DevOps Market by Type (Solutions and Services), Cloud Deployment Model (Public and Private), Organization Size (SMEs and Large Enterprises), Verticals (Telecommunications, IT & ITES, and BFSI) and Region - Global Forecast to 2028

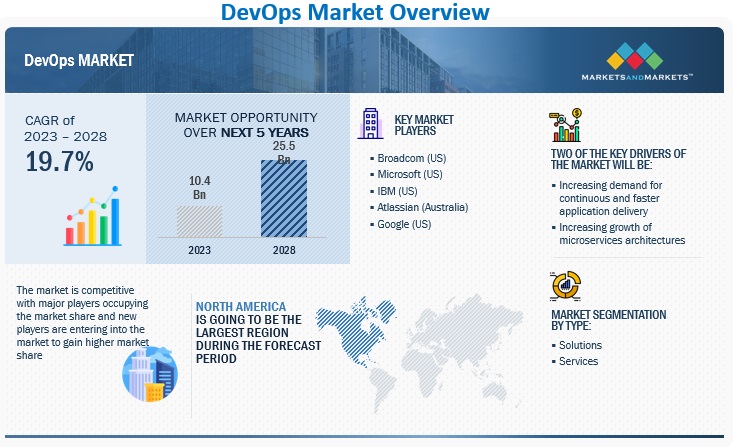

The DevOps Market size was valued at USD 10.4 billion in 2023 and is expected to grow at a CAGR of 19.7% from 2023 to 2028. The revenue forecast for 2028 is projected to reach $25.5 billion. The base year for estimation is 2022, and the historical data spans from 2023 to 2028. Agile software development and lean programming are the early foundations of many DevOps techniques for speeding up software development and deployment. Yet, DevOps originated from a number of grassroots initiatives to coordinate the work of operations team members and developers. The DevOps methodology promotes business value delivery to clients of an organization that is quicker, better, and more secure. More frequent product releases, features, or updates could represent this value. It may have to do with how quickly a product update or new function reaches customers while maintaining the necessary standards of quality and security. Perhaps it might concentrate on how soon a problem or bug is found, fixed, and then re-released.

To know about the assumptions considered for the study, Request for Free Sample Report

DevOps Market Dynamics

Driver: Increasing growth of microservices architectures

In essence, microservice architecture is the division of applications (often complicated ones) into manageable, flexible, and scalable little pieces, independent services, units, or entities. It is, in a nutshell, the antithesis of monolithic architecture. Monolithic architecture makes it difficult to introduce even minor changes to the cycle as it would need to release a new version. Users must scale the entire program and its complete code base; they cannot just deploy single parts or functionalities. Also, it becomes more complex with the larger team of developers and consumers. On the other hand, a microservice can be created, tested, and deployed independently. Even though the transition to microservices is still taking place, it is not necessarily the default choice in many sectors. Many sectors, though, that were considerably more hesitant to go down, are now prepared to switch to microservices design. By enabling more flexible cycles, delivering more customization options, and offering scalability alternatives, the advantages of microservice architecture successfully outweigh the complexity it provides. One of the major factors behind the adoption of microservices is DevOps. Since both DevOps and this long-standing trend emphasize operational effectiveness, agility, and modularity, they are inextricably linked and in fact, serve as its accelerator.

Restraint: Lack of standardized DevOps tools and solutions

The enterprise-wide adoption of DevOps is still difficult for many organizations, particularly when there is a lack of consistency in the technologies used, non-repeatable procedures, ad hoc practices, and cultural hurdles. In order to achieve standardization in DevOps as part of the DevOps transformation process, the following problems in standardization and potential solutions are listed. A survey carried out among several customer teams found that due to a lack of end-to-end orchestration, human intervention, legacy practices, inconsistent environments, longer provisioning times, and several other factors, there are difficulties in standardizing tools and eliminating process gaps. Together, they make it necessary for DevOps to be standardized across the organization to make it repeatable, predictable, and consistent. Several tools to assess with one or more qualities overlap, the learning curve to assess/perform proof of concept and selecting tools with short-term objectives rather than long-term perspectives. Further, inadequate tool expertise combined with a focus on automation in their particular field leads to siloed automation and the usage of manual, ad hoc processes. The majority of the technologies used in the CD pipeline don't have out-of-the-box integration, and teams must spend time creating unique integrations.

Opportunity: Increasing demand for streamlining collaboration between IT and Operation teams

Software development teams should follow accepted best practices to be dependable counterparts and active contributors in order to keep providing value to customers. Information silos between the development and operations teams can be significantly reduced through open and effective communication among team members and senior leaders. Transparency and trust are the cornerstones of collaborative software development. Team members with diverse types of backgrounds and degrees of expertise should have the freedom to actively participate in proposals, offer suggestions for workflows, and give feedback on completed projects. Stronger solutions result from the diversity of perspectives since an organization gains from having team members from all backgrounds offer their thoughts and insights. When given the proper tools, software development teams can operate more effectively since they can concentrate on innovation rather than repetitive manual work and keeping integrations up to date. Teams from across the entire software development process and lifecycle should be brought together by DevOps tooling so that developers, QA, security experts, product managers, designers, and team leads can work together and have visibility into projects and progress. Teams can overcome obstacles, maintain version control, and boost productivity by using the appropriate IT technologies.

Challenge: Complexities in approaching the DevOps approach

DevOps is challenging, and some of its complexity necessitates a platform that runs on top of many cloud providers, is both SaaS and managed environments, and possibly also on-premises. There are other difficulties with DevOps as well. AWS, Google Cloud Platform, Microsoft Azure, and Rackspace are just a few of the numerous cloud services available, in addition to the staggering variety of physical devices. While this is going on, IT is tackling a variety of cloud strategies, including designing cloud-native applications, transferring legacy systems to the cloud, and turning hybrid. Developers have a variety of environments to choose from, including development, test, integration, and production, in addition to life cycle support and developers work with a variety of code types. For instance, when using cloud services, they may use open-source libraries. Keep in mind the requirement to ensure that all of this code can be trusted. As this is happening, the number of nodes and applications keeps growing. IT must take action regarding security, compliance, and collaboration as all of this is happening. At the same time, designers, testers, security experts, and owners of the line of business work together as well as Dev and IT. According to secondary data, 84% of respondents have faced barriers to their DevOps implementation. The biggest problems are a shortage of skills in the workforce, outdated infrastructure, and changing business culture.

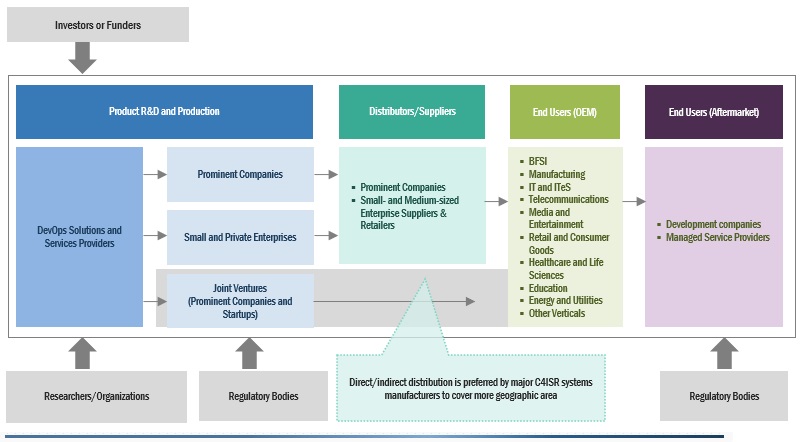

DevOps Market Ecosystem

Prominent companies in this market include companies that are responsible for delivering DevOps solutions and services to end users via various deployment models. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Broadcom (US), Microsoft (US), IBM (US), Atlassian (Australia), Google (US), AWS (US), Oracle (US), Cisco (US), and GitLab (US).

To know about the assumptions considered for the study, download the pdf brochure

Based on Solution, continuous integration and testing segment is estimated to account for the largest market share of the DevOps market

Based on the Solution, the continuous integration and testing segment is estimated to account for the largest market share of the DevOps market. This DevOps solution boosts the development's effectiveness and speed by utilizing unit and integration testing. Continuous integration and testing have a great return on investment. In a DevOps context, the test function helps developers to maintain a balance between speed and quality and using automated solutions can save testing costs and free up QA specialists' time to work more efficiently. Continuous Integration (CI) is a development methodology where developers ideally many times per day can integrate code into a shared repository. Also, regular integration helps users find faults more quickly, which is one of its main advantages.

Container services segment of the DevOps market by services is projected to witness the highest CAGR during the forecast period.

Based on services, the container services segment is estimated to account for the highest growth rate. DevOps is a mechanism to provide apps more quickly as many teams collaborate rather than operate in isolated silos. Containers are essential in facilitating this development velocity. Several containers, in the form of container clusters, are frequently utilized for larger application deployments. Operating system virtualization is a type of containerization. Anything from a small microservice or software process to a huge application could be operated inside a single container. All required executables, binary code, libraries, and configuration files are contained inside a container. Nevertheless, operating system images are not present in containers, unlike server or machine virtualization methods. As a result, they become substantially more portable and lightweight. Several containers may be deployed as one or more container clusters in bigger application deployments. An orchestrator for container deployments like Kubernetes may be used to manage these clusters. Due to various flexibility and lower infrastructure costs, containers are increasingly being used by application development teams. Microservices are most frequently used by businesses implementing DevOps approaches.

Retail and consumer goods segment of the DevOps market by vertical is projected to witness the highest CAGR during the forecast period.

Based on vertical, the retail and consumer goods segment is estimated to account for the highest growth rate. Direct-to-consumer sales are popular due to shifting consumer preferences. Traditional brick-and-mortar retailers face a serious threat from e-commerce. According to secondary data, the retail industry can also patch up serious flaws the quickest, with 53% of respondents saying they can do it in under a day. In terms of claimed "substantial" or "complete" security integration, the retail industry is in last place with 32%. Customer experience is proving to be a very important differentiating factor among the variety of online purchasing options in this industry, which is experiencing ever-increasing competition. Due to poor user experiences, online shops run the danger of losing customers. DevOps approaches have therefore been widely adopted in the retail industry due to its advantages, including greater operational efficiency, reduced cost, quicker time to market, and improved customer experience. The DevOps methodology is now being used by retailers all around the world in their initiatives for digital transformation.

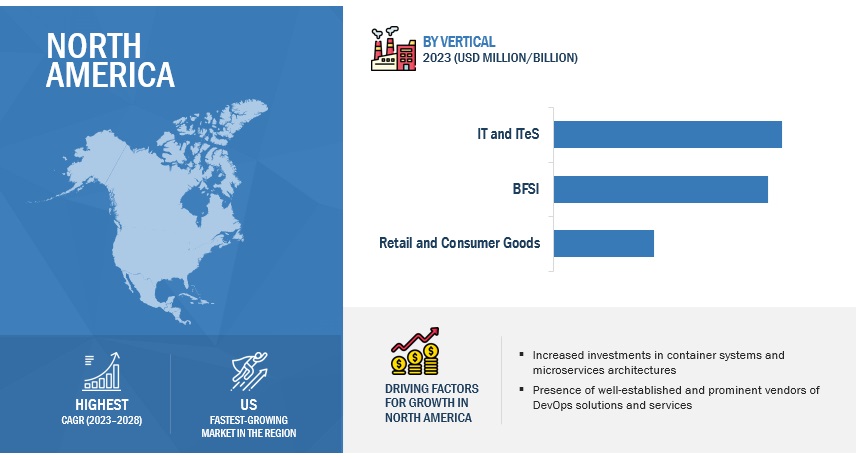

The US market is projected to contribute the largest share for the DevOps market in North America.

North America is expected to lead the DevOps market in 2023. The US is estimated to account for the largest market share in North America in 2023 in the DevOps market, and the trend is expected to continue until 2028. It is the most advanced market in terms of the adoption of DevOps due to a variety of variables, including legislative requirements, advanced IT infrastructure, the existence of multiple firms, and the availability of technical expertise in the country. The US Citizenship and Immigration Services and the California Department of Health Care Services are two government organisations that have started using the DevOps approach because of its benefits. One of the main forces behind the expansion of the DevOps industry in the US is the presence of a number of small and large DevOps providers in the country, including Microsoft, Broadcom, Oracle, IBM, and Google.

Key Market Players

The DevOps market is dominated by a few globally established players such as Broadcom Inc.(US), Microsoft Corporation (US), IBM (US), Atlassian Corporation Plc. (Australia), Google LLC (US), among others, are the key vendors that secured DevOps contracts in last few years. These vendors can bring global processes and execution expertise to the table, the local players only have local expertise. Driven by increased disposable incomes, easy access to knowledge, and fast adoption of technological products, buyers are more willing to experiment/test new things in the DevOps market.

Scope of the Report

|

Report Metrics |

Details |

|

Market value in 2028 |

USD 25.5 Billion |

|

Market value in 2023 |

USD 10.4 Billion |

|

Market Growth Rate |

19.7% CAGR |

|

Largest Market |

North America |

|

Devops Market Drivers |

|

|

Devops Market Opportunities |

|

|

Segments Covered |

Type, Cloud Deployment Models, Organization Sizes, Verticals, and Regions |

|

Geographies Covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Companies Covered |

Some of the major DevOps market vendors are Broadcom Inc.(US), Microsoft Corporation (US), IBM (US), Atlassian Corporation Plc. (Australia), Google LLC (US), AWS Inc. (US), Oracle Corporation (US), Cisco Systems Inc. (US), Micro Focus International Plc.(UK), and GitLab Inc. (US), |

This research report categorizes the DevOps market based on type, organization sizes, cloud deployment models, verticals, and regions.

Based on the Type:

-

Type

-

Solutions

-

Manage

- Continuous Business Planning

-

Deliver

- Continuous Collaborative Development

- Continuous Integration and Testing

-

Operate

- Continuous Deployment

- Continuous Monitoring and Feedback

-

Manage

-

Solutions

-

Services

- Container Services

- Api Services

- Managed Services

- Professional Services

Based on the Cloud Deployment Mode:

- Public Cloud

- Private Cloud

Based on the Organization Size:

- Large enterprises

- Small and Medium Enterprises (SMEs)

Based on the Verticals:

- Telecommunications

- IT and ITeS

- Retail and Consumer Goods

- Media and Entertainment

- Government and Public Sector

- Manufacturing

- Healthcare and Life Sciences

- Education

- Energy and Utilities

- BFSI

- Others

Based on the Region:

-

North America

- United States

- Canada

-

Europe

- United Kingdom

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- Singapore

- Australia and New Zealand

- Rest of Asia Pacific

-

Middle East & Africa

- Kingdom of Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In February 2023, In order to reduce friction and enhance user experience, GitLab has launched a number of small updates to its DevOps software suite. The monthly release cycle has seen versions 15.3 through 15.8, with version 15.9 anticipated at the end of February. GitLab's first machine-learning-powered feature enhances merge request approvals, while other noteworthy fixes and changes range from GitOps improvements to new features for Dynamic Application Security Testing (DAST).

- In September 2022, In addition to new smart connections and unified administrative controls, Atlassian released a number of improvements for its work-management and collaboration products, including Trello, Confluence, Atlas, and Jira Work Management.

- In May 2021, Amazon DevOps Guru, a fully managed operations service that uses machine learning to make it simpler for developers to improve application availability by automatically identifying operational issues and recommending specific actions for remediation, has been made generally available by Amazon Web Services. In order to assist developers in immediately comprehending the possible effect and likely causes of an issue, Amazon DevOps Guru notifies them of aberrant application behavior that may result in potential outages or service disruptions. It also provides them with detailed remedial advice.

Frequently Asked Questions (FAQ):

What is DevOps?

According to VMWare, DevOps refers to a broad variety of procedures for the creation and management of software in cloud data centers. Agile project management methods and support for microservices are at the core of DevOps. The entire software development lifecycle is approached by DevOps using automation built on version control standards. In DevOps, Git is the most widely used version control tool, followed by SVN and CVS. Managing CI/CD needs for the software lifecycle, automated code testing, container orchestration, cloud hosting, and data analytics are also included in the definition of DevOps.

According to Dynatrace, The term DevOps refers to a group of adaptable practises and procedures that businesses employ to develop and deliver applications and services by coordinating and aligning software development with IT operations.

Which country is early adopters of DevOps?

The US is at the initial stage of the adoption of DevOps.

Which are key verticals adopting application modernization services?

Key verticals adopting the DevOps market include: -

- BFSI

- Telecommunication

- IT & ITeS

- Media and Entertainment

- Education

- Government & Public Sector

- Retail & Consumer Goods

- Manufacturing

- Energy & Utility

- Healthcare & Life Sciences

- Other Verticals

Which are the key vendors exploring DevOps?

Some of the major DevOps vendors are Broadcom Inc.(US), Microsoft Corporation (US), IBM (US), Atlassian Corporation Plc. (Australia), Google LLC (US), AWS Inc. (US), Oracle Corporation (US), Cisco Systems Inc. (US), Micro Focus International Plc.(UK), GitLab Inc. (US), Dell Technologies (US), To The New Private Ltd. (Singapore), Perforce Software Inc. (US), Progress Software Corporation(US), Cigniti Technologies Ltd.(India), HashiCorp Inc. (US), JFrog Ltd. (US), Appfire Technologies Inc. (US), Tricentis, LLC (US), Digital.ai Software, Inc. (US), New Relic Inc.(US), Dynatrace LLC (US), Datadog Inc. (US), CircleCI (US), Clarive Software (Spain), OpenMake Software (US), Copado Inc. (US), Gearset Ltd.(England), CloudBees Inc.(US), SmartBear Software Inc. (US), Buddy Technology Inc. (US), Flosum Inc.(US), and Prodly Inc. (US).

What is the total CAGR expected to be recorded for the DevOps market during 2023-2028?

The CAGR is expected to record a CAGR of 19.7% from 2023-2028

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing demand for continuous and faster application delivery- Growing focus on lowering CAPEX and OPEX- Rising preference for microservice architectureRESTRAINTS- Lack of standardized DevOps tools and solutionsOPPORTUNITIES- Increasing demand for collaboration between IT and operations teams- Use of AI in application development- Growing adoption by SMEsCHALLENGES- Complexities in DevOps approach- Lack of skilled professionals

-

5.3 CASE STUDY ANALYSISCASE STUDY 1: CA BRIGHTSIDE’S OPEN MAINFRAME HELPS DOLLAR BANK TO IMPROVE USER EXPERIENCECASE STUDY 2: ATLASSIAN STREAMLINES DEVOPS PROCESS FOR DOMINO’SCASE STUDY 3: MICRO FOCUS ENABLES SMOOTH TRANSITION TO DISTRIBUTED ENVIRONMENT FOR EMPIRE LIFECASE STUDY 4: GITLAB ASSISTS FULLSAVE TO REDUCE DEVOPS TOOLCHAIN AND MULTIPLY DEPLOYMENTSCASE STUDY 5: DIGITAL.AI ENABLES STATER TO IMPLEMENT DEVOPS SUCCESSFULLY

-

5.4 ECOSYSTEM ANALYSIS

- 5.5 SUPPLY CHAIN ANALYSIS

-

5.6 PRICING ANALYSISINTRODUCTIONAVERAGE SELLING PRICE TRENDSAVERAGE SELLING PRICE TRENDS OF KEY PLAYERS, BY TYPE

-

5.7 PATENT ANALYSIS

-

5.8 TECHNOLOGY ANALYSISARTIFICIAL INTELLIGENCEBIG DATAINTERNET OF THINGSDATA ANALYTICS5G NETWORK

-

5.9 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSDEGREE OF COMPETITION

-

5.10 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATIONS, BY REGION- North America- Europe- Asia Pacific- Middle East & Africa- Latin AmericaREGULATORY IMPLICATIONS AND INDUSTRY STANDARDS- General Data Protection Regulation- SEC Rule 17a-4- ISO/IEC 27001- System and Organization Controls 2 Type II Compliance- Financial Industry Regulatory Authority- Freedom of Information Act- Health Insurance Portability and Accountability Act

- 5.11 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.12 TRENDS/DISRUPTIONS IMPACTING BUYERS

-

5.13 KEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.1 INTRODUCTIONBY TYPE: DEVOPS MARKET DRIVERS

-

6.2 SOLUTIONSMANAGE- Continuous business planningDELIVER- Continuous collaborative development- Continuous integration and testingOPERATE- Continuous development- Continuous monitoring and feedback

-

6.3 SERVICESCONTAINER SERVICES- Offer flexibility and lower costs in app developmentAPI SERVICES- Help improve security and speed up application lifecyclesMANAGED SERVICES- Provide centralized management of software deliveryPROFESSIONAL SERVICES- Growing demand due to need for business support services

-

7.1 INTRODUCTIONBY ORGANIZATION SIZE: DEVOPS MARKET DRIVERS

-

7.2 LARGE ENTERPRISESUSE OF ADVANCED SOLUTIONS TO REDUCE TTM OF APPLICATION DEVELOPMENT

-

7.3 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES)INCREASED ADOPTION OF DEVOPS TO LOWER COSTS

-

8.1 INTRODUCTIONBY CLOUD DEPLOYMENT MODEL: DEVOPS MARKET DRIVERS

-

8.2 PUBLIC CLOUDINCREASED DEMAND DUE TO QUICK DEPLOYMENT AND EASY ACCESS

-

8.3 PRIVATE CLOUDRISING NEED TO SECURE CUSTOMER DATA FROM MALWARE TO DRIVE DEMAND

-

9.1 INTRODUCTIONBY VERTICAL: DEVOPS MARKET DRIVERS

-

9.2 BANKING, FINANCIAL SERVICES, AND INSURANCERISING NEED FOR DIGITAL TRANSFORMATION AND IMPROVED CUSTOMER EXPERIENCE

-

9.3 MANUFACTURINGDEMAND FOR DEVOPS TO INTEGRATE OPERATIONAL PROCESSES

-

9.4 IT & ITESGROWING NEED TO KEEP IT INDUSTRY SECURE

-

9.5 TELECOMMUNICATIONSINCREASED IT SPENDING TO MANAGE BUSINESS OPERATIONS

-

9.6 MEDIA & ENTERTAINMENTUSE OF DEVOPS TO IMPROVE INTER-DEPARTMENTAL COMMUNICATION

-

9.7 RETAIL & CONSUMER GOODSRISING NEED TO CREATE NEW CUSTOMER EXPERIENCES

-

9.8 GOVERNMENT & PUBLIC SECTORGROWING SHIFT TO DIGITALIZATION FOR IMPROVED RELIABILITY AND EFFICIENCY

-

9.9 HEALTHCARE & LIFE SCIENCESGROWING USE OF NEW TECHNOLOGIES TO PROVIDE BETTER PATIENT CARE

-

9.10 EDUCATIONNEED FOR OPTIMAL USE OF IT RESOURCES FOR LARGE-SCALE APPLICATION DEVELOPMENT

-

9.11 ENERGY & UTILITIESSURGE IN IT SPENDING ON SOFTWARE AND SERVICES

- 9.12 OTHER VERTICALS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: DEVOPS MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTUS- Presence of several DevOps providers to drive marketCANADA- Government initiatives and security advancements to fuel adoption of DevOps services

-

10.3 EUROPEEUROPE: DEVOPS MARKET DRIVERSEUROPE: RECESSION IMPACTUK- Growing need for streamlined quality lifecycle process to boost marketGERMANY- Increasing digitalization to fuel growth of DevOps servicesFRANCE- Government initiatives to support adoption of cloud technologiesREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: DEVOPS MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTCHINA- Increasing digital transformation to fuel market growthJAPAN- Rising demand for cloud-based services to drive marketSINGAPORE- Growing investments in new technologies to drive demand for DevOpsAUSTRALIA AND NEW ZEALAND- Continuous upgrades to IT infrastructure and applications to drive demandREST OF ASIA PACIFIC

-

10.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: DEVOPS MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTKINGDOM OF SAUDI ARABIA- Rapid economic advancement to increase demand for cloud servicesQATAR- Rising ICT spending to propel market growthSOUTH AFRICA- High adoption of cloud services by startups to boost marketREST OF MIDDLE EAST & AFRICA

-

10.6 LATIN AMERICALATIN AMERICA: DEVOPS MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTBRAZIL- Presence of major cloud players to accelerate marketMEXICO- Digital transformation in telecom industry to drive marketREST OF LATIN AMERICA

- 11.1 INTRODUCTION

- 11.2 STRATEGIES/RIGHT TO WIN OF KEY PLAYERS

- 11.3 MARKET SHARE ANALYSIS

- 11.4 HISTORICAL REVENUE ANALYSIS OF TOP VENDORS

-

11.5 KEY COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.6 EVALUATION QUADRANT FOR STARTUPS/SMES, 2022RESPONSIVE COMPANIESPROGRESSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING OF STARTUPS/SMES

- 11.7 KEY MARKET DEVELOPMENTS

- 12.1 INTRODUCTION

-

12.2 MAJOR PLAYERSBROADCOM INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMICROSOFT CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewIBM CORPORATION- Business overview- Product/Solutions/Services offered- Recent developments- MnM viewATLASSIAN CORPORATION PLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGOOGLE LLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAMAZON WEB SERVICES- Business overview- Products/Solutions/Services offered- Recent developmentsORACLE CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsCISCO SYSTEMS INC.- Business overview- Products/Solutions/Services offered- Recent developmentsMICRO FOCUS INTERNATIONAL PLC- Business overview- Products/Solutions/Services offered- Recent developmentsGITLAB INC.- Business overview- Products/Solutions/Services offered- Recent developments

-

12.3 OTHER PLAYERSDELL TECHNOLOGIESTO THE NEW PRIVATE LTD.PERFORCE SOFTWARE INC.PROGRESS SOFTWARE CORPORATIONCIGNITI TECHNOLOGIESHASHICORP INC.JFROG LTD.APPFIRETRICENTIS LLCDIGITAL.AINEW RELIC INC.DYNATRACE LLCDATADOG INC.

-

12.4 STARTUPS/SMESCIRCLECICLARIVEOPENMAKE SOFTWARECAPADO INC.GEARSET LTD.CLOUDBEES INC.SMARTBEAR SOFTWARE INC.BUDDY TECHNOLOGY INC.FLOSUM INC.PRODLY INC.

-

13.1 INTRODUCTIONRELATED MARKETSLIMITATIONS

- 13.2 CONTAINERS AS A SERVICE MARKET

- 13.3 AIOPS PLATFORM MARKET

- 13.4 CONTINUOUS DELIVERY MARKET

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2015–2022

- TABLE 2 RESEARCH ASSUMPTIONS

- TABLE 3 DEVOPS MARKET: PRICING ANALYSIS, BY VENDOR

- TABLE 4 DEVOPS MARKET: AVERAGE SELLING PRICING ANALYSIS, BY TYPE

- TABLE 5 TOP PATENT OWNERS

- TABLE 6 PORTER’S FIVE FORCES ANALYSIS: DEVOPS MARKET

- TABLE 7 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 DEVOPS MARKET: KEY CONFERENCES AND EVENTS

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE SOLUTIONS

- TABLE 13 KEY BUYING CRITERIA FOR TOP THREE SOLUTIONS

- TABLE 14 DEVOPS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 15 DEVOPS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 16 DEVOPS MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 17 DEVOPS MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 18 CONTINUOUS BUSINESS PLANNING: DEVOPS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 19 CONTINUOUS BUSINESS PLANNING: DEVOPS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 20 CONTINUOUS COLLABORATIVE DEVELOPMENT: DEVOPS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 21 CONTINUOUS COLLABORATIVE DEVELOPMENT: DEVOPS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 22 CONTINUOUS INTEGRATION AND TESTING: DEVOPS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 23 CONTINUOUS INTEGRATION AND TESTING: DEVOPS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 24 CONTINUOUS DEPLOYMENT: DEVOPS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 25 CONTINUOUS DEPLOYMENT: DEVOPS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 CONTINUOUS MONITORING AND FEEDBACK: DEVOPS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 27 CONTINUOUS MONITORING AND FEEDBACK: DEVOPS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 DEVOPS MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 29 DEVOPS MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 30 CONTAINER SERVICES: DEVOPS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 31 CONTAINER SERVICES: DEVOPS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 API SERVICES: DEVOPS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 33 API SERVICES: DEVOPS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 MANAGED SERVICES: DEVOPS MARKET, BY REGION, 2018–2022 (USD MILLION

- TABLE 35 MANAGED SERVICES: DEVOPS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 PROFESSIONAL SERVICES: DEVOPS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 37 PROFESSIONAL SERVICES: DEVOPS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 DEVOPS MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 39 DEVOPS MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 40 LARGE ENTERPRISES: DEVOPS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 41 LARGE ENTERPRISES: DEVOPS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 SMALL AND MEDIUM-SIZED ENTERPRISES: DEVOPS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 43 SMALL AND MEDIUM-SIZED ENTERPRISES: DEVOPS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 DEVOPS MARKET, BY CLOUD DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 45 DEVOPS MARKET, BY CLOUD DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 46 PUBLIC CLOUD: DEVOPS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 47 PUBLIC CLOUD: DEVOPS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 48 PRIVATE CLOUD: DEVOPS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 49 PRIVATE CLOUD: DEVOPS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 DEVOPS MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 51 DEVOPS MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 52 BFSI: DEVOPS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 53 BFSI: DEVOPS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 MANUFACTURING: DEVOPS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 55 MANUFACTURING: DEVOPS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 56 IT & ITES: DEVOPS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 57 IT & ITES: DEVOPS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 58 TELECOMMUNICATIONS: DEVOPS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 59 TELECOMMUNICATIONS: DEVOPS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 MEDIA & ENTERTAINMENT: DEVOPS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 61 MEDIA & ENTERTAINMENT: DEVOPS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 RETAIL & CONSUMER GOODS: DEVOPS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 63 RETAIL & CONSUMER GOODS: DEVOPS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 64 GOVERNMENT & PUBLIC SECTOR: DEVOPS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 65 GOVERNMENT & PUBLIC SECTOR: DEVOPS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 66 HEALTHCARE & LIFE SCIENCES: DEVOPS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 67 HEALTHCARE & LIFE SCIENCES: DEVOPS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 68 EDUCATION: DEVOPS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 69 EDUCATION: DEVOPS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 70 ENERGY & UTILITIES: DEVOPS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 71 ENERGY & UTILITIES: DEVOPS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 72 OTHER VERTICALS: DEVOPS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 73 OTHER VERTICALS: DEVOPS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 74 DEVOPS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 75 DEVOPS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 76 NORTH AMERICA: DEVOPS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 77 NORTH AMERICA: DEVOPS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: DEVOPS MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 79 NORTH AMERICA: DEVOPS MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 80 NORTH AMERICA: DEVOPS MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 81 NORTH AMERICA: DEVOPS MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 82 NORTH AMERICA: DEVOPS MARKET, BY CLOUD DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 83 NORTH AMERICA: DEVOPS MARKET, BY CLOUD DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 84 NORTH AMERICA: DEVOPS MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 85 NORTH AMERICA: DEVOPS MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 86 NORTH AMERICA: DEVOPS MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 87 NORTH AMERICA: DEVOPS MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 88 NORTH AMERICA: DEVOPS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 89 NORTH AMERICA: DEVOPS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 90 US: DEVOPS MARKET, BY CLOUD DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 91 US: DEVOPS MARKET, BY CLOUD DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 92 US: DEVOPS MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 93 US: DEVOPS MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 94 CANADA: DEVOPS MARKET, BY CLOUD DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 95 CANADA: DEVOPS MARKET, BY CLOUD DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 96 CANADA: DEVOPS MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 97 CANADA: DEVOPS MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 98 EUROPE: DEVOPS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 99 EUROPE: DEVOPS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 100 EUROPE: DEVOPS MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 101 EUROPE: DEVOPS MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 102 EUROPE: DEVOPS MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 103 EUROPE: DEVOPS MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 104 EUROPE: DEVOPS MARKET, BY CLOUD DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 105 EUROPE: DEVOPS MARKET, BY CLOUD DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 106 EUROPE: DEVOPS MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 107 EUROPE: DEVOPS MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 108 EUROPE: DEVOPS MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 109 EUROPE: DEVOPS MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 110 EUROPE: DEVOPS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 111 EUROPE: DEVOPS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 112 UK: DEVOPS MARKET, BY CLOUD DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 113 UK: DEVOPS MARKET, BY CLOUD DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 114 UK: DEVOPS MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 115 UK: DEVOPS MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 116 GERMANY: DEVOPS MARKET, BY CLOUD DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 117 GERMANY: DEVOPS MARKET, BY CLOUD DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 118 GERMANY: DEVOPS MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 119 GERMANY: DEVOPS MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 120 FRANCE: DEVOPS MARKET, BY CLOUD DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 121 FRANCE: DEVOPS MARKET, BY CLOUD DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 122 FRANCE: DEVOPS MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 123 FRANCE: DEVOPS MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 124 ASIA PACIFIC: DEVOPS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 125 ASIA PACIFIC: DEVOPS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 126 ASIA PACIFIC: DEVOPS MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 127 ASIA PACIFIC: DEVOPS MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 128 ASIA PACIFIC: DEVOPS MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 129 ASIA PACIFIC: DEVOPS MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 130 ASIA PACIFIC: DEVOPS MARKET, BY CLOUD DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 131 ASIA PACIFIC: DEVOPS MARKET, BY CLOUD DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 132 ASIA PACIFIC: DEVOPS MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 133 ASIA PACIFIC: DEVOPS MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 134 ASIA PACIFIC: DEVOPS MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 135 ASIA PACIFIC: DEVOPS MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 136 ASIA PACIFIC: DEVOPS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 137 ASIA PACIFIC: DEVOPS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 138 CHINA: DEVOPS MARKET, BY CLOUD DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 139 CHINA: DEVOPS MARKET, BY CLOUD DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 140 CHINA: DEVOPS MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 141 CHINA: DEVOPS MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 142 JAPAN: DEVOPS MARKET, BY CLOUD DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 143 JAPAN: DEVOPS MARKET, BY CLOUD DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 144 JAPAN: DEVOPS MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 145 JAPAN: DEVOPS MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 146 SINGAPORE: DEVOPS MARKET, BY CLOUD DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 147 SINGAPORE: DEVOPS MARKET, BY CLOUD DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 148 SINGAPORE: DEVOPS MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 149 SINGAPORE: DEVOPS MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 150 AUSTRALIA AND NEW ZEALAND: DEVOPS MARKET, BY CLOUD DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 151 AUSTRALIA AND NEW ZEALAND: DEVOPS MARKET, BY CLOUD DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 152 AUSTRALIA AND NEW ZEALAND: DEVOPS MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 153 AUSTRALIA AND NEW ZEALAND: DEVOPS MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: DEVOPS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: DEVOPS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 156 MIDDLE EAST & AFRICA: DEVOPS MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: DEVOPS MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: DEVOPS MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: DEVOPS MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 160 MIDDLE EAST & AFRICA: DEVOPS MARKET, BY CLOUD DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: DEVOPS MARKET, BY CLOUD DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: DEVOPS MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 163 MIDDLE EAST & AFRICA: DEVOPS MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: DEVOPS MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: DEVOPS MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: DEVOPS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: DEVOPS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 168 KINGDOM OF SAUDI ARABIA: DEVOPS MARKET, BY CLOUD DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 169 KINGDOM OF SAUDI ARABIA: DEVOPS MARKET, BY CLOUD DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 170 KINGDOM OF SAUDI ARABIA: DEVOPS MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 171 KINGDOM OF SAUDI ARABIA: DEVOPS MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 172 QATAR: DEVOPS MARKET, BY CLOUD DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 173 QATAR: DEVOPS MARKET, BY CLOUD DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 174 QATAR: DEVOPS MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 175 QATAR: DEVOPS MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 176 SOUTH AFRICA: DEVOPS MARKET, BY CLOUD DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 177 SOUTH AFRICA: DEVOPS MARKET, BY CLOUD DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 178 SOUTH AFRICA: DEVOPS MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 179 SOUTH AFRICA: DEVOPS MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 180 LATIN AMERICA: DEVOPS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 181 LATIN AMERICA: DEVOPS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 182 LATIN AMERICA: DEVOPS MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 183 LATIN AMERICA: DEVOPS MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 184 LATIN AMERICA: DEVOPS MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 185 LATIN AMERICA: DEVOPS MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 186 LATIN AMERICA: DEVOPS MARKET, BY CLOUD DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 187 LATIN AMERICA: DEVOPS MARKET, BY CLOUD DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 188 LATIN AMERICA: DEVOPS MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 189 LATIN AMERICA: DEVOPS MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 190 LATIN AMERICA: DEVOPS MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 191 LATIN AMERICA: DEVOPS MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 192 LATIN AMERICA: DEVOPS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 193 LATIN AMERICA: DEVOPS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 194 BRAZIL: DEVOPS MARKET, BY CLOUD DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 195 BRAZIL: DEVOPS MARKET, BY CLOUD DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 196 BRAZIL: DEVOPS MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 197 BRAZIL: DEVOPS MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 198 MEXICO: DEVOPS MARKET, BY CLOUD DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 199 MEXICO: DEVOPS MARKET, BY CLOUD DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 200 MEXICO: DEVOPS MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 201 MEXICO: DEVOPS MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 202 MARKET SHARE OF KEY VENDORS, 2022

- TABLE 203 OVERALL COMPANY FOOTPRINT FOR KEY PLAYERS

- TABLE 204 OVERALL COMPANY FOOTPRINT FOR STARTUPS/SMES

- TABLE 205 DEVOPS MARKET: KEY STARTUPS/SMES

- TABLE 206 DEVOPS MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, 2019–2023

- TABLE 207 DEVOPS MARKET: DEALS, 2021–2023

- TABLE 208 BROADCOM INC.: BUSINESS OVERVIEW

- TABLE 209 BROADCOM INC.: PRODUCTS/SERVICES OFFERED

- TABLE 210 BROADCOM INC.: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 211 BROADCOM INC.: DEALS

- TABLE 212 MICROSOFT CORPORATION: BUSINESS OVERVIEW

- TABLE 213 MICROSOFT CORPORATION: PRODUCTS/SERVICES OFFERED

- TABLE 214 MICROSOFT CORPORATION: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 215 MICROSOFT CORPORATION: DEALS

- TABLE 216 IBM CORPORATION: BUSINESS OVERVIEW

- TABLE 217 IBM CORPORATION: PRODUCT/SERVICES OFFERED

- TABLE 218 IBM CORPORATION: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 219 IBM CORPORATION: DEALS

- TABLE 220 ATLASSIAN CORPORATION PLC: BUSINESS OVERVIEW

- TABLE 221 ATLASSIAN CORPORATION PLC: PRODUCTS/SERVICES OFFERED

- TABLE 222 ATLASSIAN CORPORATION PLC: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 223 ATLASSIAN CORPORATION PLC: DEALS

- TABLE 224 GOOGLE LLC: BUSINESS OVERVIEW

- TABLE 225 GOOGLE LLC: PRODUCTS/SERVICES OFFERED

- TABLE 226 GOOGLE LLC: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 227 GOOGLE LLC: DEALS

- TABLE 228 AMAZON WEB SERVICES: BUSINESS OVERVIEW

- TABLE 229 AMAZON WEB SERVICES: PRODUCTS/SERVICES OFFERED

- TABLE 230 AMAZON WEB SERVICES: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 231 AMAZON WEB SERVICES: DEALS

- TABLE 232 ORACLE CORPORATION: BUSINESS OVERVIEW

- TABLE 233 ORACLE CORPORATION: PRODUCTS/SERVICES OFFERED

- TABLE 234 ORACLE CORPORATION: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 235 ORACLE CORPORATION: DEALS

- TABLE 236 CISCO SYSTEMS INC.: BUSINESS OVERVIEW

- TABLE 237 CISCO SYSTEMS INC.: PRODUCTS/SERVICES OFFERED

- TABLE 238 CISCO SYSTEMS INC.: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 239 CISCO SYSTEMS INC.: DEALS

- TABLE 240 MICRO FOCUS INTERNATIONAL PLC: BUSINESS OVERVIEW

- TABLE 241 MICRO FOCUS INTERNATIONAL PLC: PRODUCTS/SERVICES OFFERED

- TABLE 242 MICRO FOCUS INTERNATIONAL PLC: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 243 MICRO FOCUS INTERNATIONAL PLC: DEALS

- TABLE 244 GITLAB INC.: BUSINESS OVERVIEW

- TABLE 245 GITLAB INC.: PRODUCTS/SERVICES OFFERED

- TABLE 246 GITLAB INC.: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 247 GITLAB INC.: DEALS

- TABLE 248 CONTAINERS AS A SERVICE MARKET, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

- TABLE 249 CONTAINERS AS A SERVICE MARKET, BY DEPLOYMENT MODEL, 2021–2027 (USD MILLION)

- TABLE 250 PUBLIC CLOUD: CONTAINERS AS A SERVICE MARKET, BY REGION, 2016–2020 (USD MILLION)

- TABLE 251 PUBLIC CLOUD: CONTAINERS AS A SERVICE MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 252 PRIVATE CLOUD: CONTAINERS AS A SERVICE MARKET, BY REGION, 2016–2020 (USD MILLION)

- TABLE 253 PRIVATE CLOUD: CONTAINERS AS A SERVICE MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 254 AIOPS PLATFORM MARKET, BY ORGANIZATION SIZE, 2016–2023 (USD MILLION)

- TABLE 255 SMALL AND MEDIUM-SIZED ENTERPRISES: AIOPS PLATFORM MARKET, BY REGION, 2016–2023 (USD MILLION)

- TABLE 256 LARGE ENTERPRISES: AIOPS PLATFORM MARKET, BY REGION, 2016–2023 (USD MILLION)

- TABLE 257 CONTINUOUS DELIVERY MARKET, BY DEPLOYMENT MODE, 2016–2023 (USD MILLION)

- TABLE 258 ON-PREMISES: CONTINUOUS DELIVERY MARKET, BY REGION, 2016–2023 (USD MILLION)

- TABLE 259 CLOUD: CONTINUOUS DELIVERY MARKET, BY REGION, 2016–2023 (USD MILLION)

- FIGURE 1 DEVOPS MARKET: RESEARCH DESIGN

- FIGURE 2 DATA TRIANGULATION

- FIGURE 3 TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 TOP-DOWN APPROACH: REVENUE OF VENDORS OFFERING DEVOPS SOLUTIONS AND SERVICES

- FIGURE 5 BOTTOM-UP APPROACH: REVENUE OF VENDORS ACROSS SERVICES

- FIGURE 6 BOTTOM-UP APPROACH (SUPPLY-SIDE): COLLECTIVE REVENUE OF DEVOPS VENDORS

- FIGURE 7 SUPPLY-SIDE CAGR PROJECTIONS

- FIGURE 8 DEVOPS MARKET SNAPSHOT, 2018–2028

- FIGURE 9 TOP MARKET SEGMENTS IN TERMS OF GROWTH RATE

- FIGURE 10 SOLUTIONS SEGMENT TO HOLD LARGER MARKET SHARE BY 2028

- FIGURE 11 CONTINUOUS INTEGRATION AND TESTING SEGMENT TO ACCOUNT FOR LARGEST MARKET BY 2028

- FIGURE 12 CONTAINER SERVICES SEGMENT TO LEAD MARKET BY 2028

- FIGURE 13 PUBLIC CLOUD SEGMENT TO DOMINATE MARKET BY 2028

- FIGURE 14 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR LARGER MARKET BY 2028

- FIGURE 15 IT & ITES VERTICAL TO BE PREDOMINANT BY 2028

- FIGURE 16 NORTH AMERICA TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 17 TECHNOLOGICAL EVOLUTION TO DRIVE DEMAND FOR DEVOPS SOLUTIONS AND SERVICES

- FIGURE 18 SOLUTIONS SEGMENT TO ACCOUNT FOR LARGER SHARE IN 2023

- FIGURE 19 PUBLIC CLOUD SEGMENT TO DOMINATE IN 2023

- FIGURE 20 LARGE ENTERPRISES SEGMENT TO LEAD IN 2023

- FIGURE 21 IT & ITES SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 22 ASIA PACIFIC TO ATTRACT MAXIMUM INVESTMENTS IN NEXT FIVE YEARS

- FIGURE 23 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: DEVOPS MARKET

- FIGURE 24 DEVOPS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 25 DEVOPS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 26 NUMBER OF PATENTS PUBLISHED, 2013-2022

- FIGURE 27 TOP TEN PATENT APPLICANTS (GLOBAL) IN 2022

- FIGURE 28 PORTER’S FIVE FORCES ANALYSIS: DEVOPS MARKET

- FIGURE 29 DEVOPS MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE SOLUTIONS

- FIGURE 31 KEY BUYING CRITERIA FOR TOP THREE SOLUTIONS

- FIGURE 32 SERVICES SEGMENT TO GROW AT HIGHER RATE DURING FORECAST PERIOD

- FIGURE 33 CONTINUOUS INTEGRATION AND TESTING SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 34 CONTAINER SERVICES SEGMENT TO LEAD MARKET IN 2028

- FIGURE 35 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT HIGHER RATE DURING FORECAST PERIOD

- FIGURE 36 PUBLIC CLOUD DEPLOYMENT MODEL TO LEAD MARKET IN 2023

- FIGURE 37 IT & ITES VERTICAL TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 38 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE BY 2028

- FIGURE 39 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 40 ASIA PACIFIC: REGIONAL SNAPSHOT

- FIGURE 41 OVERVIEW OF STRATEGIES ADOPTED BY KEY VENDORS

- FIGURE 42 DEVOPS MARKET: MARKET SHARE ANALYSIS

- FIGURE 43 HISTORICAL REVENUE ANALYSIS, 2018–2022 (USD MILLION)

- FIGURE 44 COMPANY EVALUATION MATRIX FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- FIGURE 45 COMPANY EVALUATION QUADRANT FOR KEY PLAYERS

- FIGURE 46 EVALUATION MATRIX FOR STARTUPS/SMES: CRITERIA WEIGHTAGE

- FIGURE 47 EVALUATION QUADRANT FOR STARTUPS/SMES

- FIGURE 48 BROADCOM INC.: COMPANY SNAPSHOT

- FIGURE 49 MICROSOFT CORPORATION: COMPANY SNAPSHOT

- FIGURE 50 IBM CORPORATION: COMPANY SNAPSHOT

- FIGURE 51 ATLASSIAN CORPORATION PLC: COMPANY SNAPSHOT

- FIGURE 52 GOOGLE LLC: COMPANY SNAPSHOT

- FIGURE 53 AMAZON WEB SERVICES: COMPANY SNAPSHOT

- FIGURE 54 ORACLE CORPORATION: COMPANY SNAPSHOT

- FIGURE 55 CISCO SYSTEMS INC.: COMPANY SNAPSHOT

- FIGURE 56 MICRO FOCUS INTERNATIONAL PLC: COMPANY SNAPSHOT

- FIGURE 57 GITLAB INC.: COMPANY SNAPSHOT

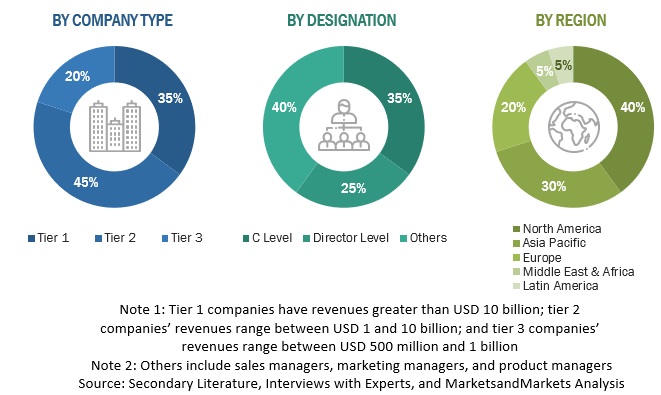

The study involved four major activities in estimating the size of the DevOps market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The market size of companies offering DevOps solutions and services was derived on the basis of the secondary data available through paid and unpaid sources and by analyzing the product portfolios of major companies in the ecosystem and rating the companies based on their product capabilities and business strategies. In the secondary research process, various sources were referred to for identifying and collecting information for the study. Secondary sources included annual reports, press releases, and investor presentations of companies and product data sheets; white papers; journals; certified publications; and articles from recognized authors, government websites, directories, and databases.

Secondary research was majorly used to obtain the key information related to the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives; all of which were further validated by primary sources.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from DevOps vendors, industry associations, and independent consultants; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, the latest trends disrupting the market, new use cases implemented, data on revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technology, component, deployment, and region. Demand-side stakeholders, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs), the installation teams of governments/end users using DevOps solutions, and digital initiatives project teams, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current use, which would affect the overall DevOps market.

Breakup of Primary Profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and forecast the DevOps market and other dependent submarkets. The bottom-up procedure was deployed to arrive at the overall market size using the revenues and offerings of key companies in the market. With data triangulation methods and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segments.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from the demand and supply sides in Telecommunications, IT & ITeS, BFSI, healthcare and life sciences,manufacturing, retail & consumer goods, government and public sector, energy & utilities, media and entertainment, education, and other verticals.

Market Definition

DevOps is an environment that brings together developers, operators, and the network team with the intent to increase the speed of software development and delivery. This agile approach represents a fundamental change in people, processes, and technologies, used to build, integrate, test, and deliver the software applications. The constant need for improvements in the application development pipeline with a focus on customers' experience has driven the rapid adoption of DevOps as a practice.

Key Stakeholders

- Training and consulting service providers

- DevOps vendors

- DevOps as a Service Providers

- Cloud Service Providers (CSPs)

- Managed Service Providers

- Telecom service providers

- System integrators

- Government agencies

Report Objectives

- To determine and forecast the global DevOps market based on type (solutions and services), cloud deployment models, organization size, verticals, and regions from 2022 to 2028, and analyze various macro and microeconomic factors affecting the market growth.

- To forecast the market size of five main regions: North America, Europe, Asia Pacific, Middle East and Africa, and Latin America

- To analyze subsegments concerning individual growth trends, prospects, and contributions to the total market.

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the market's growth.

- To provide recession impact on the adoption of DevOps adoption.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape of the major players.

- To comprehensively analyze the core competencies of the key players in the market.

- To track and analyze the competitive developments, such as product/solution launches and enhancements, business expansions, acquisitions, partnerships, and contracts and collaborations, in the market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American digital map market

Company Information

- Detailed analysis and profiling of additional market players up to 5

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in DevOps Market