Connected Logistics Market by Software (Asset Management, Warehouse IoT, Security, Network Management, Data Management, and Streaming Analytics), Platform, Service, Transportation Mode, Vertical, and Region - Global Forecast to 2021

[150 Pages Report] The connected logistics market is estimated to grow from USD 10.04 billion in 2016 to USD 41.30 billion by 2021, at a Compound Annual Growth Rate (CAGR) of 32.7% during 2016–2021. The base year considered for the study is 2015 and the market size forecast is from 2016 to 2021. Connected logistics is an interdependent set of communication devices, joints, and Internet of Things (IoT) technologies that change the key logistical processes to become more customer-centric by sharing data, information, and facts with the supply chain partners. The market for connected logistics is still nascent and can be defined as interconnected devices that logistics and IoT solutions providers use to get more visibility within warehouse, transportation, and associated logistics processes, such as order processing, financial transactions, shipping, and dispatching & picking. It helps drive more effective business decisions by identifying the crucial bottlenecks and hence, facilitates in critical decision-making.

Market Dynamics

Drivers

- Decreasing cost of sensors

- Need for operational efficiency

- Emergence of IoT connecting devices

Restraints

- Lack of uniform governance standards

Opportunities

- Increase in number of high-tech vehicles

- Increasing innovation in mobile technologies

- Increasing logistics transparency

Challenges

- Logistics security and safety issues

- Lack of data management and interoperability

Objectives of the study:

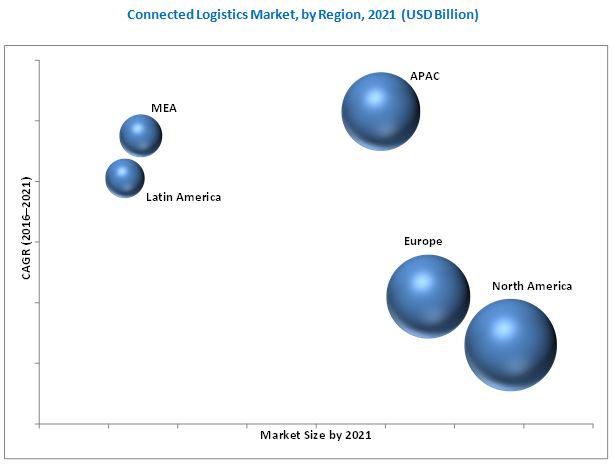

- To define, describe, and forecast the connected logistics market on the basis of five regions, namely, North America, Europe, APAC, Middle East and Africa (MEA), and Latin America.

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges).

- To strategically analyze each sub-segment with respect to individual growth trends, future prospects, and contribution to the total market.

- To analyze the opportunities in the market for stakeholders by identifying high-growth segments of the connected logistics market.

- To strategically profile key players of the market and comprehensively analyze their core competencies in the market.

- To track and analyze competitive developments, such as new product launches, mergers & acquisitions, partnerships, agreements, and collaborations in the global market.

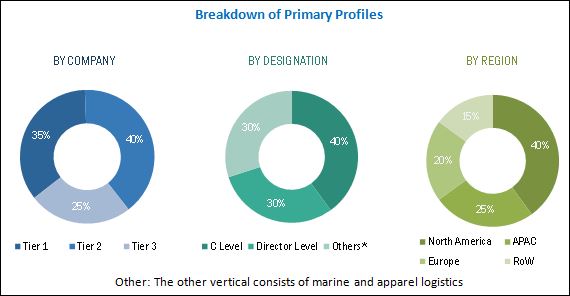

The research methodology used to estimate and forecast the connected logistics market begins with capturing data on key vendor revenues and the market size of the individual segments through secondary sources such as industry associations, trade journals etc. The vendor offerings are also taken into consideration to determine market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global market from the individual technology segment. After arriving at the overall market size, the total market was split into several segments and sub-segments, which were then verified through primary research by conducting extensive interviews with key industry personnel, such as CEOs, VPs, directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments. The breakdown of profiles of primary discussion participants is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The connected logistics market ecosystem include technology vendors such as AT&T Inc. (Texas, U.S.), Eurotech S.P.A (Italy, Europe), IBM Corporation (New York, U.S.), Intel Corporation (Santa Clara, U.S.), SAP SE (Walldorf, Germany), Infosys Limited (Karnataka, India), Cisco System Inc. (California, U.S.), HCL Technology Limited (Noida, India), ORBCOMM (New Jersey, U.S.), Cloud Logistics (Florida, U.S.) and Freightgate Inc. (California, U.S.) among others, which provide numerous IT and non-IT components required for connected logistics software and platform as well as consulting, integration and deployment, and support services to connected logistics platform.

Major Market Developments

- In January 2017, Intel partnered with Honeywell to develop an IoT-based retail industry solution; this collaboration would majorly focus on enhancing supply chain efficiency and increasing profitability by improving product visibility. The new designed solution will be in-built with tracking, monitoring, and security access of moving goods. Hence, the challenge is to ensure a better inventory accuracy and enhance customer services.

Key Target Audience for Connected Logistics Market

- Logistics Solution Providers

- Application Developers

- Network Operators (Telecom Service Providers)

- System Integrators

- Communication Equipment Providers

- Consulting Firms

- Government Agencies and Authorities

- Semiconductor Companies

- Embedded Systems Companies

- Managed Service and Middleware Companies

- Wireless Network Operators and Service Providers

- Data Management and Predictive Analysis Companies

- Sensor, Presence, Location, and Detection Solution Providers

- Internet Identity Management, Privacy, and Security Companies

- M2M, IoT, and General Telecommunications Companies

- Wireless Infrastructure Providers

Scope of the Connected Logistics Market Research Report

|

Report Metrics |

Details |

|

Market size available for years |

2016–2021 |

|

Base year considered |

2015 |

|

Forecast period |

2016–2021 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Software (Asset Management, Warehouse IoT, Security, Network Management, Data Management, and Streaming Analytics), Platform, Service, Transportation Mode, Vertical, and Region |

|

Geographies covered |

North America, Europe, APAC, Middle East and Africa (MEA), and Latin America |

|

Companies covered |

AT&T Inc. (Texas, U.S.), Eurotech S.P.A (Italy, Europe), IBM Corporation (New York, U.S.), Intel Corporation (Santa Clara, U.S.), SAP SE (Walldorf, Germany), Infosys Limited (Karnataka, India), Cisco System Inc. (California, U.S.), HCL Technology Limited (Noida, India), ORBCOMM (New Jersey, U.S.), Cloud Logistics (Florida, U.S.) and Freightgate Inc. (California, U.S.) |

The research report categorizes the Connected Logistics Market to forecast the revenues and analyze trends in each of the following subsegments:

By Software

- Asset Management

- Remote asset tracking

- Predictive asset management and monitoring

- Warehouse IoT

- Warehouse management system

- Warehouse control system

- Building Automation system

- Security

- Network Management

- Data Management

- Streaming Analytics

By Platform

- Device Management

- Application Management

- Connectivity Management

By Service

- Professional Service

- Consulting service

- Integration and deployment

- Support and maintenance

- Managed Service

By Transportation Mode

- Roadway

- Railway

- Airway

- Seaway

Connected Logistics Market By Verticals

- Retail

- Manufacturing

- Oil & Energy and Gas

- Pharmaceuticals and Healthcare

- Telecom and IT

- Automotive

- Aerospace and Defense

- Food and Beverage

- Chemical

- Others

By Region

- North America

- Europe

- Asia-Pacific (APAC)

- Middle East and Africa (MEA)

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customization as per the company’s specific requirements. The following customization options are available for the report:

Geographic Analysis

- Further country level breakdown of the North American connected logistics market

- Further country level breakdown of the European market

- Further country level breakdown of the APAC market

- Further country level breakdown of the MEA market

- Further country level breakdown of the Latin American market

Company Information

- Detailed analysis and profiling of additional market players

The connected logistics market solutions and services offer a pro-active and real-time monitoring of supply chain activities specifically logistics and warehouse related activities, providing comprehensive control over various tasks in the supply chain ecosystem. The security solution is growing rapidly owing to the increasing adoption of IoT logistics solutions and growing security concerns.

The connected logistics market is broadly classified into software, platform, service, transportation mode, verticals, and regions. The software segment is further divided into asset management solutions, warehouse IoT solutions, security solution, data management, and network management and streaming analytics. Compared to solutions, the services segment is expected to grow at a higher CAGR during the forecast period. The services in the market are aimed at enabling smart and coordinated decision-making processes and mitigating the risks and vulnerabilities of Internet of Things (IoT) in logistics using efficient tools and techniques. Moreover, these services enhance data management techniques and help to meet the end-to-end needs of all the verticals.

The security solution is expected to grow at the highest CAGR during the forecast period, as it is specifically focused on data security, which is the prime need of logistics companies. As IoT solutions offer an extremely connected system, data security solutions make sure all the data is secure. Rising incidents of data theft and data tampering have urged companies to purchase security solutions thereby causing them to grow at a high rate as compared to other solutions.

With the increasing usage of numerous devices across enterprises, various advanced threats have also evolved and the need to maintain the safety and confidentiality of data has become crucial. Due to the large number of devices connected in a connected system, tampering with even a single device in the network can turn out to be a potential threat for the company. connected logistics market devices need a dedicated security solution as this need cannot be met by PC security solutions for IoT embedded devices.

Applications areas in asset management, warehouse internet of things, data management, and network management drive growth in connected logistics market.

Asset Management

Asset management solution is safe, reliable, substantial, and an efficient approach to manage the entire logistics facility. It includes route plans for resources, timescales, route asset strategies, & a detailed plan to optimize the delivery of renewals, maintenance, and enhancement. Asset management solution assists freight and infrastructure managers to address issues, such as improvement in service availability performance & utilization for mobile, fixed, reducing service failures & delay minutes, and minimized asset costs. Asset management includes all the systems, procedures, methods, and tools to optimize performance, costs, & risks for the entire infrastructure lifecycle. The system helps reduce the operational cost of infrastructure assets and ensures top-notch performance, which elevates the reliability upon the service.

Warehouse Internet of Things

The increasing integration of ICT and IoT has provided transportation and logistics industry, a new opportunity to automate equipment & infrastructure for improving the operational efficiency. The influence of IoT has changed the trend of the logistic industry by impacting warehousing operations, freight transportation, and timely-delivery. The prime shift has taken place in the transportation and logistics operation transparency. Today, logistics system has become transparent and hence customers have a complete visibility to track shipment details in real-time, forcing logistics companies maintain high quality of goods and shipping condition throughout the supply chain.

Data Management

Data management solution is a vital part of the logistics industry. It is essential for running supply chain, production facility, and transportation services & delivery. With the increasing number of connected devices, the amount of data is also increasing across various industry verticals. In the IoT segment, data management solution helps IoT devices to collect enormous amounts of data and draw insights out of raw data which could help improve the industry’s efficiency. Hence, to extract insights from a bulk data, organizations require data management solutions to manage structured and unstructured data. Data management performs operation in six steps, such as data identification, gathering, authentication, storage, analysis, and generating information for making decisions

Network Management

Network management solution manages the entire network of an organization and ensures 24/7 IT services for users. These IT solutions manage, optimize, & analyze logistics networks, including production house, warehouses, and goods distribution centers for retailer & transport. For connected logistics, IoT solutions comprise portable devices that support different wireless technologies and communication protocols. These devices cover large area and functions, even in harsh environments. Hence, these devices need continuous monitoring and controlling to ensure smooth business operations, product security, and employee safety. The network management solution also assists in data analysis, while transferring over a network and automatically routes them to avoid congestion, which could cause network crashing. With the help of a network administrator, the solution can easily detect network failures and resolve issues in real-time or by informing the support personnel. In transportation & logistics applications, a fast and seamless data transfer is required. Therefore, the network management solution offers many benefits, such as better network connectivity, reducing rates & transportation costs, saves time & improves transportation service to boost customer satisfaction, and safety & security.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry applications catered by IoT operating systems?

Lack of uniform governance standards is a major restraining factor for the growth of the connected logistics market. However, the recent developments such as new service launches and acquisitions undertaken by the major market players are expected to boost the market growth.

The connected logistics market is growing rapidly and is being widely accepted across the regions. The solutions and services that connected logistics offers are proving to be very efficient for getting optimum production with minimal utilization of the resources. There are several established players in this market such as AT&T, Inc., (Texas, U.S.), Eurotech S.P.A (Italy, Europe), IBM Corporation (New York, U.S.), Intel Corporation (California, U.S.), SAP SE (Walldorf, Germany), Infosys Ltd., (Bengaluru, India), Cisco Systems, Inc., (California, U.S.), HCL Technologies Ltd. (Noida, India), Orbcom Inc. (New Jersey, U.S.), Cloud Logistics (Florida U.S.) and Freightgate Inc. (California, U.S.).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Attractive Market Opportunities in the Connected Logistics Market During the Forecast Period

4.2 Market Share Across Various Regions

4.3 Market By Vertical and Region

4.4 Lifecycle Analysis, By Region, 2016

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Software

5.2.2 By Platform

5.2.3 By Service

5.2.4 By Transportation Mode

5.2.5 By Vertical

5.2.6 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Decreasing Cost of Sensors

5.3.1.2 Need for Operational Efficiency

5.3.1.3 Emergence of IoT Connecting Devices

5.3.2 Opportunities

5.3.2.1 Increase in Number of High-Tech Vehicles

5.3.2.2 Increasing Innovation in Mobile Technologies

5.3.2.3 Increasing Logistics Transparency

5.3.3 Restraints

5.3.3.1 Lack of Uniform Governance Standards

5.3.4 Challenges

5.3.4.1 Logistics Security and Safety Issues

5.3.4.2 Lack of Data Management and Interoperability

6 Connected Logistics Market Industry Trends (Page No. - 43)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Evolution of IoT

6.4 Evolution of Logistics

6.5 Strategic Benchmarking

7 Market Analysis, By Component (Page No. - 47)

7.1 Introduction

8 Market Analysis, By Software (Page No. - 49)

8.1 Introduction

8.2 Asset Management

8.2.1 Remote Asset Management

8.2.2 Predictive Asset Maintenance and Monitoring

8.3 Warehouse Internet of Things

8.3.1 Building Automation System (BAS)

8.3.2 Warehouse Management System (WMS)

8.3.3 Warehouse Control System (WCS)

8.4 Security

8.5 Data Management

8.6 Network Management

8.7 Streaming Analytics

9 Connected Logistics Market Analysis, By Platform (Page No. - 58)

9.1 Introduction

9.2 Device Management Platform

9.3 Application Enablement Platform (AEP)

9.4 Network Management Platform

10 Market Analysis, By Service (Page No. - 63)

10.1 Introduction

10.2 Professional Services

10.2.1 Consulting Services

10.2.2 Integration and Deployment Services

10.2.3 Support and Maintenance

10.3 Managed Services

11 Market Analysis, By Transportation Mode (Page No. - 71)

11.1 Introduction

11.2 Roadways

11.3 Railways

11.4 Airways

11.5 Seaways

12 Connected Logistics Market Analysis, By Vertical (Page No. - 77)

12.1 Introduction

12.2 Retail

12.3 Manufacturing

12.4 Oil, Gas, and Energy

12.5 Pharmaceuticals and Healthcare

12.6 Telecom and Information Technology

12.7 Automotive

12.8 Aerospace and Defense

12.9 Food and Beverage

12.10 Chemicals

12.11 Others

13 Geographic Analysis (Page No. - 87)

13.1 Introduction

13.2 North America

13.3 Europe

13.4 Asia-Pacific

13.5 Middle East and Africa

13.6 Latin America

14 Competitive Landscape (Page No. - 109)

14.1 Overview

14.2 Competitive Situations and Trends

14.2.1 Partnerships, Agreements, and Collaborations

14.2.2 New Product Launches

14.2.3 Mergers and Acquisitions

15 Company Profiles (Page No. - 113)

15.1 Introduction

(Overview, Financials, Products & Services, Strategy, and Developments)*

15.2 AT&T, Inc.

15.3 Eurotech S.P.A.

15.4 IBM Corporation

15.5 Intel Corporation

15.6 SAP SE

15.7 Infosys Limited

15.8 Cisco Systems, Inc.

15.9 HCL Technologies Limited

15.10 Orbcomm Inc.

15.11 Cloud Logistics

15.12 Freightgate Inc.

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Companies.

16 Appendix (Page No. - 140)

16.1 Industry Excerpts

16.2 Discussion Guide

16.3 Knowledge Store: MarketsandMarkets’ Subscription Portal

16.4 Introducing RT: Real-Time Market Intelligence

16.5 Available Customizations

16.6 Related Reports

16.7 Author Details

List of Tables (79 Tables)

Table 1 Global Connected Logistics Market Size, By Component, 2015–2021 (USD Billion)

Table 2 Market Size, By Component, 2015–2021 (USD Million)

Table 3 Market Size, By Software, 2015–2021 (USD Million)

Table 4 Software: Market Size, By Region, 2015–2021 (USD Million)

Table 5 Asset Management: Market Size, By Region, 2015–2021 (USD Million)

Table 6 Warehouse IoT Solutions: Market Size, By Region, 2015–2021 (USD Million)

Table 7 Security: Market Size, By Region, 2015–2021 (USD Million)

Table 8 Data Management: Market Size, By Region, 2015–2021 (USD Million)

Table 9 Network Management: Market Size, By Region, 2015–2021 (USD Million)

Table 10 Streaming Analytics: Market Size, By Region, 2015–2021 (USD Million)

Table 11 Connected Logistics Market Size, By Platform, 2015–2021 (USD Million)

Table 12 Platform: Market Size, By Region, 2015–2021 (USD Million)

Table 13 Device Management Platform: Market Size, By Region, 2015–2021 (USD Million)

Table 14 Application Enablement Platform: Market Size, By Region, 2015–2021 (USD Million)

Table 15 Network Management Platform: Market Size, By Region, 2015–2021 (USD Million)

Table 16 Market Size, By Service, 2015–2021 (USD Million)

Table 17 Services: Market Size, By Region, 2015–2021 (USD Million)

Table 18 Professional Services: Market Size, By Type, 2015–2021 (USD Million)

Table 19 Professional Services: Market Size, By Region, 2015–2021 (USD Million)

Table 20 Consulting Services: Market Size, By Region, 2015–2021 (USD Million)

Table 21 Integration and Deployment Services: Market Size, By Region, 2015–2021 (USD Million)

Table 22 Support and Maintenance: Market Size, By Region, 2015–2021 (USD Million)

Table 23 Managed Services: Market Size, By Region, 2015–2021 (USD Million)

Table 24 Connected Logistics Market Size, By Transportation Mode, 2015–2021 (USD Million)

Table 25 Transportation Mode: Market Size, By Region, 2015–2021 (USD Million)

Table 26 Roadways: Market Size, By Region, 2015–2021 (USD Million)

Table 27 Railways: Market Size, By Region, 2015–2021 (USD Million)

Table 28 Airways: Market Size, By Region, 2015–2021 (USD Million)

Table 29 Seaways: Market Size, By Region, 2015–2021 (USD Million)

Table 30 Connected Logistics Market Size, By Vertical, 2015–2021 (USD Million)

Table 31 Retail: Market Size, By Region, 2015–2021 (USD Million)

Table 32 Manufacturing: Market Size, By Region, 2015–2021 (USD Million)

Table 33 Oil, Gas, and Energy: Market Size, By Region, 2015–2021 (USD Million)

Table 34 Pharmaceuticals and Healthcare: Market Size, By Region, 2015–2021 (USD Million)

Table 35 Telecom and Information Technology: Market Size, By Region, 2015–2021 (USD Million)

Table 36 Automotive: Market Size, By Region, 2015–2021 (USD Million)

Table 37 Aerospace and Defense: Market Size, By Region, 2015–2021 (USD Million)

Table 38 Food and Beverage: Market Size, By Region, 2015–2021 (USD Million)

Table 39 Chemicals: Market Size, By Region, 2015–2021 (USD Million)

Table 40 Others: Market Size, By Region, 2015–2021 (USD Million)

Table 41 Connected Logistics Market Size, By Region, 2015–2021 (USD Million)

Table 42 North America: Market Size, By Component, 2015–2021 (USD Million)

Table 43 North America: Market Size, By Software, 2015–2021 (USD Million)

Table 44 North America: Market Size, By Platform, 2015–2021 (USD Million)

Table 45 North America: Market Size, By Service, 2015–2021 (USD Million)

Table 46 North America: Market Size, By Professional Service, 2015–2021 (USD Million)

Table 47 North America: Market Size, By Transportation Mode, 2015–2021 (USD Million)

Table 48 North America: Market Size, By Vertical, 2015–2021 (USD Million)

Table 49 Europe: Connected Logistics Market Size, By Component, 2015–2021 (USD Million)

Table 50 Europe: Market Size, By Software, 2015–2021 (USD Million)

Table 51 Europe: Market Size, By Platform, 2015–2021 (USD Million)

Table 52 Europe: Market Size, By Service, 2015–2021 (USD Million)

Table 53 Europe: Market Size, By Professional Service, 2015–2021 (USD Million)

Table 54 Europe: Market Size, By Transportation Mode, 2015–2021 (USD Million)

Table 55 Europe: Market Size, By Vertical, 2015–2021 (USD Million)

Table 56 APAC: Market Size, By Component, 2015–2021 (USD Million)

Table 57 Asia-Pacific: Connected Logistics Market Size, By Software, 2015–2021 (USD Million)

Table 58 Asia-Pacific: Market Size, By Platform, 2015–2021 (USD Million)

Table 59 Asia-Pacific: Market Size, By Service, 2015–2021 (USD Million)

Table 60 Asia-Pacific: Market Size, By Professional Service, 2015–2021 (USD Million)

Table 61 Asia-Pacific: Market Size, By Transportation Mode, 2015–2021 (USD Million)

Table 62 Asia-Pacific: Market Size, By Vertical, 2015–2021 (USD Million)

Table 63 Middle East and Africa: Connected Logistics Market Size, By Component, 2015–2021 (USD Million)

Table 64 Middle East and Africa: Market Size, By Software, 2015–2021 (USD Million)

Table 65 Middle East and Africa: Market Size, By Platform, 2015–2021 (USD Million)

Table 66 Middle East and Africa: Market Size, By Service, 2015–2021 (USD Million)

Table 67 Middle East and Africa: Market Size, By Professional Service, 2015–2021 (USD Million)

Table 68 Middle East and Africa: Market Size, By Transportation Mode, 2015–2021 (USD Million)

Table 69 Middle East and Africa: Market Size, By Vertical, 2015–2021 (USD Million)

Table 70 Latin America: Connected Logistics Market Size, By Component, 2015–2021 (USD Million)

Table 71 Latin America: Market Size, By Software, 2015–2021 (USD Million)

Table 72 Latin America: Market Size, By Platform, 2015–2021 (USD Million)

Table 73 Latin America: Market Size, By Service, 2015–2021 (USD Million)

Table 74 Latin America: Market Size, By Professional Service, 2015–2021 (USD Million)

Table 75 Latin America: Market Size, By Transportation Mode, 2015–2021 (USD Million)

Table 76 Latin America: Market Size, By Vertical, 2015–2021 (USD Million)

Table 77 Partnerships, Agreements, and Collaborations, 2015–2017

Table 78 New Product Launches, 2014–2016

Table 79 Mergers and Acquisitions, 2014–2016

List of Figures (50 Figures)

Figure 1 Connected Logistics Market: Research Design

Figure 2 Breakdown of Primary Interviews

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Market Breakdown and Data Triangulation

Figure 6 Connected Logistics Component Snapshot: Market for Services is Expected to Grow at the Highest CAGR

Figure 7 Connected Logistics Platforms Snapshot (2016): Device Management Platform is Expected to Dominate the Market

Figure 8 Connected Logistics Services Snapshot (2016): Professional Services is Expected to Gain the Largest Market Share as Compared With Managed Services

Figure 9 Increase in Connected Devices and Evolution of High-Speed Networking Technologies is Driving the Market

Figure 10 North America is Expected to Have the Major Share in the Connected Logistics Market in 2016

Figure 11 Food and Beverage Vertical is Expected to Gain the Largest Market Share in 2016

Figure 12 Asia-Pacific is Expected to Enter the Exponential Growth Phase During 2016–2021

Figure 13 Market Segmentation By Software

Figure 14 Market Segmentation By Platform

Figure 15 Market Segmentation By Service

Figure 16 Market Segmentation By Transportation Mode

Figure 17 Market Segmentation: By Vertical

Figure 18 Market Segmentation By Region

Figure 19 Market Drivers, Restraints, Opportunities, and Challenges

Figure 20 Market Value Chain

Figure 21 Evolution of IoT

Figure 22 Evolution of Logistics

Figure 23 Connected Logistics Market Services are Expected to Grow at A Highest CAGR During the Forecast Period

Figure 24 Security Solution is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 25 Device Management is Expected to Have A Larger Market Size During the Forecast Period

Figure 26 Professional Services are Expected to Have A Larger Market Size During the Forecast Period

Figure 27 Integration and Deployment Services are Expected to Have the Largest Market Size in Professional Services Segment During the Forecast Period

Figure 28 Roadway is Expected to Have A Larger Market Size During the Forecast Period

Figure 29 Retail Vertical to Grow at the Highest CAGR During the Forecast Period

Figure 30 Asia-Pacific: an Attractive Destination for the Connected Logistics Market, 2016–2021

Figure 31 North America Snapshot

Figure 32 Asia-Pacific Snapshot

Figure 33 Companies Adopted the Strategy of Partnerships, Agreements, and Collaborations as the Key Growth Strategy From 2015 to 2017

Figure 34 Market Evaluation Framework

Figure 35 Battle for Market Share: the Strategy of Partnerships, Agreements, and Collaborations Was the Key Strategy Adopted By Key Players in the Connected Logistics Market During the Period 2014–2017

Figure 36 Geographic Revenue Mix of Top Five Market Players

Figure 37 AT&T, Inc.: Company Snapshot

Figure 38 AT&T, Inc.: SWOT Analysis

Figure 39 Eurotech S.P.A.: Company Snapshot

Figure 40 Eurotech S.P.A.: SWOT Analysis

Figure 41 IBM Corporation: Company Snapshot

Figure 42 IBM Corporation: SWOT Analysis

Figure 43 Intel Corporation: Company Snapshot

Figure 44 Intel Corporation: SWOT Analysis

Figure 45 SAP SE: Company Snapshot

Figure 46 SAP SE: SWOT Analysis

Figure 47 Infosys Limited: Company Snapshot

Figure 48 Cisco Systems Inc.: Company Snapshot

Figure 49 HCL Technologies Limited: Company Snapshot

Figure 50 Orbcomm: Company Snapshot

Growth opportunities and latent adjacency in Connected Logistics Market

Interested in market size of US ecommerce retail segment

Market trends in sustainability of transport and logistics enterprises

Interested in connected logistics