Electric Vehicle (Car) Polymers Market by Type (Engineering Plastics (ABS, PA, PC, PPS, Fluoropolymer), Elastomers (Synthetic Rubber, Natural Rubber, Fluoroelastomer)), Component (Powertrain, Exterior, Interior), and Region - Global Forecast to 2024

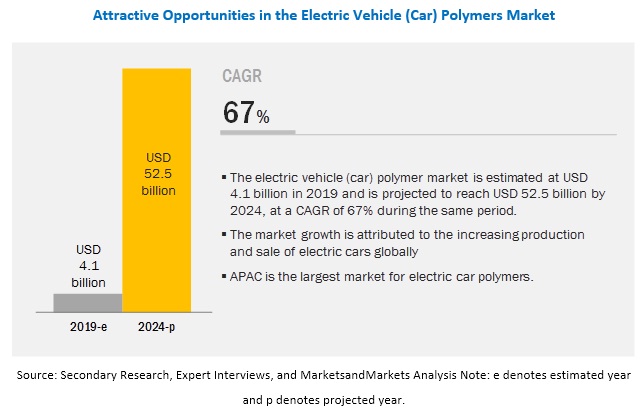

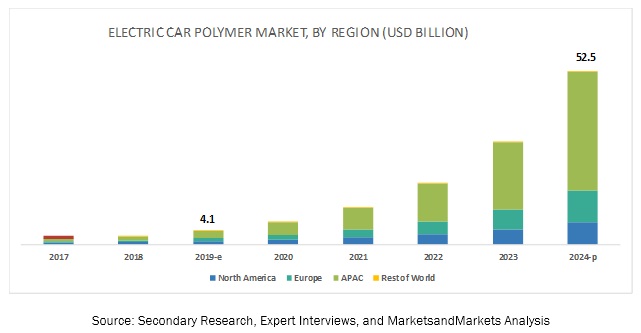

[179 Pages Report] The electric vehicle (car) polymers market size is projected to grow from the estimated USD 4.1 billion in 2019 to USD 52.5 billion by 2024, at a compound annual growth rate (CAGR) of 67% during the forecast period. Electric vehicle polymers are the polymers that are used in electric cars to reduce their weight without affecting the efficiency of the car. Polymers are the only materials that can replace metals as they have similar properties to those of metals, such as flame retardancy, abrasion resistance, stiffness, toughness, electrical insulation, and heat resistance. Replacing metals with the polymers is a key solution for the electric car manufacturers to reduce the overall weight of the electric cars.

Interior to be the second fastest-growing component segment of the electric vehicle polymers market.

The interior segment of components allows easy replacement of metals with polymers as these components have lower accidental risk and safety issues. Hence, most of electric car manufacturers use polymers in place of metals in this segment to reduce the overall weight of the electric cars. Polymer has proven to be the ideal material for the interior components of a car, as it is durable and aesthetically pleasing. In addition, it reduces noise, vibration, and harshness (NVH) levels of an electric car. Both the types of polymers, engineering plastics and elastomers, are preferred for this segment of components.

Elastomers to be the second-largest type segment of the electric vehicle polymers market.

Elastomers are materials that are produced by joining polymers through chemical bonds to achieve a crosslinking structure. The main properties of these materials are elasticity and high elongation against cracking and breaking. They are used in the form of rubber in an electric car for manufacturing of tires and as sealants. Most of the demand for elastomers is for insulation in the cars and the manufacturing of tires.

APAC is estimated to account for the largest market share during the forecast period.

APAC is estimated to dominate the overall electric vehicle polymers market in the forecast period. The region has emerged as the largest consumer of electric vehicle (car) polymers, owing to the growth in production of electric cars in China, Japan, South Korea, among other countries. Increasing concern for reducing the level of carbon footprints, increasing government support, and reduction in the overall weight of the electric cars are the factors facilitating the growth of electric vehicle (car) polymers market in this region.

Key Market Players

The leading players in the electric vehicle polymers market are BASF (Germany), DowDuPont (US), Covestro (Germany), Celanese (US), SABIC (Saudi Arabia), Solvay (Belgium), LANXESS (Germany), LG Chem (South Korea), Asahi Kasei (Japan), and Evonik Industries (Germany). Most of these leading players operate globally and have a widespread distribution network. These players have strong R&D and focus on producing high-performance polymers to meet the demands of end users. They offer customized products as per the needs of customers. Most of the players have developed partnerships with the electric vehicle producers to gain higher market shares.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

20172024 |

|

Base year |

2018 |

|

Forecast period |

20192024 |

|

Unit considered |

Value (USD Million and USD Thousand) and Volume (Kiloton and Ton) |

|

Segments |

Type, Component, and Region |

|

Regions |

North America, APAC, Europe, and Rest of the World |

|

Companies |

BASF (Germany), DowDuPont (US), Covestro (Germany), Celanese (US), SABIC (Saudi Arabia), Solvay (Belgium), LANXESS (Germany), LG Chem (South Korea), Asahi Kasei (Japan), and Evonik Industries (Germany) |

This research report categorizes the global electric vehicle polymers market on the basis of type, component, and region.

On the basis of type:

- Engineering Plastics

- Acrylonitrile Butadiene Styrene (ABS)

- Polyamide

- Polycarbonate

- Polyphenylene Sulfide (PPS)

- Polyurethane

- Polypropylene

- Fluoropolymer

- Thermoplastic Polyester

- Others (Polyethylene, Polyacetal, Polyphenylene Ether, Polyphenylene Oxide, Polysulfone, Polyethersulfone, Polyetherimide, Polyphthalamide, Polyetheretherketone)

- Elastomers

- Synthetic Rubber

- Natural Rubber

- Fluoroelastomer

- Silicone Elastomer

- Others (Thermoplastic Olefin, Styrenic Block Copolymer, Thermoplastic Polyurethane, Thermoplastic Vulcanizate, Thermoplastic Copolyester, Polyether Block Amide)

On the basis of components:

- Powertrain System

- Exterior

- Interior

On the basis of region:

- North America

- Europe

- APAC

- Rest of the World

The market is further analyzed for the key countries in each of these regions.

Recent Developments

- DowDuPont used expansion as its strategy to increase its geographic presence and strengthen its business in APAC, in 2018. In November 2018, it announced that it would invest more than USD80 million to build a new manufacturing facility in Jiangsu Province in East China. This facility will produce compounded high-end engineering plastics that cater to electronics, transportation, and industrial and consumer product markets.

- Celanese used the acquisition strategy to increase its footprint in APAC, in 2018. In October 2018, the company announced that it will acquire Next Polymers Ltd, an India-based engineering thermoplastic manufacturing company, through which it expects to increase its presence in the growing polymer market.

- LANXESS adopted the strategy of new product development to strengthen its product portfolio. In March 2016, the company introduced two new products for the polymer market Pocan BF 4232 HR and Durethan AKV 60 XF. Both the products are high-performance thermoplastics, which can replace metals in electric cars.

Key questions addressed by the report

- What are the global trends in demand for electric vehicle (car) polymers? Will the market witness an increase or decline in demand in the near future?

- What is the percentage share of electric vehicle (car) polymers present in the overall weight of an electric car?

- What were the revenue pockets for the electric vehicle (car) polymers in 2018?

- What are the different regulations developed for electric cars, globally?

- Who are the key players in the electric vehicle polymers market, globally?

Frequently Asked Questions (FAQ):

What are the driving factors for EV (cars) polymers market?

What is the major type of polymers used in electric vehicle (Cars)?

Which components of electric vehicles use polymers?

What are the opportunities for the EV polymer market?

Why polymers have importance in an electric vehicle?

Who are the major manufacturers?

What is the EV Polymers market size in terms of volume?

What is the future outlook of each segment?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Electric Vehicle Polymers Market Segmentation

1.3.2 Regions Covered

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Units Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Limitations

2.5 Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in the Electric Vehicle Polymers Market

4.2 Electric Vehicle Polymers Market, By Type

4.3 Electric Vehicle Polymers Market, By Component

4.4 APAC Electric Vehicle Polymers Market, By Type and Country

4.5 Electric Vehicle Polymers Market, By Country

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Manufacturing and Sales of Electric Cars Globally

5.2.1.2 Increasing Use to Reduce the Weight of Electric Cars

5.2.2 Restraints

5.2.2.1 High Price of Polymers

5.2.3 Opportunities

5.2.3.1 Adoption of Polymers in New Components of Electric Cars

5.2.4 Challenges

5.2.4.1 Rising Need for Technologically Advanced Polymers From Electric Car Manufacturers

5.3 Porters Five Forces Analysis

5.3.1 Threat of Substitutes

5.3.2 Threat of New Entrants

5.3.3 Bargaining Power of Suppliers

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

5.4 Macroeconomic Indicators

5.4.1 Gdp Growth Rate Forecast of Major Economies in the World

5.4.2 Electric Vehicle Market Analysis

6 Electric Vehicle Polymers Market, By Type (Page No. - 45)

6.1 Introduction

6.2 Engineering Plastics

6.2.1 Acrylonitrile Butadiene Styrene (ABS)

6.2.1.1 Adoption of Acrylonitrile Butadiene Styrene in All Components of Electric Cars is Driving Its Demand

6.2.2 Polyamide

6.2.2.1 Preference for Polyamide is Rising Owing to Its Availability in Different Grades

6.2.3 Polycarbonate

6.2.3.1 Replacement of Glass With Polycarbonate Will Provide Growth Opportunities for the Market

6.2.4 Polyphenylene Sulfide (PPS)

6.2.4.1 Need for Specialty Polymers is Driving the Market for Polyphenylene Sulfide

6.2.5 Polyurethane

6.2.5.1 Increasing Use of Polymers in the Interior Component Segment is Boosting the Market for Polyurethane

6.2.6 Polypropylene

6.2.6.1 Polypropylene Type is Expected to Grow Owing to Its Preference in the Exterior Components of Electric Vehicles

6.2.7 Fluoropolymer

6.2.7.1 Use of Polymers in the Batteries of Electric Cars is Driving the Market for Fluoropolymer

6.2.8 Thermoplastic Polyester

6.2.8.1 The Superior Properties of Thermoplastic Polyester are Boosting Its Demand

6.2.9 Others

6.3 Elastomers

6.3.1 Synthetic Rubber

6.3.1.1 Growing Demand for Tires for Electric Car Production is Expected to Boost the Market for Synthetic Rubber

6.3.2 Natural Rubber

6.3.2.1 The Rise in the Demand for Sealing Material From Electric Cars Will Positively Influence the Demand for Natural Rubber

6.3.3 Fluoroelastomer

6.3.3.1 Rising Demand for Insulating Material is Expected to Drive the Market for Fluoroelastomer

6.3.4 Silicone Elastomer

6.3.4.1 Superior Properties of Silicone Elastomer are Fueling the Market

6.3.5 Others

7 Electric Vehicle Polymers Market, By Component (Page No. - 71)

7.1 Introduction

7.2 Powertrain System

7.2.1 Increasing Demand for Polymers in Battery Packs is Expected to Spur the Demand for Electric Vehicle Polymers

7.3 Exterior

7.3.1 High Demand for Elastomers in Tires is Expected to Drive the Market

7.4 Interior

7.4.1 The Replacement of Interior Components Such as Car Upholstery and Infotainment Systems With Polymers Will Majorly Affect the Overall Weight of the Car

8 Electric Vehicle Polymers Market, By Region (Page No. - 80)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.1.1 The US is the Dominant Market for Electric Vehicle Polymers in North America

8.2.2 Canada

8.2.2.1 Engineering Plastics to Remain the Dominant Type of Electric Vehicle Polymers in Canada Owing to Its High Demand

8.2.3 Mexico

8.2.3.1 Increasing Adoption of Electric Cars in the Country is Expected to Upsurge the Demand for Electric Vehicle Polymers

8.3 Europe

8.3.1 Germany

8.3.1.1 Implementation of Attractive Incentive Schemes By the Government Will Boost the Demand for Electric Vehicles, thereby Driving the Polymers Market 97

8.3.2 France

8.3.2.1 Increasing the Focus of Auto Oems Toward the Development of Electric Vehicles Will Drive the Polymers Market

8.3.3 UK

8.3.3.1 Increasing Government Focus on Electric Vehicles Will Drive the Market

8.3.4 Norway

8.3.4.1 Norway to Be A Significant Market for Electric Vehicle Polymers in Europe Owing to the Increase in the Transition From Ice Cars to Electric Cars 104

8.3.5 Sweden

8.3.5.1 Rising Government Support for Electric Vehicles Will Drive the Polymers Market

8.3.6 Netherlands

8.3.6.1 The Netherlands is Expected to Witness The Highest Growth Due to Rising Demand for Electric Cars

8.3.7 Rest of Europe

8.4 APAC

8.4.1 China

8.4.1.1 China is the Largest Market for Electric Vehicle Polymers in the World Owing to the Large Production of Electric Cars in the Country

8.4.2 Japan

8.4.2.1 Rising Adoption of Electric Cars has Led to the Demand for Polymers in Japan

8.4.3 India

8.4.3.1 Changing Government Laws Toward Electric Cars Might Support the Growth of the Electric Vehicle Polymers Market

8.4.4 South Korea

8.4.4.1 Recent Government Policies and Investment are Expected to Drive the Electric Vehicle Polymers Market

8.4.5 Rest of APAC

8.5 Rest of the World

9 Competitive Landscape (Page No. - 130)

9.1 Introduction

9.2 Competitive Leadership Mapping, 2018

9.2.1 Visionary Leaders

9.2.2 Innovators

9.2.3 Dynamic Differentiators

9.2.4 Emerging Companies

9.2.5 Strength of Product Portfolio

9.2.6 Business Strategy Excellence

9.3 Competitive Scenario

9.3.1 Expansion

9.3.2 New Product Development

9.3.3 Acquisition

9.4 Company Product Analysis

10 Company Profiles (Page No. - 141)

10.1 BASF SE

10.1.1 Business Overview

10.1.2 Products Offered

10.1.3 SWOT Analysis

10.1.4 MnM View

10.2 DowDuPont

10.2.1 Business Overview

10.2.2 Products Offered

10.2.3 Recent Developments

10.2.4 SWOT Analysis

10.2.5 MnM View

10.3 Covestro

10.3.1 Business Overview

10.3.2 Products Offered

10.3.3 SWOT Analysis

10.3.4 MnM View

10.4 Celanese

10.4.1 Business Overview

10.4.2 Products Offered

10.4.3 Recent Developments

10.4.4 SWOT Analysis

10.4.5 MnM View

10.5 SABIC

10.5.1 Business Overview

10.5.2 Products Offered

10.5.3 Recent Developments

10.5.4 SWOT Analysis

10.5.5 MnM View

10.6 Solvay

10.6.1 Business Overview

10.6.2 Products Offered

10.6.3 Recent Developments

10.6.4 SWOT Analysis

10.6.5 MnM View

10.7 LANXESS

10.7.1 Business Overview

10.7.2 Products Offered

10.7.3 Recent Developments

10.7.4 SWOT Analysis

10.7.5 MnM View

10.8 LG Chem

10.8.1 Business Overview

10.8.2 Products Offered

10.8.3 SWOT Analysis

10.8.4 MnM View

10.9 Asahi Kasei

10.9.1 Business Overview

10.9.2 Products Offered

10.9.3 SWOT Analysis

10.9.4 MnM View

10.10 Evonik Industries

10.10.1 Business Overview

10.10.2 Products Offered

10.10.3 SWOT Analysis

10.10.4 MnM View

10.11 Additional Players

10.11.1 Daikin Industries

10.11.2 Arkema

10.11.3 Mitsubishi Engineering-Plastics Corporation

10.11.4 Jsr Corporation

10.11.5 AGC Chemicals

10.11.6 Sumitomo Chemicals

10.11.7 Lyondellbasell Industries

10.11.8 Elkem

10.11.9 China Petrochemical Group (Sinopec Group)

10.11.10 The Goodyear Tire & Rubber Company

10.11.11 DSM Engineering Plastics

10.11.12 Arlanxeo

11 Appendix (Page No. - 171)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets Subscription Portal

11.3 Available Customizations

11.4 Related Reports

11.5 Author Details

List of Tables (134 Tables)

Table 1 Targets and Objectives of Countries for Ev Deployment, 20202030

Table 2 Oem Announcements Related to Electric Cars, 20192025

Table 3 Trends and Forecast of Percentage Growth Rates Between 2017 and 2024

Table 4 Electric Vehicle Polymers Market Size, By Type, 20172024 (Kiloton)

Table 5 Electric Vehicle (Car) Polymers Market Size, By Type, 20172024 (USD Million)

Table 6 Engineering Plastics Market Size, By Region, 20172024 (Kiloton)

Table 7 Engineering Plastics Market Size, By Region, 20172024 (USD Million)

Table 8 ABS Market Size, By Region, 20172024 (Ton)

Table 9 ABS Market Size, By Region, 20172024 (USD Thousand)

Table 10 Polyamide Market Size, By Region, 20172024 (Ton)

Table 11 Polyamide Market Size, By Region, 20172024 (USD Million)

Table 12 Polycarbonate Market Size, By Region, 20172024 (Ton)

Table 13 Polycarbonate Market Size, By Region, 20172024 (USD Thousand)

Table 14 Polyphenylene Sulphide Market Size, By Region, 20172024 (Ton)

Table 15 Polyphenylene Sulphide Market Size, By Region, 20172024 (USD Thousand)

Table 16 Polyeurathane Market Size, By Region, 20172024 (Ton)

Table 17 Polyeurathane Market Size, By Region, 20172024 (USD Thousand)

Table 18 Polypropylene Market Size, By Region, 20172024 (Ton)

Table 19 Polypropylene Market Size, By Region, 20172024 (USD Thousand)

Table 20 Fluoropolymer Market Size, By Region, 20172024 (Ton)

Table 21 Fluoropolymer Market Size, By Region, 20172024 (USD Thousand)

Table 22 Thermoplastic Polyester Market Size, By Region, 20172024 (Ton)

Table 23 Thermoplastic Polyester Market Size, By Region, 20172024 (USD Thousand)

Table 24 Others Market Size, By Region, 20172024 (Ton)

Table 25 Others Market Size, By Region, 20172024 (USD Thousand)

Table 26 Elastomers Market Size, By Region, 20172024 (Ton)

Table 27 Elastomers Market Size, By Region, 20172024 (USD Thousand)

Table 28 Synthetic Rubber Market Size, By Region, 20172024 (Ton)

Table 29 Synthetic Rubber Market Size, By Region, 20172024 (USD Thousand)

Table 30 Natural Rubber Market Size, By Region, 20172024 (Ton)

Table 31 Natural Rubber Market Size, By Region, 20172024 (USD Thousand)

Table 32 Fluoroelastomer Market Size, By Region, 20172024 (Ton)

Table 33 Fluoroelastomer Market Size, By Region, 20172024 (USD Thousand)

Table 34 Silicone Elastomer Market Size, By Region, 20172024 (Ton)

Table 35 Silicone Elastomer Market Size, By Region, 20172024 (USD Thousand)

Table 36 Others Market Size, By Region, 20172024 (Ton)

Table 37 Others Market Size, By Region, 20172024 (USD Thousand)

Table 38 Components of Electric Vehicles

Table 39 Electric Vehicle Polymers Market Size, By Component, 20172024 (Kiloton)

Table 40 Electric Vehicle (Car) Polymers Market Size, By Component, 20172024 (USD Million)

Table 41 Powertrain System: Electric Vehicle Polymers Market Size, By Region, 20172024 (Ton)

Table 42 Powertrain System: Electric Vehicle (Car) Polymers Market Size, By Region, 20172024 (USD Million)

Table 43 Exterior: Electric Vehicle Polymers Market Size, By Region, 20172024 (Ton)

Table 44 Exterior: Electric Vehicle (Car) Polymers Market Size, By Region, 20172024 (USD Million)

Table 45 Interior: Electric Vehicle Polymers Market Size, By Region, 20172024 (Ton)

Table 46 Interior: Electric Vehicle (Car) Polymers Market Size, By Region, 20172024 (USD Million)

Table 47 Electric Vehicle Polymers Market Size, By Region, 20172024 (Kiloton)

Table 48 Electric Vehicle (Car) Polymers Market Size, By Region, 20172024 (USD Million)

Table 49 North America: Electric Vehicle Polymers Market Size, By Country, 20172024 (Kiloton)

Table 50 North America: Electric Vehicle Polymer Market Size, By Country, 20172024 (USD Million)

Table 51 North America: Electric Vehicle (Car) Polymers Market Size, By Type, 20172024 (Ton)

Table 52 North America: Plastic in EV Market Size, By Type, 20172024 (USD Million)

Table 53 North America: Market Size, By Component, 20172024 (Kiloton)

Table 54 North America: Market Size, By Component, 20172024 (USD Million)

Table 55 US: Electric Vehicle Polymers Market Size, By Type, 20172024 (Ton)

Table 56 US: Electric Vehicle (Car) Polymers Market Size, By Type, 20172024 (USD Million)

Table 57 US: Electric Vehicle Polymer Market Size, By Component, 20172024 (Kiloton)

Table 58 US: Plastic in EV Market Size, By Component, 20172024 (USD Million)

Table 59 Canada: Electric Vehicle Polymers Market Size, By Type, 20172024 (Ton)

Table 60 Canada: Electric Vehicle (Car) Polymers Market Size, By Type, 20172024 (USD Thousand)

Table 61 Canada: Electric Vehicle Polymer Market Size, By Component, 20172024 (Kiloton)

Table 62 Canada: Plastic in EV Market Size, By Component, 20172024 (USD Million)

Table 63 Mexico: Electric Vehicle Polymers Market Size, By Type, 20172024 (Ton)

Table 64 Mexico: Electric Vehicle (Car) Polymers Market Size, By Type, 20172024 (USD Thousand)

Table 65 Mexico: Plastic in EV Market Size, By Component, 20172024 (Ton)

Table 66 Mexico: Silicone in Electric Vehicle Market Size, By Component, 20172024 (USD Thousand)

Table 67 Europe: Electric Vehicle Polymers Market Size, By Country, 20172024 (Kiloton)

Table 68 Europe: Electric Vehicle (Car) Polymers Market Size, By Country, 20172024 (USD Million)

Table 69 Europe: Market Size, By Type, 20172024 (Ton)

Table 70 Europe: Silicone in Electric Vehicle Market Size, By Type, 20172024 (USD Million)

Table 71 Europe: Market Size, By Component, 20172024 (Kiloton)

Table 72 Europe: Market Size, By Component, 20172024 (USD Million)

Table 73 Germany: Electric Vehicle Polymers Market Size, By Type, 20172024 (Ton)

Table 74 Germany: Electric Vehicle (Car) Polymers Market Size, By Type, 20172024 (USD Thousand)

Table 75 Germany: Electric Vehicle Polymer Market Size, By Component, 20172024 (Kiloton)

Table 76 Germany: Silicone in Electric Vehicle Market Size, By Component, 20172024 (USD Million)

Table 77 France: Electric Vehicle Polymers Market Size, By Type, 20172024 (Ton)

Table 78 France: Electric Vehicle (Car) Polymers Market Size, By Type, 20172024 (USD Thousand)

Table 79 France: Electric Vehicle Polymer Market Size, By Component, 20172024 (Kiloton)

Table 80 France: Silicone in Electric Vehicle Market Size, By Component, 20172024 (USD Million)

Table 81 UK: Electric Vehicle Polymers Market Size, By Type, 20172024 (Ton)

Table 82 UK: Electric Vehicle (Car) Polymers Market Size, By Type, 20172024 (USD Thousand)

Table 83 UK: Electric Vehicle Polymer Market Size, By Component, 20172024 (Kiloton)

Table 84 UK: Silicone in Electric Vehicle Market Size, By Component, 20172024 (USD Million)

Table 85 Norway: Electric Vehicle Polymers Market Size, By Type, 20172024 (Ton)

Table 86 Norway: Electric Vehicle (Car) Polymers Market Size, By Type, 20172024 (USD Thousand)

Table 87 Norway: Electric Vehicle Polymer Market Size, By Component, 20172024 (Kiloton)

Table 88 Norway: Market Size, By Component, 20172024 (USD Million)

Table 89 Sweden: Electric Vehicle Polymers Market Size, By Type, 20172024 (Ton)

Table 90 Sweden: Electric Vehicle (Car) Polymers Market Size, By Type, 20172024 (USD Thousand)

Table 91 Weden: Electric Vehicle Polymers Market Size, By Component, 20172024 (Kiloton)

Table 92 Sweden: Electric Vehicle Polymer Market Size, By Component, 20172024 (USD Million)

Table 93 Netherlands: Electric Vehicle Polymers Market Size, By Type, 20172024 (Ton)

Table 94 Netherlands: Electric Vehicle (Car) Polymers Market Size, By Type, 20172024 (USD Thousand)

Table 95 Netherlands: Electric Vehicle Polymer Market Size, By Component, 20172024 (Kiloton)

Table 96 Netherlands: Market Size, By Component, 20172024 (USD Million)

Table 97 Rest of Europe: Electric Vehicle Polymers Market Size, By Type, 20172024 (Ton)

Table 98 Rest of Europe: Electric Vehicle (Car) Polymers Market Size, By Type, 20172024 (USD Thousand)

Table 99 Rest of Europe: Electric Vehicle Polymer Market Size, By Component, 20172024 (Kiloton)

Table 100 Rest of Europe: Market Size, By Component, 20172024 (USD Million)

Table 101 APAC: Electric Vehicle Polymers Market Size, By Country, 20172024 (Kiloton)

Table 102 APAC: Electric Vehicle (Car) Polymers Market Size, By Country, 20172024 (USD Million)

Table 103 APAC: Electric Vehicle Polymer Market Size, By Type, 20172024 (Ton)

Table 104 APAC: Market Size, By Type, 20172024 (USD Million)

Table 105 APAC: Market Size, By Component, 20172024 (Kiloton)

Table 106 APAC: Market Size, By Component, 20172024 (USD Million)

Table 107 China: Electric Vehicle Polymers Market Size, By Type, 20172024 (Ton)

Table 108 China: Electric Vehicle (Car) Polymers Market Size, By Type, 20172024 (USD Million)

Table 109 China: Electric Vehicle Polymer Market Size, By Component, 20172024 (Kiloton)

Table 110 China: Market Size, By Component, 20172024 (USD Million)

Table 111 Japan: Electric Vehicle Polymers Market Size, By Type, 20172024 (Ton)

Table 112 Japan: Electric Vehicle (Car) Polymers Market Size, By Type, 20172024 (USD Thousand)

Table 113 Japan: Electric Vehicle Polymer Market Size, By Component, 20172024 (Kiloton)

Table 114 Japan: Market Size, By Component, 20172024 (USD Million)

Table 115 India: Electric Vehicle Polymers Market Size, By Type, 20172024 (Ton)

Table 116 India: Electric Vehicle (Car) Polymers Market Size, By Type, 20172024 (USD Thousand)

Table 117 India: Electric Vehicle Polymer Market Size, By Component, 20172024 (Kiloton)

Table 118 India: Market Size, By Component, 20172024 (USD Million)

Table 119 South Korea: Electric Vehicle Polymers Market Size, By Type, 20172024 (Ton)

Table 120 South Korea: Electric Vehicle (Car) Polymers Market Size, By Type, 20172024 (USD Thousand)

Table 121 South Korea: Electric Vehicle Polymer Market Size, By Component, 20172024 (Kiloton)

Table 122 South Korea: Market Size, By Component, 20172024 (USD Million)

Table 123 Rest of APAC: Electric Vehicle Polymers Market Size, By Type, 20172024 (Ton)

Table 124 Rest of APAC: Electric Vehicle (Car) Polymers Market Size, By Type, 20172024 (USD Thousand)

Table 125 Rest of APAC: Electric Vehicle Polymer Market Size, By Component, 20172024 (Kiloton)

Table 126 Rest of APAC: Market Size, By Component, 20172024 (USD Million)

Table 127 Rest of the World: Electric Vehicle Polymers Market Size, By Type, 20172024 (Ton)

Table 128 Rest of the World: Electric Vehicle (Car) Polymers Market Size, By Type, 20172024 (USD Thousand)

Table 129 Rest of the World: Electric Vehicle Polymer Market Size, By Component, 20172024 (Ton)

Table 130 Rest of the World: Market Size, By Component, 20172024 (USD Thousand)

Table 131 Expansion, 20162018

Table 132 New Product Development, 20162018

Table 133 Acquisition, 20162018

Table 134 Company Product Analysis, 2018

List of Figures (66 Figures)

Figure 1 Electric Vehicle Polymers Market: Research Design

Figure 2 Electric Vehicle Polymer Market: Bottom-Up Approach

Figure 3 Electric Vehicle (Car) Polymers Market: Top-Down Approach

Figure 4 Electric Vehicle Polymer Market: Data Triangulation

Figure 5 Engineering Plastics Was the Dominant Type of the Market in 2018

Figure 6 Interior Was the Largest Component Segment of the Market 2018

Figure 7 ABS Accounted for the Highest Share in the Electric Vehicle Polymers Market in Europe in 2018

Figure 8 APAC Accounted for the Largest Share of the Electric Vehicle (Car) Polymers Market in 2018

Figure 9 Increasing Electric Car Production to Drive the Market

Figure 10 Engineering Plastics to Be the Largest Type Segment of the Market

Figure 11 Exterior to Be the Fastest-Growing Component of the Electric Vehicle Polymers Market

Figure 12 Engineering Plastics and China Accounted for the Largest Share of the Electric Vehicle Polymers Market in 2018

Figure 13 China to Be the Largest Electric Vehicle Polymers Market

Figure 14 Drivers, Restraints, Opportunities, and Challenges in the Electric Vehicle (Car) Polymers Market

Figure 15 Global Electric Cars Stock, 20092017

Figure 16 Electric Vehicle Polymers Market: Porters Five Forces Analysis

Figure 17 Electric Car Stock By Country, 2017

Figure 18 Electric Car Stock By Country, 2016 vs. 2017

Figure 19 Engineering Plastics Was the Larger Type in the Electric Vehicle Polymers Market

Figure 20 APAC to Be the Largest Market for Engineering Plastics Between 2019 and 2024

Figure 21 APAC to Be the Largest Market for ABS Between 2019 and 2024

Figure 22 APAC to Be the Largest Market for Polyamide Between 2019 and 2024

Figure 23 Europe to Be the Second-Largest Market for Polycarbonate Between 2019 and 2024

Figure 24 APAC to Be the Dominant Market for Polyphenylene Sulphide Between 2019 and 2024

Figure 25 APAC to Be the Largest Market for Polyurethane Between 2019 and 2024

Figure 26 APAC to Be the Largest Market for Polypropylene Between 2019 and 2024

Figure 27 APAC to Be the Largest Market for Fluoropolymer Between 2019 and 2024

Figure 28 APAC to Be the Largest Market for thermoplastic Polyester Between 2019 and 2024

Figure 29 APAC to Be the Largest Market for Other Types of Engineering Plastics

Figure 30 APAC to Be the Largest Market for Elastomers Between 2019 and 2024

Figure 31 APAC to Be the Largest Market for Synthetic Rubber Between 2019 and 2024

Figure 32 APAC to Be the Largest Market for Natural Rubber Between 2019 and 2024

Figure 33 APAC to Be the Largest Market for Fluoroelastomer Between 2019 and 2024

Figure 34 APAC to Be the Largest Market for Silicone Elastomer

Figure 35 APAC to Be the Largest Market for Other Elastomers

Figure 36 Interior Was the Dominant Component Segment of the Electric Vehicle Polymers Market

Figure 37 APAC to Be the Largest Market in Powertrain System

Figure 38 APAC to Be the Largest Market in the Exterior Segment

Figure 39 APAC to Be the Largest Market in the Interior Segment

Figure 40 China to Be the Fastest-Growing Market for Electric Vehicle Polymers

Figure 41 North America: Electric Vehicle Polymers Market Snapshot

Figure 42 Europe: Electric Vehicle Polymer Market Snapshot

Figure 43 APAC: Electric Vehicle Polymers Market Snapshot

Figure 44 China Was the Largest Electric Vehicle Polymers Market in APAC, 2018

Figure 45 Companies Adopted Expansion as the Key Growth Strategy Between 2016 and 2018

Figure 46 Electric Vehicle Polymer Market: Competitive Leadership Mapping, 2018

Figure 47 BASF SE: Company Snapshot

Figure 48 BASF SE: SWOT Analysis

Figure 49 DowDuPont: Company Snapshot

Figure 50 DowDuPont: SWOT Analysis

Figure 51 Covestro: Company Snapshot

Figure 52 Covestro: SWOT Analysis

Figure 53 Celanese: Company Snapshot

Figure 54 Celanese: SWOT Analysis

Figure 55 SABIC: Company Snapshot

Figure 56 SABIC: SWOT Analysis

Figure 57 Solvay: Company Snapshot

Figure 58 Solvay: SWOT Analysis

Figure 59 LANXESS: Company Snapshot

Figure 60 LANXESS: SWOT Analysis

Figure 61 LG Chem: Company Snapshot

Figure 62 LG Chem: SWOT Analysis

Figure 63 Asahi Kasei: Company Snapshot

Figure 64 Asahi Kasei: SWOT Analysis

Figure 65 Evonik Industries: Company Snapshot

Figure 66 Evonik Industries: SWOT Analysis

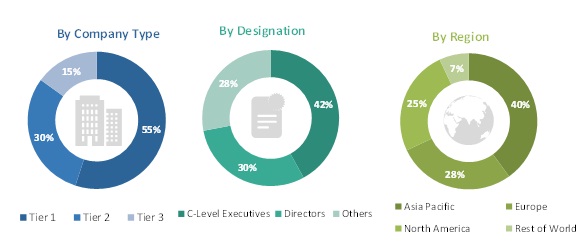

The study involves four major activities in estimating the current market size of electric vehicle polymers. Exhaustive secondary research was done to collect information related to the electric vehicle polymers market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet have been referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; gold standard & silver standard websites; regulatory bodies; trade directories; and databases.

Primary Research

The electric vehicle (car) polymers market comprises several stakeholders, such as raw material suppliers, technology developers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of the construction and transportation industries. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the global electric vehicle polymers market and to estimate the sizes of various other dependent submarkets. The research methodology used to estimate the market size includes the following steps:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key industry players along with extensive interviews with key officials, such as directors and marketing executives.

Data Triangulation

After arriving at the total market size through the estimation process explained above, the overall market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market size estimation process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated by using both the top-down and bottom-up approaches. It was then verified through primary interviews. Hence, for every data segment, there are three sourcestop-down approach, bottom-up approach, and expert interviews. The data was assumed to be correct when the values arrived at from the three sources matched.

Report Objectives

- To define, describe, and forecast the market size of electric vehicle polymers, in terms of value

- To define, describe, and forecast the market size of electric vehicle polymers, in terms of volume

- To provide information about the major factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To analyze and forecast the electric vehicle polymers market size on the basis of type

- To analyze and forecast the electric vehicle polymers market size on the basis of component

- To forecast the market size of different segments with respect to four regions, namely, APAC, Europe, North America, and Rest of the World

- To forecast the electric vehicle polymers market size of different segments with respect to key countries of each region

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To analyze the competitive developments, such as expansion, acquisition, and new product development, in the market

- To strategically profile the key players and comprehensively analyze their growth strategies

Available Customizations:

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data. The following customization options are available for the report:

Regional Analysis:

- Further breakdown of a region with respect to a particular country

Company Information:

- Detailed analysis and profiling of additional market players (up to five)

Product Analysis

- Product Matrix that gives a detailed comparison of product portfolio of each company

Growth opportunities and latent adjacency in Electric Vehicle (Car) Polymers Market