Data Prep Market by Platform (Self-Service Data Prep, Data Integration), Tool (Data Curation, Data Cataloguing, Data Quality, Data Ingestion, Data Governance), Deployment, Vertical, and Region - Global Forecast to 2021

[130 Pages Report] The overall data prep market is expected to grow from USD 1.46 billion in 2016 to USD 3.93 billion by 2021, at a CAGR of 25.2% from 2016 to 2021. Data prep makes use of tools such as data curation, data cataloging, data quality, data ingestion, and data governance to create consistent data of high quality, by eliminating low quality and incorrect data which would hamper the efficient functioning of processes like analytics and data mining. Data prep makes it possible to validate and rationalize data obtained from various disparate sources, which help with the integration of different application. The base year considered for the study is 2015, and the forecast has been provided for the period between 2016 and 2021.

Request New Version to get the global data prep market forecasts to 2025

Market Dynamics

Drivers

- Increasing importance of on-time qualified data

- Rising need for adhering to regulatory and compliance requirements

- Benefits of streamlined business operations

- The growing use of data prep for predictive business analytics

Restraints

- Presence of data silos

- Lack of awareness & expertise and other operational challenges

Opportunities

- Evolution of IoT

- Increasing number of organizations harnessing the advantage of data preparation

- Deploying specific tools & technologies to increase data access & data convergence

Challenges

- Difficulty in shifting from traditional architecture to new technologies and systems

- Data security and privacy concerns

Increasing importance of on-time qualified data

Increasing amount of unstructured data has been a major challenge among various industries. Hence, organizations are in search of tools that can arrange data in a proper format. Data preparation tools has been among those, which assist companies with on-time qualified data, which has the ability to deduce the latent information from functional data exchange in a timely manner and a consistent format without the presence of original author/owner of the data. On-time qualified information is instrumental in making effective business decisions and it helps in aligning organizations’ strategic initiatives. The major concern for various departments in an enterprise is to judge which data is qualified and to decide upon the ownership of data. The delivery of on-time data can help companies in making the most acute tactical decisions as well as establishing association rules and co-relations between different heterogeneous variables

The following are the major objectives of the study.

- To describe and forecast the data prep market, in terms of platform, tools, deployment models, and industry verticals

- To describe and forecast the global market by region– North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To provide detailed information regarding major factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the data preparation ecosystem

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing competitive landscape for market leaders

- To analyze strategic approaches such as product launches, acquisitions, contracts, agreements, and partnerships in the market

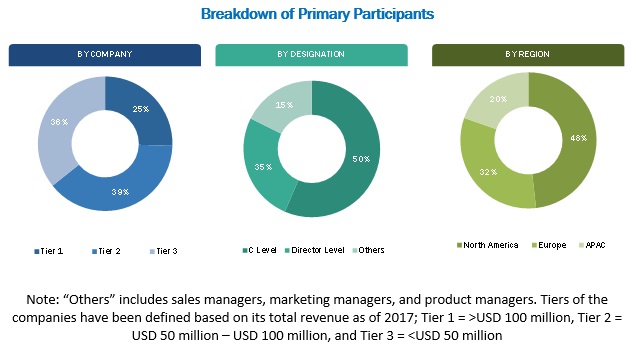

During this research study, major players operating in the data prep market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

The global market comprises a network of players involved in the research and product development; system integrator; software and service provider; distribution and sale; and post-sales services. Key players considered in the analysis of the data prep market are Alteryx (US), Informatica (US), IBM (US), TIBCO Software (US), Microsoft Corporation (US), SAS Institute (US), Datawatch (US), Tableau Software (US), Qlik Technologies (US), and SAP SE (US), Talend (US) and Microstrategy (US).

Major Market Developments

- In May 2016, Alteryx, Inc launched Alteryx analytics 10.5, which would help analysts prepare and blend data from diverse datasets and scale self-service analytics by incorporating data obtained from Amazon Aurora, Google Sheets, Adobe Analytics, and Salesforce.com, as well as in-database data blending for Apache Hive and Microsoft Azure SQL Data Warehouse.

- TIBCO partnered with DEFTeam, some big data, BI, and predictive analytics to become an authorized TIBCO training partner and help expand TIBCO’s presence in the ME and APAC markets.

- In February 2015, Informatica entered into a collaboration with Capgemini and Pivotal to be a part of the Business Data Lake ecosystem. The collaboration leveraged Informatica’s data integration software in addition to Pivotal’s advanced big data, analytics, & application software, and Capgemini’s industry and implementation expertise.

Target Audience of Data Prep Market:

- Data prep software vendors

- Cloud Service Providers (CSPs)

- Managed Service Providers (MSPs)

- System integrators

- Networking companies

- Third-party providers

- Value-Added Resellers (VARs)

- Government agencies

- Consultants/consultancies/advisory firms

- Support and maintenance service providers

- Technology providers

Scope of Data Prep Market Report

|

Report Metrics |

Details |

|

Market size available for years |

2016–2021 |

|

Base year considered |

2015 |

|

Forecast period |

2016–2021 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Platform, Tool, Deployment, Vertical and Region |

|

Geographies covered |

North America, Europe, MEA, APAC and Latin America |

|

Companies covered |

Alteryx (US), Informatica (US), IBM (US), TIBCO Software (US), Microsoft Corporation (US), SAS Institute (US), Datawatch (US), Tableau Software (US), Qlik Technologies (US), and SAP SE (US), Talend (US) and Microstrategy (US). |

By Platform

- Self-service data prep

- Data integration

Data Prep Market research By Tool

- Data curation

- Data cataloging

- Data quality

- Data ingestion

- Data governance

By Deployment model

- On-premises

- Hosted/On-cloud

By Industry vertical

- Banking, Financial Services, and Insurance (BFSI)

- Government

- Healthcare

- Retail and eCommerce

- Manufacturing

- Energy and utilities

- Transportation

- Others

By Region

- North America

- Europe

- Middle East and Africa (MEA)

- Asia Pacific (APAC)

- Latin America

Critical questions which the report answers

- What are new application areas which the data preparation companies are exploring?

- Which are the key players in the market and how intense is the competition?

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the North American data prep market

- Further breakdown of the European market

- Further breakdown of the APAC market

- Further breakdown of the MEA market

- Further breakdown of the Latin American market

Company Information

- Detailed analysis and profiling of additional market players

The overall data prep market is expected to grow from USD 1.46 billion in 2016 to USD 3.93 billion by 2021, at a CAGR of 25.2%. increasing importance of on-time qualified data, rising need for adhering to regulatory and compliance requirements, and benefits of streamlined business operations are the key factors driving the growth of this market.

Data prep makes use of tools such as data curation, data cataloging, data quality, data ingestion, and data governance to create consistent data of high quality, by eliminating low quality and incorrect data which would hamper the efficient functioning of processes like analytics and data mining. Data prep makes it possible to validate and rationalize data obtained from various disparate sources, which help with the integration of different applications.

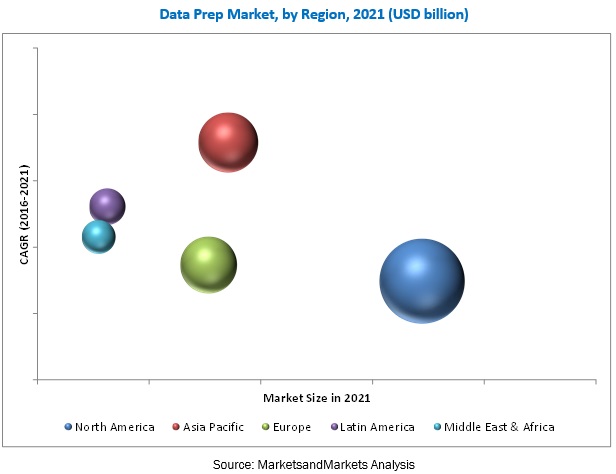

The data prep market has been segmented, on the basis of platform, tools, deployment model, and industry verticals. APAC is expected to grow at the highest CAGR during the forecast period. With the massive growth of data through IoT and other connected devices are boosting the growth of APAC region. Majority of the companies have achieved a strong position in the analytics market in this region. This is due to their well-practiced strategy of increasing customer base through acquisitions and partnerships with the significant players in the market. According to a recent study, 34% of the world’s tablet owners would be residing in APAC by 2017. As data becomes more mobile, the growth opportunities are tremendous in the data prep and related technologies market with an increasing number of organizations recognizing the importance of equipping every user with analytics capabilities.

Data curation, data cataloging, data quality, data ingestion, and data governance are the major data prep tools, which are being adopted at a massive rate.

Data Governance

Data governance deals with industry regulations and management of risk with respect to data. Companies like Informatica and Talend provide data governance solutions by giving a visibility into the data owned by the organization and the ability to identify and secure information to maintain safekeeping. Heavy fines and of non-compliance can be avoided by organizations by creating a more accurate and detailed report with the help of trusted data. The data governance tools help with elimination of reputational risk, easy identification and security of sensitive data and compliance with data related regulations.

Data Quality

Data quality is divided into data cleansing and data profiling where data profiling can be used to discover the location of error and monitor it within a particular source. Data quality ensures that data fits a particular user- specific task and is accurate & timely. Data quality is affected by the way data is entered, stored and managed. Trillium provides data prep and data quality solutions to extract insightful information form Big Data. Trillium Refine combine data preparation and data quality to improve access, prepare, link and enrich high volume disparate data. SAP EIN possesses SAP HANA smart data quality which provides a visual, interactive interface that helps eliminate the inefficiencies of traditional approaches.

Data Ingestion

Data Ingestion is the process where data obtained from various disparate sources are accessed and imported for immediate use or for storage in a database. Data ingested in company’s data warehouse can be in real time or in a batch. The data ingestion process becomes effective by prioritizing data sources, validating individual files and routing correct files to the right destination. Data preparation begins with ingestion of raw, structured and unstructured data after which processes are needed to improve the data quality and standardize the data based on specific needs of the user to make the data suitable for BI and analytics. Because of the increase in the number of data sources in different formats, organizations find tedious to ingest data at the speed which helps maintain smooth performance and a competitive advantage. Companies are using automation for data ingestion in data preparation so that the incoming data can be analyzed and accordingly used.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry applications of the data prep market?

The presence of data silos and lack of awareness and expertise and other operational challenges are the major factors restraining the growth of the data prep market. Data prep solutions and services help organizations manage huge data sets. In spite of a lot of eye-grabbing of data prep in the recent past, the actual adoption of data prep in business decision-making is still low and not very easily understood by many. The major challenges of data prep is the difficulty in shifting from traditional architecture to new technologies and systems and Data security and privacy concerns. This can limit the companies to invest in market.

Key players in the market include Microsoft Corporation (US), IBM Corporation (US), TIBCO Software (US), SAP SE (Germany), SAS Institute (US), Alteryx, Inc. (US), Informatica (US), Datawatch Corporation (US), and Talend (US). These players are increasingly undertaking mergers and acquisitions, and product launches to develop and introduce new technologies and products in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered in the Report

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 27)

4.1 Attractive Market Opportunities in the Data Prep Market

4.2 Market, By Platform

4.3 Market, By Region and Vertical

4.4 Market Potential

4.5 Lifecycle Analysis, By Region, 2016

5 Market Overview (Page No. - 30)

5.1 Introduction

5.2 Market Evolution

5.3 Market Segmentation

5.3.1 By Platform

5.3.2 By Tool

5.3.3 By Deployment Model

5.3.4 By Industry Vertical

5.3.5 By Region

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Increasing Importance of On-Time Qualified Data

5.4.1.2 Rising Need for Adhering to Regulatory and Compliance Requirements

5.4.1.3 Benefits of Streamlined Business Operations

5.4.1.4 Data Prep Tools Help Companies in Predictive Business Analytics

5.4.2 Restraints

5.4.2.1 Presence of Data Silos

5.4.2.2 Lack of Awareness & Expertise and Other Operational Challenges

5.4.3 Opportunities

5.4.3.1 Evolution of Iot

5.4.3.2 Increasing Number of Organizations Harnessing the Advantage of Data Preparation

5.4.3.3 Need for Deploying Specific Tools and Technologies to Increase Data Access and Data Convergence

5.4.4 Challenges

5.4.4.1 Difficulties in Shifting From Traditional Architecture to New Technologies and Systems

5.4.4.2 Data Security and Privacy Concerns

6 Industry Trends (Page No. - 38)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Strategic Benchmarking

6.4 Used Cases

6.4.1 Used Case 1

6.4.2 Used Case 2

6.4.3 Used Case 3

7 Market Analysis, By Platform (Page No. - 41)

7.1 Introduction

7.2 Self-Service Data Prep

7.3 Data Integration

8 Data Prep Market Analysis, By Tool (Page No. - 45)

8.1 Introduction

8.2 Data Curation

8.3 Data Cataloging

8.4 Data Quality

8.5 Data Ingestion

8.6 Data Governance

9 Market, By Deployment Model (Page No. - 51)

9.1 Introduction

9.2 Hosted

9.3 On-Premises

10 Data Prep Market Analysis, By Vertical (Page No. - 55)

10.1 Introduction

10.2 Banking, Financial Services, and Insurance

10.3 Government

10.4 Healthcare

10.5 Retail and E-Commerce

10.6 Manufacturing

10.7 Energy and Utilities

10.8 Transportation

10.9 IT and Telecommunication

10.10 Others

11 Geographic Analysis (Page No. - 66)

11.1 Introduction

11.2 North America

11.3 Europe

11.4 Asia-Pacific

11.5 Middle East and Africa

11.6 Latin America

12 Competitive Landscape (Page No. - 82)

12.1 Overview

12.2 Competitive Situations and Trends

12.2.1 Agreements, Partnerships, and Collaborations

12.2.2 Mergers and Acquisitions

12.2.3 New Product Launches

12.3 Vendor Analysis

13 Company Profiles (Page No. - 90)

13.1 Introduction

(Overview, Financials, Products & Services, Strategy, and Developments)*

13.2 Alteryx, Inc

13.3 Informatica

13.4 International Business Machines Corporation

13.5 Tibco Software Inc.

13.6 Microsoft Corporation

13.7 SAS Institute

13.8 Datawatch Corporation

13.9 Tableau Software, Inc.

13.10 Qlik Technologies Inc.

13.11 SAP SE.

13.12 Talend

13.13 Microstrategy Incorporated

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 122)

14.1 Key Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customization

14.6 Related Reports

14.7 Author Details

List of Tables (47 Tables)

Table 1 Data Prep Market Size and Growth, 2016–2021 (USD Billion, Y-O-Y %)

Table 2 Market Size, By Platform, 2014–2021 (USD Million)

Table 3 Self-Service Data Prep: Market Size, By Region, 2014–2021 (USD Million)

Table 4 Data Integration: Market Size, By Region, 2014–2021 (USD Million)

Table 5 Data Prep Market Size, By Tool, 2014–2021 (USD Million)

Table 6 Data Curation: Market Size, By Region, 2014–2021 (USD Million)

Table 7 Data Cataloging: Market Size, By Region, 2014–2021 (USD Million)

Table 8 Data Quality: Market Size, By Region, 2014–2021 (USD Million)

Table 9 Data Ingestion: Market Size, By Region, 2014–2021 (USD Million)

Table 10 Data Governance: Market Size, By Region, 2014–2021 (USD Million)

Table 11 Data Prep Market Size, By Deployment Model, 2014–2021 (USD Million)

Table 12 Hosted: Market Size, By Region, 2014–2021 (USD Million)

Table 13 On-Premises: Market Size, By Region, 2014–2021 (USD Million)

Table 14 Data Prep Market Size, By Vertical, 2014–2021 (USD Million)

Table 15 Banking, Financial Services, and Insurance: Market Size, By Region, 2014–2021 (USD Million)

Table 16 Government: Market Size, By Region, 2014–2021 (USD Million)

Table 17 Healthcare: Market Size, By Region, 2014–2021 (USD Million)

Table 18 Retail and E-Commerce: Market Size, By Region, 2014–2021 (USD Million)

Table 19 Manufacturing: Market Size, By Region, 2014–2021 (USD Million)

Table 20 Energy and Utilities: Market Size, By Region, 2014–2021 (USD Million)

Table 21 Transportation: Market Size, By Region, 2014–2021 (USD Million)

Table 22 IT and Telecommunication: Market Size, By Region, 2014–2021 (USD Million)

Table 23 Others: Market Size, By Region, 2014–2021 (USD Million)

Table 24 Data Prep Market Size, By Region, 2014–2021 (USD Million)

Table 25 North America: Market Size, By Platform, 2014–2021 (USD Million)

Table 26 North America: Market Size, By Tool, 2014–2021 (USD Million)

Table 27 North America: Market Size, By Deployment Model, 2014–2021 (USD Million)

Table 28 North America: Market Size, By Industry Vertical, 2014–2021 (USD Million)

Table 29 Europe: Data Prep Market Size, By Platform, 2014–2021 (USD Million)

Table 30 Europe: Market Size, By Tool, 2014–2021 (USD Million)

Table 31 Europe: Market Size, By Deployment Model, 2014–2021 (USD Million)

Table 32 Europe: Market Size, By Industry Vertical, 2014–2021 (USD Million)

Table 33 Asia-Pacific: Market Size, By Platform, 2014–2021 (USD Million)

Table 34 Asia-Pacific: Market Size, By Tool, 2014–2021 (USD Million)

Table 35 Asia-Pacific: Market Size, By Deployment Model, 2014–2021 (USD Million)

Table 36 Asia-Pacific: Data Prep Market Size, By Industry Vertical, 2014–2021 (USD Million)

Table 37 Middle East and Africa: Market Size, By Platform, 2014–2021 (USD Million)

Table 38 Middle East and Africa: Market Size, By Tool, 2014–2021 (USD Million)

Table 39 Middle East and Africa: Market Size, By Deployment Model, 2014–2021 (USD Million)

Table 40 Middle East and Africa: Market Size, By Industry Vertical, 2014–2021 (USD Million)

Table 41 Latin America: Data Prep Market Size, By Platform, 2014–2021 (USD Million)

Table 42 Latin America: Market Size, By Tool, 2014–2021 (USD Million)

Table 43 Latin America: Market Size, By Deployment Model, 2014–2021 (USD Million)

Table 44 Latin America: Market Size, By Industry Vertical, 2014–2021 (USD Million)

Table 45 Agreements, Partnerships, and Collaborations, 2013–2016

Table 46 Mergers and Acquisitions, 2013–2016

Table 47 New Product Launches, 2013–2016

List of Figures (51 Figures)

Figure 1 Data Prep Market: Research Design

Figure 2 Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Data Triangulation

Figure 5 Data Prep Market is Poised to Witness Growth in the Global Market for the Period 2016–2021

Figure 6 Market Snapshot on the Basis of Platforms (2016 vs 2021)

Figure 7 Market Snapshot on the Basis of Tools (2016–2021)

Figure 8 Market Snapshot on the Basis of Deployment Model (2016–2021)

Figure 9 Market is Expected to Witness Remarkable Growth Opportunities Due to the Increasing Importance of On-Time Qualified Data

Figure 10 Self-Service Data Prep Platform is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 11 North America is Expected to Hold the Largest Market Share in the Data Prep Market

Figure 12 Asia-Pacific is Expected to Witness the Highest Growth Rate During the Forecast Period

Figure 13 Regional Lifecycle: Asia-Pacific is Expected to Be in the Growth Phase in 2016

Figure 14 Evolution of Data Prep

Figure 15 Data Prep Market Segmentation: By Platform

Figure 16 Market Segmentation: By Tool

Figure 17 Market Segmentation: By Deployment Model

Figure 18 Market Segmentation: By Industry Vertical

Figure 19 Market Segmentation: By Region

Figure 20 Growth of the Data Prep Market Due to Rising Importance for On-Time Qualified Data

Figure 21 Value Chain Analysis: Data Prep Market

Figure 22 Market: Strategic Benchmarking (2013-2016)

Figure 23 Self-Service Data Prep is Expected to Grow at A Highest CAGR During the Forecast Period

Figure 24 Data Governance is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 25 Hosted Data Prep Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 26 IT and Telecommunication Vertical is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 27 Geographic Snapshot: Asia-Pacific is Estimated to Have the Highest CAGR in the Market

Figure 28 North America is Projected to Have the Largest Market Share in the Data Prep Market in the Forecast Period

Figure 29 North America: Market Snapshot

Figure 30 Europe: Market Snapshot

Figure 31 Asia-Pacific: Market Snapshot

Figure 32 Companies Adopted the Strategy of New Product Launches and New Product Developments as the Key Growth Strategy From 2015 to 2016

Figure 33 Market Evaluation Framework

Figure 34 Battle for Market Share: the Strategy of New Product Launches and New Product Developments Was the Key Strategy Adopted By Key Players in the Data Prep Market During the Period 2013–2016

Figure 35 Vendor Analysis: Criteria Weightage

Figure 36 Product Offerings Comparison

Figure 37 Business Strategy Comparison

Figure 38 Geographic Revenue Mix of Top Five Market Players

Figure 39 Alteryx, Inc: SWOT Analysis

Figure 40 Informatica: SWOT Analysis

Figure 41 International Business Machines Corporation: SWOT Analysis

Figure 42 Tibco Software: SWOT Analysis

Figure 43 Microsoft Corporation: Company Snapshot

Figure 44 Microsoft Corporation: SWOT Analysis

Figure 45 SAS Institute: Company Snapshot

Figure 46 Datawatch Corporation: Company Snapshot

Figure 47 Tableau Software, Inc.: Company Snapshot

Figure 48 Qlik Technologies Inc. : Company Snapshot

Figure 49 SAP SE: Company Snapshot

Figure 50 Talend: Company Snapshot

Figure 51 Microstrategy, Inc.: Company Snapshot

Growth opportunities and latent adjacency in Data Prep Market