Digital Lending Market by Offering (Solutions (Digital Lending Platforms and Point Solutions) and Services), Deployment Mode (Cloud and On-premises), End User (Banks, Credit Unions, and NBFCs), and Region - Global Forecast to 2026

Digital Lending Market Size, Trends, Demand, 2026

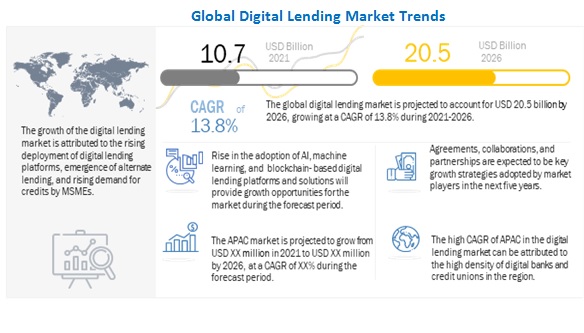

The Digital Lending Market is expected to increase from its estimated value of USD 10.7 billion in 2021 to USD 20.5 billion with a forecasted growth rate of 13.8% from 2022 to 2026. Proliferation of smartphones and growth in digitalization, need for better customer experience, government actions to safeguard digital lending, greater visibility and options for borrowers and lenders, growing demand for digital lending platforms among MSMEs, and surge in digital lending during the pandemic are expected to be the major factors driving the growth of the digital lending market.

To know about the assumptions considered for the study, Request for Free Sample Report

Digital Lending Market Dynamics

Driver: Proliferation of smartphones and growth in digitalization

Increased number of smartphones around the world has led to greater demand for digital lending solutions for faster and hassle-free processing of loans from anywhere. To meet customer expectations, digital lending platform providers are forced to enhance their offerings to provide a better customer experience. Digitalization helps to automate processes, minimizes the lending process costs, and reduces the access time for customers.

Restraint: Higher dependency on traditional lending methods

Many organizations prefer traditional lending methodologies that are often time-consuming and tedious. Due to their set customer base and standard ways of credit underwriting, they cannot embrace innovations. Furthermore, the lack of awareness of digital lending and training and skillsets to manage advanced solutions are the major factors responsible for the less adoption of automated and advanced digital lending processes.

Opportunity: Rise in adoption of AI, machine learning, and blockchain-based digital lending platforms and solutions

AI, ML, and blockchain are among the trending technologies that are expected to add advanced capabilities to digital lending platforms and open new growth avenues. Integrating these technologies provides an easy, fast, and transparent process of raising loans. AI- and ML-based algorithms can process loan applications within seconds, thereby making the approval process truly scalable. In addition to this, blockchain-based lending platform establishes a direct relationship between lenders and borrowers by removing the intermediaries or middlemen from the lending process.

Challenge: Network connectivity and infrastructural issues

The developing and underdeveloped nations in the world still use legacy telecom infrastructure incapable of delivering low latency and high-capacity connectivity. Poor internet speed can lead to a poor customer experience. Since all the services offered by digital lending platforms are online, having a slow connection will cause reduced quality of service. The lack of high-speed internet makes it very difficult to implement digital lending solutions. The organizations in such countries rely more on offline lending options, as face-to-face interactions provide better understanding and customer experience, despite the long delays in approvals.

By offering, the services segment to have a higher growth during the forecast period

The services segment of the digital lending market is expected to have a higher growth rate during the forecast period. Services offered in the market are categorized into consulting, implementation, and support and maintenance services. These services assist organizations in selecting the right solution, integrating it with their existing infrastructure, providing maintenance and support, and resolving issues over a period of time.

By point solutions, the loan origination segment to dominate the market during the forecast period

The loan origination segment to have a higher share of the solutions market. Loan origination solution is used for numerous functions, which include online loan application by the borrower, uploading of necessary documents, assessment of loan application by the lender, and approving or rejecting the loan. A loan origination solution streamlines all these processes, improving efficiency, mitigating risks, and improving customer relationships.

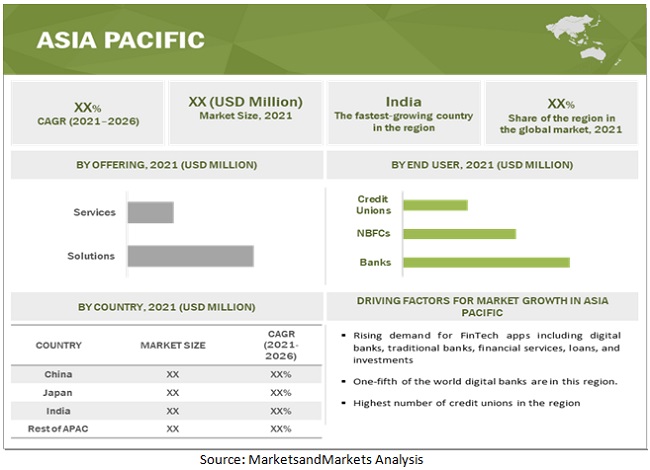

By Region, APAC to record the highest growth during the forecast period

The APAC digital lending market is estimated to have strong growth in the future. Government initiatives to promote the digital infrastructure are responsible for driving the adoption of digital lending solutions in the region. APAC is expected to be the fastest-growing market owing to the rapid economic developments, globalization, digitalization, and the increased proliferation of smartphones. Leading digital lending vendors such as Newgen Software, Nucleus Software, and Intellect Design Arena, are focusing on developing pioneering lending products and technologies, which would help automate, simplify, and manage end-to-end loan processing life cycle. The vendors have also started developing AI, ML, analytics, and blockchain-based solutions to offer a comprehensive digital lending platform.

To know about the assumptions considered for the study, download the pdf brochure

Digital Lending Companies

The report includes the study of key players offering digital lending solutions and services. It profiles major vendors in the global Market. The major vendors in the digital lending market include Fiserv (US), ICE Mortgage Technology (US), FIS (US), Newgen Software (India), Nucleus Software (India), Temenos (Switzerland), Pega (US), Sigma Infosolutions (US), Intellect Design Arena (India), and Tavant (US). These players have adopted various strategies to grow in the global market.

The study includes an in-depth competitive analysis of these key players in the digital lending market with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Metrics |

Details |

|

Digital Lending Market size value in 2021 |

10.7 billion |

|

Digital Lending Market size value in 2026 |

20.5 billion |

|

Digital Lending Market Growth Rate |

13.8% CAGR |

|

Largest Market |

Asia Pacific |

|

Digital Lending Market Drivers |

|

|

Digital Lending Market Opportunities |

|

|

Segments covered |

By offering, deployment mode, end user, and region |

|

Regions covered |

North America, Europe, APAC, MEA, Latin America |

|

List of Companies in Digital Lending |

Fiserv (US), ICE Mortgage Technology (US), FIS (US), Newgen Software (India), Nucleus Software (India), Temenos (Switzerland), Pega (US), Sigma Infosolutions (India), Intellect Design Arena (US), Tavant (US), Docutech (US), Cu Direct (US), Abrigo (US), Wizni (US), Built Technologies (US), Turnkey Lenders (US), Finastra (UK), RupeePower (India), Roostify (US), JurisTech (Malaysia), Decimal Technologies (India), HES Fintech (Belarus), ARGO (US), Symitar (US), EdgeVerv (India), TCS (India), Wipro (India), SAP (Germany), Oracle (US), BNY Mellon (US), and Black Knight (US) |

This research report categorizes the digital lending market to forecast revenues and analyze trends in each of the following subsegments:

Digital Lending Market By Offering:

-

Solutions

- Digital Lending Platforms

-

Point Solutions

- Loan Origination

- Loan Servicing

- Loan/Debt Collection

- Limit and Collateral Management

- P2P Lending Software

- Others (Digital KYC, Analytics, and ECM)

-

Services

- Consulting

- Implementation

- Support and Maintenance

Market By Deployment Mode:

- Cloud

- On-premises

Market By End User:

- Banks

- Credit Unions

- NBFCs

Market By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- India

- Australia and New Zealand (ANZ)

- Rest of APAC

-

MEA

- Kingdom of Saudi Arabia

- United Arab Emirates

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments in Digital Lending Market:

- In July 2021, Newgen Software launched its new digital transformation platform, NewgenONE. The platform helps to manage unstructured information and improve customer engagement.

- In June 2021, TPBank of Vietnam partnered with Nucleus Software to empower its digital commerce. FinnOne Neo helped TPBank to deliver instant digital loans, improve process efficiency, and better credit assessments.

- In January 2021, Fiserv acquired Ondot Systems Inc., a provider of digital experience platforms. This would help Fiserv to enhance its portfolio with digital solutions.

- In September 2020, ICE Mortgage Technology acquired Ellie Mae, a leading digital lending platform provider. The acquisition helped ICE to accelerate the automation of mortgage processes.

- In May 2020, FIS launched its new FIS Portal to help small businesses with loan forgiveness. It implements the FIS Real-time Lending Platform to automate and optimize the PPP loan forgiveness process.

Frequently Asked Questions (FAQ):

How big is the global digital Lending market?

What is the digital Lending market growth?

Which region has the largest market share in the Digital Lending Market?

Which Service is expected to have the highest growth during the forecast period?

Which Deployment mode is expected to hold a larger market size during the forecast period?

Who are the major vendors in the Digital Lending Market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES, 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2018–2021

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 6 DIGITAL LENDING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

2.3.1 TOP-DOWN APPROACH

FIGURE 8 DIGITAL LENDING MARKET SIZE ESTIMATION: TOP-DOWN APPROACH (SUPPLY-SIDE ANALYSIS)

2.3.2 BOTTOM-UP APPROACH

FIGURE 9 DIGITAL LENDING MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH (SUPPLY-SIDE ANALYSIS) (1/2)

FIGURE 10 DIGITAL LENDING MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH (SUPPLY-SIDE ANALYSIS) (2/2)

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.6 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 45)

FIGURE 11 DIGITAL LENDING MARKET, 2019–2026

FIGURE 12 LEADING SEGMENTS IN THE DIGITAL LENDING MARKET, 2021

FIGURE 13 DIGITAL LENDING MARKET: REGIONAL-WISE SHARES AND KEY DRIVING FACTORS, 2021

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 ATTRACTIVE OPPORTUNITIES IN THE DIGITAL LENDING MARKET

FIGURE 14 ACCELERATION IN DIGITAL TRANSFORMATION TO DRIVE THE DIGITAL LENDING MARKET

4.2 DIGITAL LENDING MARKET, BY OFFERING

FIGURE 15 SOLUTIONS SEGMENT EXPECTED TO LEAD THE MARKET IN 2021

4.3 DIGITAL LENDING MARKET, BY SOLUTIONS

FIGURE 16 POINT SOLUTIONS SEGMENT EXPECTED TO ACCOUNT FOR A LARGER MARKET SHARE IN 2021

4.4 DIGITAL LENDING MARKET, BY SERVICES

FIGURE 17 IMPLEMENTATION SERVICES SEGMENT EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SHARE IN 2021

4.5 DIGITAL LENDING MARKET, BY END USER

FIGURE 18 BANKS SEGMENT EXPECTED TO LEAD THE MARKET BY 2026

4.6 DIGITAL LENDING MARKET, BY DEPLOYMENT MODE

FIGURE 19 CLOUD SEGMENT EXPECTED TO LEAD THE MARKET BY 2026

4.7 DIGITAL LENDING MARKET, BY REGION

FIGURE 20 ASIA PACIFIC TO GROW AT THE HIGHEST RATE DURING THE FORECAST PERIOD

4.8 DIGITAL LENDING MARKET, BY COUNTRY

FIGURE 21 INDIA TO REGISTER THE HIGHEST GROWTH DURING THE FORECAST PERIOD

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: DIGITAL LENDING PLATFORM MARKET

5.2.1 DRIVERS

5.2.1.1 Proliferation of smartphones and growth in digitalization

FIGURE 23 GLOBAL PENETRATION OF MOBILE AND THE INTERNET, 2021

FIGURE 24 MONTHLY AVERAGE GLOBAL MOBILE DATA TRAFFIC, 2016-2020

5.2.1.2 Need for better customer experience

5.2.1.3 Government actions to safeguard digital lending

5.2.1.4 Greater visibility and options for borrowers and lenders

5.2.1.5 Growing demand for digital lending platforms among SMEs

5.2.1.6 Surge in digital lending during the pandemic

FIGURE 25 PERCENTAGE OF USERS INTERESTED IN CONTACTLESS CARD PAYMENTS

5.2.2 RESTRAINTS

5.2.2.1 Higher dependency on traditional lending methods

5.2.3 OPPORTUNITIES

5.2.3.1 Rise in adoption of AI, machine learning, and blockchain-based digital lending platforms and solutions

5.2.3.2 Increase in demand for advanced digital lending solutions for retail banking

5.2.4 CHALLENGES

5.2.4.1 Lack of digital literacy in underdeveloped countries

FIGURE 26 NUMBER OF GLOBAL INTERNET USERS, BY KEY REGIONS, 2016-2020

5.2.4.2 Network connectivity and infrastructural issues

FIGURE 27 STATE OF MOBILE INTERNET CONNECTIVITY, BY REGION, 2019

5.2.4.3 Data security and privacy concerns due to increasing cyber-attacks

5.3 INDUSTRY TRENDS

5.3.1 REGULATORY IMPLICATIONS

5.3.1.1 General Data Protection Regulation (GDPR)

5.3.1.2 Payment card industry data security standard (PCI DSS)

5.3.1.3 Payment services directive 2 (PSD2)

5.3.1.4 Know your customer (KYC)

5.3.1.5 Anti-money laundering (AML)

5.3.1.6 Electronic Identification, Authentication, and Trust Services (EIDAS)

5.3.1.7 Health insurance portability and accountability act (HIPAA)

5.3.1.8 Federal information security management act (FISMA)

5.3.1.9 Gramm-leach-Bliley act (GLBA)

5.3.1.10 Sarbanes-Oxley act (SOX)

5.3.2 DIGITAL LENDING MODELS

TABLE 3 DIGITAL LENDING MODELS

5.3.3 USE CASES

5.3.3.1 Case study 1: Finastra helped Beacon Credit Union to create accurate, compliant loan documentation in a fast, straightforward, and highly automated way

5.3.3.2 Case study 2: With the help of Fiserv, Toyota Financial Services integrated paperless contracting into its business practices

5.3.3.3 Case study 3: Nordic fintech pioneer Folkefinans migrates products to Mambu and launches revolving credit loan

5.3.3.4 Case study 4: Idea Bank reduced the generation time for each new loan or leasing application with the help of HES Fintech

5.3.3.5 Case Study 5: MoneyMan automated the entire microfinance lending process with HES Fintech

6 DIGITAL LENDING MARKET, BY OFFERING (Page No. - 67)

6.1 INTRODUCTION

6.1.1 OFFERING: MARKET DRIVERS

6.1.2 OFFERING: IMPACT OF COVID-19 ON THE MARKET

FIGURE 28 SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 4 DIGITAL LENDING MARKET SIZE, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 5 DIGITAL LENDING MARKET SIZE, BY OFFERING, 2021–2026 (USD MILLION)

6.2 SOLUTIONS

FIGURE 29 DIGITAL LENDING PLATFORMS SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 6 DIGITAL LENDING MARKET SIZE, BY SOLUTIONS, 2017–2020 (USD MILLION)

TABLE 7 DIGITAL LENDING MARKET SIZE, BY SOLUTIONS, 2021–2026 (USD MILLION)

TABLE 8 SOLUTIONS: DIGITAL LENDING MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 9 SOLUTIONS: DIGITAL LENDING MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.2.1 DIGITAL LENDING PLATFORMS

TABLE 10 DIGITAL LENDING PLATFORMS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 11 DIGITAL LENDING PLATFORMS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.2.2 POINT SOLUTIONS

FIGURE 30 P2P LENDING SOFTWARE SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 12 DIGITAL LENDING MARKET SIZE, BY POINT SOLUTIONS, 2017–2020 (USD MILLION)

TABLE 13 DIGITAL LENDING MARKET SIZE, BY POINT SOLUTIONS, 2021–2026 (USD MILLION)

TABLE 14 POINT SOLUTIONS: DIGITAL LENDING MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 15 POINT SOLUTIONS: DIGITAL LENDING MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.2.2.1 Loan Origination

TABLE 16 LOAN ORIGINATION: DIGITAL LENDING MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 17 LOAN ORIGINATION: DIGITAL LENDING MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.2.2.2 Loan Servicing

TABLE 18 LOAN SERVICING: DIGITAL LENDING MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 19 LOAN SERVICING: DIGITAL LENDING MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.2.2.3 Loan/Debt Collection

TABLE 20 LOAN/DEBT COLLECTION: DIGITAL LENDING MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 21 LOAN/DEBT COLLECTION: DIGITAL LENDING MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.2.2.4 Limit and collateral Management

TABLE 22 LIMIT AND COLLATERAL MANAGEMENT: DIGITAL LENDING MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 23 LIMIT AND COLLATERAL MANAGEMENT: DIGITAL LENDING MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.2.2.5 P2P Lending Software

TABLE 24 P2P LENDING SOFTWARE: DIGITAL LENDING MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 25 P2P LENDING SOFTWARE: DIGITAL LENDING MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.2.2.6 Others

TABLE 26 OTHERS: DIGITAL LENDING MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 27 OTHERS: DIGITAL LENDING MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3 SERVICES

FIGURE 31 SUPPORT AND MAINTENANCE SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 28 DIGITAL LENDING MARKET SIZE, BY SERVICES, 2017–2020 (USD MILLION)

TABLE 29 DIGITAL LENDING MARKET SIZE, BY SERVICES, 2021–2026 (USD MILLION)

TABLE 30 SERVICES: DIGITAL LENDING MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 31 SERVICES: DIGITAL LENDING MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.1 CONSULTING

TABLE 32 CONSULTING: DIGITAL LENDING MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 33 CONSULTING: DIGITAL LENDING MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.2 IMPLEMENTATION

TABLE 34 IMPLEMENTATION: DIGITAL LENDING MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 35 IMPLEMENTATION: DIGITAL LENDING MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.3 SUPPORT AND MAINTENANCE

TABLE 36 SUPPORT AND MAINTENANCE: DIGITAL LENDING MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 37 SUPPORT AND MAINTENANCE: DIGITAL LENDING MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7 DIGITAL LENDING MARKET, BY DEPLOYMENT MODE (Page No. - 86)

7.1 INTRODUCTION

7.1.1 DEPLOYMENT MODE: MARKET DRIVERS

7.1.2 DEPLOYMENT MODE: IMPACT OF COVID-19 ON MARKET

FIGURE 32 CLOUD SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 38 DIGITAL LENDING MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 39 DIGITAL LENDING MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

7.2 CLOUD

TABLE 40 CLOUD: DIGITAL LENDING MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 41 CLOUD: DIGITAL LENDING MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.3 ON-PREMISES

TABLE 42 ON-PREMISES: DIGITAL LENDING MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 43 ON-PREMISES: DIGITAL LENDING MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8 DIGITAL LENDING MARKET, BY END USER (Page No. - 91)

8.1 INTRODUCTION

8.1.1 END USER: MARKET DRIVERS

8.1.2 END USER: IMPACT OF COVID-19 ON THE MARKET

FIGURE 33 NBFCS SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 44 DIGITAL LENDING MARKET SIZE, BY END USER, 2017–2020 (USD MILLION)

TABLE 45 DIGITAL LENDING MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

8.2 BANKS

TABLE 46 BANKS: DIGITAL LENDING MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 47 BANKS: DIGITAL LENDING MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.3 CREDIT UNIONS

TABLE 48 CREDIT UNIONS: DIGITAL LENDING MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 49 CREDIT UNIONS: DIGITAL LENDING MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.4 NON-BANKING FINANCIAL COMPANIES (NBFCS)

TABLE 50 NBFCS: DIGITAL LENDING MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 51 NBFCS: DIGITAL LENDING MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9 DIGITAL LENDING PLATFORM MARKET, BY REGION (Page No. - 97)

9.1 INTRODUCTION

FIGURE 34 NORTH AMERICA EXPECTED TO LEAD THE DIGITAL LENDING MARKET IN 2021

FIGURE 35 ASIA PACIFIC EXPECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 52 DIGITAL LENDING MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 53 DIGITAL LENDING MARKET SIZE, 2021–2026 (USD MILLION)

9.2 NORTH AMERICA

TABLE 54 USE CASES: NORTH AMERICA

9.2.1 NORTH AMERICA: DIGITAL LENDING MARKET DRIVERS

9.2.2 NORTH AMERICA: COVID-19 IMPACT

FIGURE 36 NORTH AMERICA: MARKET SNAPSHOT

TABLE 55 NORTH AMERICA: DIGITAL LENDING MARKET SIZE, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 56 NORTH AMERICA: DIGITAL LENDING MARKET SIZE, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 57 NORTH AMERICA: DIGITAL LENDING MARKET SIZE, BY SOLUTIONS, 2017–2020 (USD MILLION)

TABLE 58 NORTH AMERICA: DIGITAL LENDING MARKET SIZE, BY SOLUTIONS, 2021–2026 (USD MILLION)

TABLE 59 NORTH AMERICA: DIGITAL LENDING MARKET SIZE, BY POINT SOLUTIONS, 2017–2020 (USD MILLION)

TABLE 60 NORTH AMERICA: DIGITAL LENDING MARKET SIZE, BY POINT SOLUTIONS, 2021–2026 (USD MILLION)

TABLE 61 NORTH AMERICA: DIGITAL LENDING MARKET SIZE, BY SERVICES, 2017–2020 (USD MILLION)

TABLE 62 NORTH AMERICA: DIGITAL LENDING MARKET SIZE, BY SERVICES, 2021–2026 (USD MILLION)

TABLE 63 NORTH AMERICA: DIGITAL LENDING MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 64 NORTH AMERICA: DIGITAL LENDING MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 65 NORTH AMERICA: DIGITAL LENDING MARKET SIZE, BY END USER, 2017–2020 (USD MILLION)

TABLE 66 NORTH AMERICA: DIGITAL LENDING MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 67 NORTH AMERICA: DIGITAL LENDING MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 68 NORTH AMERICA: DIGITAL LENDING MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

9.2.3 UNITED STATES

TABLE 69 UNITED STATES: DIGITAL LENDING MARKET SIZE, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 70 UNITED STATES: DIGITAL LENDING MARKET SIZE, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 71 UNITED STATES: DIGITAL LENDING MARKET SIZE, BY SOLUTIONS, 2017–2020 (USD MILLION)

TABLE 72 UNITED STATES: DIGITAL LENDING MARKET SIZE, BY SOLUTIONS, 2021–2026 (USD MILLION)

TABLE 73 UNITED STATES: DIGITAL LENDING MARKET SIZE, BY POINT SOLUTIONS, 2017–2020 (USD MILLION)

TABLE 74 UNITED STATES: DIGITAL LENDING MARKET SIZE, BY POINT SOLUTIONS, 2021–2026 (USD MILLION)

TABLE 75 UNITED STATES: DIGITAL LENDING MARKET SIZE, BY SERVICES, 2017–2020 (USD MILLION)

TABLE 76 UNITED STATES: DIGITAL LENDING MARKET SIZE, BY SERVICES, 2021–2026 (USD MILLION)

TABLE 77 UNITED STATES: DIGITAL LENDING MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 78 UNITED STATES: DIGITAL LENDING MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 79 UNITED STATES: DIGITAL LENDING MARKET SIZE, BY END USER, 2017–2020 (USD MILLION)

TABLE 80 UNITED STATES: DIGITAL LENDING MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

9.2.4 CANADA

9.3 EUROPE

TABLE 81 USE CASES: EUROPE

9.3.1 EUROPE: DIGITAL LENDING MARKET DRIVERS

9.3.2 EUROPE: COVID-19 IMPACT

TABLE 82 EUROPE: DIGITAL LENDING MARKET SIZE, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 83 EUROPE: DIGITAL LENDING MARKET SIZE, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 84 EUROPE: DIGITAL LENDING MARKET SIZE, BY SOLUTIONS, 2017–2020 (USD MILLION)

TABLE 85 EUROPE: DIGITAL LENDING MARKET SIZE, BY SOLUTIONS, 2021–2026 (USD MILLION)

TABLE 86 EUROPE: DIGITAL LENDING MARKET SIZE, BY POINT SOLUTIONS, 2017–2020 (USD MILLION)

TABLE 87 EUROPE: DIGITAL LENDING MARKET SIZE, BY POINT SOLUTIONS, 2021–2026 (USD MILLION)

TABLE 88 EUROPE: DIGITAL LENDING MARKET SIZE, BY SERVICES, 2017–2020 (USD MILLION)

TABLE 89 EUROPE: DIGITAL LENDING MARKET SIZE, BY SERVICES, 2021–2026 (USD MILLION)

TABLE 90 EUROPE: DIGITAL LENDING MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 91 EUROPE: DIGITAL LENDING MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 92 EUROPE: DIGITAL LENDING MARKET SIZE, BY END USER, 2017–2020 (USD MILLION)

TABLE 93 EUROPE: DIGITAL LENDING MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 94 EUROPE: DIGITAL LENDING MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 95 EUROPE: DIGITAL LENDING MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

9.3.3 UNITED KINGDOM

TABLE 96 UNITED KINGDOM: DIGITAL LENDING MARKET SIZE, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 97 UNITED KINGDOM: DIGITAL LENDING MARKET SIZE, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 98 UNITED KINGDOM: DIGITAL LENDING MARKET SIZE, BY SOLUTIONS, 2017–2020 (USD MILLION)

TABLE 99 UNITED KINGDOM: DIGITAL LENDING MARKET SIZE, BY SOLUTIONS, 2021–2026 (USD MILLION)

TABLE 100 UNITED KINGDOM: DIGITAL LENDING MARKET SIZE, BY POINT SOLUTIONS, 2017–2020 (USD MILLION)

TABLE 101 UNITED KINGDOM: DIGITAL LENDING MARKET SIZE, BY POINT SOLUTIONS, 2021–2026 (USD MILLION)

TABLE 102 UNITED KINGDOM: DIGITAL LENDING MARKET SIZE, BY SERVICES, 2017–2020 (USD MILLION)

TABLE 103 UNITED KINGDOM: DIGITAL LENDING MARKET SIZE, BY SERVICES, 2021–2026 (USD MILLION)

TABLE 104 UNITED KINGDOM: DIGITAL LENDING MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 105 UNITED KINGDOM: DIGITAL LENDING MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 106 UNITED KINGDOM: DIGITAL LENDING MARKET SIZE, BY END USER, 2017–2020 (USD MILLION)

TABLE 107 UNITED KINGDOM: DIGITAL LENDING MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

9.3.4 GERMANY

9.3.5 FRANCE

9.3.6 REST OF EUROPE

9.4 ASIA PACIFIC

TABLE 108 USE CASES: ASIA PACIFIC

9.4.1 ASIA PACIFIC: DIGITAL LENDING MARKET DRIVERS

9.4.2 ASIA PACIFIC: COVID-19 IMPACT

FIGURE 37 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 109 ASIA PACIFIC: DIGITAL LENDING MARKET SIZE, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 110 ASIA PACIFIC: DIGITAL LENDING MARKET SIZE, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 111 ASIA PACIFIC: DIGITAL LENDING MARKET SIZE, BY SOLUTIONS, 2017–2020 (USD MILLION)

TABLE 112 ASIA PACIFIC: DIGITAL LENDING MARKET SIZE, BY SOLUTIONS, 2021–2026 (USD MILLION)

TABLE 113 ASIA PACIFIC: DIGITAL LENDING MARKET SIZE, BY POINT SOLUTIONS, 2017–2020 (USD MILLION)

TABLE 114 ASIA PACIFIC: DIGITAL LENDING MARKET SIZE, BY POINT SOLUTIONS, 2021–2026 (USD MILLION)

TABLE 115 ASIA PACIFIC: DIGITAL LENDING MARKET SIZE, BY SERVICES, 2017–2020 (USD MILLION)

TABLE 116 ASIA PACIFIC: DIGITAL LENDING MARKET SIZE, BY SERVICES, 2021–2026 (USD MILLION)

TABLE 117 ASIA PACIFIC: DIGITAL LENDING MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 118 ASIA PACIFIC: DIGITAL LENDING MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 119 ASIA PACIFIC: DIGITAL LENDING MARKET SIZE, BY END USER, 2017–2020 (USD MILLION)

TABLE 120 ASIA PACIFIC: DIGITAL LENDING MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 121 ASIA PACIFIC: DIGITAL LENDING MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 122 ASIA PACIFIC: DIGITAL LENDING MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

9.4.3 CHINA

TABLE 123 CHINA: DIGITAL LENDING MARKET SIZE, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 124 CHINA: DIGITAL LENDING MARKET SIZE, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 125 CHINA: DIGITAL LENDING MARKET SIZE, BY SOLUTIONS, 2017–2020 (USD MILLION)

TABLE 126 CHINA: DIGITAL LENDING MARKET SIZE, BY SOLUTIONS, 2021–2026 (USD MILLION)

TABLE 127 CHINA: DIGITAL LENDING MARKET SIZE, BY POINT SOLUTIONS, 2017–2020 (USD MILLION)

TABLE 128 CHINA: DIGITAL LENDING MARKET SIZE, BY POINT SOLUTIONS, 2021–2026 (USD MILLION)

TABLE 129 CHINA: DIGITAL LENDING MARKET SIZE, BY SERVICES, 2017–2020 (USD MILLION)

TABLE 130 CHINA: DIGITAL LENDING MARKET SIZE, BY SERVICES, 2021–2026 (USD MILLION)

TABLE 131 CHINA: DIGITAL LENDING MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 132 CHINA: DIGITAL LENDING MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 133 CHINA: DIGITAL LENDING MARKET SIZE, BY END USER, 2017–2020 (USD MILLION)

TABLE 134 CHINA: DIGITAL LENDING MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

9.4.4 JAPAN

9.4.5 INDIA

9.4.6 REST OF ASIA PACIFIC

9.5 MIDDLE EAST AND AFRICA

9.5.1 MIDDLE EAST AND AFRICA: DIGITAL LENDING MARKET

9.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

TABLE 135 MIDDLE EAST AND AFRICA: DIGITAL LENDING MARKET SIZE, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 136 MIDDLE EAST AND AFRICA: DIGITAL LENDING MARKET SIZE, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 137 MIDDLE EAST AND AFRICA: DIGITAL LENDING MARKET SIZE, BY SOLUTIONS, 2017–2020 (USD MILLION)

TABLE 138 MIDDLE EAST AND AFRICA: DIGITAL LENDING MARKET SIZE, BY SOLUTIONS, 2021–2026 (USD MILLION)

TABLE 139 MIDDLE EAST AND AFRICA: DIGITAL LENDING MARKET SIZE, BY POINT SOLUTIONS, 2017–2020 (USD MILLION)

TABLE 140 MIDDLE EAST AND AFRICA: DIGITAL LENDING MARKET SIZE, BY POINT SOLUTIONS, 2021–2026 (USD MILLION)

TABLE 141 MIDDLE EAST AND AFRICA: DIGITAL LENDING MARKET SIZE, BY SERVICES, 2017–2020 (USD MILLION)

TABLE 142 MIDDLE EAST AND AFRICA: DIGITAL LENDING MARKET SIZE, BY SERVICES, 2021–2026 (USD MILLION)

TABLE 143 MIDDLE EAST AND AFRICA: DIGITAL LENDING MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 144 MIDDLE EAST AND AFRICA: DIGITAL LENDING MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 145 MIDDLE EAST AND AFRICA: DIGITAL LENDING MARKET SIZE, BY END USER, 2017–2020 (USD MILLION)

TABLE 146 MIDDLE EAST AND AFRICA: DIGITAL LENDING MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 147 MIDDLE EAST AND AFRICA: DIGITAL LENDING MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 148 MIDDLE EAST AND AFRICA: DIGITAL LENDING MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

9.5.3 KINGDOM OF SAUDI ARABIA

9.5.4 UNITED ARAB EMIRATES

9.5.5 REST OF MIDDLE EAST AND AFRICA

9.6 LATIN AMERICA

9.6.1 LATIN AMERICA: DIGITAL LENDING MARKET DRIVERS

9.6.2 LATIN AMERICA: COVID-19 IMPACT

TABLE 149 LATIN AMERICA: DIGITAL LENDING MARKET SIZE, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 150 LATIN AMERICA: DIGITAL LENDING MARKET SIZE, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 151 LATIN AMERICA: DIGITAL LENDING MARKET SIZE, BY SOLUTIONS, 2017–2020 (USD MILLION)

TABLE 152 LATIN AMERICA: DIGITAL LENDING MARKET SIZE, BY SOLUTIONS, 2021–2026 (USD MILLION)

TABLE 153 LATIN AMERICA: DIGITAL LENDING MARKET SIZE, BY POINT SOLUTIONS, 2017–2020 (USD MILLION)

TABLE 154 LATIN AMERICA: DIGITAL LENDING MARKET SIZE, BY POINT SOLUTIONS, 2021–2026 (USD MILLION)

TABLE 155 LATIN AMERICA: DIGITAL LENDING MARKET SIZE, BY SERVICES, 2017–2020 (USD MILLION)

TABLE 156 LATIN AMERICA: DIGITAL LENDING MARKET SIZE, BY SERVICES, 2021–2026 (USD MILLION)

TABLE 157 LATIN AMERICA: DIGITAL LENDING MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 158 LATIN AMERICA: DIGITAL LENDING MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 159 LATIN AMERICA: DIGITAL LENDING MARKET SIZE, BY END USER, 2017–2020 (USD MILLION)

TABLE 160 LATIN AMERICA: DIGITAL LENDING MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 161 LATIN AMERICA: DIGITAL LENDING MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 162 LATIN AMERICA: DIGITAL LENDING MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

9.6.3 BRAZIL

9.6.4 MEXICO

9.6.5 REST OF LATIN AMERICA

10 COMPETITIVE LANDSCAPE (Page No. - 145)

10.1 OVERVIEW

FIGURE 38 KEY DEVELOPMENTS BY THE LEADING PLAYERS IN THE DIGITAL LENDING PLATFORM MARKET, 2019–2021

10.2 TOP VENDORS IN THE DIGITAL LENDING MARKET

FIGURE 39 MAJOR VENDORS, 2021

10.3 COMPETITIVE SCENARIO

FIGURE 40 KEY MARKET EVALUATION FRAMEWORK

10.3.1 PRODUCT LAUNCHES

TABLE 163 PRODUCT LAUNCHES, 2020–2021

10.3.2 DEALS

TABLE 164 DEALS, 2019–2021

10.3.3 OTHERS

TABLE 165 OTHERS, 2019–2021

11 COMPANY PROFILES (Page No. - 149)

11.1 KEY PLAYERS

(Business overview, Products offered, Recent Developments, MNM view)*

11.1.1 FISERV

TABLE 166 FISERV: BUSINESS OVERVIEW

FIGURE 41 FISERV: COMPANY SNAPSHOT

TABLE 167 FISERV: SOLUTIONS AND SERVICES OFFERED

TABLE 168 FISERV: DIGITAL LENDING PLATFORM MARKET: NEW SOLUTION/SERVICE LAUNCHES

TABLE 169 FISERV: DIGITAL LENDING PLATFORM MARKET: DEALS

TABLE 170 FISERV: DIGITAL LENDING PLATFORM MARKET: OTHERS

11.1.2 ICE MORTGAGE TECHNOLOGY

TABLE 171 ICE MORTGAGE TECHNOLOGY: BUSINESS OVERVIEW

FIGURE 42 ICE MORTGAGE TECHNOLOGY: COMPANY SNAPSHOT

TABLE 172 ICE MORTGAGE TECHNOLOGY: SOLUTIONS AND SERVICES OFFERED

TABLE 173 ICE MORTGAGE TECHNOLOGY: DIGITAL LENDING PLATFORM MARKET: NEW SOLUTION/SERVICE LAUNCHES

TABLE 174 ICE MORTGAGE TECHNOLOGY: DIGITAL LENDING PLATFORM MARKET: DEALS

11.1.3 FIS

TABLE 175 FIS: BUSINESS OVERVIEW

FIGURE 43 FIS: COMPANY SNAPSHOT

TABLE 176 FIS: SOLUTIONS AND SERVICES OFFERED

TABLE 177 FIS: DIGITAL LENDING PLATFORM MARKET: NEW SOLUTION/SERVICE LAUNCHES

TABLE 178 FIS: DIGITAL LENDING PLATFORM MARKET: DEALS

TABLE 179 FIS: DIGITAL LENDING PLATFORM MARKET: OTHERS

11.1.4 NEWGEN SOFTWARE

TABLE 180 NEWGEN SOFTWARE: BUSINESS OVERVIEW

FIGURE 44 NEWGEN SOFTWARE: COMPANY SNAPSHOT

TABLE 181 NEWGEN SOFTWARE: SOLUTIONS AND SERVICES OFFERED

TABLE 182 NEWGEN SOFTWARE: DIGITAL LENDING PLATFORM MARKET: NEW SOLUTION/SERVICE LAUNCHES

TABLE 183 NEWGEN SOFTWARE: DIGITAL LENDING PLATFORM MARKET: DEALS

11.1.5 NUCLEUS SOFTWARE

TABLE 184 NUCLEUS SOFTWARE: BUSINESS OVERVIEW

FIGURE 45 NUCLEUS SOFTWARE: COMPANY SNAPSHOT

TABLE 185 NUCLEUS SOFTWARE: SOLUTIONS AND SERVICES OFFERED

TABLE 186 NUCLEUS SOFTWARE: DIGITAL LENDING PLATFORM MARKET: NEW SOLUTION/SERVICE LAUNCHES

TABLE 187 NUCLEUS SOFTWARE: DIGITAL LENDING PLATFORM MARKET: DEALS

11.1.6 TEMENOS

TABLE 188 TEMENOS: BUSINESS OVERVIEW

FIGURE 46 TEMENOS: COMPANY SNAPSHOT

TABLE 189 TEMENOS: SOLUTIONS AND SERVICES OFFERED

TABLE 190 TEMENOS: DIGITAL LENDING PLATFORM MARKET: NEW SOLUTION/SERVICE LAUNCHES

TABLE 191 TEMENOS: DIGITAL LENDING PLATFORM MARKET: DEALS

11.1.7 PEGA

TABLE 192 PEGA: BUSINESS OVERVIEW

FIGURE 47 PEGA: COMPANY SNAPSHOT

TABLE 193 PEGA: SOLUTIONS AND SERVICES OFFERED

11.1.8 INTELLECT DESIGN ARENA

TABLE 194 INTELLECT DESIGN ARENA: BUSINESS OVERVIEW

FIGURE 48 INTELLECT DESIGN ARENA: COMPANY SNAPSHOT

TABLE 195 INTELLECT DESIGN ARENA: SOLUTIONS AND SERVICES OFFERED

TABLE 196 INTELLECT DESIGN ARENA: DIGITAL LENDING PLATFORM MARKET: NEW SOLUTION/SERVICE LAUNCHES

TABLE 197 INTELLECT DESIGN ARENA: DIGITAL LENDING PLATFORM MARKET: DEALS

11.1.9 TAVANT

TABLE 198 TAVANT: BUSINESS OVERVIEW

TABLE 199 TAVANT: SOLUTIONS AND SERVICES OFFERED

TABLE 200 TAVANT: DIGITAL LENDING PLATFORM MARKET: NEW SOLUTION/SERVICE LAUNCHES

TABLE 201 TAVANT: DIGITAL LENDING PLATFORM MARKET: DEALS

11.1.10 SIGMA INFOSOLUTIONS

TABLE 202 SIGMA INFOSOLUTIONS: BUSINESS OVERVIEW

TABLE 203 SIGMA INFOSOLUTIONS: SOLUTIONS AND SERVICES OFFERED

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

11.2 OTHER PLAYERS

11.2.1 DOCUTECH

11.2.2 CU DIRECT

11.2.3 ABRIGO

11.2.4 WIZNI

11.2.5 BUILT TECHNOLOGIES

11.2.6 TURNKEY LENDERS

11.2.7 FINASTRA

11.2.8 RUPEEPOWER

11.2.9 ROOSTIFY

11.2.10 JURISTECH

11.2.11 DECIMAL TECHNOLOGIES

11.2.12 HES FINTECH

11.2.13 ARGO

11.2.14 SYMITAR

11.2.15 EDGEVERVE

11.2.16 TCS

11.2.17 WIPRO

11.2.18 SAP

11.2.19 ORACLE

11.2.20 BNY MELLON

11.2.21 BLACK KNIGHT

12 APPENDIX (Page No. - 199)

12.1 ADJACENT/RELATED MARKETS

12.1.1 DIGITAL BANKING PLATFORMS MARKET

12.1.1.1 Market definition

12.1.1.2 Market overview

12.1.1.3 Digital Banking Platforms Market, By Banking Type

TABLE 204 DIGITAL BANKING PLATFORMS MARKET SIZE, BY BANKING TYPE, 2016–2023 (USD MILLION)

TABLE 205 RETAIL BANKING: DIGITAL BANKING PLATFORMS MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

TABLE 206 CORPORATE BANKING: DIGITAL BANKING PLATFORMS MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

12.1.1.4 Digital Banking Platforms Market, By Banking Mode

TABLE 207 DIGITAL BANKING PLATFORMS MARKET SIZE, BY BANKING MODE, 2016–2023 (USD MILLION)

TABLE 208 ONLINE BANKING: DIGITAL BANKING PLATFORMS MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

TABLE 209 MOBILE BANKING: DIGITAL BANKING PLATFORMS MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

12.1.1.5 Digital Banking Platforms Market, By Deployment Type

TABLE 210 DIGITAL BANKING PLATFORMS MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2023 (USD MILLION)

TABLE 211 ON-PREMISES: DIGITAL BANKING PLATFORMS MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

TABLE 212 CLOUD: DIGITAL BANKING PLATFORMS MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

12.1.1.6 Digital Banking Platforms Market, By Region

TABLE 213 DIGITAL BANKING PLATFORMS MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

TABLE 214 NORTH AMERICA: DIGITAL BANKING PLATFORMS MARKET SIZE, BY COUNTRY, 2016–2023 (USD MILLION)

TABLE 215 NORTH AMERICA: DIGITAL BANKING PLATFORMS MARKET SIZE, BY BANKING TYPE, 2016–2023 (USD MILLION)

TABLE 216 NORTH AMERICA: DIGITAL BANKING PLATFORMS MARKET SIZE, BY BANKING MODE, 2016–2023 (USD MILLION)

TABLE 217 NORTH AMERICA: DIGITAL BANKING PLATFORMS MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2023 (USD MILLION)

12.1.2 ANTI-MONEY LAUNDERING MARKET

12.1.2.1 Market definition

12.1.2.2 Market overview

12.1.2.3 Anti-Money Laundering Market, By Component

TABLE 218 ANTI-MONEY LAUNDERING SOLUTION MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 219 POST-COVID-19: ANTI-MONEY LAUNDERING SOLUTION MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

12.1.2.4 Anti-Money Laundering Solution Market, By Deployment Mode

TABLE 220 ANTI-MONEY LAUNDERING SOLUTION MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 221 POST-COVID-19: ANTI-MONEY LAUNDERING SOLUTION MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

12.1.2.5 Anti-Money Laundering Solution Market, By Organization Size

TABLE 222 ANTI-MONEY LAUNDERING SOLUTION MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 223 POST-COVID-19: ANTI-MONEY LAUNDERING SOLUTION MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

12.1.2.6 Anti-Money Laundering Market, By End User

TABLE 224 ANTI-MONEY LAUNDERING SOLUTION MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 225 POST-COVID-19: ANTI-MONEY LAUNDERING SOLUTION MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

12.1.2.7 Anti-Money Laundering Market, By Region

TABLE 226 ANTI-MONEY LAUNDERING SOLUTION MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 227 POST-COVID-19: ANTI-MONEY LAUNDERING SOLUTION MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 228 NORTH AMERICA: ANTI-MONEY LAUNDERING SOLUTION MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 229 NORTH AMERICA: POST-COVID-19 ANTI-MONEY LAUNDERING SOLUTION MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 230 NORTH AMERICA: ANTI-MONEY LAUNDERING SOLUTION MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 231 NORTH AMERICA: POST-COVID-19 ANTI-MONEY LAUNDERING SOLUTION MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 232 NORTH AMERICA: ANTI-MONEY LAUNDERING SOLUTION MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 233 NORTH AMERICA: POST-COVID-19 ANTI-MONEY LAUNDERING SOLUTION MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 234 NORTH AMERICA: ANTI-MONEY LAUNDERING SOLUTION MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 235 NORTH AMERICA: POST-COVID-19 ANTI-MONEY LAUNDERING SOLUTION MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

TABLE 236 NORTH AMERICA: ANTI-MONEY LAUNDERING SOLUTION MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 237 NORTH AMERICA: POST-COVID-19 ANTI-MONEY LAUNDERING SOLUTION MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

12.1.3 BLOCKCHAIN IOT MARKET

12.1.3.1 Market Overview

12.1.3.2 Blockchain IoT Market, By Component

TABLE 238 BLOCKCHAIN IOT MARKET SIZE, BY COMPONENT, 2018–2026 (USD THOUSAND)

TABLE 239 BLOCKCHAIN IOT MARKET SIZE, BY HARDWARE, 2018–2026 (USD THOUSAND)

TABLE 240 BLOCKCHAIN IOT MARKET SIZE, BY HARDWARE, 2018–2026 (THOUSAND UNITS)

TABLE 241 BLOCKCHAIN IOT MARKET SIZE, BY SERVICE, 2018–2026 (USD THOUSAND)

12.1.3.3 Blockchain IoT Market, By Organization Size

TABLE 242 BLOCKCHAIN IOT MARKET SIZE, BY ORGANIZATION SIZE, 2018–2026 (USD THOUSAND)

12.1.3.4 Blockchain IoT Market, By Application

TABLE 243 BLOCKCHAIN IOT MARKET SIZE, BY APPLICATION, 2018–2026 (USD THOUSAND)

12.1.3.5 Blockchain IoT Market, By Vertical

TABLE 244 BLOCKCHAIN IOT MARKET SIZE, BY VERTICAL, 2018–2026 (USD THOUSAND)

12.1.3.6 Blockchain IoT Market, By Region

TABLE 245 BLOCKCHAIN IOT MARKET SIZE, BY REGION, 2018–2026 (USD THOUSAND)

12.1.4 IOT IN BFSI MARKET

12.1.4.1 Market overview

12.1.4.2 IoT in BFSI Market, By Component

TABLE 246 IOT IN BFSI MARKET SIZE, BY COMPONENT, 2016–2023 (USD MILLION)

TABLE 247 IOT IN BFSI MARKET SIZE, BY SOLUTION, 2016–2023 (USD MILLION)

TABLE 248 IOT IN BFSI MARKET SIZE, BY SERVICE, 2016–2023 (USD MILLION)

TABLE 249 PROFESSIONAL SERVICES: IOT IN BFSI MARKET SIZE, BY TYPE, 2016–2023 (USD MILLION)

12.1.4.3 IoT in BFSI Market, By End User

TABLE 250 IOT IN BFSI MARKET SIZE, BY END USER, 2016–2023 (USD MILLION)

12.1.4.4 IoT in BFSI Market, By Organization Size

TABLE 251 IOT IN BFSI MARKET SIZE, BY ORGANIZATION SIZE, 2016–2023 (USD MILLION)

12.1.4.5 IoT in BFSI market, By Region

TABLE 252 IOT IN BFSI MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

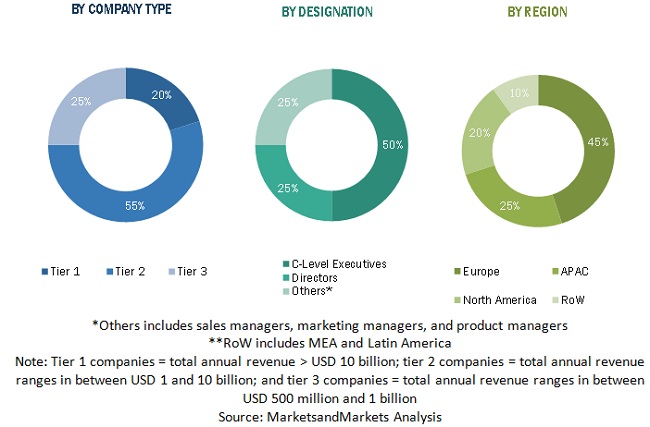

The study involved four major activities in estimating the current size of the digital lending market. Exhaustive secondary research was done to collect information on the lending industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub segments of the digital lending market

Secondary Research

In the secondary research process, various secondary sources were referred to obtain key information about industry insights, the market’s monetary chain, the overall pool of key players, market classification and segmentation, and key developments in the market. These secondary sources included annual reports, press releases, and investor presentations of companies, white papers, certified publications, and articles from recognized associations and government publishing sources.

Primary Research

Primary sources were mainly industry experts from core and related industries, preferred system developers, service providers, System Integrators (SIs), resellers, partners, and organizations related to the various segments of the industry’s value chain. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the digital lending market The primary sources from the demand side included digital lending end users, network administrators/consultants/specialists, Chief Information Officers (CIOs) and subject-matter experts from enterprises and government associations.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the global digital lending market and various other dependent submarkets in the overall market. An exhaustive list of all the vendors offering solutions and services in the digital lending market was prepared while using the top-down approach. The market share for all the vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor was evaluated based on its offering (solutions and services). The aggregate of all companies’ revenues was extrapolated to reach the overall market size.

In the bottom-up approach, the key companies offering digital lending solutions and services were identified. After confirming these companies through primary interviews with industry experts, their total revenue was estimated through annual reports, Securities and Exchange Commission (SEC) filings, and paid databases. The revenue of these companies from Business Units (BUs) that offer digital lending was identified through similar sources. Then through primaries, the data on revenue generated through specific digital lending components was collected.

Further, each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from the industry leaders, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and managers.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To describe and forecast the size of the digital lending market by offering, deployment mode, end user, and region.

- To describe and forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East and Africa (MEA)

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the Market

- To analyze the impact of COVID-19 on the Market

- To analyze micro markets with respect to the individual growth trends, prospects, and contributions to the overall digital lending market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments

- To profile key market players, including top vendors and startups, provide comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials, and provide a detailed competitive landscape of the market

- To analyze competitive developments, such as Mergers and Acquisitions (M&A); new product launches and product enhancements; agreements, partnerships, and collaborations; expansions; and Research and Development (R&D) activities in the market.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the European digital lending market

- Further breakdown of the APAC market

- Further breakdown of the LATAM market

- Further breakdown of the MEA market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Digital Lending Market

Market segmentation of POS, LOS, Servicing, Portfolio Management

Interested in SAAS Loan Origination services.

Interested in Digital Lending market.