Digital Process Automation Market by Component, Business Function (Sales Process Automation, Supply Chain Automation, Claims Automation, and Marketing Automation), Deployment Type, Organization Size, Industry Vertical, and Region - Global Forecast to 2023

[166 Pages Report] Digital process automation solutions and services offer crucial benefits to enterprises. These benefits include lowering inevitable losses, creating new opportunities, saving costs, and increasing the efficiency of business processes. The increasing demand for automation and the growing adoption of low code automation platform are expected to drive the growth of the digital process automation market. The market also faces challenges such as compatibility issues with existing business process applications and services. The major factor that is said to be restraining the growth of the digital process automation market is data security and privacy issue as process automation deals with personal data of an individual. Various opportunities present in this market include an increasing demand for streamlining business processes and integration of AI and ML.

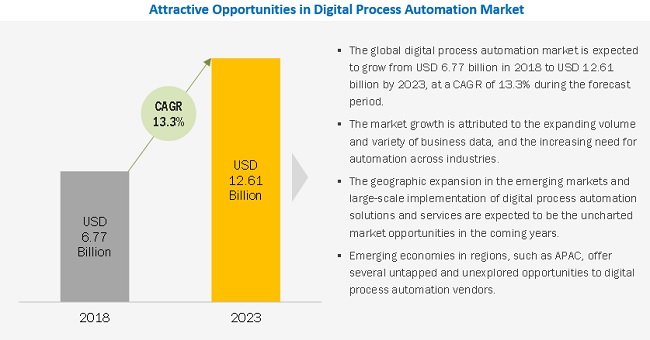

The global digital process automation market is projected to grow from USD 6.77 billion in 2018 to USD 12.61 billion by 2023, at a CAGR of 13.3% from 2018 to 2023.

By component, the services segment is expected to grow at a higher CAGR during the forecast period

Services form an integral part of the software life cycle that includes deployment, integration, product upgrade , maintenance, training, and consulting. The services are categorized into managed services and professional services. The managed services are valued based on their use and are provided by third-party vendors. The cost incurred while using the managed services is limited to the time and amount of their use. Professional services are obtained directly from parent companies. These services can be provided in the form of advisory, implementation, and support, whichinclude assistance provided during installation and maintenance activities. The demand for advisory services would increase, as the adoption of technology-based software solutions is expected to increase.

By service, the managed services segment is expected to grow at a higher CAGR during the forecast period

Managed services are provided by third parties to run and manage IT operations and infrastructure of organizations as per service-level agreements. Managed service providers take the complete responsibility of customers needs and deliver optimum services. From the digital process automation standpoint, the managed service providers run the digital process automation solution or framework for helping enterprises reach their business goals. The managed services help enterprises focus on their core competencies rather than implementing and managing the digital process automation framework. These services offer various benefits, such as reduced operational cost and improved operational efficiency

Supply chain automation segment is expected to grow at the highest CAGR during the forecast period

In recent times, the supply chain function has been greatly benefiting organizations. However, there are areas within the supply chain function where slow and manual processes exist. The globalization of business has led enterprises to deploy the digital process automation solution for optimizing their supply chain processes. Automation enables organizations to capture and process orders effectively, starting right from the initial phase of planning, configuring, pricing, and order delivery. In todays digital age, customer experience plays a vital role as a differentiator among service providers. The effective use of the digital process automation solution ensures service quality required to increase and retain customers while eliminating process inefficiencies to reduce overall costs. Additionally, it offers visibility into multi-enterprise supply chain networks of suppliers and partners, so that businesses can achieve success.

Asia Pacific is expected to grow at the highest CAGR during the forecast period

The market size in APAC is expected to grow at the highest CAGR during the forecast period. The digital process automation market is expected to grow considerably in APAC, due to the shift in the thought process of enterprises, from reducing operational costs to providing an enhanced customer experience.

Market Dynamics

Driver: Increasing adoption of the low-code automation platform

Digital process automation helps organizations transform the way they operate by streamlining their workflow to drive critical business initiatives. The solutions and services empower organizations to rapidly develop and deploy innovative applications or solutions with a zero need for new code. Low-code development brings business and IT together to deliver new customer-facing applications quickly and collaboratively. The traditional method of software/application development is time-consuming, and organizations have to rely upon software developers. Furthermore, the traditional methods delimit an organization in terms of responding rapidly toward market shifts and changing customer expectations at an enterprise scale. Low-code automation platform empowers organizations to constantly improve their customer experience, innovate more rapidly, and drive increased revenue.

Restraint: Lack of technical expertise

Organizations, nowadays, use advanced technologies, such as the industrial internet, and advanced analytics, which are complex and require in-depth technological knowledge. However, process automation can also get more complex, depending on the type of automation used. To use digital process automation solutions and services, a person needs to have technical and analytical skills that would make him/her aware of the latest solutions being used. Many end-users do not have resources with the required skills and knowledge about automation. This lack of understanding is expected to act as a key challenge for the growth of the market. It is mandatory that all the employees working with data are skilled in data science and automation. Furthermore, business knowledge and appropriate training are also needed to help build a data-driven and automated culture. Thus, the technical expertise that is needed to understand complex digital process automation solutions is expected to act as one of the biggest restraints for a majority of business end-users.

Opportunity: Integration of AI and machine learning

Recognizing the need to innovate and understanding the limitations of the existing technologies, organizations, regardless of their size, structure, or business model have started implementing digital process automation solutions. Digital process automation has unlocked new opportunities for companies and facilitated them to expand their product and service portfolios and offer multiple solutions on a centralized platform. Robotic process automation built on the core of AI and machine learning gives a competitive edge to organizations by eliminating manual work, staffing costs, and human errors. Moreover, robotic process automation offers a digital workforce, which mimics and performs tasks as humans do. It also empowers organizations to improve their accuracy in all their business functions.

Challenge: Integration with existing systems and tools

Along with time, organizations have started integrating digital process automation solutions and services. However, system complexities and implementation costs are still the major challenges faced by organizations while integrating these solutions with their existing systems. For efficient digital process automation, the existing legacy systems need to be tightly coupled with new systems. Due to the lack of resources, few organizations still rely on their existing systems that use old technologies, where manual processes lead to a high error rate and long turnaround time. In addition to this, there might be many legacy applications that may not be compatible with new systems or may require more integration effort. Moreover, because legacy systems underuse are mostly on-premises, integrating these systems with new cloud-based systems might act as a challenge to the adoption of digital process automation solutions and services.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

20162023 |

|

Base year considered |

2017 |

|

Forecast period |

20182023 |

|

Forecast units |

USD million |

|

Segments covered |

Component, Business Function, Deployment Type, Organization Size, Industry Vertical, Region |

|

Geographies covered |

North America (US, Canada), APAC (China, Japan, India, and Rest of Asia Pacific), Europe (Germany, UK, and Rest of Europe), MEA (Kingdom of Saudi Arabia, UAE, South Africa, Rest of MEA), and Latin America (Brazil, Mexico, and Rest of Latin America) |

|

Companies covered |

IBM (US), Appian (US), DST Systems (US), OpenText (Canada), K2 (US), Bizagi (England), DXC (US), Infosys (India), Oracle (US), Pegasystems (US), Tibco (US), Software AG (Germany), Cognizant (US), Mindtree (India), Newgen software (India), Nintex (US), Ayehu (US), Integrify (US), HelpSystems (US), Innov8tif (Malaysia), Novatio (US), Bonitasoft (France), Cortex (UK), PMG.net (US), and blue-infinity (Switzerland) |

The digital process automation market has been segmented as follows:

By Component

- Solution

- Services

- Professional Services

- Advisory Services

- Implementation Services

- Support Services

- Managed Services

- Professional Services

By Business Function

- Sales Process Automation

- Supply Chain Automation

- Claims Automation

- Marketing Automation

By Organization Size

- Small and Medium-sized Enterprises (SMEs)

- Large enterprises

By Deployment Type

- On-premises

- Cloud

By Industry Vertical

- Manufacturing

- Retail & Consumer Goods

- BFSI

- Telecom & IT

- Transport & Logistics

- Energy & Utility

- Media & Entertainment

- Healthcare

- Others (government and travel & hospitality)

By Region

- North America

- Europe

- APAC

- MEA

- Latin America

Key Market Players

IBM, Pegasystems, Appian, Oracle, Software AG

Recent Developments

- In June 2018, Pegasystems launched Pega Infinity, a next-generation digital transformation suite. Pega Infinity helps organizations accelerate the digital transformation of the businesses while enhancing customer experience.

- In June 2018, DXC Technology launched DXC Application Service Automation, which enables organizations to automate application management tasks. DXC Application Service Automation is powered by DXC Bionix and comprises 4 components, namely, DXC autoDetect, DXC autoManage, DXC autoResolve, and DXC autoImprove, which empower its clients to proactively troubleshoot application issue and reduce turnaround time.

- In May 2018, OpenText upgraded OpenText Release 16 by launching Enhancement Pack 4 (EP4) for its state-of-the-art Enterprise Information Management platform. This major technological upgrade would provide robustness to its EIM platform with advanced security, AI, and cloud support.

- In May 2018, Newgen Software launched OmniScan 4.1, an advanced distributed document scanning solution to digitalize and deliver critical business information.

- In May 2018, TIBCO launched the TIBCO Jaspersoft 7 to streamline the workflow of designing data visualizations by integrating them into web and mobile applications and also help companies in the deployment of embedded analytics.

Critical questions the report answers

- What are the upcoming hot bets in this market?

- Which segment provides the best opportunity for growth?

- What are the significant upcoming trends in the market?

- How will the market drivers, restraints and future opportunities affect the market dynamics?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Digital Process Automation Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Research Assumptions and Limitations

2.3.1 Assumptions

2.3.2 Limitations

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Attractive Market Opportunities in the Digital Process Automation Market

4.2 Market By Industry Vertical (2018 vs 2023)

4.3 Market Share Across Various Regions

4.4 Market Professional Services, By Region

5 Digital Process Automation Market Overview and Industry Trends (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increased Demand for Automating Business Processes

5.2.1.2 Increasing Adoption of the Low-Code Automation Platform

5.2.2 Restraints

5.2.2.1 Data Security and Privacy

5.2.2.2 Lack of Technical Expertise

5.2.3 Opportunities

5.2.3.1 Increasing Demand for Streamlining Business Processes

5.2.3.2 Integration of AI and Machine Learning

5.2.4 Challenges

5.2.4.1 Integration With Existing Systems and Tools

6 Digital Process Automation Market By Component (Page No. - 38)

6.1 Introduction

6.2 Solution

6.3 Services

7 Digital Process Automation Market By Service (Page No. - 42)

7.1 Introduction

7.2 Professional Services

7.3 Managed Services

8 Digital Process Automation Market By Professional Service (Page No. - 46)

8.1 Introduction

8.2 Advisory Services

8.3 Implementation Services

8.4 Support Services

9 Digital Process Automation Market By Business Function (Page No. - 50)

9.1 Introduction

9.2 Sales Process Automation

9.3 Supply Chain Automation

9.4 Claims Automation

9.5 Marketing Automation

10 Digital Process Automation Market By Industry Vertical (Page No. - 55)

10.1 Introduction

10.2 Manufacturing

10.3 Consumer Goods and Retail

10.4 Banking, Financial Services, and Insurance

10.5 Telecom and IT

10.6 Transportation and Logistics

10.7 Energy and Utilities

10.8 Media and Entertainment

10.9 Healthcare

10.10 Others

11 Digital Process Automation Market By Deployment Type (Page No. - 65)

11.1 Introduction

11.2 Cloud

11.3 On-Premises

12 Digital Process Automation Market By Organization Size (Page No. - 69)

12.1 Introduction

12.2 Small and Medium-Sized Enterprises

12.3 Large Enterprises

13 Digital Process Automation Market By Region (Page No. - 73)

13.1 Introduction

13.2 North America

13.2.1 United States

13.2.2 Canada

13.3 Europe

13.3.1 United Kingdom

13.3.2 Germany

13.3.3 Rest of Europe

13.4 Asia Pacific

13.4.1 China

13.4.2 Japan

13.4.3 India

13.4.4 Rest of Asia Pacific

13.5 Middle East and Africa

13.5.1 Kingdom of Saudi Arabia

13.5.2 United Arab Emirates

13.5.3 South Africa

13.5.4 Rest of Middle East and Africa

13.6 Latin America

13.6.1 Brazil

13.6.2 Mexico

13.6.3 Rest of Latin America

14 Competitive Landscape (Page No. - 99)

14.1 Overview

14.2 Market Ranking

14.3 Competitive Scenario

14.3.1 New Product and Service Launches/Product Upgradations

14.3.2 Business Expansions

14.3.3 Mergers and Acquisitions

14.3.4 Partnerships, Agreements, and Collaboration

15 Company Profiles (Page No. - 109)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

15.1 IBM

15.2 Pegasystems

15.3 Appian

15.4 Oracle

15.5 Software AG

15.6 DST Systems

15.7 Opentext Corporation

15.8 Dxc Technology

15.9 Infosys

15.10 Cognizant

15.11 Mindtree

15.12 Newgen Software

15.13 Tibco Software

15.14 K2

15.15 Bizagi

15.16 Nintex

15.17 Ayehu Software Technologies

15.18 Integrify

15.19 Helpsystems

15.20 Innov8tif

15.21 Novatio Solutions

15.22 Bonitasoft

15.23 Cortex

15.24 PMG

15.25 Blue-Infinity

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

16 Appendix (Page No. - 156)

16.1 Key Industry Insights

16.2 Discussion Guide

16.3 Knowledge Store: Marketsandmarkets Subscription Portal

16.4 Introducing RT: Real-Time Market Intelligence

16.5 Available Customizations

16.6 Related Reports

16.7 Author Details

List of Tables (78 Tables)

Table 1 United States Dollar Exchange Rate, 20142017

Table 2 Digital Process Automation Market Size, By Component, 20162023 (USD Million)

Table 3 Solution: Market Size By Region, 20162023 (USD Million)

Table 4 Services: Market Size By Region, 20162023 (USD Million)

Table 5 Market, By Service, 20162023 (USD Million)

Table 6 Professional Services: Market Size By Region, 20162023 (USD Million)

Table 7 Managed Services: Market Size By Region, 20162023 (USD Million)

Table 8 Digital Process Automation Market Size By Professional Service, 20162023 (USD Million)

Table 9 Advisory Services: Market Size By Region, 20162023 (USD Million)

Table 10 Implementation Services: Market Size By Region, 20162023 (USD Million)

Table 11 Support Services: Market Size By Region, 20162023 (USD Million)

Table 12 Digital Process Automation Market Size, By Business Function, 20162023 (USD Million)

Table 13 Sales Process Automation: Market Size By Region, 20162023 (USD Million)

Table 14 Supply Chain Automation: Market Size By Region, 20162023 (USD Million)

Table 15 Claims Automation: Market Size By Region, 20162023 (USD Million)

Table 16 Marketing Automation: Market Size By Region, 20162023 (USD Million)

Table 17 Digital Process Automation Market Size By Industry Vertical, 20162023 (USD Million)

Table 18 Manufacturing: Market Size By Region, 20162023 (USD Million)

Table 19 Consumer Goods and Retail: Market Size By Region, 20162023 (USD Million)

Table 20 Banking, Financial Services, and Insurance: Market Size By Region, 20162023 (USD Million)

Table 21 Telecom and IT: Market Size By Region, 20162023 (USD Million)

Table 22 Transportation and Logistics: Digital Process Automation Market Size By Region,20162023 (USD Million)

Table 23 Energy and Utilities: Market Size By Region, 20162023 (USD Million)

Table 24 Media and Entertainment: Market Size By Region, 20162023 (USD Million)

Table 25 Healthcare: Market Size By Region, 20162023 (USD Million)

Table 26 Others: Market Size By Region, 20162023 (USD Million)

Table 27 Digital Process Automation Market Size, By Deployment Type, 20162023 (USD Million)

Table 28 Cloud: Market Size By Region, 20162023 (USD Million)

Table 29 On-Premises: Market Size By Region, 20162023 (USD Million)

Table 30 Market Size, By Organization Size, 20162023 (USD Million)

Table 31 Small and Medium-Sized Enterprises: Market Size By Region, 20162023 (USD Million)

Table 32 Large Enterprises: Market Size By Region, 20162023 (USD Million)

Table 33 Digital Process Automation Market Size By Region, 20162023 (USD Million)

Table 34 North America: Digital Process Automation Market Size By Country, 20162023 (USD Million)

Table 35 North America: Market Size By Component, 20162023 (USD Million)

Table 36 North America: Market Size By Service, 20162023 (USD Million)

Table 37 North America: Market Size By Professional Service, 20162023 (USD Million)

Table 38 North America: Market Size By Business Function, 20162023 (USD Million)

Table 39 North America: Market Size By Industry Vertical, 20162023 (USD Million)

Table 40 North America: Market Size By Deployment Type, 20162023 (USD Million)

Table 41 North America: Market Size By Organization Size, 20162023 (USD Million)

Table 42 Europe: Digital Process Automation Market Size, By Country, 20162023 (USD Million)

Table 43 Europe: Market Size By Component, 20162023 (USD Million)

Table 44 Europe: Market Size By Service, 20162023 (USD Million)

Table 45 Europe: Market Size By Professional Service, 20162023 (USD Million)

Table 46 Europe: Market Size By Business Function, 20162023 (USD Million)

Table 47 Europe: Market Size By Industry Vertical, 20162023 (USD Million)

Table 48 Europe: Market Size By Deployment Type, 20162023 (USD Million)

Table 49 Europe: Market Size By Organization Size, 20162023 (USD Million)

Table 50 Asia Pacific: Digital Process Automation Market Size, By Country, 20162023 (USD Million)

Table 51 Asia Pacific: Market Size By Component, 20162023 (USD Million)

Table 52 Asia Pacific: Market Size By Service, 20162023 (USD Million)

Table 53 Asia Pacific: Market Size By Professional Service, 20162023 (USD Million)

Table 54 Asia Pacific: Market Size By Business Function, 20162023 (USD Million)

Table 55 Asia Pacific: Market Size By Industry Vertical, 20162023 (USD Million)

Table 56 Asia Pacific: Market Size By Deployment Type, 20162023 (USD Million)

Table 57 Asia Pacific: Market Size By Organization Size, 20162023 (USD Million)

Table 58 Middle East and Africa: Digital Process Automation Market Size, By Country, 20162023 (USD Million)

Table 59 Middle East and Africa: Market Size By Component, 20162023 (USD Million)

Table 60 Middle East and Africa: Market Size By Service, 20162023 (USD Million)

Table 61 Middle East and Africa: Market Size By Professional Service, 20162023 (USD Million)

Table 62 Middle East and Africa: Market Size By Business Function, 20162023 (USD Million)

Table 63 Middle East and Africa: Market Size By Industry Vertical, 20162023 (USD Million)

Table 64 Middle East and Africa: Market Size By Deployment Type, 20162023 (USD Million)

Table 65 Middle East and Africa: Market Size By Organization Size, 20162023 (USD Million)

Table 66 Latin America: Digital Process Automation Market Size, By Country, 20162023 (USD Million)

Table 67 Latin America: Market Size By Component, 20162023 (USD Million)

Table 68 Latin America: Market Size By Service, 20162023 (USD Million)

Table 69 Latin America: Market Size By Professional Service, 20162023 (USD Million)

Table 70 Latin America: Market Size By Business Function, 20162023 (USD Million)

Table 71 Latin America: Market Size By Industry Vertical, 20162023 (USD Million)

Table 72 Latin America: Market Size By Deployment Type, 20162023 (USD Million)

Table 73 Latin America: Market Size By Organization Size, 20162023 (USD Million)

Table 74 Market Ranking for the Digital Process Automation Market, 2018

Table 75 New Product and Service Launches/Product Upgradations, 20172018

Table 76 Business Expansions, 20172018

Table 77 Mergers and Acquisitions, 20172018

Table 78 Partnerships, Agreements, and Collaboration, 20172018

List of Figures (45 Figures)

Figure 1 Digital Process Automation Market Segmentation

Figure 2 Market Research Design

Figure 3 Breakdown of Primaries: By Company, Designation, and Region

Figure 4 Data Triangulation

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Digital Process Automation Market Assumptions

Figure 8 Market is Expected to Witness Substantial Growth During the Forecast Period

Figure 9 Market By Business Function (2018)

Figure 10 Market By Organization Size (2018)

Figure 11 Market By Deployment Type (2018)

Figure 12 Increasing Need for Streamlining Business Processes Across the Industries is Expected to Drive the Growth of Digital Business Process Automation Market

Figure 13 Increasing Adoption of Automation Solutions Across Industry Vertical is One of the Major Factors Contributing to the Growth of Digital Process Automation Market

Figure 14 North America is Expected to Have the Largest Market Share in 2018

Figure 15 Advisory Services Segment Holds the Largest Market Share Across the Growing Economies Such as Asia Pacific, Middle East and Africa, and Latin America

Figure 16 Digital Process Automation Market: Drivers, Restraints, Opportunities, and Challenges

Figure 17 Services Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 18 Managed Services Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 19 Implementation Services Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 20 Supply Chain Automation Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 21 Banking, Financial Services, and Insurance Industry Vertical is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 22 Cloud Deployment Type is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 23 Small and Medium-Sized Enterprises Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 24 North America is Estimated to Account for the Largest Market Share in 2018

Figure 25 Asia Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 26 North America: Digital Process Automation Market Snapshot

Figure 27 Asia Pacific: Market Snapshot

Figure 28 Key Developments By the Leading Players in the Digital Process Automation Market Between 2016 and 2018

Figure 29 Market Evaluation Framework

Figure 30 IBM: Company Snapshot

Figure 31 IBM: SWOT Analysis

Figure 32 Pegasystems: Company Snapshot

Figure 33 Pegasystems: SWOT Analysis

Figure 34 Appian: Company Snapshot

Figure 35 Appian: SWOT Analysis

Figure 36 Oracle: Company Snapshot

Figure 37 Oracle: SWOT Analysis

Figure 38 Software AG: Company Snapshot

Figure 39 Software AG: SWOT Analysis

Figure 40 DST Systems: Company Snapshot

Figure 41 Opentext Corporation: Company Snapshot

Figure 42 Infosys: Company Snapshot

Figure 43 Cognizant: Company Snapshot

Figure 44 Mindtree: Company Snapshot

Figure 45 Newgen Software: Company Snapshot

Growth opportunities and latent adjacency in Digital Process Automation Market