Digital Out of Home Market (DOOH) by Product (Billboard, Street Furniture, and Transit), Application (Indoor and Outdoor), Vertical (Commercial, Infrastructural, Institutional), and Geography - Global Forecast to 2023

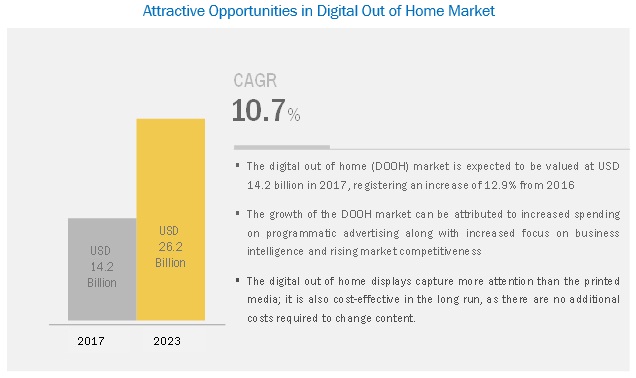

Digital out of home market is expected to witness high growth during the forecast period.The digital out of home market was valued at USD 14.2 billion in 2017 and is expected to reach USD 26.2 billion by 2023, at a CAGR of 10.7% during the forecast period. The growth of the market is supported by the increasing use of commercial display in advertising, which is a strong medium for promotion for all the sectors and applications. The DOOH market is driven by cost-effectiveness of digital displays. The players in this market need to continuously find unique product implementations and create complementary products and innovative services to increase their market share. Digital out of home provides an opportunity for marketing with digital billboards, creating interactive campaigns, and weekly promotion at a greater level without wasting paper for printed boards.

Outdoor applications to hold largest market share during the forecast period

The outdoor displays are widely used in the transportation, sports, and hospitality verticals. The penetration of the outdoor advertising is expected to be high in the transportation vertical during the forecast period. Billboard advertising typically represents large advertisements in high-traffic areas for passing pedestrians and drivers. This attracts many customers, as the advertisements are largely visible at express highways and high-density consumer exposure areas. Digital billboards are designed using computer software to allow outdoor advertisements. Constantly changing or blinking text creates an impact on the customers and enables a wide exposure to the targeted audience. Daktronics (US) is a world-leading player in manufacturing outdoor displays. Outdoor displays are manufactured considering the harsh environment. These displays are usually waterproof and can withstand high temperatures owing to their inbuilt cooling systems.

Commercial vertical expected to hold the largest market share during forecast period

The commercial vertical is expected to hold the largest share of the digital out of home market during forecast period. This is mainly due to the increasing demand for digital out of home systems in commercial applications, along with improvements in technology offerings and infrastructure expansions. The commercial vertical includes retail and hospitality, in which the customer interaction mostly takes place through kiosks and interactive billboards. Print advertisement has minimized as the digital out of home screens are being targeted toward the audiences with the help of interactive content to make the message attractive by using it effectively according to the demand in the market.

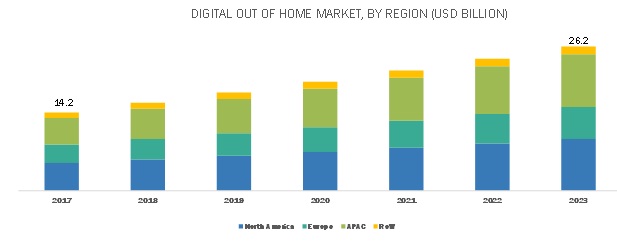

North America expected to hold the largest market share during the forecast period

North America is expected to hold the largest share and dominate the digital out of home market during the forecast period. North America being the most technologically advanced is a leader in the market for providing cutting edge technology, which is used in the advertisement sector. North America is the early adopter of latest display technology, and there is a continuous awareness regarding the benefits of commercial displays in the region. Some key players in this region include Clear Channel Outdoor Holdings, Inc. (US), Lamar Advertising Company (US), OUTFRONT Media (US), Daktronics (US), and Prismview LLC (US).

Key Market Players

In 2016, the digital out of home market was dominated by JCDecaux (France), Lamar Advertising Company (US), Clear Channel Outdoor Holdings, Inc. (US), OUTFRONT Media (US), Prismview LLC (US), and Daktronics (US). Other major players in the market include NEC Display Solutions, Ltd. (Japan), Stroer SE & Co. KGaA (Germany), Broadsign International LLC. (Canada), oOh!media Ltd. (Australia), Mvix, Inc. (US), Christie Digital Systems USA, Inc. (US), Ayuda Media Systems (US), Deepsky Corporation Ltd. (Hong Kong), and Aoto Electronics Co., Ltd (China). Major players are actively performing in the market by following contracts and partnerships as their key strategy. Along with product launches, the companies also follow other strategies such as contracts, partnerships, joint ventures, collaborations, and mergers and acquisitions.

Scope of the Report:

|

Report Metric |

Details |

|

Report Name |

Digital Out of Home Market |

|

Base year |

2016 |

|

Forecast period |

2017–2023 |

|

Units |

Value (USD) |

|

Segments covered |

Type, End User, Offerings, and Region |

|

Geographic regions covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

JCDecaux (France), Lamar Advertising Company (US), Clear Channel Outdoor Holdings, Inc. (US), OUTFRONT Media (US), Prismview LLC (US), and Daktronics (US). Other major players in the digital out of home market include NEC Display Solutions, Ltd. (Japan), Stroer SE & Co. KGaA (Germany), Broadsign International LLC. (Canada), oOh!media Ltd. (Australia), Mvix, Inc. (US), Christie Digital Systems USA, Inc. (US), Ayuda Media Systems (US), Deepsky Corporation Ltd. (Hong Kong), and Aoto Electronics Co., Ltd (China) |

Major Market Developments

- In July 2017, JCDecaux signed a new street furniture contract in Dubai along with its partner, DXB Media Advertising (UAE), for a time span of 10 years. This contract covers the installation, operation, and maintenance of 418 advertising lamp positioned along the famous Jumeirah Beach Road, as well as 50 fully-interactive e-Village situated in iconic locations around the city. This intelligent street furniture initiative is part of the 34 new projects of the Roads and Transport Authority Smart City Program. The e-Village, a smart city product, and interactive communication platforms services include e-commerce sites, and tourism and cultural, traffic, transit, and weather information

- In July 2017, Clear Channel Airports, a division of Clear Channel Outdoor Holdings, Inc. signed a 5-year extension contract with the Des Moines International Airport (US) to provide out of home advertising solutions. This contract involves the installation of both digital and static enhancements.

- In June 2017, Lamar Advertising Company and Paramount Pictures (US), a global entertainment company, have unveiled a dynamic, technology-led digital out of home (DOOH) advertising campaign to promote their film “Transformers: The Last Knight”. Using its digital billboard network in conjunction with vehicle recognition technology, the company delivers personalized, contextually relevant messages based on the make and model of the upcoming car.

Key questions addressed by the report

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming trends for the market?

- What are the opportunities for the various players present now and planning to enter at various stages of the value chain?

- How will the inorganic growth strategies implemented by the key players impact the growth rate of the market and who will have the undue advantage?

- What are the current investment trends in the market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 List of Major Secondary Sources

2.1.1.2 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Experts Involved in Primary Interviews

2.1.2.2 Breakdown of Primaries

2.1.2.3 Key Data From Primary Sources

2.1.2.4 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Capturing the Market Ranking Through Bottom-Up Analysis (Demand Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing the Market Ranking Through Top-Down Analysis (Supply Side)

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Attractive Opportunities for Growth of Market

4.2 Market, By Application

4.3 APAC Countries Exhibiting Lucrative Opportunities in Market

4.4 Market, By Vertical

4.5 Market, By Commercial Vertical

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increased Spending on Programmatic Advertising

5.2.1.2 Increasing Focus on Business Intelligence and Rising Market Competitiveness

5.2.1.3 Rising Infrastructure Investments in Emerging Countries With Improved Digital Out of Home Advertising Space

5.2.1.4 Technological Innovations in Display Technologies

5.2.2 Restraints

5.2.2.1 Increasing Trend of Online/Broadcast Advertisement

5.2.3 Opportunities

5.2.3.1 Rising Demand for Internet of Things (IoT) and Emergence of the Cloud Platform

5.2.3.2 Increasing Usage of Virtual and Augmented Reality in Digital Out of Home Advertising

5.2.3.3 Increasing Acceptance of Audio-Visual Transit Advertising

5.2.4 Challenges

5.2.4.1 Developing Equipment Suitable for All Weather Conditions

5.2.4.2 Lack of Standards for Interoperability Between Devices

6 Industry Trends (Page No. - 39)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Trends in Digital Out of Home Market

6.3.1 Rapid Growth in Use of Beacons With Focus on Analytics

6.3.2 Advancements in NFC-Enabled Digital Out of Home

6.3.3 Increasing Demand for Dynamic Content Creation

6.3.4 Impact of Latest Technological Trends on Digital Out of Home

6.3.4.1 Internet of Things (IoT)

6.3.4.2 Big Data

6.3.4.3 Artificial Intelligence

6.3.5 Trend Towards SEPArate Digital Asset Management Platform

7 Digital Out of Home Market, By Product (Qualitative Chapter) (Page No. - 43)

7.1 Introduction

7.2 Billboard

7.3 Street Furniture

7.4 Transit

8 Digital Out of Home Market, By Application (Page No. - 46)

8.1 Introduction

8.2 Indoor

8.3 Outdoor

8.4 Displays Used in Digital Out of Home Advertising

8.4.1 LCD

8.4.2 OLED Display

8.4.3 Direct-View Fine-Pixel Led

8.4.4 Direct-View Large-Pixel Led

8.4.5 E-Paper Display

9 Digital Out of Home Market, By Vertical (Page No. - 52)

9.1 Introduction

9.2 Commercial

9.2.1 Retail

9.2.2 Corporate and Government

9.2.3 Healthcare

9.2.4 Hospitality

9.3 Infrastructural

9.3.1 Transportation

9.3.2 Entertainment

9.4 Institutional

9.4.1 Banking, Financial Services, and Insurance (BFSI)

9.4.2 Education

9.5 Other Verticals

10 Geographic Analysis (Page No. - 71)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 UK

10.3.2 Germany

10.3.3 France

10.3.4 Rest of Europe

10.4 Asia Pacific (APAC)

10.4.1 China

10.4.2 Japan

10.4.3 South Korea

10.4.4 Australia

10.4.5 India

10.4.6 Rest of APAC

10.5 Rest of the World (RoW)

10.5.1 Middle East & Africa

10.5.2 South America

11 Competitive Landscape (Page No. - 87)

11.1 Introduction

11.2 Market Ranking Analysis

11.2.1 JCDecaux

11.2.2 Clear Channel Outdoor Holdings, Inc.

11.2.3 Lamar Advertising Company

11.2.4 Outfront Media, Inc.

11.2.5 DaKTronics

11.3 Company Leadership Mapping

11.3.1 Visionary Leaders

11.3.2 Dynamic Differentiators

11.3.3 Innovators

11.3.4 Emerging Companies

11.4 Competitive Benchmarking

11.4.1 Business Strategy Excellence(25 Companies)

11.4.2 Strength of Product Portfolio(25 Co,panies)

11.5 Competitive Situation and Trends

11.5.1 Major Strategies Adopted By Key Players

12 Company Profiles (Page No. - 92)

(Business Overview, Products Offered, Product Offering Scorecard, Business Strategy Scorecard, Recent Developments, Key Relationships)*

12.1 Introduction

12.2 Prismview LLC

12.3 JCDecaux

12.4 Lamar Advertising Company

12.5 Outfront Media Inc.

12.6 Clear Channel Outdoor Holdings, Inc.

12.7 NEC Display Solutions Ltd

12.8 DaKTronics

12.9 oOh!Media Ltd.

12.10 BroadSign International LLC

12.11 Mvix, Inc.

12.12 Key Innovators

12.12.1 Chrisitie Digital Systems USA, Inc.

12.12.2 Ocean Outdoor UK Ltd

12.12.3 Ayuda Media Systems

12.12.4 Aoto Electronics Co., Ltd.

12.12.5 Deepsky Corporation Ltd.

*Details on Business Overview, Products Offered, Product Offering Scorecard, Business Strategy Scorecard, Recent Developments, Key Relationships Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 132)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (30 Tables)

Table 1 Digital Out of Home Market, By Application, 2014–2023 (USD Billion)

Table 2 Market, By Vertical, 2014–2023 (USD Billion)

Table 3 Market for Commercial Vertical, By Sector, 2014–2023 (USD Million)

Table 4 Market for Commercial Vertical, By Region, 2014–2023 (USD Million)

Table 5 Market for Commercial Vertical in North America, By Country, 2014–2023 (USD Million)

Table 6 Market for Commercial Vertical in Europe, By Country, 2014–2023 (USD Million)

Table 7 Market for Commercial Vertical in APAC, By Country, 2014–2023 (USD Million)

Table 8 Market for Commercial Vertical in RoW, By Region, 2014–2023 (USD Million)

Table 9 Market for Infrastructural Vertical, By Sector, 2014–2023 (USD Million)

Table 10 Market for Infrastructural Vertical, By Region, 2014–2023 (USD Million)

Table 11 Market for Infrastructural Vertical in North America, By Country, 2014–2023 (USD Million)

Table 12 Market for Infrastructural Vertical in Europe, By Country, 2014–2023 (USD Million)

Table 13 Market for Infrastructural Vertical in APAC, By Country, 2014–2023 (USD Million)

Table 14 Market for Infrastructural Vertical in RoW, By Region, 2014–2023 (USD Million)

Table 15 Market for Institutional Vertical, By Sector, 2014–2023 (USD Million)

Table 16 Market for Institutional Vertical, By Region, 2014–2023 (USD Million)

Table 17 Market for Institutional Vertical in North America, By Country, 2014–2023 (USD Million)

Table 18 Market for Institutional Vertical in Europe, By Country, 2014–2023 (USD Million)

Table 19 Market for Institutional Vertical in APAC, By Country, 2014–2023 (USD Million)

Table 20 Market for Institutional Vertical in RoW, By Region, 2014–2023 (USD Million)

Table 21 Market for Other Verticals, By Region, 2014–2023 (USD Million)

Table 22 Market for Other Verticals in North America, By Country, 2014–2023 (USD Million)

Table 23 Market for Other Verticals in Europe, By Country, 2014–2023 (USD Million)

Table 24 Market for Other Verticals in APAC, By Country, 2014–2023 (USD Million)

Table 25 Market for Other Verticals in RoW, By Region, 2014–2023 (USD Million)

Table 26 Market, By Region, 2014–2023 (USD Billion)

Table 27 Market in North America, By Country, 2014–2023 (USD Million)

Table 28 Market in Europe, By Country, 2014–2023 (USD Million)

Table 29 Market in APAC, By Country, 2014–2023 (USD Million)

Table 30 Market in RoW, By Region, 2014–2023 (USD Million)

List of Figures (46 Figures)

Figure 1 Market Segmentation

Figure 2 Digital Out of Home (DOOH) Market, By Geography

Figure 3 Market: Process Flow of Market Size Estimation

Figure 4 Market: Research Design

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Market Breakdown & Data Triangulations

Figure 8 Market, 2014–2023 (USD Billion)

Figure 9 Market, By Application, 2014–2023 (USD Billion)

Figure 10 Market, By Vertical, 2017–2023 (USD Billion)

Figure 11 APAC Expected to Register Highest CAGR in DOOH Market Between 2017 and 2023

Figure 12 Market Expected to Exhibit High Growth Between 2017 and 2023

Figure 13 Outdoor Application is Expected to Dominate Market During Forecast Period

Figure 14 India Expected to Register Highest CAGR in Market During Forecast Period

Figure 15 Commercial Vertical to Hold Largest Share of Market Between 2017 and 2023

Figure 16 Retail Sector Expected to Grow at Highest CAGR inMarket During Forecast Period

Figure 17 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 18 Value Chain Analysis: Major Value Added During Product Development and Integration Phases

Figure 19 Products in Market

Figure 20 Market, By Application

Figure 21 Indoor Application is Expected to Register Highest CAGR During Forecast Period

Figure 22 Type of Displays in DOOH Advertising

Figure 23 Market, By Vertical

Figure 24 Infrastructural Vertical is Expected to Register Highest CAGR in Market During Forecast Period

Figure 25 APAC is Expected to Register Highest CAGR in Market for Commercial Vertical During Forecast Period

Figure 26 Market, By Geography

Figure 27 North America is Expected to Dominate Market During Forecast Period

Figure 28 Geographic Snapshot of Market: Rapidly Growing Markets Emerging as New Hotspots

Figure 29 APAC Expected to Register Highest CAGR During Forecast Period

Figure 30 US Expected to Register Highest CAGR in Market During Forecast Period

Figure 31 US Held A Major Share of Market in North America in 2016

Figure 32 UK is Expected to Dominate Market During Forecast Period

Figure 33 Australia is Expected to Register Highest CAGR in Market During Forecast Period

Figure 34 Snapshot of Market in APAC: China – Most Lucrative Market in 2015

Figure 35 Middle East & Africa is Expected to Dominate Market During Forecast Period

Figure 36 Companies Adopted New Product Launches and Expansions as the Key Growth Strategies Between 2015 and 2017

Figure 37 Market Ranking Analysis of the Top 5 Players in Market, 2016

Figure 38 Battle for Market Share: Contract and Partnerships Were the Key Strategies Adopted By Companies Between 2015 and 2017

Figure 39 Contract and Partnerships Were Major Strategies Adopted By Industry Players

Figure 40 Geographic Revenue Mix of Key Market Players

Figure 41 JCDecuax: Company Snapshot

Figure 42 Lamar Advertising Company: Company Snapshot

Figure 43 Outfront Media Inc.: Company Snapshot

Figure 44 Clear Channel Outdoor Holdings, Inc.: Company Snapshot

Figure 45 DaKTronics: Company Snapshot

Figure 46 oOh!Media Ltd.: Company Snapshot

The digital out of home (DOOH) market, was valued at USD 12.52 Billion in 2016 and is expected to reach USD 26.21 Billion by 2023, at a CAGR of 10.7% during the forecast period. The base year considered for the study is 2016 and the forecast period is between 2017 and 2023.

Objectives of the Study:

- Define, describe, and forecast the overall digital out of home (DOOH) market segmented on the basis of product, application, vertical and geography

- Forecast the size in terms of value of the market segments with respect to four major regions North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- Provide detailed information regarding the major factors influencing the growth of the DOOH market (drivers, restraints, opportunities, and industry-specific challenges)

- Analyze the micromarkets with respect to individual growth trends, prospects, and contribution to the overall DOOH market

- Analyze opportunities in the market for various stakeholders by identifying high-growth segments of the DOOH market

- Benchmark players in the market using the proprietary "Competitive Leadership Mapping" framework, which analyzes the market players on various parameters within the broad categories of strength of product portfolio and business strategy excellence

- Analyze various strategic developments such as joint ventures, mergers and acquisitions, product launches, and research and development (R&D) activities in the DOOH market

Research Methodology:

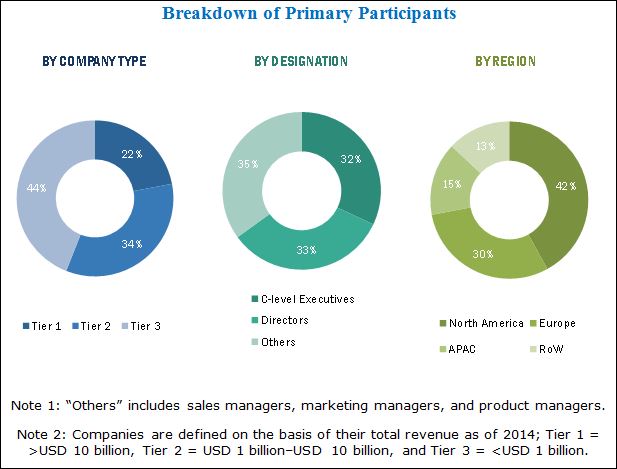

This research study incorporates the usage of secondary sources, directories, and databases, such as Hoovers, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for the extensive technical, market-oriented, and commercial study of the digital out of home market. Primary sources mainly comprise several experts from core and related industries, along with preferred suppliers, manufacturers, distributors, service providers, technology developers, alliances, and standards and certification organizations related to various parts of this industry’s value chain. In-depth interviews with various primary respondents, including key industry participants, subject matter experts (SMEs), C-level executives of key companies, and consultants have been conducted to obtain and verify the critical qualitative and quantitative information as well as assess prospects. The breakdown of the profiles of primaries has been depicted in the following figure:

To know about the assumptions considered for the study, download the pdf brochure

This report provides valuable insights into the ecosystem of the digital out of home market. The major players in this market include JCDecaux (France), Clear Channel Outdoor Holdings, Inc. (US), Lamar Advertising Company (US), OUTFRONT Media (US), Daktronics (US), Prismview LLC (US), NEC Display Solutions, Ltd. (Japan), oOh!media Ltd. (Australia), Broadsign International LLC. (Canada), Stroer SE & Co. KGaA (Germany), Mvix, Inc. (US), Christie Digital Systems USA, Inc. (US), Ayuda Media Systems (US), Deepsky Corporation Ltd. (Hong Kong), and Aoto Electronics Co., Ltd (China).

Key Target Audience:

- Raw material and manufacturing equipment suppliers

- Electronic design automation (EDA) and design tool vendors

- Software companies providing solutions in various industries that use digital out of home equipment

- Manufacturers and suppliers of hardware components

- Research institutes and organizations

- Associations and regulatory authorities

Scope of the Report:

The research report segments the digital out of home market into the following subsegments:

Digital Out of Home Market, by Product

- Billboard

- Transit

- Street Furniture

Digital Out of Home Market, by Application

- Indoor

- Outdoor

Digital Out of Home, by Vertical

- Commercial

- Retail

- Hospitality

- Healthcare

- Corporate and Government

- Infrastructural

- Transportation

- Entertainment

- Institutional

- Banking, Financial Services and Insurance (BFSI)

- Education

- Others

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report.

- Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Digital Out of Home Market