Compressor Rental Market by Compressor Type (Reciprocating, Rotary Screw), Drive Type (Engine, Gas, Hydraulic), End-Use Industry (Construction, Mining, Oil & Gas, Power, Fire Proetction, Medical), and Region - Global Forecast to 2028

Updated on : August 22, 2025

Compressor Rental Market

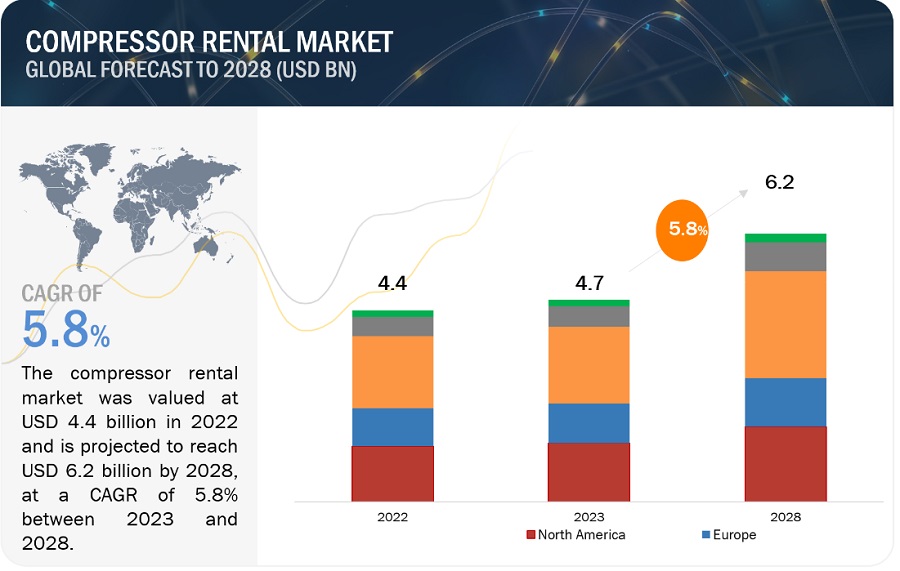

The compressor rental market was valued at USD 4.4 billion in 2022 and is projected to reach USD 6.2 billion by 2028, growing at 5.8% cagr from 2023 to 2028. Many different industries, including manufacturing, construction, automotive, oil and gas, refrigeration, and many others, employ compressors extensively, which drives the market.

Compressor Rental Market Forecast & Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Attractive Opportunities in the Compressor Rental Market

Compressor Rental Market Dynamics

Driver: New customized compressed air rental solution

Major players offer compressor rental services engineered for specific applications, for short and long term, and various ranges. Rental options provide the ability to scale compressed air capacity up or down in response to production needs or maintenance outages, negating the need for substantial capital expenditures for permanent installations. Overall, the need for adaptability, flexibility, cost savings, and operational efficiency is driving demand for customized compressed air rental solutions.

Restraint: Uncertainty in raw material prices

Raw materials for compressors include forged carbon steel, stainless steel, and cast iron, among others. Prices for these raw materials are extremely sensitive to changes in macro-economic conditions. The rental rates that compressor rental firms offer may be impacted by the volatility of raw material prices. Rental companies may need to change their rates if the price of raw materials rises noticeably in order to remain profitable and pay their costs.

Opportunity: Next generation air compressors

Smart control systems that enable remote monitoring, data analysis, and compressor performance optimization are a feature of next-generation air compressors. Real-time monitoring of important metrics, proactive maintenance, and remote diagnostics are all made possible by Internet of Things (IoT) connectivity. The demand for energy efficiency, sustainability, connection, and dependability is what is driving the development of the next generation of air compressors, thus offering opportunity for the growth of compressor rental market.

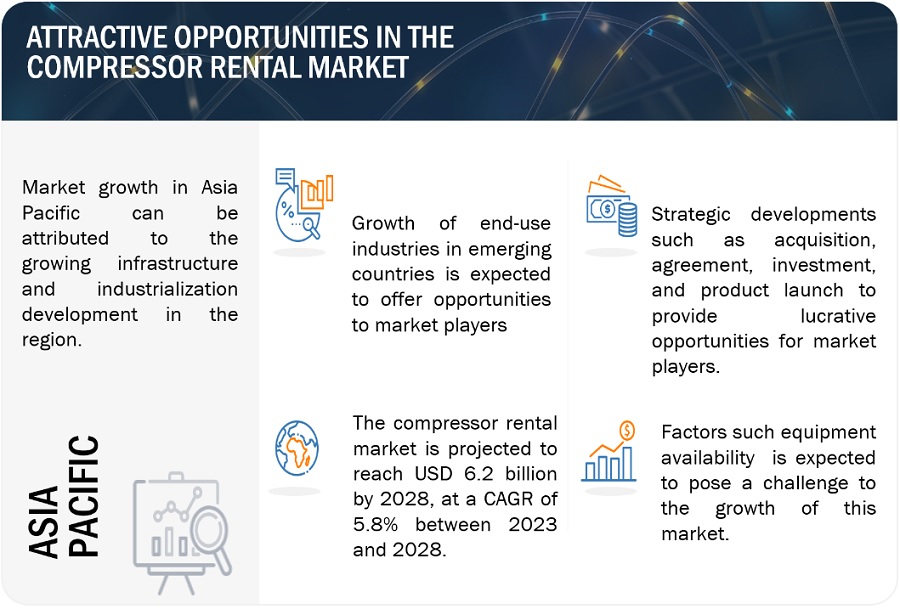

Challenge: Equipment availability challenges

The availability of equipment can be a problem when renting compressors, particularly if they are specialists in certain models or sizes, some rental companies could have a small selection of compressors. Due to greater demand, rental companies in crowded areas or large cities might stock a wider variety of compressors. On the other hand, in rural or remote places, selections can be more constrained, necessitating longer delivery periods or other rental providers. This provides a challenge to the compressor rental market.

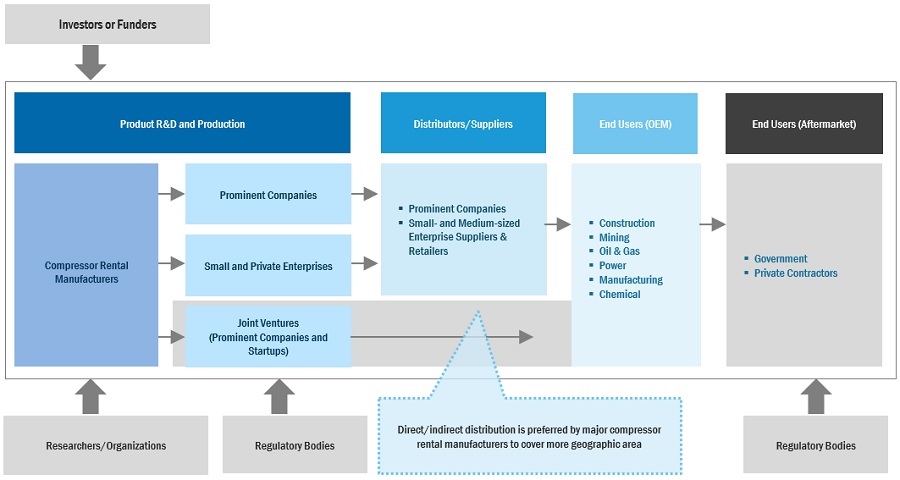

Compressor Rental Market Ecosystem

Prominent companies in this market include Atlas Copco (Sweden), United Rentals, Inc. (US), Ingersoll Rand (US), Caterpillar Inc. (US), Hertz Equipment Rental Corporation (US), Ashtead Group Plc (UK), H&E Equipment Services (US), Loxam Group (France), HSS Hire (UK).

Based on end-use industry, the construction segment dominated the compressor rental market in 2022, accounting for the largest market share. Environmental rules, such as emission standards and limits on noise pollution, are becoming more and more applicable to construction projects. Rental firms provide these regulations-compliant, contemporary compressor types, which are both energy- and environmentally friendly. Variable speed drives (VSD), a feature of energy-saving compressors, aid construction organizations in achieving sustainability objectives while lowering operating costs, thus driving the market of this segment.

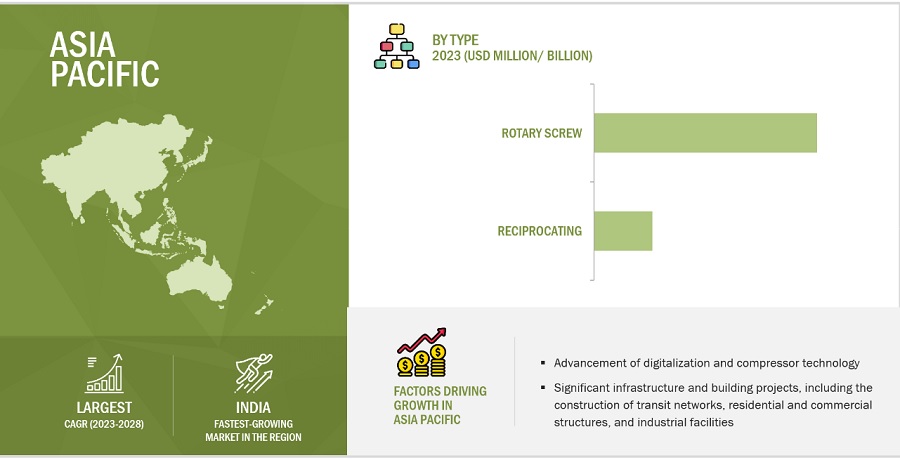

The rotary screw compressor type segment is expected to lead the compressor rental market. Rotary screw compressors are ideal for rental applications because they can be moved and set up fast and easily, especially in mobile work areas such as construction. The attraction of rotary screw compressors in the rental industry has been further boosted by technological developments. Modern rotary screw compressors now come with advanced control systems, digital interfaces, remote monitoring capabilities, and preventive maintenance features.

The Asia Pacific region is expected to lead the compressor rental market between 2023 and 2028. Advanced compressor models with attributes such as remote monitoring, proactive maintenance, and real-time data analytics are available from rental firms. Businesses will find compressor rentals more appealing as a result of these technological improvements in equipment performance, decreased downtime, and increased operational efficiency. To encourage the expansion of industry, environmental sustainability, and infrastructure development, many nations in the Asia Pacific area have implemented government initiatives and regulations, thus fueling market growth.

To know about the assumptions considered for the study, download the pdf brochure

Compressor Rental Market Players

Atlas Copco (Sweden), United Rentals, Inc. (US), Ingersoll Rand (US), Caterpillar Inc. (US), Hertz Equipment Rental Corporation (US), Ashtead Group Plc (UK), H&E Equipment Services (US), Loxam Group (France), HSS Hire (UK) are among the major players leading the market through their geographical presence, enhanced production capacities, and efficient distribution channels.

Compressor Rental Market Report Scope

|

Report Metric |

Details |

|

Market Size Available for Years |

2018 to 2028 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD Million/Billion) |

|

Segments Covered |

End-use Industry, Type, and Region |

|

Geographies Covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies Covered |

The major market players include Atlas Copco (Sweden), United Rentals, Inc. (US), Ingersoll Rand (US), Caterpillar Inc. (US), Hertz Equipment Rental Corporation (US), Ashtead Group Plc (UK), H&E Equipment Services (US), Loxam Group (France), HSS Hire (UK), and others |

This research report categorizes the compressor rental market based on end-use industry, type, and region.

On the basis of end-use industry:

- Construction

- Mining

- Oil & Gas

- Power

- Manufacturing

- Chemical

On the basis of compressor type:

- Rotary Screw

- Reciprocating

On the basis of region:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In June 2023, Atlas Copco finalized the acquisition of National Pump & Energy (NPE), a leading provider of dewatering, environmental services, and water treatment solutions in Australia and New Zealand.

- In November 2021, Ingersoll Rand acquired Dosatron International L.L.C, a renowned provider of water powered dosing pumps and systems. By acquiring Dosatron International, Ingersoll Rand strengthens its position in the market for water powered dosing pumps and systems.

- In May 2021, United Rentals Inc. completed the acquisition of General Finance Corporation that provides mobile storage, liquid containment, and modular space.

Frequently Asked Questions (FAQ):

What is the current size of the compressor rental market?

The compressor rental market was valued at USD 4.4 billion in 2022 and is projected to reach USD 6.2 billion by 2028, at a CAGR of 5.8% between 2023 and 2028.

Which region is expected to lead the market in the compressor rental market?

The compressor rental market in Asia Pacific is estimated to lead the market, owing to infrastructure development in the region.

Which is the major end-use industry of compressor rental?

The construction segment is the major end-use industry of compressor rental.

Who are the major players operating in the compressor rental market?

The major players operating in the market include Atlas Copco (Sweden), United Rentals, Inc. (US), Ingersoll Rand (US), Caterpillar Inc. (US), Hertz Equipment Rental Corporation (US), Ashtead Group Plc (UK), H&E Equipment Services (US), Loxam Group (France), HSS Hire (UK).

What is the total CAGR expected to record for the compressor rental market during 2023-2028?

The market is expected to record a CAGR of 5.8% from 2023-2028. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Availability of customized compressor rental solutions- Growing use of pneumatic power tools- Revival of mining equipment marketRESTRAINTS- Uncertainty in raw material pricesOPPORTUNITIES- Development of next-generation air compressors- Compatibility with Tier 4 enginesCHALLENGES- Availability of appropriate compressors

-

5.3 PORTER’S FIVE FORCES ANALYSISBARGAINING POWER OF SUPPLIERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 ECONOMIC INDICATORSINDUSTRY OUTLOOK- Construction- Mining- Oil & Gas- Power- Manufacturing

- 6.1 VALUE CHAIN ANALYSIS

- 6.2 TECHNOLOGY ANALYSIS

-

6.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

6.4 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1 INTRODUCTION

-

7.2 ROTARY SCREWCONSTRUCTION, MINING, AND OIL & GAS KEY END-USE INDUSTRIES

-

7.3 RECIPROCATINGAPPLICATIONS ACROSS MANUFACTURING, AUTOMOTIVE, CONSTRUCTION, AND OIL & GAS SECTORS

- 8.1 INTRODUCTION

- 8.2 ENGINE-DRIVEN COMPRESSOR

- 8.3 GAS-DRIVEN COMPRESSOR

- 8.4 HYDRAULIC-DRIVEN COMPRESSOR

- 9.1 INTRODUCTION

-

9.2 CONSTRUCTIONPOWERING PNEUMATIC TOOLS TO DRIVE MARKET

-

9.3 MININGINCREASING DEMAND FOR MINERALS TO PROPEL MARKET GROWTH

-

9.4 OIL & GASUSE FOR GAS COMPRESSION IN STORAGE, TRANSPORTATION, AND PROCESSING NATURAL GAS AND HYDROCARBON GASES

-

9.5 POWERHIGH EFFICIENCY AND POWER TO DRIVE DEMAND FOR VARIABLE SPEED DRIVE (VSD) COMPRESSOR RENTALS

-

9.6 MANUFACTURINGCOMPRESSOR RENTALS USED FOR DIVERSE APPLICATIONS

-

9.7 CHEMICALSCREW COMPRESSORS USED IN LABORATORY EQUIPMENT OR SMALL-SCALE PRODUCTION PROCESSES

- 9.8 OTHERS

- 10.1 INTRODUCTION

- 10.2 OIL-LUBRICATED

- 10.3 OIL-FREE

- 11.1 INTRODUCTION

-

11.2 ASIA PACIFICIMPACT OF RECESSION ON ASIA PACIFICCHINA- Growing demand for eco-friendly compressors to drive marketINDIA- Increased demand in construction sector to propel marketJAPAN- Growing demand for compressor rentals in power and chemical sectors to boost marketSOUTH KOREA- Growth of end-use industries to fuel demand for compressor rentalsINDONESIA- Rising demand from automotive and electronics sectors to drive marketMALAYSIA- Extensive use of rotary screw appliances to fuel demand for compressor rentalsTHAILAND- High demand for rental compressors in construction sector to drive marketSINGAPORE- Large and diversified manufacturing sector to fuel marketREST OF ASIA PACIFIC

-

11.3 NORTH AMERICAIMPACT OF RECESSION ON NORTH AMERICAUS- Increased use of rental compressors in chemical industry to drive marketCANADA- Demand for compressors in water treatment plants and power generation facilities to drive marketMEXICO- Growth of end-use industries to fuel demand for air compressors

-

11.4 EUROPEIMPACT OF RECESSION ON EUROPEGERMANY- Demand from automotive sector to boost marketFRANCE- Infrastructure development and industrial growth to drive marketUK- Growth of mining and construction sectors to drive marketITALY- Economic growth and presence of major industries to drive marketSPAIN- Growth of power and chemical industries to fuel marketREST OF EUROPE

-

11.5 MIDDLE EAST & AFRICAIMPACT OF RECESSION ON MIDDLE EAST & AFRICASAUDI ARABIA- Demand for compressors in oil & gas industry to boost marketTURKEY- Unsaturated market and emerging economy to drive growthEGYPT- Demand for compressors in cold storage and food processing to drive marketREST OF MIDDLE EAST & AFRICA

-

11.6 SOUTH AMERICAIMPACT OF RECESSION ON SOUTH AMERICABRAZIL- Thriving industrial sector to drive marketARGENTINA- Demand for portable compressors to drive marketCHILE- Growth of mining sector to drive marketREST OF SOUTH AMERICA

- 12.1 OVERVIEW

- 12.2 STRATEGIES OF KEY PLAYERS

-

12.3 REVENUE ANALYSISREVENUE ANALYSIS OF TOP PLAYERS IN COMPRESSOR RENTAL MARKET

- 12.4 MARKET SHARE ANALYSIS: COMPRESSOR RENTAL MARKET (2022)

- 12.5 COMPANY FOOTPRINT ANALYSIS

-

12.6 COMPANY EVALUATION MATRIX, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

12.7 SMALL AND MEDIUM-SIZED ENTERPRISES (SME) MATRIX, 2022PROGRESSIVE COMPANIESDYNAMIC COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKS

- 12.8 COMPETITIVE SCENARIO

-

13.1 KEY PLAYERSATLAS COPCO- Business overview- Products/Solutions/Services offered- Deals- Other developments- MnM viewUNITED RENTALS, INC.- Business overview- Products/Solutions/Services offered- Deals- Other developments- MnM viewINGERSOLL RAND- Business overview- Products/Solutions/Services offered- Deals- Other developments- MnM viewCATERPILLAR INC.- Business overview- Products/Solutions/Services offered- Deals- Other developments- MnM viewHERTZ EQUIPMENT RENTAL CORPORATION- Business overview- Products/Solutions/Services offered- Deals- Other developments- MnM viewASHTEAD GROUP PLC.- Business overview- Products/Solutions/Services offered- DealsH&E EQUIPMENT SERVICES- Business overview- Products/Solutions/Services offered- Deals- Other developmentsLOXAM GROUP- Business overview- Products/Solutions/Services offered- Deals- Other developmentsHSS HIRE- Business overview- Products/Solutions/Services offered- Other developments

-

13.2 OTHER PLAYERSACME FABCON INDIA PRIVATE LIMITED- Business overview- Products/Solutions/ Services offeredCOATES- Business overview- Products/Solutions/Services offeredKOMPRESORY PEMA- Business overview- Products/Solutions/Services offeredAR BRASIL COMPRESSORES- Business overview- Products/Solutions/Services offeredKENNARDS HIRE- Business overview- Products/Solutions/Services offeredBIGRENTZ- Business overview- Products/Solutions/Services offeredSUNSTATE EQUIPMENT CO.- Business overview- Products/Solutions/Services offeredONSITE RENTAL GROUP- Business overview- Products/Solutions/Services offeredHOME DEPOT PRODUCT AUTHORITY, LLC- Business overview- Products/Solutions/Services offeredCOOPER EQUIPMENT RENTALS LTD- Business overview- Products/Solutions/ Services offeredSHAKTIMAN EQUIPMENTS PVT LTD- Business overview- Products/Solutions/ Services offeredSTAR RENTALS- Business overview- Products/Solutions/Services offeredVANDALIA RENTAL- Business overview- Products/Solutions/Services offeredHUGG & HALL EQUIPMENT COMPANY- Business overview- Products/Solutions/Services offeredARAPAHOE RENTAL- Business overview- Products/Solutions/Services offeredPACIFIC AIR COMPRESSORS- Business overview- Products/Solutions/Services offered

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 COMPRESSOR RENTAL MARKET, BY REGION: INCLUSIONS & EXCLUSIONS

- TABLE 2 COMPRESSOR RENTAL MARKET, BY LUBRICATION SYSTEM: INCLUSIONS & EXCLUSIONS

- TABLE 3 COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE: INCLUSIONS & EXCLUSIONS

- TABLE 4 COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY: INCLUSIONS & EXCLUSIONS

- TABLE 5 COMPRESSOR RENTAL MARKET, BY DRIVE TYPE: INCLUSIONS & EXCLUSIONS

- TABLE 6 PORTER’S FIVE FORCES ANALYSIS: COMPRESSOR RENTAL MARKET

- TABLE 7 COMPRESSOR RENTAL MARKET, BY TYPE, 2016–2022 (USD MILLION)

- TABLE 8 COMPRESSOR RENTAL MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 9 ROTARY SCREW MARKET, BY REGION, 2016–2022 (USD MILLION)

- TABLE 10 ROTARY SCREW MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 11 RECIPROCATING MARKET, BY REGION, 2016–2022 (USD MILLION)

- TABLE 12 RECIPROCATING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 13 COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 14 COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 15 COMPRESSOR RENTAL MARKET FOR CONSTRUCTION END-USE INDUSTRY, BY REGION, 2016–2022 (USD MILLION)

- TABLE 16 COMPRESSOR RENTAL MARKET FOR CONSTRUCTION END-USE INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 17 COMPRESSOR RENTAL MARKET FOR MINING END-USE INDUSTRY, BY REGION, 2016–2022 (USD MILLION)

- TABLE 18 COMPRESSOR RENTAL MARKET FOR MINING END-USE INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 19 COMPRESSOR RENTAL MARKET FOR OIL & GAS END-USE INDUSTRY, BY REGION, 2016–2022 (USD MILLION)

- TABLE 20 COMPRESSOR RENTAL MARKET FOR OIL & GAS END-USE INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 21 COMPRESSOR RENTAL MARKET FOR POWER END-USE INDUSTRY, BY REGION, 2016–2022 (USD MILLION)

- TABLE 22 COMPRESSOR RENTAL MARKET FOR POWER END-USE INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 23 COMPRESSOR RENTAL MARKET FOR MANUFACTURING END-USE INDUSTRY, BY REGION, 2016–2022 (USD MILLION)

- TABLE 24 COMPRESSOR RENTAL MARKET FOR MANUFACTURING END-USE INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 COMPRESSOR RENTAL MARKET FOR CHEMICAL END-USE INDUSTRY, BY REGION, 2016–2022 (USD MILLION)

- TABLE 26 COMPRESSOR RENTAL MARKET FOR CHEMICAL END-USE INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 COMPRESSOR RENTAL MARKET FOR OTHER END-USE INDUSTRIES, BY REGION, 2016–2022 (USD MILLION)

- TABLE 28 COMPRESSOR RENTAL MARKET FOR OTHER END-USE INDUSTRIES, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 COMPRESSOR RENTAL MARKET, BY REGION, 2016–2022 (USD MILLION)

- TABLE 30 COMPRESSOR RENTAL MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 ASIA PACIFIC: COMPRESSOR RENTAL MARKET, BY COUNTRY, 2016–2022 (USD MILLION)

- TABLE 32 ASIA PACIFIC: COMPRESSOR RENTAL MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 33 ASIA PACIFIC: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 34 ASIA PACIFIC: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 35 ASIA PACIFIC: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2016–2022 (USD MILLION)

- TABLE 36 ASIA PACIFIC: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 37 CHINA: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 38 CHINA: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 39 CHINA: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2016–2022 (USD MILLION)

- TABLE 40 CHINA: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 41 INDIA: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 42 INDIA: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 43 INDIA: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2016–2022 (USD MILLION)

- TABLE 44 INDIA: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 45 JAPAN: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 46 JAPAN: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 47 JAPAN: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2016–2022 (USD MILLION)

- TABLE 48 JAPAN: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 49 SOUTH KOREA: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 50 SOUTH KOREA: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 51 SOUTH KOREA: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2016–2022 (USD MILLION)

- TABLE 52 SOUTH KOREA: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 53 INDONESIA: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 54 INDONESIA: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 55 INDONESIA: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2016–2022 (USD MILLION)

- TABLE 56 INDONESIA: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 57 MALAYSIA: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 58 MALAYSIA: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 59 MALAYSIA: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2016–2022 (USD MILLION)

- TABLE 60 MALAYSIA: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 61 THAILAND: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 62 THAILAND: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 63 THAILAND: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2016–2022 (USD MILLION)

- TABLE 64 THAILAND: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 65 SINGAPORE: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 66 SINGAPORE: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 67 SINGAPORE: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2016–2022 (USD MILLION)

- TABLE 68 SINGAPORE: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 69 REST OF ASIA PACIFIC: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 70 REST OF ASIA PACIFIC: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 71 REST OF ASIA PACIFIC: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2016–2022 (USD MILLION)

- TABLE 72 REST OF ASIA PACIFIC: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 73 NORTH AMERICA: COMPRESSOR RENTAL MARKET, BY COUNTRY, 2016–2022 (USD MILLION)

- TABLE 74 NORTH AMERICA: COMPRESSOR RENTAL MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 75 NORTH AMERICA: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 76 NORTH AMERICA: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 77 NORTH AMERICA: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2016–2022 (USD MILLION)

- TABLE 78 NORTH AMERICA: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 79 US: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 80 US: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 81 US: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2016–2022 (USD MILLION)

- TABLE 82 US: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 83 CANADA: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 84 CANADA: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 85 CANADA: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2016–2022 (USD MILLION)

- TABLE 86 CANADA: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 87 MEXICO: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 88 MEXICO: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 89 MEXICO: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2016–2022 (USD MILLION)

- TABLE 90 MEXICO: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 91 EUROPE: COMPRESSOR RENTAL MARKET, BY COUNTRY, 2016–2022 (USD MILLION)

- TABLE 92 EUROPE: COMPRESSOR RENTAL MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 93 EUROPE: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 94 EUROPE: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 95 EUROPE: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2016–2022 (USD MILLION)

- TABLE 96 EUROPE: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 97 GERMANY: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 98 GERMANY: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 99 GERMANY: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2016–2022 (USD MILLION)

- TABLE 100 GERMANY: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 101 FRANCE: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 102 FRANCE: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 103 FRANCE: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2016–2022 (USD MILLION)

- TABLE 104 FRANCE: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 105 UK: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 106 UK: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 107 UK: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2016–2022 (USD MILLION)

- TABLE 108 UK: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 109 ITALY: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 110 ITALY: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 111 ITALY: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2016–2022 (USD MILLION)

- TABLE 112 ITALY: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 113 SPAIN: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 114 SPAIN: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 115 SPAIN: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2016–2022 (USD MILLION)

- TABLE 116 SPAIN: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 117 REST OF EUROPE: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 118 REST OF EUROPE: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 119 REST OF EUROPE: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2016–2022 (USD MILLION)

- TABLE 120 REST OF EUROPE: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 121 MIDDLE EAST & AFRICA: COMPRESSOR RENTAL MARKET, BY COUNTRY, 2016–2022 (USD MILLION)

- TABLE 122 MIDDLE EAST & AFRICA: COMPRESSOR RENTAL MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 123 MIDDLE EAST & AFRICA: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 124 MIDDLE EAST & AFRICA: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 125 MIDDLE EAST & AFRICA: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2016–2022 (USD MILLION)

- TABLE 126 MIDDLE EAST & AFRICA: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 127 SAUDI ARABIA: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 128 SAUDI ARABIA: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 129 SAUDI ARABIA: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2016–2022 (USD MILLION)

- TABLE 130 SAUDI ARABIA: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 131 TURKEY: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 132 TURKEY: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 133 TURKEY: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2016–2022 (USD MILLION)

- TABLE 134 TURKEY: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 135 EGYPT: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 136 EGYPT: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 137 EGYPT: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2016–2022 (USD MILLION)

- TABLE 138 EGYPT: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 139 REST OF MIDDLE EAST & AFRICA: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 140 REST OF MIDDLE EAST & AFRICA: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 141 REST OF MIDDLE EAST & AFRICA: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2016–2022 (USD MILLION)

- TABLE 142 REST OF MIDDLE EAST & AFRICA: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 143 SOUTH AMERICA: COMPRESSOR RENTAL MARKET, BY COUNTRY, 2016–2022 (USD MILLION)

- TABLE 144 SOUTH AMERICA: COMPRESSOR RENTAL MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 145 SOUTH AMERICA: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 146 SOUTH AMERICA: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 147 SOUTH AMERICA: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2016–2022 (USD MILLION)

- TABLE 148 SOUTH AMERICA: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 149 BRAZIL: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 150 BRAZIL: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 151 BRAZIL: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2016–2022 (USD MILLION)

- TABLE 152 BRAZIL: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 153 ARGENTINA: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 154 ARGENTINA: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 155 ARGENTINA: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2016–2022 (USD MILLION)

- TABLE 156 ARGENTINA: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 157 CHILE: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 158 CHILE: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 159 CHILE: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2016–2022 (USD MILLION)

- TABLE 160 CHILE: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 161 REST OF SOUTH AMERICA: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 162 REST OF SOUTH AMERICA: COMPRESSOR RENTAL MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 163 REST OF SOUTH AMERICA: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2016–2022 (USD MILLION)

- TABLE 164 REST OF SOUTH AMERICA: COMPRESSOR RENTAL MARKET, BY COMPRESSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 165 AGREEMENTS AND JOINT VENTURES ARE KEY GROWTH STRATEGIES ADOPTED BY COMPRESSOR RENTAL PLAYERS

- TABLE 166 DEGREE OF COMPETITION

- TABLE 167 COMPRESSOR TYPE FOOTPRINT OF COMPANIES, 2022

- TABLE 168 END-USE INDUSTRY FOOTPRINT OF COMPANIES, 2022

- TABLE 169 REGIONAL FOOTPRINT OF COMPANIES, 2022

- TABLE 170 DEALS, 2018−2023

- TABLE 171 OTHERS, 2018−2023

- TABLE 172 ATLAS COPCO: COMPANY OVERVIEW

- TABLE 173 UNITED RENTALS, INC.: COMPANY OVERVIEW

- TABLE 174 INGERSOLL RAND: COMPANY OVERVIEW

- TABLE 175 CATERPILLAR INC.: COMPANY OVERVIEW

- TABLE 176 HERTZ EQUIPMENT RENTAL CORPORATION: COMPANY OVERVIEW

- TABLE 177 ASHTEAD GROUP PLC: COMPANY OVERVIEW

- TABLE 178 H&E EQUIPMENT SERVICES: COMPANY OVERVIEW

- TABLE 179 LOXAM GROUP: COMPANY OVERVIEW

- TABLE 180 HSS HIRE: COMPANY OVERVIEW

- TABLE 181 ACME FABCON INDIA PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 182 COATES: COMPANY OVERVIEW

- TABLE 183 KOMPRESORY PEMA: COMPANY OVERVIEW

- TABLE 184 AR BRASIL COMPRESSORES: COMPANY OVERVIEW

- TABLE 185 KENNARD HIRE: COMPANY OVERVIEW

- TABLE 186 BIGRENTZ: COMPANY OVERVIEW

- TABLE 187 SUNSTATE EQUIPMENT CO.: COMPANY OVERVIEW

- TABLE 188 ONSITE RENTAL GROUP: COMPANY OVERVIEW

- TABLE 189 HOME DEPOT PRODUCT AUTHORITY, LLC: COMPANY OVERVIEW

- TABLE 190 COOPER EQUIPMENT RENTALS LTD: COMPANY OVERVIEW

- TABLE 191 SHAKTIMAN EQUIPMENTS PVT LTD: COMPANY OVERVIEW

- TABLE 192 STAR RENTALS: COMPANY OVERVIEW

- TABLE 193 VANDALIA RENTAL: COMPANY OVERVIEW

- TABLE 194 HUGG & HALL EQUIPMENT COMPANY: COMPANY OVERVIEW

- TABLE 195 ARAPAHOE RENTAL: COMPANY OVERVIEW

- TABLE 196 PACIFIC AIR COMPRESSORS: COMPANY OVERVIEW

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 4 COMPRESSOR RENTAL MARKET: DATA TRIANGULATION

- FIGURE 5 MIDDLE EAST & AFRICA TO REGISTER HIGHEST CAGR IN COMPRESSOR RENTAL MARKET DURING FORECAST PERIOD

- FIGURE 6 CHEMICAL END-USE INDUSTRY PROJECTED TO BE FASTEST-GROWING END-USE INDUSTRY DURING FORECAST PERIOD

- FIGURE 7 ROTARY SCREW SEGMENT TO WITNESS HIGHER GROWTH RATE DURING FORECAST PERIOD

- FIGURE 8 COMPRESSOR RENTAL MARKET TO WITNESS HIGH GROWTH BETWEEN 2023 AND 2028

- FIGURE 9 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 10 CHINA AND CONSTRUCTION END-USE INDUSTRY SEGMENT ACCOUNTED FOR LARGEST SHARE OF ASIA PACIFIC COMPRESSOR RENTAL MARKET IN 2022

- FIGURE 11 MIDDLE EAST & AFRICA TO REGISTER HIGHEST CAGR BETWEEN 2023 AND 2028

- FIGURE 12 OVERVIEW OF FACTORS GOVERNING COMPRESSOR RENTAL MARKET

- FIGURE 13 PORTER’S FIVE FORCES ANALYSIS: COMPRESSOR RENTAL MARKET

- FIGURE 14 GROWTH OF CONSTRUCTION INDUSTRY

- FIGURE 15 VALUE CHAIN ANALYSIS OF COMPRESSOR RENTAL MARKET

- FIGURE 16 REVENUE SHIFT & NEW REVENUE POCKETS FOR COMPRESSOR RENTALS

- FIGURE 17 ROTARY SCREW SEGMENT TO DOMINATE COMPRESSOR RENTAL MARKET DURING FORECAST PERIOD

- FIGURE 18 CHEMICAL SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 19 CHINA AND INDIA TO EMERGE AS LUCRATIVE MARKETS DURING FORECAST PERIOD

- FIGURE 20 ASIA PACIFIC: COMPRESSOR RENTAL MARKET SNAPSHOT

- FIGURE 21 NORTH AMERICA: COMPRESSOR RENTAL MARKET SNAPSHOT

- FIGURE 22 EUROPE: COMPRESSOR RENTAL MARKET SNAPSHOT

- FIGURE 23 TOP PLAYERS – REVENUE ANALYSIS (2018−2022)

- FIGURE 24 RANKING OF TOP FIVE PLAYERS IN COMPRESSOR RENTAL MARKET

- FIGURE 25 CATERPILLAR INC. CAPTURED LARGEST SHARE OF COMPRESSOR RENTAL MARKET IN 2022

- FIGURE 26 OVERALL COMPANY FOOTPRINT

- FIGURE 27 COMPANY EVALUATION MATRIX, 2022

- FIGURE 28 COMPANY EVALUATION MATRIX FOR SME COMPANIES, 2022

- FIGURE 29 ATLAS COPCO: COMPANY SNAPSHOT

- FIGURE 30 UNITED RENTALS, INC.: COMPANY SNAPSHOT

- FIGURE 31 INGERSOLL RAND: COMPANY SNAPSHOT

- FIGURE 32 CATERPILLAR INC.: COMPANY SNAPSHOT

- FIGURE 33 HERTZ EQUIPMENT RENTAL CORPORATION: COMPANY SNAPSHOT

- FIGURE 34 ASHTEAD GROUP PLC: COMPANY SNAPSHOT

- FIGURE 35 H&E EQUIPMENT SERVICES: COMPANY SNAPSHOT

- FIGURE 36 LOXAM GROUP: COMPANY SNAPSHOT

- FIGURE 37 HSS HIRE: COMPANY SNAPSHOT

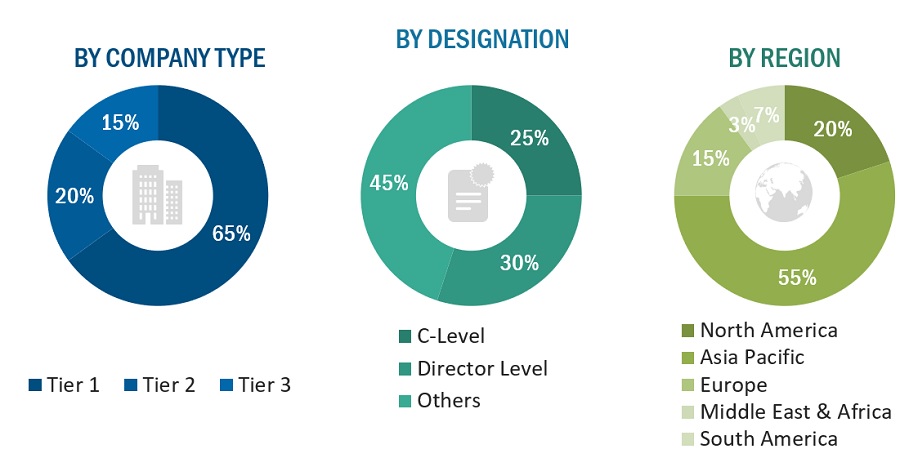

The study involved four major activities in estimating the current market size of compressor rental. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizes with industry experts across the value chain of compressor rental through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the size of the segments and sub-segments of the market.

Secondary Research

The research methodology used to estimate and forecast the access control market begins with capturing data on revenues of key vendors in the market through secondary research. In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies; articles by recognized authors; notifications by regulatory bodies; trade directories; and databases. Vendor offerings have also been taken into consideration to determine market segmentation.

Primary Research

The compressor rental market comprises several stakeholders, such as raw material suppliers, compressor rental manufacturers, and regulatory organizations in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the compressor rental market. Primary sources from the demand side included directors, marketing heads, and purchase managers from various sourcing industries.

Following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

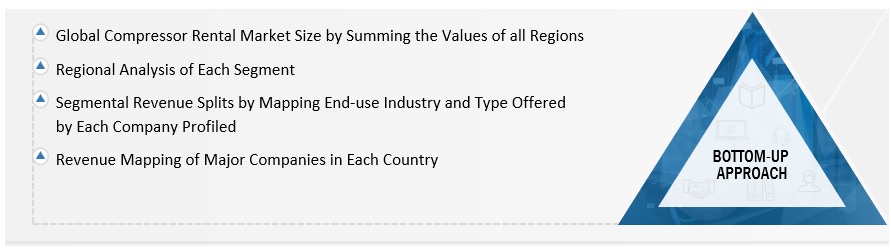

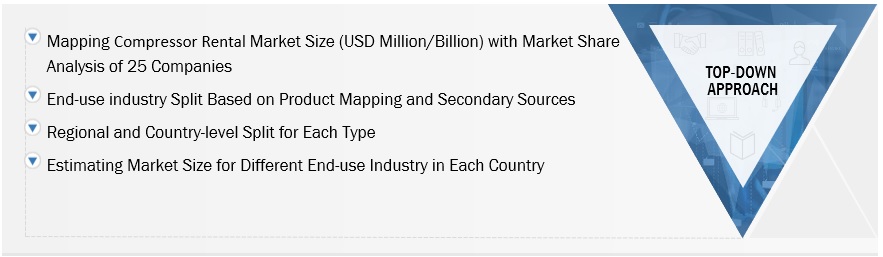

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the compressor rental market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the compressor rental market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Global Compressor Rental Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Compressor Rental Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the compressor rental sources.

Market definition

A compressor is a device, which converts power into potential energy in the form of compressed air. The energy stored in the compressed air can be used for many applications across industries such as construction, mining, oil & gas, power, and chemical, among others. Many industries choose to use rental compressors instead of buying one, as different types of compressors are required for a specific work. Air compressors are rented by the day, week, or month.

Key Stakeholders

- Manufacturers of compressor rentals

- Manufacturers in end-use industries

- Traders, distributors, and suppliers of compressor rentals

- Contract manufacturing organizations (CMOs)

- Market research and consulting firms

Report Objectives:

- To define, describe, and forecast the compressor rental market based on end-use industry, type, and region

- To analyze and forecast the value (USD million) of the compressor rental market

- To provide detailed information regarding key factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To forecast the market size in terms of value with respect to five main regions (along with countries), namely, Asia-Pacific, North America, Europe, Middle East & Africa, and South America

- To strategically profile key players and comprehensively analyze their core competencies

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the client-specific needs.

The following customization options are available for the report:

- Additional country-level analysis of the compressor rental market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Growth opportunities and latent adjacency in Compressor Rental Market