Contact Adhesive Market by Resin Type (Neoprene, Polyurethane, Acrylic, SBC), Technology (Solvent-Based, Water-Based), End-use Industry (Woodworking, Leather & Footwear, Automotive), Region (North America, Europe, APAC, MEA)- Global Forecast to 2028

Updated on : February 13, 2025

Contact Adhesives Market

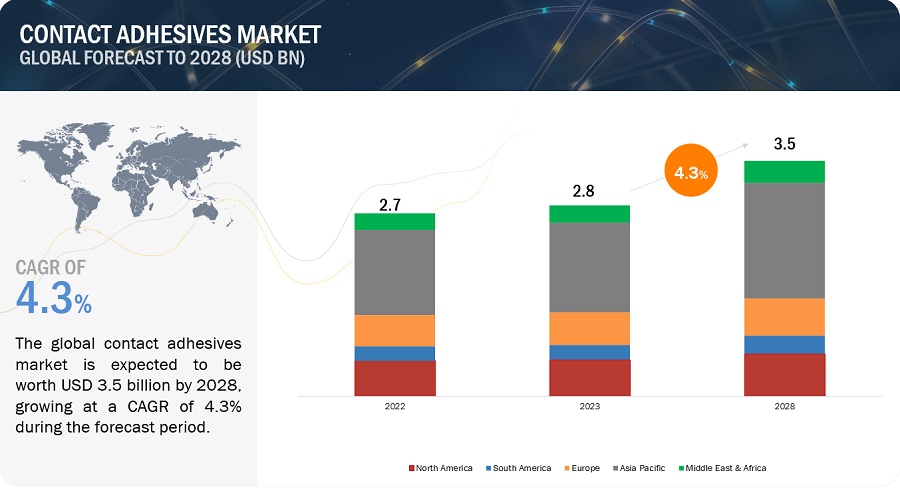

The contact adhesives market was valued at USD 2.8 billion in 2023 and is projected to reach USD 3.5 billion by 2028, growing at 4.3% cagr from 2023 to 2028. The market is expected to be driven by the growth in emerging economies. Because of the expansion of the building sector in these countries, there is a need for contact adhesives in growing economies such as Brazil, China, India, and Malaysia; renovations also play an important part in the market for contact adhesives. With urbanization and increased knowledge of the benefits of contact adhesives, the contact adhesives market in these nations is expected to rise faster than in established regions. The contact adhesives market is being driven by expanding economies and rising demand for environmentally friendly goods. The growing usage of contact adhesives in the woodworking sector is likely to open up new market prospects.

Attractive Opportunities in the Contact Adhesives Market

To know about the assumptions considered for the study, Request for Free Sample Report

Contact Adhesives Market Dynamics

Driver: The contact adhesives market in Asia Pacific, South America, and the Middle East, and Africa is expanding due to rising population, increased awareness of adhesive products, and favorable economic conditions. Contact adhesive product adoption is increasing in emerging nations, and this trend is projected to continue over the projection period. The growing knowledge of the benefits of adhesives in the woodworking, automotive, leather & footwear, and construction sectors will give opportunities for growth in these markets. Furthermore, the need for furniture, wood flooring, and windows and doors is increasing, which will boost the contact adhesives market. The Asia Pacific contact adhesives market is primarily driven by China and India, which are seeing significant expansion due to their large populations and high demand for furniture, hardwood flooring, cabinets, and other wood items. These contact adhesives are used in the woodworking industry to maintain antique furniture, flooring, and windows and doors. Flexible environmental rules, as well as cheap labor and production costs, are boosting the Asia Pacific, Middle East & Africa, and South America contact adhesives markets.

Restraints: Environmental rules govern the manufacture of chemical and petroleum-based goods in Europe and North America. The manufacture of solvent-based goods in these regions is governed by organizations such as the Epoxy Resin Committee (ERC) and the European Commission (EC). This has an impact on manufacturing capacity in Europe and North America. Environmental laws are driving manufacturers to work on manufacturing environmentally friendly adhesives. Control of Substances Hazardous to Health (COSHH), the European Union (EU), Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH), the Globally Harmonized System (GHS), and the Environmental Protection Agency (EPA) in Europe and North America also regulate the chemical industry. To limit VOC emissions, manufacturers in Europe and North America must follow laws governing the manufacturing and use of plastic adhesives in various applications. To establish compliance, manufacturers must shoulder an additional weight of labeling, documentation, and additional costs for external testing. Plastic glue makers must follow the norms and changing requirements in order to commercialize their goods. Manufacturers are restrained as a result of this.

Opportunity: Emerging economies are spending heavily on large-scale infrastructure projects. These economies' marketplaces are growing faster than those in North America and Europe. This is due to major corporations spending extensively in these locations, where there is a huge opportunity. Asia Pacific, particularly China, and India, offers tremendous development potential for contact adhesives makers. In various Asia Pacific nations, rapid urbanization, a stable economy, and a booming building industry have boosted demand for contact adhesives. More residential structures are being built in the region to fulfill the demands of the region's rising population in major cities such as Jakarta, Malaysia, Thailand, and Vietnam.

Challenges: Stringent regulatory requirements drive the adhesives business. Manufacturers of contact adhesives must adhere to VOC regulations at the municipal, state, national, and international levels. As a result, many contact adhesive providers will have to invest considerably in order to redesign their processes in order to comply with the new rules.

To acquire commercial acceptance, each new low-VOC glue must meet the performance requirements specified by ASTM International in the United States. The ASTM Technical Committee D14 on Adhesives defines standard criteria for adhesives and materials used in adhesive compounding, as well as conducts adhesive and adhesion research, including elucidation of the nature of adhesion.

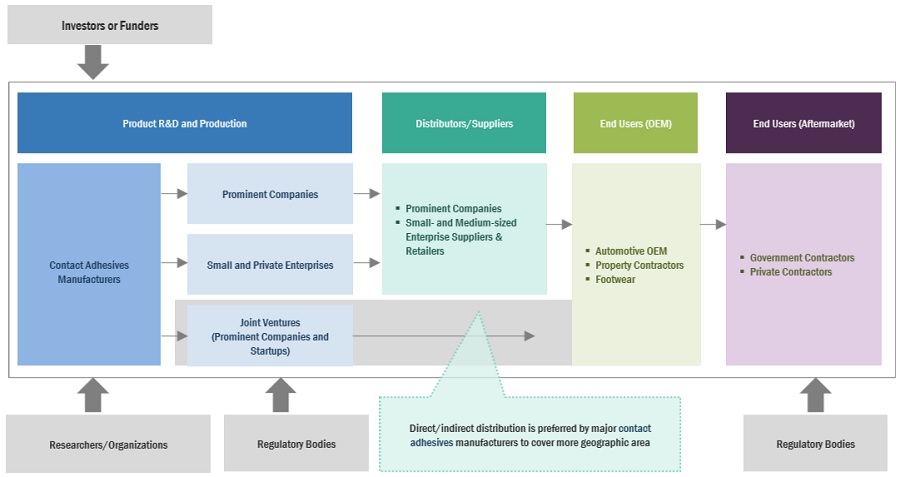

Contact Adhesives Market Ecosystem

Based on technology, the water-based segment is estimated to account for the highest CAGR in the contact adhesives market

Water-based adhesives are the most common type of glue. These are poly (vinyl acetate) emulsions, which are a stable suspension of poly (vinyl acetate) particles in water. Water-based adhesives often comprise water-soluble protective colloids such as poly (vinyl alcohol) or 2-hydroxyethyl cellulose ether and can be further compounded with plasticizers, fillers, solvents, deformers, and preservatives. They have a good combination of heat and cold resistance and have a low odor, color, and toxicity. The equipment required to apply them is easy to use and affordable. Furthermore, they are cost-effective and quite stable. Water-based contact adhesives are environmentally benign and are increasingly being employed in a variety of sectors.

Based on resin type, the acrylic segment is estimated to account for one of the highest CAGR in the contact adhesives market

Acrylic-based contact adhesives are created by polymerizing acrylate and methyl methacrylate monomers. They compete with epoxies because they may operate on filthy or poorly prepared surfaces and provide high strength when cured. They are divided into two types: one-component adhesives and two-component adhesives. These adhesives are utilized in many sectors, including construction, automotive, woodworking, bookbinding, leather & footwear, and others. Acrylic-based contact adhesives provide qualities such as sunlight resistance, temperature fluctuation stability, and water and humidity resistance. Acrylic-based contact adhesives, particularly acrylic polymer emulation, are in high demand because of their numerous uses in a wide range of industries. The increased need for better performance, durability, and ease-of-use goods are driving the expansion of the acrylic-based contact adhesives market.

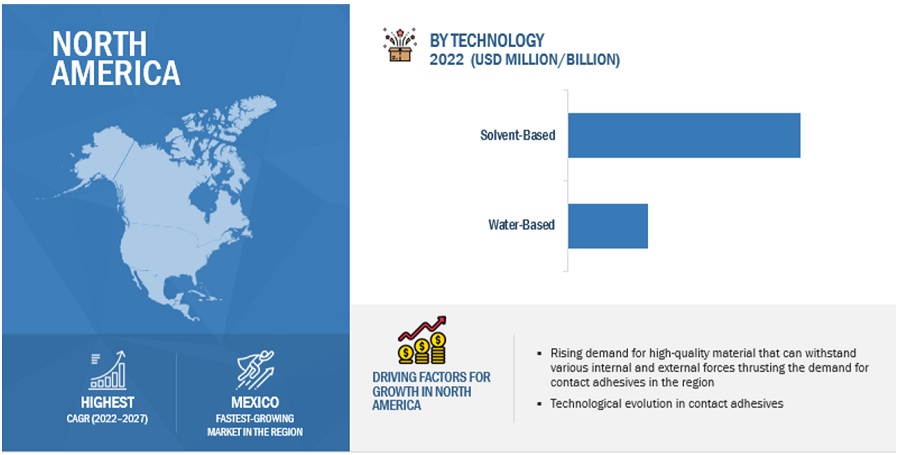

The North American market is projected to contribute one of the largest shares of the contact adhesives market.

The technical improvements in the construction industry drive the North American market for contact adhesives. The United States is expected to be the largest consumer of contact adhesive goods, with the greatest market share in terms of both value and volume among all North American nations. Mexico, despite its modest size, has shown encouraging demand, which is projected to continue in the future. The contact adhesives market in the United States is expected to rise at a rapid 3.1% CAGR during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

Contact Adhesives Market Players

Henkel AG (Germany), H.B. Fuller (US), Sika AG (Switzerland), Arkema (Bostik SA) (France), 3M (US), Huntsman Corporation (US), Illinois Tool Works Inc. (US), and Pidilite Industries Limited (India) are the key players operating in the global market.

Read More: Contact Adhesive Companies

Contact Adhesives Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2023 |

USD 2.8 Billion |

|

Revenue Forecast in 2028 |

USD 3.5 Billion |

|

CAGR |

4.3% |

|

Market size available for years |

2019-2028 |

|

Base year considered |

2022 |

|

Forecast Period |

2023-2028 |

|

Forecast Units |

Value (USD Billion) |

|

Segments Covered |

By Technology, By Resin Type, By End-Use Industry, and By Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, South America, and Middle East & Africa |

|

Companies covered |

Henkel AG (Germany), H.B. Fuller (US), Sika AG (Switzerland), Arkema (Bostik SA) (France), 3M (US), Huntsman Corporation (US), Illinois Tool Works Inc. (US), and Pidilite Industries Limited (India) |

Based on technology, the contact adhesives market has been segmented as follows:

- Water-Based

- Solvent-Based

Based on resin types, the contact adhesives market has been segmented as follows:

- Neoprene

- Polyurethane

- Acrylic

- SBC

- Others

Based on the end-use industry, the contact adhesives market has been segmented as follows:

- Construction

- Automotive

- Woodworking

- Leather & Footwear

- Others

Based on the region, the contact adhesives market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Frequently Asked Questions (FAQ):

What is the current competitive landscape in the contact adhesives market in terms of new applications, production, and sales?

Various major, medium-sized, and small-scale business firms operate in the industry on a global basis. Numerous companies are always inventing and producing new items, as well as moving into developing regions where demand is increasing, resulting in increased sales.

Which countries contribute more to the contact adhesives market?

US, UK, Canada, and Germany are major countries considered in the report.

What is the total CAGR expected to be recorded for the contact adhesives market during 2023-2028?

The CAGR is expected to record 4.3% from 2023-2028

Does this report cover the different resin type of the contact adhesives market?

Yes, the report covers the different resin type of contact adhesives.

Does this report cover the different technology of contact adhesives?

Yes, the report covers different technology of contact adhesives.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Significant demand for contact adhesives from construction sector- Economic growth and low manufacturing costsRESTRAINTS- Strict environmental laws for chemical and petroleum productsOPPORTUNITIES- Investments in large-scale infrastructure development projectsCHALLENGES- Volatile raw material prices- Stringent regulatory requirements

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 MACROECONOMIC INDICATORSINTRODUCTIONGDP TRENDS AND FORECASTGROWTH OF GLOBAL CONSTRUCTION SECTORTRENDS IN AUTOMOTIVE SECTOR

-

5.5 GLOBAL ECONOMIC SCENARIORUSSIA–UKRAINE WARCHINA- China’s debt issue- Australia–China trade war- Demand for sustainabilityEUROPE- Energy crisis in Europe

- 5.6 SUPPLY CHAIN ANALYSIS

-

5.7 PATENT ANALYSISMETHODOLOGYPUBLICATION TRENDSJURISDICTION ANALYSISTOP APPLICANTS

- 6.1 INTRODUCTION

-

6.2 SOLVENT-BASEDAPPLICATION IN WOODWORKING SUBSTRATES TO DRIVE MARKET

-

6.3 WATER-BASEDRESISTANCE TO EXTREME TEMPERATURES TO FUEL MARKET

- 7.1 INTRODUCTION

-

7.2 NEOPRENECOMMERCIALIZATION OF NATURAL ADHESIVES TO FUEL MARKET

-

7.3 POLYURETHANEWIDE USE IN AUTOMOTIVE WINDSHIELDS TO DRIVE MARKET

-

7.4 ACRYLICINCREASING USE IN AUTOMOTIVE AND CONSTRUCTION SECTORS TO DRIVE MARKET

-

7.5 STYRENE BUTADIENE COPOLYMERRESISTANCE TO HIGH TEMPERATURE TO FUEL MARKET

- 7.6 OTHER RESINS

- 8.1 INTRODUCTION

-

8.2 WOODWORKINGGROWING DEMAND FROM FURNITURE INDUSTRY TO DRIVE MARKET

-

8.3 AUTOMOTIVETECHNOLOGICAL ADVANCEMENTS IN ELECTRIC VEHICLES TO FUEL DEMAND FOR ADHESIVES

-

8.4 LEATHER & FOOTWEARHIGH PRODUCTION OF FOOTWEAR TO BOOST DEMAND FOR ADHESIVES

-

8.5 CONSTRUCTIONDEVELOPMENT OF SMART CITIES AND MEGA PROJECTS TO DRIVE MARKET

- 8.6 OTHER END USE INDUSTRIES

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICARECESSION IMPACT ON NORTH AMERICAUS- Increase in residential and nonresidential construction activities to boost marketCANADA- Growth of automotive sector to drive marketMEXICO- Development of tourism infrastructure to drive market

-

9.3 EUROPERECESSION IMPACT ON EUROPEGERMANY- Innovation in automotive designs to drive marketFRANCE- Development of affordable houses to fuel demand for adhesivesUK- Surge in construction activities to drive marketRUSSIA- High demand for residential construction to drive marketITALY- Manufacture of high-quality products to fuel demand for natural adhesivesTURKEY- Rapid urbanization and increase in purchasing power to drive marketREST OF EUROPE

-

9.4 ASIA PACIFICRECESSION IMPACT ON ASIA PACIFICCHINA- Increase in foreign investments to drive marketINDIA- Government initiatives for economic growth to fuel marketJAPAN- Investments in commercial infrastructure to drive marketSOUTH KOREA- Expansion of intra-regional trade to fuel demand for adhesivesTHAILAND- Increasing use of architectural coating products to drive marketTAIWAN- Growth of woodworking industry to fuel marketMALAYSIA- Positive economic outlook and new investments to drive marketREST OF ASIA PACIFIC

-

9.5 SOUTH AMERICARECESSION IMPACT ON SOUTH AMERICABRAZIL- Construction of new infrastructure to fuel demand for contact adhesivesARGENTINA- Availability of low-cost raw materials and labor to drive marketCOLOMBIA- Presence of leading end use industries to drive marketREST OF SOUTH AMERICA

-

9.6 MIDDLE EAST & AFRICAUAE- Growth of automotive sector to fuel marketSAUDI ARABIA- Mega housing projects to fuel demand for adhesivesSOUTH AFRICA- New urban policies and strategic acquisitions to drive marketREST OF MIDDLE EAST & AFRICA

- 10.1 OVERVIEW

-

10.2 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPARTICIPANTSPERVASIVE PLAYERS

- 10.3 STRENGTH OF PRODUCT PORTFOLIO

- 10.4 MARKET RANKING ANALYSIS

- 10.5 REVENUE ANALYSIS

- 10.6 COMPETITIVE SCENARIO

-

11.1 KEY PLAYERSHENKEL AG & CO. KGAA- Business overview- Products offered- Recent developments- MnM viewH.B. FULLER COMPANY- Business overview- Products offered- Recent developments- MnM viewSIKA AG- Business overview- Products offered- Recent developments- MnM viewARKEMA- Business overview- Products offered- Recent developments- MnM view3M- Business overview- Products offered- MnM viewHUNTSMAN INTERNATIONAL LLC- Business overview- Products offered- Recent developmentsILLINOIS TOOL WORKS INC.- Business overview- Products offeredPIDILITE INDUSTRIES LTD.- Business overview- Products offeredJUBILANT INDUSTRIES LTD.- Business overview- Products offeredASHLAND- Business overview- Products offered

-

11.2 OTHER PLAYERSMAPEI S.P.A.- Company overview- Products offeredDELO INDUSTRIE KLEBSTOFFE GMBH & CO. KGAA- Company overview- Products offeredDOW- Company overview- Products offeredCOLLANO AG- Company overview- Products offeredHELMITIN ADHESIVES- Company overview- Products offeredPARKER HANNIFIN CORP (PARKER LORD)- Company overview- Products offeredJOWAT SE- Company overview- Products offeredALPHA ADHESIVES- Company overview- Products offeredHP ADHESIVES- Company overview- Products offeredCATTIE ADHESIVES- Company overview- Products offeredSANVO- Company overview- Products offeredUNECOL SL- Company overview- Products offeredASTRAL CSL- Company overview- Products offeredRENIA GMBH- Company overview- Products offered

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 CONTACT ADHESIVES MARKET SNAPSHOT

- TABLE 2 CONTACT ADHESIVES MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 3 GDP TRENDS AND FORECAST, 2020–2027

- TABLE 4 AUTOMOTIVE PRODUCTION, 2020–2021

- TABLE 5 TOP PATENT OWNERS

- TABLE 6 CONTACT ADHESIVES MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 7 CONTACT ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 8 CONTACT ADHESIVES MARKET, BY TECHNOLOGY, 2019–2022 (KILOTON)

- TABLE 9 CONTACT ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 10 SOLVENT-BASED: CONTACT ADHESIVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 11 SOLVENT-BASED: CONTACT ADHESIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 12 SOLVENT-BASED: CONTACT ADHESIVES MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 13 SOLVENT-BASED: CONTACT ADHESIVES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 14 WATER-BASED: CONTACT ADHESIVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 15 WATER-BASED: CONTACT ADHESIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 16 WATER-BASED: CONTACT ADHESIVES MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 17 WATER-BASED: CONTACT ADHESIVES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 18 CONTACT ADHESIVES MARKET, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 19 CONTACT ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 20 CONTACT ADHESIVES MARKET, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 21 CONTACT ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 22 NEOPRENE: CONTACT ADHESIVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 23 NEOPRENE: CONTACT ADHESIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 24 NEOPRENE: CONTACT ADHESIVES MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 25 NEOPRENE: CONTACT ADHESIVES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 26 POLYURETHANE: CONTACT ADHESIVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 27 POLYURETHANE: CONTACT ADHESIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 POLYURETHANE: CONTACT ADHESIVES MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 29 POLYURETHANE: CONTACT ADHESIVES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 30 ACRYLIC: CONTACT ADHESIVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 31 ACRYLIC: CONTACT ADHESIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 ACRYLIC: CONTACT ADHESIVES MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 33 ACRYLIC: CONTACT ADHESIVES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 34 SBC: CONTACT ADHESIVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 35 SBC: CONTACT ADHESIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 SBC: CONTACT ADHESIVES MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 37 SBC: CONTACT ADHESIVES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 38 OTHER RESINS: CONTACT ADHESIVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 39 OTHER RESINS: CONTACT ADHESIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 OTHER RESINS: CONTACT ADHESIVES MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 41 OTHER RESINS: CONTACT ADHESIVES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 42 CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 43 CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 44 CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 45 CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 46 WOODWORKING: CONTACT ADHESIVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 47 WOODWORKING: CONTACT ADHESIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 48 WOODWORKING: CONTACT ADHESIVES MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 49 WOODWORKING: CONTACT ADHESIVES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 50 AUTOMOTIVE: CONTACT ADHESIVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 51 AUTOMOTIVE: CONTACT ADHESIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 AUTOMOTIVE: CONTACT ADHESIVES MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 53 AUTOMOTIVE: CONTACT ADHESIVES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 54 LEATHER & FOOTWEAR: CONTACT ADHESIVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 55 LEATHER & FOOTWEAR: CONTACT ADHESIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 56 LEATHER & FOOTWEAR: CONTACT ADHESIVES MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 57 LEATHER & FOOTWEAR: CONTACT ADHESIVES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 58 CONSTRUCTION: CONTACT ADHESIVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 59 CONSTRUCTION: CONTACT ADHESIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 CONSTRUCTION: CONTACT ADHESIVES MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 61 CONSTRUCTION: CONTACT ADHESIVES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 62 OTHER END USE INDUSTRIES: CONTACT ADHESIVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 63 OTHER END USE INDUSTRIES: CONTACT ADHESIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 64 OTHER END USE INDUSTRIES: CONTACT ADHESIVES MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 65 OTHER END USE INDUSTRIES: CONTACT ADHESIVES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 66 CONTACT ADHESIVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 67 CONTACT ADHESIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 68 CONTACT ADHESIVES MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 69 CONTACT ADHESIVES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 70 NORTH AMERICA: CONTACT ADHESIVES MARKET, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 71 NORTH AMERICA: CONTACT ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 72 NORTH AMERICA: CONTACT ADHESIVES MARKET, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 73 NORTH AMERICA: CONTACT ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 74 NORTH AMERICA: CONTACT ADHESIVES MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 75 NORTH AMERICA: CONTACT ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 76 NORTH AMERICA: CONTACT ADHESIVES MARKET, BY TECHNOLOGY, 2019–2022 (KILOTON)

- TABLE 77 NORTH AMERICA: CONTACT ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 78 NORTH AMERICA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 79 NORTH AMERICA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 80 NORTH AMERICA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 81 NORTH AMERICA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 82 NORTH AMERICA: CONTACT ADHESIVES MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 83 NORTH AMERICA: CONTACT ADHESIVES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 84 NORTH AMERICA: CONTACT ADHESIVES MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 85 NORTH AMERICA: CONTACT ADHESIVES MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 86 US: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 87 US: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 88 US: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 89 US: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 90 CANADA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 91 CANADA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 92 CANADA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 93 CANADA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 94 MEXICO: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 95 MEXICO: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 96 MEXICO: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 97 MEXICO: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 98 EUROPE: CONTACT ADHESIVES MARKET, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 99 EUROPE: CONTACT ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 100 EUROPE: CONTACT ADHESIVES MARKET, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 101 EUROPE: CONTACT ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 102 EUROPE: CONTACT ADHESIVES MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 103 EUROPE: CONTACT ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 104 EUROPE: CONTACT ADHESIVES MARKET, BY TECHNOLOGY, 2019–2022 (KILOTON)

- TABLE 105 EUROPE: CONTACT ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 106 EUROPE: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 107 EUROPE: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 108 EUROPE: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 109 EUROPE: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 110 EUROPE: CONTACT ADHESIVES MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 111 EUROPE: CONTACT ADHESIVES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 112 EUROPE: CONTACT ADHESIVES MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 113 EUROPE: CONTACT ADHESIVES MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 114 GERMANY: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 115 GERMANY: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 116 GERMANY: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 117 GERMANY: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 118 FRANCE: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 119 FRANCE: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 120 FRANCE: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 121 FRANCE: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 122 UK: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 123 UK: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 124 UK: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 125 UK: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 126 RUSSIA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 127 RUSSIA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 128 RUSSIA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 129 RUSSIA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 130 ITALY: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 131 ITALY: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 132 ITALY: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 133 ITALY: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 134 TURKEY: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 135 TURKEY: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 136 TURKEY: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 137 TURKEY: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 138 REST OF EUROPE: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 139 REST OF EUROPE: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 140 REST OF EUROPE: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 141 REST OF EUROPE: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 142 ASIA PACIFIC: CONTACT ADHESIVES MARKET, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 143 ASIA PACIFIC: CONTACT ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 144 ASIA PACIFIC: CONTACT ADHESIVES MARKET, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 145 ASIA PACIFIC: CONTACT ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 146 ASIA PACIFIC: CONTACT ADHESIVES MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 147 ASIA PACIFIC: CONTACT ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 148 ASIA PACIFIC: CONTACT ADHESIVES MARKET, BY TECHNOLOGY, 2019–2022 (KILOTON)

- TABLE 149 ASIA PACIFIC: CONTACT ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 150 ASIA PACIFIC: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 151 ASIA PACIFIC: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 152 ASIA PACIFIC: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 153 ASIA PACIFIC: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 154 ASIA PACIFIC: CONTACT ADHESIVES MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 155 ASIA PACIFIC: CONTACT ADHESIVES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 156 ASIA PACIFIC: CONTACT ADHESIVES MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 157 ASIA PACIFIC: CONTACT ADHESIVES MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 158 CHINA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 159 CHINA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 160 CHINA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 161 CHINA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 162 INDIA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 163 INDIA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 164 INDIA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 165 INDIA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 166 JAPAN: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 167 JAPAN: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 168 JAPAN: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 169 JAPAN: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 170 SOUTH KOREA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 171 SOUTH KOREA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 172 SOUTH KOREA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 173 SOUTH KOREA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 174 THAILAND: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 175 THAILAND: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 176 THAILAND: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 177 THAILAND: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 178 TAIWAN: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 179 TAIWAN: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 180 TAIWAN: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 181 TAIWAN: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 182 MALAYSIA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 183 MALAYSIA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 184 MALAYSIA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 185 MALAYSIA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 186 REST OF ASIA PACIFIC: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 187 REST OF ASIA PACIFIC: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 188 REST OF ASIA PACIFIC: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 189 REST OF ASIA PACIFIC: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 190 SOUTH AMERICA: CONTACT ADHESIVES MARKET, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 191 SOUTH AMERICA: CONTACT ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 192 SOUTH AMERICA: CONTACT ADHESIVES MARKET, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 193 SOUTH AMERICA: CONTACT ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 194 SOUTH AMERICA: CONTACT ADHESIVES MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 195 SOUTH AMERICA: CONTACT ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 196 SOUTH AMERICA: CONTACT ADHESIVES MARKET, BY TECHNOLOGY, 2019–2022 (KILOTON)

- TABLE 197 SOUTH AMERICA: CONTACT ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 198 SOUTH AMERICA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 199 SOUTH AMERICA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 200 SOUTH AMERICA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 201 SOUTH AMERICA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 202 SOUTH AMERICA: CONTACT ADHESIVES MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 203 SOUTH AMERICA: CONTACT ADHESIVES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 204 SOUTH AMERICA: CONTACT ADHESIVES MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 205 SOUTH AMERICA: CONTACT ADHESIVES MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 206 BRAZIL: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 207 BRAZIL: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 208 BRAZIL: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 209 BRAZIL: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 210 ARGENTINA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 211 ARGENTINA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 212 ARGENTINA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 213 ARGENTINA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 214 COLOMBIA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 215 COLOMBIA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 216 COLOMBIA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 217 COLOMBIA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 218 REST OF SOUTH AMERICA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 219 REST OF SOUTH AMERICA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 220 REST OF SOUTH AMERICA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 221 REST OF SOUTH AMERICA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 222 MIDDLE EAST & AFRICA: CONTACT ADHESIVES MARKET, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 223 MIDDLE EAST & AFRICA: CONTACT ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 224 MIDDLE EAST & AFRICA: CONTACT ADHESIVES MARKET, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 225 MIDDLE EAST & AFRICA: CONTACT ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 226 MIDDLE EAST & AFRICA: CONTACT ADHESIVES MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 227 MIDDLE EAST & AFRICA: CONTACT ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 228 MIDDLE EAST & AFRICA: CONTACT ADHESIVES MARKET, BY TECHNOLOGY, 2019–2022 (KILOTON)

- TABLE 229 MIDDLE EAST & AFRICA: CONTACT ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 230 MIDDLE EAST & AFRICA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 231 MIDDLE EAST & AFRICA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 232 MIDDLE EAST & AFRICA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 233 MIDDLE EAST & AFRICA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 234 MIDDLE EAST & AFRICA: CONTACT ADHESIVES MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 235 MIDDLE EAST & AFRICA: CONTACT ADHESIVES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 236 MIDDLE EAST & AFRICA: CONTACT ADHESIVES MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 237 MIDDLE EAST & AFRICA: CONTACT ADHESIVES MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 238 UAE: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 239 UAE: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 240 UAE: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 241 UAE: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 242 SAUDI ARABIA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 243 SAUDI ARABIA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 244 SAUDI ARABIA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 245 SAUDI ARABIA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 246 SOUTH AFRICA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 247 SOUTH AFRICA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 248 SOUTH AFRICA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 249 SOUTH AFRICA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 250 REST OF MIDDLE EAST & AFRICA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 251 REST OF MIDDLE EAST & AFRICA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 252 REST OF MIDDLE EAST & AFRICA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 253 REST OF MIDDLE EAST & AFRICA: CONTACT ADHESIVES MARKET, BY END USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 254 STRATEGIES ADOPTED BY KEY MARKET PLAYERS

- TABLE 255 CONTACT ADHESIVES MARKET: DEALS, 2017–2023

- TABLE 256 HENKEL AG & CO. KGAA: COMPANY OVERVIEW

- TABLE 257 HENKEL AG & CO. KGAA: DEALS

- TABLE 258 H.B. FULLER COMPANY: COMPANY OVERVIEW

- TABLE 259 H.B. FULLER COMPANY: DEALS

- TABLE 260 SIKA AG: COMPANY OVERVIEW

- TABLE 261 SIKA AG: DEALS

- TABLE 262 ARKEMA: COMPANY OVERVIEW

- TABLE 263 ARKEMA: DEALS

- TABLE 264 3M: COMPANY OVERVIEW

- TABLE 265 HUNTSMAN INTERNATIONAL LLC: COMPANY OVERVIEW

- TABLE 266 HUNTSMAN INTERNATIONAL LLC: DEALS

- TABLE 267 ILLINOIS TOOL WORKS INC.: COMPANY OVERVIEW

- TABLE 268 PIDILITE INDUSTRIES LTD.: COMPANY OVERVIEW

- TABLE 269 JUBILANT INDUSTRIES LTD.: COMPANY OVERVIEW

- TABLE 270 ASHLAND: COMPANY OVERVIEW

- TABLE 271 PARKER HANNIFIN CORP (PARKER LORD): DEALS

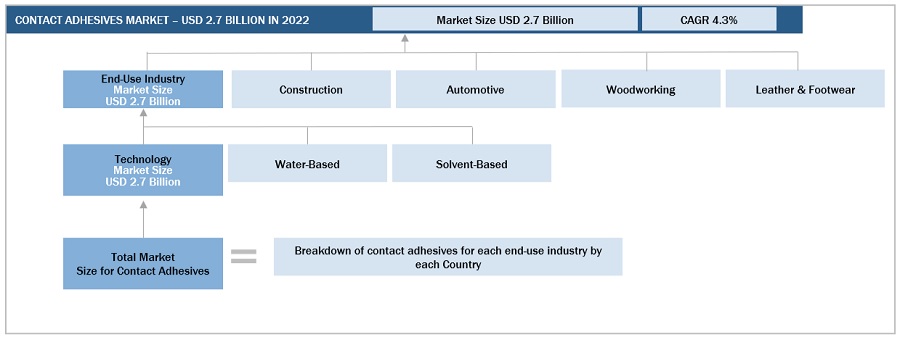

- FIGURE 1 CONTACT ADHESIVES MARKET SEGMENTATION

- FIGURE 2 CONTACT ADHESIVES MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 6 CONTACT ADHESIVES MARKET SIZE ESTIMATION, BY REGION

- FIGURE 7 CONTACT ADHESIVES MARKET SIZE ESTIMATION, BY TECHNOLOGY

- FIGURE 8 CONTACT ADHESIVES MARKET: SUPPLY-SIDE FORECAST

- FIGURE 9 METHODOLOGY FOR SUPPLY-SIDE SIZING OF CONTACT ADHESIVES MARKET

- FIGURE 10 MAJOR FACTORS RESPONSIBLE FOR GLOBAL RECESSION

- FIGURE 11 CONTACT ADHESIVES MARKET: DATA TRIANGULATION

- FIGURE 12 NEOPRENE-BASED CONTACT ADHESIVE TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 13 SOLVENT-BASED TECHNOLOGY TO ACCOUNT FOR LARGER SHARE DURING FORECAST PERIOD

- FIGURE 14 AUTOMOTIVE TO BE FASTEST-GROWING END USE INDUSTRY OF CONTACT ADHESIVES

- FIGURE 15 ASIA PACIFIC TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 16 HIGH DEMAND FROM AUTOMOTIVE INDUSTRY IN EMERGING ECONOMIES TO DRIVE MARKET

- FIGURE 17 NEOPRENE TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 18 WOODWORKING TO ACCOUNT FOR LARGEST MARKET SHARE IN 2028

- FIGURE 19 WOODWORKING INDUSTRY AND CHINA RECORDED HIGHEST GROWTH IN 2022

- FIGURE 20 EMERGING ECONOMIES TO RECORD FASTER GROWTH DURING FORECAST PERIOD

- FIGURE 21 INDIA TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 23 PORTER’S FIVE FORCES ANALYSIS: CONTACT ADHESIVES MARKET

- FIGURE 24 GLOBAL SPENDING IN CONSTRUCTION SECTOR, 2014–2035

- FIGURE 25 CONTACT ADHESIVES MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 26 NUMBER OF PATENTS PUBLISHED, 2018–2023

- FIGURE 27 PATENTS PUBLISHED BY JURISDICTION, 2018–2023

- FIGURE 28 PATENTS PUBLISHED BY MAJOR APPLICANTS, 2018–2023

- FIGURE 29 SOLVENT-BASED TECHNOLOGY TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 30 NEOPRENE RESIN TYPE TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 31 AUTOMOTIVE TO BE FASTEST-GROWING END USE INDUSTRY OF CONTACT ADHESIVES

- FIGURE 32 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE IN 2028

- FIGURE 33 NORTH AMERICA: CONTACT ADHESIVES MARKET SNAPSHOT

- FIGURE 34 EUROPE: CONTACT ADHESIVES MARKET SNAPSHOT

- FIGURE 35 ASIA PACIFIC: CONTACT ADHESIVES MARKET SNAPSHOT

- FIGURE 36 SOUTH AMERICA: CONTACT ADHESIVES MARKET SNAPSHOT

- FIGURE 37 UAE TO WITNESS HIGH GROWTH DURING FORECAST PERIOD

- FIGURE 38 CONTACT ADHESIVES MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 39 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN CONTACT ADHESIVES MARKET

- FIGURE 40 MARKET RANKING ANALYSIS, 2022

- FIGURE 41 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2018–2022

- FIGURE 42 HENKEL AG & CO. KGAA: COMPANY SNAPSHOT

- FIGURE 43 H.B. FULLER COMPANY: COMPANY SNAPSHOT

- FIGURE 44 SIKA AG: COMPANY SNAPSHOT

- FIGURE 45 ARKEMA: COMPANY SNAPSHOT

- FIGURE 46 3M: COMPANY SNAPSHOT

- FIGURE 47 HUNTSMAN INTERNATIONAL LLC: COMPANY SNAPSHOT

- FIGURE 48 ILLINOIS TOOL WORKS INC.: COMPANY SNAPSHOT

- FIGURE 49 PIDILITE INDUSTRIES LTD.: COMPANY SNAPSHOT

- FIGURE 50 JUBILANT INDUSTRIES LTD.: COMPANY SNAPSHOT

- FIGURE 51 ASHLAND: COMPANY SNAPSHOT

The study involved four major activities in estimating the current size of the contact adhesives market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering contact adhesives information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the contact adhesives market, which was validated by primary respondents.

Primary Research

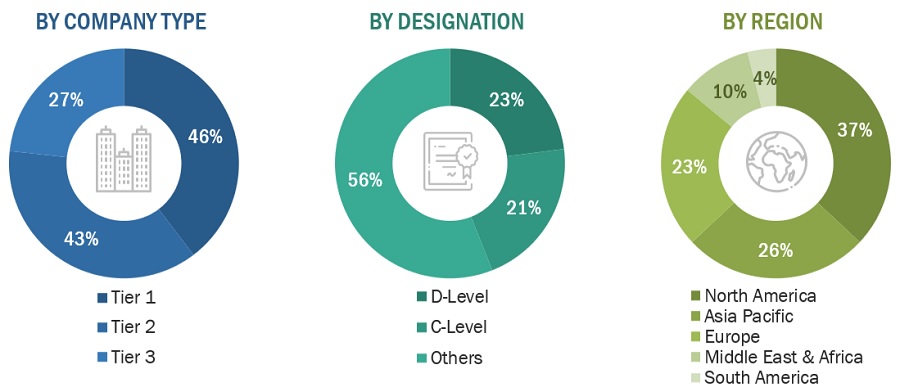

Extensive primary research was conducted after obtaining information regarding the contact adhesives market scenario through secondary research. Several primary interviews were conducted with market experts from both, the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and South America. Primary data was collected through questionnaires, emails, and telephonic interview. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from contact adhesives vendors; raw material suppliers; distributors; and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, resin type, end-use industry, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, and installation teams of the customer/end users who are using contact adhesives were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of contact adhesives and future outlook of their business which will affect the overall market.

The Breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

|

Company Name |

DESIGNATION |

|

Sika AG |

Director |

|

Huntsman Corporation |

Project Manager |

|

Henkel AG & KGaA |

Individual Industry Expert |

|

H.B Fuller |

Director |

Market Size Estimation

The research methodology used to estimate the size of the contact adhesives market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on procurements and modernizations in the end-use industries at a regional level. Such procurements provide information on the demand aspects of contact adhesives.

Global Contact Adhesives Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Contact Adhesives Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Contact adhesive provides adhesion to wood products, fabric, canvas, and leather. These are low viscosity light-colored adhesives usually taking a longer cure and set time. Contact adhesives are preferred because of their ability to bond wood and fabric substrates, resist vibration, and distribute stresses over a wide area. With the growth of the housing sector, the contact adhesives market has witnessed prominent growth.

Key Stakeholders

- End User

- Raw Material Suppliers

- Senior Management

- Procurement Department

Report Objectives

- To define, describe, segment, and forecast the size of the contact adhesives market based on technology, resin type, end-use industry, and region.

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, South America, Middle East & Africa, along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the contact adhesives market

- To analyze technological advancements and product launches in the market

- To strategically analyze micro markets, with respect to their growth trends, prospects, and their contribution to the market

- To identify financial positions, key products, and key developments of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis

- To provide a comprehensive analysis of business and corporate strategies adopted by the key players in the market

- To strategically profile key players in the market and comprehensively analyze their core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the contact adhesives market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the contact adhesives Market

Growth opportunities and latent adjacency in Contact Adhesive Market