Application Lifecycle Management Market

Application Lifecycle Management Market by Offering (Software, Services), Platform (Web-based ALM, Mobile-based ALM), Deployment (On-premises, Cloud), Vertical (IT & Software development, Telecom, BFSI) - Global Forecast to 2029

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The application lifecycle management market size was valued at USD 4.34 billion in 2024. The market is projected to grow from USD 4.70 billion in 2025 to USD 6.58 billion by 2029, exhibiting a CAGR of 8.6% during the forecast period. The growing reliance on open-source components is driving the demand for application lifecycle management (ALM) solutions that offer comprehensive dependency tracking, automated security patching, and license compliance management. As enterprises integrate open-source libraries, they require tools to monitor dependencies, detect vulnerabilities, and ensure seamless updates while maintaining software stability. Additionally, ALM solutions help enforce open-source licensing terms, mitigating legal risks and ensuring compliance with intellectual property regulations.

KEY TAKEAWAYS

-

BY OFFERINGThe software segment holds the largest share as enterprises adopt integrated platforms that unify planning, development, testing, and deployment to streamline collaboration and boost productivity. The services segment is expanding faster, driven by growing demand for consulting, integration, and managed services that support seamless implementation and optimization of ALM tools within agile and cloud-based environments.

-

BY PLATFORMWeb-based ALM is expected to hold the largest market size as it offers seamless access, centralized management, and integration with multiple enterprise tools, making it ideal for large teams. Mobile-based ALM, however, is projected to witness the highest CAGR because businesses are increasingly adopting mobile solutions to allow developers and managers to track progress, collaborate, and resolve issues on the go.

-

BY ORGANIZATION SIZELarge enterprises are expected to hold the largest market size since they handle complex, large-scale software projects requiring comprehensive ALM tools. SMEs, on the other hand, are likely to see a higher CAGR due to their growing adoption of digital tools and need for agile, cost-effective solutions to streamline software development processes.

-

BY DEPLOYMENT MODEOn-premises ALM is expected to hold the largest market size as many organizations prefer hosting critical software management tools within their secure IT infrastructure. Cloud-based ALM is anticipated to grow at a higher CAGR because it offers flexibility, scalability, and reduced upfront costs, making it attractive for companies looking to modernize development operations without heavy infrastructure investment.

-

BY VERTICALThe IT & Software Development sector is expected to hold the largest market size due to its high dependence on ALM solutions for managing complex software projects. Automotive and manufacturing verticals are projected to experience higher CAGR as these industries increasingly integrate digital workflows, IoT devices, and smart manufacturing processes, creating a growing need for efficient lifecycle management tools.

-

BY REGIONAsia Pacific is projected to grow at the highest CAGR of 12.7% during the forecast period. The Application Lifecycle Management (ALM) market in Asia-Pacific is expanding rapidly, fueled by widespread digital transformation, the growing trend of software development outsourcing, and the increasing implementation of agile and DevOps methodologies across diverse industries.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies including partnerships, collaborations, and investments. For instance, Microsoft uses its Azure DevOps platform internally to manage the development and continuous delivery of products like Microsoft 365 and Windows, enabling faster releases and seamless collaboration across global teams.

The Application Lifecycle Management (ALM) market is witnessing significant growth across platforms, organization sizes, deployment modes, verticals, and offerings. Web-based ALM dominates the platform segment due to its centralized management and integration capabilities, while mobile-based ALM is growing rapidly as organizations embrace real-time, on-the-go collaboration. Large enterprises lead in market share, leveraging ALM for complex projects, whereas SMEs are experiencing faster growth driven by agile adoption. On-premises deployment holds the largest market size, but cloud-based solutions are expanding rapidly for their scalability and cost efficiency. In terms of verticals, IT & software development remains the largest adopter, while automotive and manufacturing sectors show high growth potential due to increasing digitalization. Among offerings, software leads the market by providing integrated platforms that streamline planning, development, testing, and deployment, while services are growing at a faster pace, fueled by demand for consulting, integration, and managed services that ensure efficient ALM implementation.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The Application Lifecycle Management (ALM) market is shifting from traditional, tool-centric revenue models to more integrated and innovation-driven ecosystems. A larger portion of future revenue is expected to come from cloud-based solutions, AI-assisted development, DevOps automation, and strategic collaborations that enhance the software delivery lifecycle. Leading players such as Microsoft, Atlassian, PTC, Broadcom, HCLTech, SAP, and BMC are expanding their platforms to support these advancements, focusing on client imperatives like accelerating delivery, improving collaboration, ensuring traceability, and strengthening compliance. These efforts are enabling outcomes such as faster time-to-market, improved product quality, higher transparency, and greater agility in managing complex software development processes.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing focus on DevOps & Agile methodologies

-

Increased focus on compliance & security

Level

-

High Implementation Costs

-

Complexity in integrating ALM solutions with existing enterprise applications

Level

-

Integration with DevSecOps

-

Low-Code & No-Code Development

Level

-

Managing Multi-Cloud & Hybrid Environments

-

Lack of consistent visibility

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising focus on DevOps & Agile methodologies

The growing emphasis on DevOps and Agile methodologies is transforming software development by encouraging quicker, more iterative, and collaborative development processes. The older development models had strict, sequential procedures that tended to result in delays, inefficiencies, and expensive rework. Agile methodologies brought iterative development cycles that allowed teams to deliver incremental updates and rapidly adapt to shifting requirements. DevOps further refined this approach by bridging the gap between development and IT operations through automation, continuous integration/continuous deployment (CI/CD), and real-time monitoring. According to digital.ai’s 14th annual State of Agile report, 95% of respondents confirmed that their organizations practice Agile development methods, with 61% using Agile for over three years. This shift highlights the growing preference for Agile due to its flexibility and efficiency. Studies indicate that integrating Agile and DevOps can significantly enhance business performance. Appinventiv reports that organizations adopting Agile DevOps practices have seen approximately 60% revenue growth, nearly 2.4 times higher than those growing at a rate of just over 20%. To support this transformation, businesses increasingly leverage application lifecycle management (ALM) solutions, which integrate Agile and DevOps capabilities for seamless collaboration, version control, automated testing, and deployment. These tools enable the management of intricate development pipelines while maintaining software quality, security, and compliance. With companies continuing to value speed, efficiency, and reliability, integrating Agile, DevOps, and ALM is becoming increasingly vital for propelling innovation and sustaining a competitive advantage.

Restraint: Complexity in integrating ALM solutions with existing enterprise applications

Integrating ALM tools with existing enterprise applications, legacy systems, and third-party products is challenging for organizations. Most businesses work with heterogeneous IT environments in which development, testing, and deployment tools might not be naturally compatible. Integrating data exchange, process automation, and real-time collaboration between these systems without any hassle calls for massive customization and API building. Integration with security and compliance frameworks introduces an additional level of complexity. Organizations need to account for possible disruptions within the transition process since misplaced integrations would result in inefficiencies in workflow, lack of visibility in data, and latency in software development cycles. Unless there is an integration strategy developed, organizations run the risk of inefficiencies, data silos, and augmented operational overhead, making it harder to reach the complete potential of ALM implementation. Additionally, legacy systems tend to be inflexible for contemporary ALM processes, necessitating more workarounds or phased rollouts, making the transition difficult. To overcome these issues, organizations must focus on interoperability, invest in API-based integrations, and ensure cross-functional teams work together well during the implementation process.

Opportunity:Adoption of low-code & no-code platforms

The rise of low-code and no-code platforms allows individuals with limited coding expertise to build applications using user-friendly interfaces and pre-built components. While this trend accelerates innovation, it also raises concerns regarding security, data integrity, and compliance. To mitigate these risks, ALM vendors can provide tailored governance and lifecycle management solutions specifically designed for low-code environments. By implementing strong governance frameworks, these platforms ensure that applications comply with company standards and regulatory requirements. ALM solutions facilitate the entire development lifecycle from design to deployment and ongoing maintenance by offering tools for monitoring, version control, and policy enforcement. This approach also mitigates risks linked to decentralized development and enhances the scalability and overall value of low-code and no-code initiatives. Additionally, ALM solutions help enterprises standardize workflows, improve collaboration across teams, and accelerate time-to-market for business applications. Low-code development efficiency can be maximized through automated and AI-powered process insights embedded in ALM platforms, as these tools continuously improve development practices while maintaining alignment with industry standards.

Challenge:Managing multi-cloud & hybrid environments

Organizations face considerable obstacles when they try to manage their multi-cloud and hybrid environments for the purpose of balancing application development flexibility while maintaining scalability and efficiency. Today's enterprises handle application deployment across on-premises facilities and various cloud environments that maintain separate interface systems and configuration patterns while having distinct security measures. The wide range of system diversity creates operational complexity, which results in strained policy implementation and inconsistent performance, along with fragmented integration throughout the application development life cycle. The extensive requirements of real-time monitoring, along with API management and different compliance policies and governance standards, create additional complexity for the current landscape. ALM solutions need to offer unified, flexible tools for managing multi-cloud complex environments because this enables operational effectiveness while enabling enhanced security with scalability features across multiple platforms. Enterprises achieve workflow improvement and risk identification along with resource optimization by deploying automated systems and AI analytics with policy-based orchestration. An effective ALM strategy enables organizations to future-proof their cloud ecosystems by supporting anticipated technological changes.

Application Lifecycle Management (ALM) Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Microsoft’s Azure DevOps streamlines the entire application lifecycle by integrating planning, coding, testing, and deployment in one platform. It enables agile project management, CI/CD automation, and collaboration across teams in cloud and hybrid environments. | It helps accelerate delivery cycles, improve traceability, enhance collaboration between development and operations, and integrate seamlessly with Microsoft tools like GitHub, Teams, and Azure. |

|

Atlassian’s Jira Software and Bitbucket enable agile teams to manage projects, track issues, and collaborate on code efficiently. Together, they provide visibility across sprints, automate workflows, and support continuous integration and delivery. | They enhance productivity through real-time collaboration, reduce development bottlenecks, ensure faster bug resolution, and offer scalable workflows adaptable to any team size or methodology. |

|

PTC’s Codebeamer ALM supports end-to-end lifecycle management for complex, regulated industries by linking requirements, risk, testing, and compliance processes on a single platform. | It ensures full traceability, simplifies compliance with standards like ISO 26262 and FDA, improves collaboration between software and hardware teams, and reduces development risks and time to market. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Application Lifecycle Management (ALM) market ecosystem comprises a mix of solution providers, service providers, and regulatory bodies that collectively enable end-to-end software lifecycle management. Solution providers such as PTC, Microsoft, Atlassian, Broadcom, IBM, SAP, and BMC develop tools that integrate planning, development, testing, and deployment. Service providers like HCLTech, SAP, Microsoft, IBM, and Opentext offer consulting, implementation, and managed services to help enterprises adopt ALM frameworks efficiently. Meanwhile, regulatory bodies including MeitY (India), the ICO (UK), PIPC (Japan), and SDAIA (Saudi Arabia) ensure compliance, data protection, and security standards within software development environments. Together, these entities form a cohesive ecosystem that drives agility, governance, and innovation in modern software delivery.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Application Lifecycle Management Market, By Offering

In the Application Lifecycle Management (ALM) market, the software segment holds the largest market size because enterprises increasingly rely on integrated platforms that combine project planning, version control, testing, and deployment in a single environment. These software solutions, offered by players like Microsoft, Atlassian, and PTC, enable seamless collaboration, automation, and visibility across development teams, making them essential for modern software-driven operations. On the other hand, the services segment is projected to record a higher CAGR as organizations seek expert assistance for ALM implementation, customization, and integration with DevOps and cloud environments. The growing need for managed and consulting services to optimize development workflows and ensure smooth adoption of advanced ALM tools is driving this segment’s faster growth.

REGION

North America is estimated to account for the largest market share during the forecast period

The Application Lifecycle Management (ALM) market in Asia-Pacific is witnessing strong growth fueled by the region’s rapid digital transformation and expanding IT infrastructure. The increasing reliance on software development outsourcing and the widespread adoption of agile and DevOps methodologies are enabling organizations to accelerate product delivery, enhance collaboration, and improve software quality. This shift is driving demand for integrated ALM solutions that support automation, scalability, and continuous innovation across industries.

Application Lifecycle Management (ALM) Market: COMPANY EVALUATION MATRIX

The Application Lifecycle Management (ALM) market framework highlights how different user groups engage with the market based on their roles, data needs, and strategic goals. Investors focus on macro trends like rising DevOps adoption, cloud migration, and AI-driven automation shaping long-term growth opportunities. CXOs emphasize strategic outcomes such as faster delivery cycles, enhanced compliance, and digital transformation through integrated ALM and DevOps platforms. Researchers analyze regional adoption, pricing benchmarks, and technology evolution to track how ALM tools are reshaping industries. Analysts concentrate on vendor benchmarking, deployment models, and revenue shifts toward cloud and AI-led solutions. Together, these stakeholders form a cohesive ecosystem that drives innovation, scalability, and strategic value across the ALM landscape.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 4.34 Billion |

| Revenue Forecast in 2029 | USD 6.58 Billion |

| Growth Rate | CAGR of 8.6% from 2024-2029 |

| Actual data | 2018–2029 |

| Base year | 2024 |

| Forecast period | 2025–2029 |

| Units considered | Value (USD) Million/Billion |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By Offering, Platform, Organization Size, Deployment Mode, Vertical, and Region |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

WHAT IS IN IT FOR YOU: Application Lifecycle Management (ALM) Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Service Provider (US) |

|

|

| Company Information | Detailed analysis and profiling of additional market players (up to 5) |

|

RECENT DEVELOPMENTS

- Decembr 2024 : Atlassian Corporation and AWS announced a multi-year strategic collaboration agreement (SCA) to expedite cloud transformation and deliver advanced AI and security capabilities to enterprise customers. The collaboration enables developers to use AWS services with Atlassian's Forge platform. Both companies will explore AWS innovations, including generative AI like Amazon Bedrock, for app development and end-user solutions.

- Decembr 2025 : OpenText partnered with Secure Code Warrior to integrate its dynamic learning platform into the OpenText Fortify application security product suite. This partnership will help developers improve their secure coding skills through real-time training, reducing risks, quickly identifying and resolving vulnerabilities, and ultimately building greater trust with customers.

- Decembr 2026 : PTC partnered with Microsoft and Volkswagen Group to develop a generative artificial intelligence (AI) copilot based on the PTC Codebeamer application lifecycle management (ALM) solution.

- September 2024 : Tricentis partnered with SAP to drive advanced integrations and AI enhancements, supporting the growing adoption of SAP S/4HANA Cloud. The partnership strengthened Tricentis' integration with SAP Cloud ALM, enhancing customer experiences by streamlining the application lifecycle with its test automation solution. Their combined capabilities offer a unified approach to managing the entire application lifecycle, ensuring improved quality and faster delivery of SAP applications.

- May 2024 : Siemens partnered with Microsoft to deliver AI-enhanced solutions for resilient product lifecycle management with Azure.

Table of Contents

Methodology

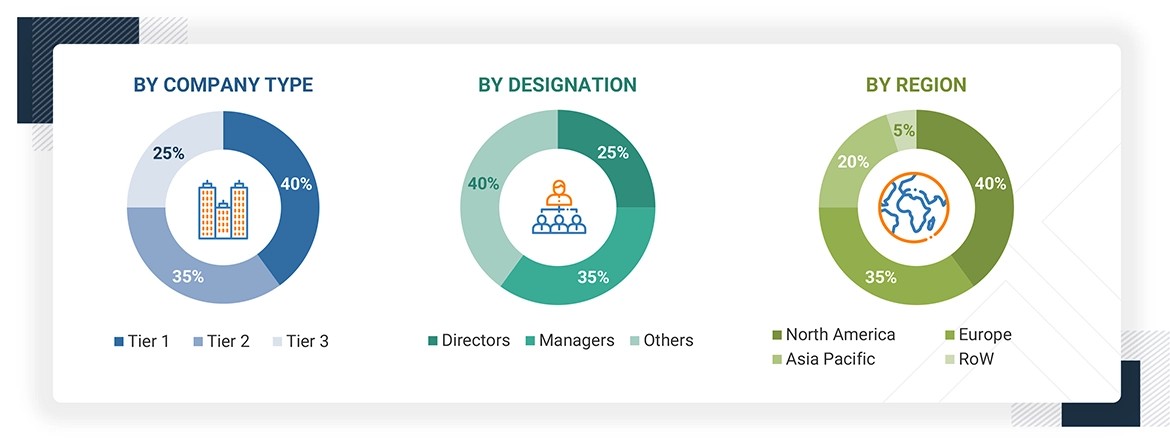

This research study involved extensive secondary sources, directories, and databases, such as Dun & Bradstreet (D&B) Hoovers and Bloomberg BusinessWeek, to identify and collect valuable information for a technical, market-oriented, and commercial study of the Application Lifecycle Management market. The primary sources have been mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the value chain of this market. In-depth interviews have been conducted with primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information.

Secondary Research

The market for companies offering Application Lifecycle Management solutions and services to different end users has been estimated and projected based on the secondary data made available through paid and unpaid sources and by analyzing their product portfolios in the ecosystem of the Application Lifecycle Management market. In the secondary research process, various sources such as Visual Studio Magazine ,IEEE Explore and Software Testing Magazine were referred to to identify and collect information on the market for this study. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles by recognized authors, directories, and databases. Secondary research has been mainly used to obtain essential information about the supply chain of the market, the total pool of key players, market classification, segmentation according to industry trends to the bottommost level, regional markets, and key developments from both market- and technology-oriented perspectives that primary sources have further validated.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related critical executives from Application Lifecycle Management solutions vendors, System Integrators, professional service providers, and industry associations; and key opinion leaders. Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped me understand various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using Application Lifecycle Management services, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of Application Lifecycle Management services which would impact the overall Application Lifecycle Management market.

Note: Others include sales managers, marketing managers, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

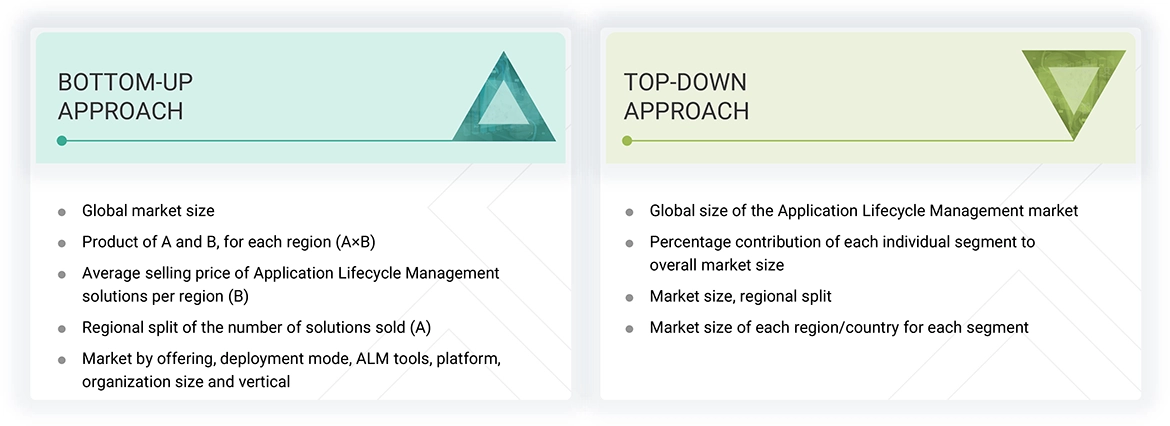

Multiple approaches were adopted to estimate and forecast the size of the Application Lifecycle Management market. The first approach involves estimating market size by summing up the revenue generated by companies through the sale of Application Lifecycle Management solutions and services.

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Application Lifecycle Management market. These methods were extensively used to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

- After arriving at the overall market size, the Application Lifecycle Management market was divided into several segments and subsegments.

Application Lifecycle Management Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size, the Application Lifecycle Management market was divided into several segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

According to PTC, Application Lifecycle Management (ALM) is the strategic process of managing a software or product lifecycle from initial idea through design, development, testing, deployment, and end of life. ALM enables software engineering teams to efficiently collaborate on projects using proven Agile practices and trusted, up-to-date information. It is a foundational discipline for successful products, teams, and companies.

Stakeholders

- Infrastructure Vendors

- Software Developers

- Project Managers

- IT Operations Teams

- Quality Assurance (QA) Teams

- Enterprise Architects

- Business Analysts

- Regulatory and Compliance Teams

- End Users

Report Objectives

- To determine, segment, and forecast the Application Lifecycle Management market based on offering, platform , deployment, organization size, vertical, and region in terms of value.

- To forecast the segment’s size with respect to five regions: North America, Europe, Asia Pacific (Asia Pacific), Latin America, and the Middle East & Africa (Middle East & Africa)

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the market

- To study the complete value chain and related industry segments and perform a value chain analysis

- To strategically analyze macro and micro-markets concerning individual growth trends, prospects, and contributions to the market

- To analyze industry trends, regulatory landscape, and patents & innovations

- To analyze opportunities for stakeholders by identifying the high-growth segments

- To track and analyze competitive developments, such as agreements, partnerships, collaborations, and R&D activities

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Analysis for additional countries (up to five)

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Application Lifecycle Management Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Application Lifecycle Management Market