DC Switchgear Market by Voltage (Up to 750 V, 750 V to 1,800 V, 1,800 V to 3,000 V, 3,000 V to 10 kV and Above 10 kV), Deployment Type (Fixed Mounting, Plug-In, and Withdrawable Units), Application, and Region - Global Forecast to 2026

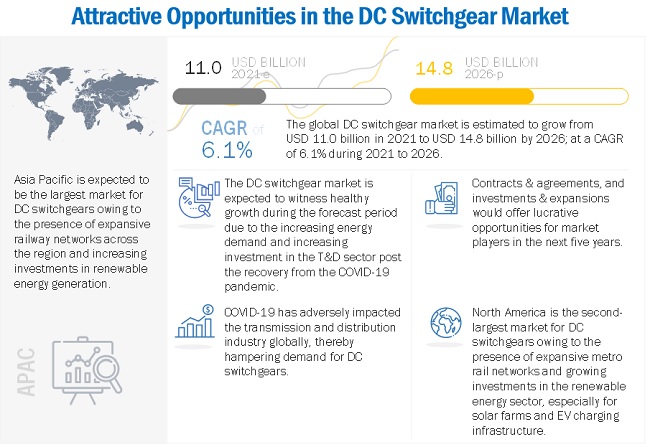

[201 Pages Report]The global DC switchgear market is projected to reach USD 14.8 billion by 2026 from an estimated market size of USD 11.0 billion in 2021, at a CAGR of 6.1% during the forecast period. The growing demand for renewable power generation and increasing investment in the upgradation and modernization of the railway sector are expected to be the major driving factors impacting the growth of the DC switchgear market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the DC switchgear Market

The outbreak of the COVID-19 pandemic has had an adverse effect on the global economy as the governments were forced to implement lockdown measures to prevent the spread of the virus. The effects of the COVID-19 pandemic, including actions taken by businesses and governments to contain the spread of the virus, have resulted in a significant and swift reduction in the demand for energy. As of May 28, 2020, 212 countries had been impacted by the pandemic, and the governments of individual countries had ordered nationwide lockdowns. This resulted in a considerable decline in transportation and related activities, which further impacted the demand for energy. These events together had caused major disruptions in the corresponding activities by market players, consequently hindering the demand for DC switchgear.

DC switchgear Market Dynamics

Driver: Increasing demand for reliable and secure power supply worldwide

According to the US Department of Energy (DOE), creating a safe and secure electrical distribution system would require an investment of about USD 1.5 to USD 2 trillion from 2022 to 2030. The governments of developing countries are investing in increasing their electrification rate by providing electricity access to remote villages. According to the International Energy Agency (IEA), by 2030, an additional 1.7 billion people are expected to gain access to electricity, and the number of people who lack electricity is expected to reduce to less than 1 billion by 2030, which is about 10% of the global population. In addition, the demand for rail transport is growing at a fast pace. These developments will reflect positively on the demand for DC.

Restraint: Impact of environmental conditions on performance of DC switchgears

Temperature and humidity, as well as water seepage out of the ground, are some factors that can affect the efficiency of DC switchgear electrical networks, especially the ones that are installed outdoor. High levels of electromagnetic interference (EMI), wide temperature ranges, and vibration and shock, as well as the presence of destructive pollutants, have the potential to interrupt or degrade the performance of electronic equipment. Therefore, the impact of environmental condition might affect the performance of DC switchgear, thus restraining the growth of the market.

Opportunities: Adoption of high voltage direct current (HVDC) technology

The rising environmental concerns urge the government to invest in renewable energy-based power generation. Renewable power generation, such as solar, wind (onshore and offshore), biomass, hydroelectric, and geothermal power plants, are located in remote areas. To connect such remotely located power generation sources and to minimize transmission losses, companies deploy HVDC systems. HVDC transmission is considered to be efficient for long-distance power transmissions. The integration of renewable power generation sources with HVDC transmission links is a growing trend and presents lucrative growth opportunity for the growth of the market.

Challenges: Cybersecurity issues

The installation of modernized DC switchgear aids the optimal functioning of any power supply system but may pose a security threat from anti-social elements. Data theft or security breach could be done by bypassing securities on the remote access, leading to blackouts and power outages. Such developments call for the designing and building of secure, efficient, and flexible next-generation cyber-physical systems. Hence, a multi-layer shield is necessary to ensure the cybersecurity of substations, of which DC switchgear is a part.

Market Interconnection

To know about the assumptions considered for the study, download the pdf brochure

The fixed mounting segment is expected to grow the fastest in the DC switchgear market, by deployment type

The DC switchgear market, by deployment type, is segmented into fixed mounting, plug-in, and withdrawable units. The fixed mounting segment is expected to grow the fastest in the market for DC switchgears, during the forecast period. The high-cost efficiency, low failure rate, and exceptional safety factor of fixed mounting DC switchgears is expected to further increase their adoption rate.

The solar farms segment is expected to be the fastest growing market, by application, during the forecast period

The DC switchgear market, by application, is segmented into railways, solar farms, battery storage, EV charging infrastructure, marine, power generation and others. The transition towards adoption of green and carbon-free power generation solution will result in development and establishment of large-scale solar farms across the world, which is expected to fuel the demand for DC switchgear in the solar farms application.

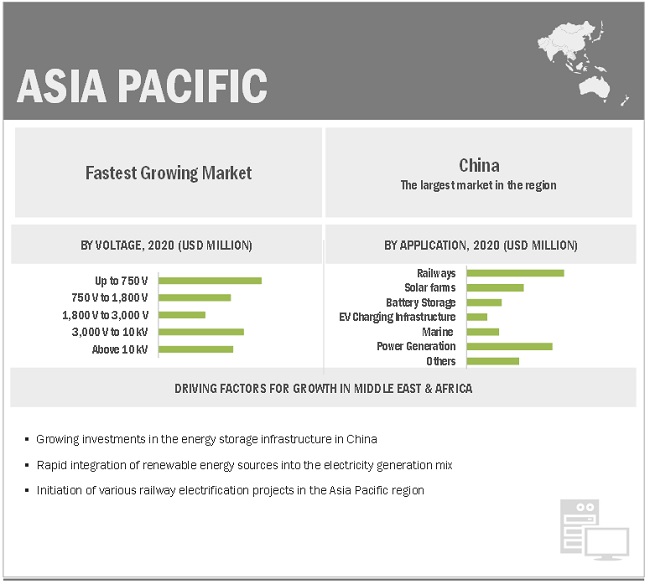

Asia Pacific is expected to dominate the global DC switchgear market, in terms of growth rate

The Asia Pacific region is expected to be the fastest growing market, followed by North America. The high growth rate of the Asia Pacific region can be attributed to the growing investments in the energy storage infrastructure, rapid integration of renewable energy sources into the electricity generation mixes and the initiation of various railway electrification projects in the region.

Key Market Players

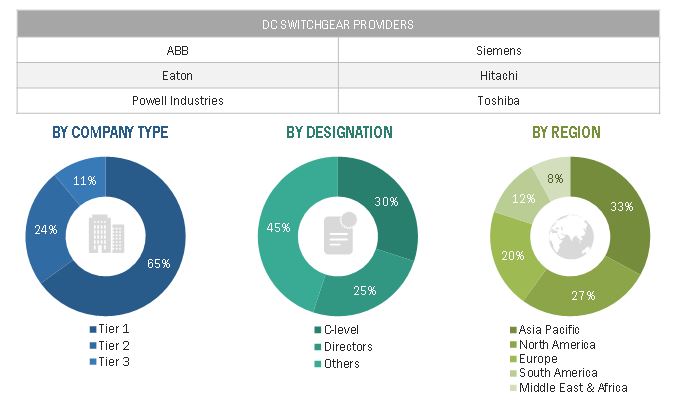

The major players in the DC switchgear market are ABB (Switzerland), Siemens (Germany), Eaton (Ireland), Hitachi Energy Ltd. (Japan), and Toshiba Infrastructure Systems & Solutions Corporation (Japan). Between 2017 and 2021, the companies adopted growth strategies such as contracts & agreements, investments & expansions, partnerships, collaborations, alliances & joint ventures to capture a larger share of the DC switchgear market.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2019–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Voltage, deployment type, application and region. |

|

Geographies covered |

North America, South America, Europe, Asia Pacific, Middle East & Africa |

|

Companies covered |

ABB (Switzerland), Siemens (Germany), Eaton (Ireland), Hitachi Energy Ltd. (Japan), Toshiba Infrastructure Systems & Solutions Corporation (Japan), General Electric (US), Schneider Electric (France), Sécheron (Switzerland), LS ELECTRIC Co., Ltd (Korea), L&T Electrical & Automation (India), Myers Power Products, Inc. (US), ENTEC Electric & Electronic (Korea), Ningbo Tianan (Group) Co., Ltd (China), PLUTON Rail PTY LTD (Ukraine), KDM Steel (China), Powell Industries (US), Brush Group (UK), Grimard (Canada), DAQO Group (China), MEIDENSHA CORPORATION (Japan), Mass-Tech Controls Pvt. Ltd. (India), FLOHE GmbH (Germany), ELEKTROBUDOWA SA (Poland), Chint Electric Co., Ltd. (China) and Schaltbau GmbH (Germany) |

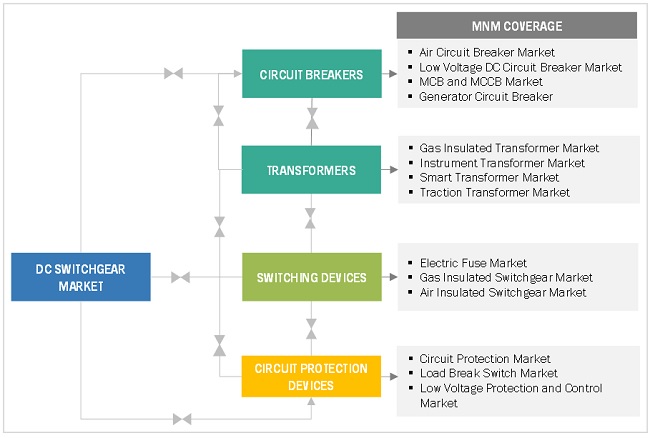

This research report categorizes the DC switchgear market by technology, application, product, and region.

On the basis of by voltage, the market has been segmented as follows:

- Up to 750 V

- 750 V to 1,800 V

- 1,800 V to 3,000 V

- 3,000 V to 10 kV

- Above 10 kV

On the basis of by deployment type, the market has been segmented as follows:

- Fixed Mounting

- Plug-In

- Withdrawable Units

On the basis of by application, the market has been segmented as follows:

- Railways

- Solar Farms

- Battery Storage

- EV Charging Infrastructure

- Marine

- Power Generation

- Others

On the basis of region, the market has been segmented as follows:

- North America

- South America

- Europe

- Asia Pacific

- Middle East & Africa

Recent Developments

- In December 2021, Rail Vikas Nigam Limited (RVNL), an organization under ministry of railways, government of India selected Hitachi Energy India's advanced power automation and control solution. Hitachi Energy India supplied remote terminal units & SCADA system for Baranagar traction substation (TSS) and Dakshineswar TSS. The scope included the design, supply, erection, testing, and commissioning of the SCADA system for 33 kV power distribution, traction substations, and auxiliary substations combined with a 750 V dc third rail traction system for Joka-Majerhat and airport-new Garia corridors.

- In December 2021, Toshiba Infrastructure Systems & Solutions Corporation has been contracted by Busan Transportation Corporation for provision of electrical equipment for railway traction in Korea. The scope of products to be supplied by the company include permanent magnet synchronous motors (PMSMs) and other electric equipment.

- In July 2021, Myers Power Products, Inc. has engaged with Joseph E. Biben Sales Corp & Biben Marketing Group to serve commercial and institutional customers in the MidAtlantic. Areas included in their territory are the states of Delaware and Maryland, Southern New Jersey, Eastern Pennsylvania, Northern Virginia, and the District of Columbia. Biben will provide sales and technical support for Myers’ medium and low voltage power distribution equipment, including power distribution centers, switchgear, unit substations, circuit breakers, and more.

Frequently Asked Questions (FAQ):

What is the current size of the DC switchgear market?

The current market size of global DC switchgear market is USD 11.0 billion in 2021

What are the major drivers for the DC switchgear market?

The factors driving the growth for DC switchgear are the growing demand for renewable power generation and increasing investment in the upgradation and modernization of the railway sector.

Which is the fastest-growing region during the forecasted period in DC switchgear market?

Asia Pacific region is expected to grow at the highest CAGR during the forecast period, driven mainly by activities in China, Japan and India.

Which is the fastest growing segment, by voltage during the forecasted period in DC switchgear market?

The up to 750 V segment is estimated to have the largest market share and expected to grow at the highest rate during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.2.1 DC SWITCHGEAR MARKET, BY VOLTAGE: INCLUSIONS & EXCLUSIONS

1.2.2 MARKET, BY DEPLOYMENT TYPE: INCLUSIONS & EXCLUSIONS

1.2.3 MARKET, BY APPLICATION: INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.4 YEARS CONSIDERED

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 1 DC SWITCHGEAR MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION METHODOLOGY

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

2.2.2.2 Primary interviews with experts

2.2.2.3 Breakdown of primaries

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 DEMAND-SIDE METRICS

FIGURE 5 MAIN METRICS CONSIDERED FOR ANALYSING AND ASSESSING DEMAND FOR DC SWITCHGEARS

2.4.1 ASSUMPTIONS FOR DEMAND-SIDE ANALYSIS

2.5 SUPPLY-SIDE ANALYSIS

FIGURE 6 KEY STEPS CONSIDERED FOR ASSESSING SUPPLY OF DC SWITCHGEARS

FIGURE 7 DC SWITCHGEAR MARKET: SUPPLY-SIDE ANALYSIS

2.5.1 SUPPLY-SIDE CALCULATIONS

2.5.2 ASSUMPTIONS FOR SUPPLY-SIDE ANALYSIS

2.6 FORECAST

3 EXECUTIVE SUMMARY (Page No. - 44)

TABLE 1 DC SWITCHGEAR MARKET SNAPSHOT

FIGURE 8 UP TO 750 V SEGMENT IS EXPECTED TO DOMINATE MARKET, BY VOLTAGE, DURING FORECAST PERIOD

FIGURE 9 FIXED MOUNTING SEGMENT IS EXPECTED TO DOMINATE MARKET, BY DEPLOYMENT TYPE, DURING FORECAST PERIOD

FIGURE 10 RAILWAYS SEGMENT IS EXPECTED TO HOLD LARGEST SIZE OF MARKET, BY APPLICATION, DURING FORECAST PERIOD

FIGURE 11 ASIA PACIFIC DOMINATED MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 ATTRACTIVE OPPORTUNITIES IN DC SWITCHGEAR MARKET

FIGURE 12 GROWING DEMAND FOR RENEWABLE POWER GENERATION AND INCREASING INVESTMENTS IN RAILWAY SECTOR ARE EXPECTED TO DRIVE MARKET, 2021–2026

4.2 MARKET, BY REGION

FIGURE 13 MARKET TO WITNESS HIGHEST GROWTH IN ASIA PACIFIC DURING FORECAST PERIOD

4.3 MARKET, BY VOLTAGE

FIGURE 14 UP TO 750 V SEGMENT DOMINATED MARKET, BY VOLTAGE, IN 2020

4.4 MARKET, BY DEPLOYMENT TYPE

FIGURE 15 FIXED MOUNTING SEGMENT DOMINATED MARKET, BY PRODUCT, IN 2020

4.5 MARKET, BY APPLICATION

FIGURE 16 RAILWAYS SEGMENT DOMINATED MARKET, BY APPLICATION, IN 2020

4.6 MARKET IN ASIA PACIFIC, BY APPLICATION & COUNTRY

FIGURE 17 RAILWAYS & CHINA DOMINATED ASIA PACIFIC MARKET, BY APPLICATION & COUNTRY, IN 2020

5 MARKET OVERVIEW (Page No. - 52)

5.1 INTRODUCTION

5.2 COVID-19 HEALTH ASSESSMENT

FIGURE 18 COVID-19 GLOBAL PROPAGATION

FIGURE 19 COVID-19 PROPAGATION IN SELECT COUNTRIES

5.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 20 COMPARISON OF GDP FOR SELECT G20 COUNTRIES IN 2020

5.4 MARKET DYNAMICS

FIGURE 21 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.4.1 DRIVERS

5.4.1.1 Increasing investments in upgrade of transmission and distribution networks

FIGURE 22 GLOBAL INVESTMENT IN POWER SECTOR, BY TECHNOLOGY, 2021

5.4.1.2 Growth in renewable power generation

5.4.1.3 Increasing demand for reliable and secure power supply worldwide

5.4.2 RESTRAINTS

5.4.2.1 Impact of environmental conditions on performance of DC switchgears

5.4.2.2 Increase in competition from unorganized sector

5.4.3 OPPORTUNITIES

5.4.3.1 Introduction of performance-based incentive schemes and definite service programs for distributors in multiple countries

5.4.3.2 Adoption of high voltage direct current (HVDC) technology

5.4.4 CHALLENGES

5.4.4.1 Cybersecurity issues

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.5.1 REVENUE SHIFT AND NEW REVENUE POCKETS IN MARKET

FIGURE 23 REVENUE SHIFT OF DC SWITCHGEAR PROVIDERS

5.6 SUPPLY CHAIN ANALYSIS

FIGURE 24 MARKET: SUPPLY CHAIN ANALYSIS

5.6.1 RAW MATERIAL SUPPLIERS

5.6.2 DC SWITCHGEAR MANUFACTURERS

5.6.3 ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC) PROVIDERS AND DC SWITCHGEAR SYSTEM MANUFACTURERS

5.6.4 DISTRIBUTORS

5.6.5 END USERS

5.7 MARKET MAP

FIGURE 25 DC SWITCHGEAR: MARKET MAP

5.8 INNOVATIONS & PATENT REGISTRATION

5.9 TECHNOLOGY ANALYSIS

5.10 SWITCHGEAR MARKET: REGULATIONS

5.11 PRICING ANALYSIS

TABLE 2 AVERAGE COST OF DC SWITCHGEAR, BY REGION, (USD)

5.12 PORTER’S FIVE FORCES ANALYSIS

FIGURE 26 MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 3 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.12.1 THREAT OF NEW ENTRANTS

5.12.2 BARGAINING POWER OF SUPPLIERS

5.12.3 BARGAINING POWER OF BUYERS

5.12.4 THREAT OF SUBSTITUTES

5.12.5 DEGREE OF COMPETITION

5.13 CASE STUDY ANALYSIS

5.13.1 SIEMENS AIMS TO ENHANCE ITS SWITCHGEAR PRODUCT PORTFOLIO THROUGH ADOPTING INORGANIC GROWTH STRATEGY

6 DC SWITCHGEAR MARKET, BY VOLTAGE (Page No. - 70)

6.1 INTRODUCTION

FIGURE 27 MARKET, BY VOLTAGE, 2020

TABLE 4 MARKET, BY VOLTAGE, 2019–2026 (USD MILLION)

6.2 UP TO 750 V

6.2.1 UP TO 750 V DC SWITCHGEARS ARE PRIMARILY USED IN METROS AND SUBURBAN RAILWAY NETWORKS

TABLE 5 UP TO 750 V: MARKET, BY REGION, 2019–2026 (USD MILLION)

6.3 750 V TO 1,800 V

6.3.1 750 V TO 1,800 V DC SWITCHGEARS ARE ASSOCIATED WITH HIGHER MATCHING LOSS AND HIGH SAFETY REQUIREMENTS

TABLE 6 750 V TO 1,800 V: MARKET, BY REGION, 2019–2026 (USD MILLION)

6.4 1,800 V TO 3,000 V

6.4.1 1800 V TO 3000 V DC SWITCHGEARS OFFER EXCEPTIONAL ENERGY EFFICIENCY AND FACILITATE HIGHER ACCELERATION OF LOCOMOTIVES

TABLE 7 1,800 V TO 3,000 V: MARKET, BY REGION, 2019–2026 (USD MILLION)

6.5 3,000 V TO 10 KV

6.5.1 GROWING INFRASTRUCTURE DEVELOPMENTS TO DRIVE MARKET FOR 3,000 V TO 10 KV DC SWITCHGEARS

TABLE 8 3,000 V TO 10 KV: MARKET, BY REGION, 2019–2026 (USD MILLION)

6.6 ABOVE 10 KV

6.6.1 INCREASING INVESTMENT IN POWER TRANSMISSION AND LOCOMOTIVES EXPECTED TO DRIVE MARKET FOR ABOVE 10 KV DC SWITCHGEARS

TABLE 9 ABOVE 10 KV: MARKET, BY REGION, 2019–2026 (USD MILLION)

7 DC SWITCHGEAR MARKET, BY DEPLOYMENT TYPE (Page No. - 76)

7.1 INTRODUCTION

FIGURE 28 MARKET, BY DEPLOYMENT TYPE, 2020

TABLE 10 MARKET, BY DEPLOYMENT TYPE, 2019–2026 (USD MILLION)

7.2 FIXED MOUNTING

7.2.1 FIXED MOUNTING OFFERS ADVANTAGES OF LOW FAILURE RATE AND HIGH SAFETY

TABLE 11 FIXED MOUNTING: MARKET, BY REGION, 2019–2026 (USD MILLION)

7.3 PLUG-IN

7.3.1 PLUG-IN SWITCHGEAR UNITS HAVE SIMPLE INSTALLATION PROCESS AND OFFER HIGH MECHANICAL STABILITY

TABLE 12 PLUG-IN: MARKET, BY REGION, 2019–2026 (USD MILLION)

7.4 WITHDRAWABLE UNIT

7.4.1 WITHDRAWABLE UNITS HAVE LOW LIFECYCLE COSTS AND OFFER HIGH FLEXIBILITY OF OPERATION

TABLE 13 WITHDRAWABLE UNIT: MARKET, BY REGION, 2019–2026 (USD MILLION)

8 DC SWITCHGEAR MARKET, BY APPLICATION (Page No. - 80)

8.1 INTRODUCTION

FIGURE 29 MARKET, BY APPLICATION, 2020

TABLE 14 MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

8.2 RAILWAYS

TABLE 15 RAILWAYS: MARKET, BY REGION, 2019–2026 (USD MILLION)

8.2.1 HEAVY RAILS

8.2.1.1 Upcoming plans for expanding heavy rail network is expected to drive market growth

TABLE 16 HEAVY RAILS: MARKET, BY REGION, 2019–2026 (USD MILLION)

8.2.2 METROS

8.2.2.1 Increasing metro projects in developing countries is likely to boost demand for dc switchgears

TABLE 17 METROS: MARKET, BY REGION, 2019–2026 (USD MILLION)

8.2.3 LIGHT RAIL

8.2.3.1 Growing demand for DC electrification system within light rail is expected to boost market

TABLE 18 LIGHT RAIL: MARKET, BY REGION, 2019–2026 (USD MILLION)

8.3 SOLAR FARMS

8.3.1 INCREASING DEMAND FOR SOLAR POWER IS EXPECTED TO BOOST MARKET GROWTH

TABLE 19 SOLAR FARMS: MARKET, BY REGION, 2019–2026 (USD MILLION)

8.4 BATTERY STORAGE

8.4.1 HUGE DEMAND FOR BATTERY STORAGE IN ASIA PACIFIC AND NORTH AMERICA IS EXPECTED TO DRIVE MARKET GROWTH

TABLE 20 BATTERY STORAGE: MARKET, BY REGION, 2019–2026 (USD MILLION)

8.5 EV CHARGING INFRASTRUCTURE

8.5.1 INCREASING NUMBER OF EV CHARGING STATIONS WORLDWIDE IS EXPECTED TO FUEL MARKET GROWTH

TABLE 21 EV CHARGING INFRASTRUCTURE: MARKET, BY REGION, 2019–2026 (USD MILLION)

8.6 MARINE

8.6.1 INCREASING NEED FOR IMPROVING ENERGY EFFICIENCY WITHIN MARINE SECTOR IS LIKELY TO BOOST DEMAND FOR DC SWITCHGEARS

TABLE 22 MARINE: MARKET, BY REGION, 2019–2026 (USD MILLION)

8.7 POWER GENERATION

8.7.1 RISING NEED OF UNINTERRUPTED AND RELIABLE POWER IS EXPECTED TO DRIVE MARKET

TABLE 23 POWER GENERATION: MARKET, BY REGION, 2019–2026 (USD MILLION)

8.8 OTHERS

TABLE 24 OTHERS: DC SWITCHGEAR MARKET, BY REGION, 2019–2026 (USD MILLION)

9 DC SWITCHGEAR MARKET, BY REGION (Page No. - 89)

9.1 INTRODUCTION

FIGURE 30 REGIONAL SNAPSHOT: MARKET IN ASIA PACIFIC IS EXPECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 31 DC SWITCHGEAR MARKET SHARE (VALUE), BY REGION, 2020

TABLE 25 MARKET, BY REGION, 2019–2026 (USD MILLION)

9.2 ASIA PACIFIC

FIGURE 32 SNAPSHOT: MARKET IN ASIA PACIFIC

9.2.1 BY VOLTAGE

TABLE 26 ASIA PACIFIC: MARKET, BY VOLTAGE, 2019–2026 (USD MILLION)

9.2.2 BY DEPLOYMENT TYPE

TABLE 27 ASIA PACIFIC: MARKET, BY DEPLOYMENT TYPE, 2019–2026 (USD MILLION)

9.2.3 BY APPLICATION

TABLE 28 ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

9.2.3.1 By railways

TABLE 29 ASIA PACIFIC: MARKET, BY RAILWAYS APPLICATION, 2019–2026 (USD MILLION)

9.2.4 BY COUNTRY

TABLE 30 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

9.2.4.1 China

9.2.4.1.1 Rising investments in renewable energy, battery storage, and railways sectors to fuel growth of DC switchgear market in China

TABLE 31 CHINA: MARKET, BY VOLTAGE, 2019–2026 (USD MILLION)

TABLE 32 CHINA: MARKET, BY DEPLOYMENT TYPE, 2019–2026 (USD MILLION)

TABLE 33 CHINA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 34 CHINA: MARKET, BY RAILWAYS APPLICATION, 2019–2026 (USD MILLION)

9.2.4.2 Australia

9.2.4.2.1 Government initiatives to enhance energy storage infrastructure to boost demand for DC switchgears

TABLE 35 AUSTRALIA: MARKET, BY VOLTAGE, 2019–2026 (USD MILLION)

TABLE 36 AUSTRALIA: MARKET, BY DEPLOYMENT TYPE, 2019–2026 (USD MILLION)

TABLE 37 AUSTRALIA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 38 AUSTRALIA: MARKET, BY RAILWAYS APPLICATION, 2019–2026 (USD MILLION)

9.2.4.3 Japan

9.2.4.3.1 Investments in energy storage and railway transportation infrastructure development to spur market growth in Japan

TABLE 39 JAPAN: MARKET, BY VOLTAGE, 2019–2026 (USD MILLION)

TABLE 40 JAPAN: MARKET, BY DEPLOYMENT TYPE, 2019–2026 (USD MILLION)

TABLE 41 JAPAN: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 42 JAPAN: MARKET, BY RAILWAYS APPLICATION, 2019–2026 (USD MILLION)

9.2.4.4 South Korea

9.2.4.4.1 South Korean government’s commitment to reduce carbon emission is expected fuel growth of DC switchgear market in South Korea

TABLE 43 SOUTH KOREA: MARKET, BY VOLTAGE, 2019–2026 (USD MILLION)

TABLE 44 SOUTH KOREA: MARKET, BY DEPLOYMENT TYPE, 2019–2026 (USD MILLION)

TABLE 45 SOUTH KOREA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 46 SOUTH KOREA: MARKET, BY RAILWAYS APPLICATION, 2019–2026 (USD MILLION)

9.2.4.5 India

9.2.4.5.1 Increased renewables target to push DC switchgear market growth in India

TABLE 47 INDIA: MARKET, BY VOLTAGE, 2019–2026 (USD MILLION)

TABLE 48 INDIA: MARKET, BY DEPLOYMENT TYPE, 2019–2026 (USD MILLION)

TABLE 49 INDIA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 50 INDIA: MARKET, BY RAILWAYS APPLICATION, 2019–2026 (USD MILLION)

9.2.4.6 Rest of Asia Pacific

TABLE 51 REST OF ASIA PACIFIC: DC SWITCHGEAR MARKET, BY VOLTAGE, 2019–2026 (USD MILLION)

TABLE 52 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT TYPE, 2019–2026 (USD MILLION)

TABLE 53 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 54 REST OF ASIA PACIFIC: MARKET, BY RAILWAYS APPLICATION, 2019–2026 (USD MILLION)

9.3 NORTH AMERICA

FIGURE 33 SNAPSHOT: DC SWITCHGEAR MARKET IN NORTH AMERICA

9.3.1 BY VOLTAGE

TABLE 55 NORTH AMERICA: MARKET, BY VOLTAGE, 2019–2026 (USD MILLION)

9.3.2 BY DEPLOYMENT TYPE

TABLE 56 NORTH AMERICA: MARKET, BY DEPLOYMENT TYPE, 2019–2026 (USD MILLION)

9.3.3 BY APPLICATION

TABLE 57 NORTH AMERICA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

9.3.3.1 By railways

TABLE 58 NORTH AMERICA: MARKET, BY RAILWAYS APPLICATION, 2019–2026 (USD MILLION)

9.3.4 BY COUNTRY

TABLE 59 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

9.3.4.1 US

9.3.4.1.1 Government initiatives to expand and modernize metro rail network is expected to drive demand for DC switchgears in US

TABLE 60 US: DC SWITCHGEAR MARKET, BY VOLTAGE, 2019–2026 (USD MILLION)

TABLE 61 US: MARKET, BY DEPLOYMENT TYPE, 2019–2026 (USD MILLION)

TABLE 62 US: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 63 US: MARKET, BY RAILWAYS APPLICATION, 2019–2026 (USD MILLION)

9.3.4.2 Canada

9.3.4.2.1 Modernization of solar power generation facilities In Canada to provide lucrative growth opportunity for DC switchgear market

TABLE 64 CANADA: MARKET, BY VOLTAGE, 2019–2026 (USD MILLION)

TABLE 65 CANADA: MARKET, BY DEPLOYMENT TYPE, 2019–2026 (USD MILLION)

TABLE 66 CANADA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 67 CANADA: MARKET, BY RAILWAYS APPLICATION, 2019–2026 (USD MILLION)

9.3.4.3 Mexico

9.3.4.3.1 Growing solar power generation is expected to boost demand for DC switchgears in Mexico

TABLE 68 MEXICO: MARKET, BY VOLTAGE, 2019–2026 (USD MILLION)

TABLE 69 MEXICO: MARKET, BY DEPLOYMENT TYPE, 2019–2026 (USD MILLION)

TABLE 70 MEXICO: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 71 MEXICO: MARKET, BY RAILWAYS APPLICATION, 2019–2026 (USD MILLION)

9.4 EUROPE

9.4.1 BY VOLTAGE

TABLE 72 EUROPE: MARKET, BY VOLTAGE, 2019–2026 (USD MILLION)

9.4.2 BY DEPLOYMENT TYPE

TABLE 73 EUROPE: MARKET, BY DEPLOYMENT TYPE, 2019–2026 (USD MILLION)

9.4.3 BY APPLICATION

TABLE 74 EUROPE: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

9.4.3.1 By railways

TABLE 75 EUROPE: MARKET, BY RAILWAYS APPLICATION, 2019–2026 (USD MILLION)

9.4.4 BY COUNTRY

TABLE 76 EUROPE: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

9.4.4.1 Germany

9.4.4.1.1 Upcoming solar power generation projects to fuel growth of DC switchgear market in Germany

TABLE 77 GERMANY: MARKET, BY VOLTAGE, 2019–2026 (USD MILLION)

TABLE 78 GERMANY: MARKET, BY DEPLOYMENT TYPE, 2019–2026 (USD MILLION)

TABLE 79 GERMANY: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 80 GERMANY: MARKET, BY RAILWAYS APPLICATION, 2019–2026 (USD MILLION)

9.4.4.2 UK

9.4.4.2.1 Growing integration of renewable energy into electricity generation mix is expected to drive demand for DC switchgears in UK

TABLE 81 UK: MARKET, BY VOLTAGE, 2019–2026 (USD MILLION)

TABLE 82 UK: MARKET, BY DEPLOYMENT TYPE, 2019–2026 (USD MILLION)

TABLE 83 UK: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 84 UK: MARKET, BY RAILWAYS APPLICATION, 2019–2026 (USD MILLION)

9.4.4.3 France

9.4.4.3.1 Growing number of solar power projects is expected to drive demand for DC switchgears in France

TABLE 85 FRANCE: MARKET, BY VOLTAGE, 2019–2026 (USD MILLION)

TABLE 86 FRANCE: MARKET, BY DEPLOYMENT TYPE, 2019–2026 (USD MILLION)

TABLE 87 FRANCE: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 88 FRANCE: MARKET, BY RAILWAYS APPLICATION, 2019–2026 (USD MILLION)

9.4.4.4 Russia

9.4.4.4.1 Increasing investments in energy storage infrastructure and railways is likely to fuel market growth

TABLE 89 RUSSIA: DC SWITCHGEAR MARKET, BY VOLTAGE, 2019–2026 (USD MILLION)

TABLE 90 RUSSIA: MARKET, BY DEPLOYMENT TYPE, 2019–2026 (USD MILLION)

TABLE 91 RUSSIA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 92 RUSSIA: MARKET, BY RAILWAYS APPLICATION, 2019–2026 (USD MILLION)

9.4.4.5 Rest of Europe

TABLE 93 REST OF EUROPE: MARKET, BY VOLTAGE, 2019–2026 (USD MILLION)

TABLE 94 REST OF EUROPE: MARKET, BY DEPLOYMENT TYPE, 2019–2026 (USD MILLION)

TABLE 95 REST OF EUROPE: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 96 REST OF EUROPE: MARKET, BY RAILWAYS APPLICATION, 2019–2026 (USD MILLION)

9.5 SOUTH AMERICA

9.5.1 BY VOLTAGE

TABLE 97 SOUTH AMERICA: MARKET, BY VOLTAGE, 2019–2026 (USD MILLION)

9.5.2 BY DEPLOYMENT TYPE

TABLE 98 SOUTH AMERICA: MARKET, BY DEPLOYMENT TYPE, 2019–2026 (USD MILLION)

9.5.3 BY APPLICATION

TABLE 99 SOUTH AMERICA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

9.5.3.1 By railways

TABLE 100 SOUTH AMERICA: MARKET, BY RAILWAYS APPLICATION, 2019–2026 (USD MILLION)

9.5.4 BY COUNTRY

TABLE 101 SOUTH AMERICA: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

9.5.4.1 Brazil

9.5.4.1.1 Significant investments in electricity distribution network to underpin market growth in Brazil

TABLE 102 BRAZIL: DC SWITCHGEAR MARKET, BY VOLTAGE, 2019–2026 (USD MILLION)

TABLE 103 BRAZIL: MARKET, BY DEPLOYMENT TYPE, 2019–2026 (USD MILLION)

TABLE 104 BRAZIL: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 105 BRAZIL: MARKET, BY RAILWAYS APPLICATION, 2019–2026 (USD MILLION)

9.5.4.2 Argentina

9.5.4.2.1 Government support to promote renewables and railways sector to favor market growth

TABLE 106 ARGENTINA: MARKET, BY VOLTAGE, 2019–2026 (USD MILLION)

TABLE 107 ARGENTINA: MARKET, BY DEPLOYMENT TYPE, 2019–2026 (USD MILLION)

TABLE 108 ARGENTINA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 109 ARGENTINA: MARKET, BY RAILWAYS APPLICATION, 2019–2026 (USD MILLION)

9.5.4.3 Rest of South America

TABLE 110 REST OF SOUTH AMERICA: DC SWITCHGEAR MARKET, BY VOLTAGE, 2019–2026 (USD MILLION)

TABLE 111 REST OF SOUTH AMERICA: MARKET, BY DEPLOYMENT TYPE, 2019–2026 (USD MILLION)

TABLE 112 REST OF SOUTH AMERICA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 113 REST OF SOUTH AMERICA: MARKET, BY RAILWAYS APPLICATION, 2019–2026 (USD MILLION)

9.6 MIDDLE EAST & AFRICA

9.6.1 BY VOLTAGE

TABLE 114 MIDDLE EAST & AFRICA: MARKET, BY VOLTAGE, 2019–2026 (USD MILLION)

9.6.2 BY DEPLOYMENT TYPE

TABLE 115 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT TYPE, 2019–2026 (USD MILLION)

9.6.3 BY APPLICATION

TABLE 116 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

9.6.3.1 By railways

TABLE 117 MIDDLE EAST & AFRICA: MARKET, BY RAILWAYS APPLICATION, 2019–2026 (USD MILLION)

9.6.4 BY COUNTRY

TABLE 118 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

9.6.4.1 Saudi Arabia

9.6.4.1.1 Increasing power generation from solar resources to fuel demand for DC switchgears

TABLE 119 SAUDI ARABIA: MARKET, BY VOLTAGE, 2019–2026 (USD MILLION)

TABLE 120 SAUDI ARABIA: MARKET, BY DEPLOYMENT TYPE, 2019–2026 (USD MILLION)

TABLE 121 SAUDI ARABIA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 122 SAUDI ARABIA: MARKET, BY RAILWAYS APPLICATION, 2019–2026 (USD MILLION)

9.6.4.2 UAE

9.6.4.2.1 Efforts to modernize electricity sector would augment demand for DC switchgears in UAE

TABLE 123 UAE: DC SWITCHGEAR MARKET, BY VOLTAGE, 2019–2026 (USD MILLION)

TABLE 124 UAE: MARKET, BY DEPLOYMENT TYPE, 2019–2026 (USD MILLION)

TABLE 125 UAE: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 126 UAE: MARKET, BY RAILWAYS APPLICATION, 2019–2026 (USD MILLION)

9.6.4.3 Kuwait

9.6.4.3.1 Initiation of various infrastructural projects in Kuwait to support DC switchgear market growth

TABLE 127 KUWAIT: MARKET, BY VOLTAGE, 2019–2026 (USD MILLION)

TABLE 128 KUWAIT: MARKET, BY DEPLOYMENT TYPE, 2019–2026 (USD MILLION)

TABLE 129 KUWAIT: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 130 KUWAIT: MARKET, BY RAILWAYS APPLICATION, 2019–2026 (USD MILLION)

9.6.4.4 South Africa

9.6.4.4.1 Development of electric vehicle charging stations would give major push to DC switchgear market in South Africa

TABLE 131 SOUTH AFRICA: MARKET, BY VOLTAGE, 2019–2026 (USD MILLION)

TABLE 132 SOUTH AFRICA: MARKET, BY DEPLOYMENT TYPE, 2019–2026 (USD MILLION)

TABLE 133 SOUTH AFRICA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 134 SOUTH AFRICA: MARKET, BY RAILWAYS APPLICATION, 2019–2026 (USD MILLION)

9.6.4.5 Rest of Middle East & Africa

TABLE 135 REST OF MIDDLE EAST & AFRICA: MARKET, BY VOLTAGE, 2019–2026 (USD MILLION)

TABLE 136 REST OF MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT TYPE, 2019–2026 (USD MILLION)

TABLE 137 REST OF MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 138 REST OF MIDDLE EAST & AFRICA: MARKET, BY RAILWAYS APPLICATION, 2019–2026 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 140)

10.1 OVERVIEW

FIGURE 34 KEY DEVELOPMENTS IN DC SWITCHGEAR MARKET, 2017 TO 2021

10.2 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2020

TABLE 139 DC SWITCHGEAR MARKET: DEGREE OF COMPETITION

FIGURE 35 SHARE ANALYSIS OF TOP PLAYERS IN DC SWITCHGEAR MARKET, 2020

10.3 MARKET EVALUATION FRAMEWORK

TABLE 140 MARKET EVALUATION FRAMEWORK, 2017–2021

10.4 SEGMENTAL REVENUE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 36 SEGMENTAL REVENUE ANALYSIS, 2016–2020

10.5 RECENT DEVELOPMENTS

10.5.1 DEALS

TABLE 141 DC SWITCHGEAR MARKET: DEALS, 2017–2021

10.5.2 OTHERS

TABLE 142 DC SWITCHGEAR MARKET: OTHERS, 2017–2021

10.6 COMPANY EVALUATION QUADRANT

10.6.1 STAR

10.6.2 EMERGING LEADER

10.6.3 PERVASIVE

10.6.4 PARTICIPANT

FIGURE 37 DC SWITCHGEAR MARKET: COMPANY EVALUATION QUADRANT, 2020

TABLE 143 COMPANY REGION FOOTPRINT

11 COMPANY PROFILES (Page No. - 150)

11.1 KEY COMPANIES

(Business and financial overview, Products/solutions/services offered, Recent developments, Product launches, Deals, MnM view, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats)*

11.1.1 ABB

TABLE 144 ABB: BUSINESS OVERVIEW

FIGURE 38 ABB: COMPANY SNAPSHOT, 2020

TABLE 145 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 146 ABB: PRODUCT LAUNCHES

TABLE 147 ABB: DEALS

TABLE 148 ABB: OTHERS

11.1.2 SIEMENS

TABLE 149 SIEMENS: BUSINESS OVERVIEW

FIGURE 39 SIEMENS: COMPANY SNAPSHOT, 2020

TABLE 150 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 151 SIEMENS: DEALS

11.1.3 EATON

TABLE 152 EATON: BUSINESS OVERVIEW

FIGURE 40 EATON: COMPANY SNAPSHOT, 2020

TABLE 153 EATON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 154 EATON: PRODUCT LAUNCHES

TABLE 155 EATON: DEALS

TABLE 156 EATON: OTHERS

11.1.4 HITACHI ENERGY LTD.

TABLE 157 HITACHI LTD.,: BUSINESS OVERVIEW

FIGURE 41 HITACHI LTD.,: COMPANY SNAPSHOT, 2020

TABLE 158 HITACHI ENERGY LTD.,: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 159 HITACHI ENERGY LTD.: DEALS

TABLE 160 HITACHI ENERGY LTD.: OTHERS

11.1.5 TOSHIBA INFRASTRUCTURE SYSTEMS & SOLUTIONS CORPORATION

TABLE 161 TOSHIBA CORPORATION: BUSINESS OVERVIEW

FIGURE 42 TOSHIBA CORPORATION: COMPANY SNAPSHOT, 2021

TABLE 162 TOSHIBA INFRASTRUCTURE SYSTEMS & SOLUTIONS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 163 TOSHIBA INFRASTRUCTURE SYSTEMS & SOLUTIONS CORPORATION: DEALS

11.1.6 GENERAL ELECTRIC

TABLE 164 GENERAL ELECTRIC: BUSINESS OVERVIEW

FIGURE 43 GENERAL ELECTRIC: COMPANY SNAPSHOT, 2020

TABLE 165 GENERAL ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

11.1.7 SCHNEIDER ELECTRIC

TABLE 166 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

FIGURE 44 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT, 2020

TABLE 167 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 168 SCHNEIDER ELECTRIC: DEALS

TABLE 169 SCHNEIDER ELECTRIC: OTHERS

11.1.8 PLUTON RAIL PTY LTD

TABLE 170 PLUTON RAIL PTY LTD: BUSINESS OVERVIEW

TABLE 171 PLUTON RAIL PTY LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 172 PLUTON RAIL PTY LTD: PRODUCT LAUNCHES

TABLE 173 PLUTON RAIL PTY LTD: DEALS

11.1.9 SÉCHERON

TABLE 174 SÉCHERON: BUSINESS OVERVIEW

TABLE 175 SÉCHERON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 176 SÉCHERON: DEALS

TABLE 177 SÉCHERON: OTHERS

11.1.10 LS ELECTRIC CO., LTD

TABLE 178 LS ELECTRIC CO., LTD: BUSINESS OVERVIEW

FIGURE 45 LS ELECTRIC CO., LTD: COMPANY SNAPSHOT, 2020

TABLE 179 LS ELECTRIC CO., LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 180 LS ELECTRIC CO., LTD: OTHERS

11.1.11 L&T ELECTRICAL & AUTOMATION

TABLE 181 L&T ELECTRICAL & AUTOMATION: BUSINESS OVERVIEW

TABLE 182 L&T ELECTRICAL & AUTOMATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

11.1.12 MYERS POWER PRODUCTS, INC.

TABLE 183 MYERS POWER PRODUCTS, INC.: BUSINESS OVERVIEW

TABLE 184 MYERS POWER PRODUCTS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 185 MYERS POWER PRODUCTS, INC.: DEALS

11.1.13 KDM STEEL

TABLE 186 KDM STEEL: BUSINESS OVERVIEW

TABLE 187 KDM STEEL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

11.1.14 ENTEC ELECTRIC & ELECTRONIC

TABLE 188 ENTEC ELECTRIC & ELECTRONIC: BUSINESS OVERVIEW

TABLE 189 ENTEC ELECTRIC & ELECTRONIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

11.1.15 BRUSH GROUP

TABLE 190 BRUSH GROUP: BUSINESS OVERVIEW

TABLE 191 BRUSH GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 192 BRUSH GROUP: DEALS

11.1.16 DAQO GROUP

TABLE 193 DAQO GROUP: BUSINESS OVERVIEW

TABLE 194 DAQO GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

11.2 OTHER COMPANIES

11.2.1 NINGBO TIANAN (GROUP) CO., LTD

11.2.2 POWELL INDUSTRIES

11.2.3 DDAQO GROUP

11.2.4 MEIDENSHA CORPORATION

11.2.5 GRIMARD

11.3 OTHER PLAYERS

*Details on Business and financial overview, Products/solutions/services offered, Recent developments, Product launches, Deals, MnM view, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 193)

12.1 INSIGHTS OF INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

This study involved four major activities in estimating the current size of the DC switchgear market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through rigorous primary research. Both top-down and bottom-up approaches were used to estimate the total market size. The market breakdown and data triangulation techniques were employed to estimate the market size of the segments and the corresponding subsegments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases such as water and wastewater management data, industry publications, several newspaper articles, Statista Industry Journal, Factiva, and water & environment journal to identify and collect information useful for a technical, market-oriented, and commercial study of the DC switchgear market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The DC switchgear market comprises several stakeholders such as companies related to the industry, consulting companies in the traction power supply, T&D utilities, government & research organizations, forums, alliances & associations, DC switchgear providers, state & national energy authorities, dealers & suppliers, and vendors. The demand side of the market is characterized by increased investment in the railways, renewable energy infrastructures and power generation utilities. The supply side is characterized by investments & expansion and, partnerships & collaborations among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global DC switchgear market and its dependent submarkets. These methods were also extensively used to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market shares in the respective regions have been determined through both primary and secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global DC switchgear Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the DC switchgear market.

Objectives of the Study

- To define and describe the DC switchgear market based on voltage, deployment type, application and region

- To provide detailed information on the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze each segment/subsegment of the market with respect to individual growth trends, future expansions, and their contributions to the market

- To analyze growth opportunities for stakeholders and the competitive landscape for market leaders

- To forecast the growth of the market with respect to six main regions—the North America, South America, Europe, Asia Pacific, and the Middle East & Africa.

- To strategically profile key players and comprehensively analyze their respective market shares and core competencies1

- To analyze competitive developments such as investments & expansions, mergers & acquisitions, product launches, contracts & agreements, and joint ventures & collaborations in the DC switchgear market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to your specific needs. The following customization options are available for the report:

Company Information

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in DC Switchgear Market