2017–2020 (KILOTON)

- TABLE 235 HYDRAULIC FLUIDS MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 236 ASIA PACIFIC: HYDRAULIC FLUIDS MARKET, BY COUNTRY, 2017–2020 (KILOTON)

- TABLE 237 ASIA PACIFIC: HYDRAULIC FLUIDS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 238 EUROPE: HYDRAULIC FLUIDS MARKET, BY COUNTRY, 2017–2020 (KILOTON)

- TABLE 239 EUROPE: HYDRAULIC FLUIDS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 240 NORTH AMERICA: HYDRAULIC FLUIDS MARKET, BY COUNTRY, 2017–2020 (KILOTON)

- TABLE 241 NORTH AMERICA: HYDRAULIC FLUIDS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 242 MIDDLE EAST & AFRICA: HYDRAULIC FLUIDS MARKET, BY COUNTRY, 2017–2020 (KILOTON)

- TABLE 243 MIDDLE EAST & AFRICA: HYDRAULIC FLUIDS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 244 SOUTH AMERICA: HYDRAULIC FLUIDS MARKET, BY COUNTRY, 2017–2020 (KILOTON)

- TABLE 245 SOUTH AMERICA: HYDRAULIC FLUIDS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

- FIGURE 1 CONSTRUCTION LUBRICANTS MARKET SEGMENTATION

- FIGURE 2 CONSTRUCTION LUBRICANTS MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): COLLECTIVE SHARE OF TOP PLAYERS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 - BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL PRODUCTS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 – BOTTOM-UP (DEMAND SIDE)

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 4 – TOP-DOWN

- FIGURE 7 CONSTRUCTION LUBRICANTS MARKET: DATA TRIANGULATION

- FIGURE 8 MARKET CAGR PROJECTIONS FROM SUPPLY SIDE

- FIGURE 9 MARKET GROWTH PROJECTIONS FROM DEMAND SIDE: DRIVERS AND OPPORTUNITIES

- FIGURE 10 ENGINE OIL SEGMENT TO LEAD CONSTRUCTION LUBRICANTS MARKET DURING FORECAST PERIOD

- FIGURE 11 MINERAL OIL SEGMENT TO LEAD CONSTRUCTION LUBRICANTS MARKET DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC DOMINATED CONSTRUCTION LUBRICANTS MARKET

- FIGURE 13 GROWING CONSTRUCTION INDUSTRY TO DRIVE CONSTRUCTION LUBRICANTS MARKET DURING FORECAST PERIOD

- FIGURE 14 ASIA PACIFIC TO BE LARGEST MARKET FOR CONSTRUCTION LUBRICANTS DURING FORECAST PERIOD

- FIGURE 15 CHINA DOMINATED CONSTRUCTION LUBRICANTS MARKET IN ASIA PACIFIC

- FIGURE 16 HYDRAULIC FLUID TO BE LARGEST TYPE SEGMENT OF CONSTRUCTION LUBRICANTS

- FIGURE 17 MINERAL OIL SEGMENT IN CONSTRUCTION LUBRICANTS TO BE LARGEST IN OVERALL MARKET

- FIGURE 18 INDIA TO REGISTER HIGHEST CAGR BETWEEN 2022 AND 2027

- FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN CONSTRUCTION LUBRICANTS MARKET

- FIGURE 20 CONSTRUCTION LUBRICANTS MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR CONSTRUCTION INDUSTRY

- FIGURE 22 KEY BUYING CRITERIA FOR CONSTRUCTION INDUSTRY

- FIGURE 23 MARKET SIZE UNDER REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIOS

- FIGURE 24 AVERAGE SELLING PRICES OF KEY PLAYERS FOR TOP THREE TYPES

- FIGURE 25 AVERAGE SELLING PRICES OF CONSTRUCTION LUBRICANTS, BY REGION, 2020–2027

- FIGURE 26 CONSTRUCTION LUBRICANTS MARKET: SUPPLY CHAIN

- FIGURE 27 CONSTRUCTION LUBRICANTS MARKET: FUTURE REVENUE MIX

- FIGURE 28 CONSTRUCTION LUBRICANTS MARKET: ECOSYSTEM

- FIGURE 29 CONSTRUCTION LUBRICANTS IMPORT, BY KEY COUNTRY (2013–2021)

- FIGURE 30 CONSTRUCTION LUBRICANTS EXPORT, BY KEY COUNTRY (2013–2021)

- FIGURE 31 PATENTS REGISTERED IN CONSTRUCTION LUBRICANTS MARKET, 2011–2021

- FIGURE 32 PATENT PUBLICATION TRENDS, 2011–2021

- FIGURE 33 LEGAL STATUS OF PATENTS FILED IN CONSTRUCTION LUBRICANTS MARKET

- FIGURE 34 MAXIMUM PATENTS FILED IN JURISDICTION OF US

- FIGURE 35 BASF SE REGISTERED MAXIMUM NUMBER OF PATENTS BETWEEN 2011 AND 2021

- FIGURE 36 MINERAL OIL-BASED LUBRICANTS TO LEAD CONSTRUCTION LUBRICANTS MARKET DURING FORECAST PERIOD

- FIGURE 37 ASIA PACIFIC TO BE LARGEST CONSTRUCTION LUBRICANTS MARKET IN MINERAL OIL SEGMENT

- FIGURE 38 EUROPE TO BE LARGEST CONSTRUCTION LUBRICANTS MARKET IN SYNTHETIC OIL SEGMENT

- FIGURE 39 ENGINE OIL SEGMENT TO LEAD CONSTRUCTION LUBRICANTS MARKET DURING FORECAST PERIOD

- FIGURE 40 ASIA PACIFIC TO BE LARGEST CONSTRUCTION LUBRICANTS MARKET IN HYDRAULIC FLUID SEGMENT

- FIGURE 41 SOUTH AMERICA TO BE FASTEST-GROWING CONSTRUCTION LUBRICANTS MARKET IN ENGINE OIL SEGMENT

- FIGURE 42 MIDDLE EAST & AFRICA TO BE SECOND-FASTEST GROWING CONSTRUCTION LUBRICANTS MARKET IN GEAR OIL SEGMENT

- FIGURE 43 EUROPE TO BE SECOND-LARGEST CONSTRUCTION LUBRICANTS MARKET IN AUTOMATIC TRANSMISSION FLUID SEGMENT

- FIGURE 44 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN GREASE SEGMENT

- FIGURE 45 NORTH AMERICA TO BE SECOND-LARGEST CONSTRUCTION LUBRICANTS MARKET IN COMPRESSOR OIL SEGMENT

- FIGURE 46 NORTH AMERICA TO BE LARGEST MARKET IN OTHER CONSTRUCTION LUBRICANTS

- FIGURE 47 ASIA PACIFIC TO BE FASTEST-GROWING CONSTRUCTION LUBRICANTS MARKET BETWEEN 2022 AND 2027

- FIGURE 48 ASIA PACIFIC: CONSTRUCTION LUBRICANTS MARKET SNAPSHOT

- FIGURE 49 NORTH AMERICA: CONSTRUCTION LUBRICANTS MARKET SNAPSHOT

- FIGURE 50 EUROPE: CONSTRUCTION LUBRICANTS MARKET SNAPSHOT

- FIGURE 51 RANKING OF TOP FIVE PLAYERS IN CONSTRUCTION LUBRICANTS MARKET, 2021

- FIGURE 52 SHELL PLC ACCOUNTED FOR LARGEST SHARE OF CONSTRUCTION LUBRICANTS MARKET IN 2021

- FIGURE 53 REVENUE ANALYSIS OF KEY COMPANIES IN PAST FIVE YEARS

- FIGURE 54 CONSTRUCTION LUBRICANTS MARKET: COMPANY FOOTPRINT

- FIGURE 55 COMPANY EVALUATION QUADRANT FOR CONSTRUCTION LUBRICANTS MARKET (TIER 1)

- FIGURE 56 STARTUPS/SMES EVALUATION QUADRANT FOR CONSTRUCTION LUBRICANTS MARKET

- FIGURE 57 SHELL PLC: COMPANY SNAPSHOT

- FIGURE 58 CHEVRON CORPORATION: COMPANY SNAPSHOT

- FIGURE 59 BP P.L.C.: COMPANY SNAPSHOT

- FIGURE 60 TOTALENERGIES SE: COMPANY SNAPSHOT

- FIGURE 61 EXXON MOBIL CORPORATION: COMPANY SNAPSHOT

- FIGURE 62 FUCHS PETROLUB SE: COMPANY SNAPSHOT

- FIGURE 63 SINOPEC CORP.: COMPANY SNAPSHOT

- FIGURE 64 LUKOIL: COMPANY SNAPSHOT

- FIGURE 65 INDIAN OIL CORPORATION LIMITED: COMPANY SNAPSHOT

- FIGURE 66 PETRONAS: COMPANY SNAPSHOT

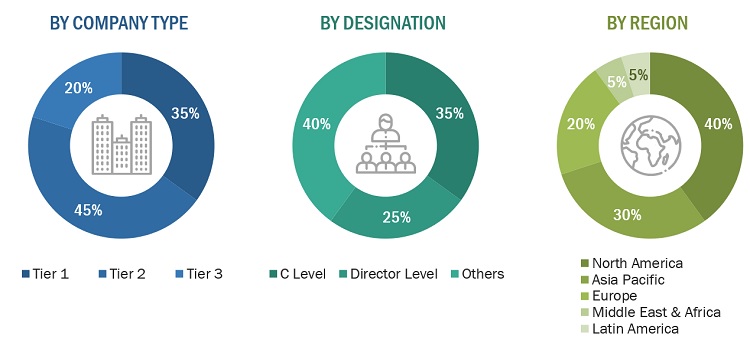

The study involved four major activities in estimating the current size of the construction lubricants market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering construction lubricants and information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the construction lubricants industry, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the construction lubricants market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa and South America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from construction lubricants vendors; system integrators; component providers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are using construction lubricants, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of construction lubricants and future outlook of their business which will affect the overall market.

The Breakdown of Primary Research

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2021 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Shell plc |

Vice-President |

|

ExxonMobil Corporation |

Director |

|

BP p.l.c. |

Project Manager |

|

Chevron Corporation |

Sales Manager |

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the construction lubricants market.

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

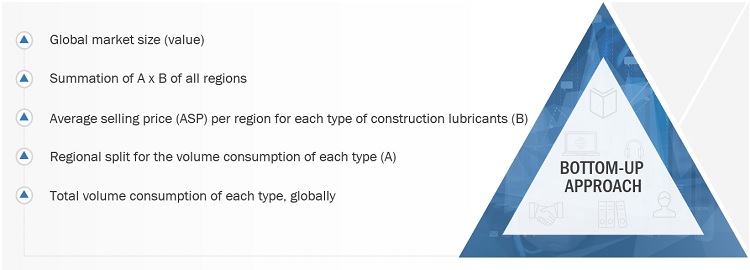

Global Construction Lubricants Market Size: Bottum Up Approach

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides of construction lubricants.

Market Definition

Construction lubricants are materials applied to decrease the friction between moving surfaces and parts. Construction lubricants help improve the efficiency of the equipment and machines used in the construction industry. These lubricants tend to have different viscosity applied on different equipment across building and construction industries.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, segment, and forecast the size of the construction lubricants market based on base oil, type, equipment, and region

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, South America, Middle East & Africa, along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the construction lubricants market

- To analyze technological advancements and product launches in the market

- To strategically analyze micro markets, with respect to their growth trends, prospects, and their contribution to the market

- To identify financial positions, key products, and key developments of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis

- To provide a comprehensive analysis of business and corporate strategies adopted by the key players in the market

- To strategically profile key players in the market and comprehensively analyze their core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the construction lubricants market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the construction lubricants market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Construction Lubricants Market