Epoxy Curing Agents Market by Type (Amine-Based Curing Agents, Anhydride Curing Agents), Application (Coatings, Construction, Adhesives, Composites, Wind Energy, Electrical & Electronics), and Region - Global Forecast to 2022

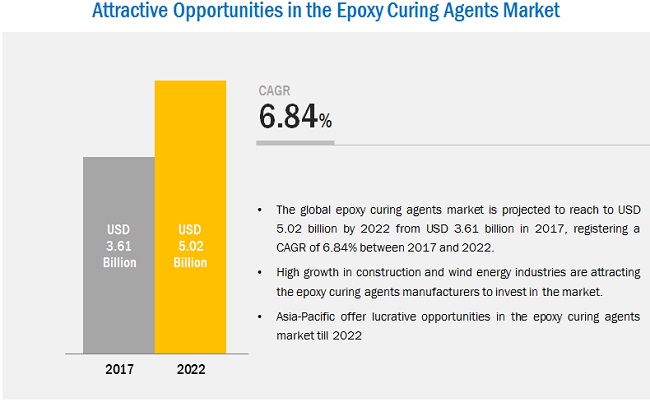

[162 Pages Report] The epoxy curing agent market is estimated at USD 3.61 billion in 2017 and is projected to reach USD 5.02 billion by 2022, at a CAGR of 6.84% during the forecast period. In this study, 2016 has been considered as the base year, and the forecast period is 2017-2022. The report aims at estimating the size and growth potential of the epoxy curing agent market across different segments, such as type, application, and region. Factors such as drivers, restraints, opportunities, and challenges influencing the growth of the epoxy curing agent market have also been studied in this report. The report analyzes opportunities in the epoxy curing agent market for stakeholders and presents a competitive landscape of the market.

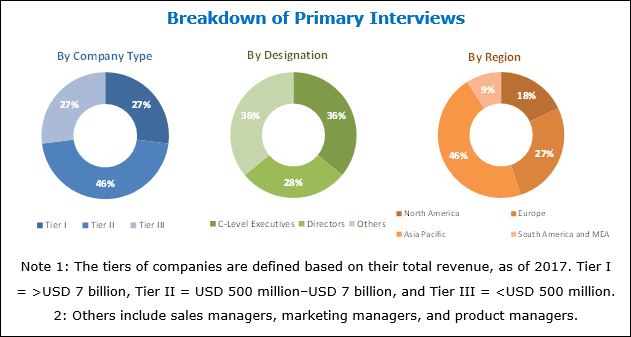

Both, top-down and bottom-up approaches have been used to estimate and validate the market size of epoxy curing agent and to estimate the sizes of various other dependent submarkets. This research study involved extensive use of secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg, Chemical Weekly, Factiva, and other government associations. Moreover, private websites and company websites have also been used to identify and collect information useful for this technical, market-oriented, and commercial study of the epoxy curing agent market. After arriving at the total market size, the overall market has been split into several segments and subsegments. The figure given below provides a breakdown of primaries conducted during the research study, based on company type, designation, and region.

To know about the assumptions considered for the study, download the pdf brochure

Evonik Industries (Germany), Hexion Inc. (US), Huntsman Corporation (US), Cardolite Corporation (US), BASF S.E. (Germany), Cardolite Corporation (US) are some of the key players operating in the epoxy curing agent market.

Key Target Audience:

- Epoxy curing agent Manufacturers

- Raw Material Suppliers

- Formulation Technology Providers

- Industry Associations

- End-User Companies

- Traders, Distributors, and Suppliers of Epoxy curing agent

- Government & Regional Agencies and Research Organizations

- NGOs, Government, and Regional Agencies

- Research Organizations and Associations

Scope of the Report

This research report categorizes the epoxy curing agent market based on type, application, and region.

Epoxy curing agent Market, By Type

- Amine-based Curing Agents

- Anhydrides Curing Agents

- Others

Epoxy curing agent Market, By Application

- Coatings

- Electrical & Electronics

- Wind Energy

- Construction

- Adhesive

- Composite

- Others

Epoxy curing agent Market, By Region

- Asia-Pacific

- Europe

- North America

- South America

- Middle East & Africa

The market is further analyzed for key countries in each of these regions.

Available Customizations:

Along with the market data, MarketsandMarkets offers customizations according to the specific needs of companies. The following customization options are available for the report:Regional Analysis:

- Country-level analysis of the epoxy curing agent market

Company Information:

- Detailed analysis and profiles of additional market players

The epoxy curing agent market is estimated at USD 3.61 billion in 2017 and is projected to reach USD 5.02 billion by 2022, at a CAGR of 6.84% from 2017 to 2022. The increasing use of epoxy curing agent in various applications, such as coatings, electrical & electronics, wind energy, construction, adhesive, and composite is driving the growth of the epoxy curing agent market.

The epoxy curing agent market has been segmented on the basis of type, application, and region. Based on type, the epoxy curing agent market has been segmented into amine-based, anhydride, and others. The amine-based segment is expected to grow at the highest CAGR in terms of value. Amine-based curing agents are more durable and chemical resistant than other curing agents, including its advanced properties such as curing time, pot life, chemical & thermal resistant, and weather ability. These curing agents play a vital role in determining the properties of the final cured product.

Based on application, the epoxy curing agent market has been segmented into coatings, electrical & electronics, wind energy, construction, adhesive, composite, and others. The wind energy segment is expected to grow at the highest CAGR, in terms of value, during the forecast period. Curing agents are preferred for epoxy resins for wind blade fabrications due to their high sheer, compressive strength, and light weight. The fatigue performance of epoxy curing agents improves the composite mechanical properties in rotor blades, thereby, enhancing the performance of wind turbine. These all are considered to be the forthcoming factors for epoxy curing agent into different applications.

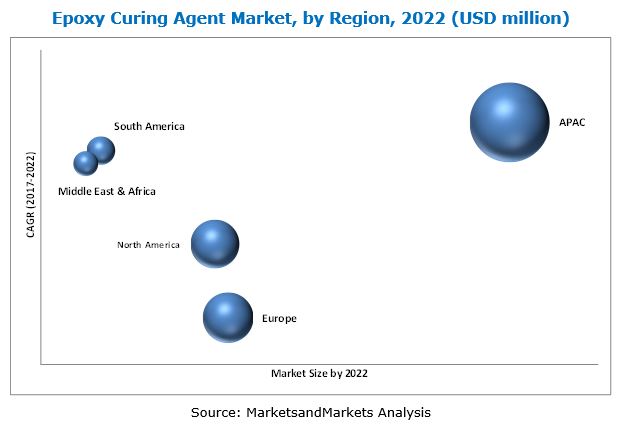

The epoxy curing agent market in the Asia Pacific region is expected to grow at the highest CAGR during the forecast period. APAC is a rapidly developing region with many emerging countries and application sectors. These hold much opportunity for industry players who are willing to invest in these areas. The rising demand for epoxy curing agent from the key applications are coating, electrical & electronics, wind energy, construction, adhesive, composite, and others from countries such as India, China, Japan and others is projected to drive the growth of the epoxy curing agent market in the region.

Strict regulations from regulatory bodies restrain the manufacturing of curing agents for epoxy resins in European regions. With the increase in environmental concerns and regulatory policies, the manufacturers are adopting eco-friendly products in various applications. Furthermore, the global manufacturers of epoxy curing agents are focusing on ensuring safety and avoid health hazards due to the VOCs emission from chemical products.

Key players operating in the epoxy curing agent market include Evonik Industries (Germany), Hexion Inc. (US), Huntsman Corporation (US), Cardolite Corporation (US), BASF S.E. (Germany), Cardolite Corporation (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Scope of the Study

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions and Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 27)

3.1 Introduction

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in the Epoxy Curing Agents Market

4.2 Epoxy Curing Agents Market, By Type

4.3 Epoxy Curing Agents Market, By Application and Country in Asia-Pacific

4.4 Epoxy Curing Agents Market, By Country

4.5 Epoxy Curing Agents Market, Developed vs Developing Countries

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Type

5.2.2 By Application

5.2.3 By Region

5.3 Market Dynamics

5.4 Impact Analysis of Drivers and Restraints

5.4.1 Drivers

5.4.1.1 High Growth in Construction and Wind Energy Industries

5.4.1.2 High Growth in End-Use Industries of Asia-Pacific

5.4.1.3 Huge Developments in Emerging Economies

5.4.1.4 Technological Advancement in Manufacturing Process

5.4.2 Restraints

5.4.2.1 Environmental Regulation in European Countries

5.4.3 Opportunities

5.4.3.1 Lucrative Opportunities Across Asia-Pacific Market

5.5 Challenges

5.5.1 Increasing Competition From the Chinese Market

6 Industry Trends (Page No. - 43)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porters Five Forces Analysis

6.3.1 Intensity of Competitive Rivalry

6.3.2 Bargaining Power of Buyers

6.3.3 Bargaining Power of Suppliers

6.3.4 Threat of Substitutes

6.3.5 Threat of New Entrants

7 Patent Details (Page No. - 48)

7.1 Introduction

7.2 Patent Details

8 Macro Economic Overview and Key Trends (Page No. - 51)

8.1 Introduction

8.2 Trends and Forecast of GDP

8.3 Trends and Forecast of the Construction Industry

8.3.1 North America: Trends and Forecast of the Construction Industry

8.3.2 Europe: Trends and Forecast of the Construction Industry

8.3.3 Asia-Pacific: Trends and Forecast of the Construction Industry

8.3.4 Middle East & Africa: Trends and Forecast of the Construction Industry

8.3.5 South America: Trends and Forecast of the Construction Industry

9 Epoxy Curing Agents Market, By Type (Page No. - 55)

9.1 Introduction

9.2 Amine-Based Curing Agents

9.2.1 Aliphatic Amine Curing Agents

9.2.1.1 Primary & Secondary Aliphatic Amine

9.2.1.2 Modified Aliphatic Amine

9.2.2 Cycloaliphatic Amine Curing Agents

9.2.3 Polyamide Curing Agents

9.2.4 Amidoamines Curing Agents

9.2.5 Other Amines-Based Curing Agents

9.2.5.1 Metaphenylene Diamine (MPDA)

9.2.5.2 Methylene Dianiline (MDA)

9.3 Anhydride Curing Agents

9.3.1 Hexahydrophthalic Anhydride (HHPA)

9.3.2 Nadic Methyl Anhydride

9.3.3 Pyromellitic Dianhydride (PMDA)

9.3.4 Other Anhydride Curing Agents

9.4 Other Curing Agents

9.4.1 Polysulfides

9.4.2 Mercaptans

9.4.3 Phenalkamine

9.4.4 Phenalkamide

9.4.5 Polyamido-Amines

9.4.6 Latent Curing Agents

10 Epoxy Curing Agents Market, By Application (Page No. - 69)

10.1 Introduction

10.2 Coatings

10.3 Electrical & Electronics

10.4 Wind Energy

10.5 Construction

10.6 Composites

10.7 Adhesives

10.8 Other Applications

10.8.1 Elastomers

10.8.2 Additives

10.8.3 Accelerators

11 Epoxy Curing Agents Market, By Region (Page No. - 82)

11.1 Introduction

11.2 North America

11.2.1 Country-Wise Key Insights

11.2.1.1 U.S.

11.2.1.2 Canada

11.2.1.3 Mexico

11.3 Europe

11.3.1 Country-Wise Key Insights

11.3.1.1 Germany

11.3.1.2 France

11.3.1.3 Netherlands

11.3.1.4 U.K.

11.3.1.5 Russia

11.3.1.6 Italy

11.3.1.7 Turkey

11.3.1.8 Spain

11.3.1.9 Rest of Europe

11.4 Asia-Pacific

11.4.1 Country-Wise Key Insights

11.4.1.1 China

11.4.1.2 India

11.4.1.3 Japan

11.4.1.4 South Korea

11.4.1.5 Taiwan

11.4.1.6 Malaysia

11.4.1.7 Indonesia

11.4.1.8 Rest of Asia-Pacific

11.5 Middle East & Africa

11.5.1 Country-Wise Key Insights

11.5.1.1 UAE

11.5.1.2 Saudi Arabia

11.5.1.3 South Africa

11.6 South America

11.6.1 Country-Wise Key Insights

11.6.1.1 Brazil

11.6.1.2 Argentina

11.6.1.3 Colombia

11.6.1.4 Rest of South America

12 Market Share Analysis (Page No. - 117)

12.1 Introduction

13 Competitive Landscape (Page No. - 118)

13.1 Overview

13.2 Competitive Situation and Trends

13.2.1 New Product Launches

13.2.2 Mergers & Acquisitions

13.2.3 Investments & Expansions

13.2.4 Agreements

14 Company Profiles (Page No. - 123)

(Overview, Financial*, Products & Services, Strategy, and Developments)

14.1 Evonik Industries

14.2 Air Products and Chemicals, Inc.

14.3 Hexion Inc.

14.4 BASF SE

14.5 Huntsman Corporation

14.6 Cardolite Corporation

14.7 Kukdo Chemical Co., Ltd.

14.8 Aditya Birla Chemicals (Thailand) Ltd.

14.9 Mitsubishi Chemical Corporation

14.10 Atul Limited

14.11 Epoxy Base Electronic Material Co. Ltd. (Grace Epoxy)

14.12 List of Other Companies

*Details Might Not Be Captured in Case of Unlisted Companies

15 Appendix (Page No. - 156)

15.1 Discussion Guide

15.2 Knowledge Store: Marketsandmarkets Subscription Portal

15.3 Introducing RT: Real-Time Market Intelligence

15.4 Available Customizations

15.5 Related Reports

15.6 Author Details

List of Tables (89 Tables)

Table 1 Epoxy Curing Agents: Market Snapshot

Table 2 Trends and Forecast of GDP, USD Billion (20152021)

Table 3 Contribution of the Construction Industry to GDP in North America, By Country, USD Billion (20142021)

Table 4 Contribution of the Construction Industry to GDP in Europe, By Country, USD Billion (20142021)

Table 5 Contribution of the Construction Industry to GDP in Asia-Pacific, By Country, USD Billion (20142021)

Table 6 Contribution of the Construction Industry to GDP in Middle East & Africa, USD Billion (20142021)

Table 7 Contribution of the Construction Industry to GDP in South America, USD Billion (20142021)

Table 8 Epoxy Curing Agent Market Size, By Type, 20152022 (USD Million)

Table 9 Epoxy Curing Agent Market Size, By Type, 20152022 (Kiloton)

Table 10 Amine-Based Curing Agents Market Size, By Amine Type, 20152022 (USD Million)

Table 11 Amine-Based Curing Agents Market Size, By Amine Type, 20152022 (Kiloton)

Table 12 Amine-Based Epoxy Curing Agents Market Size, By Region, 20152022 (USD Million)

Table 13 Amine-Based Epoxy Curing Agents Market Size, By Region, 20152022 (Kiloton)

Table 14 Aliphatic Amine Curing Agents Market Size, By Region, 20152022 (USD Million)

Table 15 Aliphatic Amine Curing Agents Market Size, By Region, 20152022 (Kiloton)

Table 16 Cycloaliphatic Amine Curing Agents Market Size, By Region, 20152022 (USD Million)

Table 17 Cycloaliphatic Amine Curing Agents Market Size, By Region, 2015-2022 (Kiloton)

Table 18 Polyamide Curing Agents Market Size, By Region, 20152022 (USD Million)

Table 19 Polyamide Curing Agents Market Size, By Region, 20152022 (Kiloton)

Table 20 Amidoamines Curing Agents Market Size, By Region, 20152022 (USD Million)

Table 21 Amidoamines Curing Agents Market Size, By Region, 20152022 (Kiloton)

Table 22 Other Amines-Based Curing Agents Market Size, By Region, 20152022 (USD Million)

Table 23 Other Amines-Based Curing Agents Market Size, By Region, 20152022 (Kiloton)

Table 24 Anhydrides Epoxy Curing Agent Market Size, By Region, 20152022 (USD Million)

Table 25 Anhydrides Epoxy Curing Agent Market Size, By Region, 20152022 (Kiloton)

Table 26 Other Epoxy Curing Agents Market Size, By Region, 20152022 (USD Million)

Table 27 Other Epoxy Curing Agents Market Size, By Region, 20152022 (Kiloton)

Table 28 Epoxy Curing Agents Market Size, By Application, 20152022 (USD Million)

Table 29 Epoxy Curing Agents Market Size, By Application, 20152022 (Kiloton)

Table 30 Epoxy Curing Agents Market Size in Coatings, By Region, 20152022 (USD Million)

Table 31 Epoxy Curing Agents Market Size in Coatings, By Region, 20152022 (Kiloton)

Table 32 Epoxy Curing Agents Market Size in Electrical & Electronics, By Region, 20152022 (USD Million)

Table 33 Epoxy Curing Agents Market Size in Electrical & Electronics, By Region, 20152022 (Kiloton)

Table 34 Epoxy Curing Agents Market Size in Wind Energy, By Region, 20152022 (USD Million)

Table 35 Epoxy Curing Agents Market Size in Wind Energy, By Region, 20152022 (Kiloton)

Table 36 Epoxy Curing Agents Market Size in Construction, By Region, 20152022 (USD Million)

Table 37 Epoxy Curing Agents Market Size in Construction, By Region, 20152022 (Kiloton)

Table 38 Epoxy Curing Agents Market Size in Composites, By Region, 20152022 (USD Million)

Table 39 Epoxy Curing Agents Market Size in Composites, By Region, 20152022 (Kiloton)

Table 40 Epoxy Curing Agents Market Size in Adhesives, By Region, 20152022 (USD Million)

Table 41 Epoxy Curing Agents Market Size in Adhesives, By Region, 20152022 (Kiloton)

Table 42 Epoxy Curing Agents Market Size in Other Applications, By Region, 20152022 (USD Million)

Table 43 Epoxy Curing Agents Market Size in Other Applications, By Region, 20152022 (Kiloton)

Table 44 Epoxy Curing Agents Market Size, By Region, 20152022 (USD Million)

Table 45 Epoxy Curing Agents Market Size, By Region, 20152022 (Kiloton)

Table 46 North America: Epoxy Curing Agents Market Size, By Country, 20152022 (USD Million)

Table 47 North America: Epoxy Curing Agents Market Size, By Country, 20152022 (Kiloton)

Table 48 North America: Epoxy Curing Agents Market Size, By Type, 20152022 (USD Million)

Table 49 North America: Epoxy Curing Agents Market Size, By Type, 20152022 (Kiloton)

Table 50 North America: Epoxy Curing Agents Market Size, By Amine Type, 20152022 (USD Million)

Table 51 North America: Epoxy Curing Agents Market Size, By Amine Type, 20152022 (Kiloton)

Table 52 North America: Epoxy Curing Agents Market Size, By Application, 20152022 (USD Million)

Table 53 North America: Epoxy Curing Agents Market Size, By Application, 20152022 (Kiloton)

Table 54 Europe: Epoxy Curing Agents Market Size, By Country, 20152022 (USD Million)

Table 55 Europe: Epoxy Curing Agents Market Size, By Country, 20152022 (Kiloton)

Table 56 Europe: Epoxy Curing Agents Market Size, By Type, 20152022 (USD Million)

Table 57 Europe: Epoxy Curing Agents Market Size, By Type, 20152022 (Kiloton)

Table 58 Europe: Epoxy Curing Agents Market Size, By Amine Type, 20152022 (USD Million)

Table 59 Europe: Epoxy Curing Agents Market Size, By Amine Type, 20152022 (Kiloton)

Table 60 Europe: Epoxy Curing Agents Market Size, By Application 20152022 (USD Million)

Table 61 Europe: Epoxy Curing Agents Market Size, By Application, 20152022 (Kiloton)

Table 62 Asia-Pacific: Epoxy Curing Agents Market Size, By Country, 20152022 (USD Million)

Table 63 Asia-Pacific: Epoxy Curing Agents Market Size, By Country, 20152022 (Kiloton)

Table 64 Asia-Pacific: Epoxy Curing Agents Market Size, By Type, 20152022 (USD Million)

Table 65 Asia-Pacific: Epoxy Curing Agents Market Size, By Type, 20152022 (Kiloton)

Table 66 Asia-Pacific: Epoxy Curing Agents Market Size, By Amine Type, 20152022 (USD Million)

Table 67 Asia-Pacific: Epoxy Curing Agents Market Size, By Amine Type, 20152022 (Kiloton)

Table 68 Asia-Pacific: Epoxy Curing Agents Market Size, By Application, 20152022 (USD Million)

Table 69 Asia-Pacific: Epoxy Curing Agents Market Size, By Application, 20152022 (Kiloton)

Table 70 Middle East & Africa: Epoxy Curing Agents Market Size, By Country, 20152022 (USD Million)

Table 71 Middle East & Africa: Epoxy Curing Agents Market Size, By Country, 20152022 (Kiloton)

Table 72 Middle East & Africa: Epoxy Curing Agents Market Size, By Type, 20152022 (USD Million)

Table 73 Middle East & Africa: Epoxy Curing Agents Market Size, By Type, 20152022 (Kiloton)

Table 74 Middle East & Africa: Epoxy Curing Agents Market Size, By Amine Type, 20152022 (USD Million)

Table 75 Middle East & Africa: Epoxy Curing Agents Market Size, By Amine Type, 20152022 (Kiloton)

Table 76 Middle East & Africa: Epoxy Curing Agents Market Size, By Application, 20152022 (USD Million)

Table 77 Middle East & Africa: Epoxy Curing Agents Market Size, By Application, 20152022 (Kiloton)

Table 78 South America: Epoxy Curing Agents Market Size, By Country, 20152022 (USD Million)

Table 79 South America: Epoxy Curing Agents Market Size, By Country, 20152022 (Kiloton)

Table 80 South America: Epoxy Curing Agents Market Size, By Type, 20152022 (USD Million)

Table 81 South America: Epoxy Curing Agents Market Size, By Type, 20152022 (Kiloton)

Table 82 South America: Epoxy Curing Agents Market, By Amine Type, 20152022 (USD Million)

Table 83 South America: Epoxy Curing Agents Market Size, By Amine Type, 20152022 (Kiloton)

Table 84 South America: Epoxy Curing Agents Market Size, By Application, 20152022 (USD Million)

Table 85 South America: Epoxy Curing Agents Market Size, By Application, 20152022 (Kiloton)

Table 86 New Product Launches, 20122017

Table 87 Mergers & Acquisitions, 20122017

Table 88 Investments & Expansions, 20122017

Table 89 Agreements, 20122017

List of Figures (53 Figures)

Figure 1 Epoxy Curing Agents: Market Segmentation

Figure 2 Epoxy Curing Agents Market: Research Design

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Epoxy Curing Agents Market: Data Triangulation

Figure 6 Asia-Pacific to Dominate the Epoxy Curing Agents Market Till 2022

Figure 7 Amine-Based Epoxy Curing Agents: the Largest Type of the Epoxy Curing Agents Market Between 2017 and 2022

Figure 8 Wind Energy to Be the Fastest-Growing Application Between 2017 and 2022

Figure 9 Asia-Pacific to Be the Fastest-Growing Market for Epoxy Curing Agents By 2022

Figure 10 Emerging Economies Offer Attractive Opportunities in the Epoxy Curing Agents Market

Figure 11 Amine-Based Curing Agents Dominate the Epoxy Curing Agents Market

Figure 12 Coatings Application Captured the Largest Share in the Emerging Asia-Pacific Market in 2016

Figure 13 India to Be the Fastest-Growing Market for Epoxy Curing Agents

Figure 14 The Market in Developing Countries to Grow Faster Than That in Developed Countries, 20172022

Figure 15 Epoxy Curing Agents Market, By Region

Figure 16 Drivers, Restraints, Opportunities, and Challenges in the Epoxy Curing Agents Market

Figure 17 Impact Analysis: Epoxy Curing Agents Market

Figure 18 Cumulative Growth in Global Wind Capacity, 20152020

Figure 19 Emerging Economies: Investment in Infrastructure Development, 20082017

Figure 20 Epoxy Curing Agent Market: Value Chain Analysis

Figure 21 Epoxy Curing Agents Market: Porters Five Forces Analysis

Figure 22 Japan Accounted for the Highest Number of Patents Between 2015 and 2016

Figure 23 Hexcel Composites Ltd Registered the Highest Number of Patents Between 2015 and 2016

Figure 24 GDP of Major Countries in the World in 2015

Figure 25 AmineBased Curing Agents to Dominate Epoxy Curing Agents Market Between 2017 and 2022

Figure 26 Coatings and Electrical & Electronics Industries to Drive the Market

Figure 27 Wind Energy is the Fastest-Growing Application Segment, 20172022

Figure 28 Growth in Electronics Industry

Figure 29 Wind Energy Market Forecast, By Region, 20162020

Figure 30 Construction Sector Growth: Developing vs Developed Nations

Figure 31 Regional Snapshot: Epoxy Curing Agents Market, Key Countries

Figure 32 Future Growth for Epoxy Curing Agents Type Centered in Asia-Pacific Between 2017 and 2022

Figure 33 Asia-Pacific to Be Fastest-Growing Application Market for Epoxy Curing Agents Market Between 2017 and 2022

Figure 34 Epoxy Curing Agents Market Was Dominated By Asia-Pacific in 2016

Figure 35 Asia-Pacific Was the Largest Epoxy Curing Agents Market in 2016

Figure 36 North American Epoxy Curing Agents Market Snapshot: U.S. Was the Largest Market in 2016

Figure 37 Europe Epoxy Curing Agents Market Snapshot: Germany is the Largest Market, 2016

Figure 38 Asia-Pacific Epoxy Curing Agents Market Snapshot: China is the Most Lucrative Market

Figure 39 Leading Players Dominated the Epoxy Curing Agents Market in 2016

Figure 40 Companies Adopted New Product Launches as the Key Growth Strategy Between 2012 and 2017

Figure 41 New Product Launches: the Key Strategy Between 2012 and 2017

Figure 42 Evonik Industries: Company Snapshot

Figure 43 Evonik Industries: SWOT Analysis

Figure 44 Air Products and Chemicals, Inc.: Company Snapshot

Figure 45 Hexion Inc.: Company Snapshot

Figure 46 Hexion Inc.: SWOT Analysis

Figure 47 BASF SE: Company Snapshot

Figure 48 BASF SE: SWOT Analysis

Figure 49 Huntsman Corporation: Company Snapshot

Figure 50 Huntsman Corporation: SWOT Analysis

Figure 51 Aditya Birla Chemicals (Thailand) Ltd.: Business Overview

Figure 52 Mitsubishi Chemical Corporation: Company Snapshot

Figure 53 Atul Limited: Company Snapshot

Growth opportunities and latent adjacency in Epoxy Curing Agents Market

Market analysis of various types and their applications the epoxy resins market

Epoxy Curing Agents Market needed at lower prices

Curing agents applications and special interest in Anhydride and E&E market.

Use of DADPS as a curing agent

Looking for updated information of the respective market