Digital Badges Market by Offering (Platforms and Services), Type (Certification, Participation, Recognition, Achievement, Contribution), End User (Academic, Corporate, Government, Non-profit Organizations) and Region - Global Forecast to 2028

Digital Badges Market Size, Key Insights & Analysis

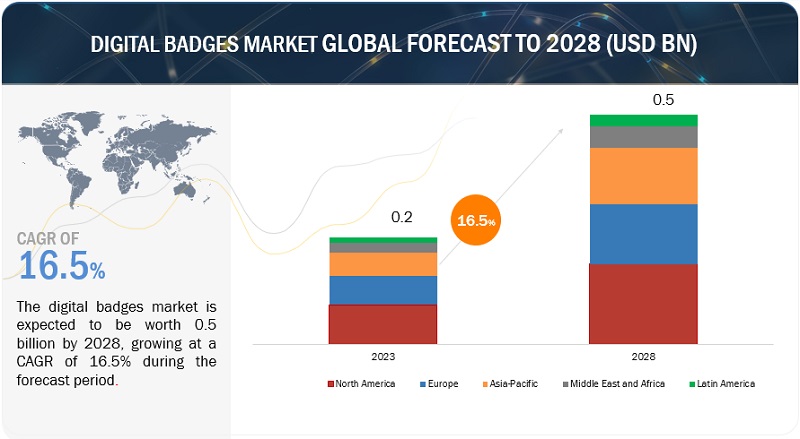

The size of the Digital Badges Market is projected to grow at a CAGR of 16.5% during the forecast period to reach USD 0.5 billion by 2028 from an estimated USD 0.2 billion in 2023. Using blockchain technology in the digital badge enhances security, prevents fraud, and builds trust among the issuers.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Digital Badges Market Dynamics

Driver: Increasing focus on employees’ professional development

Businesses invest a lot of resources on the professional development of employees. Professional development programs have been introduced by a number of large businesses, including IBM, SAP, SAS, and Oracle, to support the culture of ongoing learning and development. The visible recognition of staff skills through the digital badge system promotes professional development. Employees are encouraged to take part in professional development programs, and their completion of learning programs is acknowledged. Similar to this, IBM has introduced a number of courses and gives its staff members the chance to advance their education and demonstrate their expertise by earning digital badges.

Restraint: Lack of IT infrastructure in developing countries

For the market for digital badges to expand, a strong IT infrastructure is one of the key factors. Digital badge implementation in educational institutions is hampered by poor IT infrastructure. For example, due to a lack of suitable IT infrastructures and connectivity options, the adoption of digital badges in Africa continues to be raised. There is virtually limited internet usage in nations like Nigeria, Kenya, and Uganda. An additional obstacle to the expansion of the digital badges market is the absence of proper roadmaps for utilizing digital technologies, such as eLearning, social learning, and adaptive learning in emerging nations.

Opportunity: Gamification in the education industry

Gaming-based learning is known as gamification. It is fundamentally a collection of course materials that functions like a game and is growing in popularity among students. It enables the application of game-design ideas to engage students in problem-solving. Gamification brings 3 major elements, i.e., mechanical components, personal aspects, and emotional components in the education industry. Additionally, it encourages reluctant and unmotivated students to participate in the learning process. Gamification provides students with a secure setting in which to overcome obstacles in practical settings. This idea is centered on providing learners with interactive experiences to encourage motivating learning. Many digital badge vendors are attempting to seize this market potential. They supply badging APIs that are combined with gamification tools in learning programs.

Challenge: Lack of digital badge equivalents

One of the key issues impeding the growth of digital badges is the lack of an equivalent. Badges awarded by an organization or region are rarely accepted by other institutions or nations. Equivalence is one of the most important considerations when introducing digital badges in academic institutions like schools and colleges. Both validating and portable badges are required. Across a range of issuers and audiences, they must share the same instantly recognizable characteristics.

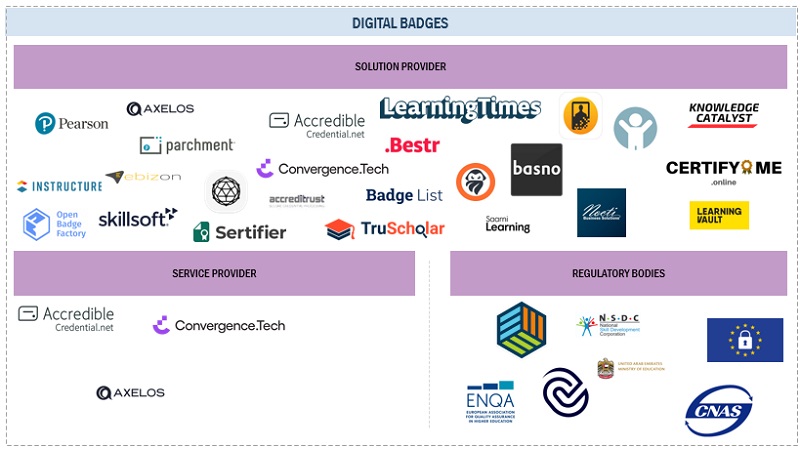

Digital badges market Ecosystem

The digital badges market comprises solution providers, service providers, regulatory bodies, and end users working together to deliver digital badges solutions for skill enhancement and motivation.

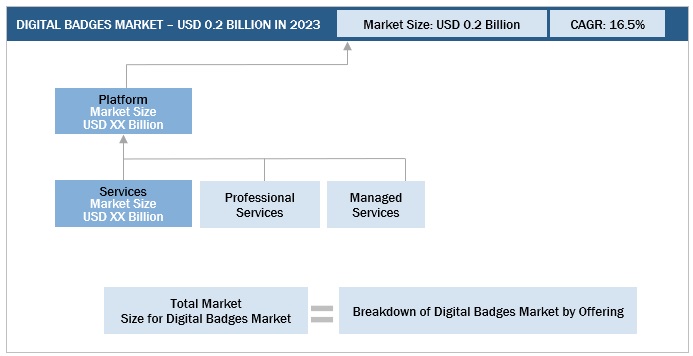

By offering, services segment holds the highest growth rate during the forecast period.

Market vendors provide digital badge services to help badge issuers set up an easy issuance process. Designing, development and support, training, and advising services are just a few of platform providers' many professional services. Designing services also involve graphic and program design. Service providers can aid in the process design for issuing badges. They may assist in defining the appropriate proof, establishing learner criteria, outlining the awarding process, and many other things. The platform interface and brand selection are both included in the visual design services. Services for development and support include assistance for development and maintenance problems and end-user support available around the clock. Training services aid in educating program managers about a company's digital credential program.

By end user, government is expected to register the fastest growth rate during the forecast period.

Digital Badges are slowly growing in Government organizations as it has significant benefits it implemented correctly can help efficiently operations within any kind of organization. Digital badges enable government agencies to validate and manage the skills and competencies of their employees. By awarding badges for specific training programs, certifications, or achievements, agencies can ensure that their workforce possesses the necessary expertise to fulfill their roles effectively. This promotes accountability and helps align employee skills with organizational objectives. Digital badges provide a standardized approach to skill recognition and competency assessment across government agencies. Badge programs can be designed based on established frameworks and industry standards, ensuring consistency in training and development efforts. Digital badges contribute to public transparency and trust in government services. By showcasing badges earned for compliance training, ethics, or specialized expertise, agencies can demonstrate their commitment to accountability and professionalism. Badges can be publicly displayed on government websites or profiles, providing transparency and instilling confidence in the public.

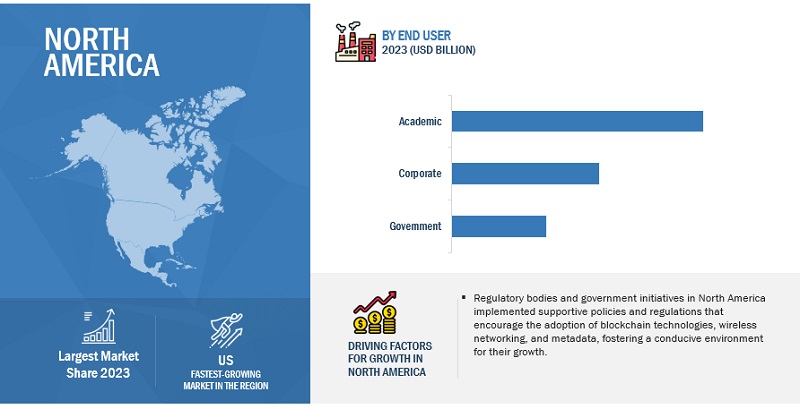

North America is expected to hold the largest market size during the forecast period.

The adoption of digital badges in North America is growing rapidly. Being a fast technology adopting region, North America is expected to have the largest market share in the digital badges market. North America holds the highest degree of competitiveness, and it accounts for the presence of more than 40% of the total digital badges providers. The US and Canada are the major contributors in the North American region. The region has well established large number of prominent educational institutes with quality education provided by them. Technological advancements have led to a rise in the adoption of digital badges in educational and corporate sectors. Digital badges help entities in these setups document and verify specific skills, thereby focusing on an individual’s credentials. There are numerous factors driving this growth, including adoption of online learning, the growing recognition of the value of digital badges by employers, the development of open badge standards, and the increasing availability of digital badge platforms in the region. The US is a leading country in the region in terms of digital badge adoption. The Digital Badges market is expected to be dominated by North America, and this trend is expected to continue during the forecast period. The presence of firms that utilize the digital badge technology has also contributed to the growth of the market.

Market Players:

The major players in the Digital badges market are Pearson (UK), Instructure (US), SkillSoft Corporation (US), PeopleCert (UK), Accredible (US), Parchment (US), EbizON (India), Accreditrust Technologies (US), Badgecraft (Lithuania), Badge List (US), Bestr (Italy), Basno (US), Saarni Learning Oy (Finland), ForAllSystems (US), LearningTimes (US), Nocti Business Solutions (US), Knowledge Catalyst, Learning Vault, Hyperstack (US), TruScholar (India), CredSure.io (Germany), CertifyMe (US), Convergence.Tech (Canada), Open Badge Factory (Finland), Sertifier (US), Certopus (India), and Virtualbadge.io (Germany). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches and enhancements, and acquisitions to expand their footprint in the Digital badges market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2017-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD) Billion |

|

Segments covered |

Offering (Platform and Services), Type, End User, and Region |

|

Region covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Companies covered |

Pearson (UK), Instructure (US), SkillSoft Corporation (US), PeopleCert (UK), Accredible (US), Parchment (US), EbizON (India), Accreditrust Technologies (US), Badgecraft (Lithuania), Badge List (US), Bestr (Italy), Basno (US), Saarni Learning Oy (Finland), ForAllSystems (US), LearningTimes (US), Nocti Business Solutions (US), Knowledge Catalyst, Learning Vault, Hyperstack (US), TruScholar (India), CredSure.io (Germany), CertifyMe (US), Convergence.Tech (Canada), Open Badge Factory (Finland), Sertifier (US), Certopus (India), and Virtualbadge.io (Germany). |

This research report categorizes the Digital badges market to forecast revenues and analyze trends in each of the following submarkets:

Based on Offering:

- Platform

-

Services

- Professional Services

- Managed Services

Based on Type:

- Certification Badges

- Recognition Badges

- Participation Badges

- Achievement Badges

- Contribution Badges

Based on End User:

- Academic

- Corporate

- Government

- Non-profit Organizations

- Other End Users

By Region:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia and New Zealand

- South Korea

- Rest of Asia Pacific

-

Middle East and Africa

- Middle East

- Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In April 2023, Accredible partnered with Cengage Partners to offer Digital Badging and Micro-credentials and integrate it with Cengage Partners learning platform.

- In November 2022, Credly by Pearson and NovoEd partnered Credly will integrates its services for NovoEd’s learning journey learning and development professional would issue digital badges to let learners track progress and celebrate their achievements.

- In April 2022, Instructure acquired Concentric Sky the creator of Badgr a micro-credentialing platform, Instructure expands its offering in credential space through this acquisition.

- In June 2021, PeopleCert acquired Axelos UK based provider of framework and certification strengthening its position in exam and certification delivery and management.

Frequently Asked Questions (FAQ):

What is the definition of Digital badges market?

Digital badges market can be defined as a set of platforms and services that are used to issue badges to the learners. A digital badge is a type of digital credential that represents the accomplishments of certain skills. It includes online images offered by issuers and displayed by professionals and learners to showcase their expertise in a certain subject, skill, or task.

What is the market size of the Digital badges market?

The digital badges market is estimated at USD 0.2 billion in 2023 and is projected to reach USD 0.5 billion by 2028, at a CAGR of 16.5% from 2023 to 2028.

What are the major drivers in the Digital badges market?

The major drivers in Digital badges market are the growth in the adoption of online education, increasing focus on employees’ professional development, and use of blockchain for digital badges.

Who are the key players operating in the Digital badges market?

The key market players profiled in the Digital badges market are Pearson (UK), Instructure (US), SkillSoft Corporation (US), PeopleCert (UK), Accredible (US), Parchment (US), EbizON (India), Accreditrust Technologies (US), Badgecraft (Lithuania), Badge List (US), Bestr (Italy), Basno (US), Saarni Learning Oy (Finland), ForAllSystems (US), LearningTimes (US), Nocti Business Solutions (US), Knowledge Catalyst, Learning Vault, Hyperstack (US), TruScholar (India), CredSure.io (Germany), CertifyMe (US), Convergence.Tech (Canada), Open Badge Factory (Finland), Sertifier (US), Certopus (India), and Virtualbadge.io (Germany).

Which are the key technology trends prevailing in Digital badges market?

Web technologies, metadata, blockchain, and APIs are the key technology trends for digital badges market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The digital badge market is an attractive market for the providers of digital badge platforms and services, as corporates and academic institutions across the world are bringing gamification into their learning content. Moreover, the rapid increase in the enrolment of online courses and MOOCs provides growth opportunities for the digital badge market worldwide.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, certified publications, and articles from recognized associations and government publishing sources. Several journals, such as the Institute of Electrical and Electronics Engineers (IEEE), ScienceDirect, ResearchGate, Academic Journals, Scientific.Net, and various telecom and Digital badges associations/forums, Wi-Fi Alliance, and 3GPP were also referred. Secondary research was used to obtain key information about industry insights, the market’s monetary chain, the overall pool of key players, market classification, and in-depth segmentation according to industry trends, regional markets, and key developments.

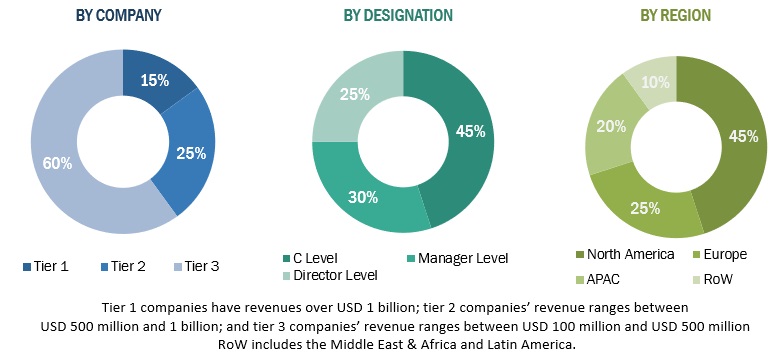

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the Digital badges market. The primary sources from the demand side included Digital badges end users, network administrators/consultants/specialists, Chief Information Officers (CIOs), and subject-matter experts from enterprises and government associations.

After the complete market engineering process (including calculations for market statistics, market breakdown, market size estimations, market forecast, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify and validate the segmentation types; industry trends; key players; the competitive landscape of the market; and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

In the complete market engineering process, both top-down and bottom-up approaches and several data triangulation methods were used to perform the market estimation and forecast for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

The breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the size of the digital badges market. The first approach involves estimating market size by summing up the revenue generated by companies through the sale of digital badges offerings, such as platform and services.

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Digital badges market. These methods were extensively used to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Digital badges Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Digital badges Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size, the Digital badges market was divided into several segments and subsegments. A data triangulation procedure was used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

Digital badges market can be defined as a set of platforms and services that are used to issue badges to the learners. A digital badge is a type of digital credential that represents the accomplishments of certain skills. It includes online images offered by issuers and displayed by professionals and learners to showcase their expertise in a certain subject, skill, or task.

According to Sertifier, digital badges are digital representations of skills, accomplishments, or competencies that an individual has acquired. They are designed to be easily shared and verified, and often include metadata that provides information about the issuer, recipient, and criteria for earning the badge. Digital badges are a visual way to recognize and validate an individual’s accomplishments, skills, or knowledge in a particular area.

Key Stakeholders

- Digital badge platform providers

- IT service providers

- Badge issuers

- Digital badge displayers

- Digital badge designers

- Cloud service providers

- Consultants/consultancies/advisory firms

- Training and education service providers

Report Objectives

- To determine and forecast the global digital badges market by offering, end-user, and region from 2017 to 2023 and analyze various macroeconomic and microeconomic factors that affect the market growth

- To forecast the size of the market segments with respect to 4 main regions, namely, North America, Europe, Asia Pacific, Middle east and Africa, and Latin America

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall market

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To profile the key market players; provide comparative analysis on the basis of business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the competitive landscape of the market

- To track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities in the digital badges market

- Track and analyze competitive developments in the market, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle East and Africa market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Digital Badges Market

"Gather insights into Digital Badging and credential management in the Middle East."