This research study involved extensive secondary sources, directories, and databases, such as Bloomberg BusinessWeek, EconoTimes, and Factiva, to identify and collect information useful for this technical, market-oriented, and commercial software asset management market. The global software asset management market is obtained by evaluating its penetration among the major vendors and their offerings in this market. We interviewed a few startups and private companies to gain better visibility and in-depth knowledge of the market across regions. In addition, we referred to a few government associations, public sources, conferences, webinars, journals, magazines, articles, and MarketsandMarkets' internal repository to arrive at the closest/actual market size.

Secondary Research

We determined the market size of companies offering software asset management based on secondary data available through paid and unpaid sources. It was also arrived at by analyzing the product portfolios of major companies and rating the companies based on their performance and quality.

In the secondary research process, various sources were referred to to identify and collect information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. We collected data from other secondary sources, such as journals, government websites, blogs, and vendors' websites. Additionally, the spending of various countries on software asset management was extracted from the respective sources. We used secondary research to obtain the critical information related to the industry's value chain and supply chain to identify the key players based on solutions, services, market classification, and segmentation according to offerings of the major players, industry trends related to offerings, verticals, and regions, and the key developments from both market- and technology-oriented perspectives.

Primary Research

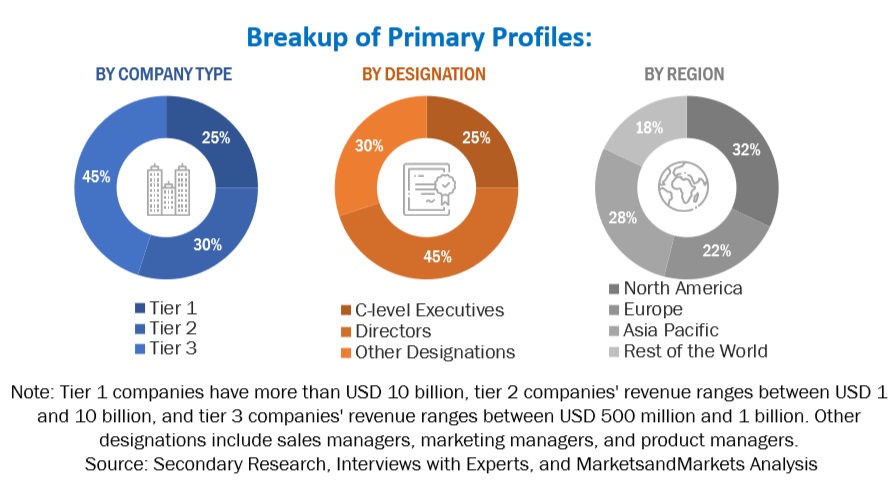

In the primary research process, we interviewed various sources from the supply and demand sides to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related executives from software asset management vendors, industry associations, and independent consultants; and key opinion leaders.

We conducted primary interviews to gather insights, such as market statistics, the latest trends disrupting the market, new use cases implemented, data on revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped me understand various trends related to technology, offerings, end users, and regions. Demand-side stakeholders, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs), and digital initiatives project teams, were interviewed to understand the buyer's perspective on suppliers, products, service providers, and their current use, which would affect the overall software asset management market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

We used top-down and bottom-up approaches to estimate and forecast the software asset management and other dependent submarkets. We deployed a bottom-up procedure to arrive at the overall market size using the revenues and offerings of key companies in the market. With data triangulation methods and validation through primary interviews, this study determined and confirmed the exact value of the overall parent market size. We used the overall market size in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segments.

We used top-down and bottom-up approaches to estimate and validate the software asset management market and other dependent subsegments.

The research methodology used to estimate the market size included the following details:

-

We identified key players in the market through secondary research and determined their revenue contributions in respective regions through primary and secondary research.

-

This procedure included studying top market players' annual and financial reports and extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives.

-

All percentage splits and breakups were determined using secondary sources and verified through primary sources.

All the possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

Software Asset Management Market: Top-down and Bottom-up approaches

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size, the market was split into several segments and subsegments—using the market size estimation processes as explained above. Where applicable, data triangulation and market breakup procedures were employed to complete the overall market engineering process and determine each market segment's and subsegment's exact statistics. The data was triangulated by studying several factors and trends from the demand and supply sides in the software asset management market.

Market Definition

Considering the views of various sources and associations, software asset management is a comprehensive strategy and set of practices aimed at managing and optimizing the purchase, deployment, maintenance, utilization, and disposal of software applications within an organization. The primary goals of software asset management include ensuring compliance with software licensing agreements, reducing IT costs, enhancing security, and improving overall operational efficiency. Software asset management deals with managing the lifecycle of software right from its purchase to usage and finally retiring the software from the enterprise infrastructure. These solutions also assist in optimizing the cost of spending on software.

As per ServiceNow, software asset management accounts for all software, both virtual and non-virtual, along the software lifecycle. Software asset management is more tactical, focusing on balancing and accounting for licenses and agreements purchased in addition to the software in use. Software assets are managed to ensure that all software usage is in line with the software vendor's terms and conditions and other conditions.

According to USU Software, software asset management is a business strategy for reclaiming budget and maximizing savings by actively controlling and automating procurement, usage, and deployment of software licenses.

As per Lansweeper, SAM manages and optimizes an organization's software assets. SAM involves the effective and efficient management of software licensing, installations, and usage throughout the software lifecycle, from acquisition to retirement. SAM is an essential practice for organizations because it helps ensure compliance with licensing agreements and improve risk management, eliminating legal and financial penalties for non-compliance. It also helps with decision-making and enables organizations to save costs by eliminating redundant software licensing, optimizing software usage, and negotiating better licensing agreements with software vendors.

Key Stakeholders

-

Software asset management providers

-

Regulators

-

Professional service providers

-

Managed Service Providers (MSPs)

-

System integrators

-

Cloud platform providers

-

Resellers and distributors

-

Investors and venture capitalists

-

Third-party software vendors

-

Consultants/consultancies/advisory firms

-

Support and maintenance service providers

-

Information technology (IT) infrastructure providers

-

Regional associations

-

Independent software vendors

Report Objectives

-

To define, describe, and forecast the software asset management market based on offerings (solutions, services), deployment models, organization sizes, verticals, and regions

-

To provide detailed information about the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

-

To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

-

To forecast the market size concerning five regions: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

-

To analyze the subsegments of the market concerning individual growth trends, prospects, and contributions to the overall market

-

To profile the key players of the market and comprehensively analyze their market size and core competencies

-

To track and analyze the competitive developments, such as product enhancements, product launches, acquisitions, partnerships, and collaborations, in the software asset management market globally

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company's specific needs. The following customization options are available for the report:

Product analysis

-

The product matrix provides a detailed comparison of each company's product portfolio.

Geographic analysis

-

Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

-

Further breakup of the North American market into countries contributing 75% to the regional market size

-

Further breakup of the Latin American market into countries contributing 75% to the regional market size

-

Further breakup of the Middle Eastern & African market into countries contributing 75% to the regional market size

-

Further breakup of the European market into countries contributing 75% to the regional market size

ompany information

-

Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Software Asset Management Market