DRAM Module and Component Market by Type (LPDRAM, DDR5, DDR4, DDR3, GDDR, HBM), End-User Industries (Server, Mobile Devices, Computers, Consumer Electronics, Automobiles), Memory (above 8GB, 6-8GB, 3-4GB, 2GB) and Geography (2021-2027)

Updated on : October 23, 2024

DRAM Module and Component Market Size & Growth

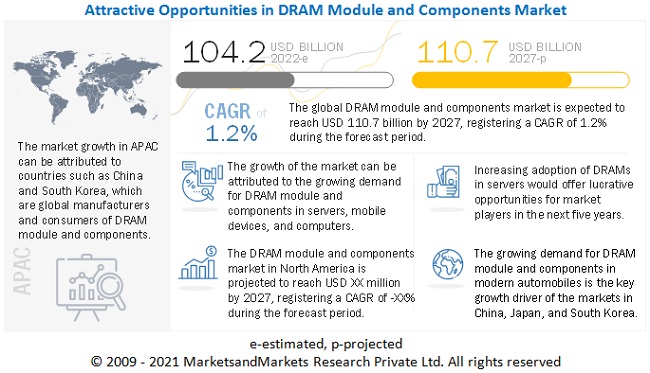

The global DRAM module and component market size was valued at USD 94.9 billion in 2021 and is expected to reach USD 110.7 billion by 2027, growing at a CAGR of 1.2% during the forecast period from 2022 to 2027.

The key factors driving the growth of the DRAM module and component market include emergence of 5G technology, growth in demand for DRAM module and components in automotive sector, growth in adoption of high-end smartphones, and others.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global DRAM Module and Component Market

The outbreak of COVID-19 has severely impacted the supply chain of mobile devices, computers, and consumer electronics, which are the leading end-user industries of the DRAM module and component market. Lockdowns and suspension of manufacturing operations have further hampered economic growth and upended the global semiconductor industry and created a major chip shortage, affecting automobiles, computers, and other industries worldwide. Nevertheless, with this shortage comes the opportunity for investments and the emergence of new players in the semiconductor industry; semiconductor producers are now scrambling to increase production.

Market Dynamics of DRAM Module and Components Market

Driver: Emergence of 5G technology

The emergence of the 5G cellular network has opened more lanes on the information superhighway, enabling vast amounts of data to move faster and more freely, reducing traffic jams. Enabled by innovations in memory and storage, 5G, coupled with next-generation technologies such as artificial intelligence (AI), shows enormous promise to transform mobile devices into prescient, intuitive, and truly smart companions. The 5G/AI revolution stands to change the way people communicate, work, consume, recreate, and experience.

In the next few years, 5G technology will integrate mobile devices with new capabilities, expanding the need for storage capacities from 512GB to 1TB; data transmission speeds of up to 20Gbps; and bandwidths allowing connections to multiple devices simultaneously, including sensors and other “smart” devices such as autonomous vehicles. The fast-processing speed, low latency, high bandwidth, and vast storage capabilities 5G wireless technology offers are projected to bring the intelligence of mobile devices to rival the human brain.

Restraint: Lack of stability under extreme environmental conditions

Stability under high temperatures and extreme environmental conditions are among the essential requirements for emerging memory technologies. Some memory offer stability and performance under high temperatures. Hence, they are used in multiple applications where they are exposed to extreme high and low temperatures. However, certain scalability and stability issues are encountered in the operation of most memory in such extreme environmental conditions.

Elevated temperatures also adversely affect reliability. DRAM thermal problems are further exacerbated as designers squeeze more DRAM chips on the already densely populated DIMMs. The physical constraints place limitations on the DIMM pitch and allowable thermal solutions. Furthermore, the dense and uniform placement of memory devices on the DIMM makes it challenging to effectively spread generated heat. As a result, heat tends to accumulate faster within the crowded DIMM.

Another issue associated with this is the operating temperature. Given that countries worldwide have different climates and extreme weather events, DRAM products must have a much wider temperature range with a higher threshold and a lower threshold than other categories of DRAM products to ensure that devices do not break down in between.

Opportunity: Increasing adoption of Internet of Things devices

Internet of Things (IoT) allows physical and virtual objects to connect through cloud technology and exchange data and information. IoT is not just a network of internet-connected things but is a network of machines and humans. IoT refers to the ever-growing network of physical objects and the communication that occurs between these objects and other internet-enabled devices and systems.

IoT ecosystem is growing fast owing to the availability of various smart products for domestic and industrial applications. The application areas of IoT include smart homes, smart grids, industrial internet, and connected cars, among many others. As the IoT modules used in various applications become compact, the demand for incorporating more memory in IoT devices increases. DRAMs are small, making them the best option for low-power, high-density applications for the smaller design of IoT solutions. This has resulted in the high demand for DRAMs from various IoT applications.

Challenge: Highly volative pricing nature of DRAM module and components

DRAM makers are pushing into the next phase of scaling but are facing several challenges as the memory technology approaches its physical limit. DRAM is used for main memory in systems, and the most advanced devices used today are based on roughly 18nm to 15nm processes. The physical limit for DRAM is somewhere about 10nm. There are efforts in R&D to extend the technology and ultimately displace it with new memory types, but so far, there is no direct replacement. Until a new solution is in place, the vendors will continue to scale the DRAM and eke out more performance, though in incremental steps at the current 1nm node regime. And at future nodes, some DRAM makers will make a big transition from traditional lithography to extreme ultraviolet (EUV) lithography for production in the fab.

With or without EUV, DRAM vendors face higher costs and other challenges. Nevertheless, DRAM is a key part of the memory/storage hierarchy in systems. In the first tier of the hierarchy, SRAM is integrated into the processor for fast data access. DRAM, the next tier, is used for main memory. And disk drives and NAND-based solid-state storage drives (SSDs) are used for storage.

The DRAM module and component industry is a vast but challenging market. DRAM vendors are in the midst of a downturn amid price pressures in the market. Yet OEMs still want faster DRAMs with more bandwidth to keep pace with the onslaught of new data-intensive applications, such as 5G and machine learning.

DRAM Module and Component Market Segmentation

Above 8GB memory segment to hold largest share of DRAM module and component market during the forecast period

Above 8GB memory segment is expected to hold the largest market share in the DRAM module and components market during the forecast period owing to the increasing applications of these DRAMs in resource-heavy applications, especially image or video processing (even 4K video), CAD, or 3D modeling and/or virtual machines. On top of that, video editing and other multimedia will be more effective with more DRAM. Having more than 8GB also comes in handy if the user makes extensive use of virtualization tools such as Microsoft Hyper-V or VMware Workstation, especially if multiple virtual machines are run simultaneously.

Automobiles industry in end-user industries segment is expected to exhibit the highest growth rate during the forecast period

The automobiles segment is expected to grow with the highest growth rate during the forecast period owing to the increasing applications of DRAM module and components in modern automotive for offering features such as infotainment, ADAS, telematics, and D-clusters (digital instrument clusters).

DRAM Module and Component Industry Regional Analysis

APAC to account for the largest market share during the forecast period

APAC holds the largest market share of the DRAM module and component market and is expected to retain its position as the largest during the forecast period due to the presence of countries such as China and South Korea in the region.

China is a key market for memory devices and continues to grow strongly due to their high demand in the mobile, automotive, and server markets, but it depends on other countries to fulfill its DRAM requirements. With the launch of "Made in China 2025" in 2015, the Chinese government, in partnership with private players, started investing billions of dollars in developing their local semiconductor industry aiming at bridging the gap between domestic production and consumption.

South Korea, on the other hand, is a leader in manufacturing mobile devices, servers, consumer electronics, computers, as well as DRAM module and components with the presence of companies such as Samsung Electronics Co., Ltd. (South Korea) and SK Hynix (South Korea)—the top 2 companies for DRAM module and components worldwide. This is the main driving factor for growth in this country.

These factors are expected to boost the growth of the DRAM module and components market in APAC during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

Top DRAM Module and Component Companies - Key Market Players

Some of the DRAM module and component companies operating in the market are

- Samsung Electronics Co., Ltd. (South Korea),

- SK Hynix Inc. (South Korea),

- Micron Technology, Inc. (US),

- Nanya Technology Corporation (Taiwan),

- Winbond Electronics Corporation (Taiwan),

- Powerchip Technology Corporation (Taiwan),

- ADATA Technology Co. Ltd. (Taiwan),

- Ramaxel Technology (Shenzhen) Co, Ltd (China),

- Kingston Technology Corporation (US),

- SMART Modular Technologies (US) and so on.

Scope of the Report

|

Report Metric |

Details |

|

Estimated Market Size |

USD 94.9 billion in 2021 |

|

Expected Market Size |

USD 110.7 billion by 2027 |

|

Growth Rate |

CAGR of 1.2% |

|

Market size available for years |

2018–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Billion/Million) |

|

Segments covered |

Type, memory, end-user industries, and Geography |

|

Geographies covered |

North America, Europe, APAC, and RoW |

|

Companies covered |

Samsung Electronics Co., Ltd. (South Korea), SK Hynix Inc. (South Korea), Micron Technology, Inc. (US), Nanya Technology Corporation (Taiwan), Winbond Electronics Corporation (Taiwan), Powerchip Technology Corporation (Taiwan), ADATA Technology Co. Ltd. (Taiwan), Ramaxel Technology (Shenzhen) Co, Ltd (China), Kingston Technology Corporation (US), SMART Modular Technologies (US), and so on. |

In this research report, the DRAM module and components market share has been segmented on the basis of type, memory, end-user industries, and geography.

DRAM Module and Component Market, by Type

- DDR2 DRAM

- DDR3 DRAM

- DDR4 DRAM

- DDR5 DRAM

- LPDRAM

- GDDR

- HBM

- Others

DRAM Module and Component Market, by Memory

- Up to 1GB

- 2GB

- 3-4GB

- 6-8GB

- Above 8GB

DRAM Module and Components Market, by End-user Industries

- Consumer Electronics

- Mobile Devices

- Servers

- Computers

- Automobiles

- Others

Geographic Analysis

- North America

- Europe

- APAC

- RoW

Recent Developments

- In March 2022, Kingston FURY, the gaming division of Kingston Technology Company, Inc., announced the release of Kingston FURY Impact DDR5 SODIMMs, which is 50% faster than DDR4 to provide a boost to gaming, rendering, and multitasking, while its low power consumption and increased efficiency keep systems cool at 1.1V.

- In February 2022, SMART Modular Technologies, Inc. announced its new DDR5 32GB Very Low-Profile Registered Dual In-Line Memory Module (VLP RDIMM). SMART’s new DuraMemory DDR5 32GB VLP RDIMM is the industry’s first DDR5 VLP RDIMM form factor.

- In December 2022, ADATA Technology Co., Ltd. announced the ADATA DDR5-4800 and XPG LANCER DDR5, the next-generation, high-performance memory modules capable of reaching frequencies of up to 5200MT/s for the upcoming 12th Gen Intel platform. As DDR5 memory modules will be available for the INTEL 12th Generation platform by the end of October 2022, ADATA has conducted joint testing with motherboard brands AORUS, ASROCK, ASUS, GIGABYTE, MSI, and ROG to ensure maximum compatibility and optimal performance.

Frequently Asked Questions (FAQ):

What is the current size of the global DRAM module and components market?

The global DRAM module and components market was valued at USD 94.9 billion in 2021 and is expected to reach USD 110.7 billion by 2027, at a CAGR of 1.2% during the forecast period from 2022 to 2027.

Who are the winners in the global DRAM module and components market share?

Some of the key companies operating in the DRAM module and component market are Samsung Electronics Co., Ltd. (South Korea), SK Hynix Inc. (South Korea), Micron Technology, Inc. (US), Nanya Technology Corporation (Taiwan), Winbond Electronics Corporation (Taiwan), Powerchip Technology Corporation (Taiwan), ADATA Technology Co. Ltd. (Taiwan), Ramaxel Technology (Shenzhen) Co, Ltd (China), Kingston Technology Corporation (US), SMART Modular Technologies (US), and so on. These players have adopted various growth strategies such as product launches/developments, partnerships/contracts/ collaborations/acquisitions to expand their global presence and increase their share in the global DRAM module and components market.

What are the major drivers for the DRAM module and component market share?

The key factors driving the growth of the DRAM module and components market include emergence of 5G technology, growth in demand for DRAM module and components in automotive sector, growth in adoption of high-end smartphones, and others.

What are the growing application verticals in the DRAM module and components market?

The servers segment is expected to hold the largest market share of the DRAM module and components market during the forecast period due to the increasing number of network users in the current highly connected IT world. The number of servers and data centers is increasing rapidly to manage the growing crowd over the network.

What are the impact of COVID-19 on the global DRAM module and components market?

Due to COVID-19, the manufacturing units of major players are highly hampered due to worldwide lockdown and limited availability of labor and raw material. A number of scheduled product launches and related developments have been postponed due to the pandemic. However, the impact of COVID-19 is expected to reduce during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 SCOPE OF STUDY

1.3.1 MARKETS COVERED

FIGURE 1 MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.3.4 INCLUSIONS AND EXCLUSIONS

1.4 CURRENCY

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY & PRIMARY RESEARCH

2.1.1.1 Key industry insights

2.1.2 SECONDARY DATA

2.1.2.1 List of major secondary sources

2.1.2.2 Secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Breakdown of primaries

2.1.3.2 Primary interviews with experts

2.1.3.3 Key data from primary sources

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market size from supply side

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.4.1 LIMITATIONS

2.5 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 39)

3.1 COVID-19 IMPACT ANALYSIS

FIGURE 6 IMPACT OF COVID-19 ON GLOBAL DRAM MODULE AND COMPONENTS MARKET

FIGURE 7 ABOVE 8GB MEMORY SEGMENT TO HOLD LARGEST SIZE OF MARKET DURING FORECAST PERIOD

FIGURE 8 LPDRAM MODULE AND COMPONENT TO HOLD LARGEST SHARE OF MARKET DURING FORECAST PERIOD

FIGURE 9 LP DDR5 TO HOLD LARGEST SHARE OF LPDRAM MODULE AND COMPONENT IN MARKET DURING FORECAST PERIOD

FIGURE 10 SERVERS SEGMENT TO HOLD LARGER SHARE OF DRAM MODULE AND COMPONENT MARKET DURING FORECAST PERIOD

FIGURE 11 MARKET IN APAC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 45)

4.1 MAJOR OPPORTUNITIES IN DRAM MODULE AND COMPONENTS MARKET

FIGURE 12 DRAM MODULE AND COMPONENT MARKET TO REGISTER HIGHEST CAGR IN APAC DURING FORECAST PERIOD

4.2 MARKET, BY TYPE

FIGURE 13 MARKET FOR DDR5 TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

4.3 MARKET, BY END-USER INDUSTRIES

FIGURE 14 MARKET FOR AUTOMOBILES TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.4 MARKET IN APAC, BY TYPE AND COUNTRY

FIGURE 15 LPDRAM MODULE AND COMPONENT AND CHINA HELD LARGEST SHARES OF DRAM MODULE AND COMPONENT MARKET IN APAC IN 2021

4.5 MARKET, BY COUNTRY

FIGURE 16 CHINA DOMINATED DRAM MODULE AND COMPONENTS MARKET IN 2021

5 MARKET OVERVIEW (Page No. - 48)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR MARKET

5.2.1 DRIVERS

5.2.1.1 Emergence of 5G technology

FIGURE 18 INTERNET USERS’ DISTRIBUTION TILL MARCH 31, 2021, BY REGION

FIGURE 19 SMARTPHONE PENETRATION RATE, 2020, BY REGION

5.2.1.2 Growth in demand for DRAM module and components in automotive sector

5.2.1.3 Growth in adoption of high-end smartphones

5.2.1.4 Increase in number of data centers due to rising adoption of cloud platforms

FIGURE 20 IMPACT ANALYSIS OF DRIVERS ON MARKET

5.2.2 RESTRAINTS

5.2.2.1 Lack of stability under extreme environmental conditions

FIGURE 21 IMPACT ANALYSIS OF RESTRAINTS ON MARKET

5.2.3 OPPORTUNITIES

5.2.3.1 Government initiatives to support in-house semiconductor production

5.2.3.2 Increasing adoption of Internet of Things devices

FIGURE 22 IMPACT ANALYSIS OF OPPORTUNITIES ON DRAM MODULE AND COMPONENT MARKET

5.2.4 CHALLENGES

5.2.4.1 US-China trade war and impact of COVID-19

5.2.4.2 Highly volatile pricing nature of DRAM module and components

FIGURE 23 IMPACT ANALYSIS OF CHALLENGES ON DRAM MODULE AND COMPONENTS MARKET

5.3 VALUE CHAIN ANALYSIS

FIGURE 24 MARKET: VALUE CHAIN

TABLE 1 MARKET: ECOSYSTEM

5.4 REVENUE SHIFT AND NEW REVENUE POCKETS FOR MARKET PLAYERS

FIGURE 25 REVENUE SHIFT IN MARKET

5.5 DRAM MODULE AND COMPONENT MARKET EVOLUTION

FIGURE 26 DRAM SPEED AND DENSITY EVOLUTION

5.6 PORTER’S FIVE FORCES ANALYSIS

TABLE 2 DRAM MODULE AND COMPONENTS MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 27 PORTER’S FIVE FORCES ANALYSIS

5.6.1 THREAT OF NEW ENTRANTS

5.6.2 THREAT OF SUBSTITUTES

5.6.3 BARGAINING POWER OF SUPPLIERS

5.6.4 BARGAINING POWER OF BUYERS

5.6.5 INTENSITY OF COMPETITIVE RIVALRY

5.7 TECHNOLOGY ANALYSIS: DRAM TECHNOLOGY NODE BY KEY PLAYERS

5.8 AVERAGE SELLING PRICE ANALYSIS

FIGURE 28 MARKET: AVERAGE SELLING PRICE

5.9 TRADE ANALYSIS

5.9.1 IMPORTS SCENARIO

TABLE 3 IMPORTS DATA, BY COUNTRY, 2017–2020 (USD MILLION)

5.9.2 EXPORTS SCENARIO

TABLE 4 EXPORTS DATA, BY COUNTRY, 2017–2020 (USD MILLION)

5.10 PATENTS ANALYSIS

FIGURE 29 NUMBER OF PATENTS GRANTED WORLDWIDE FROM 2011 TO 2021

TABLE 5 TOP 20 PATENT OWNERS IN US FROM 2011 TO 2021

5.11 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 6 MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.12 TARIFF AND REGULATORY LANDSCAPE

5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 7 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.12.2 TARIFFS AND REGULATIONS

5.12.2.1 Tariffs

5.12.2.2 Regulations

5.13 KEY STAKEHOLDERS & BUYING CRITERIA

5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

TABLE 8 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 END-USER INDUSTRIES (%)

5.13.2 BUYING CRITERIA

TABLE 9 KEY BUYING CRITERIA FOR TOP 3 END-USER INDUSTRIES

6 DRAM MODULE AND COMPONENTS MARKET, BY TYPE (Page No. - 71)

6.1 INTRODUCTION

FIGURE 30 DRAM MODULE AND COMPONENT MARKET: BY TYPE

FIGURE 31 LPDRAM MODULE AND COMPONENT SEGMENT TO HOLD LARGEST SHARE OF MARKET DURING FORECAST PERIOD

TABLE 10 MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 11 MARKET, BY TYPE, 2022–2027 (USD MILLION)

6.2 DDR2 DRAM (DOUBLE DATA RATE TWO DRAM)

6.2.1 REDUCED OPERATING VOLTAGE LEADS TO LOWER POWER CONSUMPTION AND HIGHER OPERATING SPEED

TABLE 12 DDR2 MARKET, BY GEOGRAPHY, 2018–2021 (USD MILLION)

6.3 DDR3 DRAM (DOUBLE DATA RATE THREE DRAM)

6.3.1 AUTOMATIC SELF-REFRESH AND SELF-REFRESH TEMPERATURE ENHANCE DRAM’S PERFORMANCE

TABLE 13 DDR3 MARKET, BY GEOGRAPHY, 2018–2021 (USD MILLION)

TABLE 14 DDR3 MARKET, BY GEOGRAPHY, 2022–2027 (USD MILLION)

6.4 DDR4 DRAM (DOUBLE DATA RATE FOURTH DRAM)

6.4.1 ENHANCED EFFICIENCY, SIGNAL INTEGRITY, AND STABILITY OF DATA TRANSMISSION/ACCESS TO FUEL MARKET GROWTH

TABLE 15 DDR4 MARKET, BY GEOGRAPHY, 2018–2021 (USD MILLION)

TABLE 16 DDR4 DRAM MODULE AND COMPONENT MARKET, BY GEOGRAPHY, 2022–2027 (USD MILLION)

6.5 DDR5 DRAM (DOUBLE DATA RATE FIFTH DRAM)

6.5.1 POWER MANAGEMENT INTEGRATED CIRCUIT ENSURES LOW WASTE OF POWER ON DUAL IN-LINE MEMORY MODULES

TABLE 17 DDR5 DRAM MODULE AND COMPONENTS MARKET, BY GEOGRAPHY, 2018–2021 (USD MILLION)

TABLE 18 DDR5 MARKET, BY GEOGRAPHY, 2022–2027 (USD MILLION)

6.6 LPDRAM (LOW-POWER DRAM) MODULE AND COMPONENT

6.6.1 INCREASE IN DEMAND FOR MOBILE DEVICES CREATES HIGH DEMAND FOR LOW-POWER DYNAMIC RANDOM-ACCESS MEMORY

TABLE 19 LPDRAM DRAM MODULE AND COMPONENT MARKET, BY GEOGRAPHY, 2018–2021 (USD MILLION)

TABLE 20 LPDRAM DRAM MODULE AND COMPONENT MARKET, BY GEOGRAPHY, 2022–2027 (USD MILLION)

TABLE 21 LPDRAM MODULE AND COMPONENT MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 22 LPDRAM MODULE AND COMPONENT MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 23 LP DDR2 MARKET, BY GEOGRAPHY, 2018–2021 (USD MILLION)

TABLE 24 LP DDR3 MARKET, BY GEOGRAPHY, 2018–2021 (USD MILLION)

TABLE 25 LP DDR3 MARKET, BY GEOGRAPHY, 2022–2027 (USD MILLION)

TABLE 26 LP DDR4 MARKET, BY GEOGRAPHY, 2018–2021 (USD MILLION)

TABLE 27 LP DDR4 MARKET, BY GEOGRAPHY, 2022–2027 (USD MILLION)

TABLE 28 LP DDR5 MARKET, BY GEOGRAPHY, 2018–2021 (USD MILLION)

TABLE 29 LP DDR5 MARKET, BY GEOGRAPHY, 2022–2027 (USD MILLION)

6.7 HBM (HIGH-BANDWIDTH MEMORY)

6.7.1 DEMAND FOR HIGH-BANDWIDTH MEMORY IN GRAPHICS CARDS AND HIGH PROCESSING COMPUTING APPLICATIONS DRIVING MARKET GROWTH

TABLE 30 HBM DRAM MODULE AND COMPONENT MARKET, BY GEOGRAPHY, 2018–2021 (USD MILLION)

TABLE 31 HBM DRAM MODULE AND COMPONENTS MARKET, BY GEOGRAPHY, 2022–2027 (USD MILLION)

6.8 GDDR (GRAPHICAL DUAL DATA RATE)

6.8.1 RISE IN USE OF DATA-INTENSIVE SYSTEMS DRIVES MARKET GROWTH

TABLE 32 GDDR MARKET, BY GEOGRAPHY, 2018–2021 (USD MILLION)

TABLE 33 GDDR MARKET, BY GEOGRAPHY, 2022–2027 (USD MILLION)

6.9 OTHERS

TABLE 34 OTHERS MARKET, BY GEOGRAPHY, 2018–2021 (USD MILLION)

TABLE 35 OTHERS DRAM MODULE AND COMPONENT MARKET, BY GEOGRAPHY, 2022–2027 (USD MILLION)

7 DRAM MODULE AND COMPONENTS MARKET, BY END-USER INDUSTRIES (Page No. - 86)

7.1 INTRODUCTION

FIGURE 32 MARKET, BY END-USER INDUSTRIES

FIGURE 33 SERVERS TO HOLD LARGEST SHARE OF MARKET DURING FORECAST PERIOD

TABLE 36 MARKET, BY END-USER INDUSTRIES, 2018–2021 (USD MILLION)

TABLE 37 DRAM MODULE AND COMPONENT MARKET, BY END-USER INDUSTRIES, 2022–2027 (USD MILLION)

7.2 CONSUMER ELECTRONICS

7.2.1 GROWING ADOPTION OF SMART CONSUMER ELECTRONICS FUELING MARKET GROWTH

TABLE 38 CONSUMER ELECTRONICS MARKET, BY GEOGRAPHY, 2018–2021 (USD MILLION)

TABLE 39 CONSUMER ELECTRONICS MARKET, BY GEOGRAPHY, 2022–2027 (USD MILLION)

7.3 SERVERS

7.3.1 REQUIREMENT OF INCREASED DRAM PER SERVER IS DRIVING MARKET GROWTH

TABLE 40 SERVERS DRAM MODULE AND COMPONENT MARKET, BY GEOGRAPHY, 2018–2021 (USD MILLION)

TABLE 41 SERVERS DRAM MODULE AND COMPONENTS MARKET, BY GEOGRAPHY, 2022–2027 (USD MILLION)

7.4 MOBILE DEVICES

7.4.1 INCREASE IN APPLICATIONS OF HIGH-PERFORMANCE AND LOW-POWER DRAMS IN MOBILE DEVICES TO BOOST MARKET GROWTH

TABLE 42 MOBILE DEVICES DRAM MODULE AND COMPONENT MARKET, BY GEOGRAPHY, 2018–2021 (USD MILLION)

TABLE 43 MOBILE DEVICES DRAM MODULE AND COMPONENTS MARKET, BY GEOGRAPHY, 2022–2027 (USD MILLION)

7.5 AUTOMOBILES

7.5.1 INTELLIGENT TRANSPORTATION TRENDS ARE FUELING GROWTH OF MARKET

TABLE 44 AUTOMOBILES DRAM MODULE AND COMPONENT MARKET, BY GEOGRAPHY, 2018–2021 (USD MILLION)

TABLE 45 AUTOMOBILES DRAM MODULE AND COMPONENTS MARKET, BY GEOGRAPHY, 2022–2027 (USD MILLION)

7.6 COMPUTERS

7.6.1 DRAM MODULE AND COMPONENTS FIND MAJOR APPLICATIONS IN MODERN DESKTOPS AND LAPTOPS

TABLE 46 COMPUTERS DRAM MODULE AND COMPONENT MARKET, BY GEOGRAPHY, 2018–2021 (USD MILLION)

TABLE 47 COMPUTERS DRAM MODULE AND COMPONENTS MARKET, BY GEOGRAPHY, 2022–2027 (USD MILLION)

7.7 OTHERS

TABLE 48 OTHERS: MARKET, BY GEOGRAPHY, 2018–2021 (USD MILLION)

TABLE 49 OTHERS: MARKET, BY GEOGRAPHY, 2022–2027 (USD MILLION)

8 DRAM MODULE AND COMPONENTS MARKET, BY MEMORY (Page No. - 97)

8.1 INTRODUCTION

FIGURE 34 DRAM MODULE AND COMPONENTS MARKET: BY MEMORY

FIGURE 35 ABOVE 8GB SEGMENT TO HOLD LARGEST SHARE OF DRAM MODULE AND COMPONENTS MARKET DURING FORECAST PERIOD

TABLE 50 DRAM MODULE AND COMPONENTS MARKET, BY MEMORY, 2018–2021 (USD MILLION)

TABLE 51 DRAM MODULE AND COMPONENTS MARKET, BY MEMORY, 2022–2027 (USD MILLION)

TABLE 52 SERVER DRAM MODULE AND COMPONENTS MARKET, BY MEMORY, 2018–2021 (USD MILLION)

TABLE 53 SERVER DRAM MODULE AND COMPONENTS MARKET, BY MEMORY, 2022–2027 (USD MILLION)

TABLE 54 MOBILE DEVICES DRAM MODULE AND COMPONENTS MARKET, BY MEMORY, 2018–2021 (USD MILLION)

TABLE 55 MOBILE DEVICES DRAM MODULE AND COMPONENTS MARKET, BY MEMORY, 2022–2027 (USD MILLION)

8.2 UP TO 1GB

8.2.1 GROWTH IN SMART HOME APPLICATIONS BOOSTS DEMAND FOR DRAM ASSOCIATED WITH SYSTEMS-ON-CHIPS

TABLE 56 UP TO 1GB DRAM MODULE AND COMPONENTS MARKET, BY GEOGRAPHY, 2018–2021 (USD MILLION)

TABLE 57 UP TO 1GB DRAM MODULE AND COMPONENTS MARKET, BY GEOGRAPHY, 2022–2027 (USD MILLION)

8.3 2GB

8.3.1 INCREASE IN DEMAND FOR BUDGET MOBILE DEVICES IN DEVELOPING COUNTRIES FUELING MARKET GROWTH

TABLE 58 2GB DRAM MODULE AND COMPONENTS MARKET, BY GEOGRAPHY, 2018–2021 (USD MILLION)

TABLE 59 2GB DRAM MODULE AND COMPONENTS MARKET, BY GEOGRAPHY, 2022–2027 (USD MILLION)

8.4 3–4GB

8.4.1 3–4GB DRAM IS CONSIDERED A BENCHMARK FOR LOW-END OFFICE PCS AND MID-RANGE MOBILE DEVICES

TABLE 60 3–4GB DRAM MODULE AND COMPONENTS MARKET, BY GEOGRAPHY, 2018–2021 (USD MILLION)

TABLE 61 3–4GB DRAM MODULE AND COMPONENTS MARKET, BY GEOGRAPHY, 2022–2027 (USD MILLION)

8.5 6–8GB

8.5.1 DEMAND FOR PHOTO OR VIDEO EDITING ENABLED COMPUTERS BOOSTS MARKET GROWTH

TABLE 62 6–8GB DRAM MODULE AND COMPONENTS MARKET, BY GEOGRAPHY, 2018–2021 (USD MILLION)

TABLE 63 6–8GB DRAM MODULE AND COMPONENTS MARKET, BY GEOGRAPHY, 2022–2027 (USD MILLION)

8.6 ABOVE 8GB

8.6.1 REQUIREMENT FOR LARGER DRAMS TO RUN RESOURCE-HEAVY APPLICATIONS EXPECTED TO FUEL MARKET GROWTH

TABLE 64 ABOVE 8GB DRAM MODULE AND COMPONENTS MARKET, BY GEOGRAPHY, 2018–2021 (USD MILLION)

TABLE 65 ABOVE 8GB DRAM MODULE AND COMPONENTS MARKET, BY GEOGRAPHY, 2022–2027 (USD MILLION)

9 GEOGRAPHIC ANALYSIS (Page No. - 107)

9.1 INTRODUCTION

FIGURE 36 DRAM MODULE AND COMPONENTS MARKET: BY REGION

FIGURE 37 APAC TO HOLD LARGEST SHARE OF DRAM MODULE AND COMPONENT MARKET DURING FORECAST PERIOD

TABLE 66 MARKET, BY GEOGRAPHY, 2018–2021 (USD MILLION)

TABLE 67 MARKET, BY GEOGRAPHY, 2022–2027 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 38 NORTH AMERICA: MARKET, BY COUNTRY

FIGURE 39 NORTH AMERICA: SNAPSHOT OF MARKET

TABLE 68 NORTH AMERICA: MARKET, BY END-USER INDUSTRIES, 2018–2021 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET, BY END-USER INDUSTRIES, 2022–2027 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 71 NORTH AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 72 NORTH AMERICA: LPDRAM MODULE AND COMPONENT MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 73 NORTH AMERICA: LPDRAM MODULE AND COMPONENT MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET, BY MEMORY, 2018–2021 (USD MILLION)

TABLE 75 NORTH AMERICA: MARKET, BY MEMORY, 2022–2027 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 77 NORTH AMERICA: DRAM MODULE AND COMPONENT MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

9.2.1 NORTH AMERICA: IMPACT OF COVID-19 ON MARKET

FIGURE 40 ANALYSIS OF DRAM MODULE AND COMPONENTS MARKET IN NORTH AMERICA: PRE- AND POST-COVID-19 SCENARIOS

9.2.2 US

9.2.2.1 Advanced technologies are boosting DRAM module and component market growth

9.2.3 CANADA

9.2.3.1 Government initiatives to support semiconductor market are fueling market growth

9.2.4 MEXICO

9.2.4.1 Government initiatives and political stability are contributing to market growth

9.3 EUROPE

FIGURE 41 EUROPE: DRAM MODULE AND COMPONENTS MARKET, BY COUNTRY

FIGURE 42 EUROPE: SNAPSHOT OF DRAM MODULE AND COMPONENT MARKET

TABLE 78 EUROPE: MARKET, BY END-USER INDUSTRIES, 2018–2021 (USD MILLION)

TABLE 79 EUROPE: MARKET, BY END-USER INDUSTRIES, 2022–2027 (USD MILLION)

TABLE 80 EUROPE: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 81 EUROPE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 82 EUROPE: LPDRAM MODULE AND COMPONENT MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 83 EUROPE: LPDRAM MODULE AND COMPONENT MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 84 EUROPE: MARKET, BY MEMORY, 2018–2021 (USD MILLION)

TABLE 85 EUROPE: MARKET, BY MEMORY, 2022–2027 (USD MILLION)

TABLE 86 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 87 EUROPE: DRAM MODULE AND COMPONENT MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

9.3.1 EUROPE: IMPACT OF COVID-19 ON DRAM MODULE AND COMPONENTS MARKET

FIGURE 43 ANALYSIS OF MARKET IN EUROPE: PRE- AND POST-COVID-19 SCENARIOS

9.3.2 UK

9.3.2.1 UK is the largest market for mobile devices and consumer electronics in Europe

9.3.3 GERMANY

9.3.3.1 Increase in number of data centers fueling market growth for DRAM module and component market

9.3.4 FRANCE

9.3.4.1 Government efforts to promote future technologies to boost market growth

9.3.5 ITALY

9.3.5.1 Growing use of mobile devices, consumer electronics, and automotive are major contributors to market growth

9.3.6 REST OF EUROPE

9.4 ASIA PACIFIC (APAC)

FIGURE 44 APAC: MARKET, BY COUNTRY

FIGURE 45 APAC: SNAPSHOT OF MARKET

TABLE 88 APAC: MARKET, BY END-USER INDUSTRIES, 2018–2021 (USD MILLION)

TABLE 89 APAC: MARKET, BY END-USER INDUSTRIES, 2022–2027 (USD MILLION)

TABLE 90 APAC: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 91 APAC: DRAM MODULE AND COMPONENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 92 APAC: LPDRAM MODULE AND COMPONENT MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 93 APAC: LPDRAM MODULE AND COMPONENT MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 94 APAC: DRAM MODULE AND COMPONENT MARKET, BY MEMORY, 2018–2021 (USD MILLION)

TABLE 95 APAC: MARKET, BY MEMORY, 2022–2027 (USD MILLION)

TABLE 96 APAC: MARKET, BY GEOGRAPHY, 2018–2021 (USD MILLION)

TABLE 97 APAC: MARKET, BY GEOGRAPHY, 2022–2027 (USD MILLION)

9.4.1 APAC: IMPACT OF COVID-19 ON MARKET

FIGURE 46 ANALYSIS OF DRAM MODULE AND COMPONENT MARKET IN APAC: PRE- AND POST-COVID-19 SCENARIOS

9.4.2 CHINA

9.4.2.1 Demand for mobile devices and wearable electronics devices would continue to drive the growth of the domestic DRAM module and components market

9.4.3 JAPAN

9.4.3.1 Increasing demand for memory products across different industries driving market growth

9.4.4 INDIA

9.4.4.1 Rising number of data centers is boosting market growth

9.4.5 SOUTH KOREA

9.4.5.1 Presence of top two global manufacturers of DRAM module and components is driving market growth

9.4.6 REST OF APAC

9.5 REST OF THE WORLD (ROW)

FIGURE 47 ROW: MARKET, BY COUNTRY

TABLE 98 ROW: MARKET, BY END-USER INDUSTRIES, 2018–2021 (USD MILLION)

TABLE 99 ROW: MARKET, BY END-USER INDUSTRIES, 2022–2027 (USD MILLION)

TABLE 100 ROW: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 101 ROW: DRAM MODULE AND COMPONENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 102 ROW: LPDRAM MODULE AND COMPONENT MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 103 ROW: LPDRAM MODULE AND COMPONENT MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 104 ROW: DRAM MODULE AND COMPONENT MARKET, BY MEMORY, 2018–2021 (USD MILLION)

TABLE 105 ROW: MARKET, BY MEMORY, 2022–2027 (USD MILLION)

TABLE 106 ROW: MARKET, BY GEOGRAPHY, 2018–2021 (USD MILLION)

TABLE 107 ROW: MARKET, BY GEOGRAPHY, 2022–2027 (USD MILLION)

9.5.1 ROW: IMPACT OF COVID-19 ON DRAM MODULE AND COMPONENT MARKET

FIGURE 48 ANALYSIS OF DRAM MODULE AND COMPONENTS MARKET IN ROW: PRE- AND POST-COVID-19 SCENARIOS

9.5.2 SOUTH AMERICA

9.5.2.1 DRAM module and components will witness decent growth due to increasing demand for cloud storage and data centers

9.5.3 MIDDLE EAST & AFRICA (MEA)

9.5.3.1 Rapid urbanization results in growing demand for memory storage devices

10 COMPETITIVE LANDSCAPE (Page No. - 138)

10.1 OVERVIEW

10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 108 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN MARKET

10.3 REVENUE ANALYSIS OF TOP PLAYERS

FIGURE 49 5-YEAR REVENUE ANALYSIS OF TOP PLAYERS IN MARKET, 2017–2021

10.4 MARKET SHARE ANALYSIS OF KEY PLAYERS IN DRAM MODULE AND COMPONENTS MARKET IN 2021

FIGURE 50 MARKET SHARE ANALYSIS OF KEY PLAYERS IN DRAM MODULE AND COMPONENT MARKET IN 2021

TABLE 109 MARKET: DEGREE OF COMPETITION

TABLE 110 MARKET RANKING ANALYSIS

10.5 COMPANY EVALUATION QUADRANT, 2021

10.5.1 STAR

10.5.2 EMERGING LEADER

10.5.3 PERVASIVE

10.5.4 PARTICIPANT

FIGURE 51 MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2021

10.6 COMPETITIVE BENCHMARKING

TABLE 111 COMPANY FOOTPRINT, BY TYPE (17 COMPANIES)

TABLE 112 COMPANY FOOTPRINT, BY END-USER INDUSTRIES (17 COMPANIES)

TABLE 113 COMPANY FOOTPRINT, BY GEOGRAPHY (17 COMPANIES)

TABLE 114 COMPANY PRODUCT FOOTPRINT

10.7 STARTUP/SME EVALUATION QUADRANT, 2021

10.7.1 PROGRESSIVE COMPANY

10.7.2 RESPONSIVE COMPANY

10.7.3 DYNAMIC COMPANY

10.7.4 STARTING BLOCK

FIGURE 52 DRAM MODULE AND COMPONENTS MARKET (GLOBAL): STARTUP/SME EVALUATION QUADRANT, 2021

TABLE 115 DRAM MODULE AND COMPONENT MARKET: LIST OF KEY STARTUPS/SMES

TABLE 116 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

10.8 COMPETITIVE SCENARIO AND TRENDS

10.8.1 PRODUCT LAUNCHES/DEVELOPMENTS

TABLE 117 MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, 2020–2022

10.8.2 DEALS

TABLE 118 DRAM MODULE AND COMPONENT MARKET: DEALS, 2020–2022

11 COMPANY PROFILES (Page No. - 155)

(Business Overview, Products/solutions/services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

11.1 INTRODUCTION

11.2 KEY PLAYERS

11.2.1 SAMSUNG ELECTRONICS CO., LTD.

TABLE 119 SAMSUNG ELECTRONICS CO., LTD.: BUSINESS OVERVIEW

FIGURE 53 SAMSUNG ELECTRONICS CO., LTD.: COMPANY SNAPSHOT

TABLE 120 SAMSUNG ELECTRONICS CO., LTD.: PRODUCT LAUNCHES

11.2.2 SK HYNIX INC.

TABLE 121 SK HYNIX INC.: BUSINESS OVERVIEW

FIGURE 54 SK HYNIX INC.: COMPANY SNAPSHOT

TABLE 122 SK HYNIX INC.: PRODUCT LAUNCHES

TABLE 123 SK HYNIX INC.: DEALS

11.2.3 MICRON TECHNOLOGY, INC.

TABLE 124 MICRON TECHNOLOGY, INC.: BUSINESS OVERVIEW

FIGURE 55 MICRON TECHNOLOGY, INC.: COMPANY SNAPSHOT

TABLE 125 MICRON TECHNOLOGY, INC.: PRODUCT LAUNCHES

TABLE 126 MICRON TECHNOLOGY, INC.: DEALS

11.2.4 NANYA TECHNOLOGY CORPORATION

TABLE 127 NANYA TECHNOLOGY CORPORATION: BUSINESS OVERVIEW

FIGURE 56 NANYA TECHNOLOGY CORPORATION: COMPANY SNAPSHOT

TABLE 128 NANYA TECHNOLOGY CORPORATION: DEALS

11.2.5 WINBOND ELECTRONICS CORPORATION

TABLE 129 WINBOND ELECTRONICS CORPORATION: BUSINESS OVERVIEW

FIGURE 57 WINBOND ELECTRONICS CORPORATION: COMPANY SNAPSHOT

TABLE 130 WINBOND ELECTRONICS CORPORATION: DEALS

11.2.6 POWERCHIP TECHNOLOGY CORPORATION

TABLE 131 POWERCHIP TECHNOLOGY CORPORATION: BUSINESS OVERVIEW

FIGURE 58 POWERCHIP TECHNOLOGY CORPORATION: COMPANY SNAPSHOT

11.2.7 ADATA TECHNOLOGY CO., LTD.

TABLE 132 ADATA TECHNOLOGY CO., LTD.: BUSINESS OVERVIEW

FIGURE 59 ADATA TECHNOLOGY CO., LTD.: COMPANY SNAPSHOT

TABLE 133 ADATA TECHNOLOGY CO., LTD.: PRODUCT LAUNCHES

11.2.8 RAMAXEL TECHNOLOGY (SHENZHEN) CO, LTD

TABLE 134 RAMAXEL TECHNOLOGY (SHENZHEN) CO, LTD: BUSINESS OVERVIEW

11.2.9 KINGSTON TECHNOLOGY CORPORATION

TABLE 135 KINGSTON TECHNOLOGY CORPORATION: BUSINESS OVERVIEW

TABLE 136 KINGSTON TECHNOLOGY CORPORATION: PRODUCT LAUNCHES

TABLE 137 KINGSTON TECHNOLOGY CORPORATION: DEALS

11.2.10 SMART MODULAR TECHNOLOGIES

TABLE 138 SMART MODULAR TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 60 SMART MODULAR TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 139 SMART MODULAR TECHNOLOGIES: PRODUCT LAUNCHES

TABLE 140 SMART MODULAR TECHNOLOGIES: DEALS

11.3 OTHER PLAYERS

11.3.1 SUPER MICRO COMPUTER, INC.

11.3.2 TRANSCEND INFORMATION, INC.

11.3.3 PATRIOT MEMORY

11.3.4 INNODISK CORPORATION

11.3.5 APACER TECHNOLOGY

11.3.6 ELITE SEMICONDUCTOR MICROELECTRONICS TECHNOLOGY INC.

11.3.7 INTEGRATED SILICON SOLUTION INC.

11.3.8 ETRON TECHNOLOGY, INC.

11.3.9 FIDELIX CO., LTD.

11.3.10 ROHM CO., LTD.

11.3.11 TEAM GROUP INC.

*Details on Business Overview, Products/solutions/services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 194)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

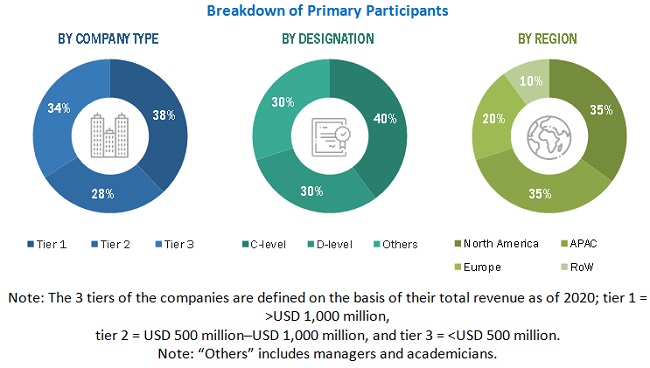

The study involved four major activities in estimating the size of the DRAM module and components market. Exhaustive secondary research was done to collect information on the market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market’s size. After that, market breakdown and data triangulation were used to determine the market sizes of segments and sub-segments.

Secondary Research

The secondary sources referred to for this research study include organizations such as Semiconductor Industry Association, Global Association of Risk Professionals, The Storage Networking Industry Association (SNIA), and so on; corporate filings (such as annual reports, investor presentations, and financial statements); and trade, and business. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by primary research.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the DRAM module and components market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand- (consumer electronics, servers, mobile devices, automobiles, computers) and supply-side (OEM/ODM, system integrators, solution providers) players across four major regions, namely, North America, Europe, APAC, and Rest of the World (South America, Africa, Middle East). Approximately 75% and 25% of primary interviews have been conducted from the demand and supply side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

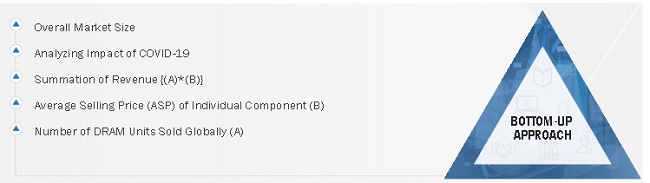

Both top-down and bottom-up approaches were used to estimate and validate the total size of the DRAM module and components market. These methods were also extensively used to estimate the sizes of various market sub-segments. The research methodology used to estimate the market sizes includes the following:

- The key players in the market were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size.

Global DRAM Module and Components Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives:

- To define, describe, segment, and forecast the DRAM module and components market in terms of value based on type, memory, and end-user industries

- To describe and forecast the size of the market for four main regions, namely, North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW), in terms of value

- To provide qualitative information about different DRAM module and components

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To provide detailed information regarding the key factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide a detailed value chain for the DRAM module and components market

- To analyze opportunities in the market for stakeholders, along with a detailed competitive landscape of the DRAM module and components market

- To strategically profile the key players and comprehensively analyze their market share and core competencies2, along with the competitive leadership mapping chart

- To analyze the competitive developments such as product launches/developments, contracts/collaborations/agreements/acquisitions in the DRAM module and components market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in DRAM Module and Component Market