Advanced Gear Shifter System Market for Automotive by Technology (Automatic Shifter, Shift-by-Wire), Component (CAN Module, ECU, Solenoid Actuator), Vehicle Type (Light Duty Vehicles, Commercial Vehicles), EV Type, and Region - Global Forecast to 2025

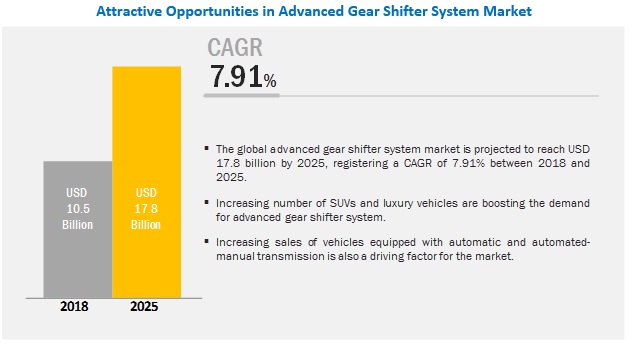

[123 Pages Report] The global advanced gear shifter system market is estimated to be USD 10.5 billion in 2018 and is projected to grow at a CAGR of 7.91% during the forecast period, to reach USD 17.8 billion by 2025. Some of the major growth drivers for the market are the increasing use of x-by-wire technology in the vehicle. The evolution of x-by-wire technology, which is an essential basic component for semi-autonomous and autonomous vehicle can create new revenue generation opportunities for advanced gear shifter system manufacturers. Currently shift-by-wire technology is finding the great amount applications in all class of vehicles. The trend is expected to continue in the future.

The CAN module segment to grow at a significant rate during the forecast period.

The CAN module segment is estimated to be the fastest growing market for advanced gear shifter systems, by components. It is followed by others. CAN module finds an extensive use for the communication purpose in modern vehicles so as in advanced shifting system. As vehicles are getting smarter and smarter, the use of CAN nodule is also increasing day by day.

The light-duty vehicle segment is estimated to be the largest market, in terms of value, in the advanced gear shifter system market.

The light-duty vehicle segment is projected to be the largest market for advanced gear shifter systems, by vehicle type. Advanced shifter technologies such as automatic shifter and shift-by-wire are extensively used in mid-size and economy class of light-duty vehicles. On the other hand, automatic shifters are used in luxury vehicles. Increasing sales of mid-size and luxury class vehicles is driving the growth of light-duty vehicle segment.

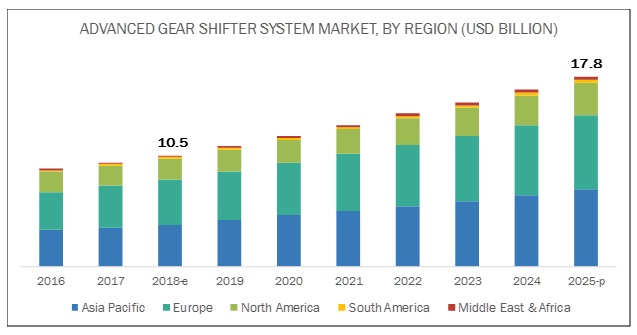

Asia Pacific is estimated to be the largest market for advanced gear shifter system during the forecast period.

The Asia Pacific market is forecasted to hold the largest market share and is estimated to grow at a significant CAGR during the forecast period. The market growth in the region can be attributed to the increase in vehicle production and adoption of advanced shifter technology in vehicles. Expansion of leading OEMs and automotive component suppliers in developing economies lie China, India are also projected to drive the growth in this region.

Some of the major restraint for the global advanced gear shifter system market is less reliability and more complexity of advanced shifter. Because of complexity of design and mechanism, these shifters are not easily repaired. Some of the major players in the global market are Dura Automotive (US), Ficosa (Spain), Kongsberg Automotive (Norway), and ZF (Germany). The last chapter of this report covers a comprehensive study of the key vendors operating in the market. The evaluation of market players is done by taking several factors into account, such as new product development, R&D expenditure, business strategies, product revenue, and organic and inorganic growth.

Scope of the Report

|

Report Metric |

Details |

|

Market Size Available for Years |

2016–2025 |

|

Base Year Considered |

2017 |

|

Forecast Period |

2018–2025 |

|

Forecast Units |

Volume (Thousand Units), Value (USD million) |

|

Segments Covered |

technology type, component type, vehicle type, electric vehicle type, and region |

|

Geographies Covered |

Asia Pacific, Europe, North America, South America and MEA |

|

Companies Covered |

Vis ZF (Germany), Kongsberg (Norway), Dura Automotive (US), Ficosa (Spain), and Stoneridge (US) |

This research report categorizes the advanced gear shifter system market based on equipment, vehicle type, electric vehicle type, and region.

Advanced Gear Shifter System Market, By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Advanced Gear Shifter System Market, By Technology

- Automatic Shifter

- Shift-By-Wire

Advanced Gear Shifter System Market, By Component

- CAN Module

- Electronic Control Unit (ECU)

- Solenoid Actuator

- Others

Advanced Gear Shifter System Market, By Vehicle

- Light Duty Vehicle

- Commercial Vehicle

Advanced Gear Shifter System Market, By Electric Vehicle

- BEV

- FCEV

- PHEV

Key Questions addressed by the report

- Autonomous vehicle questioning the existence of a conventional shifter system. What does this mean for the automotive gear box and transmission manufacturer?

- Can shift-by-wire satisfy safety critical functionality required by Automotive?

- Shift-by-wire is the most attractive areas among various shifter systems. How companies are planning to tap into this opportunity?

- What should be the go-to-market strategy for advanced gear shifter manufacturers to promote and expand various technologies into developing countries where the market is at nascent stage?

- How will the advent of autonomous vehicles impact the market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Product and Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency Exchange Rates

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Secondary Sources

2.1.1.2 Key Data From Secondary Sources

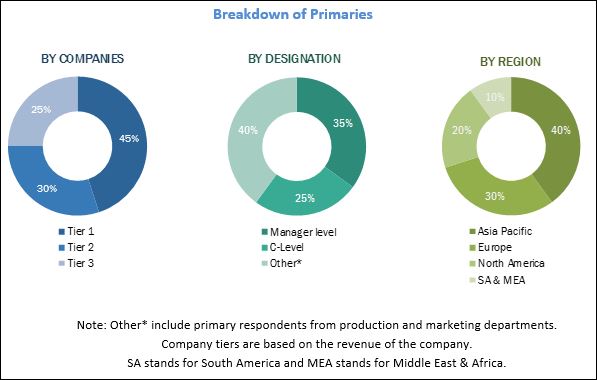

2.1.2 Primary Data

2.1.2.1 Breakdown of Primary Interviews

2.1.3 Sampling Techniques & Data Collection Methods

2.1.4 Primary Participants

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 28)

4.1 Attractive Market Opportunities in the Advanced Gear Shifter System Market

4.2 Market, By Region

4.3 Market, By Technology

4.4 Market, By Vehicle Type

4.5 Market, By Component

4.6 Market, By Electric Vehicle

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Use of X-By-Wire Technology

5.2.1.2 Advantage of Accurate and Quick Responding Gear Actuation

5.2.2 Restraints

5.2.2.1 Less Reliability and More Complexity of an Advanced Shifter

5.2.3 Opportunities

5.2.3.1 Increasing Preference for Automatic & Hybrid Transmission in Developing Countries

5.2.3.2 Haptics Shifter in Future Vehicles

5.2.4 Challenges

5.2.4.1 Developing Automotive Industry in Emerging Markets

6 Advanced Gear Shifter System Market, By Technology (Page No. - 39)

6.1 Introduction

6.2 Automatic Shifter

6.3 Shift-By-Wire (SBW)

7 Advanced Gear Shifter System Market, By Component (Page No. - 45)

7.1 Introduction

7.2 Can Module

7.3 Electronic Control Unit (ECU)

7.4 Solenoid Actuator

7.5 Others

8 Advanced Gear Shifter System Market, By Vehicle Type (Page No. - 51)

8.1 Introduction

8.2 Light-Duty Vehicles (LDV)

8.2.1 Economy Class

8.2.2 Mid-Size Class

8.2.3 Luxury Class

8.3 Commercial Vehicles

9 Advanced Gear Shifter System Market, By Electric Vehicle (Page No. - 59)

9.1 Introduction

9.2 Battery Electric Vehicle

9.3 Fuel Cell Electric Vehicle

9.4 Plug-In Hybrid Electric Vehicle

10 Advanced Gear Shifter System Market, By Region, 2018–2025 (Page No. - 65)

10.1 Introduction

10.2 Asia Pacific

10.2.1 China

10.2.2 Japan

10.2.3 India

10.2.4 South Korea

10.2.5 Rest of Asia Pacific

10.3 Europe

10.3.1 France

10.3.2 Germany

10.3.3 Italy

10.3.4 Russia

10.3.5 Spain

10.3.6 UK

10.3.7 Rest of Europe

10.4 North America

10.4.1 Canada

10.4.2 Mexico

10.4.3 US

10.5 South America

10.5.1 Brazil

10.5.2 Argentina

10.5.3 Rest of South America

10.6 Middle East & Africa

10.6.1 Iran

10.6.2 South Africa

10.6.3 Rest of Middle East & Africa

11 Competitive Landscape (Page No. - 90)

11.1 Introduction

11.2 Market Ranking Analysis

11.3 Competitive Situation & Trends

11.3.1 New Product Developments

11.3.2 Expansions

11.3.3 Mergers & Acquisitions

11.3.4 Partnerships/Supply Contracts/Collaborations/ Joint Ventures

12 Company Profiles (Page No. - 95)

(Overview, Products Offered, Recent Developments, and SWOT Analysis)*

12.1 ZF

12.2 Kongsberg Automotive

12.3 Stoneridge

12.4 Fuji Kiko

12.5 Dura

12.6 Ficosa

12.7 Küster

12.8 Kostal

12.9 GHSP

12.10 Orscheln Products

12.11 Eissmann Group Automotive

12.12 Silatech Srl

12.13 Atsumitec

12.14 Delta Kogyo

12.15 M&T Allied Technologies

*Details on Overview, Products Offered, Recent Developments, and SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 117)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Available Customizations

13.3.1 Additional Company Profiles

13.3.1.1 Business Overview

13.3.1.2 SWOT Analysis

13.3.1.3 Recent Developments

13.3.1.4 MnM View

13.3.1.5 Who–Supplies–Whom Data

13.3.2 Detailed Analysis of Automotive Applications

13.3.3 Detailed Analysis of Automotive Terminal in Off-Highway Vehicles

13.3.4 Detailed Analysis of Aftermarket

13.4 Related Reports

13.5 Author Details

List of Tables (89 Tables)

Table 1 Currency Exchange Rates (Wrt USD)

Table 2 Advanced Gear Shifter System Market: Who-Suppliers-Whom

Table 3 Market, By Technology, 2016–2025 (Thousand Units)

Table 4 Market, By Technology, 2016–2025 (USD Million)

Table 5 Automatic Shifter: Market, By Region, 2016–2025 (Thousand Units)

Table 6 Automatic Shifter: Market, By Region, 2016–2025 (USD Million)

Table 7 Shift-By-Wire: Market, By Region, 2016–2025 (Thousand Units)

Table 8 Shift-By-Wire: Market, By Region, 2016–2025 (USD Million)

Table 9 Advanced Gear Shifter System Market, By Component, 2016–2025 (USD Million)

Table 10 Can Module: Market, By Region, 2016–2025 (USD Million)

Table 11 ECU: Market, By Region, 2016–2025 (USD Million)

Table 12 Solenoid Actuator: Market, By Region, 2016–2025 (USD Million)

Table 13 Others: Market, By Region, 2016–2025 (USD Million)

Table 14 Market, By Vehicle Type, 2016–2025 (Thousand Units)

Table 15 Market, By Vehicle Type, 2016–2025 (USD Million)

Table 16 Economy Class: Market, By Region, 2016–2025 (Thousand Units)

Table 17 Economy Class: Market, By Region, 2016–2025 (USD Million)

Table 18 Mid-Size Class: Market, By Region, 2016–2025 (Thousand Units)

Table 19 Mid-Size Class: Market, By Region, 2016–2025 (USD Million)

Table 20 Luxury Class: Market, By Region, 2016–2025 (Thousand Units)

Table 21 Luxury Class: Market, By Region, 2016–2025 (USD Million)

Table 22 Commercial Vehicles: Market, By Region, 2016–2025 (Thousand Units)

Table 23 Commercial Vehicles: Market, By Region, 2016–2025 (USD Million)

Table 24 Advanced Gear Shifter System Market, By Electric Vehicle Type, 2016–2025 (Thousand Units)

Table 25 Market, By Electric Vehicle Type, 2016–2025 (USD Million)

Table 26 BEV: Market, By Region, 2016–2025 (Thousand Units)

Table 27 BEV: Market, By Region, 2016–2025 (USD Thousand)

Table 28 FCEV: Market, By Region, 2016–2025 (Thousand Units)

Table 29 FCEV: Market, By Region, 2016–2025 (USD Thousand)

Table 30 PHEV: Market, By Region, 2016–2025 (Thousand Units)

Table 31 PHEV: Market, By Region, 2016–2025 (USD Thousand)

Table 32 Market, By Region, 2016–2025 (Thousand Units)

Table 33 Advanced Gear Shifter System Market, By Region, 2016–2025 (USD Million)

Table 34 Asia Pacific: Market, By Country, 2016–2025 (Thousand Units)

Table 35 Asia Pacific: Market, By Country, 2016–2025 (USD Million)

Table 36 China: Market, By Technology, 2016–2025 (Thousand Units)

Table 37 China: Market, By Technology, 2016–2025 (USD Million)

Table 38 Japan: Market, By Technology, 2016–2025 (Thousand Units)

Table 39 Japan: Market, By Technology, 2016–2025 (USD Million)

Table 40 India: Market, By Technology, 2016–2025 (Thousand Units)

Table 41 India: Market, By Technology, 2016–2025 (USD Million)

Table 42 South Korea: Market, By Technology, 2016–2025 (Thousand Units)

Table 43 South Korea: Market, By Technology, 2016–2025 (USD Million)

Table 44 Rest of Asia Pacific: Market, By Technology, 2016–2025 (Thousand Units)

Table 45 Rest of Asia Pacific: Market, By Technology, 2016–2025 (USD Million)

Table 46 Europe: Market, By Country, 2016–2025 (Thousand Units)

Table 47 Europe: Market, By Country, 2016–2025 (USD Million)

Table 48 France: Market, By Technology, 2016–2025 (Thousand Units)

Table 49 France: Market, By Technology, 2016–2025 (USD Million)

Table 50 Germany: Market, By Technology, 2016–2025 (Thousand Units)

Table 51 Germany: Market, By Technology, 2016–2025 (USD Million)

Table 52 Italy: Market, By Technology, 2016–2025 (Thousand Units)

Table 53 Italy: Market, By Technology, 2016–2025 (USD Million)

Table 54 Russia: Market, By Technology, 2016–2025 (Thousand Units)

Table 55 Russia: Market, By Technology, 2016–2025 (USD Million)

Table 56 Spain: Market, By Technology, 2016–2025 (Thousand Units)

Table 57 Spain: Market, By Technology, 2016–2025 (USD Million)

Table 58 UK: Market, By Technology, 2016–2025 (Thousand Units)

Table 59 UK: Market, By Technology, 2016–2025 (USD Million)

Table 60 Rest of Europe: Market, By Technology, 2016–2025 (Thousand Units)

Table 61 Rest of Europe: Market, By Technology, 2016–2025 (USD Million)

Table 62 North America: Market, By Country, 2016–2025 (Thousand Units)

Table 63 North America: Market, By Country, 2016–2025 (USD Million)

Table 64 Canada: Market, By Technology, 2016–2025 (Thousand Units)

Table 65 Canada: Market, By Technology, 2016–2025 (USD Million)

Table 66 Mexico: Market, By Technology, 2016–2025 (Thousand Units)

Table 67 Mexico: Market, By Technology, 2016–2025 (USD Million)

Table 68 US: Market, By Technology, 2016–2025 (Thousand Units)

Table 69 US: Market, By Technology, 2016–2025 (USD Million)

Table 70 South America: Market, By Country, 2016–2025 (Thousand Units)

Table 71 South America: Market, By Country, 2016–2025 (USD Million)

Table 72 Brazil: Market, By Technology, 2016–2025 (Thousand Units)

Table 73 Brazil: Market, By Technology, 2016–2025 (USD Million)

Table 74 Argentina: Market, By Technology, 2016–2025 (Thousand Units)

Table 75 Argentina: Market, By Technology, 2016–2025 (USD Million)

Table 76 Rest of South America: Market, By Technology, 2016–2025 (Thousand Units)

Table 77 Rest of South America: Market, By Technology, 2016–2025 (USD Million)

Table 78 Middle East & Africa: Market, By Country, 2016–2025 (Thousand Units)

Table 79 Middle East & Africa: Market, By Country, 2016–2025 (USD Million)

Table 80 Iran: Market, By Technology, 2016–2025 (Thousand Units)

Table 81 Iran: Market, By Technology, 2016–2025 (USD Million)

Table 82 South Africa: Market, By Technology, 2016–2025 (Thousand Units)

Table 83 South Africa: Market, By Technology, 2016–2025 (USD Million)

Table 84 Rest of Middle East & Africa: Market, By Technology, 2016–2025 (Thousand Units)

Table 85 Rest of Middle East & Africa: Advanced Gear Shifter System Market, By Technology, 2016–2025 (USD Million)

Table 86 New Product Developments, 2016–2017

Table 87 Expansions, 2017–2018

Table 88 Mergers & Acquisitions, 2015–2017

Table 89 Partnerships/Joint Ventures/Supply Contracts/Collaborations, 2015–2016

List of Figures (35 Figures)

Figure 1 Advanced Gear Shifter System Market: Market Segmentation

Figure 2 Market: Research Design

Figure 3 Research Design Model

Figure 4 Market: Bottom-Up Approach

Figure 5 Data Triangulation

Figure 6 Product Lifecycle for Vehicle Gear Shifters

Figure 7 Market: Market Dynamics

Figure 8 Market: Market Size

Figure 9 Increasing Use of X-By-Wire Technology to Drive the Market, 2018 vs 2025 (USD Billion)

Figure 10 Asia Pacific is Estimated to Lead the Market, 2018 vs 2025 (USD Billion)

Figure 11 Shift-By-Wire Market is Estimated to Lead the Market, 2018 vs 2025 (USD Billion)

Figure 12 Light-Duty Vehicle is Estimated to Lead the Market, 2018 vs 2025 (USD Billion)

Figure 13 Solenoid Actuator is Estimated to Lead the Market, 2018 vs 2025 (USD Billion)

Figure 14 BEV is Estimated to Lead the Market, 2018 vs 2025 (USD Million)

Figure 15 Product Lifecycle for Vehicle Gear Shifters

Figure 16 Light Duty Vehicles Production, By Vehicle Class, 2016–2025

Figure 17 Advanced Gear Shifter System Market: Market Dynamics

Figure 18 Increasing Use of Shift-By-Wire Technology in Vehicles, 2016–2025

Figure 19 Carbon Emissions From Various Road Transportation, 2017

Figure 20 Shift-By-Wire Technology to Account for the Largest Market Share During the Forecast Period, 2018–2025 (USD Million)

Figure 21 Solenoid Actuator to Account for the Largest Market Share During the Forecast Period, 2018 vs 2025 (USD Million)

Figure 22 Luxury Class of LDV Segment to Surpass Economy Class By 2025, 2018 vs 2025 (USD Million)

Figure 23 Asia Pacific to Dominate the Market, 2018 vs 2025 (USD Million)

Figure 24 Asia Pacific: Market Snapshot

Figure 25 North America: Market Snapshot

Figure 26 Companies Adopted Supply Contracts as Key Growth Strategy Between 2015 and 2018

Figure 27 Advanced Gear Shifter System Market Ranking: 2017

Figure 28 ZF: Company Snapshot

Figure 29 ZF: SWOT Analysis

Figure 30 Kongsberg Automotive: Company Snapshot

Figure 31 Kongsberg Automotive: SWOT Analysis

Figure 32 Stoneridge: Company Snapshot

Figure 33 Stoneridge: SWOT Analysis

Figure 34 Fuji Kiko: Company Snapshot

Figure 35 Küster: Company Snapshot

The study involves four main activities to estimate the current size of the advanced gear shifter system market. Exhaustive secondary research was done to collect information on the market such as the use of different kind of shifter in various vehicle types. The next step was to validate these findings, assumptions, and market analysis with industry experts across value chains through primary research. A bottom-up approach was employed to estimate the complete market size of different segments considered in this study.

Secondary Research

The secondary sources referred to in this research study include automotive industry organizations such as the Organisation Internationale des Constructeurs d'Automobiles (OICA); corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and automotive associations. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by multiple industry experts.

Primary Research

Extensive primary research was conducted after acquiring an understanding of the scenario of the advanced gear shifter system market through secondary research. Several primary interviews were conducted with the market experts from both demand- side (OEM) and supply-side (advanced gear shifter system providers) across 5 major regions, namely, North America, Europe, Asia Pacific, South America and the Middle East & Africa (MEA). Primary data was collected through questionnaires, emails, and telephonic interviews. In our canvassing of primaries, we strived to cover various departments within organizations, which included sales, operations, and administration, to provide a holistic viewpoint of the market in our report. After interacting with the industry participants, we conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the opinions of the in-house subject-matter experts, led us to the findings as described in this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach was used to estimate and validate the total size of the advanced gear shifter system market. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of volume and value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and sub-segments. All parameters that are said to affect the markets covered in this research study have been accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated, enhanced with detailed inputs and analysis from MarketsandMarkets, and presented in the report. The data was triangulated by studying numerous factors and trends in the demand and supply sides in the Advanced Gear Shifter System market.

Report Objectives

- To define, segment, analyze, and forecast the market size, in terms of value (USD million/billion), of the advanced gear shifter system market.

- To provide a detailed analysis of the numerous factors influencing the Market (drivers, restraints, opportunities, and challenges).

- To define, describe, and project the market based on technology type, component type, vehicle type, electric vehicle type, and region.

- To project the market in 5 key regions, namely, Asia Pacific, Europe, North America, South America and Middle East & Africa (MEA).

- To analyze regional markets for growth trends, prospects, and their contribution to the overall market.

- To analyze the opportunities for stakeholders and provide details of the competitive landscape for the market leaders.

- To strategically shortlist and profile key players and comprehensively analyze their respective market share and core competencies.

- To analyze recent developments, alliances, joint ventures, product innovations, and mergers & acquisitions in the market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with company-specific needs.

The following customization options are available for the report:

Additional Company Profiles

- Business Overview

- SWOT Analysis

- Recent Developments

- MnM View

Detailed analysis of the Advanced Gear Shifter System Market, by shift-by-wire technology

Detailed analysis of the Advanced Gear Shifter System Market, by solenoid actuator

Growth opportunities and latent adjacency in Advanced Gear Shifter System Market