Driver Safety Market for Passenger Cars by Technology (Eye-Tracking/Blink-Monitoring, Facial Expressions/Head Movements, Heart Rate-Monitoring, Pressure/Angle Steering Sensor, and Lane Departure Warning), Off-Highway Vehicle, and Region - Global Forecast to 2025

[130 Pages Report] The passenger car driver safety market is primarily driven by the growing need to increase operator or driver safety in the automotive industry. Increasing competition in the automotive industry and the demand for safety-related systems will likely boost the demand for driver safety systems during the forecast period.

The increasing number of road accidents caused by driver inattentiveness is a serious issue jeopardizing passenger and driver safety. Monitoring the behavior of the driver to detect fatigue and distraction could enhance the safety of the driver and passengers. The driver safety market is projected to grow at a CAGR of 6.24% during the forecast period, to reach a market size of USD 3.20 Billion by 2025. Considering the limited penetration of these systems in the original equipment (OE) market, the study considers 2015 as the base year, and projects the market till 2025. The primary objective of the study is to define, describe, and forecast the global driver safety market for passenger cars as well as off-highway vehicles on the basis of technology and region, and to provide detailed information regarding major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges). The report analyzes the regional markets for growth trends, future prospects, and their contribution to the overall market, and tracks and analyzes competitive developments and other activities carried out by key industry participants.

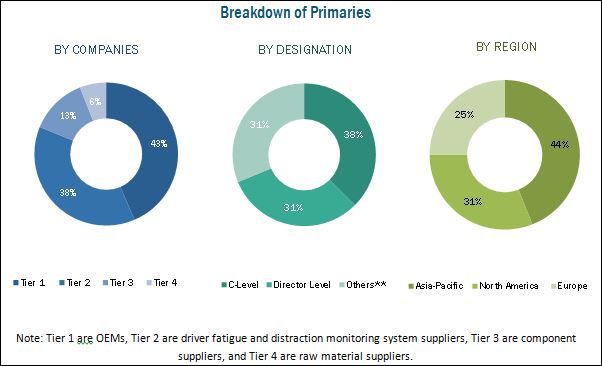

The research methodology used in the report involves various secondary sources such as the Construction Equipment Association (CEA), Association of Equipment Manufacturers (AEM), and Electronic Component Industry Association (ECIA). The market numbers for passenger cars are based on the country-wise production of these cars, while the numbers for off-highway vehicles are given in terms of sales of systems that are employed in construction and surface mining equipment (by region). This regional data is added up to derive the global data.

The production of passenger cars has been considered to arrive at the market size, in terms of volume. This country-wise market size, by volume, is then multiplied with the country-wise average OE price of each type of technology for passenger cars. This results in the country-wise market size for that particular passenger car driver safety system, in terms of value. The same method is used to derive the market size for off-highway vehicles (construction and mining equipment), by region. The summation of the country-wise and regional-level market size, in terms of value, provides the global driver safety market for passenger cars. The global market for off-highway vehicles is derived by adding the regional-level market size, in terms of value.

To know about the assumptions considered for the study, download the pdf brochure

The driver safety market ecosystem consists of various system suppliers such as Smart Eye AB (Sweden), Seeing Machines (Australia), and Tobii AB (Sweden).

Target Audience

- Driver safety system manufacturers

- Sensor manufacturers

- Distributors and suppliers of automotive safety systems

- Automobile manufacturers

- Mining and construction equipment suppliers

- Mining operators

- Industry associations and experts

Scope of the Study

-

By Technology

-

Passenger Car Driver Fatigue Monitoring System

- Eye-Tracking/Blink-Monitoring

- Facial Expressions/Head Movements

- Heart Rate-Monitoring

-

Passenger Car Distraction Monitoring System

- Pressure/Angle Steering Sensor

- Lane Departure System

-

Passenger Car Driver Fatigue Monitoring System

-

By Off-Highway

- Construction Equipment

- Mining Equipment

-

By Region

- North America

- Europe

- Asia-Pacific

- Rest of the World

Available Customizations

Off-Highway Vehicle Driver Safety Market, by Country

-

Asia-Pacific

- China

- India

- Japan

- South Korea

-

Europe

- Germany

- France

- U.K.

-

North America

- U.S.

- Mexico

- Canada

-

Rest of the World

- Brazil

- Russia

Commercial Vehicle Driver Safety Market, by Region

- Asia-Pacific

- Europe

- North America

- Rest of the World

The passenger car driver safety market is projected to grow at a CAGR of 6.24% during the forecast period, to reach a market size of USD 3.20 Billion by 2025. A wide array of upcoming infrastructural development projects, increased urbanization, and the rising demand for safety solutions has led to an increase in the demand for driver safety systems. Additionally, technological advancements such as eye-tracking technology (General Motors) and Mercedes-Benz Attention Assist (Mercedes) have boosted the demand for these systems. These advancements have increased the safety of drivers and passengers in the passenger car segment, and have resulted in a reduction in fatalities due to the same.

In this report, driver safety systems are broadly segmented based on technology into driver fatigue monitoring systems (eye-tracking/blink-monitoring, facial expressions/head movements, and heart rate-monitoring) and distraction monitoring systems (pressure/angle steering sensor and lane departure system). The distraction monitoring system segment is projected to record the largest market size by 2020, as these systems assist in preventing road accidents caused by distraction. With regard to distraction monitoring systems, the lane departure system is expected to account for the largest share by 2020, owing the benefits it offers; for instance, it alerts the driver when the vehicle is drifting out of a lane using visual, tactile, or audible warnings.

The off-highway vehicle segment includes the driver fatigue and distraction systems used in construction and mining equipment (surface mining). The mining segment of the driver fatigue and distraction monitoring market is projected to register the highest CAGR from 2016 to 2021. The increasing number of road accidents and casualties caused by fatigue are a pressing issue for mine operators. Several mine operators and OEMs have already incorporated driver fatigue and distraction monitoring systems in vehicles to overcome this problem.

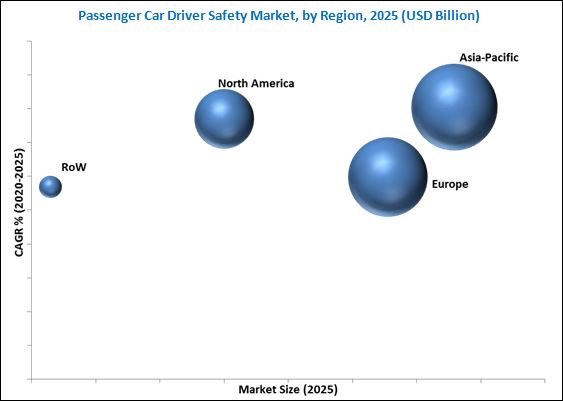

The Asia-Pacific region is estimated to dominate the driver fatigue monitoring market. This can be credited to the improving socio-economic conditions in emerging economies such as China, India, and Japan. The growing public awareness about safety solutions such as driver fatigue and distraction monitoring systems will likely lead to a substantial increase in the demand for these systems, and could influence buying behavior in the near future. The passenger car segment is estimated to lead the European distraction monitoring system market. This can be attributed to the stringent safety regulations in Europe, such as the mandatory incorporation of advanced emergency braking systems and lane departure warning systems in heavy-duty vehicles (since 1st November 2013 for new types of vehicle and 1st November 2015 for all new vehicles).

Key factors restraining the growth of the vehicle safety market include the high cost of the system and its complex nature. The driver fatigue and distraction monitoring system market for passenger cars and off-highway vehicles is dominated by a few global players, such as Continental AG (Germany), Magna International Inc. (Canada), Valeo S.A. (France), Seeing Machines (Australia), and Smart Eye AB (Sweden). Seeing Machines has a strong product portfolio, and has invested heavily in R&D to retain its market position. It has adopted agreement/joint venture/partnership as a key strategy to gain traction in the market. Meanwhile, Robert Bosch GmbH (Germany) has adopted new product development and supply contracts as key strategies to become a leading player in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.3 Data From Secondary Sources

2.4 Primary Data

2.4.1 Sampling Techniques & Data Collection Methods

2.4.2 Primary Participants

2.5 Factor Analysis

2.5.1 Introduction

2.5.2 Demand Side Analysis

2.5.2.1 Increasing Vehicle Production

2.5.2.2 Impact of Gdp on Construction & Mining Equipment Sales

2.5.2.3 Rising Demand for Hybrid and Electric Vehicles

2.5.3 Supply Side Analysis

2.5.3.1 Government Safety Regulations

2.5.3.2 Technological Advancements in Vehicle Safety and Security

2.6 Market Size Estimation

2.7 Data Triangulation

2.8 Assumptions

3 Executive Summary (Page No. - 30)

3.1 Introduction

3.2 Passenger Car Driver Fatigue (Drowsiness) & Distraction Monitoring System Market, By Region

3.3 Passenger Car Driver Fatigue (Drowsiness) & Distraction Monitoring System Market, By Technology

3.4 Passenger Car Driver Driver Fatigue (Drowsiness) & Distraction Monitoring System Market Share, By Technology & Region

3.5 Driver Safety Market for Off-Highway Vehicles

4 Premium Insights (Page No. - 35)

4.1 Attractive Market Opportunities in the Global Driver Fatigue (Drowsiness) and Distraction Monitoring System Market

4.2 Global Passenger Car Driver Fatigue (Drowsiness) Monitoring System Market Size, 2025

4.3 Global Passenger Car Driver Fatigue (Drowsiness) and Distraction Monitoring System Market, By Technology

4.4 Global Driver Fatigue (Drowsiness) and Distraction Monitoring System Market, By Off-Higway Vehicle

4.5 Passenger Car: Regional Market Share of Driver Fatigue (Drowsiness) and Distraction Monitoring System, 2016–2021

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 Driver Fatigue (Drowsiness) & Distraction Monitoring System Market Segmentation

5.2.1 Driver Fatigue (Drowsiness) & Distraction Monitoring System, By Region

5.2.2 Driver Fatigue (Drowsiness) & Distraction Monitoring System, By Vehicle Type

5.2.3 Driver Fatigue (Drowsiness) & Distraction Monitoring System, By Type of Monitoring

5.2.4 Driver Fatigue (Drowsiness) and Distraction Monitoring System Market, By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Upcoming Safety Regulations

5.3.1.2 Rising Demand for Luxury & Comfort

5.3.2 Restraints

5.3.2.1 High Cost & Complexity

5.3.3 Opportunities

5.3.3.1 Growth Potential in Aftermarket

5.3.4 Challenges

5.3.4.1 Key Stakeholders are Hesitant to Take Accountability Due to Vehicle Accidents and Privacy Concerns

5.3.4.2 Compromised Accuracy

5.4 Porter’s Five Forces Analysis

5.4.1 Competitive Rivalry

5.4.2 Threat of Substitutes

5.4.3 Bargaining Power of Buyers

5.4.4 Bargaining Power of Suppliers

5.4.5 Threat of New Entrants

6 Technology Overview (Page No. - 52)

6.1 Mercedes-Benz: Attention Assist

6.2 Ford: Driver Alert

6.3 Gm: Eye Tracking

6.4 Volvo: Driver Alert Control and Driver State Estimation

6.5 Volkswagen: Driver Alert System

6.6 Toyota: Driver Monitoring System

6.7 Seat: Fatigue / Drowsiness Detection

7 Off-Highway Vehicle: Driver Fatigue (Drowsiness) and Distraction Monitoring System Market (Page No. - 55)

7.1 Introduction

7.2 Construction Equipment

7.3 Mining Equipment

7.4 Off-Highway Vehicle: Driver Fatigue (Drowsiness) and Distraction Monitoring System Market

8 Passenger Car Driver Fatigue (Drowsiness) and Distraction Monitoring System Market, By Technology & By Regoin (Page No. - 63)

8.1 Introduction

8.2 Technology Introduction

8.2.1 Blink Monitoring

8.2.2 Facial Expression/Head Movements

8.2.3 Heart Rate Monitoring

8.2.4 Steering Pressure/Angle Sensor

8.2.5 Lane Departure Warning

8.3 Passenger Car: Driver Fatigue (Drowsiness) and Distraction Monitoring System Market, By Region

8.4 Passenger Car: Driver Fatigue (Drowsiness) and Distraction Monitoring System Market, By Technology

8.4.1 Passenger Car Eye Tracking/Blink Monitoring System Market, By Region

8.4.2 Passenger Car Facial Expression/Head Movement System Market, By Region

8.4.3 Passenger Car Heart Rate Monitoring System Market, By Region

8.4.4 Passenger Car Pressure/Angle Sensor System Market, By Region

8.4.5 Passenger Car Lane Departure Warning System Market, By Region

8.5 Asia-Pacific

8.5.1 China: Driver Safety Market, By Technology

8.5.2 Japan: Driver Safety Market, By Technology

8.5.3 India: Driver Safety Market, By Technology

8.5.4 South Korea: Driver Safety Market, By Technology

8.6 Europe

8.6.1 Germany: Driver Safety Market, By Technology

8.6.2 U.K.: Driver Safety Market, By Technology

8.6.3 France: Driver Safety Market, By Technology

8.7 North America

8.7.1 U.S.: Driver Safety Market, By Technology

8.7.2 Canada: Driver Safety Market, By Technology

8.7.3 Mexico: Driver Safety Market, By Technology

8.8 Rest of the World

8.8.1 Brazil: Driver Safety Market, By Technology

8.8.2 Russia: Driver Safety Market, By Technology

8.8.3 South Africa: Driver Safety Market, By Technology

9 Competitive Landscape (Page No. - 94)

9.1 Competitive Situation & Trends

9.2 New Product Development/Launch

9.3 Supply Contract/Agreement/Joint Venture/Partnership

10 Company Profiles (Page No. - 99)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

10.1 Robert Bosch GmbH

10.2 Denso Corporation

10.3 Continental AG

10.4 Magna International Inc.

10.5 Valeo S.A.

10.6 Tobii AB

10.7 Seeing Machines

10.8 Infineon Technologies AG

10.9 Smart Eye AB

10.10 Optalert PTY Ltd.

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 123)

11.1 Insights of Industry Experts

11.2 Discussion Guide

11.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.4 Introducing Rt: Real Time Market Intelligence

11.5 Available Customizations

11.5.1 Off-Highway Vehicle Driver Fatigue (Drowsiness) and Distraction Monitoring Systems Market, By Country

11.5.2 Commercial Vehicle Driver Fatigue (Drowsiness) and Distraction Monitoring Systems Market, By Region

11.6 Related Reports

List of Tables (66 Tables)

Table 1 Government Incentives for Electric Vehicles

Table 2 Driver Fatigue and Distraction Monitoring Systems Considered in the Study

Table 3 Luxury Vehicle Sales of Key Manufacturers, India, 2013–2015

Table 4 Luxury Vehicle Sales of Key Manufacturers, China, 2013–2015

Table 5 Off-Highway Vehicle: Driver Fatigue and Distraction Monitoring System Market Size, 2014–2021 (Units)

Table 6 Off-Highway Vehicle: Driver Fatigue and Distraction Monitoring System Market Size, 2014–2021 (USD Million)

Table 7 North America: Driver Fatigue and Distraction Monitoring System Market Size, By Off-Highway Vehicle 2014–2021 (Units)

Table 8 North America: Driver Fatigue and Distraction Monitoring System Market Size, By Off-Highway Vehicle, 2014–2021 (USD Million)

Table 9 Europe: Driver Fatigue and Distraction Monitoring System Market Size, By Off-Highway Vehicle, 2014–2021 (Units)

Table 10 Europe: Driver Fatigue and Distraction Monitoring System Market Size, By Off-Highway Vehicle, 2014–2021 (USD Million)

Table 11 Asia-Pacific: Driver Fatigue and Distraction Monitoring System Market Size, By Off-Highway Vehicle, By Vehicle Type, 2014–2021 (Units)

Table 12 Asia-Pacific: Driver Fatigue and Distraction Monitoring System Market Size, By Off-Highway Vehicle, 2014–2021 (USD Million)

Table 13 RoW: Driver Fatigue and Distraction Monitoring System Market Size, By Off-Highway Vehicle, By Vehicle Type, 2014–2021 (Units)

Table 14 RoW: Driver Fatigue and Distraction Monitoring System Market Size, By Off-Highway Vehicle, 2014–2021 (USD Million)

Table 15 Passenger Car: Driver Fatigue Monitoring System Market Size, By Region, 2018–2025 (‘000 Units)

Table 16 Passenger Car: Driver Distraction Monitoring System Market Size, By Region, 2018–2025 (‘000 Units)

Table 17 Passenger Car: Global Driver Fatigue Monitoring System Market Size, By Technology, 2018–2025 (‘000 Units)

Table 18 Passenger Car: Global Driver Distraction Monitoring System Market Size, By Technology, 2018–2025 (‘000 Units)

Table 19 Passenger Car: Driver Fatigue Monitoring System Market Size, By Region, 2018–2025 (USD Million)

Table 20 Passenger Car: Global Eye Tracking/Blink Monitoring System Market Size, By Region, 2018–2025 (‘000 Units)

Table 21 Passenger Car: Global Facial Expression/Head Movement Monitoring System Market Size, By Region, 2018–2025 (‘000 Units)

Table 22 Passenger Car: Global Heart Rate Monitoring Systems Market Size, By Region, 2018–2025 (‘000 Units)

Table 23 Passenger Car: Global Pressure/Angle Steering Sensor Systems Market Size, By Region, 2018–2025 (‘000 Units)

Table 24 Passenger Car: Global Pressure/Angle Steering Sensor System Market Size, By Region, 2018–2025 (USD Million)

Table 25 Passenger Car: Global Lane Departure Warning System Market Size, By Region, 2018–2025 (‘000 Units)

Table 26 Passenger Car: Global Lane Departure Warning System Market Size, By Region, 2018–2025 (USD Million)

Table 27 Asia-Pacific: Driver Fatigue Monitoring Systems Market Size, By Technology, 2018–2025 (‘000 Units)

Table 28 Asia-Pacific: Driver Distraction Monitoring Systems Market Size, By Technology, 2018–2025 (‘000 Units)

Table 29 Asia-Pacific: Driver Monitoring Systems Market Size, By Technology, 2018–2025 (USD Million)

Table 30 China: Driver Fatigue Monitoring Systems Market Size, By Technology, 2018–2025 (‘000 Units)

Table 31 China: Driver Distraction Monitoring Systems Market Size, By Technology, 2018–2025 (‘000 Units)

Table 32 Japan: Driver Fatigue Monitoring Systems Market Size, By Technology, 2018–2025 (‘000 Units)

Table 33 Japan: Driver Distraction Monitoring Systems Market Size, By Technology, 2018–2025 (‘000 Units)

Table 34 India: Driver Fatigue Monitoring Systems Market Size, By Technology, 2018–2025 (‘000 Units)

Table 35 India: Driver Distraction Monitoring Systems Market Size, By Technology, 2018–2025 (‘000 Units)

Table 36 South Korea: Driver Fatigue Monitoring Systems Market Size, By Technology, 2018–2025 (‘000 Units)

Table 37 South Korea: Driver Distraction Monitoring Systems Market Size, By Technology, 2018–2025 (‘000 Units)

Table 38 Europe: Driver Fatigue Monitoring Systems Market Size, By Technology, 2018–2025 (‘000 Units)

Table 39 Europe: Driver Distraction Monitoring Systems Market Size, By Technology, 2018–2025 (‘000 Units)

Table 40 Europe: Driver Monitoring Systems Market Size, By Technology, 2018–2025 (USD Million)

Table 41 Germany: Driver Fatigue Monitoring Systems Market Size, By Technology, 2018–2025 (‘000 Units)

Table 42 Germany: Driver Distraction Monitoring Systems Market Size, By Technology, 2018–2025 (‘000 Units)

Table 43 U.K. : Driver Fatigue Monitoring Systems Market Size, By Technology, 2018–2025 (‘000 Units)

Table 44 U.K. : Driver Distraction Monitoring Systems Market Size, By Technology, 2018–2025 (‘000 Units)

Table 45 France: Driver Fatigue Monitoring Systems Market Size, By Technology, 2018–2025 (‘000 Units)

Table 46 France: Driver Distraction Monitoring Systems Market Size, By Technology, 2018–2025 (‘000 Units)

Table 47 North America: Driver Fatigue Monitoring Systems Market Size, By Technology, 2018–2025 (‘000 Units)

Table 48 North America: Driver Distraction Monitoring Systems Market Size, By Technology, 2018–2025 (‘000 Units)

Table 49 North America: Driver Monitoring Systems Market Size, By Technology, 2018–2025 (USD Million)

Table 50 U.S.: Driver Fatigue Monitoring Systems Market Size, By Technology, 2018–2025 (‘000 Units)

Table 51 U.S.: Driver Distraction Monitoring Systems Market Size, By Technology, 2018–2025 (‘000 Units)

Table 52 Canada: Driver Fatigue Monitoring Systems Market Size, By Technology, 2018–2025 (‘000 Units)

Table 53 Canada: Driver Distraction Monitoring Systems Market Size, By Technology, 2018–2025 (‘000 Units)

Table 54 Mexico: Driver Fatigue Monitoring Systems Market Size, By Technology, 2018–2025 (‘000 Units)

Table 55 Mexico: Driver Distraction Monitoring Systems Market Size, By Technology, 2018–2025 (‘000 Units)

Table 56 RoW: Driver Fatigue Monitoring Systems Market Size, By Technology, 2018–2025 (‘000 Units)

Table 57 RoW: Driver Distraction Monitoring Systems Market Size, By Technology, 2018–2025 (‘000 Units)

Table 58 RoW: Driver Monitoring Systems Market Size, By Technology, 2018–2025 (USD Million)

Table 59 Brazil: Driver Fatigue Monitoring Systems Market Size, By Technology, 2018–2025 (‘000 Units)

Table 60 Brazil: Driver Distraction Monitoring Systems Market Size, By Technology, 2018–2025 (‘000 Units)

Table 61 Russia: Driver Fatigue Monitoring Systems Market Size, By Technology, 2018–2025 (‘000 Units)

Table 62 Russia: Driver Distraction Monitoring Systems Market Size, By Technology, 2018–2025 (‘000 Units)

Table 63 South Africa: Driver Fatigue Monitoring Systems Market Size, By Technology, 2018–2025 (‘000 Units)

Table 64 South Africa: Driver Distraction Monitoring Systems Market Size, By Technology, 2018–2025 (‘000 Units)

Table 65 New Product Developments/Launches, 2015–2016

Table 66 Supply Contract/Agreements/Joint Ventures/Partnerships 2014–2015

List of Figures (50 Figures)

Figure 1 Driver Fatigue & Distraction Monitoring System Market Segmentation

Figure 2 Research Design

Figure 3 Research Methodology

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 5 Vehicle Production, 2010–2015 (‘000 Units)

Figure 6 Gross Domestic Product vs Construction Equipment Sales

Figure 7 Passenger Car Driver Fatigue and Distraction Monitoring, By Technology: Bottom-Up Approach

Figure 8 Off-Highway: Driver Fatigue and Distraction Monitoring System, By Technology: Top-Down Approach

Figure 9 Passenger Car: Driver Fatigue Monitoring System Market Snapshot (2020): Asia-Pacific is Estimated to Hold the Maximum Market Share

Figure 10 Passenger Car Driver Fatigue Monitoring Systems Market Size, By Technology (‘000 Units), 2020 vs 2025

Figure 11 Passenger Car: Driver Fatigue and Distraction Monitoring Systems Market Share, By Technology, 2020

Figure 12 Driver Fatigue and Distraction Monitoring Systems Market, By Off-Highway Vehicle, 2016 vs 2021

Figure 13 Rising Demand for Luxury and Comfort to Drive the Market for Driver Fatigue Monitoring Systems

Figure 14 Asia Pacific is Anticipated to Dominate the Driver Fatigue Monitoring System Market, While Europe is Anticipated to Dominate Driver Monitoring System Market, By 2025

Figure 15 Passenger Car: Driver Distraction Monitoring System is Anticipated to Dominate Throughout the Forecast Period

Figure 16 Construction Equipments is Estimated to Hold the Maximum Share in the Total Driver Fatigue and Distraction Monitoring Market, 2016 vs 2021

Figure 17 Asia-Pacific Accounts for the Largest Share of the Driver Fatigue and Distraction Monitoring System Market, By Value, 2016–2021

Figure 18 Driver Fatigue & Distraction Monitoring System: Market Dynamics

Figure 19 Passenger Death Rate in Road Accidents Per 1,00,000 People, By Country

Figure 20 Connected Cars Market Size, 2014–2016 (USD Billion)

Figure 21 Porter’s Five Forces Analysis

Figure 22 The Competitive Rivalry is Low in the Driver Fatigue & Distraction Monitoring System Market

Figure 23 Technological Complexity has Halted the Development of A Legitimate Substitute

Figure 24 Bargaining Power of Buyers is Considered Low Due to the Unavailability of Advanced Technological Systems

Figure 25 Presence of A Large Number of Suppliers Makes the Bargaining Power of Suppliers Low-Medium

Figure 26 High-Tech Technologies and High Capital Expenditure Prevent Entry of New Players

Figure 27 Asia-Pacific is Estimated to Dominate the Driver Fatigue and Distraction Monitoring System Market for Construction Equipment

Figure 28 Driver Fatigue and Distraction Monitoring System Market for Off-Highway Vehicles, By Value, 2016 vs 2021

Figure 29 Passenger Car: Country-Wise Snapshot of the Driver Fatigue Monitoring Systems Market, By Volume (2020-2025)

Figure 30 Region Wise Market for Driver Fatigue Monitoring System Market: Asia-Pacific is Expected to Have the Largest Market Size, By Value, 2020

Figure 31 Asia-Pacific: China Leads the Market for Driver Fatigue and Distraction Monitoring Systems

Figure 32 North America: U.S. Leads the Market for Driver Fatigue and Distraction Monitoring Systems

Figure 33 Companies Adopted New Product Development & Expansion as Key Growth Strategies From 2010 to 2016

Figure 34 Market Evaluation Framework: Expansions & New Product Developments Fuelled the Growth of the Driver Fatigue & Distraction Monitoring System Market

Figure 35 Battle for Market Share: New Product Development Was the Key Strategy

Figure 36 Robert Bosch GmbH: Company Snapshot

Figure 37 Robert Bosch GmbH: SWOT Analysis

Figure 38 Denso Corporation: Company Snapshot

Figure 39 Denso Corporation: SWOT Analysis

Figure 40 Continental AG: Company Snapshot

Figure 41 Continental AG: SWOT Analysis

Figure 42 Magna International Inc.: Company Snapshot

Figure 43 Magna International Inc.: SWOT Analysis

Figure 44 Valeo S.A.: Company Snapshot

Figure 45 Valeo S.A.: SWOT Analysis

Figure 46 Tobii AB: Company Snapshot

Figure 47 Tobii AB: SWOT Analysis

Figure 48 Seeing Machines: Company Snapshot

Figure 49 Seeing Machines: SWOT Analysis

Figure 50 Infineon Technologies AG: Company Snapshot

Growth opportunities and latent adjacency in Driver Safety Market