2

RESEARCH METHODOLOGY

43

5

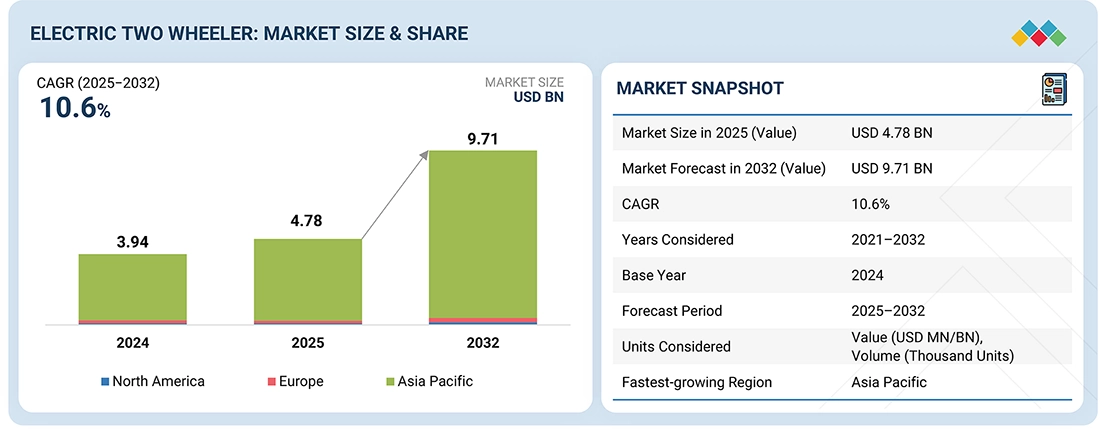

MARKET OVERVIEW

Fleet electrification and modular platforms drive innovation in urban mobility and battery systems.

68

5.2.1.1

FLEET ELECTRIFICATION FOR URBAN AND COMMERCIAL MOBILITY

5.2.1.2

ADVANCEMENTS IN BATTERY SYSTEMS

5.2.1.3

COLLABORATIONS BETWEEN OEMS, ELECTRIC TWO WHEELER MANUFACTURERS, AND FLEET OPERATORS

5.2.2.1

CHARGING INFRASTRUCTURE GAPS IN MANY EMERGING ECONOMIES AND RANGE PERFORMANCE ISSUES

5.2.2.2

BATTERY HEATING PROBLEMS AND LONG CHARGING TIMES

5.2.3.1

LIGHTWEIGHT DESIGN AND SHARED VEHICLE ARCHITECTURE INNOVATION

5.2.3.2

TRANSITION TO MODULAR AND SWAPPABLE ENERGY PLATFORMS

5.2.3.3

SOFTWARE ECOSYSTEM DEVELOPMENT AND DIGITAL VALUE CHAIN EXPANSION

5.2.4.1

RELIABILITY OF THERMAL AND POWER ELECTRONICS IN URBAN OPERATING CONDITIONS

5.2.4.2

LACK OF STANDARDIZATION IN BATTERY COMMUNICATION AND SWAPPING PROTOCOLS

5.3

UNMET NEEDS AND WHITE SPACES

5.3.1

UNMET NEEDS IN ELECTRIC TWO WHEELER MARKET

5.3.2

WHITE SPACE OPPORTUNITIES

5.4

INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

5.4.1

INTERCONNECTED MARKETS

5.4.2

CROSS-SECTOR OPPORTUNITIES

5.5

STRATEGIC MOVES BY TIER 1/2/3 PLAYERS

5.5.1

STRATEGIC MOVES BY TIER 1/2/3 PLAYERS

5.7

IMPACT OF GENERATIVE AI ON ELECTRIC TWO WHEELER MARKET

5.7.1

PRODUCT DESIGN AND DEVELOPMENT OPTIMIZATION

5.7.2

INTELLIGENT MANUFACTURING AND SUPPLY CHAIN EFFICIENCY

5.7.3

PERSONALIZATION AND USER EXPERIENCE ENHANCEMENT

5.7.4

ADVANCED BATTERY MANAGEMENT AND ENERGY OPTIMIZATION

5.8

ACOUSTIC VEHICLE ALERTING SYSTEM (AVAS) IN ELECTRIC 2-WHEELERS

5.8.1

REGULATORY FRAMEWORK AND MANDATES

5.8.2

AVAS INTEGRATION IN ELECTRIC TWO WHEELERS

5.8.3

COMPONENT ARCHITECTURE AND DESIGN TRENDS

5.8.4

FUTURE ADVANCEMENTS IN SOUND SIGNATURE AND SMART AVAS

5.8.4.1

DYNAMIC SOUND PROFILES

5.8.4.2

PSYCHOACOUSTIC TUNING

5.9

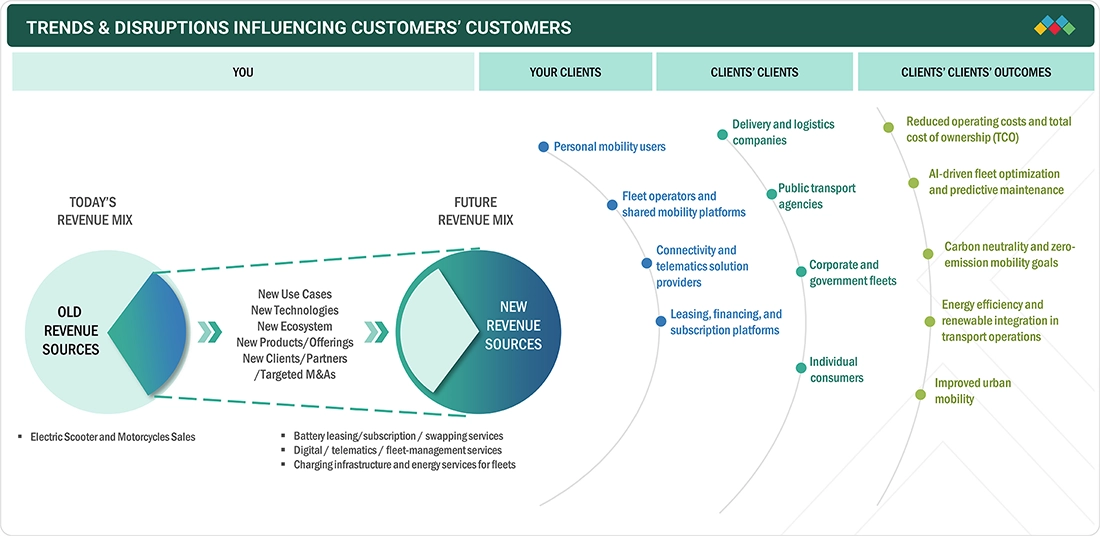

EMERGING BUSINESS MODELS IN ELECTRIC TWO WHEELER MARKET

5.9.1

SUBSCRIPTION-BASED AND LEASING MODELS

5.9.2

BATTERY SWAPPING AND ENERGY-AS-A-SERVICE (EAAS)

5.9.3

SHARED MOBILITY AND FLEET ELECTRIFICATION

5.9.4

BATTERY-AS-A-SERVICE (BAAS)

5.9.5

DIGITAL SERVICE MONETIZATION

5.10

KEY EMERGING TECHNOLOGIES

5.10.1

INTEGRATED POWERTRAIN MODULES

5.10.2

SOLID-STATE BATTERY (SSB)

5.10.3

SMART CHARGING SYSTEMS

5.11

COMPLEMENTARY TECHNOLOGIES

5.11.1

BATTERY SWAPPING IN ELECTRIC SCOOTERS

5.11.2

INTERNET OF THINGS IN ELECTRIC TWO WHEELERS

5.11.4

BATTERY-RELATED SERVICES

5.11.5

VEHICLE INTELLIGENCE & CONNECTIVITY STACK

5.12

TECHNOLOGY/PRODUCT ROADMAP

5.12.1

SHORT-TERM (2025-2027) | FOUNDATION AND EARLY COMMERCIALIZATION

5.12.2

MID-TERM (2028-2030) | EXPANSION AND STANDARDIZATION

5.12.3

LONG-TERM (2031-2035+) | MASS COMMERCIALIZATION & DISRUPTION

5.14

TOTAL COST OF OWNERSHIP

5.15.1

PRODUCTION CAPACITY OF KEY OEMS

5.15.2

TECHNOLOGICAL DEVELOPMENTS

5.15.2.4

PIAGGIO GROUP (VESPA/PIAGGIO)

5.15.2.7

NIU (CHINA/GLOBAL)

5.15.3

COMPARATIVE ANALYSIS OF MOTOR POWER AND VEHICLE RANGE ACROSS VOLTAGE LEVEL

5.16

FUTURE APPLICATIONS IN ELECTRIC TWO WHEELER ECOSYSTEM

5.16.1

BATTERY INNOVATIONS AND ENERGY STORAGE SYSTEMS

5.16.1.1

SOLID-STATE AND SEMI-SOLID BATTERIES

5.16.1.2

FAST CHARGING AND SMART CHARGING INFRASTRUCTURE

5.16.1.3

BATTERY MANAGEMENT SYSTEMS

5.16.1.4

SECOND-LIFE & RECYCLING

5.16.2

SMART/ADAPTIVE RIDE MODES AND AI

5.16.2.1

PERSONALIZED RIDE MODES

5.16.2.2

TERRAIN AND TRAFFIC ADAPTATION

5.16.3

ADVANCED RIDER/VEHICLE SAFETY SYSTEMS

5.16.3.1

AI-BASED COLLISION AVOIDANCE

5.16.3.2

CONNECTED HELMETS & WEARABLES

5.16.3.3

BLIND-SPOT MONITORING & ALERTS

5.16.4

ADVANCED RIDER/VEHICLE SAFETY SYSTEMS

5.16.4.1

VALET PARKING & REMOTE SUMMON

5.16.4.2

SELF-BALANCING & SELF-RIGHTING CONCEPTS

5.16.4.3

CONVOY/RIDE-FOLLOWING MODES

5.17

MACROECONOMICS INDICATORS

5.17.2

GDP TRENDS AND FORECAST

5.17.3

TRENDS IN GLOBAL TWO WHEELER INDUSTRY (INTERNAL COMBUSTION ENGINE AND ELECTRIC VEHICLES)

5.17.4

TRENDS IN GLOBAL AUTOMOTIVE & TRANSPORTATION INDUSTRY

5.18

TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

5.19.1

AVERAGE SELLING PRICE TREND, BY VEHICLE TYPE, 2022-2024

5.19.2

AVERAGE SELLING PRICE FOR VEHICLE TYPES BY KEY PLAYERS, 2024

5.19.3

AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024

5.20.1

RAW MATERIAL SUPPLIERS

5.20.2

COMPONENT SUPPLIERS

5.20.3

BATTERY PACK MANUFACTURERS/SUPPLIERS

5.20.4

CHARGING INFRASTRUCTURE PROVIDERS

5.20.5

ELECTRIC SCOOTER AND MOTORCYCLE MANUFACTURERS

5.21

SUPPLY CHAIN ANALYSIS

5.22.1

GENZE PARTNERED WITH LEEWAYHERTZ FOR INTEGRATION OF ELECTRIC SCOOTER WITH MOBILE APP

5.22.2

HERO ELECTRIC PARTNERED WITH EBIKEGO TO TRANSFORM LAST-MILE DELIVERIES

5.22.3

ZYPP ELECTRIC TO USE HERO ELECTRIC BIKES TO ELECTRIFY 100% LAST-MILE DELIVERY BY 2025

5.23

INVESTMENT AND FUNDING SCENARIO

5.24.1

IMPORT SCENARIO (HS CODE 871190)

5.24.2

EXPORT SCENARIO (HS CODE 871190)

5.25

KEY CONFERENCES AND EVENTS, 2025-2026

5.26

DECISION-MAKING PROCESS

5.27

BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

5.27.1

KEY STAKEHOLDERS IN BUYING PROCESS

5.28

ADOPTION BARRIERS AND INTERNAL CHALLENGES

5.29

REGULATORY LANDSCAPE AND COMPLIANCE

5.29.1

INDUSTRY STANDARDS

5.29.2

REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.30

SUSTAINABILITY INITIATIVES

5.30.1

CARBON FOOTPRINT REDUCTION THROUGH GREEN MANUFACTURING

5.30.1.1

RENEWABLE ENERGY IN FACTORIES

5.30.1.2

MATERIALS AND EFFICIENCY

5.30.1.3

CERTIFICATIONS AND TARGETS

5.30.2

ECO-APPLICATIONS AND ENVIRONMENTAL BENEFITS OF ELECTRIFICATION

5.30.3

LIFE-CYCLE ASSESSMENT (LCA) OF ELECTRIC TWO WHEELERS

5.30.3.1

ENERGY AND EMISSIONS BY PHASE

5.30.3.2

BATTERY PRODUCTION IMPACT

6

ELECTRIC TWO WHEELER MARKET, BY VEHICLE TYPE

Market Size & Growth Rate Forecast Analysis to 2032 in USD Million and Units | 14 Data Tables

143

6.2.1

GROWING FOCUS ON REDUCED EMISSIONS AND SUSTAINABLE MODELS TO DRIVE MARKET

6.3.1

RISING DEMAND FOR HIGH-PERFORMANCE AND LOW-MAINTENANCE MODELS TO DRIVE MARKET

7

ELECTRIC TWO WHEELER MARKET, BY VEHICLE CLASS

Market Size & Growth Rate Forecast Analysis to 2032 in USD Million and Units | 13 Data Tables

153

7.2.1

AVAILABILITY OF BUDGET-FRIENDLY FINANCING AND LEASING OPTIONS TO DRIVE MARKET

7.3.1

DEMAND FOR PREMIUM FEATURES AND TECHNOLOGY IN ELECTRIC TWO WHEELERS TO DRIVE MARKET

8

ELECTRIC TWO WHEELER MARKET, BY VOLTAGE TYPE

Market Size & Growth Rate Forecast Analysis to 2032 in USD Million and Units | 26 Data Tables

162

8.2.1

INCREASING DEMAND FOR SHORT COMMUTES TO DRIVE GROWTH

8.3.1

NEED FOR ADEQUATE POWER AND RANGE FOR URBAN AND SUBURBAN COMMUTING TO DRIVE GROWTH

8.4.1

EMERGING DEMAND FOR HIGH-PERFORMANCE ELECTRIC SCOOTERS TO DRIVE GROWTH

8.5.1

IMPROVED BATTERY TECHNOLOGY AND CHARGING INFRASTRUCTURE TO DRIVE GROWTH

8.6.1

INCREASED RANGE POTENTIAL AND HIGH-PERFORMANCE NEEDS TO DRIVE GROWTH

9

ELECTRIC TWO WHEELER MARKET, BY BATTERY TYPE

Market Size & Growth Rate Forecast Analysis to 2032 in USD Million and Units | 15 Data Tables

177

9.2.1

LOW RANGE AND PERFORMANCE TO DECREASE DEMAND

9.3.1

ADVANCEMENTS IN BATTERY TECHNOLOGY TO DRIVE MARKET

9.4

NICKEL METAL HYDRIDE (NIMH)

10

ELECTRIC TWO WHEELER MARKET, BY DISTANCE COVERED

Market Size & Growth Rate Forecast Analysis to 2032 in USD Million and Units | 17 Data Tables

187

10.2.1

DOMINANT USE IN CITIES FOR SHORT COMMUTES TO DRIVE MARKET

10.3.1

VERSATILITY AND RANGE ANXIETY REDUCTION TO DRIVE MARKET

10.4.1

DEVELOPMENTS IN BATTERY TECHNOLOGY TO DRIVE MARKET

11

ELECTRIC TWO WHEELER MARKET, BY USAGE

Market Size & Growth Rate Forecast Analysis to 2032 in USD Million and Units | 13 Data Tables

197

11.2.1

NEW RANGE OF PRODUCTS WITH REDUCED PRICES TO DRIVE MARKET

11.3.1

OPERATIONAL AND COST EFFICIENCY TO DRIVE MARKET

12

ELECTRIC TWO WHEELER MARKET, BY TECHNOLOGY TYPE

Market Size & Growth Rate Forecast Analysis to 2032 in USD Million and Units | 14 Data Tables

205

12.2.1

INCREASING NUMBER OF PUBLIC FAST CHARGING STATIONS FOR ELECTRIC TWO WHEELERS TO DRIVE MARKET

12.3.1

ENABLES QUICK REFUELING BY EXCHANGING DEPLETED BATTERIES FOR FULLY CHARGED ONES AT DESIGNATED STATIONS

13

ELECTRIC SCOOTER MARKET, BY MOTOR TYPE

Market Size & Growth Rate Forecast Analysis to 2032 in USD Million and Units | 13 Data Tables

214

13.2.1

HIGH TORQUE ADVANTAGE TO DRIVE MARKET

13.3.1

INCREASING PRODUCTION OF VEHICLES WITH IN-WHEEL ELECTRIC MOTORS TO DRIVE MARKET

14

ELECTRIC TWO WHEELER MARKET, BY MOTOR POWER

Market Size & Growth Rate Forecast Analysis to 2032 in USD Million and Units | 17 Data Tables

222

14.2.1

LOWER PRICE TAG THAN HIGHER-POWERED MODELS TO DRIVE MARKET

14.3.1

IMPROVED PERFORMANCE COMPARED TO LOWER-POWERED MODELS TO DRIVE MARKET

14.4.1

DEMAND FOR HIGH SPEED AND ACCELERATION WITH LONGER RANGE TO DRIVE MARKET

14.5

KEY PRIMARY INSIGHTS

15

ELECTRIC TWO WHEELER MARKET, BY REGION

Comprehensive coverage of 3 Regions with country-level deep-dive of 17 Countries | 104 Data Tables.

232

15.2.1

MACROECONOMIC OUTLOOK

15.2.2.1

INCREASING DEMAND FOR ELECTRIC SCOOTERS/MOPEDS IN METROPOLITAN CITIES TO DRIVE MARKET

15.2.3.1

INVESTMENT IN CHARGING INFRASTRUCTURE AND BATTERY SWAPPING TECHNOLOGIES TO DRIVE MARKET

15.2.4.1

INTRODUCTION OF BATTERY-AS-A-SERVICE MODEL TO DRIVE MARKET

15.2.5.1

LAUNCH OF INNOVATIVE MODELS BY DOMESTIC OEMS TO DRIVE MARKET

15.2.6.1

FOCUS ON ADVANCED ELECTRIC TWO WHEELER TECHNOLOGIES THAT ARE ENERGY-EFFICIENT AND ENVIRONMENTALLY FRIENDLY TO DRIVE MARKET

15.2.7.1

STRONG GOVERNMENT SUPPORT FOR ELECTRIC VEHICLE ADOPTION TO DRIVE MARKET

15.2.8.1

GROWTH OF ONLINE SALES OF ELECTRIC VEHICLES AND DOMESTIC MANUFACTURING TO DRIVE MARKET

15.2.9.1

INTRODUCTION OF BATTERY SWAPPING POINTS TO DRIVE MARKET

15.2.10.1

GROWING EV ECOSYSTEM TO SUPPORT MARKET GROWTH

15.2.11.1

SHIFT TOWARD SUSTAINABLE TRANSPORTATION TO DRIVE MARKET

15.3.1

MACROECONOMIC OUTLOOK

15.3.2.1

GOVERNMENT INCENTIVE PROGRAMS TO FUEL MARKET

15.3.3.1

GROWING DEMAND FOR ENERGY-EFFICIENT COMMUTING MODES TO DRIVE MARKET

15.3.4.1

NECP’S PLAN FOR FIVE MILLION ELECTRIC VEHICLES ON ROAD BY 2030 TO DRIVE MARKET

15.3.5.1

SUBSIDIES AND TAX EXEMPTIONS FOR ELECTRIC TWO WHEELERS TO DRIVE MARKET

15.3.6.1

INCREASING CONCERNS REGARDING TWO WHEELER CARBON EMISSIONS TO DRIVE MARKET

15.3.7.1

INCREASING PRESENCE OF KEY PLAYERS TO SUPPORT MARKET GROWTH

15.3.8.1

STRONG GOVERNMENT SUPPORT TO PROMOTE ELECTRIC TWO WHEELERS TO DRIVE MARKET

15.3.9.1

DEVELOPMENT OF CHARGING INFRASTRUCTURE TO DRIVE MARKET

15.3.10.1

GROWING FOCUS ON EMISSION REDUCTION TO DRIVE MARKET

15.3.11.1

GOVERNMENT SUPPORT TO DEVELOP CHARGING INFRASTRUCTURE TO DRIVE MARKET

15.4.1

MACROECONOMIC OUTLOOK

15.4.2.1

R&D OF NEW EV-RELATED TECHNOLOGIES TO DRIVE MARKET

15.4.3.1

HIGH DEMAND FOR ELECTRIC SCOOTERS AMONG YOUNG POPULATION TO DRIVE MARKET

16

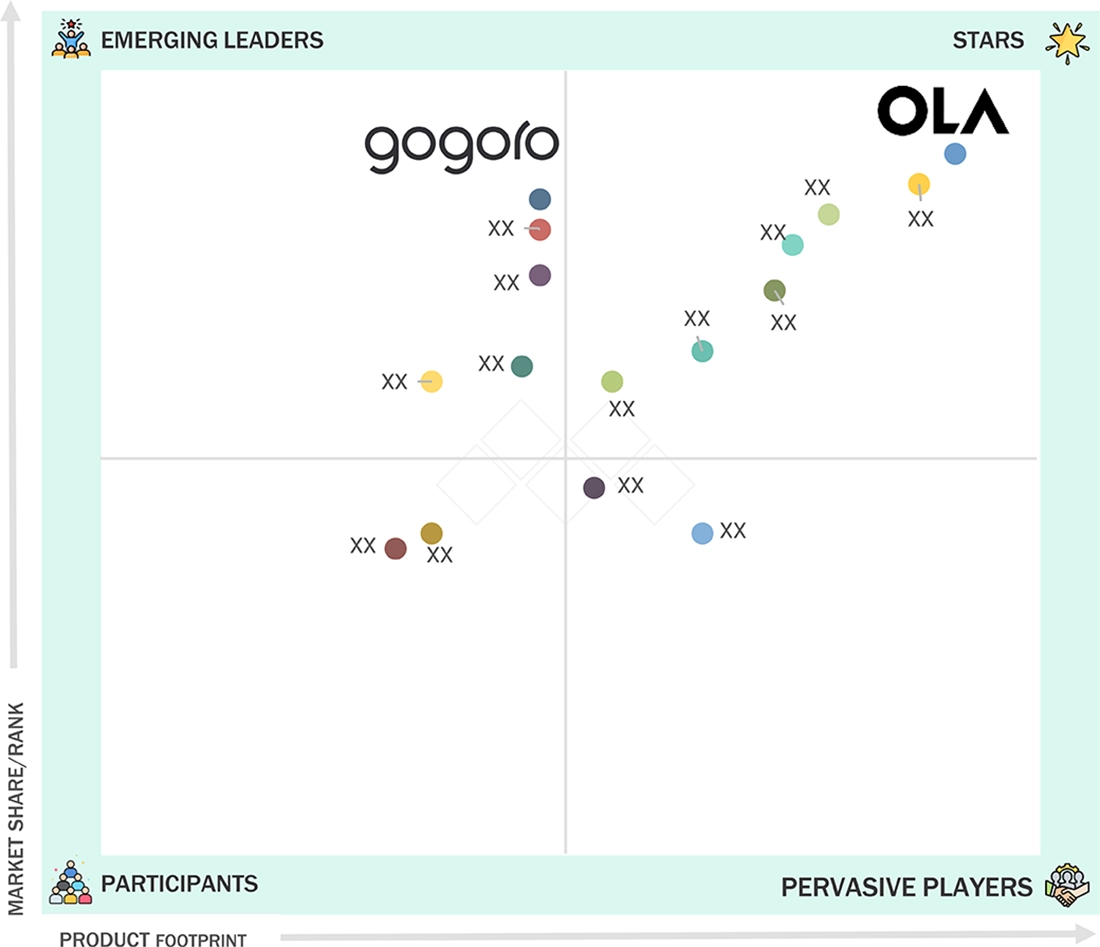

COMPETITIVE LANDSCAPE

Uncover top strategies and market leaders shaping the electric two-wheeler landscape.

284

16.2

KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022–2025

16.3

MARKET SHARE ANALYSIS OF ELECTRIC TWO WHEELER PROVIDERS, 2024

16.4

REVENUE ANALYSIS, 2020–2024

16.5

COMPANY VALUATION AND FINANCIAL METRICS

16.7

COMPANY EVALUATION MATRIX

16.8

STARTUP/SME EVALUATION MATRIX

16.8.1

PROGRESSIVE COMPANIES

16.8.2

RESPONSIVE COMPANIES

16.8.5

COMPETITIVE BENCHMARKING

16.8.5.1

KEY STARTUPS/SMES

16.8.5.2

COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

16.9

COMPETITIVE SCENARIO

16.9.1

PRODUCT LAUNCHES/DEVELOPMENTS

16.9.4

OTHER DEVELOPMENTS

17

COMPANY PROFILES

In-depth Company Profiles of Leading Market Players with detailed Business Overview, Product and Service Portfolio, Recent Developments, and Unique Analyst Perspective (MnM View)

303

17.1.1.1

BUSINESS OVERVIEW

17.1.1.2

PRODUCTS OFFERED

17.1.1.3

RECENT DEVELOPMENTS

17.1.5

YADEA TECHNOLOGY GROUP CO., LTD.

17.1.10

JIANGSU XINRI E-VEHICLE CO., LTD.

17.1.12

ASKOLL EVA S.P.A.

17.2.1

ULTRAVIOLETTE AUTOMOTIVE

17.2.2

REVOLT INTELLICORP PRIVATE LIMITED (REVOLT MOTORS)

17.2.3

Z ELECTRIC VEHICLE

17.2.5

LIGHTNING MOTORCYCLES

17.2.6

JOHAMMER E-MOBILITY GMBH

17.2.11

AIMA TECHNOLOGY GROUP CO., LTD.

17.2.12

HONDA MOTOR CO., LTD.

17.2.13

GREAVES ELECTRIC MOBILITY PRIVATE LIMITED (AMPERE VEHICLES)

17.2.14

DONGGUAN TAILING ELECTRIC VEHICLE CO., LTD.

17.2.16

TERRA MOTORS CORPORATION

17.2.17

NEXZU MOBILITY LTD. (AVAN MOTORS INDIA)

17.2.19

MAHINDRA & MAHINDRA LTD.

17.2.20

DAMON MOTORS INC.

17.2.21

VIAR MOTOR INDONESIA

17.2.26

PT VOLTA INDONESIA SEMESTA (VOLTA)

18.2

KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

18.3

CUSTOMIZATION OPTIONS

18.3.1

ELECTRIC SCOOTER MARKET, BY BATTERY TYPE AT COUNTRY LEVEL (FOR COUNTRIES COVERED IN THE REPORT)

18.3.2

PROFILING OF ADDITIONAL MARKET PLAYERS (UP TO 5)

TABLE 1

ELECTRIC TWO WHEELER MARKET DEFINITION, BY VEHICLE TYPE

TABLE 2

MARKET DEFINITION, BY BATTERY TYPE

TABLE 3

MARKET DEFINITION, BY TECHNOLOGY TYPE

TABLE 4

MARKET DEFINITION, BY VEHICLE CLASS

TABLE 5

MARKET DEFINITION, BY USAGE

TABLE 6

MARKET DEFINITION, BY MOTOR TYPE

TABLE 7

MARKET DEFINITION, BY MOTOR POWER

TABLE 8

MARKET DEFINITION, BY DISTANCE COVERED

TABLE 9

MARKET DEFINITION, BY VOLTAGE TYPE

TABLE 10

MARKET: INCLUSIONS AND EXCLUSIONS

TABLE 11

USD EXCHANGE RATES

TABLE 12

ELECTRIFICATION TARGETS OF KEY COUNTRIES IN ASIA PACIFIC

TABLE 13

ELECTRIC VEHICLE CHARGING POINTS, BY EMERGING ECONOMIES, 2024

TABLE 14

MODEL-WISE DRIVING RANGE OF ELECTRIC SCOOTERS AND MOTORCYCLES

TABLE 15

TIME REQUIRED TO CHARGE ELECTRIC SCOOTERS AND MOTORCYCLES

TABLE 16

IMPACT OF MARKET DYNAMICS

TABLE 18

OEMS WITH SUBSCRIPTION-BASED AND LEASING MODELS

TABLE 19

OEMS ADOPTING BATTERY SWAPPING AND ENERGY-AS-A-SERVICE BUSINESS MODELS

TABLE 20

COMPANIES ADOPTING SHARED MOBILITY AND FLEET ELECTRIFICATION BUSINESS MODELS

TABLE 21

OEMS OFFERING BAAS IN ELECTRIC TWO WHEELERS

TABLE 22

BILL OF MATERIALS FOR ELECTRIC SCOOTERS IN 2025

TABLE 23

BILL OF MATERIALS FOR ICE SCOOTERS IN 2025

TABLE 24

BILL OF MATERIALS FOR ELECTRIC MOTORCYCLES IN 2025

TABLE 25

BILL OF MATERIALS FOR ICE MOTORCYCLES IN 2025

TABLE 26

TCO COMPARISON: ELECTRIC VS. ICE SCOOTERS

TABLE 27

PRODUCTION CAPACITY OF KEY OEMS

TABLE 28

ANALYSIS OF MOTOR POWER AND VEHICLE RANGE ACROSS VOLTAGE LEVEL

TABLE 29

GDP PERCENTAGE CHANGE, BY KEY COUNTRY, 2021–2030

TABLE 30

AVERAGE SELLING PRICE TREND, BY VEHICLE TYPE, 2022-2024 (USD)

TABLE 31

AVERAGE SELLING PRICE OF ELECTRIC SCOOTERS BY KEY PLAYERS, 2024 (USD)

TABLE 32

AVERAGE SELLING PRICE OF ELECTRIC MOTORCYCLES BY KEY PLAYERS, 2024 (USD)

TABLE 33

AVERAGE SELLING PRICE TREND FOR ELECTRIC SCOOTERS, BY REGION, 2022-2024 (USD/UNIT)

TABLE 34

AVERAGE SELLING PRICE TREND FOR ELECTRIC MOTORCYCLES, BY REGION, 2022-2024 (USD/UNIT)

TABLE 35

ELECTRIC TWO WHEELER MARKET: ROLE OF COMPANIES IN ECOSYSTEM

TABLE 36

IMPORT DATA FOR HS CODE 871190, BY COUNTRY, 2021–2024 (USD MILLION)

TABLE 37

EXPORT DATA FOR HS CODE 871190, BY COUNTRY, 2021–2024 (USD MILLION)

TABLE 38

ELECTRIC TWO WHEELER MARKET: KEY CONFERENCES AND EVENTS, 2025–2026

TABLE 39

INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR ELECTRIC TWO WHEELERS (%)

TABLE 40

KEY BUYING CRITERIA

TABLE 41

SUBSIDY UNDER FAME II, BY VEHICLE TYPE

TABLE 42

CENTRAL AND STATE TAXES AND FEES FOR SELECT VEHICLES IN INDIA

TABLE 43

INDIA: GOVERNMENT INCENTIVES, BY STATE

TABLE 44

NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 45

EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 46

ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 47

STRATEGIC GREEN MANUFACTURING ACTIONS BY OEMS

TABLE 48

CONVENTIONAL VS. BATTERY ELECTRIC SCOOTER/MOPED AND MOTORCYCLE

TABLE 49

ELECTRIC TWO WHEELER MARKET, BY VEHICLE TYPE, 2021–2024 (THOUSAND UNITS)

TABLE 50

MARKET, BY VEHICLE TYPE, 2025–2032 (THOUSAND UNITS)

TABLE 51

MARKET, BY VEHICLE TYPE, 2021–2024 (USD MILLION)

TABLE 52

MARKET, BY VEHICLE TYPE, 2025–2032 (USD MILLION)

TABLE 53

POPULAR E-SCOOTER/MOPED AND E-MOTORCYCLE MODELS WORLDWIDE

TABLE 54

E-SCOOTER/MOPED: ELECTRIC TWO WHEELER MARKET, BY REGION, 2021–2024 (THOUSAND UNITS)

TABLE 55

E-SCOOTER/MOPED: MARKET, BY REGION, 2025–2032 (THOUSAND UNITS)

TABLE 56

E-SCOOTER/MOPED: MARKET, BY REGION, 2021–2024 (USD MILLION)

TABLE 57

E-SCOOTER/MOPED: MARKET, BY REGION, 2025–2032 (USD MILLION)

TABLE 58

E-MOTORCYCLE: MARKET, BY REGION, 2021–2024 (THOUSAND UNITS)

TABLE 59

E-MOTORCYCLE: MARKET, BY REGION, 2025–2032 (THOUSAND UNITS)

TABLE 60

E-MOTORCYCLE: MARKET, BY REGION, 2021–2024 (USD MILLION)

TABLE 61

E-MOTORCYCLE: MARKET, BY REGION, 2025–2032 (USD MILLION)

TABLE 62

ELECTRIC TWO WHEELER MARKET, BY VEHICLE CLASS, 2021–2024 (THOUSAND UNITS)

TABLE 63

MARKET, BY VEHICLE CLASS, 2025–2032 (THOUSAND UNITS)

TABLE 64

MARKET, BY VEHICLE CLASS, 2021–2024 (USD MILLION)

TABLE 65

MARKET, BY VEHICLE CLASS, 2025–2032 (USD MILLION)

TABLE 66

E-SCOOTER/MOPED AND E-MOTORCYCLE MODELS WORLDWIDE

TABLE 67

ECONOMY: MARKET, BY REGION, 2021–2024 (THOUSAND UNITS)

TABLE 68

ECONOMY: MARKET, BY REGION, 2025–2032 (THOUSAND UNITS)

TABLE 69

ECONOMY: MARKET, BY REGION, 2021–2024 (USD MILLION)

TABLE 70

ECONOMY: MARKET, BY REGION, 2025–2032 (USD MILLION)

TABLE 71

LUXURY: MARKET, BY REGION, 2021–2024 (THOUSAND UNITS)

TABLE 72

LUXURY: MARKET, BY REGION, 2025–2032 (THOUSAND UNITS)

TABLE 73

LUXURY: MARKET, BY REGION, 2021–2024 (USD MILLION)

TABLE 74

LUXURY: MARKET, BY REGION, 2025–2032 (USD MILLION)

TABLE 75

ELECTRIC SCOOTERS OFFERED BY OEMS, BY VOLTAGE TYPE

TABLE 76

ELECTRIC TWO WHEELER MARKET, BY VOLTAGE TYPE, 2021–2024 (THOUSAND UNITS)

TABLE 77

MARKET, BY VOLTAGE TYPE, 2025–2032 (THOUSAND UNITS)

TABLE 78

MARKET, BY VOLTAGE TYPE, 2021–2024 (USD MILLION)

TABLE 79

MARKET, BY VOLTAGE TYPE, 2025–2032 (USD MILLION)

TABLE 80

POPULAR E-SCOOTER/MOPED AND E-MOTORCYCLE MODELS AND THEIR BATTERY VOLTAGE

TABLE 81

36 V: ELECTRIC TWO WHEELER MARKET, BY REGION, 2021–2024 (THOUSAND UNITS)

TABLE 82

36 V: MARKET, BY REGION, 2025–2032 (THOUSAND UNITS)

TABLE 83

36 V: MARKET, BY REGION, 2021–2024 (USD MILLION)

TABLE 84

36 V: MARKET, BY REGION, 2025–2032 (USD MILLION)

TABLE 85

48 V: MARKET, BY REGION, 2021–2024 (THOUSAND UNITS)

TABLE 86

48 V: MARKET, BY REGION, 2025–2032 (THOUSAND UNITS)

TABLE 87

48 V: MARKET, BY REGION, 2021–2024 (USD MILLION)

TABLE 88

48 V: MARKET, BY REGION, 2025–2032 (USD MILLION)

TABLE 89

60 V: MARKET, BY REGION, 2021–2024 (THOUSAND UNITS)

TABLE 90

60 V: MARKET, BY REGION, 2025–2032 (THOUSAND UNITS)

TABLE 91

60 V: MARKET, BY REGION, 2021–2024 (USD MILLION)

TABLE 92

60 V: MARKET, BY REGION, 2025–2032 (USD MILLION)

TABLE 93

72 V: MARKET, BY REGION, 2021–2024 (THOUSAND UNITS)

TABLE 94

72 V: MARKET, BY REGION, 2025–2032 (THOUSAND UNITS)

TABLE 95

72 V: MARKET, BY REGION, 2021–2024 (USD MILLION)

TABLE 96

72 V: MARKET, BY REGION, 2025–2032 (USD MILLION)

TABLE 97

ABOVE 72 V: MARKET, BY REGION, 2021–2024 (THOUSAND UNITS)

TABLE 98

ABOVE 72 V: MARKET, BY REGION, 2025–2032 (THOUSAND UNITS)

TABLE 99

ABOVE 72 V: MARKET, BY REGION, 2021–2024 (USD MILLION)

TABLE 100

ABOVE 72 V: MARKET, BY REGION, 2025–2032 (USD MILLION)

TABLE 101

LITHIUM-ION VS. LEAD-ACID BATTERIES

TABLE 102

ELECTRIC TWO WHEELER MARKET, BY BATTERY TYPE, 2021–2024 (THOUSAND UNITS)

TABLE 103

MARKET, BY BATTERY TYPE, 2025–2032 (THOUSAND UNITS)

TABLE 104

MARKET, BY BATTERY TYPE, 2021–2024 (USD MILLION)

TABLE 105

MARKET, BY BATTERY TYPE, 2025–2032 (USD MILLION)

TABLE 106

POPULAR ELECTRIC SCOOTERS, BY BATTERY TYPE

TABLE 107

SEALED LEAD-ACID: MARKET, BY REGION, 2021–2024 (THOUSAND UNITS)

TABLE 108

SEALED LEAD-ACID: MARKET, BY REGION, 2025–2032 (THOUSAND UNITS)

TABLE 109

SEALED LEAD-ACID: MARKET, BY REGION, 2021–2024 (USD MILLION)

TABLE 110

SEALED LEAD-ACID: MARKET, BY REGION, 2025–2032 (USD MILLION)

TABLE 111

COMPARATIVE EVALUATION OF ELECTRIC VEHICLES USING LITHIUM-ION BATTERIES

TABLE 112

LITHIUM-ION: MARKET, BY REGION, 2021–2024 (THOUSAND UNITS)

TABLE 113

LITHIUM-ION: MARKET, BY REGION, 2025–2032 (THOUSAND UNITS)

TABLE 114

LITHIUM-ION: MARKET, BY REGION, 2021–2024 (USD MILLION)

TABLE 115

LITHIUM-ION: MARKET, BY REGION, 2025–2032 (USD MILLION)

TABLE 116

ELECTRIC TWO WHEELER MARKET, BY DISTANCE COVERED, 2021–2024 (THOUSAND UNITS)

TABLE 117

MARKET, BY DISTANCE COVERED 2025–2032 (THOUSAND UNITS)

TABLE 118

MARKET, BY DISTANCE COVERED, 2021–2024 (USD MILLION)

TABLE 119

MARKET, BY DISTANCE COVERED, 2025–2032 (USD MILLION)

TABLE 120

POPULAR ELECTRIC SCOOTERS/MOPEDS AND MOTORCYCLES WITH RANGE

TABLE 121

BELOW 75 MILES: ELECTRIC TWO WHEELER MARKET, BY REGION, 2021–2024 (THOUSAND UNITS)

TABLE 122

BELOW 75 MILES: MARKET, BY REGION, 2025–2032 (THOUSAND UNITS)

TABLE 123

BELOW 75 MILES: MARKET, BY REGION, 2021–2024 (USD MILLION)

TABLE 124

BELOW 75 MILES: MARKET, BY REGION, 2025–2032 (USD MILLION)

TABLE 125

75–100 MILES: MARKET, BY REGION, 2021–2024 (THOUSAND UNITS)

TABLE 126

75–100 MILES: MARKET, BY REGION, 2025–2032 (THOUSAND UNITS)

TABLE 127

75–100 MILES: MARKET, BY REGION, 2021–2024 (USD MILLION)

TABLE 128

75–100 MILES: MARKET, BY REGION, 2025–2032 (USD MILLION)

TABLE 129

ABOVE 100 MILES: MARKET, BY REGION, 2021–2024 (THOUSAND UNITS)

TABLE 130

ABOVE 100 MILES: MARKET, BY REGION, 2025–2032 (THOUSAND UNITS)

TABLE 131

ABOVE 100 MILES: MARKET, BY REGION, 2021–2024 (USD MILLION)

TABLE 132

ABOVE 100 MILES: MARKET, BY REGION, 2025–2032 (USD MILLION)

TABLE 133

ELECTRIC TWO WHEELER MARKET, BY USAGE, 2021–2024 (THOUSAND UNITS)

TABLE 134

MARKET, BY USAGE, 2025–2032 (THOUSAND UNITS)

TABLE 135

MARKET, BY USAGE, 2021–2024 (USD MILLION)

TABLE 136

MARKET, BY USAGE, 2025–2032 (USD MILLION)

TABLE 137

E-SCOOTER/MOPED AND E-MOTORCYCLE MODELS BY USAGE

TABLE 138

PRIVATE: ELECTRIC TWO WHEELER MARKET, BY REGION, 2021–2024 (THOUSAND UNITS)

TABLE 139

PRIVATE: MARKET, BY REGION, 2025–2032 (THOUSAND UNITS)

TABLE 140

PRIVATE: MARKET, BY REGION, 2021–2024 (USD MILLION)

TABLE 141

PRIVATE: MARKET, BY REGION, 2025–2032 (USD MILLION)

TABLE 142

COMMERCIAL: MARKET, BY REGION, 2021–2024 (THOUSAND UNITS)

TABLE 143

COMMERCIAL: MARKET, BY REGION, 2025–2032 (THOUSAND UNITS)

TABLE 144

COMMERCIAL: MARKET, BY REGION, 2021–2024 (USD MILLION)

TABLE 145

COMMERCIAL: MARKET, BY REGION, 2025–2032 (USD MILLION)

TABLE 146

MARKET, BY TECHNOLOGY TYPE, 2021–2024 (THOUSAND UNITS)

TABLE 147

MARKET, BY TECHNOLOGY TYPE, 2025–2032 (THOUSAND UNITS)

TABLE 148

MARKET, BY TECHNOLOGY TYPE, 2021–2024 (USD MILLION)

TABLE 149

MARKET, BY TECHNOLOGY TYPE, 2025–2032 (USD MILLION)

TABLE 150

E-SCOOTER/MOPED AND E-MOTORCYCLE MODELS WITH DIFFERENT CHARGING TECHNOLOGIES

TABLE 151

PLUG-IN CHARGING VS. BATTERY CHARGING

TABLE 152

PLUG-IN: ELECTRIC TWO WHEELER MARKET, BY REGION, 2021–2024 (THOUSAND UNITS)

TABLE 153

PLUG-IN: MARKET, BY REGION, 2025–2032 (THOUSAND UNITS)

TABLE 154

PLUG-IN: MARKET, BY REGION, 2021–2024 (USD MILLION)

TABLE 155

PLUG-IN: MARKET, BY REGION, 2025–2032 (USD MILLION)

TABLE 156

BATTERY: MARKET, BY REGION, 2021–2024 (THOUSAND UNITS)

TABLE 157

BATTERY: MARKET, BY REGION, 2025–2032 (THOUSAND UNITS)

TABLE 158

BATTERY: MARKET, BY REGION, 2021–2024 (USD MILLION)

TABLE 159

BATTERY: MARKET, BY REGION, 2025–2032 (USD MILLION)

TABLE 160

MARKET, BY MOTOR TYPE, 2021–2024 (THOUSAND UNITS)

TABLE 161

MARKET, BY MOTOR TYPE, 2025–2032 (THOUSAND UNITS)

TABLE 162

MARKET, BY MOTOR TYPE, 2021–2024 (USD MILLION)

TABLE 163

MARKET, BY MOTOR TYPE, 2025–2032 (USD MILLION)

TABLE 164

POPULAR E-SCOOTER/MOPED AND E-MOTORCYCLE MODELS, BY MOTOR TYPE

TABLE 165

MID-DRIVE MOTOR: MARKET, BY REGION, 2021–2024 (THOUSAND UNITS)

TABLE 166

MID-DRIVE MOTOR: MARKET, BY REGION, 2025–2032 (THOUSAND UNITS)

TABLE 167

MID-DRIVE MOTOR: MARKET, BY REGION, 2021–2024 (USD MILLION)

TABLE 168

MID-DRIVE MOTOR: MARKET, BY REGION, 2025–2032 (USD MILLION)

TABLE 169

HUB MOTOR: MARKET, BY REGION, 2021–2024 (THOUSAND UNITS)

TABLE 170

HUB MOTOR: MARKET, BY REGION, 2025–2032 (THOUSAND UNITS)

TABLE 171

HUB MOTOR: MARKET, BY REGION, 2021–2024 (USD MILLION)

TABLE 172

HUB MOTOR: MARKET, BY REGION, 2025–2032 (USD MILLION)

TABLE 173

MARKET, BY MOTOR POWER, 2021–2024 (THOUSAND UNITS)

TABLE 174

MARKET, BY MOTOR POWER, 2025–2032 (THOUSAND UNITS)

TABLE 175

MARKET, BY MOTOR POWER, 2021–2024 (USD MILLION)

TABLE 176

MARKET, BY MOTOR POWER, 2025–2032 (USD MILLION)

TABLE 177

POPULAR E-SCOOTER/MOPED AND E-MOTORCYCLE MODELS, BY MOTOR POWER

TABLE 178

LESS THAN 1.5 KW: MARKET, BY REGION, 2021–2024 (THOUSAND UNITS)

TABLE 179

LESS THAN 1.5 KW: MARKET, BY REGION, 2025–2032 (THOUSAND UNITS)

TABLE 180

LESS THAN 1.5 KW: MARKET, BY REGION, 2021–2024 (USD MILLION)

TABLE 181

LESS THAN 1.5 KW: MARKET, BY REGION, 2025–2032 (USD MILLION)

TABLE 182

1.5–3 KW: MARKET, BY REGION, 2021–2024 (THOUSAND UNITS)

TABLE 183

1.5–3 KW: MARKET, BY REGION, 2025–2032 (THOUSAND UNITS)

TABLE 184

1.5–3 KW: MARKET, BY REGION, 2021–2024 (USD MILLION)

TABLE 185

1.5–3 KW: MARKET, BY REGION, 2025–2032 (USD MILLION)

TABLE 186

ABOVE 3 KW: MARKET, BY REGION, 2021–2024 (THOUSAND UNITS)

TABLE 187

ABOVE 3 KW: MARKET, BY REGION, 2025–2032 (THOUSAND UNITS)

TABLE 188

ABOVE 3 KW: MARKET, BY REGION, 2021–2024 (USD MILLION)

TABLE 189

ABOVE 3 KW: MARKET, BY REGION, 2025–2032 (USD MILLION)

TABLE 190

MARKET, BY REGION, 2021–2024 (THOUSAND UNITS)

TABLE 191

MARKET, BY REGION, 2025–2032 (THOUSAND UNITS)

TABLE 192

MARKET, BY REGION, 2021–2024 (USD MILLION)

TABLE 193

MARKET, BY REGION, 2025–2032 (USD MILLION)

TABLE 194

ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2024 (THOUSAND UNITS)

TABLE 195

ASIA PACIFIC: MARKET, BY COUNTRY, 2025–2032 (THOUSAND UNITS)

TABLE 196

ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2024 (USD MILLION)

TABLE 197

ASIA PACIFIC: MARKET, BY COUNTRY, 2025–2032 (USD MILLION)

TABLE 198

CHINA: MARKET, BY VEHICLE TYPE, 2021–2024 (UNITS)

TABLE 199

CHINA: MARKET, BY VEHICLE TYPE, 2025–2032 (UNITS)

TABLE 200

CHINA: MARKET, BY VEHICLE TYPE, 2021–2024 (USD MILLION)

TABLE 201

CHINA: MARKET, BY VEHICLE TYPE, 2025–2032 (USD MILLION)

TABLE 202

JAPAN: MARKET, BY VEHICLE TYPE, 2021–2024 (UNITS)

TABLE 203

JAPAN: MARKET, BY VEHICLE TYPE, 2025–2032 (UNITS)

TABLE 204

JAPAN: MARKET, BY VEHICLE TYPE, 2021–2024 (USD MILLION)

TABLE 205

JAPAN: MARKET, BY VEHICLE TYPE, 2025–2032 (USD MILLION)

TABLE 206

INDIA: MARKET, BY VEHICLE TYPE, 2021–2024 (UNITS)

TABLE 207

INDIA: MARKET, BY VEHICLE TYPE, 2025–2032 (UNITS)

TABLE 208

INDIA: MARKET, BY VEHICLE TYPE, 2021–2024 (USD MILLION)

TABLE 209

INDIA: MARKET, BY VEHICLE TYPE, 2025–2032 (USD MILLION)

TABLE 210

SOUTH KOREA: MARKET, BY VEHICLE TYPE, 2021–2024 (UNITS)

TABLE 211

SOUTH KOREA: MARKET, BY VEHICLE TYPE, 2025–2032 (UNITS)

TABLE 212

SOUTH KOREA: MARKET, BY VEHICLE TYPE, 2021–2024 (USD MILLION)

TABLE 213

SOUTH KOREA: MARKET, BY VEHICLE TYPE, 2025–2032 (USD MILLION)

TABLE 214

TAIWAN: MARKET, BY VEHICLE TYPE, 2021–2024 (UNITS)

TABLE 215

TAIWAN: MARKET, BY VEHICLE TYPE, 2025–2032 (UNITS)

TABLE 216

TAIWAN: MARKET, BY VEHICLE TYPE, 2021–2024 (USD MILLION)

TABLE 217

TAIWAN: MARKET, BY VEHICLE TYPE, 2025–2032 (USD MILLION)

TABLE 218

THAILAND: MARKET, BY VEHICLE TYPE, 2021–2024 (UNITS)

TABLE 219

THAILAND: MARKET, BY VEHICLE TYPE, 2025–2032 (UNITS)

TABLE 220

THAILAND: MARKET, BY VEHICLE TYPE, 2021–2024 (USD MILLION)

TABLE 221

THAILAND: MARKET, BY VEHICLE TYPE, 2025–2032 (USD MILLION)

TABLE 222

INDONESIA: MARKET, BY VEHICLE TYPE, 2021–2024 (UNITS)

TABLE 223

INDONESIA: MARKET, BY VEHICLE TYPE, 2025–2032 (UNITS)

TABLE 224

INDONESIA: MARKET, BY VEHICLE TYPE, 2021–2024 (USD MILLION)

TABLE 225

INDONESIA: MARKET, BY VEHICLE TYPE, 2025–2032 (USD MILLION)

TABLE 226

MALAYSIA: MARKET, BY VEHICLE TYPE, 2021–2024 (UNITS)

TABLE 227

MALAYSIA: MARKET, BY VEHICLE TYPE, 2025–2032 (UNITS)

TABLE 228

MALAYSIA: MARKET, BY VEHICLE TYPE, 2021–2024 (USD MILLION)

TABLE 229

MALAYSIA: MARKET, BY VEHICLE TYPE, 2025–2032 (USD MILLION)

TABLE 230

PHILIPPINES: MARKET, BY VEHICLE TYPE, 2021–2024 (UNITS)

TABLE 231

PHILIPPINES: MARKET, BY VEHICLE TYPE, 2025–2032 (UNITS)

TABLE 232

PHILIPPINES: MARKET, BY VEHICLE TYPE, 2021–2024 (USD MILLION)

TABLE 233

PHILIPPINES: MARKET, BY VEHICLE TYPE, 2025–2032 (USD MILLION)

TABLE 234

VIETNAM: MARKET, BY VEHICLE TYPE, 2021–2024 (UNITS)

TABLE 235

VIETNAM: MARKET, BY VEHICLE TYPE, 2025–2032 (UNITS)

TABLE 236

VIETNAM: MARKET, BY VEHICLE TYPE, 2021–2024 (USD MILLION)

TABLE 237

VIETNAM: MARKET, BY VEHICLE TYPE, 2025–2032 (USD MILLION)

TABLE 238

EUROPE: MARKET, BY COUNTRY, 2021–2024 (THOUSAND UNITS)

TABLE 239

EUROPE: MARKET, BY COUNTRY, 2025–2032 (THOUSAND UNITS)

TABLE 240

EUROPE: MARKET, BY COUNTRY, 2021–2024 (USD MILLION)

TABLE 241

EUROPE: MARKET, BY COUNTRY, 2025–2032 (USD MILLION)

TABLE 242

FRANCE: MARKET, BY VEHICLE TYPE, 2021–2024 (UNITS)

TABLE 243

FRANCE: MARKET, BY VEHICLE TYPE, 2025–2032 (UNITS)

TABLE 244

FRANCE: MARKET, BY VEHICLE TYPE, 2021–2024 (USD MILLION)

TABLE 245

FRANCE: MARKET, BY VEHICLE TYPE, 2025–2032 (USD MILLION)

TABLE 246

GERMANY: MARKET, BY VEHICLE TYPE, 2021–2024 (UNITS)

TABLE 247

GERMANY: MARKET, BY VEHICLE TYPE, 2025–2032 (UNITS)

TABLE 248

GERMANY: MARKET, BY VEHICLE TYPE, 2021–2024 (USD MILLION)

TABLE 249

GERMANY: MARKET, BY VEHICLE TYPE, 2025–2032 (USD MILLION)

TABLE 250

SPAIN: MARKET, BY VEHICLE TYPE, 2021–2024 (UNITS)

TABLE 251

SPAIN: MARKET, BY VEHICLE TYPE, 2025–2032 (UNITS)

TABLE 252

SPAIN: MARKET, BY VEHICLE TYPE, 2021–2024 (USD MILLION)

TABLE 253

SPAIN: MARKET, BY VEHICLE TYPE, 2025–2032 (USD MILLION)

TABLE 254

AUSTRIA: MARKET, BY VEHICLE TYPE, 2021–2024 (UNITS)

TABLE 255

AUSTRIA: MARKET, BY VEHICLE TYPE, 2025–2032 (UNITS)

TABLE 256

AUSTRIA: MARKET, BY VEHICLE TYPE, 2021–2024 (USD MILLION)

TABLE 257

AUSTRIA: MARKET, BY VEHICLE TYPE, 2025–2032 (USD MILLION)

TABLE 258

UK: MARKET, BY VEHICLE TYPE, 2021–2024 (UNITS)

TABLE 259

UK: MARKET, BY VEHICLE TYPE, 2025–2032 (UNITS)

TABLE 260

UK: MARKET, BY VEHICLE TYPE, 2021–2024 (USD MILLION)

TABLE 261

UK: MARKET, BY VEHICLE TYPE, 2025–2032 (USD MILLION)

TABLE 262

ITALY: MARKET, BY VEHICLE TYPE, 2021–2024 (UNITS)

TABLE 263

ITALY: MARKET, BY VEHICLE TYPE, 2025–2032 (UNITS)

TABLE 264

ITALY: MARKET, BY VEHICLE TYPE, 2021–2024 (USD MILLION)

TABLE 265

ITALY: MARKET, BY VEHICLE TYPE, 2025–2032 (USD MILLION)

TABLE 266

BELGIUM: MARKET, BY VEHICLE TYPE, 2021–2024 (UNITS)

TABLE 267

BELGIUM: MARKET, BY VEHICLE TYPE, 2025–2032 (UNITS)

TABLE 268

BELGIUM: MARKET, BY VEHICLE TYPE, 2021–2024 (USD MILLION)

TABLE 269

BELGIUM: MARKET, BY VEHICLE TYPE, 2025–2032 (USD MILLION)

TABLE 270

NETHERLANDS: MARKET, BY VEHICLE TYPE, 2021–2024 (UNITS)

TABLE 271

NETHERLANDS: MARKET, BY VEHICLE TYPE, 2025–2032 (UNITS)

TABLE 272

NETHERLANDS: MARKET, BY VEHICLE TYPE, 2021–2024 (USD MILLION)

TABLE 273

NETHERLANDS: MARKET, BY VEHICLE TYPE, 2025–2032 (USD MILLION)

TABLE 274

POLAND: MARKET, BY VEHICLE TYPE, 2021–2024 (UNITS)

TABLE 275

POLAND: MARKET, BY VEHICLE TYPE, 2025–2032 (UNITS)

TABLE 276

POLAND: MARKET, BY VEHICLE TYPE, 2021–2024 (USD MILLION)

TABLE 277

POLAND: MARKET, BY VEHICLE TYPE, 2025–2032 (USD MILLION)

TABLE 278

DENMARK: MARKET, BY VEHICLE TYPE, 2021–2024 (UNITS)

TABLE 279

DENMARK: MARKET, BY VEHICLE TYPE, 2025–2032 (UNITS)

TABLE 280

DENMARK: MARKET, BY VEHICLE TYPE, 2021–2024 (USD MILLION)

TABLE 281

DENMARK: MARKET, BY VEHICLE TYPE, 2025–2032 (USD MILLION)

TABLE 282

NORTH AMERICA: MARKET, BY COUNTRY, 2021–2024 (THOUSAND UNITS)

TABLE 283

NORTH AMERICA: MARKET, BY COUNTRY, 2025–2032 (THOUSAND UNITS)

TABLE 284

NORTH AMERICA: MARKET, BY COUNTRY, 2021–2024 (USD MILLION)

TABLE 285

NORTH AMERICA: MARKET, BY COUNTRY, 2025–2032 (USD MILLION)

TABLE 286

US: MARKET, BY VEHICLE TYPE, 2021–2024 (UNITS)

TABLE 287

US: MARKET, BY VEHICLE TYPE, 2025–2032 (UNITS)

TABLE 288

US: MARKET, BY VEHICLE TYPE, 2021–2024 (USD MILLION)

TABLE 289

US: MARKET, BY VEHICLE TYPE, 2025–2032 (USD MILLION)

TABLE 290

CANADA: MARKET, BY VEHICLE TYPE, 2021–2024 (UNITS)

TABLE 291

CANADA: MARKET, BY VEHICLE TYPE, 2025–2032 (UNITS)

TABLE 292

CANADA: MARKET, BY VEHICLE TYPE, 2021–2024 (USD MILLION)

TABLE 293

CANADA: MARKET, BY VEHICLE TYPE, 2025–2032 (USD MILLION)

TABLE 294

KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022–2025

TABLE 295

DEGREE OF COMPETITION, 2024

TABLE 296

MARKET: PRODUCT COMPARISON (KEY SCOOTER MODELS)

TABLE 297

MARKET: PRODUCT COMPARISON (KEY MOTORCYCLE MODELS)

TABLE 298

MARKET: REGION FOOTPRINT

TABLE 299

MARKET: VEHICLE TYPE FOOTPRINT

TABLE 300

MARKET: BATTERY TYPE FOOTPRINT

TABLE 301

MARKET, TECHNOLOGY TYPE FOOTPRINT

TABLE 302

MARKET: KEY STARTUPS/SMES

TABLE 303

MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

TABLE 304

MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, JANUARY 2021–OCTOBER 2025

TABLE 305

MARKET: DEALS, JANUARY 2021– OCTOBER 2025

TABLE 306

MARKET: EXPANSIONS, JANUARY 2021– OCTOBER 2025

TABLE 307

MARKET: OTHER DEVELOPMENTS, JANUARY 2021– OCTOBER 2025

TABLE 308

OLA ELECTRIC: COMPANY OVERVIEW

TABLE 309

OLA ELECTRIC: PRODUCTS OFFERED

TABLE 310

OLA ELECTRIC: PRODUCT LAUNCHES/DEVELOPMENTS

TABLE 311

OLA ELECTRIC: EXPANSIONS

TABLE 312

OLA ELECTRIC: OTHERS

TABLE 313

BAJAJ AUTO LTD.: COMPANY OVERVIEW

TABLE 314

BAJAJ AUTO LTD.: PRODUCTS OFFERED

TABLE 315

BAJAJ AUTO LTD.: PRODUCT LAUNCHES/DEVELOPMENTS

TABLE 316

TVS MOTOR COMPANY: COMPANY OVERVIEW

TABLE 317

TVS MOTOR COMPANY: PRODUCTS OFFERED

TABLE 318

TVS MOTOR COMPANY.: PRODUCT LAUNCHES/UPGRADES

TABLE 319

TVS MOTOR COMPANY: DEALS

TABLE 320

TVS MOTOR COMPANY: OTHERS

TABLE 321

ATHER ENERGY: COMPANY OVERVIEW

TABLE 322

ATHER ENERGY: PRODUCTS OFFERED

TABLE 323

ATHER ENERGY: PRODUCT LAUNCHES/DEVELOPMENTS

TABLE 324

ATHER ENERGY: DEALS

TABLE 325

YADEA TECHNOLOGY GROUP CO., LTD.: COMPANY OVERVIEW

TABLE 326

YADEA TECHNOLOGY GROUP CO., LTD.: PRODUCTS OFFERED

TABLE 327

YADEA TECHNOLOGY GROUP CO., LTD.: PRODUCT LAUNCHES/DEVELOPMENTS

TABLE 328

YADEA TECHNOLOGY GROUP CO., LTD.: DEALS

TABLE 329

YADEA TECHNOLOGY GROUP CO., LTD.: EXPANSIONS

TABLE 330

YADEA TECHNOLOGY GROUP CO., LTD.: OTHERS

TABLE 331

HERO ELECTRIC: COMPANY OVERVIEW

TABLE 332

HERO ELECTRIC: PRODUCTS OFFERED

TABLE 333

HERO ELECTRIC: PRODUCT LAUNCHES/DEVELOPMENTS

TABLE 334

HERO ELECTRIC: DEALS

TABLE 335

HERO ELECTRIC: EXPANSIONS

TABLE 336

GOGORO: COMPANY OVERVIEW

TABLE 337

GOGORO: PRODUCTS OFFERED

TABLE 338

GOGORO: PRODUCT/TECHNOLOGY LAUNCHES

TABLE 340

VMOTO LIMITED: COMPANY OVERVIEW

TABLE 341

VMOTO LIMITED: PRODUCTS OFFERED

TABLE 342

VMOTO LIMITED: PRODUCT LAUNCHES/DEVELOPMENTS

TABLE 343

VMOTO LIMITED: DEALS

TABLE 344

VMOTO LIMITED: EXPANSIONS

TABLE 345

VMOTO LIMITED: OTHERS

TABLE 346

NIU INTERNATIONAL: COMPANY OVERVIEW

TABLE 347

NIU INTERNATIONAL: PRODUCTS OFFERED

TABLE 348

NIU INTERNATIONAL: PRODUCT LAUNCHES/DEVELOPMENTS

TABLE 349

NIU INTERNATIONAL: DEALS

TABLE 350

JIANGSU XINRI E-VEHICLE CO., LTD.: COMPANY OVERVIEW

TABLE 351

JIANGSU XINRI E-VEHICLE CO., LTD.: PRODUCTS OFFERED

TABLE 352

JIANGSU XINRI E-VEHICLE CO., LTD.: PRODUCT LAUNCHES/DEVELOPMENTS

TABLE 353

JIANGSU XINRI E-VEHICLE CO., LTD.: DEALS

TABLE 354

JIANGSU XINRI E-VEHICLE CO., LTD.: EXPANSIONS

TABLE 355

IDEANOMICS, INC.: COMPANY OVERVIEW

TABLE 356

IDEANOMICS, INC.: PRODUCTS OFFERED

TABLE 357

IDEANOMICS, INC.: PRODUCT LAUNCHES/DEVELOPMENTS

TABLE 358

IDEANOMICS, INC.: DEALS

TABLE 359

IDEANOMICS, INC.: EXPANSIONS

TABLE 360

ASKOLL EVA S.P.A.: COMPANY OVERVIEW

TABLE 361

ASKOLL EVA S.P.A.: PRODUCTS OFFERED

TABLE 362

ASKOLL EVA S.P.A.: DEALS

TABLE 363

ASKOLL EVA S.P.A.: OTHERS

TABLE 364

ULTRAVIOLETTE AUTOMOTIVE: COMPANY OVERVIEW

TABLE 365

REVOLT INTELLICORP PRIVATE LIMITED (REVOLT MOTORS): COMPANY OVERVIEW

TABLE 366

Z ELECTRIC VEHICLE: COMPANY OVERVIEW

TABLE 367

CAKE: COMPANY OVERVIEW

TABLE 368

LIGHTNING MOTORCYCLES: COMPANY OVERVIEW

TABLE 369

JOHAMMER E-MOBILITY GMBH: COMPANY OVERVIEW

TABLE 370

PIAGGIO GROUP: COMPANY OVERVIEW

TABLE 371

KTM AG: COMPANY OVERVIEW

TABLE 372

HARLEY DAVIDSON: COMPANY OVERVIEW

TABLE 373

BMW GROUP: COMPANY OVERVIEW

TABLE 374

AIMA TECHNOLOGY GROUP CO., LTD.: COMPANY OVERVIEW

TABLE 375

HONDA MOTOR CO., LTD.: COMPANY OVERVIEW

TABLE 376

GREAVES ELECTRIC MOBILITY PRIVATE LIMITED (AMPERE VEHICLES): COMPANY OVERVIEW

TABLE 377

DONGGUAN TAILING ELECTRIC VEHICLE CO., LTD.: COMPANY OVERVIEW

TABLE 378

CEZETA: COMPANY OVERVIEW

TABLE 379

TERRA MOTORS CORPORATION: COMPANY OVERVIEW

TABLE 380

NEXZU MOBILITY LTD. (AVAN MOTORS INDIA): COMPANY OVERVIEW

TABLE 381

EMFLUX MOTORS: COMPANY OVERVIEW

TABLE 382

MAHINDRA & MAHINDRA LTD.: COMPANY OVERVIEW

TABLE 383

DAMON MOTORS INC.: COMPANY OVERVIEW

TABLE 384

VIAR MOTOR INDONESIA: COMPANY OVERVIEW

TABLE 385

SELIS: COMPANY OVERVIEW

TABLE 386

GESITS: COMPANY OVERVIEW

TABLE 387

UNITED E-MOTOR: COMPANY OVERVIEW

TABLE 388

SMOOT ELEKTRIK: COMPANY OVERVIEW

TABLE 389

PT VOLTA INDONESIA SEMESTA (VOLTA): COMPANY OVERVIEW

TABLE 390

ALVA: COMPANY OVERVIEW

TABLE 391

NUSA MOTORS: COMPANY OVERVIEW

TABLE 392

BF GOODRICH: COMPANY OVERVIEW

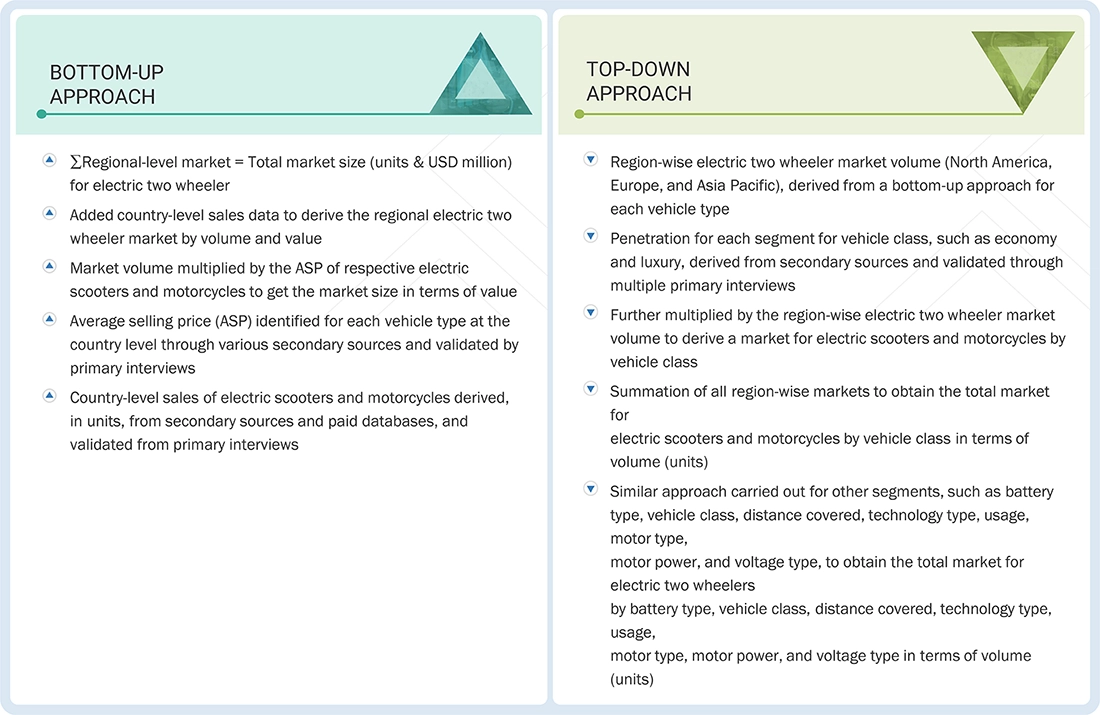

FIGURE 1

ELECTRIC TWO WHEELER MARKET SEGMENTATION & REGIONAL SCOPE

FIGURE 2

MARKET: RESEARCH DESIGN

FIGURE 3

RESEARCH DESIGN MODEL

FIGURE 4

KEY INSIGHTS FROM INDUSTRY EXPERTS

FIGURE 5

RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

FIGURE 6

MARKET: BOTTOM-UP APPROACH

FIGURE 7

MARKET: TOP-DOWN APPROACH

FIGURE 8

DATA TRIANGULATION

FIGURE 9

GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS

FIGURE 10

DEMAND- AND SUPPLY-SIDE FACTOR ANALYSIS

FIGURE 11

KEY INSIGHTS AND MARKET HIGHLIGHTS

FIGURE 12

STRATEGIES ADOPTED BY KEY PLAYERS IN MARKET

FIGURE 13

TRENDS AND DISRUPTIONS IMPACTING GROWTH OF MARKET

FIGURE 14

E-SCOOTER/MOPED SEGMENT TO HOLD LARGEST SHARE IN 2025

FIGURE 15

ASIA PACIFIC TO BE LEADING REGIONAL MARKET DURING FORECAST PERIOD

FIGURE 16

ADVANCEMENTS IN BATTERY TECHNOLOGY TO DRIVE MARKET

FIGURE 17

ASIA PACIFIC TO ACCOUNT FOR DOMINANT MARKET SHARE IN 2025

FIGURE 18

E-SCOOTER/MOPED SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 19

LITHIUM-ION SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 20

BELOW 75 MILES TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 21

HUB MOTOR SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 22

COMMERCIAL SEGMENT TO REGISTER HIGHER CAGR THAN PRIVATE SEGMENT DURING FORECAST PERIOD

FIGURE 23

ECONOMY SEGMENT TO HOLD LARGER MARKET SIZE THAN LUXURY SEGMENT DURING FORECAST PERIOD

FIGURE 24

PLUG-IN SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 25

ABOVE 3 KW SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 26

72 V SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 27

MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 28

EVOLUTION OF BATTERY TECHNOLOGIES

FIGURE 29

TECHNOLOGICAL BARRIERS FOR ELECTRIC TWO WHEELERS

FIGURE 30

MARKET: PATENT ANALYSIS, JANUARY 2015-OCTOBER 2025

FIGURE 31

LEGAL STATUS OF PATENTS, 2015–2025

FIGURE 32

SMART ELECTRIC VEHICLE CHARGING SYSTEM

FIGURE 33

TCO OF ICE VS. BATTERY SWAPPING POWERED VEHICLES

FIGURE 34

SMART IOT SOLUTION FOR ELECTRIC TWO WHEELER MANUFACTURERS

FIGURE 35

TOTAL COST OF OWNERSHIP OF ELECTRIC VS. ICE SCOOTERS

FIGURE 36

MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

FIGURE 37

AVERAGE SELLING PRICE TREND, BY VEHICLE TYPE, 2022-2024 (USD)

FIGURE 38

AVERAGE SELLING PRICE TREND FOR ELECTRIC SCOOTERS, BY REGION, 2022-2024

FIGURE 39

AVERAGE SELLING PRICE TREND FOR ELECTRIC MOTORCYCLES, BY REGION, 2022-2024

FIGURE 40

MARKET: ECOSYSTEM ANALYSIS

FIGURE 41

MARKET: SUPPLY CHAIN ANALYSIS

FIGURE 42

INVESTMENT AND FUNDING SCENARIO, 2020–2024

FIGURE 43

IMPORT DATA FOR HS CODE 871190, BY COUNTRY, 2021–2024 (USD MILLION)

FIGURE 44

EXPORT DATA FOR HS CODE 871190, BY COUNTRY, 2021–2024 (USD MILLION)

FIGURE 45

INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR ELECTRIC TWO WHEELERS

FIGURE 46

KEY BUYING CRITERIA

FIGURE 47

MARKET, BY VEHICLE TYPE, 2025 VS. 2032 (USD MILLION)

FIGURE 48

MARKET, BY VEHICLE CLASS, 2025 VS. 2032 (USD MILLION)

FIGURE 49

MARKET, BY VOLTAGE TYPE, 2025 VS. 2032 (USD MILLION)

FIGURE 50

MARKET, BY BATTERY TYPE, 2025 VS. 2032 (USD MILLION)

FIGURE 51

MARKET, BY DISTANCE COVERED, 2025 VS. 2032 (USD MILLION)

FIGURE 52

MARKET, BY USAGE, 2025 VS. 2032 (USD MILLION)

FIGURE 53

MARKET, BY TECHNOLOGY TYPE, 2025 VS. 2032 (USD MILLION)

FIGURE 54

MARKET, BY MOTOR TYPE, 2025 VS. 2032 (USD MILLION)

FIGURE 55

MARKET, BY MOTOR POWER, 2025 VS. 2032 (USD MILLION)

FIGURE 56

MARKET, BY REGION, 2025 VS. 2032

FIGURE 57

ASIA PACIFIC: REAL GDP GROWTH RATE, BY COUNTRY, 2024–2026

FIGURE 58

ASIA PACIFIC: GDP PER CAPITA, BY COUNTRY, 2024–2026

FIGURE 59

ASIA PACIFIC: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024–2026

FIGURE 60

ASIA PACIFIC: MANUFACTURING INDUSTRY’S CONTRIBUTION TO GDP, 2024

FIGURE 61

ASIA PACIFIC: MARKET SNAPSHOT

FIGURE 62

INDONESIA: ROADMAP FOR ELECTRIC MOTORCYCLE CHARGING INFRASTRUCTURE

FIGURE 63

EUROPE: REAL GDP GROWTH RATE, BY COUNTRY, 2024–2026

FIGURE 64

EUROPE: GDP PER CAPITA, BY COUNTRY, 2024–2026

FIGURE 65

EUROPE: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024–2026

FIGURE 66

EUROPE: MANUFACTURING INDUSTRY’S CONTRIBUTION TO GDP, 2024

FIGURE 67

EUROPE: MARKET, BY COUNTRY, 2025 VS. 2032 (USD MILLION)

FIGURE 68

NORTH AMERICA: REAL GDP GROWTH RATE, BY COUNTRY, 2024–2026

FIGURE 69

NORTH AMERICA: GDP PER CAPITA, BY COUNTRY, 2024–2026

FIGURE 70

NORTH AMERICA: CPI INFLATION RATE, BY COUNTRY, 2024–2026

FIGURE 71

NORTH AMERICA: MANUFACTURING INDUSTRY’S CONTRIBUTION TO GDP, 2024

FIGURE 72

NORTH AMERICA: MARKET SNAPSHOT

FIGURE 73

MARKET SHARE ANALYSIS OF ELECTRIC TWO WHEELER PROVIDERS, 2024

FIGURE 74

REVENUE ANALYSIS OF TOP 5 PLAYERS, 2020–2024

FIGURE 75

COMPANY VALUATION OF KEY PLAYERS, 2024

FIGURE 76

FINANCIAL METRICS OF KEY PLAYERS, 2024

FIGURE 77

MARKET: COMPANY EVALUATION MATRIX, 2024

FIGURE 78

MARKET: COMPANY FOOTPRINT

FIGURE 79

MARKET: STARTUP/SME EVALUATION MATRIX, 2024

FIGURE 80

OLA ELECTRIC: COMPANY SNAPSHOT

FIGURE 81

OLA ELECTRIC: PRODUCT ROADMAP

FIGURE 82

OLA ELECTRIC: MOVE OS FOR E2W

FIGURE 83

BAJAJ AUTO LTD.: COMPANY SNAPSHOT

FIGURE 84

TVS MOTOR COMPANY: COMPANY SNAPSHOT

FIGURE 85

ATHER ENERGY: COMPANY SNAPSHOT

FIGURE 86

ATHER ENERGY: PATENTS FILED ACROSS ELECTRIC TWO WHEELER DEVELOPMENT

FIGURE 87

ATHER ENERGY: PRODUCT LAUNCH ROADMAP

FIGURE 88

YADEA TECHNOLOGY GROUP CO., LTD.: COMPANY SNAPSHOT

FIGURE 89

GOGORO: COMPANY SNAPSHOT

FIGURE 90

VMOTO LIMITED: COMPANY SNAPSHOT

FIGURE 91

NIU INTERNATIONAL: COMPANY SNAPSHOT

FIGURE 92

NIU INTERNATIONAL: ORGANIZATIONAL STRUCTURE

FIGURE 93

JIANGSU XINRI E-VEHICLE CO., LTD.: COMPANY SNAPSHOT

FIGURE 94

ASKOLL EVA S.P.A.: COMPANY SNAPSHOT

John

May, 2022

What are Electric Scooter and Motorcycle Market Newer business models like sustainable and profitable revenue streams in the future?.