Decorative Concrete Market by Type (Stamped, Stained, Colored, Polished, Epoxy, Concrete Overlays), Application (Floors, Walls, Driveways & sidewalks, Pool decks), End-use Industry (Residential, Non-residential), and Region - Global Forecast to 2028

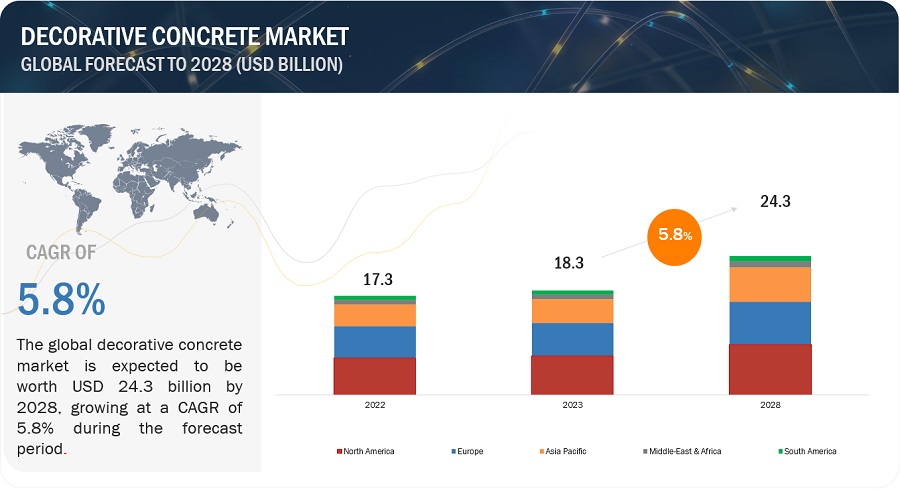

The Global Decorative Concrete Market size is projected to grow from USD 18.3 billion in 2023 to USD 24.3 billion by 2028, at a CAGR of 5.8% from 2023 to 2028.

Decorative concrete is used to cover residential and non-residential spaces, which include offices, educational institutions, hotels, healthcare facilities, recreation centers, and retails outlets to decorate and enhance the interior appearance. The growth of the decorative concrete market is attributed to the growing interest of consumers in home décor, the booming housing construction sector, rise in renovation & remodeling activities, and rapid urbanization & globalization.

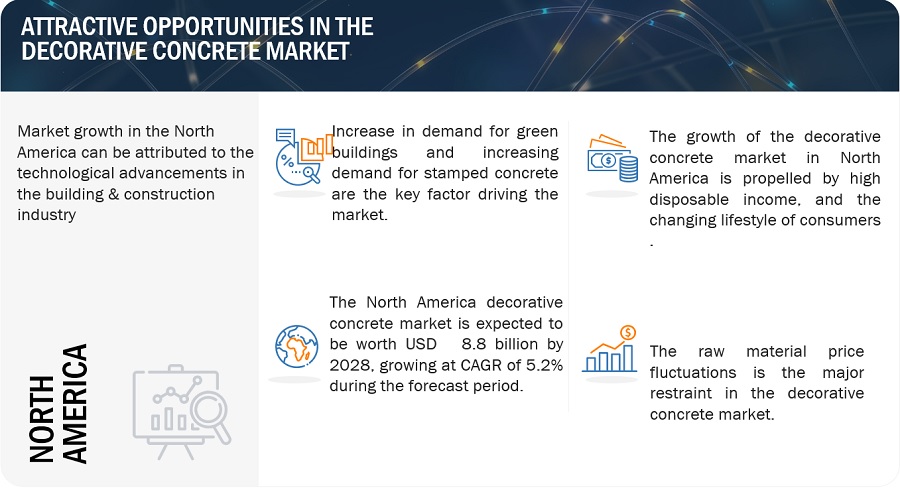

Attractive Opportunities in the Decorative Concrete Market

To know about the assumptions considered for the study, Request for Free Sample Report

Decorative concrete Market Dynamics

Driver: Increasing demand for stamped concrete for flooring applications

Stamped concrete is a continuous concrete surface that has been molded or stamped to appear very much like individual pavers, bricks, stone, or even wood. It is widely used in exterior applications such as pool decks, driveways & sidewalks, and patios. The demand and rapid growth of stamped concrete are supported by its easy installation and higher strength. The high demand for stamped concrete, especially for constructing hotel flooring and other commercial buildings, is a primary factor resulting in an upsurge in demand.

Restraint: Higher cost

Materials, such as admixtures, asphalt/bitumen, cement, and additives that are used in the manufacturing & installation process of decorative concrete, are relatively more expensive than their traditional alternatives. Decorative concrete used in the construction industry has undergone many changes and advancements in terms of concrete types and applications. Additives that are added in the concrete mix to give it the desired texture are high in cost, thus making decorative concrete expensive. In addition to that, labor costs also add up to the total cost of installing decorative concrete for repair and renovation purposes. This factor might restrict the desired growth of this market during the forecast period.

Opportunity: Rise in renovation and remodeling activities

The surge in renovation and remodeling activities presents a significant market opportunity for the decorative concrete industry. As homeowners and businesses increasingly seek to enhance the aesthetics and functionality of existing spaces, decorative concrete emerges as an attractive solution. Its versatility allows for the revitalization of various surfaces, including floors, driveways, patios, and countertops, offering a cost-effective alternative to traditional remodeling materials. The customizable nature of decorative concrete, with options such as stamped patterns, colored finishes, and textured surfaces, aligns perfectly with the growing demand for unique and personalized design choices in renovation projects. Additionally, the relatively quicker installation process of decorative concrete compared to some traditional materials makes it an appealing option for those looking to achieve transformative changes efficiently. This, in turn, creates opportunities in the decorative concrete market.

Challenge: Lack of awareness about decorative concrete in developing economies

The construction industry is slow and conservative in adopting innovative and new technologies. The construction sector comprises numerous small suppliers; its R&D budget is also limited in comparison to other sectors. There is a lack of awareness among consumers as well as building professionals about decorative concrete. The decorative concrete market has a positive outlook due to high growth in the construction industry. However, in some developing or underdeveloped countries of the Asia Pacific region as well as in Africa and South America, people are less aware of the benefits of decorative concrete.

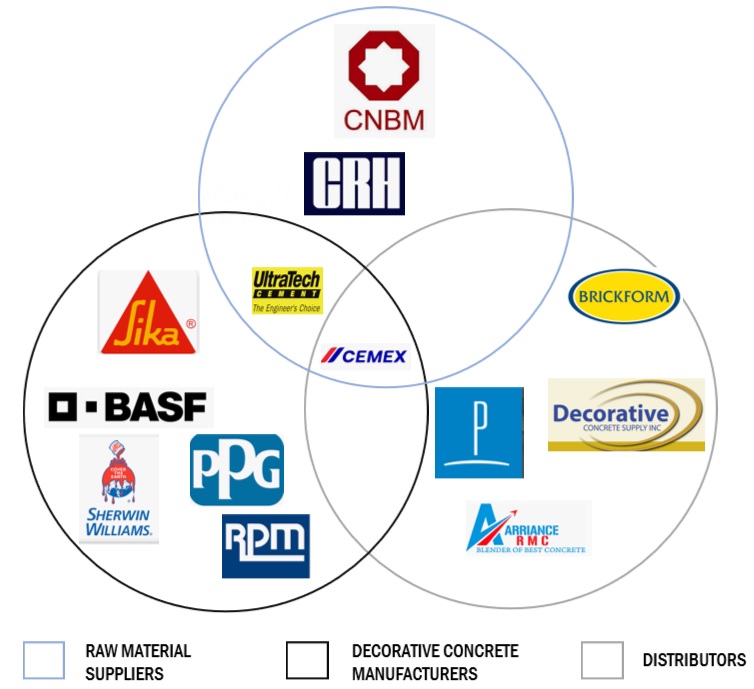

ECOSYSTEM

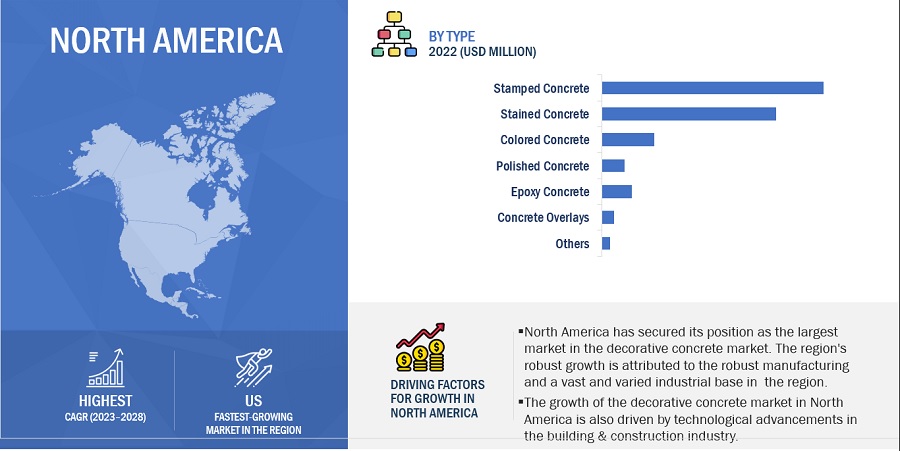

By Type stamped concrete segment to have highest share in the forecast period

Stamped concrete holds the highest market share in the decorative concrete market due to its exceptional versatility and ability to replicate the appearance of high-end materials. This decorative concrete technique involves impressing patterns and textures onto freshly poured concrete, creating surfaces that mimic the look of natural stone, brick, or tile. The popularity of stamped concrete can be attributed to its aesthetic appeal, providing property owners with a cost-effective means to achieve luxurious and sophisticated finishes. Moreover, stamped concrete offers a durable and low-maintenance solution, making it a preferred choice for both residential and commercial applications. Increased longevity and low maintenance cost are the factors responsible for the highest share of stamped concrete among the type of decorative concrete material.

By application, the floors segment led the market in 2022.

In 2022, the floors segment stood out as the largest application of decorative concrete, commanding the largest share of the market. Concrete floors are the most versatile and commonly used flooring in residential and non-residential sectors. It is referred to as polished concrete, which provides stylish contemporary flooring. It is easy to install, especially in instances where a concrete slab is available for staining, polishing, or application of a decorative coating or overlay.

By end-use industry, the non-residential segment was the largest segment in 2022.

According to OECD, “a building is regarded as a non-residential building when the minor part of the building (i.e., less than half of its gross floor area) is used for dwelling purposes.” Non-residential buildings can be classified into healthcare, education, hospitality, retail, and office. The non-residential segment dominated the global decorative concrete market in 2022. In this sector, the demand for decorative concrete is expected to be driven by increasing spending on office spaces and other commercial and institutional constructions where concrete is used extensively.

North America dominated the market in 2022.

The North American region accounted for the largest share in 2022, in terms of value, followed by Europe and Asia Pacific. The growth of the decorative concrete market in North America is driven by technological advancements in the building & construction industry. In the US, single-family homes are growing, especially in Florida, Georgia, North Carolina, Washington, Utah, Tennessee, Ohio, California, Idaho, and South Carolina. The usage of decorative and esthetic appeal flooring systems in residential applications has been a key factor driving the decorative concrete market. There is also growth in the number of non-residential buildings in North America, especially in the US, due to robust manufacturing and a vast and varied industrial base.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The Decorative concrete market comprises key manufacturers such as PPG Industries Inc. (US), BASF SE (Germany), The Sherwin-Williams Company (US), RPM International Inc. (US), Sika AG (Switzerland), Boral Limited (Australia), UltraTech Cement Limited (India), and others. Expansions, collaborations, and deals were some of the major strategies adopted by these key players to enhance their positions in the decorative concrete market. A major focus was given to the expansions and deals.

Read More: Decorative Concrete Companies

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2021–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD millions) and Volume (million square feet) |

|

Segments Covered |

Type, Application, End-Use industry, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, South America, and Middle East & Africa. |

|

Companies covered |

CEMEX, S.A.B. de C.V. (Mexico), BASF SE (Germany), Sika AG (Switzerland), RPM International Inc. (US), The Sherwin Williams Company (US), PPG Industries, Inc. (US), and Boral Limited (Australia) are the top manufacturers covered in the decorative concrete market. |

This research report categorizes the decorative concrete market based on type, application, end-use industry, and region.

Decorative concrete Market, By Type

- Stamped Concrete

- Stained Concrete

- Concrete Overlays

- Colored Concrete

- Polished Concrete

- Epoxy Concrete

- Others (Concrete dyes, engravings, and knockdown finish)

Decorative concrete Market, By Application

- Floors

- Walls

- Driveways & sidewalks

- Patios

- Pool decks

- Others (Ceilings and countertops)

Decorative concrete Market, By End-Use Industry

- Residential

- Non-residential

Decorative concrete Market, By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Recent Developments

- In Nov 2023, Sika acquired a 30% stake in Concria Oy, a Finnish startup specializing in innovative concrete floors. Concria's technology, which includes special dry shake hardeners and a unique procedure and tools for grinding and polishing concrete floors, offers numerous advantages to contractors, architects, and property owners.

- In Nov 2023, Sika expanded its production capacity for concrete admixtures in the USA, with a focus on polymer production at its Sealy site in the state of Texas. This marked Sika's second polymer investment in Texas within a span of five years.

- In Feb 2022, the Sherwin-Williams Company officially signed an agreement with the state of North Carolina, Iredell County, and the city of Statesville, marking a significant expansion of its architectural paint and coatings manufacturing capacity. Additionally, the agreement included the establishment of a larger distribution facility in Statesville, North Carolina.

- In Sep 2021, RPM acquired a manufacturing plant in Texas as part of its strategy to meet growing customer demand and optimize operational efficiencies. The addition of the Corsicana plant will enable the company to increase production capacity for several high-growth product lines, while also enhancing manufacturing processes and overall operational efficiency.

Frequently Asked Questions (FAQ):

What are the major drivers driving the growth of the decorative concrete market?

The major drivers influencing the growth of the decorative concrete market are increasing demand for stamped concrete for flooring applications and rise in demand for green buildings.

What are the major challenges in the decorative concrete market?

The major challenge is the lack of awareness of decorative concrete in emerging economies.

What are the restraining factors in the decorative concrete market?

The major restraint in the decorative concrete market is fluctuations in raw material price.

What is the key opportunity in the decorative concrete market?

Population and rapid urbanization translating to the large number of construction projects is a major opportunity in the decorative concrete market.

Who are the key players in the global decorative concrete market?

The key players operating in the decorative concrete market are The Sherwin-Williams Company (US), BASF SE (Germany), PPG Industries Inc. (US), RPM International Inc. (US), Boral Limited (Australia), UltraTech Cement Limited (India), Sika AG (Switzerland) amongst others. .

What are the most popular decorative concrete finishes for residential homes in the U.S.?

Stamped concrete, polished concrete, and stained concrete are among the most popular finishes for residential properties in the U.S. Stamped concrete mimics natural stone or brick, polished concrete offers a sleek, modern aesthetic, and stained concrete provides a customized look with vibrant or muted tones. Homeowners frequently choose these options for patios, driveways, and pool decks due to their durability and visual appeal.

How does decorative concrete perform in the UK's damp and cold climate?

Decorative concrete is highly durable and well-suited for the UK's damp and cold climate when properly sealed. It resists moisture, frost damage, and wear, making it ideal for outdoor applications like patios and driveways. Techniques such as using anti-slip sealers and ensuring proper drainage further enhance its performance and safety in wet conditions.

What are the major drivers of growth in the decorative concrete market?

The growth of the decorative concrete market in the United States is primarily driven by the increasing demand for stamped concrete in flooring applications and a rising interest in green buildings. Additionally, the popularity of remodeling and renovation activities, particularly in non-residential sectors such as hospitality and retail, is significantly contributing to market expansion.

What opportunities exist for decorative concrete in the UK market?

In the UK, there is a notable opportunity for decorative concrete driven by an increase in renovation and remodeling activities. Homeowners and businesses are increasingly seeking aesthetic enhancements for existing spaces, which decorative concrete can provide through its versatility and customization options. This trend aligns with consumer preferences for unique and personalized designs, making decorative concrete an attractive solution for various applications including floors, driveways, and patios.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing demand for stamped concrete for flooring applications- Demand for resource-efficient and environmentally friendly green buildings- Investments in infrastructure industry- Rise in population and rapid urbanizationRESTRAINTS- Volatility in raw material prices- Higher cost than traditional alternativesOPPORTUNITIES- Consumer demand for customized, visually appealing concrete solutions- Rise in demand from emerging economies- Increasing renovation and remodeling activitiesCHALLENGES- Lack of awareness about decorative concrete in emerging economies- Non-availability of skilled labor in decorative concrete market

- 6.1 TRENDS & DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.2 PRICING ANALYSIS

- 6.3 VALUE CHAIN ANALYSIS

-

6.4 ECOSYSTEM/MARKET MAP

-

6.5 TECHNOLOGY ANALYSISGLOW IN THE DARK CONCRETEDIGITAL PRINTING ON CONCRETEVERTICAL STAMPED CONCRETE

-

6.6 PATENT ANALYSISINTRODUCTIONMETHODOLOGY

-

6.7 PATENT ANALYSIS, 2013–2022

- 6.8 TRADE ANALYSIS

- 6.9 KEY CONFERENCES AND EVENTS IN 2023–2024

-

6.10 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSAVERAGE TARIFF RATESLEED CERTIFICATIONDIRECT IMPACT OF DECORATIVE CONCRETE ON LEED CERTIFICATION

-

6.11 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

6.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.13 CASE STUDY ANALYSISDECORATIVE CONCRETE OFFERED SUSTAINABLE SOLUTIONDECORATIVE CONCRETE HELPED GROCERY STORE BECOME MORE ECO-FRIENDLY

-

6.14 MACROECONOMIC INDICATORSINTRODUCTIONGDP TRENDS AND FORECASTSIMPACT OF CONSTRUCTION INDUSTRY ON DECORATIVE CONCRETE MARKET

- 7.1 INTRODUCTION

-

7.2 STAMPED CONCRETECOST-EFFECTIVENESS AND EASE OF MAINTENANCE TO DRIVE MARKET

-

7.3 STAINED CONCRETEEXCELLENT UV STABILITY AND WEAR RESISTANCE PERMITTING USE ON INTERIORS OR EXTERIORS TO DRIVE MARKET

-

7.4 COLORED CONCRETECOMMERCIAL CONCRETE LANDSCAPING AND PAVING APPLICATIONS TO DRIVE MARKET

-

7.5 POLISHED CONCRETELOWER MAINTENANCE AND RESISTANCE TO MOISTURE TO DRIVE MARKET

-

7.6 EXPOSED AGGREGATE CONCRETEBEAUTIFICATION AND DURABILITY OF CONCRETE SURFACES TO DRIVE MARKET

-

7.7 CONCRETE OVERLAYSPROTECTION OF CONCRETE FROM SALT, CHEMICALS, UV EXPOSURE, FREEZE-THAW CONDITIONS, AND ABRASION TO DRIVE MARKET

-

7.8 EPOXY CONCRETERESISTANCE TO CHEMICAL ATTACKS, CORROSION, AND ABRASION TO DRIVE MARKET

- 7.9 OTHER TYPES

- 8.1 INTRODUCTION

-

8.2 FLOORSVERSATILITY AND EASE OF INSTALLATION TO DRIVE MARKET

-

8.3 DRIVEWAYS & SIDEWALKSOFFERS ESTHETICALLY PLEASING AND SAFE PATH

-

8.4 WALLSLOWER MAINTENANCE, HIGH DURABILITY, AND STAINING TO PROVIDE NATURAL LOOK TO DRIVE MARKET

-

8.5 POOL DECKSEASE OF INSTALLATION AND PROVISION OF SAFE, SLIP-RESISTANT DECKS TO DRIVE MARKET

-

8.6 PATIOSBEAUTY, SUPERIOR DURABILITY, AND WEATHER RESISTANCE TO DRIVE MARKET

- 8.7 OTHER APPLICATIONS

- 9.1 INTRODUCTION

-

9.2 RESIDENTIALCONTROL OVER INDOOR AIR QUALITY AND PROVISION OF SAFE AND SLIP-RESISTANT FLOORS TO DRIVE MARKET

-

9.3 NON-RESIDENTIALENHANCEMENT OF FLOOR SAFETY AND OVERALL ESTHETIC APPEAL TO DRIVE MARKET

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAIMPACT OF RECESSION ON NORTH AMERICAUS- Consumer demand for esthetic, low maintenance, and durable flooring systems to drive marketCANADA- Rise in remodeling activities in residential sector to drive marketMEXICO- Rapid growth of construction and infrastructural sectors to drive market

-

10.3 EUROPEIMPACT OF RECESSION ON EUROPEGERMANY- Private and public sector investments in residential and infrastructure construction projects to drive marketFRANCE- Non-residential projects to drive marketITALY- Growing housing market to boost demandUK- Rising renovation activities to drive marketRUSSIA- Government investments in infrastructure, residential, renewable energy, mining, and healthcare projects to drive marketREST OF EUROPE

-

10.4 ASIA PACIFICIMPACT OF RECESSION ON ASIA PACIFICCHINA- Increasing applicability in residential and non-residential applications to drive marketJAPAN- Stamped concrete segment to account for largest market shareINDIA- Urbanization and significant growth of construction industry to drive marketAUSTRALIA- Growing residential and commercial construction activities to drive marketINDONESIA- Rising purchasing power and government focus on renovation of existing infrastructure to drive marketREST OF ASIA PACIFIC

-

10.5 MIDDLE EAST & AFRICAIMPACT OF RECESSION ON MIDDLE EAST & AFRICAGCC- Growth of construction industry and maintenance of extensive industrial infrastructure to drive marketUAE- Strong demand for low-maintenance flooring systems to drive marketSAUDI ARABIA- Government initiatives for developmental activities to propel marketREST OF GCCTURKEY- Substantial investments by private and public enterprises to drive marketSOUTH AFRICA- Increasing construction activities and urbanization to drive marketREST OF MIDDLE EAST & AFRICA

-

10.6 SOUTH AMERICAIMPACT OF RECESSION ON SOUTH AMERICABRAZIL- Rise in demand from residential sector to drive marketARGENTINA- Increasing government expenditure on industrial, residential, and commercial constructions to drive marketREST OF SOUTH AMERICA

- 11.1 OVERVIEW

- 11.2 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS

- 11.3 MARKET SHARE ANALYSIS

-

11.4 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 11.5 COMPANY FOOTPRINT

-

11.6 STARTUP/SME EVALUATION MATRIX, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

11.7 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHESDEALSOTHERS

-

12.1 KEY PLAYERSPPG INDUSTRIES, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBASF SE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTHE SHERWIN-WILLIAMS COMPANY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewRPM INTERNATIONAL INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSIKA AG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBORAL LIMITED- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewULTRATECH CEMENT LIMITED- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCEMEX, S.A.B. DE C.V.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHEIDELBERGCEMENT AG- Business overview- Products/Solutions/Services offered- MnM view3M COMPANY- Business overview- Products/Solutions/Services offered- MnM view

-

12.2 OTHER PLAYERSTHE EUCLID CHEMICAL COMPANYHOLCIMPALERMO CONCRETE, INC.CHRYSOBOMANITE INTERNATIONAL LIMITEDELITE CRETE SYSTEMSNEOCRETE TECHNOLOGIES PVT LTDCROSSFIELD PRODUCTS CORP.PARCHEM CONSTRUCTION SUPPLIESTARMACHICRETE DECORATIVE SYSTEMS PVT. LTD.MATTINGLY CONCRETE INC.APS CONSTRUCTION SYSTEMS (INTERNATIONAL) LTD.MAPEI INC.VULCAN MATERIALS COMPANY

- 13.1 INTRODUCTION

-

13.2 DECORATIVE COATINGS MARKETMARKET DEFINITIONMARKET OVERVIEW

- 13.3 DECORATIVE COATINGS MARKET, BY TECHNOLOGY

- 13.4 DECORATIVE COATINGS MARKET, BY RESIN TYPE

- 13.5 DECORATIVE COATINGS MARKET, BY COATING TYPE

- 13.6 DECORATIVE COATINGS MARKET, BY USER TYPE

- 13.7 DECORATIVE COATINGS MARKET, BY PRODUCT TYPE

- 13.8 DECORATIVE COATINGS MARKET, BY APPLICATION

- 13.9 DECORATIVE COATINGS MARKET, BY REGION

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 AVERAGE PRICE TREND OF KEY PLAYERS, BY TOP 3 APPLICATIONS (USD/SQUARE FEET), 2022

- TABLE 3 AVERAGE PRICE TREND, BY REGION (USD/SQUARE FEET)

- TABLE 4 ECOSYSTEM OF DECORATIVE CONCRETE MARKET

- TABLE 5 LIST OF PATENTS FOR DECORATIVE CONCRETE

- TABLE 6 DETAILED LIST OF CONFERENCES & EVENTS, 2023–2024

- TABLE 7 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 TARIFF RELATED TO ARTICLES OF CEMENT, CONCRETE, OR ARTIFICIAL STONE, WHETHER OR NOT REINFORCED

- TABLE 10 PORTER’S FIVE FORCES ANALYSIS

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- TABLE 12 KEY BUYING CRITERIA

- TABLE 13 WORLD GDP GROWTH PROJECTION, 2021–2028 (USD TRILLION)

- TABLE 14 CONSTRUCTION AS PERCENTAGE OF GDP, BY KEY COUNTRIES, 2021

- TABLE 15 DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 16 DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

- TABLE 17 DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 18 DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 19 DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 20 DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (MILLION SQUARE FEET)

- TABLE 21 DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 22 DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE FEET)

- TABLE 23 DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 24 DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE FEET)

- TABLE 25 DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 26 DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 27 DECORATIVE CONCRETE MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 28 DECORATIVE CONCRETE MARKET, BY REGION, 2021–2028 (MILLION SQUARE FEET)

- TABLE 29 NORTH AMERICA: DECORATIVE CONCRETE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 30 NORTH AMERICA: DECORATIVE CONCRETE MARKET, BY COUNTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 31 NORTH AMERICA: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 32 NORTH AMERICA: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

- TABLE 33 NORTH AMERICA: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 34 NORTH AMERICA: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 35 NORTH AMERICA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 36 NORTH AMERICA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (MILLION SQUARE FEET)

- TABLE 37 NORTH AMERICA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 38 NORTH AMERICA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE FEET)

- TABLE 39 NORTH AMERICA: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 40 NORTH AMERICA: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE FEET)

- TABLE 41 NORTH AMERICA: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 42 NORTH AMERICA: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 43 US: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 44 US: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

- TABLE 45 US: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 46 US: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 47 US: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 48 US: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (MILLION SQUARE FEET)

- TABLE 49 US: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 50 US: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE FEET)

- TABLE 51 CANADA: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 52 CANADA: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

- TABLE 53 CANADA: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 54 CANADA: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 55 CANADA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 56 CANADA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (MILLION SQUARE FEET)

- TABLE 57 CANADA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 58 CANADA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE FEET)

- TABLE 59 MEXICO: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 60 MEXICO: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

- TABLE 61 MEXICO: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 62 MEXICO: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 63 MEXICO: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 64 MEXICO: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (MILLION SQUARE FEET)

- TABLE 65 MEXICO: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 66 MEXICO: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE FEET)

- TABLE 67 EUROPE: DECORATIVE CONCRETE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 68 EUROPE: DECORATIVE CONCRETE MARKET, BY COUNTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 69 EUROPE: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 70 EUROPE: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

- TABLE 71 EUROPE: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 72 EUROPE: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 73 EUROPE: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 74 EUROPE: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (MILLION SQUARE FEET)

- TABLE 75 EUROPE: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 76 EUROPE: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE FEET)

- TABLE 77 EUROPE: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 78 EUROPE: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE FEET)

- TABLE 79 EUROPE: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 80 EUROPE: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 81 GERMANY: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 82 GERMANY: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

- TABLE 83 GERMANY: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 84 GERMANY: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 85 GERMANY: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 86 GERMANY: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (MILLION SQUARE FEET)

- TABLE 87 GERMANY: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 88 GERMANY: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE FEET)

- TABLE 89 GERMANY: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 90 GERMANY: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 91 FRANCE: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 92 FRANCE: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

- TABLE 93 FRANCE: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 94 FRANCE: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 95 FRANCE: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 96 FRANCE: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (MILLION SQUARE FEET)

- TABLE 97 FRANCE: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 98 FRANCE: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE FEET)

- TABLE 99 FRANCE: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 100 FRANCE: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 101 ITALY: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 102 ITALY: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

- TABLE 103 ITALY: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 104 ITALY: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 105 ITALY: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 106 ITALY: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (MILLION SQUARE FEET)

- TABLE 107 ITALY: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 108 ITALY: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE FEET)

- TABLE 109 ITALY: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 110 ITALY: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 111 UK: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 112 UK: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

- TABLE 113 UK: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 114 UK: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 115 UK: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 116 UK: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (MILLION SQUARE FEET)

- TABLE 117 UK: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 118 UK: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE FEET)

- TABLE 119 UK: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 120 UK: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 121 RUSSIA: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 122 RUSSIA: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

- TABLE 123 RUSSIA: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 124 RUSSIA: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 125 RUSSIA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 126 RUSSIA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (MILLION SQUARE FEET)

- TABLE 127 RUSSIA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 128 RUSSIA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE FEET)

- TABLE 129 RUSSIA: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 130 RUSSIA: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 131 REST OF EUROPE: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 132 REST OF EUROPE: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

- TABLE 133 REST OF EUROPE: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 134 REST OF EUROPE: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 135 REST OF EUROPE: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 136 REST OF EUROPE: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (MILLION SQUARE FEET)

- TABLE 137 REST OF EUROPE: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 138 REST OF EUROPE: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE FEET)

- TABLE 139 REST OF EUROPE: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 140 REST OF EUROPE: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 141 ASIA PACIFIC: DECORATIVE CONCRETE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 142 ASIA PACIFIC: DECORATIVE CONCRETE MARKET, BY COUNTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 143 ASIA PACIFIC: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 144 ASIA PACIFIC: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

- TABLE 145 ASIA PACIFIC: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 146 ASIA PACIFIC: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 147 ASIA PACIFIC: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 148 ASIA PACIFIC: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (MILLION SQUARE FEET)

- TABLE 149 ASIA PACIFIC: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 150 ASIA PACIFIC: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE FEET)

- TABLE 151 ASIA PACIFIC: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 152 ASIA PACIFIC: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE FEET)

- TABLE 153 ASIA PACIFIC: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 154 ASIA PACIFIC: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 155 CHINA: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 156 CHINA: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

- TABLE 157 CHINA: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 158 CHINA: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 159 CHINA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 160 CHINA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (MILLION SQUARE FEET)

- TABLE 161 CHINA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 162 CHINA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE FEET)

- TABLE 163 CHINA: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 164 CHINA: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 165 JAPAN: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 166 JAPAN: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

- TABLE 167 JAPAN: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 168 JAPAN: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 169 JAPAN: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 170 JAPAN: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (MILLION SQUARE FEET)

- TABLE 171 JAPAN: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 172 JAPAN: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE FEET)

- TABLE 173 JAPAN: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 174 JAPAN: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 175 INDIA: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 176 INDIA: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

- TABLE 177 INDIA: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 178 INDIA: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 179 INDIA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 180 INDIA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (MILLION SQUARE FEET)

- TABLE 181 INDIA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 182 INDIA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE FEET)

- TABLE 183 INDIA: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 184 INDIA: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 185 AUSTRALIA: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 186 AUSTRALIA: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

- TABLE 187 AUSTRALIA: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 188 AUSTRALIA: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 189 AUSTRALIA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 190 AUSTRALIA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (MILLION SQUARE FEET)

- TABLE 191 AUSTRALIA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 192 AUSTRALIA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE FEET)

- TABLE 193 AUSTRALIA: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 194 AUSTRALIA: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 195 INDONESIA: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 196 INDONESIA: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

- TABLE 197 INDONESIA: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 198 INDONESIA: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 199 INDONESIA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 200 INDONESIA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (MILLION SQUARE FEET)

- TABLE 201 INDONESIA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 202 INDONESIA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE FEET)

- TABLE 203 INDONESIA: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 204 INDONESIA: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 205 REST OF ASIA PACIFIC: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 206 REST OF ASIA PACIFIC: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

- TABLE 207 REST OF ASIA PACIFIC: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 208 REST OF ASIA PACIFIC: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 209 REST OF ASIA PACIFIC: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 210 REST OF ASIA PACIFIC: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (MILLION SQUARE FEET)

- TABLE 211 REST OF ASIA PACIFIC: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 212 REST OF ASIA PACIFIC: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE FEET)

- TABLE 213 REST OF ASIA PACIFIC: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 214 REST OF ASIA PACIFIC: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 215 MIDDLE EAST & AFRICA: DECORATIVE CONCRETE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 216 MIDDLE EAST & AFRICA: DECORATIVE CONCRETE MARKET, BY COUNTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 217 MIDDLE EAST & AFRICA: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 218 MIDDLE EAST & AFRICA: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

- TABLE 219 MIDDLE EAST & AFRICA: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 220 MIDDLE EAST & AFRICA: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 221 MIDDLE EAST & AFRICA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 222 MIDDLE EAST & AFRICA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (MILLION SQUARE FEET)

- TABLE 223 MIDDLE EAST & AFRICA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 224 MIDDLE EAST & AFRICA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE FEET)

- TABLE 225 MIDDLE EAST & AFRICA: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 226 MIDDLE EAST & AFRICA: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE FEET)

- TABLE 227 MIDDLE EAST & AFRICA: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 228 MIDDLE EAST & AFRICA: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 229 GCC: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 230 GCC: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

- TABLE 231 GCC: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 232 GCC: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 233 GCC: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 234 GCC: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (MILLION SQUARE FEET)

- TABLE 235 GCC: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 236 GCC: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE FEET)

- TABLE 237 GCC: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 238 GCC: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 239 UAE: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 240 UAE: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

- TABLE 241 UAE: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 242 UAE: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 243 UAE: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 244 UAE: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (MILLION SQUARE FEET)

- TABLE 245 UAE: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 246 UAE: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE FEET)

- TABLE 247 UAE: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 248 UAE: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 249 SAUDI ARABIA: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 250 SAUDI ARABIA: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

- TABLE 251 SAUDI ARABIA: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 252 SAUDI ARABIA: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 253 SAUDI ARABIA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 254 SAUDI ARABIA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (MILLION SQUARE FEET)

- TABLE 255 SAUDI ARABIA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 256 SAUDI ARABIA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE FEET)

- TABLE 257 SAUDI ARABIA: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 258 SAUDI ARABIA: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 259 REST OF GCC: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 260 REST OF GCC: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

- TABLE 261 REST OF GCC: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 262 REST OF GCC: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 263 REST OF GCC: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 264 REST OF GCC: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (MILLION SQUARE FEET)

- TABLE 265 REST OF GCC: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 266 REST OF GCC: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE FEET)

- TABLE 267 REST OF GCC: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 268 REST OF GCC: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 269 TURKEY: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 270 TURKEY: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

- TABLE 271 TURKEY: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 272 TURKEY: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 273 TURKEY: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 274 TURKEY: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (MILLION SQUARE FEET)

- TABLE 275 TURKEY: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 276 TURKEY: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE FEET)

- TABLE 277 TURKEY: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 278 TURKEY: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 279 SOUTH AFRICA: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 280 SOUTH AFRICA: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

- TABLE 281 SOUTH AFRICA: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 282 SOUTH AFRICA: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 283 SOUTH AFRICA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 284 SOUTH AFRICA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (MILLION SQUARE FEET)

- TABLE 285 SOUTH AFRICA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 286 SOUTH AFRICA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE FEET)

- TABLE 287 SOUTH AFRICA: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 288 SOUTH AFRICA: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 289 REST OF MIDDLE EAST & AFRICA: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 290 REST OF MIDDLE EAST & AFRICA: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

- TABLE 291 REST OF MIDDLE EAST & AFRICA: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 292 REST OF MIDDLE EAST & AFRICA: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 293 REST OF MIDDLE EAST & AFRICA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 294 REST OF MIDDLE EAST & AFRICA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (MILLION SQUARE FEET)

- TABLE 295 REST OF MIDDLE EAST & AFRICA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 296 REST OF MIDDLE EAST & AFRICA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE FEET)

- TABLE 297 REST OF MIDDLE EAST & AFRICA: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 298 REST OF MIDDLE EAST & AFRICA: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 299 SOUTH AMERICA: DECORATIVE CONCRETE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 300 SOUTH AMERICA: DECORATIVE CONCRETE MARKET, BY COUNTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 301 SOUTH AMERICA: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 302 SOUTH AMERICA: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

- TABLE 303 SOUTH AMERICA: DECORATIVE CONCRETE MARKET SIZE, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 304 SOUTH AMERICA: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 305 SOUTH AMERICA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 306 SOUTH AMERICA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (MILLION SQUARE FEET)

- TABLE 307 SOUTH AMERICA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 308 SOUTH AMERICA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE FEET)

- TABLE 309 SOUTH AMERICA: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 310 SOUTH AMERICA: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 311 BRAZIL: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 312 BRAZIL: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

- TABLE 313 BRAZIL: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 314 BRAZIL: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 315 BRAZIL: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 316 BRAZIL: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (MILLION SQUARE FEET)

- TABLE 317 BRAZIL: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 318 BRAZIL: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE FEET)

- TABLE 319 BRAZIL: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 320 BRAZIL: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 321 ARGENTINA: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 322 ARGENTINA: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

- TABLE 323 ARGENTINA: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 324 ARGENTINA: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 325 ARGENTINA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 326 ARGENTINA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (MILLION SQUARE FEET)

- TABLE 327 ARGENTINA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 328 ARGENTINA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE FEET)

- TABLE 329 ARGENTINA: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 330 ARGENTINA: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 331 REST OF SOUTH AMERICA: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 332 REST OF SOUTH AMERICA: DECORATIVE CONCRETE MARKET, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

- TABLE 333 REST OF SOUTH AMERICA: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 334 REST OF SOUTH AMERICA: DECORATIVE CONCRETE MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 335 REST OF SOUTH AMERICA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 336 REST OF SOUTH AMERICA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2017–2020 (MILLION SQUARE FEET)

- TABLE 337 REST OF SOUTH AMERICA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 338 REST OF SOUTH AMERICA: DECORATIVE CONCRETE MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE FEET)

- TABLE 339 REST OF SOUTH AMERICA: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 340 REST OF SOUTH AMERICA: DECORATIVE CONCRETE MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 341 OVERVIEW OF STRATEGIES ADOPTED BY KEY DECORATIVE CONCRETE PLAYERS

- TABLE 342 DEGREE OF COMPETITION

- TABLE 343 APPLICATION FOOTPRINT (25 COMPANIES)

- TABLE 344 REGIONAL FOOTPRINT (25 COMPANIES)

- TABLE 345 COMPANY FOOTPRINT (25 COMPANIES)

- TABLE 346 DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 347 COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 348 PRODUCT LAUNCHES, 2018–2023

- TABLE 349 DEALS, 2018–2023

- TABLE 350 OTHERS, 2018–2023

- TABLE 351 PPG INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 352 PPG INDUSTRIES, INC.: PRODUCT LAUNCHES

- TABLE 353 PPG INDUSTRIES, INC.: DEALS

- TABLE 354 BASF SE: COMPANY OVERVIEW

- TABLE 355 BASF SE: PRODUCT LAUNCHES

- TABLE 356 THE SHERWIN-WILLIAMS COMPANY: COMPANY OVERVIEW

- TABLE 357 THE SHERWIN-WILLIAMS COMPANY: OTHERS

- TABLE 358 RPM INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 359 RPM INTERNATIONAL INC.: DEALS

- TABLE 360 RPM INTERNATIONAL INC.: OTHERS

- TABLE 361 SIKA AG: COMPANY OVERVIEW

- TABLE 362 SIKA AG: DEALS

- TABLE 363 SIKA AG: OTHERS

- TABLE 364 BORAL LIMITED: COMPANY OVERVIEW

- TABLE 365 BORAL LIMITED: DEALS

- TABLE 366 BORAL LIMITED: OTHERS

- TABLE 367 ULTRATECH CEMENT LIMITED: COMPANY OVERVIEW

- TABLE 368 ULTRATECH CEMENT LIMITED: OTHERS

- TABLE 369 CEMEX, S.A.B. DE C.V.: COMPANY OVERVIEW

- TABLE 370 CEMEX, S.A.B. DE C.V.: PRODUCT LAUNCHES

- TABLE 371 CEMEX, S.A.B. DE C.V.: DEALS

- TABLE 372 CEMEX, S.A.B. DE C.V.: OTHERS

- TABLE 373 HEIDELBERGCEMENT AG: COMPANY OVERVIEW

- TABLE 374 3M COMPANY: COMPANY OVERVIEW

- TABLE 375 THE EUCLID CHEMICAL COMPANY: COMPANY OVERVIEW

- TABLE 376 HOLCIM: COMPANY OVERVIEW

- TABLE 377 PALERMO CONCRETE, INC.: COMPANY OVERVIEW

- TABLE 378 CHRYSO: COMPANY OVERVIEW

- TABLE 379 BOMANITE INTERNATIONAL LIMITED: COMPANY OVERVIEW

- TABLE 380 ELITE CRETE SYSTEMS: COMPANY OVERVIEW

- TABLE 381 NEOCRETE TECHNOLOGIES PVT LTD: COMPANY OVERVIEW

- TABLE 382 CROSSFIELD PRODUCTS CORP.: COMPANY OVERVIEW

- TABLE 383 PARCHEM CONSTRUCTION SUPPLIES: COMPANY OVERVIEW

- TABLE 384 TARMAC: COMPANY OVERVIEW

- TABLE 385 HICRETE DECORATIVE SYSTEMS PVT. LTD.: COMPANY OVERVIEW

- TABLE 386 MATTINGLY CONCRETE INC.: COMPANY OVERVIEW

- TABLE 387 APS CONSTRUCTION SYSTEMS (INTERNATIONAL) LTD.: COMPANY OVERVIEW

- TABLE 388 MAPEI INC.: COMPANY OVERVIEW

- TABLE 389 VULCAN MATERIALS COMPANY: COMPANY OVERVIEW

- TABLE 390 DECORATIVE COATINGS MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

- TABLE 391 DECORATIVE COATINGS MARKET, BY TECHNOLOGY, 2021–2027 (USD MILLION)

- TABLE 392 DECORATIVE COATINGS MARKET, BY TECHNOLOGY, 2017–2020 (KILOTON)

- TABLE 393 DECORATIVE COATINGS MARKET, BY TECHNOLOGY, 2021–2027 (KILOTON)

- TABLE 394 DECORATIVE COATINGS MARKET, BY RESIN TYPE, 2017–2020 (USD MILLION)

- TABLE 395 DECORATIVE COATINGS MARKET, BY RESIN TYPE, 2021–2027 (USD MILLION)

- TABLE 396 DECORATIVE COATINGS MARKET, BY RESIN TYPE, 2017–2020 (KILOTON)

- TABLE 397 DECORATIVE COATINGS MARKET, BY RESIN TYPE, 2021–2027 (KILOTON)

- TABLE 398 DECORATIVE COATINGS MARKET, BY COATING TYPE, 2017–2020 (USD MILLION)

- TABLE 399 DECORATIVE COATINGS MARKET, BY COATING TYPE, 2021–2027 (USD MILLION)

- TABLE 400 DECORATIVE COATINGS MARKET, BY COATING TYPE, 2017–2020 (KILOTON)

- TABLE 401 DECORATIVE COATINGS MARKET, BY COATING TYPE, 2021–2027 (KILOTON)

- TABLE 402 DECORATIVE COATINGS MARKET, BY USER TYPE, 2017–2020 (USD MILLION)

- TABLE 403 DECORATIVE COATINGS MARKET, BY USER TYPE, 2021–2027 (USD MILLION)

- TABLE 404 DECORATIVE COATINGS MARKET, BY USER TYPE, 2017–2020 (KILOTON)

- TABLE 405 DECORATIVE COATINGS MARKET, BY USER TYPE, 2021–2027 (KILOTON)

- TABLE 406 DECORATIVE COATINGS MARKET, BY PRODUCT TYPE, 2017–2020 (USD MILLION)

- TABLE 407 DECORATIVE COATINGS MARKET, BY PRODUCT TYPE, 2021–2027 (USD MILLION)

- TABLE 408 DECORATIVE COATINGS MARKET, BY PRODUCT TYPE, 2017–2020 (KILOTON)

- TABLE 409 DECORATIVE COATINGS MARKET, BY PRODUCT TYPE, 2021–2027 (KILOTON)

- TABLE 410 DECORATIVE COATINGS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 411 DECORATIVE COATINGS MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 412 DECORATIVE COATINGS MARKET, BY APPLICATION, 2017–2020 (KILOTON)

- TABLE 413 DECORATIVE COATINGS MARKET, BY APPLICATION, 2021–2027 (KILOTON)

- TABLE 414 DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 415 DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 416 DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (KILOTON)

- TABLE 417 DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (KILOTON)

- FIGURE 1 DECORATIVE CONCRETE MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 5 DATA TRIANGULATION

- FIGURE 6 STAMPED CONCRETE TYPE SEGMENT TO LEAD DECORATIVE CONCRETE MARKET DURING FORECAST PERIOD

- FIGURE 7 FLOORS APPLICATION SEGMENT TO DOMINATE DECORATIVE CONCRETE MARKET DURING FORECAST PERIOD

- FIGURE 8 NON-RESIDENTIAL SEGMENT TO BE LARGER END-USE INDUSTRY IN DECORATIVE CONCRETE MARKET DURING FORECAST PERIOD

- FIGURE 9 NORTH AMERICA ACCOUNTED FOR LARGEST SHARE OF DECORATIVE CONCRETE MARKET IN 2022

- FIGURE 10 ATTRACTIVE OPPORTUNITIES FOR PLAYERS DECORATIVE CONCRETE MARKET

- FIGURE 11 US ACCOUNTED FOR LARGEST SHARE OF MARKET IN TERMS OF VOLUME

- FIGURE 12 DECORATIVE CONCRETE MARKET IN CHINA PROJECTED TO GROW AT HIGHEST CAGR

- FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN DECORATIVE CONCRETE MARKET

- FIGURE 14 GROWTH OF INFRASTRUCTURE INDUSTRY, INCLUDING CONSTRUCTION

- FIGURE 15 RISING POPULATION TREND IN REGIONS

- FIGURE 16 ESTIMATED URBAN POPULATION, BY REGION (2021 VS. 2050)

- FIGURE 17 REVENUE SHIFT FOR DECORATIVE CONCRETE MANUFACTURERS

- FIGURE 18 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TOP 3 END-USE INDUSTRIES

- FIGURE 19 AVERAGE SELLING PRICE TREND, BY REGION (USD/SQUARE FEET)

- FIGURE 20 VALUE CHAIN ANALYSIS OF DECORATIVE CONCRETE MARKET

- FIGURE 21 ECOSYSTEM MAPPING

- FIGURE 22 LIST OF MAJOR PATENTS FOR DECORATIVE CONCRETE MARKET (2013–2022)

- FIGURE 23 EXPORT SCENARIO, HS CODE 6810: ARTICLES OF CEMENT, CONCRETE OR ARTIFICIAL STONE, WHETHER OR NOT REINFORCED (USD MILLION)

- FIGURE 24 IMPORT SCENARIO, HS CODE 6810: ARTICLES OF CEMENT, CONCRETE, OR ARTIFICIAL STONE, WHETHER OR NOT REINFORCED (USD MILLION)

- FIGURE 25 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 27 KEY BUYING CRITERIA

- FIGURE 28 POLISHED CONCRETE SEGMENT TO EXHIBIT HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 29 FLOORS SEGMENT TO DOMINATE GLOBAL DECORATIVE CONCRETE MARKET BY 2028

- FIGURE 30 NON-RESIDENTIAL SEGMENT TO LEAD DECORATIVE CONCRETE MARKET BY 2028

- FIGURE 31 CHINA TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 32 ASIA PACIFIC MARKET TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 33 NORTH AMERICA: DECORATIVE CONCRETE MARKET SNAPSHOT

- FIGURE 34 EUROPE: DECORATIVE CONCRETE MARKET SNAPSHOT

- FIGURE 35 REVENUE ANALYSIS FOR 5 KEY COMPANIES IN DECORATIVE CONCRETE MARKET

- FIGURE 36 MARKET SHARE ANALYSIS

- FIGURE 37 COMPANY EVALUATION MATRIX, 2022

- FIGURE 38 PRODUCT FOOTPRINT (25 COMPANIES)

- FIGURE 39 STARTUP/SME EVALUATION MATRIX, 2022

- FIGURE 40 PPG INDUSTRIES, INC.: COMPANY SNAPSHOT

- FIGURE 41 BASF SE: COMPANY SNAPSHOT

- FIGURE 42 THE SHERWIN-WILLIAMS COMPANY: COMPANY SNAPSHOT

- FIGURE 43 RPM INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 44 SIKA AG: COMPANY SNAPSHOT

- FIGURE 45 BORAL LIMITED: COMPANY SNAPSHOT

- FIGURE 46 ULTRATECH CEMENT LIMITED: COMPANY SNAPSHOT

- FIGURE 47 CEMEX, S.A.B. DE C.V.: COMPANY SNAPSHOT

- FIGURE 48 HEIDELBERGCEMENT AG: COMPANY SNAPSHOT

- FIGURE 49 3M COMPANY: COMPANY SNAPSHOT

The study involved four major activities for estimating the current size of the global decorative concrete market. Exhaustive secondary research was carried out to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of decorative concrete through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the decorative concrete market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, to identify and collect information for this study on the decorative concrete market. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; regulatory bodies, trade directories, and databases.

Primary Research

The decorative concrete market comprises several stakeholders in the supply chain, which include suppliers, processors, and end-product manufacturers. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the decorative concrete market. Primary sources from the supply side include associations and institutions involved in the decorative concrete industry, key opinion leaders, and processing players.

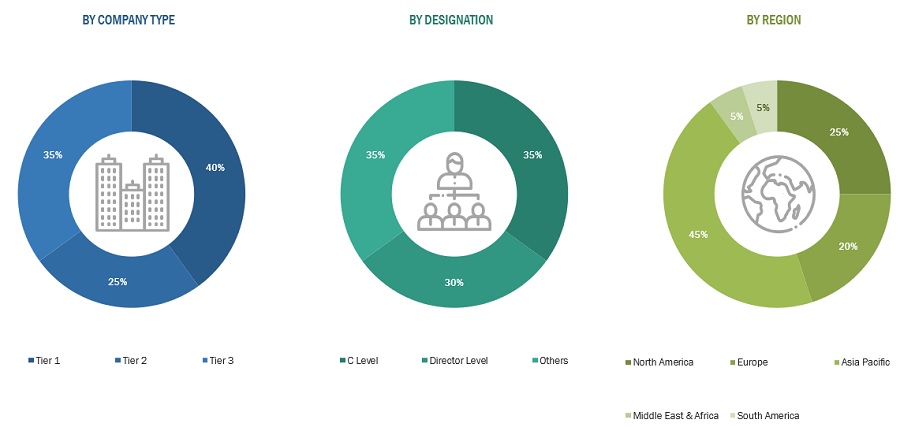

Following is the breakdown of primary respondents

Notes: Other designations include product, sales, and marketing managers.

Tiers of the companies are classified based on their annual revenues as of 2022, Tier 1 = >USD 5 Billion, Tier 2 = USD 1 Billion to USD 5 Billion, and Tier 3= <USD 1 Billion.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the size of the global decorative concrete market. These approaches were also used extensively to estimate the size of various segments of the market. The research methodology used to estimate the market size included the following details:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value, were determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players, along with extensive interviews with key officials, such as directors and marketing executives.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments of the decorative concrete market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

In addition, the market size was validated by using both the top-down and bottom-up approaches. Then, it was verified through primary interviews. Hence, for every data segment, there are three sources—top-down approach, bottom-up approach, and expert interviews. The data were assumed to be correct when the values arrived at from the three sources matched.

Market Definition

Decorative concrete refers to a specialized form of concrete that goes beyond traditional functionality, emphasizing aesthetic appeal and creative design. This type of concrete is crafted to enhance the visual and decorative aspects of surfaces, transforming them into artistic and personalized elements. Decorative concrete can take various forms, including stamped patterns, textured finishes, colored pigments, exposed aggregates, and intricate designs, allowing for a wide range of customization. It is commonly used in both interior and exterior applications, such as floors, driveways, patios, walkways, and other architectural elements.

Key Stakeholders

- Raw material suppliers

- Decorative concrete manufacturers

- Government & regulatory bodies

- Research organizations

- Associations and industry bodies

- End users

- Traders and distributors

Report Objectives

- To define, analyze, and project the size of the decorative concrete market in terms of value and volume based on type, application, end-use industry and region.

- To project the size of the market and its segments with respect to the five main regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, and South America

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders.

- To analyze the competitive developments, such as new product launches, expansions, and acquisitions, in the decorative concrete market

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Product Analysis:

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of the Rest of APAC market

- Further breakdown of Rest of Europe market

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Decorative Concrete Market