Drive by Wire Market

Drive By Wire Market by Steer by Wire, Brake by Wire, Shift by Wire, Park by Wire, Throttle by Wire, Application, and Region - Global Forecast To 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The drive by wire market is projected to reach USD 41.18 billion by 2032, from USD 29.10 billion in 2025, with a CAGR of 5.1%. Drive by wire adoption in passenger cars is primarily driven by platform flexibility, repeatable and tunable vehicle driving performance, and architectural advantages in safety redundancy. The adoption of drive by wire systems depends on overcoming three critical challenges: first, validating safe system behavior across extreme & combined real-world scenarios; second, synthetically recreating intuitive steering and pedal feedback in the absence of mechanical linkages; and third, vehicles must be engineered with fail-operational power and communication redundancy. These factors make drive by wire a fundamental shift in vehicle system engineering and the validation process.

KEY TAKEAWAYS

-

By RegionAsia Pacific accounted for over 45% of the global drive by wire market in 2025.

-

Brake By WireNorth America is expected to record the fastest growth in the brake by wire market during the forecast period.

-

Throttle by WireAsia Pacific dominated the throttle by wire market in 2025.

-

Competitive LandscapeRobert Bosch GmbH (Germany), ZF Friedrichshafen AG (Germany), Continental AG (Germany), Nexteer Automotive (US), and Curtiss-Wright Corporation (US) were identified as star players in the drive by wire market, given their strong market share and product footprint.

The drive by wire market is growing steadily due to the rising need for precise, software-controlled actuation in critical vehicle systems. OEMs across passenger cars and commercial vehicles are adopting drive by wire for steering, braking, throttle, and shifting to support electrification, automation, and centralized electronic architectures, where predictable response and fail-safe operation are required. Meanwhile, increasing production of electric and hybrid vehicles, along with growing deployment of ADAS and automated driving functions, is accelerating demand for electronic actuation. Advancements in sensors, control units, redundancy architectures, and vehicle networks are improving system reliability and safety compliance, reinforcing drive by wire adoption across vehicle platforms and sustaining long-term market growth.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Present revenue in the drive by wire market is generated mainly from throttle by wire, shift by wire, and other redundant by-wire systems deployed in passenger cars and light commercial vehicles, where electronic actuation replaces mechanical linkages while retaining partial hydraulic or mechanical backup. These systems rely on standard sensors, ECUs, actuators, and vehicle networks to deliver reliable electronic control for core driving functions. Future revenue streams are expected to be driven by steer by wire and integrated chassis by wire platforms with built-in redundancy, higher computing capability, and software-defined control. Growth will also be supported by sensor fusion, fail-operational architectures, zonal E/E systems, and OTA-enabled control software that allow drive by wire functions to scale across electric, autonomous, and next-generation vehicle platforms.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Shift toward software-defined vehicle architectures

-

High operational accuracy and reduced mechanical losses

Level

-

Legal liability in absence of mature fail-operational precedents

-

Threat of cyberattacks and compliance costs

Level

-

Integration with AI, V2X, and OTA-enabled safety functions

-

Advancements in autonomous vehicles

Level

-

Integration challenges in off-highway equipment

-

Electronic failures and rapid developments in automotive electronics

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Shift toward software-defined vehicle architectures

The shift toward software-defined vehicle architectures is driving demand for drive by wire systems that replace fixed mechanical linkages with software-controlled electronic actuation. In software-defined vehicles, steering, braking, throttle, and gear selection are managed by centralized compute and zonal controllers, which require low-latency by-wire actuators with real-time response. These systems rely on redundant sensors, fail-operational ECUs, and high-speed in-vehicle networks to maintain safety-critical control under all operating conditions. Drive by wire enables continuous software calibration, OTA updates, and feature differentiation without hardware changes, while supporting ADAS and autonomy functions that demand precise, synchronized control of vehicle motion. As OEMs move away from distributed ECU architectures toward centralized software platforms, drive by wire becomes a core enabler for scalable, upgradable, and platform-agnostic vehicle control.

Restraint: Legal liability in absence of mature fail-operational precedents

Legal liability in the absence of mature fail-operational precedents remains a key restraint for the drive by wire market, as control authority shifts from mechanical systems with human fallback to software-controlled electronic actuation. In many markets, steering by wire and brake by wire lack long-established regulatory and insurance standards, creating uncertainty around fault attribution in the event of system failure. Unlike conventional systems with a physical linkage, full by-wire architectures require validated redundancy, proven fail-operational behavior, and clear responsibility models between OEMs, suppliers, and software providers. As regulation frameworks and liability standards evolve slowly and remain region-specific, OEMs face higher certification costs, longer approval cycles, and increased legal risk, which continues to moderate the pace of full drive by wire deployment.

Opportunity: Integration with AI, V2X, and OTA-enabled safety functions

Integration with AI, V2X, and OTA-enabled safety functions represents a major opportunity for the drive by wire market, as by-wire systems convert vehicle control into software-managed functions rather than fixed mechanical actions. Drive by wire enables AI-based control algorithms, cooperative driving through V2X communication, and continuous improvement of steering, braking, and throttle behavior via OTA updates. This allows OEMs to deploy safety enhancements, new driving modes, and automated functions without hardware changes, extending vehicle lifecycle value. As vehicles move toward software-defined and connected architectures, by-wire systems become the essential interface that links AI and external data to real-time vehicle actuation, accelerating their adoption across passenger, commercial, and autonomous platforms.

Challenge: Integration challenges in off-highway equipment

Integration in off-highway equipment remains a key challenge for the drive by wire market due to the extreme operating conditions and duty cycles of construction, mining, and agricultural machinery. These vehicles operate under high vibration, shock loads, dust, moisture, and wide temperature ranges, requiring drive by wire systems to meet much higher durability and fail-safety thresholds than on-road vehicles. Additionally, off-highway platforms often rely on decentralized hydraulics and legacy mechanical controls, making integration with electronic by-wire architectures complex and costly. The need for redundant power, robust sensing, and guaranteed control response in remote or hazardous environments slows validation and deployment, limiting the pace of drive by wire adoption in off-highway applications despite strong long-term demand.

DRIVE BY WIRE MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Designs and supplies integrated brake by wire and steer by wire systems for passenger cars and electric vehicles, combining sensors, actuators, ECUs, and control software to replace hydraulic and mechanical linkages. | Enables precise vehicle control, improved braking consistency, enhanced ADAS integration, and compliance with global safety and functional-safety standards. |

|

Provides complete chassis by wire solutions, including brake by wire, steer by wire, and integrated motion control platforms optimized for software-defined vehicles and electrified architectures. | Supports modular vehicle platforms, faster OEM integration, redundancy-ready architectures, and scalable deployment across ICE, hybrid, and electric vehicles. |

|

Develops electronic braking and vehicle motion control systems that integrate brake by wire, ESC, and ADAS inputs to manage longitudinal and lateral vehicle dynamics without mechanical dependency. | Improves safety, reduces system complexity, enables energy-efficient braking for EVs, and supports automated driving functions with high reliability. |

|

Specializes in steer by wire and electric power steering systems, including hand-wheel and pinion angle sensing, designed for passenger cars, EVs, and autonomous-ready vehicle platforms. | Delivers precise steering control, design flexibility for interiors, reduced mechanical complexity, and readiness for higher levels of vehicle automation. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The drive by wire market ecosystem spans raw material suppliers, actuator and sensor manufacturers, Tier-1 suppliers, and automotive OEMs. Raw material suppliers such as Infineon Technologies, NXP Semiconductors, Texas Instruments, Murata Manufacturing, and TE Connectivity provide automotive-grade MCUs, power devices, sensors, and connectivity hardware that form the core of by-wire systems. Actuator and motion control specialists such as Nidec, Hitachi, Schaeffler, Panasonic Automotive, and CTS Corporation supply electric motors, pedals, steering actuators, and position sensors required for throttle by wire, brake by wire, and steer by wire functions. Tier-1 suppliers, including Robert Bosch GmbH, Continental AG, DENSO Corporation, Valeo, and Magna International, integrate these components into validated, safety-certified by-wire platforms aligned with ISO 26262 and UNECE requirements. Automotive OEMs such as Tesla, Hyundai Motor Company, General Motors, Volkswagen, and BYD deploy these systems across electric, hybrid, and advanced driver-assistance platforms, making drive by wire a key enabler of software-defined, electrified, and automation-ready vehicle architectures.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Drive By Wire Market, By Throttle By Wire

Throttle by wire is expected to hold the largest share of the drive by-wire market during the forecast period because it is already standard across most passenger cars, hybrids, and EVs. It is crucial for emissions control, energy efficiency, and precise torque management in software-controlled powertrains. The technology enables ADAS functions such as cruise control, traction control, and stability systems. Advances in redundant pedal sensors, fail-safe ECUs, and low-cost electronics have made throttle by wire reliable and scalable.

Drive By Wire Market, By Shift By Wire

Shift by wire is expected to hold the second-largest share of the drive by wire market during the forecast period because it is becoming standard in automatic, dual-clutch, and electrified powertrains across passenger cars and light commercial vehicles. The technology enables precise gear selection, faster shift response, and seamless integration with powertrain control software, especially in hybrids and EVs.

Drive By Wire Market, By Brake By Wire

Brake by wire is expected to record the fastest growth in the drive by wire market during the forecast period as vehicles shift toward electrification, automation, and software-controlled braking. EVs require brake by wire to blend regenerative and friction braking, improving energy recovery and driving range. New electro-mechanical brake systems remove hydraulic components, reduce weight, and simplify vehicle packaging. Advances in redundancy, fail-operational architectures, and safety certification are also accelerating OEM adoption.

REGION

Asia Pacific to be fastest-growing region in global drive by wire market during forecast period

Europe is expected to be the fastest-growing region in the global drive by wire market during the forecast period, driven by strict safety and emissions regulations, rapid electrification, and early adoption of software-defined vehicle architectures across Germany, France, the UK, Italy, and the Nordic countries. The region is accelerating the rollout of BEVs and premium EV platforms, where shift by wire, brake by wire, and park by wire are integrated at the platform level to support energy efficiency, ADAS, and automation readiness. Regulatory frameworks such as UNECE R79, R155, and R156 are indirectly pushing OEMs toward electronically controlled, redundant actuation systems, accelerating regulatory compliance of by-wire technologies. Additionally, Europe’s strong Tier-1 ecosystem and chassis engineering depth are enabling faster industrialization, with suppliers expanding safety-certified by-wire portfolios aligned with ISO 26262 requirements.

DRIVE BY WIRE MARKET: COMPANY EVALUATION MATRIX

Robert Bosch GmbH (Star) leads with a strong global market position and a broad, production-scale portfolio spanning brake by wire, steer by wire, throttle by wire, and integrated chassis control systems. Its leadership is reinforced by deep OEM relationships, early investments in software-defined vehicle architectures, and large-volume deployments across passenger cars, electric vehicles, and premium platforms in recent years. Bosch’s ability to combine sensing, actuation, control software, and functional safety compliance positions it as a preferred partner for OEMs transitioning to centralized and zonal E/E architectures. Curtiss-Wright Corporation (Emerging Leader) is strengthening its position through high-reliability by-wire actuation and control solutions, leveraging expertise in safety-critical electronics and redundant architectures. The company is expanding adoption in defense, industrial, and off-highway mobility applications, with growing relevance for autonomous and specialty vehicle programs where fail-operational performance, regulatory compliance, and predictable control are critical buying criteria.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Robert Bosch GmbH (Germany)

- Continental AG (Germany)

- ZF Friedrichshafen AG (Germany)

- Infinieon Technologies AG (Germany)

- Nexteer Automotive (US)

- CTS Corporation (US)

- DENSO Corporation (Japan)

- Aptiv PLC (Ireland)

- Hitachi, Ltd. (Japan)

- Curtiss-Wright Corporation (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 27.74 BN |

| Market Size Forecast in 2032 (Value) | USD 41.18 BN |

| Growth Rate | CAGR of 5.1% from 2025–2032 |

| Years Considered | 2021–2032 |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Units Considered | Value (USD MN/BN), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | Steer by Wire, Brake by Wire, Shift by Wire, Park by Wire, Throttle by Wire, Application |

| Regions Covered | North America, Asia Pacific, Europe, Rest of the World |

WHAT IS IN IT FOR YOU: DRIVE BY WIRE MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Passenger Vehicle OEM (EV & SDV programs) |

|

|

| Commercial Vehicle OEM (trucks & buses) |

|

|

| Tier-1 Supplier (expanding by-wire portfolio) |

|

|

| New EV Platform Developer / Start-up OEM |

|

|

RECENT DEVELOPMENTS

- November 2025 : Bosch introduced the comfort stop software feature in the US to smooth the final phase of braking, reducing head-bob and motion discomfort by coordinating signals from decoupled brake systems, drivetrain, and motion software for an improved passenger experience.

- September 2025 : ZF presented by-wire steering and braking with series systems, along with its SELECT e-drive and TherMaS thermal management platform, real-time vehicle health monitoring software, and ProAI central computer as the foundation for software-defined, electrified, and automated vehicles.

- April 2025 : Continental launched its Future Brake System roadmap, including an Integrated Brake by Wire System that combines master cylinder, brake booster, and control into a compact module, cuts brake system weight by nearly 30%, and prepares fully electro-mechanical, full dry brake concepts such as electro-mechanical brakes and a new electric caliper to support electrified and automated vehicles.

- COLUMN 'A' SHOULD BE IN TEXT FORMAT AND NOT DATE FORMAT :

Table of Contents

Methodology

Exhaustive secondary research was conducted to gather information on the market based on application type, component type, sensor type, and region. The next step was to validate these findings, assumptions, and market analysis with industry experts across value chains through primary research. Bottom-up and top-down approaches were employed to estimate the complete market size for different segments considered in this study. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for estimating the drive by wire market included automotive industry organizations, such as Organisation Internationale des Constructeurs d’Automobiles (OICA), ACEA, CAAM, IEA, and publications from government sources [country-level automotive associations and organizations, Organisation for Economic Co-operation and Development (OECD), World Bank, CDC, and Eurostat]; corporate filings (such as annual reports, investor presentations, and financial statements); and trade repositories. Additionally, historical production data was collected and analyzed, and this data was further validated by primary research

Primary Research

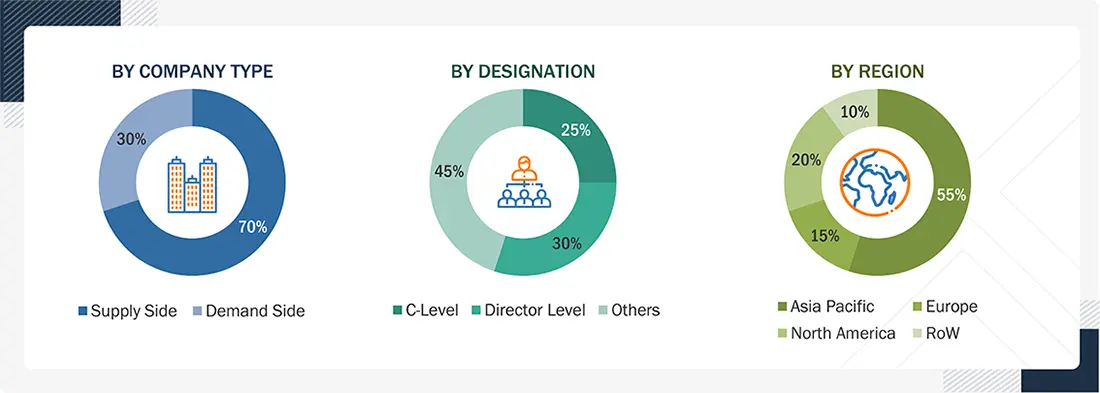

During the primary research process, various primary sources from the supply and demand sides were interviewed to gather qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as CXOs, vice presidents, directors from business development, marketing, product development/innovation teams, and related key executives from various key companies. Various system integrators, industry associations, independent consultants/industry veterans, as well as key opinion leaders, were also interviewed.

Primary interviews were conducted to gather insights, including vehicle production forecasts, drive by wire market forecasts, future technology trends, and upcoming technologies in the drive by wire market. Data triangulation was conducted across all these points, utilizing information gathered from secondary research and model mapping. Stakeholders from the demand and supply sides were interviewed to understand their views on the aforementioned points.

Primary interviews were also conducted with market experts from the demand (OEMs) and supply-side (drive by wire component manufacturers) players across four major regions, namely North America, Europe, Asia Pacific, and the Rest of the World. Approximately 30% and 70% of primary interviews were conducted from the demand and supply sides, respectively. Primary data was collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales and operations, were covered to provide a holistic viewpoint in our report.

After interacting with industry experts, brief sessions with highly experienced independent consultants were conducted to reinforce the findings from our primaries. This, along with the opinions of our in-house subject matter experts, led us to the conclusions described in the remainder of this report

Note: Others included sales, marketing, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

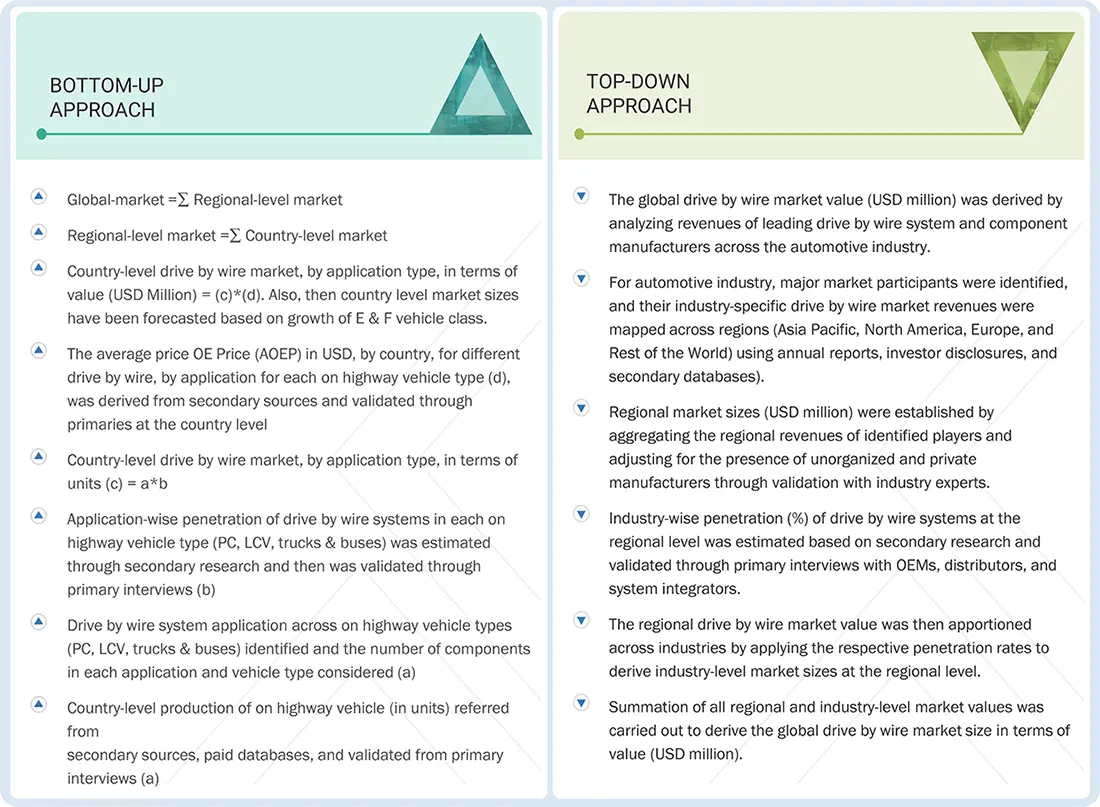

A detailed market estimation approach was employed to estimate and validate the value of the drive by wire market, as well as its dependent submarkets.

Bottom-up Approach

In the bottom-up approach, vehicle production of each vehicle type at the country level was considered. Penetration of each drive by wire application was derived through model mapping for each vehicle type. The country-level production by vehicle type was then multiplied by the penetration for each application to determine the market size of the drive by wire market in terms of volume. The country-level market size, in terms of volume, by application, was then multiplied by the country-level average OE price of each drive by wire application to determine the market size in terms of value for each vehicle type. Summation of the country-level market size for each vehicle type by application, in terms of volume and value, would give the regional-level market size. The summation of the regional markets provided the drive by wire market size. The market size for the vehicle type was derived from the global market.

Top-down Approach

The top-down approach starts with estimating the global drive by wire market value by assessing the revenue of leading manufacturers supplying drive by wire systems. Key market participants are identified, and their industry-specific drive by wire revenues are mapped across Asia Pacific, North America, Europe, and the Rest of the World using annual reports, investor disclosures, and established secondary databases.

Regional market values are derived by aggregating the mapped revenues of identified companies, with validation carried out through discussions with industry experts. Industry-wise penetration of drive by wire at the regional level is estimated through secondary research and cross-verified via primary interviews with OEMs, distributors, and system integrators. The regional market value is then distributed across end-use industries by applying the validated penetration levels, resulting in industry-level market sizes at the regional level. The global drive by wire market value is finalized by consolidating all region-wise and industry-wise market estimates to arrive at the overall market size in value terms. All assumptions were cross-verified through data triangulation and primary validation to maintain consistency and reliability across the regional forecast.

Drive by Wire Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

The drive by wire market covers electronic vehicle control systems that replace mechanical or hydraulic linkages with electronic signals and electrically actuated components. These systems translate driver inputs for steering, braking, acceleration, and gear selection into digital commands processed by control units and executed by actuators. Drive by wire includes steer by wire, brake by wire, throttle by wire, shift by wire, and park by wire systems. They enable precise control, flexible vehicle packaging, and software-based functionality, and are designed with redundancy and functional safety to support electric vehicles, software-defined vehicles, and advanced driver assistance systems.

Key Stakeholders

- Automotive OEMs

- EV and software-defined vehicle platform developers

- ECU and domain controller manufacturers

- Actuator and motor suppliers

- Power electronics and semiconductor suppliers

- Off-highway, agricultural, and construction equipment OEMs

- Testing, certification, and standards organizations

Report Objectives

-

To define, describe, and forecast the size of the drive by wire market in terms of value (USD million) and volume (thousand units) based on

- Steer by wire

- Brake by wire

- Shift by wire

- Park by wire

- Throttle by wire

- Autonomous vehicle drive by wire market by applications

- Region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing market growth

-

To study the following concerning the market

- Supply Chain Analysis

- Ecosystem Analysis

- Technology Analysis

- Case Study Analysis

- Patent Analysis

- Regulatory Landscape

- Pricing Analysis

- Impact of AI/Gen AI

- Trend and Disruption Impact

- Key Conferences and Events

- To understand competition in the drive by wire market and position players as stars, emerging leaders, pervasive players, and participants based on their product portfolios and business strategies

- To strategically analyze key player strategies/right to win, as well as evaluate the competitive leadership mapping

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To provide an analysis of recent developments, such as joint ventures, mergers & acquisitions, product launches/developments, and other activities carried out by key market players.

Available customizations:

Along with the given market data, MarketsandMarkets offers customizations in accordance with a company’s specific needs. The following customizations are available:

- Drive By Wire Market, By Application, at Country Level (For Countries Covered In Report)

- By Off-Highway Vehicle Type

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Drive By Wire Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Drive By Wire Market

User

Aug, 2019

Hello is brake and steer by wire included under "Other" in this report? (see overview graph) Or do you break out separately?.