Dental Impression Systems Market by Product (Impression Material, Intraoral Scanners, Trays), Application (Restorative and Prosthodontics Dentistry, Orthodontics), End User (Hospitals, Dental Laboratories, Forensic Laboratories) - Global Forecast to 2025

Market Growth Outlook Summary

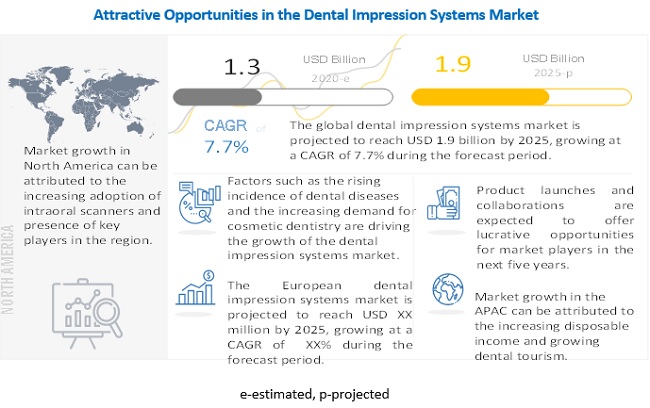

The global dental impression systems market growth forecasted to transform from $1.3 billion in 2020 to $1.9 billion by 2025, driven by a CAGR of 7.7%. Growth is driven by the rising incidence of dental diseases, increasing demand for cosmetic dentistry, and the adoption of digital dentistry. The market faces challenges such as high treatment costs, limited reimbursement, and a shortage of trained professionals. Key opportunities include the low penetration of dental implants in emerging markets. Intraoral scanners are expected to see the fastest growth, and restorative and prosthodontic dentistry dominates applications. Asia-Pacific is the fastest-growing region. Major players include 3M, Henry Schein, Dentsply Sirona, and Mitsui Chemicals.

To know about the assumptions considered for the study, Request for Free Sample Report

Dental Impression Systems Market Dynamics

Driver: Increasing demand for cosmetic dentistry

Cosmetic dentistry is one of the fastest-growing segments in the dental industry. Several studies have estimated that the market for cosmetic dentistry will continue to grow at a rapid pace. With increasing disposable incomes, the willingness to undergo expensive cosmetic procedures has also increased among the population in various countries, specifically among the aging population. The increasing income levels in developing countries such as India, China, and Brazil, which have a relatively high decayed, missing, and filled teeth (DMFT) index, is expected to boost the demand for dental impression systems in these countries during the forecast period. This rising preference for cosmetic dentistry, coupled with the increase in disposable incomes, will significantly spur the growth of the dental impression systems market in the coming years.

Restraint: High cost and limited reimbursement for dental treatments

In developed countries across North America and Europe, most insurance providers consider dental implants and clear aligners as cosmetic products and, hence, provide minimal reimbursements or do not provide reimbursements at all for these products or treatments. Therefore, a major portion of the cost of these dental procedures has to be borne by patients, with little support from insurance coverage. Due to this, the decision of patients to opt for treatment is largely dependent on its affordability. This is a major factor restricting the adoption of these high-cost treatments in developed as well as developing countries.

Opportunity: Low penetration rate of dental implants in developing countries

Advanced aesthetic solutions in restorative dentistry have limited acceptance in India, Brazil, and Russia. These countries require extensive promotional and awareness campaigns for both dentists as well as consumers to ensure product visibility and increased acceptance. Hence, Asian and Latin American countries, as well as certain European countries, offer significant growth opportunities for the dental impression systems market.

Challenge: Dearth of trained dental practitioners

The demand for dental care services is expected to grow across the globe mainly due to the changing demographics, growing dental care awareness, and the rising prevalence of dental diseases. However, a shortage of dental professionals in countries such as the US is expected to restrain market growth to a certain extent. The shortage of dentists in these countries is one of the major factors that is expected to reduce the adoption of dental impression systems in spite of the presence of a large target patient population.

By product, segment, the intraoral scanners segment is expected to grow at the highest growth rate during the forecast period

Among the product, segment, the intraoral scanners segment is expected to grow at the highest CAGR during the forecast period. The intraoral scanners segment is estimated to grow at the highest CAGR during the forecast period as these scanners increase the accuracy of dental impressions and reduce the time involved in procedures.

By application, the restorative and prosthodontics dentistry segment is expected to account for the largest share of the dental impression systems market

The restorative and prosthodontics dentistry segment accounted for the largest share of the global dental impression systems market in 2019. Growth in the edentulous population and the increasing number of patients suffering from dental problems are driving the growth of this application segment.

By end user, the dental hospitals and clinics segment is expected to account for the largest share of the dental impression systems market

Based on end user, the dental impression systems market is segmented into dental hospitals and clinics, dental laboratories, dental academics and research institutes, and forensic laboratories. The increasing number of dental clinics and hospitals across the globe and the rapid adoption of advanced technologies by small and large dental clinics and hospitals are the major factor driving the growth of dental hospitals and clinics segment.

To know about the assumptions considered for the study, download the pdf brochure

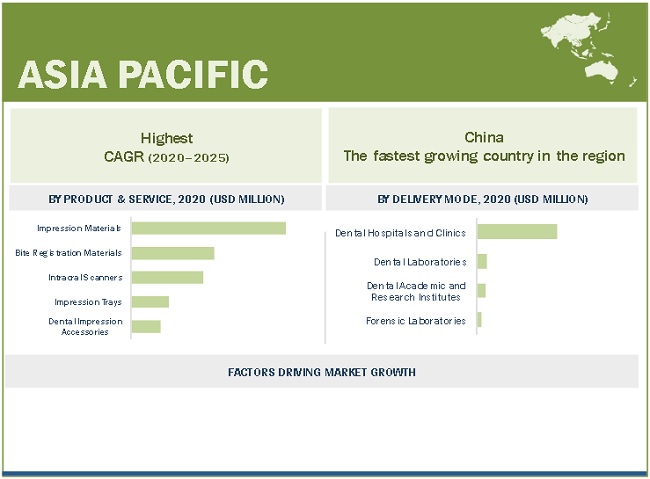

Asia-Pacific is the fastest growing market for dental impression systems market during the forecast period

The Asia Pacific market is projected to grow at the highest CAGR during the forecast period. The high growth in this regional market can be attributed to the rising patient volume, growing medical tourism, and increasing disposable incomes.

The major players in the global dental impression systems market are 3M (US), Henry Schein (US), Dentsply Sirona (US), Mitsui Chemicals (Japan), and Envista (US). Other prominent players in this market include Parkell, Inc. (US), Kettenbach GmbH & Co. KG (Germany), Zest Dental Solutions (US), Keystone Industries (US), Ultradent Products, Inc. (US), Septodont Holding (US), GC Corporation (US), DETAX (Germany), Kerr Corporation (US), Ivoclar Vivadent (US), Kuraray Co. Ltd. (Japan), BEGO (Germany), Premier Dental Products Company (US), and DMG America (US).

Scope of the Dental Impression Systems Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2020 |

$1.3 billion |

|

Projected Revenue Size by 2025 |

$1.9 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 7.7% |

|

Market Driver |

Rising incidence of dental diseases |

|

Market Opportunity |

Low penetration rate of dental implants in developing countries |

The research report categorizes the Dental impression systems market into the following segments and subsegments:

By Product

- Intraoral scanners

- Impression material

- Impression trays

- Bite registration material

- Dental impression accessories

By Application

- Restorative and prosthodontics dentistry

- Orthodontics

- Other applications

By End User

- Dental hospitals and clinics

- Dental laboratories

- Dental academics and research institutes

- Forensic laboratories

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

- Latin America

- Middle East and Africa

Recent Developments

- In 2020, BEGO (Germany) partnered with Formlabs (US) to expand access to BEGO’s dental restorative materials, enabling Formlabs’ customers to improve workflows and patient experience.

- In 2020, KaVo Kerr partnered with TeamSmile (US) to provide the dentists at TeamSmile with programs to use the digital dental equipment.

- In 2018, Coltene Holding (Switzerland) acquired SciCan (Canada) and MICRO-MEGA (France) that will strengthen Coltene’s market reach and product range, creating synergy potential, and enhancing its offerings in its dental product portfolio

Frequently Asked Questions (FAQ):

Which are the top industry players in the global dental impression systems market?

The top market players in the dental impression systems market include 3M (US), Henry Schein (US), Dentsply Sirona (US), Mitsui Chemicals (Japan), and Envista (US). Other prominent players in this market include Parkell, Inc. (US), Kettenbach GmbH & Co. KG (Germany), Zest Dental Solutions (US), Keystone Industries (US), Ultradent Products, Inc. (US), Septodont Holding (US), GC Corporation (US), DETAX (Germany), Kerr Corporation (US), Ivoclar Vivadent (US), Kuraray Co. Ltd. (Japan), BEGO (Germany), Premier Dental Products Company (US), and DMG America (US).

Which dental impression systems application have been included in this report?

This report includes the following application:

- Restorative and prosthodontics dentistry

- Orthodontics

- Other applications

Which dental impression systems products have been included in this report?

This report includes the following products:

- Intraoral scanners

- Impression material

- Impression trays

- Bite registration material

- Dental impression accessories

Which geographical region is dominating the dental impression systems market?

The global dental impression systems market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. Europe accounted for the largest share of the Dental impression systems market in 2019. The growing popularity of cosmetic dentistry, high and growing demand for technologically advanced products, increasing availability and use of intraoral scanners, and the rising incidence of dental diseases are some of the factors driving the growth of the dental impression systems market in this region. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 INCLUSIONS AND EXCLUSIONS

1.3.2 MARKETS COVERED

FIGURE 1 DENTAL IMPRESSION SYSTEMS MARKET SEGMENTATION

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 LIMITATIONS

1.5 CURRENCY

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 27)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 3 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary sources

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 5 REVENUE SHARE ANALYSIS: ILLUSTRATIVE EXAMPLE OF 3M

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ESTIMATION

2.5 ASSUMPTIONS FOR THE STUDY

2.6 COVID-19 HEALTH ASSESSMENT

2.7 COVID-19 ECONOMIC ASSESSMENT

2.8 ASSESSMENT OF THE IMPACT OF COVID-19 ON THE ECONOMIC SCENARIO

FIGURE 9 CRITERIA IMPACTING THE GLOBAL ECONOMY

2.9 ASSESSMENT OF THE IMPACT OF COVID-19 ON THE ECONOMIC SCENARIO PERTAINING TO THE DENTAL IMPRESSION SYSTEMS MARKET

3 EXECUTIVE SUMMARY (Page No. - 39)

FIGURE 10 DENTAL IMPRESSION SYSTEMS MARKET, BY PRODUCT, 2020 VS. 2025 (USD MILLION)

FIGURE 11 DENTAL IMPRESSION SYSTEMS MARKET, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

FIGURE 12 DENTAL IMPRESSION SYSTEMS MARKET, BY END USER, 2020 VS. 2025 (USD MILLION)

FIGURE 13 DENTAL IMPRESSION SYSTEMS MARKET: GEOGRAPHIC SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 42)

4.1 DENTAL IMPRESSION SYSTEMS MARKET OVERVIEW

FIGURE 14 RISING INCIDENCE OF DENTAL DISEASES AND INCREASING DEMAND FOR COSMETIC DENTISTRY TO DRIVE MARKET GROWTH

4.2 NORTH AMERICA: DENTAL IMPRESSION SYSTEMS MARKET, BY APPLICATION AND COUNTRY (2020)

FIGURE 15 RESTORATIVE AND PROSTHODONTIC DENTISTRY SEGMENT TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICAN MARKET IN 2020

4.3 GEOGRAPHICAL SNAPSHOT OF THE DENTAL IMPRESSION SYSTEMS MARKET

FIGURE 16 CHINA TO WITNESS THE HIGHEST GROWTH IN THE DENTAL IMPRESSION SYSTEMS MARKET FROM 2020 TO 2025

5 MARKET OVERVIEW (Page No. - 45)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

TABLE 1 MARKET DYNAMICS: IMPACT ANALYSIS

5.2.1 DRIVERS

5.2.1.1 Rising incidence of dental diseases

5.2.1.1.1 Dental caries and other periodontal diseases

TABLE 2 US: PERCENTAGE OF INDIVIDUALS WITH UNTREATED DENTAL CARIES (2019)

FIGURE 17 PREVALENCE OF DENTAL CARIES IN PEOPLE AGED 6 TO 19 YEARS (% POPULATION), BY COUNTRY (2019)

5.2.1.1.2 Edentulism

TABLE 3 GROWTH IN THE GERIATRIC POPULATION IN VARIOUS COUNTRIES

5.2.1.2 Increasing demand for cosmetic dentistry

FIGURE 18 US: PATIENT SPENDING ON COSMETIC DENTISTRY SERVICES, 2015 VS. 2017 (USD MILLION)

5.2.1.3 Growing dental tourism in emerging markets

FIGURE 19 AVERAGE COST OF DENTAL TREATMENTS, BY COUNTRY (2018/2019)

5.2.2 RESTRAINTS

5.2.2.1 High cost and limited reimbursement for dental treatments

TABLE 4 AVERAGE COST OF DENTAL TREATMENTS, BY COUNTRY (2019)

5.2.3 OPPORTUNITIES

5.2.3.1 Low penetration rate of dental implants in developing countries

5.2.3.2 Rising adoption of digital dentistry

5.2.4 CHALLENGES

5.2.4.1 Dearth of trained dental practitioners

5.3 COVID-19 IMPACT ON THE DENTAL IMPRESSION SYSTEMS MARKET

5.4 PORTER’S FIVE FORCES ANALYSIS

FIGURE 20 PORTER’S FIVE FORCES ANALYSIS: DENTAL IMPRESSION SYSTEMS MARKET

TABLE 5 DENTAL IMPRESSION SYSTEMS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.5 AVERAGE SELLING PRICE TREND

TABLE 6 AVERAGE SELLING PRICE OF DENTAL IMPRESSION MATERIALS, BY REGION, 2020

TABLE 7 AVERAGE SELLING PRICE OF BITE REGISTRATION MATERIALS, BY REGION, 2020

TABLE 8 AVERAGE SELLING PRICE OF DENTAL IMPRESSION TRAYS, BY REGION, 2020

5.6 VALUE CHAIN ANALYSIS

FIGURE 21 DENTAL IMPRESSION SYSTEMS MARKET: VALUE CHAIN ANALYSIS (2019)

5.7 ECOSYSTEM MAP

FIGURE 22 DENTAL IMPRESSION SYSTEMS MARKET: ECOSYSTEM MAP

5.8 INDUSTRY INSIGHTS

5.8.1 INCREASING MARKET CONSOLIDATION

TABLE 9 MAJOR ACQUISITIONS IN THE DENTAL MARKET (2015–2020)

5.8.2 CONSOLIDATION OF DENTAL LABORATORIES

5.8.3 RISING INDUSTRY-ACADEMIA COLLABORATIONS

5.8.4 TREND OF LARGE AND GROUP PRACTICES EXPECTED TO INCREASE IN EUROPE

6 DENTAL IMPRESSION SYSTEMS MARKET, BY PRODUCT (Page No. - 60)

6.1 INTRODUCTION

TABLE 10 DENTAL IMPRESSION SYSTEMS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

6.2 IMPRESSION MATERIALS

TABLE 11 DENTAL IMPRESSION MATERIALS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 12 DENTAL IMPRESSION MATERIALS MARKET, BY TYPE, 2018–2025 (USD MILLION)

6.2.1 ALGINATES

6.2.1.1 Alginates accounted for the largest share of the dental impression materials market

TABLE 13 ALGINATE DENTAL IMPRESSION PRODUCTS OFFERED BY KEY MARKET PLAYERS

TABLE 14 ALGINATE DENTAL IMPRESSION MATERIALS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

6.2.2 SILICONES

6.2.2.1 Silicones resist distortion and tear during the removal process

TABLE 15 SILICONE DENTAL IMPRESSION PRODUCTS OFFERED BY KEY MARKET PLAYERS

TABLE 16 SILICONE DENTAL IMPRESSION MATERIALS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

6.2.3 POLYETHERS

6.2.3.1 Polyether impression materials take accurate impressions

TABLE 17 POLYETHER DENTAL IMPRESSION PRODUCTS OFFERED BY KEY MARKET PLAYERS

TABLE 18 POLYETHER DENTAL IMPRESSION MATERIALS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

6.2.4 OTHER IMPRESSION MATERIALS

TABLE 19 OTHER DENTAL IMPRESSION MATERIALS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

6.3 INTRAORAL SCANNERS

6.3.1 INTRAORAL SCANNERS PROVIDE BETTER FITTING AND MORE ACCURATE DENTAL RESTORATIONS

TABLE 20 LIST OF INTRAORAL SCANNERS OFFERED BY KEY PLAYERS

TABLE 21 INTRAORAL SCANNERS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

6.4 IMPRESSION TRAYS

6.4.1 USE OF DISPOSABLE IMPRESSION TRAYS IS INCREASING IN DEVELOPED COUNTRIES

TABLE 22 DENTAL IMPRESSION TRAYS OFFERED BY KEY MARKET PLAYERS

TABLE 23 DENTAL IMPRESSION TRAYS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

6.5 BITE REGISTRATION MATERIALS

6.5.1 GROWING EDENTULOUS POPULATION HAS INCREASED THE DEMAND FOR DENTURES

TABLE 24 BITE REGISTRATION MATERIALS OFFERED BY KEY MARKET PLAYERS

TABLE 25 BITE REGISTRATION MATERIALS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

6.6 DENTAL IMPRESSION ACCESSORIES

TABLE 26 DENTAL IMPRESSION ACCESSORIES OFFERED BY KEY MARKET PLAYERS

TABLE 27 DENTAL IMPRESSION ACCESSORIES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7 DENTAL IMPRESSION SYSTEMS MARKET, BY APPLICATION (Page No. - 74)

7.1 INTRODUCTION

TABLE 28 DENTAL IMPRESSION SYSTEMS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

7.2 RESTORATIVE AND PROSTHODONTIC DENTISTRY

7.2.1 GROWING EDENTULOUS POPULATION TO SUPPORT MARKET GROWTH

TABLE 29 DENTAL IMPRESSION SYSTEMS MARKET FOR RESTORATIVE AND PROSTHODONTIC DENTISTRY, BY COUNTRY, 2018–2025 (USD MILLION)

7.3 ORTHODONTICS

7.3.1 PRESENCE OF A LARGE NUMBER OF PATIENTS WITH MALOCCLUSIONS IS A KEY MARKET DRIVER

TABLE 30 DENTAL IMPRESSION SYSTEMS MARKET FOR ORTHODONTICS, BY COUNTRY, 2018–2025 (USD MILLION)

7.4 OTHER APPLICATIONS

TABLE 31 DENTAL IMPRESSION SYSTEMS MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2018–2025 (USD MILLION)

8 DENTAL IMPRESSION SYSTEMS MARKET, BY END USER (Page No. - 79)

8.1 INTRODUCTION

TABLE 32 DENTAL IMPRESSION SYSTEMS MARKET, BY END USER, 2018–2025 (USD MILLION)

8.2 DENTAL HOSPITALS AND CLINICS

8.2.1 INCREASING NUMBER OF DENTAL CLINICS AND HOSPITALS AND RAPID ADOPTION OF ADVANCED TECHNOLOGIES DRIVING MARKET GROWTH

TABLE 33 TOP DESTINATIONS FOR COST-EFFECTIVE DENTAL TREATMENT

TABLE 34 DENTAL IMPRESSION SYSTEMS MARKET FOR DENTAL HOSPITALS AND CLINICS, BY COUNTRY, 2018–2025 (USD MILLION)

8.3 DENTAL LABORATORIES

8.3.1 CONSOLIDATION OF DENTAL LABORATORIES WILL LEAD TO GREATER PURCHASING POWER

TABLE 35 DENTAL IMPRESSION SYSTEMS MARKET FOR DENTAL LABORATORIES, BY COUNTRY, 2018–2025 (USD MILLION)

8.4 DENTAL ACADEMIC AND RESEARCH INSTITUTES

8.4.1 INCREASING DEMAND FOR SPECIALIZED DIGITAL DENTAL COURSES TO SUPPORT MARKET GROWTH

TABLE 36 DENTAL IMPRESSION SYSTEMS MARKET FOR DENTAL ACADEMIC AND RESEARCH INSTITUTES, BY COUNTRY, 2018–2025 (USD MILLION)

8.5 FORENSIC LABORATORIES

8.5.1 GROWING DEMAND FOR FORENSIC DENTISTRY TO IDENTIFY UNKNOWN HUMAN REMAINS TO DRIVE MARKET GROWTH

TABLE 37 DENTAL IMPRESSION SYSTEMS MARKET FOR FORENSIC LABORATORIES, BY COUNTRY, 2018–2025 (USD MILLION)

9 DENTAL IMPRESSION SYSTEMS MARKET, BY REGION (Page No. - 85)

9.1 INTRODUCTION

TABLE 38 DENTAL IMPRESSION SYSTEMS MARKET, BY REGION, 2018–2025 (USD MILLION)

9.2 EUROPE

FIGURE 23 EUROPE: DENTAL IMPRESSION SYSTEMS MARKET SNAPSHOT

TABLE 39 EUROPE: DENTAL IMPRESSION SYSTEMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 40 EUROPE: DENTAL IMPRESSION SYSTEMS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 41 EUROPE: DENTAL IMPRESSION MATERIALS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 42 EUROPE: DENTAL IMPRESSION SYSTEMS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 43 EUROPE: DENTAL IMPRESSION SYSTEMS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.2.1 GERMANY

9.2.1.1 Germany is the largest market for dental impression systems in Europe

TABLE 44 GERMANY: KEY MACROINDICATORS FOR THE DENTAL IMPRESSION SYSTEMS MARKET

TABLE 45 GERMANY: DENTAL IMPRESSION SYSTEMS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 46 GERMANY: DENTAL IMPRESSION MATERIALS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 47 GERMANY: DENTAL IMPRESSION SYSTEMS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 48 GERMANY: DENTAL IMPRESSION SYSTEMS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.2.2 ITALY

9.2.2.1 Increasing spending on oral health to drive the dental impression systems market in Italy

TABLE 49 ITALY: KEY MACROINDICATORS FOR THE DENTAL IMPRESSION SYSTEMS MARKET

TABLE 50 ITALY: DENTAL IMPRESSION SYSTEMS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 51 ITALY: DENTAL IMPRESSION MATERIALS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 52 ITALY: DENTAL IMPRESSION SYSTEMS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 53 ITALY: DENTAL IMPRESSION SYSTEMS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.2.3 FRANCE

9.2.3.1 Well-organized distribution network is expected to support market growth in France

TABLE 54 FRANCE: KEY MACROINDICATORS FOR THE DENTAL IMPRESSION SYSTEMS MARKET

TABLE 55 FRANCE: DENTAL IMPRESSION SYSTEMS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 56 FRANCE: DENTAL IMPRESSION MATERIALS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 57 FRANCE: DENTAL IMPRESSION SYSTEMS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 58 FRANCE: DENTAL IMPRESSION SYSTEMS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.2.4 SPAIN

9.2.4.1 Increasing number of dentists, growing dental tourism, and rising geriatric population will aid market growth

TABLE 59 SPAIN: KEY MACROINDICATORS FOR THE DENTAL IMPRESSION SYSTEMS MARKET

TABLE 60 SPAIN: DENTAL IMPRESSION SYSTEMS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 61 SPAIN: DENTAL IMPRESSION MATERIALS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 62 SPAIN: DENTAL IMPRESSION SYSTEMS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 63 SPAIN: DENTAL IMPRESSION SYSTEMS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.2.5 UK

9.2.5.1 Increased spending on oral health services to support market growth in the UK

TABLE 64 UK: KEY MACROINDICATORS FOR THE DENTAL IMPRESSION SYSTEMS MARKET

TABLE 65 UK: DENTAL IMPRESSION SYSTEMS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 66 UK: DENTAL IMPRESSION MATERIALS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 67 UK: DENTAL IMPRESSION SYSTEMS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 68 UK: DENTAL IMPRESSION SYSTEMS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.2.6 REST OF EUROPE

TABLE 69 REST OF EUROPE: DENTAL IMPRESSION SYSTEMS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 70 REST OF EUROPE: DENTAL IMPRESSION MATERIALS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 71 REST OF EUROPE: DENTAL IMPRESSION SYSTEMS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 72 REST OF EUROPE: DENTAL IMPRESSION SYSTEMS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.3 NORTH AMERICA

FIGURE 24 NORTH AMERICA: DENTAL IMPRESSION SYSTEMS MARKET SNAPSHOT

TABLE 73 NORTH AMERICA: DENTAL IMPRESSION SYSTEMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 74 NORTH AMERICA: DENTAL IMPRESSION SYSTEMS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 75 NORTH AMERICA: DENTAL IMPRESSION MATERIALS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 76 NORTH AMERICA: DENTAL IMPRESSION SYSTEMS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 77 NORTH AMERICA: DENTAL IMPRESSION SYSTEMS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.3.1 US

9.3.1.1 US dominated the North American dental impression systems market in 2019

TABLE 78 US: KEY MACROINDICATORS FOR THE DENTAL IMPRESSION SYSTEMS MARKET

TABLE 79 US: DENTAL IMPRESSION SYSTEMS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 80 US: DENTAL IMPRESSION MATERIALS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 81 US: DENTAL IMPRESSION SYSTEMS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 82 US: DENTAL IMPRESSION SYSTEMS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.3.2 CANADA

9.3.2.1 Increasing awareness of dental care to support the growth of the dental industry in Canada

TABLE 83 CANADA: KEY MACROINDICATORS FOR THE DENTAL IMPRESSION SYSTEMS MARKET

TABLE 84 CANADA: DENTAL IMPRESSION SYSTEMS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 85 CANADA: DENTAL IMPRESSION MATERIALS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 86 CANADA: DENTAL IMPRESSION SYSTEMS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 87 CANADA: DENTAL IMPRESSION SYSTEMS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.4 ASIA PACIFIC

FIGURE 25 APAC: DENTAL IMPRESSION SYSTEMS MARKET SNAPSHOT

TABLE 88 ASIA PACIFIC: DENTAL IMPRESSION SYSTEMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 89 ASIA PACIFIC: DENTAL IMPRESSION SYSTEMS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 90 ASIA PACIFIC: DENTAL IMPRESSION MATERIALS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 91 ASIA PACIFIC: DENTAL IMPRESSION SYSTEMS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 92 ASIA PACIFIC: DENTAL IMPRESSION SYSTEMS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.4.1 CHINA

9.4.1.1 Significant increase in the demand for dental care services to drive market growth in China

TABLE 93 CHINA: KEY MACROINDICATORS FOR THE DENTAL IMPRESSION SYSTEMS MARKET

TABLE 94 CHINA: DENTAL IMPRESSION SYSTEMS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 95 CHINA: DENTAL IMPRESSION MATERIALS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 96 CHINA: DENTAL IMPRESSION SYSTEMS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 97 CHINA: DENTAL IMPRESSION SYSTEMS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.4.2 JAPAN

9.4.2.1 Rising geriatric population and increasing dental awareness among patients to support market growth in Japan

TABLE 98 JAPAN: KEY MACROINDICATORS FOR THE DENTAL IMPRESSION SYSTEMS MARKET

TABLE 99 JAPAN: DENTAL IMPRESSION SYSTEMS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 100 JAPAN: DENTAL IMPRESSION MATERIALS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 101 JAPAN: DENTAL IMPRESSION SYSTEMS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 102 JAPAN: DENTAL IMPRESSION SYSTEMS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.4.3 INDIA

9.4.3.1 India to offer lucrative growth opportunities for market players

TABLE 103 INDIA: KEY MACROINDICATORS FOR THE DENTAL IMPRESSION SYSTEMS MARKET

TABLE 104 INDIA: DENTAL IMPRESSION SYSTEMS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 105 INDIA: DENTAL IMPRESSION MATERIALS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 106 INDIA: DENTAL IMPRESSION SYSTEMS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 107 INDIA: DENTAL IMPRESSION SYSTEMS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.4.4 REST OF ASIA PACIFIC

TABLE 108 REST OF ASIA PACIFIC: DENTAL IMPRESSION SYSTEMS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 109 REST OF ASIA PACIFIC: DENTAL IMPRESSION MATERIALS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 110 REST OF ASIA PACIFIC: DENTAL IMPRESSION SYSTEMS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 111 REST OF ASIA PACIFIC: DENTAL IMPRESSION SYSTEMS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.5 LATIN AMERICA

9.5.1 AVAILABILITY OF LOW-COST TREATMENTS AND GROWING MEDICAL TOURISM IN BRAZIL AND MEXICO TO SUPPORT MARKET GROWTH

TABLE 112 LATIN AMERICA: DENTAL IMPRESSION SYSTEMS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 113 LATIN AMERICA: DENTAL IMPRESSION MATERIALS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 114 LATIN AMERICA: DENTAL IMPRESSION SYSTEMS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 115 LATIN AMERICA: DENTAL IMPRESSION SYSTEMS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.6 MIDDLE EAST & AFRICA

9.6.1 MARKET GROWTH IN THE MIDDLE EAST AND AFRICA IS MAJORLY DRIVEN BY THE GROWING AWARENESS ABOUT DENTAL HYGIENE

TABLE 116 MIDDLE EAST & AFRICA: DENTAL IMPRESSION SYSTEMS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 117 MIDDLE EAST & AFRICA: DENTAL IMPRESSION MATERIALS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 118 MIDDLE EAST & AFRICA: DENTAL IMPRESSION SYSTEMS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 119 MIDDLE EAST & AFRICA: DENTAL IMPRESSION SYSTEMS MARKET, BY END USER, 2018–2025 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 126)

10.1 INTRODUCTION

10.2 MARKET EVALUATION FRAMEWORK

FIGURE 26 MARKET EVALUATION FRAMEWORK: PARTNERSHIPS, AGREEMENTS, AND COLLABORATIONS WERE THE MOST WIDELY ADOPTED STRATEGIES

10.3 MARKET SHARE ANALYSIS

FIGURE 27 VALUE-BASED GLOBAL MARKET SHARES OF KEY PLAYERS, 2019

FIGURE 28 VALUE-BASED US MARKET SHARES OF KEY PLAYERS, 2019

10.4 DENTAL IMPRESSION SYSTEMS MARKET: GEOGRAPHICAL ASSESSMENT

FIGURE 29 GEOGRAPHIC ASSESSMENT OF KEY PLAYERS IN THE DENTAL IMPRESSION SYSTEMS MARKET (2019)

10.5 DENTAL IMPRESSION SYSTEMS MARKET: R&D EXPENDITURE

FIGURE 30 R&D EXPENDITURE OF KEY PLAYERS IN THE DENTAL IMPRESSION SYSTEMS MARKET (2019)

10.6 COMPETITIVE SCENARIO

10.6.1 KEY DEVELOPMENTS IN THE DENTAL IMPRESSION SYSTEMS MARKET

TABLE 120 AGREEMENTS AND PARTNERSHIPS (2017–2020)

10.6.2 KEY ACQUISITIONS

TABLE 121 ACQUISITIONS (2017–2020)

11 COMPANY PROFILES (Page No. - 132)

11.1 COMPANY EVALUATION MATRIX: DEFINITION & METHODOLOGY

11.2 COMPANY EVALUATION MATRIX

11.2.1 STARS

11.2.2 EMERGING LEADERS

11.2.3 PERVASIVE PLAYERS

11.2.4 PARTICIPANTS

FIGURE 31 DENTAL IMPRESSION SYSTEMS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2019

11.3 COMPANY PROFILES

(Business Overview, Products Offered, Recent Developments, and MnM View)*

11.3.1 DENTSPLY SIRONA

FIGURE 32 DENTSPLY SIRONA: COMPANY SNAPSHOT (2019)

11.3.2 ENVISTA HOLDINGS CORPORATION

FIGURE 33 ENVISTA: COMPANY SNAPSHOT (2019)

11.3.3 3M

FIGURE 34 3M: COMPANY SNAPSHOT (2019)

11.3.4 HENRY SCHEIN

FIGURE 35 HENRY SCHEIN: COMPANY SNAPSHOT (2019)

11.3.5 MITSUI CHEMICALS

FIGURE 36 MITSUI CHEMICALS: COMPANY SNAPSHOT (2020)

11.3.6 KURARAY CO. LTD.

FIGURE 37 KURARAY CO. LTD.: COMPANY SNAPSHOT (2019)

11.3.7 COLTENE HOLDING

FIGURE 38 COLTENE HOLDING: COMPANY SNAPSHOT (2019)

11.3.8 KEYSTONE INDUSTRIES

11.3.9 KETTENBACH GMBH & CO. KG

11.3.10 ULTRADENT PRODUCTS, INC.

11.3.11 ZEST DENTAL SOLUTIONS

11.3.12 IVOCLAR VIVADENT AG

11.3.13 GC CORPORATION

11.3.14 BEGO GMBH & CO. KG

11.3.15 SEPTODONT HOLDING

* Business Overview, Products Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

11.4 OTHER COMPANIES

11.4.1 PARKELL, INC.

11.4.2 DETAX GMBH

11.4.3 DMG AMERICA LLC

11.4.4 KERR CORPORATION

11.4.5 PREMIER DENTAL PRODUCTS COMPANY

12 APPENDIX (Page No. - 163)

12.1 INSIGHTS FROM INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

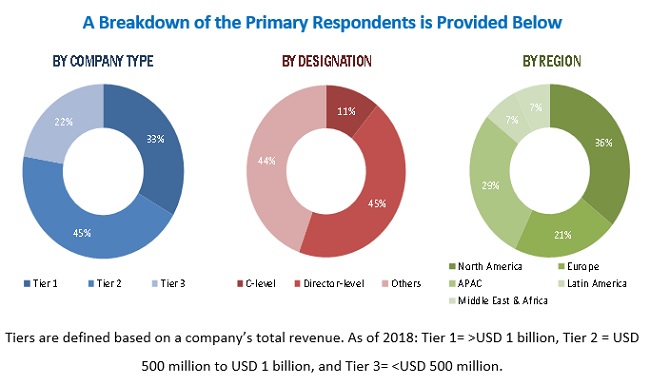

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the dental impression systems market. It was also used to obtain important information about the key players and market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the Dental impression systems market. The primary sources from the demand side included industry experts, purchase & sales managers, doctors, and personnel from research organizations. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends and key market dynamics.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the dental impression systems market was arrived at after data triangulation from two different approaches, as mentioned below.

Approach to calculate the revenue of different players in the Dental impression systems market The size of the global Dental impression systems market was obtained from annual reports, SEC filings, online publications, and extensive primary interviews. A percentage split was applied to arrive at the size of market segments. Further splits were applied to arrive at the size for each sub-segment. These percentage splits were validated by primary participants. The country-level market sizes obtained from the annual reports, SEC filings, online publications, and extensive primary interviews were added up to reach the total market size for regions. By adding up the market sizes for all the regions, the global Dental impression systems market was derived.

Approach to derive the market size and estimate market growth

The market size and market growth were estimated through primary interviews on a regional and global level. All responses were collated, and a weighted average was taken to derive a probabilistic estimate of the market size and growth rate.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Objectives of the Study

- To define, describe, and forecast the global dental impression systems market by product, application, end-user, and region

- To provide detailed information about the significant factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall dental impression systems market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the dental impression systems market in five major regions along with their respective key countries (North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa)

- To profile the key players in the global dental impression systems market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments such as product launches, expansions, and R&D activities of the leading players in the Dental impression systems market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Asia-Pacific Dental impression systems market into South Korea, Australia, and other Southeast Asian countries

- Further breakdown of the European Dental impression systems market into Russia, Switzerland, Sweden, and the Netherlands.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Dental Impression Systems Market