Screw Compressor Market

Screw Compressor Market by Type (Oil-injected, Oil-free), Technology (Stationary, Portable), Stage (Single, Multi), Capacity (upto 50 HP, 51 to 250 HP, above 250 HP), Power Source, End User, and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The screw compressor market is estimated to reach USD 16.30 billion by 2030 from an estimated value of USD 12.74 billion in 2025, at a CAGR of 5.0% during the forecast period (2025-2030). The ever-increasing energy consumption, rising demand for energy-efficient solutions, growing manufacturing industries, and rapid industrialization in emerging economies are the major driving factors for the market.

KEY TAKEAWAYS

-

BY REGIONThe Asia Pacific is expected to dominate the screw compressor market and grow at the highest CAGR of 5.7% over the forecast period.

-

BY TYPEOil-free screw compressors are expected to record a higher CAGR of 5.4% during the forecast period, owing to the requirement for 100% pure and oil-free air among various end-use industries.

-

BY TECHNOLOGYStationary screw compressors held 67.6% of the market in 2024, driven by their ability to store more compressed air and higher horsepower.

-

BY STAGEThe market for screw compressors above 250 HP is projected to grow at the higher CAGR of 5.2% during the forecast period, due to the demand for high-capacity and energy-efficient solutions in several areas.

-

COMPETITIVE LANDSCAPEAtlas Copco, Ingersoll Rand PLC, and Hitachi, Ltd. are identified as Star players in the screw compressor market, given their strong market share and product footprint.

The screw compressor market is growing due to its widespread use in various industries, including chemicals, oil & gas, metal mining, medical, pharmaceuticals, and food & beverages. It is a rotary positive displacement machine that compresses air-gas using two engaged helical rotors, offering high efficiency, continuous operation, and low maintenance compared to traditional reciprocating compressors. Factors driving demand include increasing industrial automation, energy efficiency regulations, and the need for reliable compressed air. Screw compressors are widely used in industrial processes, refrigeration, and pneumatic systems, providing continuous air, energy savings, long operational life, and other key benefits.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The screw compressor market is undergoing major changes driven by AI, IoT, and energy efficient solutions. These innovations are transforming compressor design, monitoring, and maintenance, thereby boosting efficiency and reducing costs across various industries. As demand for reliability, energy optimization, and flexibility grows, there's a shift toward oil-free compressors and smart tech. AI-based predictive maintenance, energy-efficient systems, and IoT devices help companies improve uptime and cut costs. Customer demand for customization, particularly in the oil & gas, food & beverages, and chemicals sectors, drives innovation in digital solutions. These shifts open up new revenue avenues for manufacturers, supporting energy efficiency and sustainability.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rise in energy consumption

-

Rising demand for energy efficient solutions

Level

-

High initial investments

-

Fluctuating prices of raw materials

Level

-

Growing demand for oil-free compressors in oil & gas, chemical, and petrochemical sectors

-

Industrial automation and smart manufacturing

Level

-

Energy consumption regulation and environmental concerns

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising demand of energy-efficient solutions

The focus on energy efficiency drives the screw compressor market, particularly in the manufacturing, oil & gas, food & beverage, and medical sectors, which rely heavily on compressed air that consumes significant amounts of energy. Traditional compressors operate at fixed speeds, causing energy waste and higher costs. Industries are transitioning to energy-efficient screw compressors equipped with Variable Speed Drives (VSDs) that dynamically adjust to real-time demand, thereby reducing costs and minimizing environmental impact. With rising energy prices and environmental concerns, energy efficiency is a priority. Screw compressors excel in continuous, fluctuating-demand applications, offering high efficiency and lower operating costs. They help businesses meet their sustainability goals by reducing energy use and emissions, resulting in long-term savings.

Restraint: High initial investments

Screw compressors, especially those with advanced features like Variable Speed Drives (VSDs), oil-free technology, and IoT integration, can be costly upfront. The initial capital required for purchasing and installing these compressors can be prohibitive for small and medium-sized enterprises (SMEs) and new businesses operating under tight budgets. According to insights from ELGi, the Total Cost of Ownership (TCO) for compressors encompasses not only the purchase price but also includes installation, maintenance, energy consumption, and potential downtime costs. While screw compressors are known for their energy efficiency and low maintenance, the initial expense remains a barrier for many businesses considering the switch from piston compressors or other lower-cost alternatives.

Opportunity: Growing demand for oil-free compressors in oil & gas, chemical, and petrochemical sectors

The oil and gas, chemical, and petrochemical industries require high-purity, contamination-free compressed air for various critical applications, including instrumentation, process air, nitrogen generation, and gas processing. Traditional oil-injected compressors pose a risk of oil carryover, which can contaminate the end product, damage sensitive equipment, and lead to costly operational downtime. As a result, industries are increasingly shifting towards oil-free screw compressors, which ensure 100% oil-free air, improve operational efficiency, and comply with stringent industry regulations. In the oil & gas sector, oil-free screw compressors are used in refineries, LNG plants, and offshore drilling operations, where even trace amounts of oil contamination can cause process inefficiencies or regulatory non-compliance. Similarly, in the chemical and petrochemical industries, where compressed air is often used for chemical reactions, conveying materials, and maintaining pressure in sensitive environments, oil-free technology prevents contamination risks and ensures the highest level of air purity.

Challenge: Energy consumption regulation and environmental concerns

Governments and regulatory bodies worldwide, such as the U.S. Department of Energy (DOE), the European Union’s Ecodesign Directive, and the International Energy Agency (IEA), are enforcing stringent efficiency standards to reduce industrial energy consumption and carbon emissions. Since compressed air systems account for nearly 10% of industrial energy use, manufacturers must develop high-efficiency compressors with Variable Speed Drives (VSDs), oil-free technology, and heat recovery systems to comply with evolving regulations. However, achieving compliance requires substantial R&D investments, which increase production costs and limit adoption, especially in price-sensitive markets.

Screw Compressor Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Rotary screw compressors installed in metal manufacturing for reliability upgrade | Eliminated downtime, stabilized plant air supply, reduced costs |

|

Fleet of screw compressors used during Burj Khalifa construction | Provided continuous compressed air for concrete work, ensuring project delivery |

|

Screw compressors for Hong Kong-Zhuhai-Macau Bridge construction | Efficient, large-scale air supply for bridge concrete pumps |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The screw compressor ecosystem includes all stakeholders involved in designing, manufacturing, distributing, and using screw compressors. This ecosystem consists of raw material suppliers, manufacturers, distributors, end users, and regulatory bodies or standards organizations working together to provide efficient compression solutions across different industries. Raw material suppliers supply essential metals, polymers, and lubricants, while component manufacturers produce rotors, bearings, and seals. OEMs and manufacturers assemble finished products with IoT-enabled monitoring, and technology providers, distributors, and service providers ensure availability, maintenance, and support. End users come from industries such as manufacturing, oil & gas, and pharmaceuticals, following standards set by regulatory bodies for energy efficiency, safety, and environmental compliance.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Screw Compressor Market, By Type

The oil-injected segment is expected to capture the largest share of the market by type. The oil used in the oil-injected screw compressors not only lubricates the moving components, lowering friction and wear, but also enhances operational life, making them extremely reliable in continuous and high-demand applications. Their applicability across various industries, including food and beverage, chemicals and petrochemicals, automotive, oil and gas, and food and beverage, further fuels demand.

Screw Compressor Market, By End User

The food and beverage industry is likely to witness the highest CAGR in the screw compressor market due to greater automation, stringent food safety standards, and increased energy efficiency. With the growing automation of production lines for packaging, bottling, and processing, the demand for clean and contamination-free compressed air is increasing. Screw compressors provide the ideal air quality and pressure levels for these applications, as well as energy efficiency that contributes to lower operating costs. The growth of the industry, driven by the need for packaged and processed foods, also increases the demand for efficient, tailor-made air compression solutions.

Screw Compressor Market, By Capacity

The above 250 HP segment holds the largest market share. These screw compressors are primarily used in heavy industries, such as oil & gas, power generation, and mining, where high-capacity compressors are required for continuous duty. These industries require low-pressure, high-airflow compressors for their demanding applications. Furthermore, increased investment in mega infrastructure projects, petrochemical plants, and industrial automation spurs the demand for high-performance and energy-efficient screw compressors in this sector.

REGION

Asia Pacific to be fastest-growing region in screw compressor market during forecast period

The Asia-Pacific region leads the screw compressor market due to its rapid industrialization, manufacturing growth, and large-scale infrastructure development. The region's thriving industrial operations drive demand for screw compressors, as they are essential in automation, packaging, and material handling. Moreover, the low cost of manufacture and the growing emphasis on energy efficiency in the region make screw compressors an industry favorite among industries seeking cost-efficient and high-performance technology. Government plans and investments in infrastructure, combined with rising interest in sustainable initiatives, also keep the market boosted. The location of several prominent manufacturers of compressors, combined with the rapidly growing use of advanced technologies, contributes to the Asia-Pacific region's leadership in the screw compressor market.

Screw Compressor Market: COMPANY EVALUATION MATRIX

In the screw compressor market matrix, Atlas Copco (Star) leads with a strong market share and an extensive product footprint, driven by innovation, its extensive global reach, and its service to a wide array of industries, including manufacturing, oil & gas, and construction. Doosan Bobcat (Emerging Leader) is gaining visibility with its specialized engineering expertise and adaptability, particularly through energy-efficient and scalable solutions for infrastructure and industrial applications.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 12.03 Billion |

| Market Forecast in 2030 (Value) | USD 16.30 Billion |

| Growth Rate | CAGR of 5.0% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Screw Compressor Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading screw compressor OEM |

|

|

| Screw compressor Manufacturer |

|

|

| Raw Material Supplier |

|

|

| US Based manufacturer |

|

|

RECENT DEVELOPMENTS

- October 2024 : ELGi North America has upgraded its EG Series portfolio with the introduction of the EG Super Premium 90-110 range of oil-lubricated screw air compressors and the EG PM 11-45kW Permanent Magnet Synchronous Motor compressor.

- June 2024 : Ingersoll Rand Inc. closed the acquisition of ILC Dover (“ILC”) and has acquired Complete Air and Power Solutions (“CAPS”), Del PD Pumps & Gear Pvt Ltd. (“Del Pumps”), and Fruvac Ltd. (“Fruitland Manufacturing”) for approximately USD 150 million.

- May 2024 : Atlas Copco launched the GA 11-30 FLX, dual-speed compressor. The GA 11-30 FLX utilizes its power optimally to deliver as much air as possible at all set pressures, thereby using energy more efficiently and operating more sustainably.

- May 2023 : Atlas Copco acquired Maziak Compressor Services Ltd. (UK), a distributor of air compressors, nitrogen generators, process cooling equipment, and related services and support. This acquisition will become part of the Service division within Atlas Copco’s Compressor Technique Business Area.

Table of Contents

Methodology

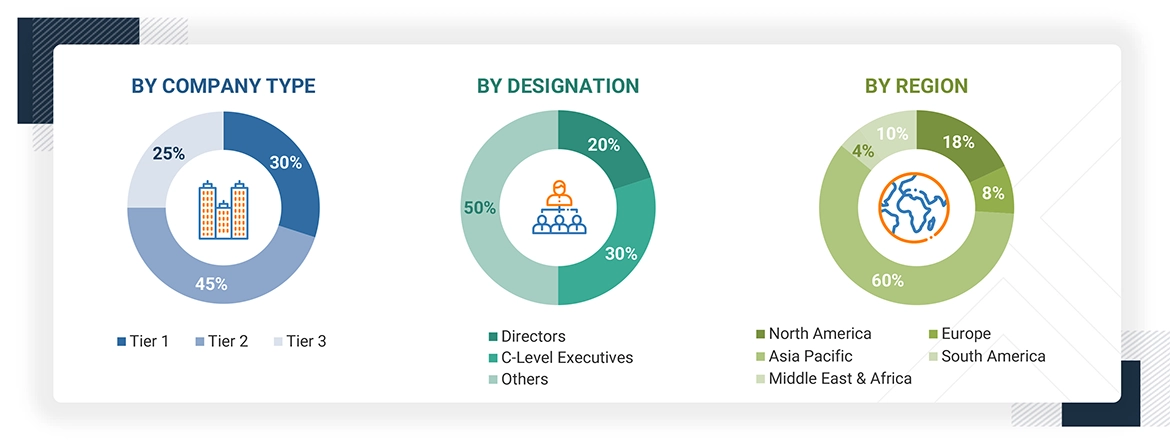

This research study involves the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg L.P., Factiva, ICIS, and OneSource, to identify and collect information useful for this technical, market-oriented, and commercial study of the screw compressor market. Primary sources are mainly industry experts from core and related industries, preferred suppliers, manufacturers, distributors, service providers, and organizations related to all segments of the value chain of this industry. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information as well as assess growth prospects of the market.

Secondary Research

Secondary sources include annual reports, press releases, and investor presentations of companies; directories and databases, which include D&B, Bloomberg, and Factiva, white papers and articles from recognized authors, and publications and databases from associations, such as the BP Statistical Review of World Energy, Energy Information Administration, and Department of Energy. Secondary research has been used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. A database of the key industry leaders has also been prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides have been interviewed to obtain and verify qualitative and quantitative information for this report as well as analyze prospects. Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related executives from various leading companies and organizations operating in the screw compressor market. Primary sources from the demand side include experts and key persons from the end user segment.

After the complete market engineering process (which includes calculations of market statistics, market breakdown, market size estimations, market forecasts, and data triangulation), extensive primary research has been conducted to gather information and verify and validate the critical numbers arrived at. Primary research has also been conducted to identify the segmentation, applications, Porter’s Five Forces, key players, competitive landscape, and key market dynamics such as drivers, opportunities, challenges, industry trends, and strategies adopted by key players.

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range between USD 1 and 10 billion; and tier 3 companies’ revenues range between USD 500 million and USD 1 billion.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

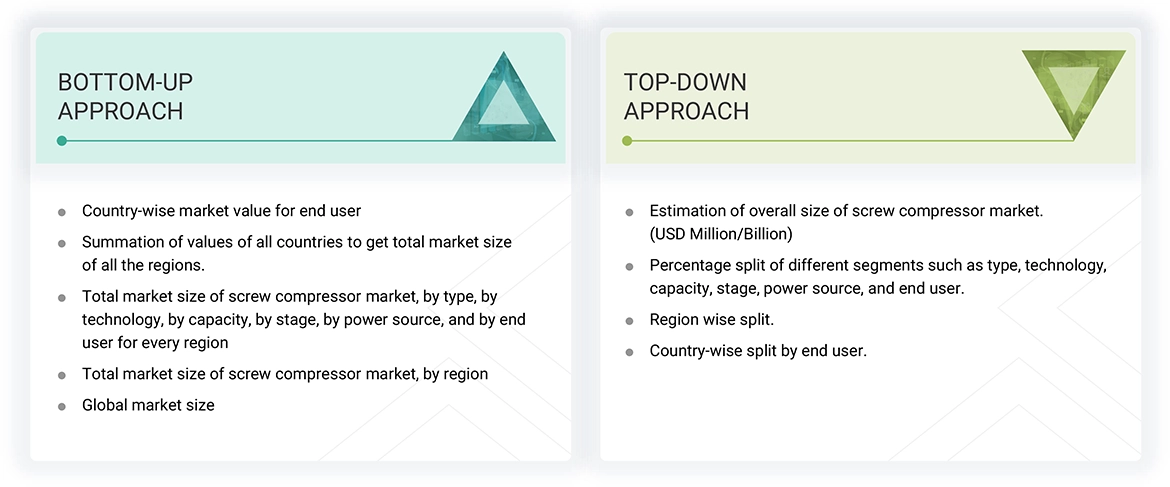

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been extensively used along with several data triangulation methods to estimate and forecast the overall market segments listed in this report.

Top-down and bottom-up approaches have been used to estimate and validate the market size of Screw Compressor for various end user in each region. The key players in the market have been identified through secondary research, and their market share in respective regions has been determined through primary and secondary research. This entire procedure includes the study of annual and financial reports of the key market players and extensive interviews for insights from industry leaders such as CEOs, vice presidents, directors, and marketing executives. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Screw Compressor Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and sub-segments. Data triangulation and market breakdown procedures have been used wherever applicable to complete the overall market engineering process and to arrive at the exact statistics for all segments and sub-segments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has been validated using both the top-down and bottom-up approaches. Then, it was verified through primary interviews. Hence, for every data segment, there are three sources—the top-down approach, the bottom-up approach, and expert interviews. When the values arrived at from the three points matched, the data was assumed to be correct.

Market Definition

A screw compressor is a type of a rotary compressor that operates on positive displacement mechanism. It uses two rotors to handle/compress a multitude of gas, ranging from air to light hydrocarbons, nitrogen, ammonia, and so on. An air compressor decreases the volume of the fluid (air or mixture of air and liquid) by the application of pressure. The potential energy of the pressurized air can then be stored in a tank and utilized to run various applications such as dehydration, bottling, controls and actuators, conveying, spraying coatings, cleaning, vacuum packing, clamping, stamping, tool powering and cleaning, combustion, and process operations such as oxidation, fractionation, cryogenics, refrigeration, filtration, aeration, controls and actuators. Screw compressors cater to various end-user industries, such as chemicals and petrochemicals, food & beverages, oil & gas, medical & pharmaceuticals, construction, automotive, packaging, metals and mining, HVAC, and others.

Stakeholders

- Government organizations and regulatory agencies

- Investors/shareholders

- Organizations, forums, alliances, and associations related to the screw compressors market

- Screw compressor manufacturing companies

- Manufacturers and equipment user associations and groups

- Environmental research institutes

- Consulting companies in the energy and power domain

- Manufacturing industry

- Investment banks

- State and national regulatory authorities

- Venture capital firms

- Financial organizations

- Research Institutes and organizations

- Environment associations

- Energy Efficiency Consultancies

- Compressed Air and Gas Institute

Report Objectives

- To describe and forecast the screw compressor market in terms of value based on type, stage, technology, power source, capacity, end user and region

- To describe and forecast the market in terms of volume based on region

- To provide detailed information about the key factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze the subsegments with respect to individual growth trends, prospects, and contributions of each segment to the overall market size

- To forecast the market size for five key regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America, along with their key countries

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To study the complete supply chain and allied industry segments and perform a supply chain analysis of the market landscape

- To study market trends, patent analysis, trade analysis, tariff and regulatory landscape, Porter’s five forces analysis, ecosystem mapping, technologies, investment and funding scenario, key stakeholders & buying criteria, case studies pertaining to market

- To analyze the opportunities for various stakeholders by identifying the high-growth segments of the market

- To profile the key players and comprehensively analyze their market positions in terms of ranking and core competencies2, along with detailing the competitive landscape for the market leaders

- To analyze competitive developments, such as Agreements, Acquisitions, contracts, mergers, expansions, product launches, investments, and acquisitions, in the market

Note: 1. Micromarkets are defined as the further segments and subsegments of the screw compressor market included in the report.

2. Core competencies of companies are captured in terms of their key developments and product portfolios, as well as key strategies adopted to sustain their position in the market.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis as per Feasibility

- Further breakdown of the screw compressors market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Screw Compressor Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Screw Compressor Market