The study involved four major activities in estimating the current size of the AVAS market. Exhaustive secondary research was done to collect information on the market, the peer market, and the child markets. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications [for example, International Organization of Motor Vehicle Manufacturers (OICA), National Highway Traffic Safety Administration (NHTSA), International Energy Association (IEA)], articles, directories, technical handbooks, trade websites, technical articles, and databases (for example, Marklines, and Factiva) have been used to identify and collect information useful for an extensive commercial study of the global AVAS market.

Primary Research

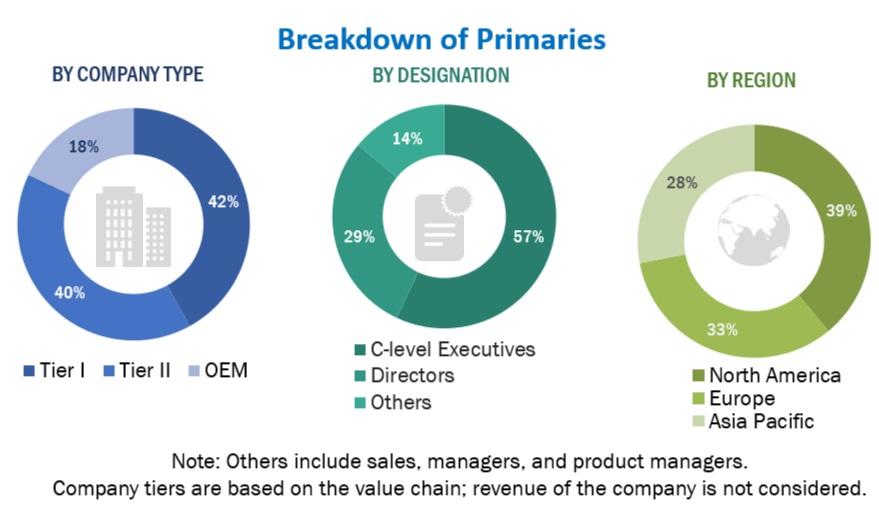

Extensive primary research was conducted after acquiring an understanding of the AVAS market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand (automotive OEMs) and supply (AVAS providers) sides across major regions, namely, North America, Europe, and Asia Pacific. Approximately 23% and 77% of primary interviews were conducted from the demand and supply sides, respectively. Primary data was collected through questionnaires, emails, and telephonic interviews.

In the canvassing of primaries, various departments within organizations, such as sales, operations, and marketing, were covered to provide a holistic viewpoint in the report. After interacting with industry experts, brief sessions were also conducted with highly experienced independent consultants to reinforce the findings from primaries. This, along with the in-house subject matter experts’ opinions, led to the findings described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

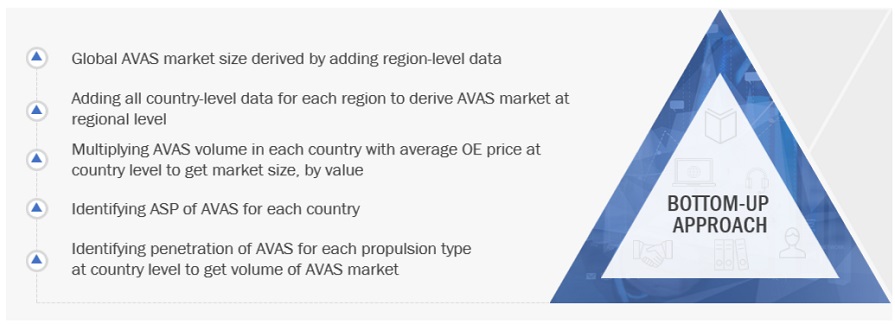

The bottom-up approach was used to estimate and validate the size of the AVAS market. This method was also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

-

The key players in the industry and markets have been identified through extensive secondary research.

-

The industry’s supply chain and market size, in terms of volume, have been determined through primary and secondary research processes.

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Size Validation

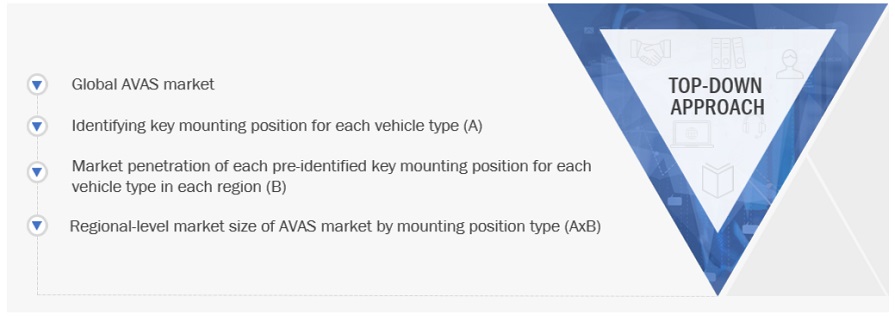

The top-down approach has been used to estimate and validate the size of the AVAS market by mounting position type in terms of volume and value. The top-down approach has been used to estimate and validate the size of the market. In this approach, the global market is bifurcated into mounting position type based on the penetration of each mounting position, which will give the volume of the market by mounting position at the regional level. Further, multiplying the volume by ASP results in the market for mounting position type by value.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

An AVAS is a sound emitting device assembled in pure electric vehicles and hybrid electric vehicles that produce a lower level sound than traditional ICE vehicles—whenever the vehicle is operating at a low speed—to warn pedestrians and other vulnerable road commuters about the vehicle's presence. Also, the sound rises and drops in pitch to signal whether the vehicle is accelerating or decelerating, respectively.

List of Key Stakeholders

-

Acoustic consultants

-

Associations, forums, and alliances related to electric vehicles

-

Automobile manufacturers

-

Automotive sensor manufacturers

-

Automotive software providers

-

Autonomous vehicle manufacturers

-

AVAS manufacturers

-

EV component manufacturers

-

EV distributors and retailers

-

EV manufacturers

-

Government agencies and policy makers

Report Objectives

-

To analyze and forecast the acoustic vehicle alerting system (AVAS) market in terms of value (USD million) and volume (thousand units) from 2024 to 2030

-

To segment the market by vehicle type, mounting position, propulsion type, sales channel, electric 2-wheeler, and region

-

To segment and forecast the market size by value and volume based on vehicle type (passenger car and commercial vehicle)

-

To segment and forecast the market size by value and volume based on mounting position (separated and integrated)

-

To segment and forecast the market size by value and volume based on propulsion type {battery electric vehicle (BEV), plug-in hybrid electric vehicle (PHEV), and fuel cell electric vehicle (FCEV)}

-

To segment and forecast the market size by value and volume based on sales channel (OEM and aftermarket)

-

To segment and forecast the market size by value and volume based on electric 2-wheeler (E-scooter/E-moped and E-motorcycle)

-

To segment and forecast the market by value and volume based on region (Asia Pacific, Europe, and North America)

-

To provide detailed information about the factors influencing the market growth (drivers, challenges, restraints, and opportunities)

-

To strategically analyze the market with respect to individual growth trends, prospects, and contributions to the total market

-

To study the following with respect to the market

-

Value Chain Analysis

-

Ecosystem Analysis

-

Technology Analysis

-

Case Study Analysis

-

Patent Analysis

-

Tariff and Regulatory Landscape

-

Average Selling Price Analysis

-

Key stakeholders and Buying Criteria

-

To strategically profile the key players and comprehensively analyze their market share and core competencies

-

To analyze the opportunities for stakeholders and the competitive landscape for market leaders

-

To track and analyze competitive developments such as deals, product launches/developments, expansions, and other activities undertaken by the key industry participants

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

-

AVAS market, by electric 2-wheeler, at country level

-

AVAS market, by propulsion type, at country level

-

Profiling of additional market players (up to 3)

George

Dec, 2022

I would like to know more details about the growth rate of the Acoustic Vehicle Alerting System Market for the next 5 years. also interested to know the top vendors in the Vehicle Alerting System market..