Digital Multimeter Market by Type (Handheld, Benchtop, Mounted), Ranging Type (Auto-ranging, Manual), Application (Automotive, Energy, Consumer Electronics & Appliances, Medical Equipment Manufacturing), and Region - Global Forecast to 2024

Digital Multimeter Market

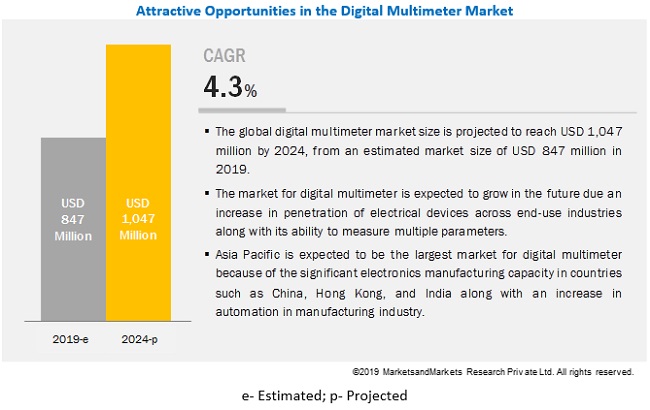

Digital Multimeter Market is expected to grow at a CAGR of 4.3%

Digital Multimeter Market and Top Companies

Key market players profiled in the digital multimeter market report includes:

- Keysight Technologies. (US)

- Gossen Metrawatt (Germany)

- National Instruments (US)

- Tektronix (US)

- Yokogawa Electric Corporation (Japan)

- Fluke Corporation (US)

- FLIR System (US)

- B&K Precision (US)

- Chauvin Arnoux (France)

- Hioki E.E. Corporation (Japan)

- Keysight Technologies (US) –Keysight Technologies offers electronic measurement services. The company offers various products and services across categories such as oscilloscopes & analyzers, meters, generators, sources & power, wireless, modular instruments, design & test software, network test, network security & visibility, and services. The digital multimeters fall in the Meters product category along with power meters & sensors, LCR meters, handheld oscilloscopes, analyzers, picoammeters, and electrometers. The company offers digital multimeter products that provide voltage measurement up to 1000 VAC/VDC.

- Gossen Metrawatt (Germany) – Gossen Metrawatt is one of the major players in the field of measuring and test instruments. The company offers various measuring and testing equipment for standardized testing of electrical systems and appliances, such as multimeters, calibrators, network analyzers, power supplies, as well as transducers and power meters for high-voltage and moving-coil measurement.

- National Instruments (US) – National Instruments designs and manufactures computer-based instrumentation hardware and software. The company’s software-centric platform provides integrated software and modular hardware to create automated test and measurement systems. The company also offers an extensive line of measurement, automation, and control products that can work either as stand-alone products or as integrated systems. National Instruments offers digital multimeters under its electronic test and instrumentation products category, along with other products such as oscilloscopes, waveform generators, and frequency counters.

- Tektronix (US) – Tektronix designs and manufactures electronic test and measurement solutions/equipment. The company offers oscilloscopes, probes, analyzers, signal generators, meters, video test equipment, sources, and supplies. The company provides products, solutions, and services for industries such as semiconductor design and manufacturing, consumer electronics and appliances, and computers and peripherals. The company offers a wide range of benchtop digital multimeters, under both Tektronix and Keithley brands, with features such as 5½-digit resolution to 8½-digit resolution, 1 M sample/s sampling speed, and LAN/LXI, USB-TMC, GPIB, and RS-232 interface options.

- Yokogawa Electric Corporation (Japan) – Yokogawa Electric Corporation provides products and solutions for measurement, control, and information technologies. It operates through three business segments: Industrial Automation and Control, Test and Measurement, and Aviation and Others. The Test and Measurement business segment of the company manufactures and supplies measuring instruments and test equipment. The company offers waveform measuring instruments; optical communications measuring instruments; signal generators; electric voltage, current, and power measuring instruments; LCD drivers; and confocal scanners. The company offers handheld and benchtop digital multimeters.

- Fluke Corporation (US) – Fluke Corporation designs and sells electronic test and measurement instruments and systems. The Company's products include digital voltmeters, electronic counters, digital thermometers, data loggers, and PC-based data acquisition systems and software for the scientific, educational, government, and industrial markets. The company offers its products to various end users such as electronic industry, biomedical industry, process instruments, and networks. It operates various subsidiary companies such as Fluke Calibration, Fluke Biomedical, Fluke Networks, Fluke Process Instruments, Amprobe, Beha-Amprobe, Comark, Pacific Laser Systems, Pomona, Raysafe, and Universal Technic. Fluke corporation offers handheld digital multimeters with various features such as TrueRMS value measurement, non-contact voltage sensing, clamp type for high current applications, remote display, wireless multimeters, and automotive multimeters

- FLIR Systems (US) – FLIR is a technology company developing advanced sensors and integrated sensor systems that enable gathering, measurement, and analysis of critical information. The company provides various solutions such as thermal imaging systems, visible-light imaging systems, locater systems, measurement and diagnostic systems, and advanced threat-detection solutions. The company offers digital multimeters under FLIR and Extech brands. The FLIR brand digital multimeters have thermal imaging capability and are mostly designed for rugged and special applications. Multimeter models for general purpose applications are available under the Extech brand.

- B&K Precision (US) – B&K Precision designs and manufactures electronic test and measurement instruments. Its product portfolio includes power supplies, DC electronic loads, oscilloscopes, signal generators (especially function and arbitrary generators), multimeters, component testers, data recorders, RF test instruments, device programmers, counters, electrical and battery testers, environmental testers, video & cable, and accessories. The company offers various benchtop as well as handheld multimeters. It also offers clamp type meters to measure high current and voltage safely. These multimeters can be used for continuity test, diode test, capacitance measurement, frequency measurement, dBm measurement, Transistor gain (hFE), and logic level.

- Chauvin Arnoux (France) – Chauvin Arnoux is one of the major players in the measurement sector. The company offers a broad range of portable and laboratory measuring instruments for use in the electrical and electronics sector. The company offers various test and measurement devices such as oscilloscopes, calibrators, earth resistivity sensors, electrical insulation testers, electromagnetic field testers, insulation testers, machine and equipment testers, loggers, micro-ohmmeters, RF wattmeter along with digital multimeters. It offers digital multimeter under three brands: Chauvin Arnoux, Metrix, and Multimetrix.

- Hioki E.E. Corporation (Japan) – Hioki E.E Corporation is a manufacturer of electrical measuring instruments. The company offers products under four product groups: automatic test equipment, data recording equipment, electronic measuring instruments, and field measuring instruments. The company offers digital multimeters under its electronic measuring instruments product group. It also provides products such as data acquisition oscilloscopes, electrometers pico-ammeters, insulation testers megohmmeters, meter relays CTs, shunts, multichannel data loggers, ground testers, voltage detectors, and phase detectors.

Digital Multimeter Market and Top Applications

Top applications in Digital Multimeter Market are:

- Automotive

- Energy

- Automotive – Digital multimeter is used in the automotive sector to test electrical and electronic components in an automobile. Present day automobiles consist of more than 50 electronic systems dedicated for monitoring and controlling all functional aspects of the vehicles. Adaptive front lighting, cruise control, engine control, wiper control, power steering, throttle control, ignition system, head-up display, battery management, and navigation system are some of the electronics devices in an automobile. Present global automotive industry trends such as electric cars, connected cars, and autonomous cars point towards a future with increased penetration of electronic components in the automobile.

- Energy – Applications covered under the energy segment include energy and utility applications. Digital multimeter is widely used by technicians across the industry value chain, from generation up until distribution. To quickly measure voltage, current, and resistance in electrical circuits and to perform tests and troubleshoot quickly, technicians rely on digital multimeter. Digital multimeters are used by linemen and operators of distribution utilities. Multimeters with advanced features such as thermal imaging are also used to identify hotspots and detect issues quickly and safely. Globally, utilities are investing heavily in upgrading grid infrastructure and adopting smart grid solutions such as smart meters, renewable energy, and automation.

Digital Multimeter Market by Type Top segments

Top By Type Digital Multimeter Market segments are:

- Handheld Multimeter– Handheld multimeters are compact, easy to use, and provide accurate measurement in many applications. These multimeters are widely used in automotive; energy; aerospace, defense & government services; and wireless communication & Infrastructure sectors. Low cost and portability are the key factors driving the adoption of digital multimeters. Global trends such as increased demand for electric vehicles, renewables, and 5G is also driving the demand for digital multimeters.

Digital Multimeter Market and Top Developments

Top Developments in Digital Multimeter Market are:

- October 2019 – Tektronix provided the University of East Anglia with 36 seated workstations. Each workstation is fitted with a Keithley 2110, 5.5 DMMs along with oscilloscopes, function generators, and triple output power supplies.

- August 2019 – Gossen Metrawatt launched new Metraline series digital multimeters. The new product includes autoblocking sockets for safety and is secure according to measuring categories CAT IV (300 V) or CAT III (600 V).

- March 2019 –Fluke Calibration launched 8588A and the 8558A 8.5-Digit Multimeter. 8588A Reference Multimeter is a stable digitizing multimeter designed for calibration standards laboratories. 8558A 8.5-Digit Multimeter digitizes 5 million readings per second, for high-resolution system automation in calibration labs and manufacturing test environments

[178 Pages Report] The global digital multimeter market size was valued at $847 million in 2019 and to reach $1,047 million by 2024, growing at a compound annual growth rate (CAGR) of 4.3% from 2019 to 2024. The key factors driving the market include increased penetration of electronic devices across various end user industries and the low cost and multifunctional nature of multimeters.

The handheld segment is expected to be the largest market during the forecast period

Handheld multimeter is expected to be the largest digital multimeter market, by type, during the forecast period. Portability and low cost of the handheld multimeter make it an attractive option for consumers. The growth of handheld multimeters can be attributed to the increased demand for multimeters in the automotive and energy sectors.

The auto-ranging segment is expected to be the fastest-growing segment in the digital multimeter market, by type, during the forecast period

The auto-ranging segment is expected to grow at the highest rate during the forecast period. Auto-ranging multimeters are easy to operate and can be operated by anyone without technical knowledge. Auto-ranging multimeters have the ability to seamlessly measure a similar electrical parameter of different ranges without manual adjustments. The growing demand for electronic devices and smart home appliances in the consumer electronics segment is expected to drive the demand for auto-ranging multimeters.

The automotive segment is expected to be the fastest-growing segment of the digital multimeter market during the forecast period

The automotive segment is expected to be the fastest-growing digital multimeter market, by application, during the forecast period. The growing demand for electric vehicles and self-driving cars in North America, Europe, and China is driving the requirement of digital multimeters. The increased penetration of electronic devices further aids the growth in non-electric automobiles.

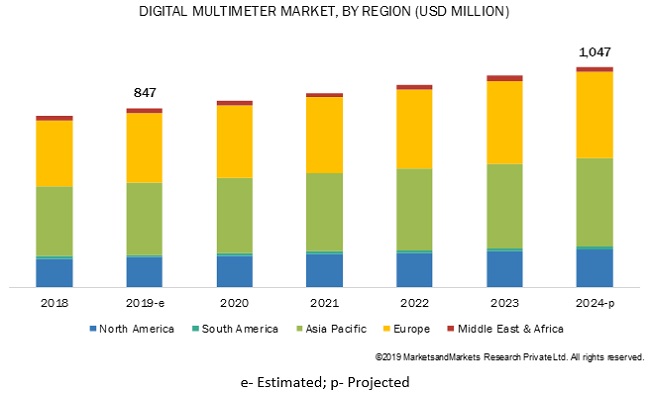

Asia Pacific is expected to be the largest digital multimeter market during the forecast period

In this report, the digital multimeter industry has been analyzed with respect to five regions, namely, Asia Pacific, North America, Europe, South America, and the Middle East & Africa. The world’s biggest electronic manufacturing companies operate from Asia Pacific because of the availability of cheap labor and the easy availability of raw materials. China, Taiwan, and Hong Kong have significant electronics manufacturing capacity. China is also one of the world’s leading manufacturers in the automotive sector. Due to these factors, Asia Pacific accounts for a significant share in the market in the forecast period.

Key Market Players

The major players in the global digital multimeter market include Fluke Corporation (US), Tektronix (US), Keysight Technologies (US), Yokogawa (Japan), Gossen Metrawatt (Germany), Hioki (Japan), National Instruments (US), and FLIR System (US).

Fluke Corporation (US) is a key player in this market. The company’s recent product launches, as part of its organic business strategy, is expected to increase its clientele base globally. Fluke Calibration launched 8588A and the 8558A 8.5-Digit Multimeter. 8588A Reference Multimeter is a stable digitizing multimeter designed for calibration standards laboratories. 8558A 8.5-Digit Multimeter digitizes 5 million readings per second, for high-resolution system automation in calibration labs and manufacturing test environments.

Keysight Technologies (US) is another major player in the digital multimeter. Keysight offers products and services for design, development, manufacture, installation, deployment, validation, optimization, and secure operation of electronics systems. The company is primarily engaged in the design, production, and sale of quality electrical and electronic products for a broad range of residential and nonresidential applications. The company has a strong presence in North America. More than 90% of the company’s revenues come from the US.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Forecast units |

Value (USD) |

|

Segments covered |

type, ranging type, application, and region |

|

Geographies covered |

Asia Pacific, North America, Europe, South America, and the Middle East & Africa |

|

Companies covered |

Keysight Technologies (US), Gossen Metrawatt (Germany), National Instruments (US), Tektronix (US), Yokogawa Electric Corporation (Japan), Fluke Corporation (US), FLIR Systems (US), B&K Precision (US), Chauvin Arnoux (France), Hioki E.E. Corporation (Japan), Sanwa Electric Instrument Company (Japan), Kyoritsu Electrical Instrument Works (Japan), Rohde & Schwarz (Germany), Teledyne Lecroy (US), Goodwill instruments (Taiwan), Klein Tools (US), Shenzen Everbest Machinery Industry (China), Mastech Group (Hong Kong), HT Italia (Italy), and GS Instech (South Korea) |

This research report categorizes the market by standard, type, voltage, application, and region.

By Type:

- Handheld

- Benchtop

- Mounted

By Ranging Type:

- Auto-ranging

- Manual

By Application:

- Automotive

- Energy

- Consumer Electronics & Appliances

- Medical Device Manufacturing

- Others

By Region:

- Asia Pacific

- North America

- Europe

- South America

- Middle East & Africa

Recent Developments

- In April 2019, Gossen Metrawatt launched new Metraline series digital multimeters. The new product includes autoblocking sockets for safety and is secure according to measuring categories CAT IV (300 V) or CAT III (600 V)

- In April 2019, Keysight Technologies, Inc., opened a new automotive customer center in Nagoya, Japan, to work with and serve customers in local proximity to support innovative technology projects. The new center includes customer electronic test and measurement labs, technical experts, and state-of-the-art test equipment, as well as a customer training facility for hands-on workshops and seminars.

- In November 2018, Tektronix introduced the Keithley DMM7512 dual-channel 7½-digit sampling multimeter. This multimeter packs two independent and identical digital multimeters into a low profile 1U high, full rack width space-saving enclosure. The DMM7512 enables the capture of transient signals and waveforms, even low-level waveforms such as battery drain currents, with its 1Msample/s, 18-bit digitizer that has voltage sensitivity of 1µV and current sensitivity of 0.1nA.

- In July 2017, After establishing subsidiaries in the US, China, Singapore, South Korea, and India, Hioki established Hioki Europe GmbH, a sales subsidiary for the European market, with its headquarters in Germany. This subsidiary is expected to enable Hioki to operate in closer proximity to major regional companies in the automotive and aerospace industries.

Key Questions Addressed by the Report

- Which revolutionary technology trends are expected over the next five years?

- Which elements of the digital multimeter market are expected to lead by 2024?

- Which type of digital multimeter is likely to get the maximum opportunity to grow during the forecast period?

- Which region is expected to lead with the highest market share by 2024?

- How are companies implementing organic and inorganic strategies to gain an increase in the digital multimeter market share?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Frequently Asked Questions (FAQ):

Which revolutionary technology trends are expected over the next 5 years?

Application specific multimeters and multimeter with infrared sensors for thermal imaging are some of the revolutionary technology trends that are observed. Digital multimeters with communication capabilities to facilitate data capture and analysis are also on the rise.

Which elements of the digital multimeter market are expected to lead by 2024?

Handheld digital multimeters are expected to lead by 2024 due to its low cost and portability. Ease of use and ability to quickly make onsite measurements further contributes to the attractiveness of the handheld type multimeters.

Which type of digital multimeter is likely to get the maximum opportunity to grow during the forecast period?

Auto-ranging digital multimeter market is likely to get the maximum opportunity to grow during the forecast period Auto-ranging multimeters are easy to operate and can be operated by anyone without technical knowledge. Such an advantage makes it an attractive option for consumers.

Which region is expected to lead with the highest market share by 2024?

The Asia Pacific region is expected to lead with the highest market share by 2024 due to the increased industrialization and presence of large manufacturing companies.

How are companies implementing organic and inorganic strategies to gain an increase in the market share?

The companies are implementing organic and inorganic strategies to gain an increase in the market share especially through new product launches and investments &expansions.

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Definition

1.2.1 Markets Covered

1.2.2 Regional Scope

1.2.3 Years Considered for the Study

1.3 Currency

1.4 Limitations

1.5 Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Scope

2.3 Market Size Estimation

2.3.1 Supply-Side Analysis

2.3.1.1 Assumptions

2.3.1.2 Key Primary Insights

2.3.1.3 Calculation

2.3.2 Demand Analysis

2.3.2.1 Key Parameters/Trends

2.3.3 Forecast

2.4 Market Breakdown and Data Triangulation

2.5 Primary Insights

3 Executive Summary (Page No. - 33)

4 Premium Insights (Page No. - 37)

4.1 Attractive Opportunities in the Digital Multimeter Market

4.2 Digital Multimeter Market, By Type

4.3 Digital Multimeter Market, By Ranging

4.4 Digital Multimeter Market, By Application

4.5 Digital Multimeter Market, By Region

5 Market Overview (Page No. - 40)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Low Cost and Versatility of Digital Multimeters

5.2.1.2 Application-Specific Product Development and Continuous Addition of New Features

5.2.1.3 Increased Penetration of Electronic Devices Across End-Use Industries

5.2.2 Restraints

5.2.2.1 Need for Periodic Recalibration Over the Product Lifetime

5.2.2.2 Competition From Small Local Manufacturers Selling Cheap Low-Quality Products

5.2.3 Opportunities

5.2.3.1 Increased Applications for Iot and Rise of Industry 4.0

5.2.3.2 Rise of the Maker Movement and Diy Culture

5.2.4 Challenges

5.2.4.1 Incorrect Operation and Inappropriate Multimeter Selection

6 Digital Multimeter Market, By Type (Page No. - 44)

6.1 Introduction

6.2 Handheld

6.2.1 High Adoption of Handheld Digital Multimeter is Due to Its Portability

6.3 Benchtop

6.3.1 Increased Investment in R&D Across End-User Segments is Driving the Market for Benchtop Multimeters

6.4 Mounted

6.4.1 Global Manufacturing Sector Growth is Expected to Drive the Market for Mounted Digital Multimeter

7 Digital Multimeter Market, By Ranging Type (Page No. - 49)

7.1 Introduction

7.2 Auto-Ranging

7.2.1 Growth of Auto-Ranging Digital Multimeter Can Be AttributedTo Its Ease of Use

7.3 Manual

7.3.1 Low Cost of Manual Ranging Digital Multimeters Makes It an Attractive Option for General Purpose Use

8 Digital Multimeter Market, By Application (Page No. - 53)

8.1 Introduction

8.2 Automotive

8.2.1 Increasing Demand for Electric Vehicles is Expected to Drive the Demand for Digital Multimeter

8.3 Energy

8.3.1 Increasing Energy Consumption and Investments in Smart Grid Infrastructure are Expected to Drive the Demand

8.4 Consumer Electronics & Appliances

8.4.1 Increased Demand for Smarthome Appliances is Expected to Drive the Demand in This Segment

8.5 Medical Equipment Manufacturing

8.5.1 High Standards for Maufacturing of Medical Equiment to Drive the Medical Equipment Manucaturing Segment

8.6 Others

8.6.1 Increased Military Spending By Global Superpowers Such as US China is Expected to Drive the Market in This Segment

9 Digital Multimeter Market, By Region (Page No. - 60)

9.1 Introduction

9.1.1 By Region

9.2 Asia Pacific

9.2.1 By Type

9.2.2 By Ranging Type

9.2.3 By Application

9.2.4 By Country

9.2.5 China

9.2.5.1 Increased Demand for Electric Vehicles and Increase in China’s Military Spending are Expected to Drive the Market in China

9.2.6 Australia

9.2.6.1 Increasing Renewable Energy Investments are Expected to Drive the Australian Market

9.2.7 India

9.2.7.1 Growth in Electronic Devices Manufacturing and Telecommunications are Expected to Drive the Indian Dmm Market

9.2.8 South Korea

9.2.8.1 Growth of Consumer Electronics Market and Increased Demand for Smart Home Devices is Expected to Drive the Market

9.2.9 Japan

9.2.9.1 Developments in the Automotive Market are Expected to Drive the Market

9.2.10 Rest of Asia Pacific

9.2.10.1 Growth of Wireless Communication and Infrastructure Market is Expected to Drive the Dmm Market

9.3 Europe

9.3.1 By Type

9.3.2 By Ranging Type

9.3.3 By Application

9.3.4 By Country

9.3.5 UK

9.3.5.1 Investments in Renewable Energy and the Strong Automotive Sector are Expected to Drive the Dmm Market

9.3.6 Germany

9.3.6.1 Investments in Energy Sector Digitalization and Electric Vehicles are Expected to Drive the German Dmm Market

9.3.7 France

9.3.7.1 Increase in Military Spending Will Drive the Market

9.3.8 Russia

9.3.8.1 Growth of Russian Defense Exports is Expected to Drive the Market

9.3.9 Spain

9.3.9.1 Growth of the Spanish Automotive Market is Expected to Drive the Dmm Market

9.3.10 Italy

9.3.10.1 Investments in Energy Sector to Reach Italy’s Renewable Energy Targets are Expected to Drive the Market

9.3.11 Rest of Europe

9.3.11.1 Increased Investments in Renewable Energy are Expected to Drive the Market

9.4 North America

9.4.1 By Type

9.4.2 By Ranging Type

9.4.3 By Application

9.4.4 By Country

9.4.5 US

9.4.5.1 Rapid Rise of Electric Vehicles and Increased Military Spending are Expected to Drive the US Dmm Market

9.4.6 Canada

9.4.6.1 Growing Demand for Broadband Services and the Increase in Ev Adoption in Canada is Expected to Drive the Market

9.4.7 Mexico

9.4.7.1 Increasing Automotive Investments in Mexico are Expected to Drive the Digital Multimeter Industry

9.5 Middle East & Africa

9.5.1 By Type

9.5.2 By Ranging Type

9.5.3 By Application

9.5.4 By Sub-Region

9.5.5 Middle East

9.5.5.1 Increasing Investment in the Defense Sector is Expected to Drive the Demand

9.5.6 Africa

9.5.6.1 Investments in Power Generation Projects Expected to Drive the Market for Digital Multimeters

9.6 South America

9.6.1 By Type

9.6.2 By Ranging Type

9.6.3 By Application

9.6.4 By Country

9.6.5 Brazil

9.6.5.1 Investments in the Energy Sector are Expected to Drive the Market in Brazil

9.6.6 Argentina

9.6.6.1 Increasing Investment in Renewable Energy Generation is Expected to Drive the Dmm Market

9.6.7 Chile

9.6.7.1 Investments in the Renewable Energy and Wireless Communication Sectors are Expected to Drive the Market

10 Competitive Landscape (Page No. - 104)

10.1 Overview

10.2 Competitive Leadership Mapping (Overall Market)

10.2.1 Visionary Leaders

10.2.2 Innovators

10.2.3 Dynamic Differentiators

10.2.4 Emerging

10.3 Market Ranking, 2018

10.4 Competitive Scenario

10.4.1 New Product Launches

10.4.2 Investments & Expansions

10.4.3 Contracts & Agreements

10.4.4 Others

11 Company Profiles (Page No. - 113)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

11.1 Keysight Technologies

11.2 Gossen Metrawatt

11.3 National Instruments

11.4 Tektronix

11.5 Yokogawa Electric Corporation

11.6 Fluke Corporation

11.7 Flir Systems

11.8 B&K Precision

11.9 Chauvin Arnoux

11.10 Hioki E.E. Corporation

11.11 Sanwa Electric Instrument Company

11.12 Kyoritsu Electrical Instrument Works

11.13 Rohde & Schwarz

11.14 Teledyne Lecroy

11.15 Good Will Instrument

* Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

11.16 Klein Tools

11.17 Shenzhen Everbest Machinery Industry

11.18 Mastech Group

11.19 HT Italia

11.20 GS Instech

12 Appendix (Page No. - 171)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (104 Tables)

Table 1 Digital Multimeter Market, By Type: Inclusions & Exclusions

Table 2 Market, By Ranging Type: Inclusions & Exclusions

Table 3 Market, By Application: Inclusions & Exclusions

Table 4 Market: Players/Companies Connected

Table 5 Market: Industry / Country Analysis

Table 6 Market Snapshot

Table 7 Price Range of Digital Multimeters

Table 8 Digital Multimeter Market Size, By Type, 2017–2024 (USD Thousand)

Table 9 Handheld: Digital Multimeter Size, By Region, 2017–2024 (USD Thousand)

Table 10 Benchtop: Digital Multimeter Size, By Region, 2017–2024 (USD Thousand)

Table 11 Mounted: Digital Multimeter Size, By Region, 2017–2024 (USD Thousand)

Table 12 Digital Multimeter Market Size, By Ranging Type, 2017–2024 (USD Thousand)

Table 13 Auto-Ranging: Market Size, By Region, 2017–2024 (USD Thousand)

Table 14 Manual: Market Size, By Region, 2017–2024 (USD Thousand)

Table 15 Digital Multimeter Market Size, By Application, 2017–2024 (USD Thousand)

Table 16 Automotive: Market Size, By Region, 2017–2024 (USD Thousand)

Table 17 Energy: Market Size, By Region, 2017–2024 (USD Thousand)

Table 18 Consumer Electronics & Appliances: Market Size, By Region, 2017–2024 (USD Thousand)

Table 19 Medical Equipment Manufacturing: Market Size, By Region, 2017–2024 (USD Thousand)

Table 20 Others: Market Size, By Region, 2017–2024 (USD Million)

Table 21 Market Size, By Region, 2017–2024 (USD Thousand)

Table 22 Asia Pacific: Digital Multimeter Market Size, By Type, 2017–2024 (USD Thousand)

Table 23 Asia Pacific: Market Size, By Ranging Type, 2017–2024 (USD Thousand)

Table 24 Asia Pacific: Market Size, By Application, 2017–2024 (USD Thousand)

Table 25 Asia Pacific: Market Size, By Country, 2017–2024 (USD Thousand)

Table 26 China: Market Size, By Type, 2017–2024 (USD Thousand)

Table 27 China: Market Size, By Ranging Type, 2017–2024 (USD Thousand)

Table 28 China: Market Size, By Application, 2017–2024 (USD Thousand)

Table 29 Australia: Digital Multimeter Market Size, By Type, 2017–2024 (USD Thousand)

Table 30 Australia: Market Size, By Ranging Type, 2017–2024 (USD Thousand)

Table 31 Australia: Market Size, By Application, 2017–2024 (USD Thousand)

Table 32 India: Market Size, By Type, 2017–2024 (USD Thousand)

Table 33 India: Market Size, By Ranging Type, 2017–2024 (USD Thousand)

Table 34 India: Market Size, By Application, 2017–2024 (USD Thousand)

Table 35 South Korea: Digital Multimeter Market Size, By Type, 2017–2024 (USD Thousand)

Table 36 South Korea: Market Size, By Ranging Type, 2017–2024 (USD Thousand)

Table 37 South Korea: Market Size, By Application, 2017–2024 (USD Thousand)

Table 38 Japan: Market Size, By Type, 2017–2024 (USD Thousand)

Table 39 Japan: Market Size, By Ranging Type, 2017–2024 (USD Thousand)

Table 40 Japan: Market Size, By Application, 2017–2024 (USD Thousand)

Table 41 Rest of Asia Pacific: Market Size, By Type, 2017–2024 (USD Thousand)

Table 42 Rest of Asia Pacific: Market Size, By Ranging Type, 2017–2024 (USD Thousand)

Table 43 Rest of Asia Pacific: Market Size, By Application, 2017–2024 (USD Thousand)

Table 44 Europe: Digital Multimeter Market Size, By Type, 2017–2024 (USD Thousand)

Table 45 Europe: Market Size, By Ranging Type, 2017–2024 (USD Thousand)

Table 46 Europe: Market Size, By Application, 2017–2024 (USD Thousand)

Table 47 Europe: Market Size, By Country 2017–2024 (USD Thousand)

Table 48 UK: Market Size, By Type, 2017–2024 (USD Thousand)

Table 49 UK: Market Size, By Ranging Type, 2017–2024 (USD Thousand)

Table 50 UK: Market Size, By Application, 2017–2024 (USD Thousand)

Table 51 Germany: Digital Multimeter Market Size, By Type, 2017–2024 (USD Thousand)

Table 52 Germany: Market Size, By Ranging Type, 2017–2024 (USD Thousand)

Table 53 Germany: Market Size, By Application, 2017–2024 (USD Thousand)

Table 54 France: Market Size, By Type, 2017–2024 (USD Thousand)

Table 55 France: Market Size, By Ranging Type, 2017–2024 (USD Thousand)

Table 56 France: Market Size, By Application, 2017–2024 (USD Thousand)

Table 57 Russia: Market Size, By Type, 2017–2024 (USD Thousand)

Table 58 Russia: Market Size, By Ranging Type, 2017–2024 (USD Thousand)

Table 59 Russia: Market Size, By Application, 2017–2024 (USD Thousand)

Table 60 Spain: Market Size, By Type, 2017–2024 (USD Thousand)

Table 61 Spain: Market Size, By Ranging Type, 2017–2024 (USD Thousand)

Table 62 Spain: Market Size, By Application, 2017–2024 (USD Thousand)

Table 63 Italy: Market Size, By Type, 2017–2024 (USD Thousand)

Table 64 Italy: Market Size, By Raniging Type, 2017–2024 (USD Thousand)

Table 65 Italy: Market Size, By Application, 2017–2024 (USD Thousand)

Table 66 Rest of Europe: Market Size, By Type, 2017–2024 (USD Thousand)

Table 67 Rest of Europe: Market Size, By Ranging Type, 2017–2024 (USD Thousand)

Table 68 Rest of Europe: Market Size, By Application, 2017–2024 (USD Thousand)

Table 69 North America: Digital Multimeter Market Size, By Type, 2017–2024 (USD Thousand)

Table 70 North America: Market Size, By Ranging Type, 2017–2024 (USD Thousand)

Table 71 North America: Market Size, By Application, 2017–2024 (USD Thousand)

Table 72 North America: Market Size, By Country, 2017–2024 (USD Thousand)

Table 73 US: Market Size, By Type, 2017–2024 (USD Thousand)

Table 74 US: Market Size, By Ranging Type, 2017–2024 (USD Thousand)

Table 75 US: Digital Multimeter Market Size, By Application, 2017–2024 (USD Thousand)

Table 76 Canada: Market Size, By Type, 2017–2024 (USD Thousand)

Table 77 Canada: Market Size, By Ranging Type, 2017–2024 (USD Thousand)

Table 78 Canada: Market Size, By Application, 2017–2024 (USD Thousand)

Table 79 Mexico: Market Size, By Type, 2017–2024 (USD Thousand)

Table 80 Mexico: Market Size, By Ranging Type, 2017–2024 (USD Thousand)

Table 81 Mexico: Market Size, By Application, 2017–2024 (USD Thousand)

Table 82 Middle East & Africa: Digital Multimeter Market Size, By Type, 2017–2024 (USD Thousand)

Table 83 Middle East & Africa: Market Size, By Ranging Type, 2017–2024 (USD Thousand)

Table 84 Middle East & Africa: Market Size, By Application, 2017–2024 (USD Thousand)

Table 85 Middle East & Africa: Market Size, By Country, 2017–2024 (USD Thousand)

Table 86 Middle East: Digital Multimeter Market Size, By Type, 2017–2024 (USD Thousand)

Table 87 Middle East: Market Size, By Ranging Type, 2017–2024 (USD Thousand)

Table 88 Middle East: Market Size, By Application, 2017–2024 (USD Thousand)

Table 89 Africa: Digital Multimeter Market Size, By Type, 2017–2024 (USD Thousand)

Table 90 Africa: Market Size, By Ranging Type, 2017–2024 (USD Thousand)

Table 91 Africa: Market Size, By Application, 2017–2024 (USD Thousand)

Table 92 South America: Digital Multimeter Market Size, By Type, 2017–2024 (USD Thousand)

Table 93 South America: Market Size, By Ranging Type, 2017–2024 (USD Thousand)

Table 94 South America: Market Size, By Application, 2017–2024 (USD Thousand)

Table 95 South America: Market Size, By Country, 2017–2024 (USD Thousand)

Table 96 Brazil: Market Size, By Type, 2017–2024 (USD Thousand)

Table 97 Brazil: Market Size, By Ranging Type, 2017–2024 (USD Thousand)

Table 98 Brazil: Digital Multimeter Market Size, By Application, 2017–2024 (USD Thousand)

Table 99 Argentina: Market Size, By Type, 2017–2024 (USD Thousand)

Table 100 Argentina: Market Size, By Ranging Type, 2017–2024 (USD Thousand)

Table 101 Argentina: Market Size, By Application, 2017–2024 (USD Thousand)

Table 102 Chile: Market Size, By Type, 2017–2024 (USD Thousand)

Table 103 Chile: Market Size, By Ranging Type, 2017–2024 (USD Thousand)

Table 104 Chile: Market Size, By Application, 2017–2024 (USD Thousand)

List of Figures (35 Figures)

Figure 1 Digital Multimeter Market: Research Design

Figure 2 Research Methodology: Illustration of Digital Multimeter Company Revenue Estimation (2018)

Figure 3 Ranking of Key Players, 2018

Figure 4 Data Triangulation Methodology

Figure 5 Key Service Providers’ Point of View

Figure 6 Handheld Segment is Expected to Dominate the Digital Multimeter Market, By Type, During the Forecast Period

Figure 7 Auto–Ranging Segment of Digital Multimeter Market, By Ranging Type, is Expected to Grow at the Fastest Rate During the Forecast Period

Figure 8 Energy Segment is Expected to Hold the Largest Share of the Digital Multimeter Market, By Application, During the Forecast Period

Figure 9 Asia Pacific Dominated the Digital Multimeter Industry in 2018

Figure 10 Growth in the Number of Electronic Devices in End Use Industries and the Ability of Dmm to Measure Multiple Parameters are Expected to Drive the Digital Multimeter Market, 2019–2024

Figure 11 Handheld Segment Dominated the Digital Multimeter Industry, By Type, in 2018

Figure 12 Auto-Ranging Segment Dominated the Digital Multimeter Industry, By Ranging, in 2018

Figure 13 Energy Segment Dominated the Digital Multimeter Industry, By Application, in 2018

Figure 14 Digital Multimeter Market in North America is Estimated to Be the Fastest Growing During the Forecast Period

Figure 15 Digital Multimeter Market: Drivers, Restraints, Opportunities, and Challenges

Figure 16 Global Iot Connected Devices, 2018-2025 (Billion Units)

Figure 17 Digital Multimeter Market Share, By Type, 2018

Figure 18 Digital Multimeter Industry Share, By Ranging Type, 2018

Figure 19 Digital Multimeter Industry Share, By Application, 2018

Figure 20 Global Snapshot: North American Market is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 21 Digital Multimeter Industry Share, By Region, 2018

Figure 22 Asia Pacific: Regional Snapshot (2018)

Figure 23 Europe: Regional Snapshot (2018)

Figure 24 Key Developments in the Digital Multimeter Market, 2014–2019

Figure 25 Digital Multimeter Market (Global) Competitive Leadership Mapping, 2018

Figure 26 Fortive Led the Digital Multimeter Industry in 2018

Figure 27 Keysight Technologies: Company Snapshot

Figure 28 Keysight Technologies: SWOT Analysis

Figure 29 Gossen Metrawatt: SWOT Analysis

Figure 30 National Instruments: Company Snapshot

Figure 31 National Instruments: SWOT Analysis

Figure 32 Tektronix: SWOT Analysis

Figure 33 Yokogawa Electric Corporation: Company Snapshot

Figure 34 Yokogawa Electric Corporation: SWOT Analysis

Figure 35 Flir Systems: Company Snapshot

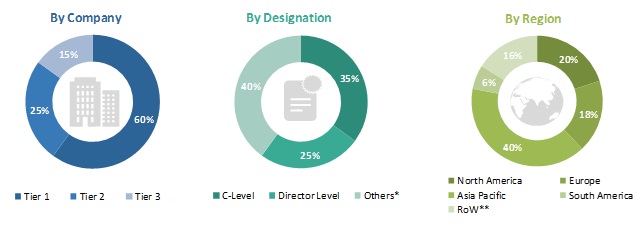

This study involved four major activities in estimating the current size of the global digital multimeter market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through rigorous primary research. Both top-down and bottom-up approaches were used to estimate the total market size. The market breakdown and data triangulation techniques were employed to estimate the market size of the segments and the corresponding subsegments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases such as UNCTAD data, industry publications, several newspaper articles, Statista Industry Journal, Factiva, and testing and measurement journals to identify and collect information useful for a technical, market-oriented, and commercial study of the digital multimeter market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The digital multimeter market comprises several stakeholders such as manufacturers, dealers & distributors, government & research organizations, forums, alliances & associations, digital multimeter suppliers, dealers & suppliers, and vendors. The demand side of the market is characterized by players from various end-use industries such as automotive, energy, consumer electronics & appliances, medical device manufacturing, aerospace, defense & government services, and wireless communication & infrastructure. The demand is also driven by the rising interest to use a digital multimeter for testing, measurement, and troubleshooting of various parameters. The supply side is characterized by the increase in new product launches, contracts & agreements and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global digital multimeter market and its dependent submarkets. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market shares in the respective regions have been determined through both primary and secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the market.

Report Objectives

- To define, describe, and forecast the global digital multimeter market based on type, ranging type, application, and region

- To provide detailed information regarding the major factors influencing the growth of the digital multimeter market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the market with respect to individual growth trends, future prospects, and contributions of each segment to the market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To benchmark players within the market using the proprietary Vendor DIVE framework, which analyzes the market players on various parameters within the broad categories of business and product strategies

- To track and analyze competitive developments such as contracts & agreements, expansions, new product developments, and mergers & acquisitions in the market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for the digital multimeter market report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Digital Multimeter Market

This report includes valuable insights into the Digital Multimeter Market. This market has a lot of growth potential.