Electric Vehicle Fluids Market by Product Type (Engine oil, Coolants, Transmission Fluids, and Greases), Vehicle type (On-highway vehicle, Off-highway vehicle), Propulsion Type (Hybrid EV, Battery EV), Fill Type, and Region - Global Forecast to 2030

Updated on : September 02, 2025

Electric Vehicle Fluids Market

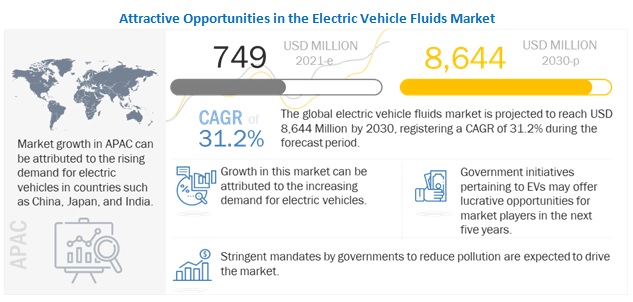

The global electric vehicle fluids market was valued at USD 749 million in 2021 and is projected to reach USD 8,644 million by 2030, growing at 31.2% cagr from 2021 to 2030. With the growing concern over tailpipe emissions and their harmful effects on the environment, stringent standards for carbon dioxide and pollutants such as nitrogen oxide, unburned hydrocarbons, and particulates have been put in place, resulting in hybrid and full EVs no longer being seen as uncommon, but the standard for the future. A specific fluid requirement in EVs is also one of the other driving factors for electric vehicle fluids as an ICE’s motor differs greatly from EV motors and thus, needs fluids, which cater to totally different functions than that in the ICEs.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on electric vehicle fluids market

As the global vehicle market gets restructured around EVs, the market for fluid for EVs emerges as the new blue ocean. With improved performances of EVs, the use of exclusive lubricant products for these vehicles is an essential practice.

EV fluids play essential roles in power trains in boosting performance and driving experience. Product types include greases, brake fluids, heat transfer fluids, and drive system fluids, all of them classed as e-fluids. Compared with conventional internal combustion engine lubricants, e-fluids cool e-motors and gears and provide insulation to electric current. Also, they extend the lifetime of each electric motor part and extend the mileage of EVs by improving machine efficiency.

Before the crisis, the EV market was booming and was driven by sales in China, first and foremost and then in other countries in Europe and North America. In the early stages of expansion, EVs have been heavily promoted by strong governmental intervention, leading to regulatory frameworks imposing stringent emission reduction levels, coupled with generous financial support and incentives.

Electric Vehicle Fluids Market Dynamics

Driver: Increasing demand for electric vehicles

With the growing concern over tailpipe emissions and their harmful effects on the environment, stringent standards for carbon dioxide and pollutants such as nitrogen oxide, unburned hydrocarbons, and particulates have been put in place, resulting in hybrid and full EVs no longer being seen as uncommon, but the standard for the future. Growth in electric vehicle production and sales drives the demand for electric vehicle fluids. Fluid is the main component of a vehicle, which improves fuel economy and helps in reducing carbon footprints in vehicles. For instance, a program launched by California Air Resources Board (CARB) also includes guidelines for manufacturers to produce and deliver zero-emission vehicles (ZEVs). Electric vehicle fluids help remove excess heat from the engine motor and keep it cool. Hence, cool engines provide better fuel efficiency. Moreover, the use of fluids to reduce heat maximizes the life of vehicles. Thus, the use of electric vehicle fluids helps in providing durability to engines.

Restraints: Initial high cost of purchasing EV

Current EVs are sold at high prices compared to conventional petrol and diesel vehicles. This price surplus can burden their market introduction. Current sales prices of EVs are still higher than similar conventional vehicles. This is mainly due to the expensive battery pack but also due to the absence of economies of scale. The production costs of a vehicle can decrease when production figures increase from 10,000 to 500,000 units a year. Currently, PHEVs have even higher initial purchase costs, because of the presence of a battery pack, a conventional internal combustion engine, and an electric engine. On the other hand, PHEVs benefit from cost savings because of the downsizing of the installed conventional engine.

Vehicles depreciate over time. The loss of value due to depreciation is the highest in the first years of the vehicle’s lifespan. Depreciation rates not only vary according to the fuel or drive train, but they also vary according to brand image, mileage, and vehicle class, among others.

Opportunities: Stringent mandates by government

Emission of carbon from ICE vehicles is now treated as a significant threat. Several countries have partnered with private companies to achieve the sustainable development of EV charging infrastructure. Governments of various countries are working in synergy with private companies to install charging infrastructure. In recent years, more than 200,000 different types of charging stations have been constructed. Convenient and affordable publicly accessible chargers will be increasingly important as EVs scale up. Governments have provided support for EV charging infrastructure through measures such as direct investment to install publicly accessible chargers or incentives for EV owners to install charging points at home. In some places, building codes may require new construction or substantial remodels to include charging points, for example, in apartment blocks and retail establishments.

The hybrid EV segment accounted for the larger market share in 2020 during the forecast period”

Battery EVs do not require a gasoline engine, which requires fuel and routine maintenance. Though battery EVs require less EV fluids than the hybrid ones, the large-scale production of battery EVs in comparison to Hybrid EVs is expected to lead to the demand for EV fluids during the forecast period. The prices of batteries for EVs are decreasing due to the advancements in technology, which are expected to result in the reduced overall prices of BEVs.

“Europe accounted for the largest market share in Electric Vehicles Fluid market in 2020, in terms of value.”

Europe led the electric vehicle fluids market with a share of 44.7%, in terms of value, in 2020 due to high prices and the high number of hybrid vehicles produced and sold in Europe, which requires more electric vehicle fluids than battery vehicle fluids. The high price of engine oil in comparison to other fluids, which are used in hybrid electric vehicles, is one of the major reasons for the largest market share of Europe in 2020. APAC is expected to be the fastest-growing market by 2030, mainly due to the expected high demand for electric vehicles in the region and the higher number of electric vehicles available for service fill during the forecast period. The High demand for electric vehicles in Europe due to government regulations and investments, subsidies, tax rebates, and others are supporting the growth of electric vehicle fluids in the region.

To know about the assumptions considered for the study, download the pdf brochure

“APAC is expected to be the fastest-growing electric vehicles fluid market during the forecast period, in terms of volume.”

APAC accounted for the largest share of 47.8% of the global electric vehicle fluids market, in terms of volume, in 2020. The market is projected to grow at a CAGR of 31.4% during the forecast period. Large-scale production and consumption of electric vehicles in the region presents a large base for electric vehicle fluids. Thus, APAC had the largest share in electric vehicle fluids market in 2020. Europe is the second-largest market for electric vehicle fluids globally, accounting for a share of 40.5%, in terms of volume, of the global electric vehicle fluids market in 2020. High demand for electric vehicles in Europe due to government regulations and investments, subsidies, tax rebates, and others are supporting the growth of electric vehicle fluids in the region. North America is the third-largest region in the global electric vehicle fluids market, in terms of volume. The US is the largest market in North America and accounts for nearly 95% of the market in the region. High sales in comparison to other North American countries and presence of the world’s largest EV producer, in the country make the US the largest market for electric vehicle fluids in North America.

Electric Vehicle Fluids Market Players

The key players in the market are focusing on strategies, such as new product launches, partnerships & agreements, acquisitions, and expansions, to expand their businesses globally. The key players in this market are Royal Dutch Shell plc (Netherlands), ExxonMobil Corporation (US), BP plc. (UK), TotalEnergies SE (France), FUCHS Petrolub AG (Germany), Petronas (Malaysia), ENEOS Corporation (Japan), Repsol S.A. (Spain), Valvoline Inc. (US), and PTT (Thailand), among others.

Electric Vehicle Fluids Market Report Scope

|

Report Metric |

Details |

|

|

|

|

|

|

|

|

|

|

|

|

|

The key players in this market are Royal Dutch Shell plc (Netherlands), ExxonMobil Corporation (US), BP plc. (UK), TotalEnergies SE (France), FUCHS Petrolub AG (Germany), Petronas (Malaysia), ENEOS Corporation (Japan), Repsol S.A. (Spain), Valvoline Inc. (US), and PTT (Thailand). |

This report categorizes the global electric vehicles fluid market based on product type, vehicle type, propulsion type, fill type and region.

On the basis of Product Type, the electric vehicles market has been segmented as follows:

- Engine oil

- Coolants

- Transmission fluids

- Greases

On the basis of Vehicle Type, the electric vehicles fluids market has been segmented as follows:

- On-highway Electric Vehicles

- Off-highway Electric Vehicles

On the basis of Propulsion Type, the electric vehicles fluids market has been segmented as follows:

- Battery electric vehicles

- Hybrid electric vehicles

On the basis of Fill Type, the electric vehicles fluids market has been segmented as follows:

- First fill

- Service fill

On the basis of Region, the electric vehicle fluids market has been segmented as follows:

- APAC

- Europe

- North America

Recent Developments

|

Company |

Date |

Deal Type |

Description |

|

Total Energies SE |

June 2021 |

Partnership |

Stellantis is one of the world's leading automakers and a mobility provider. Mobility and EV charging is a new aspect of this partnership. Free2Move, the Mobility Brand of Stellantis, will use the charging station network operated by TotalEnergies for its car-sharing activity in Paris. |

|

PTT |

June 2021 |

Partnership |

Foxconn and PTT have signed a Memorandum of Understanding to set up an open platform for producing electric vehicles (EV) and key components to serve the EV sector in Thailand. |

|

Royal Dutch Shell plc |

November 2020 |

Strategic alliance |

Kreisel Electric GmbH & Co KG is an international battery solution provider in Rainbach, Mühlkreis district, Upper Austria. Kreisel Electric and Shell have developed a unique and competitive battery solution combining Kreisel's cutting-edge lithium-ion battery module technology with Shell's tailored thermal management fluid. |

|

Total Energies SE |

October 2019 |

Agreement |

Deutsche Post DHL Group is the world's leading mail and logistics company. The Group connects people and markets and is an enabler of global trade. The signing of a Strategic Cooperation Agreement to strengthen the commitment to work together for sustainable mobility and low-carbon energies, logistics, and transport services. |

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of electric vehicle fluids market?

Increasing mandates by government

What are different type of products and vehicle types in electric vehicle fluids market?

It is classified as On-highway and off-highway vehicles

What is the biggest Restraint for electric vehicle fluids market?

High cost of purchasing EV initially .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 41)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 ELECTRIC VEHICLE FLUIDS MARKET: INCLUSIONS AND EXCLUSIONS

1.2.2 ELECTRIC VEHICLE FLUIDS MARKET: DEFINITION AND INCLUSIONS, BY PRODUCT TYPE

1.2.3 ELECTRIC VEHICLE FLUIDS MARKET: DEFINITION AND INCLUSIONS, BY FILL TYPE

1.2.4 ELECTRIC VEHICLE FLUIDS MARKET: DEFINITION AND INCLUSIONS, BY PROPULSION TYPE

1.2.5 ELECTRIC VEHICLE FLUIDS MARKET: DEFINITION AND INCLUSIONS, BY VEHICLE TYPE

1.3 MARKET SCOPE

1.3.1 ELECTRIC VEHICLE FLUIDS MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 46)

2.1 RESEARCH DATA

FIGURE 1 ELECTRIC VEHICLE FLUIDS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews – demand and supply sides

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 TOP-DOWN APPROACH

2.2.1.1 Market size estimation methodology: Parent market calculation approach

2.2.1.2 Global electric vehicle production, 2020

2.2.1.3 Passenger cars: Electric vehicle fluids market size calculation, 2020

2.2.1.3.1 Passenger cars: Electric vehicle fluids market size calculation – first fill - 2020

2.2.1.3.2 Passenger cars: Electric vehicle fluids market size calculation – service fill - 2020

2.2.1.3.3 Passenger cars: Electric vehicle fluids market size calculation – overall – 2020 (value & volume)

2.2.2 BOTTOM-UP APPROACH

FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 4– BOTTOM-UP- ELECTRIC VEHICLE FLUIDS MARKET FOR GERMANY

2.2.2.1 Germany: Electric vehicle fluids market size calculation approach

2.2.2.1.1 Germany: Electric vehicle fluids first fill market size calculation approach

TABLE 1 GERMANY: HYBRID EV FIRST FILL MARKET SIZE, 2019–2030 - TONS – A =(PRODUCTION* AVERAGE FILL RATE OF HYBRID EV VEHICLES IN KG)

TABLE 2 GERMANY: BATTERY EV FIRST FILL MARKET SIZE, 2019–2030 - TONS – B =(PRODUCTION* AVERAGE FILL RATE OF BATTERY EV VEHICLES IN KG)

2.2.2.1.2 Germany: Electric vehicle fluids service fill market size calculation approach

TABLE 3 GERMANY: HYBRID EV SERVICE FILL MARKET SIZE, 2019–2030 - TONS – C =(CONSUMPTION* AVERAGE FILL RATE OF HYBRID VEHICLES IN KG)

TABLE 4 GERMANY: BATTERY EV SERVICE FILL MARKET SIZE, 2019–2030 - TONS – D =(CONSUMPTION* AVERAGE FILL RATE OF BATTERY EV VEHICLES IN KG)

2.2.2.1.3 Germany: Overall electric vehicle fluids market size (Value & Volume)

TABLE 5 GERMANY: ELECTRIC VEHICLE FLUIDS MARKET SIZE, 2019–2030 (TON) - E=A+B+C+D

TABLE 6 GERMANY: ELECTRIC VEHICLE FLUIDS MARKET SIZE, 2019–2030 (USD THOUSAND)

2.3 DATA TRIANGULATION

FIGURE 3 ELECTRIC VEHICLE FLUIDS MARKET: DATA TRIANGULATION

2.4 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

FIGURE 4 ELECTRIC VEHICLE MARKET TIMELINE

2.4.1 DEMAND SIDE

FIGURE 5 MARKET GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS AND OPPORTUNITIES

2.5 FACTOR ANALYSIS

2.6 ASSUMPTIONS

2.7 LIMITATIONS

2.8 RISK ASSESSMENT

TABLE 7 ELECTRIC VEHICLE FLUIDS MARKET: RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 60)

FIGURE 6 BATTERY ELECTRIC VEHICLES TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

FIGURE 7 COOLANTS TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 8 SERVICE FILL EV FLUIDS TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

FIGURE 9 OFF-HIGHWAY VEHICLES TO WITNESS THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 10 EUROPE ACCOUNTED FOR THE LARGEST MARKET SHARE IN 2020

4 PREMIUM INSIGHTS (Page No. - 64)

4.1 ATTRACTIVE OPPORTUNITIES FOR ELECTRIC VEHICLE FLUID MANUFACTURERS

FIGURE 11 INCREASE IN THE DEMAND FOR ELECTRIC VEHICLES TO BOOST THE MARKET DURING THE FORECAST PERIOD

4.2 ELECTRIC VEHICLE FLUIDS MARKET, BY REGION

FIGURE 12 APAC TO BE THE LARGEST ELECTRIC VEHICLE FLUIDS MARKET BETWEEN 2021 AND 2030

4.3 ELECTRIC VEHICLE FLUIDS MARKET, BY PRODUCT TYPE, 2020

FIGURE 13 ENGINE OIL AND COOLANTS ARE THE LEADING SEGMENTS

4.4 APAC: ELECTRIC VEHICLE FLUIDS MARKET, BY PRODUCT TYPE AND COUNTRY, 2020

FIGURE 14 CHINA AND THE COOLANTS SEGMENT ACCOUNTED FOR THE LARGEST SHARES

4.5 GLOBAL ELECTRIC VEHICLE FLUIDS MARKET ATTRACTIVENESS

FIGURE 15 RUSSIA TO BE THE FASTEST-GROWING MARKET FOR ELECTRIC VEHICLE FLUIDS BETWEEN 2021 AND 2030

5 MARKET OVERVIEW (Page No. - 67)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE ELECTRIC VEHICLE FLUIDS MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing demand for electric vehicles

5.2.1.2 Specific fluid requirement for electric vehicles

FIGURE 17 DIFFERENT FLUIDS USED IN AN ELECTRIC VEHICLE

5.2.2 RESTRAINTS

5.2.2.1 Initial high cost of purchasing EV

5.2.2.2 Lack of public charging facilities

5.2.3 OPPORTUNITIES

5.2.3.1 Stringent mandates by governments

FIGURE 18 COMPARISON OF EMISSIONS BY EVS AND GASOLINE VEHICLES

5.2.3.2 Government initiatives pertaining to EVs

5.2.4 CHALLENGES

5.2.4.1 Lack of awareness of benefits of using EV fluids over regular fluids for electric vehicles

5.2.4.2 Need for standardized technologies in the driveline

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 19 ELECTRIC VEHICLE FLUIDS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF SUBSTITUTES

5.3.2 BARGAINING POWER OF SUPPLIERS

5.3.3 BARGAINING POWER OF BUYERS

5.3.4 THREAT OF NEW ENTRANTS

5.3.5 RIVALRY AMONG EXISTING COMPETITORS

TABLE 8 ELECTRIC VEHICLE FLUIDS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.4 MACROECONOMIC INDICATORS

5.4.1 GDP TRENDS AND FORECAST OF MAJOR ECONOMIES

TABLE 9 GDP TRENDS AND FORECAST, BY MAJOR ECONOMY, 2018–2026 (USD BILLION)

5.4.2 OIL & GAS INDUSTRY

TABLE 10 OIL PRODUCTION STATISTICS: TOP 15 COUNTRIES, 2015–2025 (MILLION TON)

TABLE 11 NATURAL GAS PRODUCTION STATISTICS: TOP 15 COUNTRIES, 2015–2025 (BILLION CUBIC METER)

5.5 COVID-19 IMPACT

5.5.1 INTRODUCTION

5.5.2 COVID-19 HEALTH ASSESSMENT

FIGURE 20 COUNTRY-WISE SPREAD OF COVID-19

5.5.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 21 REVISED GDP FORECAST FOR SELECT G20 COUNTRIES IN 2021

5.5.3.1 COVID-19 Impact on the economy–scenario assessment

FIGURE 22 FACTORS IMPACTING THE GLOBAL ECONOMY

FIGURE 23 SCENARIOS OF COVID-19 IMPACT

5.6 IMPACT OF COVID-19: CUSTOMER ANALYSIS

6 INDUSTRY TRENDS (Page No. - 84)

6.1 SUPPLY CHAIN ANALYSIS

FIGURE 24 ELECTRIC VEHICLE FLUIDS MARKET: SUPPLY CHAIN

6.1.1 RAW MATERIAL

6.1.2 BLENDING

6.1.3 DISTRIBUTION

6.1.4 END-USE INDUSTRIES

6.2 CONNECTED MARKET: ECOSYSTEM

FIGURE 25 ELECTRIC VEHICLE FLUIDS MARKET: ECOSYSTEM

TABLE 12 ELECTRIC VEHICLE FLUIDS MARKET: ECOSYSTEM

6.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSES

FIGURE 26 REVENUE SHIFT IN ELECTRIC VEHICLE FLUIDS MARKET

6.4 TECHNOLOGY ANALYSIS

6.5 CASE STUDY ANALYSIS

6.5.1 CASE STUDY ON JAGUAR RACING FORMULA E TEAM WITH CASTROL’S EV FLUIDS

6.5.2 AUDI LAUNCHES AUDI E-TRON THAT USES LIQUID COOLING

6.6 ELECTRIC VEHICLE FLUIDS MARKET: REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON–COVID–19 SCENARIOS

FIGURE 27 MARKET SIZE UNDER REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON–COVID–19 SCENARIOS

TABLE 13 ELECTRIC VEHICLE FLUIDS MARKET: MARKET FORECAST SCENARIOS, 2019–2030 (USD MILLION)

6.6.1 NON–COVID–19 SCENARIO

6.6.2 OPTIMISTIC SCENARIO

6.6.3 PESSIMISTIC SCENARIO

6.6.4 REALISTIC SCENARIO

6.7 TRADE DATA

6.7.1 IMPORT SCENARIO OF ELECTRIC VEHICLES

FIGURE 28 ELECTRIC VEHICLE IMPORTS, BY KEY COUNTRIES, 2017–2020

TABLE 14 ELECTRIC VEHICLE IMPORTS, BY REGION, 2017–2020 (USD MILLION)

6.7.2 EXPORT SCENARIO OF ELECTRIC VEHICLES

FIGURE 29 ELECTRIC VEHICLE EXPORTS, BY KEY COUNTRIES, 2017–2020

TABLE 15 ELECTRIC VEHICLE EXPORTS, BY REGION, 2017-2020 (USD MILLION)

6.8 AVERAGE SELLING PRICES OF ELECTRIC VEHICLE FLUIDS

TABLE 16 AVERAGE SELLING PRICES OF ELECTRIC VEHICLE FLUIDS, BY REGION, (USD/KG)

FIGURE 30 ELECTRIC VEHICLE FLUIDS, AVERAGE SELLING PRICE TREND & FORECAST

6.9 FUTURE INDUSTRY TRENDS

6.9.1 800V VEHICLES

6.9.2 BATTERY THERMAL MANAGEMENT

6.10 DEVELOPMENT IN MOTOR ENGINES IMPACT THE ELECTRIC VEHICLE FLUIDS MARKET

6.10.1 NEW DEMAND FOR E-MOBILITY

6.10.1.1 Electrical interactivity

6.10.1.2 Lower viscosities

6.10.1.3 New materials

6.10.1.4 Diverse operating temperatures

6.10.1.5 New friction requirements

6.11 NEW TECHNOLOGIES DEVELOPED BY TOP OEMS AND TIER-1 MANUFACTURERS AND THEIR STAGE OF DEVELOPMENT WITH TECHNOLOGY PARTNERS

TABLE 17 CHANGING TECHNOLOGY FOCUSES OF CUSTOMERS

6.12 OPERATIONAL DATA

6.12.1 EVS ACROSS THE WORLD

TABLE 18 EVS ACROSS THE WORLD

6.12.2 UPCOMING ELECTRIC VEHICLE MODELS, 2021-2025

TABLE 19 UPCOMING ELECTRIC VEHICLE MODELS, 2021–2025

6.12.3 TOP SELLING EV MODEL SALES WORLDWIDE, 2020 (THOUSAND UNITS)

FIGURE 31 TOP SELLING EVS IN 2020

6.12.4 EUROPE: EV SALES, BY ELECTRIC CAR SEGMENT, 2019 AND 2020

TABLE 20 EV SALES DATA (IN THOUSAND UNIT)

6.12.5 ELECTRIC VEHICLE MARKET SHARE ANALYSIS OF TOP 5 PLAYERS, 2020

FIGURE 32 MARKET SHARE ANALYSIS, 2020

6.13 COST COMPARISON OF EV VS. ICE

TABLE 21 COST COMPARISON OF PETROL AND ELECTRIC VEHICLES IN THE UK, 2020

6.14 REGULATORY LANDSCAPE

6.14.1 NETHERLANDS

TABLE 22 NETHERLANDS: INCENTIVES FOR ELECTRIC VEHICLES

TABLE 23 NETHERLANDS: ELECTRIC VEHICLE CHARGING STATION INCENTIVES

6.14.2 GERMANY

TABLE 24 GERMANY: ELECTRIC VEHICLE INCENTIVES

TABLE 25 GERMANY: ELECTRIC VEHICLE CHARGING STATION INCENTIVES

6.14.3 FRANCE

TABLE 26 FRANCE: ELECTRIC VEHICLE INCENTIVES

TABLE 27 FRANCE: ELECTRIC VEHICLE CHARGING STATION INCENTIVES

6.14.4 UK

TABLE 28 UK: ELECTRIC VEHICLE INCENTIVES

TABLE 29 UK: ELECTRIC VEHICLE CHARGING STATION INCENTIVES

6.14.5 CHINA

TABLE 30 CHINA: ELECTRIC VEHICLE INCENTIVES

TABLE 31 CHINA: ELECTRIC VEHICLE CHARGING STATION INCENTIVES

6.14.6 US

TABLE 32 US: ELECTRIC VEHICLE INCENTIVES

TABLE 33 US: ELECTRIC VEHICLE CHARGING STATION INCENTIVES

6.15 COVID-19 IMPACT ON ELECTRIC VEHICLE PRODUCTION

6.15.1 IMPACT OF COVID-19 ON ELECTRIC VEHICLE PRODUCTION

7 ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY FILL TYPE (Page No. - 110)

7.1 INTRODUCTION

FIGURE 33 SERVICE FILL SEGMENT TO REGISTER HIGHER CAGR DURING THE FORECAST PERIOD (2021–2030)

TABLE 34 ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY FILL TYPE, 2019–2020 (TON)

TABLE 35 ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY FILL TYPE, 2021–2030 (TON)

TABLE 36 ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY FILL TYPE, 2019–2020 (USD THOUSAND)

TABLE 37 ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY FILL TYPE, 2021–2030 (USD THOUSAND)

7.2 FIRST FILL

7.2.1 RISE IN ELECTRIC VEHICLE PRODUCTION TO BOOST DEMAND

TABLE 38 FIRST FILL: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2019–2020 (TON)

TABLE 39 FIRST FILL: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2021–2030 (TON)

TABLE 40 FIRST FILL: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2019–2020 (USD THOUSAND)

TABLE 41 FIRST FILL: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2021–2030 (USD THOUSAND)

7.3 SERVICE FILL

7.3.1 RISE IN ON-ROAD ELECTRIC VEHICLES AND FIXED MAINTAIN ACE INTERVALS TO PROPEL THE MARKET

TABLE 42 SERVICE FILL: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2019–2020 (TON)

TABLE 43 SERVICE FILL: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2021–2030 (TON)

TABLE 44 SERVICE FILL: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2019–2020 (USD THOUSAND)

TABLE 45 SERVICE FILL: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2021–2030 (USD THOUSAND)

8 ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PROPULSION TYPE (Page No. - 115)

8.1 INTRODUCTION

FIGURE 34 BATTERY EVS SEGMENT TO DOMINATE THE ELECTRIC VEHICLE FLUIDS MARKET DURING THE FORECAST PERIOD

TABLE 46 ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PROPULSION TYPE, 2019–2020 (TON)

TABLE 47 ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PROPULSION TYPE, 2021–2030 (TON)

TABLE 48 ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PROPULSION TYPE, 2019–2020 (USD THOUSAND)

TABLE 49 ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PROPULSION TYPE, 2021–2030 (USD THOUSAND)

8.2 BATTERY ELECTRIC VEHICLES

8.2.1 PLUGIN BATTERY ELECTRIC VEHICLES (BEVS)

8.2.1.1 Increase in vehicle range per charge to boost the demand for BEVs

8.2.2 FUEL CELL ELECTRIC VEHICLES (FCEVS)

8.2.2.1 Demand for zero-emission vehicles to uplift the demand for electric vehicle fluids

TABLE 50 BATTERY ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2019–2020 (TON)

TABLE 51 BATTERY ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2021–2030 (TON)

TABLE 52 BATTERY ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2019–2020 (USD THOUSAND)

TABLE 53 BATTERY ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2021–2030 (USD THOUSAND)

8.3 HYBRID ELECTRIC VEHICLES

8.3.1 GOVERNMENT PROVISION OF TAX BENEFITS AND INCENTIVES TO ENHANCE THE DEMAND

TABLE 54 HYBRID ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2019–2020 (TON)

TABLE 55 HYBRID ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2021–2030 (TON)

TABLE 56 HYBRID ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2019–2020 (USD THOUSAND)

TABLE 57 HYBRID ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2021–2030 (USD THOUSAND)

9 ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY VEHICLE TYPE (Page No. - 123)

9.1 INTRODUCTION

FIGURE 35 OFF-HIGHWAY ELECTRIC VEHICLES SEGMENT TO REGISTER HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 58 ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY VEHICLE TYPE, 2019–2020 (TON)

TABLE 59 ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY VEHICLE TYPE, 2021–2030 (TON)

TABLE 60 ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY VEHICLE TYPE, 2019–2020 (USD THOUSAND)

TABLE 61 ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY VEHICLE TYPE, 2021–2030 (USD THOUSAND)

9.2 ON-HIGHWAY ELECTRIC VEHICLES

TABLE 62 ON-HIGHWAY ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2019–2020 (TON)

TABLE 63 ON-HIGHWAY ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2021–2030 (TON)

TABLE 64 ON-HIGHWAY ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2019–2020 (USD THOUSAND)

TABLE 65 ON-HIGHWAY ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2021–2030 (USD THOUSAND)

TABLE 66 ON-HIGHWAY HYBRID ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2019–2020 (TON)

TABLE 67 ON-HIGHWAY HYBRID ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2021–2030 (TON)

TABLE 68 ON-HIGHWAY HYBRID ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2019–2020 (USD THOUSAND)

TABLE 69 ON-HIGHWAY HYBRID ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2021–2030 (USD THOUSAND)

TABLE 70 ON-HIGHWAY BATTERY ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2019–2020 (TON)

TABLE 71 ON-HIGHWAY BATTERY ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2021–2030 (TON)

TABLE 72 ON-HIGHWAY BATTERY ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2019–2020 (USD THOUSAND)

TABLE 73 ON-HIGHWAY BATTERY ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2021–2030 (USD THOUSAND)

9.2.1 PASSENGER CARS (PCS)

9.2.1.1 Growing emission norms to support market growth

TABLE 74 PASSENGER CARS: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2019–2020 (TON)

TABLE 75 PASSENGER CARS: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2021–2030 (TON)

TABLE 76 PASSENGER CARS: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2019–2020 (USD THOUSAND)

TABLE 77 PASSENGER CARS: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2021–2030 (USD THOUSAND)

TABLE 78 PASSENGER CARS: HYBRID ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2019–2020 (TON)

TABLE 79 PASSENGER CARS: HYBRID ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2021–2030 (TON)

TABLE 80 PASSENGER CARS: HYBRID ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2019–2020 (USD THOUSAND)

TABLE 81 PASSENGER CARS: HYBRID ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2021–2030 (USD THOUSAND)

TABLE 82 PASSENGER CARS: BATTERY ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2019–2020 (TON)

TABLE 83 PASSENGER CARS: BATTERY ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2021–2030 (TON)

TABLE 84 PASSENGER CARS: BATTERY ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2019–2020 (USD THOUSAND)

TABLE 85 PASSENGER CARS: BATTERY ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2021–2030 (USD THOUSAND)

9.2.2 COMMERCIAL VEHICLES (CVS)

9.2.2.1 Growth of e-commerce and logistics to boost demand for commercial vehicles

TABLE 86 COMMERCIAL ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2019–2020 (TON)

TABLE 87 COMMERCIAL ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2021–2030 (TON)

TABLE 88 COMMERCIAL ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2019–2020 (USD THOUSAND)

TABLE 89 COMMERCIAL ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2021–2030 (USD THOUSAND)

TABLE 90 COMMERCIAL HYBRID ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2019–2020 (TON)

TABLE 91 COMMERCIAL HYBRID ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2021–2030 (TON)

TABLE 92 COMMERCIAL HYBRID ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2019–2020 (USD THOUSAND)

TABLE 93 COMMERCIAL HYBRID ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2021–2030 (USD THOUSAND)

TABLE 94 COMMERCIAL BATTERY ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2019–2020 (TON)

TABLE 95 COMMERCIAL BATTERY ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2021–2030 (TON)

TABLE 96 COMMERCIAL BATTERY ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2019–2020 (USD THOUSAND)

TABLE 97 COMMERCIAL BATTERY ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2021–2030 (USD THOUSAND)

9.3 OFF-HIGHWAY ELECTRIC VEHICLES

9.3.1 RISING DEMAND FROM AGRICULTURE, MINING, AND CONSTRUCTION INDUSTRIES TO BOOST THE DEMAND FOR OFF-HIGHWAY VEHICLES

TABLE 98 OFF-HIGHWAY ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2019–2020 (TON)

TABLE 99 OFF-HIGHWAY ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2021–2030 (TON)

TABLE 100 OFF-HIGHWAY ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2019–2020 (USD THOUSAND)

TABLE 101 OFF-HIGHWAY ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2021–2030 (USD THOUSAND)

TABLE 102 OFF-HIGHWAY HYBRID ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2019–2020 (TON)

TABLE 103 OFF-HIGHWAY HYBRID ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2021–2030 (TON)

TABLE 104 OFF-HIGHWAY HYBRID ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2019–2020 (USD THOUSAND)

TABLE 105 OFF-HIGHWAY HYBRID ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2021–2030 (USD THOUSAND)

TABLE 106 OFF-HIGHWAY BATTERY ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2019–2020 (TON)

TABLE 107 OFF-HIGHWAY BATTERY ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2021–2030 (TON)

TABLE 108 OFF-HIGHWAY BATTERY ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2019–2020 (USD THOUSAND)

TABLE 109 OFF-HIGHWAY BATTERY ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2021–2030 (USD THOUSAND)

10 ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE (Page No. - 142)

10.1 INTRODUCTION

FIGURE 36 COOLANTS TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 110 ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2019–2020 (TON)

TABLE 111 ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2021–2030 (TON)

TABLE 112 ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2019–2020 (USD THOUSAND)

TABLE 113 ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2021–2030 (USD THOUSAND)

10.2 ENGINE OIL

10.2.1 DEMAND FROM HYBRID VEHICLES AND LOWER FILL INTERVAL TO BOOST THE MARKET FOR ENGINE OIL

TABLE 114 ENGINE OIL: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2019–2020 (TON)

TABLE 115 ENGINE OIL: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2021–2030 (TON)

TABLE 116 ENGINE OIL: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2019–2020 (USD THOUSAND)

TABLE 117 ENGINE OIL: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2021–2030 (USD THOUSAND)

10.3 COOLANTS

10.3.1 TEMPERATURE REGULATION IN ELECTRIC VEHICLE BATTERY PACKS AND THE OTHER ELECTRONIC COMPONENTS TO CONTRIBUTE TO MARKET GROWTH

TABLE 118 COOLANTS: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2019–2020 (TON)

TABLE 119 COOLANTS: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2021–2030 (TON)

TABLE 120 COOLANTS: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2019–2020 (USD THOUSAND)

TABLE 121 COOLANTS: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2021–2030 (USD THOUSAND)

10.4 TRANSMISSION FLUIDS

10.4.1 HIGHER CONSUMPTION IN HYBRID ELECTRIC VEHICLES TO FAVOR MARKET GROWTH

TABLE 122 TRANSMISSION FLUIDS: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2019–2020 (TON)

TABLE 123 TRANSMISSION FLUIDS: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2021–2030 (TON)

TABLE 124 TRANSMISSION FLUIDS: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2019–2020 (USD THOUSAND)

TABLE 125 TRANSMISSION FLUIDS: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2021–2030 (USD THOUSAND)

10.5 GREASES

10.5.1 RISE IN ELECTRIC VEHICLE PRODUCTION TO BOOST THE MARKET

TABLE 126 GREASES: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2019–2020 (TON)

TABLE 127 GREASES: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2021–2030 (TON)

TABLE 128 GREASES: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2019–2020 (USD THOUSAND)

TABLE 129 GREASES: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2021–2030 (USD THOUSAND)

10.6 OTHERS

TABLE 130 OTHERS: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2019–2020 (TON)

TABLE 131 OTHERS: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2021–2030 (TON)

TABLE 132 OTHERS: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2019–2020 (USD THOUSAND)

TABLE 133 OTHERS: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2021–2030 (USD THOUSAND)

11 ELECTRIC VEHICLE FLUIDS MARKET, BY REGION (Page No. - 151)

11.1 INTRODUCTION

FIGURE 37 APAC TO BE THE LARGEST ELECTRIC VEHICLE FLUIDS MARKET DURING THE FORECAST PERIOD

TABLE 134 ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2019–2020 (TON)

TABLE 135 ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2021–2030 (TON)

TABLE 136 ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2019–2020 (USD THOUSAND)

TABLE 137 ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY REGION, 2021–2030 (USD THOUSAND)

11.2 APAC

FIGURE 38 APAC: ELECTRIC VEHICLE FLUIDS MARKET SNAPSHOT

11.2.1 APAC: ELECTRIC VEHICLE FLUIDS MARKET, BY VEHICLE TYPE

TABLE 138 APAC: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY VEHICLE TYPE, 2019–2020 (TON)

TABLE 139 APAC: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY VEHICLE TYPE, 2021–2030 (TON)

TABLE 140 APAC: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY VEHICLE TYPE, 2019–2020 (USD THOUSAND)

TABLE 141 APAC: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY VEHICLE TYPE, 2021–2030 (USD THOUSAND)

11.2.2 APAC: ELECTRIC VEHICLE FLUIDS MARKET, BY PRODUCT TYPE

TABLE 142 APAC: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2019–2020 (TON)

TABLE 143 APAC: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2021–2030 (TON)

TABLE 144 APAC: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2019–2020 (USD THOUSAND)

TABLE 145 APAC: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2021–2030 (USD THOUSAND)

11.2.3 APAC: ELECTRIC VEHICLE FLUIDS MARKET, BY FILL TYPE

TABLE 146 APAC: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY FILL TYPE, 2019–2020 (TON)

TABLE 147 APAC: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY FILL TYPE, 2021–2030 (TON)

TABLE 148 APAC: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY FILL TYPE, 2019–2020 (USD THOUSAND)

TABLE 149 APAC: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY FILL TYPE, 2021–2030 (USD THOUSAND)

11.2.4 APAC: ELECTRIC VEHICLE FLUIDS MARKET, BY PROPULSION TYPE

TABLE 150 APAC: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PROPULSION TYPE, 2019–2020 (TON)

TABLE 151 APAC: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PROPULSION TYPE, 2021–2030 (TON)

TABLE 152 APAC: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PROPULSION TYPE, 2019–2020 (USD THOUSAND)

TABLE 153 APAC: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PROPULSION TYPE, 2021–2030 (USD THOUSAND)

11.2.5 APAC: ELECTRIC VEHICLE FLUIDS MARKET, BY COUNTRY

TABLE 154 APAC: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY COUNTRY, 2019–2020 (TON)

TABLE 155 APAC: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY COUNTRY, 2021–2030 (TON)

TABLE 156 APAC: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY COUNTRY, 2019–2020 (USD THOUSAND)

TABLE 157 APAC: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY COUNTRY, 2021–2030 (USD THOUSAND)

11.2.5.1 China

11.2.5.1.1 World’s largest consumer and producer of electric vehicle fluids

TABLE 158 CHINA: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2019–2020 (TON)

TABLE 159 CHINA: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2021–2030 (TON)

TABLE 160 CHINA: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2019–2020 (USD THOUSAND)

TABLE 161 CHINA: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2021–2030 (USD THOUSAND)

11.2.5.2 India

11.2.5.2.1 Market to witness growth during the forecast period

TABLE 162 INDIA: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2019–2020 (TON)

TABLE 163 INDIA: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2021–2030 (TON)

TABLE 164 INDIA: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2019–2020 (USD THOUSAND)

TABLE 165 INDIA: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2021–2030 (USD THOUSAND)

11.2.5.3 Japan

11.2.5.3.1 EV sales and electric vehicle charging station markets to grow significantly

TABLE 166 JAPAN: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2019–2020 (TON)

TABLE 167 JAPAN: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2021–2030 (TON)

TABLE 168 JAPAN: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2019–2020 (USD THOUSAND)

TABLE 169 JAPAN: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2021–2030 (USD THOUSAND)

11.2.5.4 Australia

11.2.5.4.1 Engine oil to account for the largest share during the forecast period

TABLE 170 AUSTRALIA: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2019–2020 (TON)

TABLE 171 AUSTRALIA: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2021–2030 (TON)

TABLE 172 AUSTRALIA: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2019–2020 (USD THOUSAND)

TABLE 173 AUSTRALIA: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2021–2030 (USD THOUSAND)

11.2.5.5 Thailand

11.2.5.5.1 Government has set target to improve the country’s position as a significant EV investment hub in the ASEAN region

TABLE 174 THAILAND: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2019–2020 (TON)

TABLE 175 THAILAND: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2021–2030 (TON)

TABLE 176 THAILAND: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2019–2020 (USD THOUSAND)

TABLE 177 THAILAND: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2021–2030 (USD THOUSAND)

11.2.5.6 Arabian Peninsula

11.2.5.6.1 Coolants to be the fastest-growing segment during the forecast period

TABLE 178 ARABIAN PENINSULA: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2019–2020 (TON)

TABLE 179 ARABIAN PENINSULA: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2021–2030 (TON)

TABLE 180 ARABIAN PENINSULA: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2019–2020 (USD THOUSAND)

TABLE 181 ARABIAN PENINSULA: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2021–2030 (USD THOUSAND)

11.2.5.7 Rest of APAC

TABLE 182 REST OF APAC: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2019–2020 (TON)

TABLE 183 REST OF APAC: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2021–2030 (TON)

TABLE 184 REST OF APAC: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2019–2020 (USD THOUSAND)

TABLE 185 REST OF APAC: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2021–2030 (USD THOUSAND)

11.3 EUROPE

FIGURE 39 EUROPE: ELECTRIC VEHICLE FLUIDS MARKET SNAPSHOT

11.3.1 EUROPE: ELECTRIC VEHICLE FLUIDS MARKET, VEHICLE TYPE

TABLE 186 EUROPE: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY VEHICLE TYPE, 2019–2020 (TON)

TABLE 187 EUROPE: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY VEHICLE TYPE, 2021–2030 (TON)

TABLE 188 EUROPE: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY VEHICLE TYPE, 2019–2020 (USD THOUSAND)

TABLE 189 EUROPE: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY VEHICLE TYPE, 2021–2030 (USD THOUSAND)

11.3.2 EUROPE: ELECTRIC VEHICLE FLUIDS MARKET, PRODUCT TYPE

TABLE 190 EUROPE: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2019–2020 (TON)

TABLE 191 EUROPE: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2021–2030 (TON)

TABLE 192 EUROPE: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2019–2020 (USD THOUSAND)

TABLE 193 EUROPE: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2021–2030 (USD THOUSAND)

11.3.3 EUROPE: ELECTRIC VEHICLE FLUIDS MARKET, FILL TYPE

TABLE 194 EUROPE: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY FILL TYPE, 2019–2020 (TON)

TABLE 195 EUROPE: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY FILL TYPE, 2021–2030 (TON)

TABLE 196 EUROPE: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY FILL TYPE, 2019–2020 (USD THOUSAND)

TABLE 197 EUROPE: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY FILL TYPE, 2021–2030 (USD THOUSAND)

11.3.4 EUROPE: ELECTRIC VEHICLE FLUIDS MARKET, PROPULSION TYPE

TABLE 198 EUROPE: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PROPULSION TYPE, 2019–2020 (TON)

TABLE 199 EUROPE: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PROPULSION TYPE, 2021–2030 (TON)

TABLE 200 EUROPE: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PROPULSION TYPE, 2019–2020 (USD THOUSAND)

TABLE 201 EUROPE: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PROPULSION TYPE, 2021–2030 (USD THOUSAND)

11.3.5 EUROPE: ELECTRIC VEHICLE FLUIDS MARKET, COUNTRY

TABLE 202 EUROPE: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY COUNTRY, 2019–2020 (TON)

TABLE 203 EUROPE: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY COUNTRY, 2021–2030 (TON)

TABLE 204 EUROPE: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY COUNTRY, 2019–2020 (USD THOUSAND)

TABLE 205 EUROPE: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY COUNTRY, 2021–2030 (USD THOUSAND)

11.3.5.1 Germany

11.3.5.1.1 Increasing sales of hybrid vehicles to boost the market

TABLE 206 GERMANY: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2019–2020 (TON)

TABLE 207 GERMANY: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2021–2030 (TON)

TABLE 208 GERMANY: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2019–2020 (USD THOUSAND)

TABLE 209 GERMANY: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2021–2030 (USD THOUSAND)

11.3.5.2 France

11.3.5.2.1 Environmental bonus to promote the sales of EVs

TABLE 210 FRANCE: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2019–2020 (TON)

TABLE 211 FRANCE: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2021–2030 (TON)

TABLE 212 FRANCE: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2019–2020 (USD THOUSAND)

TABLE 213 FRANCE: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2021–2030 (USD THOUSAND)

11.3.5.3 UK

11.3.5.3.1 The country aims to meet its target of all cars and vans being zero-emission by 2050

TABLE 214 UK: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2019–2020 (TON)

TABLE 215 UK: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2021–2030 (TON)

TABLE 216 UK: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2019–2020 (USD THOUSAND)

TABLE 217 UK: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2021–2030 (USD THOUSAND)

11.3.5.4 Italy

11.3.5.4.1 The market has witnessed growth in recent years

TABLE 218 KEY EV POLICY MEASURES AND TARGETS FOR ITALY

TABLE 219 ITALY: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2019–2020 (TON)

TABLE 220 ITALY: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2021–2030 (TON)

TABLE 221 ITALY: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2019–2020 (USD THOUSAND)

TABLE 222 ITALY: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2021–2030 (USD THOUSAND)

11.3.5.5 Russia

11.3.5.5.1 Number of electric vehicles to increase during the forecast period

TABLE 223 RUSSIA: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2019–2020 (TON)

TABLE 224 RUSSIA: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2021–2030 (TON)

TABLE 225 RUSSIA: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2019–2020 (USD THOUSAND)

TABLE 226 RUSSIA: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2021–2030 (USD THOUSAND)

11.3.5.6 Netherlands

11.3.5.6.1 The EV adoption rate in the country is one of the highest in Europe

TABLE 227 NETHERLANDS: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2019–2020 (TON)

TABLE 228 NETHERLANDS: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2021–2030 (TON)

TABLE 229 NETHERLANDS: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2019–2020 (USD THOUSAND)

TABLE 230 NETHERLANDS: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2021–2030 (USD THOUSAND)

11.3.5.7 Norway

11.3.5.7.1 Subsidies and incentives by the government supporting the growth of EVs

TABLE 231 NORWAY: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2019–2020 (TON)

TABLE 232 NORWAY: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2021–2030 (TON)

TABLE 233 NORWAY: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2019–2020 (USD THOUSAND)

TABLE 234 NORWAY: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2021–2030 (USD THOUSAND)

11.3.5.8 Sweden

11.3.5.8.1 High sales of EVs is witnessed in the country

TABLE 235 SWEDEN: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2019–2020 (TON)

TABLE 236 SWEDEN: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2021–2030 (TON)

TABLE 237 SWEDEN: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2019–2020 (USD THOUSAND)

TABLE 238 SWEDEN: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2021–2030 (USD THOUSAND)

11.3.5.9 Rest of Europe

TABLE 239 REST OF EUROPE: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2019–2020 (TON)

TABLE 240 REST OF EUROPE: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2021–2030 (TON)

TABLE 241 REST OF EUROPE: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2019–2020 (USD THOUSAND)

TABLE 242 REST OF EUROPE: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2021–2030 (USD THOUSAND)

11.4 NORTH AMERICA

FIGURE 40 NORTH AMERICA: ELECTRIC VEHICLE FLUIDS MARKET SNAPSHOT

11.4.1 NORTH AMERICA: ELECTRIC VEHICLE FLUIDS MARKET, BY VEHICLE TYPE

TABLE 243 NORTH AMERICA: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY VEHICLE TYPE, 2019–2020 (TON)

TABLE 244 NORTH AMERICA: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY VEHICLE TYPE, 2021–2030 (TON)

TABLE 245 NORTH AMERICA: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY VEHICLE TYPE, 2019–2020 (USD THOUSAND)

TABLE 246 NORTH AMERICA: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY VEHICLE TYPE, 2021–2030 (USD THOUSAND)

11.4.2 NORTH AMERICA: ELECTRIC VEHICLE FLUIDS MARKET, BY PRODUCT TYPE

TABLE 247 NORTH AMERICA: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2019–2020 (TON)

TABLE 248 NORTH AMERICA: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2021–2030 (TON)

TABLE 249 NORTH AMERICA: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2019–2020 (USD THOUSAND)

TABLE 250 NORTH AMERICA: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2021–2030 (USD THOUSAND)

11.4.3 NORTH AMERICA: ELECTRIC VEHICLE FLUIDS MARKET, BY FILL TYPE

TABLE 251 NORTH AMERICA: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY FILL TYPE, 2019–2020 (TON)

TABLE 252 NORTH AMERICA: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY FILL TYPE, 2021–2030 (TON)

TABLE 253 NORTH AMERICA: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY FILL TYPE, 2019–2020 (USD THOUSAND)

TABLE 254 NORTH AMERICA: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY FILL TYPE, 2021–2030 (USD THOUSAND)

11.4.4 NORTH AMERICA: ELECTRIC VEHICLE FLUIDS MARKET, BY PROPULSION TYPE

TABLE 255 NORTH AMERICA: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PROPULSION TYPE, 2019–2020 (TON)

TABLE 256 NORTH AMERICA: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PROPULSION TYPE, 2021–2030 (TON)

TABLE 257 NORTH AMERICA: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PROPULSION TYPE, 2019–2020 (USD THOUSAND)

TABLE 258 NORTH AMERICA: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PROPULSION TYPE, 2021–2030 (USD THOUSAND)

11.4.5 NORTH AMERICA: ELECTRIC VEHICLE FLUIDS MARKET, BY COUNTRY

TABLE 259 NORTH AMERICA: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY COUNTRY, 2019–2020 (TON)

TABLE 260 NORTH AMERICA: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY COUNTRY, 2021–2030 (TON)

TABLE 261 NORTH AMERICA: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY COUNTRY, 2019–2020 (USD THOUSAND)

TABLE 262 NORTH AMERICA: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY COUNTRY, 2021–2030 (USD THOUSAND)

11.4.5.1 US

11.4.5.1.1 Coolants segment to lead the market during the forecast period

TABLE 263 US: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2019–2020 (TON)

TABLE 264 US: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2021–2030 (TON)

TABLE 265 US: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2019–2020 (USD THOUSAND)

TABLE 266 US: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2021–2030 (USD THOUSAND)

11.4.5.2 Canada

11.4.5.2.1 Engine oil segment to lead the market during the forecast period

TABLE 267 CANADA: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2019–2020 (TON)

TABLE 268 CANADA: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2021–2030 (TON)

TABLE 269 CANADA: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2019–2020 (USD THOUSAND)

TABLE 270 CANADA: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2021–2030 (USD THOUSAND)

11.4.5.3 Mexico

11.4.5.3.1 Coolants segment to grow at the fastest rate during the forecast period

TABLE 271 MEXICO: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2019–2020 (TON)

TABLE 272 MEXICO: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2021–2030 (TON)

TABLE 273 MEXICO: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2019–2020 (USD THOUSAND)

TABLE 274 MEXICO: ELECTRIC VEHICLE FLUIDS MARKET SIZE, BY PRODUCT TYPE, 2021–2030 (USD THOUSAND)

12 COMPETITIVE LANDSCAPE (Page No. - 214)

12.1 INTRODUCTION

12.2 STRATEGIES ADOPTED BY KEY PLAYERS

FIGURE 41 OVERVIEW OF STRATEGIES ADOPTED BY ELECTRIC VEHICLE FLUID MANUFACTURERS

12.3 MARKET SHARE ANALYSIS

12.3.1 RANKING OF KEY MARKET PLAYERS

FIGURE 42 RANKING OF TOP FIVE PLAYERS IN ELECTRIC VEHICLE FLUIDS MARKET, 2020

12.3.2 MARKET SHARE OF KEY PLAYERS, 2020

TABLE 275 ELECTRIC VEHICLE FLUIDS MARKET: DEGREE OF COMPETITION

FIGURE 43 ELECTRIC VEHICLE FLUIDS MARKET SHARE, BY COMPANY, 2020

12.3.2.1 Royal Dutch Shell plc.

12.3.2.2 ExxonMobil Corporation

12.3.2.3 BP plc.

12.3.2.4 FUCHS Petrolub SE

12.3.2.5 TotalEnergies SE

12.3.3 REVENUE ANALYSIS OF KEY MARKET PLAYERS, 2019-2020

FIGURE 44 REVENUE ANALYSIS OF KEY COMPANIES FOR PAST TWO YEARS

12.4 COMPANY PRODUCT FOOTPRINT ANALYSIS

FIGURE 45 ELECTRIC VEHICLE FLUIDS MARKET: COMPANY PRODUCT FOOTPRINT

TABLE 276 ELECTRIC VEHICLE FLUIDS MARKET: PRODUCT TYPE FOOTPRINT

TABLE 277 ELECTRIC VEHICLE FLUIDS MARKET: VEHICLE TYPE FOOTPRINT

TABLE 278 ELECTRIC VEHICLE FLUIDS MARKET: COMPANY REGION FOOTPRINT

12.5 COMPANY EVALUATION QUADRANT

12.5.1 STARS

12.5.2 EMERGING LEADERS

12.5.3 PARTICIPANTS

FIGURE 46 ELECTRIC VEHICLE FLUIDS MARKET: COMPANY EVALUATION QUADRANT, 2020

12.6 COMPETITIVE SITUATIONS AND TRENDS

12.6.1 NEW PRODUCT LAUNCHES

TABLE 279 ELECTRIC VEHICLE FLUIDS MARKET: NEW PRODUCT LAUNCHES, MAY 2018 TO AUGUST 2021

12.6.2 DEALS

TABLE 280 ELECTRIC VEHICLE FLUIDS MARKET: DEALS, OCTOBER 2019 TO JUNE 2021

13 COMPANY PROFILES (Page No. - 225)

13.1 MAJOR PLAYERS

(Business Overview, Products Offered, Recent Developments, New product launch, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness competitive threats)*

13.1.1 ROYAL DUTCH SHELL PLC

FIGURE 47 ROYAL DUTCH SHELL PLC: COMPANY SNAPSHOT

TABLE 281 ROYAL DUTCH SHELL PLC: BUSINESS OVERVIEW

13.1.2 VALVOLINE INC.

FIGURE 48 VALVOLINE: COMPANY SNAPSHOT

TABLE 282 VALVOLINE INC.: BUSINESS OVERVIEW

13.1.3 TOTALENERGIES SE

FIGURE 49 TOTALENERGIES SE: COMPANY SNAPSHOT

TABLE 283 TOTALENERGIES SE: BUSINESS OVERVIEW

13.1.4 EXXONMOBIL CORPORATION

FIGURE 50 EXXONMOBIL CORPORATION: COMPANY SNAPSHOT

TABLE 284 EXXONMOBIL CORPORATION: BUSINESS OVERVIEW

13.1.5 BP PLC.

FIGURE 51 BP PLC: COMPANY SNAPSHOT

TABLE 285 BP PLC: BUSINESS OVERVIEW

13.1.6 FUCHS PETROLUB SE

FIGURE 52 FUCHS PETROLUB SE: COMPANY SNAPSHOT

TABLE 286 FUCHS PETROLUB SE: BUSINESS OVERVIEW

13.1.7 PETRONAS

FIGURE 53 PETRONAS: COMPANY SNAPSHOT

TABLE 287 PETRONAS: BUSINESS OVERVIEW

13.1.8 PTT PUBLIC COMPANY LIMITED

FIGURE 54 PTT: COMPANY SNAPSHOT

TABLE 288 PTT PUBLIC COMPANY LIMITED: BUSINESS OVERVIEW

13.1.9 REPSOL S.A

FIGURE 55 REPSOL S.A: COMPANY SNAPSHOT

TABLE 289 REPSOL S.A: BUSINESS OVERVIEW

13.1.10 ENEOS CORPORATION

FIGURE 56 ENEOS CORPORATION: COMPANY SNAPSHOT

TABLE 290 ENEOS CORPORATION: BUSINESS OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, New product launch, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness competitive threats might not be captured in case of unlisted companies.

14 ADJACENT & RELATED MARKETS (Page No. - 259)

14.1 INTRODUCTION

14.2 LIMITATION

14.3 ELECTRIC VEHICLE MARKET

14.3.1 ELECTRIC VEHICLE MARKET CONSUMPTION, BY PROPULSION TYPE

TABLE 291 ELECTRIC VEHICLE MARKET, BY PROPULSION TYPE, 2017–2020 (THOUSAND UNIT)

TABLE 292 ELECTRIC VEHICLE MARKET, BY PROPULSION TYPE, 2021–2030 (THOUSAND UNIT)

FIGURE 57 FCEV SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

14.3.1.1 Battery electric vehicle (BEV)

14.3.1.1.1 Increase in vehicle range per charge to boost demand

TABLE 293 BEV: ELECTRIC VEHICLE MARKET, BY REGION, 2017–2020 (THOUSAND UNIT)

TABLE 294 BEV: ELECTRIC VEHICLE MARKET, BY REGION, 2021–2030 (THOUSAND UNIT)

14.3.1.2 Fuel cell electric vehicle (FCEV)

14.3.1.2.1 Demand for zero emission vehicles to uplift the market

TABLE 295 FCEV: ELECTRIC VEHICLE MARKET, BY REGION, 2017–2020 (THOUSAND UNIT)

TABLE 296 FCEV: ELECTRIC VEHICLE MARKET, BY REGION, 2021–2030 (THOUSAND UNIT)

14.3.1.3 Plug-in hybrid electric vehicle (PHEV)

14.3.1.3.1 Government provision of tax benefits and incentives to boost demand

TABLE 297 PHEV: ELECTRIC VEHICLE MARKET, BY REGION, 2017–2020 (THOUSAND UNIT)

TABLE 298 PHEV: ELECTRIC VEHICLE MARKET, BY REGION, 2021–2030 (THOUSAND UNIT)

14.3.2 ELECTRIC VEHICLE MARKET CONSUMPTION, BY VEHICLE TYPE, TILL 2030

TABLE 299 ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2017–2020 (THOUSAND UNIT)

TABLE 300 ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2021–2030 (THOUSAND UNIT)

FIGURE 58 COMMERCIAL VEHICLE SEGMENT TO REGISTER HIGHER CAGR DURING THE FORECAST PERIOD

14.3.2.1 Passenger cars

14.3.2.1.1 Growing emission norms to boost the demand

TABLE 301 PASSENGER CAR: ELECTRIC VEHICLE MARKET, BY REGION, 2017–2020 (THOUSAND UNIT)

TABLE 302 PASSENGER CAR: ELECTRIC VEHICLE MARKET, BY REGION, 2021–2030 (THOUSAND UNIT)

14.3.2.2 Commercial vehicles

14.3.2.2.1 Growth of e-commerce and logistics to boost demand

TABLE 303 COMMERCIAL VEHICLE: ELECTRIC VEHICLE MARKET, BY REGION, 2017–2020 (THOUSAND UNIT)

TABLE 304 COMMERCIAL VEHICLE: ELECTRIC VEHICLE MARKET, BY REGION, 2021–2030 (THOUSAND UNIT)

15 APPENDIX (Page No. - 270)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

The study involved four major activities to estimate the market size of electric vehicle fluids market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. Findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives.

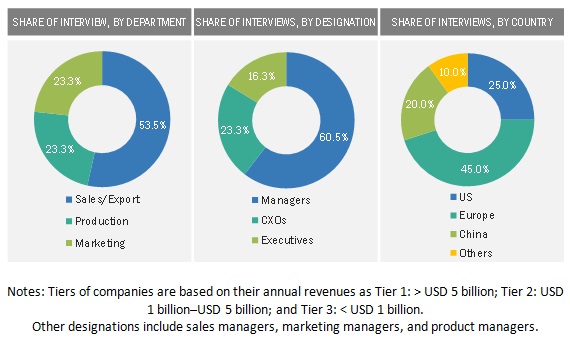

Primary Research

The electric vehicle fluids market comprises several stakeholders such as raw material suppliers, end-product manufacturers, end-users, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development in end-use application such as packaging, consumer goods, construction and automotive. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the electric vehicle fluids market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

The key players in the industry have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the market for electric vehicle (EV) fluids in terms of volume and value

- To provide detailed information regarding the important factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To estimate and forecast the market by product type, vehicle type, propulsion type, and fill type

- To forecast the market based on key regions: North America, Europe, and Asia Pacific (APAC)

- To strategically analyze the market with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities for stakeholders in the market and provide a competitive landscape for the market leaders

- To strategically profile the key players and comprehensively analyze their core competencies*

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Electric Vehicle Fluids Market