Digital Battlefield Market by Solution (Hardware, Software, Service), Technology (Artificial Intelligence, IOT, Big Data, 5G, Cloud Computing and Master Data Management), Platform, Application and Region - Global Forecast to 2030

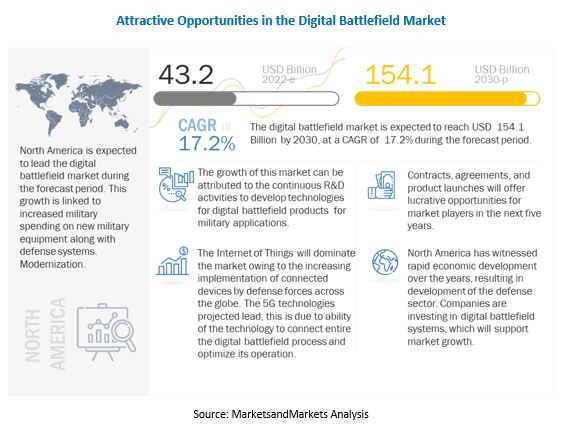

The Digital Battlefield Market size is projected to grow from USD 43.2 billion in 2022 to USD 154.1 billion by 2030, at a CAGR of 17.2% from 2022 to 2030.

Battlefield digitization is one of the major force multipliers in the conduct of warfare in an era of modern defense equipment. The utilization of digital data networks allows transmission of data or information at high speed in the form of voice, and images. Such information is transmitted and updated simultaneously and automatically to the digital IoT devices used by the armed forces commanders or staff operating within the battlefield. The high inclination of defense forces towards converting analog devices into digital systems to retain technological superiority on future battlefields is supporting growth of the Digital Battlefield Industry.

The US Army and Israeli defense forces, among other armed forces, have carried out practical analyses of numerous digital battlefields developed by Lockheed Martin Corporation (US), Northrop Grumman Corporation (US), L3Harris Technologies, Inc (US), and Raytheon Technologies Corporation(US) to equip and install digital battlefields on their armored vehicles.

For instance, in July 2022, the latest version of the Battlefield Management System has been developed by Thales, a major player in the defense, aerospace, security, and digital identification markets, and Indra, a top global technology and consulting firm (BMS). It is the most cutting-edge and efficient tactical command and control system on the market, and the Spanish Army uses it to guarantee superiority in ground deployments. The automation of the system simplifies flight planning for future airspace operations. Various players such as BAE Systems (UK), Northrop Grumman Corporation (US), Raytheon Technologies Corporation (US), Lockheed Martin Corporation (US), and Thales Group (US), among others, are prominent players operating in the digital battlefield market.

To know about the assumptions considered for the study, Request for Free Sample Report

Digital battlefield Market Dynamics:

Driver: Rapid advancement in artificial intelligence, big data analytics and robotics technologies

Big data, AI and robotic technologies are becoming a part of military organizations driven by the availability of data from digital battlefield sources such as C4ISR. Militaries are increasingly spending on information processing and analytics for improving AI capabilities in the digital battlefield. For instance, in 2020, the US Department of Defense announced an investment of over USD 712 billion on projects, including those of the Defense Advanced Research Projects Agency (DARPA) for developing AI technologies. The DARPA’s Advanced Targeting and Lethality Automated System (ATLAS) program will utilize artificial intelligence and machine learning to improve autonomous target capabilities of ground combat vehicles. Such developments are expected to escalate the digital battlefield market growth.

An efficient network is needed to collect data and keep military devices connected. Militaries can leverage big data analytics on large datasets to provide meaningful learning and results. Big Data has enabled access to large volumes of data and the ability to scale ingestion. Advancement in Big Data technologies has certainly been helpful to of the defense forces of various countries including the US, Russia and China.

Restraint: High investment in early phases is required for the digitization

Technologies like Hypersonic, Autonomous Weaponry, Drones, Robotics, Quantum Computing, and Artificial Intelligence (AI), Big Data Analytics, Missile Defense System requires heavy investment in research & development, Manufacturing, testing so that counties which have low budget for defense are less interested in this kind of technology. Systems for managing the battlefield are essential in modern combat. However, adding such capacity to a nation's defensive assets comes at a significant expense. Since it is a new idea, extensive funding is needed for its R&D. Additionally, only a few of businesses worldwide can produce battlefield management system components, which raises the price of the finished product due to the expense of intellectual property. The process of digitizing a battlefield is difficult, time-consuming, and expensive. It calls for a very high level of dedication, concentration, and vision of the current and upcoming security paradigm and technology. It presents unusual and significant obstacles, each of which calls for a coordinated response from several agencies. The design and development of digital battlefield devices embedded with artificial intelligence requires sufficient time, capital, and technical expertise; this results in high development cost, which can restrict market growth, especially for emerging economies such as India, Indonesia, and Brazil. The high maintenance cost associated with digital battlefield products may also limit market growth over the projected timeframe.

Opportunity: Increasing requirement for digital battlefield devices and technologies

Defense forces have a growing requirement to identify, process, and analyze critical information from various sources to provide more efficient situational awareness to decision-makers during combat operations; this is expected to support the demand for digital battlefield devices and technologies. The success of specific land, air, and naval military operations depends on the accuracy of situational awareness intelligence. The digital battlefield offers advanced intelligence, surveillance & reconnaissance technologies integrated with command & control capabilities, that provide air, ground, and maritime solutions with real-time situational awareness information for strategic decision-making. Such factors will support the growth of the digital battlefield market over the projected timeframe.

Challenges: Rising cyberattacks on military data transferred between digital battlefield devices

Cyberattacks work best when combined with electronic warfare (EW), disinformation operations, antisatellite attacks, and precision-guided weapons in confrontations involving modern armies. The goal is to produce operational advantage by deteriorating informational advantage, intangible assets (such as data), communications, intelligence assets, and weapon systems. The most harmful acts would combine cyberattacks and precision-guided bombs to disable or destroy crucial targets. Cyber operations can also be used to undermine decision-making by defenders and stir up civil unrest by interfering with government, energy, transportation, and financial services.

Digital battlefield Market Ecosystem:

The key stakeholders in the digital battlefield market ecosystem include companies which provide platforms and soldier systems. The major influencers in this market are investors, funders, academic researchers, integrators, service providers, and licensing agencies.

Defense segment held largest market share in terms of value in digital battlefield market

Digital battlefields are frequently utilized in the military, mostly to shield armored fighting vehicles from enemy fire. Combat helicopters, wheeled or tracked armored fighting or logistical vehicles, naval warfare ships, and other systems can all have them fitted. Modular optoelectronic sensor systems, target acquisition systems, digital radar processors for target identification, and thermal imaging devices offer improved field surveillance and fighting by day, night, or in low light. Due to the increase in cross-border conflicts, several nations are concentrating on expanding their armored vehicle fleets, which has directly contributed to the expansion of the digital battlefield sector .

The US Army and Israeli defense forces, among other armed forces, have carried out practical analyses of numerous digital battlefields developed by BAE Systems (UK), Northrop Grumman Corporation (US), Raytheon Technologies Corporation (US), Lockheed Martin Corporation (US), and Thales Group (US), among others to equip and install digital battlefields on their armored vehicles.

Digital Twin segment is anticipated to grow at highest CAGR during forecast period

The digital twin technology refers to a complex collection of technical data that is merged to make a virtual representation of a physical product. This technology can simulate the entire life cycle of the digital battlefield product, predict its behavior, and optimize its design. Digital twin technology can incorporate data analytics, artificial intelligence, and machine learning capabilities. It can also demonstrate the potential impact of real time design changes, usage conditions, and several performance variables.

In April 2021, the newest jet trainer aircraft for the Air Force is being designed and prototyped by U.S. Air Force weapons specialists utilizing computerized representations of actual objects. By allowing military corporations to compete with one other's designs online, creating a digital virtual version of a real thing, or digital twin, will aid the Air Force in developing and testing weapons.

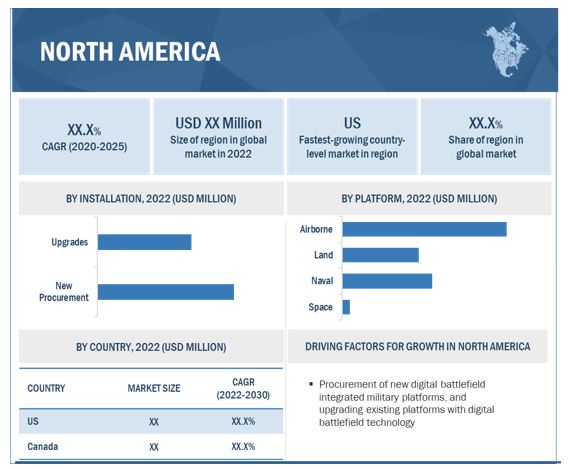

In terms of value, North America led the digital battlefield market

With its robust economy and aggressive military policy, the US is acknowledged as one of the leading consumers and adopters of digitalization in the defense industry. Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies Corporation are important US producers and developers of digital battlefield products and services. In order to make up for its numerical disadvantage, the US has historically depended on its superior technological capabilities and high standards of education and professionalization. This advantage is gradually eroding as global rivals like China invest extensively in developing their capacities. The US has been forced by this to be proactive in the development of its capabilities.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The Digital Battlefield Companies are dominated by a few globally established players such as BAE Systems (UK), Northrop Grumman Corporation (US), Raytheon Technologies Corporation (US), Lockheed Martin Corporation (US), and Thales Group (US), among others. The players are mostly engaged in new product launches & developments and having a strong global presence will enhance their position in the digital battlefield market. These players are primarily focusing on entering new markets by launching technologically advanced and cost-effective platforms and infrastructure. Apart from new product launches & developments, these players also adopted the partnerships contracts, & agreements strategy.

Scope of the report

|

Report Metric |

Details |

|

Growth Rate

|

17.2 %

|

| Estimated Market Size in 2022 |

USD 43.2 Billion |

| Projected Market Size in 2030 |

USD 154.1 Billion |

|

Market size available for years |

2019–2030 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2030 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

By Technology, By Application, By Platform, By Installation, By Solution. |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East, Africa, and Latin America |

|

Companies covered |

Lockheed Martin Corporation (US), Raytheon Technologies Corporation (US), Northrop Grumman Corporation (US), BAE Systems (UK), Thales Group (France), L3Harris Technologies, Inc. (US), and Israel Aerospace Industries (Israel), are some of the major suppliers of Digital battlefield. (25 Companies) |

The study categorizes the digital battlefield market based on technology, application, platform, installation, solution, and region

By Technology

- Artificial Intelligence

- 3d Printing

- Internet Of Things

- Big Data Analytics

- Robotic Process Automation

- Cloud Computing & Master Data Management

- Digital Twin

- Blockchain

- Ar And Vr

- 5g

By Application

- Warfare Platform

- Cyber Security

- Logistics & Transportation

- Surveillance & Situational Awareness

- Command & Control

- Communication

- Health Monitoring

-

Simulation & Training

- Combat Simulation And Training

- Command And Control Training

- Design And Manufacturing

- Predictive Maintenance

- Threat Monitoring

- Real-Time Fleet Management

- Electronic Warfare

- Others

By Platform

-

Land

- Military Fighting Vehicles (Mfvs)

- Unmanned Ground Vehicles (Ugvs)

- Weapon Systems

- Headquarter And Command Centres

- Dismounted Soldier

-

Naval

- Naval Ships

- Submarines

- Unmanned Maritime Vehicles (Umvs)

-

Airborne

- Combat Aircraft

- Helicopter

- Special Mission Aircraft

- Unmanned Aerial Vehicles (Uavs)

-

Space

- Cubesat

- Satellites

By Installation

- New Procurement

- Upgradation

By Solution

-

Hardware

- Communication Devices

-

Wearable Devices

- Smart Clothing

- Exoskeleton

- Smart Helmets

- Imaging Devices

- Display Devices

- Tracking Devices

- Computer Hardware Devices

- Data Distribution Units

- Night Vision Devices

- Rfid

- 3d Printers

- Others

-

Software

- Command & Control Software

- Military Situational Awareness

- Security Management

- Inventory Management

- Fleet Management

- Weapon Integration

- Robotic Process Automation

- Others

-

Services

- Deployment & Integration

- Upgrade & Maintenance

- Software Support

- Others

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Recent Developments

- In July 2022, the latest version of the Battlefield Management System has been developed by Thales, a major player in the defense, aerospace, security, and digital identification markets, and Indra, a top global technology and consulting firm (BMS). It is the most cutting-edge and efficient tactical command and control system on the market, and the Spanish Army uses it to guarantee superiority in ground deployments.

- In June 2022, one of the first mission-critical apps to finish a cloud transfer is the Mobility Air Forces Automated Flight Planning Service, or MAFPS, from BAE Systems. For the U.S. Air Force, BAE Systems has been a trailblazer in improving mission management and agile airspace planning for warfighters. The cloud environment will improve our customers' operational access to MAFPS' top-notch services. The automation of the system simplifies flight planning for future airspace operations.

- In December 2021, the program is ready to seamlessly connect, make important decisions, and speed up the design and development of NGI software with this approved digital ecosystem in place. The MDA can evaluate and collaborate on code development and release because the Northrop Grumman, Raytheon, and MDA teams are all brought together into a single, agile, secure, and effective development environment by the common software factory.

- In April 2021, the Stinger missile launcher, a man-portable weapon used to defend against a variety of aerial targets, is now available as part of Raytheon Technologies' new Stinger Virtual Trainer system, which makes use of recent developments in virtual reality and gaming to offer military agencies a safer, less expensive, and simpler way for troops to train with it.

Frequently Asked Questions (FAQs):

What is the current size of the digital battlefield market?

The global digital battlefield market size is projected to grow from USD 43.2 billion in 2022 to USD 154.1 billion by 2030, at a CAGR of 17.2% from 2022 to 2030.

Who are the winners in the digital battlefield market?

BAE Systems (UK), Northrop Grumman Corporation (US), Raytheon Technologies Corporation (US), Lockheed Martin Corporation (US), and Thales Group (US) are some of the winners in the market.

What are some of the technological advancements in the market?

Blockchain, artificial intelligence, and nanotechnology and machine learning are some of the technological advancements in the digital battlefield market.

What are the factors driving the growth of the market?

The digital battlefield market is being driven by factors such as rising demand for advanced military fleets across globe.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 53)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 DIGITAL BATTLEFIELD MARKET SEGMENTATION

1.3.1 REGIONAL SCOPE

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

TABLE 1 USD EXCHANGE RATES

1.5 LIMITATIONS

1.6 INCLUSIONS & EXCLUSIONS

1.7 MARKET STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 58)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH FLOW

FIGURE 3 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary sources

2.1.2.2 Key primary details

2.1.2.3 Key data from primary sources

2.1.2.4 Breakdown of primaries

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 FACTOR ANALYSIS

2.2.1 INTRODUCTION

2.2.2 DEMAND-SIDE INDICATORS

2.2.2.1 Increase in conflicts and disputes globally

2.2.2.2 Rise in defense budgets of emerging economies

2.3 MARKET SIZE ESTIMATION

2.3.1 MARKET DEFINITION & SCOPE

2.3.1.1 By platform

2.3.1.2 By application

2.3.1.3 By solution

2.3.1.4 By installation

2.3.1.5 By technology

2.4 RESEARCH APPROACH & METHODOLOGY

2.4.1 BOTTOM-UP APPROACH

2.4.1.1 Digital battlefield market approach -1

2.4.1.2 Digital battlefield market approach -2

2.4.1.3 Digital battlefield market approach -3

2.4.1.4 Digital battlefield market size, by segment

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.4.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.5 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.6 GROWTH RATE ASSUMPTIONS

2.7 RESEARCH ASSUMPTIONS

FIGURE 8 ASSUMPTIONS FOR STUDY

2.8 RISKS

3 EXECUTIVE SUMMARY (Page No. - 70)

FIGURE 9 AIRBORNE SEGMENT TO ACCOUNT FOR LARGEST SHARE OF DIGITAL BATTLEFIELD MARKET IN 2022

FIGURE 10 SOFTWARE SEGMENT TO DOMINATE DIGITAL BATTLEFIELD MARKET IN 2022

FIGURE 11 NEW PROCUREMENT TO LEAD DIGITAL BATTLEFIELD MARKET IN 2022

FIGURE 12 INTERNET OF THINGS TO COMMAND DIGITAL BATTLEFIELD MARKET DURING FORECAST PERIOD

FIGURE 13 NORTH AMERICA TO HOLD LARGEST SHARE OF DIGITAL BATTLEFIELD MARKET IN 2022

4 PREMIUM INSIGHTS (Page No. - 74)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN DIGITAL BATTLEFIELD MARKET, 2022–2030

FIGURE 14 INCREASING INVESTMENTS TO DRIVE DIGITAL BATTLEFIELD MARKET

4.2 DIGITAL BATTLEFIELD MARKET, BY PLATFORM

FIGURE 15 AIRBORNE PLATFORM TO DOMINATE DIGITAL BATTLEFIELD MARKET DURING FORECAST PERIOD

4.3 DIGITAL BATTLEFIELD MARKET, BY AIRBORNE PLATFORM

FIGURE 16 FIGHTER JETS TO LEAD DIGITAL BATTLEFIELD MARKET DURING FORECAST PERIOD

4.4 DIGITAL BATTLEFIELD MARKET, BY NAVAL PLATFORM

FIGURE 17 NAVAL SHIPS TO HOLD LARGEST SHARE IN DIGITAL BATTLEFIELD MARKET DURING FORECAST PERIOD

4.5 DIGITAL BATTLEFIELD MARKET, BY LAND PLATFORM

FIGURE 18 MILITARY FIGHTING VEHICLES TO HOLD MAJOR SHARE OF DURING FORECAST PERIOD

4.6 DIGITAL BATTLEFIELD MARKET, BY SPACE PLATFORM

FIGURE 19 SATELLITES TO COMMAND DIGITAL BATTLEFIELD MARKET DURING FORECAST PERIOD

4.7 DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY

FIGURE 20 INTERNET OF THINGS TO BE DOMINANT TECHNOLOGY IN DIGITAL BATTLEFIELD MARKET

4.8 DIGITAL BATTLEFIELD MARKET, BY COUNTRY

FIGURE 21 AUSTRALIA TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 78)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 DIGITAL BATTLEFIELD MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Preference for cloud services by military and defense organizations

5.2.1.2 Increased spending on modern and advanced equipment to strengthen defense forces

TABLE 2 DEFENSE EXPENDITURE OF MAJOR COUNTRIES (USD BILLION)

FIGURE 23 DEFENSE BUDGET OF KEY COUNTRIES, 2020–2021

5.2.1.3 Focus on operational readiness to achieve operational superiority and safeguard soldiers

5.2.1.4 Rapid development in artificial intelligence, big data analytics, and robotics

5.2.1.5 Growing demand for 5G devices for high-speed data transfer

5.2.1.6 Proliferation of asymmetric warfare

5.2.1.7 Increasing military procurement of wireless connectivity technologies

5.2.1.8 Growing adoption of integrated digital battlefield technologies

5.2.2 RESTRAINTS

5.2.2.1 High investment requirements in early phases of digitization

5.2.2.2 Limited electromagnetic (EM) space due to high density

5.2.2.3 Absence of roadmap, vision, and government policies

5.2.2.4 Lack of infrastructure for development of communication technologies

5.2.2.5 Information warfare (IW) management

5.2.3 OPPORTUNITIES

5.2.3.1 Growing need for digital battlefield technologies

5.2.3.2 Rising adoption of AI and IoT devices in life-threatening military operations

5.2.3.3 Incorporation of satellite-based geospatial analytical and GIS tools

5.2.4 CHALLENGES

5.2.4.1 Managing skilled manpower for digital battlefield technologies

5.2.4.2 Data storage and security

5.2.4.3 Rising cyberattacks on military data transferred between digital battlefield devices

5.2.4.4 Minimizing weight and size of devices while maintaining advanced features

5.3 TRENDS IMPACTING CUSTOMER BUSINESS

5.3.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR DIGITAL BATTLEFIELD PRODUCT MANUFACTURERS

FIGURE 24 REVENUE SHIFT IN DIGITAL BATTLEFIELD MARKET

5.4 DIGITAL BATTLEFIELD MARKET ECOSYSTEM

5.4.1 PROMINENT COMPANIES

5.4.2 PRIVATE AND SMALL ENTERPRISES

5.4.3 END USERS

FIGURE 25 DIGITAL BATTLEFIELD: MARKET ECOSYSTEM MAP

TABLE 3 DIGITAL BATTLEFIELD MARKET ECOSYSTEM

5.5 VALUE CHAIN ANALYSIS

FIGURE 26 DIGITAL BATTLEFIELD MARKET: VALUE CHAIN ANALYSIS

5.6 USE CASE ANALYSIS

5.6.1 USE CASE: AI PROVIDES COMBATANTS WITH COGNITIVE EDGE OVER OPPONENTS

TABLE 4 ARTIFICIAL INTELLIGENCE GIVES COGNITIVE EDGE TO COMBATANTS

5.6.2 USE CASE: BATTLE MANAGEMENT SYSTEMS

TABLE 5 BATTLE MANAGEMENT SYSTEMS ENHANCE SEARCH & RESCUE

5.6.3 USE CASE: THALES GROUP – INDIAN DEFENSE FORCES

TABLE 6 ENHANCED DEFENSE CAPABILITY OF INDIAN DEFENSE FORCES

5.6.4 USE CASE: DATA ANALYTICS

TABLE 7 DATA ANALYTICS ENHANCE DIGITAL BATTLEFIELD OPERATIONS

5.7 AVERAGE SELLING PRICE OF DIGITAL BATTLEFIELD SOLUTIONS

FIGURE 27 AVERAGE SELLING PRICE TREND OF DIGITAL BATTLEFIELD SOLUTIONS (2022)

5.8 TRADE ANALYSIS

TABLE 8 NAVIGATIONAL INSTRUMENTS: COUNTRY-WISE IMPORTS, 2020–2021 (USD THOUSAND)

TABLE 9 NAVIGATIONAL INSTRUMENTS: COUNTRY-WISE EXPORTS, 2020–2021 (USD THOUSAND)

TABLE 10 RADAR APPARATUS: COUNTRY-WISE EXPORTS, 2020–2021 (USD THOUSAND)

TABLE 11 RADAR APPARATUS: COUNTRY-WISE IMPORTS, 2020–2021 (USD THOUSAND)

5.9 PORTER'S FIVE FORCES ANALYSIS

TABLE 12 DIGITAL BATTLEFIELD SYSTEM MARKET: PORTER'S FIVE FORCE ANALYSIS

FIGURE 28 PORTER'S FIVE FORCES ANALYSIS

5.9.1 THREAT OF NEW ENTRANTS

5.9.2 THREAT OF SUBSTITUTES

5.9.3 BARGAINING POWER OF SUPPLIERS

5.9.4 BARGAINING POWER OF BUYERS

5.9.5 INTENSITY OF COMPETITIVE RIVALRY

5.1 KEY STAKEHOLDERS & BUYING CRITERIA

5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF TOP FOUR PLATFORMS

TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF TOP FOUR PLATFORMS (%)

5.10.2 BUYING CRITERIA

FIGURE 30 KEY BUYING CRITERIA FOR TOP FOUR PLATFORMS

TABLE 14 KEY BUYING CRITERIA FOR TOP FOUR PLATFORMS

5.11 TARIFF AND REGULATORY LANDSCAPE

5.11.1 NORTH AMERICA

5.11.2 EUROPE

5.11.3 ASIA PACIFIC

5.11.4 MIDDLE EAST

5.12 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 15 DIGITAL BATTLEFIELD MARKET: CONFERENCES & EVENTS, 2022–2023

6 INDUSTRY TRENDS (Page No. - 104)

6.1 INTRODUCTION

6.2 TECHNOLOGY ANALYSIS

6.2.1 5G NETWORKING FOR FASTER DATA TRANSFER

6.2.2 USE OF SMART SENSORS FOR MILITARY APPLICATIONS

6.2.3 IMPLEMENTATION OF ARTIFICIAL INTELLIGENCE (AI), DEEP LEARNING IN MODERN WARFARE

FIGURE 31 IMPROVEMENTS IN ARTIFICIAL INTELLIGENCE

6.2.4 INTRODUCTION OF INTERNET OF THINGS (IOT) SYSTEMS IN MILITARY

FIGURE 32 IMPLEMENTATION OF IOT IN MILITARY

6.2.5 PLATFORM TELEMATICS

6.3 TECHNOLOGY TRENDS

6.3.1 HARDWARE: NEW WEAPONS TECHNOLOGY

6.3.2 INTEGRATED PLATFORMS THROUGH DIGITAL TWIN TECHNOLOGY

6.3.3 ENERGY HARVESTING

6.3.4 ADVANCED ANALYTICS (DATA PROCESSING AND ANALYTICS)

6.3.5 CYBER WARFARE

6.3.6 ADDITIVE MANUFACTURING

6.3.7 BLOCKCHAIN

6.4 SUPPLY CHAIN ANALYSIS

FIGURE 33 SUPPLY CHAIN ANALYSIS

6.5 IMPACT OF MEGATRENDS

6.5.1 COORDINATED MILITARY ACTIONS TO LEAD TO COOPERATIVE COMBAT

6.5.2 ARTIFICIAL INTELLIGENCE AND MILITARY ROBOTS HELP EXPLORE BATTLEFIELDS

6.6 PATENT ANALYSIS

TABLE 16 DIGITAL BATTLEFIELD: KEY PATENTS (2019–2022)

FIGURE 34 SURGE IN ROBOTICS-RELATED INNOVATIONS

FIGURE 35 LEADING INDUSTRY INVENTORS IN MILITARY ROBOTICS

7 DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY (Page No. - 118)

7.1 INTRODUCTION

FIGURE 36 5G SEGMENT TO RECORD HIGHEST CAGR BETWEEN 2022 AND 2030

TABLE 17 DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 18 DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION)

7.2 ARTIFICIAL INTELLIGENCE

7.2.1 TRANSFORMS BATTLE FROM SPECIALIZED, MECHANIZED CONFLICT TO INTELLIGENT, ROBOTIC, AND DIGITAL CONFLICT

TABLE 19 ARTIFICIAL INTELLIGENCE: DIGITAL BATTLEFIELD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 20 ARTIFICIAL INTELLIGENCE: DIGITAL BATTLEFIELD MARKET, BY REGION, 2022–2030 (USD MILLION)

7.3 3D PRINTING

7.3.1 USE OF 3D PRINTING IN MASS PRODUCTION TO BECOME COMMONPLACE

TABLE 21 3D PRINTING: DIGITAL BATTLEFIELD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 22 3D PRINTING: DIGITAL BATTLEFIELD MARKET, BY REGION, 2022–2030 (USD MILLION)

7.4 INTERNET OF THINGS

7.4.1 RESOLUTION OF PROBLEMS RELATED TO WAR AND COMBAT DRIVES MARKET GROWTH

TABLE 23 INTERNET OF THINGS: DIGITAL BATTLEFIELD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 24 INTERNET OF THINGS: DIGITAL BATTLEFIELD MARKET, BY REGION, 2022–2030 (USD MILLION)

7.5 BIG DATA ANALYTICS

7.5.1 RESULT OF EXPANSION OF DIGITAL DATA ON INTERNET AND LINKED DEVICES

TABLE 25 BIG DATA ANALYTICS: DIGITAL BATTLEFIELD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 26 BIG DATA ANALYTICS: DIGITAL BATTLEFIELD MARKET, BY REGION, 2022–2030 (USD MILLION)

7.6 ROBOTIC PROCESS AUTOMATION

7.6.1 INCREASES PRODUCTIVITY, CYCLE TIME, AND ACCURACY IN SUPPLY CHAIN MANAGEMENT PROCEDURES

TABLE 27 ROBOTIC PROCESS AUTOMATION: DIGITAL BATTLEFIELD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 28 ROBOTIC PROCESS AUTOMATION: DIGITAL BATTLEFIELD MARKET, BY REGION, 2022–2030 (USD MILLION)

7.7 CLOUD COMPUTING & MASTER DATA MANAGEMENT

7.7.1 PROVIDE NEW CAPABILITIES AND PROMPT UPGRADES TO ACHIEVE OPERATIONAL GOALS

TABLE 29 CLOUD COMPUTING & MASTER DATA MANAGEMENT: DIGITAL BATTLEFIELD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 30 CLOUD COMPUTING & MASTER DATA MANAGEMENT: DIGITAL BATTLEFIELD MARKET, BY REGION, 2022–2030 (USD MILLION)

7.8 DIGITAL TWIN

7.8.1 COST- AND TIME-EFFICIENCY ASSIST MARKET EXPANSION

TABLE 31 DIGITAL TWIN: DIGITAL BATTLEFIELD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 32 DIGITAL TWIN: DIGITAL BATTLEFIELD MARKET, BY REGION, 2022–2030 (USD MILLION)

7.9 BLOCKCHAIN

7.9.1 ENHANCED SECURITY FOR AUTOMATED SYSTEMS FUELS GROWTH

TABLE 33 BLOCKCHAIN: DIGITAL BATTLEFIELD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 34 BLOCKCHAIN: DIGITAL BATTLEFIELD MARKET, BY REGION, 2022–2030 (USD MILLION)

7.10 AUGMENTED REALITY & VIRTUAL REALITY (AR & VR)

7.10.1 ECONOMICAL WAY TO GUARANTEE TRAINING CONSISTENCY AND ASSESS INDIVIDUAL PERFORMANCE

TABLE 35 AR & VR: DIGITAL BATTLEFIELD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 36 AR & VR: DIGITAL BATTLEFIELD MARKET, BY REGION, 2022–2030 (USD MILLION)

7.11 5G

7.11.1 FACILITATES DATA TRANSFER BETWEEN OPERATORS AND MILITARY VEHICLES

TABLE 37 5G: BATTLEFIELD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 38 5G: BATTLEFIELD MARKET, BY REGION, 2022–2030 (USD MILLION)

8 DIGITAL BATTLEFIELD MARKET, BY APPLICATION (Page No. - 134)

8.1 INTRODUCTION

FIGURE 37 PREDICTIVE MAINTENANCE TO RECORD HIGHEST CAGR BETWEEN 2022 AND 2030

TABLE 39 DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 40 DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

8.2 WARFARE PLATFORMS

8.2.1 RISING DEMAND FOR ELECTRONIC WARFARE PLATFORMS TO BOOST SEGMENT GROWTH

TABLE 41 WARFARE PLATFORMS: DIGITAL BATTLEFIELD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 42 WARFARE PLATFORMS: DIGITAL BATTLEFIELD MARKET, BY REGION, 2022–2030 (USD MILLION)

8.3 CYBERSECURITY

8.3.1 INCREASING CYBERATTACKS AND NEED FOR SECURITY TO DRIVE MARKET

TABLE 43 CYBERSECURITY: DIGITAL BATTLEFIELD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 44 CYBERSECURITY: DIGITAL BATTLEFIELD MARKET, BY REGION, 2022–2030 (USD MILLION)

8.4 LOGISTICS & TRANSPORTATION

8.4.1 PLAY KEY ROLE IN MILITARY OPERATIONS

TABLE 45 LOGISTICS & TRANSPORTATION: DIGITAL BATTLEFIELD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 46 LOGISTICS & TRANSPORTATION: DIGITAL BATTLEFIELD MARKET, BY REGION, 2022–2030 (USD MILLION)

8.5 SURVEILLANCE & SITUATIONAL AWARENESS

8.5.1 USE TO GATHER ACTIONABLE INTELLIGENCE TO DRIVE SEGMENT

TABLE 47 SURVEILLANCE & SITUATIONAL AWARENESS: DIGITAL BATTLEFIELD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 48 SURVEILLANCE & SITUATIONAL AWARENESS DIGITAL BATTLEFIELD MARKET, BY REGION, 2022–2030 (USD MILLION)

8.6 COMMAND & CONTROL

8.6.1 EFFICIENT INFORMATION COLLECTION FOR BETTER DECISION-MAKING TO SUPPORT SEGMENT GROWTH

TABLE 49 COMMAND & CONTROL: DIGITAL BATTLEFIELD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 50 COMMAND & CONTROL: DIGITAL BATTLEFIELD MARKET, BY REGION, 2022–2030 (USD MILLION)

8.7 COMMUNICATION

8.7.1 ENABLES CLEAR AND UNAMBIGUOUS FLOW OF INFORMATION

TABLE 51 COMMUNICATION: DIGITAL BATTLEFIELD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 52 COMMUNICATION: DIGITAL BATTLEFIELD MARKET, BY REGION, 2022–2030 (USD MILLION)

8.8 HEALTH MONITORING

8.8.1 RISING NEED TO REDUCE BATTLEFIELD FATALITIES

TABLE 53 HEALTH MONITORING: DIGITAL BATTLEFIELD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 54 HEALTH MONITORING: DIGITAL BATTLEFIELD MARKET, BY REGION, 2022–2030 (USD MILLION)

8.9 SIMULATION & TRAINING

8.9.1 INCREASING INVESTMENTS TO DRIVE SEGMENT GROWTH

TABLE 55 SIMULATION & TRAINING: DIGITAL BATTLEFIELD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 56 SIMULATION & TRAINING: DIGITAL BATTLEFIELD MARKET, BY REGION, 2022–2030 (USD MILLION)

8.9.1.1 Combat simulation & training

8.9.1.2 Command & control training

8.10 DESIGN & MANUFACTURING

8.10.1 EMPHASIS ON SYSTEMATIC & QUANTITATIVE ANALYTICAL TECHNIQUES TO SUPPORT SEGMENT GROWTH

TABLE 57 DESIGN & MANUFACTURING: DIGITAL BATTLEFIELD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 58 DESIGN & MANUFACTURING: DIGITAL BATTLEFIELD MARKET, BY REGION, 2022–2030 (USD MILLION)

8.11 PREDICTIVE MAINTENANCE

8.11.1 INCREASING FOCUS ON DECREASING DOWNTIME

TABLE 59 PREDICTIVE MAINTENANCE: DIGITAL BATTLEFIELD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 60 PREDICTIVE MAINTENANCE: DIGITAL BATTLEFIELD MARKET, BY REGION, 2022–2030 (USD MILLION)

8.12 THREAT MONITORING

8.12.1 RISING ADOPTION OF DIGITAL BATTLEFIELD PRODUCTS IN UAVS

TABLE 61 THREAT MONITORING: DIGITAL BATTLEFIELD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 62 THREAT MONITORING: DIGITAL BATTLEFIELD MARKET, BY REGION, 2022–2030 (USD MILLION)

8.13 REAL-TIME FLEET MANAGEMENT

8.13.1 HIGH DEMAND FOR FLEET MANAGEMENT SOFTWARE & SOLUTIONS FOR MILITARY PURPOSES

TABLE 63 REAL-TIME FLEET MANAGEMENT: DIGITAL BATTLEFIELD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 64 REAL-TIME FLEET MANAGEMENT: DIGITAL BATTLEFIELD MARKET, BY REGION, 2022–2030 (USD MILLION)

8.14 ELECTRONIC WARFARE

8.14.1 HIGH INVESTMENT TO BOOST SEGMENT GROWTH

TABLE 65 ELECTRONIC WARFARE: DIGITAL BATTLEFIELD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 66 ELECTRONIC WARFARE: DIGITAL BATTLEFIELD MARKET, BY REGION, 2022–2030 (USD MILLION)

8.15 INFORMATION PROCESSING

8.15.1 NEED TO PROCESS HIGH VOLUMES OF DATA SUPPORTS SEGMENT GROWTH

TABLE 67 INFORMATION PROCESSING: DIGITAL BATTLEFIELD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 68 INFORMATION PROCESSING: DIGITAL BATTLEFIELD MARKET, BY REGION, 2022–2030 (USD MILLION)

8.16 OTHERS

TABLE 69 OTHER APPLICATIONS: DIGITAL BATTLEFIELD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 70 OTHER APPLICATIONS: DIGITAL BATTLEFIELD MARKET, BY REGION, 2022–2030 (USD MILLION)

9 DIGITAL BATTLEFIELD MARKET, BY PLATFORM (Page No. - 152)

9.1 INTRODUCTION

FIGURE 38 SPACE PLATFORM TO RECORD HIGHEST CAGR BETWEEN 2022 AND 2030

TABLE 71 DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 72 DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

9.2 LAND

TABLE 73 LAND: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 74 LAND: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 75 LAND: DIGITAL BATTLEFIELD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 76 LAND: DIGITAL BATTLEFIELD MARKET, BY REGION, 2022–2030 (USD MILLION)

9.2.1 MILITARY FIGHTING VEHICLES (MFVS)

9.2.1.1 Rising demand for MFVs for use in cross-border conflicts

9.2.2 UNMANNED GROUND VEHICLES (UGVS)

9.2.2.1 Increasing demand for self-driven ground vehicles embedded with advanced military equipment and technologies

9.2.3 WEAPON SYSTEMS

9.2.3.1 Rising preference for weapon systems to enhance combat power

9.2.4 HEADQUARTERS & COMMAND CENTERS

9.2.4.1 Increasing need for cybersecurity to protect headquarters & command centers

9.2.5 DISMOUNTED SOLDIER SYSTEMS

9.2.5.1 Growing requirement for support systems for dismounted soldiers

9.3 NAVAL

TABLE 77 NAVAL: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 78 NAVAL: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 79 NAVAL: DIGITAL BATTLEFIELD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 80 NAVAL: DIGITAL BATTLEFIELD MARKET, BY REGION, 2022–2030 (USD MILLION)

9.3.1 NAVAL SHIPS

9.3.1.1 Heavy spending on destroyers by US, Saudi Arabia, and Germany

9.3.2 SUBMARINES

9.3.2.1 Acceleration in global submarine technology development

9.3.3 UNMANNED MARITIME VEHICLES (UMVS)

9.3.3.1 Adoption of UMVs for defense applications aids market growth

9.4 AIRBORNE

TABLE 81 AIRBORNE: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 82 AIRBORNE: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 83 AIRBORNE: DIGITAL BATTLEFIELD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 84 AIRBORNE: DIGITAL BATTLEFIELD MARKET, BY REGION, 2022–2030 (USD MILLION)

9.4.1 FIGHTER AIRCRAFT

9.4.1.1 Increasing procurement of advanced fighter aircraft for combat missions to drive market growth

9.4.2 MILITARY HELICOPTERS

9.4.2.1 Growing application in search & rescue and combat operations

9.4.3 SPECIAL MISSION AIRCRAFT

9.4.3.1 High usage for strategic military operations to drive demand

9.4.4 UAVS

9.4.4.1 Can readily explore areas that are inaccessible to people

9.5 SPACE

TABLE 85 SPACE: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 86 SPACE: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 87 SPACE: DIGITAL BATTLEFIELD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 88 SPACE: DIGITAL BATTLEFIELD MARKET, BY REGION, 2022–2030 (USD MILLION)

9.5.1 CUBESATS

9.5.1.1 Exponential increase in frequency of CubeSat launches

9.5.2 SATELLITES

9.5.2.1 Growing focus on enhancing surveillance and security capabilities and reducing attack response time

10 DIGITAL BATTLEFIELD MARKET, BY INSTALLATION (Page No. - 165)

10.1 INTRODUCTION

FIGURE 39 NEW PROCUREMENT TO RECORD HIGHER CAGR BETWEEN 2020 AND 2025

TABLE 89 DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

TABLE 90 DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2022–2030 (USD MILLION)

10.2 NEW PROCUREMENT

10.2.1 DEPLOYMENT OF ADVANCED DIGITAL BATTLEFIELD SYSTEMS ACROSS MILITARY PLATFORMS DRIVES MARKET

TABLE 91 NEW PROCUREMENT: DIGITAL BATTLEFIELD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 92 NEW PROCUREMENT: DIGITAL BATTLEFIELD MARKET, BY REGION, 2022–2030 (USD MILLION)

10.3 UPGRADES

10.3.1 INCREASING NEED FOR UPGRADES TO PROTECT SYSTEMS FROM INCOMING THREATS

TABLE 93 UPGRADES: DIGITAL BATTLEFIELD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 94 UPGRADES: DIGITAL BATTLEFIELD MARKET, BY REGION, 2022–2030 (USD MILLION)

11 DIGITAL BATTLEFIELD MARKET, BY SOLUTION (Page No. - 170)

11.1 INTRODUCTION

FIGURE 40 SOFTWARE TO RECORD HIGHEST CAGR BETWEEN 2022 AND 2030

TABLE 95 DIGITAL BATTLEFIELD MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 96 DIGITAL BATTLEFIELD MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

11.2 HARDWARE

11.2.1 ONGOING IMPROVEMENTS IN COMMUNICATIONS TECHNOLOGY TO FUEL SEGMENT GROWTH

11.2.1.1 Communication devices

11.2.1.2 Wearable devices

11.2.1.2.1 Smart clothing

11.2.1.2.2 Exoskeletons

11.2.1.2.3 Smart helmets

11.2.1.3 Imaging devices

11.2.1.4 Display devices

11.2.1.5 Tracking devices

11.2.1.6 Computer hardware devices

11.2.1.7 Data distribution units

11.2.1.8 Night vision devices

11.2.1.9 RFID

11.2.1.10 3D printers

11.2.1.11 Others (Wi-Fi devices, terminals)

11.3 SOFTWARE

11.3.1 ENABLES INTEGRATION OF MULTIPLE SENSORS WITH SINGLE COMMAND SYSTEM

11.3.1.1 Command & control software

11.3.1.2 Military situational awareness

11.3.1.3 Security management

11.3.1.4 Inventory management

11.3.1.5 Fleet management

11.3.1.6 Weapon integration

11.3.1.7 Robotic process automation

11.3.1.8 Others

11.4 SERVICES

11.4.1 PROVIDE SUPPORT FOR SOFTWARE UPGRADES AND ADDITION OF NEW ALGORITHMS

11.4.1.1 Deployment & integration

11.4.1.2 Upgrades & maintenance

11.4.1.3 Software support

11.4.1.4 Others

12 REGIONAL ANALYSIS (Page No. - 183)

12.1 INTRODUCTION

FIGURE 41 NORTH AMERICA PROJECTED TO DOMINATE MARKET FROM 2022 TO 2030

TABLE 97 DIGITAL BATTLEFIELD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 98 DIGITAL BATTLEFIELD MARKET, BY REGION, 2022–2030 (USD MILLION)

12.2 NORTH AMERICA

12.2.1 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 42 NORTH AMERICA: DIGITAL BATTLEFIELD MARKET SNAPSHOT

TABLE 99 NORTH AMERICA: DIGITAL BATTLEFIELD MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 100 NORTH AMERICA: DIGITAL BATTLEFIELD MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

TABLE 101 NORTH AMERICA: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 102 NORTH AMERICA: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 103 NORTH AMERICA: DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

TABLE 104 NORTH AMERICA: DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2022–2030 (USD MILLION)

TABLE 105 NORTH AMERICA: DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 106 NORTH AMERICA: DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

TABLE 107 NORTH AMERICA: DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 108 NORTH AMERICA: DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION)

12.2.2 US

12.2.2.1 Modernization programs and defense policies increase demand for digitalization

FIGURE 43 US: MILITARY SPENDING, 2011–2021 (USD BILLION)

TABLE 109 US: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 110 US: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 111 US: DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

TABLE 112 US: DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2022–2030 (USD MILLION)

TABLE 113 US: DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 114 US: DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

TABLE 115 US: DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 116 US: DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION)

12.2.3 CANADA

12.2.3.1 Increasing R&D investment to drive market growth

FIGURE 44 CANADA: MILITARY SPENDING, 2016–2021 (USD BILLION)

TABLE 117 CANADA: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 118 CANADA: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 119 CANADA: DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

TABLE 120 CANADA: DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2022–2030 (USD MILLION)

TABLE 121 CANADA: DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 122 CANADA: DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

TABLE 123 CANADA: DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 124 CANADA: DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION)

12.3 EUROPE

12.3.1 PESTLE ANALYSIS: EUROPE

FIGURE 45 EUROPE: DIGITAL BATTLEFIELD MARKET SNAPSHOT

TABLE 125 EUROPE: DIGITAL BATTLEFIELD MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 126 EUROPE: DIGITAL BATTLEFIELD MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

TABLE 127 EUROPE: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 128 EUROPE: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 129 EUROPE: DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

TABLE 130 EUROPE: DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2022–2030 (USD MILLION)

TABLE 131 EUROPE: DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 132 EUROPE: DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

TABLE 133 EUROPE: DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 134 EUROPE: DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION)

12.3.2 UK

12.3.2.1 Modernization of miliary programs underway

FIGURE 46 UK: MILITARY SPENDING, 2016–2021 (USD BILLION)

TABLE 135 UK: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 136 UK: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 137 UK: DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

TABLE 138 UK: DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2022–2030 (USD MILLION)

TABLE 139 UK: DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 140 UK: DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

TABLE 141 UK: DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 142 UK: DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION)

12.3.3 FRANCE

12.3.3.1 Heavy investment in research & development to drive market

FIGURE 47 FRANCE: MILITARY SPENDING, 2016–2020 (USD BILLION)

TABLE 143 FRANCE: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 144 FRANCE: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 145 FRANCE: DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

TABLE 146 FRANCE: DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2022–2030 (USD MILLION)

TABLE 147 FRANCE: DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 148 FRANCE: DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

TABLE 149 FRANCE: DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 150 FRANCE: DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION)

12.3.4 GERMANY

12.3.4.1 Digitization to boost market growth

FIGURE 48 GERMANY: MILITARY SPENDING, 2016–2020 (USD BILLION)

TABLE 151 GERMANY: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 152 GERMANY: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 153 GERMANY: DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

TABLE 154 GERMANY: DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2022–2030 (USD MILLION)

TABLE 155 GERMANY: DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 156 GERMANY: DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

TABLE 157 GERMANY: DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 158 GERMANY: DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION)

12.3.5 RUSSIA

12.3.5.1 Preparation for new round of rapid defense investment amid conflict with Ukraine

FIGURE 49 RUSSIA: MILITARY SPENDING, 2016–2021 (USD BILLION)

TABLE 159 RUSSIA: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 160 RUSSIA: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 161 RUSSIA: DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

TABLE 162 RUSSIA: DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2022–2030 (USD MILLION)

TABLE 163 RUSSIA: DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 164 RUSSIA: DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

TABLE 165 RUSSIA: DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 166 RUSSIA: DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION)

12.3.6 ITALY

12.3.6.1 Upgrade of defense equipment and introduction of new platforms to boost market

FIGURE 50 ITALY: MILITARY SPENDING, 2016–2020 (USD BILLION)

TABLE 167 ITALY: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 168 ITALY: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 169 ITALY: DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

TABLE 170 ITALY: DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2022–2030 (USD MILLION)

TABLE 171 ITALY: DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 172 ITALY: DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

TABLE 173 ITALY: DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 174 ITALY: DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION)

12.3.7 REST OF EUROPE

12.3.7.1 Surge in border disputes to increase demand for military procurement

TABLE 175 REST OF EUROPE: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 176 REST OF EUROPE: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 177 REST OF EUROPE: DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

TABLE 178 REST OF EUROPE: DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2022–2030 (USD MILLION)

TABLE 179 REST OF EUROPE: DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 180 REST OF EUROPE: DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

TABLE 181 REST OF EUROPE: DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 182 REST OF EUROPE: DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION)

12.4 ASIA PACIFIC

12.4.1 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 51 ASIA PACIFIC: DIGITAL BATTLEFIELD MARKET SNAPSHOT

TABLE 183 ASIA PACIFIC: DIGITAL BATTLEFIELD MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 184 ASIA PACIFIC: DIGITAL BATTLEFIELD MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

TABLE 185 ASIA PACIFIC: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 186 ASIA PACIFIC: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 187 ASIA PACIFIC: DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

TABLE 188 ASIA PACIFIC: DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2022–2030 (USD MILLION)

TABLE 189 ASIA PACIFIC: DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 190 ASIA PACIFIC: DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

TABLE 191 ASIA PACIFIC: DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 192 ASIA PACIFIC: DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION)

12.4.2 INDIA

12.4.2.1 Growing focus on developing advanced weaponry to ensure border security

FIGURE 52 INDIA: MILITARY SPENDING, 2016–2021 (USD BILLION)

TABLE 193 INDIA: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 194 INDIA: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 195 INDIA: DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

TABLE 196 INDIA: DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2022–2030 (USD MILLION)

TABLE 197 INDIA: DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 198 INDIA: DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

TABLE 199 INDIA: DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 200 INDIA: DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION)

12.4.3 CHINA

12.4.3.1 Increasing expenditure on military equipment to drive market

FIGURE 53 CHINA: MILITARY SPENDING, 2016–2021 (USD BILLION)

TABLE 201 CHINA: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 202 CHINA: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 203 CHINA: DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

TABLE 204 CHINA: DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2022–2030 (USD MILLION)

TABLE 205 CHINA: DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 206 CHINA: DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

TABLE 207 CHINA: DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 208 CHINA: DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION)

12.4.4 JAPAN

12.4.4.1 Continuous efforts to strengthen combat capabilities

FIGURE 54 JAPAN: MILITARY SPENDING, 2016–2020 (USD BILLION)

TABLE 209 JAPAN: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 210 JAPAN: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 211 JAPAN: DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

TABLE 212 JAPAN: DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2022–2030 (USD MILLION)

TABLE 213 JAPAN: DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 214 JAPAN: DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

TABLE 215 JAPAN: DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 216 JAPAN: DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION)

12.4.5 SOUTH KOREA

12.4.5.1 Vision to digitally transform defense sector drives market

FIGURE 55 SOUTH KOREA: MILITARY SPENDING, 2016–2020 (USD BILLION)

TABLE 217 SOUTH KOREA: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 218 SOUTH KOREA: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 219 SOUTH KOREA: DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

TABLE 220 SOUTH KOREA: DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2022–2030 (USD MILLION)

TABLE 221 SOUTH KOREA: DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 222 SOUTH KOREA: DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

TABLE 223 SOUTH KOREA: DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 224 SOUTH KOREA: DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION)

12.4.6 AUSTRALIA

12.4.6.1 High demand for modern digital technologies in military equipment

FIGURE 56 AUSTRALIA: MILITARY SPENDING, 2016–2020 (USD BILLION)

TABLE 225 AUSTRALIA: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 226 AUSTRALIA: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 227 AUSTRALIA: DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

TABLE 228 AUSTRALIA: DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2022–2030 (USD MILLION)

TABLE 229 AUSTRALIA: DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 230 AUSTRALIA: DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

TABLE 231 AUSTRALIA: DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 232 AUSTRALIA: DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION)

12.4.7 REST OF ASIA PACIFIC

12.4.7.1 Modernized militaries and heavy spending on R&D to boost market

TABLE 233 REST OF ASIA PACIFIC: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 234 REST OF ASIA PACIFIC: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 235 REST OF ASIA PACIFIC: DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

TABLE 236 REST OF ASIA PACIFIC: DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2022–2030 (USD MILLION)

TABLE 237 REST OF ASIA PACIFIC: DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 238 REST OF ASIA PACIFIC: DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

TABLE 239 REST OF ASIA PACIFIC: DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 240 REST OF ASIA PACIFIC: DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION)

12.5 MIDDLE EAST & AFRICA

12.5.1 PESTLE ANALYSIS: MIDDLE EAST & AFRICA

FIGURE 57 MIDDLE EAST & AFRICA: DIGITAL BATTLEFIELD MARKET SNAPSHOT

TABLE 241 MIDDLE EAST & AFRICA: DIGITAL BATTLEFIELD MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 242 MIDDLE EAST & AFRICA: DIGITAL BATTLEFIELD MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

TABLE 243 MIDDLE EAST & AFRICA: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 244 MIDDLE EAST & AFRICA: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 245 MIDDLE EAST & AFRICA: DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

TABLE 246 MIDDLE EAST & AFRICA: DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2022–2030 (USD MILLION)

TABLE 247 MIDDLE EAST & AFRICA: DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 248 MIDDLE EAST & AFRICA: DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

TABLE 249 MIDDLE EAST & AFRICA: DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 250 MIDDLE EAST & AFRICA: DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION)

12.5.2 ISRAEL

12.5.2.1 Major hub for leading military system manufacturers and defense organizations

FIGURE 58 ISRAEL: MILITARY SPENDING, 2016–2020 (USD BILLION)

TABLE 251 ISRAEL: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 252 ISRAEL: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 253 ISRAEL: DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

TABLE 254 ISRAEL: DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2022–2030 (USD MILLION)

TABLE 255 ISRAEL: DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 256 ISRAEL: DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

TABLE 257 ISRAEL: DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 258 ISRAEL: DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION)

12.5.3 TURKEY

12.5.3.1 Growing deployment of digital battlefield systems to strengthen defense capability

FIGURE 59 TURKEY: MILITARY SPENDING, 2016–2020 (USD BILLION)

TABLE 259 TURKEY: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 260 TURKEY: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 261 TURKEY: DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

TABLE 262 TURKEY: DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2022–2030 (USD MILLION)

TABLE 263 TURKEY: DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 264 TURKEY: DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

TABLE 265 TURKEY: DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 266 TURKEY: DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION)

12.5.4 SAUDI ARABIA

12.5.4.1 Growing need for cyber defense boosts market

FIGURE 60 SAUDI ARABIA: MILITARY SPENDING, 2016–2020 (USD BILLION)

TABLE 267 SAUDI ARABIA: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 268 SAUDI ARABIA: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 269 SAUDI ARABIA: DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

TABLE 270 SAUDI ARABIA: DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2022–2030 (USD MILLION)

TABLE 271 SAUDI ARABIA: DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 272 SAUDI ARABIA: DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

TABLE 273 SAUDI ARABIA: DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 274 SAUDI ARABIA: DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION)

12.5.5 SOUTH AFRICA

12.5.5.1 Need for enhanced military organization

FIGURE 61 SOUTH AFRICA: MILITARY SPENDING, 2016–2020 (USD BILLION)

TABLE 275 SOUTH AFRICA: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 276 SOUTH AFRICA: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 277 SOUTH AFRICA: DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

TABLE 278 SOUTH AFRICA: DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2022–2030 (USD MILLION)

TABLE 279 SOUTH AFRICA: DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 280 SOUTH AFRICA: DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

TABLE 281 SOUTH AFRICA: DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 282 SOUTH AFRICA: DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION)

12.6 LATIN AMERICA

12.6.1 PESTLE ANALYSIS: LATIN AMERICA

FIGURE 62 LATIN AMERICA: DIGITAL BATTLEFIELD MARKET SNAPSHOT

TABLE 283 LATIN AMERICA: DIGITAL BATTLEFIELD MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 284 LATIN AMERICA: DIGITAL BATTLEFIELD MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

TABLE 285 LATIN AMERICA: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 286 LATIN AMERICA: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 287 LATIN AMERICA: DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

TABLE 288 LATIN AMERICA: DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2022–2030 (USD MILLION)

TABLE 289 LATIN AMERICA: DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 290 LATIN AMERICA: DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

TABLE 291 LATIN AMERICA: DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 292 LATIN AMERICA: DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION)

12.6.2 MEXICO

12.6.2.1 Increasing focus on strengthening ISR capabilities to fuel market growth

FIGURE 63 MEXICO: MILITARY SPENDING, 2016–2020 (USD BILLION)

TABLE 293 MEXICO: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 294 MEXICO: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 295 MEXICO: DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

TABLE 296 MEXICO: DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2022–2030 (USD MILLION)

TABLE 297 MEXICO: DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 298 MEXICO: DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

TABLE 299 MEXICO: DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 300 MEXICO: DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION)

12.6.3 BRAZIL

12.6.3.1 Modernization of armed forces propels market

FIGURE 64 BRAZIL: MILITARY SPENDING, 2016–2020 (USD BILLION)

TABLE 301 BRAZIL: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 302 BRAZIL: DIGITAL BATTLEFIELD MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

TABLE 303 BRAZIL: DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

TABLE 304 BRAZIL: DIGITAL BATTLEFIELD MARKET, BY INSTALLATION, 2022–2030 (USD MILLION)

TABLE 305 BRAZIL: DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 306 BRAZIL: DIGITAL BATTLEFIELD MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

TABLE 307 BRAZIL: DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 308 BRAZIL: DIGITAL BATTLEFIELD MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 295)

13.1 INTRODUCTION

TABLE 309 KEY DEVELOPMENTS BY LEADING PLAYERS IN DIGITAL BATTLEFIELD MARKET BETWEEN 2019 AND 2022

13.2 RANKING ANALYSIS OF KEY MARKET PLAYERS, 2021

FIGURE 65 RANKING ANALYSIS OF TOP FIVE PLAYERS, 2021

13.3 MARKET SHARE OF KEY PLAYERS, 2021

TABLE 310 DIGITAL BATTLEFIELD MARKET: DEGREE OF COMPETITION

13.4 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS, 2021

13.5 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 311 COMPANY PRODUCT FOOTPRINT

TABLE 312 COMPANY SOLUTION FOOTPRINT

TABLE 313 COMPANY PLATFORM FOOTPRINT

TABLE 314 COMPANY REGION FOOTPRINT

13.6 COMPANY EVALUATION QUADRANT

13.6.1 STARS

13.6.2 EMERGING LEADERS

13.6.3 PERVASIVE PLAYERS

13.6.4 PARTICIPANTS

FIGURE 66 MARKET COMPETITIVE LEADERSHIP MAPPING, 2021

13.7 COMPETITIVE LEADERSHIP MAPPING (SME)

13.7.1 PROGRESSIVE COMPANIES

13.7.2 RESPONSIVE COMPANIES

13.7.3 STARTING BLOCKS

13.7.4 DYNAMIC COMPANIES

FIGURE 67 DIGITAL BATTLEFIELD MARKET (SME) COMPETITIVE LEADERSHIP MAPPING, 2021

13.8 COMPETITIVE SCENARIO

13.8.1 MARKET EVALUATION FRAMEWORK

13.8.2 PRODUCT LAUNCHES

TABLE 315 PRODUCT LAUNCHES, 2019–AUGUST 2022

13.8.3 DEALS

TABLE 316 DEALS, 2019–AUGUST 2022

14 COMPANY PROFILES (Page No. - 324)

14.1 INTRODUCTION

14.2 KEY PLAYERS

(Business overview, Products/Solutions/Services, Recent developments, MnM view, Key strengths, Strategic choices, and Weaknesses and competitive threats)*

14.2.1 RAYTHEON TECHNOLOGIES CORPORATION

TABLE 317 RAYTHEON TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

FIGURE 68 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

TABLE 318 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 319 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCT LAUNCHES

TABLE 320 RAYTHEON TECHNOLOGIES CORPORATION: DEALS

14.2.2 LOCKHEED MARTIN CORPORATION

TABLE 321 LOCKHEED MARTIN CORPORATION: BUSINESS OVERVIEW

FIGURE 69 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

TABLE 322 LOCKHEED MARTIN CORPORATION: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 323 LOCKHEED MARTIN CORPORATION: DEALS

14.2.3 NORTHROP GRUMMAN CORPORATION

TABLE 324 NORTHROP GRUMMAN CORPORATION: BUSINESS OVERVIEW

FIGURE 70 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

TABLE 325 NORTHROP GRUMMAN CORPORATION: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 326 NORTHROP GRUMMAN CORPORATION: PRODUCT LAUNCHES

TABLE 327 NORTHROP GRUMMAN CORPORATION: DEALS

14.2.4 BAE SYSTEMS

TABLE 328 BAE SYSTEMS: BUSINESS OVERVIEW

FIGURE 71 BAE SYSTEMS: COMPANY SNAPSHOT

TABLE 329 BAE SYSTEMS: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 330 BAE SYSTEMS: PRODUCT LAUNCHES

TABLE 331 BAE SYSTEMS: DEALS

14.2.5 THALES GROUP

TABLE 332 THALES GROUP: BUSINESS OVERVIEW

FIGURE 72 THALES GROUP: COMPANY SNAPSHOT

TABLE 333 THALES GROUP: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 334 THALES GROUP: PRODUCT LAUNCHES

TABLE 335 THALES GROUP: DEALS

14.2.6 L3HARRIS TECHNOLOGIES, INC.

TABLE 336 L3HARRIS TECHNOLOGIES, INC.: BUSINESS OVERVIEW

FIGURE 73 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

TABLE 337 L3HARRIS TECHNOLOGIES, INC.: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 338 L3HARRIS TECHNOLOGIES, INC.: PRODUCT LAUNCHES

TABLE 339 L3HARRIS TECHNOLOGIES, INC.: DEALS

14.2.7 ELBIT SYSTEMS LTD.

TABLE 340 ELBIT SYSTEMS LTD.: BUSINESS OVERVIEW

FIGURE 74 ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT

TABLE 341 ELBIT SYSTEMS LTD.: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 342 ELBIT SYSTEMS LTD.: PRODUCT LAUNCHES

TABLE 343 ELBIT SYSTEMS LTD.: DEALS

14.2.8 GENERAL DYNAMICS CORPORATION

TABLE 344 GENERAL DYNAMICS CORPORATION: BUSINESS OVERVIEW

FIGURE 75 GENERAL DYNAMICS CORPORATION: COMPANY SNAPSHOT

TABLE 345 GENERAL DYNAMICS CORPORATION: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 346 GENERAL DYNAMICS CORPORATION: PRODUCT LAUNCHES

TABLE 347 GENERAL DYNAMICS CORPORATION: DEALS

14.2.9 RHEINMETALL AG

TABLE 348 RHEINMETALL AG: BUSINESS OVERVIEW

FIGURE 76 RHEINMETALL AG: COMPANY SNAPSHOT

TABLE 349 RHEINMETALL AG: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 350 RHEINMETALL AG: DEALS

14.2.10 LEONARDO

TABLE 351 LEONARDO: BUSINESS OVERVIEW

FIGURE 77 LEONARDO: COMPANY SNAPSHOT

TABLE 352 LEONARDO: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 353 LEONARDO: PRODUCT LAUNCHES

TABLE 354 LEONARDO: DEALS

14.2.11 SAAB AB

TABLE 355 SAAB AB: BUSINESS OVERVIEW

FIGURE 78 SAAB AB: COMPANY SNAPSHOT

TABLE 356 SAAB AB: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 357 SAAB AB: DEALS

14.2.12 AIRBUS SE

TABLE 358 AIRBUS SE: BUSINESS OVERVIEW

FIGURE 79 AIRBUS SE: COMPANY SNAPSHOT

TABLE 359 AIRBUS SE: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 360 AIRBUS SE: PRODUCT LAUNCHES

14.2.13 CURTISS-WRIGHT

TABLE 361 CURTISS-WRIGHT: BUSINESS OVERVIEW

FIGURE 80 CURTISS-WRIGHT: COMPANY SNAPSHOT

TABLE 362 CURTISS-WRIGHT: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 363 CURTISS-WRIGHT: DEALS

14.2.14 LEIDOS

TABLE 364 LEIDOS: BUSINESS OVERVIEW

FIGURE 81 LEIDOS: COMPANY SNAPSHOT

TABLE 365 LEIDOS: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 366 LEIDOS: DEALS

14.2.15 BOOZ ALLEN HAMILTON

TABLE 367 BOOZ ALLEN HAMILTON: BUSINESS OVERVIEW

FIGURE 82 BOOZ ALLEN HAMILTON: COMPANY SNAPSHOT

TABLE 368 BOOZ ALLEN HAMILTON: PRODUCT/SOLUTION/SERVICE OFFERINGS

14.2.16 ASELSAN A.S.

TABLE 369 ASELSAN A.S.: BUSINESS OVERVIEW

TABLE 370 ASELSAN A.S: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 371 ASELSAN A.S: DEALS

14.2.17 INDRA

TABLE 372 INDRA: BUSINESS OVERVIEW

TABLE 373 INDRA: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 374 INDRA: DEALS

14.2.18 TELEDYNE FLIR LLC

TABLE 375 TELEDYNE FLIR LLC: BUSINESS OVERVIEW

TABLE 376 TELEDYNE FLIR LLC: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 377 TELEDYNE FLIR LLC: DEALS

14.2.19 COBHAM LIMITED

TABLE 378 COBHAM LIMITED: BUSINESS OVERVIEW

TABLE 379 COBHAM LIMITED: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 380 COBHAM LIMITED: PRODUCT LAUNCHES

TABLE 381 COBHAM LIMITED: DEALS

14.2.20 ATOS SE

TABLE 382 ATOS SE: BUSINESS OVERVIEW

TABLE 383 ATOS SE: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 384 ATOS SE: DEALS

14.3 OTHER PLAYERS

14.3.1 ROLTA INDIA LIMITED

TABLE 385 ROLTA LIMITED: COMPANY OVERVIEW

14.3.2 RAFAEL ADVANCED DEFENSE SYSTEMS LIMITED

TABLE 386 RAFAEL ADVANCED DEFENSE SYSTEMS LIMITED: COMPANY OVERVIEW

14.3.3 ISRAEL AEROSPACE INDUSTRIES

TABLE 387 ISRAEL AEROSPACE INDUSTRIES: COMPANY OVERVIEW

14.3.4 TELEPLAN GLOBE AS

TABLE 388 TELEPLAN GLOBE AS: COMPANY OVERVIEW

14.3.5 ROHDE & SCHWARZ

TABLE 389 ROHDE & SCHWARZ: COMPANY OVERVIEW

*Details on Business overview, Products/Solutions/Services, Recent developments, MnM view, Key strengths, Strategic choices, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 395)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 CUSTOMIZATION OPTIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the Digital Battlefield Market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The share of companies in the digital battlefield market was determined using secondary data made available through paid and unpaid sources, and by analyzing the product portfolio of major companies operating in the market. These companies were rated based on the performance and quality of their products. Data points were further validated by primary sources.

Secondary sources referred to for this research study on the digital battlefield market included government sources such as the US Department of Defense (DoD), Trade Statistics For International Business Development, the US Department of Army (DoA), UN DATABASE, World Bank Database, and defense budgets of various countries; corporate filings such as annual reports, investor presentations, and financial statements; and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall size of the digital battlefield market, which was further validated by primary respondents.

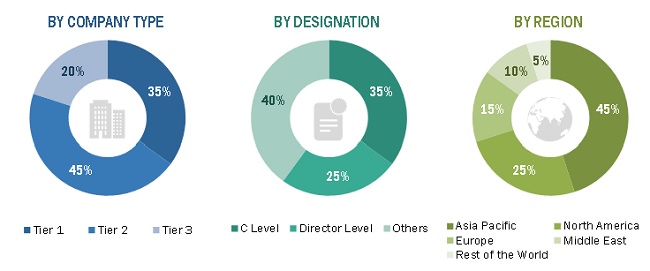

Primary Research

Extensive primary research was conducted after obtaining information about the current scenario of the digital battlefield market through secondary research. Several primary interviews were conducted with market experts from both, demand- and supply-side across 6 major regions, namely, North America, Europe, Asia Pacific (APAC), Latin America, the Middle East, and Africa. Primary data was collected through questionnaires, emails, and telephonic interviews. The supply side is characterized by suppliers, manufacturers, solution providers, technology developers, alliances, and organizations. The following is the breakdown of the primary respondents that were interviewed to obtain qualitative and quantitative information about the digital battlefield market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

- The top-down and bottom-up approaches were used to estimate and validate the size of the digital battlefield market. The figure in the section below is a representation of the overall market size estimation process employed for the purpose of this study.

- The research methodology used to estimate the market size also includes the following details.

- Key players in the industry and markets were identified through secondary research, and their market share was determined through primary and secondary research. This included an extensive study of annual and financial reports of top market players and interviews of CEOs, directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Digital battlefield Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics for market segments and subsegments, the data triangulation and market breakdown procedures explained below were implemented, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand and supply sides. Along with this, the market size was validated using both, the top-down and bottom-up approaches.

The following figure indicates the market breakdown structure and the data triangulation procedure implemented in the market engineering process used in this report.

Report Objectives

- To analyze the digital battlefield market and provide projections for it from 2022 to 2030

- To define, describe, and forecast the size of the digital battlefield market based on end use, capability, product, and platform, along with a regional analysis

- To understand the market structure by identifying its various subsegments

- To provide in-depth market intelligence regarding the dynamics and major factors that influence the growth of the digital battlefield market (drivers, restraints, opportunities, and challenges)

- To analyze opportunities in the market for stakeholders by identifying key trends

- To analyze competitive developments such as new product launches, contracts, partnerships, collaborations, expansions, acquisitions, and new product development in the digital battlefield market

- To provide a detailed competitive landscape of the digital battlefield market, along with an analysis of the business and corporate strategies adopted by key market players

- To strategically profile key market players and comprehensively analyze their core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

Geographic analysis

- Rest of Asia Pacific and Rest of Europe breakdown at country level

Company information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Digital Battlefield Market