Dental Imaging Market: Growth, Size, Share, and Trends

Dental Imaging Market by Product (Extraoral Imaging (CBCT, Panoramic), Intraoral Imaging (X-ray, Intraoral Camera, IOL Scanner)), Application (Endodontics, Implantology), & End User (Dental Hospitals, Dental Diagnostic Centers) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The dental imaging market is projected to reach USD 4.69 billion by 2030 from USD 3.08 billion in 2024, at a CAGR of 7.5 % from 2025 to 2030. Dental imaging systems provide images of the teeth, which helps dentists in evaluating a patient’s oral health. These systems provide high-quality image acquisition in a short period of time and enable less exposure to radiation It helps dentists diagnose and monitor oral health conditions, such as cavities, bone loss, and impacted teeth. Common technologies include X-rays, intraoral cameras, and cone beam CT scans. These systems improve accuracy in treatment planning and patient care.

KEY TAKEAWAYS

-

BY PRODUCTBased on product, the dental imaging market has been segmented into extraoral and intraoral imaging. Within extraoral imaging, panoramic imaging accounted for the largest share in 2024. The large share of this segment is driven by its broad use in general dentistry, implantology, endodontics, and periodontics. Panoramic imaging provides a full view of dental structures, enabling accurate diagnosis, detection of abnormalities, and effective treatment planning, making it essential for both routine and complex procedures.

-

BY APPLICATIONBased on application, the market has been segmented into implantology, endodontics, oral & maxillofacial surgery, orthodontics, and other applications. Within these segments, orthodontics is expected to grow at the fastest rate in 2030. The growth of this segment is driven by the extensive use of dental imaging in orthodontics for accurate assessment, diagnosis, and personalized treatment planning. Rising demand for aesthetic and corrective dental care further boosts its adoption.

-

BY END USERBased on end user, the dental imaging market has been segmented into dental clinics and hospitals, dental diagnostic centers, and dental academic and research institutes. The dental clinics and hospitals segment held the highest market share in 2024. The high market share of this segment is attributed to increasing affordability of imaging systems, rising need for accurate and rapid diagnosis, and increasing awareness among patients.

-

BY REGIONThe dental imaging market is segmented by region into North America, Europe, Asia Pacific, Latin America, GCC Countries, and the Middle East & Africa. Asia Pacific is expected to grow fastest with a CAGR of 9.9%, fueled by the increasing burden of dental disorders and the growing demand for advanced imaging solutions in large markets such as China and India. Rising adoption of dental imaging systems for diagnostics, orthodontics, and implantology is further driving regional market expansion.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies including partnerships and collaborations. For instance, Dentsply Sirona has partnered with Siemens Healthineers to develop the MAGNETOM Free.Max Dental Edition—the first magnetic resonance imaging system designed specifically for dental applications.

The dental imaging market is experiencing robust growth, primarily fueled by the increasing global prevalence of dental disorders such as periodontitis, complex caries, and tooth loss, which necessitates advanced diagnostic tools. This growth is compounded by the rising demand for precision in complex procedures across orthodontics, implantology, and endodontics.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The dental imaging market is undergoing a major transformation, One of the most significant disruptions impacting customer businesses in the dental imaging market is the accelerated shift toward digital and AI-integrated technologies. Traditional 2D imaging tools are rapidly being replaced by advanced modalities such as Cone Beam Computed Tomography (CBCT), intraoral scanners, and panoramic 3D imaging systems, which provide far superior diagnostic accuracy and enable comprehensive treatment planning. This evolution is largely driven by the need for precision in implantology, orthodontics, and endodontics, as well as the growing patient demand for quicker, safer, and more transparent dental procedures. Adding to this disruption is the emergence of AI-powered imaging analysis platforms, which assist in automatically detecting caries, bone loss, root canal anomalies, and even oral cancers. These systems are transforming diagnostics from a subjective process into a data-driven, standardized workflow, minimizing human error and improving treatment outcomes. However, implementing these solutions poses challenges for dental practices—particularly smaller clinics—which must invest in new hardware, compatible software, training, and data security protocols. The adoption of cloud-based image storage, teledentistry platforms, and interoperable imaging systems further compels customers to overhaul existing infrastructure. Furthermore, the rise of portable and handheld imaging devices is enabling mobile dentistry and expanding care to remote or underserved regions. This not only disrupts traditional practice models but also increases competition and raises the bar for service delivery. As a result, dental businesses must stay agile, tech-savvy, and proactive in embracing innovation to remain competitive and meet evolving clinical and patient demands.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Technological advancements

-

Increasing number of dental practices and rising dental expenditure

Level

-

High cost of dental imaging systems

Level

-

High growth potential in emerging countries

-

Artificial intelligence in dental imaging

Level

-

Managing high volume of imaging data

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Technological Advancements

Technological advancement is the primary driver of the dental imaging market, enabling improved diagnostic capabilities and more precise treatment outcomes. Innovations such as high-resolution 3D cone beam computed tomography (CBCT) offer detailed visualization of anatomical structures, which is critical for complex procedures like implants, orthodontics, and oral surgery. Similarly, the evolution of intraoral scanners is delivering faster, more accurate, and patient-friendly results, enhancing efficiency in both diagnosis and treatment planning. These advancements are not only elevating clinical accuracy but also improving patient experience and overall workflow efficiency in dental practices.

Restraint: High cost of dental imaging systems

The high cost of dental imaging systems, particularly advanced technologies like CBCT and 3D intraoral scanners, is a significant restraint in the dental imaging market, disproportionately affecting small-sized clinics and individual dental practitioners. The substantial initial investment and ongoing maintenance costs of these systems create a significant financial barrier. This burden often leads to a competitive imbalance, as larger clinics and corporate chains can more easily afford and leverage these technologies. Consequently, smaller practices may be limited to older, less efficient equipment, hindering their ability to offer comprehensive diagnostic services and limiting the overall adoption of cutting-edge technology in the broader market.

Opportunity: AI in dental imaging

AI presents a significant opportunity in the dental imaging market, providing accurate diagnostics and enhanced treatment planning. Its ability to analyze vast amounts of imaging data, such as X-Ray and CBCT scans, improves both speed and accuracy, helping dentists to detect dental caries, periodontal disease, and other dental conditions that may not be visible to the human eye. This capability not only saves time and reduces the cost of further procedures but also enables more precise, personalized treatment plans and predictive analytics for disease progression. Consequently, the integration of AI is becoming a competitive necessity, elevating the standard of care and improving the overall patient experience through more efficient and effective visits.

Challenge: Managing high volume of imaging data

The rapid expansion of dental imaging, fueled by technologies such as CBCT and intraoral scanners, poses a significant data management challenge for dental clinics. The sheer volume of these massive datasets necessitates large storage solutions, robust network infrastructure, and higher IT costs, creating a substantial financial and technical burden, particularly for small-scale practices with limited resources. Effectively managing this data requires a powerful network for seamless data transfer and a strong analytical process, which also raises critical patient data privacy concerns, adding another layer of complexity for practices to navigate.

Dental Imaging Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Advanced CBCT systems and panoramic X-ray solutions for extraoral imaging | High-resolution 3D imaging, accurate diagnostics, reduced radiation dose, broad clinical utility |

|

Intraoral scanners for orthodontic and restorative workflows | Precise digital impressions, seamless integration with clear aligners, enhances treatment accuracy |

|

Dental CBCT, panoramic, and intraoral imaging systems | Comprehensive imaging portfolio, clear visualization, supports implantology and endodontics |

|

CBCT systems, intraoral scanners | Efficient diagnostics, detailed 3D visualization, faster workflows, enhances clinical confidence |

|

Wide range of CBCT units, panoramic imaging, and intraoral scanners | Ultra-low dose imaging, seamless software integration, ergonomic design, advanced diagnostics |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The dental imaging market operates within a multifaceted ecosystem involving stakeholders across product innovation, manufacturing, distribution, regulation, and advocacy. Manufacturers are at the forefront of developing advanced formulations that improve efficacy, reduce discomfort, and enhance the patient experience. Distributors such as Patterson Dental and Henry Schein play a critical role by ensuring reliable and widespread access to dental imaging. Their well-established supply chains and logistics capabilities enable timely product availability to dental clinics, hospitals, and surgical centers across various regions. Regulatory agencies like the US Food and Drug Administration (FDA) and the European Medicines Agency (EMA) are responsible for overseeing the safety, quality, and approval of dental imaging products, ensuring that they meet stringent compliance standards. While formal reimbursement mechanisms are generally limited in this market, procurement decisions are primarily made at the clinic or institutional level based on product performance, safety, and cost-efficiency. Dental professionals and clinics are key players, selecting dental imaging products based on clinical needs, patient profiles, and procedural requirements. Professional organizations and advocacy groups further support the ecosystem by promoting awareness, guiding clinical best practices, and encouraging responsible use of imaging products, ultimately contributing to safe, effective, and patient-centered dental care.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Dental Imaging Market, By Product

Based on product, dental imaging market can be segmented broadly into intraoral and extraoral imaging. The extraoral dental imaging segment is expected to exhibit the fastest growth. Within the extraoral imaging segment, 3D CBCT systems are expected to grow at the fastest CAGR during the forecast period. The super diagnostic capabilities and detailed accurate 3D visualization, growing dental implants market, increase in purchasing power in developing and integration with digital workflows maybe attributed to the rapid growth of this segment.

Dental Imaging Market, By Application

Based on application, implantology, oral & maxillofacial surgery, orthodontics, endodontics, and periodontics the are the leading adopters of dental imaging. Of these, the implantology segment accounted for the largest share of the dental imaging market in 2024. The growing adoption of dental implants due to the outstanding results, rising demand for tooth replacement in the adults and aging population due to increase in aesthetics awareness and priority for permanent dental solution demand, are responsible for driving the growth of the segment during the forecast period.

Dental Imaging Market, By End User

This segment is segmented into dental hospitals & clinics, dental diagnostic centers, dental academic & research institutes. The dental hospitals & clinics is experiencing strong growth due to rising demand for specialized diagnostic services, cutting-edge technology like CBCT and 3D scanning, and increased referrals from dentists for more detailed imaging. The focus on early disease detection and precise diagnosis drives dental professionals and patients to rely more on diagnostic centers, as timely identification helps prevent future complications, making these services highly preferred. In addition, the expansion of dental infrastructure and increasing public awareness of oral health are contributing to more frequent and proactive diagnostic visits. Technological advances—such as AI-powered image analysis and digital radiography systems—are also streamlining workflows and improving diagnostic speed, accuracy, and patient comfort. The availability of government and private investment for upgrading facilities further accelerates the segment’s expansion

REGION

Asia Pacific to be fastest-growing region in global dental imaging market during forecast period

The Asia-Pacific region is expected to register the fastest growth in the dental imaging market during the forecast period, driven by several factors. Rising prevalence of dental disorders, coupled with growing awareness of oral health and preventive dentistry, is a major growth catalyst. Increasing disposable incomes, urbanization, and lifestyle changes are further fueling demand for advanced dental care services. Moreover, strong participation from local and global manufacturers introducing cost-effective and region-specific imaging solutions, along with supportive government programs and rapid expansion of dental clinics and hospitals, is making advanced imaging technologies more accessible. The growing adoption of digital and AI-integrated dental imaging systems across the region is further accelerating market growth.

Dental Imaging Market: COMPANY EVALUATION MATRIX

In the dental imaging market matrix, Envista (Star) leads with scale, extensive distribution, and a broad solutions portfolio. Durr Dental Se (Emerging Leader) is gaining momentum with innovative products and packaging technologies. While Envista dominates through reach, Durr Dental Se’s innovation positions it for rapid growth toward the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 3.07 Billion |

| Revenue Forecast in 2030 | USD 4.69 Billion |

| Growth Rate | CAGR of 7.5% from 2025-2030 |

| Actual data | 2023-2030 |

| Base year | 2024 |

| Forecast period | 2025-2030 |

| Units considered | Value (USD Million), Volume (Thousands Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | By Product: Extraoral Imaging System, Intraoral Imaging System, Dental Imaging Software. By Application: Implantology, Endodontics, oral and Maxillofacial Surgery, Orthodontics, other Applications. By End User: Dental Hospitals and Clinics, Dental Diagnostic Centers, Dental Academic and Research Institute. By Region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, GCC Countries, and the Middle East & Africa |

WHAT IS IN IT FOR YOU: Dental Imaging Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | ||

| Company Information | ||

| Geographic Analysis |

RECENT DEVELOPMENTS

- March 2025 : Vatech and Pearl announced a strategic alliance to revolutionize dental diagnostics by integrating Pearl’s AI-powered pathology detection into Vatech’s imaging software, enhancing diagnostic accuracy and patient care globally.

- Sepember 2024 : DEXIS expanded its digital ecosystem by introducing three new innovations designed to enhance connectivity and streamline dental workflows. These advancements aim to improve efficiency and integration across dental practices, supporting more seamless and effective patient care.

- June 2024 : Dentsply Sirona has partnered with Siemens Healthineers to develop the MAGNETOM Free.Max Dental Edition—the first magnetic resonance imaging system designed specifically for dental applications. This innovative, radiation-free technology offers high-contrast soft tissue imaging, setting a new standard in dental diagnostics.

- January 2024 : Envista has announced its partnership with Women in DSO as a Platinum Industry Partner. This collaboration underscores Envista’s commitment to supporting and empowering women leaders within the dental support organization (DSO) sector, promoting gender diversity and professional growth across the industry

Table of Contents

Methodology

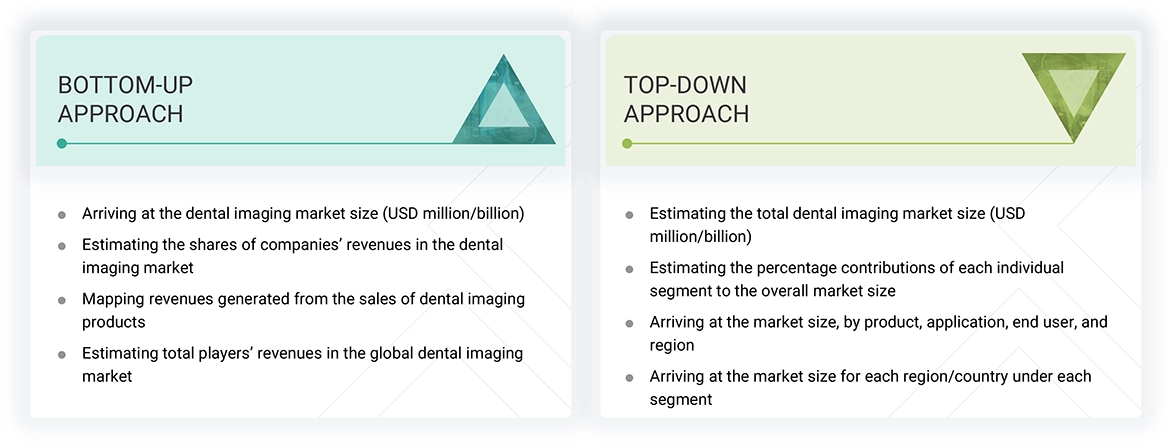

The study focused on estimating the current size of the dental imaging market. Extensive secondary research was conducted to gather information about the dental imaging industry. The findings, assumptions, and estimations were then validated through primary research with industry experts across the value chain. Various methods were utilized to estimate the total market size, including top-down and bottom-up approaches. Following this, market segmentation and data triangulation procedures were applied to determine the sizes of the different segments and subsegments within the dental imaging market.

Secondary Research

In the secondary research process, various sources were utilized, including annual reports, press releases, and investor presentations from companies, as well as white papers, certified publications, and articles by recognized authors. We also referenced reputable websites, regulatory bodies, and databases such as D&B Hoovers, Bloomberg Business, and Factiva. These sources were instrumental in identifying and collecting information for the study of the dental imaging market.

The research aimed to gather important insights about key industry players, market classification, and segmentation based on current industry trends. It also looked into geographic markets and significant developments related to the field. Additionally, a database of the leading industry players was compiled through this secondary research.

Primary Research

After gathering information about the dental imaging market through secondary research, extensive primary research was conducted. Several interviews were held with market experts from both the demand and supply sides across major regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Data was collected through questionnaires, emails, and telephone interviews.

The primary sources from the supply side included various industry experts, such as chief executive officers (CEOs), vice presidents (VPs), directors of business development, marketing, product development/innovation teams, and other key executives from manufacturers and distributors operating in the dental imaging market.

These primary interviews aimed to gather insights on market statistics, revenue data from products and services, market breakdowns, size estimations, forecasting, and data triangulation. The research also provided an understanding of trends related to technologies, applications, end users, and regions.

Stakeholders from the demand side, including customers and end users of dental imaging products, were interviewed to gain insights into their perspectives on suppliers, products, their current usage, and future outlooks on their business. This information is valuable as it influences the overall market dynamics.

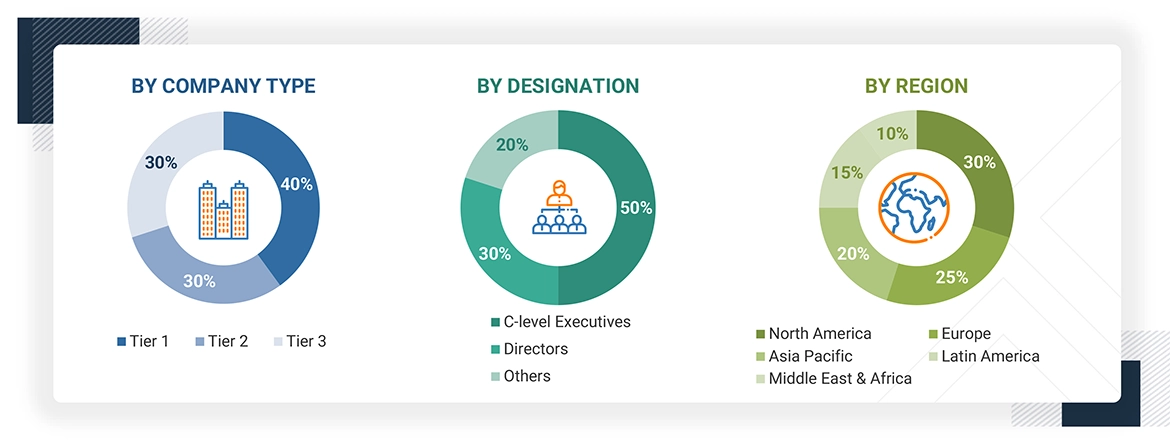

The following is a breakdown of the primary respondents:

Note 1: Others include sales, marketing, and product managers.

Note 2: C-level executives include CEOs, COOs, CTOs, and VPs.

Note 3: Companies are classified into tiers based on their total revenue. As of 2024, Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the dental imaging market includes the following details.

The market sizing was undertaken from a global perspective.

Country-level Analysis: The size of the dental imaging market was obtained from the annual presentations of leading players and secondary data available in the public domain. The share of products in the overall dental imaging market was obtained from secondary data and validated by primary participants to arrive at the total dental imaging market. Primary participants further validated the numbers.

Geographic market assessment (by region & country): The geographic assessment was done using the following approaches:

Approach 1: Geographic revenue contributions/splits of leading players in the market (wherever available) and respective growth trends

Approach 2: Geographic adoption trends for individual devices & consumables segments by end users and growth prospects for each of the segments (assumptions and indicative estimates validated from primary interviews)

At each point, the assumptions and approaches were validated by industry experts who were contacted during primary research. Considering the limitations of data available from secondary research, revenue estimates for individual companies (for the overall dental imaging market and geographic market assessment) were ascertained based on a detailed analysis of their respective product offerings, geographic reach/strength (direct or through distributors or suppliers), and the shares of the leading players in a particular region or country.

Global Dental Imaging Market Size: Bottom-up Approach & Top-down Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes, the market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides of the dental imaging market.

Market Definition

Dental imaging systems are advanced technologies that capture detailed images of a patient's teeth and surrounding structures, which are crucial for dentists to accurately assess oral health. These systems utilize sophisticated imaging techniques, such as digital radiography, to deliver high-resolution images quickly, significantly reducing the time patients spend in the dental chair. Additionally, these modern methods are designed to minimize patients' exposure to radiation compared to traditional imaging techniques, ensuring a safer experience while still providing essential diagnostic information. By enhancing the visualization of dental issues such as cavities, bone loss, and other anomalies, these imaging systems play a vital role in effective treatment planning and maintaining overall oral health.

Stakeholders

- Dental imaging product manufacturers and distributors

- Dental imaging research and development (R&D) companies

- Dental diagnostic centers

- Government associations

- Market research and consulting firms

- Venture capitalists and investors

- Research and consulting firms

- Market research and consulting firms

- Dental hospitals and clinics

- Dental academic and research institutes

- Government dental research organizations

Report Objectives

- To define, describe, and forecast the global dental imaging market by product, application, end user, and region

- To provide detailed information about the factors influencing market growth (such as drivers, opportunities, restraints, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall dental imaging market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the revenue of the market segments concerning five main regions: North America (the US and Canada), Europe (Germany, France, the UK, Italy, Spain, and the Rest of Europe), the Asia Pacific (China, Japan, India, South Korea, Australia, and the Rest of Asia Pacific), Latin America (Mexico, Brazil, and the Rest of Latin America), and the Middle East & Africa (GCC Countries and the Rest of Middle East & Africa)

- To profile key players in the global dental imaging market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments such as mergers & acquisitions, new product/technology launches, expansions, collaborations and agreements, and R&D activities of the leading players in the global dental imaging market

Frequently Asked Questions (FAQ)

What is the expected addressable value of the dental imaging market over the next five years?

The dental imaging market is projected to reach USD 4.69 billion by 2030 from USD 3.26 billion in 2025, at a CAGR of 7.5% from 2025 to 2030.

What are the key drivers for the dental imaging market?

Several elements drive the dental imaging market globally. These include the increase in dental and gum diseases, the rise in dental professionals worldwide, and technological advancements.

Which dental imaging market types have been included in this report?

This report contains the following main segments:

-

Extraoral Imaging Systems

- Panoramic Systems

- Panoramic & Cephalometric Systems

- 3D CBCT Systems

-

Intraoral Imaging Systems

- Intraoral Scanners

- Intraoral X-ray Systems

- Intraoral Sensors

- Intraoral Photostimulable Phosphor Systems

- Intraoral Cameras

What are the strategies adopted by the top market players to penetrate emerging regions?

The major players in the market use partnerships, expansions, distribution agreements, product launches, and product approvals as important growth tactics.

Who are the main players in this market?

The main vendors in the market are Envista (US), DENTSPLY SIRONA, Inc. (US), and VATECH (South Korea).

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Dental Imaging Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Dental Imaging Market