The research study involved four major steps in estimating the size of the aerospace testing market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The next step has been to validate these findings and assumptions and size them with the help of primary research with industry experts across the value chain. Both top-down and bottom-up approaches have been used to estimate the market size. After this, the market breakdown and data triangulation approaches have been adopted to estimate the market sizes of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were referred to to identify and collect information required for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, and articles from recognized authors. Secondary research has been mainly done to obtain key information about the market’s value chain, the pool of key market players, market segmentation according to industry trends, regional outlook, and developments from market and technology perspectives.

In the aerospace testing market report, the global market size has been estimated using the top-down and bottom-up approaches, along with several other dependent submarkets. The major players in the market were identified using extensive secondary research, and their presence in the market was determined using secondary and primary research. All the percentage splits and breakdowns have been determined using secondary sources and verified through primary sources.

Primary Research

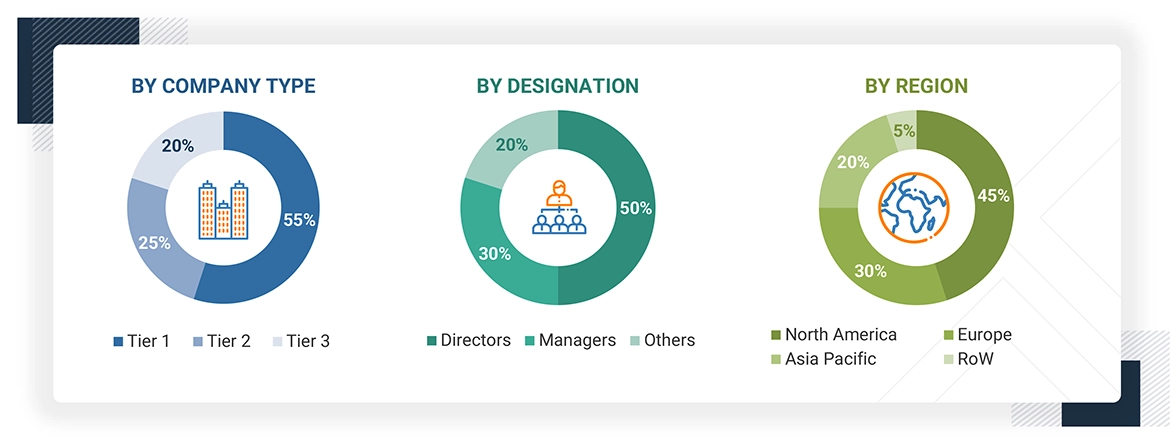

Extensive primary research has been conducted after understanding the aerospace testing market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from demand- and supply-side vendors across four major regions—North America, Europe, Asia Pacific, and RoW. Approximately 25% of the primary interviews have been conducted with the demand-side vendors and 75% with the supply-side vendors. Primary data has been collected mainly through telephonic interviews, which consist of 80% of the total primary interviews; questionnaires and emails have also been used to collect the data.

After successful interaction with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings of our primary research. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the report. The breakdown of primary respondents is as follows:

Note: “Others” includes sales, marketing, and product managers

About the assumptions considered for the study, To know download the pdf brochure

Market Size Estimation

In the complete market engineering process, top-down and bottom-up approaches and several data triangulation methods have been used to estimate and forecast the market size for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analyses have been performed on the complete market engineering process to list the key information/insights throughout the report. The following table explains the process flow of the market size estimation.

The key players in the aerospace testing market were identified through secondary research, and their rankings in the respective regions were determined through primary and secondary research. This entire procedure involved the study of the annual and financial reports of top players, and interviews with industry experts, such as chief executive officers, vice presidents, directors, and marketing executives, for quantitative and qualitative key insights. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, supplemented with detailed inputs and analysis from MarketsandMarkets, and presented in this report.

Bottom-Up Approach

-

Major companies that provide aerospace testing services were identified. This included analyzing company portfolios, service offerings, and presence across various regions.

-

The segment-specific revenues of the companies, particularly those related to aerospace testing, were determined.

-

These individual revenue figures were compiled to determine the total revenue generated across the identified companies within the sector.

-

Using this consolidated data, the global market size for aerospace testing was obtained.

Top-Down Approach

-

Estimated the overall aerospace testing market size, then segmented the global market by allocating shares to in-house and outsourced sources to determine the aerospace testing market by sourcing type

-

Estimated the aerospace testing market size by end users by assigning end user penetration splits to the global aerospace testing market based on their respective proportions of testing demand

-

Applied market share splits to the global aerospace testing market to derive the market segmentation, by testing type

-

Distributed the testing types across regions and countries by aligning regional aerospace activity with economic indicators, aerospace manufacturing presence, and national development initiatives

Aerospace Testing Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above—the market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed to complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment. The data has been triangulated by studying various factors and trends from the demand and supply sides in the aerospace testing market.

Growth opportunities and latent adjacency in Aerospace Testing Market