EMC Testing Market by Offering (Hardware & Software and services), End-Use Application (Consumer Appliances & Electronics, Automotive, Military & Aerospace, IT & Telecommunications, Medical, Industrial), and Geography - Global Forecast 2034

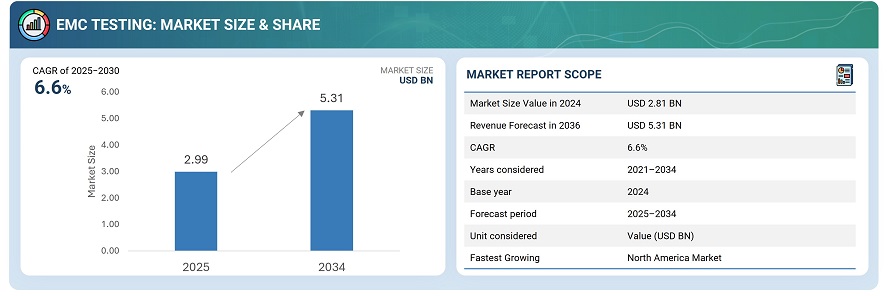

The global EMC testing market was valued at USD 2.81 billion in 2024 and is projected to reach USD 5.31 billion by 2034, growing at a CAGR of 6.4% between 2025 and 2034.

The market’s expansion is driven by the rising complexity of electronic systems, increasing adoption of electric and autonomous vehicles, and proliferation of 5G networks, IoT devices, and connected medical equipment. Stringent regulatory standards across automotive, aerospace, telecom, and industrial sectors continue to mandate advanced electromagnetic compatibility testing to ensure reliability, safety, and interoperability. Furthermore, rapid electrification and renewable integration are encouraging investments in high-frequency EMC test systems and hybrid test chambers. Overall, the market is becoming increasingly service-oriented, with laboratories expanding global footprints and adopting digital-twin-based validation, AI-enabled automation, and cloud-linked compliance management to meet evolving certification needs.

Electromagnetic Compatibility (EMC) testing is the process of evaluating electrical and electronic devices to ensure they operate correctly within their electromagnetic environment without causing or experiencing unacceptable interference. It assesses both emissions (unwanted electromagnetic energy a device generates) and immunity (a device’s ability to resist external disturbances). EMC testing ensures product safety, regulatory compliance, and reliable performance across communication, automotive, medical, and industrial applications.

Market by Application

Consumer Appliances and Electronics

The consumer appliances and electronics segment dominates the EMC testing market, driven by continuous innovations in smartphones, wearables, smart home devices, and entertainment systems. Increasing miniaturization, wireless connectivity, and integration of IoT functions have intensified electromagnetic emission challenges, necessitating advanced compliance testing. Manufacturers are heavily investing in pre-compliance and full-compliance EMC testing to meet global certification standards such as CISPR, FCC, and CE for product reliability and market access.

Medical

The medical segment represents one of the fastest-growing markets for EMC testing, supported by expanding use of electronic equipment in diagnostics, imaging, and life-support systems. Devices like pacemakers, infusion pumps, and MRI machines must maintain high electromagnetic immunity to ensure patient safety and operational accuracy. Stringent standards from IEC and FDA are compelling medical device manufacturers to adopt comprehensive EMC validation across both development and production stages globally.

Industrial

The industrial sector relies on EMC testing to ensure the safe functioning of automation controllers, drives, robotics, and power systems within electromagnetically dense environments. Growing deployment of Industry 4.0 technologies and connected manufacturing infrastructure amplifies the need for immunity verification and emissions control. Manufacturers increasingly partner with accredited test labs to meet IEC 61000-6 standards and maintain operational integrity of complex industrial systems across harsh electromagnetic conditions.

Market by Offering

Hardware & Software

The hardware and software segment forms the technological backbone of the EMC testing market, comprising test receivers, antennas, amplifiers, chambers, and automation platforms used for emission and immunity evaluation. Demand is driven by rising electronic integration in vehicles, medical devices, and communication systems. Continuous upgrades toward hybrid test chambers, multi-antenna setups, and AI-based automation are enhancing efficiency. Although mature, this segment maintains stable growth supported by the modernization of testing infrastructure worldwide.

Services

The services segment represents the larger and faster-growing portion of the EMC testing market, fueled by increasing product complexity and stricter international compliance mandates. Manufacturers across the automotive, telecom, and medical sectors increasingly outsource EMC validation to accredited laboratories for quicker market entry and cost efficiency. Expanding global certification schemes, regional testing standards, and the emergence of digital-twin-enabled testing are further propelling service providers’ growth and global network expansion.

Market by Geography

The Asia Pacific region continues to dominate the EMC testing market, fueled by the rapid expansion of electronics manufacturing, accelerated 5G network deployment, and strong growth in electric and autonomous vehicles. Countries such as China, Japan, South Korea, and India are investing heavily in advanced test facilities and regional certification standards. North America remains a key market, supported by stringent FCC and FDA regulations, increasing adoption of connected medical and defense electronics, and ongoing R&D in EV and aerospace technologies. Europe shows steady momentum, driven by CE compliance, renewable energy integration, and advanced automotive innovation under the Euro NCAP and UNECE frameworks. Meanwhile, the Rest of the World region is witnessing gradual growth, with emerging demand from Latin America and the Middle East for industrial automation, smart infrastructure, and telecom equipment testing.

Market Dynamics

Driver: Growing adoption of electronic systems and wireless technologies

The proliferation of electronic components in vehicles, consumer devices, and industrial systems is significantly increasing the need for EMC testing. The rise of wireless communication technologies such as 5G, Wi-Fi 6, and IoT creates higher electromagnetic emission levels, necessitating stricter compliance testing. Additionally, advancements in autonomous systems and connected healthcare devices demand enhanced immunity standards to ensure safe and interference-free operation across diverse environments.

Restraint: High cost and complexity of EMC testing infrastructure

Setting up EMC testing laboratories involves substantial capital investment in anechoic chambers, shielded rooms, antennas, amplifiers, and advanced test automation systems. The complexity of testing multi-frequency and multi-standard products further increases operational costs and time to market. Smaller manufacturers often face challenges in maintaining in-house facilities, forcing them to depend on third-party labs, which can lead to scheduling delays and increased testing expenditures.

Opportunity: Expansion of electric vehicles and renewable energy systems

The growing shift toward electrification and clean energy is opening new avenues for EMC testing applications. Electric vehicles, charging infrastructure, inverters, and renewable power systems involve high-voltage electronics that can cause electromagnetic interference if not properly managed. Increasing regulatory focus on safety, interoperability, and grid stability is driving demand for advanced EMC validation of EV components, battery systems, and renewable power converters worldwide.

Challenge: Rapidly evolving regulatory standards across regions

The continuous evolution of regional EMC compliance frameworks poses a significant challenge for global manufacturers. Differences between FCC, CISPR, CE, and IEC standards often require multiple testing cycles for the same product. As electronic devices become more complex, maintaining compliance with diverse emission and immunity thresholds across various geographies adds testing burdens. This dynamic regulatory landscape compels companies to invest heavily in ongoing certification updates and multi-standard testing capabilities.

Future Outlook

Between 2025 and 2034, the EMC testing market is expected to witness steady expansion as electronic integration deepens across industries. The rapid evolution of 5G networks, electric and autonomous vehicles, renewable power systems, and connected medical devices will heighten the need for advanced EMC validation. Growing adoption of AI-driven automation, simulation-based pre-compliance tools, and digital-twin testing environments will enhance testing precision and reduce time-to-market. As global regulatory frameworks tighten and product complexity increases, EMC testing will remain a critical enabler of safety, interoperability, and reliability in the connected ecosystem, fostering long-term opportunities for both testing service providers and equipment manufacturers.

Key Market Players

The top EMC testing companies are Intertek Group plc (UK), SGS SA (Switzerland), Bureau Veritas (France), TÜV SÜD (Germany), and Keysight Technologies, Inc. (US).

Key Questions addressed in this report:

- Where will all these developments take the industry in the mid to long term?

- What are the emerging applications of EMC testing?

- Which countries are expected to witness significant growth in the EMC testing market?

- What are the major contributors to the EMC testing market?

- Who are the key players in this market? What are their major strategies to strengthen their market presence?

Table of Contents

1 Introduction (Page No. - 22)

1.1 Study Objectives

1.2 Market Definition and Scope

1.2.1 Inclusions and Exclusions

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for This Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 26)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumption

3 Executive Summary (Page No. - 33)

4 Premium Insights (Page No. - 36)

4.1 Stringent Regulations in Countries Leading to Increased Opportunities for EMC Testing Market

4.2 Market, By End-Use Application

4.3 Market for Hardware & Software, By End-Use Application

4.4 Market, By End-Use Application

4.5 Market for Automotive End-Use Application, By Geography

5 Market Overview (Page No. - 40)

5.1 Introduction

5.2 Core Industry Segments for Parent TIC Market

5.2.1 TIC Standards and Regulatory Bodies

5.2.2 Companies Offering TIC Services

5.2.3 End-Use Industries

5.3 Key Industry Trends in TIC Market

5.4 Major EMC Regulations

5.5 Common Interference Problems

5.6 Market Dynamics

5.6.1 Drivers

5.6.1.1 Increasing Requirement for Carrying Out EMC Pre-Compliance Testing of Products

5.6.1.2 Growing Demand for Ensuring Effective Interoperability of Connected Devices and Networks

5.6.1.3 Prevailing Trend of Outsourcing EMC Testing By Manufacturers Worldwide

5.6.1.4 Increasing Number of Mobile Subscribers and Growing Mobile Data Requirements

5.6.1.5 Adhering to Domestic and International EMC Standards and Regulations

5.6.2 Restraints

5.6.2.1 High Costs of EMC Testing

5.6.3 Opportunities

5.6.3.1 Increased Adoption of IoT-Enabled Devices

5.6.3.2 Advent of 5G Technology

5.6.4 Challenges

5.6.4.1 Limiting Level of Interference Among Connected Devices

5.6.4.2 Long Lead Time for Overseas Qualification Assessments

6 EMC Testing Market, By Testing Method (Page No. - 53)

6.1 Introduction

6.2 EMC Emissions and Immunity Testing

6.3 Electrostatic Discharge Testing

6.4 Conducted Emissions and Immunity Testing

6.5 Radio Frequency Compatibility Testing

7 EMC Testing Market, By Offering (Page No. - 57)

7.1 Introduction

7.2 Hardware & Software

7.2.1 Product Testing

7.2.1.1 Anechoic and Semi-Anechoic Chamber

7.2.1.2 Open Area Test Site

7.2.2 Component Testing

7.2.2.1 Spectrum Analyzers

7.2.2.2 Amplifiers

7.2.2.3 Signal Generators

7.3 Services

7.3.1 Testing Services

7.3.2 Inspection Services

7.3.3 Certification Services

7.3.3.1 Calibration Services

7.3.3.2 Repair Services/After-Sales Services

7.3.3.3 Other Services

8 EMC Testing Market, By End-Use Application (Page No. - 66)

8.1 Introduction

8.2 Automotive

8.2.1 Rising Demand for Sophisticated Electronic Systems in Sport Utility Vehicles Drives Growth of Market in Automotive Sector

8.3 Military and Aerospace

8.3.1 Rf and Signal Generators Most Widely Used in Aerospace and Military

8.4 IT and Telecommunications

8.4.1 Increasing Demand for Wireless Technologies Triggers Growth in IT and Telecommunications

8.5 Consumer Appliances and Electronics

8.5.1 Electronic Products Manufacturing is Highly Competitive Industry With Challenging Standards for Reliability and Performance

8.6 Medical

8.6.1 EMC Testing Ensures Increased Efficiency and Accuracy of Medical Devices

8.7 Industrial

8.7.1 Innovations and Developments in EMC Testing Will Help in Catering to Various Industries

8.8 Renewable Energy

8.8.1 EMC Testing Finds Huge Opportunities in Non-Conventional Energy Sources

8.9 Railways

8.9.1 EMC Tested Railways are Proven to Be Safer and Reliable

9 Geographic Analysis (Page No. - 96)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.1.1 Increasing Investment in Developing Next Generation of Aerospace and Military Technologies

9.2.2 Canada

9.2.2.1 Growing Demand for Communication Testing and Broadband Services

9.2.3 Mexico

9.2.3.1 Rising Foreign Direct Investments

9.3 Europe

9.3.1 Germany

9.3.1.1 Growing Focus on Research and Development in Automotive Industry

9.3.2 UK

9.3.2.1 Increasing Demand for EMC Testing in Military and Aerospace Sector to Meet Regulatory Compliances

9.3.3 France

9.3.3.1 Surging Demand for Manufacturing Operations to Cater to Growing Number of Commercial and Defense Aviation Projects

9.3.4 Italy

9.3.4.1 Rising Government Initiatives to Maintain Quality of Products and Meet National and International Regulatory Standards

9.3.5 Netherlands

9.3.5.1 Increasing Innovations in Netherlands has Led to Increase in New Product Offerings

9.3.6 Spain

9.3.6.1 Healthcare, Automotive, and Energy are Main Industries Impacting Growth of Market in Spain

9.3.7 Turkey

9.3.7.1 Growing Focus on Innovation, Technology, and Manufacturing to Improve Global Rankings

9.3.8 Poland

9.3.8.1 Gaming and Agriculture Industry Generate Employment in Poland

9.3.9 Belgium

9.3.9.1 Manufacturing and Metal Processing Companies to Contribute to Market Growth in Belgium

9.3.10 Russian Federation

9.3.10.1 Scope of EMC Testing in Russia is Limitless Considering Abundance of Opportunities in This Space

9.3.11 Rest of Europe

9.4 APAC

9.4.1 China

9.4.1.1 Growing Development in Medical Device Industry

9.4.2 Japan

9.4.2.1 Increasing Demand for Early Stage Qualification (ESQ) Services in Qualification Testing of Aerospace Components

9.4.3 India

9.4.3.1 Rising Investments By Telecom Network Operators in Testing, Analyzing, and Measuring Electronic and Mechanical Devices

9.4.4 Taiwan

9.4.4.1 Huge Potential in Consumer Electronics and Automotive Industries

9.4.5 Thailand

9.4.5.1 Import-Export of Automobile Components and Electronics has Huge Potential in Thailand

9.4.6 Indonesia

9.4.6.1 Mandatory EMC Testing of Electronic Devices in Indonesia

9.4.7 Malaysia

9.4.7.1 Manufacturing, IT, and Banking Industries Drive Economy in Malaysia

9.4.8 South Korea

9.4.8.1 Presence of Giants Like Samsung, Hyundai and Other Players Increase Scope for EMC Testing Companies in Korea

9.4.9 Australia

9.4.9.1 Mining and Healthcare Segments Back Economy of Australia

9.4.10 Rest of APAC

9.5 RoW

9.5.1 South America

9.5.1.1 Brazil

9.5.1.1.1 Favorable Government Policies in Energy, Infrastructure, Health, Defense, and Aviation, and IT Sectors to Bring New Market Opportunities for EMC Testing

9.5.1.2 Chile

9.5.1.2.1 Favorable Government Policies Attract Huge Investments in Communication Services and Infrastructure

9.5.1.3 Argentina

9.5.1.3.1 Mutual Agreements and Contracts have Increased Import and Export of Products in Argentina

9.5.1.4 Czech Republic

9.5.1.4.1 Exports Leading Way to Generate Revenue for Czech Republic

9.5.2 Middle East & Africa

9.5.2.1 South Africa

9.5.2.1.1 Drivers Affecting Market in Africa are Infrastructure, Communication, and Networking

9.5.2.2 United Arab Emirates

9.5.2.2.1 Developments in Telecommunications Sector to Boost EMC Testing Market

9.5.2.3 Saudi Arabia

9.5.2.3.1 Existence of Oil Reserves Creates New Revenue Pockets for Market in Saudi Arabia

9.5.2.4 Oman

9.5.2.4.1 Great Opportunities in Telecom and Agriculture Sectors in This Country

9.5.2.5 Qatar

9.5.2.5.1 Diversification Into New Avenues With Support of Investments

10 Competitive Landscape (Page No. - 135)

10.1 Overview

10.2 Ranking Analysis: EMC Testing Market

10.3 Competitive Leadership Mapping, 2019

10.3.1 Visionary Leaders

10.3.2 Dynamic Differentiators

10.3.3 Innovators

10.3.4 Emerging Companies

10.4 Strength of Product and Service Portfolio

10.5 Business Strategy Excellence

10.6 Competitive Situation and Trends

10.6.1 Expansions

10.6.2 Product and Service Launches and Developments

10.6.3 Acquisitions

10.6.4 Agreements and Contracts

11 Company Profiles (Page No. - 145)

11.1 Introduction

(Business Overview, Product/ Services/Solutions Offered, Recent Developments, SWOT Analysis, and MnM View)*

11.2 Key Players

11.2.1 Bureau Veritas

11.2.2 Intertek

11.2.3 SGS Group

11.2.4 TUV Nord Group

11.2.5 TUV SUD

11.2.6 Eurofins Scientific

11.2.7 UL LLC

11.2.8 TUV Rheinland

11.2.9 Dekra Se

11.2.10 NTS

11.2.11 Cetecom- Rwtüv GmbH

11.2.12 Fortive

11.2.13 Keysight Technologies

11.2.14 Rohde & Schwarz

11.2.15 Yokogawa Electric

11.2.16 Ametek CTS

11.2.17 HV Technologies

11.2.18 Thermo Fisher Scientific

11.2.19 MCS Test Equipment

11.3 Other Key Players

11.3.1 Testilabs

11.3.2 Electro Magnetic Test

11.4 Right-To-Win

11.4.1 EMC Testing Service Providers

11.4.1.1 Intertek

11.4.1.2 SGS Group

11.4.1.3 Bureau Veritas

11.4.2 EMC Testing Equipment Providers

11.4.2.1 Keysight Technologies

11.4.2.2 Fortive

11.4.2.3 Ametek CTS

*Details on Business Overview, Product/ Services/Solutions Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 203)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (112 Tables)

Table 1 Mergers and Acquisitions – Major Strategy Adopted By Key Market Players in TIC Market

Table 2 Major Regulations Across Different Countries

Table 3 Causes and Remedies of Multiple Interference Types

Table 4 Cost Estimates for Different Stages of EMC Testing

Table 5 Difference Between ESD Testing Models

Table 6 EMC Testing Market, By Offering, 2016–2024 (USD Million)

Table 7 EMC Testing Market for Hardware & Software, By End-Use Application, 2016–2024 (USD Thousand)

Table 8 EMC Testing Market for Services, By End-Use Application (USD Million)

Table 9 Market for Services, By Type, 2016–2024 (USD Million)

Table 10 Market, By End-Use Application, 2016–2024 (USD Million)

Table 11 Market for Automotive End-Use Application, By Region, 2016–2024 (USD Thousand)

Table 12 Market for Automotive End-Use Application in North America, By Country, 2016–2024 (USD Thousand)

Table 13 Market for Automotive End-Use Application in Europe, By Country, 2016–2024 (USD Thousand)

Table 14 Market for Automotive End-Use Application in APAC, By Country, 2016–2024 (USD Thousand)

Table 15 Market for Automotive End-Use Application in RoW, By Region, 2016–2024 (USD Thousand)

Table 16 Market for Automotive End-Use Application in South America, By Country, 2016–2024 (USD Thousand)

Table 17 Market for Automotive End-Use Application in MEA, By Country, 2016–2024 (USD Thousand)

Table 18 Market for Military and Aerospace, By Region, 2016–2024 (USD Million)

Table 19 Market for Military and Aerospace in North America, By Country, 2016–2024 (USD Thousand)

Table 20 Market for Military and Aerospace in Europe, By Country, 2016–2024 (USD Thousand)

Table 21 Market for Military and Aerospace in APAC, By Country, 2016–2024 (USD Thousand)

Table 22 Market for Military and Aerospace in RoW, By Region, 2016–2024 (USD Thousand)

Table 23 Market for Military and Aerospace in South America, By Country, 2016–2024 (USD Thousand)

Table 24 Market for Military and Aerospace in MEA, By Country, 2016–2024 (USD Thousand)

Table 25 Market for IT and Telecommunications, By Region, 2016–2024 (USD Thousand)

Table 26 Market for IT and Telecommunications in North America, By Country, 2016–2024 (USD Thousand)

Table 27 Market for IT and Telecommunications in Europe, By Country, 2016–2024 (USD Thousand)

Table 28 Market for IT and Telecommunications in APAC, By Country, 2016–2024 (USD Thousand)

Table 29 Market for IT and Telecommunications in RoW, By Region, 2016–2024 (USD Thousand)

Table 30 Market for IT and Telecommunications in South America, By Country, 2016–2024 (USD Thousand)

Table 31 Market for IT and Telecommunications in MEA, By Country, 2016–2024 (USD Thousand)

Table 32 Market for Consumer Appliances and Electronics, By Region, 2016–2024 (USD Million)

Table 33 Market for Consumer Appliances and Electronics in North America, By Country, 2016–2024 (USD Thousand)

Table 34 Market for Consumer Appliances and Electronics in Europe, By Country, 2016–2024 (USD Thousand)

Table 35 Market for Consumer Appliances and Electronics in APAC, By Country, 2016–2024 (USD Thousand)

Table 36 Market for Consumer Appliances and Electronics in RoW, By Region, 2016–2024 (USD Thousand)

Table 37 Market for Consumer Appliances and Electronics in South America, By Country, 2016–2024 (USD Thousand)

Table 38 Market for Consumer Appliances and Electronics in MEA, By Country, 2016–2024 (USD Thousand)

Table 39 Market for Medical End-Use Application, By Region, 2016–2024 (USD Thousand)

Table 40 Market for Medical End-Use Application in North America, By Country, 2016–2024 (USD Thousand)

Table 41 Market for Medical End-Use Application in Europe, By Country, 2016–2024 (USD Thousand)

Table 42 Market for Medical End-Use Application in APAC, By Country, 2016–2024 (USD Thousand)

Table 43 Market for Medical End-Use Application in RoW, By Region, 2016–2024 (USD Thousand)

Table 44 Market for Medical End-Use Application in South America, By Country, 2016–2024 (USD Thousand)

Table 45 Market for Medical End-Use Application in MEA, By Country, 2016–2024 (USD Thousand)

Table 46 Market for Industrial, By Region, 2016–2024 (USD Thousand)

Table 47 Market for Industrial in North America, By Country, 2016–2024 (USD Thousand)

Table 48 Market for Industrial in Europe, By Country, 2016–2024 (USD Thousand)

Table 49 Market for Industrial in APAC, By Country, 2016–2024 (USD Thousand)

Table 50 Market for Industrial in RoW, By Region, 2016–2024 (USD Thousand)

Table 51 Market for Industrial in South America, By Country, 2016–2024 (USD Thousand)

Table 52 Market for Industrial in MEA, By Country, 2016–2024 (USD Thousand)

Table 53 Market for Renewable Energy, By Region, 2016–2024 (USD Thousand)

Table 54 Market for Renewable Energy in North America, By Country, 2016–2024 (USD Thousand)

Table 55 Market for Renewable Energy in Europe, By Country, 2016–2024 (USD Thousand)

Table 56 Market for Renewable Energy in APAC, By Country, 2016–2024 (USD Thousand)

Table 57 Market for Renewable Energy in RoW, By Region, 2016–2024 (USD Thousand)

Table 58 Market for Renewable Energy in South America, By Country, 2016–2024 (USD Thousand)

Table 59 Market for Renewable Energy in MEA, By Country, 2016–2024 (USD Thousand)

Table 60 Market for Railways, By Region, 2016–2024 (USD Thousand)

Table 61 Market for Railways in North America, By Country, 2016–2024 (USD Thousand)

Table 62 Market for Railways in Europe, By Country, 2016–2024 (USD Thousand)

Table 63 Market for Railways in APAC, By Country, 2016–2024 (USD Thousand)

Table 64 Market for Railways in RoW, By Region, 2016–2024 (USD Thousand)

Table 65 Market for Railways in South America, By Country, 2016–2024 (USD Thousand)

Table 66 Market for Railways in MEA, By Country, 2016–2024 (USD Thousand)

Table 67 EMC Testing Market, By Region, 2016–2024 (USD Million)

Table 68 Market in North America, By End-Use Application, 2016–2024 (USD Million)

Table 69 Market in North America, By Country, 2016–2024 (USD Million)

Table 70 Market in US, By End-Use Application, 2016–2024 (USD Million)

Table 71 Market in Canada, By End-Use Application, 2016–2024 (USD Thousand)

Table 72 Market in Mexico, By End-Use Application, 2016–2024 (USD Thousand)

Table 73 Market in Europe, By End-Use Application, 2016–2024 (USD Million)

Table 74 Market in Europe, By Country, 2016–2024 (USD Thousand)

Table 75 Market in Germany, By End-Use Application, 2016–2024 (USD Thousand)

Table 76 Market in UK, By End-Use Application, 2016–2024 (USD Thousand)

Table 77 Market in France, By End-Use Application, 2016–2024 (USD Thousand)

Table 78 Market in Italy, By End-Use Application, 2016–2024 (USD Thousand)

Table 79 Market in Netherlands, By End-Use Application, 2016–2024 (USD Thousand)

Table 80 Market in Spain, By End-Use Application, 2016–2024 (USD Thousand)

Table 81 Market in Turkey, By End-Use Application, 2016–2024 (USD Thousand)

Table 82 Market in Poland, By End-Use Application, 2016–2024 (USD Thousand)

Table 83 Market in Belgium, By End-Use Application, 2016–2024 (USD Thousand)

Table 84 Market in Russian Federation, By End-Use Application, 2016–2024 (USD Thousand)

Table 85 Market in Rest of Europe, By End-Use Application, 2016–2024 (USD Thousand)

Table 86 Market in APAC, By Country, 2016–2024 (USD Thousand)

Table 87 Market in APAC, By End-Use Application, 2016–2024 (USD Million)

Table 88 Market in China, By End-Use Application, 2016–2024 (USD Thousand)

Table 89 Market in Japan, By End-Use Application, 2016–2024 (USD Thousand)

Table 90 Market in India, By End-Use Application, 2016–2024 (USD Thousand)

Table 91 Market in Taiwan, By End-Use Application, 2016–2024 (USD Thousand)

Table 92 Market in Thailand, By End-Use Application, 2016–2024 (USD Thousand)

Table 93 Market in Indonesia, By End-Use Application, 2016–2024 (USD Thousand)

Table 94 Market in Malaysia, By End-Use Application, 2016–2024 (USD Thousand)

Table 95 Market in South Korea, By End-Use Application, 2016–2024 (USD Thousand)

Table 96 Market in Australia, By End-Use Application, 2016–2024 (USD Thousand)

Table 97 Market in Rest of APAC, By End-Use Application, 2016–2024 (USD Thousand)

Table 98 Market in RoW, By Region, 2016–2024 (USD Million)

Table 99 Market in RoW, By End-Use Application, 2016–2024 (USD Thousand)

Table 100 Market in Brazil, By End-Use Application, 2016–2024 (USD Thousand)

Table 101 Market in Chile, By End-Use Application, 2016–2024 (USD Thousand)

Table 102 Market in Argentina, By End-Use Application, 2016–2024 (USD Thousand)

Table 103 Market in Czech Republic, By End-Use Application, 2016–2024 (USD Thousand)

Table 104 Market in South Africa, By End-Use Application, 2016–2024 (USD Thousand)

Table 105 Market in Untied Arab Emirates, By End-Use Application, 2016–2024 (USD Thousand)

Table 106 Market in Saudi Arabia, By End-Use Application, 2016–2024 (USD Thousand)

Table 107 Market in Oman, By End-Use Application, 2016–2024 (USD Thousand)

Table 108 EMC Testing Market in Qatar, By End-Use Application, 2016–2024 (USD Thousand)

Table 109 Expansions, 2018 & 2019

Table 110 Product and Service Launches and Developments, 2019

Table 111 Acquisitions, 2019

Table 112 Agreements and Contracts, 2018 & 2019

List of Figures (55 Figures)

Figure 1 EMC Testing Market

Figure 2 Research Design

Figure 3 Process Flow of Market Size Estimation

Figure 4 Data Triangulation

Figure 5 EMC Testing Market Share, By Offering (2019)

Figure 6 EMC Testing Market, By Application (2019)

Figure 7 EMC Testing Market Global Scenario

Figure 8 Increasing Adoption of EMC Testing Across Multiple Industries to Drive Growth of Market During Forecast Period

Figure 9 Consumer Appliances and Electronics Holds Majority Share of EMC Test Market, By End-Use Application, in Terms of Value, in 2019

Figure 10 IT & Telecommunications Holds Majority Share of Market for Hardware & Software, in Terms of Value, in 2019

Figure 11 Consumer Appliances and Electronics Holds Largest Market Size of Market in 2019

Figure 12 APAC Holds Largest Share of Market for Automotive End-Use Application in 2019

Figure 13 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 14 Market Drivers and Their Impact

Figure 15 Global Subscribers and Mobile Internet Users, 2018–2025 (Billion)

Figure 16 Global IoT Connections, 2018–2025 (Billion)

Figure 17 Market Restraints and Their Impact

Figure 18 Market Opportunities and Their Impact

Figure 19 Increase in Global Volume of IoT Devices, 2015–2020 (Million Units)

Figure 20 Market Challenges and Their Impact

Figure 21 Market, By Testing Method

Figure 22 Types of Electromagnetic Compatibility

Figure 23 Common Models of ESD Testing

Figure 24 Market, By Offering

Figure 25 Market, By Service Type

Figure 26 Market, By End-Use Application

Figure 27 Market for Automotive End-Use Application in APAC Accounted for Largest Size in 2018

Figure 28 Market for IT and Telecommunications in APAC to Continue to Hold Largest Size During Forecast Period

Figure 29 Europe to Witness Largest Size in Market for Consumer Appliances and Electronics Applications During Forecast Period

Figure 30 Market for Medical End-Use Application in North America Held Largest Size in 2018

Figure 31 Market for Industrial End-Use Application in APAC Held Largest Market Share in 2019

Figure 32 Market for Renewable Energy in APAC to Hold Largest Size During Forecast Period

Figure 33 North America Led Market for Railways in 2018

Figure 34 North America: Market Snapshot

Figure 35 Europe: Market Snapshot

Figure 36 APAC: EMC Testing Market Snapshot

Figure 37 RoW: EMC Testing Market Snapshot

Figure 38 Players in Market Adopted New Product Launches & Developments as Their Key Strategy for Business Expansion From 2017 to 2019

Figure 39 Ranking of Top 3 Players in EMC Testing Market, By Service (2019)

Figure 40 Ranking of Top 3 Players in EMC Testing Market, By Equipment (2019)

Figure 41 EMC Testing Market (Global) Competitive Leadership Mapping, 2018

Figure 42 Bureau Veritas SA: Company Snapshot

Figure 43 Intertek: Company Snapshot

Figure 44 SGS Group: Company Snapshot

Figure 45 TUV Nord Group: Company Snapshot

Figure 46 TUV SUD: Company Snapshot

Figure 47 Eurofins Scientific: Company Snapshot

Figure 48 TUV Rheinland: Company Snapshots

Figure 49 Dekra SE: Company Snapshot

Figure 50 Fortive: Company Snapshot

Figure 51 Keysight Technologies: Company Snapshot

Figure 52 Rohde & Schwarz: Company Snapshot

Figure 53 Yokogawa Electric: Company Snapshot

Figure 54 Ametek CTS: Company Snapshot

Figure 55 Thermo Scientific: Company Snapshot

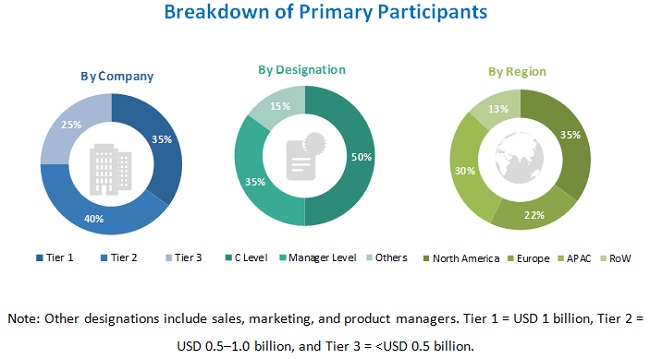

The study involved four major activities in estimating the current size of the EMC testing market. Exhaustive secondary research was done to collect information on the market and its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were employed to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. These secondary sources include biometric technologies journals and magazines, IEEE journals; annual reports, press releases, and investor presentations of companies; white papers; certified publications and articles from recognized authors; and directories and databases such as Factiva, Hoovers, and OneSource.

Primary Research

In the primary research process, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information important for this report. The primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and related executives from key companies and organizations operating in the EMC testing market. After complete market engineering (including calculations regarding market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information as well as verify and validate the critical numbers arrived at.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the EMC testing market and other dependent submarkets listed in this report.

- Key players in the industry and markets have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the global market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at exact statistics for all segments and subsegments, market breakdown and data triangulation procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends identified from both demand and supply sides in government, consumer electronics, healthcare, banking & finance, travel & immigration, automotive, and military & defense verticals among others.

Report Objectives

The following are the primary objectives of the study.

- To define, describe, and forecast the EMC testing market, by offering, end-use application, and geography, in terms of value

- To forecast the market size of various segments with respect to 4 main regions: North America, Europe, Asia Pacific, and the Rest of the World, in terms of value

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To describe EMC testing methods

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To strategically profile the key players and comprehensively analyze their market ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze the competitive developments such as agreements, contracts, partnerships, acquisitions, and product launches & developments carried out in the EMC testing market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in EMC Testing Market