E-bike Market Size, Share & Analysis

E-bike Market by Class (Class I, II, III), Battery (Li-ion, Li-ion Polymer, Lead Acid), Motor (Mid, Hub), Mode (Throttle, Pedal Assist), Usage (Mountain/Trekking, City/Urban, Cargo), Speed, Battery Capacity, Component, and Region - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global eBike market size is forecasted to grow from USD 54.12 billion in 2025 to USD 87.15 billion by 2032, with a CAGR of 7.0%. Several factors are fueling growth in the eBike industry. Improvements in technology are making batteries more efficient and affordable, allowing for longer ranges at lower costs. This, along with the integration of IoT and app-based connectivity, appeals to both individual commuters and commercial fleets. Additionally, eBikes are a highly cost-effective solution in crowded urban areas, with operating costs much lower than those of cars or traditional two-wheelers. Their low ownership and maintenance costs, combined with government incentives and dedicated urban infrastructure, are making them an increasingly popular transportation option. The main challenges include dependence on imported lithium cells and motors, which exposes OEMs to price shifts and tariffs, especially in markets like the US and India. Furthermore, the lack of uniform regulations on speed, safety, and road classification creates uncertainty for OEMs and users.

KEY TAKEAWAYS

-

BY USAGEThe mountain & trekking eBikes segment is expected to grow rapidly. These bikes use motors with over 70 Nm torque and batteries exceeding 650 Wh for climbing and long-distance touring. Asia Oceania (China, Japan, South Korea) leads in urban bike adoption, which is quickly expanding in European and North American cities.

-

BY CLASSClass-I eBikes are projected to have the largest share, especially in Europe and Asia Oceania, where regulations define Class-I as standard pedal-assist eBikes exempt from registration. Class II eBikes are gaining traction in North America, as they are legal in 30+ US states. eBikes equipped with ≤250 W motors and providing pedal-assist only up to 25 km/h are classified as standard bicycles. They do not require registration, a license, or insurance. In contrast, eBikes that offer assistance up to 45 km/h and have motor power up to 4 kW are classified as mopeds. These require registration, insurance, and the use of a helmet.

-

BY DRIVE SYSTEMChain drives deliver strong torque transfer, making them suitable for high-performance eMTBs and cargo eBikes. This segment dominates in terms of volume, especially in the sports and MTB categories. The belt drives segment is growing rapidly, especially in North America and urban markets, due to their quiet operation, low upkeep, and suitability for daily commuting.

-

BY MODEPedal-assist eBikes are categorized as Class I (up to 20 mph) and Class III (up to 28 mph) in North America. In the EU, they are limited to 25 km/h with 250W for bicycle-equivalent classification. Throttle-assist eBikes usually fall under Class II in North America (up to 20 mph with throttle).

-

BY REGIONThe Asia Oceania region dominates the market for eBikes under 40 Nm due to a strong demand for affordable and low-speed models, which aligns with regional regulations in countries like India. Key players in China, such as Yadea and AIMA Technology Group Co., Ltd., offer eBike models that feature large-capacity batteries. Popular models include the Mtb Pedelec eBike M4, the City E-spresso eBike Pedelec T5 700c, and the Airwheel E19B101.

-

COMPETITIVE LANDSCAPEKey players in the eBike market are Pon. Bike (Netherlands), Accell Group N.V. (Netherlands), Giant Manufacturing Co., Ltd. (Taiwan), Yadea Group Holdings, Ltd. (China), and Merida Bicycle (Taiwan). Key strategies adopted to maintain their position in the global eBike market are vital global networking, mergers and acquisitions, partnerships, and technological advancement.

The eBike market is witnessing strong growth, driven by multiple factors. Advancements in battery technology are improving efficiency and affordability, enabling longer ranges at lower costs. At the same time, the integration of IoT and app-based connectivity is enhancing user experience for both individual commuters and commercial fleets. In congested urban areas, eBikes present a highly cost-effective mobility solution, with operating costs significantly lower than those of cars or conventional two-wheelers. Their low ownership and maintenance expenses, coupled with government incentives and the development of dedicated infrastructure, are further strengthening their appeal.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The eBike market is evolving quickly, driven by technological innovation, changing consumer preferences, and supportive regulations. Key trends such as connected mobility, lightweight components, and smart drive systems are enhancing product capabilities. Additionally, disruptions like micro-mobility platforms, last-mile delivery solutions, and fleet management are transforming business models. Together, these factors are creating new revenue streams and competitive opportunities, positioning eBikes as a vital component of sustainable urban transportation in the future.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising demand for micro-mobility services

Level

-

Varied government regulations and the need for proper infrastructure in emerging economies

Level

-

Developments in drive motors for improved performance of eBikes.

Level

-

High price of eBikes

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising demand for micro-mobility services

The rise of micro-mobility as a service (MaaS) is accelerating global eBike adoption by reducing ownership barriers and boosting awareness through higher utilization rates and extended service range per charge. Also, eBikes allow riders to cover 30–40% longer trips than pedal bikes. Companies like Lime, Bird, Dott, and Lyft are expanding services, with 2024 seeing a sharp rise in shared eBike usage. Lyft alone reports 41 million rides in US cities. Supported by city partnerships, infrastructure upgrades, and digital systems, countries such as the US, Germany, France, China, and India are witnessing strong eBike growth driven by MaaS integration.

Restraint: Varied government regulations and the need for proper infrastructure in emerging economies

Different countries have different rules for motor power, speed, licensing, and registration. For example, the US uses a three-class system with speeds up to 45 km/h. The EU limits standard pedelecs to 250W and 25 km/h, and they only require licenses and insurance for speed pedelecs. China restricts eBikes to 400W and 25 km/h with mandatory registration, while Japan enforces even stricter limits and classifies throttle eBikes as mopeds. Besides regulations, adoption in emerging economies of Asia Oceania is slowed down by a lack of infrastructure like dedicated bike lanes, safe parking, and charging stations. These regulatory differences and infrastructure gaps together create big barriers to widespread eBike use worldwide.

Opportunity: Developments in drive motors for improved performance of eBikes

The rapid growth of compact, high-performance drive motors offers a significant opportunity for the eBike market. Innovations such as mid-drive systems that provide higher torque, energy-efficient integration, and smart features like regenerative braking and anti-theft functions are enhancing performance and riding experience. Collaborations between OEMs and suppliers, along with acquisitions like Yamaha’s purchase of Brose’s eBike division, demonstrate the industry’s focus on in-house innovation and differentiation. These advancements enable manufacturers to produce lightweight, powerful, and premium eBikes, boosting competitiveness in both commuter and high-end segments.

Challenge: High price of eBikes

Despite strong demand, the high cost of eBikes remains a significant barrier to adoption, especially in price-sensitive areas. While typical models cost between USD 1,500 and 1,700, premium models can reach up to USD 5,000, which exceeds the price of traditional bicycles. In markets like North America and Europe, consumer demand for advanced technology drives prices higher, whereas in Asia, affordability restricts widespread adoption. Policy measures, such as China’s requirement for lithium-ion batteries and trade-in subsidies, have phased out cheaper but less efficient models, further increasing costs. To tackle this issue, OEMs are exploring production efficiencies, local manufacturing, and incentive-based strategies to make eBikes more affordable without sacrificing performance.

MARKET ECOSYSTEM

The ecosystem analysis highlights various eBike market players, primarily represented by raw material suppliers, component manufacturers, eBike manufacturers, and end users.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Electric Bike Market, By Usage

Mountain and trekking eBikes are becoming increasingly popular because of their strong performance and versatility. Meanwhile, cargo eBikes are predicted to grow at the fastest pace. They offer a cost-effective and eco-friendly alternative to traditional delivery vehicles, especially for short-distance trips.

Electric Bike Market, By Class

Class I eBikes currently dominate the market owing to their affordability and widespread adoption for commuting purposes. Conversely, Class III eBikes are anticipated to experience the most rapid growth, as consumers increasingly favor higher speed, efficiency, and performance for extended urban commutes. The United States and Canada are notably promising markets for Class III eBikes, as regulations are progressively permitting the use of Class III eBikes on city streets and shared pathways.

Electric Bike Market, By Component

The eBike market is segmented by component into batteries, electric motors, frames with forks, wheels, crank gears, motor controllers, and brake systems. These are offered as standard components in all eBikes. Lithium-ion batteries replaced lead-acid ones in eBikes because they are lighter and store more energy, which boosts efficiency. They also last longer and charge faster, providing better performance and convenience. >70 Nm motors are growing faster in eBikes because riders demand higher torque for better acceleration, hill climbing, and carrying loads. They also enable premium performance and off-road applications, driving adoption in both urban and recreational segments.

Electric Bike Market, By Drive Type

The eBike market can be segmented by drive type, primarily into chain drive and belt drive systems, each offering distinct advantages based on use case, maintenance needs, and performance preferences. Chain drive is dominating the market due to its cost-effectiveness, higher torque handling, and wide compatibility. Belt drives are more expensive, but are gaining traction for their low maintenance, quieter operation, and longer lifespan, aligning with premium and urban mobility segments.

Electric Bike Market, By Mode

In this segment, eBikes are broadly grouped by mode into pedal-assist systems, which activate the motor only when the rider pedals, and throttle-based systems, which operate the motor on demand without pedaling. Major OEMs continue to invest in the pedal-assist segment with new product launches. North America accounts for the largest market share for throttle-assist eBikes, driven by supportive regulations, a strong consumer preference for convenient and low-effort commuting, and the popularity of eBikes among delivery workers and casual riders.

Electric Bike Market, By Ownership

The global eBike market is divided into two main categories based on ownership: personal and shared mobility. Personally owned eBikes are the dominant segment, particularly in regions such as Europe, North America, and Asia-Oceania. These bikes are commonly used for daily commuting, fitness, and recreational activities. Consumers tend to prefer Class I and Class III pedal-assist bikes for personal use because of their longer range, comfort, and conformity with regulations for urban road use. On the other hand, shared eBike services are increasingly available through public bike-sharing programs, which are rapidly expanding in urban areas across Europe and the United States.

Electric Bike Market, By Speed

An eBike is assisted by a motor and a battery for easy riding. Since the motor helps in the pedaling/throttling of the cyclist, the speed of an eBike is greater than that of a conventional bike. The speed that an eBike can reach depends on the electric motor's power and other factors. Based on geographic location, the regulations for eBike speed vary. For instance, in the US, the top speed allowed for eBikes is up to 45 km/h, and in Europe, higher speeds up to 45 km/h with motor assistance may require registration, licensing, and insurance.

Electric Bike Market, By Battery Capacity

Battery capacity plays a crucial role in determining the range, performance, and application of an eBike. Lower-capacity batteries (<250W) are typically found in urban commuter and folding eBikes, offering lightweight and cost-effective solutions. Mid-range capacities (250–650W) are popular across multi-purpose, city, and eMTBs, balancing power and efficiency. High-capacity batteries (>650W) are increasingly used in cargo eBikes, long-range tourers, and performance eMTBs, where extended range and high torque are essential.

Electric Bike Market, By Battery Integration

The placement of batteries in an eBike substantially influences its performance, weight distribution, and handling characteristics. Internally or integrated batteries are built into the frame, offering a more streamlined and aesthetically cohesive appearance that harmonizes with the overall design of the eBike. Conversely, externally mounted batteries are more conspicuous and facilitate easier removal. Currently, the integrated battery configuration is predominant in the eBike market, primarily owing to its design advantages and superior performance. By embedding the battery within the frame, manufacturers such as Trek (US), Pedego Electric Bikes (US), and Giant Bicycles (Taiwan) enhance weight distribution, thereby improving handling and ride stability.

Electric Bike Market, By Battery Type

The lithium-ion battery has become the standard type and is estimated to make up more than 90% of the market. Lithium-ion polymer batteries are expected to outperform lithium-ion batteries in terms of range and power. However, their high cost limits their widespread use. Lead-acid batteries are the most affordable and are in the process of phase-out because they are vulnerable and do not last long. Other battery types, such as nickel-metal hydride (NiMH), lithium-cobalt (LCO), lithium-magnesium (LiMg204), and graphene-lithium batteries, are emerging technologies with potential to enter the eBike market during the forecast period.

Electric Bike Market, By Battery Voltage

The eBike market is categorized by battery voltage into three segments: less than 39V, 39V to 45V, and 45V to 51V. Higher voltage batteries deliver greater power and efficiency compared to their lower voltage counterparts. A higher voltage allows the battery to supply more power to the motor, resulting in faster acceleration and improved hill-climbing ability. Conversely, lower voltage batteries are more affordable and lightweight, making them suitable for casual riders or those with shorter commutes, as they provide sufficient power for everyday use. The segment with batteries under 39V is expected to dominate the market during the forecast period due to its affordability and capability to power eBikes effectively.

Electric Bike Market, By Motor Power (NM)

Torque, measured in Newton-meters (Nm), is a crucial factor for assessing eBike performance. It directly influences acceleration, hill-climbing ability, and the efficiency of carrying loads. The segment of torque ranging from over 40 to under 70 Nm dominates the eBike market, as it meets the torque needs of multi-purpose and urban eBikes. These types of eBikes typically require around 40 to 60 Nm for optimal overall performance.

Electric Bike Market, By Motor Weight

The weight of an eBike motor significantly impacts overall efficiency, handling, and ride quality. As eBikes become more popular for urban, recreational, and performance-based uses, manufacturers are innovating to provide optimized power-to-weight ratios tailored to specific rider needs. Motors weighing under 2 kg are typically found in lightweight city eBikes, folding bikes, and some gravel or endurance models. The 2 to 2.4 kg category strikes a balance between weight and power. In contrast, motors exceeding 2.4 kg are commonly used in high-performance eBikes, including electric mountain bikes (eMTBs), cargo bikes, and speed pedelecs.

Electric Bike Market, By Motor Power (Watt)

Watt (W) indicates the amount of power a motor can deliver to help the rider. It is broken down into peak and continuous power. Regulations differ by country and region. In some places, eBikes are considered bicycles and follow bicycle laws, while in others, they are treated as motor vehicles and face stricter rules. Motors with higher wattage may have restrictions or require special permits. In Europe, eBikes are limited to 250W when used on public roads for safety and regulation reasons.

Electric Bike Market, By Motor Type

eBike motors are primarily hub-drive and mid-drive, each with strategic advantages. Hub motors dominate low to mid-range models due to lower cost and simpler integration, supporting rapid scalability in price-sensitive markets. Mid-drive motors, offering superior torque, hill-climbing ability, and better weight distribution, are strategically positioned in premium and performance eBikes, enabling OEMs to differentiate on efficiency and rider experience.

REGION

Asia Oceania is expected to be the largest region in the global eBike market during the forecast period.

Asia Oceania continues to be the largest eBike market globally in terms of production and sales, with China maintaining a leading position in both regional and global contexts. In 2024, China constituted approximately 85% of the global eBike unit volume, thereby reaffirming its preeminent status in manufacturing and consumption. Taiwan, which hosts major OEMs such as Giant Manufacturing, exported around 686,000 eBikes in 2023, with export volume in the first quarter of 2025 stabilizing at approximately 90,600 units—representing a 9% year-on-year reduction—indicating a potential recovery from previous oversupply challenges. Within the Asia Oceania region, urban and city eBikes are predominant due to persistent traffic congestion and a growing trend among consumers towards health-conscious transportation options. Concurrently, mountain and trekking eBikes are increasingly prevalent among adventure-oriented riders. Class?I pedal-assist models continue to dominate markets such as China, Japan, South Korea, and Taiwan, where regulatory frameworks favor the use of such bicycles.

e-bike market: COMPANY EVALUATION MATRIX

The microquadrant offers information on major players providing eBikes and presents the findings and analysis of each vendor's performance within the set criteria. The company evaluation matrix for the eBike market ranks players based on market share and product footprint. Firms in the Stars quadrant, such as Pon. Bike, lead the eBike market with a strong presence and a diverse product portfolio.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Pon.Bike (Netherlands)

- Accell Group N.V. (Netherlands)

- Giant Manufacturing Co., Ltd. (Taiwan)

- Merida Industry Co., Ltd. (Taiwan)

- Yamaha Motor Co., Ltd. (Japan)

- Specialized Bicycle Components Inc (US)

- Trek Bicycle Corporation (US)

- Cube (Germany)

- Yadea Group Holdings Ltd. (China)

- AIMA Technology Group Co. Ltd. (China)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2025 | USD 54.12 billion |

| Revenue Forecast in 2032 | USD 87.15 billion |

| Growth Rate | 7.0% |

| Years Considered | 2021 – 2032 |

| Base Year | 2024 |

| Forecast Period | 2032 |

| Units Considered | Value (USD Million), Volume (Thousand Units) |

| Report Coverage | Revenue Forecast, Regional Market Share, Competitive Landscape, Driving Factors, Trends & Disruption, OEM Analysis, Bill of Materials, Total Cost of Ownership, OEM Analysis and Others |

| Segments Covered |

|

| Regional Scope | Asia Oceania, Europe, and North America |

WHAT IS IN IT FOR YOU: e-bike market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| EU and US Sales Volume |

|

|

| E-bike OEM-wise global Market Share | OEM-wise global market share for Accel Group, Pon.Bike, GIANT, MERIDA, DECHATHLON, YAMAHA, CUBU, TREK, Specialized, 2023 – 2024 |

|

| E-Bike Drive Unit | Global Drive Unit Market Share: Bosch, Shimano, Yamaha, Brose, Bafang, Panasonic, 2023 – 2024 |

|

RECENT DEVELOPMENTS

- March 2025 : Accell Group officially opened a new KOGA Experience Center in Heerenveen, Netherlands. The latest KOGA models are on display and available for test rides at this center, which shows Accell’s commitment to maintaining premium bike manufacturing in Heerenveen, Netherlands.

- March 2025 : Brose SE sold its eBike drives business to Yamaha Motor Co., Ltd., pending approval from antitrust authorities. Yamaha Motor's eBike Systems GmbH will take over the eBike drive and systems business. Going forward, Yamaha will utilize Brose's development resources in the eBike sector to further improve the planning and design of new products.

- March 2025 : Giant Group announced a new operations facility in Kunshan, China. The 17,000?m² building will feature a Bike Park experience zone and an e-commerce operations center.

- December 2024 : Accell Group signed a four-year partnership with the Dutch cycling team, Team Picnic PostNL. Its Lapierre brand became the team’s bike sponsor, while XLC (Accell’s European brand) supplied accessories and travel essentials. The partnership took effect on January 1, 2025.

- May 2024 : Yadea introduced the UFO S, a compact foldable electric bicycle, at China Cycle 2024. Engineered for urban commuting, it is equipped with 14-inch tires, a 250W rear hub motor with a peak output of 420W, and a maximum speed of 25 km/h.

Table of Contents

Methodology

The research study involved various secondary sources, such as company annual reports/presentations, industry association publications, e-bike magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases, which were used to identify and collect information for an extensive study of the e-bike market. Primary sources—experts from related industries, automobile OEMs, and suppliers—were interviewed to obtain and verify critical information and assess prospects and market estimations.

Secondary Research

Secondary sources for this research study included the e-bike industry association, internal databases, corporate filings (such as annual reports, investor presentations, and financial statements), and data from trade and business. Secondary data was collected and analyzed to determine the overall market size, further validated by primary research.

Primary Research

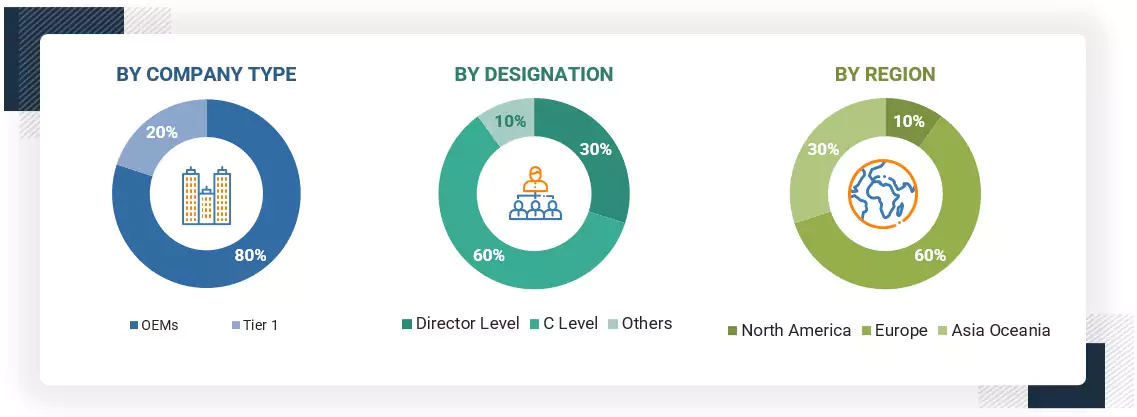

In the primary research process, several primary interviews were conducted with market experts from the demand and supply sides across three major regions: North America, Europe, and Asia Oceania. 20% and 80% of primary interviews were conducted with the OEMs and Tier-1 players, respectively.

Primary data was collected through questionnaires, e-mails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in the report. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to validate the findings from the primaries. This and insights by in-house subject-matter experts led to the conclusions described in the remainder of this report.

Note: Others include sales, marketing, and product managers.

Source: Secondary Research, Primary Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

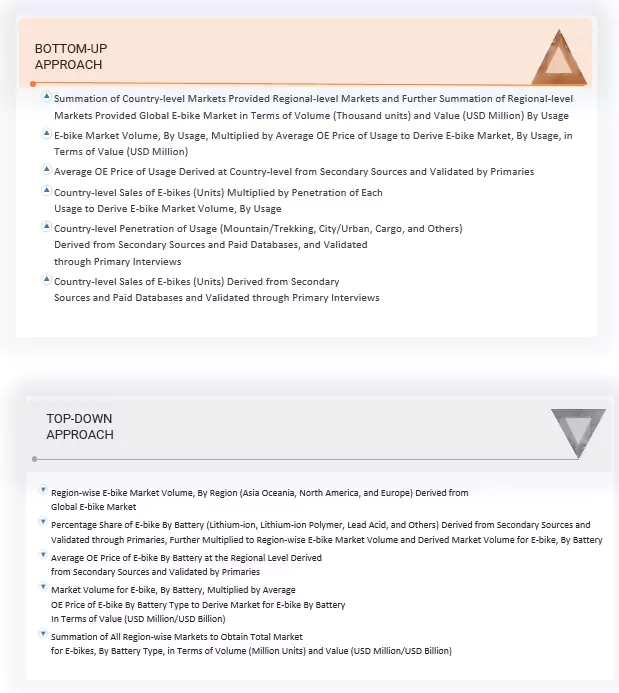

The bottom-up approach was used to derive the e-bike market size based on volume and value. This was followed by primary interviews and feature mapping on a regional basis from the MarketsandMarkets repository.

The market size was validated through in-depth interviews with industry experts—excerpts available in the discussion guide in the appendix—and secondary research. The report-writing phase began after arriving at the final numbers for the market size.

By estimating the regional market size for e-bikes by battery type, the global e-bike market was derived in terms of volume. The percentage share of e-bikes by battery type (lithium-ion, lithium-ion polymer, lead-acid, and others) was derived from secondary sources and validated through primary sources. It was multiplied by the region-wise e-bike market volume. The market volume for e-bikes, by battery type, was derived from this. The average OE price of an e-bike by battery type at the regional level was derived from secondary sources, and primary sources validated the same. The market volume for e-bikes, by battery type, was multiplied by the average OE price of e-bikes. The market for e-bikes by battery type was derived in terms of value (USD million). All region-wise markets were summed to obtain the total market for e-bikes by battery type in terms of volume (thousand units) and value (USD million).

A similar approach was followed to obtain the e-bike market by motor type, mode, component, and speed.

Market Size Estimation Methodology-Bottom-up approach

The bottom-up approach was used to estimate and validate the size of the e-bike market by usage. Country-level e-bike sales (in terms of volume) were derived from secondary sources such as country-wise manufacturing associations. They paid for databases and validated them through primary interviews to determine the size of the e-bike market by class and usage in terms of volume. Country-level penetration by usage type (mountain/trekking bikes, city/urban, cargo, and others) was derived from secondary sources and paid databases and validated through primary interviews.

The market was then forecasted based on various parameters such as analysis of the historical data, market trends, and growth drivers such as increasing bike sales, an increase in infrastructural development activities, economic conditions, and government incentives and subsidies. Technological advancements in e-bike motors, emerging market opportunities, and competitive landscape assessments were also considered to arrive at the country-wise forecast of the e-bikes by usage.

The country-level e-bike sales (by volume) were multiplied by the penetration of each usage type. The e-bike market volume, by usage type, was derived through this. The average OE price by usage type was derived from secondary sources, and primary sources validated the same. The e-bike market volume, by usage, was multiplied by the average OE usage price. The e-bike market, by usage type, in terms of value (USD million), was derived through this. The summation of country-level markets provided the regional-level market. Further summation of the regional-level markets provided the global e-bike market in terms of volume (thousand units) and value (USD million) by usage.

E-bike Market : Top-Down and Bottom-Up Approach

Data Triangulation

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All parameters expected to affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, supplemented with detailed inputs and analysis from MarketsandMarkets, and presented in the report.

Market Definition

An e-bike is a bicycle with a small electric motor and a rechargeable battery to assist the power provided by the rider. The batteries can be recharged by connecting them to a plug. A typical e-bike needs 6 to 8 hours to charge the battery and has a range of 35 to 50 km at a speed of about 20 km/h.

Stakeholders

- E-bike manufacturers

- E-bike battery & motor manufacturers

- Component suppliers for e-bikes

- Raw material suppliers for e-bikes

- Country-level associations

- Traders, distributors, and suppliers of e-bikes

Report Objectives

-

To define, describe, and forecast the size of the global e-bike market in terms of value (USD million) and volume (thousand units)

- By Class (Class-I, Class-II, Class-III) at the regional level

- By Speed (up to 25 km/h, 25-45 km/h) at the regional level

- By Battery Type (Lithium-ion, Lithium-ion Polymer, Lead Acid, and Others) at the regional level

- By Motor Type (Hub and Mid) at the regional level

- By Mode (Pedal Assist and Throttle) at the regional level

- By Component (Batteries, Electric Motors, Frames With Forks, Wheels, Crank Gears, Brake Systems, and Motor Controller) at the regional level

- By Usage (Mountain/Trekking, City/Urban, Cargo, and Others) at the regional level

- By Ownership (Shared and Personal)

- By Battery Capacity (<250W, >250 & <450W, >450 & <650W, and >650W)

- By Motor Weight (<2 kg, >2 kg & <2.4 kg, >2.4 kg)

- By Motor Power (<40nm, >40nm-<70nm, >70nm)

- Country-level analysis of class-wise and usage-wise segments (Asia Oceania, Europe, and North America)

- To understand the dynamics (drivers, restraints, opportunities, and challenges) of the market

- To strategically analyze the market with trade analysis, pricing analysis, recession impact, case study analysis, patent analysis, technology analysis, regulatory analysis, key conferences and events, bill of material, the total cost of ownership, pricing analysis trends/disruptions impacting buyers, financial matrix, investment, and funding case scenario

- To analyze the competitive landscape of the global players in the market, along with their market share/ranking

- To analyze the competitive leadership mapping of the global and regional e-bike manufacturers and e-bike component suppliers in the market

- To analyze a detailed listing of OEMs and their brands, OEM-wise technical specifications, mergers & acquisitions, partnerships, collaborations, expansions, and new product launches/developments undertaken by critical participants in the market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations per company-specific needs. The following customization options are available for the report:

BY DESIGN

- Foldable

- Unfoldable

BY FRAME MATERIAL

- Carbon Fiber

- Carbon Steel

- Aluminum

- Aluminum Alloy

Key Questions Addressed by the Report

What is the current size of the global e-bike market?

The global e-bike market is projected to reach USD 87.15 billion by 2032, up from USD 54.12 billion in 2025, with Asia Oceania dominating the market.

Which class type is currently leading the e-bike market?

Class I is leading the class-type segment of the electric bike market. Class I e-bikes, with their pedal-assist only functionality and speed limit (typically 25 km/h or 15 mph), often need more regulations than higher-powered Class II or III e-bikes.

Many companies operate in the e-bike market worldwide. Do you know who the front leaders are and what strategies they have adopted?

The e-bike market is dominated by major players such as Pon. Bike (Netherlands), Accell Group N.V. (Netherlands), Giant Manufacturing Co., Ltd. (Taiwan), Yadea Group Holdings, Ltd. (China), and Merida Bicycle (Taiwan). Their key strategies include mergers and acquisitions, partnerships, and technological advancements.

How does the demand for e-bikes vary by region?

Asia Oceania is the largest e-bike market in terms of manufacturing and sales. China is currently the largest market for e-bikes in the region, followed by Japan, India, South Korea, Taiwan, and Australia.

What are the drivers and opportunities for electric bike manufacturers?

The growth of the e-bike market is expected mainly due to growing traffic congestion in cities, the growing popularity of electric mountain bikes (e-MTBs), and government support for increasing e-bike sales in support of lower-emission transportation commutes.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the E-bike Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in E-bike Market

luna

Apr, 2021

Merida Industry Co., Ltd is a Taiwan-based company.

User

Jan, 2021

We are an electric bike brand and we are interested in obtaining this report. .

Daniela

Feb, 2020

Is it possible to discuss the market segmentation by the country-level?.

MnM Analyst

May, 2020

Market Segment is already discussed at country level. Do you have any specific requirement?.

Ekaterina

Jul, 2022

Profiles of key players in U.S market, their product portfolio analysis, organic and in-organic growth strategies, contract awarded & details of the contracts, key investments and all other key development including SWOT analysis will be provided. Similarly, for the E-Scooter and E- Motorcycles market we will provide the historical units sales data and revenues and growth forecast. Profiles of key players in U.S market, their product portfolio analysis, organic and in-organic growth strategies, contract awarded & details of the contracts, key investments and all other key development including SWOT analysis will be provided. Demographic analysis is only done from qualitative standpoint, and we have covered the buyer behaviour analysis by age, however we have provided the market size and growth forecast by Usage – (Mountain, Trekking, City/Urban, Cargo, Others), at a regional level and country level. for the E-Scooter and E- Motorcycles market we will provide the historical units sales data and revenues and growth forecast. .

Sofia

Jul, 2022

E-Bike market report was published early this year, and this new version has an improved scope and we have provided the regional and country level market size and growth forecast in terms of unit sales and revenues further broken down by By Class, By Usage, By Battery, By Speed, By Motor and By Mode and Average Selling Price by segments.Market share analysis of key players, including their revenue analysis for last three years, product and business revenues, key financial analysis, organic and in-organic growth strategies, contract awarded & details of the contracts, key investments and expansions plans in terms of production and market penetration, and all other key development including SWOT analysis are provided for all global and regional players..

Jo

Jul, 2020

There is no reference to RAD BIkes in the report and yet they appear to be taking the US market by storm.... am I missing something?.

apoorv

Jul, 2019

I may be interested in buying your E-bike market report and like to get a better idea of scope and contents..

Akshit

Jun, 2019

Looking for e-bike market potential and forecasting data. To analyse and size the market for investment potential for Valeo. .

User

Jun, 2019

The following are the specific items that we are looking to gather from the e-bike report: 1) market size ($) breakdown by geography 2) market size forecast overall and by geography 3) volume (units) breakdown by geography 4) Market share breakdown by key buyers (e.g. OEMs) 5) Total available market for connected services overall and by geography 6) Connected Services market share by competition 7) Percentage of OEMs producing connected solutions in-house vs outsourcing 8) What jobs are OEMs trying to accomplish with connected services 9) What are some pains OEMs are experiencing with connected services, how are they trying to solve them 10) What are some gains that OEMs are creating through connected service solutions Please let me know which items would be available in the report and which portion(s) of the report they would be contained in. If this would be best addressed in a conversation, do you have availability to speak, preferably tomorrow - my phone number should be attached. Thank you.

Nilesh

Jun, 2019

We are building a global e-bike brand and we would like to have access to the report to get more information and identify opportunities to prepare our master plan for the next five years.

Nilesh

Jun, 2019

We are the biggest lead-acid battery in North America and we are seeing the market for electric bikes growing. So, we would like to understand more about this market in South America..

Nilesh

Jun, 2019

Would like to know the current Global Market scenario in E-bike and accordingly what is the future of this category in India.

Atul

May, 2019

I`m trying to make a general view of the electro bikes and other electric two wheels vehicles, use in mexican cities and their potential to reduce criteria pollutants as a substitute of internal combustion engines vehicles..