Diesel Engines Market by Speed (Low, Medium, High), Power Rating (Below 0.5 MW, 0.5-1.0 MW, 1.1-2.0 MW, 2.1-5.0 MW, Above 5.0 MW), End User (Power Generation, Marine, Locomotive, Mining, Oil & Gas, Construction) & Region - Global Forecast to 2028

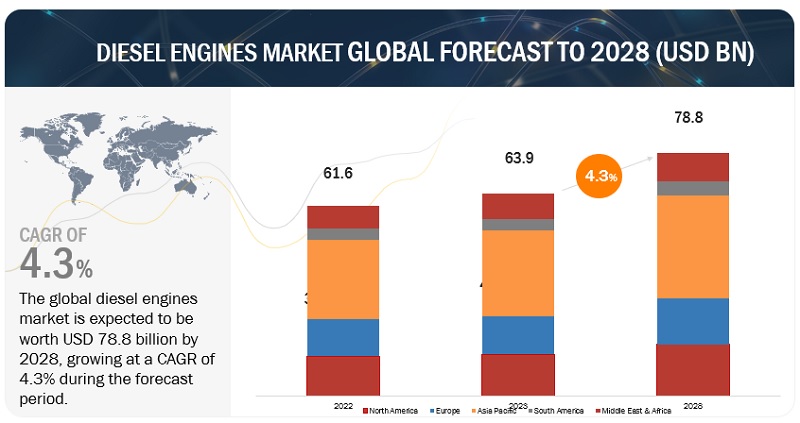

[277 Pages Report] The global Diesel Engines Market size was valued at USD 63.9 billion in 2023 and to reach USD 78.8 billion by 2028, growing at a compound annual growth rate (CAGR) of 4.3% from 2023 to 2028. Boost in production and manufacturing demand in the medium to long term will generate demand for continuous and reliable power supply. However, the loss of consistent power supply would result in plant downtime and hence heavy losses. The performance of power generation and oil & gas plus mining industries is expected to drive the growth of the diesel engine market.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Diesel Engines Market Dynamics

Driver: Increasing urbanization and industrialization

According to the UN, as of 2022, 50% of the global population lives in urban areas and is projected to increase to 68% by 2050. North America, South America, and Europe remain the most urbanized regions, while rapid urbanization is expected in Africa and Asia Pacific during the forecast period. Urbanization requires the development of basic support infrastructure and power T&D networks. The rising demand for modern infrastructure in urban areas has increased activity in the construction, chemical & petrochemical, food & beverage, and utilities sectors. Power reliability is one of the key growth factors for the industries, which can be achieved using diesel engines as a primary or backup source of power generation.

Restraint: High fuel costs and operation & maintenance costs

Diesel fuel is costly compared to alternatives such as gasoline and other fuels, especially for longer-duration operations. Preventive maintenance requires regular servicing and refilling of the lubrication, cooling, fueling systems, starting batteries, and fuel filters. These costs add up to the total operating and maintenance costs of diesel engines and are higher than the operating cost of renewable technologies. Moreover, factors such as extreme temperatures, weather, and saltwater (in marine applications) can increase the frequency of maintenance activities. On the contrary, new emerging technologies, such as battery energy systems for backup power solutions, have no fuel costs and are easy to maintain and operate. With the growing competition from these emerging technologies, high fuel costs and operation and maintenance costs of diesel engines can be major restraints for market growth.

Opportunity: Growth in hybrid power generation in rural and remote locations

Hybrid power generation can meet the power requirement of remote areas or off-grid locations, such as remote industrial units, telecom towers, small villages and islands. Most off-grid sites are located in developing regions such as Africa and Asia Pacific, where electrification is not absolute. However, the growing power demand can be met by deploying hybrid power systems designed according to the individual power requirements of residential and non-residential customers. Diesel generators are combined with renewable sources (wind, solar, or both) by the hybrid power systems to ensure a 24*7 power supply to off-grid sites with fewer interruptions. For example, the wind-diesel system generates electricity using wind turbines and diesel generators. This system helps reduce fuel consumption and operating costs. Therefore, hybrid power generation is expected to gain momentum during the forecast period for an adequate and reliable power supply.

Challenge: Rising demand for natural gas in power generation applications

The advancement of oil & gas drilling and extraction technologies in the recent past has made shale gas more economical. This advancement has also resulted in abundant natural gas production, resulting in a sharp downturn in the natural gas prices in the US market and price corrections in the global market. The low natural gas prices compared to diesel prices have encouraged the increased use of natural gas engines for electricity generation. Utilities have since embraced natural gas-fired power plants as the cheapest sources of large-scale electricity generation. Most of capacity growth would take place at the expense of coal and nuclear power generation, whose share is expected to reduce.

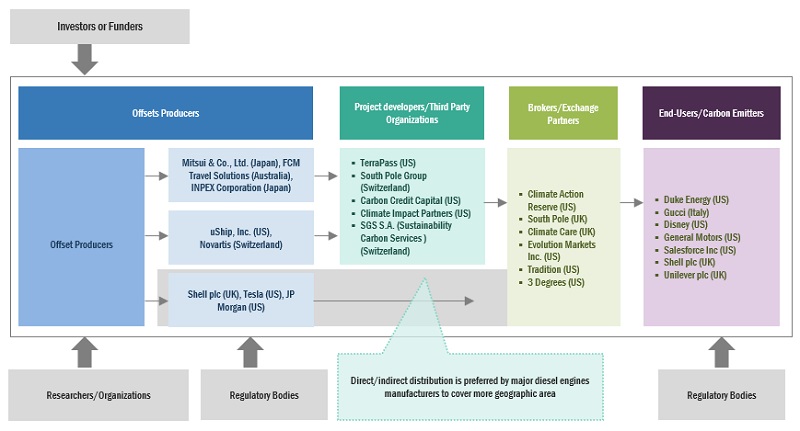

Diesel Engines Ecosystem

Prominent companies in this diesel engine market include well-established raw material providers/suppliers, component manufacturers, diesel engine manufacturers/assemblers, distributors, end users, and post-sales services. These companies have been operating in the market for several years and possess state-of-the-art technologies, substabtial R&D investments, a diversified product portfolio, and strong global sales and marketing networks. Caterpillar (US), Cummins Inc. (US), Volvo Penta (Sweden), Hyundai Heavy Industries (South Korea), and MAN Energy Solutions (Germany) are some of the prominent companies in this market.

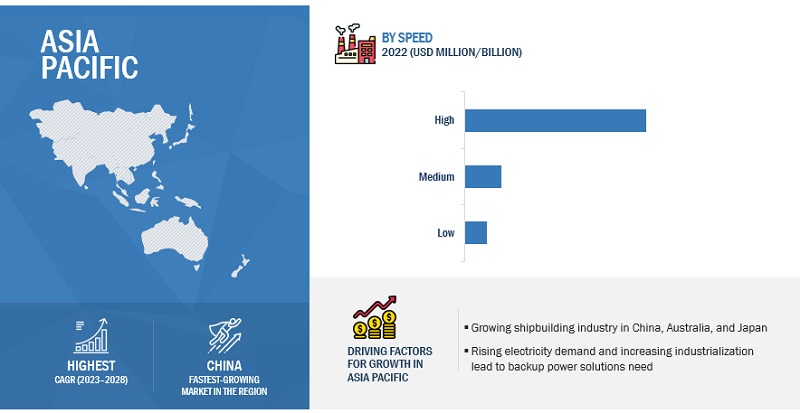

By speeds, high-speed engines followed by medium-speed engines are expected to be the fastest-growing market segment during the forecast period.

This report segments the diesel engines market based on speed into low, medium, and high. 720–1,200 rpm is considered under the medium-speed diesel engines. High speed is bifurcated into two segments, 1200–1800 rpm and above 1800 rpm. High-speed diesel engines have wide applications in marines, power generation, and other sectors. Medium- and slow-speed engines are known for fuel flexibility and can operate on low-grade fuels. Medium-speed engines are common on smaller ships and power plants, driving electrical generators and propellers. The medium-speed marine diesel engine is usually used on amphibious warfare ships like landing craft utility (LCU), main auxiliary engineering ships, and Tugboats.

By End User, the power generation segment is expected to be the largest during the forecast period

The diesel engine market has been categorized based on end-users into power generation, marines, locomotives, mining, oil & gas, construction, and others. Diesel engines are used for emergency standby, prime/continuous, and peak shaving operations across the end users as needed. Increasing demand for uninterrupted power supply to support manufacturing and processing activities is expected to aid the demand growth for diesel engines for power generation applications.

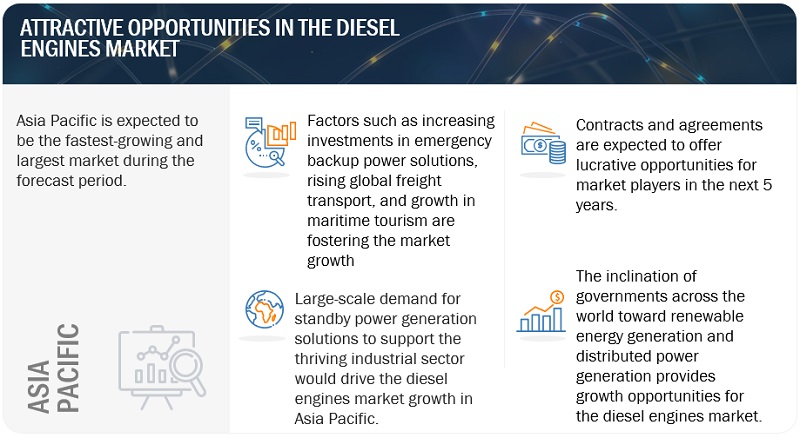

“Asia Pacific is projected to be the fastest-growing region during the forecast period”

Asia Pacific is expected to fastest growing region in the diesel engines market between 2023–2028, followed by North America and Europe. The rising number of boats, crafts, and vessels will contribute to the growth of propulsion systems and small marine engines in the Asia Pacific region. The demand for small marine engines in the defense sector is also expected to increase because of the ongoing territorial conflicts among countries such as China, the Philippines, North Korea, Japan, India, Vietnam, Pakistan, and Afghanistan, thereby driving the diesel engine market in the region for marine applications. Hence, these factors are expected to fuel the growth of the diesel market in the Asia Pacific region.

Key Market Players

Global players dominate the market. The major players in the diesel engines market are Caterpillar (US), Cummins Inc. (US), Volvo Penta (Sweden), Hyundai Heavy Industries (South Korea), and MAN Energy Solutions (Germany). Strategies such as product launches, agreements, and contracts are followed by these companies to capture a significant diesel engine market share.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2021–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

Speed, Power Rating, End-User, and Region |

|

Geographies covered |

Asia Pacific, North America, Europe, South America, Middle East & Africa |

|

Companies covered |

Caterpillar (US), Cummins Inc. (US), Volvo Penta (Sweden), Hyundai Heavy Industries (South Korea), MAN Energy Solutions (Germany), Doosan Infracore (South Korea), Mitsubishi Heavy Industries(Japan), Yanmar Holdings (Japan), FPT Industrial (Italy), IHI Power Systems (Japan), Wartsila (Finland), Kohler (US), Kubota (Japan), Rolls Royce Holdings (UK), Mahindra Powertrain (India), Guangzhou Diesel Engine Factory (China), Daihatsu Diesel Mfg. (Japan), CNPC Jichai Power Company Limited (China), The Liebherr Group (Switzerland), Anglo Belgian Corporation (Belgium) |

This research report categorizes the diesel engine market by speed, power rating, end user, and region.

On the basis of speed, the diesel engines market has been segmented as follows:

- Low (Up to 720 rpm)

- Medium (720–1200 rpm)

- High (1200–1800 rpm, Above 1800 rpm)

On the basis of power rating, the diesel engine market has been segmented as follows:

- Below 0.5 MW

- 0.5–1.0 MW

- 1.1–2.0 MW

- 2.1–5.0 MW

- Above 5.0 MW

On the basis of end user, the diesel market has been segmented as follows:

- Power generation

- Marines

- Locomotives

- Oil & Gas

- Mining

- Construction

- Others

On the basis of region, the diesel market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- South America

- Middle East & Africa

Recent Developments

- In March 2023, Caterpillar announced the development of the CAT C13D, a new 13-liter diesel engine platform designed to achieve best-in-class power density, torque, and fuel efficiency for optimizing the performance of heavy-duty off-highway applications. The C13D would meet the emissions standards of higher regulated markets, such as EU stage v, US EPA tier 4 final, China non-road IV, Korea stage V, and Japan 2014, with models available for lesser regulated markets.

- In June 2022, WinGD and Hyundai Heavy Industries’ Engine Machinery Division (EMD) collaborated on delivering the first WinGD engine capable of running on ammonia, providing a vital step in shipping’s progress toward decarbonization.

- In February 2021, Cummins provided Isuzu with midrange B6.7 diesel platforms for medium-size trucks to meet global customer needs. Cummins and Isuzu would closely work together to integrate the engine with Isuzu’s chassis and to meet Japan’s emission regulations.

Frequently Asked Questions (FAQ):

What is the current size of the diesel engines market?

The current market size of the diesel engines market is USD 61.6 billion in 2022.

What are the major drivers for the diesel engines market?

The boost in demand for reliable and uninterrupted power supply is the major driving factor for the diesel engine market.

Which is the largest region during the forecasted diesel engines market period?

Asia Pacific is expected to dominate the diesel engine market between 2023–2028. The increase in defense spending and the rise in domestic ship production are key factors contributing to the growth of the diesel engines market in the region.

Which is the largest segment in the diesel engines market during the forecasted period?

High-speed engines are expected to be the largest market during the forecast period. High-speed engines have vast applications in power generation and the marine industry. Hence it is the largest segment in the diesel engines market.

Which is the fastest segment by the end user during the forecasted period in the diesel engines market?

Due to increasing industrialization and urbanization, power generation is expected to be the fastest market during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising demand for reliable and uninterrupted power- Growing maritime tourism and international marine freight transportation- Increasing urbanization and industrializationRESTRAINTS- High fuel and operation & maintenance costs- Competition from alternative energy sourcesOPPORTUNITIES- Growth in hybrid power generation in rural and remote locationsCHALLENGES- Production of higher levels of NOx and particulate matter emissions- Rising demand for natural gas in power generation applications

-

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSREVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN DIESEL ENGINES MARKET

-

5.4 TECHNOLOGY ANALYSISDIESEL ENGINE TECHNOLOGY

-

5.5 PRICING ANALYSISAVERAGE SELLING PRICE OF DIESEL ENGINES

- 5.6 KEY CONFERENCES AND EVENTS, 2022–2024

-

5.7 VALUE CHAIN ANALYSISRAW MATERIAL PROVIDERS/SUPPLIERSCOMPONENT MANUFACTURERSDIESEL ENGINE MANUFACTURERS/ASSEMBLERSDISTRIBUTORSEND USERSPOST-SALES SERVICE PROVIDERS

- 5.8 MARKET MAP

-

5.9 TRADE ANALYSISREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSCODES AND REGULATIONS RELATED TO DIESEL ENGINES

-

5.10 PATENT ANALYSIS

-

5.11 PORTER’S FIVE FORCES ANALYSISTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF NEW ENTRANTSINTENSITY OF COMPETITIVE RIVALRY

-

5.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESS

- 5.13 BUYING CRITERIA

-

5.14 CASE STUDY ANALYSISUSE OF NEW TECHNOLOGY TO HELP ACHIEVE NET ZERO AMBITIONS- Problem statement- SolutionDIESEL-POWERED ELECTRICITY GENERATION FOR EMERGENCY POWER SUPPLY- Isuzu motors limited- Summa health

- 6.1 INTRODUCTION

-

6.2 BELOW 0.5 MWRISING POPULATION AND DEMAND FOR RESIDENTIAL BACKUP SOLUTIONS

-

6.3 0.5–1 MWGROWING COMMERCIAL REAL ESTATE INVESTMENTS

-

6.4 1.1–2 MWINCREASING DATA CENTER INVESTMENTS

-

6.5 2.1–5.0 MWRISING INDUSTRIAL INVESTMENTS AND UTILITY RELIABILITY INVESTMENTS

-

6.6 ABOVE 5.0 MWSURGING DEMAND FROM UTILITY-SCALE DIESEL POWER GENERATION AND LARGE INDUSTRIAL PLANTS

- 7.1 INTRODUCTION

-

7.2 LOW-SPEEDRISING DEMAND FOR MARINE APPLICATIONS

-

7.3 MEDIUM-SPEEDUPGRADED VERSIONS AND NEW DESIGNS

-

7.4 HIGH-SPEEDINCREASING DEMAND FOR TUGBOATS

- 8.1 INTRODUCTION

-

8.2 POWER GENERATIONINCREASED REQUIREMENT FOR RELIABLE AND CONTINUOUS POWER SUPPLY

-

8.3 MARINESRISING DEMAND FOR MARITIME TRANSPORT

-

8.4 LOCOMOTIVESONGOING RAILWAY ELECTRIFICATION PROJECTS TO HINDER GROWTH

-

8.5 MININGGROWING MINING OPERATIONS

-

8.6 OIL & GASINCREASING METAL PRICES PROMPT COMPANIES TO ADOPT BETTER STRATEGIES

-

8.7 CONSTRUCTIONGROWING OPPORTUNITIES IN RESIDENTIAL AND NON-RESIDENTIAL SECTORS

- 8.8 OTHERS

- 9.1 INTRODUCTION

-

9.2 ASIA PACIFICRECESSION IMPACTBY SPEEDBY MEDIUM SPEED END USERBY POWER RATINGBY END USERBY COUNTRY- China- India- Australia- Rest of Asia Pacific

-

9.3 EUROPERECESSION IMPACTBY SPEEDBY MEDIUM SPEED END USERBY POWER RATINGBY END USERBY COUNTRY- Germany- UK- France- Italy- Rest of Europe

-

9.4 SOUTH AMERICARECESSION IMPACTBY SPEEDBY MEDIUM SPEED END USERBY POWER RATINGBY END USERBY COUNTRY- Brazil- Argentina- Chile- Rest of South America

-

9.5 NORTH AMERICARECESSION IMPACTBY SPEEDBY POWER RATINGBY END USERBY MEDIUM SPEED END USERBY COUNTRY- US- Canada- Mexico

-

9.6 MIDDLE EAST & AFRICARECESSION IMPACTBY SPEEDBY POWER RATINGBY END USERBY MEDIUM SPEED END USERBY COUNTRY- Saudi Arabia- UAE- Algeria- Nigeria- Kuwait- Iran- Rest of Middle East & Africa

- 10.1 INTRODUCTION

- 10.2 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS

- 10.3 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

-

10.4 COMPANY EVALUATION QUADRANTSTARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

-

10.5 STARTUP/SME EVALUATION QUADRANT, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 10.6 COMPETITIVE BENCHMARKING

- 10.7 DIESEL ENGINES MARKET: COMPANY FOOTPRINT

- 10.8 COMPETITIVE SCENARIO

-

11.1 KEY PLAYERSCATERPILLAR- Business overview- Products offered.- Recent developments- MnM viewCUMMINS- Business overview- Products offered.- Recent developments- MnM viewVOLVO PENTA- Business overview- Products offered.- Recent developments- MnM viewMAN ENERGY SOLUTIONS- Business overview- Products offered.- Recent developments- MnM viewHYUNDAI HEAVY INDUSTRIES CO., LTD.- Business overview- Products offered- Recent developments- MnM viewWARTSILA- Business overview- Products offered.- Recent developmentsMITSUBISHI HEAVY INDUSTRIES ENGINE & TURBOCHARGERS(MHIET)- Business overview- Products offered- Recent developmentsROLLS-ROYCE HOLDINGS- Business overview- Products offered- Recent developmentsDOOSAN INFRACORE- Business overview- Products offered- Recent developmentsYANMAR HOLDINGS CO., LTD.- Business overview- Products offered- Recent developmentsIHI POWER SYSTEMS CO., LTD.- Business overview- Products offeredKOHLER- Business overview- Products offered- Recent developmentsCHINA NATIONAL PETROLEUM CORPORATION JICHAI POWER COMPANY LIMITED- Business overview- Products offeredFPT INDUSTRIAL- Business overview- Products offered- Recent developmentsDAIHATSU DIESEL MFG.- Business overview- Products offered- Recent developments

-

11.2 OTHER PLAYERSANGLO BELGIAN CORPORATIONKUBOTA ENGINE AMERICA CORPORATIONTHE LIEBHERR GROUPGUANGZHOU DIESEL ENGINE FACTORY CO. LTDMAHINDRA POWERTRAIN

- 12.1 INSIGHTS OF INDUSTRY EXPERTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS

- TABLE 1 DIESEL ENGINES MARKET, BY SPEED: INCLUSIONS AND EXCLUSIONS

- TABLE 2 MARKET, BY POWER RATING: INCLUSIONS AND EXCLUSIONS

- TABLE 3 MARKET, BY END USER: INCLUSIONS AND EXCLUSIONS

- TABLE 4 MARKET SNAPSHOT

- TABLE 5 CALIFORNIA EMISSION STANDARDS FOR HEAVY-DUTY OTTO CYCLE ENGINES, FTP, G/BHP·HR

- TABLE 6 TIER 4 EMISSION STANDARDS: ENGINES ABOVE 560 KW, G/KWH

- TABLE 7 AVERAGE SELLING PRICE OF DIESEL ENGINES, 2022

- TABLE 8 AVERAGE SELLING PRICE OF DIESEL ENGINES OFFERED, BY KEY PLAYERS (2022)

- TABLE 9 DIESEL ENGINES MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 10 MARKET MAP: DIESEL ENGINE MARKET

- TABLE 11 DIESEL ENGINE MARKET: ROLE IN ECOSYSTEM

- TABLE 12 COUNTRY-WISE IMPORT DATA FOR HARMONIZED SYSTEM CODE: 840810 COMPRESSION-IGNITION INTERNAL COMBUSTION PISTON ENGINES (DIESEL OR SEMI-DIESEL) FOR MARINE PROPULSION (USD THOUSAND)

- TABLE 13 COUNTRY-WISE EXPORT DATA FOR HARMONIZED SYSTEM CODE: 840810 COMPRESSION-IGNITION INTERNAL COMBUSTION PISTON ENGINES (DIESEL OR SEMI-DIESEL) FOR MARINE PROPULSION (USD THOUSAND)

- TABLE 14 COUNTRY-WISE IMPORT DATA FOR HARMONIZED SYSTEM CODE:840890 COMPRESSION-IGNITION INTERNAL COMBUSTION PISTON ENGINE "DIESEL OR SEMI-DIESEL ENGINE" (EXCLUDING ENGINES FOR MARINE PROPULSION AND ENGINES FOR VEHICLES OF CHAPTER 87) (USD THOUSAND)

- TABLE 15 COUNTRY-WISE EXPORT DATA FOR HARMONIZED SYSTEM CODE: 840890 COMPRESSION-IGNITION INTERNAL COMBUSTION PISTON ENGINE "DIESEL OR SEMI-DIESEL ENGINE" (EXCLUDING ENGINES FOR MARINE PROPULSION AND ENGINES FOR VEHICLES OF CHAPTER 87) (USD THOUSAND)

- TABLE 16 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 REST OF WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 MARKET: CODES AND REGULATIONS

- TABLE 21 DIESEL ENGINE: INNOVATIONS AND PATENT REGISTRATIONS, 2019–2022

- TABLE 22 DIESEL ENGINE MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 23 INFLUENCE OF KEY STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 24 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 25 GLOBAL DIESEL ENGINES MARKET, BY POWER RATING, 2021–2028 (USD MILLION)

- TABLE 26 GLOBAL MARKET, BY POWER RATING, 2021–2028 (UNITS)

- TABLE 27 BELOW 0.5 MW: MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 28 BELOW 0.5 MW: MARKET, BY REGION, 2021–2028 (UNITS)

- TABLE 29 0.5–1 MW: MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 30 0.5–1 MW: MARKET, BY REGION, 2021–2028 (UNITS)

- TABLE 31 1.1–2.0 MW: MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 32 1.1–2.0 MW: MARKET, BY REGION, 2021–2028 (UNITS)

- TABLE 33 2.1–5.0 MW: MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 34 2.1–5.0 MW: MARKET, BY REGION, 2021–2028 (UNITS)

- TABLE 35 ABOVE 5.0 MW: GLOBAL MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 36 ABOVE 5.0 MW: GLOBAL MARKET, BY REGION, 2021–2028 (UNITS)

- TABLE 37 DIESEL ENGINE MARKET, BY SPEED, 2021–2028 (USD MILLION)

- TABLE 38 DIESEL ENGINES MARKET, BY SPEED, 2021–2028 (UNITS)

- TABLE 39 HIGH SPEED: ENGINES MARKET, BY SPEED, 2021–2028 (USD MILLION)

- TABLE 40 HIGH SPEED: ENGINES MARKET, BY SPEED, 2021–2028 (UNITS)

- TABLE 41 LOW-SPEED: ENGINES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 42 LOW-SPEED: ENGINES MARKET, BY REGION, 2021–2028 (UNITS)

- TABLE 43 MEDIUM-SPEED: ENGINES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 44 MEDIUM-SPEED: ENGINES MARKET, BY REGION, 2021–2028 (UNITS)

- TABLE 45 MEDIUM-SPEED: ENGINES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 46 MEDIUM-SPEED: ENGINES MARKET, BY END USER, 2021–2028 (UNITS)

- TABLE 47 HIGH-SPEED: ENGINES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 48 HIGH-SPEED: ENGINES MARKET, BY REGION, 2021–2028 (UNITS)

- TABLE 49 DIESEL ENGINE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 50 DIESEL ENGINES MARKET, BY END USER, 2021–2028 (UNITS)

- TABLE 51 POWER GENERATION: ENGINES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 52 POWER GENERATION: ENGINES MARKET, BY REGION, 2021–2028 (UNITS)

- TABLE 53 MARINES: ENGINES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 54 MARINES: ENGINES MARKET, BY REGION, 2021–2028 (UNITS)

- TABLE 55 LOCOMOTIVES: GLOBAL ENGINES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 56 LOCOMOTIVES: GLOBAL ENGINES MARKET, BY REGION, 2021–2028 (UNITS)

- TABLE 57 MINING: DIESEL ENGINE MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 58 MINING: DIESEL ENGINE MARKET, BY REGION, 2021–2028 (UNITS)

- TABLE 59 OIL & GAS: DIESEL ENGINE MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 60 OIL & GAS: DIESEL ENGINE MARKET, BY REGION, 2021–2028 (UNITS)

- TABLE 61 CONSTRUCTION: ENGINES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 62 CONSTRUCTION: ENGINES MARKET, BY REGION, 2021–2028 (UNITS)

- TABLE 63 OTHERS: MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 64 OTHERS: MARKET, BY REGION, 2021–2028 (UNITS)

- TABLE 65 DIESEL ENGINE MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 66 DIESEL ENGINES MARKET, BY REGION, 2021–2028 (UNITS)

- TABLE 67 ASIA PACIFIC: DIESEL ENGINES MARKET, BY SPEED, 2021–2028 (USD MILLION)

- TABLE 68 ASIA PACIFIC: MARKET, BY SPEED, 2021–2028 (UNITS)

- TABLE 69 ASIA PACIFIC: MARKET, BY HIGH SPEED, 2021–2028 (USD MILLION)

- TABLE 70 ASIA PACIFIC: MARKET, BY HIGH SPEED, 2021–2028 (UNITS)

- TABLE 71 ASIA PACIFIC: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (USD MILLION)

- TABLE 72 ASIA PACIFIC: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (UNITS)

- TABLE 73 ASIA PACIFIC: MARKET, BY POWER RATING, 2021–2028 (USD MILLION)

- TABLE 74 ASIA PACIFIC: MARKET, BY POWER RATING, 2021–2028 (UNITS)

- TABLE 75 ASIA PACIFIC: MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 76 ASIA PACIFIC: MARKET, BY END USER, 2021–2028 (UNITS)

- TABLE 77 ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 78 ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2028 (UNITS)

- TABLE 79 CHINA: DIESEL ENGINES MARKET, BY SPEED, 2021–2028 (USD MILLION)

- TABLE 80 CHINA: MARKET, BY SPEED, 2021–2028 (UNITS)

- TABLE 81 CHINA: MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 82 CHINA: MARKET, BY END USER, 2021–2028 (UNITS)

- TABLE 83 CHINA: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (USD MILLION)

- TABLE 84 CHINA: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (UNITS)

- TABLE 85 INDIA: DIESEL ENGINE MARKET, BY SPEED, 2021–2028 (USD MILLION)

- TABLE 86 INDIA: MARKET, BY SPEED, 2021–2028 (UNITS)

- TABLE 87 INDIA: MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 88 INDIA: MARKET, BY END USER, 2021–2028 (UNITS)

- TABLE 89 INDIA: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (USD MILLION)

- TABLE 90 INDIA: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (UNITS)

- TABLE 91 AUSTRALIA: DIESEL ENGINES MARKET, BY SPEED, 2021–2028 (USD MILLION)

- TABLE 92 AUSTRALIA: MARKET, BY SPEED, 2021–2028 (UNITS)

- TABLE 93 AUSTRALIA: MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 94 AUSTRALIA: MARKET, BY END USER, 2021–2028 (UNITS)

- TABLE 95 AUSTRALIA: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (USD MILLION)

- TABLE 96 AUSTRALIA: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (UNITS)

- TABLE 97 REST OF ASIA PACIFIC: MARKET, BY SPEED, 2021–2028 (USD MILLION)

- TABLE 98 REST OF ASIA PACIFIC: MARKET, BY SPEED, 2021–2028 (UNITS)

- TABLE 99 REST OF ASIA PACIFIC: MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 100 REST OF ASIA PACIFIC: MARKET, BY END USER, 2021–2028 (UNITS)

- TABLE 101 REST OF ASIA PACIFIC: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (USD MILLION)

- TABLE 102 REST OF ASIA PACIFIC: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (UNITS)

- TABLE 103 EUROPE: DIESEL ENGINES MARKET, BY SPEED, 2021–2028 (USD MILLION)

- TABLE 104 EUROPE: MARKET, BY SPEED, 2021–2028 (UNITS)

- TABLE 105 EUROPE: MARKET, BY HIGH SPEED, 2021–2028 (USD MILLION)

- TABLE 106 EUROPE: MARKET, BY HIGH SPEED, 2021–2028 (UNITS)

- TABLE 107 EUROPE: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (USD MILLION)

- TABLE 108 EUROPE: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (UNITS)

- TABLE 109 EUROPE: MARKET, BY POWER RATING, 2021–2028 (USD MILLION)

- TABLE 110 EUROPE: MARKET, BY POWER RATING, 2021–2028 (UNITS)

- TABLE 111 EUROPE: MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 112 EUROPE: MARKET, BY END USER, 2021–2028 (UNITS)

- TABLE 113 EUROPE: MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 114 EUROPE: MARKET, BY COUNTRY, 2021–2028 (UNITS)

- TABLE 115 GERMANY: DIESEL ENGINE MARKET, BY SPEED, 2021–2028 (USD MILLION)

- TABLE 116 GERMANY: MARKET, BY SPEED, 2021–2028 (UNITS)

- TABLE 117 GERMANY: MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 118 GERMANY: MARKET, BY END USER, 2021–2028 (UNITS)

- TABLE 119 GERMANY: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (USD MILLION)

- TABLE 120 GERMANY: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (UNITS)

- TABLE 121 UK: DIESEL ENGINES MARKET, BY SPEED, 2021–2028 (USD MILLION)

- TABLE 122 UK: MARKET, BY SPEED, 2021–2028 (UNITS)

- TABLE 123 UK: MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 124 UK: MARKET, BY END USER, 2021–2028 (UNITS)

- TABLE 125 UK: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (USD MILLION)

- TABLE 126 UK: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (UNITS)

- TABLE 127 FRANCE: DIESEL ENGINE MARKET, BY SPEED, 2021–2028 (USD MILLION)

- TABLE 128 FRANCE: MARKET, BY SPEED, 2021–2028 (UNITS)

- TABLE 129 FRANCE: MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 130 FRANCE: MARKET, BY END USER, 2021–2028 (UNITS)

- TABLE 131 FRANCE: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (USD MILLION)

- TABLE 132 FRANCE: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (UNITS)

- TABLE 133 ITALY: DIESEL ENGINES MARKET, BY SPEED, 2021–2028 (USD MILLION)

- TABLE 134 ITALY: MARKET, BY SPEED, 2021–2028 (UNITS)

- TABLE 135 ITALY: MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 136 ITALY: MARKET, BY END USER, 2021–2028 (UNITS)

- TABLE 137 ITALY: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (USD MILLION)

- TABLE 138 ITALY: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (UNITS)

- TABLE 139 REST OF EUROPE: MARKET, BY SPEED, 2021–2028 (USD MILLION)

- TABLE 140 REST OF EUROPE: MARKET, BY SPEED, 2021–2028 (UNITS)

- TABLE 141 REST OF EUROPE: MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 142 REST OF EUROPE: MARKET, BY END USER, 2021–2028 (UNITS)

- TABLE 143 REST OF EUROPE: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (USD MILLION)

- TABLE 144 REST OF EUROPE: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (UNITS)

- TABLE 145 SOUTH AMERICA: DIESEL ENGINES MARKET, BY SPEED, 2021–2028 (USD MILLION)

- TABLE 146 SOUTH AMERICA: MARKET, BY SPEED, 2021–2028 (UNITS)

- TABLE 147 SOUTH AMERICA: MARKET, BY HIGH SPEED, 2021–2028 (USD MILLION)

- TABLE 148 SOUTH AMERICA: MARKET, BY HIGH SPEED, 2021–2028 (UNITS)

- TABLE 149 SOUTH AMERICA: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (USD MILLION)

- TABLE 150 SOUTH AMERICA: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (UNITS)

- TABLE 151 SOUTH AMERICA: MARKET, BY POWER RATING, 2021–2028 (USD MILLION)

- TABLE 152 SOUTH AMERICA: MARKET, BY POWER RATING, 2021–2028 (UNITS)

- TABLE 153 SOUTH AMERICA: MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 154 SOUTH AMERICA: MARKET, BY END USER, 2021–2028 (UNITS)

- TABLE 155 SOUTH AMERICA: MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 156 SOUTH AMERICA: MARKET, BY COUNTRY, 2021–2028 (UNITS)

- TABLE 157 BRAZIL: DIESEL ENGINES MARKET, BY SPEED, 2021–2028 (USD MILLION)

- TABLE 158 BRAZIL: MARKET, BY SPEED, 2021–2028 (UNITS)

- TABLE 159 BRAZIL: MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 160 BRAZIL: MARKET, BY END USER, 2021–2028 (UNITS)

- TABLE 161 BRAZIL: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (USD MILLION)

- TABLE 162 BRAZIL: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (UNITS)

- TABLE 163 ARGENTINA: DIESEL ENGINE MARKET, BY SPEED, 2021–2028 (USD MILLION)

- TABLE 164 ARGENTINA: MARKET, BY SPEED, 2021–2028 (UNITS)

- TABLE 165 ARGENTINA: MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 166 ARGENTINA: MARKET, BY END USER, 2021–2028 (UNITS)

- TABLE 167 ARGENTINA: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (USD MILLION)

- TABLE 168 ARGENTINA: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (UNITS)

- TABLE 169 CHILE: DIESEL ENGINES MARKET, BY SPEED, 2021–2028 (USD MILLION)

- TABLE 170 CHILE: MARKET, BY SPEED, 2021–2028 (UNITS)

- TABLE 171 CHILE: MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 172 CHILE: MARKET, BY END USER, 2021–2028 (UNITS)

- TABLE 173 CHILE: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (USD MILLION)

- TABLE 174 CHILE: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (UNITS)

- TABLE 175 REST OF SOUTH AMERICA: MARKET, BY SPEED, 2021–2028 (USD MILLION)

- TABLE 176 REST OF SOUTH AMERICA: MARKET, BY SPEED, 2021–2028 (UNITS)

- TABLE 177 REST OF SOUTH AMERICA: MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 178 REST OF SOUTH AMERICA: MARKET, BY END USER, 2021–2028 (UNITS)

- TABLE 179 REST OF SOUTH AMERICA: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (USD MILLION)

- TABLE 180 REST OF SOUTH AMERICA: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (UNITS)

- TABLE 181 NORTH AMERICA: DIESEL ENGINES MARKET, BY SPEED, 2021–2028 (USD MILLION)

- TABLE 182 NORTH AMERICA: MARKET, BY SPEED, 2021–2028 (UNITS)

- TABLE 183 NORTH AMERICA: MARKET, BY HIGH SPEED, 2021–2028 (USD MILLION)

- TABLE 184 NORTH AMERICA: MARKET, BY HIGH SPEED, 2021–2028 (UNITS)

- TABLE 185 NORTH AMERICA: MARKET, BY POWER RATING, 2021–2028 (USD MILLION)

- TABLE 186 NORTH AMERICA: MARKET, BY POWER RATING, 2021–2028 (UNITS)

- TABLE 187 NORTH AMERICA: MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 188 NORTH AMERICA: MARKET, BY END USER, 2021–2028 (UNITS)

- TABLE 189 NORTH AMERICA: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (USD MILLION)

- TABLE 190 NORTH AMERICA: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (UNITS)

- TABLE 191 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 192 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2028 (UNITS)

- TABLE 193 US: DIESEL ENGINES MARKET, BY SPEED, 2021–2028 (USD MILLION)

- TABLE 194 US: MARKET, BY SPEED, 2021–2028 (UNITS)

- TABLE 195 US: MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 196 US: MARKET, BY END USER, 2021–2028 (UNITS)

- TABLE 197 US: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (USD MILLION)

- TABLE 198 US: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (UNITS)

- TABLE 199 CANADA: DIESEL ENGINE MARKET, BY SPEED, 2021–2028 (USD MILLION)

- TABLE 200 CANADA: MARKET, BY SPEED, 2021–2028 (UNITS)

- TABLE 201 CANADA: MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 202 CANADA: MARKET, BY END USER, 2021–2028 (UNITS)

- TABLE 203 CANADA: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (USD MILLION)

- TABLE 204 CANADA: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (UNITS)

- TABLE 205 MEXICO: DIESEL ENGINES MARKET, BY SPEED, 2021–2028 (USD MILLION)

- TABLE 206 MEXICO: MARKET, BY SPEED, 2021–2028 (UNITS)

- TABLE 207 MEXICO: MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 208 MEXICO: MARKET, BY END USER, 2021–2028 (UNITS)

- TABLE 209 MEXICO: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (USD MILLION)

- TABLE 210 MEXICO: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (UNITS)

- TABLE 211 MIDDLE EAST & AFRICA: DIESEL ENGINES MARKET, BY SPEED, 2021–2028 (USD MILLION)

- TABLE 212 MIDDLE EAST & AFRICA: MARKET, BY SPEED, 2021–2028 (UNITS)

- TABLE 213 MIDDLE EAST & AFRICA: MARKET, BY HIGH SPEED, 2021–2028 (USD MILLION)

- TABLE 214 MIDDLE EAST & AFRICA: MARKET, BY HIGH SPEED, 2021–2028 (UNITS)

- TABLE 215 MIDDLE EAST & AFRICA: MARKET, BY POWER RATING, 2021–2028 (USD MILLION)

- TABLE 216 MIDDLE EAST & AFRICA: MARKET, BY POWER RATING, 2021–2028 (UNITS)

- TABLE 217 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 218 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2021–2028 (UNITS)

- TABLE 219 MIDDLE EAST & AFRICA: MARKET, BY MEDIUM SPEED E ND USER, 2021–2028 (USD MILLION)

- TABLE 220 MIDDLE EAST & AFRICA: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (UNITS)

- TABLE 221 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 222 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2021–2028 (UNITS)

- TABLE 223 SAUDI ARABIA: DIESEL ENGINE MARKET, BY SPEED, 2021–2028 (USD MILLION)

- TABLE 224 SAUDI ARABIA: MARKET, BY SPEED, 2021–2028 (UNITS)

- TABLE 225 SAUDI ARABIA: MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 226 SAUDI ARABIA: MARKET, BY END USER, 2021–2028 (UNITS)

- TABLE 227 SAUDI ARABIA: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (USD MILLION)

- TABLE 228 SAUDI ARABIA: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (UNITS)

- TABLE 229 UAE: DIESEL ENGINES MARKET, BY SPEED, 2021–2028 (USD MILLION)

- TABLE 230 UAE: MARKET, BY SPEED, 2021–2028 (UNITS)

- TABLE 231 UAE: MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 232 UAE: MARKET, BY END USER, 2021–2028 (UNITS)

- TABLE 233 UAE: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (USD MILLION)

- TABLE 234 UAE: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (UNITS)

- TABLE 235 ALGERIA: DIESEL ENGINE MARKET, BY SPEED, 2021–2028 (USD MILLION)

- TABLE 236 ALGERIA: MARKET, BY SPEED, 2021–2028 (UNITS)

- TABLE 237 ALGERIA: MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 238 ALGERIA: MARKET, BY END USER, 2021–2028 (UNITS)

- TABLE 239 ALGERIA: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (USD MILLION)

- TABLE 240 ALGERIA: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (UNITS)

- TABLE 241 NIGERIA: MARKET, BY SPEED, 2021–2028 (USD MILLION)

- TABLE 242 NIGERIA: MARKET, BY SPEED, 2021–2028 (UNITS)

- TABLE 243 NIGERIA: MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 244 NIGERIA: MARKET, BY END USER, 2021–2028 (UNITS)

- TABLE 245 NIGERIA: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (USD MILLION)

- TABLE 246 NIGERIA: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (UNITS)

- TABLE 247 KUWAIT: DIESEL ENGINES MARKET, BY SPEED, 2021–2028 (USD MILLION)

- TABLE 248 KUWAIT: MARKET, BY SPEED, 2021–2028 (UNITS)

- TABLE 249 KUWAIT: MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 250 KUWAIT: MARKET, BY END USER, 2021–2028 (UNITS)

- TABLE 251 KUWAIT: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (USD MILLION)

- TABLE 252 KUWAIT: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (UNITS)

- TABLE 253 IRAN: DIESEL ENGINE MARKET, BY SPEED, 2021–2028 (USD MILLION)

- TABLE 254 IRAN: MARKET, BY SPEED, 2021–2028 (UNITS)

- TABLE 255 IRAN: MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 256 IRAN: MARKET, BY END USER, 2021–2028 (UNITS)

- TABLE 257 IRAN: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (USD MILLION)

- TABLE 258 IRAN: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (UNITS)

- TABLE 259 REST OF THE MIDDLE EAST & AFRICA: MARKET, BY SPEED, 2021–2028 (USD MILLION)

- TABLE 260 REST OF THE MIDDLE EAST & AFRICA: MARKET, BY SPEED, 2021–2028 (UNITS)

- TABLE 261 REST OF THE MIDDLE EAST & AFRICA: MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 262 REST OF THE MIDDLE EAST & AFRICA: MARKET, BY END USER, 2021–2028 (UNITS)

- TABLE 263 REST OF THE MIDDLE EAST & AFRICA: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (USD MILLION)

- TABLE 264 REST OF THE MIDDLE EAST & AFRICA: MARKET, BY MEDIUM SPEED END USER, 2021–2028 (UNITS)

- TABLE 265 OVERVIEW OF KEY STRATEGIES DEPLOYED BY TOP PLAYERS, 2018–2022

- TABLE 266 DIESEL ENGINES MARKET: DEGREE OF COMPETITION

- TABLE 267 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 268 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]

- TABLE 269 BY SPEED: COMPANY FOOTPRINT

- TABLE 270 BY POWER OUTPUT: COMPANY FOOTPRINT

- TABLE 271 BY END USER: COMPANY FOOTPRINT

- TABLE 272 COMPANY FOOTPRINT

- TABLE 273 MARKET: DEALS, 2019–2022

- TABLE 274 MARKET: PRODUCT LAUNCHES, 2020–2023

- TABLE 275 CATERPILLAR: COMPANY OVERVIEW

- TABLE 276 CATERPILLAR: PRODUCTS OFFERED

- TABLE 277 CATERPILLAR: PRODUCT LAUNCHES

- TABLE 278 CUMMINS: COMPANY OVERVIEW

- TABLE 279 CUMMINS: PRODUCTS OFFERED

- TABLE 280 CUMMINS: PRODUCT LAUNCHES

- TABLE 281 CUMMINS: DEALS

- TABLE 282 VOLVO PENTA: COMPANY OVERVIEW

- TABLE 283 VOLVO PENTA: PRODUCTS OFFERED

- TABLE 284 VOLVO PENTA: PRODUCT LAUNCHES

- TABLE 285 MAN ENERGY SOLUTIONS: COMPANY OVERVIEW

- TABLE 286 MAN, ENERGY SOLUTIONS: PRODUCTS OFFERED

- TABLE 287 MAN ENERGY SOLUTIONS: PRODUCT LAUNCHES

- TABLE 288 HYUNDAI HEAVY INDUSTRIES CO., LTD.: COMPANY OVERVIEW

- TABLE 289 HYUNDAI HEAVY INDUSTRIES CO., LTD.: PRODUCTS OFFERED

- TABLE 290 HYUNDAI HEAVY INDUSTRIES CO., LTD.: PRODUCT LAUNCHES

- TABLE 291 HYUNDAI HEAVY INDUSTRIES CO., LTD.: DEALS

- TABLE 292 WARTSILA: BUSINESS OVERVIEW

- TABLE 293 WARTSILA: PRODUCTS OFFERED

- TABLE 294 WARTSILA: PRODUCT LAUNCHES

- TABLE 295 WARTSILA: DEALS

- TABLE 296 MITSUBISHI HEAVY INDUSTRIES ENGINE & TURBOCHARGERS, LTD.: BUSINESS OVERVIEW

- TABLE 297 MITSUBISHI HEAVY INDUSTRIES ENGINE & TURBOCHARGERS, LTD.: PRODUCTS OFFERED

- TABLE 298 MITSUBISHI HEAVY INDUSTRIES ENGINE & TURBOCHARGERS, LTD.: PRODUCT LAUNCHES

- TABLE 299 MITSUBISHI HEAVY INDUSTRIES: DEALS

- TABLE 300 ROLLS-ROYCE HOLDINGS: COMPANY OVERVIEW

- TABLE 301 ROLLS-ROYCE HOLDINGS: PRODUCTS OFFERED

- TABLE 302 ROLLS ROYCE HOLDINGS: PRODUCT LAUNCHES

- TABLE 303 ROLLS-ROYCE HOLDINGS: DEALS

- TABLE 304 DOOSAN INFRACORE: COMPANY OVERVIEW

- TABLE 305 DOOSAN INFRACORE: PRODUCTS OFFERED

- TABLE 306 DOOSAN INFRACORE: PRODUCT LAUNCHES

- TABLE 307 DOOSAN INFRACORE: DEALS

- TABLE 308 YANMAR HOLDINGS CO., LTD.: COMPANY OVERVIEW

- TABLE 309 YANMAR HOLDINGS CO., LTD.: PRODUCTS OFFERED

- TABLE 310 YANMAR HOLDINGS CO., LTD.: PRODUCT LAUNCHES

- TABLE 311 YANMAR HOLDINGS CO., LTD.: DEALS

- TABLE 312 IHI POWER SYSTEMS CO., LTD.: COMPANY OVERVIEW

- TABLE 313 IHI POWER SYSTEMS CO., LTD.: PRODUCTS OFFERED

- TABLE 314 KOHLER: COMPANY OVERVIEW

- TABLE 315 KOHLER: PRODUCTS OFFERED

- TABLE 316 KOHLER: DEALS

- TABLE 317 (CNPC) JICHAI POWER COMPANY LIMITED: COMPANY OVERVIEW

- TABLE 318 (CNPC) JICHAI POWER COMPANY LIMITED: PRODUCTS OFFERED

- TABLE 319 FPT INDUSTRIAL: COMPANY OVERVIEW

- TABLE 320 FPT INDUSTRIAL: PRODUCTS OFFERED

- TABLE 321 FPT INDUSTRIAL: PRODUCT LAUNCHES

- TABLE 322 DAIHATSU DIESEL MFG.: COMPANY OVERVIEW

- TABLE 323 DAIHATSU DIESEL MFG.: PRODUCTS OFFERED

- TABLE 324 DAIHATSU DIESEL MFG.: DEALS

- FIGURE 1 DIESEL ENGINE MARKET: RESEARCH DESIGN

- FIGURE 2 DATA TRIANGULATION

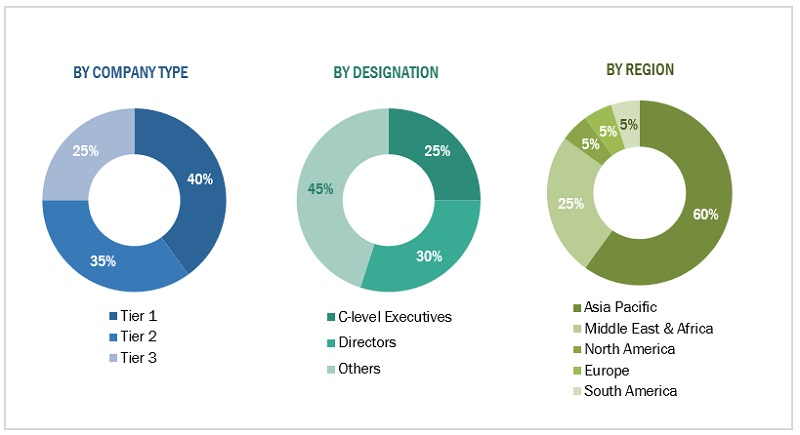

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 MAIN METRICS CONSIDERED WHILE ANALYZING AND ASSESSING DEMAND FOR DIESEL ENGINES

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 7 KEY STEPS CONSIDERED FOR ASSESSING SUPPLY OF DIESEL ENGINES

- FIGURE 8 DIESEL POWER ENGINE MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 9 ASIA PACIFIC DOMINATED DIESEL ENGINE MARKET IN 2022

- FIGURE 10 HIGH-SPEED SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD, BY SPEED

- FIGURE 11 BELOW 0.5 MW SEGMENT TO DOMINATE DIESEL POWER ENGINE MARKET BY 2028

- FIGURE 12 POWER GENERATION TO SECURE LARGEST MARKET SHARE DURING FORECAST PERIOD, BY END USER

- FIGURE 13 RISING NEED FOR BACKUP POWER TO DRIVE MARKET GROWTH DURING 2023–2028

- FIGURE 14 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 BY SPEED, 1,000–1,500 RPM SEGMENT ACCOUNTED FOR LARGER SHARE OF ASIA PACIFIC DIESEL ENGINE MARKET IN 2022

- FIGURE 16 BY SPEED, HIGH-SPEED DIESEL ENGINES EXPECTED TO SECURE LARGEST SHARE OF MARKET, IN 2028

- FIGURE 17 BY POWER RATING, BELOW 0.5 MW SEGMENT EXPECTED TO SECURE LARGEST SHARE OF MARKET, IN 2028

- FIGURE 18 POWER GENERATION PROJECTED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2028

- FIGURE 19 DIESEL ENGINES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 GLOBAL ELECTRICITY DEMAND BY SECTOR, 2018–2040

- FIGURE 21 GLOBAL POPULATION, 1950–2050

- FIGURE 22 REVENUE SHIFT FOR DIESEL ENGINE PROVIDERS

- FIGURE 23 AVERAGE SELLING PRICES OF OFFERINGS OF KEY PLAYERS, BY POWER RATING

- FIGURE 24 VALUE CHAIN ANALYSIS: DIESEL ENGINE MARKET

- FIGURE 25 PORTER’S FIVE FORCES ANALYSIS FOR DIESEL ENGINES MARKET

- FIGURE 26 INFLUENCE OF KEY STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 27 INFLUENCE OF KEY STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 28 GLOBAL DIESEL ENGINES MARKET, BY POWER RATING IN 2022

- FIGURE 29 DIESEL ENGINE MARKET, BY SPEED IN 2022

- FIGURE 30 GLOBAL DIESEL ENGINES MARKET, BY END USER IN 2022

- FIGURE 31 DIESEL ENGINE MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 32 DIESEL ENGINES MARKET SHARE, BY REGION, 2022

- FIGURE 33 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 34 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 35 DIESEL ENGINES MARKET SHARE ANALYSIS, 2021

- FIGURE 36 TOP PLAYERS IN DIESEL POWER ENGINE MARKET FROM 2017–2021

- FIGURE 37 COMPETITIVE LEADERSHIP QUADRANT: DIESEL POWER ENGINE MARKET, 2022

- FIGURE 38 DIESEL ENGINES MARKET: STARTUP/SME EVALUATION QUADRANT, 2022

- FIGURE 39 CATERPILLAR: COMPANY SNAPSHOT

- FIGURE 40 CUMMINS: COMPANY SNAPSHOT

- FIGURE 41 VOLVO PENTA: COMPANY SNAPSHOT

- FIGURE 42 MAN ENERGY SOLUTIONS: COMPANY SNAPSHOT

- FIGURE 43 HYUNDAI HEAVY INDUSTRIES CO., LTD.: COMPANY SNAPSHOT

- FIGURE 44 WARTSILA: COMPANY SNAPSHOT

- FIGURE 45 MITSUBISHI HEAVY INDUSTRIES ENGINE & TURBOCHARGERS, LTD.: COMPANY SNAPSHOT

- FIGURE 46 ROLLS ROYCE HOLDINGS: COMPANY SNAPSHOT

- FIGURE 47 DOOSAN INFRACORE: COMPANY SNAPSHOT

- FIGURE 48 YANMAR HOLDINGS CO., LTD.: COMPANY SNAPSHOT

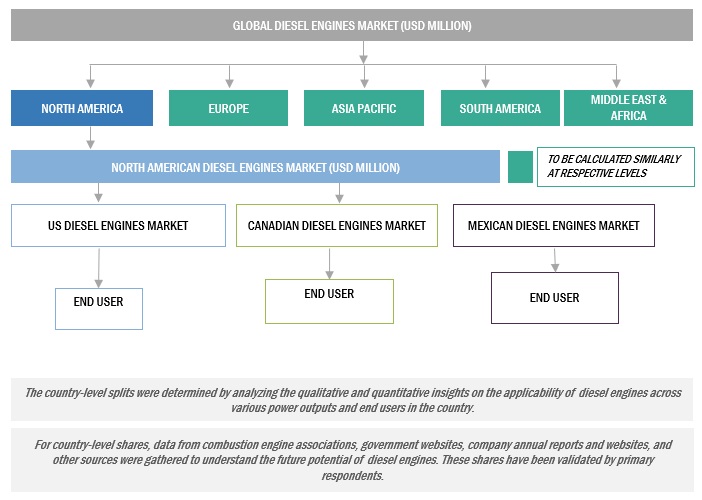

The study involved major activities in estimating the current size of the diesel engines market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the diesel engines market involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, International Energy Agency, and BP Statistical Review of World Energy, to identify and collect information useful for a technical, market-oriented, and commercial study of the diesel engine market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The diesel engines market comprises several stakeholders such as raw material providers/suppliers, component manufacturers, diesel engine manufacturers/assemblers, distributors, end users, and post-sales services in the supply chain. The demand side of this market is characterized by the investments in the purchase of diesel engines by the different end users. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the diesel engine market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Diesel Engines Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Definition

An engine is a machine for converting various energy forms into mechanical force and motion. Diesel engines work on the basis of compression ignition technology and are considered one of the most reliable and capable fossil fuel-based power generation technologies. These engines are coupled with an alternator to generate power as and when demanded. They are used for continuous and intermittent power supply to various end users such as oil & gas, mining, locomotive, etc.

Key Stakeholders

- Utilities

- Oil & Gas Companies

- Power Generation Companies

- Heavy Industries

- Railway Companies

- Shipbuilding Industry

- Government and Research Organizations

- Third-party Testing Companies

- Diesel Power Engine Manufacturers, Dealers, and Suppliers

- Organizations, Forums, Alliances, and Associations Related to Various End User Verticals

- State and National Regulatory Authorities

Objectives of the Study

- To define, describe, analyze, and forecast the diesel engines market, by speed, power rating, and end user, in terms of value and volume

- To describe and forecast the diesel engine market in key regions—Asia Pacific, North America, Europe, South America, and the Middle East & Africa, along with respective countries, in terms of value and volume

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the market growth

- To strategically analyze the power diesel engine market with respect to individual growth trends, future market expansions, and the contribution of each market segment to the overall market growth

- To analyze opportunities in the market for stakeholders by identifying high-growth market segments and sketching the competitive landscape of market leaders

- To strategically profile the key players and comprehensively analyze their respective market shares

- To analyze strategic approaches such as investments and expansions; mergers and acquisitions; product launches; contracts and agreements; and joint ventures and collaborations in the market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Diesel Engines Market