Cross Linking Agents Market by Chemistry (Amino, Amine, Amide, Aziridine, Isocyanate, Carbodiimide), Application (Decorative, Industrial (Transportation Coatings, Industrial, Protective Coatings, Marine Coatings), & Region - Global Forecast to 2028

Updated on : July 28, 2025

Cross Linking Agents Market

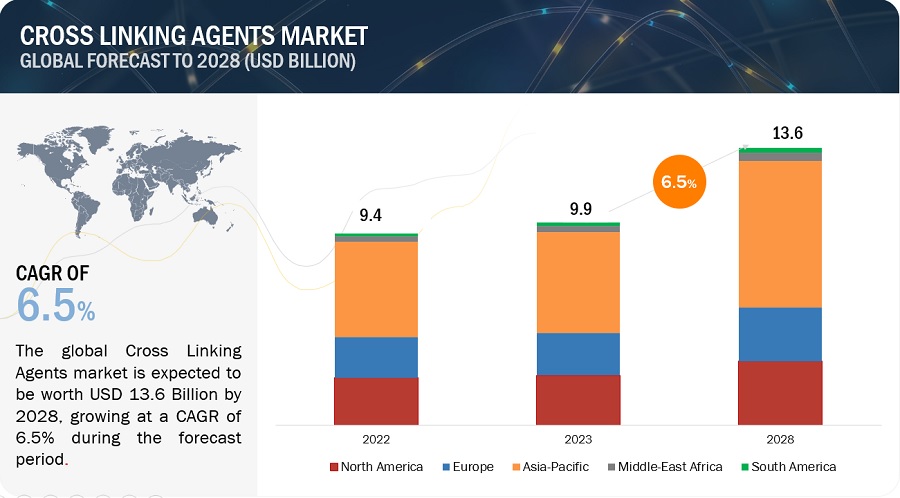

The global cross linking agents market was valued at USD 9.9 billion in 2023 and is projected to reach USD 13.6 billion by 2028, growing at 6.5% cagr from 2023 to 2028. The growing focus on sustainability and eco-friendly solutions is leading to the development of novel cross-linking agents that offer reduced environmental impact. Furthermore, advancements in technology and research are enabling the creation of new cross-linking agents with improved efficiency, versatility, and compatibility with different polymer systems, opening further avenues for market expansion.

Attractive Opportunities in the Cross Linking Agents Market

Note: e-estimated p-projected.

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Cross Linking Agents Market Dynamics

Driver: Increasing demand for high performance materials

Increasing demand for high-performance materials have emerged as a driver in the cross linking agents market. Industries such as automotive, aerospace, and electronics require materials with enhanced properties such as strength, durability, and heat resistance. Cross-linking agents play a vital role in achieving these improved material properties by forming covalent bonds between polymer chains, resulting in a three-dimensional network structure. The use of cross-linking agents allows manufacturers to meet the growing demand for high-performance materials that can withstand demanding applications and environments.

Restraint: The environmental and regulatory concerns associated with certain cross-linking agents

The environmental and regulatory concerns associated with certain cross-linking agents act as a restraint in the cross linking agents market. Some traditional cross-linking agents, such as certain epoxy resins or isocyanates, may release volatile organic compounds (VOCs) or hazardous byproducts during the cross-linking process. This can pose health and environmental risks. As a result, there is a growing need for environmentally friendly and low-VOC alternatives. Addressing these concerns and developing sustainable cross-linking agents that meet regulatory requirements present a challenge for the industry.

Opportunities: The growing demand for bio-based and renewable cross-linking agents

With increasing environmental consciousness and the shift towards sustainable practices, there is a rising need for cross-linking agents derived from renewable sources such as plant-based materials or bio-based chemicals. Developing bio-based cross-linking agents not only reduces the reliance on fossil fuels but also offers eco-friendly alternatives with lower carbon footprints. This presents a significant opportunity for companies to innovate and capture a growing market segment focused on sustainability.

Challenges: The increasing complexity of regulatory compliance

One of the major challenges in the cross-linking agents market is the increasing complexity of regulatory compliance. As environmental and safety regulations become stricter, manufacturers of cross-linking agents need to ensure their products meet the evolving standards. This involves extensive testing, documentation, and compliance with various regional and international regulations. Keeping up with these complex and ever-changing regulatory requirements can be challenging for companies, requiring significant investments in research, testing, and compliance infrastructure. Failure to meet regulatory standards may result in penalties, reputational damage, and loss of market share.

Cross Linking Agents Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of cross linking agents. These companies have been operating in the market for several years and possess a diversified product portfolio and strong global sales and marketing networks. Prominent companies in this market include BASF SE (Germany), Covestro AG (Germany), Allnex Group (Germany), Evonik Industries (Germany), Hunstman Corporation (US).

Based on chemistry, Amino is projected to account for the largest share of the cross linking agent market

Based on chemistry, amino accounts for the largest market share during the forecast period. Amino compounds, such as amino resins and amino silanes, offer excellent cross-linking capabilities and compatibility with a wide range of polymers. They form strong and stable bonds, resulting in improved mechanical properties, thermal stability, and adhesion. Moreover, amino compounds find extensive applications in various industries, including coatings, adhesives, and sealants, where their versatility and performance benefits are highly valued. Additionally, the continuous research and development efforts in amino chemistry have led to the introduction of advanced and specialized amino-based cross-linking agents, further boosting their dominance in the market.

Based on application, industrial application to be the fastest-growing application segment of the cross linking agents market

Based on application, The majority of the market share for cross linking agents is held by the industrial application, which is also the biggest market segment. the industrial segment encompasses a wide range of industries, including automotive, construction, electronics, and packaging, all of which have a significant demand for cross-linked materials. Cross-linking agents enhance the performance and durability of materials in these industries, providing benefits such as improved mechanical properties, resistance to chemicals and weathering, and increased product lifespan. Moreover, the industrial sector prioritizes product quality, reliability, and regulatory compliance, which drives the demand for cross-linking agents to meet these stringent requirements. The extensive and diverse use of cross-linked materials in industrial applications solidifies the dominance of the industrial application segment in the cross-linking agents market.

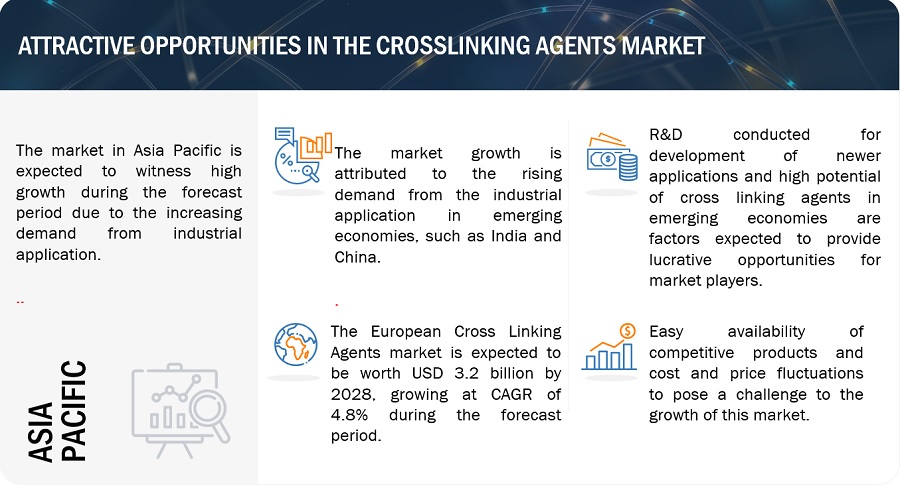

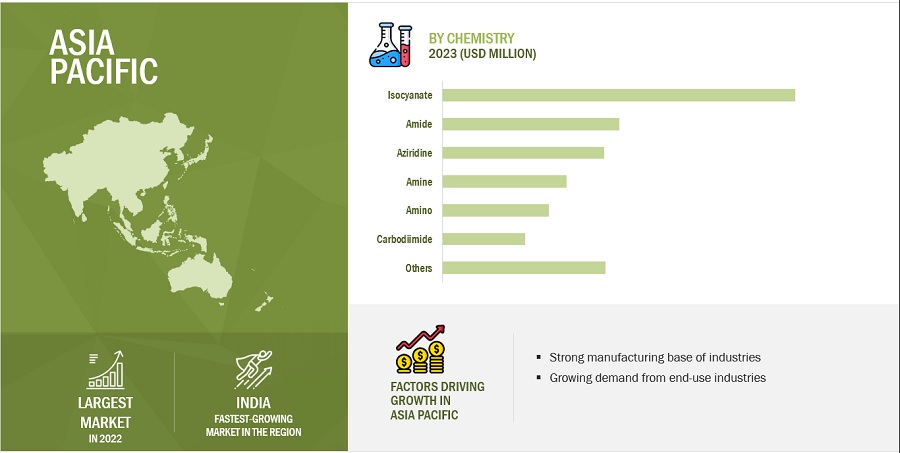

Asia Pacific is expected to be the fastest growing market during the forecast period.

Based on the region, Asia Pacific accounts for the fastest growing market. This is primarily driven by the region's strong industrial and manufacturing sectors, particularly in China, India, and Japan, which generate substantial demand for cross-linking agents in industries such as automotive, construction, electronics, and packaging. Additionally, factors like rapid urbanization, infrastructure development, and increasing disposable incomes contribute to the rising demand for high-performance materials that rely on cross-linking agents. Furthermore, supportive government initiatives, investments in research and development, and a growing focus on eco-friendly solutions further bolster the market's growth in the Asia Pacific region.

To know about the assumptions considered for the study, download the pdf brochure

Cross Linking Agents Market Players

The cross linking agents market is dominated by a few major players that have a wide regional presence. The key players in the cross linking agents market are BASF SE (Germany), Covestro AG (Germany), Allnex Group (Germany), Evonik Industries (Germany), Hunstman Corporation (US), Wanhua Chemicals Group Co. Ltd (China), The Dow Chemical Company (US), DSM Coatings Resins (China), and Ineos (UK). In the last few years, the companies have adopted growth strategies such as Product launches, Investments, Acquisitions, and expansions to capture a larger share of the cross linking agents market.

Cross Linking Agents Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2023 |

USD 9.9 billion |

|

Revenue Forecast in 2028 |

USD 13.6 billion |

|

CAGR |

6.5% |

|

Years considered for the study |

2021-2028 |

|

Base Year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Volume (Kilo Tons); Value (USD Million/Billion) |

|

Segments |

Chemistry, Application, and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

BASF SE (Germany), Covestro AG (Germany) Allnex Group (Germany), Evonik Industries (Germany), Hunstman Corporation (US), Aditya Birla Corporation (India), Wanhua Chemicals Group Co. Ltd (China), The Dow Chemical Company (US), DSM Coatings Resins (China), Ineos (UK) |

This report categorizes the global cross linking agents market based on chemistry, application grade, and region.

On the basis of chemistry, the cross linking agents market has been segmented as follows:

- Amino

- Amine

- Amide

- Aziridine

- Carbodiimide

- Isocyanate

- Others

On the basis of application, the cross linking agents market has been segmented as follows:

- Decorative

- Industrial

On the basis of region, the cross linking agents market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In 2023, BASF announced to expand its existing capacity of isocyanate. The company will increase production capacity to approximately 600,000 metric tons per year.

- In May 2021, Wanhua Chemical announced that Wanhua Chemical (Ningbo) Co., Ltd. plans to implement the MDI/HDI technical transformation and capacity expansion integration project in the existing plant. Wanhua Chemical also plans to build a new 280,000-ton/year modified MDI production unit, with a total capacity of 300,000 tons/year Modified MDI production capacity.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the cross linking agents market?

The growth of this market can be attributed to the growing focus on sustainability and ecofriendly solutions.

Which are the key applications driving the cross linking agents market?

The sectors driving the demand for cross linking agents are industrial & decorative coatings.

Who are the major manufacturers?

Major manufacturers include BASF SE (Germany), Covestro AG (Germany), Allnex Group (Germany), Evonik Industries (Germany), Hunstman Corporation (US) among others.

What will be the growth prospects of the cross linking agents market?

Increasing demand from industrial coatings to drive the market during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing demand for crosslinking agents for water-based coatings- Increasing demand for high-performance materials- Rising industrial and automotive sectors driving demand for crosslinking agents in Asia Pacific- Rapidly growing powder coatings applicationRESTRAINTS- Non-recyclable property and high price of crosslinking agents- Environmental and regulatory concerns associated with certain crosslinking agents- Presence of self-crosslinking agentsOPPORTUNITIES- Development of sustainable products- Growing demand for bio-based and renewable crosslinking agents- Rising demand for eco-friendly crosslinking agentsCHALLENGES- Stringent government regulations- Increasing complexity of regulatory compliance

-

5.3 TRADE ANALYSISIMPORT-EXPORT SCENARIO OF CROSSLINKING AGENTS MARKET

- 5.4 IMPACT OF RECESSION ON CROSSLINKING AGENTS MARKET

-

5.5 VALUE CHAIN ANALYSISRAW MATERIAL SUPPLIERSMANUFACTURERSDISTRIBUTORSEND CONSUMERS

-

5.6 PORTER’S FIVE FORCES ANALYSISBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTSINTENSITY OF COMPETITIVE RIVALRY

-

5.7 ECOSYSTEM MAPPING

- 5.8 TECHNOLOGY ANALYSIS

-

5.9 MACROECONOMIC INDICATORSGDP TRENDS & FORECASTS

-

5.10 TARIFF AND REGULATORY LANDSCAPENORTH AMERICAEUROPEASIA PACIFIC

-

5.11 RAW MATERIAL ANALYSISEPOXY RESINSISOCYANATESAMINESPEROXIDESSILANES

-

5.12 CASE STUDY ANALYSISCOVESTRO AG’S DESMODUR CROSSLINKERS TO IMPROVE INDUSTRIAL HYGIENE AND TO COMPLY WITH PROPOSED EU LEGISLATIONS.COVESTRO AG OFFERS IMPRAFIX ISOCYANATE CROSSLINKERS AND ADDITIVES TO INCREASE MECHANICAL PROPERTIES, CHEMICAL RESISTANCE, AND SUSTAINABILITY OF POLYURETHANE-BASED TEXTILE COATINGS

- 5.13 PRICING ANALYSIS

-

5.14 PATENT ANALYSISMETHODOLOGYPATENTS GRANTED WORLDWIDE, 2012–2022PATENT PUBLICATION TRENDSINSIGHTSLEGAL STATUS OF PATENTSJURISDICTION-WISE PATENT ANALYSISTOP COMPANIES/APPLICANTSTOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

- 6.1 INTRODUCTION

-

6.2 AMINOAPPLICATIONS IN AUTOMOTIVE & INDUSTRIAL WOOD TO DRIVE MARKET

-

6.3 AMINESUPERIOR ADHESION PROPERTIES TO DRIVE MARKET

-

6.4 ISOCYANATEFAST AND EFFICIENT CURING PROPERTIES TO DRIVE MARKET

-

6.5 AMIDEEXCELLENT MECHANICAL PROPERTIES TO DRIVE MARKET

-

6.6 AZIRIDINESTRONG ADHESION AND BONDING STRENGTH TO DRIVE MARKET

-

6.7 CARBODIIMIDEEXCELLENT ADHESION PROPERTY TO DRIVE MARKET

- 6.8 OTHERS

- 7.1 INTRODUCTION

-

7.2 DECORATIVE COATINGSINCREASING DEMAND FROM RESIDENTIAL, INSTITUTIONAL, AND INDUSTRIAL BUILDINGS TO DRIVE MARKET

-

7.3 INDUSTRIAL COATINGSPROTECTIVE AND CORROSION COATINGSTRANSPORTATION COATINGSINDUSTRIAL WOOD COATINGSPROTECTIVE COATINGSMARINE COATINGSCAN/COIL COATINGSGENERAL INDUSTRIAL COATINGSOTHER COATINGS

- 8.1 INTRODUCTION

-

8.2 NORTH AMERICAUS- Increasing demand for rapid industrial growth to drive marketCANADA- Increasing demand from paints and coatings applications to drive marketMEXICO- Increasing demand from architectural coatings to drive market

-

8.3 EUROPEFRANCE- Growing demand from industrial coatings to drive marketGERMANY- Rising demand from automotive coatings to drive marketUK- Growing demand from architectural coatings to drive marketPOLAND- Increasing demand from end use industry to drive marketTURKEY- Increasing demand for paint & coatings due to rapid urbanization to drive marketREST OF EUROPE

-

8.4 ASIA PACIFICCHINA- Increasing demand for high-quality products to drive marketJAPAN- Rising demand for transportation coatings to drive marketSOUTH KOREA- Rising demand for construction coatings to drive marketINDIA- Increasing demand for decorative paint & coatings to drive marketVIETNAM- Rising demand for industrial coatings to drive marketINDONESIA- Rising demand for architectural coatings to drive marketREST OF ASIA PACIFIC

-

8.5 MIDDLE EAST & AFRICASAUDI ARABIA- Expansion in industries such as automotive, textile, and construction to drive marketUAE- Growing awareness of environmental concerns to drive marketSOUTH AFRICA- Increasing demand from adhesives and coatings to drive marketREST OF MIDDLE EAST & AFRICA

-

8.6 SOUTH AMERICABRAZIL- Developing manufacturing base in country to drive marketARGENTINA- Increasing demand from manufacturing and automotive sectors to drive marketREST OF SOUTH AMERICA

- 9.1 OVERVIEW

- 9.2 RANKING ANALYSIS OF KEY MARKET PLAYERS, 2022

- 9.3 MARKET SHARE ANALYSIS

- 9.4 REVENUE ANALYSIS OF TOP PLAYERS

- 9.5 MARKET EVALUATION MATRIX

-

9.6 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

9.7 START-UPS AND SMALL & MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIXRESPONSIVE COMPANIESSTARTING BLOCKSPROGRESSIVE COMPANIESDYNAMIC COMPANIES

- 9.8 COMPANY APPLICATION FOOTPRINT

- 9.9 COMPANY REGION FOOTPRINT

- 9.10 STRENGTH OF PRODUCT PORTFOLIO

- 9.11 BUSINESS STRATEGY EXCELLENCE

-

9.12 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

10.1 KEY PLAYERSBASF SE- Business overview- Products offered- Recent developments- MnM viewCOVESTRO AG- Business overview- Products offered- Recent developments- MnM viewALLNEX GROUP- Business overview- Products offered- Recent developments- MnM viewEVONIK INDUSTRIES- Business overview- Products offered- Recent developments- MnM viewHUNTSMAN CORPORATION- Business overview- Products offered- Recent developments- MnM viewWACKER CHEMIE AG- Business overview- Products offered- Recent developments- MnM viewWANHUA CHEMICAL GROUP CO., LTD.- Business overview- Products offered- Recent developments- MnM viewTHE DOW CHEMICAL COMPANY- Business overview- Products offered- Recent developments- MnM viewDSM COATING RESINS LTD- Business overview- Products offered- MnM viewADITYA BIRLA ADVANCED MATERIALS- Business overview- Products offered- Recent developments- MnM view

-

10.2 OTHER PLAYERSHEXION INC.SEALED AIR CORPORATIONLORD CORPORATIONDUPONTSHANGHAI SISHENG POLYMER MATERIALS CO. LTD.MOMENTIVE PERFORMANCE INC.NAGASE AMERICA CORPORATIONINCOREZ LIMITEDBAXENDEN CHEMICALS LIMITEDANGUS CHEMICAL COMPANYSHANGHAI ZEALCHEM CO. LTD.SUPER URECOAT INDUSTRIESELANTAS GMBHMEL CHEMICALSSTAHL HOLDINGS B.V.

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS

- TABLE 1 IMPORT TRADE DATA FOR ISOCYANATES

- TABLE 2 EXPORT TRADE DATA FOR ISOCYANATES

- TABLE 3 PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 CROSSLINKING AGENTS MARKET: ECOSYSTEM

- TABLE 5 PROJECTED REAL GDP GROWTH (ANNUAL PERCENTAGE CHANGE), BY KEY COUNTRY, 2018–2025

- TABLE 6 AVERAGE SELLING PRICE, BY REGION (USD/KG)

- TABLE 7 AVERAGE SELLING PRICE, BY PLAYER (USD/KG)

- TABLE 8 TOTAL NUMBER OF PATENTS

- TABLE 9 TOP TEN PATENT OWNERS

- TABLE 10 CROSSLINKING AGENTS MARKET, BY CHEMISTRY, 2019–2022 (KILOTON)

- TABLE 11 CROSSLINKING AGENTS MARKET, BY CHEMISTRY, 2023–2028 (KILOTON)

- TABLE 12 CROSSLINKING AGENTS MARKET, BY CHEMISTRY, 2019–2022 (USD MILLION)

- TABLE 13 CROSSLINKING AGENTS MARKET, BY CHEMISTRY, 2023–2028 (USD MILLION)

- TABLE 14 CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 15 CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 16 CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 17 CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 18 CROSSLINKING AGENTS MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 19 CROSSLINKING AGENTS MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 20 CROSSLINKING AGENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 21 CROSSLINKING AGENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 22 NORTH AMERICA: CROSSLINKING AGENTS MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 23 NORTH AMERICA: CROSSLINKING AGENTS MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 24 NORTH AMERICA: CROSSLINKING AGENTS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 25 NORTH AMERICA: CROSSLINKING AGENTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 26 NORTH AMERICA: CROSSLINKING AGENTS MARKET, BY CHEMISTRY, 2019–2022 (KILOTON)

- TABLE 27 NORTH AMERICA: CROSSLINKING AGENTS MARKET, BY CHEMISTRY, 2023–2028 (KILOTON)

- TABLE 28 NORTH AMERICA: CROSSLINKING AGENTS MARKET, BY CHEMISTRY, 2019–2022 (USD MILLION)

- TABLE 29 NORTH AMERICA: CROSSLINKING AGENTS MARKET, BY CHEMISTRY, 2023–2028 (USD MILLION)

- TABLE 30 NORTH AMERICA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 31 NORTH AMERICA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 32 NORTH AMERICA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 33 NORTH AMERICA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 34 US: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 35 US: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 36 US: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 37 US: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 38 CANADA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 39 CANADA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 40 CANADA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 41 CANADA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 42 MEXICO: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 43 MEXICO: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 44 MEXICO: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 45 MEXICO: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 46 EUROPE: CROSSLINKING AGENTS MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 47 EUROPE: CROSSLINKING AGENTS MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 48 EUROPE: CROSSLINKING AGENTS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 49 EUROPE: CROSSLINKING AGENTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 50 EUROPE: CROSSLINKING AGENTS MARKET, BY CHEMISTRY, 2019–2022 (KILOTON)

- TABLE 51 EUROPE: CROSSLINKING AGENTS MARKET, BY CHEMISTRY, 2023–2028 (KILOTON)

- TABLE 52 EUROPE: CROSSLINKING AGENTS MARKET, BY CHEMISTRY, 2019–2022 (USD MILLION)

- TABLE 53 EUROPE: CROSSLINKING AGENTS MARKET, BY CHEMISTRY, 2023–2028 (USD MILLION)

- TABLE 54 EUROPE: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 55 EUROPE: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 56 EUROPE: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 57 EUROPE: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 58 FRANCE: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 59 FRANCE: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 60 FRANCE: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 61 FRANCE: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 62 GERMANY: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 63 GERMANY: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 64 GERMANY: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 65 GERMANY: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 66 UK: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 67 UK: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 68 UK: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 69 UK: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 70 POLAND: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 71 POLAND: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 72 POLAND: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 73 POLAND: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 74 TURKEY: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 75 TURKEY: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 76 TURKEY: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 77 TURKEY: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 78 REST OF EUROPE: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 79 REST OF EUROPE: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 80 REST OF EUROPE: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 81 REST OF EUROPE: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 82 ASIA PACIFIC: CROSSLINKING AGENTS MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 83 ASIA PACIFIC: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 84 ASIA PACIFIC: CROSSLINKING AGENTS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 85 ASIA PACIFIC: CROSSLINKING AGENTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 86 ASIA PACIFIC: CROSSLINKING AGENTS MARKET, BY CHEMISTRY, 2019–2022 (KILOTON)

- TABLE 87 ASIA PACIFIC: CROSSLINKING AGENTS MARKET, BY CHEMISTRY, 2023–2028 (KILOTON)

- TABLE 88 ASIA PACIFIC: CROSSLINKING AGENTS MARKET, BY CHEMISTRY, 2019–2022 (USD MILLION)

- TABLE 89 ASIA PACIFIC: CROSSLINKING AGENTS MARKET, BY CHEMISTRY, 2023–2028 (USD MILLION)

- TABLE 90 ASIA PACIFIC: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 91 ASIA PACIFIC: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 92 ASIA PACIFIC: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 93 ASIA PACIFIC: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 94 CHINA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 95 CHINA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 96 CHINA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 97 CHINA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 98 JAPAN: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 99 JAPAN: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 100 JAPAN: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 101 JAPAN: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 102 SOUTH KOREA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 103 SOUTH KOREA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 104 SOUTH KOREA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 105 SOUTH KOREA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 106 INDIA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 107 INDIA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 108 INDIA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 109 INDIA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 110 VIETNAM: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 111 VIETNAM: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 112 VIETNAM: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 113 VIETNAM: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 114 INDONESIA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 115 INDONESIA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 116 INDONESIA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 117 INDONESIA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 118 REST OF ASIA PACIFIC: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 119 REST OF ASIA PACIFIC: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 120 REST OF ASIA PACIFIC: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 121 REST OF ASIA PACIFIC: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 122 MIDDLE EAST & AFRICA: CROSSLINKING AGENTS MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 123 MIDDLE EAST & AFRICA: CROSSLINKING AGENTS MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 124 MIDDLE EAST & AFRICA: CROSSLINKING AGENTS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 125 MIDDLE EAST & AFRICA: CROSSLINKING AGENTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 126 MIDDLE EAST & AFRICA: CROSSLINKING AGENTS MARKET, BY CHEMISTRY, 2019–2022 (KILOTON)

- TABLE 127 MIDDLE EAST & AFRICA: CROSSLINKING AGENTS MARKET, BY CHEMISTRY, 2023–2028 (KILOTON)

- TABLE 128 MIDDLE EAST & AFRICA: CROSSLINKING AGENTS MARKET, BY CHEMISTRY, 2019–2022 (USD MILLION)

- TABLE 129 MIDDLE EAST & AFRICA: CROSSLINKING AGENTS MARKET, BY CHEMISTRY, 2023–2028 (USD MILLION)

- TABLE 130 MIDDLE EAST & AFRICA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 131 MIDDLE EAST & AFRICA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 132 MIDDLE EAST & AFRICA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 133 MIDDLE EAST & AFRICA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 134 SAUDI ARABIA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 135 SAUDI ARABIA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 136 SAUDI ARABIA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 137 SAUDI ARABIA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 138 UAE: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 139 UAE: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 140 UAE: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 141 UAE: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 142 SOUTH AFRICA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 143 SOUTH AFRICA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 144 SOUTH AFRICA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 145 SOUTH AFRICA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 146 REST OF MIDDLE EAST & AFRICA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 147 REST OF MIDDLE EAST & AFRICA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 148 REST OF MIDDLE EAST & AFRICA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 149 REST OF MIDDLE EAST & AFRICA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 150 SOUTH AMERICA: CROSSLINKING AGENTS MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 151 SOUTH AMERICA: CROSSLINKING AGENTS MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 152 SOUTH AMERICA: CROSSLINKING AGENTS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 153 SOUTH AMERICA: CROSSLINKING AGENTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 154 SOUTH AMERICA: CROSSLINKING AGENTS MARKET, BY CHEMISTRY, 2019–2022 (KILOTON)

- TABLE 155 SOUTH AMERICA: CROSSLINKING AGENTS MARKET, BY CHEMISTRY, 2023–2028 (KILOTON)

- TABLE 156 SOUTH AMERICA: CROSSLINKING AGENTS MARKET, BY CHEMISTRY, 2019–2022 (USD MILLION)

- TABLE 157 SOUTH AMERICA: CROSSLINKING AGENTS MARKET, BY CHEMISTRY, 2023–2028 (USD MILLION)

- TABLE 158 SOUTH AMERICA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 159 SOUTH AMERICA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 160 SOUTH AMERICA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 161 SOUTH AMERICA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 162 BRAZIL: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 163 BRAZIL: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 164 BRAZIL: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 165 BRAZIL: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 166 ARGENTINA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 167 ARGENTINA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 168 ARGENTINA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 169 ARGENTINA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 170 REST OF SOUTH AMERICA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 171 REST OF SOUTH AMERICA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 172 REST OF SOUTH AMERICA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 173 REST OF SOUTH AMERICA: CROSSLINKING AGENTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 174 COMPANIES ADOPTED ACQUISITIONS AND EXPANSIONS AS KEY GROWTH STRATEGIES BETWEEN 2020 AND 2023

- TABLE 175 CROSSLINKING AGENTS MARKET: DEGREE OF COMPETITION

- TABLE 176 CROSSLINKING AGENTS MARKET: REVENUE ANALYSIS (USD)

- TABLE 177 MARKET EVALUATION MATRIX

- TABLE 178 PRODUCT LAUNCHES, 2020–2023

- TABLE 179 DEALS, 2020–2023

- TABLE 180 OTHER DEVELOPMENTS, 2020–2023

- TABLE 181 BASF SE: COMPANY OVERVIEW

- TABLE 182 BASF SE: OTHERS

- TABLE 183 COVESTRO AG: COMPANY OVERVIEW

- TABLE 184 COVESTRO AG: DEALS

- TABLE 185 COVESTRO AG: OTHERS

- TABLE 186 ALLNEX GROUP: COMPANY OVERVIEW

- TABLE 187 ALLNEX GROUP: DEALS

- TABLE 188 ALLNEX GROUP: OTHERS

- TABLE 189 EVONIK INDUSTRIES: COMPANY OVERVIEW

- TABLE 190 EVONIK INDUSTRIES: PRODUCT LAUNCHES

- TABLE 191 HUNTSMAN CORPORATION: COMPANY OVERVIEW

- TABLE 192 HUNTSMAN CORPORATION: DEALS

- TABLE 193 HUNTSMAN CORPORATION: OTHERS

- TABLE 194 WACKER CHEMIE AG: COMPANY OVERVIEW

- TABLE 195 WACKER CHEMIE AG: DEALS

- TABLE 196 WACKER CHEMIE AG: OTHERS

- TABLE 197 WANHUA CHEMICAL GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 198 WANHUA CHEMICAL GROUP CO., LTD.: OTHERS

- TABLE 199 THE DOW CHEMICAL COMPANY: COMPANY OVERVIEW

- TABLE 200 THE DOW CHEMICAL COMPANY: OTHERS

- TABLE 201 DSM COATING RESINS LTD.: COMPANY OVERVIEW

- TABLE 202 ADITYA BIRLA ADVANCED MATERIALS: COMPANY OVERVIEW

- TABLE 203 ADITYA BIRLA ADVANCED MATERIALS: OTHERS

- TABLE 204 HEXION INC.: COMPANY OVERVIEW

- TABLE 205 SEALED AIR CORPORATION: COMPANY OVERVIEW

- TABLE 206 LORD CORPORATION: COMPANY OVERVIEW

- TABLE 207 DUPONT: COMPANY OVERVIEW

- TABLE 208 SHANGHAI SISHENG POLYMER MATERIALS CO. LTD.: COMPANY OVERVIEW

- TABLE 209 MOMENTIVE PERFORMANCE INC.: COMPANY OVERVIEW

- TABLE 210 NAGASE AMERICA CORPORATION: COMPANY OVERVIEW

- TABLE 211 INCOREZ LIMITED: COMPANY OVERVIEW

- TABLE 212 BANXENDEN CHEMICALS LIMITED: COMPANY OVERVIEW

- TABLE 213 ANGUS CHEMICAL COMPANY: COMPANY OVERVIEW

- TABLE 214 SHANGHAI ZEALCHEM CO. LTD.: COMPANY OVERVIEW

- TABLE 215 SUPER URECOAT INDUSTRIES: COMPANY OVERVIEW

- TABLE 216 ELANTAS GMBH: COMPANY OVERVIEW

- TABLE 217 MEL CHEMICALS: COMPANY OVERVIEW

- TABLE 218 STAHL HOLDINGS B.V.: COMPANY OVERVIEW

- FIGURE 1 CROSSLINKING AGENTS: MARKET SEGMENTATION

- FIGURE 2 CROSSLINKING AGENTS MARKET: RESEARCH DESIGN

- FIGURE 3 CROSSLINKING AGENTS MARKET: BOTTOM-UP APPROACH

- FIGURE 4 CROSSLINKING AGENTS MARKET: TOP-DOWN APPROACH

- FIGURE 5 CROSSLINKING AGENTS MARKET: DATA TRIANGULATION

- FIGURE 6 ISOCYANATE CHEMISTRY TO LEAD CROSSLINKING AGENTS MARKET DURING FORECAST PERIOD

- FIGURE 7 INDUSTRIAL COATINGS APPLICATION TO LEAD CROSSLINKING AGENTS MARKET DURING FORECAST PERIOD

- FIGURE 8 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF CROSSLINKING AGENTS MARKET IN 2022

- FIGURE 9 ASIA PACIFIC TO OFFER ATTRACTIVE OPPORTUNITIES IN CROSSLINKING AGENTS MARKET DURING FORECAST PERIOD

- FIGURE 10 CHINA INDUSTRIAL COATINGS SEGMENT TO LEAD CROSSLINKING AGENTS MARKET IN ASIA PACIFIC IN 2023

- FIGURE 11 ISOCYANATE TO REMAIN LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 12 INDUSTRIAL COATINGS TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 13 INDIA TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN CROSSLINKING AGENTS MARKET

- FIGURE 15 OVERVIEW OF CROSSLINKING AGENTS MARKET VALUE CHAIN

- FIGURE 16 CROSSLINKING AGENTS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 17 CROSSLINKING AGENTS MARKET: ECOSYSTEM MAPPING

- FIGURE 18 TOTAL NUMBER OF PATENTS DURING LAST 10 YEARS

- FIGURE 19 PATENT ANALYSIS, BY LEGAL STATUS

- FIGURE 20 TOP JURISDICTIONS FOR CROSSLINKING AGENTS PATENTS

- FIGURE 21 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

- FIGURE 22 ISOCYANATE TO BE LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 23 INDUSTRIAL COATINGS TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 24 RAPID GROWTH MARKETS EMERGING AS NEW HOTSPOTS

- FIGURE 25 EUROPE: CROSSLINKING AGENTS MARKET SNAPSHOT

- FIGURE 26 ASIA PACIFIC: CROSSLINKING AGENTS MARKET SNAPSHOT

- FIGURE 27 RANKING OF TOP FIVE PLAYERS IN CROSSLINKING AGENTS MARKET, 2022

- FIGURE 28 CROSSLINKING AGENTS MARKET SHARE, BY COMPANY, 2022

- FIGURE 29 CROSSLINKING AGENTS MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 30 CROSSLINKING AGENTS MARKET: START-UPS AND SMES MATRIX, 2022

- FIGURE 31 BASF SE: COMPANY SNAPSHOT

- FIGURE 32 COVESTRO AG: COMPANY SNAPSHOT

- FIGURE 33 EVONIK INDUSTRIES: COMPANY SNAPSHOT

- FIGURE 34 HUNTSMAN CORPORATION: COMPANY SNAPSHOT

- FIGURE 35 WACKER CHEMIE AG: COMPANY SNAPSHOT

- FIGURE 36 THE DOW CHEMICAL COMPANY: COMPANY SNAPSHOT

The study involved four major activities in estimating the market size of the Cross Linking Agents market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, certified publications, articles from recognized authors, gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key Cross Linking Agents, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The Cross Linking Agents market comprises several stakeholders in the value chain, which include raw material suppliers, manufacturers, and end users. Various primary sources from the supply and demand sides of the Cross Linking Agents market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the Cross Linking Agents industry.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to chemistry, application, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of Cross Linking Agents and future outlook of their business which will affect the overall market.

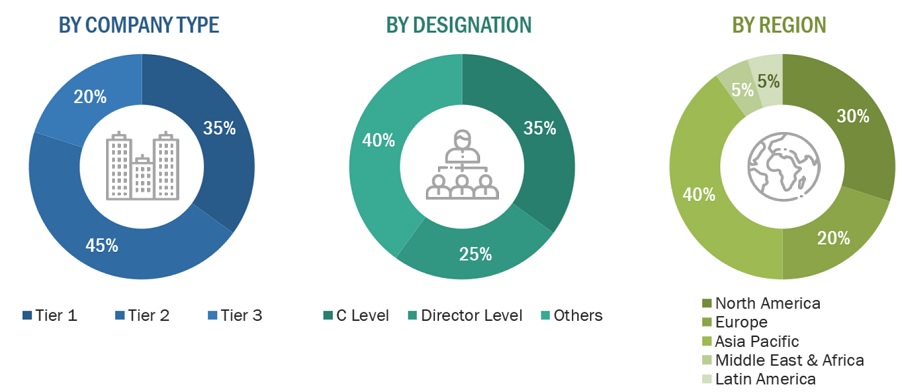

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2022 available in the public domain, product portfolios, and geographical presence.

Other designations include sales representatives, production heads, and technicians.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach was used to estimate and validate the size of various submarkets for Cross Linking Agents for each region. The research methodology used to estimate the market size included the following steps:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- The global market was then segmented into five major regions and validated by industry experts.

- All percentage shares, splits, and breakdowns based on chemistry, application, and country were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added with detailed inputs and analysis and presented in this report.

Cross Linking Agents Market: Bottum-Up Approach

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Cross Linking Agent Market: Top-Down Approach

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

Data Triangulation

After arriving at the total market size from the estimation process Cross Linking Agents above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

Cross-linking agents, also known as crosslinkers, are chemical compounds used to form covalent bonds between polymer chains. They play a crucial role in polymer chemistry and materials science by enhancing the properties of polymers. By connecting adjacent polymer chains, cross-linking agents create a three-dimensional network structure, making the material more rigid, durable, and heat resistant. These agents can be organic, such as di- or multifunctional compounds, peroxides, and aziridines, or inorganic compounds. Their ability to create cross-links between polymer chains improves the overall performance and stability of polymers in various applications including decorative and industrial.

Key Stakeholders

- Cross Linking Agents Manufacturers

- Cross Linking Agents Traders, Distributors, and Suppliers

- Raw Type Suppliers

- Government and Private Research Organizations

- Associations and Industrial Bodies

- R&D Institutions

- Environmental Support Agencies

Report Objectives

- To define, describe, and forecast the size of the Cross Linking Agents market, in terms of value and volume.

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market.

- To estimate and forecast the market size based on chemistry, application, and region.

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries.

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market.

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders.

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market.

- To strategically profile key market players and comprehensively analyze their core competencies.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players

Tariff & Regulations

- Regulations and impact on Cross Linking Agents market

By Form Analysis

- Market size for Cross Linking Agents in terms of value and volume

Growth opportunities and latent adjacency in Cross Linking Agents Market