Concrete Restoration Market by Material Type (Shotcrete, Quick Setting Cement Mortar, Fiber Concrete), Target Application (Roads, Highways & Bridges, Buildings & Balconies, Industrial Structures) and Region - Global Forecast to 2026

Updated on : September 02, 2025

Concrete Restoration Market

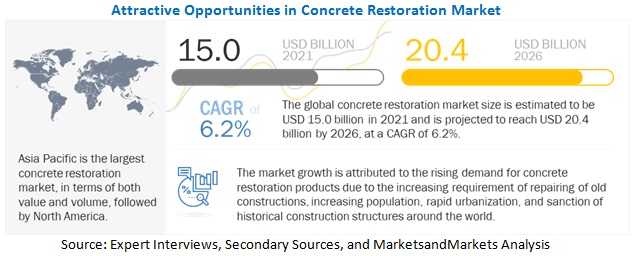

The global concrete restoration market was valued at USD 15.0 billion in 2021 and is projected to reach USD 20.4 billion by 2026, growing at 6.2% cagr from 2021 to 2026. The high growth of concrete restoration can be attributed to the growing number of construction repair projects globally due to the rising population, rapid urbanization, and increased economic growth in some regions. Emerging markets like China, the UAE, and India are showing remarkable growth due to the aforementioned factors. This has been a decisive factor in the concrete restoration market growth, especially in regions like North America and Europe, where concrete restoration products' usage is relatively high. By 2026, many new companies will emerge from China, having low-cost concrete restoration products and, thus, offer heavy competition to the existing market players.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on Concrete Restoration Market

The novel coronavirus pandemic had created ripples across the global industries, affecting the global supply chains, which move materials and components rapidly across borders and fabrication facilities. This had resulted in delays or non-arrival of raw materials, disrupted financial flows, and growing absenteeism among production line workers. These factors have affected the world’s economy and performance of different industries. The loss of various industry had directly affected the concrete restoration market.

Concrete Restoration Market Dynamics

Driver: Pressure on existing infrastructure due to rising population

Builders and governments across Europe have invested a large sum of money and time in developing their countries' infrastructure. The infrastructure includes roads and bridges, schools, hospitals, and power generation facilities such as power plants, dams, production plants, and other such facilities. Infrastructure plays a vital role in the growth of countries. These infrastructures need to last for an extended period to reap the benefits.

The pressure on the existing infrastructure is growing due to the increasing aging population and migrants. According to Eurostat, European countries will have approximately 125 million people above 65 years by 2025. These countries also have a higher life expectancy, which has led to increased pressure on the existing infrastructure. The pressure is further increased with the rise in the migrant population. In 2015, around 4.7 million people entered the European Union. This has resulted in further pressure on the existing social infrastructure, which needs to be expanded and refurbished according to the population's needs.

The population in China and India roughly accounts for about 37% of the total world population. China and India account for 1.4 billion and 1.3 billion people, respectively. The high population in these countries is leading to inequitable distribution of available resources. The existing infrastructure, such as roads, bridges, and water supply systems, are overburdened by the population rise and are showing signs of crumbling. This has led the authorities to take up restoration initiatives in these countries. Thus, the increasing population will drive the growth of the concrete restoration market during the forecast period.

Restraint: Stringent regulations in developed markets

According to the standards set by the European Union, any product to be used for the restoration of concrete structures must comply with the EN 1504 regulation of the European Union. The regulation pays attention to the quality of raw material used in the restoration products' manufacturing process. It also provides control and testing guidelines for the material. This may be a restraint for the market if the manufacturer is unable to meet the regulations. In addition, it also contributes to the cost of manufacturing the product.

Opportunity: Growing trend of shifting to renewable energy generation

The developed nations, especially in Europe, have pledged to reduce their carbon emission rate. This has led to the shift of their energy source towards renewable energy sources such as wind energy and hydropower. In the UK, coal-based power plants generated just 1% of the total electricity in 2019. Renewable energy sources contributed 39% of the electricity demand of the UK. The country has one of the largest offshore wind farms globally that is currently supplying 9% of the country’s energy needs. Wind turbines are installed on large concrete foundations, which require periodic maintenance.

The old thermal power plants are being shut down in the European Union due to their commitment to reducing their carbon footprint. Dams and wind turbines structures require more periodic maintenance than thermal power plants to function properly. Thus, the increasing adoption of renewable energy is expected to create opportunities for concrete restoration manufacturers to expand their business, especially in wind turbines and hydropower sectors.

Challenge: Rise of new construction technology as a replacement for restoration materials

Although in its nascent stage, self-healing concrete is slowly gaining popularity in the construction industry. It is a mixture of cement, aggregates, water, and limestone-producing bacteria, which helps in filling the cracks as soon as they appear on the concrete surface. The material can fill small cracks of up to 0.08 mm. Research has been conducted to improve the efficiency of such concrete materials. This might significantly reduce the need for infrastructure restoration in structures and may become a significant replacement for restoration in the near future.

The concrete restoration market in the quick setting cement mortar segment is expected to hold the largest share during the forecast period.

quick setting cement accounted for the largest market share in 2020. It is a special cement formulation that develops a rapid compressive strength and significantly reduces the waiting on cement (WOC) time compared to traditional cement systems. It is used in underwater construction like river bridge construction. Part of bridge construction like a pier, foundation, pier cap, pile cap, and piles, all those constructions use quick setting cement mortar in concrete.

The concrete restoration market in the marine segment is projected to register the highest CAGR during the forecast period.

The marine application is projected to register the highest CAGR, in terms of value, during the forecast period. The concrete used in the marine industry is exposed to numerous harsh conditions, including physical and chemical attacks. The projected growth shows that most target applications will grow at a high CAGR from 2021–2026, overcoming the adverse effects of global lockdowns and economic standstill caused by the COVID–19 pandemic.

Asia Pacific concrete restoration market is estimated to register the highest CAGR during the forecast period.

APAC is projected to have the highest growth in the concrete restoration market and will expand significantly by 2026. The region is the largest consumer of concrete restoration. The growth of the concrete restoration market in the region is attributed to the high population in China and India. The increasing population in these countries is overburdening the concrete structures. These structures may crumble over time and would collapse if periodic maintenance is not carried out. The growth of the concrete restoration market in APAC is driven by increasing expansion, rapid modernization, and urbanization in different countries. There is high industrial growth in Japan, China, South Korea, and India, among other countries. Mega infrastructure repair projects and repairing of bridges, pipelines, public buildings, and water structures, among other projects, have propelled the demand for concrete restoration across APAC. Concrete restoration products are used to add more strength to old construction structures, including highways, bridges & buildings, marine structures, water treatment plants, MRI rooms, parking structures, and salt and smelting plants in the APAC region. The use of concrete restoration continues to increase in these applications. China, Japan, India, and South Korea are the major markets for concrete restoration in this region. The other countries in the APAC region expected to experience heavy concrete restoration products are New Zealand, Singapore, Thailand, and Malaysia. China is the most dominant player in the concrete restoration market in this region.

APAC has some of the largest and fastest-growing economies globally, and construction is a major growth sector in these emerging markets. The increased socio-economic standards and huge private investment coupled with government spending on repairing infrastructures are key growth drivers of APAC construction products. The increasing know-how and awareness about the usage and advantage of concrete restoration will also drive the market growth in APAC.

To know about the assumptions considered for the study, download the pdf brochure

North America to account for the second-largest share of the global concrete restoration market during the forecast period.

North America is the second-largest market for concrete restoration. The concrete restoration market in the North American region is driven by their target application in restoration work of commercial, residential, bridges, silo-flue pipes, oil and natural gas pipelines, water structures, and industrial structures. Important restoration projects like the Old Youngs Bay Bridge across Youngs Bay in Astoria, Oregon (US), Huntley Bridge Perry’s Creek Bridge in Burleigh Falls, Ontario (Canada), and Teed Bridge Cumberland County, Nova Scotia (Canada), amongst many other projects, are driving the market of concrete restoration in North America.

Concrete Restoration Market Players

Sika AG (Switzerland), Fosroc (UK), Mapei SpA (Italy), RPM International (US) and Master Builders Solutions (US) are some of the players operating in the global market.

Concrete Restoration Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2019–2026 |

|

Base year |

2020 |

|

Forecast period |

2021–2026 |

|

Units considered |

Value (USD Million) and Volume (Kiloton) |

|

Segments |

Material Type |

|

Regions |

Asia Pacific, North America, Europe, the Middle East & Africa, and South America |

|

Companies |

Sika (Switzerland), Mapei S.p.A (Italy), Master Builders Solutions (Germany), Fosroc (UAE), BASF SE (Germany), Pidilite Industries (India), RPM International (US), Fyfe (US), Saint-Gobain Weber S.A. (France), and The Euclid Chemical Company (UK) |

This research report categorizes the concrete restoration market based on material type, target application, and region.

Based on Material Type, the concrete restoration market has been segmented as follows:

- Shotcrete

- Quick setting cement mortar

- Fiber concrete

- Others (concrete bonding agents, grout, etc.)

Based on Target Application, the concrete restoration market has been segmented as follows:

- Water & Wastewater Treatment

- Dams & Reservoirs

- Roads, Highways & Bridges

- Marine

- Buildings & Balconies

- Others (parking structures, industrial facilities, other miscellaneous)

Based on the Region, the concrete restoration market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Frequently Asked Questions (FAQ):

Does this report covers the new applications of concrete restoration?

Yes the report covers the new applications of concrete restoration

Does this report cover the volume tables in addition to value tables?

Yes the report covers the market both in terms of volume as well as value

What is the current competitive landscape in the concrete restoration market in terms of new applications, production, and sales?

The market has various large, medium, and small scale players operating across the globe. Many players are constantly innovating and developing new products and expanding to developing countries where the demand is constantly growing; thereby boosting sales.

Which all countries are considered in the report?

US, France, China, and Germany are major countries considered in the report. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET INCLUSIONS AND EXCLUSIONS

1.3.1 MARKET INCLUSIONS

1.3.2 MARKET EXCLUSIONS

1.4 MARKET SCOPE

1.5 YEARS CONSIDERED FOR THE STUDY

1.6 CURRENCY

1.7 UNIT CONSIDERED

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 23)

2.1 RESEARCH DATA

FIGURE 1 CONCRETE RESTORATION MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key primary data sources

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 TOP-DOWN APPROACH

FIGURE 2 CONCRETE RESTORATION MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

FIGURE 3 CONCRETE RESTORATION MARKET, BY REGION,2020

FIGURE 4 CONCRETE RESTORATION MARKET, BY TARGET APPLICATION, 2020

2.3 MARKET FORECAST APPROACH

2.3.1 SUPPLY-SIDE FORECAST

FIGURE 5 CONCRETE RESTORATION MARKET SIZE ESTIMATION: SUPPLY-SIDE APPROACH

2.3.2 DEMAND-SIDE FORECAST

FIGURE 6 CONCRETE RESTORATION MARKET SIZE ESTIMATION: DEMAND-SIDE APPROACH

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 CONCRETE RESTORATION MARKET: DATA TRIANGULATION

2.5 FACTOR ANALYSIS

2.6 ASSUMPTIONS

2.7 RISK ANALYSIS ASSESSMENT

2.8 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 33)

TABLE 1 CONCRETE RESTORATION MARKET SNAPSHOT, 2021 VS. 2026

FIGURE 8 QUICK SETTING CEMENT MORTAR LED OVERALL CONCRETE RESTORATION MARKET

FIGURE 9 MARINE APPLICATION TO REGISTER HIGHEST CAGR IN CONCRETE RESTORATION MARKET

FIGURE 10 APAC DOMINATED CONCRETE RESTORATION MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 37)

4.1 ATTRACTIVE OPPORTUNITIES IN CONCRETE RESTORATION MARKET

FIGURE 11 SIGNIFICANT GROWTH EXPECTED IN CONCRETE RESTORATION MARKET BETWEEN 2021 AND 2026

4.2 CONCRETE RESTORATION MARKET, BY MATERIAL TYPE

FIGURE 12 QUICK SETTING CEMENT MORTAR SEGMENT TO REGISTER HIGHEST GROWTH IN CONCRETE RESTORATION MARKET

4.3 APAC CONCRETE RESTORATION MARKET, BY MATERIAL TYPE AND BY TARGET APPLICATION, 2020

FIGURE 13 QUICK SETTING CEMENT MORTAR AND INDUSTRIAL STRUCTURE SEGMENTS ACCOUNTED FOR THE LARGEST SHARES

4.4 CONCRETE RESTORATION MARKET, DEVELOPED VS. DEVELOPING COUNTRIES

FIGURE 14 DEVELOPING COUNTRIES TO GROW FASTER THAN DEVELOPED COUNTRIES

4.5 CONCRETE RESTORATION MARKET, BY COUNTRY

FIGURE 15 INDIA TO REGISTER HIGHEST CAGR IN CONCRETE RESTORATION MARKET

5 MARKET OVERVIEW (Page No. - 40)

5.1 INTRODUCTION

5.2 VALUE CHAIN ANALYSIS

FIGURE 16 CONCRETE RESTORATION MARKET: VALUE CHAIN ANALYSIS

TABLE 2 CONCRETE RESTORATION MARKET: SUPPLY CHAIN ECOSYSTEM

5.2.1 COVID-19 IMPACT ON VALUE CHAIN

5.2.1.1 Action plan against current vulnerability

5.3 MARKET DYNAMICS

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN CONCRETE RESTORATION MARKET

5.3.1 DRIVERS

5.3.1.1 Pressure on existing infrastructure due to rising population

5.3.1.2 Deteriorating condition of existing infrastructure

5.3.1.3 Need to increase the life span of existing buildings

5.3.2 RESTRAINTS

5.3.2.1 Stringent regulations in developed markets

5.3.3 OPPORTUNITIES

5.3.3.1 Growing trend of shifting to renewable energy generation

5.3.4 CHALLENGES

5.3.4.1 Rise of new construction technology as a replacement for restoration materials

5.3.4.2 Impact of COVID-19 on the construction industry

5.4 PORTER’S FIVE FORCES ANALYSIS

TABLE 3 CONCRETE RESTORATION MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 18 PORTER’S FIVE FORCES ANALYSIS: CONCRETE RESTORATION MARKET

5.4.1 BARGAINING POWER OF SUPPLIERS

5.4.2 THREAT OF NEW ENTRANTS

5.4.3 THREAT OF SUBSTITUTES

5.4.4 BARGAINING POWER OF BUYERS

5.4.5 INTENSITY OF COMPETITION

5.5 MACROECONOMIC INDICATORS

5.5.1 INTRODUCTION

5.5.2 TRENDS AND FORECAST OF GDP

TABLE 4 TRENDS AND FORECAST OF GDP, PERCENTAGE CHANGE, 2018–2025

5.6 TRENDS AND FORECAST OF CONSTRUCTION INDUSTRY

FIGURE 19 GLOBAL SPENDING IN CONSTRUCTION INDUSTRY, 2017–2025

5.7 IMPACT OF TRENDS AND TECHNOLOGY DISRUPTION ON MANUFACTURERS OF CONCRETE RESTORATION: YC AND YCC SHIFT

FIGURE 20 CONCRETE RESTORATION MARKET: YC AND YCC SHIFT

5.7.1 CONCRETE RESTORATION

5.7.2 YC SHIFT

5.7.3 YCC SHIFT

5.8 TRADE ANALYSIS

5.8.1 EXPORTS

TABLE 5 CEMENT EXPORTED VALUE (USD THOUSAND)

5.8.2 IMPORTS

TABLE 6 CEMENT IMPORTED VALUE (USD THOUSAND)

5.9 KEY MARKET FOR IMPORT/EXPORT

5.9.1 CHINA

5.9.2 US

5.9.3 GERMANY

5.9.4 UK

5.9.5 FRANCE

5.9.6 JAPAN

5.10 COVID-19 IMPACT

5.10.1 OVERVIEW

5.11 COVID-19 ECONOMIC ASSESSMENT

5.11.1 MAJOR ECONOMIC EFFECTS OF COVID-19

FIGURE 21 REVISED GDP FORECASTS DUE TO COVID-19 FOR SELECT G20 COUNTRIES IN 2020

5.11.2 SCENARIO ASSESSMENT

FIGURE 22 FACTORS IMPACTING ECONOMY OF SELECT G20 COUNTRIES IN 2020

6 CONCRETE RESTORATION MARKET, BY MATERIAL TYPE (Page No. - 58)

6.1 INTRODUCTION

FIGURE 23 QUICK SETTING CEMENT MORTAR TO DOMINATE OVERALL CONCRETE RESTORATION MARKET

TABLE 7 CONCRETE RESTORATION MARKET SIZE, BY MATERIAL TYPE, 2019–2026 (USD MILLION)

TABLE 8 CONCRETE RESTORATION MARKET SIZE, BY MATERIAL TYPE, 2019–2026 (KILOTON)

6.2 SHOTCRETE

6.2.1 SHOTCRETE IS USED FOR HORIZONTAL, VERTICAL, CURVED, OR THIN CONCRETE STRUCTURES AND SHALLOW REPAIRS

TABLE 9 SHOTCRETE: CONCRETE RESTORATION MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 10 SHOTCRETE: CONCRETE RESTORATION MARKET, BY REGION, 2019–2026 (KILOTON)

6.3 QUICK SETTING CEMENT MORTAR

6.3.1 QUICK SETTING CEMENT IS USED IN RAIN & COLD WEATHER CONDITIONS

TABLE 11 QUICK SETTING CEMENT MORTAR: CONCRETE RESTORATION MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 12 QUICK SETTING CEMENT MORTAR: CONCRETE RESTORATION MARKET, BY REGION, 2019–2026 (KILOTON)

6.4 FIBER CONCRETE

6.4.1 FIBERS SUITABLE FOR REINFORCING CONCRETE ARE SYNTHETIC, STEEL, GLASS, NATURAL, AND BASALT FIBERS

TABLE 13 FIBER CONCRETE: CONCRETE RESTORATION MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 14 FIBER CONCRETE: CONCRETE RESTORATION MARKET, BY REGION, 2019–2026 (KILOTON)

6.5 OTHER MATERIAL TYPES

TABLE 15 OTHER MATERIAL TYPES: CONCRETE RESTORATION MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 16 OTHER MATERIAL TYPES: CONCRETE RESTORATION MARKET, BY REGION, 2019–2026 (KILOTON)

7 CONCRETE RESTORATION MARKET, BY TARGET APPLICATION (Page No. - 65)

7.1 INTRODUCTION

FIGURE 24 ROADS, HIGHWAYS & BRIDGES SEGMENT TO DOMINATE OVERALL CONCRETE RESTORATION MARKET

TABLE 17 CONCRETE RESTORATION MARKET SIZE, BY TARGET APPLICATION, 2019–2026 (USD MILLION)

TABLE 18 CONCRETE RESTORATION MARKET SIZE, BY TARGET APPLICATION, 2019–2026 (KILOTON)

7.2 WATER & WASTEWATER TREATMENT

7.2.1 WATER TREATMENT PLANT PROCESSES LIQUID TO SUPPLY SAFE, POTABLE DRINKING WATER FOR COMMERCIAL AND RESIDENTIAL USE

TABLE 19 CONCRETE RESTORATION MARKET SIZE IN WATER & WASTEWATER TREATMENT, BY REGION, 2019–2026 (USD MILLION)

TABLE 20 CONCRETE RESTORATION MARKET SIZE IN WATER & WASTEWATER TREATMENT, BY REGION, 2019–2026 (KILOTON)

7.3 DAMS & RESERVOIRS

7.3.1 DETERIORATION OF DAMS OCCURS DUE TO POOR WORKMANSHIP, OUTDATED CONSTRUCTION PROCEDURES, AND USE OF LOW–QUALITY CONSTRUCTION MATERIALS

TABLE 21 CONCRETE RESTORATION MARKET SIZE IN DAMS & RESERVOIRS, BY REGION, 2019–2026 (USD MILLION)

TABLE 22 CONCRETE RESTORATION MARKET SIZE IN DAMS & RESERVOIRS, BY REGION, 2019–2026 (KILOTON)

7.4 ROADS, HIGHWAYS & BRIDGES

7.4.1 TRAFFIC-INDUCED FATIGUE ON STRUCTURES AND EXTREME TEMPERATURES IN DAY AND NIGHT, LEADING TO EXPANSION AND CONTRACTION OF CEMENT

TABLE 23 CONCRETE RESTORATION MARKET SIZE IN ROADS, HIGHWAYS & BRIDGES, BY REGION, 2019–2026 (USD MILLION)

TABLE 24 CONCRETE RESTORATION MARKET SIZE IN ROADS, HIGHWAYS & BRIDGES, BY REGION, 2019–2026 (KILOTON)

7.5 MARINE

7.5.1 CONCRETE USED IN A MARINE ENVIRONMENT IS EXPOSED TO NUMEROUS HARSH CONDITIONS, WHICH INCLUDE BOTH PHYSICAL AND CHEMICAL ATTACKS

TABLE 25 CONCRETE RESTORATION MARKET SIZE IN MARINE APPLICATION, BY REGION, 2019–2026 (USD MILLION)

TABLE 26 CONCRETE RESTORATION MARKET SIZE IN MARINE APPLICATION, BY REGION, 2019–2026 (KILOTON)

7.6 BUILDINGS & BALCONIES

7.6.1 STRUCTURES EXPOSED TO VARIOUS ENVIRONMENTAL AND CHEMICAL SUBSTANCES DAILY WILL MAKES THEM VULNERABLE TO DAMAGE

TABLE 27 CONCRETE RESTORATION MARKET SIZE IN BUILDINGS & BALCONIES, BY REGION, 2019–2026 (USD MILLION)

TABLE 28 CONCRETE RESTORATION MARKET SIZE IN BUILDINGS & BALCONIES, BY REGION, 2019–2026 (KILOTON)

7.7 INDUSTRIAL STRUCTURES

7.7.1 CONCRETE RESTORATION PRODUCTS PROVIDE HIGH ELASTIC MODULUS AND FATIGUE STRENGTH TO INDUSTRIAL STRUCTURES

TABLE 29 CONCRETE RESTORATION MARKET SIZE IN INDUSTRIAL STRUCTURES, BY REGION, 2019–2026 (USD MILLION)

TABLE 30 CONCRETE RESTORATION MARKET SIZE IN INDUSTRIAL STRUCTURES, BY REGION, 2019–2026 (KILOTON)

7.8 OTHERS

TABLE 31 CONCRETE RESTORATION MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2019–2026 (USD MILLION)

TABLE 32 CONCRETE RESTORATION MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2019–2026 (KILOTON)

8 CONCRETE RESTORATION MARKET SIZE, BY REGION (Page No. - 75)

8.1 INTRODUCTION

FIGURE 25 APAC TO REGISTER HIGHEST CAGR BETWEEN 2021 AND 2026

TABLE 33 CONCRETE RESTORATION MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 34 CONCRETE RESTORATION MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

8.2 NORTH AMERICA

8.2.1 COVID-19 IMPACT ON NORTH AMERICA

FIGURE 26 NORTH AMERICA: CONCRETE RESTORATION MARKET SNAPSHOT

TABLE 35 NORTH AMERICA: CONCRETE RESTORATION MARKET SIZE, BY MATERIAL TYPE, 2019–2026 (USD MILLION)

TABLE 36 NORTH AMERICA: CONCRETE RESTORATION MARKET SIZE, BY MATERIAL TYPE, 2019–2026 (KILOTON)

TABLE 37 NORTH AMERICA: CONCRETE RESTORATION MARKET SIZE, BY TARGET APPLICATION, 2019–2026 (USD MILLION)

TABLE 38 NORTH AMERICA: CONCRETE RESTORATION MARKET SIZE, BY TARGET APPLICATION, 2019–2026 (KILOTON)

TABLE 39 NORTH AMERICA: CONCRETE RESTORATION MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 40 NORTH AMERICA: CONCRETE RESTORATION MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

8.2.2 US

8.2.2.1 Large backlog of aging buildings requiring repair and maintenance to drive demand

8.2.3 CANADA

8.2.3.1 Harsh climatic conditions leading to increase in maintenance of transport system

8.2.4 MEXICO

8.2.4.1 Increasing dependence on public-private partnerships to develop and maintain country’s infrastructure to drive market

8.3 APAC

8.3.1 IMPACT OF COVID-19 ON APAC

FIGURE 27 APAC: CONCRETE RESTORATION MARKET SNAPSHOT

TABLE 41 APAC: CONCRETE RESTORATION MARKET SIZE, BY MATERIAL TYPE, 2019–2026 (USD MILLION)

TABLE 42 APAC: CONCRETE RESTORATION MARKET SIZE, BY MATERIAL TYPE, 2019–2026 (KILOTON)

TABLE 43 APAC: CONCRETE RESTORATION MARKET SIZE, BY TARGET APPLICATION, 2019–2026 (USD MILLION)

TABLE 44 APAC: CONCRETE RESTORATION MARKET SIZE, BY TARGET APPLICATION, 2019–2026 (KILOTON)

TABLE 45 APAC: CONCRETE RESTORATION MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 46 APAC: CONCRETE RESTORATION MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

8.3.2 CHINA

8.3.2.1 High expenditure on repair of large concrete structures such as dams and bridges

8.3.3 INDIA

8.3.3.1 Large infrastructure investment plans by government to boost demand

8.3.4 SOUTH KOREA

8.3.4.1 Development and maintenance of civil infrastructure to drive demand

8.3.5 INDONESIA

8.3.5.1 Indonesian economy has been growing steadily for several years due to increased domestic consumption and FDIs

8.3.6 VIETNAM

8.3.6.1 Vietnam is rapidly adopting new production technologies and modernizing its economy by increasing imports and exports

8.3.7 THAILAND

8.3.7.1 Government’s spending on infrastructure projects drives demand for concrete restoration

8.3.8 REST OF APAC

8.4 EUROPE

8.4.1 COVID-19 IMPACT ON EUROPE

FIGURE 28 EUROPE: CONCRETE RESTORATION MARKET SNAPSHOT

TABLE 47 EUROPE: CONCRETE RESTORATION MARKET SIZE, BY MATERIAL TYPE, 2019–2026 (USD MILLION)

TABLE 48 EUROPE: CONCRETE RESTORATION MARKET SIZE, BY MATERIAL TYPE, 2019–2026 (KILOTON)

TABLE 49 EUROPE: CONCRETE RESTORATION MARKET SIZE, BY TARGET APPLICATION, 2019–2026 (USD MILLION)

TABLE 50 EUROPE: CONCRETE RESTORATION MARKET SIZE, BY TARGET APPLICATION, 2019–2026 (KILOTON)

TABLE 51 EUROPE: CONCRETE RESTORATION MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 52 EUROPE: CONCRETE RESTORATION MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

8.4.2 GERMANY

8.4.2.1 High public expenditure on maintenance of public infrastructure to drive growth

8.4.3 ITALY

8.4.3.1 Deteriorating public infrastructure putting pressure on government to increase spending on repair & maintenance of structures

8.4.4 FRANCE

8.4.4.1 Expenditure on maintenance of public infrastructure to support market growth

8.4.5 UK

8.4.5.1 High investment in maintenance of bridges to support growth

8.4.6 SPAIN

8.4.6.1 Investment in wind energy sector driving demand for concrete restoration

8.4.7 RUSSIA

8.4.7.1 High investment in upgradation of concrete restoration to drive market growth

8.4.8 REST OF EUROPE

8.5 MIDDLE EAST & AFRICA

8.5.1 COVID-19 IMPACT ON MIDDLE EAST & AFRICA

FIGURE 29 MIDDLE EAST & AFRICA: CONCRETE RESTORATION MARKET SNAPSHOT

TABLE 53 MIDDLE EAST & AFRICA: CONCRETE RESTORATION MARKET SIZE, BY MATERIAL TYPE, 2019–2026 (USD MILLION)

TABLE 54 MIDDLE EAST & AFRICA: CONCRETE RESTORATION MARKET SIZE, BY MATERIAL TYPE, 2019–2026 (KILOTON)

TABLE 55 MIDDLE EAST & AFRICA: CONCRETE RESTORATION MARKET SIZE, BY TARGET APPLICATION, 2019–2026 (USD MILLION)

TABLE 56 MIDDLE EAST & AFRICA: CONCRETE RESTORATION MARKET SIZE, BY TARGET APPLICATION, 2019–2026 (KILOTON)

TABLE 57 MIDDLE EAST & AFRICA: CONCRETE RESTORATION MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 58 MIDDLE EAST & AFRICA: CONCRETE RESTORATION MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

8.5.2 SAUDI ARABIA

8.5.2.1 Heavy investment in development of commercial infrastructure to drive concrete restoration market

8.5.3 UAE

8.5.3.1 Government policy supporting growth of infrastructure projects to drive market

8.5.4 QATAR

8.5.4.1 Construction sector in Qatar is largest employer, with 37% of working population

8.5.5 SOUTH AFRICA

8.5.5.1 Government’s efforts to build social infrastructure would lead market

8.5.6 REST OF THE MIDDLE EAST & AFRICA

8.6 SOUTH AMERICA

8.6.1 IMPACT OF COVID-19 ON SOUTH AMERICA

FIGURE 30 SOUTH AMERICA: CONCRETE RESTORATION MARKET SNAPSHOT

TABLE 59 SOUTH AMERICA: CONCRETE RESTORATION MARKET SIZE, BY MATERIAL TYPE, 2019–2026 (USD MILLION)

TABLE 60 SOUTH AMERICA: CONCRETE RESTORATION MARKET SIZE, BY MATERIAL TYPE, 2019–2026 (KILOTON)

TABLE 61 SOUTH AMERICA: CONCRETE RESTORATION MARKET SIZE, BY TARGET APPLICATION, 2019–2026 (USD MILLION)

TABLE 62 SOUTH AMERICA: CONCRETE RESTORATION MARKET SIZE, BY TARGET APPLICATION, 2019–2026 (KILOTON)

TABLE 63 SOUTH AMERICA: CONCRETE RESTORATION MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 64 SOUTH AMERICA: CONCRETE RESTORATION MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

8.6.2 BRAZIL

8.6.2.1 Brazil’s construction repair industry is increasingly adopting concrete restoration products

8.6.3 ARGENTINA

8.6.3.1 Government partnering with international agencies to boost construction industry and maintain existing infrastructure

8.6.4 CHILE

8.6.4.1 Government launched a pilot program to restart construction activities

8.6.5 COLOMBIA

8.6.5.1 Development of underground construction is increasing

8.6.6 REST OF SOUTH AMERICA

9 COMPETITIVE LANDSCAPE (Page No. - 105)

9.1 INTRODUCTION

9.2 MARKET SHARE ANALYSIS

TABLE 65 CONCRETE RESTORATION MARKET: DEGREE OF COMPETITION

FIGURE 31 CONCRETE RESTORATION MARKET: MARKET SHARE ANALYSIS, 2020

9.2.1 MARKET RANKING ANALYSIS

FIGURE 32 RANKING OF KEY PLAYERS

9.3 COMPANY EVALUATION QUADRANT, 2020

9.3.1 STARS

9.3.2 EMERGING LEADERS

9.3.3 PERVASIVE

9.3.4 PARTICIPANTS

FIGURE 33 CONCRETE RESTORATION MARKET: COMPETITIVE LEADERSHIP MAPPING, 2020

9.4 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 34 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN CONCRETE RESTORATION MARKET

9.5 BUSINESS STRATEGY EXCELLENCE

FIGURE 35 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN CONCRETE RESTORATION MARKET

10 COMPANY PROFILES (Page No. - 112)

10.1 KEY PLAYERS

(Business Overview, Products Offered, MnM view, Current focus and strategies, Threat from competition, Right to win)*

10.1.1 SIKA AG

TABLE 66 SIKA: COMPANY OVERVIEW

FIGURE 36 SIKA: COMPANY SNAPSHOT

10.1.2 MAPEI S.P.A

TABLE 67 MAPEI S.P.A: COMPANY OVERVIEW

FIGURE 37 MAPEI S.P.A: COMPANY SNAPSHOT

10.1.3 MASTER BUILDERS’ SOLUTIONS

TABLE 68 MASTER BUILDERS’ SOLUTIONS: COMPANY OVERVIEW

10.1.4 FOSROC

TABLE 69 FOSROC: COMPANY OVERVIEW

10.1.5 BASF SE

TABLE 70 BASF SE: COMPANY OVERVIEW

FIGURE 38 BASF SE: COMPANY SNAPSHOT

10.1.6 PIDILITE INDUSTRIES LIMITED

TABLE 71 PIDILITE INDUSTRIES LIMITED: COMPANY OVERVIEW

FIGURE 39 PIDILITE INDUSTRIES LIMITED: COMPANY SNAPSHOT

10.1.7 RPM INTERNATIONAL INC.

TABLE 72 RPM INTERNATIONAL INC.: COMPANY OVERVIEW

FIGURE 40 RPM INTERNATIONAL INC.: COMPANY SNAPSHOT

10.1.8 FYFE

TABLE 73 FYFE: COMPANY OVERVIEW

10.1.9 SAINT-GOBAIN WEBER S.A.

TABLE 74 SAINT-GOBAIN WEBER S.A.: COMPANY OVERVIEW

FIGURE 41 SAINT-GOBAIN WEBER S.A.: COMPANY SNAPSHOT

10.1.10 THE EUCLID CHEMICAL COMPANY

TABLE 75 THE EUCLID CHEMICAL COMPANY: COMPANY OVERVIEW

*Details on Business Overview, Products Offered, MnM view, Current focus and strategies, Threat from competition, Right to win might not be captured in case of unlisted companies.

10.2 OTHER PLAYERS

10.2.1 W. R. MEADOWS, INC.

10.2.2 AQUAFIN, INC.

10.2.3 CONCRETE CRAFT

10.2.4 DAYTON SUPERIOR

10.2.5 PERMA CONSTRUCTION AIDS PVT. LTD.

10.2.6 CHEMBOND CHEMICALS LIMITED

10.2.7 TCC MATERIALS

10.2.8 RONACRETE LTD.

10.2.9 MC BUILDING CHEMICALS

10.2.10 GARON PRODUCTS INC.

10.2.11 ARDEX GMBH

10.2.12 ADHESIVE TECHNOLOGY CORP.

10.2.13 FLEXCRETE TECHNOLOGIES LTD.

10.2.14 REMMERS BAUSTOFFTECHNIK GMBH

10.2.15 SCHOMBURG GMBH & CO. KG.

11 APPENDIX (Page No. - 139)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

11.3 AVAILABLE CUSTOMIZATIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

The study involved four major activities in estimating the current market size of concrete restoration. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and subsegments of the overall market.

Secondary Research

This research report involves the use of extensive secondary sources, directories, and databases, such as Bloomberg, BusinessWeek, Factiva, ICIS, and OneSource to identify and collect information useful for the technical, market-oriented, and commercial study of the concrete restoration market. The secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles from recognized authors, authenticated directories, and databases.

Primary Research

The concrete restoration market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations. The demand side of this market is characterized by the development of the concrete restoration applications. The supply side included industry experts, such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

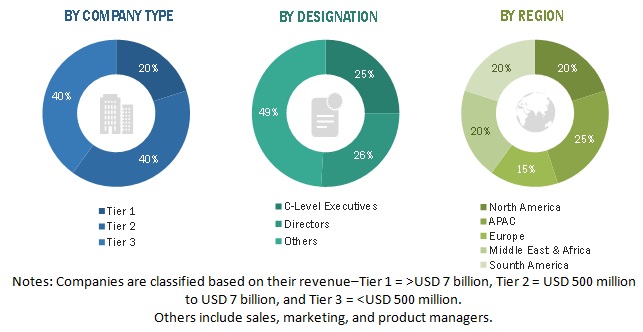

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the concrete restoration market. These approaches have also been used extensively to estimate the size of various dependent sub-segments of the market. The research methodology used to estimate the market size includes the following steps:

- The key players have been identified through extensive secondary research.

- The concrete restoration industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Data Triangulation

After arriving at the overall size of the concrete restoration market from the estimation process explained above, the total market has been split into several segments and sub-segments. The data triangulation and market breakdown procedures have been employed, wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Apart from this, the market size has been validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the concrete restoration market in terms of value and volume

- To provide information about the factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To forecast and analyze the market based on material type, and target application

- To analyze and forecast the market size concerning five main regions, namely, Asia Pacific (APAC), North America, Europe, the Middle East & Africa, and South America, along with their respective key countries

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze competitive developments such as new product launch, merger & acquisition, and investment & expansion in the market

- To analyze opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To strategically profile the key players in the market and comprehensively analyze their core competencies

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country

Company Information

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Concrete Restoration Market